UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2007

OR

o TRANSITIONAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______.

COMMISSION FILE NUMBER 000-32985

WACCAMAW BANKSHARES, INC.

(Exact name of registrant as specified in its charter)

NORTH CAROLINA | | 52-2329563 |

| (State or Other Jurisdiction of | | (I.R.S. Employer |

| Incorporation or Organization) | | Identification No.) |

110 NORTH J. K. POWELL BOULEVARD

WHITEVILLE, NORTH CAROLINA 28472

(Address of Principal Executive Offices)(Zip Code)

Registrant’s Telephone number, including area code: (910) 641-0044

Securities registered pursuant to Section 12(b) of the Act

NONE

Securities registered pursuant to Section 12(g) of the Act:

COMMON STOCK, NO PAR VALUE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

o Yes x No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter. $ 63,768,978.

Indicate the number of shares outstanding of each of the registrant’s classes of Common Stock as of the latest practicable date. 5,436,970 shares of Common Stock outstanding as of March 20, 2008:

Documents Incorporated by Reference.

The Registrant’s Annual Report to stockholders for the fiscal year ended December 31, 2007, incorporated in Part II of this Form 10-K

Registrant’s Proxy Statement for the 2008 Annual Meeting of Stockholders, incorporated into Part III of this Form 10-K

FORM 10-K CROSS-REFERENCE INDEX

| PART I | | FORM 10-K | | PROXY STATEMENT | | ANNUAL REPORT |

| | | | | | | |

| Item 1 - Business | | X | | | | |

| Item 1A - Risk Factors | | X | | | | |

| Item 1B - Unresolved Staff Comments | | X | | | | |

| Item 2 - Properties | | X | | | | |

| Item 3 - Legal Proceedings | | X | | | | |

Item 4 - Submission of Matters to a Vote Of Security Holders | | X | | | | |

| | | | | | | |

| PART II | | | | | | |

| | | | | | | |

Item 5-Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | X | | | | |

| Item 6 - Selected Financial Data | | X | | | | |

Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | | | | X |

Item 7A - Quantitative and Qualitative Disclosures About Market Risk | | | | | | X |

| Item 8 - Financial Statements and Supplementary Data | | | | | | X |

Item 9 - Changes in and Disagreements with Accountants on Accounting and Financial Disclosures | | X | | | | |

| Item 9A - Controls and Procedures | | X | | | | |

| Item 9B - Other Information | | X | | | | |

| | | | | | | |

| PART III | | | | | | |

| | | | | | | |

Item 10 - Directors, Executive Officers and Corporate Governance | | X | | X | | |

| Item 11 - Executive Compensation | | | | X | | |

Item 12 - Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | | | X | | |

Item 13 - Certain Relationships and Related Transactions, and Director Independence | | | | X | | |

Item 14 - Principal Accounting Fees and Services | | | | X | | |

| | | | | | | |

| PART IV | | | | | | |

| | | | | | | |

| Item 15 - Exhibits, Financial Statement Schedules | | X | | | | |

PART 1

ITEM 1 - BUSINESS

General

Waccamaw Bankshares, Inc. (the “Company”) was formed during 2001 as a financial holding company chartered in the State of North Carolina. On July 1, 2001, the Company acquired all the outstanding shares of Waccamaw Bank (the “Bank”) in a tax-free exchange. To date, the only business activities of the Company consist of the activities of the Bank.

Waccamaw Bank was organized and incorporated under the laws of the State of North Carolina on August 28, 1997 and commenced operations on September 2, 1997. The Bank currently serves Columbus County, North Carolina and surrounding areas through three banking offices, Brunswick County through seven banking offices, New Hanover County through one banking office, Bladen County through one banking office, Lancaster County, South Carolina through one banking office and Horry County, South Carolina through three banking offices. As a state-chartered bank which is a member of the Federal Reserve, the Bank is subject to regulation by the North Carolina Commissioner of Banks and the Federal Reserve.

Location and Service Area

The Company’s primary service area is Columbus, Brunswick, Bladen and New Hanover Counties of North Carolina and Lancaster and Horry Counties of South Carolina. The principal business of the Company is to provide comprehensive individual and corporate banking services to its main service area. These services include demand and time deposits as well as commercial, installment, mortgage and other consumer lending services that are traditionally available from community banks.

Columbus County is located in the southeastern portion of North Carolina near the South Carolina border. Whiteville, the largest city in the county is approximately 45 miles west of Wilmington, North Carolina, 150 miles southeast of Charlotte, North Carolina, and 45 miles north of Myrtle Beach, South Carolina. These cities all have national or regional airports.

Brunswick County is adjacent to Columbus County to the southeast and also borders South Carolina. Shallotte, the largest city in the county, is approximately 35 miles southwest of Wilmington and 35 miles northeast of Myrtle Beach.

New Hanover County is a coastal county and adjacent to Brunswick County to the north. Wilmington, the largest city in the county, has a diversified economy which includes shipping, manufacturing, medical and retail industries.

Bladen County is adjacent to Columbus County to the northeast. Elizabethtown, the largest city in the county is approximately 50 miles northwest of Wilmington and 80 miles northwest of Myrtle Beach.

Lancaster County is located near the middle of the state near the North Carolina border and approximately 40 miles south of Charlotte, NC and fifty miles north of Columbia, South Carolina. These cities all have national or regional airports.

Horry County is located in the northeastern portion of South Carolina near the North Carolina border. Myrtle Beach, the largest city in the county, has a diversified economy which includes tourism, manufacturing, medical and retail industries.

The principal components of the economy in the Company’s primary service area are manufacturing, agriculture and tourism. Manufacturing employment is concentrated in the wood products and textile industries. The primary agriculture products are tobacco and hogs.

Competition

The primary business activity of the Company is commercial banking. This activity is conducted by the Bank which is the wholly owned subsidiary of the Company.

Banking is a highly competitive industry. The principal areas and methods of competition in the banking industry are the services that are offered, the pricing of those services, the convenience and availability of the services and the degree of expertise and personal manner with which those services are offered. The Bank encounters strong competition from other commercial banks, including the largest North Carolina banks, operating in the Bank’s market area. There are 16 offices of 5 other commercial banks operating in Columbus County, 35 offices of 7 other commercial banks operating in Brunswick County, 71 offices of 16 other commercial banks operating in New Hanover County, 8 offices of 6 other commercial banks operating in Bladen County, 9 offices of 5 other commercial banks operating in Lancaster County and 113 offices of 17 other commercial banks operating in Horry County. In the conduct of certain aspects of its business, the Bank also competes with credit unions, money market mutual funds, and other non-bank financial institutions, some of which are not subject to the same degree of regulation as the Bank. Many of these competitors have substantially greater resources and lending abilities than the Bank and offer certain services, such as investment banking, trust, interstate and international banking services, that the Bank cannot or will not provide.

Supervision and Regulation

The Company and the Bank are subject to state and federal banking laws and regulations. These impose specific requirements and restrictions and provide for general regulatory oversight with respect to virtually all aspects of operations. These laws and regulations are generally intended to protect depositors, not stockholders. To the extent that the following summary describes statutory or regulatory provisions, it is qualified in its entirety by reference to the particular statutory and regulatory provisions. Any change in applicable laws or regulations may have a material effect on the business and prospects of the Company. Beginning with the enactment of the Financial Institutions Reform, Recovery and Enforcement Act of 1989 ("FIRREA") and following with the Federal Deposit Insurance Corporation Improvement Act ("FDICIA"), enacted in 1991, numerous additional regulatory requirements have been placed on the banking industry in the past five years, and additional changes have been proposed. The operations of the Company and the Bank may be affected by legislative changes and the policies of various regulatory authorities. The Company is unable to predict the nature or the extent of the effect on its business and earnings that fiscal or monetary policies, economic control, or new federal or state legislation may have in the future.

Federal Bank Holding Company Regulation (Financial Holding Company Regulations)

The Company is a financial holding company within the meaning of the Gramm-Leach-Bliley Act of 1999 (the "GLB Act"). Under the GLB Act, which became effective on March 11, 2000, the types of activities in which a bank holding company may engage were significantly expanded. Subject to various limitations, the GLB Act generally permits a bank holding company to elect to become a “financial holding company.” A financial holding company may affiliate with securities firms and insurance companies and engage in other activities that are "financial in nature." Among the activities that are deemed "financial in nature" are, in addition to traditional lending activities, securities underwriting, dealing in or making a market in securities, sponsoring mutual funds and investment companies, insurance underwriting and agency activities, certain merchant banking activities and activities that the Federal Reserve considers to be closely related to banking.

A bank holding company may become a financial holding company under the GLB Act if each of its subsidiary banks is "well capitalized" under the Federal Deposit Insurance Corporation Improvement Act prompt corrective action provisions, is well managed and has at least a satisfactory rating under the Community Reinvestment Act. In addition, the bank holding company must file a declaration with the Federal Reserve if it falls out of compliance with these requirements and may be required to cease engaging in some of its activities.

Under the GLB Act, the Federal Reserve serves as the primary "umbrella" regulator of financial holding companies, with supervisory authority over each parent company and limited authority over its subsidiaries. Expanded financial activities of financial holding companies generally will be regulated according to the type of such financial activity- banking activities by banking regulators, securities activities by securities regulators and insurance activities by insurance regulators. The GLB Act also imposes additional restrictions and heightened disclosure requirements regarding information collected by financial institutions.

The Company is also still subject to the Bank Holding Company Act (the "BHCA"). Under the BHCA, the Company is subject to periodic examination by the Federal Reserve and is required to file periodic reports of its operations and such other information as the Federal Reserve may require.

Investments, Control, and Activities. With certain limited exceptions, the BHCA requires every holding company to obtain the prior approval of the Federal Reserve before (i) acquiring substantially all the assets of any bank, (ii) acquiring direct or indirect ownership or control of any voting shares of any bank if after such an acquisition it would own or control more than 5% of the voting shares of such bank (unless it already owns or controls the majority of such shares), or (iii) merging or consolidating with another holding company.

In addition, and subject to certain exceptions, the BHCA and the Change in Bank Control Act, together with regulations thereunder, require Federal Reserve approval (or, depending on the circumstances, no notice of disapproval) prior to any person or company acquiring "control" of a holding company, such as the Company. Control is conclusively presumed to exist if an individual or company acquires 25% or more of any class of voting securities of the holding company. In the case of the Company, under Federal Reserve regulations control will be rebuttably presumed to exist if a person acquires at least 10% of the outstanding shares of any class of voting securities.

Source of Strength; Cross-Guarantee. In accordance with Federal Reserve policy, the Company is expected to act as a source of financial strength to the Bank and to commit resources to support the Bank in circumstances in which the Company might not otherwise do so. Under the BHCA, the Federal Reserve may require a holding company to terminate any activity or relinquish control of a nonbank subsidiary (other than a nonbank subsidiary of a bank) upon the Federal Reserve's determination that such activity or control constitutes a serious risk to the financial soundness or stability of any subsidiary depository institution of the bank holding company. Further, federal bank regulatory authorities have additional discretion to require a holding company to divest itself of any bank or nonbank subsidiary if the agency determines that divestiture may aid the depository institution's financial condition. The Bank may be required to indemnify, or cross-guarantee, the FDIC against losses it incurs with respect to any other bank which the Company controls, which in effect makes the Company's equity investments in healthy bank subsidiaries available to the FDIC to assist any failing or failed bank subsidiary of the Company. The Bank is the only bank currently controlled by the Company.

The Bank

The Company is the holding company for the Bank, which is a North Carolina banking corporation. Substantially all Company revenues are earned through the operations of the Bank. The Bank is subject to examination and supervision by the Federal Reserve and the North Carolina Commissioner of Banks (the “Commissioner”). The Federal Reserve monitors the Bank’s compliance with several federal statutes such as the Community Reinvestment Act of 1977 and the Depository Institution Management Interlocks Act. The Federal Reserve has broad enforcement authority to prevent the continuance or development of unsafe and unsound banking practices, including the issuance of cease and desist orders and the removal of officers and directors. The Federal Reserve must approve the establishment of branch offices, conversions, mergers, assumptions of deposit liabilities between insured and uninsured institutions, and the acquisition or establishment of certain subsidiary corporations. The Federal Reserve can prevent capital or surplus diminution in such transactions where the deposit accounts of the resulting, continuing or assuring bank are federally insured.

The Bank is subject to capital requirements and limits on activities established by the Federal Reserve. Under the capital regulations, the Bank generally is required to maintain Tier 1 risk-based capital, in such terms as defined therein, of 4.0% and total risk-based capital of 8.0%. In addition, the Bank is required to provide a minimum leverage ratio Tier 1 capital to adjusted average quarterly assets (leverage ratio) equal to 3.0%, plus an additional cushion of one to two percent if the Bank has less than the highest regulatory rating. The Bank is not permitted to engage in any activity not permitted for a national bank unless (i) it is in compliance with its capital requirement and (ii) the FDIC determines that the activity would not pose a risk to the deposit insurance fund. With certain exceptions, the Bank also is not permitted to acquire equity investments of a type, or in an amount, not permitted for a national bank.

Federal banking law requires the federal banking agencies to take “prompt corrective action” in respect of insured depository institutions that do not meet minimum capital requirements. There are five tiers: “well capitalized,” “adequately capitalized,” “undercapitalized,” “significantly undercapitalized” and “critically undercapitalized,” as defined by regulations promulgated by the FDIC and the other federal depository institution regulatory agencies. A depository institution is well capitalized if it significantly exceeds the minimum level required by regulation for each relevant capital measure, adequately capitalized if it meets each such measure, undercapitalized if it fails to meet any such measure, significantly undercapitalized if it is below such measures, and critically undercapitalized if it fails to meet any critical capital level set forth in the regulations. The critical capital level must be a level of tangible equity capital equal to not more than 65.0% of the minimum leverage ratio prescribed by regulation. A depository institution may be deemed to be in a capitalization category that is lower than is indicated by its actual capital position if it receives an unsatisfactory examination rating.

The Bank is required to pay deposit insurance assessments set by the FDIC. Under the current assessment rate schedule, the Bank assessment will range from no assessment to .27% of the Bank’s average deposit base, with the exact assessment determined by the Bank’s capital and the FDIC’s supervisory opinion of the Bank’s operations. Only the strongest banks are not required to pay an assessment. The insurance assessments rate may change periodically. Changes in the assessment rate may have a material effect on the Bank’s operating results. The FDIC has the authority to terminate deposit insurance.

The earnings of the Bank are affected significantly by the policies of the Federal Reserve Board, a federal agency which regulates the money supply in order to mitigate recessionary and inflationary pressures. Among the techniques used to implement these objectives are open market transactions in United States government securities, changes in the rate paid by banks on bank borrowings, and changes in reserve requirements against bank deposits. These techniques are used in varying combinations to influence overall growth and distribution of bank loans, investments, and deposits, and their use may also affect interest rates charged on loans or paid on deposits.

The monetary policies of the Federal Reserve Board have had a significant effect on the operating results of commercial banks in the past and are expected to continue to do so in the future. In view of changing conditions in the national economy and money markets, as well as the effect of actions by monetary and fiscal authorities, no prediction can be made as to possible future changes in interest rates, deposit levels, loan demand or the business and earnings of the Bank.

The Bank is chartered by the State of North Carolina and is subject to extensive supervision and regulation by the Commissioner. The Commissioner enforces state laws that set specific requirements for bank capital, the payment of dividends, loans to officers and directors, record keeping, and types and amounts of loans and investments made by commercial banks. Among other things, the approval of the Commissioner is generally required before a North Carolina chartered commercial bank may establish branch offices. North Carolina banking law requires that any merger, liquidation or sale of substantially all of the assets of the Bank must be approved by the Commissioner and the holders of two-thirds of the Bank’s outstanding common stock.

Pursuant to North Carolina banking laws, no person may directly or indirectly purchase or acquire voting stock of the Bank which would result in the change of control of the Bank unless the Commissioner has approved the acquisition. A person will be deemed to have acquired “control” of the Bank if that person directly or indirectly (i) owns, controls or has power to vote 10% or more of the voting stock of the Bank, or (ii) otherwise possesses the power to direct or cause the direction of the management and policy of the Bank.

In its lending activities, the Bank is subject to North Carolina usury laws which generally limit or restrict the rates of interest, fees and charges and other terms and conditions in connection with various types of loans.

North Carolina banking law requires that bank holding companies register with the Commissioner. The Commissioner must also approve any acquisition of control of a state-chartered bank by a bank holding company.

In 1994, Congress adopted new legislation which generally permits an adequately capitalized and managed bank holding company to acquire control of a bank in any state, subject to certain state law requirements. North Carolina banking law has been amended to authorize banking organizations in any state to acquire North Carolina banking institutions on a reciprocal basis. North Carolina banking law authorizes North Carolina banks to establish branches in other states and permits out-of-state banks to establish branches in North Carolina on a reciprocal basis. The overall effect of this legislation will increase competition in the banking industry in North Carolina, however, the State of South Carolina does not allow North Carolina chartered banks to establish branches in South Carolina. As a result, North Carolina chartered banks may only establish offices within the State of South Carolina through acquisitions of existing South Carolina institutions effected in compliance with South Carolina banking law.

Material Customers

Deposits are derived from a broad base of customers in the Company’s trade area. No material portion of deposits have been obtained from a single person or a group of persons. Management does not believe the loss of any one customer would have a material adverse effect on the business of the Company.

The majority of loans and commitments to extend credit have been granted to customers in the Company’s market area. The majority of such customers are depositors. The Bank generally does not extend credit to any single borrower or group of related borrowers in excess of approximately $4.0 million.

Rights

No patents, trademarks, licenses, franchises or concessions held are of material significance to the Company.

Environmental Laws

Compliance with Federal, State, or local provisions regulating the discharge of materials into the environment has not had, nor is it expected to have in the future, a material effect upon the Company’s capital expenditures, earnings or competitive position.

Employees

The Company had no compensated employees. The Bank presently has 150 full-time equivalent employees consisting of 143 full-time employees and 13 part-time employees.

ITEM 1A - RISK FACTORS

An investment in the registrant’s common stock involves a number of risks. We urge you to read all of the information contained in this annual report on Form 10-K. In addition, we urge you to consider carefully the following factors before you invest in shares of the registrant’s common stock.

We may not be able to maintain and manage our growth, which may adversely affect our results of operations and financial condition and the value of our common stock.

Our strategy has been to increase the size of our company by opening new offices, acquiring other banks and by pursuing business development opportunities. We have grown rapidly since we commenced operations. We can provide no assurance that we will continue to be successful in increasing the volume of loans and deposits at acceptable risk levels and upon acceptable terms while managing the costs and implementation risks associated with our growth strategy. There can be no assurance that our further expansion will be profitable or that we will continue to be able to sustain our historical rate of growth, either through internal growth or through successful expansion of our markets, or that we will be able to maintain capital sufficient to support our continued growth. If we grow too quickly, however, and are not able to control costs and maintain asset quality, rapid growth also could adversely affect our financial performance.

Changes in interest rates affect our interest margins, which can adversely affect our profitability.

We may not be able to effectively manage changes in interest rates that affect what we charge as interest on our earning assets and the expense we must pay on interest-bearing liabilities, which may significantly reduce our earnings. Since rates charged on our loans often tend to react to market conditions faster than do rates paid on our deposit accounts, these rate cuts have had a negative impact on our earnings until we could make appropriate adjustments in our deposit rates. Fluctuations in interest rates are not predictable or controllable and, therefore, there can be no assurances of our ability to continue to maintain a consistent positive spread between the interest earned on our earning assets and the interest paid on our interest-bearing liabilities.

Our profitability depends significantly on economic conditions in our market area.

Our success depends to a large degree on the general economic conditions in our market areas. The local economic conditions in these areas have a significant impact on the amount of loans that we make to our borrowers, the ability of our borrowers to repay these loans and the value of the collateral securing these loans. A significant decline in general economic conditions caused by inflation, recession, unemployment or other factors beyond our control would impact these local economic conditions and could negatively affect our financial condition and performance.

If we lose key employees with significant business contacts in our market area, our business may suffer.

Our success is largely dependent on the personal contacts of our officers and employees in our market area. If we lose key employees temporarily or permanently, our business could be hurt. We could be particularly hurt if our key employees went to work for our competitors. Our future success depends on the continued contributions of our existing senior management personnel.

If we experience greater loan losses than anticipated, it will have an adverse effect on our net income.

While the risk of nonpayment of loans is inherent in banking, if we experience greater nonpayment levels than we anticipate, our earnings and overall financial condition, as well as the value of our common stock, could be adversely affected.

We cannot assure you that our monitoring procedures and policies will reduce certain lending risks or that our allowance for loan losses will be adequate to cover actual losses. In addition, as a result of the rapid growth in our loan portfolio, loan losses may be greater than management’s estimates. Loan losses can cause insolvency and failure of a financial institution and, in such an event, our stockholders could lose their entire investment. In addition, future provisions for loan losses could materially and adversely affect our profitability. Any loan losses will reduce the loan loss allowance. A reduction in the loan loss allowance will be restored by an increase in our provision for loan losses. This would reduce our earnings, which could have an adverse effect on our stock price.

In order to be profitable, we must compete successfully with other financial institutions which have greater resources and capabilities than we do.

The banking business in North Carolina in general is extremely competitive. Most of our competitors are larger and have greater resources than we do and have been in existence a longer period of time. We must overcome historical bank-customer relationships to attract customers away from our competition. We compete with the following types of institutions:

· other commercial banks · savings banks · thrifts · credit unions · consumer finance companies | | · securities brokerage firms · mortgage brokers · insurance companies · mutual funds · trust companies |

Some of our competitors are not regulated as extensively as we are and, therefore, may have greater flexibility in competing for business. Some of these competitors are subject to similar regulation but have the advantages of larger established customer bases, higher lending limits, extensive branch networks, numerous automated teller machines, greater advertising-marketing budgets or other factors.

Our legal lending limit is determined by law. The size of the loans which we offer to our customers may be less than the size of the loans that larger competitors are able to offer. This limit may affect to some degree our success in establishing relationships with the larger businesses in our market.

New or acquired branch facilities and other facilities may not be profitable.

We may not be able to correctly identify profitable locations for new branches and the costs to start up new branch facilities or to acquire existing branches, and the additional costs to operate these facilities, may increase our noninterest expense and decrease earnings in the short term. If other banks or branches of other banks become available for sale, we may acquire them. It may be difficult to adequately and profitably manage our growth through the establishment of these branches. In addition, we can provide no assurance that these branch sites will successfully attract enough deposits to offset the expenses of operating these branch sites. Any new or acquired branches will be subject to regulatory approval, and there can be no assurance that we will succeed in securing such approvals.

Government regulations may prevent or impair our ability to pay dividends, engage in additional acquisitions, or operate in other ways.

Current and future legislation and the policies established by federal and state regulatory authorities will affect our operations. We are subject to supervision and periodic examination by the Federal Reserve Board and the North Carolina Commissioner of Banks. Our principal subsidiary, Waccamaw Bank, as a state-chartered member bank, also receives regulatory scrutiny from the North Carolina Commissioner of Banks and the Federal Reserve. Banking regulations are designed primarily for the protection of depositors rather than stockholders, and they may limit our growth and the return to you as an investor by restricting its activities, such as:

| | · | the payment of dividends to stockholders; |

| | | |

| | · | possible transactions with or acquisitions by other institutions; |

| | | |

| | · | desired investments; |

| | | |

| | · | loans and interest rates; |

| | | |

| | · | interest rates paid on deposits; |

| | | |

| | · | the possible expansion of branch offices; and |

| | | |

| | · | the ability to provide securities or trust services. |

We are registered with the Federal Reserve Board as a financial holding company. We cannot predict what changes, if any, will be made to existing federal and state legislation and regulations or the effect that such changes may have on our business. The cost of compliance with regulatory requirements may adversely affect our ability to operate profitably.

Our stock trading volume has been low compared with larger financial holding companies.

The trading volume in our common stock on the Nasdaq Global Market has been comparable to other similarly sized bank holding companies since trading on the Global Market began. Nevertheless, this trading volume does not compare with more seasoned companies listed on other stock exchanges. Thus, the market in our common stock is somewhat limited in scope relative to some other companies. In addition, we can provide no assurance that a more active and liquid trading market for our stock will develop in the future.

Our articles of incorporation include anti-takeover provisions that may prevent stockholders from receiving a premium for their shares or effecting a transaction favored by a majority of stockholders.

Our articles of incorporation include anti-takeover provisions, including a supermajority vote requirement for a merger under certain circumstances as well as a provision allowing our Board of Directors to consider the social and economic effects of a proposed merger. Such provisions may have the effect of preventing Stockholders from receiving a premium for their shares of common stock and discouraging a change of control by allowing management to prevent a transaction favored by a majority of the Stockholders.

Our securities are not FDIC insured.

Our common stock is not a savings or deposit account or other obligation of the Bank, and is not insured by the Federal Deposit Insurance Corporation or any other governmental agency and is subject to investment risk, including the possible loss of principal.

ITEM 1B - UNRESOLVED STAFF COMMENTS

Not applicable

ITEM 2 - PROPERTIES

The Company purchased a 2.44 acre tract of real estate in March of 1999 for $233,318 from a Company director to be used as a construction site for a banking facility. This transactions was effected at arm’s length and management believes that the purchase price was at or below fair market value. The construction was completed in April of 2001 at a cost of $1.8 million. The two story building has approximately 12,000 finished square feet. In addition to the tellers inside the building, the Bank utilizes 3 drive-up lanes and an ATM to service the needs of customers.

The Bank has two additional branches in Columbus County located at 105 Hickman Road, Tabor City, North Carolina and 111 Strawberry Boulevard, Chadbourn, North Carolina. The Tabor City Branch is located in a 3,800 square foot building that includes two drive-up lanes and an ATM. The property is leased for $33,474 per year. The lease was assumed from the prior tenant and expires in 2011. The Bank has the option to extend the lease for four additional five year terms.

The Chadbourn branch is a one-story brick building with approximately 2,500 square feet of floor space that was leased following a Centura branch acquisition. The Bank has a five year lease with the option to renew for five additional terms of five years each. The branch also has drive-up facilities.

The Bank has seven branches located in Brunswick County, two in Shallotte, North Carolina, one in Holden Beach, North Carolina, two in Southport, North Carolina, one in Ocean Isle, North Carolina and one in Oak Island, North Carolina. The Shallotte Main Street branch is housed in a 2,521 square foot facility that includes two drive-up lanes and an ATM. The building is leased for a term of ten years beginning on February 1, 2000. The Bank has the option to renew the lease for three additional terms of five years.

The Shallotte Smith Street branch is housed in a 3,515 square foot facility that includes one drive-up lane and an ATM. The land and building were purchased at a cost of $2.2 million in September 2007 from BB&T.

The Holden Beach branch is housed in a 1,200 square foot facility that includes one drive-up lane and an ATM. The building is leased for a term of five years beginning on October 10, 2000. The Bank has the option to renew the lease for five additional terms of five years.

The Southport Howe Street branch is housed in a 1,860 square foot facility. The land and building are leased for a term of five years beginning on March 1, 2005. The Bank has the option to renew the lease for five additional terms of five years.

The Southport Supply Road branch is housed in a 3,858 square foot facility. The construction was completed in December 2006 at a cost of $1.2 million. The land is leased for a term of five years beginning on March 1, 2005. The Bank has the option to renew the lease for five additional terms of five years.

The Oak Island branch is housed in a 2,490 square foot facility. The land and building were purchased from BB&T at a cost of $1.5 million and has one drive-up lane and an ATM.

The Elizabethtown branch is housed in a 2,016 square foot facility. The land is leased for a term of five years beginning on November 7, 2005.

The Kerr Avenue branch in Wilmington is housed in a 3,000 square foot facility that includes two drive-up lanes and an ATM. The building is leased for a term of five years beginning on August 1, 2004. The Bank has a five year lease with the option to renew for five additional terms of five years.

The Heath Springs branch is housed in a 5,500 square foot facility. The building was purchased from The Bank of Heath Springs for $463,168.

The Ocean Isle branch is housed in a 2,982 square foot facility and has one drive-up lane and an ATM. The construction was completed in July 2007 at a cost of $921,000. The land is leased for a term of ten years beginning on March 1, 2007. The bank has the option to renew the lease for four additional terms of five years.

The Conway 16th Avenue branch is housed in a 1,350 square foot facility. The Bank has a five year lease beginning on September 1, 2006. The Conway branch is also leasing a 1,536 square foot facility for a term of eighteen months beginning on July 1, 2007.

The Conway Medical Center branch is housed in a 1,508 square foot facility. The building was purchased for $600,000 from BB&T and has one drive-up lane and an ATM.

The Myrtle Beach branch is housed in a 2,400 square foot facility and has one drive-up lane and an ATM. The lease was assumed from BB&T and expires in 2010 with the option to renew the lease for an additional term of five years.

The bank has an operations center located on Madison Street in Whiteville which is housed in a 7,700 square foot facility. The building is leased for a term of seven years beginning on January 1, 2006. The Bank has the option to renew the lease for five additional terms of five years.

ITEM 3 - LEGAL PROCEEDINGS

The Company is not party to, nor is any of its property the subject of, any material pending legal proceeding incidental to the business of the Company or the Bank.

ITEM 4 - SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matter was submitted to a vote of security holders during the fourth quarter of the fiscal year covered by this report.

PART II

ITEM 5 - MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company’s articles of incorporation authorize it to issue up to 25,000,000 shares of common stock, no par value, of which 5,436,970 shares were issued and outstanding as of March 20, 2008. The stock is listed on the NASDAQ Global Market under the symbol “WBNK”

The approximate number of holders of the Company’s shares of common stock as of March 20, 2008 is 1,900. There were 45,978 shares issued and outstanding of the Company’s Series A convertible preferred stock as of March 20, 2008.

The Board of Directors anticipates that all or substantially all of the Company’s earnings in the foreseeable future will be required for use in the development of the Company’s business. The payment of future cash dividends will be determined by the Board of Directors and is dependent upon the receipt of dividends from the Bank. To date, the Company has not paid any cash dividends.

The availability of dividends from the Bank is dependant on the Bank’s earnings, financial condition, business projections, and other pertinent factors. In addition, North Carolina banking law will prohibit the payment of cash dividends if the bank’s surplus is less than 50% of its paid-in capital. Also, under federal banking law, no cash dividend may be paid if the Bank is undercapitalized, or insolvent or if payment of the cash dividend would render the Bank undercapitalized or insolvent, and no cash dividend may be paid by the Bank if it is in default of any deposit insurance assessment due to the FDIC.

Set forth below are the approximate high and low (bid quotations/sales price), known to the management of the Company, for each quarter in the last three fiscal years. These quotations reflect inter-dealer prices, without retail mark-up, mark-down, or commissions and may not represent actual transactions.

| | | 2007 | | 2006 | | 2005 | |

| | | High | | Low | | High | | Low | | High | | Low | |

| First Quarter | | $ | 15.90 | | $ | 14.00 | | $ | 17.27 | | $ | 15.91 | | $ | 17.50 | | $ | 15.68 | |

| Second Quarter | | | 14.75 | | | 12.91 | | | 16.12 | | | 14.77 | | | 17.05 | | | 15.91 | |

| | | 13.86 | | | 11.69 | | | 16.58 | | | 13.81 | | | 18.86 | | | 16.36 | |

| Fourth Quarter | | | 14.00 | | | 10.25 | | | 16.36 | | | 13.75 | | | 17.77 | | | 15.91 | |

See Item 12 of this report for disclosure regarding securities authorized for issuance and equity compensation plans required by Item 201(d) of Regulation S-K.

On December 20, 2006, the Company sold 59,192 units, each consisting of one share of the Company’s Series A Preferred Stock and one warrant to purchase one share of common stock at $24.00. The units were sold for $17.00 each for an aggregate offering price of $1,006,264. The units were privately placed in accordance with, and in a transaction exempt from registration under the Securities Act of 1933 by, Section 4(2) of the Securities Act, Regulation D and Rule 506 thereunder. The units were sold to 20 individuals or entities, inclusive of accredited and non-accredited investors as those terms are defined by Regulation D.

The Series A Preferred Stock, issued in connection with the unit placement, is convertible to shares of common stock of the Company at the election of the holder of the Series A Preferred Stock on a date which is not before one year and one day after the units were first issued or at the election of the Company if the holders of the Preferred Stock would be afforded any voting rights under North Carolina law. The warrants may be converted into shares of common stock upon the payment by the holder of the exercise price of $21.82 per share (adjusted for 11 for 10 stock split in 2007). The warrants may be exercised at any time before 5:00 p.m., Eastern Standard Time, September 30, 2009.

ITEM 6 - SELECTED FINANCIAL DATA

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| | (thousands, except share data and ratios) | |

Summary of Operations: | | | | | | | | | | | |

| Interest income | | $ | 31,637 | | $ | 25,379 | | $ | 18,228 | | $ | 11,450 | | $ | 9,957 | |

| Interest expense | | | 16,296 | | | 11,226 | | | 7,536 | | | 3,766 | | | 3,627 | |

| Net interest income | | | 15,341 | | | 14,153 | | | 10,692 | | | 7,684 | | | 6,330 | |

| Provision for credit losses | | | 386 | | | 1,450 | | | 1,370 | | | 819 | | | 730 | |

| Net interest income after provision | | | | | | | | | | | | | | | | |

| for loan losses | | | 14,955 | | | 12,703 | | | 9,322 | | | 6,865 | | | 5,600 | |

| Total non-interest income | | | 3,443 | | | 2,581 | | | 2,269 | | | 2,445 | | | 2,053 | |

| Total non-interest expense | | | 12,440 | | | 9,422 | | | 6,967 | | | 5,687 | | | 4,436 | |

| Income before income taxes | | | 5,958 | | | 5,862 | | | 4,624 | | | 3,623 | | | 3,217 | |

| Income tax (expense) benefit | | | (2,049 | ) | | (2,210 | ) | | (1,589 | ) | | (1,209 | ) | | (1,210 | ) |

| Net income | | $ | 3,909 | | $ | 3,652 | | $ | 3,035 | | $ | 2,414 | | $ | 2,007 | |

| | | | | | | | | | | | | | | | | |

Per Common Share Data: 1 | | | | | | | | | | | | | | | | |

| Basic earnings per share | | $ | .73 | | $ | .71 | | $ | .61 | | $ | .49 | | $ | .41 | |

| Diluted earnings per share | | | .72 | | | .69 | | | .58 | | | .47 | | | .39 | |

| Market Price | | | | | | | | | | | | | | | | |

| High | | | 15.90 | | | 17.27 | | | 18.86 | | | 24.68 | | | 10.98 | |

| Low | | | 10.25 | | | 13.81 | | | 15.68 | | | 9.85 | | | 6.31 | |

| Close | | | 10.50 | | | 14.88 | | | 16.14 | | | 16.36 | | | 10.32 | |

| Book value | | | 6.44 | | | 5.77 | | | 4.48 | | | 3.99 | | | 3.45 | |

| | | | | | | | | | | | | | | | | |

Selected Average Balances: | | | | | | | | | | | | | | | | |

| Total assets | | $ | 438,579 | | $ | 356,675 | | $ | 302,381 | | $ | 217,035 | | $ | 177,563 | |

| Loans, net | | | 332,451 | | | 279,625 | | | 238,579 | | | 168,757 | | | 137,403 | |

| Securities | | | 65,454 | | | 46,561 | | | 31,257 | | | 29,068 | | | 19,663 | |

| Interest-earning assets | | | 404,329 | | | 331,713 | | | 284,320 | | | 200,982 | | | 165,847 | |

| Deposits | | | 354,512 | | | 298,324 | | | 252,994 | | | 169,162 | | | 147,663 | |

| Interest-bearing liabilities | | | 366,266 | | | 295,596 | | | 256,492 | | | 179,696 | | | 146,438 | |

| Shareholders’ equity | | | 33,501 | | | 25,945 | | | 20,254 | | | 17,941 | | | 15,633 | |

| | | | | | | | | | | | | | | | | |

Selected Year-End Balance Sheet Data: | | | | | | | | | | | | | | | | |

| Total assets | | $ | 508,368 | | $ | 399,581 | | $ | 322,792 | | $ | 258,412 | | $ | 193,207 | |

| Loans, net | | | 355,138 | | | 312,253 | | | 257,575 | | | 206,666 | | | 142,342 | |

| Securities | | | 102,644 | | | 52,986 | | | 35,214 | | | 30,232 | | | 24,053 | |

| Interest-earning assets | | | 458,695 | | | 374,047 | | | 306,987 | | | 247,432 | | | 181,648 | |

| Deposits | | | 378,179 | | | 327,352 | | | 271,035 | | | 207,642 | | | 154,796 | |

| Interest-bearing liabilities | | | 437,207 | | | 315,346 | | | 273,171 | | | 218,592 | | | 158,828 | |

| Shareholders’ equity | | | 35,023 | | | 31,703 | | | 22,499 | | | 19,899 | | | 16,963 | |

| | | | | | | | | | | | | | | | | |

Selected Performance Ratios: | | | | | | | | | | | | | | | | |

| Return on average assets | | | .89 | % | | 1.02 | % | | 1.00 | % | | 1.11 | % | | 1.13 | % |

| Return on average equity | | | 11.67 | % | | 14.07 | % | | 14.98 | % | | 13.46 | % | | 12.84 | % |

| Net interest margin | | | 3.79 | % | | 4.27 | % | | 3.76 | % | | 3.82 | % | | 3.82 | % |

| | | | | | | | | | | | | | | | | |

Asset Quality Ratios: | | | | | | | | | | | | | | | | |

| Nonperforming loans to period-end loans | | | 1.24 | % | | .49 | % | | 80 | % | | 1.16 | % | | .93 | % |

| Allowance for loan losses to period-end loans | | | 1.49 | % | | 1.54 | % | | 1.50 | % | | 1.33 | % | | 1.53 | % |

| Net loan charge-offs to average loans | | | (.03 | )% | | .20 | % | | .09 | % | | 0.15 | % | | 0.27 | % |

Capital Ratios: | | | | | | | | | | | | | | | | |

| Total risk-based capital | | | 10.88 | % | | 11.82 | % | | 12.36 | % | | 13.64 | % | | 14.24 | % |

| Tier 1 risk-based capital | | | 9.63 | % | | 10.57 | % | | 11.11 | % | | 10.53 | % | | 12.91 | % |

| Leverage ratio | | | 8.70 | % | | 9.61 | % | | 9.37 | % | | 9.44 | % | | 10.47 | % |

| Equity to assets ratio | | | 6.89 | % | | 7.93 | % | | 6.97 | % | | 7.70 | % | | 8.78 | % |

| | | | | | | | | | | | | | | | | |

Capital Ratios: | | | | | | | | | | | | | | | | |

| Number of banking offices | | | 16 | | | 11 | | | 8 | | | 6 | | | 5 | |

| Number of full time equivalent employees | | | 150 | | | 109 | | | 85 | | | 73 | | | 58 | |

1 | Adjusted for the effects of 6 for 5 stock splits in 2003 and 2004, 2 for 1 stock split in 2004 and 11 for 10 stock split in 2007. |

ITEM 7 - MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The information required by this item is incorporated by reference to the Company’s 2007 annual report to stockholders.

ITEM 7A - QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company’s profitability is dependent to a large extent upon its net interest income, which is the difference between its interest income on interest-bearing assets, such as loans and investments, and its interest expense on interest-bearing liabilities, such as deposits and borrowings. The Company’s primary market risk is interest rate risk, which is the result of differing maturities or repricing intervals of interest-earning assets and interest-bearing liabilities with the goals of minimizing interest rate fluctuations in its net interest income. The Company does not maintain a trading account, nor is it subject to currency exchange risk or commodity price risk.

The Company’s Asset/Liability Committee (“ALCO”) meets on a monthly basis in order to assess interest rate risk, liquidity, capital and overall balance sheet management through rate shock analysis measuring various interest rate scenarios over the future 12 months. Through ALCO, the Company is able to determine fluctuations to net interest income from changes in the Prime Rate of up to 300 basis points up or down during a 12-month period. ALCO also reviews policies and procedures related to funds management and interest rate risk based on local, national and global economic conditions along with funding strategies and balance sheet management to minimize the potential impact of earnings and liquidity from interest rate movements.

The following table presents information about the contractual maturities, average interest rates and estimated fair values of the Company’s financial instruments that are considered market risk sensitive.

Expected Maturities of Market Sensitive Instruments Held at December 31, 2007

($ in thousands)

| | | | | | | | | | | | | Average | | Estimated | |

| | | | | | | | | | | | | Interest | | Fair | |

| | | Months | | Months | | Months | | Months | | Total | | Rate | | Value | |

Earning Assets: | | | | | | | | | | | | | | | |

| Loans | | $ | 213,459 | | $ | 21,851 | | $ | 88,671 | | $ | 36,996 | | $ | 360,977 | | | 8.27 | % | $ | 361,047 | |

| Investments | | | 794 | | | 14 | | | 5,881 | | | 95,955 | | | 102,644 | | | 5.81 | % | | 102,644 | |

| Deposits with banks | | | 912 | | | - | | | - | | | - | | | 912 | | | 5.19 | % | | 912 | |

| Total | | | 215,165 | | | 21,865 | | | 94,552 | | | 132,951 | | | 464,533 | | | 7.82 | % | | 464,603 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | |

| Demand accounts | | | 24,841 | | | - | | | - | | | - | | | 24,841 | | | .62 | % | | 24,841 | |

| Savings and money market | | | 71,760 | | | - | | | - | | | - | | | 71,760 | | | 3.35 | % | | 71,760 | |

| Time deposits | | | 63,399 | | | 165,871 | | | 16,314 | | | 3,624 | | | 249,208 | | | 5.05 | % | | 249,715 | |

| Repurchase agreements and | | | | | | | | | | | | | | | | | | | | | | |

| purchased funds | | | 24,651 | | | 10,000 | | | 10,000 | | | - | | | 44,651 | | | 5.08 | % | | 44,651 | |

| Other borrowings | | | 14,248 | | | 7,000 | | | 11,500 | | | 14,000 | | | 46,748 | | | 5.96 | % | | 45,698 | |

| Total | | $ | 198,899 | | $ | 182,871 | | $ | 37,814 | | $ | 17,624 | | $ | 437,208 | | | 4.46 | % | $ | 436,665 | |

ITEM 8 - FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The following financial statements of the Company and the Report of independent registered public accounting firm set forth on pages 6 through 39 of the Company’s 2007 Annual Report to Stockholders are incorporated herein by reference:

| | 1. | Consolidated Balance Sheets as of December 31, 2007 and 2006 |

| | 2. | Consolidated Statements of Income for the years ended December 31, 2007, 2006 and 2005 |

| | 3. | Consolidated Statements of Changes in Stockholders’ Equity for the years ended December 31, 2007, 2006 and 2005 |

| | 4. | Consolidated Statements of Cash Flows for the years ended December 31, 2007, 2006 and 2005 |

| | 5. | Notes to Consolidated Financial Statements |

| | 6. | Report of independent registered public accounting firm |

ITEM 9 - CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A(T) - CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

At the end of the period covered by this report, the Company carried out an evaluation, under the supervision and with the participation of the Company’s management, including the Company’s Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of the Company’s disclosure controls and procedures pursuant to Securities Exchange Act Rule 13a-14.

Based upon that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and procedures were effective (1) to provide reasonable assurance that information required to be disclosed by the Company in the reports filed or submitted by it under the Securities Exchange Act was recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and (2) to provide reasonable assurance that information required to be disclosed by the Company in such reports is accumulated and communicated to the Company’s management, including its Chief Executive Officer and Chief Financial Officer, as appropriate to allow for timely decisions regarding required disclosure.

Management's Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting for the Company. The Company's internal control over financial reporting is a process designed under the supervision of the Company's CEO and CFO to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the Company's financial statements for external reporting purposes in accordance with U.S. generally accepted accounting principles. Management has made a comprehensive review, evaluation and assessment of the Company's internal control over financial reporting as of December 31, 2007. In making its assessment of internal control over financial reporting, management used the criteria issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in Internal Control−−Integrated Framework. In accordance with Section 404 of the Sarbanes−Oxley Act of 2002, management makes the following assertions:

| | · | Management has implemented a process to monitor and assess both the design and operating effectiveness of internal control over financial reporting. |

| | · | All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. |

| | ·

| The Company’s management assessed the effectiveness of the company’s internal control over financial reporting as of December 31, 2007. In making this assessment, it used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control—Integrated Framework. Based on that assessment, we believe that, as of December 31, 2007, the company’s internal control over financial reporting is effective based on those criteria. |

This annual report does not include an attestation report of the company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the company's registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the company to provide only management's report in this annual report.

Changes in Internal Control over Financial Reporting

Management of the Company has evaluated, with the participation of the Company's CEO and CFO, changes in the Company's internal controls over financial reporting (as defined in Rule 13a−15(f) and 15d−15(f) of the Exchange Act) during the fourth quarter of 2007. In connection with such evaluation, the Company has determined that there have been no changes in internal control over financial reporting during the fourth quarter that have materially affected or are reasonably likely to materially affect, the Company's internal control over financial reporting.

ITEM 9B - OTHER INFORMATION

None.

PART III

ITEM 10 - DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The information required by this item is incorporated by reference to the Company’s proxy statement for the 2008 Annual Meeting of Stockholders, pages 4-10 and 19-20.

Code of Ethics

The Company’s Board of Directors has adopted a Code of Ethics that applies to its directors and to all of its executive officers, including without limitation its principal executive officer and principal financial officer. A copy of the Company’s Code of Ethics is provided at the Company’s website: www.waccamawbank.com.

ITEM 11 - EXECUTIVE COMPENSATION

The information required by this item is incorporated by reference to the Company’s proxy statement for the 2008 Annual Meeting of Stockholders, pages 11-18.

ITEM 12 - SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Certain information required by this item is incorporated by reference to the Company’s proxy statement for the 2008 Annual Meeting of Stockholders, pages 3-4.

Set forth below is certain information regarding the Company’s various stock option plans.

Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants, and rights (a) | | Weighted-average exercise price of outstanding options, warrants, and rights (b) | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |

| Equity compensation plans approved by security holders | | | 367,656 | | $ | 12.72 | | | 154,524 | |

| Equity compensation plans not approved by security holders | | | None | | | None | | | None | |

| Total | | | 367,656 | | $ | 12.72 | | | 154,524 | |

ITEM 13 - CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

The information required by this item is incorporated by reference to the Company’s proxy statement for the 2008 Annual Meeting of Stockholders, pages 6 and 9.

ITEM 14 - PRINCIPAL ACCOUNTING FEES AND SERVICES

The information required by this item is incorporated by reference to the Company’s proxy statement for the 2008 Annual Meeting of Stockholders, pages 18-19.

PART IV

ITEM 15 - EXHIBITS, FINANCIAL STATEMENT SCHEDULES

| (a) | The following documents are filed as part of this report: |

| | 1. | Financial statements from the Registrant’s Annual Report to stockholders for the fiscal year ended December 31, 2007, which are incorporated herein by reference: |

Consolidated Balance Sheets as of December 31, 2007 and 2006.

Consolidated Statements of Income for the years ended December 31, 2007, 2006 and 2005.

Consolidated Statements of Changes in Stockholders’ Equity for the years ended December 31, 2007, 2006 and 2005.

Consolidated Statements of Cash Flows for the years ended December 31, 2007, 2006 and 2005.

Notes to Consolidated Financial Statements.

Report of independent registered public accounting firm.

| | 2. | Financial statement schedules required to be filed by Item 8 of this Form: |

None

EXHIBIT NUMBER | | DESCRIPTION OF EXHIBIT |

| | | |

| 3.1 | | Registrant’s Articles of Incorporation* |

| | | |

| 3.2 | | Registrant’s Bylaws* |

| | | |

| 4.1 | | Specimen Stock Certificate** |

| | | |

| 10.1 | | Employment Agreement of James G. Graham*** |

| | | |

| 10.2 | | Waccamaw Bank 1998 Incentive Stock Option Plan*** |

| | | |

| 10.3 | | Waccamaw Bank 1998 Nonstatutory Stock Option Plan*** |

| | | |

| 10.4 | | Supplemental Executive Retirement Plan |

| | | |

| 13 | | Annual Report to Stockholders (Filed herewith) |

| | | |

| 21 | | Subsidiaries of Registrant (Filed herewith) |

| | | |

| 31(i) | | |

| | | |

| 31(ii) | | Certification of Principal Accounting Officer Pursuant to Section 302 of the Sarbanes Oxley Act (Filed herewith) |

| | | |

| 32 | | Certification Pursuant to Section 906 of the Sarbanes Oxley Act (Filed herewith) |

| | | |

| 99 | | Registrant’s Definitive Proxy Statement**** |

| | * | Incorporated by reference from exhibits 3(i) and 3(ii) to Registrant’s Current Report on Form 8-K12g3, as filed with the Commission on July 1, 2001. |

| | ** | Incorporated by reference from exhibit 4.1 to Registrant’s Annual Report on Form 10-KSB for the year ended December 31, 2001. |

| | *** | Incorporated by reference from Exhibits 10.2, 10.3 and 10.4 to Annual Report on Form 10-KSB of Waccamaw Bank, as filed with the FDIC. |

| | **** | Filed with the Commission pursuant to Rule 14a-6. |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized

| | | |

| | WACCAMAW BANKSHARES, INC. |

|

|

|

| March 28, 2007 | | /s/ James G. Graham |

|

James G. Graham |

| President and Chief Executive Officer |

| | | |

| March 28, 2007 | | /s/ David A. Godwin |

|

David A. Godwin |

| | Vice-President and Chief Financial Officer |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has to be signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

Signature | | Title | | Date |

| | | | |

| | President and | | March 20, 2008 |

| | Chief Executive Officer | | |

| | | | | |

| | | | |

| | Director | | March 20, 2008 |

| M. B. “Bo” Biggs | | | | |

| | | | | |

| | | | |

| | Director | | March 20, 2008 |

| Dr. Maudie M. Davis | | | | |

| | | | | |

| | | | |

| | Director | | March 20, 2008 |

| E. Autry Dawsey, Sr. | | | | |

| | | | | |

| | | | |

| | Director | | March 20, 2008 |

| Monroe Enzor, III | | | | |

| | | | | |

| | | | |

| | Director | | March 20, 2008 |

| James E. Hill, Jr. | | | | |

| | | | | |

| | | | |

| | Director, Chairman | | March 20, 2008 |

| | of the Board | | |

| | | | | |

| | | | |

| | Director | | March 20, 2008 |

| Dale Ward | | | | |

| | | | | |

| | | | |

/s/ J. Densil Worthington | | Director | | March 20, 2008 |

| J. Densil Worthington | | | | |

| | | | | |

| | | | | |

| /s/ Brian Campbell | | Director | | March 20, 2008 |

| Brian Campbell | | | | |

EXHIBIT INDEX

EXHIBIT NUMBER | | DESCRIPTION OF EXHIBIT |

| | | |

| 3.1 | | Registrant’s Articles of Incorporation* |

| | | |

| 3.2 | | Registrant’s Bylaws* |

| | | |

| 4.1 | | Specimen Stock Certificate** |

| | | |

| 10.1 | | Employment Agreement of James G. Graham*** |

| | | |

| 10.2 | | Waccamaw Bank 1998 Incentive Stock Option Plan*** |

| | | |

| 10.3 | | Waccamaw Bank 1998 Nonstatutory Stock Option Plan*** |

| | | |

| 10.4 | | Supplemental Executive Retirement Plan |

| | | |

| 13 | | Annual Report to Stockholders (Filed herewith) |

| | | |

| 21 | | Subsidiaries of Registrant (Filed herewith) |

| | | |

| 31(i) | | Certification of Principal Executive Officer Pursuant to Section 302 of the Sarbanes Oxley Act (Filed herewith) |

| | | |

| 31(ii) | | Certification of Principal Accounting Officer Pursuant to Section 302 of the Sarbanes Oxley Act (Filed herewith) |

| | | |

| 32 | | Certification Pursuant to Section 906 of the Sarbanes Oxley Act (Filed herewith) |

| | | |

| 99 | | Registrant’s Definitive Proxy Statement**** |

| | * | Incorporated by reference from exhibits 3(i) and 3(ii) to Registrant’s Current Report on Form 8-K12g3, as filed with the Commission on July 1, 2001. |

| | ** | Incorporated by reference from exhibit 4.1 to Registrant’s Annual Report on Form 10-KSB for the year ended December 31, 2001. |

| | *** | Incorporated by reference from Exhibits 10.2, 10.3 and 10.4 to Annual Report on Form 10-KSB of Waccamaw Bank, as filed with the FDIC. |

| | **** | Filed with the Commission pursuant to Rule 14a-6. |

INTRODUCTION

Table of Contents | | |

| | | |

| Introduction | | 1 |

| | | |

| Statement of Mission | | 2 |

| | | |

| Stock Performance | | 2 |

| | | |

| Significant Trends | | 3 |

| | | |

| Financial Highlights | | 4 |

| | | |

| Shareholder Letter | | 5 |

| | | |

| Consolidated Balance Sheets | | 7 |

| | | |

| Consolidated Statements of Income | | 8 |

| | | |

| Consolidated Statements of Changes in Stockholders' Equity and Comprehensive Income | | 9 |

| | | |

| Consolidated Statements of Cash Flows | | 10 |

| | | |

| Notes to Consolidated Financial Statements | | 12 |

| | | |

| Report of Independent Registered Public Accounting Firm | | 39 |

| | | |

| Management’s Discussion and Analysis | | 40 |

| | | |

| Stockholder Information | | 57 |

STATEMENT OF MISSION

Waccamaw Bank serves a principled mission:

• to be the strongest independent bank in the coastal Carolina region;

• to offer fairly priced products and services that meet the financial needs of our community;

• to operate in an efficient manner designed for customer convenience;

• to be a good corporate neighbor within our communities;

• to maintain safety, soundness and profitability;

• to care for a quality staff that supports this mission.

STOCK PERFORMANCE

| | | | Period Ending | |

Index | | | 12/31/02 | | | 12/31/03 | | | 12/31/04 | | | 12/31/05 | | | 12/31/06 | | | 12/31/07 | |

| Waccamaw Bankshares, Inc. | | | 100.00 | | | 181.60 | | | 288.00 | | | 284.00 | | | 261.92 | | | 184.80 | |

| NASDAQ Composite | | | 100.00 | | | 150.01 | | | 162.89 | | | 165.13 | | | 180.85 | | | 198.60 | |

| SNL Southeast Bank Index | | | 100.00 | | | 125.58 | | | 148.92 | | | 152.44 | | | 178.75 | | | 134.65 | |

Significant Trends

Financial Highlights Summary1

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

Summary of Operations | | | | | | | | | | | |

| Interest income | | $ | 31,637 | | $ | 25,379 | | $ | 18,228 | | $ | 11,450 | | $ | 9,957 | |

| Interest expense | | | (16,296 | ) | | (11,226 | ) | | (7,536 | ) | | (3,766 | ) | | (3,627 | ) |

| Net interest income | | | 15,341 | | | 14,153 | | | 10,692 | | | 7,684 | | | 6,330 | |

| Provision for loan losses | | | (386 | ) | | (1,450 | ) | | (1,370 | ) | | (819 | ) | | (730 | ) |

| Other income | | | 3,443 | | | 2,581 | | | 2,269 | | | 2,445 | | | 2,053 | |

| Other expense | | | (12,440 | ) | | (9,422 | ) | | (6,967 | ) | | (5,687 | ) | | (4,436 | ) |

| Income tax expense | | | (2,049 | ) | | (2,210 | ) | | (1,589 | ) | | (1,209 | ) | | (1,210 | ) |

| Net income | | $ | 3,909 | | $ | 3,652 | | $ | 3,035 | | $ | 2,414 | | $ | 2,007 | |

Per Share Data2 | | | | | | | | | | | | | | | | |

| Basic earnings per share | | $ | .73 | | $ | .71 | | $ | .61 | | $ | .49 | | $ | .41 | |

| Diluted earnings per share | | | .72 | | | .69 | | | .58 | | | .47 | | | .39 | |

| Book value | | | 6.44 | | | 5.77 | | | 4.48 | | | 3.99 | | | 3.45 | |

Average Balance Sheet Summary | | | | | | | | | | | | | | | | |

| Loans, net | | $ | 332,451 | | $ | 279,625 | | $ | 238,579 | | $ | 168,757 | | $ | 137,403 | |

| Securities | | | 65,454 | | | 46,561 | | | 31,257 | | | 29,068 | | | 19,663 | |

| Total assets | | | 438,579 | | | 356,675 | | | 302,381 | | | 217,035 | | | 177,563 | |

| Deposits | | | 354,512 | | | 298,324 | | | 252,994 | | | 169,162 | | | 147,663 | |

| Shareholders’ equity | | | 33,501 | | | 25,945 | | | 20,254 | | | 17,941 | | | 15,633 | |

Selected Ratios | | | | | | | | | | | | | | | | |

| Average equity to average assets | | | 7.64 | % | | 7.27 | % | | 6.70 | % | | 8.27 | % | | 8.80 | % |

| Return on average assets | | | .89 | % | | 1.02 | % | | 1.00 | % | | 1.11 | % | | 1.13 | % |

| Return on average equity | | | 11.67 | % | | 14.07 | % | | 14.98 | % | | 13.46 | % | | 12.84 | % |

1 In thousands of dollars, except per share data.2 Adjusted for the effects of 6 for 5 stock splits in 2003 and 2004, 2 for 1 stock split in 2004 and 11 for 10 stock split in 2007.

To Our Shareholders, Clients and Friends:

We are pleased to report 2007 proved to be a significant year in the progress of Waccamaw Bankshares, Inc. It was a year in which the bank celebrated its tenth year of operations and saw significant growth and expansion as we worked hard to position the bank for the future. As you will find in this report we achieved another year of record earnings and created a much stronger franchise as we took advantages of opportunities within our market to open five new offices prior to the end of 2007. Waccamaw Bankshares, Inc. is optimistic about our company’s expansion as we continue to grow Coastal Carolina Strong.

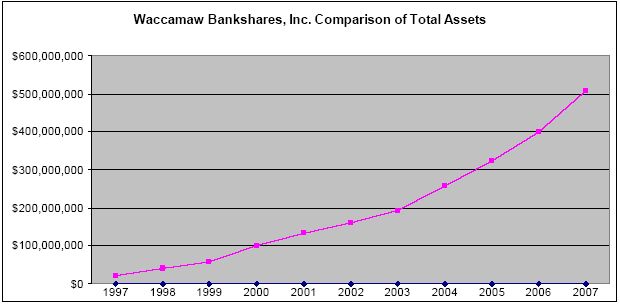

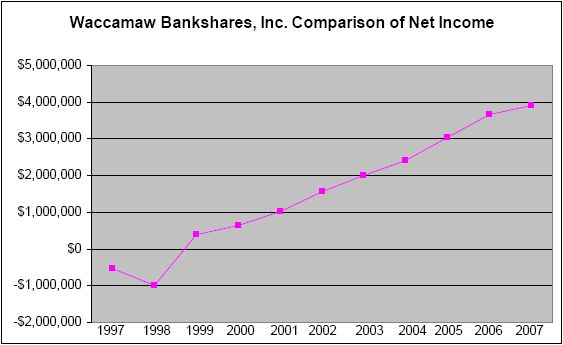

With assets over $500 million dollars, it is with significant pride the directors, management and staff report record profits for the year end of December 31, 2007—$3.9 million dollars—a 7.04% increase over the $3,652,016 earned in 2006. It is significant to note that Waccamaw Bankshares, Inc. assets passed the major $500 million dollar milestone and closed the year at $508,367,919 in total assets; a 27.2% increase over 2006.

The banking industry faced many challenges during the year with declining interest rates, questionable credit quality in some segments of our industry and a slowing national economy. We are pleased to report that the bank has absolutely no exposure to sub prime mortgages and continues to work very hard to protect what we believe is strong asset quality.

In addition to the financial performance of 2007, we continued to branch in the very strongest markets available to the bank. We strengthened the bank’s franchise by opening three additional offices in fast growing Brunswick County, North Carolina with offices in Sunset Beach, Oak Island and a second office in Shallotte. The bank also took the opportunity to continue our expansion into economically attractive Horry County, South Carolina with a second office in the Conway area and a new office in south Myrtle Beach. This expansion gives us four offices in South Carolina with three in Horry County. Our fourth office in Horry County, South Carolina will be located in Little River and is currently under construction with a second quarter 2008 scheduled opening. At the close of 2007, the bank operates a total of 16 full service offices in a footprint not duplicated by any other community banking franchise. It is our belief this creates substantial value for our shareholders and well positions the bank for the years to come. The bank began a significant new marketing effort in September as we celebrated our tenth anniversary. The marketing effort that began simultaneously with our tenth anniversary, Simply Free Checking is the centerpiece of the realignment of our entire consumer checking offerings. The response to date has been tremendous. This effort is bringing hundreds of new clients to our bank and gives us an opportunity to form solid relationships with these clients as well as supporting a much larger customer base.

It is without question that the national financial turmoil has served to weaken the values of financial companies and is likely to continue into 2008. While the bank enjoys a strong franchise, it cannot insulate itself from the interest rate environment which is causing a very rapid narrowing in net interest margins or other external economic factors. Asset quality for the bank remains satisfactory while net losses declined in 2007. The management and staff are working hard to provide the best possible financial results for the company as we proceed to capitalize on the new opportunities afforded to us by our branch expansion. We know that the new offices will perform well in the future and anticipate bringing them to a profitable status as quickly as possible.

While the national economy in 2008 provides a generous amount of uncertainties, we are optimistic that the staff and management of the bank will perform well despite these challenges. I would like to take this opportunity to thank you for your confidence and support. Each shareholder, client, and friend carries great value for Waccamaw Bankshares, Inc. We would like to thank our staff and the entire Waccamaw Bank family for the performance and for the value they add everyday. As you review this report, please feel free to contact us with any questions or comments. Thank you for banking with Waccamaw Bank.

Sincerely,

James G. Graham

President and Chief Executive Officer

Alan W. Thompson

Chairman of the Board

Consolidated Balance Sheets

December 31, 2007 and 2006

| | 2007 | | 2006 | |

Assets | | | | | |

| Cash and due from banks | | $ | 11,809,251 | | $ | 9,183,383 | |

| Interest-bearing deposits with banks | | | 912,195 | | | 790,360 | |

| Total cash and cash equivalents | | | 12,721,446 | | | 9,973,743 | |

| Federal funds sold | | | - | | | 2,598,000 | |

| Investment securities, available for sale | | | 99,302,322 | | | 50,529,163 | |

| Restricted equity securities | | | 3,342,006 | | | 2,457,206 | |

| Loans, net of allowance for loan losses | | | | | | | |

| of $5,385,782 in 2007 and $4,885,992 in 2006 | | | 355,138,167 | | | 312,253,190 | |

| Property and equipment, net | | | 14,537,739 | | | 6,671,773 | |

| Goodwill | | | 2,727,152 | | | 2,665,602 | |

| Intangible assets, net | | | 673,374 | | | 930,555 | |

| Accrued income | | | 2,939,264 | | | 2,627,020 | |

| Bank owned life insurance | | | 11,777,361 | | | 5,419,130 | |

| Other assets | | | 5,209,088 | | | 3,455,911 | |

| Total assets | | $ | 508,367,919 | | $ | 399,581,293 | |

Liabilities and Stockholders' Equity | | | | | | | |

Liabilities | | | | | | | |

| Noninterest-bearing deposits | | $ | 32,371,173 | | $ | 49,163,297 | |

| Interest-bearing deposits | | | 345,808,162 | | | 278,188,470 | |

| Total deposits | | | 378,179,335 | | | 327,351,767 | |

| Securities sold under agreements to repurchase | | | 29,222,000 | | | 5,410,000 | |

| Federal funds purchased | | | 15,429,300 | | | - | |

| Short-term borrowings | | | 13,000,000 | | | - | |

| Long-term debt | | | 25,500,000 | | | 23,500,000 | |

| Guaranteed preferred beneficial interest in the | | | | | | | |

| company’s junior subordinated debentures | | | 8,248,000 | | | 8,248,000 | |

| Accrued interest payable | | | 2,125,673 | | | 1,412,300 | |

| Other liabilities | | | 1,640,470 | | | 1,956,596 | |

| Total liabilities | | | 473,344,778 | | | 367,878,663 | |

| Commitments and contingencies | | | - | | | - | |

Stockholders’ equity | | | | | | | |

| Preferred stock, Series A, non-cumulative, non-voting, | | | | | | | |

| no par value; 1,000,000 shares authorized; | | | | | | | |

| 48,178 and 65,111 issued and outstanding at | | | | | | | |

| December 31, 2007 and 2006, respectively | | | 793,967 | | | 993,112 | |

| Common stock, no par; 25,000,000 shares authorized; | | | | | | | |

| 5,434,770 and 5,320,666 shares issued and outstanding | | | | | | | |