Filed by: SUEZ

pursuant to Rule 425 under the Securities Act of 1933

Subject Company: SUEZ

Exchange Act File Number: 001-15232

Date: March 28, 2006

Important Information

This communication does not constitute an offer to purchase or exchange or the solicitation of an offer to sell or exchange any securities of Suez or an offer to sell or exchange or the solicitation of an offer to buy or exchange any securities of Gaz de France, nor shall there be any sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares to be issued in connection with the proposed business combination to holders of Suez ordinary shares (including Suez ordinary shares represented by Suez American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration.

In connection with the proposed business combination, the required information document will be filed with theAutorité des marchés financiers (“AMF”) and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the United States, Gaz de France may file with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4, which will include a prospectus. Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information. If and when filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s web site at (www.sec.gov) and will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of Suez securities may obtain free copies of documents filed with the AMF at the AMF’s website at (www.amf-france.org) or directly from Gaz de France on its web site at: (www.gazdefrance.com) or directly from Suez on its website at: (www.suez.com), as the case may be.

Forward-Looking Statements

This communication contains forward-looking information and statements about Gaz de France, Suez and their combined businesses after completion of the proposed business combination. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with theAutorité des marchés financiers (“AMF”) made by Gaz de France and Suez, including those listed under “Facteurs de Risques” in theDocument de Base filed by Gaz de France on April 1, 2005 (under no: I.05-037) and in theDocument de Référence and its update filed by Suez on April 14, 2005 (under no: D.05-0429) and September 7 (under no: D.05-0429-A01), respectively, theNote d’opération filed by Suez on September 7, 2005 under no 05-673, and theNote d’opération filed by Suez on November 24, 2005 under no 05-810, as well as under “Risk Factors” in the Annual Report on Form 20-F for 2004 that Suez filed with the SEC on June 29, 2005. Except as required by applicable law, neither Gaz de France nor Suez undertakes any obligation to update any forward-looking information or statements.

THE FOLLOWING IS AN ENGLISH TRANSLATION OF A PRESENTATION THAT HAS

BEEN DELIVERED BY SUEZ TO ITS EMPLOYEES

10 good reasons for Suez-Gaz de France merger A Common strategic vision 1. Birth of World leader in energy and environment 2. A Major European group 3. An Ambitious industrial project 4. A Balanced portfolio of activities 5. Substantial Potential for growth and development 6. Reinforced commercial positions 7. A Solid financial structure 8. A Merger to create value and jobs 9. A Fair parity 10. A Commitment to dividends Outline merger timetable |

A Common strategic vision In the fast consolidating energy sector, the challenge is energy security, secure gas and electricity supply. Another challenge is the gas/electricity convergence that the Suez Group has been actively implementing for over ten years, for the promotion of energy efficiency. The Suez-Gaz de France merger is born of a joint determination to achieve major player status through consolidation. The merger brings into being an actor with a leading competitive position in its markets, able to respond to the challenges it faces, an actor delivering service to its customers. This project relies on a common strategic vision, building coherence for both groups, continuing the rationale of the partnerships already in place. The planned merger is also part of the gas/electricity convergence pursued by both groups, responding to customer expectations for combined gas/electricity offers, in fully liberalised markets. This merger is meaningful and leverages the good match between the two companies: culture of public and customer service, the same values rooted in sustainable development. This merger has been approved by the Boards of Suez and Gaz de France, and has the support of the major shareholders of the two groups. |

Birth of World leader in energy and environment services As Europe’s leading gas purchaser, the new group will be able to leverage a reinforced portfolio of procurement. It will also be Europe’s leading gas supplier and gas industry player, and one of the global leaders in liquefied natural gas. As Europe’s fifth ranked electricity producer, its production mix is highly diversified: hydro power, renewables, gas and nuclear – the new group will have perfectly balanced resources at its disposal, making it the closest-tailored of all the major European players to market needs. The new group will also be Europe’s largest operator of gas-fuelled combined cycle electricity power plant, a considerable advantage for a group on the way to becoming Europe’s leading player in the gas industry. It will be European leader in energy services, of critical importance in this period of cost savings, high energy prices and of searching for energy efficiencies. The group will provide its customers an active advisory service in the field of the rational use of energy. The Group will also operate Europe’s largest gas transportation and distribution network. Finally, the Group will be the global leader in water and waste services. |

A Major European Group The new group will be unchallenged as the European leader in its field, 86% of its revenue being generated in Europe, 56% in France and Benelux. Its roots in both markets are reinforced by extensive European and international market share. 29% of total revenues are generated in the rest of Europe. 7% of revenues are generated in North America, in South America (leading private producer of electricity in Brazil), and also in India, Thailand and China. The new group is European leader in services to local authorities, not only by revenue (No. 1), but also by stock market capitalization (No. 2). |

An Ambitious industrial project This projected merger is the result of a common strategic vision, shared by both companies. Leadership ambition. To propel the new Group to European leadership in the fields of gas, electricity, services and the environment Market place ambition. Territorial roots in the French-Belgian markets, supported by selective involvement in the global markets Business development ambition. Balanced portfolio of activities to provide a highly attractive match between business lines, and a leading position at the heart of Europe in gas/electricity convergence. Control over resources, both in electricity thanks to nuclear, and in gas, where the new group has the most diversified sources of procurement in Europe Growth ambition. Substantial potential to build on existing market share in Europe, and in a limited number of significant global markets Ambitious know-how. Common values, complementary know-how and technological leadership |

A Balanced portfolio of activities The new Group’s businesses will be highly coherent: balance between regulated and unregulated activities; upstream and downstream; gas and electricity. In environmental terms, the business portfolio is a low emitter of C02. Finally, the new Group will have real expertise in the nuclear field. |

A Substantial potential for growth and development The strength of the Suez-Gaz de France merger is its potential for growth and development in all its businesses. Core business includes among on-going projects: Gaz de France exploration-production projects LNG, including projects for liquefaction plant and for additional terminals, serviced by its fleet of methane tankers… Participation in the development of European infrastructures (Medagas pipeline between Algeria and Spain and the Baltic pipeline connecting Russia to Germany… Projects for electricity production, notably involving renewable energies… In environment (water, waste) Projects for desalination combined with the energy business in the Middle-East Determined development in Europe, whilst building on strong market share in North America, China and Australia Development of delegated management contracts and consultancy services on major international development projects |

Reinforced commercial positions The new Group will be stronger in market terms, both in energy and water distribution, and in its other services to local authorities. Servicing 65 million customers in waste, 80 million in potable water, 20.2 million in gas and electricity, enjoying high profile brand names (Suez, Gaz de France, Gaz de France Dolcevita, Gaz de France Provalys, Electrabel, Sita, Lyonnaise des Eaux, Degrémont, Elyo, Cofathec, Savelys…), the new Group has the resources to develop an even more ambitious sales and marketing policy in response to customer expectations. The group is ready for the comprehensive liberalisation of the European energy markets in 2007. |

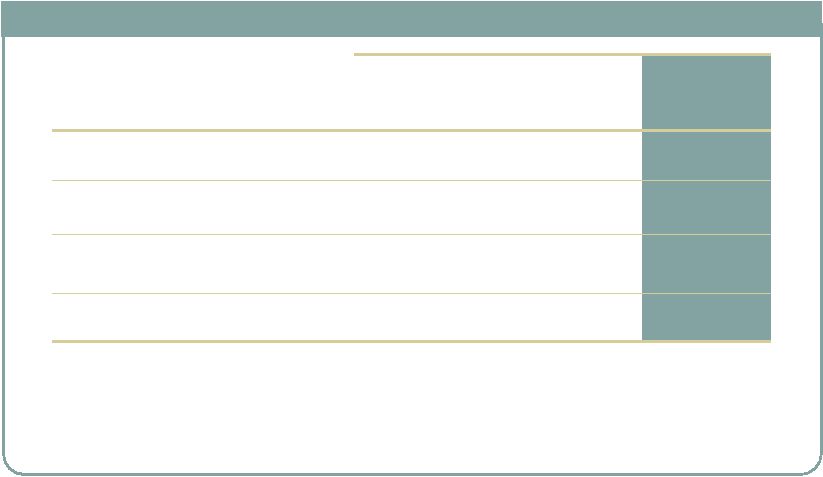

A Solid financial structure Financial structure of combined entity 63.9 22.4 41.5 Revenue 2005 Category A AA- A- S&P rating 72.9 29.7 43.2 Stock market capitalization (spot price 24/02/06) 6.5 Suez 4.2 Gaz de France 10.7 EBITDA 2005 Suez Gaz de France In € billion |

A Merger to create value The merger between the two Groups generates significant operational synergies, including in the short term. €500 million expected in the first three years. In the longer term, the merger will also generate other synergies notably tied to the new Group’s development opportunities which are estimated at €500 million. The new Group will put on all the more value as it is set to become the leading player in services to local authorities, and will be better diversified in terms of regulatory and geographical risks. The stock’s liquidity will also be enhanced. The new Group will be ideally positioned as a major actor in the European job market. |

A Fair parity The merger parity is one Gaz de France share for one Suez share after payment of extraordinary dividend of €1. Parities have been set on the basis of classic multi-criteria analysis. This parity is within the range of average stock market ratios, over one month, three months and six months. Share ownership in the new group will break down as 57% former Suez shareholders and 43% former Gaz de France shareholders. The leading shareholder will be the French State, owning a stake of approximately 34%. The merger will have an accretive effect on earnings per share, recurrent and before depreciation of goodwill for the shareholders, for both Gaz de France and Suez. The transaction will create value for the shareholders of both companies. |

A Commitment to dividends The new Group’s financial management will be rigorous and dynamic. The new Group will benefit from considerable ability to generate free cash flow, and will serve to finance its growth-oriented investment policy and dynamic dividend distribution. The distribution policy will focus on offering competitive yields (dividends, share repurchase). |

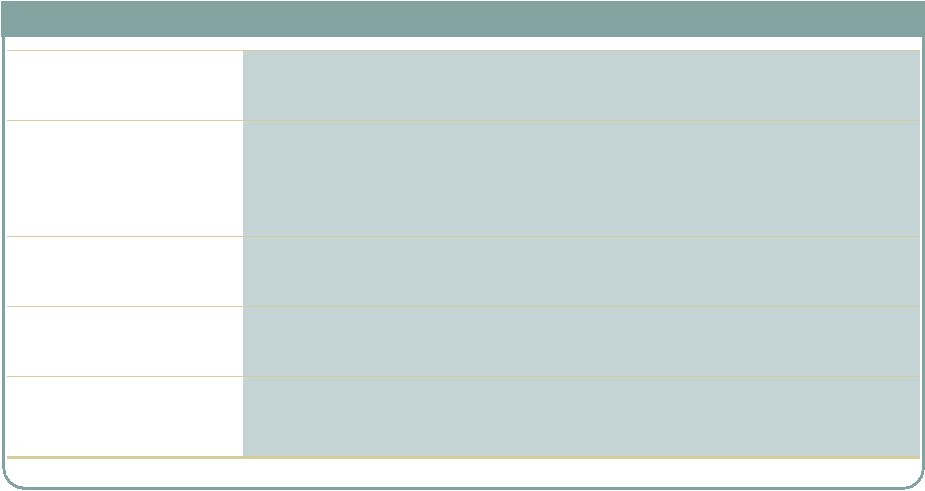

Outline merger timetable Registration of merger documents by financial market authorities Mid-November 2006 Registration of draft merger document by AMF financial regulator Mid-October 2006 Boards of Directors of Suez et Gaz de France to approve and sign draft merger agreement End September 2006 Suez and Gaz de France Extraordinary General Meetings to approve merger and make necessary changes to the Objects and Articles of Association Mid-December 2006 Notification of merger to European Commission and other competent Authorities April 2006 Outline merger timetable • The name of the new entity will be determined ahead of the Extraordinary General Meetings of the Shareholders of the two Groups approving the merger |