Filed by: SUEZ

pursuant to Rule 425 under the Securities Act of 1933

Subject Company: SUEZ

Exchange Act File Number: 001-15232

Date: May 4, 2006

ImportantInformation

Thiscommunication does notconstitute an offer topurchase orexchange or thesolicitation of an offer to sell orexchange anysecurities of SUEZ or an offer to sell orexchange or thesolicitation of an offer to buy orexchange anysecurities of Gaz deFrance, nor shall there be any sale orexchange ofsecurities in anyjurisdiction(includingthe UnitedStates,Germany, Italy andJapan) in which such offer,solicitation or sale orexchange would beunlawful prior to theregistration orqualification under the laws of suchjurisdiction.Thedistribution of thiscommunication may, in somecountries, berestricted by law orregulation. Accordingly,persons who come intopossession of thisdocument should informthemselves of andobserve theserestrictions. To the fullest extentpermitted byapplicable law, Gaz deFrance and SUEZdisclaim anyresponsibilityor liability for theviolation of suchrestrictions by anyperson.

The Gaz deFranceordinary shares to be issued inconnection with theproposedbusinesscombination toholders of SUEZordinary shares(including SUEZordinary sharesrepresented by SUEZAmericanDepositaryShares) may not beoffered or sold in the United States exceptpursuant to aneffectiveregistrationstatement under the United StatesSecurities Act of 1933, asamended,orpursuant to a validexemption fromregistration.

In connection with the proposedbusinesscombination, the requiredinformationdocument will be filed with the Autorité des marchésfinanciers(“AMF”) and, to the extent Gaz de France is required or otherwisedecides to register the Gaz de Franceordinary shares to be issued in connection with the businesscombination in the United States, Gaz de France may file with the United States Securities and ExchangeCommission(“SEC”), a registrationstate ment on Form F-4, which will include a prospectus. Investors are stronglyadvised to read the informationdocument filed with the AMF, the registrationstatement and the prospectus, if and when available, and any other relevantdocuments filed with the SEC and/or the AMF, as well as any amendments and s upplements to those documents,because they will containimportantinformation. If and when filed, investors may obtain free copies of the registrationstatement, the prospectus as well as other relevantdocuments filed with the SEC, at the SEC’s website at www.sec.gov and will receiveinformation at an appropriate time on how to obtain these transaction -relateddocuments for free from Gaz de France or its duly designated agent. Investors and holders of SUEZ securities may obtain free copies of documents filed with the AMF at the AMF’s website at www.amf-france. org or directly from Gaz de France on its website at: www.gazdefrance. com or directly from SUEZ on its website at: www.suez.com, as the case may be.

Forward-LookingStatements

Thiscommunicationcontainsforward-lookinginformation andstatements about Gaz deFrance, SUEZ and theircombinedbusinesses aftercompletion of theproposed businesscombination. Forward-lookingstatements arestatements that are nothistorical facts. Thesestatementsincludefinancialprojections,synergies, costsavings andestimates and theirunderlyingassumptions,statementsregardingplans,objectives,savings,expectations andbenefits from thetransaction andexpectations withrespect to futureoperations,products andservices, andstatementsregarding futureperformance. Forward-lookingstatements aregenerallyidentified by the words“expect,” “anticipates,” “believes,” “intends,” “estimates”and similarexpressions. Although themanagements of Gaz deFrance and SUEZbelieve that theexpectationsreflected in suchforward-lookingstatements arereasonable,investors andholders of Gaz deFrance and SUEZordinary shares arecautioned thatforward-lookinginformation andstatements are notguarantees of futureperformances and aresubject tovarious risks anduncertainties, many of which aredifficult to predict andgenerallybeyond the control of Gaz deFrance and SUEZ, that could cause actual resultsdevelopments,synergies,savings andbenefits from thetransaction to differmaterially from thoseexpressed in, orimplied orprojected by, theforward-lookinginformation andstatements. These risks anduncertaintiesinclude thosediscussed oridentified in the public filings with theAutoritédesmarchésfinanciers(“AMF”) made by Gaz deFrance and SUEZ,including those listed under“Facteurs deRisques”in theDocument de Base filed by Gaz deFrance on April 1, 2005 (under no: I.05-037) and in theDocument deRéférencefiled by SUEZ on April 11, 2006 (under no: D.06-0248), as well asdocumentsfiled by SUEZ with the SEC,including those listed under “RiskFactors”in theAnnual Report on Form 20-F for 2004 that SUEZ filed with the SEC on June 29, 2005.Exceptasrequired byapplicable law,neither Gaz deFrance nor SUEZundertakes anyobligation toupdate anyforward-lookinginformation orstatements.

ON MAY 4, 2006, THE FOLLOWING PRESENTATION WAS MADE AVAILABLE ON SUEZ’S WEBSITE IN CONNECTION WITH AN INFORMATIONAL CONFERENCE CALL HELD IN PARIS, FRANCE

A value creating transaction

May 2006

1

|  |

Disclaimer

Important Information

This communication does not constitute an offer to purchase or exchange or the

solicitation of an offer to sell or exchange any securities of SUEZ or an offer

to sell or exchange or the solicitation of an offer to buy or exchange any

securities of Gaz de France, nor shall there be any sale or exchange of

securities in any jurisdiction (including the United States, Germany, Italy and

Japan) in which such offer, solicitation or sale or exchange would be unlawful

prior to the registration or qualification under the laws of such jurisdiction.

The distribution of this communication may, in some countries, be restricted by

law or regulation. Accordingly, persons who come into possession of this

document should inform themselves of and observe these restrictions. To the

fullest extent permitted by applicable law, Gaz de France and SUEZ disclaim any

responsibility or liability for the violation of such restrictions by any

person.

The Gaz de France ordinary shares to be issued in connection with the proposed

business combination to holders of SUEZ ordinary shares (including SUEZ

ordinary shares represented by SUEZ American Depositary Shares) may not be

offered or sold in the United States except pursuant to an effective

registration statement under the United States Securities Act of 1933, as

amended, or pursuant to a valid exemption from registration.

In connection with the proposed business combination, the required information

document will be filed with the Autorite des marches financiers ("AMF") and, to

the extent Gaz de France is required or otherwise decides to register the Gaz

de France ordinary shares to be issued in connection with the business

combination in the United States, Gaz de France may file with the United States

Securities and Exchange Commission ("SEC"), a registration statement on Form

F-4, which will include a prospectus. Investors are strongly advised to read

the information document filed with the AMF, the registration statement and the

prospectus, if and when available, and any other relevant documents filed with

the SEC and/or the AMF, as well as any amendments and supplements to those

documents, because they will contain important information. If and when filed,

investors may obtain free copies of the registration statement, the prospectus

as well as other relevant documents filed with the SEC, at the SEC's website at

www.sec.gov and will receive information at an appropriate time on how to

obtain these transaction-related documents for free from Gaz de France or its

duly designated agent. Investors and holders of SUEZ securities may obtain free

copies of documents filed with the AMF at the AMF's website at

www.amf-france.org or directly from Gaz de France on its website at:

www.gazdefrance.com or directly from SUEZ on its website at: www.suez.com, as

the case may be.

Forward-Looking Statements

This communication contains forward-looking information and statements about

Gaz de France, SUEZ and their combined businesses after completion of the

proposed business combination. Forward-looking statements are statements that

are not historical facts. These statements include financial projections,

synergies, cost savings and estimates and their underlying assumptions,

statements regarding plans, objectives, savings, expectations and benefits from

the transaction and expectations with respect to future operations, products

and services, and statements regarding future performance. Forward-looking

statements are generally identified by the words "expect," "anticipates,"

"believes," "intends," "estimates" and similar expressions. Although the

managements of Gaz de France and SUEZ believe that the expectations reflected

in such forward-looking statements are reasonable, investors and holders of Gaz

de France and SUEZ ordinary shares are cautioned that forward-looking

information and statements are not guarantees of future performances and are

subject to various risks and uncertainties, many of which are difficult to

predict and generally beyond the control of Gaz de France and SUEZ, that could

cause actual results developments, synergies, savings and benefits from the

transaction to differ materially from those expressed in, or implied or

projected by, the forward-looking information and statements. These risks and

uncertainties include those discussed or identified in the public filings with

the Autorite des marches financiers ("AMF") made by Gaz de France and SUEZ,

including those listed under "Facteurs de Risques" in the Document de Base

filed by Gaz de France on April 1, 2005 (under no: I.05-037) and in the

Document de Reference filed by SUEZ on April 11, 2006 (under no: D.06-0248), as

well as documents filed by SUEZ with the SEC, including those listed under

"Risk Factors" in the Annual Report on Form 20-F for 2004 that SUEZ filed with

the SEC on June 29, 2005. Except as required by applicable law, neither Gaz de

France nor SUEZ undertakes any obligation to update any forward-looking

information or statements.

This release is also available on the Internet: http://www.suez.com -

http://www.gazdefrance.com

2

|  |

Table of Contents

1. An industrial project to create value

2. Synergies resulting from scale

3. Synergies arising from complementarity

4. Capital expenditure synergies, tax and financial optimization

5. Update on the merger process

3

|  |

1. An industrial project to create value

4

|  |

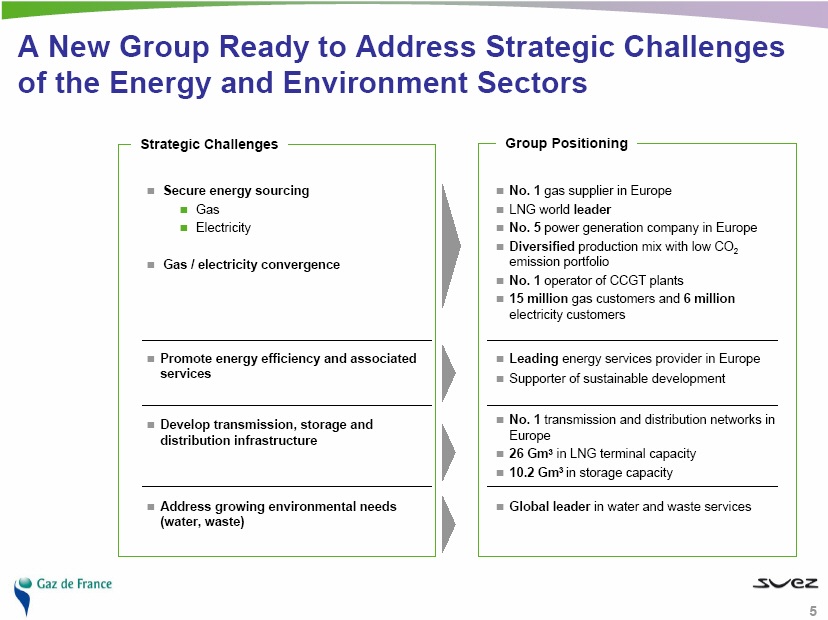

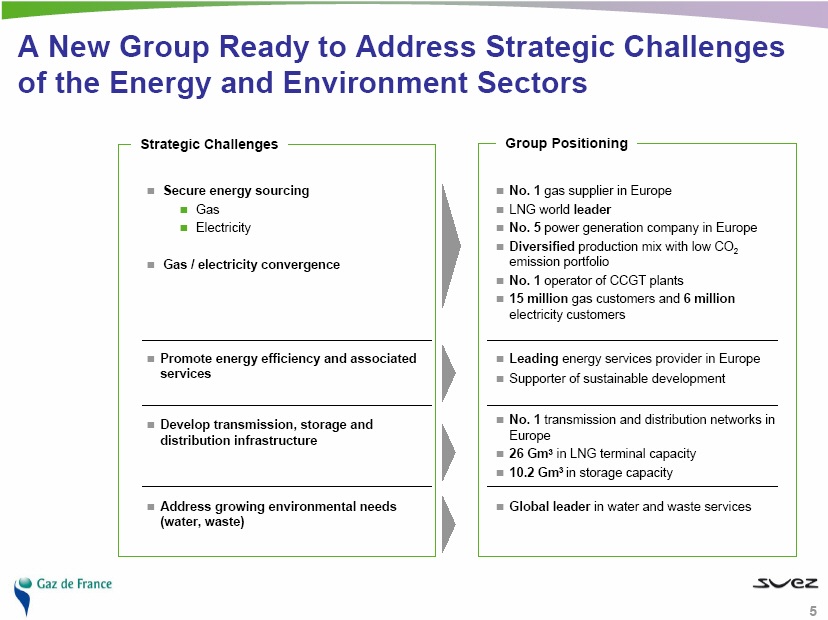

A New Group Ready to Address Strategic Challenges

of the Energy and Environment Sectors

Strategic Challenges Group Positioning

o Secure energy sourcing o No. 1 gas supplier in Europe

o Gas o LNG world leader

o Electricity o No. 5 power generation company in Europe

o Gas / electricity convergence o Diversified production mix with low CO2 emission portfolio

o No. 1 operator of CCGT plants

o 15 million gas customers and 6 million electricity customers

o Promote energy efficiency and associated services o Leading energy services provider in Europe

o Supporter of sustainable development

o Develop transmission, storage and distribution o No. 1 transmission and distribution networks in Europe

infrastructure o 26 Gm3 in LNG terminal capacity

o 10.2 Gm3 in storage capacity

o Address growing environmental needs (water, waste) o Global leader in water and waste services

5

|  |

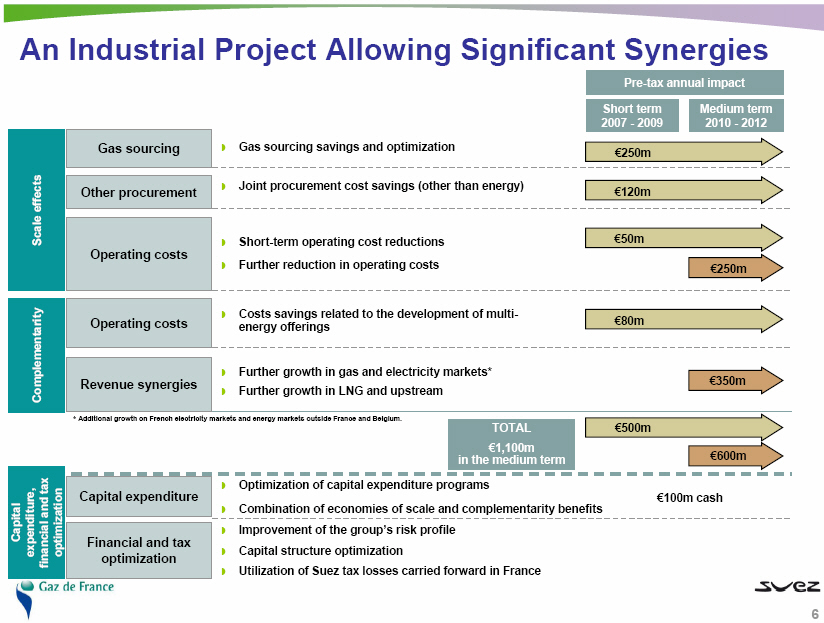

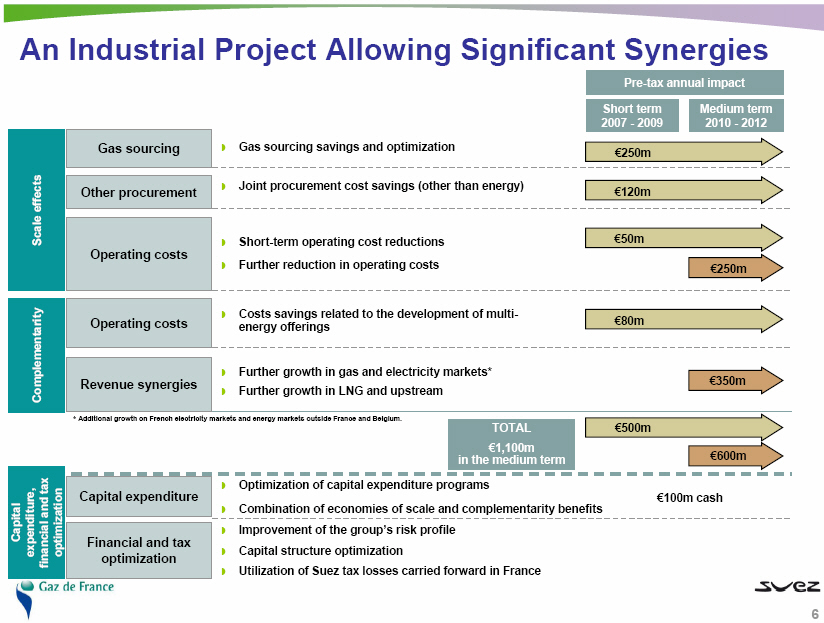

An Industrial Project Allowing Significant Synergies

Pre-tax annual impact

Short term Medium Term

Scale effects 2007 - 2009 2010 - 2012

- -------------

Gas sourcing Gas sourcing savings and optimization (pound)250m---->

Other procurement Joint procurement cost savings (other than energy) (pound)120m---->

Operating costs Short-term operating cost reductions (pound)50m----->

Further reduction in operating costs (pound)250m-->

Complementary

- -------------

Operating costs Costs savings related to the development of multi-energy (pound)80m----->

offerings

Revenue synergies Further growth in gas and electricity markets* (pound)350m-->

Further growth in LNG and upstream

- -----------------------------------------------------------------------------------------------------------------------

* Additional growth on French electricity markets and energy markets outside France and Belgium.

TOTAL (pound)500m---->

(pound)1,100m

in the medium term (pound)600m-->

Capital expenditure, financial and tax optimization

- ---------------------------------------------------

Capital expenditure Optimization of capital expenditure programs

Combination of economies of scale and complementarity benefits

Financial and tax optimization Improvement of the group's risk profile

Capital structure optimization

Utilization of Suez tax losses carried forward in France

6

|  |

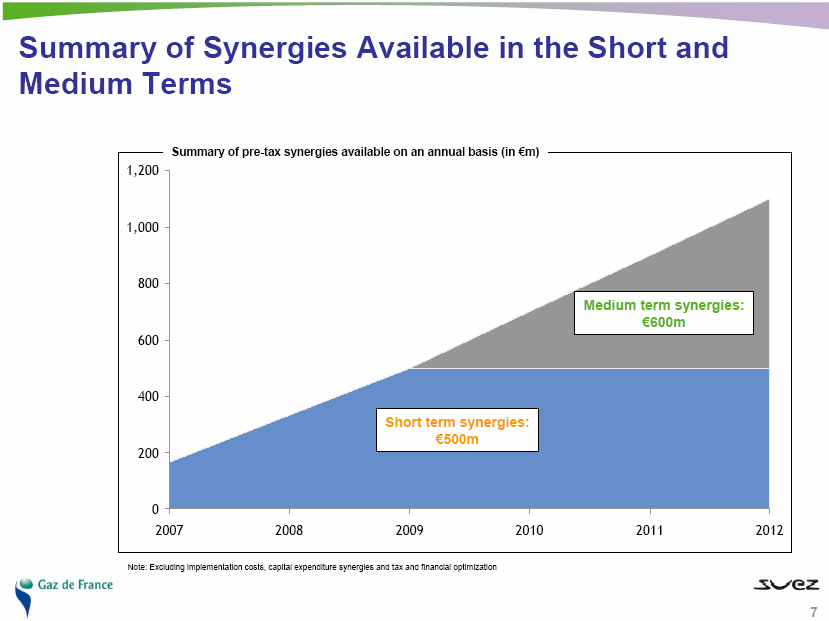

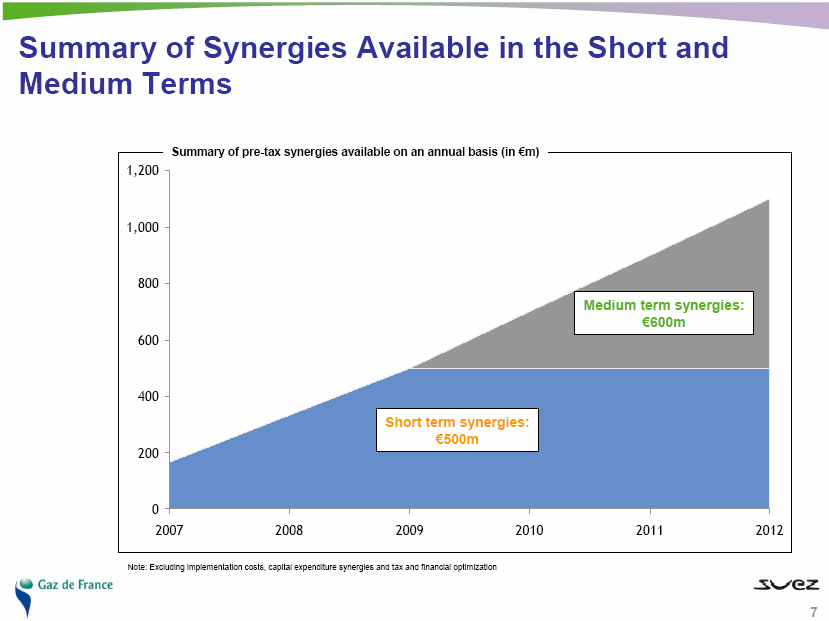

Summary of Synergies Available in the Short and Medium Terms

Summary of pre-tax synergies available on an annual basis (in (pound)m)

Note: Excluding implementation costs, capital expenditure synergies and tax and financial optimization

7

|  |

2. Synergies resulting from scale

8

|  |

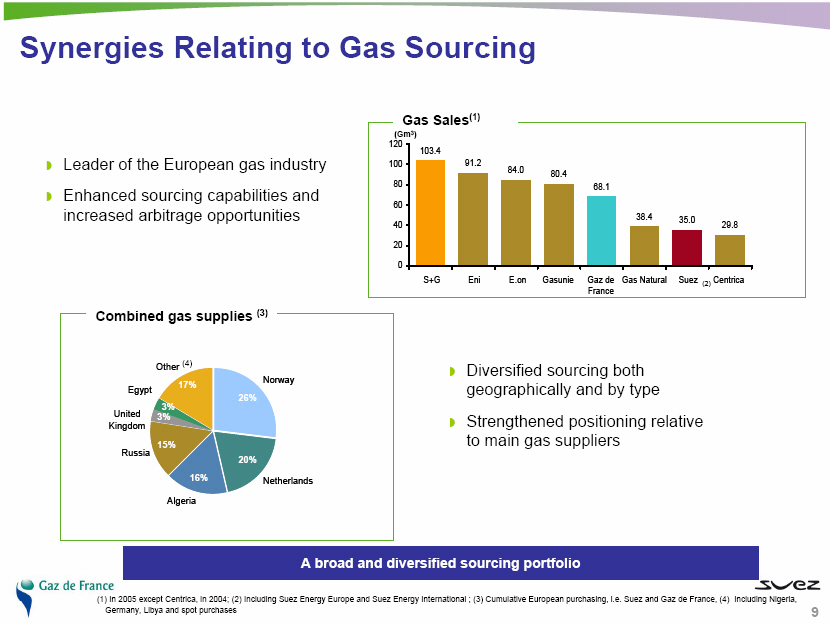

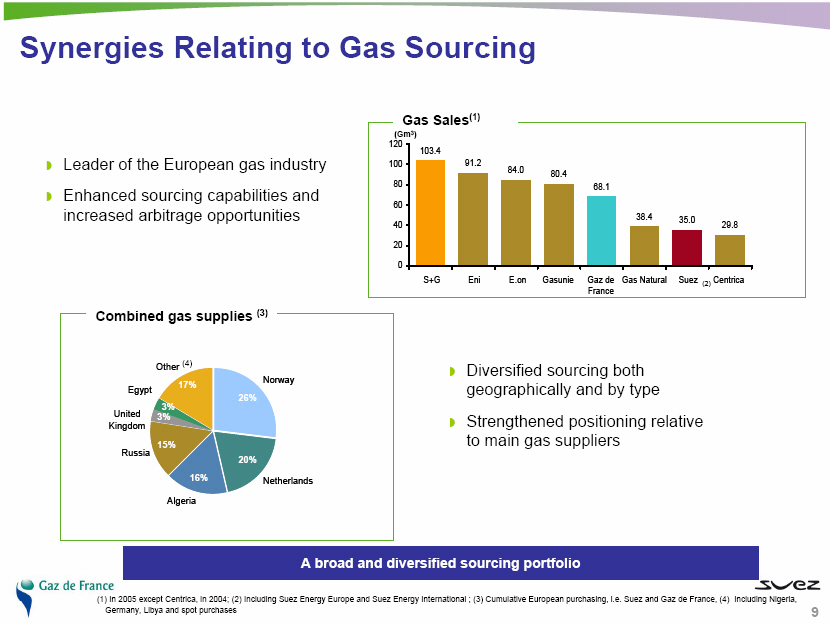

Synergies Relating to Gas Sourcing

(1) In 2005 except Centrica, in 2004;

(2) Including Suez Energy Europe and Suez Energy International ; (3) Cumulative

European purchasing, i.e. Suez and Gaz de France, (4) Including Nigeria,

Germany, Libya and spot purchases

o Leader of the European gas industry

o Enhanced sourcing capabilities and increased arbitrage opportunities

o Diversified sourcing both geographically and by type

o Strengthened positioning relative to main gas suppliers

Gas Sales(1)

(Gm3)

103.4 91.2 84.0 80.4 68.1 38.4 35.0 29.8

120

100

80

60

40

20

0

S+G Eni E.on Gasunie Gaz de France Gas Natural Suez(2) Centrica

Combined gas supplies (3)

A broad and diversified sourcing portfolio

Other (4) 17%

Egypt 3%

United Kingdom 3%

Russia 15%

Algeria 16%

Netherlands 20%

Norway 26%

9

|  |

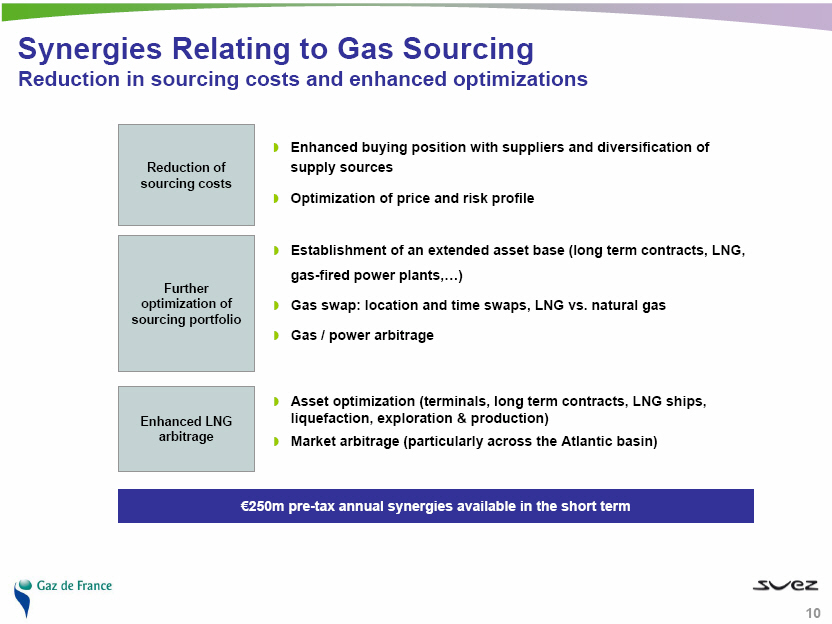

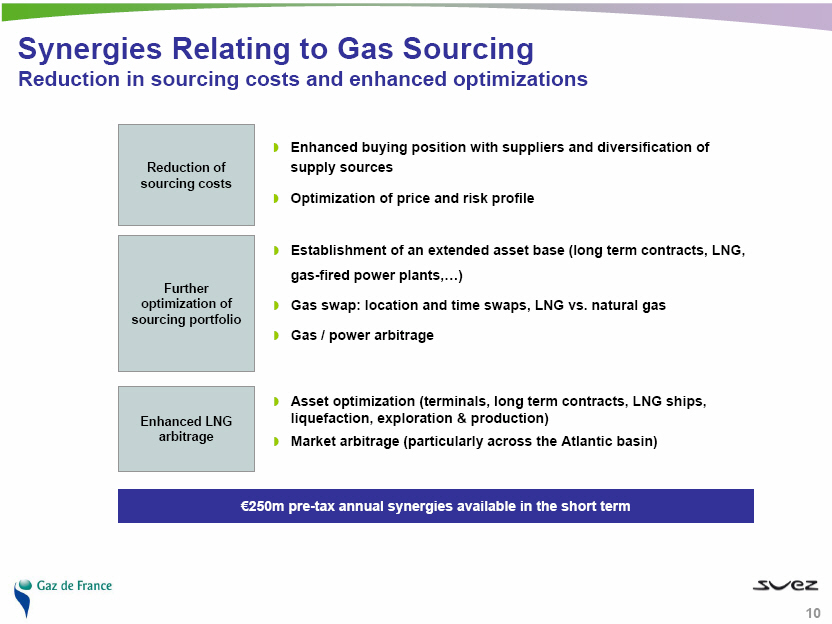

Synergies Relating to Gas Sourcing

Reduction in sourcing costs and enhanced optimizations

Reduction of sourcing costs

o Enhanced buying position with suppliers and diversification of supply sources

o Optimization of price and risk profile

Further optimization of sourcing portfolio

o Establishment of an extended asset base (long term contracts, LNG, gas-fired

power plants,)

o Gas swap: location and time swaps, LNG vs. natural gas

o Gas / power arbitrage

Enhanced LNG arbitrage

o Asset optimization (terminals, long term contracts, LNG ships, liquefaction,

exploration & production)

o Market arbitrage (particularly across the Atlantic basin)

250m pre-tax annual synergies available in the short term

10

|  |

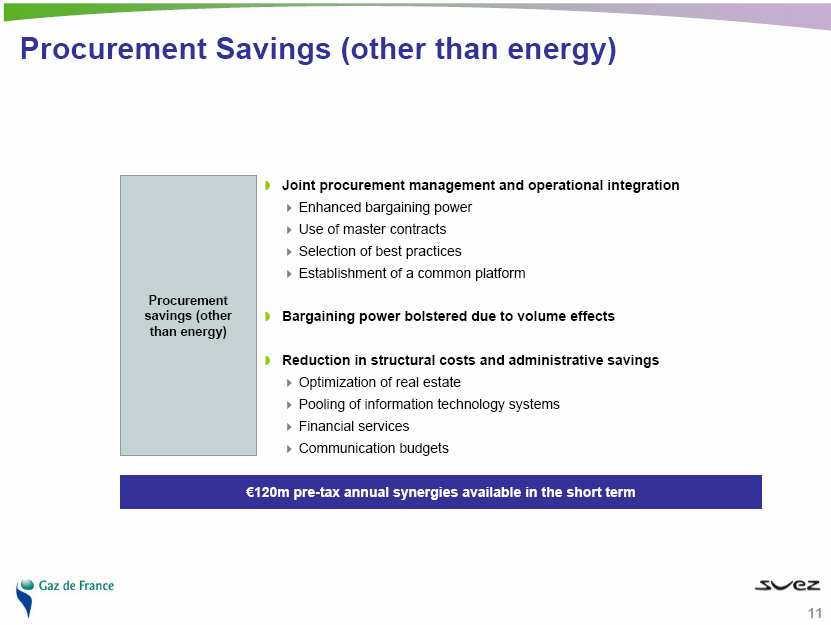

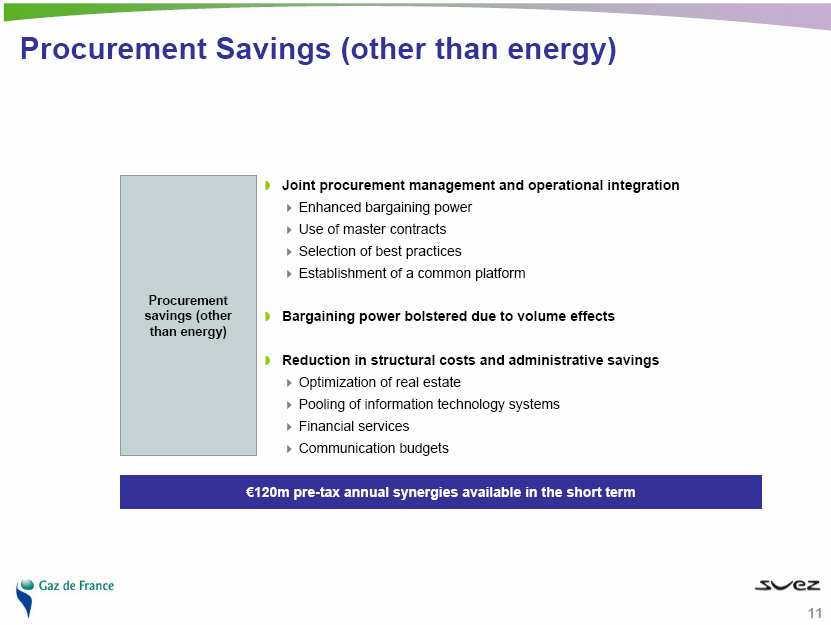

Procurement Savings (other than energy)

Procurement savings (other than energy)

o Joint procurement management and operational integration

o Enhanced bargaining power

o Use of master contracts

o Selection of best practices

o Establishment of a common platform

o Bargaining power bolstered due to volume effects

o Reduction in structural costs and administrative savings

o Optimization of real estate

o Pooling of information technology systems

o Financial services

o Communication budgets

120m pre-tax annual synergies available in the short term

11

|  |

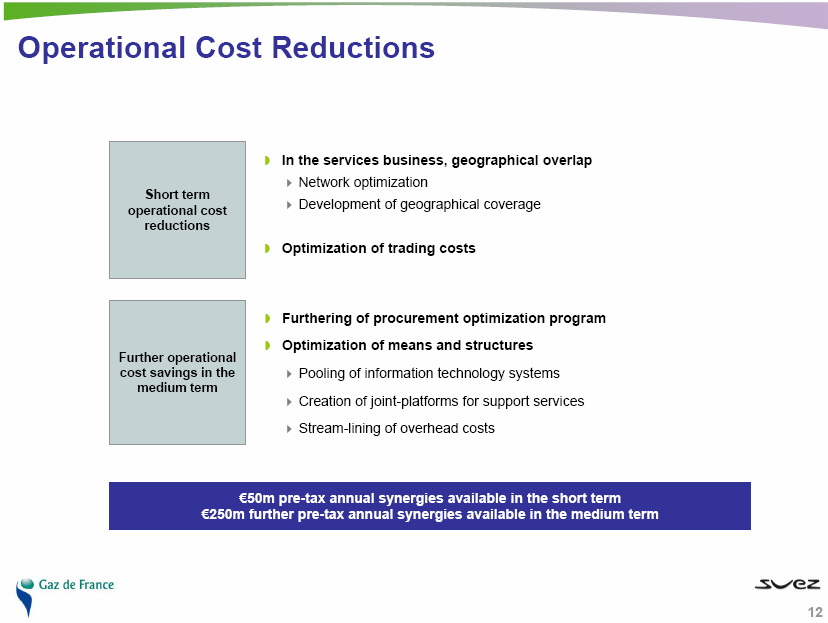

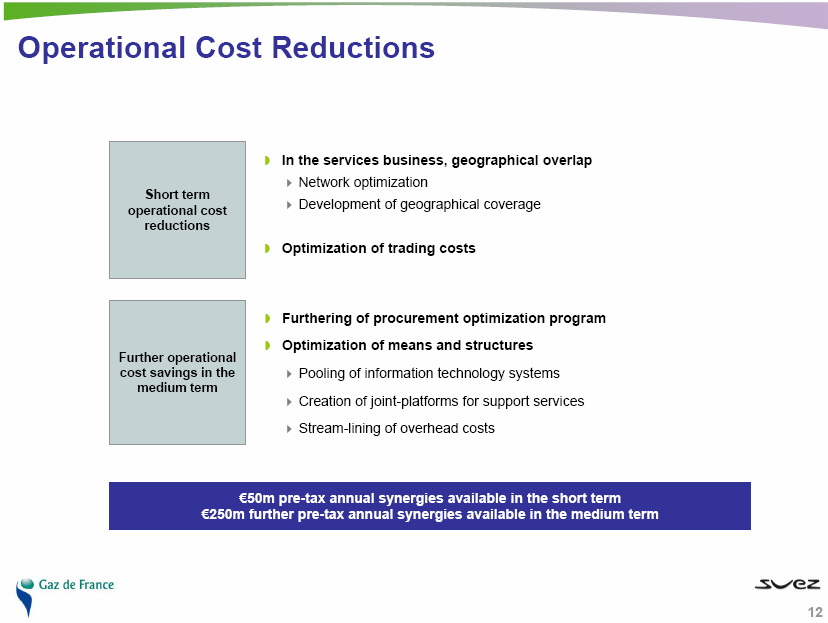

Operational Cost Reductions

Short term operational cost reductions

o In the services business, geographical overlap

o Network optimization

o Development of geographical coverage

o Optimization of trading costs

Further operational cost savings in the medium term

o Furthering of procurement optimization program

o Optimization of means and structures

o Pooling of information technology systems

o Creation of joint-platforms for support services

o Stream-lining of overhead costs

50m pre-tax annual synergies available in the short term

250m further pre-tax annual synergies available in the medium term

12

|  |

3. Synergies arising from complementarity

13

|  |

A Positioning Across the Value Chain

Based on gas-electricity convergence

Infrastructure Activities

LNG Terminals / LNG Ships

International Transmission

Transmission / Storage

Distribution

Competitive Businesses

Exploration Production

LNG

Electricity Production

- - CCGT

- - Nuclear

- - Hydro

- - Renewable Energies

Trading

Gas and Electricity

Sales

- - Industrial and Services

- - Residential

Energy Services

Gas Sourcing

- - Long Term Contract Portfolio

- - Short Term Purchases

14

|  |

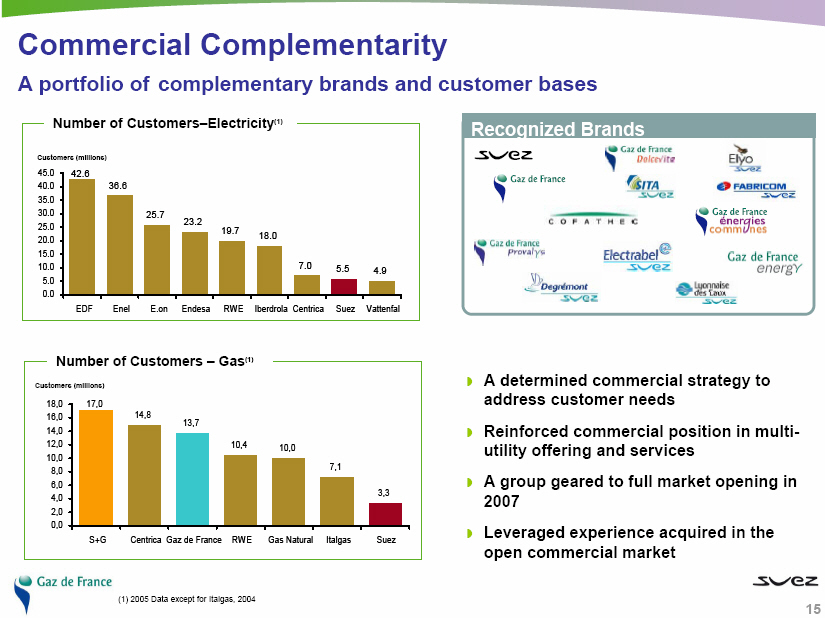

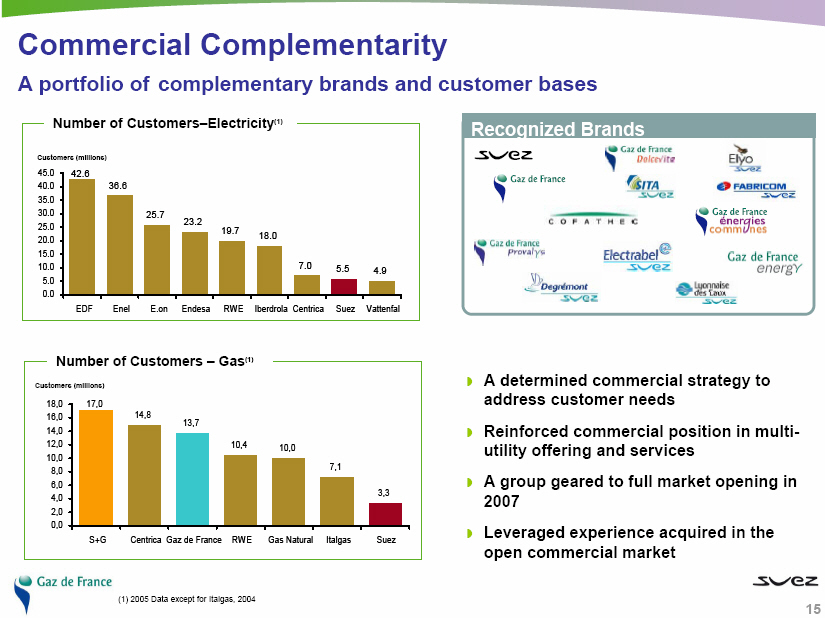

Commercial Complementarity

A portfolio of complementary brands and customer bases

Number of Customers-Electricity(1)

Number of Customers - Gas(1)

(1) 2005 Data except for Italgas, 2004

Recognized Brands

o) A determined commercial strategy to address customer needs

o) Reinforced commercial position in multi-utility offering and services

o) A group geared to full market opening in 2007

o) Leveraged experience acquired in the open commercial market

15

|  |

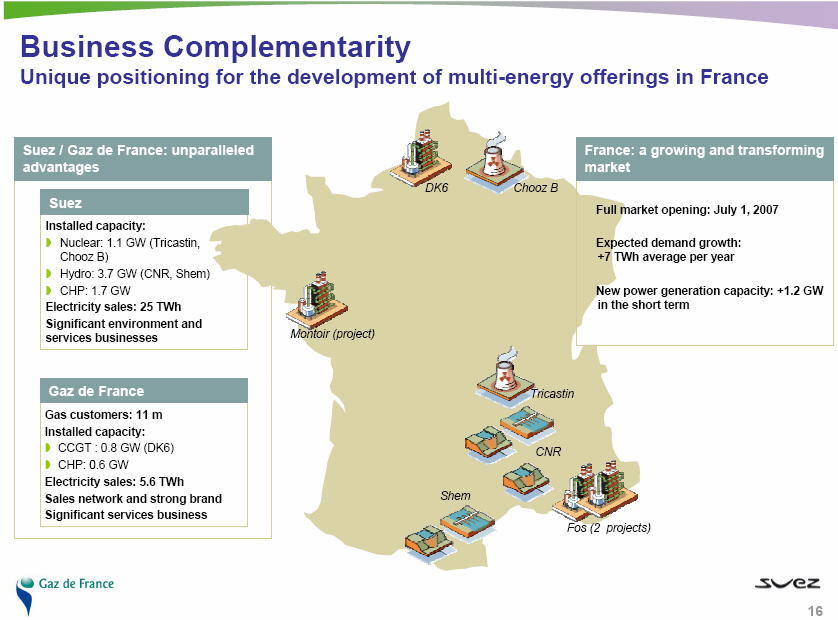

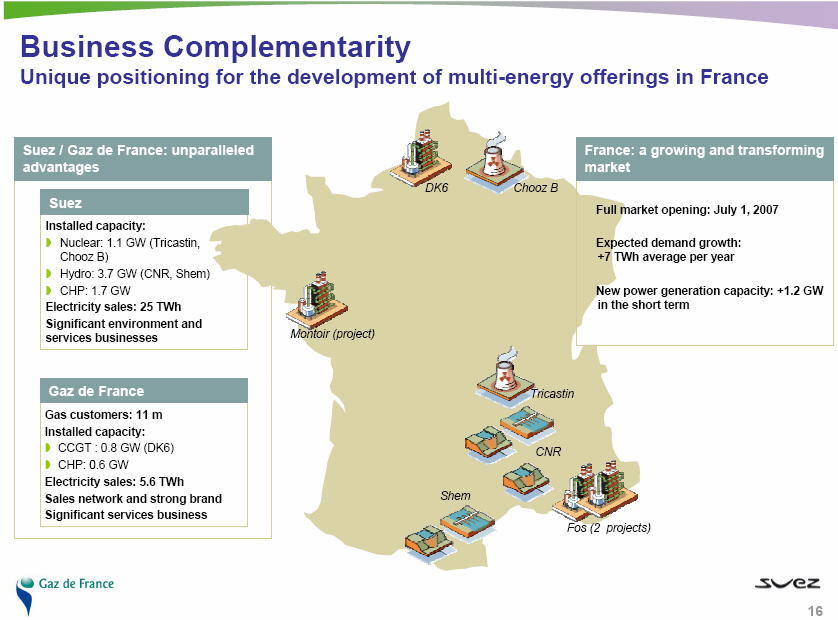

Business Complementarity

Unique positioning for the development of multi-energy offerings in France

Suez / Gaz de France: unparalleled advantages

Suez

Installed capacity:

o) Nuclear: 1.1 GW (Tricastin, Chooz B)

o) Hydro: 3.7 GW (CNR, Shem)

o) CHP: 1.7 GW

Electricity sales: 25 TWh

Significant environment and services businesses

Gaz de France

Gas customers: 11 m

Installed capacity:

o) CCGT : 0.8 GW (DK6)

o) CHP: 0.6 GW

Electricity sales: 5.6 TWh

Sales network and strong brand

Significant services business

France: a growing and transforming market

Full market opening: July 1, 2007

Expected demand growth:

+7 TWh average per year

New power generation capacity: +1.2 GW in the short term

Fos (2 projects)

16

|  |

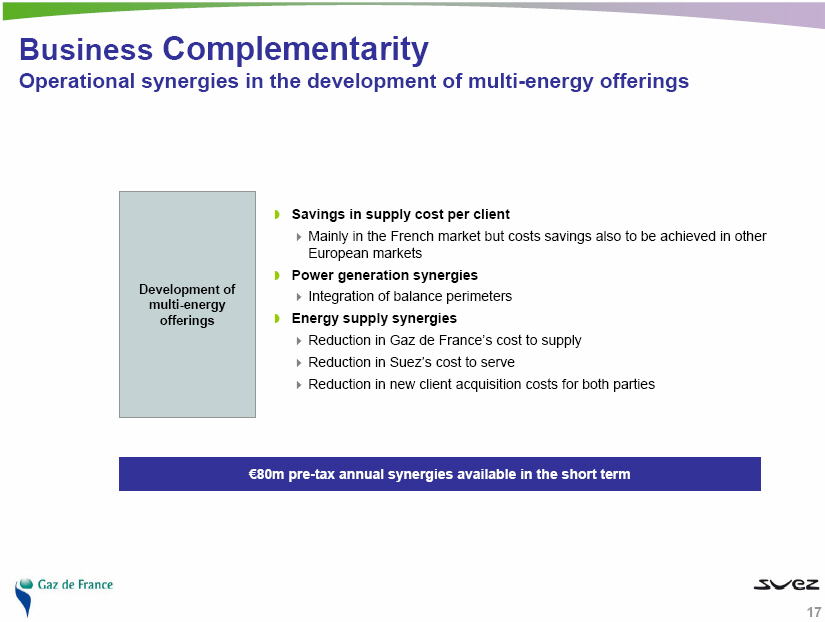

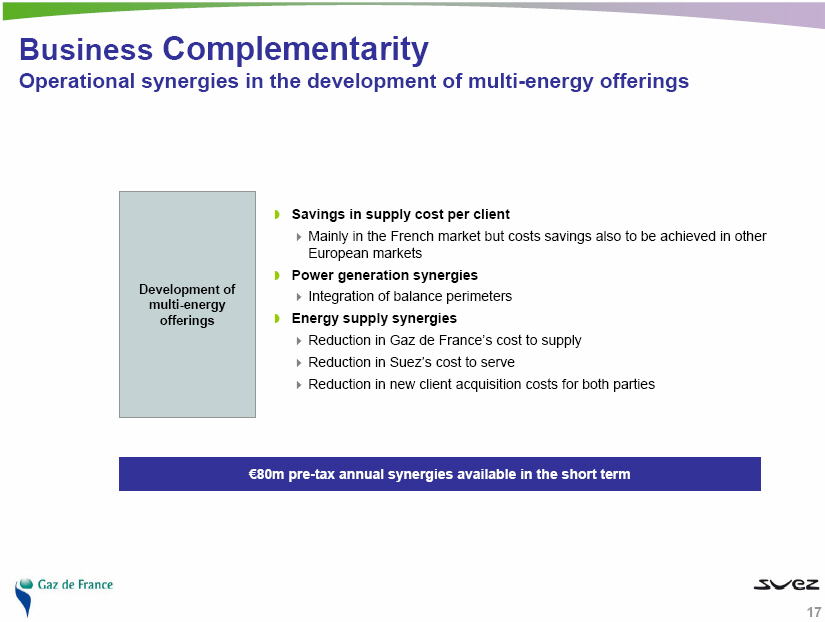

Business Complementarity

Operational synergies in the development of multi-energy offerings

Development of multi-energy offerings

o) Savings in supply cost per client

o Mainly in the French market but costs savings also to be achieved

in other European markets

o) Power generation synergies

o Integration of balance perimeters

o) Energy supply synergies

o Reduction in Gaz de France's cost to supply

o Reduction in Suez's cost to serve

o Reduction in new client acquisition costs for both parties

(pound)80m pre-tax annual synergies available in the short term

17

|  |

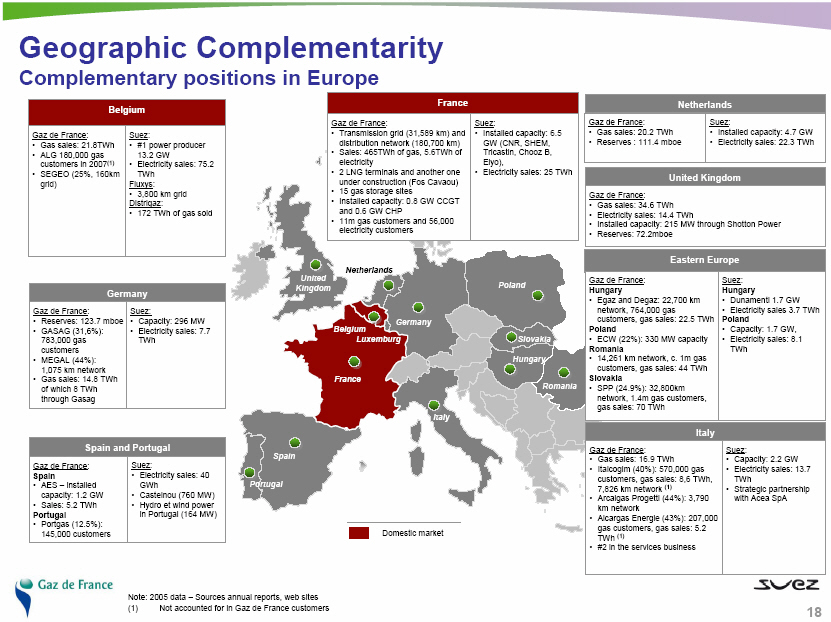

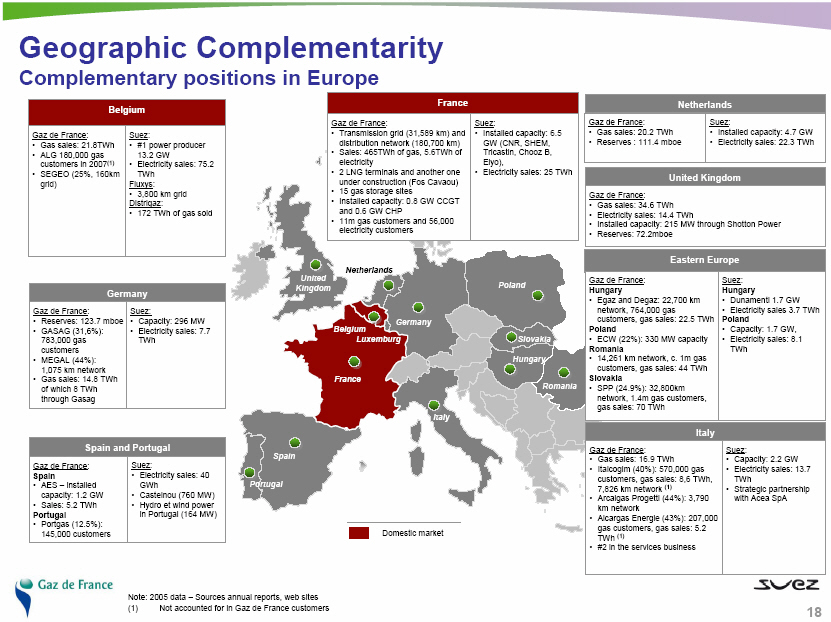

Geographic Complementarity

Complementary positions in Europe

Belgium

Gaz de France:

o Gas sales: 21.8TWh

o ALG 180,000 gas customers in 2007(1)

o SEGEO (25%, 160km grid)

Suez:

o #1 power producer 13.2 GW

o Electricity sales: 75.2 TWh

Fluxys:

o 3,800 km grid

Distrigaz:

o 172 TWh of gas sold

Germany

Gaz de France:

o Reserves: 123.7 mboe

o GASAG (31,6%): 783,000 gas customers

o MEGAL (44%): 1,075 km network

o Gas sales: 14.8 TWh of which 8 TWh through Gasag

Suez:

o Capacity: 296 MW

o Electricity sales: 7.7 TWh

Spain and Portugal

Gaz de France:

Spain

o AES - installed capacity: 1.2 GW

o Sales: 5.2 TWh

Portugal

o Portgas (12.5%): 145,000 customers

Suez:

o Electricity sales: 40 GWh

o Castelnou (760 MW)

o Hydro et wind power in Portugal (164 MW)

France

Gaz de France:

o Transmission grid (31,589 km) and distribution network (180,700 km)

o Sales: 465TWh of gas, 5.6TWh of electricity

o 2 LNG terminals and another one under construction (Fos Cavaou)

o 15 gas storage sites

o Installed capacity: 0.8 GW CCGT and 0.6 GW CHP

o 11m gas customers and 56,000 electricity customers

Suez:

o Installed capacity: 6.5 GW (CNR, SHEM, Tricastin, Chooz B, Elyo),

o Electricity sales: 25 TWh

Netherlands

Gaz de France:

o Gas sales: 20.2 TWh

o Reserves : 111.4 mboe

Suez:

o Installed capacity: 4.7 GW

o Electricity sales: 22.3 TWh

United Kingdom

Gaz de France:

o Gas sales: 34.6 TWh

o Electricity sales: 14.4 TWh

o Installed capacity: 215 MW through Shotton Power

o Reserves: 72.2mboe

Eastern Europe

Gaz de France:

Hungary

o Egaz and Degaz: 22,700 km network, 764,000 gas customers, gas sales:

22.5 TWh

Poland

o ECW (22%): 330 MW capacity

Romania

o 14,261 km network, c. 1m gas customers, gas sales: 44 TWh

Slovakia

o SPP (24.9%): 32,800km network, 1.4m gas customers, gas sales: 70 TWh

Suez:

Hungary

o Dunamenti 1.7 GW

o Electricity sales 3.7 TWh

Poland

o Capacity: 1.7 GW,

o Electricity sales: 8.1 TWh

Italy

Gaz de France:

o Gas sales: 16.9 TWh

o Italcogim (40%): 570,000 gas customers, gas sales: 8,6 TWh, 7,826 km

network (1)

o Arcalgas Progetti (44%): 3,790 km network

o Alcargas Energie (43%): 207,000 gas customers, gas sales: 5.2 TWh (1)

o #2 in the services business

Suez:

o Capacity: 2.2 GW

o Electricity sales: 13.7 TWh

o Strategic partnership with Acea SpA

Domestic market

Note: 2005 data - Sources annual reports, web sites

o Not accounted for in Gaz de France customers

18

|  |

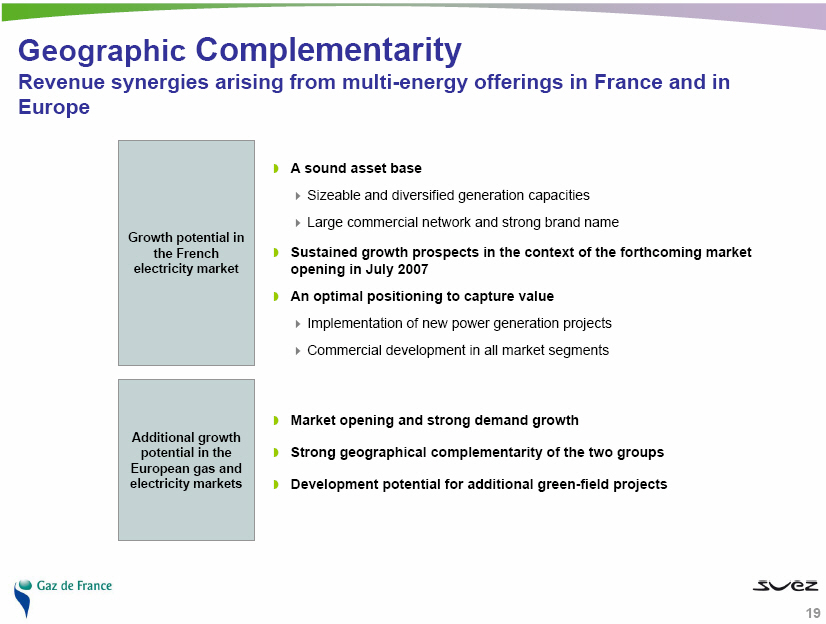

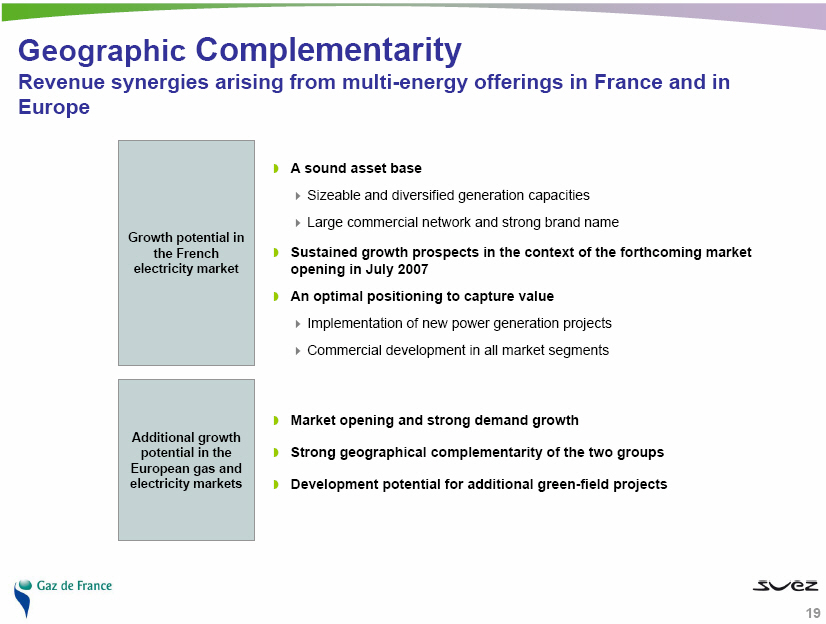

Geographic Complementarity

Revenue synergies arising from multi-energy offerings in France and in Europe

Growth potential in the French electricity market

o) A sound asset base

o Sizeable and diversified generation capacities

o Large commercial network and strong brand name

o) Sustained growth prospects in the context of the forthcoming market

opening in July 2007

o) An optimal positioning to capture value

o Implementation of new power generation projects

o Commercial development in all market segments

Additional growth potential in the European gas and electricity markets

o) Market opening and strong demand growth

o) Strong geographical complementarity of the two groups

o) Development potential for additional green-field projects

19

|  |

LNG and Upstream Complementarity

A global platform

Rabaska (Quebec)

o Regasification unit project in partnership between Gaz de France and

Enbridge Ltd.

Neptune LNG

o Offshore LNG regasification project

Neptune LNG

Everett

o 5.5mton LNG per year

o 165,000 m3 LNG storage capacity

Bahamas

o Regasification unit project

Atlantic LNG

o Suez has a 10% stake in the liquefaction plant (3.1mton LNG per year)

Trinidad and Tobago

Isle of Grain (UK)

o LNG import terminal owned by National Grid

o Gaz de France has booked 6.5mtpa capacity from 2008

Montoir de Bretagne

o 8.3mton LNG per year

o 360,000 m3 LNG storage capacity

Fos Tonkin

o 150,000 m3 LNG storage capacity

Fos Cavaou

o 70% GdF; 30% Total

o Under construction

Nigeria

o Partnership between Suez and Brass LNG

for 2mton LNG expected from 2010

Yemen

o Import contract with Suez Global LNG

Snovit

(liquefaction plant under construction)

Zeebrugge

o Fluxys (57.3% Suez)

o Import capacity: 4,5mton LNG per year (expansion to 9mton expected)

o LNG storage capacity of 260,000 m3

Idku (Egypt)

o Gaz de France has a 5% stake in the liquefaction plant

Qatar

o Ras Gas: Contract with Distrigaz (57.2% Suez) to import LNG from Qatar

Petronet LNG (India)

o Gaz de France has a 10% stake in Petronet LNG which has built the first

LNG regasification plant in India

Regasification plant (Gaz de France / Suez resp.)

Liquefaction plant

LNG contracts and flows, imports

LNG contracts, exports

Exploration and production related to LNG

20

|  |

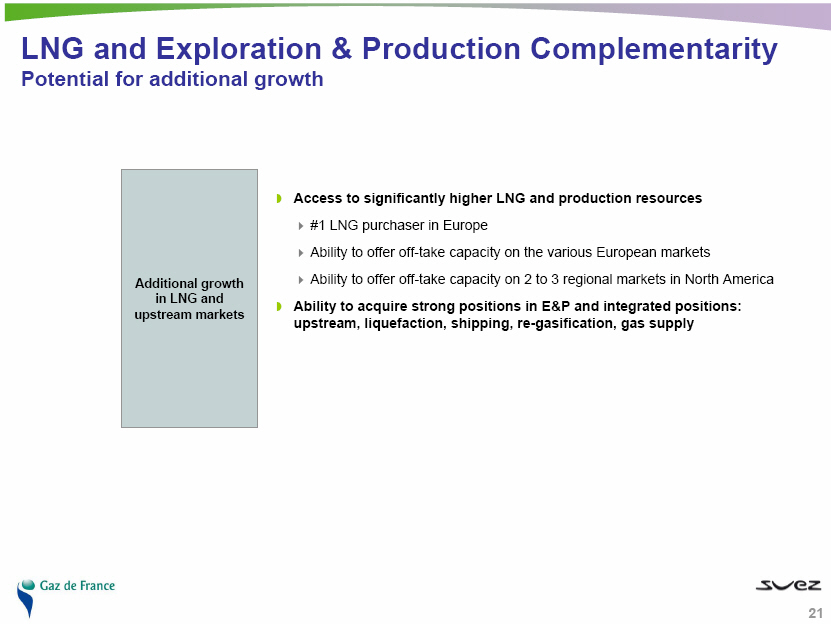

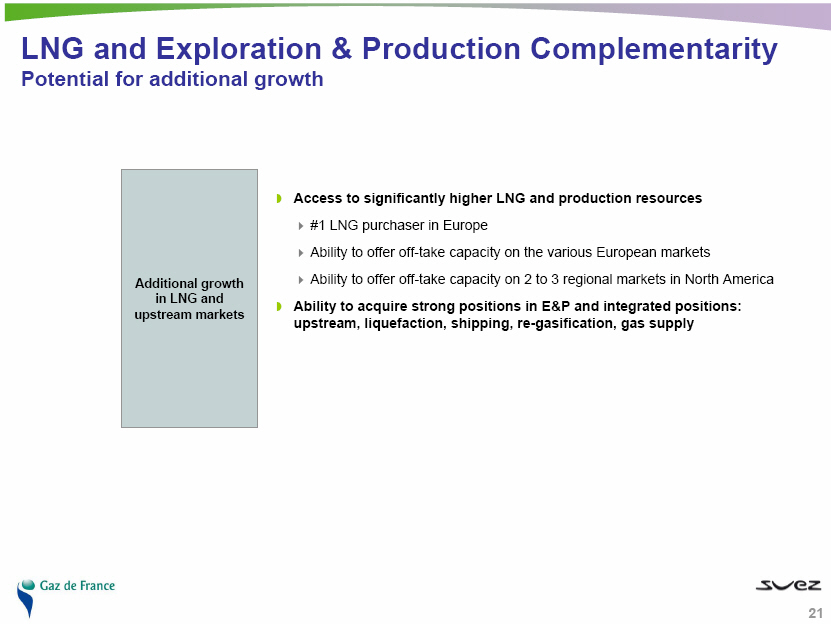

LNG and Exploration & Production Complementarity

Potential for additional growth

Additional growth in LNG and upstream markets

o) Access to significantly higher LNG and production resources

o #1 LNG purchaser in Europe

o Ability to offer off-take capacity on the various European

markets

o Ability to offer off-take capacity on 2 to 3 regional markets in

North America

o) Ability to acquire strong positions in E&P and integrated positions:

upstream, liquefaction, shipping, re-gasification, gas supply

21

|  |

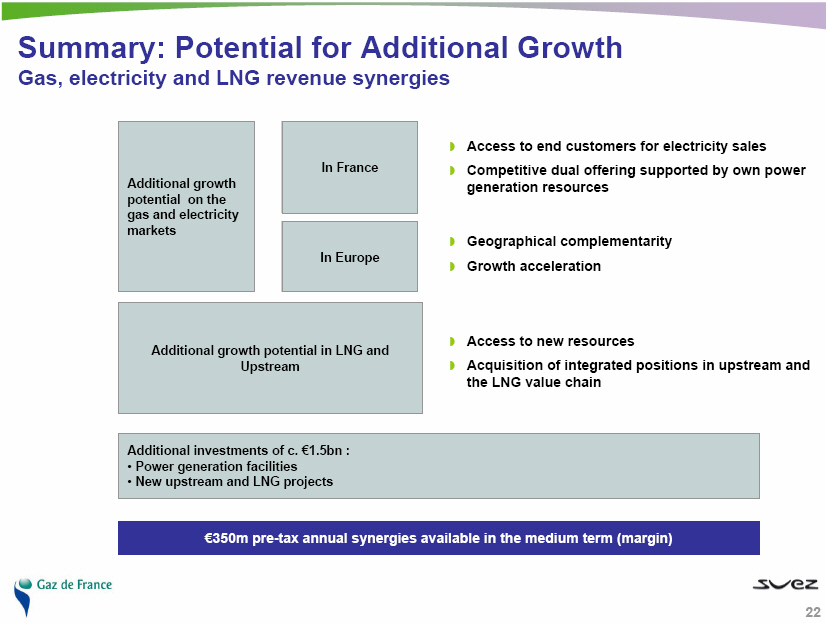

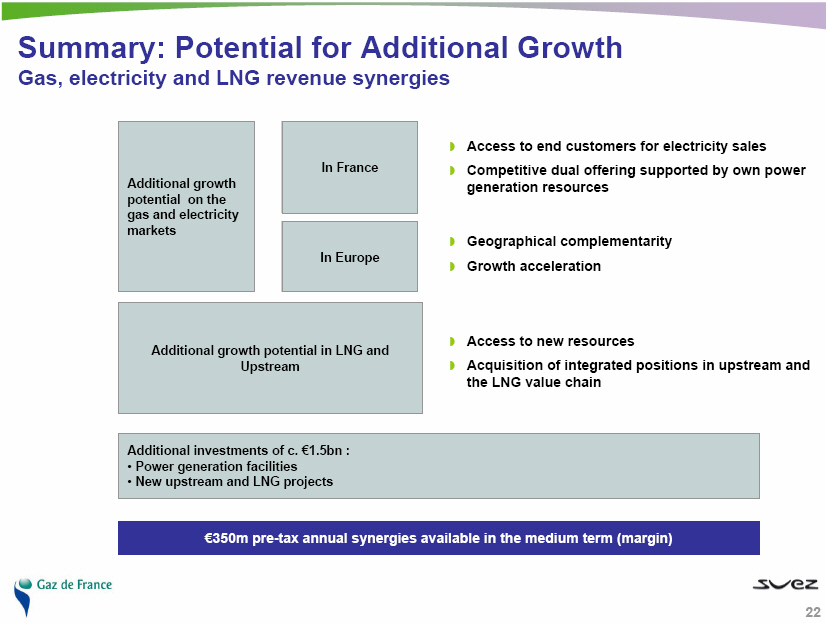

Summary: Potential for Additional Growth

Gas, electricity and LNG revenue synergies

Additional growth potential on the gas and electricity markets

Additional growth potential in LNG and Upstream

In France

In Europe

o Access to end customers for electricity sales

o Competitive dual offering supported by own power generation resources

o Geographical complementarity

o Growth acceleration

o Access to new resources

o Acquisition of integrated positions in upstream and the LNG value chain

Additional investments of c. (euro)1.5bn:

o Power generation facilities

o New upstream and LNG projects

(euro)350m pre-tax annual synergies available in the medium term (margin)

22

|  |

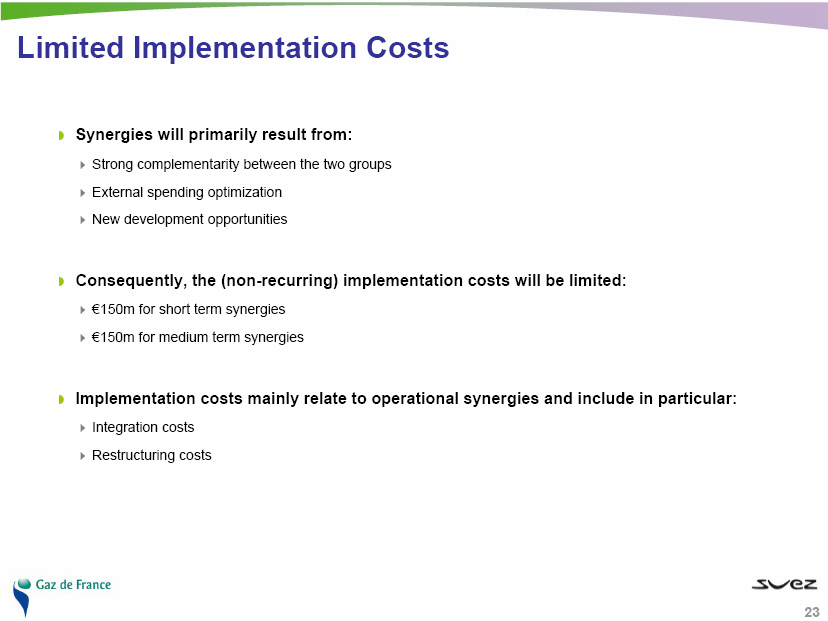

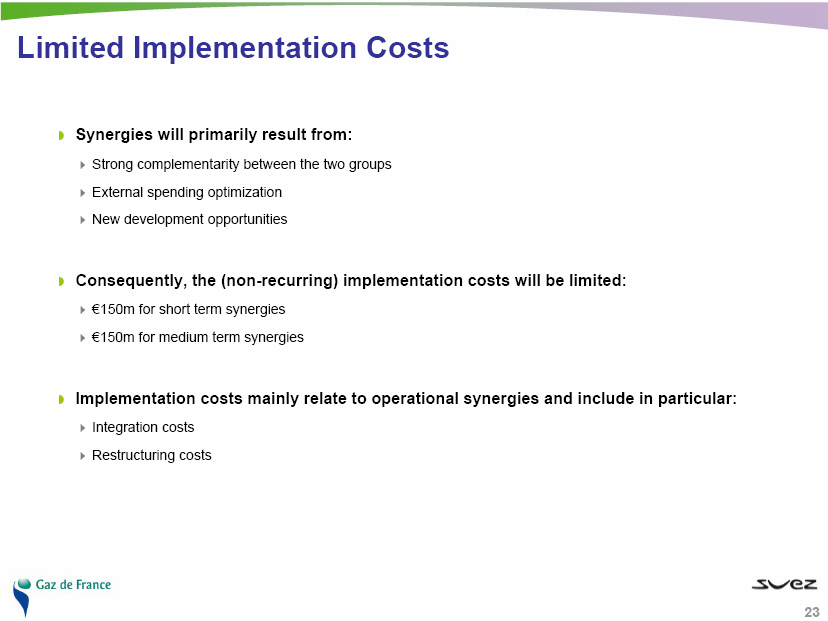

Limited Implementation Costs

o Synergies will primarily result from:

o Strong complementarity between the two groups

o External spending optimization

o New development opportunities

o Consequently, the (non-recurring) implementation costs will be limited:

o (euro)150m for short term synergies

o (euro)150m for medium term synergies

o Implementation costs mainly relate to operational synergies and include in

particular:

o Integration costs

o Restructuring costs

23

|  |

4. Capital expenditure synergies, tax and financial optimization

24

|  |

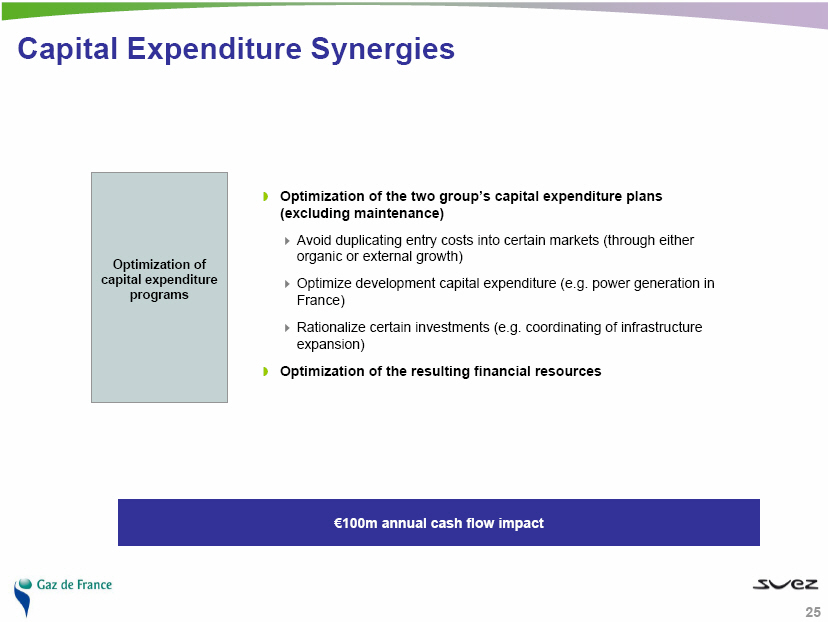

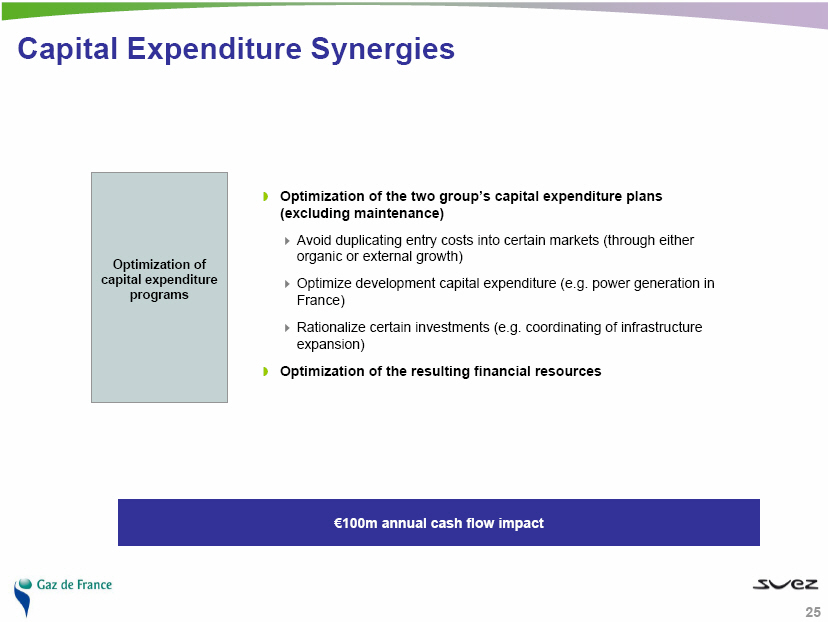

Capital Expenditure Synergies

Optimization of capital expenditure programs

o Optimization of the two group's capital expenditure plans (excluding

maintenance)

o Avoid duplicating entry costs into certain markets (through either

organic or external growth)

o Optimize development capital expenditure (e.g. power generation in France)

o Rationalize certain investments (e.g. coordinating of infrastructure

expansion)

o Optimization of the resulting financial resources

(euro)100m annual cash flow impact

25

|  |

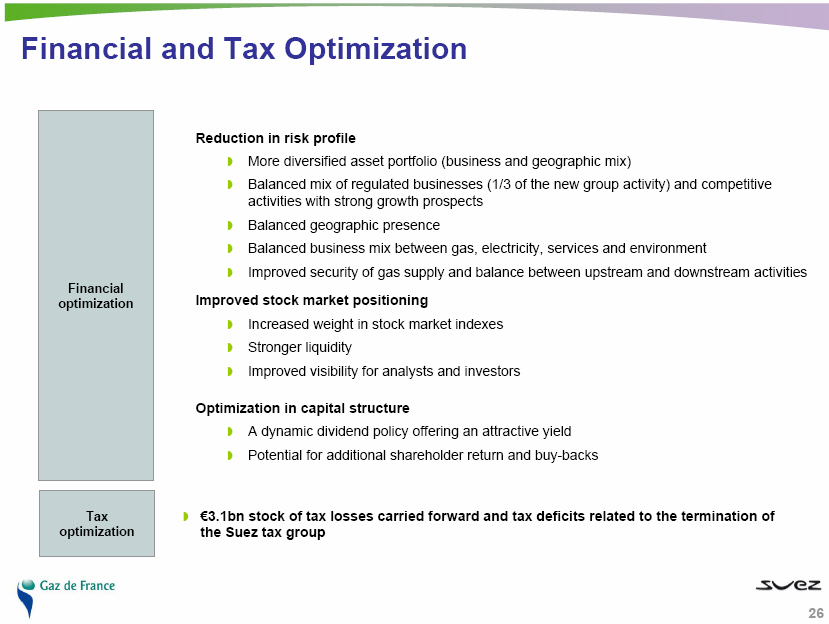

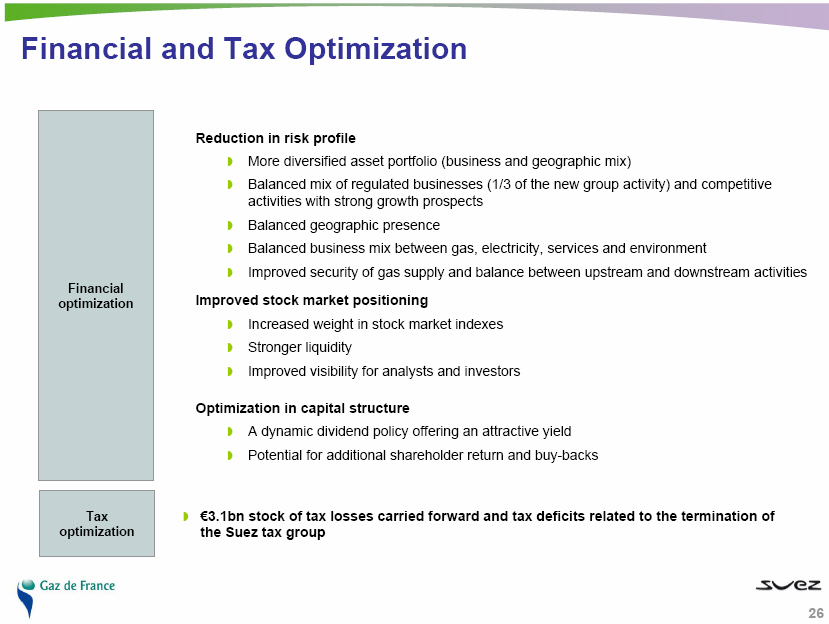

Financial and Tax Optimization

Financial optimization

Tax optimization

Reduction in risk profile

o More diversified asset portfolio (business and geographic mix)

o Balanced mix of regulated businesses (1/3 of the new group activity) and

competitive activities with strong growth prospects

o Balanced geographic presence

o Balanced business mix between gas, electricity, services and environment

o Improved security of gas supply and balance between upstream and downstream

activities

Improved stock market positioning

o Increased weight in stock market indexes

o Stronger liquidity

o Improved visibility for analysts and investors

Optimization in capital structure

o A dynamic dividend policy offering an attractive yield

o Potential for additional shareholder return and buy-backs

o (euro)3.1bn stock of tax losses carried forward and tax deficits related to

the termination of the Suez tax group

26

|  |

5. Update on the merger process

27

|  |

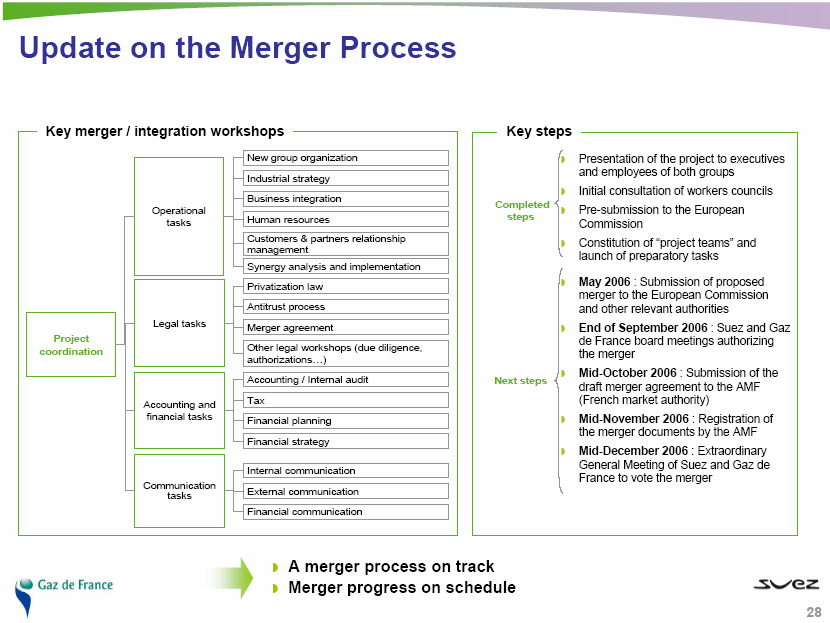

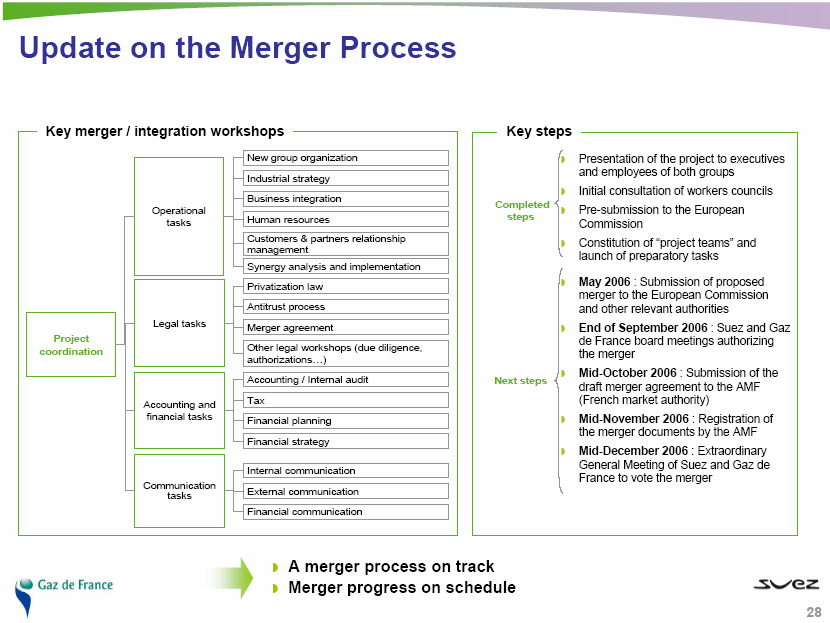

Key merger / integration workshops

Project coordination

Operational tasks

New group organization

Industrial strategy

Business integration

Human resources

Customers & partners relationship management

Synergy analysis and implementation

Legal tasks

Privatization law

Antitrust process

Merger agreement

Other legal workshops (due diligence, authorizations)

Accounting and financial tasks

Accounting / Internal audit

Tax

Financial planning

Financial strategy

Communication tasks

Internal communication

External communication

Financial communication

Key steps

Completed steps

o Presentation of the project to executives and employees of both groups

o Initial consultation of workers councils

o Pre-submission to the European Commission

o Constitution of "project teams" and launch of preparatory tasks

Next steps

o May 2006 : Submission of proposed merger to the European Commission

and other relevant authorities

o End of September 2006 : Suez and Gaz de France board meetings authorizing

the merger o Mid-October 2006 : Submission of the draft merger agreement to

the AMF (French market authority)

o Mid-November 2006 : Registration of

the merger documents by the AMF

o Mid-December 2006 : Extraordinary General Meeting of Suez and Gaz de France to

vote the merger

o A merger process on track

o Merger progress on schedule

28

|  |

Gaz de France SUEZ

May 2006

|  |