Contents

TransAlta Corporation • Annual Information Form 1

Presentation of Information

The information contained in this Annual Information Form (AIF) is given as of or for the year ended Dec. 31, 2024, unless otherwise noted. All dollar amounts are in Canadian dollars, unless otherwise noted. All references to the "Company" and to "TransAlta", "we", "our" and "us" refer to TransAlta Corporation and its subsidiaries on a consolidated basis. Reference to "TransAlta Corporation" refer to TransAlta Corporation only. Certain capitalized terms defined throughout the body of this AIF and abbreviations and acronyms that may not otherwise be defined are defined in Appendix "B" – Glossary of Terms.

Certain portions of TransAlta's management's discussion and analysis dated Feb. 19, 2025 (MD&A) are incorporated by reference into this AIF as stated below and noted elsewhere in this AIF. The MD&A can be found on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov.

Forward-Looking Statements

This AIF, including the information incorporated by reference herein, includes "forward-looking information," within the meaning of applicable Canadian securities laws, and "forward-looking statements," within the meaning of applicable U.S. securities laws, including the Private Securities Litigation Reform Act of 1995 (collectively referred to herein as forward-looking statements).

Forward-looking statements are not facts, but only predictions and generally can be identified by the use of statements that include phrases such as "may", "will", "can", "could", "would", "shall", "believe", "expect", "estimate", "anticipate", "intend", "plan", "forecast", "foresee", "potential", "enable", "continue" or other comparable terminology. These statements are not guarantees of our future performance, events or results and are subject to risks, uncertainties and other important factors that could cause our actual performance, events or results to be materially different from those set out in or implied by the forward-looking statements.

In particular, this AIF (including the information incorporated by reference herein) contains forward-looking statements about the following, among other things:

•The strategic objectives of the Company and that the execution of the Company's strategy will realize value for shareholders;

•Our capital allocation and financing strategy;

•Our sustainability goals and targets, including those in our 2024 Sustainability Report;

•Our 2025 Outlook;

•Our financial and operational performance, including our hedge position;

•Optimizing and diversifying our existing assets;

•The increasingly contracted nature of our fleet;

•Expectations about strategies for growth and expansion, including opportunities for Centralia redevelopment, and data centre opportunities;

•Expected costs and schedules for planned projects;

•Expected regulatory processes and outcomes, including in relation to the Alberta restructured energy market;

•The power generation industry and the supply and demand of electricity;

•The cyclicality of our business;

•Expected outcomes with respect to legal proceedings;

•The expected impact of future tax and accounting changes; and

•Expected industry, market and economic conditions.

The forward-looking statements contained in this AIF (or incorporated herein by reference) are based on many assumptions including, but not limited to, the following:

TransAlta Corporation • Annual Information Form 2

•No significant changes to applicable laws and regulations;

•No unexpected delays in obtaining required regulatory approvals;

•No material adverse impacts to investment and credit markets;

•No significant changes to power price and hedging assumptions;

•No significant changes to gas commodity price assumptions and transport costs;

•No significant changes to interest rates;

•No significant changes to the demand and growth of renewables generation;

•No significant changes to the integrity and reliability of our facilities;

•No significant changes to the Company's debt and credit ratings;

•No unforeseen changes to economic and market conditions; and

•No significant event occurring outside the ordinary course of business.

These assumptions are based on information currently available to TransAlta, including information obtained from third-party sources. Actual results may differ materially from those predicted.

Factors that may adversely impact what is expressed or implied by forward-looking statements contained in this AIF (or incorporated herein by reference) include, but are not limited to:

•Fluctuations in power prices;

•Changes in supply and demand for electricity;

•Our ability to contract our electricity generation for prices that will provide expected returns;

•Our ability to replace contracts as they expire;

•Risks associated with development projects and acquisitions;

•Any difficulty raising needed capital in the future on reasonable terms or at all;

•Our ability to achieve our targets relating to environmental, social and governance (ESG) performance;

•Long-term commitments on gas transportation capacity that may not be fully utilized over time;

•Changes to the legislative, regulatory and political environments;

•Environmental requirements and changes in, or liabilities under, these requirements;

•Operational risks involving our facilities, including unplanned outages and equipment failure;

•Disruptions in the transmission and distribution of electricity;

•Reductions in production;

•Impairments and/or writedowns of assets;

•Adverse impacts on our information technology systems and our internal control systems, including increased cybersecurity threats;

•Commodity risk management and energy trading risks;

•Reduced labour availability and ability to continue to staff our operations and facilities;

•Disruptions to our supply chains;

•Climate-change related risks;

•Reductions to our generating units' relative efficiency or capacity factors;

•General economic risks, including deterioration of equity and debt markets, increasing interest rates or rising inflation;

•General domestic and international economic and political developments, including potential trade tariffs;

•Industry risk and competition;

•Counterparty credit risk;

TransAlta Corporation • Annual Information Form 3

•Inadequacy or unavailability of insurance coverage;

•Increases in the Company's income taxes and any risk of reassessments;

•Legal, regulatory and contractual disputes and proceedings involving the Company;

•Reliance on key personnel; and

•Labour relations matters.

The foregoing risk factors, among others, are described in further detail under the heading "Governance and Risk Management" in the MD&A, which section is incorporated by reference herein.

Readers are urged to consider these factors carefully when evaluating the forward-looking statements and are cautioned not to place undue reliance on them. The forward-looking statements included in this AIF are made only as of the date hereof and we do not undertake to publicly update these forward-looking statements to reflect new information, future events or otherwise, except as required by applicable laws. The purpose of the financial outlooks contained herein (including as may be incorporated by reference) is to give the reader information about management's current expectations and plans and readers are cautioned that such information may not be appropriate for other purposes.

Non-IFRS Financial Measures

We use a number of financial measures to evaluate our performance and the performance of our business segments, including measures and ratios that do not have any standardized meaning under International Financial Reporting Standards (IFRS), and therefore are unlikely to be comparable to similar measures presented by other companies and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. In addition, TransAlta cautions the reader that information provided in this AIF regarding the Company's outlook on certain matters, is provided to give context to the nature of some of the Company's future plans and may not be appropriate for other purposes. Refer to the "Additional IFRS Measures and Non-IFRS Financial Measures" and "Key Non-IFRS Financial Ratios" sections of the MD&A, for more information, which sections are incorporated by reference.

Corporate Structure

Name and Incorporation

TransAlta is a corporation organized under the Canada Business Corporations Act (CBCA). The Company was formed by a Certificate of Amalgamation issued on Oct. 8, 1992. On Dec. 31, 1992, a Certificate of Amendment was issued in connection with a plan of arrangement under the CBCA involving the Company and TransAlta Utilities Corporation (TransAlta Utilities or TAU). The plan of arrangement, which was approved by shareholders on Nov. 26, 1992, resulted in shareholders of TAU exchanging their common shares for common shares of TransAlta Corporation on a one-for-one basis. Upon completion of the arrangement, TAU became a wholly owned subsidiary of TransAlta Corporation.

Effective Jan. 1, 2009, we completed a reorganization, whereby the assets and business affairs of TAU and TransAlta Energy Corporation (TransAlta Energy) (with the exception of the wind business) were transferred to TransAlta Generation Partnership, a then new Alberta general partnership, whose partners are the Company and TransAlta Generation Ltd., a wholly owned subsidiary of TransAlta. TransAlta Generation Partnership is managed by TransAlta Corporation pursuant to the terms of a partnership agreement and a management services agreement. Immediately following the transfer of assets by TAU and TransAlta Energy to TransAlta Generation Partnership, TransAlta Corporation amalgamated with TAU, TransAlta Energy and Keephills 3 GP Ltd. pursuant to the provisions of the CBCA. Effective June 1, 2023, TransAlta Corporation amalgamated with its wholly owned subsidiary TransAlta Investment Ltd. On Oct. 5, 2023, TransAlta Corporation acquired all of the outstanding common shares of TransAlta Renewables Inc. (TransAlta Renewables) not already owned, directly or indirectly, by the Company.

TransAlta Corporation • Annual Information Form 4

We amended our articles at several instances in connection with issuances of preferred shares including on Oct. 1, 2020, when we created the Series I Shares, a new series of redeemable, retractable first preferred shares that were issued to an affiliate of Brookfield Renewable Partners (Brookfield). See the "Capital Structure – Exchangeable Securities" section of this AIF.

Our registered and head office is located at TransAlta Place, Suite 1400, 1100 1 St SE, Calgary, Alberta, Canada, T2G 1B1.

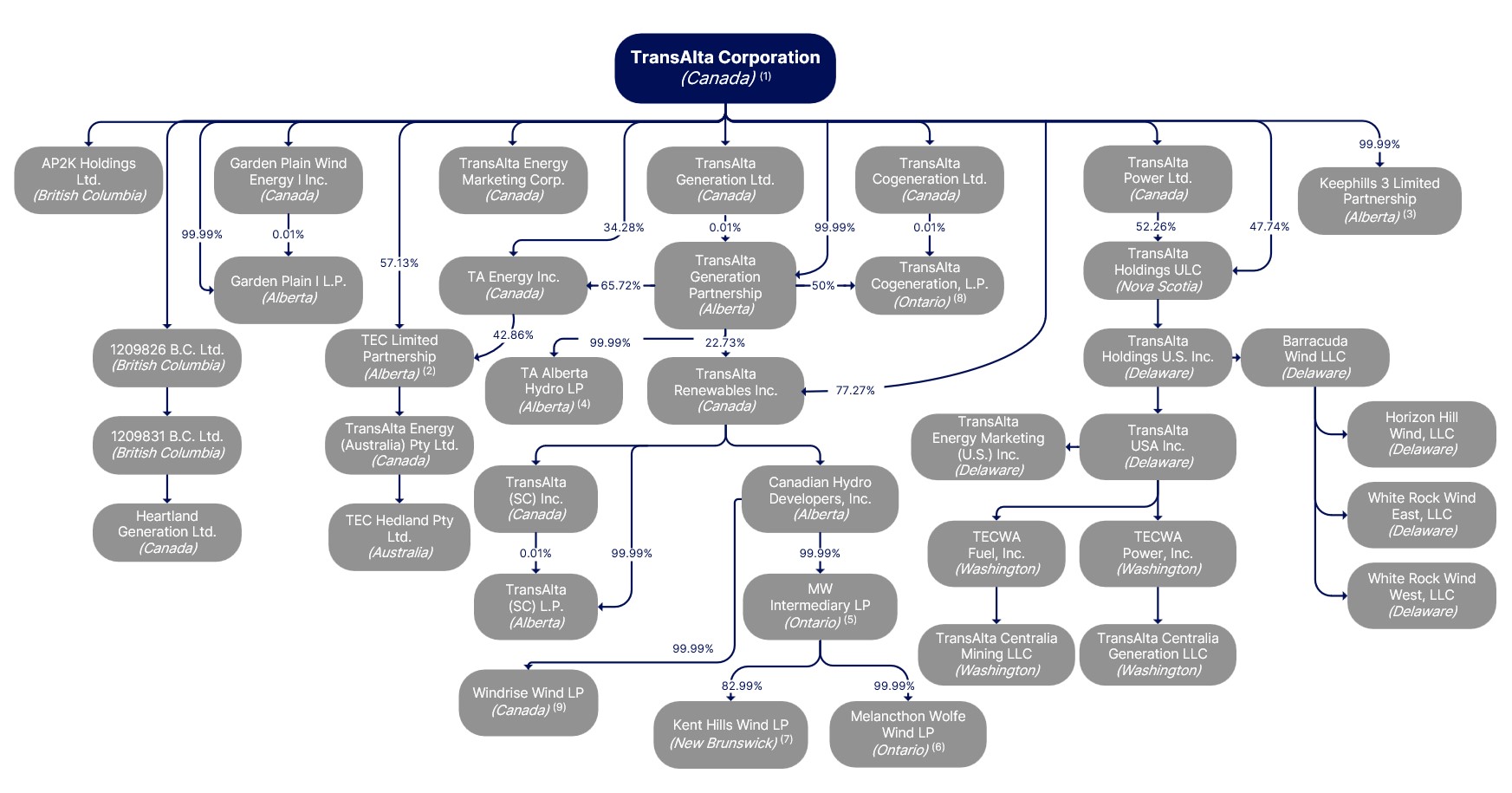

Intercorporate Relationships

As of Dec. 31, 2024, our principal subsidiaries and their respective jurisdictions of formation are set out in the organization chart below. The Company’s remaining subsidiaries each account for (i) less than 10 per cent of the Company’s consolidated assets as at Dec. 31, 2024 and (ii) less than 10 per cent of the Company’s consolidated revenues for the year ended Dec. 31, 2024. The diagram below does not include all of the subsidiaries of TransAlta. The total assets and revenues of excluded subsidiaries in the aggregate did not exceed 20 per cent of the Company’s total consolidated assets or total consolidated revenues as at and for the year ended Dec. 31, 2024.

(1) Unless otherwise stated, ownership is 100 per cent.

(2) The remaining 0.01 per cent of TEC Limited Partnership is owned by TransAlta (Ft. McMurray) Ltd, a wholly owned subsidiary of the Company.

(3) The remaining 0.01 per cent of Keephills 3 Limited Partnership is owned by Vision Quest WindElectric Ltd., a wholly owned subsidiary of the Company.

(4) The remaining 0.01 per cent of TA Alberta Hydro LP is owned by TA Alberta Hydro Inc., a wholly owned subsidiary of the Company.

(5) The remaining 0.01 per cent of MW Intermediary LP is owned by MW Intermediary Inc., a wholly owned subsidiary of Canadian Hydro Developers, Inc.

(6) The remaining 0.01 per cent of Melancthon Wolfe Wind LP is owned by Melancthon Wolfe Wind Inc., a wholly owned subsidiary of MW Intermediary LP.

(7) Of the 17.01 per cent of Kent Hills Wind LP, 17.00 per cent is owned by Natural Forces Technologies Inc. and 0.01 percent is owned by Kent Hills Wind Inc.

(8) The remaining 49.99 per cent of TransAlta Cogeneration LP is owned by CPH Cogen Inc.

(9) The remaining 0.01 per cent of Windrise Wind LP is owned by Windrise Wind Energy Inc., a wholly owned subsidiary of Canadian Hydro Developers, Inc.

TransAlta Corporation • Annual Information Form 5

General Development of the Business

Summarized below are significant developments that have occurred in our business segments during the last three financial years. These events include growth, innovation, acquisitions, recontracting, retirement of assets, dispositions, corporate changes, and other events or conditions that have influenced the general development of the Company's business.

Three-Year History

2024

Acquisition of Heartland Generation from Energy Capital Partners

On Dec. 4, 2024, the Company closed the acquisition of Heartland Generation Ltd. and certain affiliates (collectively, Heartland) for a purchase price of $542 million from an affiliate of Energy Capital Partners (ECP), the parent of Heartland (the Transaction). To meet the requirements of the federal Competition Bureau, the Company entered into a consent agreement with the Commissioner of Competition pursuant to which TransAlta agreed to divest Heartland's Poplar Hill and Rainbow Lake assets (the Planned Divestitures) following closing of the Transaction. In consideration of the Planned Divestitures, TransAlta and ECP agreed to a reduction of $80 million from the original purchase price for the Transaction. ECP will be entitled to receive the proceeds from the sale of Poplar Hill and Rainbow Lake, net of certain adjustments following completion of the Planned Divestitures. TransAlta also received a further $95 million at closing of the Transaction to reflect the economic benefit of the Heartland business arising from Oct. 31, 2023 to the closing date of the Transaction, pursuant to the terms of the share purchase agreement. The net cash payment for the Transaction, before working capital adjustments, totalled $215 million, and was funded through a combination of cash on hand and draws on TransAlta's credit facilities.

Excluding the Planned Divestitures, the Transaction adds 1,747 MW (net interest) of complementary capacity from nine facilities, including contracted cogeneration and peaking generation, legacy gas-fired thermal generation, and transmission capacity, all of which will be critical to support reliability in the Alberta electricity market.

Mothballing of Sundance Unit 6

On Nov. 4, 2024, the Company provided notice to the Alberta Electric System Operator (AESO) that Sundance Unit 6 will be mothballed on April 1, 2025, for a period of up to two years depending on market conditions. TransAlta maintains the flexibility to return the mothballed unit to service when market fundamentals or opportunities to contract are secured. The unit remains available and fully operational for the first quarter of 2025.

Horizon Hill Wind Facility

On May 21, 2024, the 202 MW Horizon Hill wind facility achieved commercial operation. The facility is located in Logan County, Oklahoma and is fully contracted to Meta Platforms Inc. for the offtake of 100 per cent of the generation.

White Rock Wind Facility

On Jan. 1, 2024, the 100 MW White Rock West wind facility achieved commercial operation. On April 22, 2024, the 202 MW White Rock East wind facility also completed commissioning. The facilities are located in Caddo County, Oklahoma and are contracted under two long-term power purchase agreements (PPAs) with Amazon Energy LLC for the offtake of 100 per cent of the generation.

Production Tax Credit (PTC) Sale Agreements

On Feb. 22, 2024, the Company entered into 10-year transfer agreements with an AA- rated customer for the sale of approximately 80 per cent of the expected PTCs to be generated from the White Rock and the Horizon Hill wind facilities.

On June 21, 2024, the Company entered into an additional 10-year transfer agreement with an A+ rated customer for the sale of the remaining 20 per cent of the expected PTCs.

TransAlta Corporation • Annual Information Form 6

Mount Keith West Network Upgrade Project.

Construction of the Mount Keith West Network upgrade project commenced in the fourth quarter of 2024 under the PPA with BHP Nickel West. The works comprise upgrades to the Mount Keith 132kV network via an extension of existing Gas Insulated Switchgear, new 132kV transformers and new 11kV switchrooms that will replace legacy 11kV switchgear located at TransAlta’s diesel power station.

Mount Keith 132kV Transmission Expansion

The Mount Keith 132kV expansion project was completed during the first quarter of 2024. The expansion was developed under the existing PPA with BHP Nickel West (BHP), which extends until Dec. 31, 2038. The expansion will facilitate the connection of additional generating capacity to the transmission network which supports BHP's operations.

Normal Course Issuer Bid

During the year ended Dec. 31, 2024, the Company purchased and cancelled a total of 13,467,400 common shares, pursuant to its Normal Course Issuer Bid program at an average price of $10.59 per common share, for a total cost of $143 million, including taxes.

2023

Northern Goldfields Solar Achieves Commercial Operation

On Nov. 22, 2023, the 48 MW Northern Goldfields solar and battery storage facilities achieved commercial operation. The facilities consist of the 27 MW Mount Keith solar facility, the 11 MW Leinster solar facility, the 10 MW Leinster battery energy storage system and interconnecting transmission infrastructure, all of which are now integrated into TransAlta’s existing 145 MW Southern Cross Energy North remote network in Western Australia. The facilities are fully contracted to BHP under a PPA expiring in 2038.

Kent Hills Wind Facilities

Our Kent Hills wind facilities were partially returned to service in the fourth quarter of 2023, with all turbines commissioned and the remediation project completed in the first quarter of 2024. On June 2, 2022, we announced the rehabilitation plan for the Kent Hills 1 and 2 wind facilities. In addition to the announcement, TransAlta amended and extended PPAs with New Brunswick Power Corporation (NB Power) in respect of each of the Kent Hills 1, 2 and 3 wind facilities, providing for an additional 10-year contract term to December 2045 and an effective 10 per cent reduction to the original contract prices from January 2023 through December 2033. In addition, both parties have agreed to work in good faith to evaluate the installation of a battery energy storage system at Kent Hills and to consider a potential repowering of Kent Hills at the end of life in 2045.

Garden Plain Wind Facility Reaches Commercial Operations

In August 2023, the Garden Plain wind facility was commissioned adding 130 MW to our gross installed capacity. The facility is fully contracted with Pembina Pipeline Corporation (Pembina) and PepsiCo Canada (PepsiCo), with a weighted average contract life of approximately 17 years. The facility consists of 26 Siemens-Gamesa turbines.

Acquisition of TransAlta Renewables Inc.

On Oct. 5, 2023, the Company completed the acquisition of TransAlta Renewables for $1.3 billion, consisting of $800 million of cash and approximately 46 million common shares of the Company. TransAlta's acquisition of TransAlta Renewables' common shares resulted in TransAlta Renewables becoming a wholly owned subsidiary of the Company. Prior thereto, TransAlta and its affiliates collectively owned 60.1 per cent of TransAlta Renewables.

Pingston Successfully Recontracted

During 2023, the Company successfully recontracted the Pingston facility for a period of 20 years. Pingston is a 45 MW run-of-river hydroelectric facility located on Pingston Creek, British Columbia.

2022

Public Offering of US Senior Green Bonds and Release of Inaugural Green Bond Framework

On Nov. 17, 2022, the Company issued US$400 million Senior Notes, which have a coupon rate of 7.750 per cent per annum and mature on Nov. 15, 2029.

TransAlta Corporation • Annual Information Form 7

The Company allocated an amount equal to the net proceeds from this offering to finance or refinance new and/or existing eligible green projects in accordance with its Green Bond Framework (the Framework). The Framework received a second-party opinion from Sustainalytics, which verified that it aligned with the Green Bond Principles from the International Capital Market Association.

Executed Industrial Contract Extensions at Sarnia Cogeneration

During the second and fourth quarters of 2022, the Company executed contracts for the supply of electricity and steam from the Sarnia cogeneration facility with three of its legacy industrial customers, and three new customers, who had previously been resold utilities as part of a legacy customer's contract. Following the contracting efforts in 2021 and 2022, the Sarnia cogeneration facility has been fully recontracted without interruption to the customers' delivery terms. The contracts extend to April 30, 2031, for four customers, and to Dec. 31, 2032 for the other three customers.

Executed Contract Renewals with the IESO at Sarnia Cogeneration and Melancthon 1 Wind Facilities

On Aug. 23, 2022, TransAlta was awarded capacity contracts for the Sarnia cogeneration facility and the Melancthon 1 wind facility from the Ontario Independent Electricity System Operator (IESO) as part of the IESO’s Medium-Term Capacity Procurement Request for Proposals. The capacity contracts run from May 1, 2026, to April 30, 2031.

TransAlta Corporation • Annual Information Form 8

Business of TransAlta

Our Hydro, Wind and Solar, Gas and Energy Transition segments are responsible for operating and maintaining our electrical generation facilities in Canada, the United States and Western Australia. Our Energy Marketing segment is responsible for marketing and scheduling our merchant asset fleet in North America (excluding Alberta) along with the procurement of natural gas, transport and storage for our gas fleet, providing knowledge to support our growth team, and generating a stand-alone gross margin separate from our asset business through a leading North American energy marketing platform and trading.

In Alberta, the Company manages merchant exposure by executing hedging strategies that include a significant base of commercial and industrial customers, supplemented with financial hedges. A significant portion of our thermal generation capacity in Alberta is hedged to provide greater cash flow certainty while also capturing higher returns for our shareholders through the optimization of our merchant generation portfolio.

These segments are all supported by a Corporate segment.

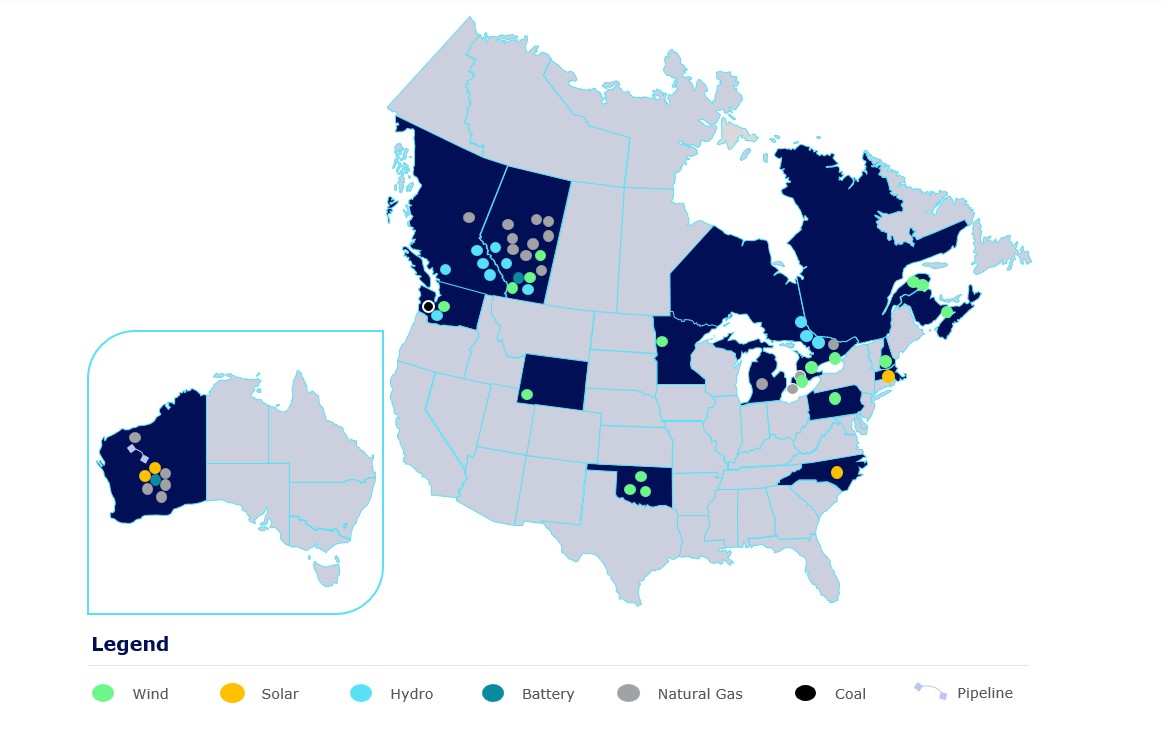

TransAlta's Map of Operations

The following map outlines the Company's operations as of Dec. 31, 2024:

The following sections of this AIF provide detailed information on facilities by geographic location and fuel type.

TransAlta Corporation • Annual Information Form 9

Hydro Segment

The Hydro segment holds a net capacity interest of 922 MW of generating capacity. The facilities are located in Alberta, British Columbia, and Ontario.

As well as contracting for power, we enter into long and short-term contracts to sell the environmental attributes from our merchant hydro facilities. These activities help to ensure earnings stability from these assets. Generally, for facilities under long-term contracts, the benefit of the environmental attributes generated is provided to the contract holder.

The following table summarizes our hydroelectric facilities as at Dec. 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Facility Name | Province | Nameplate Capacity (MW)(1) | Consolidated Interest | Gross Installed Capacity (MW)(1) | Ownership | Net Capacity Ownership Interest (MW)(1) | Commercial Operation Date(2) | Revenue Source(3) | Contract Expiry Date(4) |

| Alberta - Bow River System | | | | | | | | |

Barrier(5)(6) | AB | 13 | 100 | % | 13 | 100 | % | 13 | 1947 | Merchant | ‑ |

Bearspaw(5)(6) | AB | 17 | 100 | % | 17 | 100 | % | 17 | 1954 | Merchant | ‑ |

Cascade(5)(6) | AB | 36 | 100 | % | 36 | 100 | % | 36 | 1942, 1957 | Merchant | ‑ |

Ghost(5)(6) | AB | 54 | 100 | % | 54 | 100 | % | 54 | 1929, 1954 | Merchant | ‑ |

Horseshoe(5)(6) | AB | 14 | 100 | % | 14 | 100 | % | 14 | 1911 | Merchant | ‑ |

Interlakes(5)(6) | AB | 5 | 100 | % | 5 | 100 | % | 5 | 1955 | Merchant | ‑ |

Kananaskis(5)(6) | AB | 19 | 100 | % | 19 | 100 | % | 19 | 1913, 1951 | Merchant | ‑ |

Pocaterra(6) | AB | 15 | 100 | % | 15 | 100 | % | 15 | 1955 | Merchant | ‑ |

Rundle(5)(6) | AB | 50 | 100 | % | 50 | 100 | % | 50 | 1951, 1960 | Merchant | ‑ |

Spray(5)(6) | AB | 112 | 100 | % | 112 | 100 | % | 112 | 1951, 1960 | Merchant | ‑ |

Three Sisters(5) | AB | 3 | 100 | % | 3 | 100 | % | 3 | 1951 | Merchant | ‑ |

| Alberta - Oldman River System | | | | | | | | |

Belly River(6) | AB | 3 | 100 | % | 3 | 100 | % | 3 | 1991 | Merchant | ‑ |

St. Mary(6) | AB | 2 | 100 | % | 2 | 100 | % | 2 | 1992 | Merchant | ‑ |

Taylor(6) | AB | 13 | 100 | % | 13 | 100 | % | 13 | 2000 | Merchant | ‑ |

Waterton(6) | AB | 3 | 100 | % | 3 | 100 | % | 3 | 1992 | Merchant | ‑ |

Alberta - North Saskatchewan River System(6) | | | | | | | |

Bighorn(5)(6) | AB | 120 | 100 | % | 120 | 100 | % | 120 | 1972 | Merchant | ‑ |

Brazeau(5)(6) | AB | 355 | 100 | % | 355 | 100 | % | 355 | 1965, 1967 | Merchant | ‑ |

| BC Hydro | | | | | | | | | |

Akolkolex(6) | BC | 10 | 100 | % | 10 | 100 | % | 10 | 1995 | LTC | 2046 |

Bone Creek(6) | BC | 19 | 100 | % | 19 | 100 | % | 19 | 2011 | LTC | 2031 |

Pingston(6) | BC | 45 | 50 | % | 22.5 | 100 | % | 23 | 2003, 2004 | LTC | 2043 |

Upper Mamquam(6) | BC | 25 | 100 | % | 25 | 100 | % | 25 | 2005 | LTC | 2045 |

| Ontario Hydro | | | | | | | | |

| Misema | ON | 3 | 100 | % | 3 | 100 | % | 3 | 2003 | LTC | 2027 |

Moose Rapids(6) | ON | 1 | 100 | % | 1 | 100 | % | 1 | 1997 | LTC | 2030 |

| Ragged Chute | ON | 7 | 100 | % | 7 | 100 | % | 7 | 1991 | LTC | 2029 |

| Total Hydroelectric Capacity | 944 | | 922 | | 922 | | | |

(1) MW are rounded to the nearest whole number. The gross installed capacity reflects the basis of consolidation of underlying assets owned, whereas net capacity ownership interest deducts capacity attributable to the non-controlling interest in these assets and is calculated after the consolidation of underlying assets.

(2) A second date in this column refers to a second unit that was subsequently operational.

(3) The large majority of the Company’s contracted operating facilities benefit from inflation adjustment provisions that apply to all or a portion of our revenues under such contracts.

(4) Where no contract expiry date is indicated, the facility operates as merchant.

(5) These facilities form part of the hydro assets that are subject to an Investment Agreement. See the "Capital Structure – Investment Agreement" section of this AIF for further details.

(6) These facilities are EcoLogo® certified. EcoLogo certification is granted to products with an environmental performance

that meets or exceeds all government, industrial safety and performance standards.

TransAlta Corporation • Annual Information Form 10

Bow River System

Barrier

Barrier is a hydroelectric facility with installed capacity of 13 MW located on the Kananaskis River near Seebe, Alberta. Commercial operations began in 1947. Generation from the facility is currently sold in the Alberta electricity market and creates Emission Performance Credits (EPCs) under the Alberta Technology Innovation and Emissions Reduction (TIER) system.

Bearspaw

Bearspaw is a hydroelectric facility with installed capacity of 17 MW located on the Bow River in Calgary, Alberta. Commercial operations began in 1954. Generation from the facility is currently sold in the Alberta electricity market and creates EPCs under the TIER system.

Cascade

Cascade is a hydroelectric facility with installed capacity of 36 MW located on the Cascade River in Banff National Park, Alberta. This facility was purchased from the Government of Canada in 1941. The following year, we built a new dam and power plant to replace the original, and then, in 1957, added a second generating unit. Generation from the facility is currently sold in the Alberta electricity market and creates EPCs under the TIER system.

Ghost

Ghost is a hydroelectric facility with installed capacity of 54 MW located on the Bow River near Cochrane, Alberta. Commercial operations began in 1929. Generation from the facility is currently sold in the Alberta electricity market and creates EPCs under the TIER system.

Horseshoe

Horseshoe is a run-of-river hydroelectric facility with installed capacity of 14 MW located on the Bow River near Seebe, Alberta. Commercial operations began in 1911. Generation from the facility is currently sold in the Alberta electricity market and creates EPCs under the TIER system.

Interlakes

Interlakes is a hydroelectric facility with installed capacity of 5 MW located at Kananaskis Lakes, Alberta. Commercial operations began in 1955. Generation from the facility is currently sold in the Alberta electricity market and creates EPCs under the TIER system.

Kananaskis

Kananaskis is a run-of-river hydroelectric facility with installed capacity of 19 MW located on the Bow River in Seebe, Alberta. Commercial operations began in 1913. Generation from the facility is currently sold in the Alberta electricity market and creates EPCs under the TIER system.

Pocaterra

Pocaterra is a hydroelectric facility with installed capacity of 15 MW located at Kananaskis Lakes, Alberta. Commercial operations began in 1955. Generation from the facility is sold in the Alberta electricity market and creates EPCs under the TIER system.

Rundle

Rundle is a hydroelectric facility with installed capacity of 50 MW located in Canmore, Alberta, on the Spray system. Commercial operations began in 1951. Generation from the facility is currently sold in the Alberta electricity market and creates EPCs under the TIER system.

Spray

Spray is a hydroelectric facility with installed capacity of 112 MW located in Canmore, Alberta, on the Spray system. Commercial operations began in 1951. Generation from the facility is currently sold in the Alberta electricity market and creates EPCs under the TIER system.

Three Sisters

Three Sisters is a hydroelectric facility with installed capacity of 3 MW located at the base of the Three Sisters Dam near Canmore, Alberta, on the Spray system. Commercial operations began in 1951. Generation from the facility is currently sold in the Alberta electricity market.

TransAlta Corporation • Annual Information Form 11

Oldman River System

Belly River

Belly River is a run-of-river hydroelectric facility with installed capacity of 3 MW located on the Waterton-St. Mary Headworks Irrigation Canal System, east of the Waterton Reservoir, approximately 75 kilometres southwest of Lethbridge in southern Alberta. Due to its location along the irrigation canal, Belly River operates from April to October when water is diverted through the canal as part of the St. Mary Irrigation District Water Management Plan. Commercial operations began in March 1991. Generation from the facility is currently sold in the Alberta electricity market.

St. Mary

St. Mary is a run-of-river hydroelectric facility with installed capacity of 2 MW located at the base of the dam impounding the St. Mary Reservoir, near Magrath, in southern Alberta. Commercial operations began in 1992. Generation from the facility is currently sold in the Alberta electricity market.

Taylor

Taylor is a run-of-river hydroelectric facility with installed capacity of 13 MW and is located adjacent to the Taylor Coulee Chute on the Waterton-St. Mary Headworks Irrigation Canal System, which is owned by the Government of Alberta. Commercial operations began in 2000. Generation from the facility is currently sold in the Alberta electricity market.

Waterton

Waterton is a run-of-river hydroelectric facility with installed capacity of 3 MW located at the base of the Waterton Dam on the Waterton Reservoir, near Hill Spring, southwest of Lethbridge, Alberta. Commercial operations began in 1992. Generation from the facility is currently sold in the Alberta electricity market.

North Saskatchewan River System

Bighorn

Bighorn is a hydroelectric facility with installed capacity of 120 MW located near Nordegg, Alberta. Commercial operations began in 1972. Generation from the facility is currently sold in the Alberta electricity market and creates EPCs under the TIER system.

Brazeau

Brazeau is a hydroelectric facility with installed capacity of 355 MW located near Drayton Valley, Alberta. Commercial operations began in 1967. Generation from the facility is currently sold in the Alberta electricity market and creates EPCs under the TIER system.

BC Hydro Facilities

Akolkolex

Akolkolex is a run-of-river hydroelectric facility with installed capacity of 10 MW and is located on the Akolkolex River, south of Revelstoke, British Columbia. Commercial operations began in 1995. The output from the facility is sold to British Columbia Hydro and Power Authority (BC Hydro) under a PPA that terminates in 2046.

Bone Creek

Bone Creek is a run-of-river hydroelectric facility with installed capacity of 19 MW and is located on Bone Creek, 90 kilometres south of Valemount, British Columbia. Commercial operations began in 2011. The output from the facility is sold to BC Hydro under a PPA that terminates in 2031.

Pingston

Pingston is a run-of-river hydroelectric facility with installed capacity of 45 MW and is located on Pingston Creek, southwest of Revelstoke, British Columbia, and downriver of the Akolkolex facility. Pingston is equally owned with Evolugen Trading and Marketing LP, a subsidiary of Brookfield. Commercial operations began in 2003. The output from the facility is sold to BC Hydro under a recontracted 20-year PPA that expires on May 8, 2043.

TransAlta Corporation • Annual Information Form 12

Upper Mamquam

Upper Mamquam is a run-of-river hydroelectric facility with installed capacity of 25 MW located on the Mamquam River, east of Squamish, British Columbia, and north of Vancouver. Commercial operations began in 2005. The output from the facility is sold to BC Hydro under a PPA that terminates in 2045.

Ontario Hydro Facilities

Misema

Misema is a run-of-river hydroelectric facility with installed capacity of 3 MW located on the Misema River, close to Englehart, in northern Ontario. Commercial operations began in 2003. Generation from this facility is sold to the IESO under a contract that terminates on May 3, 2027.

Moose Rapids

Moose Rapids is a run-of-river hydroelectric facility with installed capacity of 1 MW located on the Wanapitei River, near Sudbury, in northern Ontario. Commercial operations began in 1997. Generation from this facility is sold to the IESO under a contract that terminates on Dec. 31, 2030.

Ragged Chute

Ragged Chute is a run-of-river hydroelectric facility with installed capacity of 7 MW located on the Montréal River, south of Temiskaming Shores, in northern Ontario. The Company leases this facility from Ontario Power Generation Inc. (OPG). The facility has been operating since 1991. Generation from this facility is sold to the IESO under a contract that terminates on June 30, 2029. Upon termination, the asset will transfer to OPG together with a payment of $6.6 million to the Company.

Wind and Solar Segment

As at Dec. 31, 2024, the Wind and Solar segment held interests in approximately 2,559 MW of net wind and solar generating capacity. This capacity consists of 12 wind facilities in Western Canada, four in Ontario, two in Québec, three in New Brunswick and eight in the United States, more specifically in Washington, Wyoming, Minnesota, Oklahoma, Pennsylvania and New Hampshire. The Company also holds a 10 MW utility-scale battery energy storage system in Alberta, 143 MW of solar facilities in Massachusetts and North Carolina, and a 38 MW solar facility and a 10 MW battery energy storage system in Western Australia.

In addition to contracting for the sale of the power generation, we also enter into long- and short-term contracts to sell the environmental and tax attributes from the merchant wind and solar facilities. These activities help to ensure earnings consistency from these assets. Generally, for facilities under a long-term PPA, the purchaser also benefits from any environmental attributes associated with the facility.

TransAlta Corporation • Annual Information Form 13

The following table summarizes our Wind and Solar generation facilities as at Dec. 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Facility Name | Province/ State | Nameplate Capacity (MW)(1) | Consolidated Interest | Gross Installed Capacity (MW)(1) | Ownership | Net Capacity Ownership Interest (MW)(1) | Commercial Operation Date(2) | Revenue Source(3) | Contract Expiry Date(4) |

| Alberta Wind | | | | | | | | |

Ardenville(5) | AB | 69 | 100 | % | 69 | 100 | % | 69 | 2010 | Merchant | ‑ |

Blue Trail and Macleod Flats(5) | AB | 69 | 100 | % | 69 | 100 | % | 69 | 2009 and 2004 | Merchant | ‑ |

Castle River(5)(6) | AB | 44 | 100 | % | 44 | 100 | % | 44 | 1997‑2001 | Merchant | - |

Cowley North(5) | AB | 20 | 100 | % | 20 | 100 | % | 20 | 2001 | Merchant | ‑ |

| Garden Plain | AB | 130 | 100 | % | 130 | 100 | % | 130 | 2023 | LTC | 2035-2041 |

McBride Lake(5) | AB | 75 | 50 | % | 38 | 100 | % | 38 | 2004 | Merchant | |

Oldman(5) | AB | 4 | 100 | % | 4 | 100 | % | 4 | 2007 | Merchant | - |

Sinnott(5) | AB | 5 | 100 | % | 5 | 100 | % | 5 | 2001 | Merchant | ‑ |

Soderglen(5) | AB | 71 | 50 | % | 36 | 100 | % | 36 | 2006 | Merchant | ‑ |

Summerview 1(5) | AB | 68 | 100 | % | 68 | 100 | % | 68 | 2004 | Merchant | ‑ |

Summerview 2 (5) | AB | 66 | 100 | % | 66 | 100 | % | 66 | 2010 | Merchant | ‑ |

| Windrise | AB | 206 | 100 | % | 206 | 100 | % | 206 | 2021 | LTC | 2041 |

| Alberta Battery Energy Storage | | | | | | | | |

| WindCharger | AB | 10 | 100 | % | 10 | 100 | % | 10 | 2020 | Merchant | ‑ |

| Eastern Canada Wind | | | | | | | | |

| Kent Breeze | ON | 20 | 100 | % | 20 | 100 | % | 20 | 2011 | LTC | 2031 |

| Kent Hills 1 | NB | 96 | 100 | % | 96 | 83 | % | 80 | 2008 | LTC | 2045 |

| Kent Hills 2 | NB | 54 | 100 | % | 54 | 83 | % | 45 | 2010 | LTC | 2045 |

| Kent Hills 3 | NB | 17 | 100 | % | 17 | 83 | % | 14 | 2018 | LTC | 2045 |

Le Nordais(5)(7) | QC | 98 | 100 | % | 98 | 100 | % | 98 | 1999 | LTC | 2033 |

| Melancthon 1 | ON | 68 | 100 | % | 68 | 100 | % | 68 | 2006 | LTC | 2031 |

| Melancthon 2 | ON | 132 | 100 | % | 132 | 100 | % | 132 | 2008 | LTC | 2028 |

New Richmond(5) | QC | 68 | 100 | % | 68 | 100 | % | 68 | 2013 | LTC | 2033 |

| Wolfe Island | ON | 198 | 100 | % | 198 | 100 | % | 198 | 2009 | LTC | 2029 |

| US Wind | | | | | | | | |

| Antrim | NH | 29 | 100 | % | 29 | 100 | % | 29 | 2019 | LTC | 2039 |

| Big Level | PA | 90 | 100 | % | 90 | 100 | % | 90 | 2019 | LTC | 2034 |

| Horizon Hill | OK | 202 | 100 | % | 202 | 100 | % | 202 | 2024 | LTC | - |

| Lakeswind | MN | 50 | 100 | % | 50 | 100 | % | 50 | 2014 | LTC | 2034 |

| Skookumchuck Wind | WA | 137 | 49 | % | 67 | 100 | % | 67 | 2020 | LTC | 2040 |

| White Rock East | OK | 202 | 100 | % | 202 | 100 | % | 202 | 2024 | LTC | - |

| White Rock West | OK | 100 | 100 | % | 100 | 100 | % | 100 | 2024 | LTC | - |

| Wyoming Wind | WY | 140 | 100 | % | 140 | 100 | % | 140 | 2003 | LTC | 2028 |

| US Solar | | | | | | | | |

Mass Solar (7) | MA | 21 | 100 | % | 21 | 100 | % | 21 | 2012-2015 | LTC | 2032-2045 |

North Carolina Solar(7) | NC | 122 | 100 | % | 122 | 100 | % | 122 | 2019-2021 | LTC | 2033 |

| Australian Solar | | | | | | | | | |

Northern Goldfields(7) | WA | 38 | 100 | % | 38 | 100 | % | 38 | 2023 | LTC | 2038 |

| Australia Battery Energy Storage | | | | | | | | |

| Northern Goldfields Battery | WA | 10 | 100 | % | 10 | 100 | % | 10 | 2023 | LTC | 2038 |

| Total Wind and Solar Capacity | 2,729 | | 2,587 | | 2,559 | | | |

| | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

(1) MW are rounded to the nearest whole number. The gross installed capacity reflects the basis of consolidation of the underlying assets owned, whereas net capacity ownership interest deducts capacity attributable to non-controlling interest in these assets and is calculated after consolidation of the underlying assets.

(2) A second date in this column refers to a second facility that was subsequently operational.

TransAlta Corporation • Annual Information Form 14

(3) The large majority of the Company’s contracted operating facilities benefit from inflation adjustment provisions that apply to all or a portion of our revenues under such contracts.

(4) Where no contract expiry date is indicated, the facility operates as merchant or certain contract terms are confidential and have note been disclosed.

(5) These facilities are EcoLogo® certified. EcoLogo certification is granted to products with an environmental performance that meets or exceeds all government, industrial safety and performance standards.

(6) Includes six additional turbines at other locations.

(7) Includes multiple facilities.

Alberta Wind Facilities

Ardenville

Ardenville is a 69 MW wind facility located approximately 14 kilometres south of Fort Macleod. The facility began commercial operations in November 2010. It satisfies the eligibility criteria for an opted-in facility under Section 4 of the TIER regulation and is voluntarily choosing to participate in the regulation for the purposes of being able to generate emission performance credits (opt-in facility). An opt-in facility is not considered a large emitter of greenhouse gases (GHG) and as such we elected to participate in TIER. Generation from the facility is currently sold in the Alberta electricity market.

Blue Trail and Macleod Flats

Blue Trail is a 66 MW wind facility located in southern Alberta. The facility began commercial operations in November 2009. The Blue Trail wind facility created carbon offset credits under TIER until Sept. 16, 2022, at which time the facility became an opt-in facility under TIER.

Macleod Flats is a 3 MW wind facility located near Fort Macleod. It was commissioned in 2004 and was acquired by TransAlta in 2009. This facility generates Renewable Energy Certificate (REC) credits. Generation from the facilities is currently sold in the Alberta electricity market.

Castle River

Castle River is a 39.5 MW wind facility located southwest of Pincher Creek. This facility also includes an additional six turbines, totalling 4 MW that are located individually in the Cardston County and Hill Spring areas of southwestern Alberta. The facility began commercial operations in stages from November 1997 through to July 2001. This facility generates EPCs under the TIER system. Generation from the facility is currently sold in the Alberta electricity market.

Cowley North

Cowley North is a 19.5 MW wind facility located near the towns of Cowley and Pincher Creek, in southern Alberta. The facility began commercial operations in the fall of 2001. The Cowley North facility creates EPCs under the TIER system. Generation from the facility is currently sold in the Alberta electricity market.

Garden Plain

Garden Plain is a 130 MW wind facility located approximately 30 kilometres north of Hanna. This facility began commercial operations in August 2023. The facility is fully contracted with 100 MW being sold under a PPA with Pembina that terminates in 2041 and the remaining 30 MW of generation being contracted to PepsiCo under a PPA and terminates in 2035.

McBride Lake

McBride Lake is a 75.2 MW wind facility located south of Fort Macleod. The McBride Lake facility is co-owned with ENMAX Generation Portfolio Inc. The facility began commercial operations on April 30, 2004. A 20-year PPA with ENMAX Energy Corporation terminated on April 30, 2024 and generation from the facility is currently sold in the Alberta electricity market.

Oldman

Oldman is a 3.6 MW wind facility located east of the Oldman River Dam, near Pincher Creek in southern Alberta. The facility has been in operation since March 2007. In 2021, TransAlta acquired 100 per cent of the facility from a subsidiary of Boralex. This facility sells energy into the Alberta electricity market.

Sinnott

Sinnott is a 5 MW wind facility located directly east of the Cowley North wind facility and north of Pincher Creek. The facility began commercial operations in the fall of 2001. The facility sells energy into the Alberta electricity market and generates EPCs under the TIER system.

TransAlta Corporation • Annual Information Form 15

Soderglen

Soderglen is a 71 MW wind facility located southwest of Fort Macleod. The facility is co-owned with CNOOC Petroleum North America ULC. The facility began commercial operations in September 2006. The Soderglen wind facility creates EPCs under the TIER system, of which TransAlta receives 25 per cent. The Company is entitled to 50 per cent of the generation that is sold into the Alberta electricity market.

Summerview 1

Summerview 1 is a 68 MW wind facility located approximately 15 kilometres northeast of Pincher Creek. The facility began commercial operations in September 2004. The facility sells energy into the Alberta electricity market and generates EPCs under the TIER system.

Summerview 2

Summerview 2 is a 66 MW wind facility located approximately 15 kilometres northeast of Pincher Creek. The facility began commercial operations in February 2010. The facility sells energy into the Alberta electricity market and generated carbon offset credits under TIER until November 2022, after which it became an opt-in facility under TIER.

Windrise

Windrise is a 206 MW wind facility located in the county of Willow Creek. The facility began commercial operations in November 2021. Generation from the facility is sold to the AESO under a 20-year PPA that expires in 2041.

Alberta Battery Energy Storage

WindCharger

WindCharger is Alberta's first utility-scale battery storage facility. The facility consists of a lithium-ion battery using Tesla Megapack technology that has a nameplate capacity of 10 MW and a total storage capacity of 20 MWh. WindCharger is located in southern Alberta in the Municipal District of Pincher Creek, next to the Summerview wind facility substation. The storage project achieved commercial operations on Oct. 15, 2020. WindCharger stores energy produced by the nearby Summerview 2 wind facility and discharges this energy for ancillary services. The facility is an opt-in facility under TIER.

Eastern Canada Wind Facilities

Kent Breeze

Kent Breeze is a 20 MW wind facility located in Thamesville, Ontario. The facility began commercial operations in 2011. Generation from this facility is sold to the IESO under a 20-year PPA that expires in 2031.

Kent Hills 1

Kent Hills 1 is a 96 MW wind facility located near Moncton, New Brunswick. The facility began commercial operations in December 2008. The Company owns 83 per cent of the facility and Natural Forces Technologies Inc., a wind developer based in Atlantic Canada that co-developed the project with TransAlta, owns 17 per cent. Generation from this facility is sold under a PPA with NB Power that expires in 2045.

Kent Hills 2

Kent Hills 2 is a 54 MW wind facility located near Moncton, New Brunswick. The facility began commercial operations in November 2010. The Company owns 83 per cent of the facility and Natural Forces Technologies Inc., a wind developer based in Atlantic Canada that co-developed the project with TransAlta, owns 17 per cent. On June 2, 2022, the Company announced the extension of the previous 2035 PPA term for an additional 10-year period through to December 2045.

Kent Hills 3

Kent Hills 3 is a 17.25 MW wind facility located near Moncton, New Brunswick. The facility began commercial operations in November 2018. The Company owns 83 per cent of the facility and Natural Forces Technologies Inc., a wind developer based in Atlantic Canada that co-developed the project with TransAlta, owns 17 per cent. On June 2, 2022, we announced the extension of the previous 2035 PPA term for an additional 10-year period through to December 2045.

TransAlta Corporation • Annual Information Form 16

Le Nordais

Le Nordais is a 97.5 MW wind facility located on the Gaspé Peninsula of Québec. The facility has two sites, Cap-Chat with 74 turbines and Matane with 56 turbines. The facility began commercial operations in 1999. Generation from this facility is sold to Hydro-Québec pursuant to an energy supply agreement that terminates in 2033, and the facility generates RECs.

Melancthon 1

Melancthon 1 is a 67.5 MW wind facility located in Melancthon Township near Shelburne, Ontario. The facility began commercial operations in March 2006. Generation from this facility is sold to the IESO pursuant to a PPA that expires in 2026; a new Medium-Term 1 (MT1) capacity contract with the IESO will begin on May 1, 2026, and terminate on April 30, 2031. The Company submitted a binding offer in January 2025 to participate in the 5-year Medium-Term 2 Energy Contract (MT2(e)), which will be awarded by April 1, 2025. If successful, this energy contract will replace the MT1 and be effective May 1, 2026 to April 30, 2031.

Melancthon 2

Melancthon 2 is a 132 MW wind facility located adjacent to Melancthon 1, in the Melancthon and Amaranth townships, Ontario. The facility began commercial operations in November 2008. Generation from this facility is sold to the IESO pursuant to a PPA that terminates in 2028. The Company submitted a binding offer in January 2025 to participate in the 5-year MT2(e), which will be awarded by April 1, 2025. If successful, the current PPA will extend to April 30, 2029 and the MT2(e) will be effective May 1, 2029 to April 30, 2034.

New Richmond

New Richmond is a 68 MW wind facility located in New Richmond, Québec. The facility began commercial operations in March 2013. Generation from this facility is sold under a 20-year electricity supply agreement with Hydro-Québec Distribution that terminates in 2033.

Wolfe Island

Wolfe Island is a 197.8 MW wind facility located on Wolfe Island, near Kingston, Ontario. The facility began commercial operations in June 2009. Generation from this facility is sold to the IESO pursuant to a PPA that terminates in 2029. The Company submitted a binding offer in January 2025 to participate in the 5-year MT2(e), which will be awarded by April 1, 2025. If successful, the current PPA will terminate early and the MT2(e) will be effective May 1, 2029 to April 30, 2034.

US Wind and Solar Facilities

Antrim

Antrim is a 28.8 MW wind facility located in Antrim, New Hampshire. The wind facility was commissioned in December 2019. The wind facility is fully operational and contracted under two long-term PPAs until 2039 with Partners Healthcare and New Hampshire Electric. Ninety-nine per cent of production tax credits are allocated to tax equity partners and the remainder is allocated to TransAlta.

Big Level

Big Level is a 90 MW wind facility located in Potter County, Pennsylvania. The wind facility was commissioned in December 2019. Generation from the facility is sold under a PPA with Microsoft that terminates in 2034. Ninety-nine per cent of production tax credits are allocated to tax equity partners and the remainder is allocated to TransAlta.

Horizon Hill

Horizon Hill is a 202 MW wind facility located in Logan County, Oklahoma. 100 per cent of the generation offtake from the project is sold to Meta, under a long-term PPA. Under the PPA, Meta receives both renewable electricity and environmental attributes. The Horizon Hill facilities achieved commercial operation on May 21, 2024. The company has entered into two 10-year transfer agreements with A+ and AA- rated customers for the sale of 100 per cent of the expected production tax credits to be generated from the Horizon Hill, White Rock East, and White Rock West facilities. See the "General Development of the Business – Three-Year History" section of this AIF for further details.

TransAlta Corporation • Annual Information Form 17

Lakeswind

Lakeswind is a 50 MW wind facility located near Rollag, Minnesota, and is fully operational and contracted under a long-term PPA until 2034 with several high-quality counterparties. Ninety-nine per cent of production tax credits are allocated to tax equity partners and the remainder is allocated to TransAlta.

Mass Solar

Mass Solar is a 21 MW solar portfolio consisting of multiple sites located in Massachusetts, and is contracted under long-term PPAs expiring between 2032 and 2045 with several high-quality counterparties.

North Carolina Solar

North Carolina Solar is a 122 MW solar portfolio consisting of 20 sites located in North Carolina. The facilities were commissioned between November 2019 and May 2021. The facilities are secured by long-term PPAs with two subsidiaries of Duke Energy and are automatically extended unless terminated by either party.

Skookumchuck

Skookumchuck is a 137 MW wind facility that located in Lewis and Thurston counties, Washington. The facility began commercial operations in November 2020 and is secured by a long-term PPA with Puget Sound Energy Inc. that expires in 2040. Ninety-nine per cent of production tax credits are allocated to tax equity partners and the remainder are allocated to the Company and our partner Southern Power Company.

White Rock East and White Rock West

White Rock East and White Rock West are 201.5 MW and 99.5 MW wind facilities located in Caddo County, Oklahoma. On Dec. 22, 2021, TransAlta executed two long-term Power PPAs with Amazon for the offtake of 100 per cent of the generation from both facilities. White Rock West achieved commercial operation on Jan. 1, 2024 and White Rock East achieved commercial operation on April 22, 2024. The company has entered into two 10-year transfer agreements with A+ and AA- rated customers for the sale of 100 per cent of the expected production tax credits to be generated from the Horizon Hill, White Rock East, and White Rock West facilities. See the "General Development of the Business – Three-Year History" section of this AIF for further details.

Wyoming

Wyoming is a 140 MW wind facility located near Evanston, Wyoming. The facility began commercial operations in December 2003, and is contracted under a long-term PPA until 2028 with an investment-grade counterparty.

Australia Battery and Solar Facilities

Northern Goldfields Solar

Northern Goldfields Solar facilities consist of the 27 MW Mount Keith solar facility, 11 MW Leinster solar facility, 10 MW/5 MWh Leinster battery energy storage system facility and interconnecting transmission infrastructure, all of which are integrated into the existing Southern Cross Energy North remote electrical network in Western Australia. The combined solar and energy storage facilities began commercial operations in November 2023 and is contracted with BHP to 2038. See the "General Development of the Business" section of this AIF for further details.

TransAlta Corporation • Annual Information Form 18

Gas Segment

The Gas segment holds a net capacity ownership interest of 4,525 MW. The facilities are located in Alberta, Ontario, Michigan and Western Australia.

The following table summarizes our natural-gas-fired generation facilities as at Dec. 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Facility Name | Province/ State | Nameplate Capacity (MW)(1) | Consolidated Interest | Gross Installed Capacity (MW)(1) | Ownership | Net Capacity Ownership Interest (MW)(1) | Commercial Operation Date | Revenue Source(2) | Contract Expiry Date(3) |

| British Columbia | | | | | | | | | |

| McMahon | BC | 120 | 50 | % | 60 | 100 | % | 60 | 1993 | LTC | 2029 |

| Alberta | | | | | | | | |

| Battle River 4 | AB | 155 | 100 | % | 155 | 100 | % | 155 | 1975 | Merchant | - |

| Battle River 5 | AB | 395 | 100 | % | 395 | 100 | % | 395 | 1981 | Merchant | - |

| Fort Saskatchewan | AB | 118 | 60 | % | 71 | 50 | % | 35 | 1999 | LTC/Merchant | 2029 |

| Joffre | AB | 474 | 40 | % | 190 | 100 | % | 190 | 2000 | LTC/Merchant | 2041 |

| Keephills Unit No. 2 | AB | 395 | 100 | % | 395 | 100 | % | 395 | 1984 | Merchant | - |

| Keephills Unit No. 3 | AB | 466 | 100 | % | 466 | 100 | % | 466 | 2011 | Merchant | - |

| Muskeg River | AB | 202 | 100 | % | 202 | 100 | % | 202 | 2003 | LTC | 2042 |

Poplar Creek(4) | AB | 230 | 100 | % | 230 | 100 | % | 230 | 2001 | LTC | 2030 |

| Primrose | AB | 100 | 50 | % | 50 | 100 | % | 50 | 1998 | LTC | 2028 |

| Scotford | AB | 195 | 100 | % | 195 | 100 | % | 195 | 2003 | LTC/Merchant | 2043 |

| Sheerness Unit No.1 | AB | 400 | 100 | % | 400 | 75 | % | 300 | 1986 | Merchant | - |

| Sheerness Unit No.2 | AB | 400 | 100 | % | 400 | 75 | % | 300 | 1990 | Merchant | - |

| Sundance Unit No. 6 | AB | 401 | 100 | % | 401 | 100 | % | 401 | 1980 | Merchant | - |

| Valleyview 1 | AB | 50 | 100 | % | 50 | 100 | % | 50 | 2001 | Merchant | - |

| Valleyview 2 | AB | 50 | 100 | % | 50 | 100 | % | 50 | 2008 | Merchant | - |

| Total Alberta Gas Capacity | 4,031 | | 3,650 | | 3,414 | | | |

| Ontario and United States | | | | |

| Ada | MI | 29 | 100 | % | 29 | 100 | % | 29 | 1991 | LTC | 2026 |

| Ottawa | ON | 74 | 100 | % | 74 | 50 | % | 37 | 1992 | LTC/Merchant | 2033 |

| Sarnia | ON | 499 | 100 | % | 499 | 100 | % | 499 | 2003 | LTC | 2031 |

| Windsor | ON | 72 | 100 | % | 72 | 50 | % | 36 | 1996 | LTC/Merchant | 2031 |

| Total Ontario and United States Gas Capacity | 674 | | 674 | | 601 | | | |

| Australia | | | | |

| Fortescue River Gas Pipeline | WA | N/A | 100 | % | N/A | 43 | % | N/A | 2015 | LTC | 2035 |

| Parkeston | WA | 110 | 50 | % | 55 | 100 | % | 55 | 1996 | LTC/Merchant | 2027 |

| South Hedland | WA | 150 | 100 | % | 150 | 100 | % | 150 | 2017 | LTC | 2042 |

Southern Cross (5) | WA | 245 | 100 | % | 245 | 100 | % | 245 | 1996 | LTC | 2038 |

| Total Australian Gas Capacity | 505 | | 450 | | 450 | | | |

| Total Gas Capacity | 5,330 | | 4,834 | | 4,525 | | | |

(1) MW are rounded to the nearest whole number. The gross installed capacity reflects the basis of consolidation of the underlying assets owned, whereas net capacity ownership interest deducts capacity attributable to non-controlling interest in these assets and is calculated after the consolidation of the underlying assets.

(2) The large majority of the Company’s contracted operating facilities benefit from inflation-adjustment provisions that apply to all or a portion of our revenues under such contracts.

(3) Where no contract expiry date is indicated, the facility operates as merchant.

(4) The Poplar Creek facility is operated by Suncor Energy Inc. (Suncor)

(5) Includes four facilities. Excludes the Northern Goldfields facilities, which are in the Wind and Solar segment.

TransAlta Corporation • Annual Information Form 19

British Columbia Gas Facilities

McMahon

The McMahon natural-gas-fired cogeneration facility is located in Taylor. The 120 MW McMahon facility has been in operation since 1993, and is fully contracted with Brookfield and NorthRiver Midstream for steam and BC Hydro for electricity through to 2029.

Alberta Gas Facilities

Battle River 4 and 5

The Battle River 4 and 5 facilities are located near Forestburg. Battle River 4 and 5 are 155 MW and 395 MW, respectively, having completed their conversion to natural gas in 2021 and 2019, respectively. The end of regulatory life for Battle River 4 and 5 is set for 2033 and 2037, respectively. Generation from the facilities is currently sold in the Alberta electricity market.

Fort Saskatchewan

We have a net ownership interest of 30 per cent in the Fort Saskatchewan facility. See the "Business of TransAlta – Non-Controlling Interests" section of this AIF for further details. The 118 MW natural-gas-fired combined-cycle cogeneration facility is owned by TA Cogen and Prairie Boys Capital Corporation. The contract at the facility has an initial 10-year term, which began on Jan. 1, 2020, with the option for two five-year extensions. Generation from the facility is currently sold in the Alberta electricity market.

Joffre

The Joffre natural-gas-fired cogeneration facility is located in Red Deer. TransAlta owns a 40 per cent interest in the facility, with Capital Power and Nova Chemicals owning 40 per cent and 20 per cent, respectively. The 474 MW Joffre facility has been in operation since 2000 and is 26 per cent (122 MW) contracted to Nova Chemicals through to 2041. The remaining uncontracted electricity capacity is sold in the Alberta energy market.

Keephills 2

The Keephills 2 facility is located approximately 70 kilometres west of Edmonton. Keephills 2 is a 395 MW gas-fired unit that completed its conversion to natural gas in 2021. The end of regulatory life for this unit is set for 2037. Generation from the facility is currently sold in the Alberta electricity market.

Keephills 3

The Keephills 3 facility is located approximately 70 kilometres west of Edmonton. Keephills 3 is a 466 MW gas-fired unit that completed its conversion to natural gas in 2021. The end of regulatory life for this unit is set for 2039. Generation from the facility is currently sold in the Alberta electricity market.

Muskeg River

The Muskeg River natural-gas-fired cogeneration facility is located in Fort McMurray. The 202 MW Muskeg River facility has been in operation since 2003 and is fully contracted to the Athabasca Oil Sands Project, which consists of Canadian Natural Resources Limited (CNRL), Chevron and Shell, through to 2042.

Poplar Creek

The Poplar Creek natural-gas-fired cogeneration facility is located in Fort McMurray. The Poplar Creek cogeneration facility had been built and contracted to provide steam and electricity to Suncor's oil sands operations. In 2015, Suncor acquired the Company's two steam turbines with an installed capacity of 126 MW and certain transmission interconnection assets. In addition, Suncor assumed full operational control of the cogeneration facility and has the right to use the full 230 MW capacity of the Company's gas generators until Dec. 31, 2030. The ownership of the Poplar Creek facility will transfer to Suncor on Dec. 31, 2030.

Primrose

The Primrose natural-gas-fired cogeneration facility is located near Bonnyville. TransAlta owns a 50 per cent interest with CNRL owning the remaining 50 per cent of the facility. The 100 MW Primrose facility has been in operation since 1998 and is fully contracted to CNRL through to 2028, at which time, will be transferred to CNRL at the expiry of the PPA with no remaining liabilities for TransAlta.

TransAlta Corporation • Annual Information Form 20

Scotford

The Scotford natural-gas-fired cogeneration facility is located in northeast of Fort Saskatchewan. The 195 MW Scotford facility has been in operation since 2003, and is fully contracted to CNRL, Chevron and Shell through to 2043.

Sheerness 1 and 2

The Sheerness 1 and 2 facilities are located approximately 200 kilometres northeast of Calgary. The 400 MW Sheerness 1 and 400 MW Sheerness 2 facilities are gas-fired units that completed their conversion to natural gas in 2021 and 2020, respectively. The end of regulatory life for these units is set for 2037. Generation from the facilities is currently sold in the Alberta electricity market.

Sundance 6

The Sundance 6 facility is located approximately 70 kilometres west of Edmonton. Sundance 6 is a 401 MW gas-fired unit that completed its conversion to natural gas in 2021. The end of regulatory life for this unit is set for 2037. Generation from the facility is currently sold in the Alberta electricity market. In November of 2024, the Company announced that the unit will be mothballed at the end of the first quarter of 2025.

Valleyview 1 and 2

The Valleyview 1 and 2 natural-gas-fired simple-cycle gas turbine generator facilities are located in Valleyview. The 50 MW Valleyview 1 and 50 MW Valleyview 2 facilities have been in operation since 2001 and 2008, respectively. Generation from the facilities is currently sold in the Alberta electricity market.

Off-Coal Agreement

On Nov. 24, 2016, we entered into the Off-Coal Agreement with the Government of Alberta pertaining to our cessation of emissions from the Keephills 3 and Sheerness coal-fired facilities. Under the Off-Coal Agreement, we are entitled to receive annual cash payments of approximately $41 million, net to TransAlta, from the Government of Alberta that commenced in 2017, and will terminate in 2030, subject to satisfaction of certain terms and conditions that include our cessation of all coal-fired emissions on or before Dec. 31, 2030. Other conditions include maintaining prescribed spending on investment and investment-related activities in Alberta, maintaining a significant business presence in Alberta (including through the maintenance of prescribed employment levels), maintaining spending on programs and initiatives to support the communities surrounding the facilities and the employees of the Company negatively impacted by the phase-out of coal generation, and the fulfilment of all obligations to affected employees, in each case as prescribed by the Off-Coal Agreement.

Eastern Canada and US Gas Facilities

Ada

Ada is a 29 MW contracted cogeneration facility located in Ada, Michigan. The facility has been in operation since 1991 and produces approximately 18,000 tonnes of steam hourly. The electricity and steam output of the facility are fully contracted until 2026 with Consumers Energy and Amway.

Ottawa

The Ottawa facility is owned by TA Cogen. See the "Business of TransAlta – Non-Controlling Interests" section of this AIF for further details. It is a 74 MW combined-cycle cogeneration facility located in Ottawa, Ontario. On Aug. 30, 2013, the Company announced the recontracting of the facility with the IESO for a 20-year term, effective January 2014. The Ottawa facility also provides thermal energy to the member hospitals and treatment centres of the Ottawa Health Sciences Centre and the National Defence Medical Centre. The thermal energy contract with the Ottawa Health Sciences Centre has a term to Dec. 31, 2033, with an automatic renewal of a five-year term unless terminated by either party.

Sarnia

The Sarnia cogeneration facility is a 499 MW combined-cycle cogeneration facility located in Sarnia, Ontario, that provides power and/or steam to nearby industrial facilities. The facility also provides electricity to the IESO under a contract that terminates on April 30, 2031, with the industrial customer contract terminations occurring from April 30, 2031, through Dec. 31, 2032.

TransAlta Corporation • Annual Information Form 21

Windsor

The Windsor facility is owned by TA Cogen. See the "Business of TransAlta – Non-Controlling Interests" section of this AIF for further details. It is a 72 MW combined-cycle cogeneration facility located in Windsor, Ontario. Effective Dec. 1, 2016, the Windsor facility began operating under an agreement with the IESO with a 15-year term for up to 72 MW of capacity. The Windsor facility also provides thermal energy to Stellantis Canada (formerly, FCA Canada, Inc. and Chrysler Canada) in Windsor under a contract that expires in 2028, with a series of six successive renewal terms of one year each.

Australian Gas Facilities

Fortescue River Gas Pipeline

In 2014, we established the Fortescue River Gas Pipeline joint venture with AGI Fortescue River Pty Limited. The joint venture (of which TransAlta is a 43 per cent partner) was successfully awarded the contract to design, build, own and operate the 270-kilometre Fortescue River Gas Pipeline, located in the Pilbara region of Western Australia, to deliver natural gas to Fortescue Metal Group's (FMG) Solomon facility. The pipeline was completed in the first quarter of 2015 and operates under a take-or-pay natural gas transport agreement with a subsidiary of FMG for an initial term of 20 years. The 16-inch diameter pipeline has an initial free-flow capacity of 64 terajoules per day. Under the gas tariff agreement, FMG has the option to purchase the Fortescue River Gas Pipeline commencing March 2020. FMG maintains its option and the joint venture continues to deliver natural gas to the Solomon facility.

Parkeston

The Parkeston facility is a 110 MW dual-fuel natural gas- and diesel-fired power station located near Kalgoorlie, Western Australia, which is owned in partnership through a 50/50 joint venture with Northern Star (NPK) Pty Ltd., a subsidiary of Northern Star Resources Limited. The Parkeston facility primarily supplies energy to Kalgoorlie Consolidated Gold Mines pursuant to a supply contract that extends to October 2027. Any merchant capacity and energy are sold in Western Australia's wholesale electricity market.

South Hedland

The South Hedland Power Station is a 150 MW combined-cycle power station located near South Hedland, Western Australia, which achieved commercial operation in 2017. The facility is contracted with two customers. Horizon Power, the state-owned electricity supplier in the region has contracted 110MW until 2042. The second customer is the port operations of FMG for 35 MW of capacity until 2037.

Southern Cross Energy

Southern Cross Energy Partnership (SCE) has power stations at Mount Keith, Leinster, Kalgoorlie and Kambalda. In total, a combined gas- and diesel-fired capacity of 245 MW is available from these facilities. In 2023, SCE added battery and renewable energy capacity to the SCE fleet with separate solar facilities at Leinster (11 MW) and Mount Keith (27 MW), as well as a battery energy storage system at Leinster (10 MW/5 MWh). SCE also completed the expansion of the Mount Keith 132kV transmission system to support BHP's Northern Goldfields-based operations in the first quarter of 2024.

The PPA with BHP for the facilities expires on Dec. 31, 2038. The PPA provides, among other things, SCE with the exclusive right to supply electricity, transmission, and distribution infrastructure for BHP's mining operations located within a specified area in the Goldfields region of Western Australia for the duration of the PPA.

The PPA supports BHP's future power requirements and emission reduction targets by providing BHP participation rights in integrating renewable electricity generation, including solar, wind and energy storage technologies, into BHP's mining operations located in the Goldfields region, subject to the satisfaction of certain conditions. New-build projects have already been completed under this contract, including the Northern Goldfields solar and battery project in Mount Keith and Leinster that reached commercial operation in November 2023. Additional projects are in the development and construction stages. See the "General Development of the Business" section of this AIF for further details.

On July 11, 2024, BHP announced a period of temporary suspension of operations for its Western Australian nickel operations in response to the low nickel price outlook. The PPA remains in place and SCE is working closely with BHP to manage the impact of reduced load. BHP intends to review the decision to temporarily suspend its Western Australian nickel operations by February 2027.

TransAlta Corporation • Annual Information Form 22

Energy Transition Segment

The Energy Transition segment holds a net ownership interest in 671 MW of generating capacity. The two facilities are located in the United States.

The following table summarizes our Energy Transition facilities as at Dec. 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Facility Name | Province/ State | Nameplate Capacity (MW)(1) | Consolidated Interest | Gross Installed Capacity (MW)(1) | Ownership | Net Capacity Ownership Interest (MW)(1) | Commercial Operation Date | Revenue Source | Contract Expiry Date |

| US | | | | | | | | | |

| Centralia | WA | 670 | 100 | % | 670 | 100 | % | 670 | 1971 | LTC/Merchant | 2025 |

Skookumchuck(2) | WA | 1 | 100 | % | 1 | 100 | % | 1 | 1970 | LTC | 2025 |

| Total Energy Transition Capacity | 671 | | 671 | | 671 | | | |

(1) MW are rounded to the nearest whole number. The gross installed capacity reflects the basis of consolidation of underlying assets owned, whereas net capacity ownership interest deducts capacity attributable to non-controlling interest in these assets and is calculated after consolidation of underlying assets.

(2) This facility is used to provide a reliable water supply to the Centralia facility.

Centralia

The Centralia coal-fired facility is located in Centralia, Washington, and consists of one 670 MW unit. On July 25, 2012, we announced that we entered into an 11-year PPA to provide electricity from the Centralia thermal facility to Puget Sound Energy. The contract terminates on Dec. 31, 2025 when the facility is scheduled to stop burning coal. Under the agreement, Puget Sound Energy purchases 380 MW of baseload power to December 2024 and 300 MW in 2025. The coal used to fuel the Centralia facility is sourced from the Powder River Basin in Montana and Wyoming. The Centralia facility has coal contracts in place that expire at the end of 2025.

We sell electricity from the Centralia thermal facility into the Western Electricity Coordinating Council and, in particular, to the U.S. Pacific Northwest electricity market. Our strategy is to balance contracted and non-contracted sales of electricity to manage production and price risk.

Since 2015, we have invested US$55 million to support energy efficiency, economic and community development, and education and retraining initiatives in Washington State. The initiatives are part of Centralia's transition from coal-fired operations in Washington, beginning on Dec. 31, 2020. Such community investment is part of the TransAlta Energy Transition Bill (chapter 180, Laws of 2011) (the Bill). The Bill was an agreement between policymakers, environmentalists, labour leaders and TransAlta to transition away from coal in Washington State.

Skookumchuck Hydro

We own a 1 MW hydroelectric generating facility that is located on the Skookumchuck River near Centralia, Washington, and related assets that are used to provide water supply to our generation facilities in Centralia. On Dec. 7, 2020, we entered into a PPA with Puget Sound Energy for the Skookumchuck hydro facility. The contract terminates in 2025 when the facility is scheduled to retire.

Reclamation Activities

Centralia Mine

We own a coal mine adjacent to the Centralia facility, although mining operations were discontinued at the Centralia coal mine on Nov. 27, 2006. The mine is currently in the reclamation phase and we continue to perform reclamation and associated work.

Under the U.S. Federal Mine Safety and Health Act, we must report all citations at our Centralia mine. There was one injury incident reported at the mine during 2024. The total dollar value of all Mine Safety and Health Administration (MSHA) assessments is not material.

TransAlta Corporation • Annual Information Form 23

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mine or

Operating

Name/MSHA

Identification

Number | Total Number of Section 104 Violations for which Citations Received | Total Number of Orders Issued Under Section 104(b) | Total Number of Citations and Orders for Unwarrantable Failure to Comply with Mandatory Health or Safety Standards Under Section 104(d) | Total Number of Flagrant Violations Under Section 110(b)(2) | Total Number of Imminent Danger Orders Issued Under Section 107(a) | Total Dollar Value of MSHA Assessments Proposed | Total Number of Mining Related Fatalities | Received

Notice of

Pattern

Violations

Under

Section

104(e)

(yes/no) | Received

Notice of

Potential

to Have

Pattern

Under

Section

104(e)

(yes/no) | Number of Legal Actions Initiated or Pending During Period |

| 4500416 | 10(1) | 0 | 0 | 0 | 0 | 1,430 (2) | 0 | No | No | 0 |

(1) Section 104 Violations: TransAlta Centralia Mining (9 violations) and Dickson Company (contractor) (1 violation).

(2) Citations in Contest: Coalview Centralia LLC ($1,287) and Dickson Company ($143).

Highvale Mine