SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to § 240.14a-12 |

SeraCare Life Sciences, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1. | | Title of each class of securities to which transaction applies: |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials: |

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1. | | Amount Previously Paid: |

| | 2. | | Form, Schedule or Registration Statement No.: |

SERACARE LIFE SCIENCES

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On February 10, 2005

SeraCare Life Sciences hereby invites you, as one of our shareholders, to attend our annual meeting of shareholders either in person or by proxy. The meeting will be held at the Four Seasons Aviara Resort, 7100 Four Seasons Point, Carlsbad, CA 92009 at 9:00 a.m., local time, for the purpose of considering and acting upon the following matters:

| | 1. | | Electing all of our directors for the ensuing year; |

| | 2. | | Approving an amendment to the 2001 Stock Incentive Plan to increase the number of shares available for award grants under the plan; |

| | 3. | | Approving the Employee Stock Purchase Plan; and |

| | 4. | | Transacting any other business that may properly come before the meeting. |

Only shareholders of record at the close of business on December 20, 2004 are entitled to receive notice of and to vote at the annual meeting or any adjournment of the meeting.

|

By Order of the Board Of Directors |

|

|

|

Jerry L. Burdick Secretary |

Oceanside, California

January 10, 2005

YOUR VOTE IS IMPORTANT. ALL SHAREHOLDERS ARE URGED TO ATTEND THE MEETING IN PERSON OR BY PROXY. WHETHER OR NOT YOU EXPECT TO BE PRESENT, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE FURNISHED FOR THAT PURPOSE.

SERACARE LIFE SCIENCES

1935 Avenida del Oro

Oceanside, California 92056

(760) 806-8922

PROXY STATEMENT

The board of directors of SeraCare Life Sciences, Inc. (“SeraCare Life Sciences”) is soliciting the enclosed proxy for use at our annual meeting of shareholders to be held on Thursday, February 10, 2005, at 9:00 a.m., local time, or at any adjournments of the meeting. This proxy statement and the accompanying Notice of Annual Meeting of Shareholders describe the purposes of the annual meeting. The meeting will be held at the Four Seasons Aviara Resort, 7100 Four Seasons Point, Carlsbad, CA 92009. These proxy solicitation materials were mailed on or about January 10, 2005 to all shareholders entitled to vote at the annual meeting.

QUESTIONS AND ANSWERS ABOUT THE MEETING

| Q: | | What am I being asked to vote on? |

| | A: | | (1) The election of nominees to serve on our board of directors; |

| | (2) | | The approval of an amendment to the 2001 Stock Incentive Plan to increase the number of shares available for award grants under the plan; and |

| | (3) | | The approval of the Employee Stock Purchase Plan. |

| Q: | | How does the board recommend I vote on this proposal? |

| | A: | | Our board of directors recommends: a vote FOR each of the nominees for director; FOR approval of the amendment to the 2001 Stock Incentive Plan; and FOR the approval of the Employee Stock Purchase Plan. |

| Q: | | Who is entitled to vote? |

| | A: | | The record date for the annual meeting is December 20, 2004. Shareholders of record as of the close of business on that date are entitled to vote at the annual meeting. |

| | A: | | If you are the record holder of your shares, you may sign and date the enclosed proxy card and return it in the pre-paid envelope, vote via telephone or the internet following the instructions on the enclosed proxy card, or attend and vote at the annual meeting in person. |

| Q: | | What if my shares are held by a broker? |

| | A: | | If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. |

1

| Q: | | Can I revoke my proxy later? |

| | A: | | Yes. You have the right to revoke your proxy at any time before the annual meeting by: |

| | (1) | | delivering a signed revocation or a subsequently dated, signed proxy card to the Secretary of SeraCare Life Sciences before the annual meeting, or |

| | (2) | | attending the annual meeting and voting in person. |

However, if you have delivered a valid proxy, your mere presence at the annual meeting will not, by itself, revoke that proxy.

| Q: | | How many shares can vote? |

| | A: | | As of the close of business on the record date of December 20, 2004, 9,914,448 shares of common stock were issued and outstanding. We have no other class of voting securities outstanding. Each share of common stock entitles its holder to one vote. |

| Q: | | How is a quorum determined? |

| | A: | | For the purposes of determining a quorum, shares held by brokers or nominees will be treated as present even if the broker or nominee does not have discretionary power to vote on a particular matter or if instructions were never received from the beneficial owner. Abstentions will be counted as present for quorum purposes. |

| Q: | | What constitutes a quorum? |

| | A: | | A quorum is a majority of the voting power of the shares entitled to vote at the annual meeting. Because there were 9,914,448 shares of common stock of our company outstanding as of the record date, we will need holders of at least 4,957,225 shares of common stock of our company present in person or by proxy at the annual meeting for a quorum to exist. |

| Q: | | What is required to approve each proposal? |

| | A: | | A plurality of the shares of common stock voted in person or by proxy is required to elect the nominees for directors. A plurality means that the eight (8) nominees receiving the largest number of votes cast will be elected. Because directors are elected by plurality, abstentions and broker non-votes will be entirely excluded from the vote and will have no effect on the election of directors. |

To approve each of the amendment to the 2001 Stock Incentive Plan and the Employee Stock Purchase Plan, holders of a majority of the shares represented at the annual meeting and voting on the applicable matter (which shares voting on the applicable matter must also constitute at least a majority of the required quorum) must vote in favor of the applicable proposal. With respect to these proposals, broker non-votes will be treated as shares that are not present and not voting (even though those shares are considered entitled to vote for quorum purposes and may be entitled to vote on other matters) and abstentions will be treated as shares that are present but are not voting (even though those shares are considered entitled to vote for quorum purposes and may be entitled to vote on other matters). Thus, both broker non-votes and abstentions will be entirely excluded from the vote on these matters.

| Q: | | What are Broker Non-Votes? |

| | A: | | “Broker non-votes” are shares held by brokers or nominees for which the broker or nominee lacks discretionary power to vote and never received specific voting instructions from the beneficial owner of the shares. |

2

| Q: | | How will my shares be voted if I return a blank proxy card? |

| | A: | | If you sign and send in your proxy card and do not indicate how you want to vote, we will count your proxy as a vote FOR approval of the amendment to the 2001 Stock Incentive Plan, FOR approval of the Employee Stock Purchase Plan and FOR each of the director nominees named in this proxy statement. If a broker or nominee who does not have discretion to vote has delivered a proxy but has failed to physically indicate on the proxy card that broker’s lack of authority to vote, we will treat the shares as present and count the shares as votes FOR approval of the amendment to the 2001 Stock Incentive Plan, FOR approval of the Employee Stock Purchase Plan and FOR each of the director nominees named in this proxy statement. |

| Q: | | How will voting on any other business be conducted? |

| | A: | | Although we do not know of any business to be considered at the annual meeting other than the proposals described in this proxy statement, if any other business comes before the annual meeting, your signed proxy card gives authority to the proxyholders, Michael F. Crowley Jr. and Tim T. Hart, to vote on those matters at their discretion. |

| Q: | | What if a quorum is not present at the meeting? |

| | A: | | If a quorum is not present at the scheduled time of the annual meeting, we may adjourn the meeting, either with or without the vote of the shareholders. If we propose to have the shareholders vote whether to adjourn the meeting, the proxyholders will vote all shares for which they have authority in favor of the adjournment. We may also adjourn the meeting if for any reason we believe that additional time should be allowed for the solicitation of proxies. An adjournment will have no effect on the business that may be conducted at the annual meeting. |

| Q: | | How much stock do SeraCare Life Sciences’ directors and executive officers own? |

| | A: | | As of December 20, 2004, our current directors and executive officers collectively had beneficial ownership (excluding options and warrants) of 1,280,886 shares, constituting approximately 12.9% of our outstanding shares. These persons have indicated that they currently intend to vote the shares held by them FOR approval of the amendment to the 2001 Stock Incentive Plan, FOR approval of the Employee Stock Purchase Plan and FOR each of the director nominees named in this proxy statement. |

| Q: | | Who will bear the costs of this solicitation? |

| | A: | | We will pay the cost of this solicitation of proxies by mail. Our officers and regular employees may also solicit proxies in person or by telephone without additional compensation. We will make arrangements with brokerage houses, custodians, nominees and other fiduciaries to send proxy materials to their principals, and we will reimburse these persons for related postage and clerical expenses. |

3

PROPOSAL 1—ELECTION OF DIRECTORS

The current term of office of all of our directors expires at the 2005 annual meeting. The board of directors proposes that the following nominees, all of whom are currently serving as directors, be re-elected for a new term of one year and until their successors are duly elected and qualified. The persons named in the enclosed form of proxy intend, if authorized, to vote the proxies FOR the election as directors of each of the eight persons named below as nominees. If any nominee declines or is unable to serve as a director, which we do not anticipate, the persons named as proxies reserve full discretion to vote for any other person who may be nominated.

Director Nominees and Executive Officers

Set forth below are the names, ages, positions and offices held with us (if any), and principal occupations and employment during the past five years, of our director nominees and executive officers.

| | | | | | |

Name

| | Age

| | Position

| | Director/ Officer

Since

|

Barry D. Plost | | 58 | | Chairman of the Board | | 1998 |

Michael F. Crowley Jr. | | 37 | | Director, President and Chief Executive Officer | | 2000 |

Tim T. Hart | | 47 | | Chief Financial Officer | | 2003 |

Jerry L. Burdick | | 65 | | Director and Secretary | | 1998 |

Samuel Anderson | | 69 | | Director | | 2001 |

Ezzat Jallad | | 42 | | Director | | 2001 |

Dr. Nelson Teng | | 58 | | Director | | 2001 |

Robert J. Cresci | | 61 | | Director | | 2001 |

Dr. Bernard Kasten | | 58 | | Director | | 2001 |

Barry D. Plost began serving as Chairman of the board of directors and Chief Executive Officer of our company when Biomat USA, Inc. (formerly known as SeraCare, Inc.) acquired our company in February 1998. From the time of our spin-off from Biomat USA in September 2001 until July 10, 2002, Mr. Plost served as our interim Chief Executive Officer. Mr. Plost has served as Chairman, President and Chief Executive Officer of Biomat USA, Inc. since February 6, 1996. Mr. Plost also serves on the PPTA Source board of directors of the Plasma Protein Therapeutics Association. Mr. Plost also serves on the board of Probitas Pharma S.A. and is a member of its Executive Committee. Probitas Pharma S.A. is the parent company of Instituto Grifols S.A., which purchased Biomat USA, and is a supplier to SeraCare Life Sciences. Mr. Plost also became a consultant to the Company effective October 1, 2004.

Michael F. Crowley Jr. was elected to the board of directors on July 10, 2002 the same time he was appointed Chief Executive Officer. From November 2000 until his appointment as our Chief Executive Officer, Mr. Crowley served as our President and Chief Operating Officer. Prior to his role as President, Mr. Crowley served as our Vice President of Operations from January 1998 to November 2000. Mr. Crowley has been employed by the company since 1986.

Jerry L. Burdick has served as our Secretary and a member of our board of directors since February 1998. From February 1998 until January 9, 2002, Mr. Burdick also served as our Chief Financial Officer and Executive Vice President. At Biomat USA, Mr. Burdick served as Executive Vice President, Secretary and a director from December 1, 1995 until July 31, 2004, and as Chief Financial Officer from December 1, 1995 through September 8, 1999, as Acting Chief Financial Officer from November 30, 1999 through December 31, 1999 and was reappointed Chief Financial Officer effective January 1, 2000, a position he held until July 31, 2004. Mr. Burdick became a consultant to the Company beginning in August 2004. Mr. Burdick is a Certified Public Accountant in the State of California and has held senior financial positions with various companies including International Rectifier Corporation and Getty Oil Company.

Samuel Anderson has served as a member of our board of directors since September 25, 2001. Mr. Anderson entered into a Consulting Agreement in April 2002 with SeraCare Life Sciences to offer advisory

4

services to our Chief Executive Officer. Mr. Anderson was a director of and consultant to Biomat USA from April 1996 to September 2001. Mr. Anderson also serves on the boards of Cytologic, Inc. and Cypress Bioscience, Inc.

Ezzat Jallad has served as a member of our board of directors since September 25, 2001. Mr. Jallad was a director of Biomat USA from October 1996 to September 2001. For the last five years, Mr. Jallad has been Executive Vice President of FCIM Corp. Mr. Jallad also serves on the board of Chili-Up, Inc.

Dr. Nelson Teng has served as a member of our board of directors since September 25, 2001. Dr. Teng was a director of Biomat USA from January 1997 to September 2001. Dr. Teng has been the director of Gynecologic Oncology and Associate Professor of Gynecology and Obstetrics at Stanford University School of Medicine since 1981. Dr. Teng also co-founded ADEZA Biomedical in 1984 and UNIVAX Biologics in 1988. In addition, Dr. Teng has served as a scientific advisor and consultant to several biotechnology companies and venture capital firms and has authored over 100 publications and 15 patents. Dr. Teng currently serves on the boards of several private companies.

Robert J. Cresci has served as a member of our board of directors since September 25, 2001. Mr. Cresci was a director of Biomat USA from April 1998 to September 2001. Mr. Cresci has been a managing director of Pecks Management Partners Ltd., an investment management firm, since September 1990. Mr. Cresci currently serves on the boards of Sepracor, Inc., Luminex Corporation, j2 Global Communications, Inc., Continucare Corporation and several private companies.

Dr. Bernard Kasten has served as a member of our board of directors since September 25, 2001. Dr. Kasten was a director of Biomat USA from March 2001 to September 2001. Dr. Kasten is Vice President of Medical Affairs for MedPlus Incorporated, a subsidiary of Quest Diagnostics, Inc. He joined Quest Diagnostics in 1996 as Vice President of Business Development for Medicine and Science. Dr. Kasten also serves on the Board of Directors for Siga Technologies, Inc. and several private companies.

Tim T. Hart was appointed Chief Financial Officer of our company on May 20, 2003. Prior to joining the Company, Mr. Hart served as Vice President of Alliance Pharmaceutical from May 1999 to April 2003. From August 1998 to April 2003, Mr. Hart also served as Chief Financial Officer of Alliance Pharmaceutical. He joined Alliance in 1991 as Controller and also served as Treasurer from 1994 through 2003. Previously, Mr. Hart was employed in various financial management positions at Cubic Corporation for over eight years. He was also employed by Ernst & Whinney in San Diego, California as a C.P.A. Mr. Hart is a Certified Public Accountant in the States of California and Tennessee.

Board Composition

Our board of directors consists of eight authorized members. All directors are elected to hold office until our next annual meeting of shareholders and until their successors have been elected. Officers are elected and serve at the discretion of the board of directors. There are no family relationships among any of our directors or executive officers.

Certain Relationships and Related Transactions

Transactions with Management and Others

Effective April 15, 2002, Samuel Anderson became a consultant to SeraCare Life Sciences pursuant to a three-year Consulting Agreement. Under the terms of this agreement, Mr. Anderson serves as an advisor to the Chief Executive Officer and receives an annual consulting fee of $56,000.

Jerry Burdick is currently our Secretary. Effective August 15, 2004, Jerry Burdick became a consultant to the Company pursuant to a two year Consulting Agreement. Under terms of the Consulting Agreement, Mr. Burdick receives $10,000 per month plus an hourly consulting fee for services performed on behalf of the Company and reimbursement for expenses incurred.

5

Pursuant to an agreement entered into with the Company on January 3, 2005, Barry D. Plost became a consultant to the Company effective October 1, 2004. Under terms of the two-year Consulting Agreement, Mr. Plost receives $200,000 annually plus reimbursement for expenses incurred.

Certain Business Relationships

The Company is a party to an agreement with Biomat USA, Inc. which sets forth the terms and conditions pursuant to which Biomat USA, Inc. will supply the Company with certain plasma products until January 2006 at prices which will be agreed upon on an annual basis. Under this agreement, Biomat USA, Inc. will also provide plasmapheresis services on donors referred by the Company, including collecting, testing and delivering the plasma. The plasma products provided by Biomat USA, Inc. to the Company under this agreement are subject to minimum quality specifications set forth in the agreement and are subject to specifications for delivery, storage and handling of the plasma in accordance with applicable laws, industry standards and good manufacturing practices.

The Company is also party to an agreement with Instituto Grifols S.A. (a subsidiary of Probitas Pharma S.A.), under which Instituto Grifols S.A. supplies it with Human Serum Albumin, which the Company then distributes to various biotech companies. Under this agreement, Instituto Grifols S.A. also supplies the Company with Human Serum Albumin for use in diagnostic products. The Company obtains a substantial portion of its revenue and operating margin from sales of products incorporating the Human Serum Albumin supplied by Instituto Grifols S.A. under this agreement. The agreement was amended in 2001 to extend its term until March 31, 2006. In connection with an agreement for the supply of Human Serum Albumin that the Company entered into with one of its significant customers, it also amended the terms of the agreement with Instituto Grifols S.A. to conform certain aspects of the agreement with this customer contract.

Probitas Pharma S.A. currently holds a five-year warrant to purchase 563,347 shares of the Company’s common stock at an exercise price of $3.05 per share. On September 25, 2001, Probitas Pharma S.A., through its subsidiary Instituto Grifols S.A., acquired Biomat USA, Inc., our former parent.

The Company purchased from subsidiaries of Biomat USA, Inc. products and services totaling $268,196 during the year ended September 30, 2002, $2,602,950 during the year ended September 30, 2003 and $1,346,075 during the year ended September 30, 2004. During the same periods, the Company purchased plasma products from other subsidiaries of Probitas Pharma S.A. totaling, $8,746,472, $5,790,904 and $4,962,723 respectively. Accounts payable under agreements with these related parties as of September 30, 2004 and 2003 totaled $1,681,192 and $2,414,670 respectively.

Mr. Barry D. Plost is currently Chairman of the Board of Directors of the Company. Mr. Plost is also President and a director of Biomat USA, Inc. and serves as a director of Probitas Pharma S.A. Mr. Plost became a consultant to the Company effective October 1, 2004 for which he is compensated $200,000 annually.

Mr. Jerry L. Burdick, a current Board Member is currently Secretary of the Company. In addition, Mr. Burdick became a consultant to the Company in August 2004. The Company pays Mr. Burdick a monthly fee of $10,000 plus an hourly consulting fee for services performed. Mr. Burdick became a consultant to Biomat USA, Inc. in August 2004.

Mr. Sam Anderson, a current Board Member is a consultant to the Company pursuant to a contract which runs through April 14, 2005. The Company pays Mr. Anderson an annual consulting fee of $56,000.

In October 2003, Dr. Kasten was granted an option to purchase 25,000 shares of common stock at an exercise price equal to the fair market value of the stock at the date of grant. The fair value of the options as determined using the Black-Scholes model was $39,558 in non-cash acquisition costs which was recorded during the year ended September 30, 2004.

6

In order to fund the cash portion of the purchase price of the BioMedical Resources, Inc. acquisition, the Company borrowed $2,500,000 from Mr. Plost, which loan was secured by all the Company’s assets. Interest was payable at the rate of 6% per annum and was payable in full on or before October 14, 2003. On October 7, 2003, the entire loan was repaid by the Company.

On September 14, 2004, the Company entered into a four-and-one-half-year $4,000,000 Subordinated Note Agreement (“Subordinated Notes”) with certain lenders. Two of the three lenders (Barry Plost and Dr. Bernard Kasten who collectively hold $3,500,000) are members of the board of directors of the Company, and the administrative agent is a corporation controlled by Mr. Plost. The $3,500,000 is classified as long-term notes payable to related parties in the balance sheets. The remaining $500,000 is classified as a component of long-term debt. The Company issued the $4,000,000 in notes under the Note Agreement to fund a portion of the purchase price for the acquisition by the Company of substantially all of the assets of the BBI Diagnostics and BBI Biotech Research Laboratories, Inc. divisions of Boston Biomedica, Inc. Until September 15, 2006, the Subordinated Notes bear interest at a rate equal to 14% per annum, increasing thereafter to 16% per annum. Interest is payable monthly in cash, except that any amount in excess of 14% per annum shall be paid in kind, unless payment in cash is permitted under the Company’s credit agreement with its senior lendors (the “Credit Agreement”) and the Company elects to pay such amount in cash. The Subordinated Notes are due on March 15, 2009, and have no scheduled prepayments or sinking fund requirements. The Subordinated Notes may be repaid at any time prior to March 15, 2005 in an amount equal to the principal thereof plus accrued interest. At any time after March 15, 2005 until and including March 15, 2008, the Subordinated Notes may be prepaid only with the payment of a fee equal to 3% (initially) of the amount to be repaid, declining each year by 1%. Mandatory prepayment of the Subordinated Notes is required upon a change of control in an amount equal to 101% of the principal thereof, plus accrued interest. The Subordinated Notes are secured by substantially all the assets of the Company, second in priority to the lien securing obligations under the Credit Agreement and are subordinated in right of payment to obligations under the Credit Agreement. The Subordinated Notes contains standard representations, covenants and events of default for facilities of this type. Occurrence of an event of default allows the holders to accelerate payment of the Subordinated Notes, in addition to the exercise of other legal remedies, including foreclosing on collateral, subject to the provisions of the subordination agreement with the lenders under the Credit Agreement.

Board of Directors and Committees of Our Board of Directors

Our board of directors held six regular meetings and no special meeting during fiscal 2004. Each of the directors attended at least 75% of the total number of meetings of the board held while he was a director and of each committee on which he served during the period in which he served as a member of that committee. Our board has established the committees described below, and may establish others from time to time. Our board of directors has determined that each of Messrs. Cresci, Jallad, Teng, Kasten and Anderson meet the independence requirements of Nasdaq Marketplace Rule 4200.

Audit Committee

The Audit Committee assists our board of directors in discharging its responsibilities relating to the accounting, reporting, and financial practices of our company, and has general responsibility for oversight and review of the accounting and financial reporting practices, internal controls and accounting and audit activities of our company. The Audit Committee acts pursuant to a written charter. The Audit Committee Charter was originally adopted by our board of directors on November 30, 2001 and was amended and restated on January 2, 2004.

The members of the Audit Committee are Messrs. Cresci (chairman), Teng and Jallad. Our board of directors has determined that each of the members of the Audit Committee qualifies as an “independent” director under the Nasdaq rules applicable to members. The foregoing determination includes the board’s determination that Robert Cresci is an independent director under the Nasdaq rules even though he may be deemed to fall outside of the safe harbor provisions of Rule 10A-3(e)(1(ii) under the Securities Act of 1933 because he serves as

7

a managing member of Pecks Management Partners, Ltd., which is an investment advisor to funds holding approximately 14.7% of our company’s outstanding common stock. Our board of directors has also determined that Mr. Cresci is an “audit committee financial expert” as defined by the rules of the Securities and Exchange Commission.

The Audit Committee held four meetings during fiscal 2004. A copy of the report of the Audit Committee is contained in this proxy statement.

Compensation Committee

The Compensation Committee was formed in September 2001 and consists of Messrs. Anderson and Jallad. The Compensation Committee establishes remuneration levels for our executive officers, reviews management organization and development and reviews significant employee benefit programs. The Compensation Committee held four meetings during fiscal 2004. A copy of the report of the Compensation Committee is contained in this proxy statement.

Nominating and Governance Committee

The Nominating and Governance Committee was formed in January 2004 and consists of Messrs. Kasten and Anderson. The Nominating and Governance Committee identifies individuals qualified to become members of the board of directors, develops and recommends to the board a set of corporate governance principles applicable to our company, and takes such other actions within the scope of its charter as the Committee deems necessary or appropriate. A copy of the charter of the Nominating and Corporate Governance Committee can be found in the Corporate Governance section of our Web site at http://www.seracare.com.

Since our spin-off from Biomat USA in September of 2001, we have not received nominations from any shareholders for directors other than our current board members. Accordingly, the Nominating and Corporate Governance Committee has not at this time adopted a formal policy by which our shareholders may recommend director candidates, however the Committee will consider candidates recommended by shareholders. A shareholder wishing to submit such a recommendation should send a letter to the Secretary of our company at 1935 Avenida del Oro, Oceanside, California 92056. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Director Nominee Recommendation.” The letter must identify the author as a shareholder and provide a brief summary of the candidate’s qualifications, as well as contact information for both the candidate and the shareholder. At a minimum, candidates for election to the Board must meet the independence requirements of Nasdaq Marketplace Rule 4200. Candidates should also have relevant business and financial experience, and they must be able to read and understand fundamental financial statements. Other than the addition of Michael Crowley, Jr. to our board in July 2002, our board composition has not changed since our spin-off from Biomat USA in September 2001, and our Nominating and Corporate Governance Committee has not yet developed a formal process for identifying or evaluating new nominees to the board. Candidates recommended by shareholders will be evaluated in the same manner as candidates recommended by anyone else, although the Nominating and Corporate Governance Committee may prefer candidates who are personally known to the existing directors and whose reputations are highly regarded. The Committee will consider all relevant qualifications as well as the needs of our company in terms of compliance with Nasdaq listing standards and Securities and Exchange Commission rules.

Our Nominating and Corporate Governance Committee recommended to our board of directors the nomination for re-election to our board of each of the above nominees.

Shareholder Communication with Our Board of Directors

Shareholders who wish to communicate with our board of directors or with a particular director may send a letter to the Secretary of our company at 1935 Avenida del Oro, Oceanside, California 92056. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Shareholder-Board

8

Communication” or “Shareholder-Director Communication.” All such letters must identify the author as a shareholder and clearly state whether the intended recipients are all members of the Board or just certain specified individual directors. The Secretary will make copies of all such letters and circulate them to the appropriate director or directors. Our board encourages but does not require board member attendance at our annual meeting. All members of our board attended last year’s annual meeting.

Compensation of Directors

Our board of directors consists of 8 authorized members. Each director, excluding Michael F. Crowley Jr., is entitled to an annual cash fee of $10,000 plus expenses to be paid the first month of each fiscal year, a $1,500 fee for each meeting personally attended and a $500 fee for each meeting telephonically attended. In addition, each director, excluding Michael F. Crowley Jr. and Barry Plost receives annually a fully vested five-year option to purchase 15,000 shares of our common stock with an exercise price equal to 100% of the fair market value (determined in accordance with our 2001 Stock Incentive Plan) of our common stock on the date of the grant. Our Chairman of the Board, Barry D. Plost receives a fully vested five year option to purchase 25,000 shares of our common stock at an exercise price equal to 100% of the fair market value (determined in accordance with our 2001 Stock Incentive Plan) of our common stock on the date of the grant for services performed in his capacity as Chairman of our board of directors.

Each member of our Audit Committee except for Robert Cresci receives a $2,500 annual fee for serving on the Audit Committee. Mr. Robert Cresci receives a cash fee of $7,500 annually and $1,000 for each Audit Committee meeting attended in person and $500 for each such meeting attended electronically for serving as the Audit Committee Chairman. Mr. Cresci also receives a fully vested five-year option to purchase 5,000 shares of the Company’s Common Stock at an exercise price equal to 100% of the fair market value (determined in accordance with our 2001 Stock Incentive Plan) of our common stock on the date of grant for serving as the Audit Committee Chairman. All members of the Audit Committee are entitled to be reimbursed for their expenses in serving on the Audit Committee

Each member of our Compensation Committee except for Samuel Anderson receives a $2,500 annual fee for serving on the Compensation Committee. Mr. Anderson receives a cash fee of $5,000 annually for serving as the Compensation Committee Chairman. All members of the Compensation Committee are entitled to be reimbursed for their expenses in serving on the Compensation Committee.

Other Arrangements with Directors

Effective October 1, 2004, Mr. Barry D. Plost became a consultant to the Company pursuant to a two year agreement for which he is compensated $200,000 annually.

Effective August 19, 2004, Mr. Jerry L. Burdick became a consultant to the Company pursuant to a two year agreement. Under terms of the agreement, the Company pays Mr. Burdick a monthly fee of $10,000 plus an hourly consulting fee for services performed.

Effective April 15, 2002, Samuel Anderson became a consultant to SeraCare Life Sciences pursuant to a three-year Consulting Agreement. Under the terms of this agreement, Mr. Anderson serves as an advisor to the Chief Executive Officer and receives an annual consulting fee of $56,000.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee is a former or current officer or employee of our company; however, Samuel Anderson is a consultant to our company. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board of directors or on our Compensation Committee.

9

Code of Ethics

Our company has adopted a code of ethics that applies to our chief executive officer, chief financial officer and controller. A copy of the code of ethics can be found in the Corporate Governance section of our Web site at http://www.seracare.com.

Equity Security Ownership of Management and Other Beneficial Ownership

The following sets forth information as of December 20, 2004 (the “Reference Date”) with respect to the beneficial ownership of our common stock, (i) by each person known to us to own beneficially more than five percent of our common stock, (ii) by each executive officer and director, and (iii) by all officers and directors as a group.

| | | | |

| | | Shares of Common Stock Beneficially Owned(1)

|

Individual / Group

| | Amount and Nature of Beneficial

Ownership

| | Percent

of Class

|

Barry D. Plost(2) | | 887,658 | | 8.8 |

| | |

Jerry L. Burdick(3) | | 236,444 | | 2.4 |

| | |

Dr. Nelson Teng(4) | | 300,000 | | 3.0 |

| | |

Samuel Anderson(5) | | 240,341 | | 2.4 |

| | |

Ezzat Jallad(6) | | 132,000 | | 1.3 |

| | |

Robert Cresci(7) | | 120,443 | | 1.2 |

| | |

Dr. Bernard Kasten(8) | | 150,000 | | 1.5 |

| | |

Michael F. Crowley Jr.(9) | | 154,000 | | 1.5 |

| | |

Tim T. Hart | | — | | — |

| | |

Thomas Lawlor | | — | | — |

| | |

All officers and directors (10 persons) | | 2,220,886 | | 20.5 |

| | |

Other beneficial owners: | | | | |

| | |

Pecks Management Partners, Ltd.(10) One Rockefeller Plaza New York, NY 10020 | | 1,459,438 | | 14.7 |

| | |

Ashford Capital Management, Inc.(11) P.O. Box 4172 Wilmington, Delaware 19807 | | 1,000,035 | | 10.1 |

| | |

Probitas Pharma, S.A.(12) Calle de la Marina, 16-18 Torre Mapfre, Pl. 27, | | 563,347 | | 5.4 |

| (1) | | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options or warrants held by that person that are currently exercisable or will become exercisable within 60 days after December 20, 2004, are deemed outstanding; such shares are not deemed outstanding for purposes of computing percentage ownership of any other person. Unless otherwise indicated below, the person and entities named in the table have sole voting and investment power with respect to all shares beneficially owned, subject to community property |

10

| | laws where applicable. Unless otherwise indicated, the address for each person is c/o SeraCare Life Sciences, Inc., 1935 Avenida del Oro, Oceanside, California 92056. |

| (2) | | 185,000 of these shares result from options or warrants that are exercisable within 60 days. Also includes 1,900 shares held by Mr. Plost’s spouse. |

| (3) | | 85,000 of these shares result from options that are exercisable within 60 days. Also includes 8,000 shares held by Mr. Burdick’s spouse. |

| (4) | | 110,000 of these shares result from options that are exercisable within 60 days. |

| (5) | | 85,000 of these shares result from options that are exercisable within 60 days. Also includes 154,861 shares of common stock held by a trust of which Mr. Anderson is trustee and 480 shares held by Mr. Anderson’s spouse. Mr. Anderson disclaims beneficial ownership of the shares held by his spouse. |

| (6) | | 70,000 of these shares result from options that are exercisable within 60 days. |

| (7) | | 115,000 of these shares result from options that are exercisable within 60 days. Mr. Cresci is a managing director of Pecks Management Partners, Ltd. |

| (8) | | All of these shares result from options that are exercisable within 60 days. |

| (9) | | 140,000 of these shares result from options that are exercisable within 60 days. |

| (10) | | According to a Schedule 13F filed with the SEC by Pecks Management Ltd. on November 24, 2003, 1,459,438 shares of common stock are held of record by clients of Pecks Management Ltd. (“Pecks”), and Pecks, in its capacity as investment advisor, may be deemed to have beneficial ownership of all such 1,459,438 shares. Mr. Cresci is a managing director of Pecks Management Partners, Ltd. |

| (11) | | According to a Schedule 13F filed with the SEC by Ashford Capital Management, Inc. on November 15, 2004, 1,000,035 shares of common stock are held of record by clients of Ashford Capital Management, Inc. (“Ashford”), and Ashford, in its capacity as investment advisor, may be deemed to have beneficial ownership of all such 1,000,035 shares. |

| (12) | | All of these shares result from a warrant that is exercisable within 60 days. |

Section 16(A) Beneficial Ownership Reporting Compliance

Based upon our review of forms filed by directors, officers and certain beneficial owners of our common stock (the “Section 16 Reporting Persons”) pursuant to Section 16 of the Securities Exchange Act of 1934, as amended, we believe that during fiscal 2004 no filings were filed late by the Section 16 Reporting Persons.

Recommendation of SeraCare Life Sciences Board of Directors

The eight (8) nominees receiving the highest number of votes will be elected to the board of directors.

Our board of directors recommends a vote FOR the election of each of the above nominees as a director.

11

OTHER INFORMATION

Executive Compensation

Summary Compensation Table

The following table summarizes certain compensation information concerning the annual and long-term compensation for services rendered by Michael F. Crowley Jr., (our Chief Executive Officer) and Tim T. Hart (our Chief Financial Officer) for the three years ended September 30, 2004, 2003 and 2002.

| | | | | | | | | | | | | |

| | | Period Ended

| | Annual

Compensation(1)

| | Long-Term

Compensation

| | |

Name and Principal Position

| | | | Salary

($)(2)

| | Bonus

($)(3)

| | Securities

Underlying

Options Granted

| | Other

Compensation

($)

|

Michael F. Crowley Jr. Chief Executive Officer | | September 30, 2004 September 30, 2003 September 30, 2002 | | $

$

$ | 191,666

175,000

175,000 | | $

$

$ | 100,000

75,000

50,000 | | 45,000

45,000

100,000 | | $

$

$ | 9,000

6,550

4,800 |

| | | | | |

Tim T. Hart (4) Chief Financial Officer | | September 30, 2004 September 30, 2003 | | $

$ | 156,249

54,615 | | $

$ | —

— | | 20,000

20,000 | | $

$ | 5,400

1,800 |

| (1) | | The annual compensation reported does not include the value of certain perquisites, which in the aggregate did not exceed the lesser of either $50,000 or 10% of the total annual salary and bonus for the named executive officers. |

| (2) | | Amounts shown include base compensation earned and received by the named executive officers. |

| (3) | | Amounts represent bonuses earned in the fiscal year but paid in the following fiscal year. |

| (4) | | Tim T. Hart was appointed as our Chief Financial Officer on May 20, 2003. |

Options

The table below sets forth certain information regarding options granted during fiscal 2004 to the executive officers named in the Summary Compensation Table.

Option Grants In Last Fiscal Year

| | | | | | | | | | | | | | | | |

| | | Individual Grants

| | Potential Realizable Value at

Assumed Annual Rates

of Stock Price

Appreciation for Option Term

|

Name

| | Number of Securities Underlying Options Granted(1)

| | Percent of Total Options Granted to Employees in Fiscal Year (%)

| | | Exercise Price Per

Share

| | Expiration Date

| | 5%

| | 10%

|

Michael F. Crowley Jr. | | 45,000 | | 17.1 | % | | $ | 8.19 | | October 27, 2009 | | $ | 125,342 | | $ | 284,359 |

Tim T. Hart | | 20,000 | | 7.6 | % | | $ | 8.19 | | October 27, 2009 | | $ | 55,708 | | $ | 126,382 |

Aggregated Option Exercises In Last Fiscal Year and Fiscal Year-End Option Values

| | | | | | | | | | | | | | |

| | | Options Exercised

| | Number of Securities

Underlying Unexercised Options at 9/30/2004

| | Value of Unexercised In-the-Money Options at 9/30/2004(1)

|

Name

| | Shares Acquired

| | Value Realized

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Michael F. Crowley Jr. | | — | | — | | 140,000 | | 90,000 | | $ | 1,399,000 | | $ | 574,200 |

Tim T. Hart | | — | | — | | — | | 40,000 | | $ | — | | $ | 255,200 |

| (1) | | Market value of the underlying securities at year-end, less the exercise price of “in-the-money” options. |

12

Employee Incentive Plans

SeraCare Life Sciences provides a 401(k) plan to its employees and makes discretionary matching contributions. Total contributions from SeraCare Life Sciences to this plan for the plan year ended December 31, 2003 were $66,000.

Employment Contracts

Biomat USA, Inc., our former parent, entered into an employment agreement with Michael F. Crowley Jr., effective on November 1, 2000, to serve as our President for a twenty-eight month period. We were assigned this agreement by Biomat USA in connection with our spin off in September 2001, and on October 15, 2001, we awarded Mr. Crowley options to purchase 100,000 shares of our common stock at an exercise price of $3.25 per share, which vests in full on October 15, 2004 and expires on October 15, 2007. We amended the agreement in November 2001 so as to extend Mr. Crowley’s employment through September 25, 2004 and increase his base compensation to $175,000. We further amended the agreement in June 2003 so as to extend Mr. Crowley’s employment through September 25, 2005. Pursuant to the employment agreement, Mr. Crowley received a bonus of $75,000 for fiscal year 2003. On November 16, 2004, we amended Mr. Crowley’s employment agreement to increase his base compensation to $275,000 and to extend the term of his agreement to September 25, 2006. Pursuant to the employment agreement, Mr. Crowley received a bonus of $100,000 for fiscal year 2004.

On November 8, 2004, the Company entered into an employment agreement with Thomas Lawlor pursuant to which Mr. Lawlor will serve as the Company’s Global Chief Operating Officer. The employment agreement has an effective date of December 13, 2004. The employment agreement has an initial term of one year and, in the absence of advance written notice by either party to the other, will be automatically extended for an additional year on each anniversary of the effective date of the employment agreement. The employment agreement provides for the payment of an annual base salary of $250,000 and a one time sign-on bonus of $50,000. The employment agreement also provides for an annual bonus. The annual bonus is to be determined by the Compensation Committee of the Company’s Board of Directors, but must be at least $50,000 per fiscal year subject to a maximum bonus amount of $120,000 for the Company’s fiscal year ending September 30, 2005. Mr. Lawlor is also entitled to participate in and be covered by all other employee health, insurance, 401K and other plans and benefits currently established for the employees of the Company. In addition, the employment agreement provides Mr. Lawlor with a $1,000 per month automobile allowance, paid time off benefits of no less than four weeks per year and reimbursement of all business expenses. If the Company terminates Mr. Lawlor’s employment without cause, or if Mr. Lawlor terminates his employment under certain circumstances set forth in the employment agreement, then Mr. Lawlor shall be entitled to a lump sum payment equal to one times the value of his annual base salary under the employment agreement plus the accrued but unpaid portion of his annual bonus that the Compensation Committee has determined Mr. Lawlor is eligible to receive for the applicable fiscal year. In such event, the unvested portion of Mr. Lawlor’s stock options (described below) that was scheduled to vest if Mr. Lawlor had remained employed by the Company for the remainder of the fiscal year in which his employment is terminated, will vest in full. In the event of a change-in-control of the Company (as defined in the employment agreement) in which all of the following have occurred (i) Mr. Lawlor’s employment agreement is not assumed by the surviving entity, (ii) Mr. Lawlor is not offered a similar position with similar benefits, and (iii) Mr. Lawlor voluntarily resigns following the change-in-control, then any unvested portion of Mr. Lawlor’s stock options (described below) will vest in full and Mr. Lawlor would be entitled to a lump sum payment equal to one and one-half times the value of his annual base salary under the employment agreement plus the accrued but unpaid portion of his annual bonus that the Compensation Committee has determined Mr. Lawlor is eligible to receive for the applicable fiscal year. In accordance with the terms of his employment agreement, on December 13, 2004, the Company granted to Mr. Lawlor a nonqualified stock option to purchase 160,000 shares of the Company’s common stock at an exercise price equal to the closing price per share of the Company’s common stock on December 13, 2004. The stock option vests in three equal annual installments and expires six years from the date of grant. Vesting of the stock option may be accelerated under certain circumstances.

13

Tim T. Hart has been an at will employee since his appointment as our Chief Financial Officer on May 22, 2003, and is remunerated for his services at an annual rate of $175,000.

THE FOLLOWING REPORT OF THE COMPENSATION COMMITTEE AND THE PERFORMANCE GRAPH THAT APPEARS AFTER THE REPORT SHALL NOT BE DEEMED TO BE SOLICITING MATERIAL OR TO BE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES EXCHANGE ACT OF 1934 OR INCORPORATED BY REFERENCE IN ANY DOCUMENT SO FILED.

BOARD COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the board of directors is responsible for oversight of executive compensation and review of SeraCare Life Sciences’ overall compensation programs.

Compensation Philosophy

Generally, SeraCare Life Sciences’ compensation programs are designed to attract, retain, motivate and appropriately reward individuals who are responsible for SeraCare Life Sciences’ short- and long-term profitability, growth and return to shareholders. The overall compensation philosophy followed by the Committee is to pay competitively while emphasizing qualitative indicators of corporate and individual performance.

Executive Compensation

The Committee also uses stock option awards made under the SeraCare Life Sciences, Inc. 2001 Stock Incentive Plan to provide various incentives for key personnel, including executive officers. Stock options are priced at the fair market value of the common stock of SeraCare Life Sciences on the date of the grant, and typically vest at the rate of 33 1/3% per year over three years, unless determined otherwise by the board or other committee overseeing the Plan.

Michael F. Crowley Jr. and Tim T. Hart each received stock option awards in fiscal 2004. The Committee also periodically makes recommendations to the board of directors for additional stock option awards for eligible individuals, including executive officers, based upon a subjective evaluation of individual current performance, assumption of significant responsibilities, anticipated future contributions, and/or ability to impact overall corporate and/or business unit financial results.

To the extent readily determinable, and as one of the factors in its consideration of compensation matters, the Compensation Committee also considers the anticipated tax treatment to SeraCare Life Sciences and to the executives of various payments and benefits, specifically in consideration of Section 162(m) of the Internal Revenue Code. The Committee will not, however, limit executive compensation to that which is deductible.

Chief Executive Compensation

Mr. Crowley became Chief Executive Officer of SeraCare Life Sciences in July 2002. During fiscal 2004, Mr. Crowley received a base salary of $175,000 and a management bonus of $100,000 for the fiscal year 2004, pursuant to the terms of his employment agreement (see “Employment Contracts” above). On November 16, 2004 pursuant to recommendation of the Compensation Committee, the annual base salary of Mr. Crowley was increased to $275,000 and his employment agreement was extended to September 25, 2006.

Effective December 13, 2004, pursuant to recommendation of the Compensation Committee, the Board approved an employment agreement with Thomas Lawlor pursuant to which Mr. Lawlor will serve as the Company’s Global Chief Operating Officer. The employment agreement has an initial term of one year and, in

14

the absence of advance written notice by either party to the other, will be automatically extended for an additional year on each anniversary of the effective date of the employment agreement. The employment agreement provides for the payment of an annual base salary of $250,000 and a one time sign-on bonus of $50,000. The employment agreement also provides for an annual bonus. The annual bonus is to be determined by the Compensation Committee of the Company’s Board of Directors, but must be at least $50,000 per fiscal year subject to a maximum bonus amount of $120,000 for the Company’s fiscal year ending September 30, 2005. Mr. Lawlor is also entitled to participate in and be covered by all other employee health, insurance, 401K and other plans and benefits currently established for the employees of the Company. In addition, the employment agreement provides Mr. Lawlor with a $1,000 per month automobile allowance, paid time off benefits of no less than four weeks per year and reimbursement of all business expenses. In accordance with the terms of his employment agreement, on December 13, 2004, the Company granted to Mr. Lawlor a nonqualified stock option to purchase 160,000 shares of the Company’s common stock at an exercise price equal to the closing price per share of the Company’s common stock on December 13, 2004. The stock option vests in three equal annual installments and expires six years from the date of grant. Vesting of the stock option may be accelerated under certain circumstances.

Other Actions of the Compensation Committee

On November 16, 2004, pursuant to recommendation of the Compensation Committee, the Board of Directors of SeraCare Life Sciences, Inc. (“the Board”) approved revised compensation for members of the Board as follows:

| | A. | | All Board members except Michael Crowley, Jr. and Barry D. Plost shall receive an annual fee of $10,000 in cash and 15,000 shares of the Company’s common stock with an exercise price equal to 100% of the fair market value (determined in accordance with the terms of the Company’s 2001 Stock Incentive Plan) on the date of the grant. Mr. Plost in his capacity as Chairman of the Board shall receive a fully vested five-year option to purchase 25,000 shares of the Company’s common stock at an exercise price equal to 100% of the fair market value (determined in accordance with the terms of the Company’s 2001 Stock Incentive Plan) on the date of the grant. All members of the Board other than Mr. Crowley shall receive $1,500 plus expenses for each in-person Board meeting attended and $500 for each telephonic Board meeting attended. |

| | B. | | In addition to the consideration enumerated in A. above, the Board approved annual cash compensation of $2,500 for members of the Audit Committee and Compensation Committee except for the Chairpersons of such committee’s. The Chairman of the Compensation Committee shall receive annual cash consideration of $5,000. The Chairman of the Audit Committee shall receive a fully vested five-year option to purchase 5,000 shares of the Company’s common stock at an exercise price equal to 100% of the fair market value (determined in accordance with the terms of the Company’s 2001 Stock Incentive Plan) on the date of the grant and annual cash consideration of $7,500 plus $1,000 for each in-person Audit Committee meeting attended and $500 for each telephonic Audit Committee meeting attended. |

COMPENSATION COMMITTEE

Samuel Anderson

Ezzat Jallad

15

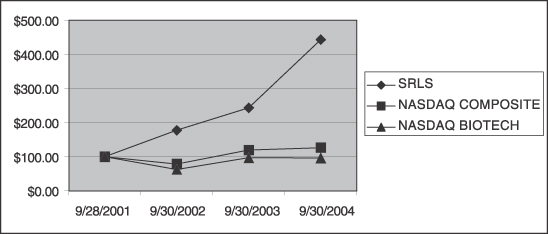

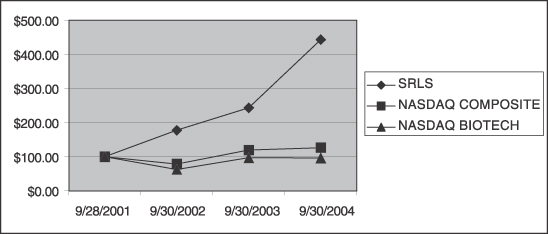

PERFORMANCE GRAPH

The following graph compares the change in the Company’s cumulative total stockholder return from September 30,2001 to September 30,2004, which includes the last trading day of fiscal 2004, with the cumulative total return on the Nasdaq Composite Index and the Nasdaq Biotechnology Index for that period.

| | | | | | | | | | | | |

PERFORMANCE GRAPH

| | 9/28/2001

| | 9/30/2002

| | 9/30/2003

| | 9/30/2004

|

SRLS | | $ | 100.00 | | $ | 177.30 | | $ | 242.91 | | $ | 443.26 |

NASDAQ COMPOSITE | | $ | 100.00 | | $ | 78.20 | | $ | 119.22 | | $ | 126.56 |

NASDAQ BIOTECH | | $ | 100.00 | | $ | 62.60 | | $ | 97.01 | | $ | 96.21 |

Assumes $100 invested on September 28, 2001 in the company’s common stock, the Nasdaq Composite Index and the Nasdaq Biotechnology Index. The reported closing sales price of our common stock on the OTCBB on September 25, 2001, the first day after our spin-off from Biomat USA, Inc., was $1.50. The closing price of our common stock on September 28, 2001, the final trading day of September 2001, was $2.82. The closing price of our common stock on September 30, 2002, the final trading day of September 2002, was $5.00. The closing price of our common stock on September 30, 2003, the final trading day of September 2003, was $6.85. The closing price of our common stock on September 30, 2004, the final trading day of September 2004, was $12.50.

16

PROPOSAL 2—AMENDMENT TO OUR 2001 STOCK INCENTIVE PLAN

We maintain the SeraCare Life Sciences, Inc. 2001 Stock Incentive Plan. Our board of directors approved, subject to shareholder approval, an amendment to the 2001 Stock Incentive Plan that would increase the number of shares of our common stock available for award grants under the 2001 Stock Incentive Plan from 1,500,000 shares to 1,800,000 shares (an increase of 300,000 shares). Shareholders are being asked to approve the amendment.

As of December 31, 2004, approximately 1,043,500 of the 1,500,000 shares then available for award grant purposes under the 2001 Stock Incentive Plan had been issued pursuant to awards granted under the plan or were subject to awards then outstanding under the plan, and approximately 456,500 shares were then available for additional award grants. Our board of directors believes that the additional shares requested under the 2001 Stock Incentive Plan will give us greater flexibility to structure future incentives and better attract, retain and motivate employees, officers and directors.

If the amendment is not approved by shareholders, the current share limit under the 2001 Stock Incentive Plan will remain in effect.

Summary Description of the Plan

The principal terms of the 2001 Stock Incentive Plan are summarized below. The following summary is qualified in its entirety by the full text of the 2001 Stock Incentive Plan, which has been filed as an exhibit to the copy of this Proxy Statement that was filed electronically with the Securities and Exchange Commission and can be reviewed on the Securities and Exchange Commission’s Web site at http://www.sec.gov and on our Web site at http://www.seracare.com. A copy of the 2001 Stock Incentive Plan document may also be obtained without charge by writing Tim T. Hart at SeraCare Life Sciences, Inc., 1935 Avenida del Oro, Oceanside, California 92056.

Purpose. The purpose of the 2001 Stock Incentive Plan is to promote the success of SeraCare Life Sciences, Inc. and the interests of our shareholders by providing an additional means to attract, motivate, retain and reward eligible persons with awards and incentives for high levels of individual performance and improved financial performance of the Company.

Awards. The 2001 Stock Incentive Plan authorizes stock options, restricted stock, and stock unit awards. The 2001 Stock Incentive Plan gives us the flexibility to offer competitive incentives and to tailor benefits to specific needs and circumstances. Generally, an option will expire, or other award will vest, not more than 10 years after the date of grant.

Administration. The 2001 Stock Incentive Plan will be administered by our board of directors or by one or more committees appointed by our board of directors. The appropriate acting body is referred to as the “Administrator.” The Administrator is currently our board of directors.

The Administrator determines the number of shares that are to be subject to awards and the terms and conditions of such awards, including the price, if any, to be paid for the shares or the award and the vesting and exercisability provisions. Subject to the other provisions of the 2001 Stock Incentive Plan and in addition to such other authority as may be contemplated by the plan, the Administrator has the authority:

| | • | | to permit the recipient of any award to pay the purchase price of shares of common stock or the award in cash or by check, the delivery of previously owned shares of common stock, or a cashless exercise or third party payment in such manner as may be authorized by the Administrator; |

| | • | | to accelerate the receipt or vesting of benefits pursuant to an award; |

17

| | • | | to make certain adjustments to an outstanding award and authorize the conversion, succession or substitution of an award; and |

| | • | | to determine the fair market value of our stock for plan purposes and to construe and interpret the plan. |

Eligibility. Persons eligible to receive awards under the 2001 Stock Incentive Plan include our officers and employees, our directors, and certain consultants and advisors to us. As of December 31, 2004, all of our officers and employees (approximately 250 individuals), including all of our named executive officers, and each of our seven non-employee directors were considered eligible under the 2001 Stock Incentive Plan, subject to the power of the Administrator to determine eligible persons to whom awards will be granted.

Transfer Restrictions. Awards under the 2001 Stock Incentive Plan are generally not transferable by the recipient other than by will or the laws of descent and distribution and are generally exercisable, during the recipient’s lifetime, only by the recipient. The Administrator may permit certain award transfers, such as for estate or tax planning purposes.

Limits on Awards; Authorized Shares. The maximum number of shares of our common stock that may be issued or delivered pursuant to awards granted under the 2001 Stock Incentive Plan is 1,500,000 shares; however, this maximum will increase to 1,800,000 shares if shareholders approve the proposed plan amendment. The 2001 Stock Incentive Plan limits the total number of shares that may be issued or delivered pursuant to the exercise of incentive stock option grants under the plan to 1,000,000 shares. The 2001 Stock Incentive Plan also limits the total number of shares subject to options, or all awards, that may be granted under the 2001 Stock Incentive Plan during any calendar year to 150,000 shares for any one individual.

As is customary in incentive plans of this nature, the number and kind of shares available under the 2001 Stock Incentive Plan and the then-outstanding awards, as well as exercise or purchase prices and share limits, are subject to adjustment in the event of certain reorganizations, mergers, combinations, consolidations, recapitalizations, reclassifications, stock splits, reverse stock splits, stock dividends, asset sales or other similar events, or extraordinary dividends or distributions of property to shareholders.

The 2001 Stock Incentive Plan will not limit the authority of our board of directors or the Administrator to grant awards or authorize any other compensation, with or without reference to our common stock, under any other plan or authority.

Stock Options. An option is the right to purchase shares of common stock at a future date at a specified price, which is referred to as the exercise price of the option. An option may either be an incentive stock option or a nonqualified stock option. Incentive stock option benefits are taxed differently from nonqualified stock options, as described under “U.S. Federal Income Tax Consequences of Awards Under the Plan” below. Incentive stock options are also subject to more restrictive terms and are limited in amount by the U.S. Internal Revenue Code and the 2001 Stock Incentive Plan.

Exercise Price. The per share exercise price of each option will be determined by the Administrator at the time of grant. Except for options granted pursuant to an assumption or substitution for other options (such as in the context of a merger or acquisition), in no case will the per share exercise price of an option be less than the fair market value of a share of our common stock on the date of grant of the option. Full payment for shares purchased on the exercise of an option must be made at the time of such exercise in a manner approved by the Administrator.

Restricted Stock Awards. A restricted stock award is an award typically for a fixed number of shares of our common stock subject to restrictions. The Administrator specifies the price, if any, the participant must pay for such shares and the restrictions imposed on such shares. The restrictions may include, for example, continued service only and/or performance standards.

18

Stock Units. A stock unit is a bookkeeping entry measured in shares of our common stock. Vested stock units may be paid out in our common stock or in cash, subject to terms and conditions imposed by the Administrator. The Administrator may award stock units to participants, may allow participants to defer other compensation or award payment in the form of a stock unit credit, and may grant stock units in exchange for other awards.

Acceleration of Awards; Possible Early Termination of Awards. Unless the administrator acts in advance of a Change in Control Event to prevent the acceleration of awards, upon a Change in Control Event each option will become immediately vested and exercisable and each award of restricted stock will immediately vest free of restrictions. Awards may terminate to the extent that they are vested and not exercised prior to a Change in Control Event or other event that we do not survive. A “Change in Control Event” under the 2001 Stock Incentive Plan generally includes (1) our dissolution or liquidation, (2) certain mergers and other reorganizations in which our shareholders do not continue to own at least half of our stock or our successor’s stock following the transaction, (3) certain sales of all or substantially all of our business or assets, (4) certain persons acquiring 25% or more of our outstanding voting stock, and (5) certain changes in a majority of our board of directors over a period not longer than two years.

Termination of or Changes to the Plan. Our board of directors may amend or terminate the 2001 Stock Incentive Plan at any time and in any manner. Shareholder approval for an amendment will generally not be obtained unless shareholder approval for the amendment is required by applicable law. Unless previously terminated by our board of directors, the 2001 Stock Incentive Plan will terminate on September 24, 2011. Outstanding awards may be amended, subject, however, to the consent of the holder if the amendment materially and adversely affects the rights of the holder.

U.S. Federal Income Tax Consequences of Awards under the Plan. The U.S. federal income tax consequences of the 2001 Stock Incentive Plan under current federal law, which is subject to change, are summarized in the following discussion of the general tax principles applicable to the 2001 Stock Incentive Plan. This summary is not intended to be exhaustive and, among other considerations, does not describe state, local, or international tax consequences.

With respect to a nonqualified stock option, we are generally entitled to deduct and the optionee recognizes taxable income in an amount equal to the difference between the option exercise price and the fair market value of the shares at the time of exercise. With respect to an incentive stock option under Section 422 of the U.S. Internal Revenue Code, we are generally not entitled to a deduction nor does the optionee recognize income at the time of exercise, although the optionee may be subject to the U.S. federal alternative minimum tax.

With respect to purchases of restricted shares, if the shares are subject to a substantial risk of forfeiture the purchaser has income equal to the excess of the fair market value of the shares over the price paid (if any) for the shares only at the time the restrictions lapse (unless the purchaser elects to accelerate recognition as of the date of grant). A purchaser of shares that are not subject to a substantial risk of forfeiture has income at the time of purchase equal to the excess of the fair market value of the shares at that time over the price paid (if any) for the shares. Stock unit awards are generally subject to tax at the time of payment. In each of the foregoing cases, we will generally have a corresponding deduction at the time the award recipient recognizes income.

If an award is accelerated under the 2001 Stock Incentive Plan in connection with a change in control (as this term is used under the U.S. Internal Revenue Code), we may not be permitted to deduct the portion of the compensation attributable to the acceleration (“parachute payments”) if it exceeds certain threshold limits under the U.S. Internal Revenue Code (and certain related excise taxes may be triggered). Furthermore, if the compensation attributable to awards is not “performance-based” within the meaning of Section 162(m) of the U.S. Internal Revenue Code, we may not be permitted to deduct the compensation that is not performance-based in excess of $1,000,000 in certain circumstances.

Specific Benefits; Historical Grants Under the Plan. We have not approved any awards under the 2001 Stock Incentive Plan that are contingent on shareholder approval of the proposed plan amendment. If the

19

additional shares that will be available under the 2001 Stock Incentive Plan if shareholders approve the proposed plan amendment had been available for award purposes in fiscal 2004, we expect that our award grants for fiscal 2004 would not have been substantially different from those actually made under the plan.

For information regarding stock options granted to our directors and named executive officers during fiscal 2004, see the material under the heading “Proposal 1—Election of Directors—Compensation of Directors” above, and under the heading “Other Information—Executive Compensation” above. For additional information regarding past option grants under the 2001 Stock Incentive Plan, see the “Aggregate Past Grants under the 2001 Stock Incentive Plan” table below.

We are not currently considering any specific additional awards under the 2001 Stock Incentive Plan. The number, amount and type of awards to be received by or allocated to eligible persons in the future under the plan, if shareholders approve the proposed plan amendment, cannot be determined at this time.

The closing market price for a share of our common stock on December 31, 2004 was $14.92 per share.

20

AGGREGATE PAST GRANTS UNDER THE 2001 STOCK INCENTIVE PLAN

As of December 31, 2004, options covering 1,043,500 shares of our common stock had been granted under the 2001 Stock Incentive Plan. Of these options, the following number of shares have been granted subject to options to the persons and groups identified below:

| | | | | | | | |

Name and Position

| | Number of Shares Subject to Past Option Grants

| | Number of Shares Acquired On Exercise

| | Number of Shares Underlying Options as of December 31, 2004

|

| | | | Exercisable

| | Unexercisable

|

Executive Group: | | | | | | | | |

Michael F. Crowley, Jr. Chief Executive Officer | | 190,000 | | — | | 100,000 | | 90,000 |

Tim T. Hart Chief Financial Officer | | 40,000 | | — | | — | | 40,000 |

| | |

| |

| |

| |

|

Total for Executive Group | | 230,000 | | — | | 100,000 | | 130,000 |

| | |

| |

| |

| |

|

Non-Executive Director Group: | | | | | | | | |

Barry D. Plost | | 145,000 | | — | | 145,000 | | — |

Jerry L. Burdick | | 60,000 | | — | | 60,000 | | — |

Samuel Anderson | | 60,000 | | — | | 60,000 | | — |

Ezzat Jallad | | 70,000 | | — | | 70,000 | | — |

Dr. Nelson Teng | | 70,000 | | — | | 70,000 | | — |

Robert J. Cresci | | 75,000 | | — | | 75,000 | | — |

Dr. Bernard Kasten | | 110,000 | | — | | 110,000 | | — |

| | |

| |

| |

| |

|

Total for Non-Executive Director Group | | 590,000 | | — | | 590,000 | | — |

| | |

| |

| |

| |

|

Each other person who has received 5% or more of the options | | — | | — | | — | | — |

All Employees, including all current officers who are not executive officers or directors, as a group | | 223,500 | | 4,998 | | — | | 218,502 |

| | |

| |

| |

| |

|

Total | | 1,043,500 | | 4,998 | | 690,000 | | 348,502 |

| | |

| |

| |

| |

|

Each of the non-executive directors identified above is a nominee for re-election as a director at the 2005 annual meeting.

Securities Authorized for Issuance Under Equity Compensation Plan

Equity Compensation Plans Approved by Stockholders. We maintain the SeraCare Life Sciences, Inc. 2001 Stock Incentive Plan. On September 25, 2001, we granted to each of Messrs. Plost, Burdick, Teng, Kasten, Cresci, Jallad and Anderson options to purchase 40,000 shares of our common stock at an exercise price of $1.00 per share. These options were granted outside the scope of the 2001 Stock Incentive Plan. Our 2001 Stock Incentive Plan and the September 25, 2001 option grants referred to in the previous sentence were approved by our shareholders in September 2001. The September 25, 2001 option grants referred to above are fully vested and have a maximum term of five years from the date of grant.

Equity Compensation Plan Not Approved by Stockholders. On October 4, 2001, we granted options covering an aggregate of 40,000 shares to certain consultants for services that have been rendered. These options were not granted under the 2001 Stock Incentive Plan, and we were not required to obtain shareholder approval for these options. Each of these options was fully vested at grant and has a maximum term of three years from the date of grant. These options were exercised in November 2004.

21

Summary Table. The following table sets forth, for our 2001 Stock Incentive Plan and the other option grants referred to above, the number of shares of our common stock subject to outstanding options, the weighted-average exercise price of outstanding options, and the number of shares remaining available for future award grants as of September 30, 2004.

| | | | | | | | | |

Plan Category

| | Number of Shares to

be Issued Upon Exercise

of Outstanding Options

| | | Weighted-Average Exercise Price of Outstanding Options

| | Number of Shares Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Shares Reflected in the First Column)

| |

Equity compensation plans approved by shareholders | | 1,133,500 | (1) | | $ | 5.45 | | 576,500 | (2) |

Equity compensation plans not approved by shareholders | | 40,000 | | | $ | 5.00 | | — | |

| (1) | | Of these shares 923,500 are subject to options granted under the 2001 Stock Incentive Plan and an aggregate of 210,000 are subject to the September 25, 2001 option grants to Messrs. Plost, Burdick, Teng, Kasten, Cresci, Jallad and Anderson. |

| (2) | | Reflects shares then available for award grants under the 2001 Stock Incentive Plan. All of the shares available under the 2001 Stock Incentive Plan are available for grant subject to stock options, restricted stock or other awards authorized under the 2001 Stock Incentive Plan. |

Vote Required

To approve the amendment to the 2001 Stock Incentive Plan, holders of a majority of the shares represented at the annual meeting and voting on the applicable matter (which shares voting on the applicable matter must also constitute at least a majority of the required quorum) must vote in favor of the proposed amendment to the 2001 Stock Incentive Plan. With respect to this proposal, broker non-votes will be treated as shares that are not present and not voting (even though those shares are considered entitled to vote for quorum purposes and may be entitled to vote on other matters) and abstentions will be treated as shares that are present but are not voting (even though those shares are considered entitled to vote for quorum purposes and may be entitled to vote on other matters). Thus, both broker non-votes and abstentions will be entirely excluded from the vote on this matter.

Our board recommends a vote FOR the proposed amendment to the 2001 Stock Incentive Plan. The shares represented by the proxies received will be voted FOR approval of the proposed amendment, unless the proxy indicates a vote against approval or an abstention from voting.

22

PROPOSAL 3—APROVAL OF EMPLOYEE STOCK PURCHASE PLAN

Shareholders are being asked to approve the SeraCare Life Sciences, Inc. Employee Stock Purchase Plan (the “ESPP”), which was adopted by our board of directors on January 3, 2005, subject to shareholder approval.