TRANSALTA CORPORATION

Management’s Discussion and Analysis

This Management’s Discussion and Analysis (MD&A) contains forward-looking statements. These statements are based on certain estimates and assumptions and involve risks and uncertainties. Actual results may differ materially. Refer to the Forward-Looking Statements section of this MD&A for additional information.

Table of Contents

This MD&A should be read in conjunction with our 2024 audited annual consolidated financial statements (the consolidated financial statements) and our 2024 Annual Information Form (AIF), each for the fiscal year ended Dec. 31, 2024. In this MD&A, unless the context otherwise requires, “we”, “our”, “us”, the “Company” and “TransAlta” refer to TransAlta Corporation and its subsidiaries. The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) for Canadian publicly accountable enterprises as issued by the International Accounting Standards Board (IASB) and in effect at Dec. 31, 2024. All tabular amounts in the following discussion are in millions of Canadian dollars unless otherwise noted, except amounts per share, which are in whole dollars to the nearest two decimals. This MD&A is dated Feb. 19, 2025. Additional information respecting TransAlta, including our AIF for the year ended Dec. 31, 2024, is available on SEDAR+ at www.sedarplus.ca, on EDGAR at www.sec.gov and on our website at www.transalta.com. Information on or connected to our website is not incorporated by reference herein.

| | | | | | | | |

| TransAlta Corporation | 2024 Integrated Report | M1 |

Forward-Looking Statements

This MD&A includes "forward-looking information" within the meaning of applicable Canadian securities laws and "forward-looking statements" within the meaning of applicable U.S. securities laws, including the Private Securities Litigation Reform Act of 1995 (collectively referred to herein as "forward-looking statements").

Forward-looking statements are not facts, but only predictions and generally can be identified by the use of statements that include phrases such as "may", "will", "can", "could", "would", "shall", "believe", "expect", "estimate", "anticipate", "intend", "plan", "forecast", "foresee", "potential", "enable", "continue" or other comparable terminology. These statements are not guarantees of our future performance, events or results and are subject to risks, uncertainties and other important factors that could cause our actual performance, events or results to be materially different from those set out in or implied by the forward-looking statements.

In particular, this MD&A contains forward-looking statements about the following, among other things:

•The strategic objectives of the Company and that the execution of the Company’s strategy will realize value for shareholders;

•Our capital allocation and financing strategy;

•Our sustainability goals and targets, including those in our 2024 Sustainability Report;

•Our 2025 Outlook;

•Our financial and operational performance, including our hedge position;

•Optimizing and diversifying our existing assets;

•The increasingly contracted nature of our fleet;

•Expectations about strategies for growth and expansion, including opportunities for Centralia redevelopment, and data centre opportunities;

•Expected costs and schedules for planned projects;

•Expected regulatory processes and outcomes, including in relation to the Alberta restructured energy market;

•The power generation industry and the supply and demand of electricity;

•The cyclicality of our business;

•Expected outcomes with respect to legal proceedings;

•The expected impact of future tax and accounting changes; and

•Expected industry, market and economic conditions.

The forward-looking statements contained in this MD&A are based on many assumptions including, but not limited to, the following:

•No significant changes to applicable laws and regulations;

•No unexpected delays in obtaining required regulatory approvals;

•No material adverse impacts to investment and credit markets;

•No significant changes to power price and hedging assumptions;

•No significant changes to gas commodity price assumptions and transport costs;

•No significant changes to interest rates;

•No significant changes to the demand and growth of renewables generation;

•No significant changes to the integrity and reliability of our facilities;

•No significant changes to the Company's debt and credit ratings;

•No unforeseen changes to economic and market conditions; and

•No significant event occurring outside the ordinary course of business.

These assumptions are based on information currently available to TransAlta, including information obtained from third-party sources. Actual results may differ materially from those predicted by such assumptions.

Factors that may adversely impact what is expressed or implied by forward-looking statements contained in this MD&A include, but are not limited to:

•Fluctuations in power prices;

•Changes in supply and demand for electricity;

•Our ability to contract our electricity generation for prices that will provide expected returns;

•Our ability to replace contracts as they expire;

•Risks associated with development projects and acquisitions;

•Any difficulty raising needed capital in the future on reasonable terms or at all;

•Our ability to achieve our targets relating to environmental, social and governance (ESG) performance;

•Long-term commitments on gas transportation capacity that may not be fully utilized over time;

•Changes to the legislative, regulatory and political environments;

•Environmental requirements and changes in, or liabilities under, these requirements;

•Operational risks involving our facilities, including unplanned outages and equipment failure;

•Disruptions in the transmission and distribution of electricity;

•Reductions in production;

•Impairments and/or writedowns of assets;

•Adverse impacts on our information technology systems and our internal control systems, including increased cybersecurity threats;

•Commodity risk management and energy trading risks;

| | | | | | | | |

| M2 | TransAlta Corporation | 2024 Integrated Report |

•Reduced labour availability and ability to continue to staff our operations and facilities;

•Disruptions to our supply chains;

•Climate-change related risks;

•Reductions to our generating units' relative efficiency or capacity factors;

•General economic risks, including deterioration of equity markets, increasing interest rates or rising inflation;

•General domestic and international economic and political developments, including potential trade tariffs;

•Industry risk and competition;

•Counterparty credit risks;

•Inadequacy or unavailability of insurance coverage;

•Increases in the Company's income taxes and any risk of reassessments;

•Legal, regulatory and contractual disputes and proceedings involving the Company;

•Reliance on key personnel; and

•Labour relations matters.

The foregoing risk factors, among others, are described in further detail in the Governance and Risk Management section of this MD&A.

Readers are urged to consider these factors carefully when evaluating the forward-looking statements, which reflect the Company's expectations only as of the date hereof and are cautioned not to place undue reliance on them. The forward-looking statements included in this document are made only as of the date hereof and we do not undertake to publicly update these forward-looking statements to reflect new information, future events or otherwise, except as required by applicable laws. The purpose of the financial outlooks contained herein is to give the reader information about management's current expectations and plans and readers are cautioned that such information may not be appropriate for other purposes. In light of these risks, uncertainties and assumptions, the forward-looking statements might occur to a different extent or at a different time than we have described, or might not occur at all. We cannot assure that projected results or events will be achieved.

| | | | | | | | |

| TransAlta Corporation | 2024 Integrated Report | M3 |

Description of the Business

TransAlta Corporation is one of Canada’s largest publicly traded power generators, owning and operating a diverse fleet across Canada, the United States and Western Australia. Our portfolio includes hydro, wind, solar, battery storage, natural gas and coal, complemented by our exceptional asset optimization and energy marketing capabilities. As one of Canada’s largest producers of wind and thermal generation and Alberta’s largest producer of hydro power, TransAlta remains committed to a balanced, technology-agnostic generation mix. With strong cash flows underpinned by a high-quality portfolio, TransAlta strives to deliver sustainable long-term shareholder value in an evolving energy landscape.

The Company's goal is to deliver solutions to meet our customers' needs for reliable, sustainable power. With over a century of experience, TransAlta is a trusted partner delivering tailored solutions. Our strategic priorities include optimizing our Alberta Portfolio, executing our growth plan, realizing the value of our legacy generating facilities, maintaining financial strength and capital discipline, defining the next generation of power solutions and leading in ESG and market policy development. We are primarily focused on opportunities within our core markets of Canada, the United States and Western Australia.

Our sustainability goals include our commitment to cease coal-fired generation at the end of 2025. We remain on track to achieve our 2026 target of 75 per cent scope 1 and 2 GHG emissions reductions since 2015 and our carbon net-zero goal by 2045. Since 2005, we have reduced our scope 1 and 2 GHG emissions by 32 million tonnes (MT) of CO2e or an 77 per cent reduction, representing approximately 11 per cent of Canada's Paris Agreement 2030 decarbonization target(1).

Portfolio of Assets

Our asset portfolio is geographically diversified with operations across our core markets.

Our Hydro, Wind and Solar, Gas and Energy Transition segments are responsible for operating and maintaining our generation facilities. Our Energy Marketing segment is responsible for marketing and scheduling our merchant asset fleet in North America (excluding Alberta) along with the procurement, transport and storage of natural gas, providing knowledge to support our growth team, and generating a stand-alone gross margin separate from our asset business through a leading North American energy marketing and trading platform.

Our highly diversified portfolio consists of both merchant assets and high-quality contracted assets. Our merchant assets include our unique hydro merchant portfolio and our merchant legacy thermal portfolio and wind assets. Our merchant exposure is primarily in Alberta, where 58 per cent of our capacity is located and 77 per cent of our Alberta capacity is available to participate in the merchant market. Our high-quality contracted assets provide stable long-term cash flow and earnings, balancing our merchant fleet.

In Alberta, the Company manages merchant exposure by executing hedging strategies that include a significant base of commercial and industrial (C&I) customers, supplemented with financial hedges. A significant portion of our thermal generation capacity in Alberta is hedged to provide greater cash flow certainty while also capturing higher returns for our shareholders through the optimization of our merchant generation portfolio. Refer to the 2025 Outlook section and the Optimization of the Alberta Portfolio of this MD&A for further details.

(1)In 2005, TransAlta's estimated scope 1 and 2 GHG emissions were 41.9 MT of CO2e, which did not receive independent limited assurance. Canada's Paris Agreement 2030 decarbonization target assumed 293 MT of CO2e or a 40 per cent reduction from a 2005 baseline of 732 MT of CO2e.

| | | | | | | | |

| M4 | TransAlta Corporation | 2024 Integrated Report |

The following table provides our consolidated ownership by segment of our facilities across the regions in which we operate as of Dec. 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hydro | Wind & Solar | Gas | Energy Transition | | | Total |

Year ended Dec. 31, 2024 | Gross Installed Capacity (MW) | Number of

facilities | Gross Installed Capacity (MW)(1) | Number of

facilities | Gross Installed Capacity (MW)(1)(2) | Number of facilities(2) | Gross Installed Capacity (MW) | Number of facilities(3) | | | Gross Installed Capacity (MW) | Number of

facilities |

| Alberta | 834 | | 17 | | 764 | | 14 | | 3,650 | | 15 | | — | | — | | | | 5,248 | | 46 | |

| | | | | | | | | | | |

| Canada, excluding Alberta | 88 | | 7 | | 751 | | 9 | | 705 | | 4 | | — | | — | | | | 1,544 | | 20 | |

| | | | | | | | | | | |

| U.S. | — | | — | | 1,024 | | 10 | | 29 | | 1 | | 671 | | 2 | | | | 1,724 | | 13 | |

| | | | | | | | | | | |

| Western Australia | — | | — | | 48 | | 3 | | 450 | | 6 | | — | | — | | | | 498 | | 9 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total | 922 | | 24 | | 2,587 | | 36 | | 4,834 | | 26 | | 671 | | 2 | | | | 9,014 | | 88 | |

| | | | | | | | | | | | |

(1)Gross installed capacity for consolidated reporting is based on a proportionate interest held in a facility. Refer to the Plant Summary section for details.

(2)Includes 1,747 MW of capacity attributable to nine facilities acquired from Heartland, which exclude the Planned Divestitures. Refer to the Significant and Subsequent events section.

(3)Includes the Centralia coal facility and the Skookumchuck hydro facility.

Contracted Capacity

The following table provides our contracted capacity by segment in MW and as a percentage of total gross installed capacity of our facilities across the regions in which we operate as of Dec. 31, 2024:

| | | | | | | | | | | | | | | | | | | |

| As at Dec. 31, 2024 | Hydro | Wind & Solar | Gas(1) | Energy Transition | | | Total |

| Alberta | — | 336 | 887 | — | | | 1,223 |

| Canada, excluding Alberta | 88 | 751 | 705 | — | | | 1,544 |

| U.S. | — | 1,024 | 29 | 381 | | | 1,434 |

| Western Australia | — | 48 | 450 | — | | | 498 |

| Total contracted capacity (MW) | 88 | 2,159 | 2,071 | 381 | | | 4,699 |

| Contracted capacity as a % of total capacity (%) | 10 | 83 | 43 | 57 | | | 52 |

| | | | | | | |

(1)Includes contracted capacity of 436 MW from facilities acquired from Heartland: 376 MW in Alberta and 60 MW in Canada, excluding Alberta. The figures exclude the contracted capacity of Planned Divestitures. Refer to the Significant and Subsequent events section.

Approximately 52 per cent of our total installed capacity is contracted. Contracts are primarily with strong creditworthy counterparties.

The following table provides the weighted average contract life by segment of our contracted and merchant facilities across the regions in which we operate as of Dec. 31, 2024:

| | | | | | | | | | | | | | | | | | | |

| As at Dec. 31, 2024 | Hydro | Wind & Solar | Gas(1) | Energy Transition | | | Total |

| Alberta | — | | 7 | | 2 | | — | | | | 3 | |

| Canada, excluding Alberta | 15 | | 9 | | 7 | | — | | | | 8 | |

| U.S. | — | | 13 | | 1 | | — | | | | 8 | |

| Western Australia | — | | 14 | | 14 | | — | | | | 14 | |

| | | | | | | |

Total weighted average contract life (years)(2) | 1 | | 10 | | 4 | | — | | | | 5 | |

(1)Total weighted average contract life calculation of our gas facilities as at Dec. 31, 2024 includes the contracts added from the acquisition of Heartland and excludes the contracts pertaining to Planned Divestitures.

(2)The contract life of merchant facilities is included as nil years.

| | | | | | | | |

| TransAlta Corporation | 2024 Integrated Report | M5 |

Highlights

For the year ended Dec. 31, 2024, the Company demonstrated strong financial and operational performance. The results were within the upper range of management's expectations due to active management of the Company's merchant portfolio and hedging strategies. During 2024, the Company settled a higher volume of hedges at prices that were significantly above the spot market in Alberta and achieved commercial operation at the White Rock and Horizon Hill wind facilities. On Dec. 4, 2024, the Company also completed the acquisition of Heartland Generation, which added 1,747 MW to gross

installed capacity. IFRS financial results include the Poplar Hill and Rainbow Lake facilities, (collectively, the Planned Divestitures), which the Company agreed to divest pursuant to a consent agreement entered into with the Commissioner of Competition for Canada. Our non-IFRS measures and operational KPIs exclude the results of the Planned Divestitures. Refer to the Significant and Subsequent Events section of this MD&A for details on the Heartland acquisition and the Planned Divestitures.

| | | | | | | | | | | | | |

| | | |

| Year ended Dec. 31 | | | 2024 | 2023 | 2022(4) |

| Operational information | | | | | |

| Availability (%) | | | 91.2 | | 88.8 | | 89.8 | |

| Production (GWh) | | | 22,811 | | 22,029 | | 21,258 | |

| Select financial information | | | | | |

| Revenues | | | 2,845 | | 3,355 | | 2,976 | |

| | | | | |

| | | | | |

| | | | | |

Adjusted EBITDA(1) | | | 1,253 | | 1,632 | | 1,656 | |

| Earnings before income taxes | | | 319 | | 880 | | 353 | |

| | | | | |

| Net earnings attributable to common shareholders | | | 177 | | 644 | | 4 | |

| Cash flows | | | | | |

| Cash flow from operating activities | | | 796 | | 1,464 | | 877 | |

Funds from operations(1)(2) | | | 810 | | 1,351 | | 1,346 | |

Free cash flow(1)(2) | | | 569 | | 890 | | 961 | |

| Per share | | | | | |

| Weighted average number of common shares outstanding | | | 302 | | 276 | | 271 | |

| Net earnings per share attributable to common shareholders, basic and diluted | | | 0.59 | | 2.33 | | 0.01 | |

| Dividends declared per common share | | | 0.24 | | 0.22 | | 0.21 | |

| Dividends declared per preferred share | | | 1.36 | | 1.33 | | 0.25 | |

Funds from operations per share(1)(2) | | | 2.68 | | 4.89 | | 4.97 | |

Free cash flow per share(1)(2) | | | 1.88 | | 3.22 | | 3.55 | |

| | | | | |

| As at Dec. 31 | | | 2024 | 2023 | 2022 |

| Liquidity and capital resources | | | | | |

Available liquidity(5) | | | 1,616 | | 1,738 | | 2,118 | |

| Adjusted net debt to adjusted EBITDA (times) | | | 3.6 | | 2.5 | | 2.1 | |

| | | | | |

Total consolidated net debt(1)(3) | | | 3,798 | | 3,453 | | 2,854 | |

| | | | | |

| | | | | |

| Assets and liabilities | | | | | |

| Total assets | | | 9,499 | | 8,659 | | 10,741 | |

Total long-term liabilities(6) | | | 5,087 | | 5,253 | | 5,864 | |

Total liabilities(7) | | | 7,656 | | 6,995 | | 8,752 | |

(1)These items are not defined and have no standardized meaning under IFRS and may not be comparable to similar measures presented by other issuers. Presenting these items from period to period provides management and investors with the ability to evaluate earnings (loss) trends more readily in comparison with prior periods’ results. Refer to the Segmented Financial Performance and Operating Results section of this MD&A for further discussion of these items, including, where applicable, reconciliations to measures calculated in accordance with IFRS. Also, refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A.

(2)Funds from operations (FFO) per share and free cash flow (FCF) per share are calculated using the weighted average number of common shares outstanding during the period. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A for the purpose of these non-IFRS ratios.

(3)Refer to the table in the Financial Capital section of this MD&A for more details on the composition of total consolidated net debt.

(4)During 2024 our adjusted EBITDA composition was amended to exclude the impact of Brazeau penalties and related provisions. Therefore, the Company has applied this composition to all previously reported periods. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A.

(5)Available liquidity is calculated as a sum of total available capacity under the committed credit and term facilities and cash and cash equivalents net of bank overdraft, less the amounts drawn under the non-committed demand facilities.

(6)Total long-term liabilities correspond to total non-current liabilities in the consolidated statements of financial position under IFRS .

(7)Total liabilities correspond to a sum of current and non-current liabilities in the consolidated statements of financial position under IFRS.

| | | | | | | | |

| M6 | TransAlta Corporation | 2024 Integrated Report |

Operating Performance

The following table provides availability (%) by segment:

| | | | | | | | | | | | | |

| Year ended Dec. 31 | | | 2024 | 2023 | 2022 |

| Hydro | | | 90.7 | | 90.8 | | 96.7 | |

| Wind and Solar | | | 93.4 | | 86.9 | | 83.8 | |

| Gas | | | 92.2 | | 91.6 | | 94.6 | |

Energy Transition(1) | | | 80.0 | | 79.8 | | 77.2 | |

| Availability (%) | | | 91.2 | | 88.8 | | 89.8 | |

(1)Availability adjusted for dispatch optimization for the year ended 2022 was 79 per cent.

Availability is an important measure for the Company as it represents the percentage of time a facility is available to produce electricity and is an indicator of the overall performance of the fleet.

The Company schedules dedicated time (planned outages) to maintain, repair or make improvements to the facilities at a time that will minimize the impact to operations. In high price environments, actual outage schedules may change to accelerate the return to service of the unit.

2024 versus 2023

Availability for the year ended Dec. 31, 2024, was 91.2 per cent, compared to 88.8 per cent in 2023, consistent with management's expectations. Higher availability compared to the prior year was primarily due to:

•The addition of the White Rock and Horizon Hill wind facilities; and

•The return to service of the Kent Hills wind facilities.

2023 versus 2022

Availability for the year ended Dec. 31, 2023, was 88.8 per cent, compared to 89.8 per cent in 2022. Lower availability compared to the prior year was primarily due to:

•Planned outages in the Hydro segment, mainly at our Alberta Hydro Assets, to perform scheduled maintenance; and

•Planned outages at Sundance Unit 6, Sheerness Unit 1, Keephills Units 2 and 3 and Sarnia for scheduled maintenance in the Gas segment; partially offset by

•Lower planned outages at Centralia Unit 2 in the Energy Transition segment; and

•The partial return to service of the Kent Hills wind facilities.

Production and Long-Term Average Generation

The following table provides the long-term average generation (LTA generation) on a consolidated basis for each of our segments:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 | 2023 | 2022 |

| Year ended Dec. 31 | Actual production (GWh) | LTA generation (GWh) | Production as a % of LTA | Actual production (GWh) | LTA generation (GWh) | Production as a % of LTA | Actual production (GWh) | LTA generation (GWh) | Production as a % of LTA | |

| Hydro | 1,723 | | 2,015 | | 86 | % | 1,769 | | 2,015 | | 88 | % | 1,988 | | 2,015 | | 99 | % | | | |

| Wind and Solar | 5,949 | | 6,876 | | 87 | % | 4,243 | | 5,127 | | 83 | % | 4,248 | | 4,950 | | 86 | % | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Gas | 12,317 | | | | 11,873 | | | | 11,448 | | | | | | |

| Energy Transition | 2,822 | | | | 4,144 | | | | 3,574 | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total | 22,811 | | | | 22,029 | | | | 21,258 | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | |

| TransAlta Corporation | 2024 Integrated Report | M7 |

In addition to availability, the Company uses LTA generation as another indicator of performance for the renewable facilities whereby actual production levels are compared against the expected long-term average. In the short term, for each of the Hydro and Wind and Solar segments, the conditions will vary from one period to the next. Over longer durations, facilities are expected to produce in line with their long-term averages, which is broadly considered a reliable indicator of performance.

LTA generation is calculated on an annualized basis from the average annual energy yield predicted from our simulation model based on historical resource data performed over a period of typically greater than 25 years.

The LTA generation for Gas and Energy Transition is not applicable as these facilities are dispatchable and their production is largely dependent on market conditions and merchant demand.

2024 versus 2023

Total production for 2024 increased by 782 GWh, or four per cent, compared to 2023, primarily due to:

•Production from new facilities, including the White Rock West and East wind facilities commissioned in January and April 2024, respectively, the Horizon Hill wind facility commissioned in May 2024, and the Northern Goldfields solar facilities commissioned in November 2023;

•Production from the facilities acquired with Heartland;

•Favourable market conditions in the Ontario wholesale power market that enabled higher dispatch at the Sarnia facility in the Gas segment that resulted in higher merchant production to the Ontario grid;

•The return to service of the Kent Hills wind facilities in the first quarter of 2024; and

•Full-year production from the Garden Plain wind facility; partially offset by

•Increased economic dispatch at the Centralia facility due to lower market prices compared to the prior year in the Energy Transition segment; and

•Higher dispatch optimization in Alberta.

2023 versus 2022

Total production for 2023, increased by 771 GWh, or four per cent, compared to 2022, primarily due to:

•Lower planned and unplanned outages at the Centralia facility in the Energy Transition segment compared to prior year, which allowed the Company to increase dispatch during the periods of higher merchant pricing;

•Higher availability in the Gas segment during periods of supply tightness, allowing for the Company to operate during periods of peak pricing;

•Production from new facilities, including the Garden Plain wind facility, commissioned in August 2023 and the Northern Goldfields solar facilities in November 2023; and

•The partial return to service of the Kent Hills wind facilities in the fourth quarter of 2023, partially offset by

•Lower than average wind and water resources in the year;

•Lower availability in the Hydro segment due to increased planned maintenance outages compared to 2022; and

•Relatively mild weather in the fourth quarter of 2023, compared to the same period in 2022 when markets experienced tighter supply due to the extreme cold weather in Alberta.

| | | | | | | | |

| M8 | TransAlta Corporation | 2024 Integrated Report |

Market Pricing

| | | | | | | | | | | |

| Year ended Dec. 31, 2024 | 2024 | 2023 | 2022 |

| Alberta spot power price ($/MWh) | 63 | | 134 | | 162 | |

| Mid-Columbia spot power price (US$/MWh) | 56 | | 76 | | 82 | |

| Ontario spot power price ($/MWh) | 32 | | 28 | | 47 | |

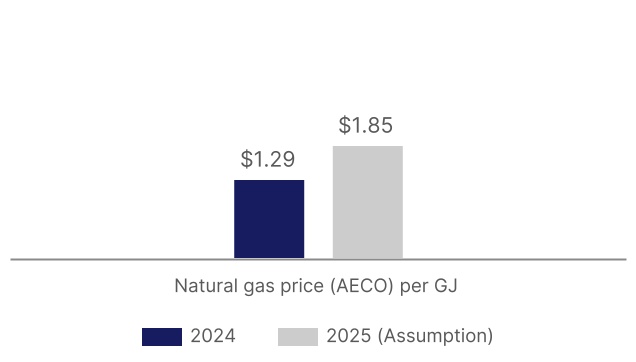

| Natural gas price (AECO) per GJ ($) | 1.29 | | 2.54 | | 5.08 | |

For the year ended Dec. 31, 2024, spot electricity prices in Alberta were 53 per cent lower compared to 2023, driven by lower natural gas prices and the anticipated increased supply from new renewable and combined-cycle gas facilities.

Spot electricity prices in the Pacific Northwest were 26 per cent lower compared to 2023 due to lower natural gas prices.

AECO natural gas prices for the year ended Dec. 31, 2024, were 49 per cent lower compared to 2023, mainly due to higher gas production and higher storage levels in Alberta and throughout North America.

For the year ended Dec. 31, 2023, spot electricity prices in Alberta and the Pacific Northwest were lower compared to

2022. Lower prices in both regions resulted from lower natural gas prices and overall weaker weather-driven demand in the second half of 2023, with notably lower prices due to above normal weather patterns in the fourth quarter of 2023.

For Alberta specifically, warm weather in the fourth quarter of 2023 resulted in a strong wind resource pattern, which, combined with new installed capacity, added supply in the market compared to the prior year.

AECO natural gas prices for the year ended Dec. 31, 2023, were lower compared to 2022, mainly due to increased production and storage levels in Alberta and North America.

Financial Performance Review of Consolidated Information

| | | | | | | | | | | | | | | | |

| | | |

| Year ended Dec. 31 | | | 2024 | | 2023 | 2022 |

| Revenues | | | 2,845 | | | 3,355 | | 2,976 | |

| Fuel and purchased power | | | 939 | | | 1,060 | | 1,263 | |

| Carbon compliance | | | 112 | | | 112 | | 78 | |

| Operations, maintenance and administration | | | 655 | | | 539 | | 521 | |

| Depreciation and amortization | | | 531 | | | 621 | | 599 | |

| Asset impairment charges (reversals) | | | 46 | | | (48) | | 9 | |

| Interest income | | | 30 | | | 59 | | 24 | |

| Interest expense | | | 324 | | | 281 | | 286 | |

| Earnings before income taxes | | | 319 | | | 880 | | 353 | |

| Income tax expense | | | 80 | | | 84 | | 192 | |

| Net earnings attributable to common shareholders | | | 177 | | | 644 | | 4 | |

| Net earnings attributable to non-controlling interests | | | 10 | | | 101 | | 111 | |

2024 versus 2023

Revenues totalling $2,845 million, decreased by $510 million, or 15 per cent, compared to 2023, primarily due to:

•Lower merchant spot and hedged power prices in the Alberta market;

•Lower revenue from derivatives and other trading activities in the Wind and Solar segment driven by higher unrealized mark-to-market losses on the long-term wind energy sales related to the Oklahoma facilities, primarily

due to strengthening forecasted wind capture prices reflected in the year; and

•Lower revenue at Centralia due to higher economic dispatch driven by lower market prices; partially offset by

•Higher revenue from derivatives and other trading activities in the Gas segment driven by higher volume of favourable hedging positions settled, which generated positive contributions over settled spot prices in Alberta;

| | | | | | | | |

| TransAlta Corporation | 2024 Integrated Report | M9 |

•Higher environmental and tax attributes revenues from the Hydro segment and the sale of production tax credits from the Oklahoma wind facilities to taxable U.S. counterparties;

•Commercial operation of the White Rock and Horizon Hill wind facilities, the Northern Goldfields solar facilities, the Mount Keith 132kV expansion and return to service of the Kent Hills wind facilities; and

•Higher revenue in the Gas segment with the acquisition of Heartland.

Fuel and purchased power costs totalling $939 million, decreased by $121 million, or 11 per cent, compared to 2023, primarily due to:

•Lower purchased power costs driven by lower Mid-Columbia prices on repurchases of power;

•Lower fuel consumption due to higher dispatch optimization in the Gas segment in Alberta and higher economic dispatch in the Energy Transition segment; and

•Lower natural gas prices.

Carbon compliance costs totalling $112 million, were consistent with 2023, primarily due to:

•Utilization of internally generated and externally purchased emission credits to settle a portion of our 2023 GHG obligation; offset by

•An increase in the carbon price from $65 per tonne in 2023 to $80 per tonne in 2024; and

•Higher production in the Gas segment.

OM&A expenses totalling $655 million, increased by $116 million, or 22 per cent, compared to 2023, primarily due to:

•Penalties assessed by the Alberta Market Surveillance Administrator for self-reported contraventions pertaining to hydro ancillary services provided during 2021 and 2022;

•Higher spend to support strategic and growth initiatives;

•The addition of the White Rock and Horizon Hill wind facilities and the return to service of the Kent Hills wind facilities;

•The Heartland acquisition-related transaction and restructuring costs, mainly comprising severance, legal and consulting fees; and

•Higher spending related to the planning and design of an upgrade to our enterprise resource planning (ERP) system.

Depreciation and amortization totalling $531 million, decreased by $90 million, or 14 per cent, compared to 2023, primarily due to:

•Revisions to useful lives of certain facilities in prior and current periods; partially offset by

•Commercial operation of the White Rock and Horizon Hill wind facilities and return to service of the Kent Hills wind facilities.

Asset impairment charges totalling $46 million, increased by $94 million, compared to asset impairment recoveries in 2023, primarily due to:

•An increase in decommissioning and restoration provisions on retired assets driven by a decrease in discount rates and revisions in estimated decommissioning costs; and

•Impairment charges related to development projects that are no longer proceeding.

Interest income totalling $30 million, decreased by $29 million, or 49 per cent, compared to 2023, primarily due to lower cash balances and lower interest rates.

Interest expense totalling $324 million, increased by 43 million, or 15 per cent, compared to 2023, primary due to lower capitalized interest resulting from lower construction activity in 2024 compared to 2023.

Earnings before income taxes totalling $319 million, decreased by $561 million, or 64 per cent, compared to 2023, due to the above noted items. Refer to the Segment Financial Performance and Operating Results section for additional information.

Income tax expense totalling $80 million, decreased by $4 million, or five per cent, compared to 2023, due to:

•Lower earnings before income taxes due to the above noted items; partially offset by

•A recovery related to the reversal of previously derecognized Canadian deferred tax assets.

Net earnings attributable to non-controlling interests totalling $10 million, decreased by $91 million, or 90 per cent, compared to 2023, primarily due to lower net earnings for TransAlta Cogeneration, LP (TA Cogen) resulting from lower merchant pricing in the Alberta market and the acquisition of TransAlta Renewables Inc. (TransAlta Renewables) on Oct. 5, 2023.

| | | | | | | | |

| M10 | TransAlta Corporation | 2024 Integrated Report |

2023 versus 2022

Revenues totalling $3,355 million, increased by $379 million, or 13 per cent, compared to 2022, primarily due to:

•Higher realized and unrealized gains from hedging and derivative positions across the segments; partially offset by

•Lower revenue from merchant sales due to lower spot power prices and production in Alberta.

Fuel and purchased power costs totalling $1,060 million, decreased by $203 million, or 16 per cent, compared to 2022, primarily due to:

•Lower natural gas commodity pricing; partially offset by

•Higher fuel usage in both the Gas and Energy Transition segments.

Carbon compliance costs totalling $112 million, increased by $34 million, or 44 per cent, compared to 2022, primarily due to:

•An increase in the carbon price per tonne from $50 per tonne in 2022 to $65 per tonne in 2023;

•Higher production in the Gas segment; and

•No utilization of emission credits to settle GHG obligations as was done in the prior year.

OM&A expenses totalling $539 million, increased by $18 million, or three per cent, compared to 2022, primarily due to:

•Higher spending on strategic and growth initiatives;

•Higher costs associated with the relocation of the Company's head office; and

•Increased costs due to inflationary pressures.

Depreciation and amortization totalling $621 million, increased by $22 million, or four per cent, compared to 2022, primarily due to:

•Revisions to useful lives of certain facilities; and

•Commercial operation of new facilities.

Asset impairment reversals totalling $48 million, increased by $57 million, compared to an asset impairment charge in 2022, primarily due to:

•decommissioning and restoration provisions for retired assets being favourably impacted by a change in timing of expected cash outflows, partially offset by lower discount rates, resulting in a net impairment reversal of $34 million; and

•A Hydro segment impairment reversal of $10 million due to a contract extension and favourable changes in power price assumptions.

Interest income totalling $59 million, increased by $35 million, or 146 per cent, compared to 2022, primarily due to higher cash balances and favourable interest rates.

Earnings before income taxes totalling $880 million, increased by $527 million, or 149 per cent, compared to 2022, due to the above noted items.

Income tax expense totalling $84 million, decreased by $108 million, or 56 per cent, compared to 2022, due to a recovery relating to the reversal of previously derecognized Canadian deferred tax assets and lower U.S. non-deductible expenses relating to U.S. operations, partially offset by higher earnings from Canadian operations.

Net earnings attributable to non-controlling interests totalling $101 million, decreased by $10 million, or nine per cent, compared to 2022, primarily due to lower net earnings for TA Cogen.

| | | | | | | | |

| TransAlta Corporation | 2024 Integrated Report | M11 |

Adjusted EBITDA — 2024 versus 2023

For the year ended Dec. 31, 2024, the Company's adjusted EBITDA was $1,253 million as compared to $1,632 million in 2023, a decrease of $379 million, or 23 per cent. The major factors impacting adjusted EBITDA are summarized in the following table:

| | | | | |

| Year ended Dec. 31 |

| Adjusted EBITDA for the year ended Dec. 31, 2023 | 1,632 | |

Hydro: Lower primarily due to lower spot power prices and ancillary services prices in the Alberta market, partially offset by realized premiums above the spot power prices, higher environmental and tax attributes revenues due to higher sales of emission credits to third parties and intercompany sales to the Gas segment and higher ancillary service volumes due to increased demand by the Alberta Electric System Operator (AESO). | (143) | |

Wind and Solar: Higher primarily due to new sales of production tax credits, the return to service of the Kent Hills wind facilities, the commercial operation of the White Rock and Horizon Hill wind facilities, partially offset by lower realized power pricing in the Alberta market and higher OM&A due to the addition of new wind facilities. | 59 | |

Gas: Lower primarily due to lower power prices in the Alberta market and resulting increase in economic dispatch, an increase in the price of carbon, higher carbon costs and fuel usage related to production and lower capacity payments, partially offset by a higher volume of favourable hedging positions settled, the utilization of emission credits to settle a portion of our 2023 GHG obligation and lower natural gas prices. | (266) | |

Energy Transition: Lower primarily due to increased economic dispatch driven by lower market prices which negatively impacted merchant production, partially offset by lower fuel and purchased power costs. | (31) | |

Energy Marketing: Higher primarily due to favourable market volatility and the timing of realized settled trades during the current year in comparison to the prior year and lower OM&A. | 22 | |

Corporate: Lower primarily due to higher spend to support strategic and growth initiatives. | (20) | |

Adjusted EBITDA(1) for the year ended Dec. 31, 2024 | 1,253 | |

(1)Adjusted EBITDA is not defined and has no standardized meaning under IFRS and may not be comparable to similar measures presented by other issuers. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A. For a comparison of 2024 and 2023 earnings before income tax, the most directly comparable IFRS measure, see pages M67-M68

| | | | | | | | |

| M12 | TransAlta Corporation | 2024 Integrated Report |

Adjusted EBITDA — 2023 versus 2022

For the year ended Dec. 31, 2023, the Company's adjusted EBITDA was $1,632 million compared to $1,656 million in 2022, a decrease of $24 million. The major factors impacting adjusted EBITDA are summarized in the following table:

| | | | | |

| Year ended Dec. 31 |

Adjusted EBITDA for the year ended Dec. 31, 2022(1) | 1,656 | |

Hydro: Lower primarily due to lower ancillary services volumes, lower spot power and ancillary services prices in the Alberta market, lower production due to lower availability and lower than average water resources, partially offset by realized gains from hedging strategy and sales of environmental attributes. | (90) | |

Wind and Solar: Lower primarily due to lower environmental attribute revenues, lower realized power prices in Alberta, lower wind resource across the operating fleet, lower liquidated damages recognized at the Windrise wind facility and higher OM&A, partially offset by the commercial operation of the Garden Plain wind facility, the Northern Goldfields solar facilities and the partial return to service of the Kent Hills wind facilities. | (54) | |

Gas: Higher primarily due to higher power price hedges partially offsetting the impacts of lower Alberta spot prices, lower natural gas commodity costs and higher production, partially offset by lower thermal revenues, higher carbon prices and higher carbon costs and fuel usage related to production. | 172 | |

Energy Transition: Higher primarily due to higher production from higher availability and merchant sales volumes, partially offset by lower market prices compared to the prior year. | 36 | |

Energy Marketing: Lower primarily due to lower realized settled trades during the year on market positions in comparison to prior year and higher OM&A. | (74) | |

Corporate: Lower primarily due to increased spending to support strategic and growth initiatives and higher costs associated with the relocation of the Company's head office. | (14) | |

Adjusted EBITDA(2) for the year ended Dec. 31, 2023 | 1,632 | |

(1)During 2024 our adjusted EBITDA composition was amended to exclude the impact of Brazeau penalties and related provisions. Therefore, the Company has applied this composition to all previously reported periods. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A.

(2)Adjusted EBITDA is not defined and has no standardized meaning under IFRS and may not be comparable to similar measures presented by other issuers. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A. For a comparison of 2023 and 2022 earnings before income tax, the most directly comparable IFRS measure, see pages M68-M69.

| | | | | | | | |

| TransAlta Corporation | 2024 Integrated Report | M13 |

Free Cash Flow — 2024 versus 2023

For the year ended Dec. 31, 2024, the Company's FCF decreased by $321 million, or 36 per cent, compared to 2023, but was within the upper range of our expected full-year financial guidance. The major factors impacting FCF are summarized in the following table:

| | | | | |

| Year ended Dec. 31 |

| FCF for the year ended Dec. 31, 2023 | 890 | |

| Lower Adjusted EBITDA due to the items noted above. | (379) | |

| Higher current income tax expense due to the full utilization of Canadian non-capital loss carryforwards in 2023, partially offset by lower earnings before income taxes in 2024 compared to the prior year. | (93) | |

Higher net interest expense(1) due to lower capitalized interest resulting from lower construction activity in 2024 compared to 2023 and lower interest income due to lower cash balances and interest rates in 2024 compared to prior year. | (67) | |

| Lower distributions paid to subsidiaries' non-controlling interests relating to lower TA Cogen net earnings resulting from lower merchant pricing in the Alberta market and the cessation of distributions to TransAlta Renewables non-controlling interest. On Oct. 5, 2023, the Company acquired all of the outstanding common shares of TransAlta Renewables not already owned, directly or indirectly. | 183 |

| Higher provisions accrued in the current year compared to the prior year resulting in higher FCF. | 11 | |

| Lower sustaining capital expenditures due to the receipt of a lease incentive related to the Company's head office, and lower planned major maintenance at our Alberta and Western Australian gas facilities, partially offset by higher major maintenance at our Alberta Hydro facilities. | 32 |

| |

| |

| |

Other non-cash items(2) | 14 |

Other(3) | (22) | |

FCF(4) for the year ended Dec. 31, 2024 | 569 | |

(1)Net interest expense includes interest expense less interest income and excludes non-cash items like financing amortization and accretion.

(2)Other non-cash items consists of Alberta market pool incentives, carbon obligation and contract liabilities. Refer to the Reconciliation of Cash Flow from Operations to FFO and FCF section tables in this MD&A for more details.

(3)Other consists of higher realized foreign exchange loss, higher decommissioning and restoration costs settled, higher dividends paid on preferred shares, lower principal payments on lease liabilities and lower productivity capital. Refer to the Reconciliation of Cash Flow from Operations to FFO and FCF section tables in this MD&A for more details.

(4)FCF is not defined and has no standardized meaning under IFRS and may not be comparable to similar measures presented by other issuers. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A. For a comparison of 2024 and 2023 cash flow from operations, the most directly comparable IFRS measure, see page M56.

| | | | | | | | |

| M14 | TransAlta Corporation | 2024 Integrated Report |

Free Cash Flow — 2023 versus 2022

For the year ended Dec. 31, 2023, the Company's FCF decreased by $71 million, or 7 per cent, compared to 2022, and was in line with our revised expected full-year financial guidance. The major factors impacting FCF are summarized in the following table:

| | | | | |

| Year ended Dec. 31 |

| FCF for the year ended Dec. 31, 2022 | 961 | |

| Lower Adjusted EBITDA due to the items noted above. | (24) | |

| Higher interest income due to higher cash balances and favourable interest rates. | 35 | |

| Lower current income tax expense due to previously restricted non-capital loss carryforwards that were utilized to offset taxable income. | 15 | |

| Higher sustaining capital expenditures due to higher planned major maintenance costs for the Hydro and Gas segments, partially offset by lower planned major maintenance in the Wind and Solar and Energy Transition segments. | (32) | |

| |

| Higher distributions paid to subsidiaries' non-controlling interests related to the timing of distributions paid to TA Cogen, partially offset by lower distributions paid to TransAlta Renewables. | (36) | |

| Lower provisions being accrued compared to the prior year, with no notable settlements being recorded in either year. | (26) | |

Other non-cash items(1) | 11 | |

Other(2) | (14) | |

FCF(3) for the year ended Dec. 31, 2023 | 890 | |

(1)Other non-cash items consists of Alberta market pool incentives, carbon obligation, contract liabilities, the SunHills royalty onerous contract and Brazeau penalties. Refer to the Reconciliation of Cash Flow from Operations to FFO and FCF section tables in this MD&A for more details.

(2)Other consists of higher realized foreign exchange loss, higher decommissioning and restoration costs settled, higher dividends paid on preferred shares and higher principal payments on lease liabilities. Refer to the Reconciliation of Cash Flow from Operations to FFO and FCF section tables in this MD&A for more details.

(3)FCF is not defined and has no standardized meaning under IFRS and may not be comparable to similar measures presented by other issuers. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A. For a comparison of 2023 and 2022 cash flow from operations, the most directly comparable IFRS measure, see page M57.

| | | | | | | | |

| TransAlta Corporation | 2024 Integrated Report | M15 |

Capital Expenditures

Sustaining Capital Expenditures

We are in a long-cycle business that requires significant capital expenditures. Our goal is to undertake sustaining capital expenditures that ensure our facilities operate reliably and safely.

The Company's sustaining capital expenditures by segment are summarized in the table below:

| | | | | | | | | | | |

| Year ended Dec. 31 | 2024 | 2023 | 2022 |

| Hydro | 56 | | 41 | | 35 | |

| Wind and Solar | 20 | | 15 | | 18 | |

| Gas | 52 | | 76 | | 41 | |

| Energy Transition | 12 | | 15 | | 19 | |

| | | |

| Corporate | 2 | | 27 | | 29 | |

| Sustaining capital expenditures | 142 | | 174 | | 142 | |

Total sustaining capital expenditures in 2024 were $32 million lower compared to 2023, primarily due to:

•The receipt of a lease incentive related to the Company's head office, included in the Corporate segment; and

•Lower planned major maintenance at our Alberta and Western Australian gas facilities; partially offset by

•Higher major maintenance at our Alberta hydro assets; and

•Higher major maintenance at our Wind and Solar facilities.

Total sustaining capital expenditures in 2023 were $32 million higher compared to 2022, primarily due to:

•Higher planned major maintenance at our Alberta Hydro assets;

•Higher planned major maintenance at our Sarnia, Sundance Unit 6 and Keephills Units 2 and 3 facilities in the Gas segments; partially offset by

•Lower planned major maintenance in the Wind and Solar segment primarily due to a reduction in major component replacements; and

•Lower planned outage work performed in the Energy Transition segment.

| | | | | | | | |

| M16 | TransAlta Corporation | 2024 Integrated Report |

Growth and Development Expenditures

Growth and development expenditures are impacted by the timing and construction of projects within the development pipeline. The following table provides our growth and development spending by segment:

| | | | | | | | | | | |

| Year ended Dec. 31 | 2024 | 2023 | 2022 |

| Hydro | 9 | | 6 | | 2 | |

| Wind and Solar | 64 | | 673 | | 711 | |

| Gas | 59 | | 60 | | 61 | |

| | | |

| | | |

| Growth and development expenditures | 132 | | 739 | | 774 | |

Growth and development expenditures were lower in 2024 compared to 2023 and 2022, as many of the development projects achieved commercial operation in the first half of 2024. The White Rock East and Horizon Hill wind facilities were commissioned in the second quarter of 2024. The White Rock West wind facility and Mount Keith 132kV expansion were commissioned in the first quarter of 2024.

Refer to the Strategic Priorities section of this MD&A for more details.

In 2023 and 2022, the growth and development expenditures incurred primarily related to:

•The Garden Plain wind facility, which achieved commercial operation in August 2023;

•The Northern Goldfields solar facilities, which achieved commercial operation in November 2023;

•The White Rock and the Horizon Hill wind projects; and

•The Mount Keith 132kV expansion.

Significant and Subsequent Events

Declared Increase in Common Share Dividend

The Company’s Board of Directors has approved a $0.02 annualized increase to the common share dividend, or 8 per cent increase, and declared a dividend of $0.065 per common share to be payable on July 1, 2025 to shareholders of record at the close of business on June 1, 2025. The quarterly dividend of $0.065 per common share represents an annualized dividend of $0.26 per common share.

TransAlta Acquires Heartland Generation from Energy Capital Partners

On Dec. 4, 2024, the Company closed the acquisition of Heartland Generation Ltd. and certain affiliates (collectively, Heartland) for a purchase price of $542 million from an affiliate of Energy Capital Partners (ECP), the parent of Heartland (the Transaction). To meet the requirements of the federal Competition Bureau, the Company entered into a consent agreement with the Commissioner of Competition pursuant to which TransAlta agreed to divest Heartland's Poplar Hill and Rainbow Lake assets (the Planned Divestitures) following closing of the Transaction. In consideration of the Planned Divestitures, TransAlta and ECP agreed to a reduction of $80 million from the original purchase price for the Transaction. ECP will be entitled to receive the proceeds from the sale of Poplar Hill and Rainbow Lake, net of certain adjustments

following completion of the Planned Divestitures. TransAlta also received a further $95 million at closing of the Transaction to reflect the economic benefit of the Heartland business arising from Oct. 31, 2023 to the closing date of the Transaction, pursuant to the terms of the share purchase agreement. The net cash payment for the Transaction, before working capital adjustments, totalled $215 million, and was funded through a combination of cash on hand and draws on TransAlta's credit facilities.

Excluding the Planned Divestitures, the Transaction adds 1,747 MW (net interest) of complementary capacity from nine facilities, including contracted cogeneration and peaking generation, legacy gas-fired thermal generation, and transmission capacity, all of which will be critical to support reliability in the Alberta electricity market.

Mothballing of Sundance Unit 6

On Nov. 4, 2024, the Company provided notice to the AESO that Sundance Unit 6 will be mothballed on April 1, 2025, for a period of up to two years depending on market conditions. TransAlta maintains the flexibility to return the mothballed unit to service when market fundamentals improve or opportunities to contract are secured. The unit remains available and fully operational for the first quarter of 2025.

| | | | | | | | |

| TransAlta Corporation | 2024 Integrated Report | M17 |

Appointment of New Chief Financial Officer (CFO)

The Board appointed Joel Hunter as Executive Vice President, Finance and CFO, effective July 1, 2024.

Production Tax Credit (PTC) Sale Agreements

On Feb. 22, 2024, the Company entered into 10-year transfer agreements with an AA- rated customer for the sale of approximately 80 per cent of the expected PTCs to be generated from the White Rock and the Horizon Hill wind facilities.

On June 21, 2024, the Company entered into an additional 10-year transfer agreement with an A+ rated customer for the sale of the remaining 20 per cent of the expected PTCs.

The expected average annual EBITDA from the two agreements is approximately $78 million (US$57 million).

Normal Course Issuer Bid (NCIB)

TransAlta remains committed to enhancing shareholder returns through appropriate capital allocation such as share buybacks and its quarterly dividend. In the first quarter of 2024, the Company announced an enhanced common share repurchase program for 2024, allocating up to $150 million, and targeting up to 42 per cent of 2024 FCF guidance, to be returned to shareholders in the form of share repurchases and dividends.

On May 27, 2024, the Company announced that it had received approval from the Toronto Stock Exchange to purchase up to 14 million common shares during the 12-month period that commenced May 31, 2024, and terminates May 31, 2025. Any common shares purchased under the NCIB will be cancelled.

For the year ended Dec. 31, 2024, the Company purchased and cancelled a total of 13,467,400 common shares, at an average price of $10.59 per common share, for a total cost of $143 million, including taxes.

Horizon Hill Wind Facility Achieves Commercial Operation

On May 21, 2024, the 202 MW Horizon Hill wind facility achieved commercial operation. The facility is located in Logan County, Oklahoma and is fully contracted to Meta Platforms Inc. for the offtake of 100 per cent of the generation.

White Rock Wind Facilities Achieve Commercial Operation

On Jan. 1, 2024, the 100 MW White Rock West wind facility achieved commercial operation. On April 22, 2024, the 202 MW White Rock East wind facility also completed commissioning. The facilities are located in Caddo County, Oklahoma and are contracted under two long-term power purchase agreements (PPAs) with Amazon Energy LLC for the offtake of 100 per cent of the generation.

Mount Keith 132kV Expansion Complete

The Mount Keith 132kV expansion project was completed during the first quarter of 2024. The expansion was developed under the existing PPA with BHP Nickel West (BHP), which extends until Dec. 31, 2038. The expansion will facilitate the connection of additional generating capacity to the transmission network which supports BHP's operations.

| | | | | | | | |

| M18 | TransAlta Corporation | 2024 Integrated Report |

Segmented Financial Performance and Operating Results

Segmented information is prepared on the same basis that the Company manages its business, evaluates financial results and makes key operating decisions. The following table reflects the summary financial information on a consolidated basis for the year ended Dec. 31:

| | | | | | | | | | | |

| Adjusted EBITDA(1) |

| Year ended Dec. 31 | 2024 | 2023 | 2022(2) |

| Hydro | 316 | | 459 | | 549 | |

| Wind and Solar | 316 | | 257 | | 311 | |

| Gas | 535 | | 801 | | 629 | |

| Energy Transition | 91 | | 122 | | 86 | |

| Energy Marketing | 131 | | 109 | | 183 | |

| Corporate | (136) | | (116) | | (102) | |

Total adjusted EBITDA(1) | 1,253 | | 1,632 | | 1,656 | |

| Earnings before income taxes | 319 | | 880 | | 353 | |

(1)This item is not defined and has no standardized meaning under IFRS and may not be comparable to similar measures presented by other issuers. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A.

(2)During 2024 our adjusted EBITDA composition was amended to exclude the impact of Brazeau penalties and related provisions. Therefore, the Company has applied this composition to all previously reported periods. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A.

2024 versus 2023

Earnings before income taxes for the year ended Dec. 31, 2024, decreased by $561 million, or 64 per cent, compared to 2023, primarily due to:

•The factors causing lower adjusted EBITDA above;

•Higher asset impairment charges related to an increase in the decommissioning provision on retired assets, driven by a decrease in discount rates and revisions in estimated decommissioning costs, and higher impairment charges related to development projects that are no longer proceeding;

•Lower unrealized mark-to-market gains and lower realized gains on closed exchange positions in the Energy Marketing segment mainly driven by market volatility across North American power and natural gas markets;

•Higher unrealized mark-to-market losses recorded in the Wind and Solar segment primarily related to the long-term wind energy sales related to the Oklahoma facilities;

•Higher interest expense due to lower capitalized interest during 2024 resulting from lower construction activity in 2024 compared to 2023;

•Lower capacity payments in 2024 for Southern Cross Energy in Western Australia due to the scheduled conclusion on Dec. 31, 2023, of the demand capacity charge under the customer contract, partially offset by the commencement in March 2024 of capacity payments

for the Mount Keith 132kV expansion;

•Heartland acquisition-related transaction and restructuring costs;

•Lower interest income due to lower cash balances and lower interest rates during 2024;

•Higher spending relating to planning and design work on a planned upgrade to our ERP system; and

•Penalties assessed by the Alberta Market Surveillance Administrator for self-reported contraventions pertaining to Hydro ancillary services provided during 2021 and 2022; partially offset by

•Lower depreciation and amortization compared to 2023 related to revisions of useful lives of certain facilities in prior and current periods, partially offset by the commercial operation of new facilities during the year and the return to service of the Kent Hills wind facilities;

•Higher unrealized mark-to-market gains recorded in the Energy Transition segment primarily related to the favourable changes in forward prices; and

•Higher net other operating income mainly due to Sundance A decommissioning cost reimbursement.

2023 versus 2022

Earnings before income taxes for the year ended Dec. 31, 2023, increased by $527 million, or 149 per cent, compared to 2022, primarily due to:

| | | | | | | | |

| TransAlta Corporation | 2024 Integrated Report | M19 |

•Higher unrealized mark-to-market gains in in the Gas segment primarily related to higher power price hedges;

•Higher unrealized mark-to-market gains in the Wind and Solar segment primarily related to Garden Plain and Big Level, partially offset by unrealized mark-to-market losses related to the Oklahoma facilities;

•Higher realized mark-to-market losses on closed exchange positions in the Energy Marketing segment mainly driven by market volatility across the North American power and natural gas markets;

•Higher asset impairment reversals for the Hydro and Wind and Solar segments due to favourable changes in power price assumptions and contract extensions, partially offset by a change in decommissioning and

restoration provisions for retired assets due to a change in the timing of expected cash outflows and the revisions in discount rates;

•Higher interest income due to higher cash balances and favourable interest rates; partially offset by

•Lower adjusted EBITDA (as described above);

•Lower gain on sale of assets in 2023. In 2022 the Company closed the sale of two hydro facilities and sold equipment related to its Energy Transition segment; and

•Higher depreciation and amortization due to revisions to useful lives of certain facilities and commercial operation of new facilities.

| | | | | | | | |

| M20 | TransAlta Corporation | 2024 Integrated Report |

Hydro

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Year ended Dec. 31 | | | 2024 | 2023 | Change | 2022(7) | Change |

| Gross installed capacity (MW) | | | 922 | | 922 | | — | | — | % | 922 | — | | — | % |

| LTA generation (GWh) | | | 2,015 | | 2,015 | | — | | — | % | 2,015 | | — | | — | % |

| Availability (%) | | | 90.7 | | 90.8 | | (0.1) | | — | % | 96.7 | | (5.9) | | (6) | % |

| | | | | | | | | |

| Production | | | | | | | | | |

| Contract production (GWh) | | | 281 | | 277 | | 4 | | 1 | % | 323 | | (46) | | (14) | % |

| Merchant production (GWh) | | | 1,442 | | 1,492 | | (50) | | (3) | % | 1,665 | | (173) | | (10) | % |

| Total energy production (GWh) | | | 1,723 | | 1,769 | | (46) | | (3) | % | 1,988 | | (219) | | (11) | % |

Ancillary service volumes (GWh)(1) | | | 2,951 | | 2,582 | | 369 | | 14 | % | 3,124 | | (542) | | (17) | % |

| | | | | | | | | |

Alberta Hydro Assets revenues(2)(3) | | | 144 | | 291 | | (147) | | (51) | % | 328 | | (37) | | (11) | % |

Other Hydro Assets and other revenues(2)(4) | | | 49 | | 51 | | (2) | | (4) | % | 42 | | 9 | | 21 | % |

| Alberta Hydro ancillary services revenues | | | 136 | | 173 | | (37) | | (21) | % | 256 | | (83) | | (32) | % |

| | | | | | | | | |

| Environmental and tax attributes revenues | | | 61 | | 14 | | 47 | | 336 | % | 1 | | 13 | | 1300 | % |

| | | | | | | | | |

| | | | | | | | | |

Adjusted revenues(5) | | | 390 | | 529 | | (139) | | (26) | % | 627 | | (98) | | (16) | % |

| Fuel and purchased power | | | 16 | | 19 | | (3) | | (16) | % | 22 | | (3) | | (14) | % |

Adjusted gross margin(6) | | | 374 | | 510 | | (136) | | (27) | % | 605 | | (95) | | (16) | % |

Adjusted OM&A(5) | | | 55 | | 48 | | 7 | | 15 | % | 53 | | (5) | | (9) | % |

| Taxes, other than income taxes | | | 3 | | 3 | | — | | — | % | 3 | | — | | — | % |

Adjusted EBITDA(6) | | | 316 | | 459 | | (143) | | (31) | % | 549 | | (90) | | (16) | % |

| Supplemental Information: | | | | | | | | | |

| Gross revenues per MWh | | | | | | | | | |

Alberta Hydro Assets energy ($/MWh)(2)(3) | | | 100 | | 195 | | (95) | | (49) | % | 197 | (2) | | (1) | % |

Alberta Hydro Assets ancillary ($/MWh)(1) | | | 46 | | 67 | | (21) | | (31) | % | 76 | (9) | | (12) | % |

| | | | | | | | | |

| | | | | | | | | |

(1)Ancillary services as described in the AESO Consolidated Authoritative Document Glossary.

(2)Alberta Hydro Assets include 13 hydro facilities on the Bow and North Saskatchewan river systems. Other Hydro Assets include our hydro facilities in British Columbia, Ontario and Alberta (other than the Alberta Hydro Assets).

(3)Alberta Hydro Assets revenues include revenues from swaps and forward hedges.

(4)Other revenues includes revenues from our transmission business and other contractual arrangements, including the flood mitigation agreement with the Government of Alberta and black start services.

(5)For details of the adjustments to revenues and OM&A included in adjusted EBITDA refer to the Additional IFRS and Non-IFRS Measures section of this MD&A.

(6)Adjusted EBITDA and adjusted gross margin are not defined and have no standardized meaning under IFRS and may not be comparable to similar measures presented by other issuers. Refer to the Additional IFRS and Non-IFRS Measures section of this MD&A.

(7)During 2024 our adjusted EBITDA composition was amended to exclude the impact of Brazeau penalties and related provisions. Therefore, the Company has applied this composition to all previously reported periods. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A.

| | | | | | | | |

| TransAlta Corporation | 2024 Integrated Report | M21 |

2024 versus 2023

Adjusted revenues for the year ended Dec. 31, 2024, decreased compared to 2023, primarily due to:

•Lower spot power prices and ancillary services prices in the Alberta market; partially offset by

•Realized premiums above spot power prices and positive contributions from hedging;

•Higher environmental and tax attributes revenues due to increased sales of emission credits to third parties and intercompany sales to the Gas segment; and

•Higher ancillary services volumes due to increased demand by the AESO.

Adjusted EBITDA for the year ended Dec. 31, 2024, decreased compared to 2023, primarily due to lower adjusted revenues as explained by the factors above.

For further discussion on the Alberta market conditions and pricing, refer to the Alberta Electricity Portfolio section of this MD&A.

2023 versus 2022

Adjusted revenues for the year ended Dec. 31, 2023, decreased compared to 2022, primarily due to:

•Lower ancillary services volumes due to the AESO procuring lower volumes given its decision to reduce the cumulative volume of imports into Alberta;

•Lower spot power prices and ancillary services prices in the Alberta market; and

•Lower production due to lower availability from planned outages at our Alberta Hydro Assets and lower than average water resources; partially offset by

•Realized gains from our hedging strategy for the Alberta Hydro Assets; and

•Sales of environmental attributes driven by an increase in emission credit sales.

Adjusted EBITDA for the year ended Dec. 31, 2023, decreased compared to 2022, primarily due to lower adjusted revenues as explained by the factors above.

| | | | | | | | |

| M22 | TransAlta Corporation | 2024 Integrated Report |

Wind and Solar | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Year ended Dec. 31 | | | 2024 | | 2023 | | Change | 2022 | Change |

Gross installed capacity (MW)(1) | | | 2,587 | | | 2,084 | | 503 | | 24 | % | 1,906 | | 178 | | 9 | % |

| LTA generation (GWh) | | | 6,876 | | | 5,127 | | 1,749 | | 34 | % | 4,950 | | 177 | | 4 | % |

| Availability (%) | | | 93.4 | | | 86.9 | | 6.5 | | 7 | % | 83.8 | | 3.1 | | 4 | % |

| | | | | | | | | | | |

| Production | | | | | | | | | | | |

| Contract production (GWh) | | | 4,720 | | | 3,095 | | | 1,625 | | 53 | % | 3,182 | | (87) | | (3) | % |

| Merchant production (GWh) | | | 1,229 | | | 1,148 | | | 81 | | 7 | % | 1,066 | | 82 | | 8 | % |

| Total production (GWh) | | | 5,949 | | | 4,243 | | | 1,706 | | 40 | % | 4,248 | | (5) | | — | % |

| | | | | | | | | | | |

| Revenues | | | 372 | | | 347 | | | 25 | | 7 | % | 357 | | (10) | | (3) | % |

| | | | | | | | | | | |

| Environmental and tax attributes revenues | | | 77 | | | 26 | | | 51 | | 196 | % | 50 | | (24) | | (48) | % |

| | | | | | | | | | | |

Adjusted revenues(2) | | | 449 | | | 373 | | | 76 | | 20 | % | 407 | | (34) | | (8) | % |

| Fuel and purchased power | | | 30 | | | 30 | | | — | | — | % | 31 | | (1) | | (3) | % |

| Carbon compliance | | | — | | | — | | | — | | — | % | 1 | | (1) | | (100) | % |

Adjusted gross margin(3) | | | 419 | | | 343 | | | 76 | | 22 | % | 375 | | (32) | | (9) | % |

Adjusted OM&A(2) | | | 97 | | | 80 | | | 17 | | 21 | % | 68 | | 12 | | 18 | % |

| Taxes, other than income taxes | | | 16 | | | 12 | | | 4 | | 33 | % | 12 | | — | | — | % |

| Net other operating income | | | (10) | | | (6) | | | (4) | | 67 | % | (16) | | 10 | | (63) | % |

Adjusted EBITDA(3) | | | 316 | | | 257 | | | 59 | | 23 | % | 311 | | (54) | | (17) | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1)Gross installed capacity and availability for 2024 include the 100 MW White Rock West and 202 MW White Rock East wind facilities that achieved commercial operation in January and April 2024, respectively, and the 202 MW Horizon Hill wind facility that achieved commercial operation in May 2024.Tower removal at Sinott in 2025, reduced gross installed capacity by 1 MW. Gross installed capacity and availability for 2024 and 2023 include the 130 MW Garden Plain wind facility that achieved commercial operation in August 2023 and the 48 MW Northern Goldfields solar facilities that achieved commercial operation in November 2023.

(2)For details of the adjustments to revenues and OM&A included in adjusted EBITDA, refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A. The Skookumchuck wind facility has been included on a proportionate basis in the Wind and Solar segment.

(3)Adjusted EBITDA and adjusted gross margin are not defined and have no standardized meaning under IFRS and may not be comparable to similar measures presented by other issuers. Refer to the Additional IFRS and Non-IFRS Measures section of this MD&A.

| | | | | | | | |

| TransAlta Corporation | 2024 Integrated Report | M23 |

2024 versus 2023

Adjusted revenues for the year ended Dec. 31, 2024, increased compared to 2023, primarily due to:

•Higher environmental and tax attributes revenues from the sale of production tax credits from Horizon Hill and White Rock West and East wind facilities to taxable US counterparties;

•Higher production from the return to service of the Kent Hills wind facilities; and

•Commercial operation of the Horizon Hill and White Rock West and East wind facilities; partially offset by

•Lower realized power prices in the Alberta market.

Adjusted EBITDA for the year ended Dec. 31, 2024, increased compared to the same period in 2023, primarily due to:

•Higher adjusted revenues as explained by the factors above; partially offset by

•Higher OM&A mainly due to the addition of new wind facilities.

2023 versus 2022

Adjusted revenues for the year ended Dec. 31, 2023, decreased compared to 2022, primarily due to:

•Lower environmental attribute revenues driven by a reduction of offsets and emission credit sales;

•Lower realized power prices in Alberta; and

•Weaker than long-term average wind resource across the operating fleets; partially offset by

•Commercial operation of the Garden Plain wind facility and the Northern Goldfield Solar facilities in the third and fourth quarter, respectively; and

•The partial return to service of the Kent Hills wind facilities.

Adjusted EBITDA for the year ended Dec. 31, 2023, decreased compared to the same period in 2022, primarily due to:

•Lower adjusted revenues as explained by the factors above;

•Higher OM&A related to salary escalations, higher insurance costs and long-term service agreement escalations; and

•Lower liquidated damages recognized at the Windrise wind facility.

| | | | | | | | |

| M24 | TransAlta Corporation | 2024 Integrated Report |

Gas

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Year ended Dec. 31 | | | 2024 | | 2023 | | Change | 2022 | Change |

Gross installed capacity (MW)(1) | | | 4,834 | | | 3,084 | | | 1,750 | | 57 | % | 3,084 | | — | | — | % |

| Availability (%) | | | 92.2 | | | 91.6 | | | 0.6 | | 1 | % | 94.6 | | (3.0) | | (3) | % |

| Production | | | | | | | | | | | |

| Contract sales volume (GWh) | | | 6,874 | | | 4,322 | | | 2,552 | | 59 | % | 3,806 | | 516 | | 14 | % |

| Merchant sales volume (GWh) | | | 6,576 | | | 7,889 | | | (1,313) | | (17) | % | 7,927 | | (38) | | — | % |

Purchased power (GWh)(2) | | | (1,133) | | | (338) | | | (795) | | 235 | % | (285) | | (53) | | 19 | % |

| Total production (GWh) | | | 12,317 | | | 11,873 | | | 444 | | 4 | % | 11,448 | | 425 | | 4 | % |

| | | | | | | | | | | |

Adjusted revenues(3) | | | 1,321 | | | 1,525 | | | (204) | | (13) | % | 1,521 | | 4 | | — | % |

Adjusted fuel and purchased power(3) | | | 470 | | | 449 | | | 21 | | 5 | % | 637 | | (188) | | (30) | % |

| Carbon compliance | | | 145 | | | 112 | | | 33 | | 29 | % | 83 | | 29 | | 35 | % |

Adjusted gross margin(4) | | | 706 | | | 964 | | | (258) | | (27) | % | 801 | | 163 | | 20 | % |

| OM&A | | | 198 | | | 192 | | | 6 | | 3 | % | 195 | | (3) | | (2) | % |

| Taxes, other than income taxes | | | 13 | | | 11 | | | 2 | | 18 | % | 15 | | (4) | | (27) | % |

| Net other operating income | | | (40) | | | (40) | | | — | | — | % | (38) | | (2) | | 5 | % |

Adjusted EBITDA(4) | | | 535 | | | 801 | | | (266) | | (33) | % | 629 | | 172 | | 27 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1)Gross installed capacity and availability for 2024 include the 1,747 MW Heartland gas facilities and exclude the Planned Divestitures. Refer to the Significant and Subsequent events section. Gross installed capacity for Keephills Unit 3 was adjusted by 3 MW during 2024 due to reduced equipment load.

(2)Power required to fulfil contractual obligations during planned and unplanned outages is included in purchased power.

(3)For details of the adjustments to revenues and fuel and purchased power included in adjusted EBITDA, refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A.

(4)Adjusted EBITDA and adjusted gross margin are not defined and have no standardized meaning under IFRS and may not be comparable to similar measures presented by other issuers. Refer to the Additional IFRS Measures and Non-IFRS Measures section of this MD&A.

2024 versus 2023

The Gas fleet performance was broadly in line with management's expectations for the segment.

Adjusted revenues for the year ended Dec. 31, 2024, decreased compared to 2023, primarily due to:

•Lower power prices in the Alberta market;

•Increased dispatch optimization from Alberta Gas facilities driven by lower power prices; and

•Lower capacity payments in 2024 for Southern Cross Energy in Western Australia due to the scheduled conclusion on Dec. 31, 2023, of the demand capacity charge under the customer contract, partially offset by the commencement in March 2024 of capacity payments for the Mount Keith 132kV expansion; partially offset by

•Higher volume of favourable hedging positions settled, which generated positive contributions over settled spot prices in Alberta.

Adjusted EBITDA for the year ended Dec. 31, 2024, decreased compared to 2023, primarily due to:

•Lower adjusted revenues explained above;

•An increase in the carbon price from $65 to $80 per tonne, impacting gross margin from our Canadian gas facilities; and

•Higher carbon costs and fuel usage related to production; partially offset by

•The utilization of emission credits to settle a portion of our 2023 GHG obligation; and

•Lower natural gas prices.

| | | | | | | | |