UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10487

Hotchkis & Wiley Funds

(Exact name of registrant as specified in charter)

601 South Figueroa Street, 39th Floor

Los Angeles, California 90017-5704

(Address of principal executive offices) (Zip code)

Anna Marie Lopez

Hotchkis & Wiley Capital Management, LLC

601 South Figueroa Street, 39th Floor

Los Angeles, California 90017-5704

(Name and address of agent for service)

Copies to:

Maureen A. Miller, Esq.

Joseph M. Mannon, Esq.

Vedder Price P.C.

222 North LaSalle Street, 26th Floor

Chicago, Illinois 60601

(Counsel for the registrant)

(213) 430-1000

Registrant’s telephone number, including area code

Date of fiscal year end: June 30, 2024

Date of reporting period: June 30, 2024

Item 1. Reports to Stockholders.

| (a) |

| Hotchkis & Wiley Diversified Value Fund |  |

| Class A | HWCAX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $115 | 1.05% |

| Hotchkis & Wiley Diversified Value Fund | PAGE 1 | TSR_AR_44134R750 |

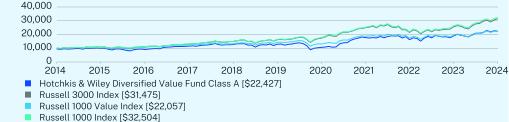

1 Year | 5 Year | 10 Year | |

Class A (without sales charge) | 18.48 | 11.65 | 9.00 |

Class A (with sales charge) | 12.26 | 10.45 | 8.41 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 1000 Value Index | 13.06 | 9.01 | 8.23 |

Russell 1000 Index | 23.88 | 14.61 | 12.51 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

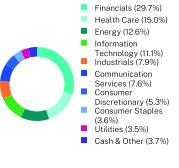

Net Assets | $111,256,188 |

Number of Holdings | 77 |

Net Advisory Fee | $499,450 |

Portfolio Turnover | 34% |

Top 10 Holdings | (%) |

Citigroup, Inc. | 3.9% |

Wells Fargo & Co. | 3.6% |

Telefonaktiebolaget LM Ericsson | 3.5% |

Workday, Inc. | 3.2% |

APA Corp. | 3.2% |

General Motors Company | 3.0% |

F5, Inc. | 2.8% |

Elevance Health, Inc. | 2.8% |

Alphabet, Inc. | 2.3% |

Comcast Corp. | 2.3% |

| Hotchkis & Wiley Diversified Value Fund | PAGE 2 | TSR_AR_44134R750 |

| Hotchkis & Wiley Diversified Value Fund | PAGE 3 | TSR_AR_44134R750 |

| Hotchkis & Wiley Diversified Value Fund |  |

| Class I | HWCIX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $88 | 0.80% |

| Hotchkis & Wiley Diversified Value Fund | PAGE 1 | TSR_AR_44134R768 |

1 Year | 5 Year | 10 Year | |

Class I | 18.81 | 11.92 | 9.27 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 1000 Value Index | 13.06 | 9.01 | 8.23 |

Russell 1000 Index | 23.88 | 14.61 | 12.51 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $111,256,188 |

Number of Holdings | 77 |

Net Advisory Fee | $499,450 |

Portfolio Turnover | 34% |

Top 10 Holdings | (%) |

Citigroup, Inc. | 3.9% |

Wells Fargo & Co. | 3.6% |

Telefonaktiebolaget LM Ericsson | 3.5% |

Workday, Inc. | 3.2% |

APA Corp. | 3.2% |

General Motors Company | 3.0% |

F5, Inc. | 2.8% |

Elevance Health, Inc. | 2.8% |

Alphabet, Inc. | 2.3% |

Comcast Corp. | 2.3% |

| Hotchkis & Wiley Diversified Value Fund | PAGE 2 | TSR_AR_44134R768 |

| Hotchkis & Wiley Diversified Value Fund | PAGE 3 | TSR_AR_44134R768 |

| Hotchkis & Wiley Large Cap Value Fund |  |

| Class A | HWLAX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $131 | 1.20% |

| Hotchkis & Wiley Large Cap Value Fund | PAGE 1 | TSR_AR_44134R107 |

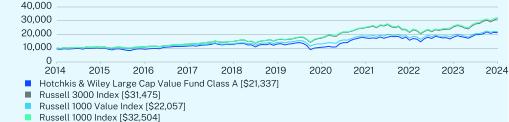

1 Year | 5 Year | 10 Year | |

Class A (without sales charge) | 18.03 | 10.24 | 8.46 |

Class A (with sales charge) | 11.83 | 9.06 | 7.87 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 1000 Value Index | 13.06 | 9.01 | 8.23 |

Russell 1000 Index | 23.88 | 14.61 | 12.51 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

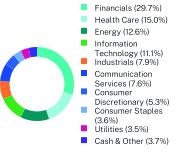

Net Assets | $355,456,530 |

Number of Holdings | 64 |

Net Advisory Fee | $2,507,165 |

Portfolio Turnover | 22% |

Top Holdings | (%) |

Citigroup, Inc. | 4.0% |

Wells Fargo & Co. | 3.7% |

Telefonaktiebolaget LM Ericsson | 3.7% |

F5, Inc. | 3.6% |

General Motors Co. | 3.4% |

APA Corp. | 3.4% |

Elevance Health, Inc. | 3.4% |

Hartford Financial Services Group, Inc. | 2.6% |

Comcast Corp. | 2.6% |

American International Group, Inc. | 2.5% |

| Hotchkis & Wiley Large Cap Value Fund | PAGE 2 | TSR_AR_44134R107 |

| Hotchkis & Wiley Large Cap Value Fund | PAGE 3 | TSR_AR_44134R107 |

| Hotchkis & Wiley Large Cap Value Fund |  |

| Class I | HWLIX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $104 | 0.95% |

| Hotchkis & Wiley Large Cap Value Fund | PAGE 1 | TSR_AR_44134R503 |

1 Year | 5 Year | 10 Year | |

Class I | 18.30 | 10.51 | 8.73 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 1000 Value Index | 13.06 | 9.01 | 8.23 |

Russell 1000 Index | 23.88 | 14.61 | 12.51 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $355,456,530 |

Number of Holdings | 64 |

Net Advisory Fee | $2,507,165 |

Portfolio Turnover | 22% |

Top Holdings | (%) |

Citigroup, Inc. | 4.0% |

Wells Fargo & Co. | 3.7% |

Telefonaktiebolaget LM Ericsson | 3.7% |

F5, Inc. | 3.6% |

General Motors Co. | 3.4% |

APA Corp. | 3.4% |

Elevance Health, Inc. | 3.4% |

Hartford Financial Services Group, Inc. | 2.6% |

Comcast Corp. | 2.6% |

American International Group, Inc. | 2.5% |

| Hotchkis & Wiley Large Cap Value Fund | PAGE 2 | TSR_AR_44134R503 |

| Hotchkis & Wiley Large Cap Value Fund | PAGE 3 | TSR_AR_44134R503 |

| Hotchkis & Wiley Large Cap Value Fund |  |

| Class Z | HWLZX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Z | $93 | 0.85% |

| Hotchkis & Wiley Large Cap Value Fund | PAGE 1 | TSR_AR_44134R511 |

1 Year | Since Inception (09/30/2019) | |

Class Z | 18.42 | 11.33 |

Russell 3000 Index | 23.13 | 14.66 |

Russell 1000 Value Index | 13.06 | 9.19 |

Russell 1000 Index | 23.88 | 15.09 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $355,456,530 |

Number of Holdings | 64 |

Net Advisory Fee | $2,507,165 |

Portfolio Turnover | 22% |

Top Holdings | (%) |

Citigroup, Inc. | 4.0% |

Wells Fargo & Co. | 3.7% |

Telefonaktiebolaget LM Ericsson | 3.7% |

F5, Inc. | 3.6% |

General Motors Co. | 3.4% |

APA Corp. | 3.4% |

Elevance Health, Inc. | 3.4% |

Hartford Financial Services Group, Inc. | 2.6% |

Comcast Corp. | 2.6% |

American International Group, Inc. | 2.5% |

| Hotchkis & Wiley Large Cap Value Fund | PAGE 2 | TSR_AR_44134R511 |

| Hotchkis & Wiley Large Cap Value Fund | PAGE 3 | TSR_AR_44134R511 |

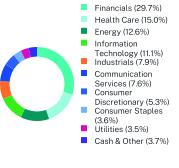

| Hotchkis & Wiley Mid-Cap Value Fund |  |

| Class A | HWMAX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $129 | 1.20% |

| Hotchkis & Wiley Mid-Cap Value Fund | PAGE 1 | TSR_AR_44134R206 |

1 Year | 5 Year | 10 Year | |

Class A (without sales charge) | 15.65 | 11.21 | 5.76 |

Class A (with sales charge) | 9.58 | 10.01 | 5.19 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell Midcap Value Index | 11.98 | 8.49 | 7.60 |

Russell Midcap Index Index | 12.88 | 9.46 | 9.04 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $432,171,338 |

Number of Holdings | 73 |

Net Advisory Fee | $3,497,573 |

Portfolio Turnover | 28% |

Top Holdings | (%) |

Kosmos Energy Ltd. | 4.9% |

APA Corp. | 4.8% |

Popular, Inc. | 4.4% |

Telefonaktiebolaget LM Ericsson | 4.4% |

Citizens Financial Group, Inc. | 4.2% |

Fluor Corp. | 3.6% |

F5, Inc. | 3.3% |

Adient PLC | 2.7% |

State Street Corp. | 2.7% |

CNO Financial Group, Inc. | 2.4% |

| Hotchkis & Wiley Mid-Cap Value Fund | PAGE 2 | TSR_AR_44134R206 |

| Hotchkis & Wiley Mid-Cap Value Fund | PAGE 3 | TSR_AR_44134R206 |

| Hotchkis & Wiley Mid-Cap Value Fund |  |

| Class I | HWMIX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $108 | 1.00% |

| Hotchkis & Wiley Mid-Cap Value Fund | PAGE 1 | TSR_AR_44134R800 |

1 Year | 5 Year | 10 Year | |

Class I | 15.88 | 11.43 | 5.99 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell Midcap Value Index | 11.98 | 8.49 | 7.60 |

Russell Midcap Index | 12.88 | 9.46 | 9.04 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $432,171,338 |

Number of Holdings | 73 |

Net Advisory Fee | $3,497,573 |

Portfolio Turnover | 28% |

Top Holdings | (%) |

Kosmos Energy Ltd. | 4.9% |

APA Corp. | 4.8% |

Popular, Inc. | 4.4% |

Telefonaktiebolaget LM Ericsson | 4.4% |

Citizens Financial Group, Inc. | 4.2% |

Fluor Corp. | 3.6% |

F5, Inc. | 3.3% |

Adient PLC | 2.7% |

State Street Corp. | 2.7% |

CNO Financial Group, Inc. | 2.4% |

| Hotchkis & Wiley Mid-Cap Value Fund | PAGE 2 | TSR_AR_44134R800 |

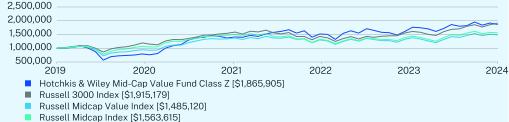

| Hotchkis & Wiley Mid-Cap Value Fund |  |

| Class Z | HWMZX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Z | $95 | 0.88% |

| Hotchkis & Wiley Mid-Cap Value Fund | PAGE 1 | TSR_AR_44134R495 |

1 Year | Since Inception (09/30/2019) | |

Class Z | 16.05 | 14.03 |

Russell 3000 Index | 23.13 | 14.66 |

Russell Midcap Value Index | 11.98 | 8.68 |

Russell Midcap Index | 12.88 | 9.87 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $432,171,338 |

Number of Holdings | 73 |

Net Advisory Fee | $3,497,573 |

Portfolio Turnover | 28% |

Top Holdings | (%) |

Kosmos Energy Ltd. | 4.9% |

APA Corp. | 4.8% |

Popular, Inc. | 4.4% |

Telefonaktiebolaget LM Ericsson | 4.4% |

Citizens Financial Group, Inc. | 4.2% |

Fluor Corp. | 3.6% |

F5, Inc. | 3.3% |

Adient PLC | 2.7% |

State Street Corp. | 2.7% |

CNO Financial Group, Inc. | 2.4% |

| Hotchkis & Wiley Mid-Cap Value Fund | PAGE 2 | TSR_AR_44134R495 |

| Hotchkis & Wiley Mid-Cap Value Fund | PAGE 3 | TSR_AR_44134R495 |

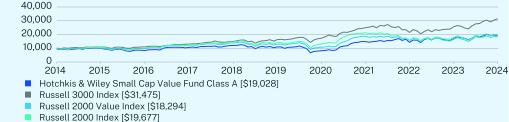

| Hotchkis & Wiley Small Cap Value Fund |  |

| Class A | HWSAX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $127 | 1.20% |

| Hotchkis & Wiley Small Cap Value Fund | PAGE 1 | TSR_AR_44134R305 |

1 Year | 5 Year | 10 Year | |

Class A (without sales charge) | 11.41 | 11.74 | 7.22 |

Class A (with sales charge) | 5.56 | 10.54 | 6.64 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 2000 Value Index | 10.90 | 7.07 | 6.23 |

Russell 2000 Index | 10.06 | 6.94 | 7.00 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $777,230,486 |

Number of Holdings | 66 |

Net Advisory Fee | $5,147,846 |

Portfolio Turnover | 45% |

Top Holdings | (%) |

F5, Inc. | 6.3% |

Stagwell, Inc. | 4.8% |

NOV, Inc. | 4.5% |

Arrow Electronics, Inc. | 4.4% |

Popular, Inc. | 3.6% |

Ecovyst, Inc. | 3.4% |

Enstar Group Ltd. | 3.3% |

Fluor Corp. | 3.2% |

Jones Lang LaSalle, Inc. | 2.9% |

First Hawaiian, Inc. | 2.9% |

| Hotchkis & Wiley Small Cap Value Fund | PAGE 2 | TSR_AR_44134R305 |

| Hotchkis & Wiley Small Cap Value Fund | PAGE 3 | TSR_AR_44134R305 |

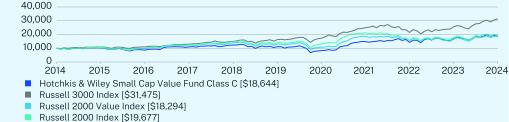

| Hotchkis & Wiley Small Cap Value Fund |  |

| Class C | HWSCX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $205 | 1.95% |

| Hotchkis & Wiley Small Cap Value Fund | PAGE 1 | TSR_AR_44134R842 |

1 Year | 5 Year | 10 Year | |

Class C (without sales charge) | 10.60 | 10.92 | 6.43 |

Class C (with sales charge) | 9.60 | 10.92 | 6.43 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 2000 Value Index | 10.90 | 7.07 | 6.23 |

Russell 2000 Index | 10.06 | 6.94 | 7.00 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $777,230,486 |

Number of Holdings | 66 |

Net Advisory Fee | $5,147,846 |

Portfolio Turnover | 45% |

Top Holdings | (%) |

F5, Inc. | 6.3% |

Stagwell, Inc. | 4.8% |

NOV, Inc. | 4.5% |

Arrow Electronics, Inc. | 4.4% |

Popular, Inc. | 3.6% |

Ecovyst, Inc. | 3.4% |

Enstar Group Ltd. | 3.3% |

Fluor Corp. | 3.2% |

Jones Lang LaSalle, Inc. | 2.9% |

First Hawaiian, Inc. | 2.9% |

| Hotchkis & Wiley Small Cap Value Fund | PAGE 2 | TSR_AR_44134R842 |

| Hotchkis & Wiley Small Cap Value Fund | PAGE 3 | TSR_AR_44134R842 |

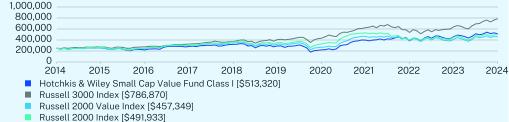

| Hotchkis & Wiley Small Cap Value Fund |  |

| Class I | HWSIX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $103 | 0.97% |

| Hotchkis & Wiley Small Cap Value Fund | PAGE 1 | TSR_AR_44134R867 |

1 Year | 5 Year | 10 Year | |

Class I | 11.68 | 11.96 | 7.46 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 2000 Value Index | 10.90 | 7.07 | 6.23 |

Russell 2000 Index | 10.06 | 6.94 | 7.00 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $777,230,486 |

Number of Holdings | 66 |

Net Advisory Fee | $5,147,846 |

Portfolio Turnover | 45% |

Top Holdings | (%) |

F5, Inc. | 6.3% |

Stagwell, Inc. | 4.8% |

NOV, Inc. | 4.5% |

Arrow Electronics, Inc. | 4.4% |

Popular, Inc. | 3.6% |

Ecovyst, Inc. | 3.4% |

Enstar Group Ltd. | 3.3% |

Fluor Corp. | 3.2% |

Jones Lang LaSalle, Inc. | 2.9% |

First Hawaiian, Inc. | 2.9% |

| Hotchkis & Wiley Small Cap Value Fund | PAGE 2 | TSR_AR_44134R867 |

| Hotchkis & Wiley Small Cap Value Fund |  |

| Class Z | HWSZX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Z | $91 | 0.86% |

| Hotchkis & Wiley Small Cap Value Fund | PAGE 1 | TSR_AR_44134R487 |

1 Year | Since Inception (09/30/2019) | |

Class Z | 11.80 | 13.31 |

Russell 3000 Index | 23.13 | 14.66 |

Russell 2000 Value Index | 10.90 | 7.59 |

Russell 2000 Index | 10.06 | 7.87 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $777,230,486 |

Number of Holdings | 66 |

Net Advisory Fee | $5,147,846 |

Portfolio Turnover | 45% |

Top Holdings | (%) |

F5, Inc. | 6.3% |

Stagwell, Inc. | 4.8% |

NOV, Inc. | 4.5% |

Arrow Electronics, Inc. | 4.4% |

Popular, Inc. | 3.6% |

Ecovyst, Inc. | 3.4% |

Enstar Group Ltd. | 3.3% |

Fluor Corp. | 3.2% |

Jones Lang LaSalle, Inc. | 2.9% |

First Hawaiian, Inc. | 2.9% |

| Hotchkis & Wiley Small Cap Value Fund | PAGE 2 | TSR_AR_44134R487 |

| Hotchkis & Wiley Small Cap Value Fund | PAGE 3 | TSR_AR_44134R487 |

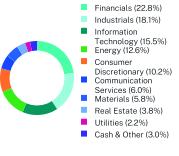

| Hotchkis & Wiley Small Cap Diversified Value Fund |  |

| Class A | HWVAX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $109 | 1.05% |

| Hotchkis & Wiley Small Cap Diversified Value Fund | PAGE 1 | TSR_AR_44134R644 |

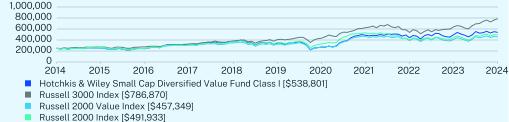

1 Year | 5 Year | 10 Year | |

Class A (without sales charge) | 8.33 | 9.08 | 7.71 |

Class A (with sales charge) | 2.67 | 7.90 | 7.13 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 2000 Value Index | 10.90 | 7.07 | 6.23 |

Russell 2000 Index | 10.06 | 6.94 | 7.00 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

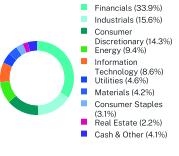

Net Assets | $788,569,923 |

Number of Holdings | 359 |

Net Advisory Fee | $4,539,446 |

Portfolio Turnover | 54% |

Top Holdings | (%) |

Sandy Spring Bancorp, Inc. | 0.5% |

National Energy Services Reunited Corp. | 0.5% |

ACI Worldwide, Inc. | 0.5% |

California Resources Corp. | 0.5% |

NMI Holdings, Inc. | 0.5% |

Vista Outdoor, Inc. | 0.5% |

Hanmi Financial Corp. | 0.5% |

Zions Bancorp NA | 0.4% |

Eagle Bancorp, Inc. | 0.4% |

Bread Financial Holdings, Inc. | 0.4% |

| Hotchkis & Wiley Small Cap Diversified Value Fund | PAGE 2 | TSR_AR_44134R644 |

| Hotchkis & Wiley Small Cap Diversified Value Fund | PAGE 3 | TSR_AR_44134R644 |

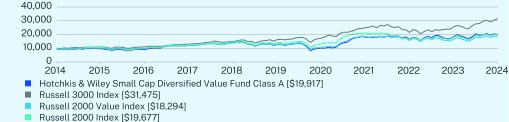

| Hotchkis & Wiley Small Cap Diversified Value Fund |  |

| Class I | HWVIX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $83 | 0.80% |

| Hotchkis & Wiley Small Cap Diversified Value Fund | PAGE 1 | TSR_AR_44134R651 |

1 Year | 5 Year | 10 Year | |

Class I | 8.53 | 9.36 | 7.98 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 2000 Value Index | 10.90 | 7.07 | 6.23 |

Russell 2000 Index | 10.06 | 6.94 | 7.00 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $788,569,923 |

Number of Holdings | 359 |

Net Advisory Fee | $4,539,446 |

Portfolio Turnover | 54% |

Top Holdings | (%) |

Sandy Spring Bancorp, Inc. | 0.5% |

National Energy Services Reunited Corp. | 0.5% |

ACI Worldwide, Inc. | 0.5% |

California Resources Corp. | 0.5% |

NMI Holdings, Inc. | 0.5% |

Vista Outdoor, Inc. | 0.5% |

Hanmi Financial Corp. | 0.5% |

Zions Bancorp NA | 0.4% |

Eagle Bancorp, Inc. | 0.4% |

Bread Financial Holdings, Inc. | 0.4% |

| Hotchkis & Wiley Small Cap Diversified Value Fund | PAGE 2 | TSR_AR_44134R651 |

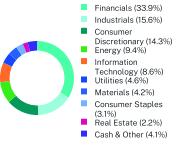

| Hotchkis & Wiley Small Cap Diversified Value Fund |  |

| Class Z | HWVZX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Z | $79 | 0.76% |

| Hotchkis & Wiley Small Cap Diversified Value Fund | PAGE 1 | TSR_AR_44134R479 |

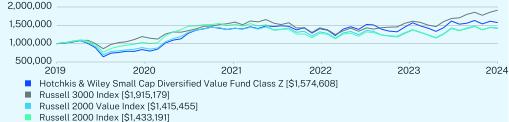

1 Year | Since Inception (09/30/2019) | |

Class Z | 8.57 | 10.03 |

Russell 3000 Index | 23.13 | 14.66 |

Russell 2000 Value Index | 10.90 | 7.59 |

Russell 2000 Index | 10.06 | 7.87 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

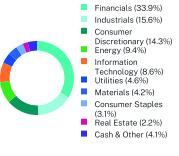

Net Assets | $788,569,923 |

Number of Holdings | 359 |

Net Advisory Fee | $4,539,446 |

Portfolio Turnover | 54% |

Top Holdings | (%) |

Sandy Spring Bancorp, Inc. | 0.5% |

National Energy Services Reunited Corp. | 0.5% |

ACI Worldwide, Inc. | 0.5% |

California Resources Corp. | 0.5% |

NMI Holdings, Inc. | 0.5% |

Vista Outdoor, Inc. | 0.5% |

Hanmi Financial Corp. | 0.5% |

Zions Bancorp NA | 0.4% |

Eagle Bancorp, Inc. | 0.4% |

Bread Financial Holdings, Inc. | 0.4% |

| Hotchkis & Wiley Small Cap Diversified Value Fund | PAGE 2 | TSR_AR_44134R479 |

| Hotchkis & Wiley Small Cap Diversified Value Fund | PAGE 3 | TSR_AR_44134R479 |

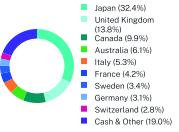

| Hotchkis & Wiley Global Value Fund |  |

| Class A | HWGAX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $133 | 1.20% |

| Hotchkis & Wiley Global Value Fund | PAGE 1 | TSR_AR_44134R677 |

1 Year | 5 Year | 10 Year | |

Class A (without sales charge) | 21.33 | 10.14 | 6.66 |

Class A (with sales charge) | 14.98 | 8.96 | 6.09 |

MSCI World Index | 20.19 | 11.78 | 9.16 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $37,580,034 |

Number of Holdings | 61 |

Net Advisory Fee | $157,288 |

Portfolio Turnover | 48% |

Top Holdings | (%) |

Telefonaktiebolaget LM Ericsson | 4.6% |

F5, Inc. | 3.8% |

Workday, Inc. | 3.8% |

Elevance Health, Inc. | 3.0% |

Alphabet, Inc. | 3.0% |

CVS Health Corp. | 2.6% |

Citigroup, Inc. | 2.5% |

Siemens AG | 2.5% |

Medtronic PLC | 2.4% |

Samsung Electronics Co. Ltd. | 2.4% |

| Hotchkis & Wiley Global Value Fund | PAGE 2 | TSR_AR_44134R677 |

| Hotchkis & Wiley Global Value Fund |  |

| Class I | HWGIX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $105 | 0.95% |

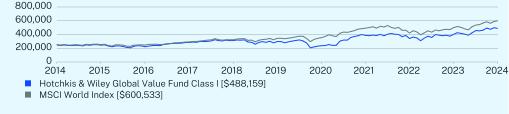

| Hotchkis & Wiley Global Value Fund | PAGE 1 | TSR_AR_44134R685 |

1 Year | 5 Year | 10 Year | |

Class I | 21.57 | 10.41 | 6.92 |

MSCI World Index | 20.19 | 11.78 | 9.16 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $37,580,034 |

Number of Holdings | 61 |

Net Advisory Fee | $157,288 |

Portfolio Turnover | 48% |

Top Holdings | (%) |

Telefonaktiebolaget LM Ericsson | 4.6% |

F5, Inc. | 3.8% |

Workday, Inc. | 3.8% |

Elevance Health, Inc. | 3.0% |

Alphabet, Inc. | 3.0% |

CVS Health Corp. | 2.6% |

Citigroup, Inc. | 2.5% |

Siemens AG | 2.5% |

Medtronic PLC | 2.4% |

Samsung Electronics Co. Ltd. | 2.4% |

| Hotchkis & Wiley Global Value Fund | PAGE 2 | TSR_AR_44134R685 |

| Hotchkis & Wiley International Value Fund |  |

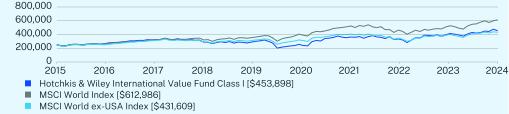

| Class I | HWNIX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $102 | 0.95% |

| Hotchkis & Wiley International Value Fund | PAGE 1 | TSR_AR_44134R636 |

1 Year | 5 Year | Since Inception (12/31/2015) | |

Class I | 14.18 | 9.39 | 7.27 |

MSCI World Index | 20.19 | 11.78 | 11.13 |

MSCI World ex-USA Index | 11.22 | 6.55 | 6.64 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $3,646,979 |

Number of Holdings | 54 |

Net Advisory Fee | $0 |

Portfolio Turnover | 35% |

Top Holdings | (%) |

Telefonaktiebolaget LM Ericsson | 5.2% |

Siemens AG | 4.1% |

Shell PLC | 3.7% |

Samsung Electronics Co. Ltd. | 3.5% |

Babcock International Group PLC | 3.5% |

Lloyds Banking Group PLC | 3.3% |

Henkel AG & Co. KGaA | 3.3% |

WPP PLC | 3.0% |

Heineken Holding NV | 3.0% |

Qantas Airways Ltd. | 2.8% |

| Hotchkis & Wiley International Value Fund | PAGE 2 | TSR_AR_44134R636 |

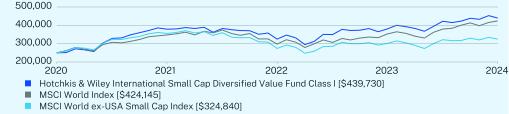

| Hotchkis & Wiley International Small Cap Diversified Value Fund |  |

| Class I | HWTIX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $107 | 0.99% |

| Hotchkis & Wiley International Small Cap Diversified Value Fund | PAGE 1 | TSR_AR_44134R453 |

1 Year | Since Inception (06/30/2020) | |

Class I | 15.63 | 15.16 |

MSCI World Index | 20.19 | 14.13 |

MSCI World ex-USA Small Cap Index | 7.80 | 6.77 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $8,063,379 |

Number of Holdings | 303 |

Net Advisory Fee | $0 |

Portfolio Turnover | 62% |

Top Holdings | (%) |

Canadian Western Bank | 0.8% |

Kamei Corp. | 0.6% |

Fast Fitness Japan, Inc. | 0.6% |

Inter Action Corp. | 0.6% |

Cresco Ltd. | 0.6% |

Financial Partners Group Co. Ltd. | 0.6% |

Morita Holdings Corp. | 0.6% |

GLOBERIDE, Inc. | 0.6% |

Trancom Co. Ltd. | 0.6% |

Dai Nippon Toryo Co. Ltd. | 0.6% |

| Hotchkis & Wiley International Small Cap Diversified Value Fund | PAGE 2 | TSR_AR_44134R453 |

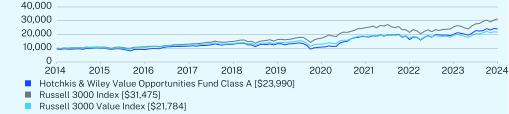

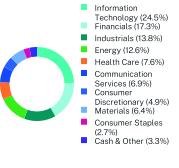

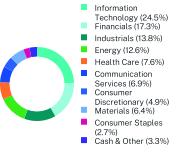

| Hotchkis & Wiley Value Opportunities Fund |  |

| Class A | HWAAX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $129 | 1.18% |

| Hotchkis & Wiley Value Opportunities Fund | PAGE 1 | TSR_AR_44134R792 |

1 Year | 5 Year | 10 Year | |

Class A (without sales charge) | 18.68 | 12.65 | 9.74 |

Class A (with sales charge) | 12.44 | 11.44 | 9.14 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 3000 Value Index | 12.93 | 8.89 | 8.10 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $653,108,717 |

Number of Holdings | 69 |

Net Advisory Fee | $4,501,560 |

Portfolio Turnover | 71% |

Top Holdings | (%) |

F5, Inc. | 6.8% |

Telefonaktiebolaget LM Ericsson | 6.4% |

Workday, Inc. | 4.8% |

Arrow Electronics, Inc. | 3.5% |

Shell PLC | 3.3% |

Baker Hughes Co. | 3.2% |

Siemens AG | 3.1% |

General Motors Co. | 3.1% |

NOV, Inc. | 3.1% |

Stagwell, Inc. | 3.0% |

| Hotchkis & Wiley Value Opportunities Fund | PAGE 2 | TSR_AR_44134R792 |

| Hotchkis & Wiley Value Opportunities Fund |  |

| Class C | HWACX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $207 | 1.90% |

| Hotchkis & Wiley Value Opportunities Fund | PAGE 1 | TSR_AR_44134R826 |

1 Year | 5 Year | 10 Year | |

Class C (without sales charge) | 17.85 | 11.85 | 8.94 |

Class C (with sales charge) | 16.85 | 11.85 | 8.94 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 3000 Value Index | 12.93 | 8.89 | 8.10 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $653,108,717 |

Number of Holdings | 69 |

Net Advisory Fee | $4,501,560 |

Portfolio Turnover | 71% |

Top Holdings | (%) |

F5, Inc. | 6.8% |

Telefonaktiebolaget LM Ericsson | 6.4% |

Workday, Inc. | 4.8% |

Arrow Electronics, Inc. | 3.5% |

Shell PLC | 3.3% |

Baker Hughes Co. | 3.2% |

Siemens AG | 3.1% |

General Motors Co. | 3.1% |

NOV, Inc. | 3.1% |

Stagwell, Inc. | 3.0% |

| Hotchkis & Wiley Value Opportunities Fund | PAGE 2 | TSR_AR_44134R826 |

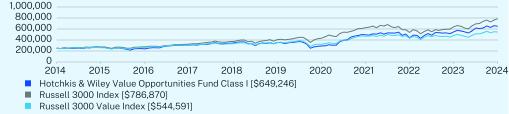

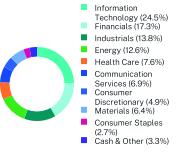

| Hotchkis & Wiley Value Opportunities Fund |  |

| Class I | HWAIX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $104 | 0.95% |

| Hotchkis & Wiley Value Opportunities Fund | PAGE 1 | TSR_AR_44134R834 |

1 Year | 5 Year | 10 Year | |

Class I | 18.97 | 12.94 | 10.01 |

Russell 3000 Index | 23.13 | 14.14 | 12.15 |

Russell 3000 Value Index | 12.93 | 8.89 | 8.10 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $653,108,717 |

Number of Holdings | 69 |

Net Advisory Fee | $4,501,560 |

Portfolio Turnover | 71% |

Top Holdings | (%) |

F5, Inc. | 6.8% |

Telefonaktiebolaget LM Ericsson | 6.4% |

Workday, Inc. | 4.8% |

Arrow Electronics, Inc. | 3.5% |

Shell PLC | 3.3% |

Baker Hughes Co. | 3.2% |

Siemens AG | 3.1% |

General Motors Co. | 3.1% |

NOV, Inc. | 3.1% |

Stagwell, Inc. | 3.0% |

| Hotchkis & Wiley Value Opportunities Fund | PAGE 2 | TSR_AR_44134R834 |

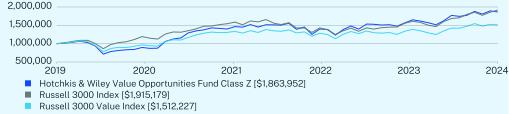

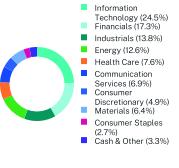

| Hotchkis & Wiley Value Opportunities Fund |  |

| Class Z | HWAZX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Z | $94 | 0.86% |

| Hotchkis & Wiley Value Opportunities Fund | PAGE 1 | TSR_AR_44134R461 |

1 Year | Since Inception (09/30/2019) | |

Class Z | 19.06 | 14.01 |

Russell 3000 Index | 23.13 | 14.66 |

Russell 3000 Value Index | 12.93 | 9.10 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $653,108,717 |

Number of Holdings | 69 |

Net Advisory Fee | $4,501,560 |

Portfolio Turnover | 71% |

Top Holdings | (%) |

F5, Inc. | 6.8% |

Telefonaktiebolaget LM Ericsson | 6.4% |

Workday, Inc. | 4.8% |

Arrow Electronics, Inc. | 3.5% |

Shell PLC | 3.3% |

Baker Hughes Co. | 3.2% |

Siemens AG | 3.1% |

General Motors Co. | 3.1% |

NOV, Inc. | 3.1% |

Stagwell, Inc. | 3.0% |

| Hotchkis & Wiley Value Opportunities Fund | PAGE 2 | TSR_AR_44134R461 |

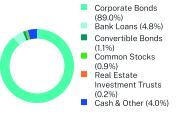

| Hotchkis & Wiley High Yield Fund |  |

| Class A | HWHAX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $96 | 0.92% |

| Hotchkis & Wiley High Yield Fund | PAGE 1 | TSR_AR_44134R727 |

1 Year | 5 Year | 10 Year | |

Class A (without sales charge) | 9.48 | 3.03 | 3.26 |

Class A (with sales charge) | 5.37 | 2.24 | 2.87 |

ICE BofA U.S. Corporate Bond Index | 5.04 | 0.78 | 2.39 |

ICE BofA BB-B U.S. High Yield Constrained Index | 10.15 | 3.69 | 4.25 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $897,796,524 |

Number of Holdings | 212 |

Net Advisory Fee | $4,451,409 |

Portfolio Turnover | 44% |

Top 10 Issuers | (%) |

CCO Holdings LLC / CCO Holdings Capital Corp. | 2.0% |

Carnival Corp. | 1.7% |

TransDigm, Inc. | 1.1% |

Authentic Brands Group LLC | 1.1% |

Iracore Holdings Corp. | 1.0% |

TK Elevator Holdco GmbH | 1.0% |

WR Grace Holdings LLC | 0.9% |

Spirit AeroSystems, Inc. | 0.8% |

Mativ Holdings, Inc. | 0.8% |

EMRLD Borrower LP / Emerald Co.-Issuer, Inc. | 0.8% |

| Hotchkis & Wiley High Yield Fund | PAGE 2 | TSR_AR_44134R727 |

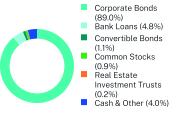

| Hotchkis & Wiley High Yield Fund |  |

| Class I | HWHIX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $73 | 0.70% |

| Hotchkis & Wiley High Yield Fund | PAGE 1 | TSR_AR_44134R735 |

1 Year | 5 Year | 10 Year | |

Class I | 9.68 | 3.34 | 3.55 |

ICE BofA U.S. Corporate Bond Index | 5.04 | 0.78 | 2.39 |

ICE BofA BB-B U.S. High Yield Constrained Index | 10.15 | 3.69 | 4.25 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $897,796,524 |

Number of Holdings | 212 |

Net Advisory Fee | $4,451,409 |

Portfolio Turnover | 44% |

Top 10 Issuers | (%) |

CCO Holdings LLC / CCO Holdings Capital Corp. | 2.0% |

Carnival Corp. | 1.7% |

TransDigm, Inc. | 1.1% |

Authentic Brands Group LLC | 1.1% |

Iracore Holdings Corp. | 1.0% |

TK Elevator Holdco GmbH | 1.0% |

WR Grace Holdings LLC | 0.9% |

Spirit AeroSystems, Inc. | 0.8% |

Mativ Holdings, Inc. | 0.8% |

EMRLD Borrower LP / Emerald Co.-Issuer, Inc. | 0.8% |

| Hotchkis & Wiley High Yield Fund | PAGE 2 | TSR_AR_44134R735 |

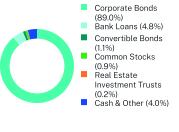

| Hotchkis & Wiley High Yield Fund |  |

| Class Z | HWHZX | ||

| Annual Shareholder Report | June 30, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Z | $63 | 0.60% |

| Hotchkis & Wiley High Yield Fund | PAGE 1 | TSR_AR_44134R529 |

1 Year | 5 Year | Since Inception (03/29/2018) | |

Class Z | 9.90 | 3.42 | 3.53 |

ICE BofA U.S. Corporate Bond Index | 5.04 | 0.78 | 2.10 |

ICE BofA BB-B U.S. High Yield Constrained Index | 10.15 | 3.69 | 4.42 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $897,796,524 |

Number of Holdings | 212 |

Net Advisory Fee | $4,451,409 |

Portfolio Turnover | 44% |

Top 10 Issuers | (%) |

CCO Holdings LLC / CCO Holdings Capital Corp. | 2.0% |

Carnival Corp. | 1.7% |

TransDigm, Inc. | 1.1% |

Authentic Brands Group LLC | 1.1% |

Iracore Holdings Corp. | 1.0% |

TK Elevator Holdco GmbH | 1.0% |

WR Grace Holdings LLC | 0.9% |

Spirit AeroSystems, Inc. | 0.8% |

Mativ Holdings, Inc. | 0.8% |

EMRLD Borrower LP / Emerald Co.-Issuer, Inc. | 0.8% |

| Hotchkis & Wiley High Yield Fund | PAGE 2 | TSR_AR_44134R529 |

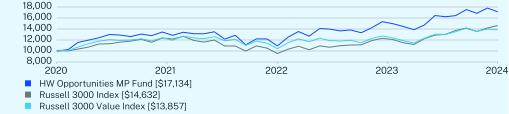

| HW Opportunities MP Fund |  |

| HOMPX | ||

| Annual Shareholder Report | June 30, 2024 |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| HW Opportunities MP Fund | $0 | 0.00% |

| HW Opportunities MP Fund | PAGE 1 | TSR_AR_44134R446 |

1 Year | Since Inception (12/29/2020) | |

Fund | 20.57 | 16.62 |

Russell 3000 Index | 23.13 | 11.48 |

Russell 3000 Value Index | 12.93 | 9.77 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $64,347,023 |

Number of Holdings | 54 |

Net Advisory Fee | $0 |

Portfolio Turnover | 93% |

Top Holdings | (%) |

Stagwell, Inc. | 6.9% |

Ecovyst, Inc. | 5.5% |

Siemens AG | 5.3% |

NOV, Inc. | 5.0% |

Randstad NV | 4.8% |

F5, Inc. | 4.6% |

Workday, Inc. | 4.1% |

U-Haul Holding Co. | 4.1% |

Olin Corp. | 4.0% |

Qantas Airways Ltd. | 3.9% |

| HW Opportunities MP Fund | PAGE 2 | TSR_AR_44134R446 |

| HW Opportunities MP Fund | PAGE 3 | TSR_AR_44134R446 |

| (b) | Not applicable. |

Item 2. Code of Ethics.

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report. A copy of the code of ethics is available without charge, upon request, by calling toll-free at 1-800-796-5606.

Item 3. Audit Committee Financial Expert.

As of the end of the period covered by this report, the registrant’s Board of Trustees (the “Board”) has determined that Robert Fitzgerald, a member of the registrant’s Audit Committee, is an “audit committee financial expert” and “independent,” as such terms are defined in this Item.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to professional services performed by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit or review of financial statements that are not reported under “Audit Fees”. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The principal accountant did not provide any other services.

The following table details the aggregate fees billed or expected to be billed to the Funds for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| FYE 6/30/2024 | FYE 6/30/2023 | |

| (a) Audit Fees | $250,800 | $224,200 |

| (b) Audit-Related Fees | $0 | $0 |

| (c) Tax Fees | $0 | $0 |

| (d) All Other Fees | $0 | $0 |

(e)(1) The registrant’s Audit Committee (the “Committee”) has adopted policies and procedures with regard to the pre-approval of services. The Committee shall pre approve any engagements of the independent auditors to provide any non-prohibited services to the registrant, including the fees and other compensation to be paid to the independent auditors. The Committee has delegated certain pre-approval responsibilities to its Char, who may grant the pre-approval of

services to the registrant for non-prohibited services for engagements of less than $5,000. The Committee shall also pre-approve any engagement of the independent auditors, including the fees and other compensation to be paid to the independent auditors, to provide any non-audit services to the registrant’s investment adviser, Hotchkis & Wiley Capital Management, LLC (the “Advisor”) (or any “control affiliate” of the Advisor providing ongoing services to the registrant), if the engagement relates directly to the operations and financial reporting of the registrant. The Chair of the Committee may grant the pre-approval for non-prohibited services to the Advisor for engagements of less than $5,000. All such delegated pre-approvals shall be presented to the Committee no later than the next Committee meeting.

(e)(2) The Committee approved in advance all audit services and non-audit services that Deloitte & Touche LLP (“D&T”) provided to the Funds, except for any non-audit services that were subject to the pre-approval exception under Rule 2-01 of Regulation S-X (the “pre-approval exception”). The percentage of fees billed by D&T applicable to non-audit services pursuant to the pre-approval exception were as follows:

| FYE 6/30/2024 | FYE 6/30/2023 | |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the full time permanent employees of the principal accountant.

(g) During the last two fiscal years, D&T has served as the auditor to the Advisor and/or affiliates of the Advisor, and has rendered non-audit services to the Advisor and/or affiliates of the Advisor. The non-audit services that D&T provided to the Advisor and/or affiliates of the Advisor in 2024 and 2023 consisted of preparing state and federal tax returns. D&T charged $225,000 and $216,560 for such non-audit services to the Advisor and/or affiliates of the Advisor for 2024 and 2023, respectively. None of the non-audit services provided by D&T to the Advisor and/or affiliates of the Advisor directly related to the operations or financial reporting of the registrant.

(h) The Committee has considered whether the provision of audit and non-audit services that were rendered to the Advisor and any entity controlling, controlled by or under common control with the Advisor is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

Items 4(i) and 4(j) are not applicable to the registrant.

Item 5. Audit Committee of Listed Registrants.

Not applicable to this registrant.

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this Form. |

| (b) | Not applicable. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Page | |||

Schedule of Investments | |||

Shares | Value | ||||||||

COMMON STOCKS - 99.2% | |||||||||

Aerospace & Defense - 3.2% | |||||||||

Boeing Co.(a) | 7,660 | $ 1,394,197 | |||||||

General Dynamics Corp. | 2,100 | 609,294 | |||||||

RTX Corp. | 15,300 | 1,535,967 | |||||||

3,539,458 | |||||||||

Air Freight & Logistics - 2.2% | |||||||||

FedEx Corp. | 8,020 | 2,404,717 | |||||||

Automobile Components - 3.3% | |||||||||

Adient PLC(a) | 10,274 | 253,870 | |||||||

Aptiv PLC(a) | 14,600 | 1,028,132 | |||||||

BorgWarner, Inc. | 15,400 | 496,496 | |||||||

Magna International, Inc. | 44,700 | 1,872,930 | |||||||

3,651,428 | |||||||||

Automobiles - 3.0% | |||||||||

General Motors Co. | 72,600 | 3,372,996 | |||||||

Banks - 13.9% | |||||||||

Bank of America Corp. | 23,200 | 922,664 | |||||||

Citigroup, Inc. | 67,774 | 4,300,938 | |||||||

Citizens Financial Group, Inc. | 68,100 | 2,453,643 | |||||||

First Citizens BancShares, Inc./NC - Class A | 352 | 592,631 | |||||||

Truist Financial Corp. | 22,900 | 889,665 | |||||||

US Bancorp | 58,500 | 2,322,450 | |||||||

Wells Fargo & Co. | 67,034 | 3,981,149 | |||||||

15,463,140 | |||||||||

Beverages - 0.7% | |||||||||

Anheuser-Busch InBev SA/NV - ADR | 14,300 | 831,545 | |||||||

Capital Markets - 4.3% | |||||||||

Bank of New York Mellon Corp. | 28,200 | 1,688,898 | |||||||

Goldman Sachs Group, Inc. | 2,990 | 1,352,437 | |||||||

State Street Corp. | 23,900 | 1,768,600 | |||||||

4,809,935 | |||||||||

Chemicals - 1.3% | |||||||||

Olin Corp. | 31,400 | 1,480,510 | |||||||

Communications Equipment - 6.3% | |||||||||

F5, Inc.(a) | 18,500 | 3,186,255 | |||||||

Telefonaktiebolaget LM Ericsson - ADR(b) | 625,800 | 3,861,186 | |||||||

7,047,441 | |||||||||

Construction & Engineering - 0.4% | |||||||||

Fluor Corp.(a) | 10,800 | 470,340 | |||||||

Consumer Finance - 1.2% | |||||||||

Capital One Financial Corp. | 4,600 | 636,870 | |||||||

Discover Financial Services | 5,500 | 719,455 | |||||||

1,356,325 | |||||||||

Electric Utilities - 1.9% | |||||||||

PPL Corp. | 75,900 | 2,098,635 | |||||||

Electronic Equipment, Instruments & Components - 2.1% | |||||||||

Corning, Inc. | 29,300 | 1,138,305 | |||||||

TE Connectivity Ltd. | 7,900 | 1,188,397 | |||||||

2,326,702 | |||||||||

Shares | Value | ||||||||

Energy Equipment & Services - 3.9% | |||||||||

Baker Hughes Co. | 34,500 | $1,213,365 | |||||||

Halliburton Co. | 14,700 | 496,566 | |||||||

NOV, Inc. | 108,400 | 2,060,684 | |||||||

Schlumberger NV | 12,900 | 608,622 | |||||||

4,379,237 | |||||||||

Entertainment - 0.5% | |||||||||

Warner Bros Discovery, Inc.(a) | 78,600 | 584,784 | |||||||

Financial Services - 2.8% | |||||||||

Corebridge Financial, Inc. | 40,700 | 1,185,184 | |||||||

Fidelity National Information Services, Inc. | 25,500 | 1,921,680 | |||||||

3,106,864 | |||||||||

Food Products - 0.8% | |||||||||

Conagra Brands, Inc. | 29,600 | 841,232 | |||||||

Health Care Equipment & Supplies - 4.7% | |||||||||

GE HealthCare Technologies, Inc. | 27,012 | 2,104,775 | |||||||

Medtronic PLC | 31,882 | 2,509,432 | |||||||

Zimmer Biomet Holdings, Inc. | 5,340 | 579,550 | |||||||

5,193,757 | |||||||||

Health Care Providers & Services - 9.4% | |||||||||

Centene Corp.(a) | 18,700 | 1,239,810 | |||||||

Cigna Group | 3,300 | 1,090,881 | |||||||

CVS Health Corp. | 40,400 | 2,386,024 | |||||||

Elevance Health, Inc. | 5,800 | 3,142,788 | |||||||

HCA Healthcare, Inc. | 3,260 | 1,047,373 | |||||||

Humana, Inc. | 2,800 | 1,046,220 | |||||||

Labcorp Holdings, Inc. | 2,700 | 549,477 | |||||||

10,502,573 | |||||||||

Hotels, Restaurants & Leisure - 0.6% | |||||||||

Booking Holdings, Inc. | 170 | 673,455 | |||||||

Insurance - 4.3% | |||||||||

American International Group, Inc. | 34,300 | 2,546,432 | |||||||

Hartford Financial Services Group, Inc. | 22,500 | 2,262,150 | |||||||

4,808,582 | |||||||||

Interactive Media & Services - 2.3% | |||||||||

Alphabet, Inc. - Class A | 14,200 | 2,586,530 | |||||||

IT Services - 0.5% | |||||||||

Cognizant Technology Solutions Corp. - Class A | 7,400 | 503,200 | |||||||

Machinery - 3.8% | |||||||||

CNH Industrial NV | 106,000 | 1,073,780 | |||||||

Cummins, Inc. | 5,740 | 1,589,578 | |||||||

PACCAR, Inc. | 9,300 | 957,342 | |||||||

Timken Co. | 7,000 | 560,910 | |||||||

4,181,610 | |||||||||

Media - 3.8% | |||||||||

Comcast Corp. - Class A | 65,800 | 2,576,728 | |||||||

Omnicom Group, Inc. | 6,400 | 574,080 | |||||||

Paramount Global - Class B | 29,000 | 301,310 | |||||||

WPP PLC - ADR(b) | 17,300 | 791,994 | |||||||

4,244,112 | |||||||||

Multi-Utilities - 1.0% | |||||||||

Dominion Energy, Inc. | 21,700 | 1,063,300 | |||||||

1 |

Shares | Value | ||||||||

COMMON STOCKS - (Continued) | |||||||||

Oil Gas & Consumable Fuels - 8.7% | |||||||||

APA Corp. | 119,700 | $3,523,968 | |||||||

Cenovus Energy, Inc. | 38,100 | 749,046 | |||||||

Marathon Oil Corp. | 38,350 | 1,099,495 | |||||||

Murphy Oil Corp. | 12,000 | 494,880 | |||||||

Ovintiv, Inc. | 33,600 | 1,574,832 | |||||||

Shell PLC - ADR | 30,762 | 2,220,401 | |||||||

9,662,622 | |||||||||

Personal Care Products - 2.2% | |||||||||

Unilever PLC - ADR | 43,800 | 2,408,562 | |||||||

Pharmaceuticals - 1.0% | |||||||||

GSK PLC - ADR | 14,340 | 552,090 | |||||||

Sanofi SA - ADR | 11,200 | 543,424 | |||||||

1,095,514 | |||||||||

Semiconductors & Semiconductor Equipment - 0.6% | |||||||||

Micron Technology, Inc. | 5,500 | 723,415 | |||||||

Software - 3.8% | |||||||||

Oracle Corp. | 4,650 | 656,580 | |||||||

Workday, Inc. - Class A(a) | 15,900 | 3,554,604 | |||||||

4,211,184 | |||||||||

Wireless Telecommunication Services - 0.7% | |||||||||

Vodafone Group PLC - ADR | 84,963 | 753,622 | |||||||

TOTAL COMMON STOCKS (Cost $94,269,059) | 110,377,327 | ||||||||

SHORT-TERM INVESTMENTS - 0.8% | |||||||||

Money Market Funds - 0.1% | |||||||||

Invesco Government & Agency Portfolio - Class Institutional, 5.23%(c) | 97,007 | 97,007 | |||||||

Par | |||||||||

Time Deposits - 0.7% | |||||||||

Citigroup, Inc., 4.68%, 07/01/2024(d) | 789,433 | 789,433 | |||||||

Citigroup, Inc., 2.59%, 07/01/2024(d) | EUR | 3 | 3 | ||||||

789,436 | |||||||||

TOTAL SHORT-TERM INVESTMENTS | |||||||||

(Cost $886,443) | 886,443 | ||||||||

TOTAL INVESTMENTS - 100.0% | |||||||||

(Cost $95,155,502) | $111,263,770 | ||||||||

Liabilities in Excess of Other Assets - 0.0%(e) | (7,582) | ||||||||

TOTAL NET ASSETS - 100.0% | $111,256,188 | ||||||||

(a) | Non-income producing security. |

(b) | All or a portion of this security is on loan as of June 30, 2024. The total market value of these securities was $95,077 which represented 0.1% of net assets. |

(c) | The rate shown represents the 7-day effective yield as of June 30, 2024. |

(d) | Invested through a cash management account administered by Brown Brothers Harriman & Co. |

(e) | Represents less than 0.05% of net assets. |

2 |

Shares | Value | ||||||||

COMMON STOCKS - 97.9% | |||||||||

Aerospace & Defense - 1.3% | |||||||||

General Dynamics Corp. | 6,300 | $ 1,827,882 | |||||||

Huntington Ingalls Industries, Inc. | 11,200 | 2,758,896 | |||||||

4,586,778 | |||||||||

Air Freight & Logistics - 2.2% | |||||||||

FedEx Corp. | 25,600 | 7,675,904 | |||||||

Automobile Components - 1.9% | |||||||||

Magna International, Inc. | 163,700 | 6,859,030 | |||||||

Automobiles - 3.4% | |||||||||

General Motors Co. | 262,200 | 12,181,812 | |||||||

Banks - 13.8% | |||||||||

Bank of America Corp. | 74,900 | 2,978,773 | |||||||

Citigroup, Inc. | 226,688 | 14,385,620 | |||||||

Citizens Financial Group, Inc. | 213,800 | 7,703,214 | |||||||

Truist Financial Corp. | 73,400 | 2,851,590 | |||||||

US Bancorp | 201,300 | 7,991,610 | |||||||

Wells Fargo & Co. | 221,863 | 13,176,444 | |||||||

49,087,251 | |||||||||

Capital Markets - 5.1% | |||||||||

Bank of New York Mellon Corp. | 105,200 | 6,300,428 | |||||||

Goldman Sachs Group, Inc. | 11,600 | 5,246,912 | |||||||

State Street Corp. | 90,700 | 6,711,800 | |||||||

18,259,140 | |||||||||

Chemicals - 1.6% | |||||||||

Olin Corp. | 119,000 | 5,610,850 | |||||||

Communications Equipment - 7.3% | |||||||||

F5, Inc.(a) | 74,700 | 12,865,581 | |||||||

Telefonaktiebolaget LM Ericsson - ADR(b) | 2,096,400 | 12,934,788 | |||||||

25,800,369 | |||||||||

Consumer Finance - 1.2% | |||||||||

Capital One Financial Corp. | 13,100 | 1,813,695 | |||||||

Discover Financial Services | 19,300 | 2,524,633 | |||||||

4,338,328 | |||||||||

Electric Utilities - 2.0% | |||||||||

PPL Corp. | 256,800 | 7,100,520 | |||||||

Electronic Equipment, Instruments & Components - 2.4% | |||||||||

Corning, Inc. | 101,200 | 3,931,620 | |||||||

TE Connectivity Ltd. | 30,100 | 4,527,943 | |||||||

8,459,563 | |||||||||

Energy Equipment & Services - 3.8% | |||||||||

Baker Hughes Co. | 110,300 | 3,879,251 | |||||||

Halliburton Co. | 57,900 | 1,955,862 | |||||||

NOV, Inc. | 408,700 | 7,769,387 | |||||||

13,604,500 | |||||||||

Entertainment - 0.8% | |||||||||

Warner Bros Discovery, Inc.(a) | 373,600 | 2,779,584 | |||||||

Financial Services - 4.5% | |||||||||

Corebridge Financial, Inc. | 133,500 | 3,887,520 | |||||||

Euronet Worldwide, Inc.(a) | 43,200 | 4,471,200 | |||||||

Fidelity National Information Services, Inc. | 102,500 | 7,724,400 | |||||||

16,083,120 | |||||||||

Shares | Value | ||||||||

Food Products - 1.4% | |||||||||

Conagra Brands, Inc. | 90,200 | $ 2,563,484 | |||||||

General Mills, Inc. | 40,200 | 2,543,052 | |||||||

5,106,536 | |||||||||

Health Care Equipment & Supplies - 5.0% | |||||||||

GE HealthCare Technologies, Inc. | 85,662 | 6,674,783 | |||||||

Medtronic PLC | 109,600 | 8,626,616 | |||||||

Zimmer Biomet Holdings, Inc. | 24,200 | 2,626,426 | |||||||

17,927,825 | |||||||||

Health Care Providers & Services - 9.0% | |||||||||

Cigna Group | 12,300 | 4,066,011 | |||||||

CVS Health Corp. | 140,530 | 8,299,702 | |||||||

Elevance Health, Inc. | 22,400 | 12,137,664 | |||||||

HCA Healthcare, Inc. | 13,200 | 4,240,896 | |||||||

Humana, Inc. | 8,500 | 3,176,025 | |||||||

31,920,298 | |||||||||

Insurance - 5.1% | |||||||||

American International Group, Inc. | 119,500 | 8,871,680 | |||||||

Hartford Financial Services Group, Inc. | 92,600 | 9,310,004 | |||||||

18,181,684 | |||||||||

Interactive Media & Services - 2.3% | |||||||||

Alphabet, Inc. - Class A | 44,480 | 8,102,032 | |||||||

IT Services - 0.5% | |||||||||

Amdocs Ltd. | 21,500 | 1,696,780 | |||||||

Machinery - 4.4% | |||||||||

CNH Industrial NV | 339,200 | 3,436,096 | |||||||

Cummins, Inc. | 24,100 | 6,674,013 | |||||||

PACCAR, Inc. | 29,650 | 3,052,171 | |||||||

Stanley Black & Decker, Inc. | 33,200 | 2,652,348 | |||||||

15,814,628 | |||||||||

Media - 3.6% | |||||||||

Comcast Corp. - Class A | 231,600 | 9,069,456 | |||||||

Paramount Global - Class B | 105,200 | 1,093,028 | |||||||

WPP PLC - ADR(b) | 55,000 | 2,517,900 | |||||||

12,680,384 | |||||||||

Multi-Utilities - 1.5% | |||||||||

Dominion Energy, Inc. | 106,300 | 5,208,700 | |||||||

Oil Gas & Consumable Fuels - 8.8% | |||||||||

APA Corp. | 413,300 | 12,167,552 | |||||||

Marathon Oil Corp. | 153,400 | 4,397,978 | |||||||

Murphy Oil Corp. | 37,970 | 1,565,883 | |||||||

Ovintiv, Inc. | 107,480 | 5,037,588 | |||||||

Shell PLC - ADR | 110,872 | 8,002,741 | |||||||

31,171,742 | |||||||||

Personal Care Products - 2.2% | |||||||||

Unilever PLC - ADR | 141,900 | 7,803,081 | |||||||

Pharmaceuticals - 1.0% | |||||||||

GSK PLC - ADR | 44,340 | 1,707,090 | |||||||

Sanofi SA - ADR | 39,000 | 1,892,280 | |||||||

3,599,370 | |||||||||

Software - 0.9% | |||||||||

Oracle Corp. | 22,660 | 3,199,592 | |||||||

3 |

Shares | Value | ||||||||

COMMON STOCKS - (Continued) | |||||||||

Wireless Telecommunication Services - 0.9% | |||||||||

Vodafone Group PLC - ADR | 347,444 | $3,081,828 | |||||||

TOTAL COMMON STOCKS (Cost $288,594,305) | 347,921,229 | ||||||||

SHORT-TERM INVESTMENTS - 2.7% | |||||||||

Money Market Funds - 0.6% | |||||||||

Invesco Government & Agency Portfolio - Class Institutional, 5.23%(c) | 2,032,063 | 2,032,063 | |||||||

Par | |||||||||

Time Deposits - 2.1% | |||||||||

Citigroup, Inc., 2.59%, 07/01/2024(d) | EUR | 17 | 18 | ||||||

JPMorgan Chase & Company, 4.68%, 07/01/2024(d) | 7,498,174 | 7,498,174 | |||||||

7,498,192 | |||||||||

TOTAL SHORT-TERM INVESTMENTS (Cost $9,530,254) | 9,530,255 | ||||||||

TOTAL INVESTMENTS - 100.6% | |||||||||

(Cost $298,124,559) | $357,451,484 | ||||||||

Liabilities in Excess of Other Assets - (0.6)% | (1,994,954) | ||||||||

TOTAL NET ASSETS - 100.0% | $355,456,530 | ||||||||

(a) | Non-income producing security. |

(b) | All or a portion of this security is on loan as of June 30, 2024. The total market value of these securities was $1,990,209 which represented 0.6% of net assets. |

(c) | The rate shown represents the 7-day effective yield as of June 30, 2024. |

(d) | Invested through a cash management account administered by Brown Brothers Harriman & Co. |

4 |

Shares | Value | ||||||||

COMMON STOCKS - 97.7% | |||||||||

Air Freight & Logistics - 0.6% | |||||||||

FedEx Corp. | 8,500 | $ 2,548,640 | |||||||

Automobile Components - 7.2% | |||||||||

Adient PLC(a) | 472,500 | 11,675,475 | |||||||

BorgWarner, Inc. | 146,500 | 4,723,160 | |||||||

Goodyear Tire & Rubber Co.(a) | 190,100 | 2,157,635 | |||||||

Lear Corp. | 34,400 | 3,928,824 | |||||||

Magna International, Inc. | 204,100 | 8,551,790 | |||||||

31,036,884 | |||||||||

Automobiles - 0.5% | |||||||||

Harley-Davidson, Inc. | 59,700 | 2,002,338 | |||||||

Banks - 13.3% | |||||||||

Citizens Financial Group, Inc. | 507,600 | 18,288,828 | |||||||

Comerica, Inc. | 79,400 | 4,052,576 | |||||||

First Citizens BancShares, Inc./NC - Class A | 2,587 | 4,355,499 | |||||||

First Horizon Corp. | 290,300 | 4,578,031 | |||||||

KeyCorp | 254,100 | 3,610,761 | |||||||

Popular, Inc. | 214,300 | 18,950,549 | |||||||

Western Alliance Bancorp | 57,100 | 3,587,022 | |||||||

57,423,266 | |||||||||

Capital Markets - 3.7% | |||||||||

Lazard, Inc. | 42,000 | 1,603,560 | |||||||

Northern Trust Corp. | 33,000 | 2,771,340 | |||||||

State Street Corp. | 157,700 | 11,669,800 | |||||||

16,044,700 | |||||||||

Chemicals - 3.2% | |||||||||

Huntsman Corp. | 182,800 | 4,162,356 | |||||||

Olin Corp. | 204,400 | 9,637,460 | |||||||

13,799,816 | |||||||||

Commercial Services & Supplies - 1.7% | |||||||||

Brink’s Co. | 73,800 | 7,557,120 | |||||||

Communications Equipment - 7.7% | |||||||||

F5, Inc.(a) | 82,800 | 14,260,644 | |||||||

Telefonaktiebolaget LM Ericsson - ADR(b) | 3,060,100 | 18,880,817 | |||||||

33,141,461 | |||||||||

Construction & Engineering - 3.6% | |||||||||

Fluor Corp.(a) | 360,200 | 15,686,710 | |||||||

Consumer Finance - 2.0% | |||||||||

Discover Financial Services | 34,200 | 4,473,702 | |||||||

SLM Corp. | 206,400 | 4,291,056 | |||||||

8,764,758 | |||||||||

Electric Utilities - 1.6% | |||||||||

NRG Energy, Inc. | 27,100 | 2,110,006 | |||||||

PPL Corp. | 171,200 | 4,733,680 | |||||||

6,843,686 | |||||||||

Electronic Equipment, Instruments & Components - 1.9% | |||||||||

Arrow Electronics, Inc.(a) | 68,800 | 8,308,288 | |||||||

Energy Equipment & Services - 2.7% | |||||||||

Expro Group Holdings NV(a) | 128,483 | 2,944,830 | |||||||

Halliburton Co. | 85,100 | 2,874,678 | |||||||

Shares | Value | ||||||||

NOV, Inc. | 302,100 | $5,742,921 | |||||||

11,562,429 | |||||||||

Entertainment - 1.0% | |||||||||

Warner Bros Discovery, Inc.(a) | 604,600 | 4,498,224 | |||||||

Financial Services - 1.9% | |||||||||

Euronet Worldwide, Inc.(a) | 16,100 | 1,666,350 | |||||||

Fidelity National Information Services, Inc. | 84,900 | 6,398,064 | |||||||

8,064,414 | |||||||||

Food Products - 0.8% | |||||||||

Conagra Brands, Inc. | 126,000 | 3,580,920 | |||||||

Ground Transportation - 1.0% | |||||||||

U-Haul Holding Co. | 69,600 | 4,177,392 | |||||||

Health Care Providers & Services - 4.8% | |||||||||

Centene Corp.(a) | 93,200 | 6,179,160 | |||||||

Humana, Inc. | 9,500 | 3,549,675 | |||||||

Labcorp Holdings, Inc. | 10,900 | 2,218,259 | |||||||

Universal Health Services, Inc. - Class B | 48,500 | 8,969,105 | |||||||

20,916,199 | |||||||||

Hotels, Restaurants & Leisure - 0.8% | |||||||||

Marriott Vacations Worldwide Corp. | 37,500 | 3,274,500 | |||||||

Household Durables - 1.2% | |||||||||

Whirlpool Corp. | 51,800 | 5,293,960 | |||||||

Insurance - 7.0% | |||||||||

American International Group, Inc. | 88,400 | 6,562,816 | |||||||

CNO Financial Group, Inc. | 373,000 | 10,339,560 | |||||||

Enstar Group Ltd.(a) | 27,400 | 8,376,180 | |||||||

Hartford Financial Services Group, Inc. | 47,500 | 4,775,650 | |||||||

30,054,206 | |||||||||

Machinery - 3.2% | |||||||||

Allison Transmission Holdings, Inc. | 57,300 | 4,349,070 | |||||||

CNH Industrial NV | 558,700 | 5,659,631 | |||||||

Stanley Black & Decker, Inc. | 49,600 | 3,962,544 | |||||||

13,971,245 | |||||||||

Media - 1.1% | |||||||||

Omnicom Group, Inc. | 27,100 | 2,430,870 | |||||||

Paramount Global - Class B | 236,800 | 2,460,352 | |||||||

4,891,222 | |||||||||

Multi-Utilities - 1.0% | |||||||||

Dominion Energy, Inc. | 87,700 | 4,297,300 | |||||||

Oil Gas & Consumable Fuels - 16.1% | |||||||||

APA Corp. | 710,166 | 20,907,287 | |||||||

Baytex Energy Corp.(b) | 2,449,500 | 8,524,260 | |||||||

California Resources Corp. | 101,900 | 5,423,118 | |||||||

Cenovus Energy, Inc. | 166,400 | 3,271,424 | |||||||

Crescent Energy Co. - Class A | 18,600 | 220,410 | |||||||

Kosmos Energy Ltd.(a) | 3,793,120 | 21,013,885 | |||||||

Ovintiv, Inc. | 96,500 | 4,522,955 | |||||||

SilverBow Resources, Inc.(a) | 147,900 | 5,595,057 | |||||||

69,478,396 | |||||||||

Personal Care Products - 0.8% | |||||||||

Herbalife Ltd.(a) | 315,200 | 3,274,928 | |||||||

5 |

Shares | Value | ||||||||

COMMON STOCKS - (Continued) | |||||||||

Pharmaceuticals - 1.0% | |||||||||

Jazz Pharmaceuticals PLC(a) | 41,400 | $4,418,622 | |||||||

Professional Services - 1.4% | |||||||||

ManpowerGroup, Inc. | 89,700 | 6,261,060 | |||||||

Real Estate Management & Development - 1.0% | |||||||||

Jones Lang LaSalle, Inc.(a) | 20,900 | 4,290,352 | |||||||

Software - 0.8% | |||||||||

Workday, Inc. - Class A(a) | 15,000 | 3,353,400 | |||||||

Specialty Retail - 1.8% | |||||||||

Lithia Motors, Inc. | 8,700 | 2,196,315 | |||||||

ODP Corp.(a) | 145,645 | 5,719,479 | |||||||

7,915,794 | |||||||||

Textiles, Apparel & Luxury Goods - 0.5% | |||||||||

Capri Holdings Ltd.(a) | 67,600 | 2,236,208 | |||||||

Trading Companies & Distributors - 0.8% | |||||||||

WESCO International, Inc. | 20,900 | 3,313,068 | |||||||

TOTAL COMMON STOCKS (Cost $364,987,917) | 422,281,506 | ||||||||

REAL ESTATE INVESTMENT TRUSTS - 0.5% | |||||||||

Hotel & Resort Real Estate Investment Trusts - 0.1% | |||||||||

Pebblebrook Hotel Trust | 43,100 | 592,625 | |||||||

Office Real Estate Investment Trusts - 0.4% | |||||||||

Vornado Realty Trust | 58,000 | 1,524,820 | |||||||

TOTAL REAL ESTATE INVESTMENT TRUSTS | |||||||||

(Cost $3,154,657) | 2,117,445 | ||||||||

SHORT-TERM INVESTMENTS - 2.8% | |||||||||

Money Market Funds - 1.0% | |||||||||

Invesco Government & Agency Portfolio - Class Institutional, 5.23%(c) | 4,570,645 | 4,570,645 | |||||||

Par | |||||||||

Time Deposits - 1.8% | |||||||||

Citigroup, Inc., 4.68%, 07/01/2024(d) | 7,629,231 | 7,629,231 | |||||||

7,629,231 | |||||||||

TOTAL SHORT-TERM INVESTMENTS | |||||||||

(Cost $12,199,876) | 12,199,876 | ||||||||

TOTAL INVESTMENTS - 101.0% | |||||||||

(Cost $380,342,450) | $436,598,827 | ||||||||

Liabilities in Excess of Other Assets - (1.0)% | (4,427,489) | ||||||||

TOTAL NET ASSETS - 100.0% | $432,171,338 | ||||||||

(a) | Non-income producing security. |

(b) | All or a portion of this security is on loan as of June 30, 2024. The total market value of these securities was $4,415,573 which represented 1.0% of net assets. |

(c) | The rate shown represents the 7-day effective yield as of June 30, 2024. |

(d) | Invested through a cash management account administered by Brown Brothers Harriman & Co. |

6 |

Shares | Value | |||||

COMMON STOCKS - 96.6% | ||||||

Automobile Components - 2.5% | ||||||

Adient PLC(a) | 796,600 | $19,683,986 | ||||

Banks - 9.5% | ||||||

Bank of NT Butterfield & Son Ltd. | 372,800 | 13,092,736 | ||||

First Hawaiian, Inc. | 1,067,200 | 22,155,072 | ||||

First Horizon Corp. | 444,400 | 7,008,188 | ||||

Popular, Inc. | 314,300 | 27,793,549 | ||||

Synovus Financial Corp. | 62,400 | 2,507,856 | ||||

WaFd, Inc. | 39,498 | 1,128,853 | ||||

73,686,254 | ||||||

Capital Markets - 3.6% | ||||||

Evercore, Inc. - Class A | 7,700 | 1,604,911 | ||||

Perella Weinberg Partners | 283,700 | 4,610,125 | ||||

Stifel Financial Corp. | 259,600 | 21,845,340 | ||||

28,060,376 | ||||||

Chemicals - 5.8% | ||||||

Ecovyst, Inc.(a) | 2,959,500 | 26,546,715 | ||||

Olin Corp. | 391,100 | 18,440,365 | ||||

44,987,080 | ||||||

Commercial Services & Supplies - 2.1% | ||||||

Brink’s Co. | 120,100 | 12,298,240 | ||||

MillerKnoll, Inc. | 80,800 | 2,140,392 | ||||

Quad/Graphics, Inc. | 402,700 | 2,194,715 | ||||

16,633,347 | ||||||

Communications Equipment - 8.4% | ||||||

F5, Inc.(a) | 285,100 | 49,102,773 | ||||

Telefonaktiebolaget LM Ericsson - ADR(b) | 2,568,600 | 15,848,262 | ||||

64,951,035 | ||||||

Construction & Engineering - 3.2% | ||||||

Fluor Corp.(a) | 565,000 | 24,605,750 | ||||

Consumer Finance - 2.5% | ||||||

SLM Corp. | 948,100 | 19,710,999 | ||||

Electric Utilities - 0.8% | ||||||

OGE Energy Corp. | 166,100 | 5,929,770 | ||||

Electronic Equipment, Instruments & Components - 7.1% | ||||||

Arrow Electronics, Inc.(a) | 281,100 | 33,945,636 | ||||

Belden, Inc. | 146,100 | 13,704,180 | ||||

Plexus Corp.(a) | 71,600 | 7,387,688 | ||||

55,037,504 | ||||||

Energy Equipment & Services - 5.1% | ||||||

Expro Group Holdings NV(a) | 209,382 | 4,799,035 | ||||

NOV, Inc. | 1,819,300 | 34,584,893 | ||||

39,383,928 | ||||||

Financial Services - 1.3% | ||||||

Euronet Worldwide, Inc.(a) | 38,600 | 3,995,100 | ||||

WEX, Inc.(a) | 35,600 | 6,306,184 | ||||

10,301,284 | ||||||

Ground Transportation - 2.4% | ||||||

U-Haul Holding Co. | 305,900 | 18,360,118 | ||||

Hotels, Restaurants & Leisure - 3.4% | ||||||

International Game Technology PLC | 234,600 | 4,799,916 | ||||

Marriott Vacations Worldwide Corp. | 245,900 | 21,471,988 | ||||

26,271,904 | ||||||

Shares | Value | |||||

Insurance - 5.9% | ||||||

CNO Financial Group, Inc. | 121,900 | $3,379,068 | ||||

Enstar Group Ltd.(a) | 83,919 | 25,654,038 | ||||

Global Indemnity Group LLC - Class A | 316,036 | 9,824,169 | ||||

Horace Mann Educators Corp. | 205,600 | 6,706,672 | ||||

45,563,947 | ||||||

Machinery - 5.1% | ||||||

Allison Transmission Holdings, Inc. | 89,700 | 6,808,230 | ||||

Atmus Filtration Technologies, Inc.(a) | 267,600 | 7,701,528 | ||||

Greenbrier Cos., Inc. | 200,500 | 9,934,775 | ||||

Miller Industries, Inc./TN | 95,800 | 5,270,916 | ||||

Timken Co. | 125,400 | 10,048,302 | ||||

39,763,751 | ||||||

Media - 6.0% | ||||||

National CineMedia, Inc.(a) | 2,046,800 | 8,985,452 | ||||

Stagwell, Inc.(a) | 5,524,400 | 37,676,408 | ||||

46,661,860 | ||||||

Multi-Utilities - 1.4% | ||||||

Avista Corp. | 322,500 | 11,161,725 | ||||

Oil Gas & Consumable Fuels - 7.5% | ||||||

APA Corp. | 136,408 | 4,015,851 | ||||

Baytex Energy Corp. | 1,715,186 | 5,968,847 | ||||

Berry Corp. | 1,814,800 | 11,723,608 | ||||

Crescent Energy Co. - Class A | 153,200 | 1,815,420 | ||||

Kinetik Holdings, Inc. | 31,390 | 1,300,802 | ||||

Kosmos Energy Ltd.(a) | 3,598,300 | 19,934,582 | ||||

Murphy Oil Corp. | 104,300 | 4,301,332 | ||||

NextDecade Corp.(a) | 834,900 | 6,629,106 | ||||

Range Resources Corp. | 83,500 | 2,799,755 | ||||

58,489,303 | ||||||

Personal Care Products - 0.2% | ||||||

Herbalife Ltd.(a) | 142,900 | 1,484,731 | ||||

Professional Services - 3.1% | ||||||

ASGN, Inc.(a) | 61,800 | 5,448,907 | ||||

Hudson Global, Inc.(a)(c) | 147,460 | 2,449,310 | ||||

Korn Ferry | 39,600 | 2,658,744 | ||||

ManpowerGroup, Inc. | 199,800 | 13,946,040 | ||||

24,503,001 | ||||||

Real Estate Management & Development - 3.2% | ||||||

Jones Lang LaSalle, Inc.(a) | 109,600 | 22,498,688 | ||||

RMR Group, Inc. - Class A | 117,400 | 2,653,240 | ||||

25,151,928 | ||||||

Specialty Retail - 4.3% | ||||||

Lithia Motors, Inc. | 22,700 | 5,730,615 | ||||

ODP Corp.(a) | 357,380 | 14,034,313 | ||||

Sonic Automotive, Inc. - Class A | 246,600 | 13,432,302 | ||||

33,197,230 | ||||||

Trading Companies & Distributors - 2.2% | ||||||

Rush Enterprises, Inc. - Class A | 135,200 | 5,660,824 | ||||

WESCO International, Inc. | 70,900 | 11,239,068 | ||||

16,899,892 | ||||||

TOTAL COMMON STOCKS (Cost $645,187,935) | 750,480,703 | |||||

7 |

Shares | Value | |||||

REAL ESTATE INVESTMENT TRUSTS - 0.6% | ||||||

Real Estate Management & Development - 0.6% | ||||||

Seritage Growth Properties -Class A(a) | 1,075,610 | $5,023,099 | ||||

TOTAL REAL ESTATE INVESTMENT TRUSTS | ||||||

(Cost $16,974,776) | 5,023,099 | |||||

SHORT-TERM INVESTMENTS - 3.9% | ||||||

Money Market Funds - 1.0% | ||||||

Invesco Government & Agency Portfolio - Class Institutional, 5.23%(d) | 8,062,567 | 8,062,567 | ||||

Par | ||||||

Time Deposits - 2.9% | ||||||

Citigroup, Inc., 4.68%, 07/01/2024(e) | 22,444,666 | 22,444,666 | ||||

22,444,666 | ||||||

TOTAL SHORT-TERM INVESTMENTS | ||||||

(Cost $30,507,233) | 30,507,233 | |||||

TOTAL INVESTMENTS - 101.1% | ||||||

(Cost $692,669,944) | $786,011,035 | |||||

Liabilities in Excess of Other Assets - (1.1)% | (8,780,549) | |||||

TOTAL NET ASSETS - 100.0% | $777,230,486 | |||||

(a) | Non-income producing security. |

(b) | All or a portion of this security is on loan as of June 30, 2024. The total market value of these securities was $7,895,134 which represented 1.0% of net assets. |

(c) | Affiliated company as defined by the Investment Company Act of 1940. See Note 6. |

(d) | The rate shown represents the 7-day effective yield as of June 30, 2024. |

(e) | Invested through a cash management account administered by Brown Brothers Harriman & Co. |

8 |

Shares | Value | |||||

COMMON STOCKS - 95.6% | ||||||

Aerospace & Defense - 1.0% | ||||||

AerSale Corp.(a) | 351,800 | $2,434,456 | ||||

Moog, Inc. - Class A | 11,200 | 1,873,760 | ||||

National Presto Industries, Inc. | 20,414 | 1,533,704 | ||||

V2X, Inc.(a) | 44,955 | 2,156,042 | ||||

7,997,962 | ||||||

Automobile Components - 1.2% | ||||||

Adient PLC(a) | 117,605 | 2,906,020 | ||||

Fox Factory Holding Corp.(a) | 18,900 | 910,791 | ||||

Goodyear Tire & Rubber Co.(a) | 260,400 | 2,955,540 | ||||

Phinia, Inc. | 72,700 | 2,861,472 | ||||

9,633,823 | ||||||

Banks - 20.6% | ||||||

1st Source Corp. | 16,206 | 868,966 | ||||

Arrow Financial Corp. | 30,200 | 786,710 | ||||

Associated Banc-Corp. | 156,700 | 3,314,205 | ||||

Banc of California, Inc. | 263,218 | 3,363,926 | ||||

Bank of Marin Bancorp | 98,300 | 1,591,477 | ||||

BankUnited, Inc. | 101,210 | 2,962,417 | ||||

BayCom Corp. | 36,300 | 738,705 | ||||

BCB Bancorp, Inc. | 53,500 | 568,705 | ||||

Berkshire Hills Bancorp, Inc. | 77,100 | 1,757,880 | ||||

BOK Financial Corp. | 19,200 | 1,759,488 | ||||

Bridgewater Bancshares, Inc.(a) | 74,590 | 865,990 | ||||

Brookline Bancorp, Inc. | 380,199 | 3,174,662 | ||||

Cambridge Bancorp | 38,400 | 2,649,600 | ||||

Camden National Corp. | 53,516 | 1,766,028 | ||||

Capitol Federal Financial, Inc. | 302,300 | 1,659,627 | ||||

Cathay General Bancorp | 45,932 | 1,732,555 | ||||

Central Pacific Financial Corp. | 124,100 | 2,630,920 | ||||

Civista Bancshares, Inc. | 39,000 | 604,110 | ||||

CNB Financial Corp./PA | 36,800 | 751,088 | ||||

Columbia Banking System, Inc. | 103,700 | 2,062,593 | ||||

Community Trust Bancorp, Inc. | 39,710 | 1,733,739 | ||||

ConnectOne Bancorp, Inc. | 170,900 | 3,228,301 | ||||

CrossFirst Bankshares, Inc.(a) | 124,820 | 1,749,976 | ||||

Dime Community Bancshares, Inc. | 127,200 | 2,594,880 | ||||

Eagle Bancorp, Inc. | 186,530 | 3,525,417 | ||||

Enterprise Financial Services Corp. | 42,700 | 1,746,857 | ||||

FB Financial Corp. | 20,725 | 808,897 | ||||

Financial Institutions, Inc. | 39,961 | 772,046 | ||||

First Busey Corp. | 32,900 | 796,509 | ||||

First Business Financial Services, Inc. | 21,665 | 801,388 | ||||

First Financial Corp./IN | 67,763 | 2,499,099 | ||||

First Foundation, Inc. | 286,000 | 1,873,300 | ||||

First Hawaiian, Inc. | 160,440 | 3,330,734 | ||||

First Internet Bancorp | 51,189 | 1,383,127 | ||||

First Interstate BancSystem, Inc. - Class A | 27,500 | 763,675 | ||||

First Merchants Corp. | 22,302 | 742,434 | ||||

First Mid Bancshares, Inc. | 24,100 | 792,408 | ||||

First of Long Island Corp. | 165,680 | 1,660,114 | ||||

Flushing Financial Corp. | 216,018 | 2,840,637 | ||||

FS Bancorp, Inc. | 21,380 | 779,301 | ||||

Great Southern Bancorp, Inc. | 17,110 | 951,487 | ||||

Hanmi Financial Corp. | 215,567 | 3,604,280 | ||||

Heartland Financial USA, Inc. | 42,500 | 1,889,125 | ||||

Heritage Commerce Corp. | 203,400 | 1,769,580 | ||||

Heritage Financial Corp./WA | 93,200 | 1,680,396 | ||||

Shares | Value | |||||

Hilltop Holdings, Inc. | 81,800 | $ 2,558,704 | ||||

Home Bancorp, Inc. | 19,700 | 788,197 | ||||

Hope Bancorp, Inc. | 306,733 | 3,294,312 | ||||

Horizon Bancorp, Inc./IN | 205,200 | 2,538,324 | ||||

Independent Bank Corp./MI | 67,300 | 1,817,100 | ||||

Independent Bank Group, Inc. | 19,800 | 901,296 | ||||

Investar Holding Corp. | 56,000 | 862,400 | ||||

Kearny Financial Corp./MD | 291,400 | 1,792,110 | ||||

Live Oak Bancshares, Inc. | 52,700 | 1,847,662 | ||||

Mercantile Bank Corp. | 19,400 | 787,058 | ||||

MidWestOne Financial Group, Inc. | 30,794 | 692,557 | ||||

Northeast Bank | 13,200 | 803,352 | ||||

Northeast Community Bancorp, Inc. | 44,800 | 798,336 | ||||