UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-10487 |

|

Hotchkis & Wiley Funds |

(Exact name of registrant as specified in charter) |

|

725 South Figueroa Street, 39th Floor

Los Angeles, California | |

90017-5439

|

(Address of principal executive offices) | | (Zip code) |

|

Anna Marie Lopez Hotchkis & Wiley Capital Management, LLC 725 South Figueroa Street, 39th Floor Los Angeles, California 90017-5439 |

(Name and address of agent for service) |

|

Copies to: Maureen A. Miller, Esq. Joseph M. Mannon, Esq. Vedder Price P.C. 222 North LaSalle Street, 26th Floor Chicago, Illinois 60601 |

(Counsel for the registrant) |

|

Registrant’s telephone number, including area code: | (213) 430-1000 | |

|

Date of fiscal year end: | June 30, 2018 | |

|

Date of reporting period: | June 30, 2018 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

Hotchkis & Wiley Funds

Annual Report

JUNE 30, 2018

DIVERSIFIED VALUE FUND

LARGE CAP VALUE FUND

MID-CAP VALUE FUND

SMALL CAP VALUE FUND

SMALL CAP DIVERSIFIED VALUE FUND

GLOBAL VALUE FUND

INTERNATIONAL VALUE FUND

VALUE OPPORTUNITIES FUND

CAPITAL INCOME FUND

HIGH YIELD FUND

SHAREHOLDER LETTER | | | 1 | | |

| FUND INFORMATION | | | 4 | | |

| FUND PERFORMANCE DATA | | | 6 | | |

SCHEDULE OF INVESTMENTS: | |

| DIVERSIFIED VALUE FUND | | | 16 | | |

| LARGE CAP VALUE FUND | | | 18 | | |

| MID-CAP VALUE FUND | | | 20 | | |

| SMALL CAP VALUE FUND | | | 22 | | |

| SMALL CAP DIVERSIFIED VALUE FUND | | | 24 | | |

| GLOBAL VALUE FUND | | | 31 | | |

| INTERNATIONAL VALUE FUND | | | 33 | | |

| VALUE OPPORTUNITIES FUND | | | 35 | | |

| CAPITAL INCOME FUND | | | 39 | | |

| HIGH YIELD FUND | | | 47 | | |

| STATEMENTS OF ASSETS & LIABILITIES | | | 53 | | |

| STATEMENTS OF OPERATIONS | | | 55 | | |

| STATEMENTS OF CHANGES IN NET ASSETS | | | 57 | | |

| FINANCIAL HIGHLIGHTS | | | 62 | | |

| NOTES TO THE FINANCIAL STATEMENTS | | | 67 | | |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 83 | | |

| FUND EXPENSE EXAMPLES | | | 84 | | |

BOARD CONSIDERATIONS IN APPROVING CONTINUATION OF

INVESTMENT ADVISORY AGREEMENTS | | | 86 | | |

| MANAGEMENT | | | 88 | | |

INFORMATION ABOUT THE FUNDS | | | BACK COVER | | |

DEAR SHAREHOLDER:

The following investment review and annual report relates to the activities of the Hotchkis & Wiley Funds for the twelve-month period ended June 30, 2018.

OVERVIEW

The S&P 500® Index returned +14.4% and the Russell Developed Index returned +12.1% (in US dollar terms) over the twelve-month period ended June 30, 2018. The positive performance from global equities suggests that for the time being, investors are choosing to focus on strong corporate earnings as opposed to trade war risks and geopolitical tensions. Global earnings grew more than +30% year-over-year in the most recently reported quarter, with many companies reporting earnings growth of more than 50% from a year ago. Interestingly, the composition of this fastest-growing cohort was broadly distributed across sectors even though stock performance across sectors has varied significantly.

There were large performance differences between sectors, with information technology, energy, and consumer discretionary leading the way and non-cyclical sectors lagging. Globally, growth outperformed value over the past 12 months, which poses a challenge to our value-focused investment approach. Fortunately, markets move in cycles, and this headwind can shift into a tailwind when value comes back into vogue.

The valuation of broad equity markets across the globe appears above average, but this is heavily influenced by certain market segments that we view as considerably overvalued. Valuation spreads are wide. In light of value's underperformance, we are often asked what would serve as the catalyst to bring value back into vogue; unfortunately we do not have a definitive answer. A rise in interest rates should favor value stocks, which are shorter duration instruments than growth stocks. An economic slowdown could favor value if the revenue/earnings projections for growth stocks fail to live up to the rosy expectations embedded in the elevated valuation multiples. Perhaps the "catalyst" will be investors' eventual recognition of the wide valuation disparity across equity markets, as has often been the case. While the timing is uncertain, we are confident that the cycle will shift in favor of value once again.

The ICE BofAML U.S. High Yield Index ((high yield market) one-year return posted a gain of 2.53%) was positive but only slightly so. After several rate hikes, the Federal Funds Target Rate now stands at 2.0%, and the yield curve has flattened but is not inverted. Lower rated high yield credits absorbed the rate hikes better than the BB- rated cohort, and thus outperformed over the twelve-month period. The broad high yield market closed the period with a yield-to-worst of 6.53% and a spread over treasuries of 371 basis points — modestly higher than one year ago.

While credit valuations are not overly exciting, the high yield market continued to demonstrate signs of good health. The trailing 12 month default rate closed just above 2% as of June 30, well below its long-term average. Revenue and profits continued to grow at a modest yet decidedly positive pace. The overall high yield market has shrunk as fund flows have been negative, particularly in high yield ETFs, and most new issuance coming to market has been for refinancing. Leverage has shown nascent signs of rising but this has not worried rating

agencies, whose upgrades have considerably outpaced downgrades. Also, despite lower inventories at primary dealers — the byproduct of a more stringent regulatory environment — liquidity across the high yield market has continued to improve.

HOTCHKIS & WILEY DIVERSIFIED VALUE FUND

The Fund's Class I shares had a total return of 9.81% for the one year ended June 30, 2018 compared to the Russell 1000® Value Index return of 6.77%.

The Fund's Class I shares outperformed the Russell 1000® Value Index over the twelve-month period. The overweight position in energy, which was the Fund's and the market's top-performing sector, helped relative performance but not as much as positive stock selection in the sector helped. The Fund's energy stocks returned +42% compared to +23% for the index's energy stocks. Positive stock selection in consumer staples and health care also helped performance, along with the overweight exposure to information technology. Stock selection in consumer discretionary, financials, and information technology were performance detractors. The largest positive contributors to relative performance were Marathon Oil, Microsoft, Hess, Hewlett Packard Enterprise, and Royal Dutch Shell; the largest detractors were AIG, Johnson Controls, Oracle, Goodyear Tire, and Cummins.

HOTCHKIS & WILEY LARGE CAP VALUE FUND

The Fund's Class I shares had a total return of 10.01% for the one year ended June 30, 2018 compared to the Russell 1000® Value Index return of 6.77%.

The Fund's Class I shares outperformed the Russell 1000® Value Index over the twelve-month period. The exposure to energy was the largest positive contributor in the period, as both the overweight allocation and positive stock selection worked in the Fund's favor. Positive stock selection in consumer staples and health care also helped, as did the overweight position in information technology — the market's best performing sector after energy. Stock selection in financials, information technology, and materials hurt performance relative to the benchmark. The largest individual contributors to relative performance were Marathon Oil, Microsoft, Hess, Hewlett Packard Enterprise, and General Electric; the largest detractors were AIG, Johnson Controls, Oracle, Vodafone, and Cummins.

HOTCHKIS & WILEY MID-CAP VALUE FUND

The Fund's Class I shares had a total return of 14.32% for the one year ended June 30, 2018 compared to the Russell Midcap® Value Index return of 7.60%.

The Fund's Class I shares outperformed the Russell Midcap® Value Index over the twelve-month period. Positive stock selection in industrials, utilities, and financials contributed to the outperformance, along with the overweight exposures to energy and information technology. Stock selection in health care and consumer discretionary detracted from performance, as did the lack of exposure to materials. The largest individual positive contributors were Whiting Petroleum, NRG Energy, Cairn Energy, Kohl's, and Navistar; the largest detractors were Office Depot, Ophir Energy, Goodyear Tire, Bed Bath & Beyond, and ARRIS International.

1

HOTCHKIS & WILEY SMALL CAP VALUE FUND

The Fund's Class I shares had a total return of 13.33% for the one year ended June 30, 2018 compared to the Russell 2000® Value Index return of 13.10%.

Over the twelve-month period, the Fund's Class I shares outperformed the Russell 2000® Value Index. The Fund was overweight energy, which was among the market's best performing sectors. The Fund's energy positions also outperformed the index's energy positions. This overweight and positive stock selection combined lead to the Fund's outperformance over the period. Positive stock selection in financials and the overweight position in industrials also helped. Stock selection in consumer discretionary and industrials detracted from performance, as did the underweight exposure to health care which was the index's top performer. The largest individual positive contributors to relative performance were Whiting Petroleum, TCF Financial, Matson, Oppenheimer Holdings, and PBF Energy; the largest detractors were Office Depot, WestJet Airlines, ARRIS International, Elah Holdings, and Tutor Perini.

HOTCHKIS & WILEY SMALL CAP DIVERSIFIED VALUE FUND

The Fund's Class I shares had a total return of 17.48% for the one year ended June 30, 2018 compared to the Russell 2000® Value Index return of 13.10%.

The Fund's Class I shares outperformed the Russell 2000® Value Index over the twelve-month period, largely due to positive stock selection. Stock selection was positive in 9 of the 11 GICS® sectors over the course of the year. It was most positive in energy, financials, and industrials. The Fund was overweight stocks with a market cap of less than $1 billion, which outperformed the rest of the market and thus helped relative performance. The underweight position and stock selection in health care detracted from performance.

HOTCHKIS & WILEY GLOBAL VALUE FUND

The Fund's Class I shares had a total return of 9.59% for the one year ended June 30, 2018 compared to the Russell Developed Index return of 12.09%.

Over the twelve-month period, the Fund's Class I shares underperformed the Russell Developed Index. The Fund's value approach was a large headwind during the year as global growth stocks outperformed global value stocks by a wide margin. Large cap growth constituents in information technology and consumer discretionary led the market, and our absence in these position hurt relative performance. The overweight position in financials also detracted from returns. The overweight position and positive stock selection in energy helped relative performance in the year, along with positive stock selection in consumer staples. The largest individual detractors to relative performance were AIG, WestJet Airlines, Ophir Energy, Office Depot, and ARRIS International; the largest positive contributors were Whiting Petroleum, Hewlett Packard Enterprise, Royal Mail, Tesco, and Marathon Oil.

HOTCHKIS & WILEY INTERNATIONAL VALUE FUND

The Fund's Class I shares had a total return of 3.50% for the one year ended June 30, 2018 compared to the Russell Developed ex-U.S. Index return of 8.29%.

The Fund's Class I shares underperformed the Russell Developed ex-U.S. Index over the twelve-month period. International growth stocks outperformed international value stocks by a large magnitude, which presented a brisk headwind for our value approach compared to our core benchmark. The underweight allocation and stock selection in materials also detracted from performance, along with stock selection in information technology and consumer discretionary. Positive stock selection in consumer staples and the overweight positions in both information technology and energy helped relative performance. The largest individual detractors to relative performance were WestJet Airlines, Ophir Energy, ARRIS International, Societe Generale, and Draegerwerk; the largest positive contributors were Tesco, Royal Mail, Embraer, WorleyParsons, and Frank's International.

HOTCHKIS & WILEY VALUE OPPORTUNITIES FUND

The Fund's Class I shares had a total return of 12.11% for the one year ended June 30, 2018 compared to the S&P 500® Index return of 14.37%.

Over the twelve-month period, the Fund's Class I shares underperformed the S&P 500® Index. The Fund's value focus hurt performance relative to the core benchmark as a handful of large growth stocks that we did not own led the market. Accordingly, our positions in consumer discretionary and information technology lagged the S&P 500® Index's performance in these sectors. The overweight exposure and stock selection in financials also detracted from performance. The overweight allocation and positive security selection in energy helped performance over the period. Positive security selection in consumer staples and health care were also meaningful positive contributors. The largest individual detractors to relative performance were AIG, WestJet Airlines, Office Depot, Oracle, and ARRIS International; the largest positive contributors were Whiting Petroleum, Hewlett Packard Enterprise, Royal Mail, GEO Group, and National Oilwell Varco.

HOTCHKIS & WILEY CAPITAL INCOME FUND

The Fund's Class I shares had a total return of 6.71% for the one year ended June 30, 2018, compared to the 50/50 blended benchmark of the S&P 500® Index and the ICE BofAML U.S. Corporate, Government and Mortgage Index return of 6.86%.

The Fund underperformed the 50/50 blended benchmark over the twelve-month period. The Fund's average equity weight over the twelve-month period was 56% versus a long-term target of 50%. This helped performance as equities outperformed both investment grade and high yield bonds.

The equity portion of the Fund underperformed the S&P 500® Index over the period. The primary reason for the underperformance was the significant outperformance of growth over value, which is not a conducive environment for our value centric process. We did not hold a handful of richly valued growth stocks in the consumer discretionary and information technology sectors that were significant drivers of the index's performance. Stock selection in financials and the underweight allocation to information technology hurt relative returns. Positive stock selection in consumer staples, industrials, and utilities helped relative performance. The overweight allocation to energy and underweight allocation to health care also helped. The largest individual detractors to relative performance were Energy XXI Gulf Coast,

2

WestJet Airlines, Office Depot, Ophir Energy, and AIG; the largest positive contributors were Whiting Petroleum, Royal Mail, Hewlett Packard Enterprise, Matson, and Kosmos Energy.

The fixed income portion of the Fund outperformed the ICE BofAML U.S. Corporate, Government and Mortgage Index as high yield bonds outperformed investment grade bonds over the period. The fixed income portion of the Fund also outperformed the ICE BofAML U.S. High Yield Index over the twelve-month period. Positive credit selection and the underweight in BB-rated credits both helped relative performance. Credit selection was strongest in basic industry, retail, and automotive. The overweight allocation to energy also helped. Credit selection in consumer goods detracted from performance.

HOTCHKIS & WILEY HIGH YIELD FUND

The Fund's Class I shares had a total return of 2.87% for the one year ended June 30, 2018 compared to the ICE BofAML BB-B U.S. High Yield Constrained Index return of 1.86%.

The Fund's Class I shares outperformed the ICE BofAML BB-B U.S. High Yield Constrained Index over the twelve-month period. The Fund's underweight to BB-rated securities and overweight to B-rated credits helped relative performance as the highest rated credits underperformed. Positive credit selection was the primary driver of outperformance, and was particularly strong in basic industry, retail, and banking. The overweight allocation to energy also helped. Credit selection and the overweight in consumer goods detracted from performance.

CONCLUSION

We appreciate your continued support of the Hotchkis & Wiley Funds, and we look forward to serving your investment needs in the future.

Sincerely,

| |

| |

| |

| |

Anna Marie Lopez

President | | George Davis

Fund Manager | | Sheldon Lieberman

Fund Manager | | Patty McKenna

Fund Manager | |

| |

| |

| |

| |

James Miles

Fund Manager | | Stan Majcher

Fund Manager | | David Green

Fund Manager | | Scott McBride

Fund Manager | |

| |

| |

| |

| |

Judd Peters

Fund Manager | | Ray Kennedy

Fund Manager | | Mark Hudoff

Fund Manager | | Patrick Meegan

Fund Manager | |

| |

| |

| |

| |

Scott Rosenthal

Fund Manager | | Richard Mak

Fund Manager | | Ryan Thomes

Fund Manager | | Noah Mayer

Fund Manager | |

3

ABOUT FUND PERFORMANCE

The Large Cap Value Fund, Mid-Cap Value Fund and High Yield Fund have five classes of shares. The Diversified Value Fund, Small Cap Value Fund, Small Cap Diversified Value Fund, Global Value Fund, International Value Fund, Value Opportunities Fund and Capital Income Fund have four classes of shares. Each share class has its own sales charge and expense structure, allowing you to invest in the way that best suits your needs. Currently, the Small Cap Diversified Value Fund, Global Value Fund and Capital Income Fund are not offering Class C shares to investors, the International Value Fund is not offering Class A or Class C shares to investors and the Funds are not offering Class T shares to investors.

Class I shares have no initial sales charge and bear no ongoing distribution and service fees under a 12b-1 plan. Class I shares are available only to eligible investors.

Class A shares incur a maximum initial sales charge of 5.25% for the Diversified Value Fund, Large Cap Value Fund, Mid-Cap Value Fund, Small Cap Value Fund, Small Cap Diversified Value Fund, Global Value Fund, International Value Fund and Value Opportunities Fund, 4.75% for the Capital Income Fund and 3.75% for the High Yield Fund and an annual distribution and service fee of 0.25%.

Class C shares are subject to an annual distribution and service fee of 1.00%. In addition, Class C shares are subject to a 1.00% contingent deferred sales charge (CDSC) if redeemed within one year after purchase. Class C shares automatically convert to Class A shares approximately eight years after purchase and will then be subject to lower annual distribution and service fees.

Class R shares have no initial sales charge or CDSC and are subject to an annual distribution and service fee of 0.50%. Class R shares are offered only by the Large Cap Value Fund and Mid-Cap Value Fund and are available only to certain retirement plans.

Class T shares incur a maximum initial sales charge of 2.50% and an annual distribution and service fee of 0.25%.

Class Z shares have no initial sales charge and bear no ongoing distribution and service fees under a 12b-1 plan. Class Z shares are offered only by the High Yield Fund and are available only to eligible investors (provided that no compensation, administrative payments, sub-transfer agency payments and service payments are required).

FUND RISKS

Mutual fund investing involves risk; loss of principal is possible. The Mid-Cap Value Fund, Small Cap Value Fund, Small Cap Diversified Value Fund, Global Value Fund, International Value Fund and Value Opportunities Fund invest in small- and medium-capitalization companies which tend to have limited liquidity and greater price volatility than large-capitalization companies. The Value Opportunities Fund is a non-diversified fund which involves greater risk than investing in diversified funds, such as business risk, significant stock price fluctuations and sector concentration. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. The Value Opportunities Fund, Capital Income Fund and High Yield Fund invest in debt securities that decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Value Opportunities Fund, Capital Income Fund and High Yield Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and

interest than higher-rated securities. The Value Opportunities Fund, Capital Income Fund and High Yield Fund may utilize derivative instruments, which derive their performance from the performance of an underlying asset, index, interest rate or currency exchange rate. Derivatives can be volatile and involve various types and degrees of risks. Depending upon the characteristics of particular derivatives, they can suddenly become illiquid. Investments by the Capital Income Fund and High Yield Fund in asset-backed and mortgage-backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. The Funds may invest in foreign securities, including developed and emerging markets, which involve greater volatility and political, economic, and currency risks.

MARKET INDEXES

The following are definitions for indexes used in the shareholder letter and the fund performance data on the following pages. These indexes are unmanaged and include the reinvestment of dividends, but do not reflect the payment of transaction costs and advisory and other fees associated with an investment in the Funds. The securities that comprise these indexes may differ substantially from the securities in the Funds' portfolios. The Funds' value disciplines may prevent or restrict investments in the benchmark indexes. It is not possible to invest directly in an index. Each index named is not the only index which may be used to characterize performance of a specific Fund and other indexes may portray different comparative performance.

S&P 500® Index, a capital weighted, unmanaged index, represents the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange.

Russell 1000® Index, an unmanaged index, measures the performance of the 1,000 largest companies in the Russell 3000® Index.

Russell 1000® Value Index measures the performance of those Russell 1000® companies with lower price-to-book ratios and lower forecasted growth values.

Russell Midcap® Index, an unmanaged index, measures the performance of the 800 smallest companies in the Russell 1000® Index.

Russell Midcap® Value Index measures the performance of those Russell Midcap® companies with lower price-to-book ratios and lower forecasted growth values.

Russell 2000® Index, an unmanaged index, measures the performance of the 2,000 smallest companies in the Russell 3000® Index.

Russell 2000® Value Index measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values.

Russell 3000® Index, an unmanaged index, is comprised of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

Russell 3000® Value Index measures the performance of those Russell 3000® companies with lower price-to-book ratios and lower forecasted growth values.

Russell Developed Index measures the performance of the investable securities in developed countries globally across all market capitalization ranges.

4

Russell Developed ex-U.S. Index measures the performance of the investable securities in developed countries globally across all market capitalization ranges, excluding U.S. securities.

ICE BofAML U.S. Corporate, Government and Mortgage Index is a broad-based measure of the total rate of return performance of the U.S. investment grade bond markets. The Index is a capitalization weighted aggregation of outstanding U.S. Treasury, agency and supranational, mortgage pass-through, and investment grade corporate bonds meeting specified selection criteria.

ICE BofAML BB-B U.S. High Yield Constrained Index contains all securities in the ICE BofAML U.S. High Yield Index rated BB+ through B- by S&P (or equivalent as rated by Moody's or Fitch), but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%.

ICE BofAML U.S. High Yield Index tracks the performance of below investment grade, but not in default, U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market, and includes issues with a credit rating of BBB or below, as rated by Moody's and S&P.

DISCLOSURE

Past performance does not guarantee future results.

The shareholder letter reflects opinions of Fund managers as of June 30, 2018. They are subject to change and any forecasts made cannot be guaranteed. The Funds might not continue to hold any securities mentioned and have no obligation to disclose purchases or sales in these securities. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings for June 30, 2018. Indexes do not incur expenses or sales loads and are not available for investment.

The Global Industry Classification Standard (GICS®) was developed by MSCI, an independent provider of global indices and benchmark-related products and services, and Standard & Poor's (S&P), an independent international financial data and investment services company. The GICS methodology has been widely accepted as an industry analysis framework for investment research, portfolio management and asset allocation. The GICS structure consists of 11 sectors, 24 industry groups, 68 industries and 157 sub-industries. Each stock that is classified will have a coding at all four of these levels.

Investing in value stocks presents the risk that value stocks may fall out of favor with investors and underperform other asset types during a given period.

Each type of asset class or investment product has a different risk-return profile, which should be considered when investing. All investments contain risk and may lose value.

Earnings growth is not representative of the Fund's future performance.

Yield-to-Worst is the lowest possible yield from owning a bond considering all potential call dates prior to maturity.

Earnings Per Share (EPS) is the portion of a company's profit allocated to each shareholder. It is calculated based on Net Income Available for Common Shareholders divided by the Basic Weighted Average Shares Outstanding.

A basis point is one hundredth of one percent (0.01%).

Market Capitalization of a company is calculated by multiplying the number of outstanding shares by the current market price of a share.

Spread is the percentage point difference between yields of various classes of bonds compared to treasury bonds.

Investment grade indicates that a municipal or corporate bond has a relatively low risk of default.

Credit Quality weights by rating were derived from the highest bond rating as determined by S&P, Moody's or Fitch. Bond ratings are grades given to bonds that indicate their credit quality as determined by private independent rating services such as S&P, Moody's and Fitch. These firms evaluate a bond issuer's financial strength, or its ability to pay a bond's principal and interest in a timely fashion. Ratings are expressed as letters ranging from 'AAA', which is the highest grade, to 'D', which is the lowest grade. In limited situations when none of the three rating agencies have issued a formal rating, the Advisor will classify the security as nonrated.

During the year ended June 30, 2018, the Value Opportunities Fund held futures contracts, which resulted in realized and unrealized gains, and purchased put options, which resulted in unrealized losses, and the Capital Income Fund and High Yield Fund held credit default swap contracts, which resulted in realized and unrealized losses to each Fund.

5

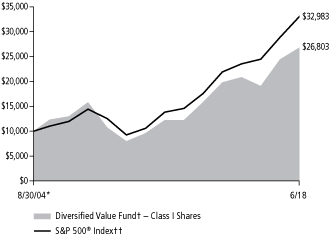

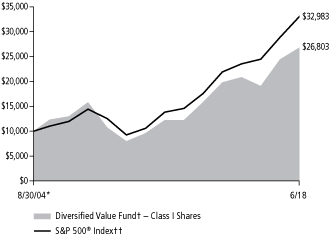

DIVERSIFIED VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2018 | | 1 Year | | 5 Years | | 10 Years | | Since

8/30/04* | |

Class I | |

Average annual total return | | | 9.81 | % | | | 11.08 | % | | | 9.59 | % | | | 7.39 | % | |

Class A | |

Average annual total return (with sales charge) | | | 3.81 | % | | | 9.62 | % | | | 8.73 | % | | | 6.71 | % | |

Average annual total return (without sales charge) | | | 9.57 | % | | | 10.82 | % | | | 9.32 | % | | | 7.12 | % | |

Class C | |

Average annual total return (with CDSC) | | | 7.77 | % | | | 9.99 | % | | | 8.53 | % | | | 6.34 | % | |

Average annual total return (without CDSC) | | | 8.77 | % | | | 9.99 | % | | | 8.53 | % | | | 6.34 | % | |

S&P 500® Index†† | |

Average annual total return | | | 14.37 | % | | | 13.42 | % | | | 10.17 | % | | | 9.01 | % | |

Russell 1000® Index†† | |

Average annual total return | | | 14.54 | % | | | 13.37 | % | | | 10.20 | % | | | 9.25 | % | |

Russell 1000® Value Index†† | |

Average annual total return | | | 6.77 | % | | | 10.34 | % | | | 8.49 | % | | | 7.94 | % | |

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charges of each specific class. Returns for Class A reflect the maximum initial sales charge of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in equity securities of companies with market capitalizations similar to the Russell 1000® Index.

†† See index descriptions in the Fund Information section.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I, Class A and Class C.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

6

LARGE CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2018 | | 1 Year | | 5 Years | | 10 Years | | Since

6/24/87* | |

Class I | |

Average annual total return | | | 10.01 | % | | | 11.57 | % | | | 9.71 | % | | | 9.22 | % | |

Class A | |

Average annual total return (with sales charge) | | | 3.96 | % | | | 10.10 | % | | | 8.84 | % | | | 8.78 | % | |

Average annual total return (without sales charge) | | | 9.72 | % | | | 11.30 | % | | | 9.43 | % | | | 8.97 | % | |

Class C | |

Average annual total return (with CDSC) | | | 7.92 | % | | | 10.46 | % | | | 8.66 | % | | | 8.15 | % | |

Average annual total return (without CDSC) | | | 8.92 | % | | | 10.46 | % | | | 8.66 | % | | | 8.15 | % | |

Class R | |

Average annual total return | | | 9.47 | % | | | 11.02 | % | | | 9.17 | % | | | 8.69 | % | |

S&P 500® Index†† | |

Average annual total return | | | 14.37 | % | | | 13.42 | % | | | 10.17 | % | | | 9.75 | % | |

Russell 1000® Index†† | |

Average annual total return | | | 14.54 | % | | | 13.37 | % | | | 10.20 | % | | | 9.84 | % | |

Russell 1000® Value Index†† | |

Average annual total return | | | 6.77 | % | | | 10.34 | % | | | 8.49 | % | | | n/a | | |

Returns shown for Class A, Class C, and Class R shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A — 10/26/01; Class C — 2/4/02; Class R — 8/28/03.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charges of each specific class. Returns for Class A reflect the maximum initial sales charge of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in equity securities of companies with market capitalizations similar to the Russell 1000® Index.

†† See index descriptions in the Fund Information section.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

MID-CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2018 | | 1 Year | | 5 Years | | 10 Years | | Since

1/2/97* | |

Class I | |

Average annual total return | | | 14.32 | % | | | 9.26 | % | | | 12.50 | % | | | 12.29 | % | |

Class A | |

Average annual total return (with sales charge) | | | 8.05 | % | | | 7.81 | % | | | 11.61 | % | | | 11.73 | % | |

Average annual total return (without sales charge) | | | 14.05 | % | | | 8.98 | % | | | 12.22 | % | | | 12.01 | % | |

Class C | |

Average annual total return (with CDSC) | | | 12.20 | % | | | 8.17 | % | | | 11.45 | % | | | 11.21 | % | |

Average annual total return (without CDSC) | | | 13.20 | % | | | 8.17 | % | | | 11.45 | % | | | 11.21 | % | |

Class R | |

Average annual total return | | | 13.74 | % | | | 8.71 | % | | | 11.94 | % | | | 11.80 | % | |

Russell Midcap® Index†† | |

Average annual total return | | | 12.33 | % | | | 12.22 | % | | | 10.23 | % | | | 10.30 | % | |

Russell Midcap® Value Index†† | |

Average annual total return | | | 7.60 | % | | | 11.27 | % | | | 10.06 | % | | | 10.49 | % | |

Returns shown for Class A, Class C, and Class R shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A, Class C — 1/2/01; Class R — 8/28/03.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charges of each specific class. Returns for Class A reflect the maximum initial sales charge of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in equity securities of companies with market capitalizations similar to the Russell Midcap® Index.

†† See index descriptions in the Fund Information section.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

8

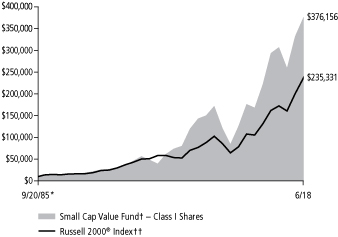

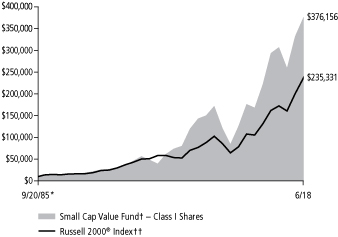

SMALL CAP VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2018 | | 1 Year | | 5 Years | | 10 Years | | Since

9/20/85* | |

Class I | |

Average annual total return | | | 13.33 | % | | | 11.17 | % | | | 11.95 | % | | | 11.70 | % | |

Class A | |

Average annual total return (with sales charge) | | | 7.10 | % | | | 9.70 | % | | | 11.06 | % | | | 11.27 | % | |

Average annual total return (without sales charge) | | | 13.05 | % | | | 10.89 | % | | | 11.67 | % | | | 11.45 | % | |

Class C | |

Average annual total return (with CDSC) | | | 11.21 | % | | | 10.06 | % | | | 10.89 | % | | | 10.65 | % | |

Average annual total return (without CDSC) | | | 12.21 | % | | | 10.06 | % | | | 10.89 | % | | | 10.65 | % | |

Russell 2000® Index†† | |

Average annual total return | | | 17.57 | % | | | 12.46 | % | | | 10.60 | % | | | 10.12 | % | |

Russell 2000® Value Index†† | |

Average annual total return | | | 13.10 | % | | | 11.18 | % | | | 9.88 | % | | | n/a | | |

Returns shown for Class A and Class C shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of each specific class. (Inception dates: Class A — 10/6/00; Class C — 2/4/02.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charges of each specific class. Returns for Class A reflect the maximum initial sales charge of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in equity securities of companies with market capitalizations similar to the Russell 2000® Index.

†† See index descriptions in the Fund Information section.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

SMALL CAP DIVERSIFIED VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2018 | | 1 Year | | Since

6/30/14* | |

Class I | |

Average annual total return | | | 17.48 | % | | | 11.00 | % | |

Class A | |

Average annual total return (with sales charge) | | | 10.98 | % | | | 9.21 | % | |

Average annual total return (without sales charge) | | | 17.18 | % | | | 10.68 | % | |

Russell 2000® Index†† | |

Average annual total return | | | 17.57 | % | | | 9.83 | % | |

Russell 2000® Value Index†† | |

Average annual total return | | | 13.10 | % | | | 8.51 | % | |

Average annual total returns with sales charge shown for Class A shares have been adjusted to reflect the applicable sales charge of the class. Returns for Class A reflect the maximum initial sales charge of 5.25%. Average annual total returns without sales charge do not reflect the sales charge. Had the sales charge been included, the Fund's returns would have been lower.

† The Fund invests primarily in equity securities of companies with market capitalizations similar to the Russell 2000® Index.

†† See index descriptions in the Fund Information section.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I and Class A.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

10

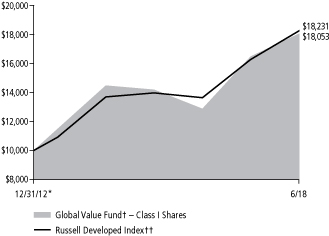

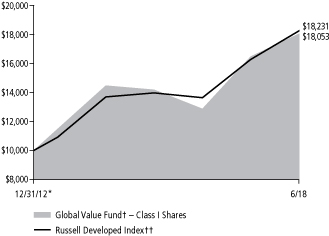

GLOBAL VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2018 | | 1 Year | | 5 Years | | Since

12/31/12* | |

Class I | |

Average annual total return | | | 9.59 | % | | | 9.46 | % | | | 11.35 | % | |

Class A | |

Average annual total return (with sales charge) | | | 3.61 | % | | | 8.03 | % | | | 10.01 | % | |

Average annual total return (without sales charge) | | | 9.36 | % | | | 9.20 | % | | | 11.09 | % | |

Russell Developed Index†† | |

Average annual total return | | | 12.09 | % | | | 10.81 | % | | | 11.54 | % | |

Returns shown for Class A shares for the periods prior to its inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of the class. (Inception date: Class A — 8/30/13.)

Average annual total returns with sales charge shown for Class A shares have been adjusted to reflect the applicable sales charge of the class. Returns for Class A reflect the maximum initial sales charge of 5.25%. Average annual total returns without sales charge do not reflect the sales charge. Had the sales charge been included, the Fund's returns would have been lower.

† The Fund invests primarily in U.S. and non-U.S. companies.

†† See index description in the Fund Information section.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

11

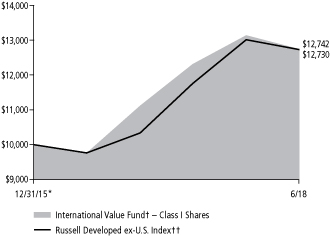

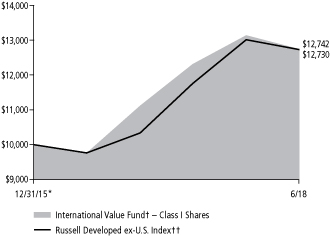

INTERNATIONAL VALUE FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2018 | | 1 Year | | Since

12/31/15* | |

Class I | |

Average annual total return | | | 3.50 | % | | | 10.18 | % | |

Russell Developed ex-U.S. Index†† | |

Average annual total return | | | 8.29 | % | | | 10.14 | % | |

† The Fund invests primarily in non-U.S. companies.

†† See index description in the Fund Information section.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

12

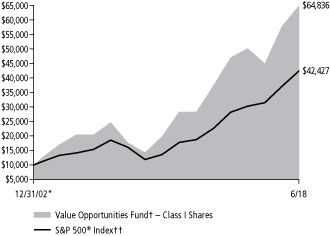

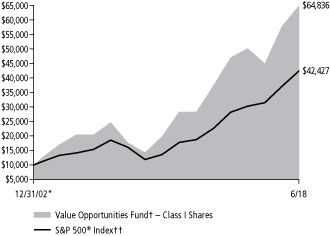

VALUE OPPORTUNITIES FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2018 | | 1 Year | | 5 Years | | 10 Years | | Since

12/31/02* | |

Class I | |

Average annual total return | | | 12.11 | % | | | 11.63 | % | | | 13.91 | % | | | 12.82 | % | |

Class A | |

Average annual total return (with sales charge) | | | 5.98 | % | | | 10.16 | % | | | 13.02 | % | | | 12.21 | % | |

Average annual total return (without sales charge) | | | 11.84 | % | | | 11.35 | % | | | 13.63 | % | | | 12.60 | % | |

Class C | |

Average annual total return (with CDSC) | | | 9.99 | % | | | 10.53 | % | | | 12.83 | % | | | 11.73 | % | |

Average annual total return (without CDSC) | | | 10.99 | % | | | 10.53 | % | | | 12.83 | % | | | 11.73 | % | |

S&P 500® Index†† | |

Average annual total return | | | 14.37 | % | | | 13.42 | % | | | 10.17 | % | | | 9.77 | % | |

Returns shown for Class C shares for the periods prior to its inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of the class. (Inception date: Class C — 8/28/03.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charges of each specific class. Returns for Class A reflect the maximum initial sales charge of 5.25%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charge. Had the sales charge or CDSC been included, the Fund's returns would have been lower.

† The Fund invests primarily in securities of companies with strong capital appreciation potential.

†† See index description in the Fund Information section.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I and Class A.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13

CAPITAL INCOME FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2018 | | 1 Year | | 5 Years | | Since

12/31/10* | |

Class I | |

Average annual total return | | | 6.71 | % | | | 8.64 | % | | | 10.02 | % | |

Class A | |

Average annual total return (with sales charge) | | | 1.28 | % | | | 7.30 | % | | | 9.43 | % | |

Average annual total return (without sales charge) | | | 6.34 | % | | | 8.36 | % | | | 10.14 | % | |

S&P 500® Index†† | |

Average annual total return | | | 14.37 | % | | | 13.42 | % | | | 13.18 | % | |

ICE BofAML U.S. Corporate, Government and Mortgage Index†† | |

Average annual total return | | | –0.40 | % | | | 2.34 | % | | | 2.81 | % | |

Returns shown for Class A shares for the periods prior to its inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of the class. (Inception date: Class A — 2/28/11.)

Average annual total returns with sales charge shown for Class A shares have been adjusted to reflect the applicable sales charge of the class. Returns for Class A reflect the maximum initial sales charge of 4.75%. Average annual total returns without sales charge do not reflect the sales charge. Had the sales charge been included, the Fund's returns would have been lower.

† The Fund invests primarily in dividend-paying equities and high yield fixed income securities.

†† See index descriptions in the Fund Information section.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

14

HIGH YIELD FUND

Total Return Based on a $10,000 Investment

Comparative Results†††

For Periods ended June 30, 2018 | | 1 Year | | 5 Years | | Since

3/31/09* | |

Class I | |

Average annual total return | | | 2.87 | % | | | 5.17 | % | | | 10.52 | % | |

Class A | |

Average annual total return (with sales charge) | | | –1.13 | % | | | 4.12 | % | | | 9.72 | % | |

Average annual total return (without sales charge) | | | 2.68 | % | | | 4.92 | % | | | 10.17 | % | |

Class C | |

Average annual total return (with CDSC) | | | 0.76 | % | | | 4.13 | % | | | 9.41 | % | |

Average annual total return (without CDSC) | | | 1.76 | % | | | 4.13 | % | | | 9.41 | % | |

Class Z | |

Average annual total return | | | 2.93 | % | | | 5.27 | % | | | 10.63 | % | |

ICE BofAML BB-B U.S. High Yield Constrained Index†† | |

Average annual total return | | | 1.85 | % | | | 5.33 | % | | | 10.30 | % | |

Returns shown for Class A, Class C and Class Z shares for the periods prior to their inception are derived from the historical performance of Class I shares of the Fund during such periods and have been adjusted to reflect the higher total annual operating expenses of Class A and Class C shares and lower total annual operating expenses of Class Z shares. (Inception dates: Class A — 5/29/09; Class C — 12/31/12; Class Z — 3/29/18.)

Average annual total returns with sales charge and CDSC shown for Class A and Class C shares, respectively, have been adjusted to reflect the applicable sales charges of each specific class. Returns for Class A reflect the maximum initial sales charge of 3.75%. Class C shares have no adjustment for sales charges, but redemptions within one year of purchase may be subject to a CDSC of 1%. Average annual total returns without sales charge or CDSC do not reflect the sales charges. Had the sales charge or CDSC been included, the Fund's returns would have been lower. Effective August 29, 2014, the Fund imposes a 2.00% redemption fee on shares that are redeemed or exchanged if they have been held for 90 days or less. Returns shown do not reflect the imposition of the redemption fee. Had the redemption fee been included, the Fund's returns would have been lower.

† The Fund invests primarily in high yield securities.

†† See index description in the Fund Information section.

††† Fund returns during certain periods shown reflect a fee waiver and/or expense reimbursement. Without waiver/reimbursement, returns would have been lower. Returns shown include the reinvestment of all dividends.

* Commencement of Class I.

Past performance is not indicative of future results and the graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

15

Schedule of Investments — June 30, 2018

Hotchkis & Wiley Diversified Value Fund

Largest Equity Holdings | | Percent of

net assets | |

American International Group, Inc. | | | 4.93 | % | |

Wells Fargo & Company | | | 3.98 | % | |

Citigroup, Inc. | | | 3.85 | % | |

Hewlett Packard Enterprise Company | | | 3.83 | % | |

Apache Corp. | | | 3.49 | % | |

Oracle Corp. | | | 3.47 | % | |

Marathon Oil Corp. | | | 3.02 | % | |

Microsoft Corp. | | | 3.01 | % | |

Hess Corp. | | | 2.88 | % | |

Discovery, Inc. - Class C | | | 2.58 | % | |

COMMON

STOCKS — 99.60% | | Shares

Held | | Value | |

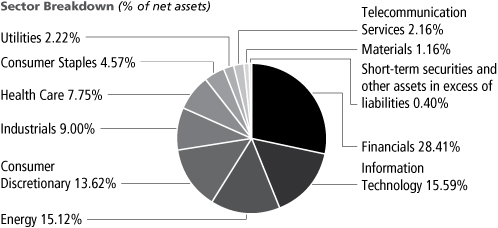

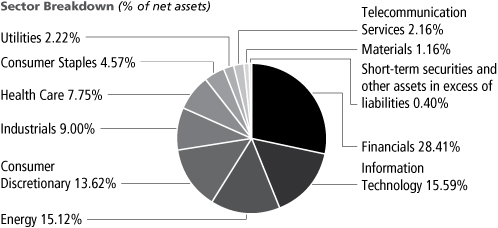

CONSUMER DISCRETIONARY — 13.62%

Auto Components — 2.76% | |

Adient PLC | | | 19,174 | | | $ | 943,169 | | |

The Goodyear Tire & Rubber Company | | | 44,500 | | | | 1,036,405 | | |

Magna International, Inc. | | | 17,100 | | | | 994,023 | | |

| | | | 2,973,597 | | |

Automobiles — 3.13% | |

General Motors Company | | | 65,400 | | | | 2,576,760 | | |

Harley-Davidson, Inc. | | | 19,000 | | | | 799,520 | | |

| | | | 3,376,280 | | |

Media — 7.32% | |

CBS Corp. | | | 24,900 | | | | 1,399,878 | | |

Comcast Corp. | | | 68,400 | | | | 2,244,204 | | |

Discovery, Inc. — Class A (a) (l) | | | 15,500 | | | | 426,250 | | |

Discovery, Inc. — Class C (a) | | | 109,000 | | | | 2,779,500 | | |

The Interpublic Group of Companies, Inc. | | | 22,500 | | | | 527,400 | | |

Omnicom Group, Inc. | | | 6,600 | | | | 503,382 | | |

| | | | 7,880,614 | | |

Specialty Retail — 0.41% | |

Bed Bath & Beyond, Inc. | | | 22,300 | | | | 444,328 | | |

TOTAL CONSUMER DISCRETIONARY | | | 14,674,819 | | |

CONSUMER STAPLES — 4.57%

Beverages — 1.60% | |

PepsiCo, Inc. | | | 15,800 | | | | 1,720,146 | | |

Food Products — 1.94% | |

Kellogg Company | | | 8,300 | | | | 579,921 | | |

Mondelez International, Inc. | | | 36,900 | | | | 1,512,900 | | |

| | | | 2,092,821 | | |

Personal Products — 1.03% | |

Unilever PLC — ADR | | | 20,000 | | | | 1,105,600 | | |

TOTAL CONSUMER STAPLES | | | 4,918,567 | | |

| | Shares

Held | | Value | |

ENERGY — 15.12%

Energy Equipment & Services — 1.37% | |

National Oilwell Varco, Inc. | | | 34,100 | | | $ | 1,479,940 | | |

Oil, Gas & Consumable Fuels — 13.75% | |

Andeavor | | | 6,000 | | | | 787,080 | | |

Apache Corp. | | | 80,500 | | | | 3,763,375 | | |

Hess Corp. | | | 46,400 | | | | 3,103,696 | | |

Kosmos Energy Ltd. (a) | | | 75,900 | | | | 627,693 | | |

Marathon Oil Corp. | | | 155,700 | | | | 3,247,902 | | |

Murphy Oil Corp. | | | 47,400 | | | | 1,600,698 | | |

Royal Dutch Shell PLC — ADR | | | 24,262 | | | | 1,679,658 | | |

| | | | 14,810,102 | | |

TOTAL ENERGY | | | 16,290,042 | | |

FINANCIALS — 28.41%

Banks — 13.33% | |

Bank of America Corp. | | | 84,622 | | | | 2,385,494 | | |

CIT Group, Inc. | | | 10,500 | | | | 529,305 | | |

Citigroup, Inc. | | | 61,974 | | | | 4,147,300 | | |

Citizens Financial Group, Inc. | | | 31,900 | | | | 1,240,910 | | |

JPMorgan Chase & Company | | | 17,000 | | | | 1,771,400 | | |

Wells Fargo & Company | | | 77,334 | | | | 4,287,397 | | |

| | | | 14,361,806 | | |

Capital Markets — 3.36% | |

The Bank of New York Mellon Corp. | | | 9,800 | | | | 528,514 | | |

The Goldman Sachs Group, Inc. | | | 7,300 | | | | 1,610,161 | | |

Morgan Stanley | | | 10,000 | | | | 474,000 | | |

State Street Corp. | | | 10,800 | | | | 1,005,372 | | |

| | | | 3,618,047 | | |

Consumer Finance — 4.41% | |

Ally Financial, Inc. | | | 30,100 | | | | 790,727 | | |

Capital One Financial Corp. | | | 25,500 | | | | 2,343,450 | | |

Discover Financial Services | | | 23,000 | | | | 1,619,430 | | |

| | | | 4,753,607 | | |

The accompanying notes are an integral part of these financial statements.

16

Schedule of Investments — June 30, 2018

Hotchkis & Wiley Diversified Value Fund

| | Shares

Held | | Value | |

Diversified Financial Services — 1.05% | |

AXA Equitable Holdings, Inc. (a) | | | 54,800 | | | $ | 1,129,428 | | |

Insurance — 6.26% | |

American International Group, Inc. | | | 100,200 | | | | 5,312,604 | | |

The Travelers Companies, Inc. | | | 11,700 | | | | 1,431,378 | | |

| | | | 6,743,982 | | |

TOTAL FINANCIALS | | | 30,606,870 | | |

HEALTH CARE — 7.75%

Biotechnology — 0.78% | |

Biogen, Inc. (a) | | | 2,900 | | | | 841,696 | | |

Health Care Equipment & Supplies — 2.54% | |

Koninklijke Philips NV | | | 14,066 | | | | 594,570 | | |

Medtronic PLC | | | 18,882 | | | | 1,616,488 | | |

Zimmer Biomet Holdings, Inc. | | | 4,700 | | | | 523,768 | | |

| | | | 2,734,826 | | |

Health Care Providers & Services — 1.53% | |

Anthem, Inc. | | | 6,900 | | | | 1,642,407 | | |

Pharmaceuticals — 2.90% | |

GlaxoSmithKline PLC — ADR | | | 42,500 | | | | 1,713,175 | | |

Sanofi — ADR | | | 35,300 | | | | 1,412,353 | | |

| | | | 3,125,528 | | |

TOTAL HEALTH CARE | | | 8,344,457 | | |

INDUSTRIALS — 9.00%

Aerospace & Defense — 0.38% | |

Embraer SA — ADR | | | 16,400 | | | | 408,360 | | |

Building Products — 2.24% | |

Johnson Controls International PLC | | | 72,147 | | | | 2,413,317 | | |

Electrical Equipment — 0.73% | |

Eaton Corp. PLC | | | 10,600 | | | | 792,244 | | |

Industrial Conglomerates — 1.84% | |

General Electric Company | | | 145,700 | | | | 1,982,977 | | |

Machinery — 3.81% | |

| CNH Industrial NV | | | 171,400 | | | | 1,804,842 | | |

Cummins, Inc. | | | 13,200 | | | | 1,755,600 | | |

PACCAR, Inc. | | | 8,700 | | | | 539,052 | | |

| | | | 4,099,494 | | |

TOTAL INDUSTRIALS | | | 9,696,392 | | |

INFORMATION TECHNOLOGY — 15.59%

Communications Equipment — 2.17% | |

Telefonaktiebolaget LM Ericsson — ADR | | | 305,200 | | | | 2,340,884 | | |

Electronic Equipment, Instruments & Components — 2.60% | |

Corning, Inc. | | | 83,900 | | | | 2,308,089 | | |

TE Connectivity Ltd. | | | 5,500 | | | | 495,330 | | |

| | | | 2,803,419 | | |

| | Shares

Held | | Value | |

IT Services — 0.51% | |

Teradata Corp. (a) | | | 13,500 | | | $ | 542,025 | | |

Software — 6.48% | |

Microsoft Corp. | | | 32,900 | | | | 3,244,269 | | |

Oracle Corp. | | | 84,800 | | | | 3,736,288 | | |

| | | | 6,980,557 | | |

Technology Hardware, Storage & Peripherals — 3.83% | |

Hewlett Packard Enterprise Company | | | 282,600 | | | | 4,128,786 | | |

TOTAL INFORMATION TECHNOLOGY | | | 16,795,671 | | |

MATERIALS — 1.16%

Containers & Packaging — 1.16% | |

International Paper Company | | | 23,900 | | | | 1,244,712 | | |

TOTAL MATERIALS | | | 1,244,712 | | |

TELECOMMUNICATION SERVICES — 2.16%

Wireless Telecommunication Services — 2.16% | |

Vodafone Group PLC — ADR | | | 95,663 | | | | 2,325,568 | | |

TOTAL TELECOMMUNICATION SERVICES | | | 2,325,568 | | |

UTILITIES — 2.22%

Electric Utilities — 2.22% | |

PPL Corp. | | | 41,400 | | | | 1,181,970 | | |

The Southern Company | | | 26,100 | | | | 1,208,691 | | |

TOTAL UTILITIES | | | 2,390,661 | | |

Total common stocks

(Cost $119,726,468) | | | | | 107,287,759 | | |

Total long-term investments

(Cost $119,726,468) | | | | | 107,287,759 | | |

COLLATERAL FOR SECURITIES ON LOAN — 0.39% | |

Money Market Funds — 0.39% | |

Invesco Government & Agency Portfolio —

Institutional Class, 1.81%^ | | | 416,970 | | | | 416,970 | | |

Total collateral for securities on loan

(Cost $416,970) | | | 416,970 | | |

Total investments — 99.99%

(Cost $120,143,438) | | | | | 107,704,729 | | |

Other assets in excess of liabilities — 0.01% | | | | | 11,828 | | |

Net assets — 100.00% | | $ | 107,716,557 | | |

(a) — Non-income producing security.

(l) — All or a portion of this security is on a loan. The total market value of securities on loan was $408,688. The remaining contractual maturity of all of the securities lending transactions is overnight and continuous.

ADR — American Depositary Receipt

^ — Rate shown is the 7-day yield as of June 30, 2018.

The accompanying notes are an integral part of these financial statements.

17

Schedule of Investments — June 30, 2018

Hotchkis & Wiley Large Cap Value Fund

Largest Equity Holdings | | Percent of

net assets | |

American International Group, Inc. | | | 4.83 | % | |

Wells Fargo & Company | | | 4.26 | % | |

Citigroup, Inc. | | | 4.07 | % | |

Hewlett Packard Enterprise Company | | | 3.77 | % | |

Oracle Corp. | | | 3.65 | % | |

Apache Corp. | | | 3.26 | % | |

Microsoft Corp. | | | 2.97 | % | |

Marathon Oil Corp. | | | 2.92 | % | |

Hess Corp. | | | 2.74 | % | |

Discovery, Inc. - Class C | | | 2.62 | % | |

COMMON

STOCKS — 98.21% | | Shares

Held | | Value | |

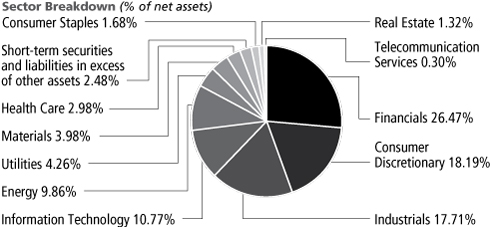

CONSUMER DISCRETIONARY — 12.28%

Auto Components — 2.17% | |

Adient PLC | | | 88,191 | | | $ | 4,338,115 | | |

Magna International, Inc. | | | 86,100 | | | | 5,004,993 | | |

| | | | 9,343,108 | | |

Automobiles — 3.13% | |

General Motors Company | | | 258,300 | | | | 10,177,020 | | |

Harley-Davidson, Inc. | | | 77,300 | | | | 3,252,784 | | |

| | | | 13,429,804 | | |

Media — 6.43% | |

CBS Corp. | | | 102,500 | | | | 5,762,550 | | |

Comcast Corp. | | | 271,300 | | | | 8,901,353 | | |

Discovery, Inc. — Class A (a) (l) | | | 61,500 | | | | 1,691,250 | | |

Discovery, Inc. — Class C (a) | | | 440,800 | | | | 11,240,400 | | |

| | | | 27,595,553 | | |

Specialty Retail — 0.55% | |

Bed Bath & Beyond, Inc. | | | 118,300 | | | | 2,357,128 | | |

TOTAL CONSUMER DISCRETIONARY | | | 52,725,593 | | |

CONSUMER STAPLES — 4.14%

Beverages — 1.69% | |

PepsiCo, Inc. | | | 66,400 | | | | 7,228,968 | | |

Food Products — 1.44% | |

Mondelez International, Inc. | | | 150,900 | | | | 6,186,900 | | |

Personal Products — 1.01% | |

Unilever PLC — ADR | | | 78,700 | | | | 4,350,536 | | |

TOTAL CONSUMER STAPLES | | | 17,766,404 | | |

ENERGY — 15.06%

Energy Equipment & Services — 1.32% | |

National Oilwell Varco, Inc. | | | 130,600 | | | | 5,668,040 | | |

| | Shares

Held | | Value | |

Oil, Gas & Consumable Fuels — 13.74% | |

Andeavor | | | 23,600 | | | $ | 3,095,848 | | |

Apache Corp. | | | 299,400 | | | | 13,996,950 | | |

Hess Corp. | | | 176,000 | | | | 11,772,640 | | |

Marathon Oil Corp. | | | 601,800 | | | | 12,553,548 | | |

Murphy Oil Corp. | | | 290,900 | | | | 9,823,693 | | |

Royal Dutch Shell PLC — ADR | | | 111,372 | | | | 7,710,284 | | |

| | | | 58,952,963 | | |

TOTAL ENERGY | | | 64,621,003 | | |

FINANCIALS — 28.02%

Banks — 13.53% | |

Bank of America Corp. | | | 333,749 | | | | 9,408,384 | | |

Citigroup, Inc. | | | 261,188 | | | | 17,478,701 | | |

Citizens Financial Group, Inc. | | | 104,000 | | | | 4,045,600 | | |

JPMorgan Chase & Company | | | 85,100 | | | | 8,867,420 | | |

Wells Fargo & Company | | | 329,563 | | | | 18,270,973 | | |

| | | | 58,071,078 | | |

Capital Markets — 3.15% | |

The Goldman Sachs Group, Inc. | | | 38,300 | | | | 8,447,831 | | |

State Street Corp. | | | 54,700 | | | | 5,092,023 | | |

| | | | 13,539,854 | | |

Consumer Finance — 4.10% | |

Capital One Financial Corp. | | | 111,900 | | | | 10,283,610 | | |

Discover Financial Services | | | 103,900 | | | | 7,315,599 | | |

| | | | 17,599,209 | | |

Diversified Financial Services — 0.97% | |

AXA Equitable Holdings, Inc. (a) | | | 201,700 | | | | 4,157,037 | | |

Insurance — 6.27% | |

American International Group, Inc. | | | 391,200 | | | | 20,741,424 | | |

The Travelers Companies, Inc. | | | 50,300 | | | | 6,153,702 | | |

| | | | 26,895,126 | | |

TOTAL FINANCIALS | | | 120,262,304 | | |

The accompanying notes are an integral part of these financial statements.

18

Schedule of Investments — June 30, 2018

Hotchkis & Wiley Large Cap Value Fund

| | Shares

Held | | Value | |

HEALTH CARE — 7.79%

Health Care Equipment & Supplies — 3.26% | |

Koninklijke Philips NV | | | 80,666 | | | $ | 3,409,752 | | |

Medtronic PLC | | | 77,900 | | | | 6,669,019 | | |

Zimmer Biomet Holdings, Inc. | | | 35,100 | | | | 3,911,544 | | |

| | | | 13,990,315 | | |

Health Care Providers & Services — 1.57% | |

Anthem, Inc. | | | 28,300 | | | | 6,736,249 | | |

Pharmaceuticals — 2.96% | |

GlaxoSmithKline PLC — ADR | | | 180,200 | | | | 7,263,862 | | |

Sanofi — ADR | | | 136,100 | | | | 5,445,361 | | |

| | | | 12,709,223 | | |

TOTAL HEALTH CARE | | | 33,435,787 | | |

INDUSTRIALS — 8.71%

Aerospace & Defense — 0.51% | |

Embraer SA — ADR | | | 88,500 | | | | 2,203,650 | | |

Building Products — 2.43% | |

Johnson Controls International PLC | | | 311,319 | | | | 10,413,620 | | |

Industrial Conglomerates — 1.72% | |

General Electric Company | | | 543,000 | | | | 7,390,230 | | |

Machinery — 4.05% | |

| CNH Industrial NV (l) | | | 676,900 | | | | 7,127,757 | | |

Cummins, Inc. | | | 61,200 | | | | 8,139,600 | | |

PACCAR, Inc. | | | 34,300 | | | | 2,125,228 | | |

| | | | 17,392,585 | | |

TOTAL INDUSTRIALS | | | 37,400,085 | | |

INFORMATION TECHNOLOGY — 16.53%

Communications Equipment — 3.99% | |

ARRIS International PLC (a) | | | 265,900 | | | | 6,499,925 | | |

Telefonaktiebolaget LM Ericsson — ADR | | | 1,384,900 | | | | 10,622,183 | | |

| | | | 17,122,108 | | |

Electronic Equipment, Instruments & Components — 2.15% | |

Corning, Inc. | | | 335,400 | | | | 9,226,854 | | |

Software — 6.62% | |

Microsoft Corp. | | | 129,200 | | | | 12,740,412 | | |

Oracle Corp. | | | 356,000 | | | | 15,685,360 | | |

| | | | 28,425,772 | | |

Technology Hardware, Storage & Peripherals — 3.77% | |

Hewlett Packard Enterprise Company | | | 1,106,400 | | | | 16,164,504 | | |

TOTAL INFORMATION TECHNOLOGY | | | 70,939,238 | | |

| | Shares

Held | | Value | |

MATERIALS — 1.58%

Containers & Packaging — 1.58% | |

International Paper Company | | | 130,500 | | | $ | 6,796,440 | | |

TOTAL MATERIALS | | | 6,796,440 | | |

TELECOMMUNICATION SERVICES — 2.49%

Wireless Telecommunication Services — 2.49% | |

Vodafone Group PLC — ADR | | | 439,544 | | | | 10,685,315 | | |

TOTAL TELECOMMUNICATION SERVICES | | | 10,685,315 | | |

UTILITIES — 1.61%

Electric Utilities — 1.61% | |

PPL Corp. | | | 160,400 | | | | 4,579,420 | | |

The Southern Company | | | 50,700 | | | | 2,347,917 | | |

TOTAL UTILITIES | | | 6,927,337 | | |

Total common stocks

(Cost $449,028,457) | | | | | 421,559,506 | | |

Total long-term investments

(Cost $449,028,457) | | | | | 421,559,506 | | |

COLLATERAL FOR SECURITIES ON LOAN — 0.39% | |

Money Market Funds — 0.39% | |

Invesco Government & Agency Portfolio —

Institutional Class, 1.81%^ | | | 1,663,360 | | | | 1,663,360 | | |

Total collateral for securities on loan

(Cost $1,663,360) | | | 1,663,360 | | |

SHORT-TERM

INVESTMENTS — 1.64% | | Principal

Amount | | | |

Time Deposits — 1.64% | |

Banco Santander SA,

1.27%, 07/02/2018* | | $ | 7,045,829 | | | | 7,045,829 | | |

Total short-term investments

(Cost $7,045,829) | | | 7,045,829 | | |

Total investments — 100.24%

(Cost $457,737,646) | | | | | 430,268,695 | | |

Liabilities in excess of other assets — (0.24)% | | | | | (1,014,433 | ) | |

Net assets — 100.00% | | $ | 429,254,262 | | |

(a) — Non-income producing security.

(l) — All or a portion of this security is on loan. The total market value of securities on loan was $1,628,643. The remaining contractual maturity of all of the securities lending transactions is overnight and continuous.

ADR — American Depositary Receipt

^ — Rate shown is the 7-day yield as of June 30, 2018.

* — Invested through a cash management account administered by Brown Brothers Harriman & Co.

The accompanying notes are an integral part of these financial statements.

19

Schedule of Investments — June 30, 2018

Hotchkis & Wiley Mid-Cap Value Fund

Largest Equity Holdings | | Percent of

net assets | |

Popular, Inc. | | | 5.13 | % | |

Whiting Petroleum Corp. | | | 5.08 | % | |

Hewlett Packard Enterprise Company | | | 4.24 | % | |

ARRIS International PLC | | | 4.05 | % | |

Telefonaktiebolaget LM Ericsson | | | 3.47 | % | |

Cairn Energy PLC | | | 3.37 | % | |

Kosmos Energy Ltd. | | | 3.29 | % | |

Discovery, Inc. - Class C | | | 3.12 | % | |

CIT Group, Inc. | | | 3.06 | % | |

Citizens Financial Group, Inc. | | | 2.91 | % | |

COMMON

STOCKS — 98.62% | | Shares

Held | | Value | |

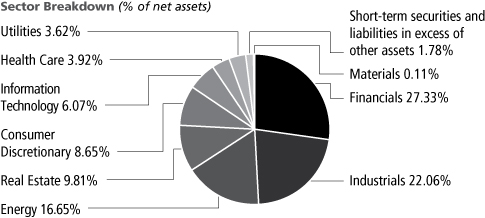

CONSUMER DISCRETIONARY — 17.08%

Auto Components — 4.83% | |

Adient PLC | | | 302,800 | | | $ | 14,894,732 | | |

The Goodyear Tire & Rubber Company | | | 2,164,700 | | | | 50,415,863 | | |

Magna International, Inc. | | | 442,200 | | | | 25,705,086 | | |

| | | | 91,015,681 | | |

Household Durables — 2.42% | |

TRI Pointe Group, Inc. (a) | | | 2,795,700 | | | | 45,737,652 | | |

Media — 5.22% | |

CBS Corp. | | | 187,300 | | | | 10,530,006 | | |

Discovery, Inc. — Class A (a) (l) | | | 403,700 | | | | 11,101,750 | | |

Discovery, Inc. — Class C (a) | | | 2,309,400 | | | | 58,889,700 | | |

News Corp. | | | 1,150,500 | | | | 17,832,750 | | |

| | | | 98,354,206 | | |

Multiline Retail — 0.48% | |

Kohl's Corp. | | | 124,100 | | | | 9,046,890 | | |

Specialty Retail — 4.13% | |

Bed Bath & Beyond, Inc. | | | 1,750,800 | | | | 34,884,690 | | |

Office Depot, Inc. | | | 16,862,500 | | | | 42,999,375 | | |

| | | | 77,884,065 | | |

TOTAL CONSUMER DISCRETIONARY | | | 322,038,494 | | |

CONSUMER STAPLES — 1.56%

Food Products — 1.56% | |

Bunge Ltd. | | | 421,900 | | | | 29,410,649 | | |

TOTAL CONSUMER STAPLES | | | 29,410,649 | | |

ENERGY — 23.37%

Energy Equipment & Services — 6.87% | |

C&J Energy Services, Inc. (a) | | | 1,382,400 | | | | 32,624,640 | | |

Frank's International NV (a) | | | 1,463,800 | | | | 11,417,640 | | |

McDermott International, Inc. (a) | | | 761,033 | | | | 14,954,305 | | |

Superior Energy Services, Inc. (a) | | | 3,232,600 | | | | 31,485,524 | | |

Weatherford International PLC (a) (l) | | | 11,876,300 | | | | 39,073,027 | | |

| | | | 129,555,136 | | |

| | Shares

Held | | Value | |

Oil, Gas & Consumable Fuels — 16.50% | |

Apache Corp. | | | 230,400 | | | $ | 10,771,200 | | |

Cairn Energy PLC (a) (v) | | | 19,353,700 | | | | 63,549,008 | | |

Hess Corp. | | | 77,300 | | | | 5,170,597 | | |

Kosmos Energy Ltd. (a) | | | 7,503,400 | | | | 62,053,118 | | |

Marathon Oil Corp. | | | 222,200 | | | | 4,635,092 | | |

Murphy Oil Corp. | | | 595,800 | | | | 20,120,166 | | |

Ophir Energy PLC (a) (o) | | | 56,578,900 | | | | 37,708,315 | | |

Sanchez Energy Corp. (a) (l) | | | 2,483,700 | | | | 11,226,324 | | |

Whiting Petroleum Corp. (a) | | | 1,817,425 | | | | 95,814,646 | | |

| | | | 311,048,466 | | |

TOTAL ENERGY | | | 440,603,602 | | |

FINANCIALS — 21.18%

Banks — 11.32% | |

CIT Group, Inc. | | | 1,144,224 | | | | 57,680,332 | | |

Citizens Financial Group, Inc. | | | 1,410,300 | | | | 54,860,670 | | |

Fifth Third Bancorp | | | 142,700 | | | | 4,095,490 | | |

Popular, Inc. | | | 2,140,500 | | | | 96,772,005 | | |

| | | | 213,408,497 | | |

Consumer Finance — 5.64% | |

Ally Financial, Inc. | | | 977,700 | | | | 25,684,179 | | |

Discover Financial Services | | | 315,300 | | | | 22,200,273 | | |

Santander Consumer USA Holdings, Inc. | | | 1,092,200 | | | | 20,850,098 | | |

SLM Corp. (a) | | | 1,243,600 | | | | 14,239,220 | | |

Synchrony Financial | | | 702,000 | | | | 23,432,760 | | |

| | | | 106,406,530 | | |

Diversified Financial Services — 1.04% | |

AXA Equitable Holdings, Inc. (a) | | | 951,900 | | | | 19,618,659 | | |

The accompanying notes are an integral part of these financial statements.

20

Schedule of Investments — June 30, 2018

Hotchkis & Wiley Mid-Cap Value Fund

| | Shares

Held | | Value | |

Insurance — 3.18% | |

Alleghany Corp. | | | 16,800 | | | $ | 9,659,496 | | |

CNO Financial Group, Inc. | | | 1,863,600 | | | | 35,482,944 | | |

Enstar Group Ltd. (a) | | | 71,100 | | | | 14,739,030 | | |

| | | | 59,881,470 | | |

TOTAL FINANCIALS | | | 399,315,156 | | |

HEALTH CARE — 2.23%

Health Care Equipment & Supplies — 0.48% | |

Zimmer Biomet Holdings, Inc. | | | 80,600 | | | | 8,982,064 | | |

Health Care Providers & Services — 0.21% | |

LifePoint Health, Inc. (a) | | | 82,100 | | | | 4,006,480 | | |

Pharmaceuticals — 1.54% | |

Mallinckrodt PLC (a) (l) | | | 1,555,400 | | | | 29,023,764 | | |

TOTAL HEALTH CARE | | | 42,012,308 | | |

INDUSTRIALS — 10.66%

Aerospace & Defense — 1.58% | |

Embraer SA — ADR | | | 1,196,800 | | | | 29,800,320 | | |

Air Freight & Logistics — 1.42% | |

Royal Mail PLC (v) | | | 4,023,100 | | | | 26,765,349 | | |

Construction & Engineering — 1.88% | |

Fluor Corp. | | | 208,300 | | | | 10,160,874 | | |

KBR, Inc. | | | 1,408,800 | | | | 25,245,696 | | |

| | | | 35,406,570 | | |

Machinery — 3.78% | |

Allison Transmission Holdings, Inc. | | | 231,500 | | | | 9,373,435 | | |

Cummins, Inc. | | | 134,000 | | | | 17,822,000 | | |

Navistar International Corp. (a) | | | 1,082,200 | | | | 44,067,184 | | |

| | | | 71,262,619 | | |

Road & Rail — 2.00% | |

AMERCO | | | 79,600 | | | | 28,349,540 | | |

Avis Budget Group, Inc. (a) | | | 287,400 | | | | 9,340,500 | | |

| | | | 37,690,040 | | |

TOTAL INDUSTRIALS | | | 200,924,898 | | |

INFORMATION TECHNOLOGY — 16.24%

Communications Equipment — 7.52% | |

ARRIS International PLC (a) | | | 3,118,600 | | | | 76,234,177 | | |

Telefonaktiebolaget LM Ericsson — ADR | | | 8,537,900 | | | | 65,485,693 | | |

| | | | 141,719,870 | | |

Electronic Equipment, Instruments & Components — 4.01% | |

Avnet, Inc. | | | 983,000 | | | | 42,160,870 | | |

Corning, Inc. | | | 1,215,500 | | | | 33,438,405 | | |

| | | | 75,599,275 | | |

IT Services — 0.47% | |

Teradata Corp. (a) | | | 222,300 | | | | 8,925,345 | | |

Technology Hardware, Storage & Peripherals — 4.24% | |

Hewlett Packard Enterprise Company | | | 5,465,100 | | | | 79,845,111 | | |

TOTAL INFORMATION TECHNOLOGY | | | 306,089,601 | | |

| | Shares

Held | | Value | |

REAL ESTATE — 3.34%

Equity Real Estate Investment Trusts — 3.34% | |

Colony Capital, Inc. | | | 1,671,900 | | | $ | 10,432,656 | | |

The GEO Group, Inc. | | | 1,910,050 | | | | 52,602,777 | | |

TOTAL REAL ESTATE | | | 63,035,433 | | |

UTILITIES — 2.96%

Electric Utilities — 0.70% | |

PPL Corp. | | | 463,100 | | | | 13,221,505 | | |

Independent Power and Renewable Electricity

Producers — 2.26% | |

NRG Energy, Inc. | | | 1,385,500 | | | | 42,534,850 | | |

TOTAL UTILITIES | | | 55,756,355 | | |

Total common stocks

(Cost $1,706,355,486) | | | | | 1,859,186,496 | | |

Total long-term investments

(Cost $1,706,355,486) | | | | | 1,859,186,496 | | |

COLLATERAL FOR SECURITIES ON LOAN — 1.55% | |

Money Market Funds — 1.55% | |

Invesco Government & Agency Portfolio —

Institutional Class, 1.81%^ | | | 29,260,359 | | | | 29,260,359 | | |

Total collateral for securities on loan

(Cost $29,260,359) | | | 29,260,359 | | |

SHORT-TERM

INVESTMENTS — 1.95% | | Principal

Amount | | | |

Time Deposits — 1.95% | |

Banco Santander SA,

1.27%, 07/02/2018* | | $ | 9,146,249 | | | | 9,146,249 | | |

Barclays PLC, 1.27%, 07/02/2018* | | | 27,551,600 | | | | 27,551,600 | | |

Brown Brothers Harriman & Co.,

0.23%, 07/02/2018* | | GBP | 68 | | | | 89 | | |

Total short-term investments

(Cost $36,697,938) | | | 36,697,938 | | |

Total investments — 102.12%

(Cost $1,772,313,783) | | | | | 1,925,144,793 | | |

Liabilities in excess of other assets — (2.12)% | | | | | (39,999,031 | ) | |

Net assets — 100.00% | | $ | 1,885,145,762 | | |

(a) — Non-income producing security.

(l) — All or a portion of this security is on a loan. The total market value of securities on loan was $28,571,388. The remaining contractual maturity of all of the securities lending transactions is overnight and continuous.

(o) — Affiliated issuer. See Note 6 in Notes to the Financial Statements.

(v) — Security was fair valued as a result of market movements following the close of local trading using a third-party vendor's proprietary fair value pricing model. The total market value of these securities was $90,314,357, which represented 4.79% of net assets. See Security Valuation in Note 1 in Notes to the Financial Statements.

ADR — American Depositary Receipt

GBP — British Pound

^ — Rate shown is the 7-day yield as of June 30, 2018.

* — Invested through a cash management account administered by Brown Brothers Harriman & Co.

The accompanying notes are an integral part of these financial statements.

21

Schedule of Investments — June 30, 2018

Hotchkis & Wiley Small Cap Value Fund

Largest Equity Holdings | | Percent of

net assets | |

Whiting Petroleum Corp. | | | 6.48 | % | |

Seritage Growth Properties | | | 5.09 | % | |

ARRIS International PLC | | | 4.57 | % | |

Enstar Group Ltd. | | | 4.43 | % | |

Matson, Inc. | | | 3.73 | % | |

Frank's International NV | | | 3.32 | % | |

Popular, Inc. | | | 3.26 | % | |