SECURITIES AND EXCHANGE COMMISSION

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the fiscal year ended December 31, 2008

¨ TRANSITIONAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from _______ to _______.

COMMISSION FILE NUMBER 000-32985

WACCAMAW BANKSHARES, INC.

(Exact name of registrant as specified in its charter)

| NORTH CAROLINA | | 52-2329563 |

| (State or Other Jurisdiction of | | (I.R.S. Employer |

| Incorporation or Organization) | | Identification No.) |

110 NORTH J. K. POWELL BOULEVARD | | |

| WHITEVILLE, NORTH CAROLINA | | 28472 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone number, including area code: (910) 641-0044

Securities registered pursuant to Section 12(b) of the Act

NONE

Securities registered pursuant to Section 12(g) of the Act:

COMMON STOCK, NO PAR VALUE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | Large accelerated filer ¨ | Accelerated filer ¨ |

| | | |

| | Non-accelerated filer (Do not check if | |

| | a smaller reporting company) ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act):

¨ Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing sales price of the Registrant’s Common Stock reported on the NASDAQ Global Select Market on June 30, 2008 was $42,488,115. Solely for purposes of this calculation, the term “affiliate” includes all directors and executive officers of the Registrant and all beneficial owners of more than 5% of the Registrant’s voting securities.

As of March 20, 2009, the Registrant had outstanding 5,523,549 shares of Common Stock.

Documents Incorporated by Reference.

The Registrant’s Annual Report to stockholders for the fiscal year ended December 31, 2008

Registrant’s Proxy Statement for the 2009 Annual Meeting of Stockholders

FORM 10-K CROSS-REFERENCE INDEX

| PART I | FORM 10-K | PROXY STATEMENT | ANNUAL REPORT |

| | | | |

| Item 1 – Business | 2 | | |

| Item 1A – Risk Factors | 7 | | |

| Item 1B – Unresolved Staff Comments | 7 | | |

| Item 2 – Properties | 7 | | |

| Item 3 – Legal Proceedings | 8 | | |

Item 4 – Submission of Matters to a Vote Of Security Holders | 8 | | |

| | | | |

| PART II | | | |

| | | | |

| Item 5–Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 9 | | |

| Item 6 – Selected Financial Data | 10 | | |

| Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | 11 |

| Item 7A – Quantitative and Qualitative Disclosures About Market Risk | | | 11 |

| Item 8 – Financial Statements and Supplementary Data | | | 12 |

| Item 9 – Changes in and Disagreements with Accountants on Accounting and Financial Disclosures | 12 | | |

| Item 9A – Controls and Procedures | 12 | | |

| Item 9B – Other Information | 13 | | |

| | | | |

| PART III | | | |

| | | | |

| Item 10 – Directors, ExecutiveOfficers and Corporate Governance | 14 | 14 | |

| Item 11 – Executive Compensation | | 14 | |

| Item 12 – Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 14 | |

| Item 13 – Certain Relationships and Related Transactions, and Director Independence | | 14 | |

| Item 14 – Principal Accounting Fees and Services | | 14 | |

| | | | |

| PART IV | | | |

| | | | |

| Item 15 – Exhibits, Financial Statement Schedules | 15 | | |

PART 1

ITEM 1 – BUSINESS

General

Waccamaw Bankshares, Inc. (the “Company”) was formed during 2001 as a financial holding company chartered in the state of North Carolina. On July 1, 2001, the Company acquired all the outstanding shares of Waccamaw Bank (the “Bank”) in a tax-free exchange. To date, the only business activities of the Company consist of the activities of the Bank.

Waccamaw Bank was organized and incorporated under the laws of the State of North Carolina on August 28, 1997 and commenced operations on September 2, 1997. The Bank currently serves Columbus County, North Carolina and surrounding areas through three banking offices, Brunswick County through seven banking offices, New Hanover County through one banking office, Bladen County through one banking office, and Lancaster County, South Carolina through one banking office and Horry County through four banking offices. As a state chartered bank which is a member of the Federal Reserve, the Bank is subject to regulation by the Commissioner of Banks and the Federal Reserve.

Location and Service Area

The Company’s primary service area is Columbus, Brunswick, Bladen and New Hanover Counties of North Carolina and Lancaster and Horry Counties of South Carolina. The principal business of the Company is to provide comprehensive individual and corporate banking services through its main service area. These services include demand and time deposits as well as commercial, installment, mortgage and other consumer lending services that are traditionally available from community banks.

Columbus County is located in the southeastern portion of North Carolina near the South Carolina border. Whiteville, the largest city in the county is approximately 45 miles west of Wilmington, North Carolina, 150 miles southeast of Charlotte, North Carolina, and 45 miles north of Myrtle Beach, South Carolina. These cities all have national or regional airports.

Brunswick County is adjacent to Columbus County to the southeast and also borders South Carolina. Shallotte, the largest city in the county, is approximately 35 miles southwest of Wilmington and 35 miles northeast of Myrtle Beach.

New Hanover County is a coastal county and adjacent to Brunswick County to the north. Wilmington, the largest city in the county, has a diversified economy which includes shipping, manufacturing, medical and retail industries.

Bladen County is adjacent to Columbus County to the northeast. Elizabethtown, the largest city in the county is approximately 50 miles northwest of Wilmington and 80 miles northwest of Myrtle Beach.

Lancaster County is located near the mid part of the state near the North Carolina border and approximately 40 miles south of Charlotte, NC and fifty miles north of Columbia. These cities all have national or regional airports.

Horry County is located in the northeastern portion of South Carolina near the North Carolina border. Myrtle Beach, the largest city in the county, has a diversified economy which includes tourism, manufacturing, medical and retail industries.

The principle components of the economy are manufacturing, agriculture and tourism. Manufacturing employment is concentrated in the wood products and textile industries. The primary agriculture products are tobacco and hogs.

Competition

The primary business activity of the Company is commercial banking. This activity is conducted by the Bank which is the wholly-owned subsidiary of the Company.

Banking is a highly competitive industry. The principal areas and methods of competition in the banking industry are the services that are offered, the pricing of those services, the convenience and availability of the services and the degree of expertise and personal manner with which those services are offered. The Bank encounters strong competition from other commercial banks, including the largest North Carolina banks, operating in the Bank’s market area. There are 14 offices of 5 other commercial banks operating in Columbus County, 44 offices of 11 other commercial banks operating in Brunswick County, 77 offices of 17 other commercial banks operating in New Hanover County, 8 offices of 5 other commercial banks operating in Bladen County, 8 offices of 4 other commercial banks operating in Lancaster County and 104 offices of 18 other commercial banks operating in Horry County. In the conduct of certain aspects of its business, the Bank also competes with credit unions, money market mutual funds, and other non-bank financial institutions, some of which are not subject to the same degree of regulation as the Bank. Many of these competitors have substantially greater resources and lending abilities than the Company and offer certain services, such as investment banking, trust, interstate and international banking services, that the Company cannot or will not provide.

Supervision and Regulation

The Company and the Bank are subject to state and federal banking laws and regulations. These impose specific requirements and restrictions and provide for general regulatory oversight with respect to virtually all aspects of operations. These laws and regulations are generally intended to protect depositors, not Stockholders. To the extent that the following summary describes statutory or regulatory provisions, it is qualified in its entirety by reference to the particular statutory and regulatory provisions. Any change in applicable laws or regulations may have a material effect on the business and prospects of the Company. Beginning with the enactment of the Financial Institutions Reform, Recovery and Enforcement Act of 1989 ("FIRREA") and following with the Federal Deposit Insurance Corporation Improvement Act ("FDICIA"), enacted in 1991, numerous additional regulatory requirements have been placed on the banking industry in the past five years, and additional changes have been proposed. The operations of the Company and the Bank may be affected by legislative changes and the policies of various regulatory authorities. The Company is unable to predict the nature or the extent of the effect on its business and earnings that fiscal or monetary policies, economic control, or new federal or state legislation may have in the future.

Federal Bank Holding Company Regulation (Financial Holding Company Regulations)

The Company is a financial holding company within the meaning of the Gramm-Leach-Bliley Act of 1999 (the "GLB Act"). Under the GLB Act, which became effective on March 11, 2000, the types of activities in which a bank holding company may engage were significantly expanded. Subject to various limitations, the GLB Act generally permits a bank holding company to elect to become a "financial holding company". A financial holding company may affiliate with securities firms and insurance companies and engage in other activities that are "financial in nature." Among the activities that are deemed "financial in nature" are, in addition to traditional lending activities, securities underwriting, dealing in or making a market in securities, sponsoring mutual funds and investment companies, insurance underwriting and agency activities, certain merchant banking activities and activities that the Federal Reserve considers to be closely related to banking.

A bank holding company may become a financial holding company under the GLB Act if each of its subsidiary banks is "well capitalized" under the Federal Deposit Insurance Corporation Improvement Act prompt corrective action provisions, is well managed and has at least a satisfactory rating under the Community Reinvestment Act. In addition, the bank holding company must file a declaration with the Federal Reserve if it falls out of compliance with these requirements and may be required to cease engaging in some of its activities.

Under the GLB Act, the Federal Reserve serves as the primary "umbrella" regulator of financial holding companies, with supervisory authority over each parent company and limited authority over its subsidiaries. Expanded financial activities of financial holding companies generally will be regulated according to the type of such financial activity, banking activities by banking regulators, securities activities by securities regulators and insurance activities by insurance regulators. The GLB Act also imposes additional restrictions and heightened disclosure requirements regarding information collected by financial institutions.

The Company is also still subject to the Bank Holding Company Act (the "BHCA"). Under the BHCA, the Company is subject to periodic examination by the Federal Reserve and is required to file periodic reports of its operations and such other information as the Federal Reserve may require.

Investments, Control, and Activities. With certain limited exceptions, the BHCA requires every holding company to obtain the prior approval of the Federal Reserve before (i) acquiring substantially all the assets of any bank, (ii) acquiring direct or indirect ownership or control of any voting shares of any bank if after such an acquisition it would own or control more than 5% of the voting shares of such bank (unless it already owns or controls the majority of such shares), or (iii) merging or consolidating with another holding company.

In addition, and subject to certain exceptions, the BHCA and the Change in Bank Control Act, together with regulations there under, require Federal Reserve approval (or, depending on the circumstances, no notice of disapproval) prior to any person or company acquiring "control" of a holding company, such as the Company. Control is conclusively presumed to exist if an individual or company acquires 25% or more of any class of voting securities of the holding company. In the case of the Company, under Federal Reserve regulations control will be rebuttable presumed to exist if a person acquires at least 10% of the outstanding shares of any class of voting securities.

Source of Strength; Cross-Guarantee. In accordance with Federal Reserve policy, the Company is expected to act as a source of financial strength to the Bank and to commit resources to support the Bank in circumstances in which the Company might not otherwise do so. Under the BHCA, the Federal Reserve may require a holding company to terminate any activity or relinquish control of a nonbank subsidiary (other than a nonbank subsidiary of a bank) upon the Federal Reserve's determination that such activity or control constitutes a serious risk to the financial soundness or stability of any subsidiary depository institution of the bank holding company. Further, federal bank regulatory authorities have additional discretion to require a holding company to divest itself of any bank or nonbank subsidiary if the agency determines that divestiture may aid the depository institution's financial condition. The Bank may be required to indemnify, or cross-guarantee, the FDIC against losses it incurs with respect to any other bank which the Company controls, which in effect makes the Company's equity investments in healthy bank subsidiaries available to the FDIC to assist any failing or failed bank subsidiary of the Company. The Bank is the only bank currently controlled by the Company.

The Bank

The Company is the holding company for the Bank, which is a North Carolina banking corporation. Substantially all Company revenues are earned through the operations of the Bank. The Bank is subject to examination and supervision by the Federal Reserve and the North Carolina Commissioner of Banks (the “Commissioner”). The Federal Reserve monitors the Bank’s compliance with several federal statutes such as the Community Reinvestment Act of 1977 and the Interlocks Act. The Federal Reserve has broad enforcement authority to prevent the continuance or development of unsafe and unsound banking practices, including the issuance of cease and desist orders and the removal of officers and directors. The Federal Reserve must approve the establishment of branch offices, conversions, and mergers, assumptions of deposit liabilities between insured and uninsured institutions, and the acquisition or establishment of certain subsidiary corporations. The Federal Reserve can prevent capital or surplus diminution in such transactions where the deposit accounts of the resulting, continuing or assuring bank are federally insured.

The Bank is subject to capital requirements and limits on activities established by the Federal Reserve. Under the capital regulations, the Bank generally is required to maintain Tier 1 risk-based capital, in such terms as defined therein, of 4.0% and total risk-based capital of 8.0%. In addition, the Bank is required to provide a minimum leverage ratio Tier 1 capital to adjusted average quarterly assets (leverage ratio) equal to 3.0%, plus an additional cushion of one to two percent if the Bank has less than the highest regulatory rating. The Bank is not permitted to engage in any activity not permitted for a national bank unless (i) it is in compliance with its capital requirement and (ii) the FDIC determines that the activity would not pose a risk to the deposit insurance fund. With certain exceptions, the Bank also is not permitted to acquire equity investments of a type, or in an amount, not permitted for a national bank.

Federal banking law requires the federal banking agencies to take “prompt corrective action” in respect of insured depository institutions that do not meet minimum capital requirements. There are five tiers: “well capitalized”, “adequately capitalized”, “undercapitalized”, “significantly undercapitalized” and “critically undercapitalized”, as defined by regulations promulgated by the FDIC and the other federal depository institution regulatory agencies. A depository institution is well capitalized if it significantly exceeds the minimum level required by regulation for each relevant capital measure, adequately capitalized if it meets each such measure, undercapitalized if it fails to meet any such measure, significantly undercapitalized if it is below such measures, and critically undercapitalized if it fails to meet any critical capital level set forth in the regulations. The critical capital level must be a level of tangible equity capital equal to not more than 65.0% of the minimum leverage ratio prescribed by regulation. A depository institution may be deemed to be in a capitalization category that is lower than is indicated by its actual capital position if it receives an unsatisfactory examination rating.

The Bank is required to pay deposit insurance assessments set by the FDIC. Under the current assessment rate schedule, the Bank assessment will range from .05% to .43% of the Bank’s average deposit base, with the exact assessment determined by the Bank’s capital and the FDIC’s supervisory opinion of the Bank’s operations. The insurance assessments rate may change periodically. Changes in the assessment rate may have a material effect on the Bank’s operating results. The FDIC has the authority to terminate deposit insurance.

Under regulations effective January 1, 2007, the Federal Deposit Insurance Corporation adopted a new risk-based premium system that provides for quarterly assessments based on an insured institution’s ranking in one of four risk categories based upon supervisory and capital evaluations. Institutions are assessed at annual rates ranging from 5 to 43 basis points, respectively, depending on each institution’s risk of default as measured by regulatory capital ratios and other supervisory measures. Under a proposal announced by the Federal Deposit Insurance Corporation on October 7, 2008, the assessment rate schedule would be raised uniformly by seven basis points (annualized) beginning on January 1, 2009. Beginning with the second quarter of 2009, base assessment rates before adjustments would range from 10 to 45 basis points, and further changes would be made to the deposit insurance assessment system, including requiring riskier institutions to pay a larger share. The proposal would impose higher assessment rates on institutions with a significant reliance on secured liabilities and on institutions which rely significantly on brokered deposits (but, for well-managed and well-capitalized institutions, only when accompanied by rapid asset growth). The proposal would reduce assessment rates for institutions that hold long-term unsecured debt and, for smaller institutions, high levels of Tier 1 (defined below) capital.

On February 27, 2009 the FDIC voted to amend the restoration of the Deposit Insurance Fund. The Board took action by imposing a special assessment on insured institutions of 20 basis points, implementing changes to the risk- based assessment system, and increased regular premium rates for 2009, which banks must pay on top of the special assessment. The 20 basis point special assessment on the industry will be as of June 30, 2009, payable September 30, 2009. As a result of the special assessment and increased regular assessments the Company projects it will experience an increase in FDIC assessment by approximately $1.0 million from 2008 to 2009. The 20 basis point special assessment represents $928,000 of this increase.

On March 5, 2009, the FDIC Chairman announced that the FDIC intends to lower the special assessment from 20 basis points to 10 basis points. The approval of the cutback is contingent on whether Congress clears legislation that would expand the FDIC’s line of credit with the Treasury to $100 billion. Legislation to increase the FDIC’s borrowing authority on a permanent basis is also expected to advance to Congress, which should aid in reducing the burden on the industry. The assessment rates, including the special assessment, are subject to change at the discretion of the Board of Directors of the FDIC.

The earnings of the Bank are affected significantly by the policies of the Federal Reserve Board, a federal agency which regulates the money supply in order to mitigate recessionary and inflationary pressures. Among the techniques used to implement these objectives are open market transactions in United States government securities, changes in the rate paid by banks on bank borrowings, and changes in reserve requirement against bank deposits. These techniques are used in varying combinations to influence overall growth and distribution of bank loans, investments, and deposits, and their use may also affect interest rates charged on loans or paid on deposits.

The monetary policies of the Federal Reserve Board have had a significant effect on the operating results of commercial banks in the past and are expected to continue to do so in the future. In view of changing conditions in the national economy and money markets, as well as the effect of actions by monetary and fiscal authorities, no prediction can be made as to possible future changes in interest rates, deposit levels, loan demand or the business and earnings of the Bank.

The Bank is chartered by the State of North Carolina and is subject to extensive supervision and regulation by the Commissioner. The Commissioner enforces state laws that set specific requirements for bank capital, the payment of dividends, loans to officers and directors, record keeping, and types and amounts of loans and investments made by commercial banks. Among other things, the approval of the Commissioner is generally required before a North Carolina chartered commercial bank may establish branch offices. North Carolina banking law requires that any merger, liquidation or sale of substantially all of the assets of the Bank must be approved by the Commissioner and the holders of two-thirds of the Bank’s outstanding common stock.

Pursuant to North Carolina banking laws, no person may directly or indirectly purchase or acquire voting stock of the Bank which would result in the change of control of the Bank unless the Commissioner has approved the acquisition. A person will be deemed to have acquired “control” of the Bank if that person directly or indirectly (i) owns, controls or has power to vote 10% or more of the voting stock of the Bank, or (ii) otherwise possesses the power to direct or cause the direction of the management and policy of the Bank.

In its lending activities, the Bank is subject to North Carolina usury laws which generally limit or restrict the rates of interest, fees and charges and other terms and conditions in connection with various types of loans.

North Carolina banking law requires that bank holding companies register with the Commissioner. The Commissioner must also approve any acquisition of control of a state-chartered bank by a bank holding company.

In 1994, Congress adopted new legislation which generally permits an adequately capitalized and managed bank holding company to acquire control of a bank in any state, subject to certain state law requirements. North Carolina banking law has been amended to authorize banking organizations in any state to acquire North Carolina banking institutions on a reciprocal basis. North Carolina banking law authorizes North Carolina banks to establish branches in other states and permits out-of-state banks to establish branches in North Carolina on a reciprocal basis. The overall effect of this legislation will increase competition in the banking industry in North Carolina, however, the State of South Carolina does not allow North Carolina chartered banks to establish branches in South Carolina. As a result, North Carolina chartered banks may only establish offices within the State of South Carolina through acquisitions of existing South Carolina institutions effected in compliance with South Carolina banking law.

Material Customers

Deposits are derived from a broad base of customers in the Company’s trade area. No material portion of deposits has been obtained from a single person or a group of persons. Management does not believe the loss of any one customer would have a material adverse effect on the business of the Company.

The majority of loans and commitments to extend credit have been granted to customers in the Company’s market area. The majority of such customers are depositors. The Bank generally does not extend credit to any single borrower or group of related borrowers in excess of approximately $4.0 million.

Rights

No patents, trademarks, licenses, franchises or concessions held are of material significance to the Company.

Environmental Laws

Compliance with Federal, State, or Local provisions regulating the discharge of materials into the environment has not had, nor is it expected to have in the future, a material effect upon the Company’s capital expenditures, earnings or competitive position.

Employees

The Company had no compensated employees. The Bank presently has 148 full-time equivalent employees consisting of 140 full-time employees and 16 part-time employees.

ITEM 1A – RISK FACTORS

Not applicable due to smaller reporting company

ITEM 1B – UNRESOLVED STAFF COMMENTS

Not applicable

ITEM 2 - PROPERTIES

The Company purchased a 2.44 acre tract of real estate for $233,318 from a Company director to be used as a construction site for a banking facility. This transaction was effected at arm’s length and management believes that the purchase price was at or below fair market value. The construction was completed in April of 2001 at a cost of $1.8 million. The two story building has approximately 12,000 finished square feet. In addition to the tellers inside the building, the Bank utilizes 3 drive-up lanes and an ATM to service the need of customers.

The Bank has two additional branches in Columbus County located at 105 Hickman Road, Tabor City, North Carolina and 111 Strawberry Boulevard, Chadbourn, North Carolina. The Tabor City Branch is located in a 3,800 square foot building that includes two drive-up lanes and an ATM. The property is leased for $33,474 per year. The lease was assumed from the prior tenant and expires in 2011. The Bank has the option to extend the lease for four additional five year terms.

The Chadbourn branch is a one-story brick building with approximately 2,500 square feet of floor space that was leased following a Centura branch acquisition. The Bank has a five year lease with the option to renew for five additional terms of five years each. The branch also has drive-up facilities.

The Bank has seven branches located in Brunswick County, two in Shallotte, North Carolina, one in Holden Beach, North Carolina, two in Southport, North Carolina, one in Ocean Isle, North Carolina and one in Oak Island, North Carolina. The Shallotte Main Street branch is housed in a 2,521 square foot facility that includes two drive-up lanes and an ATM. The building is leased for a term of ten years beginning on February 1, 2000. The Bank has the option to renew the lease for three additional terms of five years.

The Shallotte Smith Street branch is housed in a 3,515 square foot facility that includes one drive-up lane and an ATM. The land and building was purchased at a cost of $2.2 million in September 2007 from BB&T.

The Holden Beach branch is housed in a 1,200 square foot facility that includes one drive-up lane and an ATM. The building is leased for a term of five years beginning on October 10, 2000. The Bank has the option to renew the lease for five additional terms of five years.

The Southport Howe Street branch is housed in a 1,860 square foot facility. The land and building are leased for a term of five years beginning on March 1, 2005. The Bank has the option to renew the lease for five additional terms of five years.

The Southport Supply Road branch is housed in a 3,858 square foot facility. The construction was completed in December 2006 at a cost of $1.2 million. The land is leased for a term of five years beginning on March 1, 2005. The Bank has the option to renew the lease for five additional terms of five years.

The Oak Island branch is housed in a 2,490 square foot facility. The land and building was purchased from BB&T at a cost of $1.5 million and has one drive-up lane and an ATM.

The Elizabethtown branch is housed in a 2,016 square foot facility. The land is leased for a term of five years beginning on November 7, 2005.

The Kerr Avenue branch in Wilmington is housed in a 3,000 square foot facility that includes two drive-up lanes and an ATM. The building is leased for a term of five years beginning on August 1, 2004. The Bank has a five year lease with the option to renew for five additional terms of five years.

The Heath Springs branch is housed in a 5,500 square foot facility. The building was purchased from The Bank of Heath Springs for $463,168.

The Ocean Isle branch is housed in a 2,982 square foot facility and has one drive-up lane and an ATM. The construction was completed in July 2007 at a cost of $921,000. The land is leased for a term of ten years beginning on March 1, 2007. The bank has the option to renew the lease for four additional terms of five years.

The Conway 16th Avenue branch is housed in a 1,350 square foot facility. The Bank has a five year lease beginning on September 1, 2006.

The Conway Medical Center branch is housed in a 1,508 square foot facility. The building was purchased for $600,000 from BB&T and has one drive-up lane and an ATM.

The Myrtle Beach branch is housed in a 2,400 square foot facility and has one drive-up lane and an ATM. The lease was assumed from BB&T and expires in 2010 with the option to renew the lease for an additional term of five years.

The Little River branch is housed in a 10,000 square foot facility and has three drive-up lanes and an ATM. The construction was completed in August 2008 at a cost of $2.7 million and the land was purchased for $990,000.

The bank has an operations center located on Madison Street in Whiteville which is housed in a 7,700 square foot facility. The building is leased for a term of seven years beginning on January 1, 2006. The Bank has the option to renew the lease for five additional terms of five years.

ITEM 3 – LEGAL PROCEEDINGS

On the normal course of business, Waccamaw Bankshares’ subsidiary, Waccamaw Bank, may be named as a party in legal disputes.

Currently, the Bank is a party to a legal proceeding arising out of a contract between Eastwood Homes Coastal Carolina, LLC, a home builder, and Landcraft Management, LLC, a developer. According to the lawsuit filed September 19, 2008, in the United States Bankruptcy Court for the Eastern District of North Carolina, Eastwood claims Landcraft did not act in a forthright manner and breached the terms of the contract. Therefore, Eastwood asserts that certain letters of credit it provided should be nullified and that it should be awarded both actual and punitive damages. The Bank has been named as a party to this suit due to a loan it provided to Landcraft. Although there is no assurance that this matter will be resolved favorably and that the Bank’s financial statements will not be adversely affected, management currently expects that there will be no material adverse effect on its financial condition or results of operations resulting from the resolution of this or any other pending legal proceeding.

ITEM 4 – SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matter was submitted to a vote of security holders during the fourth quarter of the fiscal year covered by this report.

PART II

ITEM 5 – MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company’s articles of incorporation authorize it to issue up to 25,000,000 shares of common stock, no par value, of which 5,523,549 shares were issued and outstanding as of March 20, 2009. The stock is listed on the NASDAQ Global Market under the symbol “WBNK”.

The approximate number of holders of the Company’s shares of common stock as of March 20, 2009 is 1,900. There were 28,184 shares issued and outstanding of the Company’s Series A convertible preferred stock as of March 20, 2009.

The Board of Directors anticipates that all or substantially all of the Company’s earnings in the foreseeable future will be required for use in the development of the Company’s business. The payment of future cash dividends will be determined by the Board of Directors and is dependent upon the receipt of dividends from the Bank. To date, the Company has not paid any cash dividends.

The availability of dividends from the Bank is dependant on the Bank’s earnings, financial condition, business projections, and other pertinent factors. In addition, North Carolina banking law will prohibit the payment of cash dividends if the bank’s surplus is less than 50% of its paid-in capital. Also, under federal banking law, no cash dividend may be paid if the Bank is undercapitalized or insolvent or if payment of the cash dividend would render the Bank undercapitalized or insolvent and no cash dividend may be paid by the Bank if it is in default of any deposit insurance assessment due to the FDIC.

Set forth below are the approximate high and low (bid quotations/sales price), known to the management of the Bank, for each quarter in the last three fiscal years. These quotations reflect inter-dealer prices, without retail mark-up, mark-down, or commissions and may not represent actual transactions.

| | | 2008 | | | 2007 | | | 2006 | |

| | | High | | | Low | | | High | | | Low | | | High | | | Low | |

| First Quarter | | $ | 11.00 | | | $ | 9.25 | | | $ | 15.90 | | | $ | 14.00 | | | $ | 17.27 | | | $ | 15.91 | |

| Second Quarter | | | 9.99 | | | | 8.70 | | | | 14.75 | | | | 12.91 | | | | 16.12 | | | | 14.77 | |

| Third Quarter | | | 9.94 | | | | 6.11 | | | | 13.86 | | | | 11.69 | | | | 16.58 | | | | 13.81 | |

| Fourth Quarter | | | 9.08 | | | | 5.00 | | | | 14.00 | | | | 10.25 | | | | 16.36 | | | | 13.75 | |

See Item 12 of this report for disclosure regarding securities authorized for issuance and equity compensation plans required by Item 201(d) of Regulation S-K.

On December 20, 2006, the Company sold 65,111 units, each consisting of one share of the Company’s Series A Preferred Stock and one warrant to purchase one share of common stock at $21.82 per share (adjusted for 11 for 10 stock split in 2007). The units were sold for $17.00 each for an aggregate offering price of $1,006,264. The units were privately placed in accordance with, and in a transaction exempt from registration under the Securities Act of 1933 by, Section 4(2) of the Securities Act, Regulation D and Rule 506 hereunder. The units were sold to 20 individuals or entities, inclusive of accredited and non-accredited investors as those terms are defined by Regulation D.

The Series A Preferred Stock, issued in connection with the unit placement, are convertible to shares of common stock of the Company at the election of the holder of the Series A Preferred Stock on a date which is not before one year and one day after the units were first issued or at the election of the Company if the holders of the Preferred Stock would be afforded any voting rights under North Carolina law. The warrants may be converted into shares of common stock upon the payment by the holder of the exercise price of $21.82 per share (adjusted for 11 for 10 stock split in 2007). The warrants may be exercised at any time before 5:00 p.m., Eastern Standard Time, September 30, 2009.

ITEM 6 – SELECTED FINANCIAL DATA

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | (thousands, except share data and ratios) | |

| Summary of Operations: | | | | | | | | | | | | | | | |

| Interest income | | $ | 30,485 | | | $ | 31,637 | | | $ | 25,379 | | | $ | 18,228 | | | $ | 11,450 | |

| Interest expense | | | 16,934 | | | | 16,296 | | | | 11,226 | | | | 7,536 | | | | 3,766 | |

| Net interest income | | | 13,551 | | | | 15,341 | | | | 14,153 | | | | 10,692 | | | | 7,684 | |

| Provision for loan losses | | | 2,990 | | | | 386 | | | | 1,450 | | | | 1,370 | | | | 819 | |

| Net interest income after provision | | | | | | | | | | | | | | | | | | | | |

| for loan losses | | | 10,561 | | | | 14,955 | | | | 12,703 | | | | 9,322 | | | | 6,865 | |

| Total non-interest income | | | 966 | | | | 3,443 | | | | 2,581 | | | | 2,269 | | | | 2,445 | |

| Total non-interest expense | | | 15,397 | | | | 12,440 | | | | 9,422 | | | | 6,967 | | | | 5,687 | |

| Income (loss) before income taxes | | | (3,870 | ) | | | 5,958 | | | | 5,862 | | | | 4,624 | | | | 3,623 | |

| Income tax (expense) benefit | | | 1,827 | | | | (2,049 | ) | | | (2,210 | ) | | | (1,589 | ) | | | (1,209 | ) |

| Net income (loss) | | $ | (2,043 | ) | | $ | 3,909 | | | $ | 3,652 | | | $ | 3,035 | | | $ | 2,414 | |

| | | | | | | | | | | | | | | | | | | | | |

Per Common Share Data: 1 | | | | | | | | | | | | | | | | | | | | |

| Basic income (loss) per share | | $ | (.37 | ) | | $ | .73 | | | $ | .71 | | | $ | .61 | | | $ | .49 | |

| Diluted income (loss) per share | | | (.37 | ) | | | .72 | | | | .69 | | | | .58 | | | | .47 | |

| Market Price | | | | | | | | | | | | | | | | | | | | |

| High | | | 11.00 | | | | 15.90 | | | | 17.27 | | | | 18.86 | | | | 24.68 | |

| Low | | | 5.00 | | | | 10.25 | | | | 13.75 | | | | 15.68 | | | | 9.85 | |

| Close | | | 5.01 | | | | 10.50 | | | | 14.88 | | | | 16.14 | | | | 16.36 | |

| Book value | | | 5.04 | | | | 6.44 | | | | 5.77 | | | | 4.48 | | | | 3.99 | |

| | | | | | | | | | | | | | | | | | | | | |

| Selected Average Balances: | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 539,468 | | | $ | 438,579 | | | $ | 356,675 | | | $ | 302,381 | | | $ | 217,035 | |

| Loans, net | | | 376,747 | | | | 332,451 | | | | 279,625 | | | | 238,579 | | | | 168,757 | |

| Securities | | | 105,819 | | | | 65,454 | | | | 46,561 | | | | 31,257 | | | | 29,068 | |

| Interest-earning assets | | | 490,883 | | | | 404,329 | | | | 331,713 | | | | 284,320 | | | | 200,982 | |

| Deposits | | | 415,711 | | | | 354,512 | | | | 298,324 | | | | 252,994 | | | | 169,162 | |

| Interest-bearing liabilities | | | 469,829 | | | | 366,266 | | | | 295,596 | | | | 256,492 | | | | 179,696 | |

| Stockholders’ equity | | | 33,460 | | | | 33,501 | | | | 25,945 | | | | 20,254 | | | | 17,941 | |

| | | | | | | | | | | | | | | | | | | | | |

| Selected Year-End Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 537,450 | | | $ | 508,368 | | | $ | 399,581 | | | $ | 322,792 | | | $ | 258,412 | |

| Loans, net | | | 378,883 | | | | 355,138 | | | | 312,253 | | | | 257,575 | | | | 206,666 | |

| Securities | | | 91,535 | | | | 102,644 | | | | 52,986 | | | | 35,214 | | | | 30,232 | |

| Interest-earning assets | | | 495,218 | | | | 458,695 | | | | 374,047 | | | | 306,987 | | | | 247,432 | |

| Deposits | | | 418,580 | | | | 378,179 | | | | 327,352 | | | | 271,035 | | | | 207,642 | |

| Interest-bearing liabilities | | | 471,122 | | | | 437,207 | | | | 315,346 | | | | 273,171 | | | | 218,592 | |

| Stockholders’ equity | | | 27,844 | | | | 35,023 | | | | 31,703 | | | | 22,499 | | | | 19,899 | |

| | | | | | | | | | | | | | | | | | | | | |

| Selected Performance Ratios: | | | | | | | | | | | | | | | | | | | | |

| Return on average assets | | | (.38 | ) % | | | .89 | % | | | 1.02 | % | | | 1.00 | % | | | 1.11 | % |

| Return on average equity | | | (6.11 | ) % | | | 11.67 | % | | | 14.07 | % | | | 14.98 | % | | | 13.46 | % |

| Net interest margin | | | 2.76 | % | | | 3.79 | % | | | 4.27 | % | | | 3.76 | % | | | 3.82 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Asset Quality Ratios: | | | | | | | | | | | | | | | | | | | | |

| Nonperforming loans to period-end loans | | | 4.67 | % | | | 1.24 | % | | | .49 | % | | | 80 | % | | | 1.16 | % |

| Allowance for loan losses to period-end loans | | | 1.86 | % | | | 1.49 | % | | | 1.54 | % | | | 1.50 | % | | | 1.33 | % |

| Net loan charge-offs to average loans | | | .32 | % | | | (.03 | ) % | | | .20 | % | | | .09 | % | | | 0.15 | % |

| Capital Ratios: | | | | | | | | | | | | | | | | | | | | |

| Total risk-based capital | | | 11.68 | % | | | 10.88 | % | | | 11.82 | % | | | 12.36 | % | | | 13.64 | % |

| Tier 1 risk-based capital | | | 9.76 | % | | | 9.63 | % | | | 10.57 | % | | | 11.11 | % | | | 10.53 | % |

| Leverage ratio | | | 8.00 | % | | | 8.70 | % | | | 9.61 | % | | | 9.37 | % | | | 9.44 | % |

| Equity to assets ratio | | | 5.18 | % | | | 6.89 | % | | | 7.93 | % | | | 6.97 | % | | | 7.70 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Capital Ratios: | | | | | | | | | | | | | | | | | | | | |

| | | 17 | | | | 16 | | | | 11 | | | | 8 | | | | 6 | |

| Number of full time equivalent employees | | | 148 | | | | 150 | | | | 109 | | | | 85 | | | | 73 | |

| 1 | Adjusted for the effects of 6 for 5 stock splits in 2004, 2 for 1 stock split in 2004 and 11 for 10 stock split in 2007. |

ITEM 7 – MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The information required by this item is incorporated by reference to the Company’s 2008 annual report to stockholders.

ITEM 7A – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company’s profitability is dependent to a large extent upon its net interest income, which is the difference between its interest income on interest-bearing assets, such as loans and investments, and its interest expense on interest-bearing liabilities, such as deposits and borrowings. The Company’s primary market risk is interest rate risk, which is the result of differing maturities or re-pricing intervals of interest-earning assets and interest-bearing liabilities with the goals of minimizing interest rate fluctuations in its net interest income. The Company does not maintain a trading account, nor is it subject to currency exchange risk or commodity price risk.

The Company’s Asset/Liability Committee (“ALCO”) meets on a monthly basis in order to assess interest rate risk, liquidity, capital and overall balance sheet management through rate shock analysis measuring various interest rate scenarios over the future 12 months. Through ALCO, the Company is able to determine fluctuations to net interest income from changes in the Prime lending rate of up to 300 basis points up or down during a 12-month period. ALCO also reviews policies and procedures related to funds management and interest rate risk based on local, national and global economic conditions along with funding strategies and balance sheet management to minimize the potential impact of earnings and liquidity from interest rate movements.

The following table presents information about the contractual maturities, average interest rates and estimated fair values of the Company’s financial instruments that are considered market risk sensitive.

Expected Maturities of Market Sensitive Instruments Held at December 31, 2008

($ in thousands)

| | | | | | | | | | | | | | | | | | Average | | | Estimated | |

| | | 1-3 | | | 4-12 | | | 13-60 | | | Over 60 | | | | | | Interest | | | Fair | |

| | | Months | | | Months | | | Months | | | Months | | | Total | | | Rate | | | Value | |

| Earning Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans | | $ | 160,464 | | | $ | 47,818 | | | $ | 126,100 | | | $ | 51,689 | | | $ | 386,071 | | | | 6.39 | % | | $ | 388,586 | |

| Investments | | | 1,153 | | | | 2,030 | | | | 1,130 | | | | 87,222 | | | | 91,535 | | | | 5.98 | % | | | 91,535 | |

| Federal funds sold | | | 4,281 | | | | - | | | | - | | | | - | | | | 4,281 | | | | 1.11 | % | | | 4,281 | |

| Deposits with banks | | | 2,685 | | | | - | | | | - | | | | - | | | | 2,685 | | | | 1.60 | % | | | 2,685 | |

| Total | | | 168,583 | | | | 49,848 | | | | 127,230 | | | | 138,911 | | | | 484,572 | | | | 6.21 | % | | | 487,087 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Demand accounts | | | 31,567 | | | | - | | | | - | | | | - | | | | 31,567 | | | | .61 | % | | | 31,567 | |

| Savings and money market | | | 82,459 | | | | - | | | | - | | | | - | | | | 82,459 | | | | 2.41 | % | | | 82,459 | |

| Time deposits | | | 90,235 | | | | 135,017 | | | | 40,818 | | | | 2,325 | | | | 268,395 | | | | 4.16 | % | | | 268,482 | |

| Repurchase agreements and Purchased funds | | | 3,830 | | | | - | | | | 20,000 | | | | - | | | | 23,830 | | | | 3.28 | % | | | 23,830 | |

| Short-term borrowings | | | 6,000 | | | | - | | | | - | | | | - | | | | 6,000 | | | | 4.33 | % | | | 6,000 | |

| Long-term debt | | | - | | | | - | | | | 33,500 | | | | 13,000 | | | | 46,500 | | | | 3.72 | % | | | 43,867 | |

| Subordinated debentures | | | 12,372 | | | | - | | | | - | | | | - | | | | 12,372 | | | | 6.31 | % | | | 7,793 | |

| Total | | $ | 226,463 | | | $ | 135,017 | | | $ | 94,318 | | | $ | 15,325 | | | $ | 471,123 | | | | 3.60 | % | | $ | 463,998 | |

ITEM 8 – FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The following financial statements of the Company and the Report of independent registered public accounting firm set forth on pages 14 through 46 of the Company’s 2008 Annual Report to Stockholders are incorporated herein by reference:

| | 1. | Consolidated Balance Sheets as of December 31, 2008 and 2007 |

| | 2. | Consolidated Statements of Income for the years ended December 31, 2008, 2007 and 2006 |

| | 3. | Consolidated Statements of Stockholders’ Equity for the years ended December 31, 2008, 2007 and 2006 |

| | 4. | Consolidated Statements of Cash Flows for the years ended December 31, 2008, 2007 and 2006 |

| | 5. | Notes to Consolidated Financial Statements |

| | 6. | Report of Independent Registered Public Accounting Firm |

ITEM 9 – CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

| Item 9A(T). | Controls and Procedures |

Our management, under the supervision and with the participation of our Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of the design and operation of our disclosure controls and procedures in accordance with Rule 13a-15 of the Securities Exchange Act of 1934 (the “Exchange Act”). Our management, including our Chief Executive Officer and Chief Financial Officer, identified a material weakness in our internal control over financial reporting that existed as of year-end 2008, as more fully described below in “Management’s Annual Report on Internal Control over Financial Reporting.” Solely as a result of the material weakness, our Chief Executive Officer and Chief Financial Officer concluded that, as of the end of the period covered by this report, our disclosure controls and procedures were not effective in enabling us to provide reasonable assurance that we are able to record, process, summarize and report in a timely manner the information required to be disclosed in reports we file under the Exchange Act. Nonetheless, this material weakness identified as of year end 2008 did not result in a material misstatement of any of the Company’s financial statements, including the annual and interim financial statements for 2008.

In connection with the above evaluation of our disclosure controls and procedures, no change in our internal control over financial reporting was identified that occurred during our fourth quarter of 2008 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting. However, our management, including our Chief Executive Officer and Chief Financial Officer, is taking remedial measures to address this material weakness, as described below in “Management’s Annual Report on Internal Control over Financial Reporting.” We anticipate completion of our implementation of such remedial measures prior to the time of our next periodic filing.

MANAGEMENT’S ANNUAL REPORT

ON INTERNAL CONTROL OVER FINANCIAL REPORTING

The management of Waccamaw Bankshares, Inc. and Subsidiary (the “Company”) is responsible for establishing and maintaining adequate internal control over financial reporting. The Company’s internal control system was designed to provide reasonable assurance to the Company’s management and board of directors regarding the preparation and fair presentation of published financial statements.

All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis.

The Company’s management assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2008. In making this assessment, it used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control—Integrated Framework. As of December 31, 2008, the Company determined that its process for determining and reporting the fair value of certain investment securities available for sale, as well as its process for effectively analyzing certain securities for other than temporary impairment, resulted in a material weakness. This material weakness was the result of not identifying securities that were being carried at par rather than fair value, coupled with a lack of proper documentation and analysis in conjunction with our other than temporary impairment evaluation for certain securities. While the fair value of our investment securities and our conclusions as to other than temporary impairment are materially correct as reported at December 31, 2008, this material weakness, if not detected and corrected, could have impacted these determinations in the future periods.

The Company is taking steps to remediate the material weakness, including designing and implementing additional control procedures to ensure that the Company’s determination of investment fair value is performed as necessary and to properly document and evaluate other than temporary impairment as necessary.

This annual report does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this annual report.

ITEM 9B – OTHER INFORMATION

None.

PART III

ITEM 10 – DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The information required by this item is incorporated by reference to the Company’s proxy statement for the 2009 Annual Meeting of Stockholders, pages 4-9, 13-14 and 19-20.

Code of Ethics

The Company’s Board of Directors has adopted a Code of Ethics that applies to its directors and to all of its executive officers, including without limitation its principal executive officer and principal financial officer. A copy of the Company’s Code of Ethics is provided at the Company’s website: www.waccamawbank.com.

ITEM 11 – EXECUTIVE COMPENSATION

The information required by this item is incorporated by reference to the Company’s proxy statement for the 2009 Annual Meeting of Stockholders, pages 10-18.

ITEM 12 – SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Certain information required by this item is incorporated by reference to the Company’s proxy statement for the 2009 Annual Meeting of Stockholders, pages 3-4.

Set forth below is certain information regarding the Company’s various stock option plans.

| Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants, and rights (a) | | | Weighted-average exercise price of outstanding options, warrants, and rights (b) | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |

| | | | | | | | | | |

| Equity compensation plans approved by security holders | | | 329,489 | | | $ | 14.64 | | | | 679,473 | |

| | | | | | | | | | | | | |

| Equity compensation plans not approved by security holders | | None | | | None | | | None | |

| | | | | | | | | | | | | |

| Total | | | 329,489 | | | $ | 14.64 | | | | 679,473 | |

ITEM 13 – CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

The information required by this item is incorporated by reference to the Company’s proxy statement for the 2009 Annual Meeting of Stockholders, pages 6 and 9.

ITEM 14 – PRINCIPAL ACCOUNTING FEES AND SERVICES

The information required by this item is incorporated by reference to the Company’s proxy statement for the 2009 Annual Meeting of Stockholders, page 19.

PART IV

ITEM 15 – EXHIBITS, FINANCIAL STATEMENT SCHEDULES

| EXHIBIT | | |

| NUMBER | | DESCRIPTION OF EXHIBIT |

| | | |

| 3.1 | | Registrant’s Articles of Incorporation* |

| | | |

| 3.2 | | Registrant’s Bylaws* |

| | | |

| 4.1 | | Specimen Stock Certificate** |

| | | |

| 10.1 | | Employment Agreement of James G. Graham*** |

| | | |

| 10.2 | | Waccamaw Bank 1998 Incentive Stock Option Plan*** |

| | | |

| 10.3 | | Waccamaw Bank 1998 Nonstatutory Stock Option Plan*** |

| | | |

| 13 | | Annual Report to Stockholders (Filed herewith) |

| | | |

| 21 | | Subsidiaries of Registrant (Filed herewith) |

| | | |

| 23.1 | | Consent of Dixon Hughes PLLC |

| | | |

| 23.2 | | Consent of Elliott Davis, PLLC |

| | | |

| 31(i) | | Certification of Principal Executive Officer Pursuant to Section 302 of the Sarbanes Oxley Act (Filed herewith) |

| | | |

| 31(ii) | | Certification of Principal Accounting Officer Pursuant to Section 302 of the Sarbanes Oxley Act (Filed herewith) |

| | | |

| 32 | | Certification Pursuant to Section 906 of the Sarbanes Oxley Act (Filed herewith) |

| | | |

| 99 | | Registrant’s Definitive Proxy Statement**** |

| | * | Incorporated by reference from exhibits 3(i) and 3(ii) to Registrant’s Current Report on Form 8-K12g3, as filed with the Commission on July 1, 2001. |

| | ** | Incorporated by reference from exhibit 4.1 to Registrant’s Annual Report on Form 10-KSB for the year ended December 31, 2001. |

| | *** | Incorporated by reference from Exhibits 10.2, 10.3 and 10.4 to Annual Report on Form 10-KSB of Waccamaw Bank, as filed with the FDIC. |

| **** | Filed with the Commission pursuant to Rule 14a-6. |

SIGNATURES

In accordance with Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant caused this report to be signed on behalf by the undersigned, thereunto duly authorized

| | | WACCAMAW BANKSHARES, INC. |

| | | |

| March 31, 2009 | | /s/ James G. Graham |

| | | | |

| Date | | James G. Graham |

| | | President and Chief Executive Officer |

In accordance with the Exchange Act, this report has to be signed below by the following persons on behalf of the registrant and in the capacity and on the dates indicated.

| Signature | | Title | | Date |

| | | | | |

| /s/ James G. Graham | | | | |

| | | President and | | March 31, 2009 |

| James G. Graham | | Chief Executive Officer | | |

| | | | | |

| /s/ Neil C. Bender, II | | | | |

| | | Director | | March 31, 2009 |

| Neil C. Bender | | | | |

| | | | | |

| /s/ M. B. “Bo” Biggs | | | | |

| | | Director | | March 31, 2009 |

| M. B. “Bo” Biggs | | | | |

| | | | | |

| /s/ Dr. Maudie M. Davis | | | | |

| | | Director | | March 31, 2009 |

| Dr. Maudie M. Davis | | | | |

| | | | | |

| /s/ Monroe Enzor, III | | | | |

| | | Director | | March 31, 2009 |

| Monroe Enzor, III | | | | |

| | | | | |

| /s/ James E. Hill, Jr. | | | | |

| | | Director | | March 31, 2009 |

| James E. Hill, Jr. | | | | |

| | | | | |

| /s/ Alan W. Thompson | | | | |

| | | Director, Chairman | | March 31, 2009 |

| Alan W. Thompson | | of the Board | | |

| | | | | |

| /s/ Dale Ward | | | | |

| | | Director | | March 31, 2009 |

| Dale Ward | | | | |

| | | | | |

| /s/ J. Densil Worthington | | | | |

| | | Director | | March 31, 2009 |

| J. Densil Worthington | | | | |

| | | | | |

| /s/ Brian Campbell | | | | |

| | | Director | | March 31, 2009 |

| Brian Campbell | | | | |

EXHIBIT INDEX

| EXHIBIT | | |

| NUMBER | | DESCRIPTION OF EXHIBIT |

| | | |

| 3.1 | | Registrant’s Articles of Incorporation* |

| | | |

| 3.2 | | Registrant’s Bylaws* |

| | | |

| 4.1 | | Specimen Stock Certificate** |

| | | |

| 10.1 | | Employment Agreement of James G. Graham*** |

| | | |

| 10.2 | | Waccamaw Bank 1998 Incentive Stock Option Plan*** |

| | | |

| 10.3 | | Waccamaw Bank 1998 Nonstatutory Stock Option Plan*** |

| | | |

| 13 | | Annual Report to Stockholders (Filed herewith) |

| | | |

| 21 | | Subsidiaries of Registrant (Filed herewith) |

| | | |

| 23.1 | | Consent of Dixon Hughes PLLC |

| | | |

| 23.2 | | Consent of Elliott Davis, PLLC |

| | | |

| 31.1 | | Certification of Principal Executive Officer Pursuant to Section 302 of the Sarbanes Oxley Act (Filed herewith) |

| | | |

| 31.2 | | Certification of Principal Accounting Officer Pursuant to Section 302 of the Sarbanes Oxley Act (Filed herewith) |

| | | |

| 32.1 | | Certification Pursuant to Section 906 of the Sarbanes Oxley Act (Filed herewith) |

| | | |

| 99 | | Registrant’s Definitive Proxy Statement*** |

| | * | Incorporated by reference from exhibits 3(i) and 3(ii) to Registrant’s Current Report on Form 8-K12g3, as filed with the Commission on July 1, 2001. |

| | ** | Incorporated by reference from exhibit 4.1 to Registrant’s Annual Report on Form 10-KSB for the year ended December 31, 2001. |

| | *** | Incorporated by reference from Exhibits 10.2, 10.3 and 10.4 to Annual Report on Form 10-KSB of Waccamaw Bank, as filed with the FDIC. |

| **** | Filed with the Commission pursuant to Rule 14a-6. |

INTRODUCTION

Table of Contents

| Introduction | 1 |

| | |

| Statement of Mission | 2 |

| | |

| Significant Trends | 3 |

| | |

| Financial Highlights | 4 |

| | |

| Shareholder Letter | 5-6 |

| | |

| Consolidated Balance Sheets | 7 |

| | |

| Consolidated Statements of Income | 8 |

| | |

| Consolidated Statements of Changes in Stockholders' Equity | 9 |

| | |

| Consolidated Statements of Cash Flows | 10-11 |

| | |

| Notes to Consolidated Financial Statements | 12 |

| | |

| Report of Independent Registered Public Accounting Firms | 41-42 |

| | |

| Management’s Discussion and Analysis | 43 |

| | |

| Stockholder Information | 62 |

STATEMENT OF MISSION

Waccamaw Bank serves a principled mission:

• to be the strongest independent bank in the coastal Carolina region;

• to offer fairly priced products and services that meet the financial needs of our community;

• to operate in an efficient manner designed for customer convenience;

• to be a good corporate neighbor within our communities;

• to maintain safety, soundness and profitability;

• to care for a quality staff that supports this mission.

Significant Trends

Financial Highlights Summary1

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| Summary of Operations | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Interest income | | $ | 30,485 | | | $ | 31,637 | | | $ | 25,379 | | | $ | 18,228 | | | $ | 11,450 | |

| Interest expense | | | (16,934 | ) | | | (16,296 | ) | | | (11,226 | ) | | | (7,536 | ) | | | (3,766 | ) |

| Net interest income | | | 13,551 | | | | 15,341 | | | | 14,153 | | | | 10,692 | | | | 7,684 | |

| | | | | | | | | | | | | | | | | | | | | |

| Provision for loan losses | | | (2,990 | ) | | | (386 | ) | | | (1,450 | ) | | | (1,370 | ) | | | (819 | ) |

| Other income | | | 966 | | | | 3,443 | | | | 2,581 | | | | 2,269 | | | | 2,445 | |

| Other expense | | | (15,397 | ) | | | (12,440 | ) | | | (9,422 | ) | | | (6,967 | ) | | | (5,687 | ) |

| Income tax (expense) benefit | | | 1,827 | | | | (2,049 | ) | | | (2,210 | ) | | | (1,589 | ) | | | (1,209 | ) |

| Net income (loss) | | $ | (2,043 | ) | | $ | 3,909 | | | $ | 3,652 | | | $ | 3,035 | | | $ | 2,414 | |

| | | | | | | | | | | | | | | | | | | | | |

Per Share Data2 | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic income (loss) per share | | $ | (.37 | ) | | $ | .73 | | | $ | .71 | | | $ | .61 | | | $ | .49 | |

| Diluted income (loss) per share | | | (.37 | ) | | | .72 | | | | .69 | | | | .58 | | | | .47 | |

| Book value | | | 5.04 | | | | 6.44 | | | | 5.77 | | | | 4.48 | | | | 3.99 | |

| | | | | | | | | | | | | | | | | | | | | |

| Average Balance Sheet Summary | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Loans, net | | $ | 376,747 | | | $ | 332,451 | | | $ | 279,625 | | | $ | 238,579 | | | $ | 168,757 | |

| Securities | | | 105,819 | | | | 65,454 | | | | 46,561 | | | | 31,257 | | | | 29,068 | |

| Total assets | | | 539,468 | | | | 438,579 | | | | 356,675 | | | | 302,381 | | | | 217,035 | |

| Deposits | | | 415,711 | | | | 354,512 | | | | 298,324 | | | | 252,994 | | | | 169,162 | |

| Stockholders’ equity | | | 33,460 | | | | 33,501 | | | | 25,945 | | | | 20,254 | | | | 17,941 | |

| | | | | | | | | | | | | | | | | | | | | |

| Selected Ratios | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Average equity to average assets | | | 6.20 | % | | | 7.64 | % | | | 7.27 | % | | | 6.70 | % | | | 8.27 | % |

| Return on average assets | | | (.38 | )% | | | .89 | % | | | 1.02 | % | | | 1.00 | % | | | 1.11 | % |

| Return on average equity | | | (6.11 | )% | | | 11.67 | % | | | 14.07 | % | | | 14.98 | % | | | 13.46 | % |

| 1 | In thousands of dollars, except per share data. |

| 2 | Adjusted for the effects of 6 for 5 stock split in 2004, 2 for 1 stock split in 2004 and 11 for 10 stock split in 2007. |

Shareholder Letter

Dear Shareholders, Clients, and Friends:

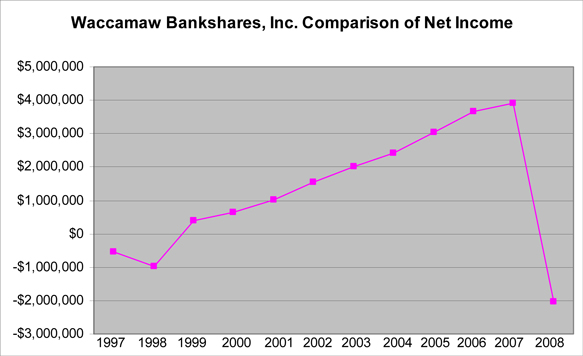

To state that the year of 2008 will long be remembered is certainly an understatement. This past year was as one of the most unprecedented years of economic turmoil in the lifetime of most active Americans. Our nation has witnessed economic events which would have been unthinkable only twelve months prior with some of the best known financial companies in America ceasing to exist as independent entities. Therefore, the financial results reported herein deviate from our nine year record of consecutive annual increases in profitability. While our financial results compare favorably to some banks in our trade area, Waccamaw Bankshares is reporting a net loss for the year. Despite these economic issues Waccamaw Bankshares, Inc., and its subsidiary Waccamaw Bank, remain quite sound and well capitalized as we look forward to putting the turmoil of 2008 behind us.

At year end, our total assets stood at $537 million and the Company is reporting an after tax net loss of $2,043,030. The Federal Government placed the Federal National Mortgage Association (Fannie Mae-FNMA), a Government Sponsored Enterprise (GSE), into conservatorship on September 7, 2008. Waccamaw owned $2 million of FNMA’s Securities, and therefore, the entire investment was considered impaired by accounting standards and was written off. Yet as of December 31, 2008, the Federal National Mortgage Association had not drawn upon one penny of the “rescue” line of credit established to “save” this Government Sponsored Enterprise. At year end another $1,383,688 of trust preferred investment securities was considered impaired due to the market value being lower than book value or Waccamaw Bank’s purchase price for a period of time and was written off as well. While recovery of all principle is possible, this action is the recognition of “Mark to Market Accounting” (MTM) standards and as a result, we will attempt to illustrate the impact of MTM for your understanding. For example, you decide to sell your house and set a price at the same time your neighbor decided to sell their home. After a period of time when no buyers were in the market, so under Mark to Market Accounting, the value of your home is zero. Does this seem logical? If you answered no, you now understand Mark to Market Accounting.

During the year, the bank expensed $2.9 million for provisional loan losses and believes the risks in the bank’s portfolio have been adequately addressed. We remain diligent in maintaining a strong credit quality as possible during these difficult times. During the year, America experienced historic interest rate reductions with prime rate falling from 7.25% to 3.25% during the year. Quite simply, our cost of funds could not be reduced quickly enough to maintain an adequate interest rate spread between the rates we charged on our loans and the cost of our deposits, therefore, the bank’s net interest margin suffered.

The five new offices which opened in 2007 and our newest office located in Little River, South Carolina which opened in 2008, are progressing toward profitability. However, profitability was not possible for any of these offices given the economic challenges of the year. Although these offices operated at a loss in 2008, we remained convinced that these offices will provide significant earnings performance in the years to come.

An expense reduction effort began in early 2008 and continued throughout the year reflecting the lower than anticipated business volume in our market. No incentive pay was received by any officer level staff as a result of 2008 performance, executive pay was reduced, and director fees were eliminated during the year just to mention a few of the expense reductions. Further this effort will continue into 2009 and significant results will be achieved.

Waccamaw is very pleased to report other meaningful issues that will be reflected in the 2009 performance. Obvious to all, interest rates are no longer falling and our cost of funds are improving daily as rates paid on interest bearing accounts fall and deposits are renewed at increasingly lower rates. Also many of our floating rate loans have now reached their minimum rate level and our net interest margin is now improving. One of the most significant events during the year was the results gained through the bank’s High Performance Checking (HPC) initiative which began in September of 2007. High Performance Checking has been a tremendous success since its inception with service charge income increasing nearly 60% as the bank increased the number of checking accounts by 22%. Waccamaw has gained a business relationship with nearly 3,500 households as a result. This initiative has created an opportunity to build long lasting relationships to benefit the bank for many years to come.

During the third quarter, Waccamaw Bank and Waccamaw Bankshares increased regulatory capital by $8 million through a series of non-dilutive capital offerings which provided an advantageous cost of capital to support the bank’s growth. Since these offerings were accomplished, the bank’s capital base is significantly stronger without selling additional shares of stock and diluting the earnings base of our shareholders. We have positioned the bank to withstand the current economic challenges and to take advantage of the opportunities that lie ahead as economic conditions improve.

Shareholder Letter

As mentioned earlier, the bank's seventeenth office was opened on U.S. 17 North in Little River, South Carolina during August with a robust welcome from the community. This office experienced one of the best openings our bank has enjoyed in many years and we are pleased with the initial response of the Little River community. Waccamaw now operates five South Carolina offices with four in fast growing Horry County and one in Lancaster County southeast of Charlotte. This new office provides a location to connect our seven office locations in Brunswick with our South Carolina offices while making our services more convenient for those clients in the Highway 90 and Highway 9 corridors connecting with Tabor City.

Our company has invested heavily in our branch structure and has built a franchise unlike any other of our community bank competitors. The strategic value of our expansion was not anticipated to result in increased profitability in the short term or in anticipation of the economic situation we now find ourselves. These new offices are located in some of the fastest growing areas of our nation and profits from these offices will benefit this bank for many years to come.

We look forward to 2009 with optimism as our new offices become stronger, the interest rate environment stabilizes, and our nation works though the current recession. Our staff is well positioned, well trained, and focused on delivering the highest quality service of any bank in our market. Our bank remains well capitalized and financially strong and is an active lender in the communities we serve. It is with these facts in mind, we look forward to presenting improved financial performance to you in the years to come.

Sincerely,

| James G. Graham | Alan W. Thompson |

| President and Chief Executive Officer | Chairman of the Board |

Consolidated Balance Sheets

December 31, 2008 and 2007

| | | 2008 | | | 2007 | |

| Assets | | | | | | |

| Cash and due from banks | | $ | 8,947,752 | | | $ | 11,809,251 | |

| Interest-bearing deposits with banks | | | 2,684,741 | | | | 912,195 | |

| Total cash and cash equivalents | | | 11,632,493 | | | | 12,721,446 | |

| | | | | | | | | |

| Federal funds sold | | | 4,281,000 | | | | - | |

| Investment securities, available for sale | | | 87,402,799 | | | | 99,302,322 | |

| Restricted equity securities | | | 4,131,906 | | | | 3,342,006 | |

| Loans, net of allowance for loan losses of $7,187,981 in 2008 and $5,385,782 in 2007 | | | 378,882,889 | | | | 355,138,167 | |

| Property and equipment, net | | | 17,597,502 | | | | 14,537,739 | |

| Goodwill | | | 2,727,152 | | | | 2,727,152 | |

| Intangible assets, net | | | 416,194 | | | | 673,374 | |

| Accrued income | | | 2,448,477 | | | | 2,939,264 | |

| Bank owned life insurance | | | 17,834,763 | | | | 11,777,361 | |

| Other assets | | | 10,095,259 | | | | 5,209,088 | |

| Total assets | | $ | 537,450,434 | | | $ | 508,367,919 | |

| | | | | | | | | |

| Liabilities and Stockholders' Equity | | | | | | | | |

| | | | | | | | | |

| Liabilities | | | | | | | | |

| Noninterest-bearing deposits | | $ | 36,159,809 | | | $ | 32,371,173 | |

| Interest-bearing deposits | | | 382,420,080 | | | | 345,808,162 | |

| Total deposits | | | 418,579,889 | | | | 378,179,335 | |

| | | | | | | | | |

| Securities sold under agreements to repurchase | | | 23,830,000 | | | | 29,222,000 | |

| Federal funds purchased | | | - | | | | 15,429,300 | |

| Other short-term borrowings | | | 10,000,000 | | | | 13,000,000 | |

| Long-term debt | | | 42,500,000 | | | | 25,500,000 | |

| Junior subordinated debentures | | | 12,372,000 | | | | 8,248,000 | |

| Accrued interest payable | | | 1,328,976 | | | | 2,125,673 | |

| Other liabilities | | | 995,414 | | | | 1,640,470 | |

| Total liabilities | | | 509,606,279 | | | | 473,344,778 | |

| | | | | | | | | |

| Commitments and contingencies | | | | | | | | |

| | | | | | | | | |

| Stockholders’ equity | | | | | | | | |

| Preferred stock, Series A, non-cumulative, non-voting, no par value; 1,000,000 shares authorized; | | | | | | | | |

| 28,184 and 48,178 issued and outstanding at December 31, 2008 and 2007, respectively | | | 464,476 | | | | 793,967 | |

| Common stock, no par; 25,000,000 shares authorized; | | | | | | | | |

| 5,523,549 and 5,434,770 shares issued and outstanding at December 31, 2008 and 2007, respectively | | | 24,591,884 | | | | 23,785,199 | |

| Retained earnings | | | 8,907,591 | | | | 11,124,589 | |

| Accumulated other comprehensive loss | | | (6,119,796 | ) | | | (680,614 | ) |

| Total stockholders’ equity | | | 27,844,155 | | | | 35,023,141 | |

| Total liabilities and stockholders’ equity | | $ | 537,450,434 | | | $ | 508,367,919 | |

See Notes to Consolidated Financial Statements

Consolidated Statements of Income

Years ended December 31, 2008, 2007, and 2006

| | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | |

| Interest income | | | | | | | | | |

| Loans and fees on loans | | $ | 24,056,784 | | | $ | 27,492,792 | | | $ | 22,584,611 | |

| Investment securities, taxable | | | 5,612,932 | | | | 3,231,060 | | | | 2,195,843 | |

| Investment securities, nontaxable | | | 714,011 | | | | 574,181 | | | | 330,656 | |

| Federal funds sold | | | 69,850 | | | | 289,740 | | | | 226,152 | |

| Deposits with banks | | | 31,745 | | | | 48,892 | | | | 42,205 | |

| Total interest income | | | 30,485,322 | | | | 31,636,665 | | | | 25,379,467 | |

| | | | | | | | | | | | | |

| Interest expense | | | | | | | | | | | | |

| Deposits | | | 13,502,304 | | | | 13,669,795 | | | | 9,488,101 | |

| Federal funds purchased and securities sold under agreements to repurchase | | | 1,103,935 | | | | 468,792 | | | | 225,725 | |

| Other borrowed funds | | | 2,328,430 | | | | 2,157,460 | | | | 1,512,314 | |

| Total interest expense | | | 16,934,669 | | | | 16,296,047 | | | | 11,226,140 | |

| Net interest income | | | 13,550,653 | | | | 15,340,618 | | | | 14,153,327 | |

| | | | | | | | | | | | | |

| Provision for loan losses | | | 2,990,096 | | | | 385,864 | | | | 1,450,000 | |

| Net interest income after provision for loan losses | | | 10,560,557 | | | | 14,954,754 | | | | 12,703,327 | |

| | | | | | | | | | | | | |

| Noninterest income | | | | | | | | | | | | |

| Service charges on deposit accounts | | | 2,115,172 | | | | 1,325,296 | | | | 1,100,378 | |

| ATM and check cashing fees | | | 755,029 | | | | 537,750 | | | | 438,538 | |