Overall

Some lenders will exit sector

Financial aid officers will be regulated to do what is in best

interest of students

Reduce interest rate

subsidy

Lower margins on federal student loans

Reduced incentives to financial aid officers

Reduced ability to lock up volume at certain schools

Reduce guarantee rates

Lower margins on federal student loans

School as lender deals in jeopardy

Eliminate Preferred Lender

Lists

Reduced market share (1,500 schools have two lenders with

90% market share)

Eliminate perks to colleges

Lower sales expense

Revise business model due to reduced exclusivity

Eliminate lender-sponsored

call centers

Business disruption

Sale or closing of call centers

23

Proposed Regulations Effect on Other Lenders

Proposed Regulations Effect on MRU

Overall

Reduced competition/increased market share

Lower customer acquisition costs

Better rates for students!

Reduce interest rate

subsidy

No effect on P+L

MRU now discounts federal loans

Reduce guarantee rates

No effect – origination focused on high quality private loans

Federal loans < 5% of originations

Eliminate Preferred Lender

Lists

Increased market share for MRU as students shop for best

offer

Eliminate perks to colleges

No effect on P+L

Increased market share for MRU

Eliminate lender-sponsored

call centers

No effect

24

New Strategic Partnerships

Leading provider of test prep and educational services

Reach over 50% of college and graduate school-bound students annually

More than two million students applying to college and grad school

are assisted by The Princeton Review every year

Exclusive multi-year education financing partnership

MyRichUncle featured on The Princeton Review website; in their popular

books; and at a broad spectrum of events at high schools and colleges

Exclusive right to market The Princeton Review’s extensive database

MyRichUncle innovative test prep loan

Initial co-branded marketing campaigns generating strong response

25

New Strategic Partnerships

World’s largest student and youth travel company

More than 300 branches in 90 countries

Servicing 2.5 million students every year

More than 70 retail locations in U.S.

Aligns MRU with the 18 to 30 year-old market

Distribution at retail for MRU products

Additional direct-to-consumer point of contact

MyRichUncle innovative travel financing products

26

Corporate and Capital Market Milestones

27

June 2007

First securitization of $200 million of prime private loans

Mar/Apr 2007

Partnered with The Princeton Review and STA Travel

October 2006

Listed on NASDAQ under symbol UNCL

May 2006

Began student advocacy position

May/June 2006

Launched Preprime and Federal student loan products

January 2006

$175 million credit facility with Merrill Lynch

May 2005

Launched MyRichUncle private loan platform

July 2004

Merged into NASDAQ listed company (MHOI )

1999 to 2004

Developed credit and origination model with data back to 1967

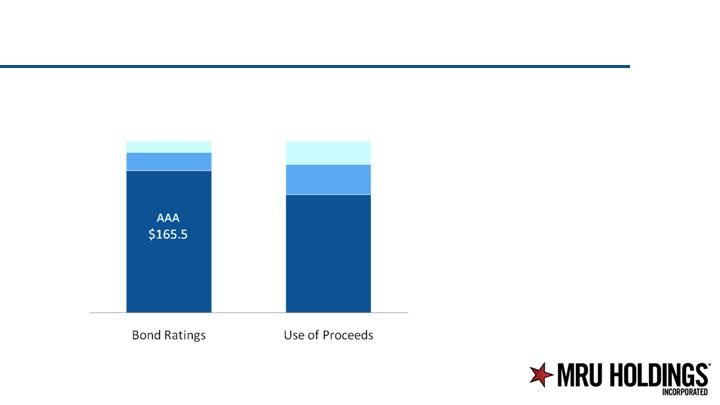

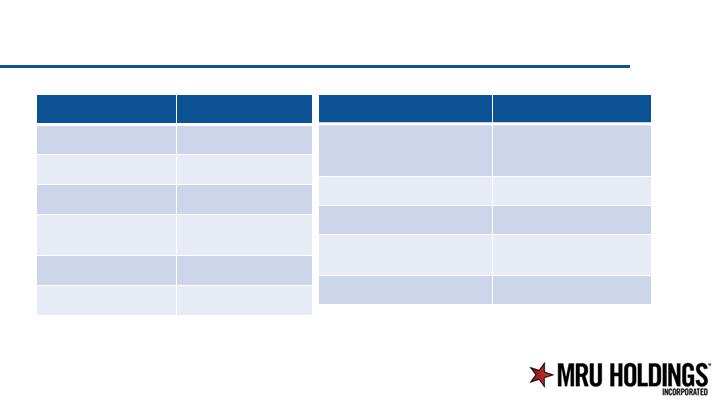

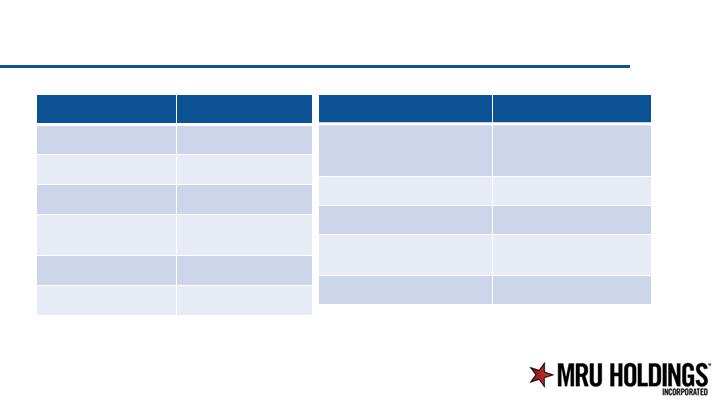

MRU Capital Structure

Shares (6/30/07)

Common Stock

25,714,393

Convertible Preferred

8,257,575

Primary

33,971,968

Warrants

Outstanding

6,555,292

Options Outstanding

4,954,814

Fully Diluted

45,482,074

Market Cap

(at $6.30 Treasury Stock

Method)

$250 MLN

Stock Symbol

UNCL

Exchange

NASDAQ Global Market

Added to Russell Microcap

Index

June 2007

First $200mm securitization

June 2007

28

MRU Key Investment Characteristics

Student lending is fastest growing segment of consumer finance

market

Building brand equity as an advocate for a growing student

population

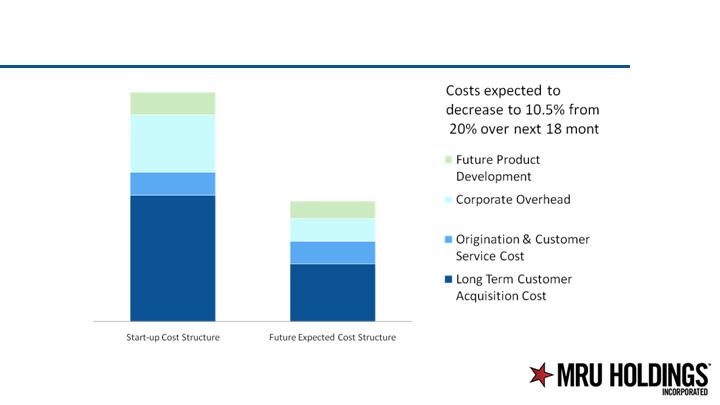

Broad range of competitively-priced products through efficient

direct-to-consumer model

Proprietary underwriting platform incorporating credit/income

data

Securitization business model

Strong management team

29

Appendix

30

MRU in the Media – Tech’s Best Young Entrepreneurs

31

MRU in the Media – Fast Company’s Fast 50

32

MRU in the Media—Launch of Federal Loan Product

33

MRU in the Media—Introduction of Preprime Loans

34

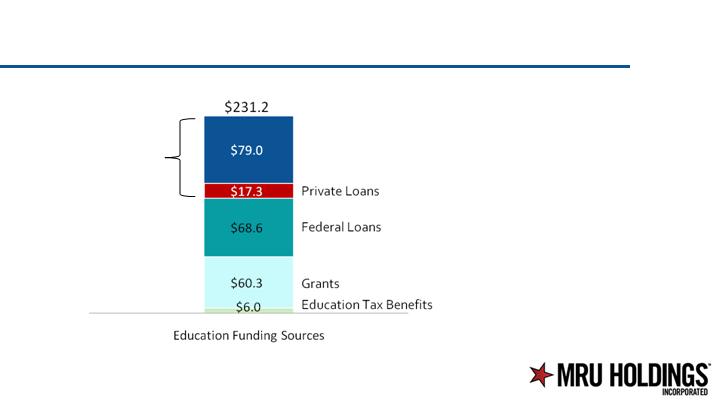

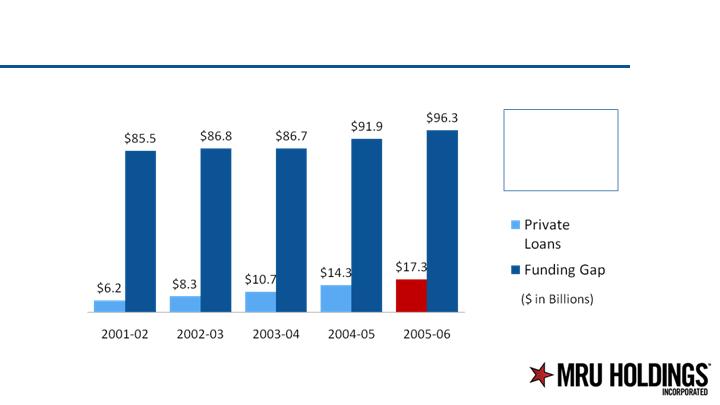

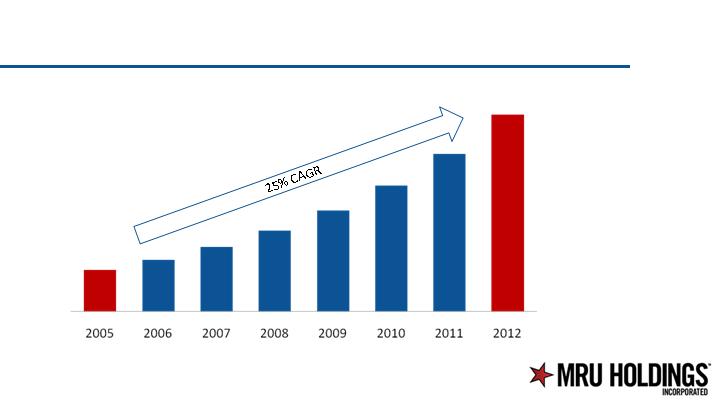

Fastest Growing Consumer Finance Asset Class

Private student loan business growing 25% annually

Growth accelerating as consumers move away from home equity and

savings to finance education costs

Student loan sector dominated by Sallie Mae and others

focused on federal student loan market

Banks and finance companies focus on mortgages and credit cards

Limited number of companies provide private student loans on

principal basis

First Marblehead (FMD), the leading pure private loan play, grew 10x+

in past five years

35

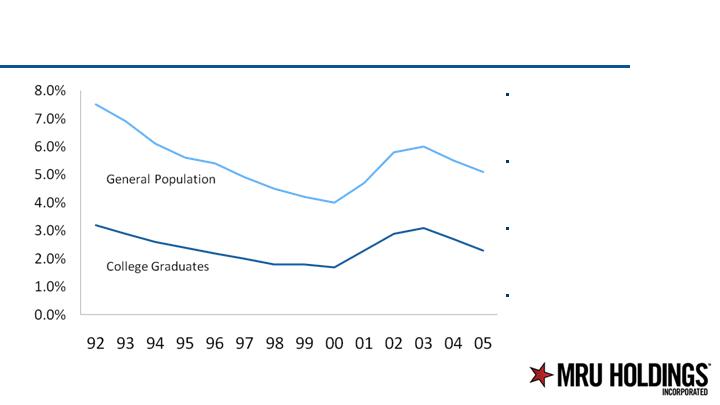

Lower Risk than Other Unsecured Consumer Loans

College grads have lower borrowing risk for lenders

Higher annual income growth

Higher lifetime income

Lower unemployment rate and variability

Majority of loans are co-signed

Co-signed loans are serviced by two incomes

Growing post-graduation income for students

Co-signers provide support for early life-cycle payments

36

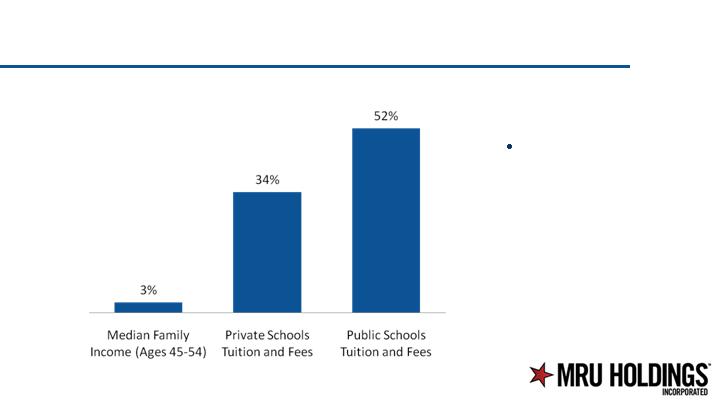

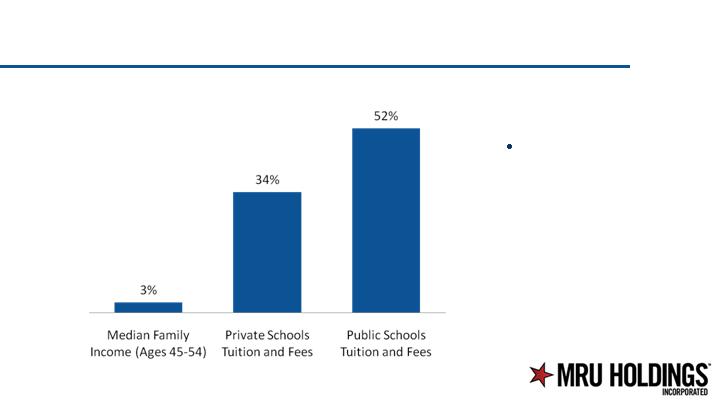

Education Costs Increasing Faster than Income

Cost of

attendance

increasing over

10x compared

to income

growth

Inflation-Adjusted Change in Family

Income vs. Tuition and Fees at Four-

Year Schools from 1995-96 to 2005-06

37

Demand for Student Loans Is Inelastic Year-on-Year

Demand for education increasing while supply (schools) remains flat

Student enrollment up 23% in past ten years

Projected enrollment up 13% by 2015

Enrollment rises in good and bad economic cycles driving demand for

student loans

Tuition rising and acceptance rates dropping

38

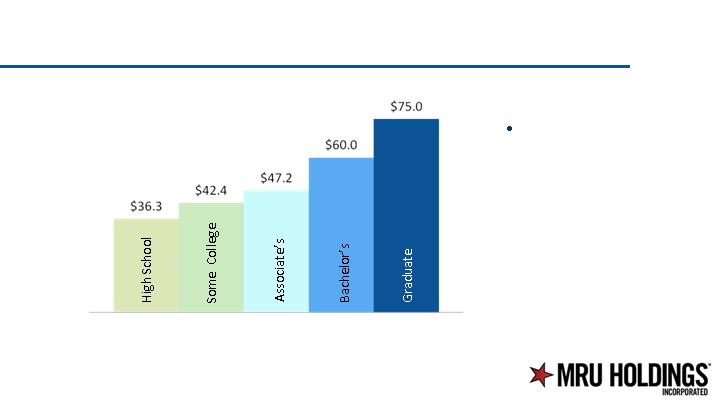

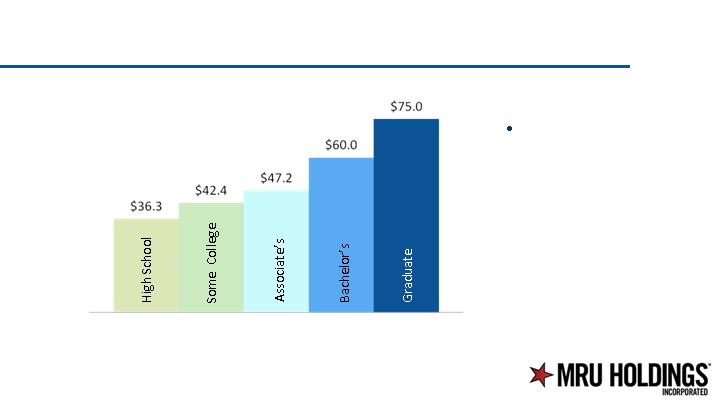

Student Loans a Better Credit Risk – Higher Annual Income

Average Annual Income by

Education Level Achieved

($ in thousands)

Average income

of college

graduates is 65%

greater than

general

population

39

Student Loans a Better Credit Risk – Greater Income Growth

% Change in Annual Income

in 2005 Constant Dollars

(1995 to 2005)

Income of

college and

above graduates

increasing while

others declining

40

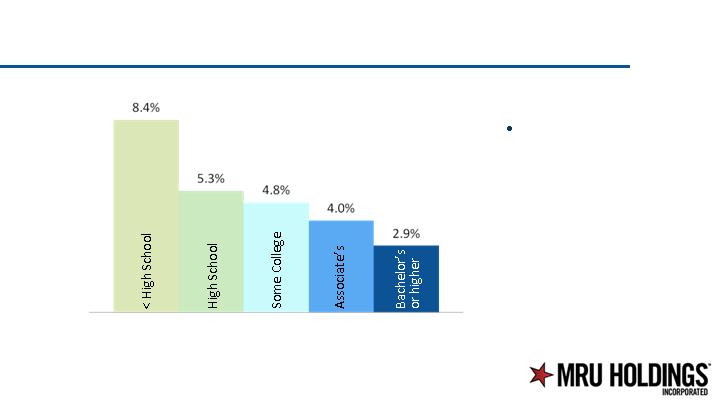

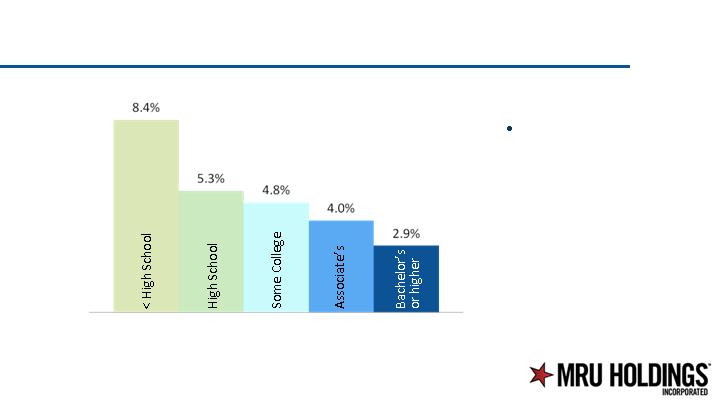

Student Loans a Better Credit Risk – Lower Unemployment Levels

Unemployment by Level

of Education Achieved

Unemployment

rates for college

graduates are

far below

general

population

41

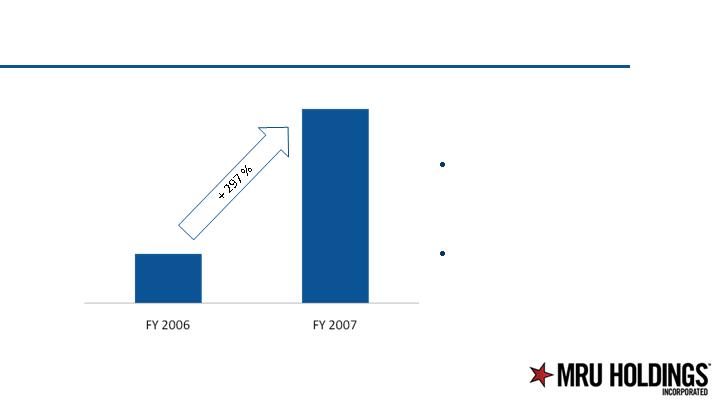

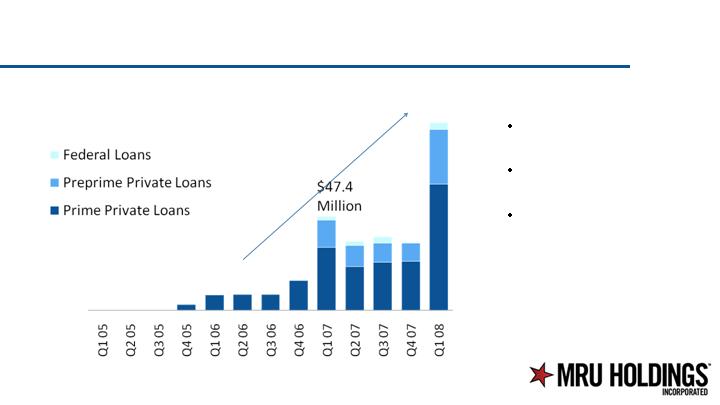

Volume Growth by Same Quarter is Very Strong

Q1 08 will continue to

show healthy growth

in origination volume

vs. Q1 07

($ in Millions)

42

Sources

43

There are industry and economic data throughout this presentation that were

sourced from The College Board, IES National Center for Education Statistics, Student Market Measure and the Bureau of Labor Statistics.