SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ PreliminaryProxy Statement | | ¨ Confidential,For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x DefinitiveProxy Statement | | |

¨ Definitive Additional Materials | | |

¨ SolicitingMaterial Pursuant to § 240.1a-11(c) or § 240.14 | | |

SeraCare Life Sciences, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| | 1. | | Title of each class of securities to which transaction applies: |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials:

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1. | | Amount Previously Paid: |

| | 2. | | Form, Schedule or Registration Statement No.: |

SERACARE LIFE SCIENCES

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On February 26, 2003

SeraCare Life Sciences hereby invites you, as one of our shareholders, to attend our annual meeting of shareholders either in person or by proxy. The meeting will be held at the offices of Biomat USA, Inc., located at 1925 Century Park East, Suite 920, Los Angeles, California 90067 at 9:00 a.m., local time, for the purpose of considering and acting upon the following matters:

| 1. | | Electing all of our directors for the ensuing year; |

| 2. | | Approving an amendment to the 2001 Stock Incentive Plan to increase the number of shares available for award grants under the plan and to increase certain other award limits under the plan; and |

| 3. | | Transacting any other business that may properly come before the meeting. |

Only shareholders of record at the close of business on January 17, 2003 are entitled to receive notice of and to vote at the annual meeting or any adjournment of the meeting.

| By Order of the Board of Directors, |

|

|

Jerry L. Burdick Secretary |

Oceanside, California

January 23, 2003

YOUR VOTE IS IMPORTANT. ALL SHAREHOLDERS ARE URGED TO ATTEND THE MEETING IN PERSON OR BY PROXY. WHETHER OR NOT YOU EXPECT TO BE PRESENT, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE FURNISHED FOR THAT PURPOSE.

SERACARE LIFE SCIENCES, INC.

1935 Avenida del Oro, Suite F

Oceanside, California 92056

(760) 806-8922

PROXY STATEMENT

The board of directors of SeraCare Life Sciences, Inc. (“SeraCare Life Sciences”) is soliciting the enclosed proxy for use at our annual meeting of shareholders to be held on Wednesday, February 26, 2003, at 9:00 a.m., local time, or at any adjournments of the meeting. This proxy statement and the accompanying Notice of Annual Meeting of Shareholders describe the purposes of the annual meeting. The annual meeting will be held at the offices of Biomat USA, Inc., located at 1925 Century Park East, Suite 920, Los Angeles, California 90067. These proxy solicitation materials were mailed on or about January 23, 2003 to all shareholders entitled to vote at the annual meeting.

QUESTIONS AND ANSWERS ABOUT THE MEETING

| | Q: | | What am I being asked to vote on? |

| | A: | | (1) The election of nominees to serve on our board of directors; and |

| | (2) | | The approval of an amendment to the 2001 Stock Incentive Plan to increase the number of shares available for award grants under the plan and to increase certain other award limits under the plan. |

| | Q: | | How does the board recommend I vote on these proposals? |

| | A: | | Our board of directors recommends a vote FOR each of the nominees for director and FOR the approval of the amendment to the 2001 Stock Incentive Plan. |

| | Q: | | Who is entitled to vote? |

| | A: | | The record date for the annual meeting is January 17, 2003. Shareholders of record as of the close of business on that date are entitled to vote at the annual meeting. |

| | A: | | If you are the record holder of your shares, you may sign and date the enclosed proxy card and return it in the pre-paid envelope or attend and vote at the annual meeting in person. |

| | Q: | | What if my shares are held by a broker? |

| | A: | | If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. |

| | Q: | | Can I revoke my proxy later? |

| | A: | | Yes. You have the right to revoke your proxy at any time before the annual meeting by: |

| | (1) | | delivering a signed revocation or a subsequently dated, signed proxy card to the Secretary of SeraCare Life Sciences before the annual meeting, or |

| | (2) | | attending the annual meeting and voting in person. |

| | | | However, if you have delivered a valid proxy, your mere presence at the annual meeting will not, by itself, revoke that proxy. |

| | Q: | | How many shares can vote? |

| | A: | | As of the close of business on the record date of January 17, 2003, 7,436,078 shares of common stock were issued and outstanding. We have no other class of voting securities outstanding. Each share of common stock entitles its holder to one vote. |

| | Q: | | How is a quorum determined? |

| | A: | | For the purposes of determining a quorum, shares held by brokers or nominees will be treated as present even if the broker or nominee does not have discretionary power to vote on a particular matter or if instructions were never received from the beneficial owner. Abstentions will be counted as present for quorum purposes. |

| | Q: | | What is required to approve each proposal? |

| | A: | | A plurality of the shares of common stock voted in person or by proxy is required to elect the nominees for directors. A plurality means that the eight (8) nominees receiving the largest number of votes cast will be elected. Once a quorum has been established, each shareholder voting for the election of directors may cumulate his votes and give one candidate a number of votes equal to the number of directors to be elected multiplied by the number of shares that the shareholder is entitled to vote, or distribute the shareholder’s votes on the same principle among as many candidates as the shareholder may select, provided that votes cannot be cast for more than eight (8) candidates. However, no shareholder shall be entitled to cumulate votes unless the candidate’s name has been placed in nomination prior to the voting and the shareholder, or any other shareholder, has given notice at the meeting, prior to the voting, of the intention to cumulate the shareholder’s votes. |

| | | | To approve the amendment to the 2001 Stock Incentive Plan, holders of a majority of the shares represented and voted at the annual meeting, either in person or by proxy, must vote in favor of the proposal. |

| | Q: | | What happens if I abstain? |

| | A: | | Under California law abstentions will be counted for purposes of determining the presence or absence of a quorum for the transaction of business, but will not be counted for purposes of determining the total number of votes cast with respect to a proposal. |

| | Q: | | What are Broker Non-Votes and how are they counted? |

| | A: | | “Broker non-votes” are shares held by brokers or nominees for which the broker or nominee lacks discretionary power to vote and never received specific voting instructions from the beneficial owner of the shares. Broker non-votes will be counted for purposes of calculating a quorum, but will not be counted for purposes of determining the total number of votes cast with respect to a proposal. |

2

| | Q: | | How will my shares be voted if I return a blank proxy card? |

| | A: | | If you sign and send in your proxy card and do not indicate how you want to vote, we will count your proxy as a vote FOR approval of the amendment to the 2001 Stock Incentive Plan and FOR each of the director nominees named in this proxy statement. If a broker or nominee who does not have discretion to vote has delivered a proxy but has failed to physically indicate on the proxy card that broker’s lack of authority to vote, we will treat the shares as present and count the shares as votes FOR the approval of the amendment to the 2001 Stock Incentive Plan and FOR each of the director nominees named in this proxy statement. |

| | Q: | | How will voting on any other business be conducted? |

| | A: | | Although we do not know of any business to be considered at the annual meeting other than the proposals described in this proxy statement, if any other business comes before the annual meeting, your signed proxy card gives authority to the proxyholders, Michael F. Crowley II and Dennis M. Mulroy, to vote on those matters at their discretion. |

| | Q: | | What if a quorum is not present at the meeting? |

| | A: | | If a quorum is not present at the scheduled time of the annual meeting, we may adjourn the meeting, either with or without the vote of the shareholders. If we propose to have the shareholders vote whether to adjourn the meeting, the proxyholders will vote all shares for which they have authority in favor of the adjournment. We may also adjourn the meeting if for any reason we believe that additional time should be allowed for the solicitation of proxies. An adjournment will have no effect on the business that may be conducted at the annual meeting. |

| | Q: | | How much stock do SeraCare Life Sciences’ directors and executive officers own? |

| | A: | | As of January 9, 2003, our current directors and executive officers collectively had the power to vote 1,797,488 shares, constituting approximately 22.3% of the outstanding shares. These persons have indicated that they currently intend to vote the shares held by them FOR the approval of the amendment to the 2001 Stock Incentive Plan and FOR each of the director nominees named in this proxy statement. |

| | Q: | | Who will bear the costs of this solicitation? |

| | A: | | We will pay the cost of this solicitation of proxies by mail. Our officers and regular employees may also solicit proxies in person or by telephone without additional compensation. We will make arrangements with brokerage houses, custodians, nominees and other fiduciaries to send proxy materials to their principals, and we will reimburse these persons for related postage and clerical expenses. |

3

PROPOSAL 1—ELECTION OF DIRECTORS

The current term of office of all of our directors expires at the 2003 annual meeting. The board of directors proposes that the following nominees, all of whom are currently serving as directors, be re-elected for a new term of one year and until their successors are duly elected and qualified. The persons named in the enclosed form of proxy intend, if authorized, to vote the proxies FOR the election as directors of each of the eight persons named below as nominees. If any nominee declines or is unable to serve as a director, which we do not anticipate, the persons named as proxies reserve full discretion to vote for any other person who may be nominated.

Director Nominees and Executive Officers

Set forth below are the names, ages, positions and offices held with us (if any), and principal occupations and employment during the past five years, of our director nominees and executive officers.

Name

| | Age

| | Position

| | Director/ Officer Since

|

| Barry D. Plost | | 57 | | Chairman of the Board | | 1998 |

|

| Michael F. Crowley II | | 35 | | Director, President and Chief Executive Officer | | 2000 |

|

| Dennis M. Mulroy | | 47 | | Chief Financial Officer | | 2001 |

|

| Jerry L. Burdick | | 63 | | Director and Secretary | | 1998 |

|

| Samuel Anderson | | 67 | | Director | | 2001 |

|

| Ezzat Jallad | | 40 | | Director | | 2001 |

|

| Dr. Nelson Teng | | 56 | | Director | | 2001 |

|

| Robert J. Cresci | | 59 | | Director | | 2001 |

|

| Dr. Bernard Kasten | | 56 | | Director | | 2001 |

Barry D. Plost began serving as Chairman of the board of directors and Chief Executive Officer of our company when Biomat USA, Inc. (formerly known as SeraCare, Inc.) acquired our company in February 1998. From the time of our spin-off from Biomat USA in September 2001 until July 10, 2002, Mr. Plost served as our interim Chief Executive Officer. Mr. Plost has served as Chairman, President and Chief Executive Officer of Biomat USA, Inc. since February 6, 1996. Mr. Plost also serves on the PPTA Sources board of directors of the Plasma Protein Therapeutics Association. Mr. Plost also serves on the board of Probitas Pharma S.A. and is a member of its Executive Committee. Probitas Pharma S.A. is the parent company of Instituto Grifols S.A., which purchased Biomat USA, and is a supplier to SeraCare Life Sciences.

Michael F. Crowley II was elected to the board of directors on July 10, 2002 the same time he was appointed Chief Executive Officer. From November 2000 until his appointment as our Chief Executive Officer, Mr. Crowley served as our President and Chief Operating Officer. Prior to his role as President, Mr. Crowley served as our Vice President of Operations from January 1998 to November 2000. Mr. Crowley has been employed by the company since 1986.

Dennis M. Mulroy was appointed Chief Financial Officer of our company on November 19, 2001. Mr. Mulroy most recently served as the chief financial officer of Bioceutix Inc., a privately-held developer of skin treatment products from January 2001 to November 2001. From August 2000 to January 2001, Mr. Mulroy served as Chief Financial Officer of Bidland Systems, a privately-held application service provider for e-commerce. From February 2000 to June 2000, Mr. Mulroy served as the Chief Financial Officer of Enhanced Information Services, a privately-held medical products and services provider over the internet. From August 1999 to February 2000, Mr. Mulroy served as the vice president of finance and assistant corporate secretary of TelePacific Communications, a privately-held full service telecommunication provider. From January 1997 to

4

April 1999, Mr. Mulroy served as the vice president of finance and administration and corporate secretary of First World Communications, Inc., a publicly traded full service telecommunication provider. Prior to his employment by First World Communications, Mr. Mulroy was the chief financial officer of River Medical Inc. Mr. Mulroy is a Certified Public Accountant in the State of California.

Jerry L. Burdick has served as our Secretary and a member of our board of directors since February 1998. From February 1998 until January 9, 2002, Mr. Burdick also served as our Chief Financial Officer and Executive Vice President. At Biomat USA, Mr. Burdick has served as Executive Vice President, Secretary and a director since December 1, 1995, as Chief Financial Officer from December 1, 1995 through September 8, 1999, as Acting Chief Financial Officer from November 30, 1999 through December 31, 1999 and was reappointed Chief Financial Officer effective January 1, 2000. Mr. Burdick is a Certified Public Accountant in the State of California and has held senior financial positions with various companies including International Rectifier Corporation and Getty Oil Company.

Samuel Anderson has served as a member of our board of directors since September 25, 2001. Mr. Anderson entered into a Consulting Agreement in April 2002 with SeraCare Life Sciences to offer advisory services to our Chief Executive Officer. Mr. Anderson was a director of and consultant to Biomat USA from April 1996 to September 2001. Mr. Anderson also serves on the boards of Hycor Biomedical, Inc. and Cypress Bioscience, Inc.

Ezzat Jallad has served as a member of our board of directors since September 25, 2001. Mr. Jallad was a director of Biomat USA from October 1996 to September 2001. For the last five years, Mr. Jallad has been Executive Vice President of FCIM Corp. Mr. Jallad also serves on the board of Chili-Up, Inc.

Dr. Nelson Teng has served as a member of our board of directors since September 25, 2001. Dr. Teng was a director of Biomat USA from January 1997 to September 2001. Dr. Teng has been the director of Gynecologic Oncology and Associate Professor of Gynecology and Obstetrics at Stanford University School of Medicine since 1981. Dr. Teng also co-founded ADEZA Biomedical in 1984 and UNIVAX Biologics in 1988. In addition, Dr. Teng has served as a scientific advisor and consultant to several biotechnology companies and venture capital firms and has authored over 100 publications and 15 patents. Dr. Teng serves on several other boards of directors.

Robert J. Cresci has served as a member of our board of directors since September 25, 2001. Mr. Cresci was a director of Biomat USA from April 1998 to September 2001. Mr. Cresci has been a managing director of Pecks Management Partners Ltd., an investment management firm, since September 1990. Mr. Cresci currently serves on the boards of Sepracor, Inc., Luminex Corporation, Aviva Petroleum Ltd., Film Roman, Inc., j2 Global Communications, Inc., Candlewood Hotel Co., Inc., Continucare Corporation, LTWC Corporation and several private companies.

Dr. Bernard Kasten has served as a member of our board of directors since September 25, 2001. Dr. Kasten was a director of Biomat USA from March 2001 to September 2001. Dr. Kasten is Vice President of Business Development for Medicine and Science for Quest Diagnostics, Inc., a position he has held since 1996. Dr. Kasten also serves on the Scientific Advisory Board of Structural Bio Informatics Inc., which specializes in genomic- based protein modeling and therapeutic drug design.

Board Composition

Our board of directors consists of eight authorized members. All directors are elected to hold office until our next annual meeting of shareholders and until their successors have been elected. Officers are elected and serve at the discretion of the board of directors. There are no family relationships among any of our directors or executive officers.

5

Certain Relationships and Related Transactions

Transactions with Management and Others

Effective April 15, 2002, Samuel Anderson became a consultant to SeraCare Life Sciences pursuant to a three year Consulting Agreement. Under the terms of this agreement, Mr. Anderson serves as an advisor to the Chief Executive Officer and receives an annual consulting fee of $70,000.

Certain Business Relationships

On September 24, 2001 in connection with the merger of our former parent Biomat USA, Inc. with a subsidiary of Instituto Grifols, S.A., Biomat USA spun-off our company to Biomat USA’s then existing shareholders in a distribution. In connection with the spin-off, we entered into the following agreements with Biomat USA, Inc.:

| | • | | Master Separation and Distribution Agreement. This agreement outlines the terms and conditions of our separation and distribution from Biomat USA. |

| | • | | General Assignment and Assumption Agreement. This agreement identifies the assets and liabilities relating to our business that Biomat USA transferred to us and that we accepted as part of the separation. |

| | • | | Employee Matters Agreement. This agreement provided for the orderly transition of certain employee benefit programs for our employees. |

| | • | | Tax Sharing Agreement. This agreement sets forth SeraCare Life Sciences’ and Biomat USA’s respective rights and obligations to payments and refunds, if any, with respect to taxes for periods before and after the spin-off and related matters such as the filing of tax returns and conduct of audits and other proceedings involving claims made by taxing authorities. |

| | • | | Trademark License Agreement. This agreement provides for a perpetual license from Biomat USA to us to use the registered service mark “SeraCare” in our business. This agreement also provided for the transfer from Biomat USA to us of the domain name “www.seracare.net“. |

| | • | | Supply and Services Agreement. This agreement sets forth the terms and conditions pursuant to which Biomat USA will supply us with certain plasma products until January 2006 at prices which will be agreed upon on an annual basis. Under this agreement, Biomat USA will also provide plasmapheresis services on donors referred by us, including collecting, testing and delivering the plasma to us. The plasma products provided by Biomat USA to us under this agreement are subject to minimum quality specifications set forth in the agreement and are subject to specifications for delivery, storage and handling of the plasma in accordance with applicable laws, industry standards and good manufacturing practices. |

In connection with the Supply and Services Agreement we issued to Probitas Pharma, the parent of Instituto Grifols, S.A., a five year warrant to purchase 563,347 shares of our common stock at an exercise price of $3.05 per share (which was the average of the closing prices of our common stock for the first twenty trading days after our spin-off from Biomat USA).

SeraCare Life Sciences is also party to an agreement with Instituto Grifols, S.A. under which Instituto Grifols supplies us with Human Serum Albumin, which we then distribute to various biotech companies. Under this agreement, Instituto Grifols also supplies us with Human Serum Albumin for use in diagnostic products. We obtain a substantial portion of our revenue and operating margin from sales of products incorporating the Human Serum Albumin supplied to us by Instituto Grifols under this agreement. The agreement was amended in 2001 to extend its term until March 31, 2006. In connection with a recent agreement for the supply of Human Serum

6

Albumin that we entered into with one of our significant customers we also amended the terms of our agreement with Instituto Grifols to conform certain aspects of the agreement with this customer contract.

SeraCare Life Sciences purchased from subsidiaries of Biomat USA products and services totaling $268,196 during the fiscal year ended September 30, 2002. During the same period, SeraCare Life Sciences purchased plasma products from other subsidiaries of Probitas Pharma S.A. totaling $8,746,472. The amount of business to be transacted in fiscal year 2003 between SeraCare Life Sciences and Biomat USA, Inc., Probitas Pharma, S.A. and its subsidiaries is expected to approximate the amount of business transacted in fiscal year 2002.

Mr. Barry D. Plost is currently our Chairman of the board of directors. Mr. Plost is also President of Biomat USA, Inc. and serves as a director of Probitas Pharma S.A.

Mr. Jerry L. Burdick is currently our Secretary as well as a member of our board of directors. Mr. Burdick is also the Chief Financial Officer of Biomat USA, Inc.

Board of Directors and Committees of Our Board of Directors

Our board of directors held four regular meetings and one special meeting during fiscal 2002. Ezzat Jallad attended three of the five meetings of the board of directors and two of the three meetings of the Audit Committee. Each of the other directors attended at least 75% of the total number of meetings of the board held while he was a director and of each committee on which he served during the period in which he served as a member of that committee. Our board has established the following committees, and may establish others from time to time:

Audit Committee

The Audit Committee was formed in September 2001 and consists of Messrs. Cresci, Jallad and Teng. The Audit Committee recommends to the board the independent auditors to be selected to audit our company’s annual financial statements and approves any special assignments given to such auditors. The Audit Committee also reviews the planned scope of the annual audit and the independent auditors’ letter of comments and management’s responses thereto, and any major accounting changes made or contemplated.

The Audit Committee Charter, which sets forth the authority and responsibilities of the Audit Committee, was approved by the board of directors in November 2001. A copy of the restated Audit Committee Charter is attached to this proxy statement as Annex A. The Audit Committee assists our board of directors in overseeing the accounting and financial reporting processes of SeraCare Life Sciences and audits of our financial statements, including the integrity of our financial statements, compliance with legal and regulatory requirements, our independent auditors’ qualifications and independence, the performance of our independent auditors, and such other duties as may be directed by our board of directors. The Audit Committee Charter requires that the Audit Committee consist of not less than three board members who satisfy the “independence” requirements of Nasdaq. The Audit Committee consists of Messrs. Cresci, Jallad and Teng, each of whom satisfies these requirements. The Audit Committee held three meetings during fiscal 2002. A copy of the report of the Audit Committee is contained in this proxy statement.

Compensation Committee

The Compensation Committee was formed in September 2001 and consists of Messrs. Anderson and Jallad. The Compensation Committee establishes remuneration levels for our executive officers, reviews management organization and development and reviews significant employee benefit programs.

7

Compensation of Directors

Our board of directors consists of 8 authorized members. Each director, excluding Michael F. Crowley II and Samuel Anderson, is entitled to an annual cash fee of $10,000 plus expenses to be paid the first month of each fiscal year, a $1,000 fee for each meeting personally attended and a $500 fee for each meeting telephonically attended. In addition, each director, excluding Michael F. Crowley II, receives annually a fully vested option to purchase 10,000 shares of our common stock with an exercise price equal to 100% of the fair market value of our common stock on the date of the grant.

In addition, beginning with fiscal 2003, each member of our audit committee is entitled to a $1,000 fee for each meeting personally attended and also received a one-time fully vested option to purchase 5,000 shares of our common stock with an exercise price equal to 100% of the fair market value of our common stock on the date of the grant.

Pursuant to our 2001 Stock Incentive Plan, each of Messrs. Plost, Burdick, Anderson, Teng, Cresci, Jallad and Kasten received on May 13, 2002 a fully vested five year option to purchase 25,000 shares of our common stock at an exercise price of $5.93 per share.

Chairman of the Board Barry D. Plost received on July 10, 2002 a fully vested five year option to purchase 25,000 shares of our common stock at an exercise price of $6.06 per share for services performed in his capacity as Chairman of our board of directors.

Other Arrangements with Directors

Effective April 15, 2002, Samuel Anderson became a consultant to SeraCare Life Sciences pursuant to a three year Consulting Agreement. Under the terms of this agreement, Mr. Anderson serves as an advisor to the Chief Executive Officer and receives an annual consulting fee of $70,000.

For his services on the Scientific Advisory Board, Dr. Bernard Kasten received on July 10, 2002 a fully vested five year option to purchase 25,000 shares of common stock at an exercise price of $6.06 per share.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee is a former or current officer or employee of SeraCare Life Sciences; however, Samuel Anderson is a consultant to SeraCare Life Sciences. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board of directors or on our Compensation Committee.

8

Equity Security Ownership of Management and Other Beneficial Ownership

The following sets forth information as of January 9, 2003 (the “Reference Date”) with respect to the beneficial ownership of our common stock, (i) by each person known to us to own beneficially more than five percent of our common stock, (ii) by each executive officer and director, and (iii) by all officers and directors as a group.

| | | Shares of Common Stock Beneficially Owned(1)

|

Individual / Group

| | Amount and Nature of Beneficial Ownership

| | Percent of Class

|

| Barry D. Plost(2) | | 782,658 | | 10.3 |

|

| Jerry L. Burdick(3) | | 190,444 | | 2.6 |

|

| Dr. Nelson Teng(4) | | 270,000 | | 3.6 |

|

| Samuel Anderson(5) | | 222,386 | | 3.0 |

|

| Ezzat Jallad(6) | | 102,000 | | 1.4 |

|

| Robert Cresci(7)(8) | | 86,000 | | 1.2 |

|

| Dr. Bernard Kasten(7) | | 100,000 | | 1.3 |

|

| Michael F. Crowley II(7) | | 44,000 | | * |

|

| Dennis M. Mulroy | | — | | * |

|

| All officers and directors (9 persons) | | 1,797,488 | | 22.3 |

|

| Other beneficial owners: | | | | |

|

| Pecks Management Partners, Ltd.(8) | | 1,459,438 | | 19.8 |

| One Rockefeller Plaza | | | | |

| New York, NY 10020 | | | | |

|

| Ashford Capital Management, Inc.(9) | | 739,600 | | 10.0 |

| P.O. Box 4172 | | | | |

| Wilmington, Delaware 19807 | | | | |

|

| Probitas Pharma, S.A. | | 563,347 | | 7.6 |

| Calle de la Marina, 16-18 Torre | | | | |

| Mapfre, Pl. 27, | | | | |

| 08005 Barcelona Spain | | | | |

| (1) | | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options or warrants held by that person that are currently exercisable or will become exercisable within 60 days after January 9, 2003, are deemed outstanding; such shares are not deemed outstanding for purposes of computing percentage ownership of any other person. Unless otherwise indicated below, the person and entities named in the table have sole voting and investment power with respect to all shares beneficially owned, subject to community property laws where applicable. Unless otherwise indicated, the address for each person is c/o SeraCare Life Sciences, Inc., 1935 Avenida del Oro, Suite F, Oceanside, California 92056. |

| (2) | | 202,500 of these shares result from options or warrants that are exercisable within 60 days. Also includes 1,900 shares held by Mr. Plost’s spouse. |

| (3) | | 60,000 of these shares result from options that are exercisable within 60 days. Also includes 8,000 shares held by Mr. Burdick’s spouse. |

| (4) | | 80,000 of these shares result from options that are exercisable within 60 days. |

9

| (5) | | 60,000 of these shares result from options that are exercisable within 60 days. Also includes 162,386 shares of common stock held by a trust of which Mr. Anderson is trustee. |

| (6) | | 40,000 of these shares result from options that are exercisable within 60 days. |

| (7) | | All of these shares result from options that are exercisable within 60 days. |

| (8) | | Mr. Cresci is a managing director of Pecks Management Partners, Ltd. |

| (9) | | According to a Schedule 13G filed with the SEC by Ashford Capital Management, Inc. on November 27, 2002, 739,600 shares of common stock are held of record by clients of Ashford Capital Management, Inc. (“Ashford”), and Ashford, in its capacity as investment advisor, may be deemed to have beneficial ownership of all such 739,600 shares. The address of Ashford listed in the Schedule 13G is P.O. Box 4172, Wilmington, DE 19807. |

Section 16(A) Beneficial Ownership Reporting Compliance

Based upon our review of forms filed by directors, officers and certain beneficial owners of our common stock (the “Section 16 Reporting Persons”) pursuant to Section 16 of the Securities Exchange Act of 1934, as amended, we have identified the following filings that were filed late by the Section 16 Reporting Persons during the fiscal year ended September 30, 2002:

| | • | | Samuel Anderson was late in filing two Form 4’s with respect to three transactions; |

| | • | | Jerry L. Burdick was late in filing one Form 4 with respect to one transaction; |

| | • | | Robert Cresci was late in filing one Form 4 with respect to one transaction; |

| | • | | Ezzat Jallad was late in filing one Form 4 with respect to one transaction; |

| | • | | Bernard Kasten was late in filing one Form 4 with respect to one transaction; |

| | • | | Barry D. Plost was late in filing one Form 4 with respect to one transaction; and |

| | • | | Nelson Teng was late in filing one Form 4 with respect to one transaction. |

Recommendation of SeraCare Life Sciences Board of Directors

The eight (8) nominees receiving the highest number of votes will be elected to the board of directors.

Our board of directors recommends a vote FOR the election of each of the above nominees as a director.

10

OTHER INFORMATION

Executive Compensation

Summary Compensation Table

The following table summarizes certain compensation information concerning the annual and long-term compensation for services rendered by Michael F. Crowley II, our Chief Executive Officer, Dennis M. Mulroy, our Chief Financial Officer, and Barry D. Plost, Chairman and former Interim Chief Executive Officer for the twelve month periods ended February 29, 2000, February 28, 2001 and September 30, 2002 and the transition period from March 1, 2001 to September 30, 2001.

| | | Period Ended(1)

| | Annual Compensation(2)

| | Long-Term Compensation

|

Name and Principal Position

| | | Salary ($)(3)

| | Bonus ($)(4)

| | Securities Underlying Options Granted

| | Other Compensation ($)

|

| Barry D. Plost(5) | | September 30, 2002 | | | — | | | — | | 50,000 | | | — |

| Chairman and former | | September 30, 2001 | | | — | | | — | | 40,000 | | | — |

| Interim Chief Executive | | February 28, 2001 | | | — | | | — | | — | | | — |

| Officer | | February 29, 2000 | | | — | | | — | | — | | | — |

|

| Michael F. Crowley II | | September 30, 2002 | | $ | 175,000 | | $ | 50,000 | | 100,000 | | $ | 4,800 |

| Chief Executive Officer | | September 30, 2001 | | $ | 84,583 | | | — | | — | | $ | 2,800 |

| | | February 28, 2001 | | $ | 116,624 | | $ | 65,250 | | 44,000 | | $ | 5,200 |

| | | February 29, 2000 | | $ | 91,666 | | $ | 10,000 | | — | | $ | 1,450 |

|

| Dennis M. Mulroy(6) | | September 30, 2002 | | $ | 126,464 | | $ | 10,000 | | 25,000 | | | — |

| Chief Financial Officer | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| (1) | | Each of the periods ended February 29, 2000, February 28, 2001 and September 30, 2002 are twelve month periods. The period ended September 30, 2001 is the transition period from March 1, 2001 to September 30, 2001. |

| (2) | | The annual compensation reported does not include the value of certain perquisites, which in the aggregate did not exceed the lesser of either $50,000 or 10% of the total annual salary and bonus for the named executive. |

| (3) | | Amounts shown include base compensation earned and received by executive officers. |

| (4) | | Amounts represent bonuses earned in the fiscal year but paid in the following fiscal year. |

| (5) | | Barry D. Plost resigned as Interim Chief Executive Officer on July 10, 2002. Other than his compensation for services as a member of our board of directors, Mr. Plost did not receive any compensation for his services as an executive officer. Mr. Plost is a director and executive officer of our former parent, Biomat USA, Inc., and is compensated by Biomat USA for his services to Biomat USA pursuant to his employment agreement with Biomat USA. |

| (6) | | Dennis M. Mulroy was appointed Chief Financial Officer of SeraCare Life Sciences on November 19, 2001. |

11

Options

The table below sets forth certain information regarding options granted during fiscal 2002 to the executive officers named in the Summary Compensation Table.

Option Grants In Last Fiscal Year

| | | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term |

| | | Number of Securities Underlying Options Granted(1)

| | Percent of Total Options Granted to Employees in Fiscal Year (%)(1)

| | | Exercise Price Per Share

| | Expiration Date

| |

|

Name

| | | | | | 5%

| | 10%

|

| Barry D. Plost | | 25,000 | | 10.6 | % | | 5.93 | | May 13, 2007 | | $ | 40,959 | | $ | 90,508 |

| | | 25,000 | | 10.6 | % | | 6.06 | | July 10, 2007 | | $ | 41,857 | | $ | 92,492 |

| Michael F. Crowley II | | 100,000 | | 42.6 | % | | 3.25 | | September 25, 2007 | | $ | 110,531 | | $ | 250,757 |

| Dennis M. Mulroy | | 25,000 | | 10.6 | % | | 4.30 | | November 19, 2007 | | $ | 36,560 | | $ | 82,943 |

| (1) | | For purposes of this calculation, the options granted to Mr. Plost are included in determining the total options granted to employees in fiscal 2002 although other than his compensation for services as a member of our board of directors, Mr. Plost did not receive any compensation for his services as an executive officer. |

Aggregated Option Exercises In Last Fiscal Year and Fiscal Year-End Option Values

| | | Options Exercised

| | Number of Securities Underlying Unexercised Options at 9/30/2002

| | Value of Unexercised In-the-Money Options at 9/30/2002(1)

|

Name

| | Shares Acquired

| | Value Realized

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Barry D. Plost | | — | | — | | 202,500 | | — | | $ | 477,500 | | | — |

| Michael F. Crowley II | | — | | — | | 44,000 | | 100,000 | | $ | 183,000 | | $ | 175,000 |

| Dennis M. Mulroy | | — | | — | | — | | 25,000 | | | — | | $ | 17,500 |

| (1) | | Market value of the underlying securities at year-end, less the exercise price of “in-the-money” options. |

Employee Incentive Plans

SeraCare Life Sciences provides a 401(k) plan to its employees and makes discretionary matching contributions. Total contributions from SeraCare Life Sciences to this plan were $70,744 in fiscal 2002.

Employment Contracts

Biomat USA, Inc., our former parent, entered into an employment agreement with Michael F. Crowley II, effective on November 1, 2000, to serve as our President for a twenty-eight month period. We were assigned this agreement by Biomat USA in connection with our spin off in September 2001, and on October 15, 2001, we awarded Mr. Crowley options to purchase 100,000 shares of our common stock at an exercise price of $3.25 per share, which vests in full on October 15, 2004 and expires on October 15, 2007. We amended the agreement in November 2001 so as to extend Mr. Crowley’s employment through September 25, 2004 and increase his base compensation to $175,000. In July 2002, Mr. Crowley was appointed by the board of directors as Chief Executive Officer, succeeding Barry D. Plost, who held the position of Interim Chief Executive Officer. Pursuant to the employment agreement, Mr. Crowley received a bonus of $50,000 for fiscal year 2002.

Mr. Plost served as our Interim Chief Executive Officer until July 2002 and received no compensation for his services as an executive officer. Mr. Plost is compensated by us only for his service as Chairman of the board. Our former parent, Biomat USA, Inc. is a party to an employment agreement with Mr. Plost, Biomat USA’s Chairman of the board, President and Chief Executive Officer.

Dennis M. Mulroy has been an at will employee since his appointment as our Chief Financial Officer on November 19, 2001, and is remunerated for his services at an annual rate of $145,000.

12

THE FOLLOWING REPORT OF THE COMPENSATION COMMITTEE AND THE PERFORMANCE GRAPH THAT APPEARS AFTER THE REPORT SHALL NOT BE DEEMED TO BE SOLICITING MATERIAL OR TO BE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES EXCHANGE ACT OF 1934 OR INCORPORATED BY REFERENCE IN ANY DOCUMENT SO FILED.

BOARD COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the board of directors is responsible for oversight of executive compensation and review of SeraCare Life Sciences’ overall compensation programs.

Compensation Philosophy

Generally, SeraCare Life Sciences’ compensation programs are designed to attract, retain, motivate and appropriately reward individuals who are responsible for SeraCare Life Sciences’ short- and long-term profitability, growth and return to shareholders. The overall compensation philosophy followed by the Committee is to pay competitively while emphasizing qualitative indicators of corporate and individual performance.

Executive Compensation

The Committee also uses stock option awards made under the SeraCare Life Sciences, Inc. 2001 Stock Incentive Plan to provide various incentives for key personnel and directors, including executive officers. Stock options are priced at the fair market value of the common stock of SeraCare Life Sciences on the date of the grant, and typically vest at the rate of 33 1/3% per year over three years, unless determined otherwise by the board or other committee overseeing the Plan.

Barry D. Plost, Michael F. Crowley II and Dennis M. Mulroy all received stock option awards in fiscal 2002. The Committee also periodically makes recommendations to the board of directors for additional stock option awards for eligible individuals, including executive officers, based upon a subjective evaluation of individual current performance, assumption of significant responsibilities, anticipated future contributions, and/or ability to impact overall corporate and/or business unit financial results.

To the extent readily determinable, and as one of the factors in its consideration of compensation matters, the Compensation Committee also considers the anticipated tax treatment to SeraCare Life Sciences and to the executives of various payments and benefits, specifically in consideration of Section 162(m) of the Internal Revenue Code. The Committee will not, however, limit executive compensation to that which is deductible.

Chief Executive Compensation

Mr. Crowley became Chief Executive Officer of SeraCare Life Sciences in July 2002. During fiscal 2002, Mr. Crowley received a base salary of $175,000 and a management bonus of $50,000, pursuant to the terms of his employment agreement (see “Employment Contracts” above).

Effective October 15, 2001, the board of directors also awarded Mr. Crowley options to purchase 100,000 shares of common stock at an exercise price of $3.25. These options vest on October 15, 2004 and expire on October 15, 2007.

13

Prior to Mr. Crowley’s appointment to Chief Executive Officer, Mr. Plost served as Interim Chief Executive Officer during fiscal year 2002. Mr. Plost received no compensation for his services as an executive officer.

COMPENSATION COMMITTEE

Samuel Anderson

Ezzat Jallad

14

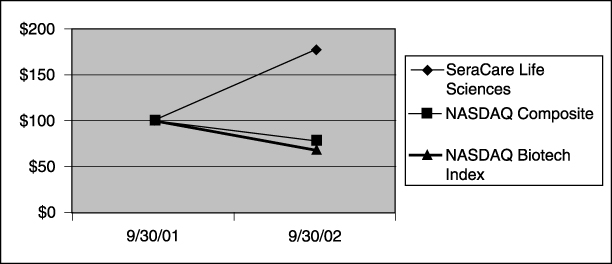

PERFORMANCE GRAPH

The following graph compares the change in the Company’s cumulative total stockholder return from September 30, 2001 to September 30, 2002, which includes the last trading day of fiscal 2001, with the cumulative total return on the Nasdaq Composite Index and the Nasdaq Biotechnology Index for that period.

| | | 9/30/01

| | 9/30/02

|

| SeraCare Life Sciences, Inc. | | $ | 100 | | $ | 177 |

| Nasdaq Composite Index | | $ | 100 | | $ | 78 |

| Nasdaq Biotechnology Index | | $ | 100 | | $ | 63 |

Assumes $100 invested on September 30, 2001 in the company’s common stock, the Nasdaq Composite Index and the Nasdaq Biotechnology Index. The reported closing sales price of our common stock on the OTCBB on September 25, 2001, the first day after our spin-off from Biomat USA, Inc., was $1.50. The closing price of our common stock on September 28, 2001, the final trading day of September 2001, was $2.82. The closing price of our common stock on September 30, 2002, the final trading day of September 2002, was $5.00.

15

PROPOSAL 2—AMENDMENT TO OUR 2001 STOCK INCENTIVE PLAN

We maintain the SeraCare Life Sciences, Inc. 2001 Stock Incentive Plan. Our board of directors approved, subject to shareholder approval, the amendment to the 2001 Stock Incentive Plan described below. Shareholders are being asked to approve the amendment. If approved by shareholders, the amendment will:

| | • | | increase the number of shares of our common stock available for award grants under the 2001 Stock Incentive Plan from 600,000 shares to 1,000,000 shares (an increase of 400,000 shares); |

| | • | | increase the limit on the number of shares of our common stock that may be granted subject to incentive stock options under the 2001 Stock Incentive Plan from 300,000 shares to 500,000 shares (an increase of 200,000 shares); and |

| | • | | increase the limit on the number of shares of our common stock that may be granted subject to options and all other awards to any one person during any calendar year under the 2001 Stock Incentive Plan from 50,000 shares to 150,000 shares (an increase of 100,000 shares). |

Any shares issued on exercise of an incentive stock option granted under the 2001 Stock Incentive Plan count against the total number of shares authorized under the plan. Thus, the proposed increase in the incentive stock option limit described above does not increase the total number of shares that will be available for all award grants under the plan.

As of December 31, 2002, approximately 540,000 of the 600,000 shares then available for award grant purposes under the 2001 Stock Incentive Plan had been issued pursuant to awards granted under the plan or were subject to awards then outstanding under the plan, and approximately 60,000 shares were then available for additional award grants. Our board of directors believes that the additional shares requested under the 2001 Stock Incentive Plan, and the increases in the incentive stock option and individual share limits referred to above, will give us greater flexibility to structure future incentives and better attract, retain and motivate employees, officers and directors.

If the amendment is not approved by shareholders, the current share limits under the 2001 Stock Incentive Plan will remain in effect.

Summary Description of the Plan

The principal terms of the 2001 Stock Incentive Plan are summarized below. The following summary is qualified in its entirety by the full text of the 2001 Stock Incentive Plan, which has been filed as an exhibit to the copy of this Proxy Statement that was filed electronically with the Securities and Exchange Commission and can be reviewed on the Securities and Exchange Commission’s Web site at http://www.sec.gov. A copy of the 2001 Stock Incentive Plan document may also be obtained by writing Dennis M. Mulroy at SeraCare Life Sciences, Inc., 1935 Avenida del Oro, Suite F, Oceanside, California 92056.

Purpose. The purpose of the 2001 Stock Incentive Plan is to promote the success of SeraCare Life Sciences, Inc. and the interests of our shareholders by providing an additional means to attract, motivate, retain and reward eligible persons with awards and incentives for high levels of individual performance and improved financial performance of the company.

Awards. The 2001 Stock Incentive Plan authorizes stock options, restricted stock, and stock unit awards. The 2001 Stock Incentive Plan gives us the flexibility to offer competitive incentives and to tailor benefits to specific needs and circumstances. Generally, an option will expire, or other award will vest, not more than 10 years after the date of grant.

Administration. The 2001 Stock Incentive Plan will be administered by our board of directors or by one or more committees appointed by our board of directors. The appropriate acting body is referred to as the “Administrator.” The Administrator is currently our board of directors.

16

The Administrator determines the number of shares that are to be subject to awards and the terms and conditions of such awards, including the price, if any, to be paid for the shares or the award and the vesting and exercisability provisions. Subject to the other provisions of the 2001 Stock Incentive Plan and in addition to such other authority as may be contemplated by the plan, the Administrator has the authority:

| | • | | to permit the recipient of any award to pay the purchase price of shares of common stock or the award in cash or by check, the delivery of previously owned shares of common stock, or a cashless exercise or third party payment in such manner as may be authorized by the Administrator; |

| | • | | to accelerate the receipt or vesting of benefits pursuant to an award; |

| | • | | to make certain adjustments to an outstanding award and authorize the conversion, succession or substitution of an award; and |

| | • | | to determine the fair market value of our stock for plan purposes and to construe and interpret the plan. |

Eligibility. Persons eligible to receive awards under the 2001 Stock Incentive Plan include our officers and employees, our directors, and certain consultants and advisors to us. As of December 31, 2002, all of our officers and employees (approximately thirty-three (33) individuals), including all of our named executive officers, and each of our seven non-employee directors were considered eligible under the 2001 Stock Incentive Plan, subject to the power of the Administrator to determine eligible persons to whom awards will be granted.

Transfer Restrictions. Awards under the 2001 Stock Incentive Plan are generally not transferable by the recipient other than by will or the laws of descent and distribution and are generally exercisable, during the recipient’s lifetime, only by the recipient. The Administrator may permit certain award transfers, such as for estate or tax planning purposes.

Limits on Awards; Authorized Shares. The maximum number of shares of our common stock that may be issued or delivered pursuant to awards granted under the 2001 Stock Incentive Plan is 600,000 shares; however, this maximum will increase to 1,000,000 shares if shareholders approve the proposed plan amendment. The 2001 Stock Incentive Plan limits the total number of shares that may be issued or delivered pursuant to the exercise of incentive stock option grants under the plan to 300,000 shares; however, this limit will increase to 500,000 shares if shareholders approve the proposed plan amendment. The 2001 Stock Incentive Plan also limits the total number of shares subject to options, or all awards, that may be granted under the 2001 Stock Incentive Plan during any calendar year to 50,000 shares for any one individual; however, this limit will increase to 150,000 shares if shareholders approve the proposed plan amendment.

As is customary in incentive plans of this nature, the number and kind of shares available under the 2001 Stock Incentive Plan and the then-outstanding awards, as well as exercise or purchase prices and share limits, are subject to adjustment in the event of certain reorganizations, mergers, combinations, consolidations, recapitalizations, reclassifications, stock splits, reverse stock splits, stock dividends, asset sales or other similar events, or extraordinary dividends or distributions of property to shareholders.

The 2001 Stock Incentive Plan will not limit the authority of our board of directors or the Administrator to grant awards or authorize any other compensation, with or without reference to our common stock, under any other plan or authority.

Stock Options. An option is the right to purchase shares of common stock at a future date at a specified price, which is referred to as the exercise price of the option. An option may either be an incentive stock option or a nonqualified stock option. Incentive stock option benefits are taxed differently from nonqualified stock options, as described under “U.S. Federal Income Tax Consequences of Awards Under the Plan” below. Incentive stock options are also subject to more restrictive terms and are limited in amount by the U.S. Internal Revenue Code and the 2001 Stock Incentive Plan.

17

Exercise Price. The per share exercise price of each option will be determined by the Administrator at the time of grant. Except for options granted pursuant to an assumption or substitution for other options (such as in the context of a merger or acquisition), in no case will the per share exercise price of an option be less than the fair market value of a share of our common stock on the date of grant of the option. Full payment for shares purchased on the exercise of an option must be made at the time of such exercise in a manner approved by the Administrator.

Restricted Stock Awards. A restricted stock award is an award typically for a fixed number of shares of our common stock subject to restrictions. The Administrator specifies the price, if any, the participant must pay for such shares and the restrictions imposed on such shares. The restrictions may include, for example, continued service only and/or performance standards.

Stock Units. A stock unit is a bookkeeping entry measured in shares of our common stock. Vested stock units may be paid out in our common stock or in cash, subject to terms and conditions imposed by the Administrator. The Administrator may award stock units to participants, may allow participants to defer other compensation or award payment in the form of a stock unit credit, and may grant stock units in exchange for other awards.

Non-Employee Director Awards. The 2001 Stock Incentive Plan previously contained certain provisions pursuant to which certain directors were eligible for automatic stock option grants under the plan. These automatic stock option grant provisions were frozen by our board of directors effective September 30, 2002. Thus, unless our board of directors provides otherwise, no new automatic stock option grants will be made to directors under the 2001 Stock Incentive Plan. However, directors remain eligible for discretionary award grants under the 2001 Stock Incentive Plan.

Acceleration of Awards; Possible Early Termination of Awards. Unless the administrator acts in advance of a Change in Control Event to prevent the acceleration of awards, upon a Change in Control Event each option will become immediately vested and exercisable and each award of restricted stock will immediately vest free of restrictions. Awards may terminate to the extent that they are vested and not exercised prior to a Change in Control Event or other event that we do not survive. A “Change in Control Event” under the 2001 Stock Incentive Plan generally includes (1) our dissolution or liquidation, (2) certain mergers and other reorganizations in which our shareholders do not continue to own at least half of our stock or our successor’s stock following the transaction, (3) certain sales of all or substantially all of our business or assets, (4) certain persons acquiring 25% or more of our outstanding voting stock, and (5) certain changes in a majority of our board of directors over a period not longer than two years.

Termination of or Changes to the Plan. Our board of directors may amend or terminate the 2001 Stock Incentive Plan at any time and in any manner. Shareholder approval for an amendment will generally not be obtained unless shareholder approval for the amendment is required by applicable law. Unless previously terminated by our board of directors, the 2001 Stock Incentive Plan will terminate on September 24, 2011. Outstanding awards may be amended, subject, however, to the consent of the holder if the amendment materially and adversely affects the rights of the holder.

U.S. Federal Income Tax Consequences of Awards under the Plan. The U.S. federal income tax consequences of the 2001 Stock Incentive Plan under current federal law, which is subject to change, are summarized in the following discussion of the general tax principles applicable to the 2001 Stock Incentive Plan. This summary is not intended to be exhaustive and, among other considerations, does not describe state, local, or international tax consequences.

With respect to a nonqualified stock option, we are generally entitled to deduct and the optionee recognizes taxable income in an amount equal to the difference between the option exercise price and the fair market value of the shares at the time of exercise. With respect to an incentive stock option under Section 422 of the U.S.

18

Internal Revenue Code, we are generally not entitled to a deduction nor does the optionee recognize income at the time of exercise, although the optionee may be subject to the U.S. federal alternative minimum tax.

With respect to purchases of restricted shares, if the shares are subject to a substantial risk of forfeiture the purchaser has income equal to the excess of the fair market value of the shares over the price paid (if any) for the shares only at the time the restrictions lapse (unless the purchaser elects to accelerate recognition as of the date of grant). A purchaser of shares that are not subject to a substantial risk of forfeiture has income at the time of purchase equal to the excess of the fair market value of the shares at that time over the price paid (if any) for the shares. Stock unit awards are generally subject to tax at the time of payment. In each of the foregoing cases, we will generally have a corresponding deduction at the time the award recipient recognizes income.

If an award is accelerated under the 2001 Stock Incentive Plan in connection with a change in control (as this term is used under the U.S. Internal Revenue Code), we may not be permitted to deduct the portion of the compensation attributable to the acceleration (“parachute payments”) if it exceeds certain threshold limits under the U.S. Internal Revenue Code (and certain related excise taxes may be triggered). Furthermore, if the compensation attributable to awards is not “performance-based” within the meaning of Section 162(m) of the U.S. Internal Revenue Code, we may not be permitted to deduct the compensation that is not performance-based in excess of $1,000,000 in certain circumstances.

Specific Benefits; Historical Grants Under the Plan. Except for the grants referred to in the “New Plan Benefits” table below, we have not approved any awards under the 2001 Stock Incentive Plan that are contingent on shareholder approval of the proposed plan amendment. If the additional shares that will be available under the 2001 Stock Incentive Plan if shareholders approve the proposed plan amendment had been available for award purposes in fiscal 2002, we expect that our award grants for fiscal 2002 would not have been substantially different from those actually made under the plan and those described in the New Plan Benefits table below.

For information regarding stock options granted to our directors and named executive officers during fiscal 2002, see the material under the heading “Proposal 1—Election of Directors—Compensation of Directors” above, under the heading “Other Information—Executive Compensation” above, and in the New Plan Benefits table below. For additional information regarding past option grants under the 2001 Stock Incentive Plan, see the “Aggregate Past Grants under the 2001 Stock Incentive Plan” table below.

We are not currently considering any specific additional awards under the 2001 Stock Incentive Plan. The number, amount and type of awards to be received by or allocated to eligible persons in the future under the plan, if shareholders approve the proposed plan amendment, cannot be determined at this time.

The closing market price for a share of our common stock on January 17, 2003 was $5.35 per share.

19

NEW PLAN BENEFITS

Our board of directors has approved, subject to shareholder approval of the proposed amendment to the 2001 Stock Incentive Plan, the following stock option grants under the 2001 Stock Incentive Plan:

Name and Position

| | Number of Shares Subject to Options

|

Executive Group: | | |

| Barry D. Plost | | 35,000 |

| Chairman and former Interim Chief Executive Officer | | |

| Michael F. Crowley, II | | 50,000 |

| Chief Executive Officer | | |

| Dennis M. Mulroy | | — |

| Chief Financial Officer | | |

| | |

|

| | | 85,000 |

| | |

|

Non-Executive Director Group: | | |

| Jerry L. Burdick | | — |

| Samuel Anderson | | — |

| Ezzat Jallad | | — |

| Dr. Nelson Teng | | — |

| Robert J. Cresci | | — |

| Dr. Bernard Kasten | | 10,000 |

| | |

|

| | | 10,000 |

| | |

|

Non-Executive Officer Employee Group | | — |

| | |

|

| Total | | 95,000 |

| | |

|

The stock options reflected in the foregoing table would have exceeded the individual award grant limit as currently in effect under the 2001 Stock Incentive Plan. These stock options will be effective only if shareholders approve the proposed amendment to the 2001 Stock Incentive Plan, which, in part, increases the individual share limit under the plan. Each of these stock options was granted, subject to shareholder approval of the proposed plan amendment, during fiscal 2002 or fiscal 2003 and has a maximum term of five years from the date of grant. The options granted to Mr. Plost and Dr. Kasten were granted on October 8, 2002 and have an exercise price of $5.10 per share and were fully vested on the date of grant. The options granted to Mr. Crowley were granted on October 15, 2001 and have an exercise price of $3.25 per share and vest on October 15, 2004.

20

AGGREGATE PAST GRANTS UNDER THE 2001 STOCK INCENTIVE PLAN

As of December 31, 2002, options covering 540,000 shares of our common stock had been granted under the 2001 Stock Incentive Plan. Of these options, the following number of shares have been granted subject to options to the persons and groups identified below:

Name and Position

| | Number of Shares Subject to Past Option Grants

| | | Number of Shares Acquired On Exercise

| | Number of Shares Underlying Options as of December 31, 2002

| |

| | | | Exercisable

| | Unexercisable

| |

Executive Group: | | | | | | | | | | |

| Barry D. Plost | | 85,000 | (1) | | — | | 50,000 | | 35,000 | (1) |

| Chairman and former Interim Chief Executive Officer | | | | | | | | | | |

| Michael F. Crowley, II | | 100,000 | (1) | | — | | — | | 100,000 | (1) |

| Chief Executive Officer | | | | | | | | | | |

| Dennis M. Mulroy | | 25,000 | | | — | | — | | 25,000 | |

| Chief Financial Officer | | | | | | | | | | |

| | |

|

| |

| |

| |

|

|

| Total for Executive Group | | 210,000 | | | — | | 50,000 | | 160,000 | |

| | |

|

| |

| |

| |

|

|

Non-Executive Director Group: | | | | | | | | | | |

| Jerry L. Burdick | | 35,000 | | | — | | 35,000 | | — | |

| Samuel Anderson | | 35,000 | | | — | | 35,000 | | — | |

| Ezzat Jallad | | 40,000 | | | — | | 40,000 | | — | |

| Dr. Nelson Teng | | 40,000 | | | — | | 40,000 | | — | |

| Robert J. Cresci | | 40,000 | | | — | | 40,000 | | — | |

| Dr. Bernard Kasten | | 60,000 | (1) | | — | | 50,000 | | 10,000 | (1) |

| | |

|

| |

| |

| |

|

|

| Total for Non-Executive Director Group | | 250,000 | | | — | | 240,000 | | 10,000 | |

| | |

|

| |

| |

| |

|

|

| Each other person who has received 5% or more of the options | | — | | | — | | — | | — | |

| All employees, including all current officers who are not executive officers or directors, as a group | | 80,000 | | | — | | — | | 80,000 | |

| | |

|

| |

| |

| |

|

|

| Total | | 540,000 | | | — | | 290,000 | | 250,000 | |

| | |

|

| |

| |

| |

|

|

| (1) | | Includes options, identified in the New Plan Benefits table above, that have been granted subject to shareholder approval of the proposed plan amendment. |

Mr. Plost and each of the non-executive directors identified above is a nominee for re-election as a director at the 2003 annual meeting.

Securities Authorized for Issuance Under Equity Compensation Plan

Equity Compensation Plans Approved by Stockholders. We maintain the 2001 Stock Incentive Plan summarized above. In addition, on September 25, 2001 we granted to each of Messrs. Plost, Burdick, Teng, Kasten, Cresci, Jallad and Anderson options to purchase 40,000 shares of our common stock at an exercise price of $1.00 per share. These options were granted outside of the scope of the 2001 Stock Incentive Plan. Our 2001 Stock Incentive Plan and the other September 25, 2001 option grants referred to in the previous sentence were approved by our shareholders in September 2001. The September 25, 2001 option grants referred to above are fully vested and have a maximum term of five years from the date of grant.

Equity Compensation Plan Not Approved by Stockholders. On October 4, 2001, we granted options covering an aggregate of 40,000 shares to certain consultants for services that have been rendered. These options

21

were not granted under the 2001 Stock Incentive Plan and we were not required to obtain shareholder approval for these options. Each of these options was fully vested at grant and has a maximum term of three years from the date of grant.

Summary Table. The following table sets forth, for our 2001 Stock Incentive Plan and the other option grants referred to above, the number of shares of our common stock subject to outstanding options, the weighted-average exercise price of outstanding options, and the number of shares remaining available for future award grants as of September 30, 2002.

Plan Category

| | Number of Shares to be Issued Upon Exercise of Outstanding Options

| | | Weighted-Average Exercise Price of Outstanding Options

| | | Number of Shares Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Shares Reflected in the First Column)

| |

| Equity compensation plans approved by shareholders | | 620,000 | (1)(2) | | $ | 3.49 | (1) | | 190,000 | (3) |

| Equity compensation plans not approved by shareholders | | 40,000 | | | $ | 5.00 | | | — | |

| (1) | | Includes the options, identified under “New Plan Benefits” above, that have been granted under the 2001 Stock Incentive Plan during fiscal 2002 subject to shareholder approval of the proposed plan amendment described above. |

| (2) | | Of these shares, 410,000 are subject to options granted under the 2001 Stock Incentive Plan and an aggregate of 210,000 are subject to the September 25, 2001 option grants to Messrs. Plost, Burdick, Teng, Kasten, Cresci, Jallad and Anderson. |

| (3) | | Reflects shares then available for award grants under the 2001 Stock Incentive Plan. The total number of shares reflected in this column does not reflect the additional 400,000 shares of our common stock that will be available for delivery pursuant to awards under the 2001 Stock Incentive Plan if shareholders approve the proposed plan amendment described above. All of the shares available under the 2001 Stock Incentive Plan are available for grant subject to stock options, restricted stock or other awards authorized under the 2001 Stock Incentive Plan. |

Vote Required

Assuming a quorum is present, the affirmative vote of a majority of the votes represented and voted at the meeting, either in person or by proxy, is required to approve the proposed amendments to the 2001 plan. Any shares not voted at the meeting whether by broker non-votes, abstentions or otherwise will have no impact on the vote.

Our board recommends a vote FOR the proposed amendments to the 2001 plan. The shares represented by the proxies received will be voted FOR approval of the proposed amendments, unless the proxy indicates a vote against approval or an abstention from voting.

22

THE FOLLOWING REPORT OF THE AUDIT COMMITTEE SHALL NOT BE DEEMED TO BE SOLICITING MATERIAL OR TO BE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES EXCHANGE ACT OF 1934 OR INCORPORATED BY REFERENCE IN ANY DOCUMENT SO FILED.

AUDIT COMMITTEE REPORT

In accordance with its written charter, the Audit Committee assists the board of directors in fulfilling its responsibility for oversight of the quality of SeraCare Life Sciences’ financial reporting process, system of internal controls, audit process and process for monitoring compliance with laws and regulations.

The Audit Committee consists of three members, each of whom satisfies the independence, financial literacy and experience requirements of Nasdaq.

Management and the external auditors are responsible for planning or conducting audits and determining SeraCare Life Sciences’ financial statements are accurate and are in accordance with generally accepted accounting principles. The Audit Committee’s responsibility is to monitor and review these processes and procedures. The members of the Audit Committee are not professionally engaged in the practice of accounting or auditing. The Audit Committee relies, without independent verification, on the information provided to it and on the representations made by management and the independent auditors that the financial statements have been prepared in conformity with generally accepted accounting principles.

During fiscal 2002, the Audit Committee held three meetings. During the fiscal year the Audit Committee met and held discussions with management and the independent auditors. The meetings were conducted so as to encourage communication among the members of the Audit Committee, management and the independent auditors. The Audit Committee discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61, as amended, “Communications with Audit Committees.”

The Audit Committee reviewed and discussed the audited consolidated financial statements of SeraCare Life Sciences as of and for the year ended September 30, 2002 with management and the independent auditors, and the board of directors including the Audit Committee received an opinion of KPMG LLP as to the conformity of such audited consolidated financial statements with generally accepted accounting principles.

The Audit Committee discussed with the independent auditors the overall scope and plans for the audit. The Audit Committee met regularly with the independent auditors, with and without management present, to discuss the results of their examination, the evaluation of SeraCare Life Sciences’ internal controls and the overall quality of SeraCare Life Sciences’ accounting procedures.

In addition, the Audit Committee obtained from KPMG LLP written documentation describing all relationships between KPMG LLP and SeraCare Life Sciences that might bear on KPMG LLP’s independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees.” The Audit Committee discussed with KPMG LLP any relationships that may have an impact on its objectivity and independence and satisfied itself as to KPMG LLP’s independence. The Audit Committee also considered whether the provision of information technology and similar services and other non-audit services by KPMG LLP to SeraCare Life Sciences is compatible with maintaining KPMG LLP’s independence. The Audit Committee also reviewed, among other things, the amount of fees paid to KPMG LLP for audit and non-audit services.

23

Based on the above-mentioned review and discussions with management and KPMG LLP, and subject to the limitations on our role and responsibility described above and in the Audit Committee Charter, the Audit Committee recommended to the board of directors that SeraCare Life Sciences’ audited consolidated financial statements be included in SeraCare Life Sciences’ Annual Report on Form 10-K for the fiscal year ended September 30, 2002, for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE

Robert Cresci

Ezzat Jallad

Nelson Teng

24

INDEPENDENT ACCOUNTANTS

Effective February 4, 2002, SeraCare Life Sciences chose not to extend the engagement of BDO Seidman LLP as the company’s independent accountants. The decision to change independent accountants was recommended by the Audit Committee of our board of directors and approved by our board of directors. During the transition period ended September 30, 2001, the years ended February 28, 2001 and February 29, 2000, and the interim period from September 30, 2001 to February 7, 2002, we have had no disagreements with BDO Seidman LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of BDO Seidman LLP would have caused them to make reference thereto in their report on our financial statements for such periods.

During the transition period ended September 30, 2001, the years ended February 28, 2001 and February 29, 2000, and the interim period from September 30, 2001 to February 7, 2002, we have had no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K.

SeraCare Life Sciences provided BDO Seidman LLP with a copy of the above disclosures and requested that it furnish us with a letter addressed to the Securities and Exchange Commission stating whether or not it agrees with the above statements. That letter was attached to a Form 8-K we filed on February 7, 2002 to disclose its change in auditors.

SeraCare Life Sciences engaged KPMG LLP as its new independent accountants effective February 4, 2002. During the transition period ended September 30, 2001, the years ended February 28, 2001 and February 29, 2000, and through the date of engagement of KPMG LLP, we have not consulted with KPMG LLP on items which (1) related to the application of accounting principles to a specified transaction (proposed or completed) by us, or the type of audit opinion that might be rendered on our financial statements, and resulted in a written report being provided by KPMG LLP to us or oral advice being provided by KPMG to us that KPMG LLP concluded was an important factor considered by us in reaching a decision as to the accounting, auditing or financial reporting issue; or (2) concerned the subject matter of a disagreement or reportable event with BDO Seidman LLP (as described in Item 304(a)(2) of Regulation S-K).

Our independent auditor for fiscal year 2002 was KPMG LLP and they will continue to serve as our auditor. We do not anticipate a representative from KPMG LLP will be present at the annual meeting.

Fees Paid to Independent Public Accountants

For the fiscal year ended September 30, 2002, fees paid for services provided by BDO Seidman LLP and KPMG LLP were as follows:

Audit Fees

Fees paid for services rendered for the audit of our annual financial statements for the fiscal year ended September 30, 2002 and the reviews of our financial statements included in our quarterly reports on Form 10-Q for the same fiscal year were $11,000 for BDO Seidman LLP and $96,230 for KPMG LLP.

Financial Information Systems Design and Implementation Fees

BDO Seidman LLP and KPMG LLP rendered no services covered in this section “Financial Information Systems Design and Implementation Fees.”

All Other Fees

BDO Seidman LLP did not render any services other than those service covered in the section captioned “Audit Fees.” Fees paid for services rendered by KPMG LLP, other than those services covered in the sections

25

captioned “Audit Fees” and “Financial Information Systems Design and Implementation Fees,” were $11,500, all of which were fees for tax services rendered by KPMG LLP.

The Audit Committee has concluded that the provision of non-audit services by our principal independent accountants is compatible with maintaining auditor independence.

Shareholder Proposals for the 2004 Annual Meeting

Proposals of shareholders intended to be presented at our next annual meeting must be received by us by September 25, 2003 to be considered for inclusion in our proxy statement relating to that meeting. Shareholders desiring to present a proposal at the next annual meeting but who do not desire to have the proposal included in the proxy materials distributed by us must deliver written notice of such proposal to us no later than November 24, 2003, but not prior to October 25, 2003, or the persons appointed as proxies in connection with the next annual meeting will have discretionary authority to vote on any such proposal.

GENERAL