UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

WACCAMAW BANKSHARES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

WACCAMAW BANKSHARES, INC.

110 North J.K. Powell Boulevard

Whiteville, North Carolina 28472

(910) 641-0044

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held

April 21, 2005

NOTICE is hereby given that the Annual Meeting of Shareholders of Waccamaw Bankshares, Inc. (the “Company”) will be held as follows:

| | |

| Place: | | Waccamaw Bank and Corporate Center 110 North J.K. Powell Boulevard Whiteville, North Carolina 28472 |

| |

| Date: | | April 21, 2005 |

| |

| Time: | | 7:00 p.m. |

The purposes of the meeting are:

| | 1. | To amend Article II of the Articles of Incorporation of the Company to increase the number of shares of common stock which the Company has the authority to issue to 25,000,000. |

| | 2. | To elect three members of the Board of Directors for three-year terms. |

| | 3. | To approve an amendment to the Company’s 1998 Nonstatutory Stock Option Plan. |

| | 4. | To approve an amendment to the Company’s 1998 Incentive Stock Option Plan. |

| | 5. | To ratify the appointment of Larrowe & Company P.L.C. as the Company’s independent public accountants for 2005. |

| | 6. | To transact any other business that may properly come before the meeting. |

You are cordially invited to attend the meeting in person. However, even if you expect to attend the meeting, you are requested to complete, sign and date the enclosed appointment of proxy and return it in the envelope provided for that purpose to ensure that a quorum is present at the meeting. The giving of an appointment of proxy will not affect your right to revoke it or to attend the meeting and vote in person.

|

| By Order of the Board of Directors |

|

| |

| James G. Graham |

| President and Chief Executive Officer |

March 8, 2005

WACCAMAW BANKSHARES, INC.

110 North J.K. Powell Boulevard

Whiteville, North Carolina 28472

(910) 641-0044

PROXY STATEMENT

Mailing Date: On or about March 8, 2005

ANNUAL MEETING OF SHAREHOLDERS

To Be Held

April 21, 2005

General

This Proxy Statement is furnished in connection with the solicitation of the enclosed appointment of proxy by the Board of Directors of Waccamaw Bankshares, Inc. (the “Company”) for the Annual Meeting of Shareholders of the Company to be held at the Waccamaw Bank and Corporate Center, 110 North J.K. Powell Boulevard, Whiteville, North Carolina, at 7:00 p.m. on April 21, 2005, and any adjournments thereof.

Solicitation and Voting of Appointments of Proxy; Revocation

Persons named in the appointment of proxy as proxies to represent shareholders at the Annual Meeting are Freda H. Gore, David A. Godwin and Crawford Monroe Enzor, III. Shares represented by each appointment of proxy which is properly executed and returned, and not revoked, will be voted in accordance with the directions contained in the appointment of proxy. If no directions are given, each such appointment of proxy will be votedFOR the election of each of the three nominees for director named in Proposal 2 below andFOR Proposals 1, 3, 4 and 5. If, at or before the time of the Annual Meeting, any nominee named in Proposal 2 has become unavailable for any reason, the proxies will have the discretion to vote for a substitute nominee. On such other matters as may come before the meeting, the proxies will be authorized to vote shares represented by each appointment of proxy in accordance with their best judgment on such matters. An appointment of proxy may be revoked by the shareholder giving it at any time before it is exercised by filing with E. Autry Dawsey, Sr., Secretary of the Company, a written instrument revoking it or a duly executed appointment of proxy bearing a later date, or by attending the Annual Meeting and announcing his or her intention to vote in person.

Expenses of Solicitation

The Company will pay the cost of preparing, assembling and mailing this Proxy Statement and other proxy solicitation expenses. In addition to the use of the mails, appointments of proxy may be solicited in person or by telephone by the Company’s officers, directors and employees without additional compensation. The Company will reimburse banks, brokers and other custodians,

nominees and fiduciaries for their costs in sending the proxy materials to the beneficial owners of the Company’s common stock.

Record Date

The close of business on February 24, 2005, has been fixed as the record date (the “Record Date”) for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. Only those shareholders of record on that date will be eligible to vote on the proposals described herein.

Voting Securities

The voting securities of the Company are the shares of common stock, no par value per share, of which 5,000,000 shares are authorized and 4,530,402 shares were outstanding on December 31, 2004. As of December 31, 2004, there were approximately 1,918 holders of record of the Company’s common stock.

Voting Procedures; Quorum; Votes Required for Approval

Each shareholder is entitled to one vote for each share held of record on the Record Date on each director to be elected and on each other matter submitted for voting. In accordance with North Carolina law, shareholders will not be entitled to vote cumulatively in the election of directors at the Annual Meeting.

A majority of the shares of the Company’s common stock issued and outstanding on the Record Date must be present in person or by proxy to constitute a quorum for the conduct of business at the Annual Meeting.

Assuming a quorum is present, in the case of Proposal 2 below, the three directors receiving the greatest number of votes shall be elected.

In the case of Proposals 1, 3, 4 and 5 below, for such proposal to be approved, the number of votes cast for approval must exceed the number of votes cast against the proposal. Abstentions and broker nonvotes will have no effect.

Authorization to Vote on Adjournment and Other Matters

Unless the Secretary of the Company is instructed otherwise, by signing an appointment of proxy, shareholders will be authorizing the proxyholders to vote in their discretion regarding any procedural motions which may come before the Annual Meeting. For example, this authority could be used to adjourn the Annual Meeting if the Company believes it is desirable to do so. Adjournment or other procedural matters could be used to obtain more time before a vote is taken in order to solicit additional appointments of proxy to establish a quorum or to provide additional information to shareholders. However, appointments of proxy voted against one or more of the Proposals will not be used to adjourn the Annual Meeting. The Company does not have any plans to adjourn the meeting at this time, but intends to do so, if needed, to promote shareholder interests.

Beneficial Ownership of Voting Securities

As of December 31, 2004, no shareholder known to management owned more than 5% of the Company’s common stock.

As of December 31, 2004, the beneficial ownership of the Company’s common stock, by directors individually, and by directors and executive officers as a group, was as follows:

| | | | | |

NAME AND ADDRESS OF BENEFICIAL OWNER

| | AMOUNT AND NATURE OF BENEFICIAL OWNERSHIP(1)(2)

| | | PERCENT OF CLASS(3)

|

M. B. (“Bo”) Biggs Lumberton, NC | | 21,204 | | | * |

Dr. Maudie M. Davis Tabor City, NC | | 35,508 | | | * |

E. Autry Dawsey, Sr. Whiteville, NC | | 184,014 | (4) | | 4.06 |

Crawford Monroe Enzor, III Cerro Gordo, NC | | 150,390 | (5) | | 3.30 |

James G. Graham Whiteville, NC | | 155,804 | (6) | | 3.35 |

James E. Hill, Jr. Whiteville, NC | | 52,220 | (7) | | 1.15 |

Alan W. Thompson Whiteville, NC | | 91,210 | (8) | | 2.01 |

R. Dale Ward Whiteville, NC | | 97,651 | (9) | | 2.15 |

J. Densil Worthington Chadbourn, NC | | 113,105 | (10) | | 2.49 |

All Directors and Executive Officers as a group (13 persons) | | 936,228 | | | 19.69 |

| (1) | Except as otherwise noted, to the best knowledge of the Company’s management, the above individuals and group exercise sole voting and investment power with respect to all shares shown as beneficially owned other than the following shares as to which such powers are shared: Mr. Graham – 5,760 shares, Mr. Hill – 8,640 shares and Mr. Worthington – 24,192 shares. |

| (2) | Included in the beneficial ownership tabulations are the following options to purchase shares of common stock of the Company exercisable within 60 days of December 31, 2004: Dr. Davis - 23,224 shares; Mr. Enzor - 23,224 shares; Mr. Graham - 121,144 shares; Mr. Hill - 13,934 shares; Mr. Thompson - 11,904 shares; Mr. Ward - 9,293 shares; and Mr. Worthington - 4,651 shares. |

| (3) | The calculation of the percentage of class beneficially owned by each individual and the group is based, in each case, on the sum of (1) 4,530,402 outstanding shares of common stock; and (2) options to purchase common stock capable of being exercised by the individual or group within 60 days of December 31, 2004. |

| (4) | Includes 29,022 shares held by Mr. Dawsey as custodian for grandchildren. |

| (5) | Includes 82,224 shares held by members of Mr. Enzor’s immediate family. |

| (6) | Includes 24,462 shares held in the Company’s 401(k) Plan as to which Mr. Graham exercises voting power. |

| (7) | Includes 412 shares held by Mr. Hill’s spouse as custodian for a child. |

| (8) | Includes 2,000 shares held by Mr. Thompson as custodian for a child. |

| (9) | Includes 758 shares held by Mr. Ward as custodian for his child. |

| (10) | Includes 11,376 shares held by Mr. Worthington as custodian for his child. |

Section 16(a) Beneficial Ownership Reporting Compliance

Directors and executive officers of the Company are required by federal law to file reports with the Securities and Exchange Commission (“SEC”) regarding the amount of and changes in their beneficial ownership of the Company’s common stock. To the best knowledge of management of the Company, all such required reports have been filed on a timely basis.

PROPOSAL 1: AMENDMENT OF ARTICLES OF INCORPORATION

The Board of Directors has voted to recommend to the shareholders an amendment to Article II of the Company’s Articles of Incorporation to increase by 20,000,000 the number of authorized shares of the Company’s capital stock (the “Share Amendment”). The Company’s Articles of Incorporation presently authorize the issuance of up to 6,000,000 shares of capital stock, with 5,000,000 of such shares classified as common stock, no par value per share, and the remaining 1,000,000 shares classified as preferred stock, no par value per share. On the Record Date, the Company had 4,530,402 shares of common stock, and no shares of preferred stock, issued and outstanding. If the Share Amendment is approved by the shareholders, the Company will have 26,000,000 shares authorized, with 25,000,000 of such shares classified as no par value common stock and the remaining 1,000,000 shares classified as preferred stock.

The relative rights and limitations of the Company’s common stock and preferred stock would remain unchanged if the Share Amendment is approved. Holders of the capital stock of the Company shall not be entitled to preemptive rights with respect to any shares of capital stock of the Company which may be issued.

The Share Amendment has been recommended by the Board of Directors to ensure that an adequate supply of authorized but unissued shares is available for general corporate needs, such as future stock dividends or stock splits. There are currently no plans or arrangements relating to the issuance of any of the additional shares of common stock proposed to be authorized by the Share Amendment.

If the Share Amendment is approved by the shareholders, shares of the Company’s capital stock would remain available for issuance without further action by the shareholders, unless otherwise required by the Company’s Articles of Incorporation or bylaws or by applicable law.

The issuance of additional shares of common stock may, among other things, have a dilutive effect on earnings per share and on the equity and voting power of existing holders of common stock. The issuance of additional shares of common stock or shares of preferred stock by the Company may also potentially have an anti-takeover effect by making it more difficult to obtain shareholder approval of various actions, such as a merger or removal of management.

The text of Article II of the Company’s Articles of Incorporation, as proposed to be amended, is as follows:

The amount of authorized capital stock of the Corporation shall be 26,000,000 shares, to be divided into 25,000,000 shares of common stock, no par value, and 1,000,000 shares of preferred stock. The common stock shall be of one class. Subject to the rights of the preferred stock as determined by the Board of Directors, the holders of the common stock shall have one vote per share on all matters on which the holders of the common stock are entitled to vote. The shares of preferred stock may be issued from time to time by the Corporation in such series as the Board of Directors may determine and shall have such voting powers, designations, preferences, limitations, and relative rights as the Board of Directors may and hereby is authorized to determine.

In order for Proposal 1 to be approved, the number of votes cast in favor of it must exceed the number of votes cast against it.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE PROPOSED AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION.

PROPOSAL 2: ELECTION OF DIRECTORS

The Company’s Bylaws provide that its Board of Directors shall consist of between five and sixteen members, as determined by the Board of Directors or the shareholders, and that they shall be staggered into terms of one, two, and three years in as equal numbers as possible. The Board of Directors has set the number of directors of the Company at nine. Each nominated and incumbent director has served as a director of Waccamaw Bank (the “Bank”) since 1997 and as a director of the Company since the Bank’s reorganization into the bank holding company form of organization on July 1, 2001, except Mr. Graham who was first elected as a director of the Bank in 1999.

The three directors listed below, whose terms expire at the Annual Meeting, have each been renominated for a term of three years.

| | | | | | |

Name and Age

| | Position(s)

Held

| | Director

Since

| | Principal Occupation and Business Experience During Past 5 Years

|

M. B. (“Bo”) Biggs (49) | | Director | | 1997 | | Certified Public Accountant; Chief Financial Officer, Comptroller/Secretary-Treasurer and Director, K.M. Biggs, Inc. (farming and commercial real estate management), Lumberton, NC; Chief Financial Officer, Secretary-Treasurer and Director, Biggs Park, Inc. (shopping center), Lumberton, NC. |

| | | |

James G. Graham (54) | | President,

CEO and

Director | | 1999 | | President and Chief Executive Officer, Waccamaw Bankshares, Inc., Whiteville, NC, 2001-Present and Waccamaw Bank, Whiteville, NC, 1999-Present; President and Chief Executive Officer, Miners and Merchants Bank & Trust Co. and its holding company, Commonwealth Community Bancorp, Grundy, VA, 1984-1998. |

| | | |

J. Densil Worthington (50) | | Director | | 1997 | | President, Worthington Funeral Home, Inc., Chadbourn, NC; Secretary/Treasurer, Independent Medical Supplies, Inc., Chadbourn, NC. |

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” EACH OF THE NOMINEES FOR DIRECTOR OF THE COMPANY.

Incumbent Directors

The Company’s Board of Directors includes the following directors whose terms will continue after the Annual Meeting. Certain information regarding those directors is set forth in the following table:

| | | | | | |

Name and Age

| | Director Since

| | Term

Expires

| | Principal Occupation and Business Experience During Past 5 Years

|

Dr. Maudie M. Davis (52) | | 1997 | | 2006 | | Principal, South Columbus High School, Tabor City, NC. |

| | | |

E. Autry Dawsey, Sr. (68) | | 1997 | | 2007 | | President and Chief Executive Officer, Premiere Management Company, Inc. (management company for the following enterprises); President, K.A.R. Enterprises, Inc. (motel); President, B&D Enterprises (real estate); President, Dawsey Investment Co., Inc. (fast food); President, Premiere Construction, Inc. (construction company); Managing Partner, Premiere Enterprises of Whiteville, LLC (real estate); President, Premiere Hospitality Group, Inc. (motel); Managing Partner, Dawcut Hospitality, LLC (hotel); President, Lake Waccamaw Convalescent Center, Inc. (nursing home); President, 701 Associates (real estate); D&H Foods (“Sonic” fast food restaurant). |

| | | |

Crawford Monroe Enzor, III (40) | | 1997 | | 2007 | | Owner, Monroe Enzor, III Farms, Cerro Gordo, NC; President, Enzor Farms, Inc., Fair Bluff, NC. |

| | | |

James E. Hill, Jr. (58) | | 1997 | | 2006 | | Attorney, Hill & High, L.L.P., Whiteville, NC; farming operations; Hill & High Real Estate; Walker – Hill Real Estate. |

| | | | | | |

Name and Age

| | Director Since

| | Term

Expires

| | Principal Occupation and Business Experience During Past 5 Years

|

Alan W. Thompson (41) | | 1997 | | 2006 | | President, Thompson, Price, Scott, Adams & Co., P.A. (certified public accountants), Whiteville, NC; President, Medical Billing Organization, Inc. (medical billing company), Whiteville, NC; Manager, AT Consulting Services, LLC (financial services), Whiteville, NC; Manager, TSA Rentals, LLC (rental real estate), Whiteville, NC. |

| | | |

R. Dale Ward (52) | | 1997 | | 2007 | | President, J. D. Wright Roofing Co., Inc., Tabor City, NC; Columbus County, NC, School Board, since 1994, including three years as chairman; Partner, Crown Investments, LLC (real estate). |

Director Relationships

No director is a director of any company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934 (the “Exchange Act”) or subject to the requirements of Section 15(d) of the Exchange Act, or any company registered as an investment company under the Investment Company Act of 1940.

Meetings and Committees of the Board of Directors

The Company held seven meetings of its Board in 2004. Each director attended 75% or more of the aggregate number of meetings of the Board and any committees on which he or she served. It is the policy of the Company that directors attend each annual meeting and any special meetings of the Company’s shareholders. Each of the Company’s directors attended the 2004 Annual Meeting of shareholders.

The Company’s Board has several standing committees, including an Executive Committee, a Nominating & Compensation Committee and an Audit Committee.

Executive Committee. The Executive Committee is empowered to act for the entire Board during intervals between Board meetings. The members of the Executive Committee are Messrs. Dawsey, Enzor, Graham, Hill and Thompson. The Executive Committee met two times during 2004.

Nominating & Compensation Committee. The functions of the Nominating & Compensation Committee are performed by the Executive Committee, with the exception of Mr. Graham. While Mr. Graham consults with the Nominating & Compensation Committee on certain matters, he does not have voting rights in connection with the committee’s activities. The Nominating & Compensation Committee reviews and approves all salaries and benefits of Company personnel. The duties of the Nominating & Compensation Committee also include: (i) assisting the Board, on an annual basis, by identifying individuals qualified to become Board members, and recommending to the Board the director nominees for the next annual meeting of shareholders; (ii) assisting the Board in the event of any vacancy on the Board by identifying individuals qualified to become Board members, and recommending to the Board qualified

individuals to fill any such vacancy; and (iii) recommending to the Board, on an annual basis, director nominees for each committee of the Board.

The Company’s common stock is traded on the Nasdaq SmallCap Market and the voting members of the Nominating & Compensation Committee are “independent” as defined by Nasdaq listing standards. The bylaws of the Company state that candidates may be nominated for election to the Board of Directors by the Nominating & Compensation Committee or by any shareholder of the Company’s common stock. It is the policy of the Nominating & Compensation Committee to consider all shareholder nominations. Shareholder nominations must be submitted to the Nominating & Compensation Committee in writing on or before September 30th of the year preceding the annual meeting at which the nominee would stand for election to the Board of Directors and must be accompanied by each nominee’s written consent to serve as a director of the Company if elected. The bylaws of the Company require that all nominees for director, including shareholder nominees, have business, economic or residential ties to the Company’s market area and have owned at least 1,000 shares of the Company’s common stock since the last business day of the calendar year preceding the meeting at which the nominee is to stand for election. The Nominating & Compensation Committee has adopted a formal written charter, which was included as an exhibit to the proxy statement for the Company’s 2004 Annual Meeting of Shareholders.

Report of the Audit Committee

The Audit Committee of the Company, which met four times during 2004, is responsible for receiving and reviewing the annual audit report of the Company’s independent auditors and reports of examinations by bank regulatory agencies, and helps formulate, implement, and review the Company’s internal audit program. The Audit Committee assesses the performance and independence of the Company’s independent auditors and recommends their appointment and retention. The Audit Committee has in place policies and procedures that involve an assessment of the performance and independence of the Company’s independent auditors, an evaluation of any conflicts of interest that may impair the independence of the independent auditors and pre-approval of an engagement letter that outlines all services to be rendered by the independent auditors.

During the course of its examination of the Company’s audit process in 2004, the Audit Committee reviewed and discussed the audited financial statements with management. The Audit Committee also discussed with the independent auditors, Larrowe & Company, P.L.C., all matters required to be discussed by the Statement of Auditing Standards No. 61, as amended. Furthermore, the Audit Committee received from Larrowe & Company, P.L.C. disclosures regarding their independence required by the Independence Standards Board Standard No. 1, as amended and discussed with Larrowe & Company, P.L.C. their independence.

Based on the review and discussions above, the Audit Committee (i) recommended to the Board that the audited financial statements be included in the Company’s annual report on Form 10-KSB for the year ended December 31, 2004 for filing with the SEC and (ii) recommended that shareholders ratify the appointment of Larrowe & Company, P.L.C. as auditors for 2005.

The Audit Committee members are “independent” and “financially literate” as defined by Nasdaq listing standards. The Board of Directors has determined that M. B. “Bo” Biggs, CPA and Alan W. Thompson, CPA, each a member of the Audit Committee, meet the requirements adopted by the SEC for qualification as an “audit committee financial expert.” An audit committee financial expert is defined as a person who has the following attributes: (i) an understanding of generally accepted accounting principles (“GAAP”) and financial statements; (ii) the ability to assess the general application of GAAP in connection with the accounting for estimates, accruals and reserves; (iii) experience preparing, auditing, analyzing or evaluating financial statements that are of the same level of complexity that can be expected in the Company’s financial statements, or experience supervising people engaged in such activities; (iv) an understanding of internal controls and procedures for financial reporting; and (v) an understanding of audit committee functions.

The Audit Committee has a written charter which is reviewed by the Committee for adequacy on an annual basis. The Audit Committee Charter is included in this Proxy Statement asExhibit A.

This report is submitted by the Audit Committee: M. B. “Bo” Biggs, Alan W. Thompson and J. Densil Worthington.

Director Compensation

Board Fees. During 2004, all directors were paid $400 for each Board meeting attended, except for the Chairman of the Board (or Vice-Chairman, as applicable) who received $750 for each Board meeting chaired. Each director was also paid an annual retainer of $1,200 and $200 for each Committee meeting attended, except for the acting Chairman of the committee who received $250 for each committee meeting chaired. Mr. Graham did not receive any compensation for attending committee meetings.

1998 Nonstatutory Stock Option Plan. The shareholders previously approved the 1998 Nonstatutory Stock Option Plan pursuant to which options are available for issuance to members of the Company’s Board of Directors and the Board of any subsidiary of the Company. In connection with the reorganization of the Bank into the holding company form of organization which resulted in the creation of the Company, the Nonqualified Stock Option Plan was adopted by the Company and options under such plan are now options of the Company. During the fiscal year ended December 31, 2004, each director of the Company was granted 1,500 options under the Nonqualified Stock Option Plan.

Executive Officers

Set forth below is certain information regarding the Company’s Executive Officers.

| | | | | | |

NAME

| | AGE

| | POSITION WITH COMPANY

| | BUSINESS EXPERIENCE

|

| James G. Graham | | 54 | | Director, President & Chief

Executive Officer | | President and Chief Executive Officer, Waccamaw Bankshares, Inc., Whiteville, NC, 2001-Present and Waccamaw Bank, Whiteville, NC, 1999-Present; President and Chief Executive Officer, Miners and Merchants Bank & Trust Co. and its holding company, Commonwealth Community Bancorp, Grundy, VA, 1984-1998. |

| | | |

| Perry Bradford Dawson | | 48 | | Senior Vice President and

Chief Banking Officer of

Waccamaw Bank | | Senior Vice President and Chief Banking Officer, Waccamaw Bank, Whiteville, NC, 2003-Present; prior to that, Vice President, First Citizens Bank, Wilmington, NC, 1998-2003; prior to that, Vice President, National Bank of South Carolina, North Myrtle Beach, SC, 1996-1998. |

| | | |

| Freda H. Gore | | 43 | | Vice President and Chief

Operations Officer of

Waccamaw Bank | | Vice President and Chief Operations Officer of Waccamaw Bank, Whiteville, NC, 1997-Present. |

| | | |

| David A. Godwin | | 48 | | Vice President and Chief

Financial Officer of

Waccamaw Bank | | Vice President and Chief Financial Officer of Waccamaw Bank, Whiteville, NC, 2001-Present; prior to that, Comptroller, Four Seasons Screen Printing Co., Conway, SC, February 2001-July 2001; prior to that Chief Financial Officer/Comptroller, Jones Stores, Inc., Tabor City, NC, 1995-2001 (retail variety stores). |

| | | |

| Richard C. Norris | | 39 | | Vice President and

Senior Credit Officer

of Waccamaw Bank | | Vice President and Senior Credit Officer, Waccamaw Bank, Whiteville, NC, 2003-Present; prior to that, Senior Business Underwriter, First Citizens Bank, Raleigh, NC, 1996-2003. |

Executive Compensation

The following table shows the cash and certain other compensation paid to or received or deferred by James G. Graham and Perry Bradford Dawson for services rendered in all capacities during the fiscal years ended December 31, 2004, 2003 and 2002. No other current executive officer of the Company received compensation during 2004 that exceeded $100,000.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | |

| | | | | | | | Annual Compensation(1)

|

Name and Principal Position

| | Year

| | Salary

| | | Bonus

| | Other Annual

Compensation

|

James G. Graham, President, Chief Executive Officer and Director | | 2004

2003

2002 | | $

| 170,000

150,000

130,000 |

| | $

| 21,190

3,706

12,500 | | $

| 11,297

12,389

12,601 |

| | | | |

Perry Bradford Dawson, Senior Vice President and Chief Banking Officer of Waccamaw Bank | | 2004

2003 | | $

| 101,317

23,306 |

(2) | | $

| 10,000

-0- | | $

| -0-

-0- |

| (1) | In addition to compensation paid in cash, the Company’s executive officers receive certain personal benefits. However, the aggregate value of such non-cash benefits received by Mr. Graham during 2004, 2003 and 2002 did not exceed 10% of cash compensation paid to him. |

10

| (2) | Mr. Dawson became employed by the Company on October 1, 2003. |

1998 Incentive Stock Option Plan. The shareholders previously approved the 1998 Incentive Stock Option Plan (the “Incentive Option Plan”) pursuant to which options are available for issuance to officers and key employees of the Company and any of its subsidiaries. In connection with the reorganization of the Bank into the holding company form of organization which resulted in the creation of the Company, the Incentive Option Plan was adopted by the Company and options under such plan are now options of the Company.

The following table sets forth information regarding options to purchase shares of the Company’s common stock that were granted to Messrs. Graham and Dawson during the fiscal year ended December 31, 2004.

OPTION GRANTS IN FISCAL YEAR 2004

(INDIVIDUAL GRANTS)

| | | | | | | | | | | | | |

Name

| | Number of

Securities

Underlying Options Granted

| | | % of Total

Options Granted to Employees

| | | Exercise or Base Price

($/Share)

| | Expiration Date

| | Grant Date

Value(1)

|

James G. Graham | | 1,500 | (2) | | 30.0 | % | | $ | 19.75 | | Dec. 17, 2014 | | -0- |

Perry Bradford Dawson | | -0- | | | — | | | | — | | — | | — |

| (1) | Stock option exercise price equal to fair market value of underlying security on the date of grant. |

| (2) | Stock options granted pursuant to the Company’s 1998 Nonstatutory Stock Option Plan. |

The following table sets forth information regarding option exercises and option values as of the end of the fiscal year ended December 31, 2004.

AGGREGATED OPTION EXERCISES IN FISCAL 2004

AND FISCAL YEAR END OPTION VALUES

| | | | | | | | | |

Name

| | Shares

Acquired on Exercise

| | Value

Realized

| | Number of Securities Underlying

Unexercised Options at Fiscal Year End Exercisable/Unexercisable

| | Value of Unexercised In-The-Money Options at Fiscal Year End Exercisable/

Unexercisable(1)

|

James G. Graham | | -0- | | $ | -0- | | 121,144 /1,500 | | $1,859,560 / $-0- |

Perry Bradford Dawson | | -0- | | $ | -0- | | 4,800 /19,200 | | $38,400 /$153,600 |

| (1) | The closing price of the Company’s common stock at December 31, 2004 was $18.00 per share. |

Employment Agreement. The Bank is party to an employment agreement dated January 1, 1999 with James G. Graham, President and Chief Executive Officer of the Bank and Company (the “Employment Agreement”). The term of the Employment Agreement is one year and on each anniversary of the effective date the term automatically extends for one year unless notice is received 90 days prior to the anniversary date that the term will not be extended. The Employment Agreement provides for an annual base salary and for discretionary bonuses and participation in other pension and profit-sharing plans maintained by the Bank on behalf of its employees, as well as fringe benefits normally associated with Mr. Graham’s position or made available to all other employees. Mr. Graham’s current base salary under the Employment Agreement is $170,000. The Employment Agreement provides that Mr. Graham may be terminated for “cause” as defined in the Employment Agreement, and that the Employment Agreement may otherwise be terminated, in some cases with certain financial consequences, by the Bank or by Mr. Graham. The Employment Agreement provides that should the Bank terminate the Employment Agreement other than for cause within 24 months of a “change in control,” or should Mr. Graham terminate the agreement within such 24 month period because his compensation or responsibilities are reduced, or his workplace is moved an unreasonable distance from his current work place, then he shall receive 200% of his “base salary” as defined in Section 280G(b)(3) of the Internal Revenue Code.

Compensation Committee Interlocks and Insider Participation

No member of the Nominating and Compensation Committee is now, or formerly was, an officer or employee of the Company or the Bank. Mr. Graham makes recommendations to the Committee regarding compensation of the executive officers. Mr. Graham participates in the deliberations, but not the decisions, of the Committee regarding compensation of executive officers other than himself. He does not participate in the Committee’s discussions or decisions regarding his own compensation.

Report of the Compensation Committee

The Nominating & Compensation Committee meets on an as needed basis to review the salaries and compensation programs required to attract and retain the Company’s executive officers. While the committee makes recommendations to the Board of Directors regarding the compensation of the executive officers, the Board of Directors ultimately determines such compensation. The salary of each of the Company’s executive officers is determined based upon the executive officer’s experience, managerial effectiveness, contribution to the Company’s overall profitability, maintenance of regulatory compliance standards and professional leadership. The Committee also compares the compensation of the Company’s executive officers with compensation paid to executives of similarly situated bank holding companies, other businesses in the Company’s market area and appropriate state and national salary data. These factors were considered in establishing the compensation of Mr. Graham during the fiscal year ended December 31, 2004. All executive officers of the Company, including Mr. Graham, are eligible to receive discretionary bonuses declared by the Board of Directors. The amount of such bonuses and incentive payments is based upon the Company’s budget and the attainment of corporate goals and objectives. Finally, the interests of the Company’s executive officers are aligned with that of its shareholders through the use of equity-based compensation, specifically the grant of stock options with exercise prices established at the fair market value of the Company’s common stock at the time of grant.

This report is submitted by the Nominating & Compensation Committee: E. Autry Dawsey, Sr., Crawford Monroe Enzor, III, James E. Hill, Jr. and Alan W. Thompson.

Indebtedness of and Transactions with Management

The Company has had and expects to have in the future, banking transactions in the ordinary course of business with certain of its current directors, nominees for director, executive officers and their associates. All loans included in such transactions will be made on substantially the same terms, including interest rates, repayment terms and collateral, as those prevailing at the time such loans were made for comparable transactions with other persons, and will not involve more than the normal risk of collectibility or present other unfavorable features.

Loans made by the Bank to directors and executive officers are subject to the requirements of Regulation O of the Board of Governors of the Federal Reserve System. Regulation O requires, among other things, prior approval of the Board of Directors with any “interested director” not participating, dollar limitations on amounts of certain loans and prohibits any favorable treatment being extended to any director or executive officer in any of the Bank’s lending matters. To the best knowledge of the management of the Company and the Bank, Regulation O has been complied with in its entirety.

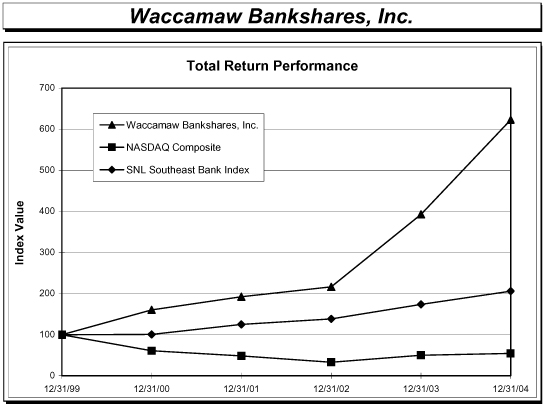

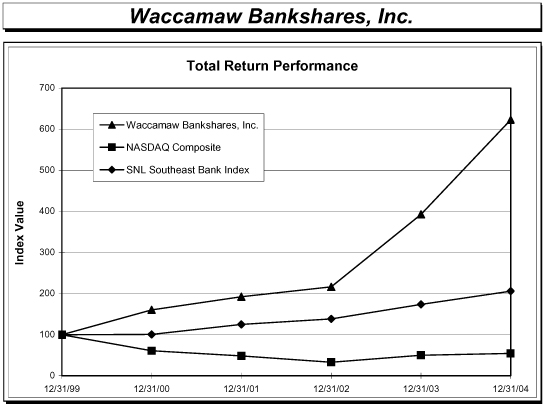

Performance Graph

The following graph compares (i) the yearly change in the cumulative total stockholder return on the Company’s common stock with (ii) the cumulative return of the Nasdaq Composite, and (iii) the SNL Southeast Bank Index. The graph assumes that the value of an investment in the Company’s common stock and in each index was $100 on December 31, 1999, and that all dividends were reinvested. The performance shown in the graph represents past performance and should not be considered an indication of future performance.

PROPOSAL 3: APPROVAL OF AN AMENDMENT TO

THE 1998 NONSTATUTORY STOCK OPTION PLAN

On January 20, 2005, the Board of Directors approved an amendment to the Waccamaw Bankshares, Inc. 1998 Nonstatutory Stock Option Plan (the “NSSO Plan”), subject to shareholder approval, to increase the total number of shares available for grant upon the exercise of options granted under the NSSO Plan. The proposed amendment provides that an aggregate of 138,136 shares will be added to the 320,122 shares currently reserved by the Company for issuance upon the exercise of stock options granted from time to time under the NSSO Plan. The purpose of the NSSO Plan generally is to assist the Company in attracting and retaining directors whose interests are the same as those of shareholders, and to provide an additional incentive for directors to whom nonstatutory stock options are granted to manage the Company in a manner that will enhance financial performance and shareholder value. The proposed amendment to the NSSO Plan will allow the Company to continue to address these goals through the grant of nonstatutory stock options to directors in the future.

The NSSO Plan is administered by the Board of Directors and generally provides for the issuance and sale of shares of the Company’s common stock (subject to adjustment as described below) upon the exercise of nonstatutory stock options. The Board of Directors is authorized to determine the persons to whom and numbers of shares for which nonstatutory stock options will be granted, to

interpret and construe the terms and provisions of the NSSO Plan and to make rules and other determinations relating to and reasonable or advisable in administering the NSSO Plan. The NSSO Plan provides that, to the extent permitted by applicable law, members of the Board will be indemnified by the Company for certain legal expenses and liability incurred in connection with the administration of the NSSO Plan.

The price per share of common stock covered by each nonstatutory stock option granted shall be set by the Board of Directors at the time such option is granted, but shall not be less than 100% of the fair market value (as determined by the Board) of a share of common stock at the time of grant. The fair market value of a share of common stock at the date of grant shall be determined according to the NSSO Plan in the following manner: (1) if on the date of grant, the common stock of the Company is traded on a securities exchange, the fair market value will be equal to the mean of the closing sales price as reported on each of the ten trading days immediately preceding the date of grant, provided that if a closing sales price is not reported for each of the ten trading days immediately preceding the date of grant, the fair market value shall be equal to the mean of the closing sales prices on those trading days for which such price is available; (2) if the common stock of the Company is not listed on any exchange or no closing sales prices are reported on an exchange, but quotations for the common stock are regularly listed on Nasdaq or another comparable system, the fair market value shall be equal to the mean of the average of the closing bid and asked prices as quoted on such system for each of the ten trading days preceding the date of grant, provided that if closing bid and asked prices are not available for each of the ten trading days, the fair market value shall be equal to the mean of the average of the closing bid and asked prices on those trading days during the ten-day period for which such prices are available; or (3) if the common stock is not quoted on Nasdaq or another comparable system, or no such quotations are available on Nasdaq, the fair market value shall be determined by the Board of Directors making a good faith estimate of value based upon the then current financial information of the Company and similarly situated peer institutions. If the Board of Directors determines that the price as determined above does not represent the fair market value of the shares of common stock on the date of grant, the Board may then consider such other factors as it deems appropriate in determining such fair market value.

Each nonstatutory stock option will become exercisable as specified by the Board of Directors at the time of grant and will expire and may not thereafter be exercised after the earlier of: (i) the expiration date set by the Board at the time of grant (which may be no more than 10 years after the date of grant); (ii) the date the optionee resigns from the Board of Directors or completes his or her term without reelection; (iii) 12 months after the optionee’s death: (1) while serving as a director; (2) after the optionee’s retirement from the Board in accordance with the Company’s bylaw provisions; or (3) following a “change in control”, but in all events, within 10 years after the date of grant. In connection with any nonstatutory stock option granted, the Board may impose such other restrictions or conditions as it may deem appropriate. Nonstatutory stock options are 100% vested upon grant and are not subject to any vesting schedule.

No monetary consideration will be received by the Company upon the grant of a nonstatutory stock option. In order to exercise a nonstatutory stock option, the optionee must give the Company written notice of exercise and pay the aggregate exercise price for shares being purchased. Such payment must be made in cash or in issued and outstanding shares of the Company’s common

stock. Optionees will have no rights as shareholders of the Company with respect to any shares covered by nonstatutory stock options granted to them until those such options have been exercised and the exercise price of such shares has been paid to the Company.

In the event of increases, decreases or changes in the Company’s outstanding common stock resulting from a stock dividend, recapitalization, reclassification, stock split, combination or similar event, or resulting from an exchange of shares or merger or other reorganization in which the Company is the surviving entity, the Board shall make equitable proportionate adjustments in the aggregate number and kind of shares available under the NSSO Plan, the number and kind of shares which are covered by each then outstanding nonstatutory stock option, and in the exercise price of each unexercised nonstatutory stock option. Unless amended by the Board, the standard Nonstatutory Option Agreement (the “NSSO Agreement”) shall be binding upon any successor in interest to the Company. However, except upon a “change in control” (as defined in the NSSO Agreement), the NSSO Plan and any options granted thereunder shall terminate upon the effective date of the Company’s dissolution or liquidation.

The Board may, from time to time, amend, modify, suspend, terminate or discontinue the NSSO Plan without notice. However, no such action will adversely affect any optionee’s rights under any then outstanding nonstatutory stock option without such optionee’s prior written consent. In addition, approval of the Company’s shareholders shall be required for any modification or amendment of the NSSO Plan that (i) increases the aggregate number of shares of common stock subject to the NSSO Plan, (ii) changes the provisions of the NSSO Plan with respect to the determination of persons to whom nonstatutory Stock options may be granted, or (iii) otherwise materially increases the benefits accruing to optionees under the NSSO Plan. Consistent with the terms of the NSSO Plan, the Board may modify any outstanding nonstatutory stock option pursuant to a written agreement with the optionee.

Nonstatutory stock options granted under the NSSO Plan will not qualify for favorable income tax treatment. As a result, an optionee will be taxed in the year in which a nonstatutory stock option is exercised. The excess of the fair market value of the stock at the time the nonstatutory stock option was exercised over the exercise price will be treated as ordinary income. Moreover, the Company will not be permitted to take a tax deduction at any time in connection with nonstatutory stock options. At its discretion, the Board may withhold from an optionee’s director’s fees or any other amount due to such optionee, if any, (or from shares being purchased upon the exercise of a nonstatutory stock option), the amount of any required tax withholdings for which the Company is responsible.

A copy of the NSSO Plan is on file and may be inspected by any shareholder at the Company’s office in Whiteville, North Carolina, and a copy will be available for inspection by any shareholder at the Annual Meeting. Additionally, any shareholder wishing to receive a copy of the NSSO Plan free of charge should contact David A. Godwin, Chief Financial Officer of the Company of the Company, at 110 North J.K. Powell Boulevard, Whiteville, North Carolina 28472.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” PROPOSAL 3 APPROVING AN AMENDMENT TO THE COMPANY’S 1998 NONSTATUTORY STOCK OPTION PLAN.

PROPOSAL 4: APPROVAL OF AMENDMENT TO

1998 INCENTIVE STOCK OPTION PLAN

On January 20, 2005, the Board of Directors approved an amendment to the Waccamaw Bankshares, Inc. 1998 Incentive Stock Option Plan (the “ISO Plan”), subject to shareholder approval, to increase the shares available for issuance upon the exercise of options granted under the ISO Plan. The amendment, which will aid the Company in attracting and retaining the personnel necessary for its continued growth, provides that an aggregate of 138,136 shares will be added to the 320,122 shares currently reserved for issuance by the Company upon exercise of stock options granted from time to time under the ISO Plan. Stock options granted under the ISO Plan are intended to qualify as “incentive stock options” within the meaning of Section 422A of the Internal Revenue Code (the “Code”). Under the Code, incentive stock options are afforded favorable tax treatment to recipients upon compliance with certain restrictions, but do not result in tax deductions for the Company. The purpose of the ISO Plan is to increase the performance incentive for employees of the Company and its subsidiaries, to encourage the continued employment of current employees and to attract new employees by facilitating their purchase of a stock interest in the Company.

The ISO Plan is administered by the Board of Directors. No member of the Board who is not also an employee of the Company or one of its subsidiaries is eligible to receive options under the ISO Plan. Employees of the Company and its subsidiaries are eligible to receive options under the ISO Plan at no cost to them other than the option exercise price. Generally, the exercise price for options granted pursuant to the ISO Plan may not be less than 100% of the fair market value of the underlying shares of common stock on the date of grant. No option will be exercisable more than ten years after the date that it is granted. In the case of an employee who owns more than 10% of the outstanding shares of common stock of the Company at the time the stock option is granted, the option price may not be less than 110% of the fair market value of the shares on the date of the grant, and the option shall not be exercisable more than five years from the date it is granted. The optionee cannot transfer or assign any option other than by will or in accordance with the laws of descent and distribution. In the event the optionee is discharged for cause or voluntary separation on the part of an optionee (but not separation due to retirement or disability) the options will immediately terminate. In the event of an optionee’s retirement, the options will continue to be exercisable for three months following retirement. In the event an optionee becomes disabled or dies, the options will continue to be exercisable for twelve months following the date of the disability or death. Shares of common stock subject to options, which expire or terminate prior to the exercise of the options, shall lapse and such shares shall again be available for future grants under the ISO Plan.

The Company receives no monetary consideration at the time of granting incentive stock options. The consideration, if any, which the Company receives from the granting of such stock options is the further dedication of its employees in the performance of their responsibilities, duties, and functions on behalf of the Company. Upon exercise of options, the Company will receive payment of cash or stock from the optionee in exchange for shares issued.

Subject to alternative minimum tax rules under the Code, a recipient of a stock option under the ISO Plan will not be taxed upon either the grant of the option or on the date he or she exercises such option. Unless subject to the alternative minimum tax, a recipient will be taxed only upon the sale of the stock underlying the option and will be taxed on the difference between the option price and the sales price of the stock. The taxable amount will be treated as capital gain. If the incentive option requirements are satisfied, the Company will not be eligible for a corresponding deduction for any portion of the stock option.

A copy of the ISO Plan is on file and may be inspected by any shareholder at the Company’s office in Whiteville, North Carolina, and a copy will be available for inspection by any shareholder at the Annual Meeting. Additionally, any shareholder wishing to receive a copy of the ISO Plan free of charge should contact David A. Godwin, Chief Financial Officer of the Company, at 110 North J.K. Powell Boulevard, Whiteville, North Carolina 28472.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” PROPOSAL 4 APPROVING AN AMENDMENT TO THE COMPANY’S 1998 INCENTIVE STOCK OPTION PLAN.

PROPOSAL 5: RATIFICATION OF INDEPENDENT PUBLIC ACCOUNTANTS

The Audit Committee of the Board of Directors has appointed the firm of Larrowe & Company, P.L.C., Certified Public Accountants, as the Company’s independent public accountants for 2005. A representative of Larrowe & Company, P.L.C. is expected to be present at the Annual Meeting and available to respond to appropriate questions, and will have the opportunity to make a statement if he or she desires to do so.

The Company has paid Larrowe & Company, P.L.C. fees in connection with its assistance in the Company’s annual audit and review of the Company’s financial statements. Sometimes the Company engages Larrowe & Company, P.L.C. to assist in other areas of financial planning. The following table sets forth the fees billed to the Company by Larrowe & Company, P.L.C. in various categories during 2004 and 2003.

| | | | | | |

Category

| | 2004 Amount Billed

| | 2003 Amount Billed

|

Audit Fees: | | $ | 40,250 | | $ | 35,100 |

Audit-Related Fees: | | | 3,536 | | | 13,795 |

Tax Fees | | | 1,650 | | | 1,500 |

All Other Fees: | | | -0- | | | -0- |

| | |

|

| |

|

|

Total Fees Paid: | | $ | 45,436 | | $ | 50,395 |

| | |

|

| |

|

|

All services rendered by Larrowe & Company, P.L.C. during 2004 and 2003 were subject to pre-approval by the Audit Committee.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” RATIFICATION OF LARROWE & COMPANY, P.L.C. AS THE COMPANY’S INDEPENDENT PUBLIC ACCOUNTANTS FOR 2005.

OTHER MATTERS

The Board of Directors knows of no other business that will be brought before the Annual Meeting. Should other matters properly come before the meeting, the proxies will be authorized to vote shares represented by each appointment of proxy in accordance with their best judgment on such matters.

PROPOSALS FOR 2006 ANNUAL MEETING

It is anticipated that the 2006 Annual Meeting will be held on a date during April 2006. Any proposal of a shareholder which is intended to be presented at the 2006 Annual Meeting must be received by the Company at its main office in Whiteville, North Carolina no later than November 15, 2005, in order that such Proposal be timely received for inclusion in the proxy statement and appointment of proxy to be issued in connection with that meeting. If a Proposal for the 2006 Annual Meeting is not expected to be included in the proxy statement for that meeting, the Proposal must be received by the Company by February 15, 2006 for it to be timely received for consideration. The Company will use its discretionary authority for any Proposals received thereafter.

SHAREHOLDER COMMUNICATIONS

The Company does not currently have a formal policy regarding shareholder communications with the Board of Directors, however, any shareholder may submit written communications to E. Autry Dawsey, Sr., Corporate Secretary, Waccamaw Bankshares, Inc., 110 North J.K. Powell Boulevard, Whiteville, North Carolina 28472, whereupon such communications will be forwarded to the Board of Directors if addressed to the Board of Directors as a group or to the individual director or directors addressed.

ADDITIONAL INFORMATION

A COPY OF THE COMPANY’S 2004 ANNUAL REPORT ON FORM 10-KSB WILL BE PROVIDED WITHOUT CHARGE TO ANY SHAREHOLDER ENTITLED TO VOTE AT THE ANNUAL MEETING UPON THAT SHAREHOLDER’S WRITTEN REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO DAvid A. Godwin, CHIEF FINANCIAL OFFICER, WACCAMAW BANKSHARES, INC., 110 NORTH J.K. POWELL BOULEVARD, WHITEVILLE, NORTH CAROLINA 28472.

Exhibit A

AUDIT COMMITTEE CHARTER

MISSION STATEMENT

The Audit Committee shall assist the Board of Directors (the “Board”) in fulfilling its oversight responsibilities. The Audit Committee shall review the financial reporting process, the system of internal control, the audit process, and the company’s process for monitoring compliance with laws and regulations with the Board, Management, and the Internal and External Auditors. To effectively perform his or her role, each committee member shall obtain an understanding of the detailed responsibilities of committee membership as well as the company’s business, operations, and risks.

Each Audit Committee member shall satisfy the independence and financial literacy requirements for serving on the audit committee, and at least one member must have accounting or related financial management expertise, all as stated in the rules of The Nasdaq Stock Market, Inc.

ORGANIZATION

Committee Composition. The Audit Committee shall be comprised of three or more directors as determined by the Board, each of whom shall be independent directors, and free from any relationship that, in the opinion of the Board, would interfere with the exercise of his or her independent judgment as a member of the Committee. All members should have a working familiarity with basic finance and accounting practices, and at least one member of the Committee shall have accounting or related financial management expertise. Committee members may enhance their familiarity with finance and accounting by participating in educational programs conducted by the Corporation or an outside consultant. Unless a Chair is elected by the full Board, the members of the Committee may designate a Chair by majority vote of the full Committee membership.

Frequency of meetings. The Audit Committee shall hold four regular meetings each year. Any member of the Committee, the Internal Auditor or the External Auditor can make a request to the Chairperson for special meetings. For both regular and special meetings, a quorum must be present in order to transact official business.

ROLES AND RESPONSIBILITIES

Internal Control

| | • | | Evaluate whether management is setting the appropriate tone at the top by communicating the importance of internal control and ensuring that all individuals possess an understanding of their roles and responsibilities. |

| | • | | Focus on the extent to which internal and external auditors review computer systems and applications, the security of such systems and applications, and the contingency plan for processing financial information in the event of a systems breakdown. |

| | • | | Gain an understanding of whether internal control recommendations made by internal and external auditors have been implemented by management. |

| | • | | Ensure that the internal auditors keep the audit committee informed about fraud, illegal acts, deficiencies in internal control, and certain other matters. |

Financial Reporting

General

| | • | | Review significant accounting and reporting issues, including recent professional and regulatory pronouncements, and understand their impact on the financial statements. |

| | • | | Ask management and the internal and external auditors about significant risks and exposures and the plans to minimize such risks. |

Annual Financial Statements

| | • | | Review the annual financial statements and determine whether they are complete and consistent with the information known to committee members; assess whether the financial statements reflect appropriate accounting principles. |

| | • | | Pay particular attention to complex and/or unusual transactions such as restructuring changes and derivative disclosures. |

| | • | | Focus on judgmental areas such as those involving valuation of assets and liabilities, including, for example, the accounting for and disclosure of loans losses; warranty, product, and environmental liability; litigation reserves; and other commitments and contingencies. |

| | • | | Meet with management and the external auditors to review the financial statements and the results of the audit. |

| | • | | Consider management’s handling of proposed audit adjustments identified by the external auditors. |

| | • | | Review Management’s Discussion and Analysis and other sections of the annual report before its release and consider whether the information is adequate and consistent with members’ knowledge about the company and its operation. |

| | • | | Ensure that the external auditors communicate certain required matters to the committee. |

Interim Financial Statements

| | • | | Be briefed on how management develops and summarizes quarterly financial information, the extent of internal audit involvement, the extent to which the external auditors review quarterly financial information, and whether that review is performed on a pre-or post-issuance basis. |

| | • | | Meet with management and, if a pre-issuance review was completed, with the external auditors, either telephonically or in person, to review the interim financial statements and the results of the review (this may be done by the committee Chairperson or the entire committee). |

| | • | | To gain insight into the fairness of the interim statements and disclosures, obtain explanations from management and from internal and external auditors on whether: |

| | • | | Actual financial results for the quarter or interim period varied significantly from budgeted or projected results. |

| | • | | Changes in financial ratios and relationships in the interim financial statements are consistent with changes in the company’s operations and financing practices. |

| | • | | Generally accepted accounting principles have been consistently applied. |

| | • | | There are any actual or proposed changes in accounting or financial reporting practices. |

| | • | | There are any significant or unusual events or transactions. |

| | • | | The company’s financial and operating controls are functioning effectively. |

| | • | | The company has complied with the terms of loan agreements or security indentures. |

| | • | | Ensure that the external auditors communicate certain required matters to the committee. |

Compliance with Laws and Regulations

| | • | | Review the effectiveness of the system for monitoring compliance with laws and regulations, and the results of management’s investigation and follow-up (including disciplinary action) on any fraudulent acts or accounting irregularities. |

| | • | | Periodically obtain updates from management, general counsel, and tax director regarding compliance. |

| | • | | Be satisfied that all regulatory compliance matters have been considered in the preparation of the financial statements. |

| | • | | Review the findings of any examinations by regulatory agencies. |

Internal Audit

| | • | | Review the activities and organizational structure of the internal audit function. |

| | • | | Review the qualifications of the internal audit function and concur in the appointment, replacement, reassignment, or dismissal of the director of internal audit. |

| | • | | Review the effectiveness of the internal audit function. |

External Audit

| | • | | Review the external auditors’ proposed audit scope and approach. |

| | • | | Review the performance of the external auditors and recommend to the Board the appointment or discharge of the external auditors. |

| | • | | Review and confirm the independence of the external auditors by reviewing the nonaudit services provided and the auditors’ assertion on their independence in accordance with professional standards. |

Other Responsibilities

| | • | | Meet with the external auditors, director of internal audit and management in separate executive sessions to discuss any matters that the committee or these groups believe should be discussed privately. |

| | • | | Ensure that significant findings and recommendations made by the internal and external auditors are received and discussed on a timely basis. |

| | • | | If necessary, institute special investigations and, if appropriate, hire special counsel or experts to assist. |

| | • | | Perform other oversight functions as requested by the full Board. |

| | • | | Review and update the charter, receive approval of changes from the Board. |

REPORTING RESPONSIBILITIES

| | • | | Regularly update the Board about committee activities and make appropriate recommendations. |

REVOCABLE PROXY

WACCAMAW BANKSHARES, INC.

110 North J.K. Powell Boulevard

Whiteville, North Carolina 28472

APPOINTMENT OF PROXY

SOLICITED BY BOARD OF DIRECTORS

The undersigned hereby appoints Freda H. Gore, David A. Godwin and Crawford Monroe Enzor, III (the “Proxies”), or any of them, as attorneys and proxies, with full power of substitution, to vote all shares of the common stock of Waccamaw Bankshares, Inc. (the “Company”) held of record by the undersigned on February 24, 2005, at the Annual Meeting of Shareholders of the Company to be held at the Waccamaw Bank and Corporate Center, 110 North J.K. Powell Boulevard, Whiteville, North Carolina, at 7:00 p.m. on April 21, 2005, and at any adjournments thereof. The undersigned hereby directs that the shares represented by this Appointment of Proxy be voted as follows on the proposals listed below:

1. APPROVAL OF AMENDMENT TO ARTICLES OF INCORPORATION: Proposal to approve an amendment to the Company’s Articles of Incorporation to increase the number of authorized shares of common stock from 5,000,000 to 25,000,000.

| | | | | | | | | | |

| ¨ | | FOR | | ¨ | | AGAINST | | ¨ | | ABSTAIN |

2. ELECTION OF DIRECTORS: Proposal to elect three directors of the Company, each for a three year term.

| | | | | | |

| ¨ | | FOR all nominees listed below (except as indicated otherwise below) | | ¨ | | WITHHOLD AUTHORITY to vote for all nominees listed below |

NOMINEES:

M.B. (“Bo”) Biggs

James G. Graham

J. Densil Worthington

Instruction: To withhold authority to vote for one or more nominees, write that nominee’s name on the line below.

___________________________________________________________________________________

3. APPROVAL OF AMENDMENT TO 1998 NONSTATUTORY STOCK OPTION PLAN: Proposal to approve an amendment to the Company’s 1998 Nonstatutory Stock Option Plan increasing the number of options available for grant under the plan by 138,136.

| | | | | | | | | | |

| ¨ | | FOR | | ¨ | | AGAINST | | ¨ | | ABSTAIN |

4. APPROVAL OF AMENDMENT TO 1998 INCENTIVE STOCK OPTION PLAN: Proposal to approve an amendment to the Company’s 1998 Incentive Stock Option Plan increasing the number of options available for grant under the plan by 138,136.

| | | | | | | | | | |

| ¨ | | FOR | | ¨ | | AGAINST | | ¨ | | ABSTAIN |

5. RATIFICATION OF INDEPENDENT PUBLIC ACCOUNTANTS: Proposal to ratify the appointment of Larrowe & Company, P.L.C. as the Company’s independent accountants for 2005.

| | | | | | | | | | |

| ¨ | | FOR | | ¨ | | AGAINST | | ¨ | | ABSTAIN |

6. OTHER BUSINESS: On such other matters as may properly come before the Annual Meeting, the Proxies are authorized to vote the shares represented by this Appointment of Proxy in accordance with their best judgment.

THE SHARES REPRESENTED BY THIS APPOINTMENT OF PROXY WILL BE VOTED BY THE PROXIES IN ACCORDANCE WITH THE SPECIFIC INSTRUCTIONS ABOVE. IN THE ABSENCE OF INSTRUCTIONS, THE PROXIES WILL VOTE SUCH SHARES “FOR” THE ELECTION OF EACH OF THE NOMINEES LISTED IN PROPOSAL 2 ABOVE AND “FOR” PROPOSALS 1, 3, 4 AND 5 ABOVE. IF, AT OR BEFORE THE TIME OF THE MEETING, ANY OF THE NOMINEES LISTED IN PROPOSAL 2 FOR ANY REASON HAVE BECOME UNAVAILABLE FOR ELECTION OR UNABLE TO SERVE AS DIRECTORS, THE PROXIES HAVE THE DISCRETION TO VOTE FOR A SUBSTITUTE NOMINEE OR NOMINEES. THIS APPOINTMENT OF PROXY MAY BE REVOKED AT ANY TIME BEFORE IT IS EXERCISED BY FILING WITH THE SECRETARY OF THE COMPANY AN INSTRUMENT REVOKING IT OR A DULY EXECUTED APPOINTMENT OF PROXY BEARING A LATER DATE, OR BY ATTENDING THE ANNUAL MEETING AND REQUESTING THE RIGHT TO VOTE IN PERSON.

| | |

| Date: _________________________________, 2005 |

|

| ___________________________________ (SEAL) |

(Signature) |

|

| ___________________________________ (SEAL) |

(Signature, if shares held jointly) |

|

| Instruction: Please sign aboveexactly as your name appears on this appointment of proxy. Joint owners of shares shouldboth sign. Fiduciaries or other persons signing in a representative capacity should indicate the capacity in which they are signing. |

IMPORTANT: TO INSURE THAT A QUORUM IS PRESENT, PLEASE SEND IN YOUR APPOINTMENT OF PROXY WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING. EVEN IF YOU SEND IN YOUR APPOINTMENT OF PROXY YOU WILL BE ABLE TO VOTE IN PERSON AT THE MEETING IF YOU SO DESIRE.

PLEASE MARK, SIGN, DATE AND PROMPTLY RETURN THIS PROXY CARD IN THE

ENCLOSED ENVELOPE.