Filed by: SUEZ

pursuant to Rule 425 under the Securities Act of 1933

Subject Company: SUEZ

Exchange Act File Number: 001-15232

Date: February 28, 2006

Important Information

This communication does not constitute an offer to purchase or exchange or the solicitation of an offer to sell or exchange any securities of Suez or an offer to sell or exchange or the solicitation of an offer to buy or exchange any securities of Gaz de France, nor shall there be any sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares to be issued in connection with the proposed business combination to holders of Suez ordinary shares (including Suez ordinary shares represented by Suez American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration.

In connection with the proposed business combination, the required information document will be filed with theAutorité des marchés financiers (“AMF”) and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the United States, Gaz de France may file with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4, which will include a prospectus. Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information. If and when filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s web site at (www.sec.gov) and will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of Suez securities may obtain free copies of documents filed with the AMF at the AMF’s website at (www.amf-france.org) or directly from Gaz de France on its web site at: (www.gazdefrance.com) or directly from Suez on its website at: (www.suez.com), as the case may be.

Forward-Looking

Statements This communication contains forward-looking information and statements about Gaz de France, Suez and their combined businesses after completion of the proposed business combination. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with theAutorité des marchés financiers (“AMF”) made by Gaz de France and Suez, including those listed under “Facteurs de Risques” in theDocument de Base filed by Gaz de France on April 1, 2005 (under no: I.05-037) and in theDocument de Référence and its update filed by Suez on April 14, 2005 (under no: D.05-0429) and September 7 (under no: D.05-0429-A01), respectively, theNote d’opération filed by Suez on September 7, 2005 under no 05-673, and theNote d’opération filed by Suez on November 24, 2005 under no 05-810, as well as under “Risk Factors” in the Annual Report on Form 20-F for 2004 that Suez filed with the SEC on June 29, 2005. Except as required by applicable law, neither Gaz de France nor Suez undertakes any obligation to update any forward-looking information or statements.

THE FOLLOWING IS A COMMUNICATION PRESENTED BY SUEZ AND GAZ DE

FRANCE AT AN INFORMATION MEETING HELD ON FEBRUARY 28, 2006

Information meeting

Creation of a World Leader in Energy and Environment

28th February 2006

Disclaimer

Important Information

This communication does not constitute an offer to purchase or exchange or the solicitation of an offer to sell or exchange any securities of Suez or an offer to sell or exchange or the solicitation of an offer to buy or exchange any securities of Gaz de France, nor shall there be any sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares to be issued in connection with the proposed business combination to holders of Suez ordinary shares (including Suez ordinary shares represented by Suez American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration.

In connection with the proposed business combination, the required information document will be filed with the Autorité des marchés financiers (“AMF”) and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the United States, Gaz de France may file with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4, which will include a prospectus. Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information. If and when filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s web site at (www.sec.gov) and will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of Suez securities may obtain free copies of documents filed with the AMF at the AMF’s website at (www.amf-france.org) or directly from Gaz de France on its web site at: (www.gazdefrance.com) or directly from Suez on its website at: (www.suez.com), as the case may be.

Forward-Looking Statements

This communication contains forward-looking information and statements about Gaz de France, Suez and their combined businesses after completion of the proposed business combination. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with the Autorité des marchés financiers (“AMF”) made by Gaz de France and Suez, including those listed under “Facteurs de Risques” in the Document de Base filed by Gaz de France on April 1, 2005 (under no: I.05-037) and in the Document de Référence and its update filed by Suez on April 14, 2005 (under no: D.05-0429) and September 7 (under no: D.05-0429-A01), respectively, the Note d’opération filed by Suez on September 7, 2005 under no 05-673, and the Note d’opération filed by Suez on November 24, 2005 under no 05-810, as well as under “Risk Factors” in the Annual Report on Form 20-F for 2004 that Suez filed with the SEC on June 29, 2005. Except as required by applicable law, neither Gaz de France nor Suez undertakes any obligation to update any forward-looking information or statements.

A merger to serve a shared strategic vision

A leader in Energy and Environment

Reinforcement of positions anchored in France and Benelux

High potential for growth in Europe and internationally

Strong synergies in energy businesses

Combined competencies of over 200,000 employees

Contents

1. Transaction summary

2. An ambitious industrial project

3. A transaction to create value

4. Main transaction terms

5. Conclusion

1. Transaction summary

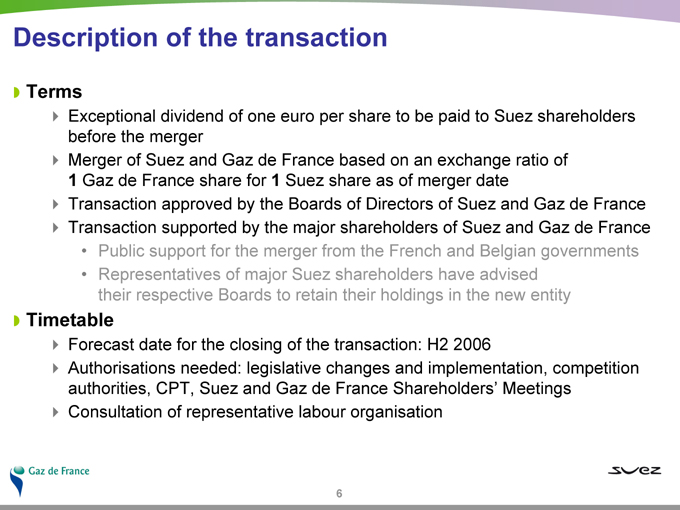

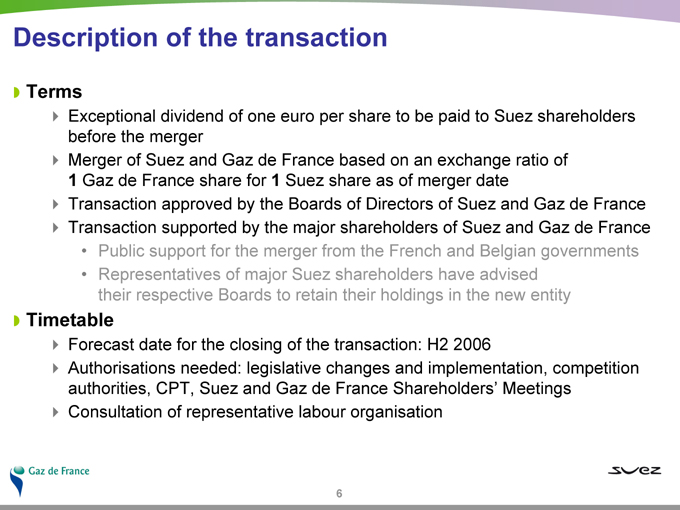

Description of the transaction

Terms

Exceptional dividend of one euro per share to be paid to Suez shareholders before the merger Merger of Suez and Gaz de France based on an exchange ratio of

1 | | Gaz de France share for 1 Suez share as of merger date |

Transaction approved by the Boards of Directors of Suez and Gaz de France Transaction supported by the major shareholders of Suez and Gaz de France

Public support for the merger from the French and Belgian governments Representatives of major Suez shareholders have advised their respective Boards to retain their holdings in the new entity

Timetable

Forecast date for the closing of the transaction: H2 2006

Authorisations needed: legislative changes and implementation, competition authorities, CPT, Suez and Gaz de France Shareholders’ Meetings Consultation of representative labour organisation

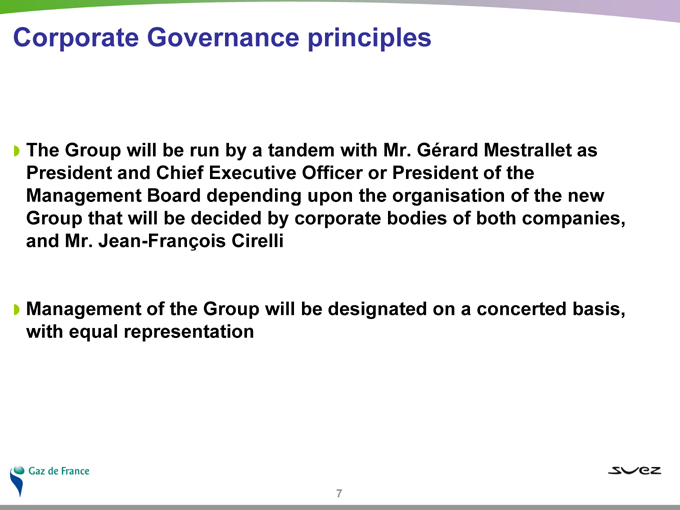

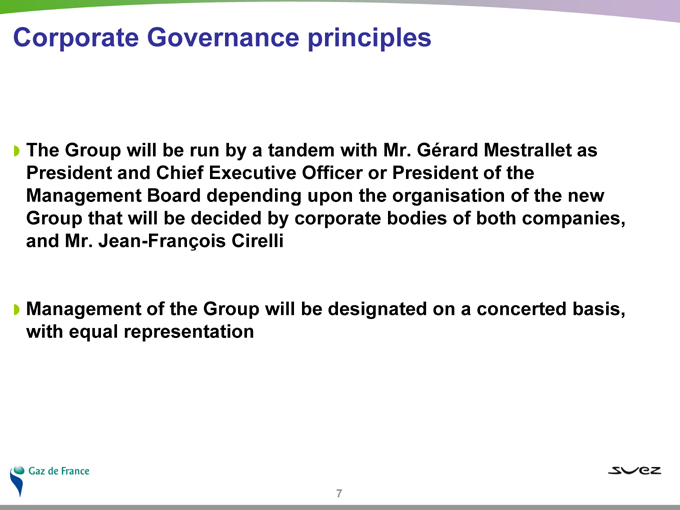

Corporate Governance principles

The Group will be run by a tandem with Mr. Gérard Mestrallet as President and Chief Executive Officer or President of the Management Board depending upon the organisation of the new Group that will be decided by corporate bodies of both companies, and Mr. Jean-François Cirelli

Management of the Group will be designated on a concerted basis, with equal representation

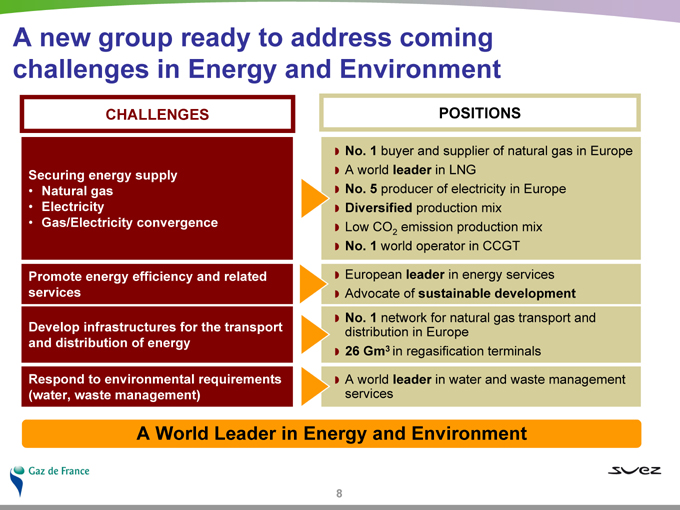

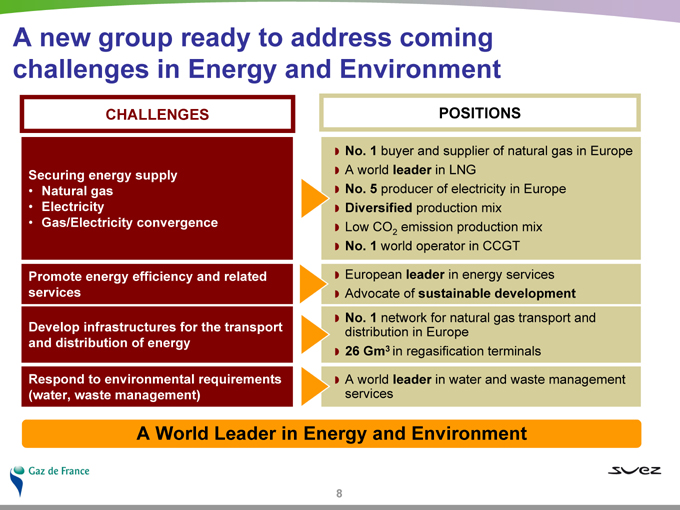

A new group ready to address coming challenges in Energy and Environment

CHALLENGES

Securing energy supply

Natural gas Electricity

Gas/Electricity convergence

Promote energy efficiency and related services

Develop infrastructures for the transport and distribution of energy

Respond to environmental requirements (water, waste management)

POSITIONS

No. 1 buyer and supplier of natural gas in Europe

A world leader in LNG

No. 5 producer of electricity in Europe

Diversified production mix

Low CO2 emission production mix

No. 1 world operator in CCGT

European leader in energy services

Advocate of sustainable development

No. 1 network for natural gas transport and distribution in Europe

26 Gm3 in regasification terminals

A world leader in water and waste management services

A World Leader in Energy and Environment

A merger to serve a shared strategic vision

The transaction is consistent with both groups’ strategic vision

Continuity of existing partnerships Response to increased energy demand A boost in gas/electricity convergence

Reinforcement of the group’s competitive position, benefiting from their geographic anchoring in France and Belgium

A concerted combination of two groups with shared values, committed to sustainable development A significant step in preparing the complete opening of European energy markets

9

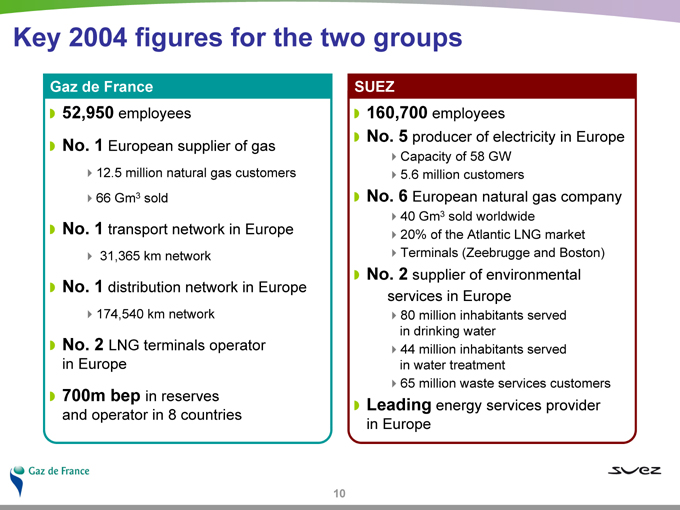

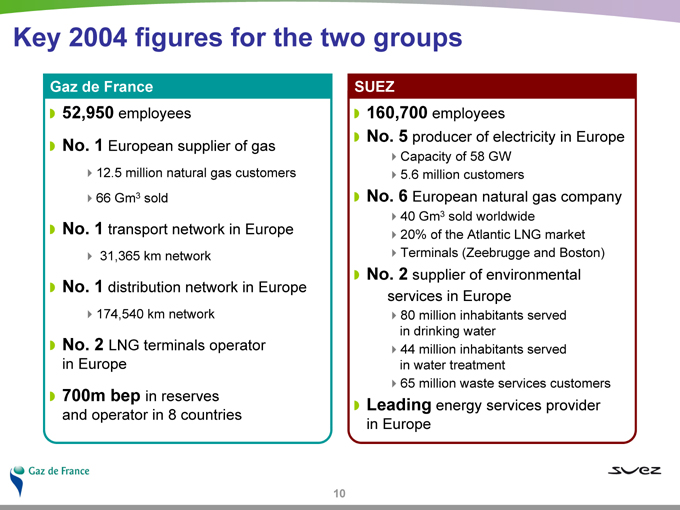

Key 2004 figures for the two groups

Gaz de France

52,950 employees

No. 1 European supplier of gas

12.5 million natural gas customers 66 Gm3 sold

No. 1 transport network in Europe

31,365 km network

No. 1 distribution network in Europe

174,540 km network

No. 2 LNG terminals operator in Europe

700m bep in reserves and operator in 8 countries

SUEZ

160,700 employees

No. 5 producer of electricity in Europe

Capacity of 58 GW 5.6 million customers

No. 6 European natural gas company

40 Gm3 sold worldwide

20% of the Atlantic LNG market Terminals (Zeebrugge and Boston)

No. 2 supplier of environmental services in Europe

80 million inhabitants served in drinking water 44 million inhabitants served in water treatment 65 million waste services customers

Leading energy services provider in Europe

10

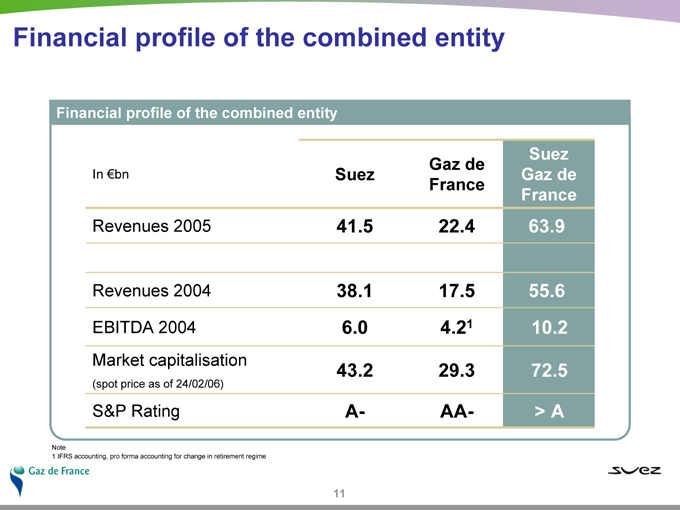

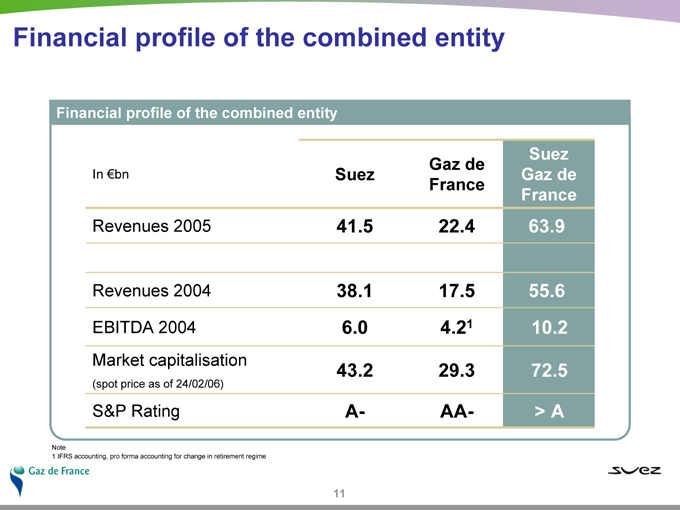

Financial profile of the combined entity

Financial profile of the combined entity

In €bn Suez Gaz de France Suez Gaz de France

Revenues 2005 41.5 22.4 63.9

Revenues 2004 38.1 17.5 55.6

EBITDA 2004 6.0 4.21 10.2

Market capitalisation

43.2 29.3 72.5

(spot price as of 24/02/06)

S&P Rating A- AA- > A

Note

1 | | IFRS accounting, pro forma accounting for change in retirement regime |

11

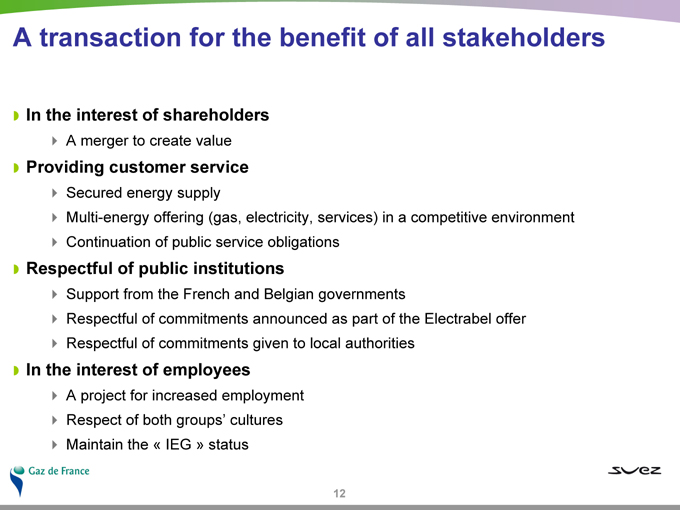

A transaction for the benefit of all stakeholders

In the interest of shareholders

A merger to create value

Providing customer service

Secured energy supply

Multi-energy offering (gas, electricity, services) in a competitive environment Continuation of public service obligations

Respectful of public institutions

Support from the French and Belgian governments

Respectful of commitments announced as part of the Electrabel offer Respectful of commitments given to local authorities

In the interest of employees

A project for increased employment Respect of both groups’ cultures Maintain the « IEG » status

12

2. An ambitious industrial project

13

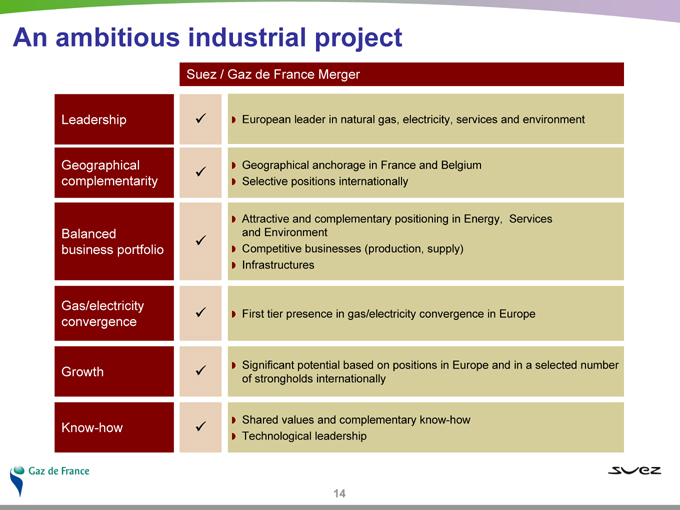

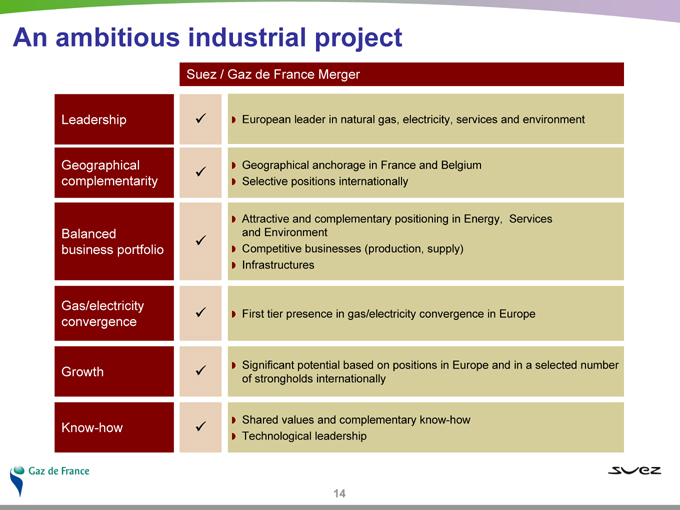

An ambitious industrial project

Suez / Gaz de France Merger

Leadership European leader in natural gas, electricity, services and environment

Geographical Geographical anchorage in France and Belgium

complementarity Selective positions internationally Attractive and complementary positioning in Energy, Services

Balanced business portfolio and Environment Competitive businesses (production, supply) Infrastructures

Gas/electricity convergence First tier presence in gas/electricity convergence in Europe

Growth Significant potential based on positions in Europe and in a selected number of strongholds internationally

Know-how Shared values and complementary know-how Technological leadership

14

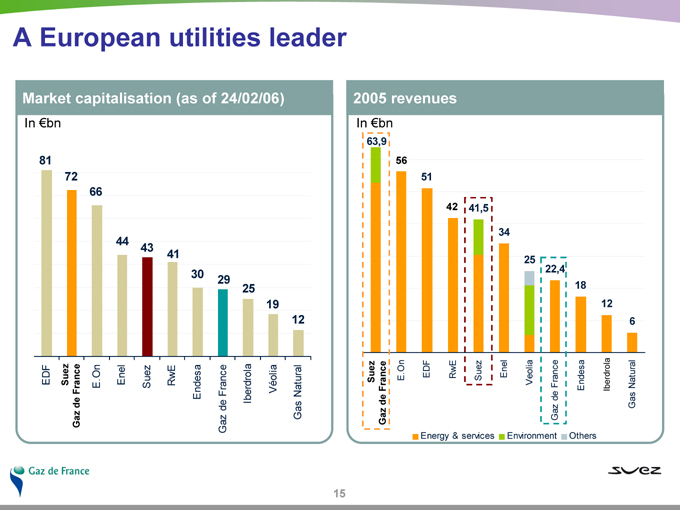

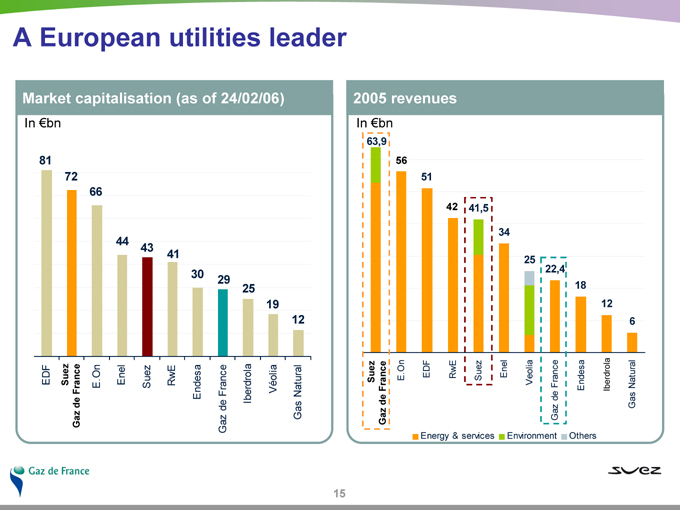

A European utilities leader

Market capitalisation (as of 24/02/06)

In €bn

81 72 66

44 43 41 30 29 25 19 12

EDF

Suez Gaz de France

E.On Enel Suez RwE

Endesa Gaz de France Iberdrola Véolia Gas Natural

2005 revenues

In €bn

63,9

56

51

42 41,5 34

25 22,4 18 12 6

Suez Gaz de France

E.On EDF RwE Suez Enel Veolia Gaz de France Endesa

Iberdrola

Gas Natural

Energy & services Environment Others

15

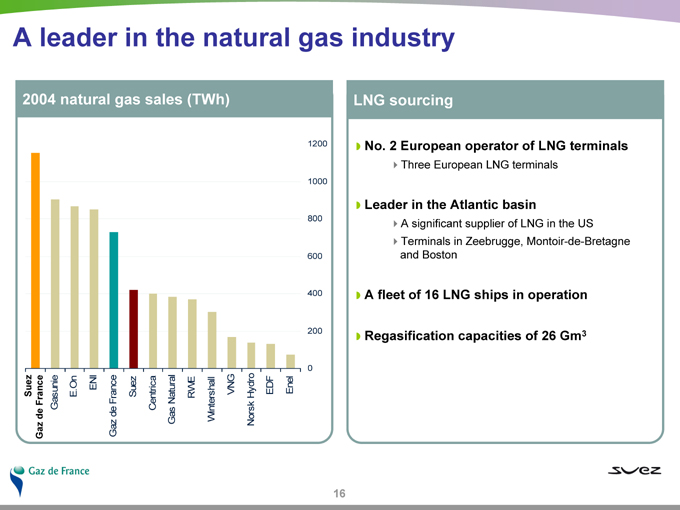

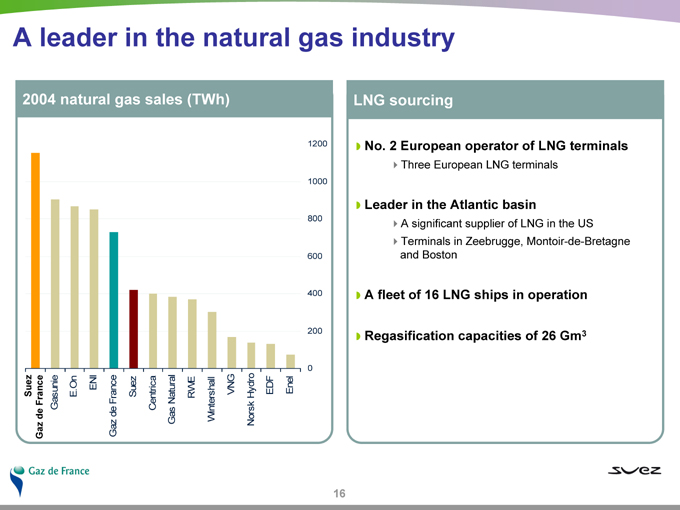

A leader in the natural gas industry

2004 natural gas sales (TWh)

1200 1000 800 600 400 200 0

Suez Gaz de France

Gasunie E.On

ENI Gaz de France Suez

Centrica Gas Natural

RWE

Wintershall

VNG

Norsk Hydro EDF

Enel

LNG sourcing

No. 2 European operator of LNG terminals

Three European LNG terminals

Leader in the Atlantic basin

A significant supplier of LNG in the US Terminals in Zeebrugge, Montoir-de-Bretagne and Boston

A fleet of 16 LNG ships in operation

Regasification capacities of 26 Gm3

16

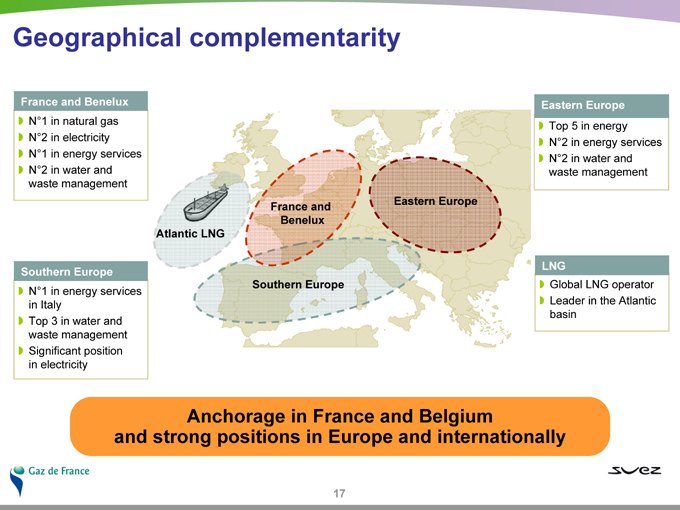

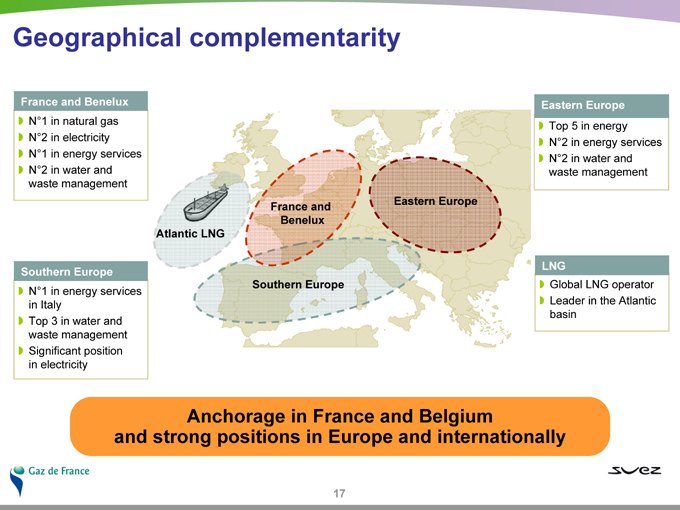

Geographical complementarity

France and Benelux

N°1 in natural gas N°2 in electricity N°1 in energy services N°2 in water and waste management

Southern Europe

N°1 in energy services in Italy Top 3 in water and waste management Significant position in electricity

Atlantic LNG

France and Benelux

Southern Europe

Eastern Europe

Eastern Europe

Top 5 in energy N°2 in energy services N°2 in water and waste management

LNG

Global LNG operator Leader in the Atlantic basin

Anchorage in France and Belgium and strong positions in Europe and internationally

17

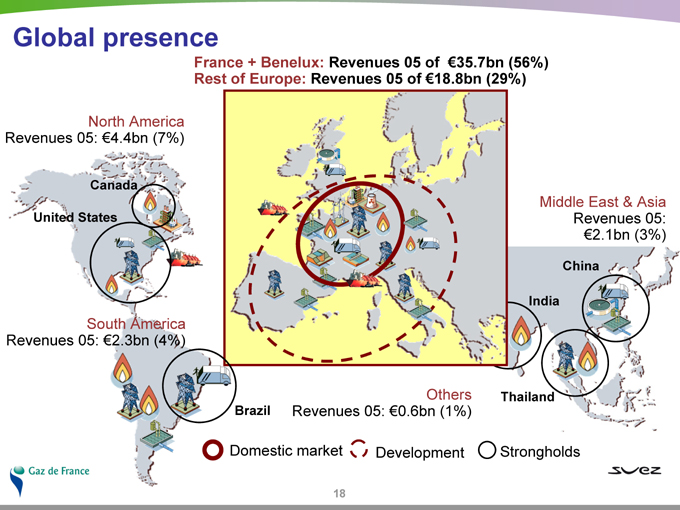

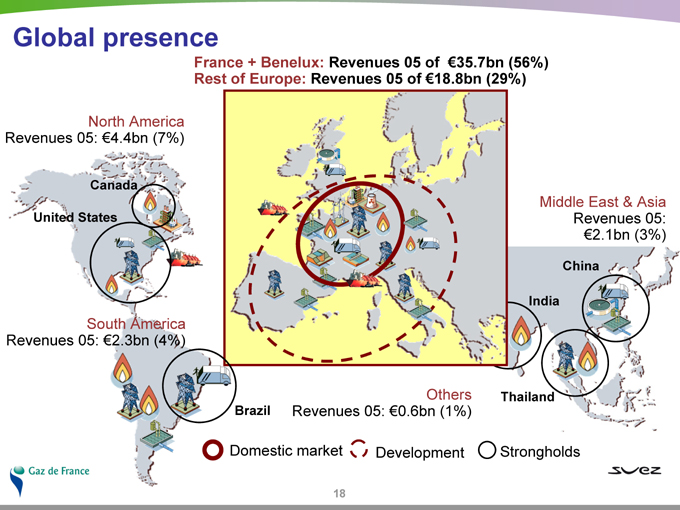

Global presence

France + Benelux: Revenues 05 of €35.7bn (56%) Rest of Europe: Revenues 05 of €18.8bn (29%)

North America Revenues 05: €4.4bn (7%)

Canada

United States

South America Revenues 05: €2.3bn (4%)

Middle East & Asia Revenues 05: €2.1bn (3%)

China

India

Brazil

Others Revenues 05: €0.6bn (1%)

Thailand

Domestic market Development Strongholds

18

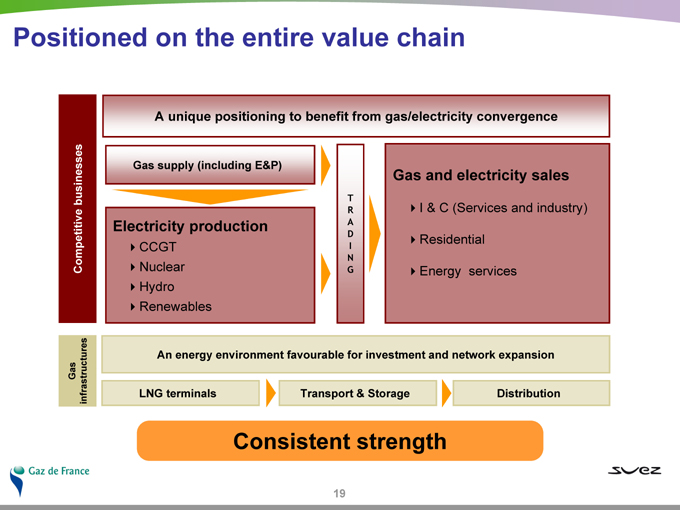

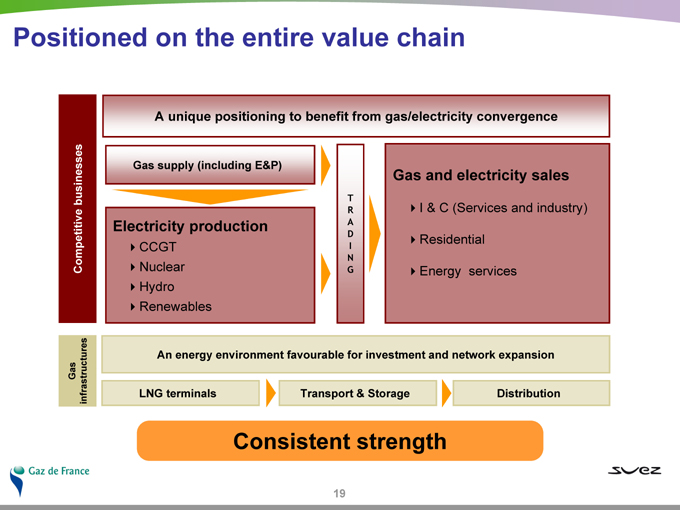

Positioned on the entire value chain

Competitive businesses

A unique positioning to benefit from gas/electricity convergence

Gas supply (including E&P)

Electricity production

CCGT Nuclear Hydro Renewables

TRADING

Gas and electricity sales

I & C (Services and industry) Residential Energy services

Gas infrastructures

An energy environment favourable for investment and network expansion

LNG terminals

Transport & Storage

Distribution

Consistent strength

19

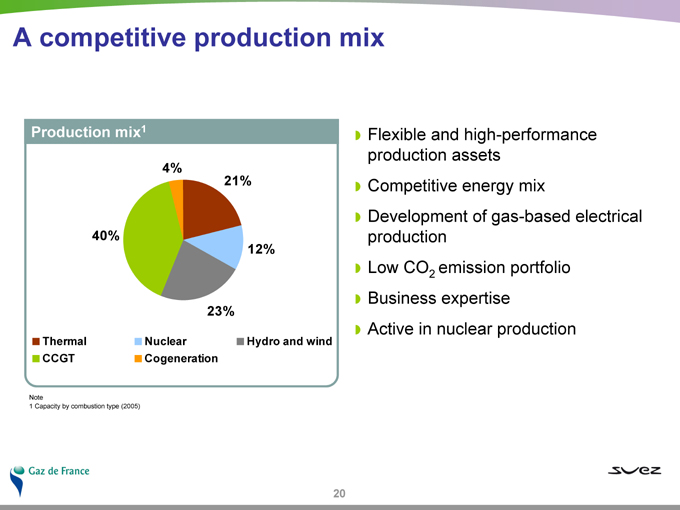

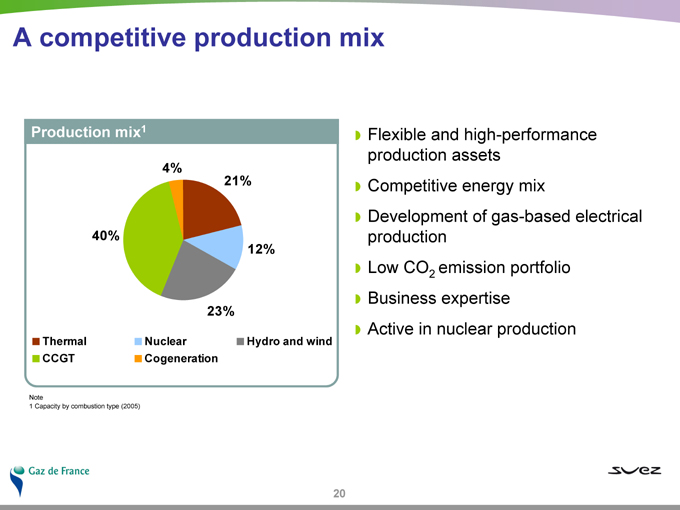

A competitive production mix

Production mix1

4%

21%

40%

12%

23%

Thermal CCGT

Nuclear Cogeneration

Hydro and wind

Note

1 | | Capacity by combustion type (2005) |

Flexible and high-performance production assets Competitive energy mix Development of gas-based electrical production

Low CO2 emission portfolio

Business expertise

Active in nuclear production

20

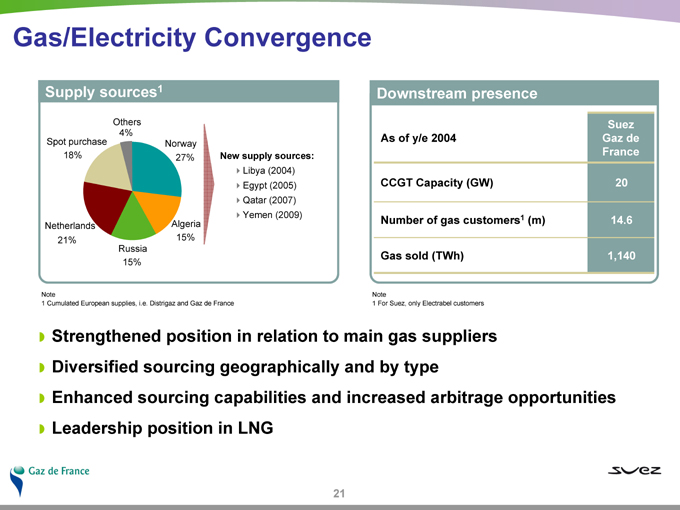

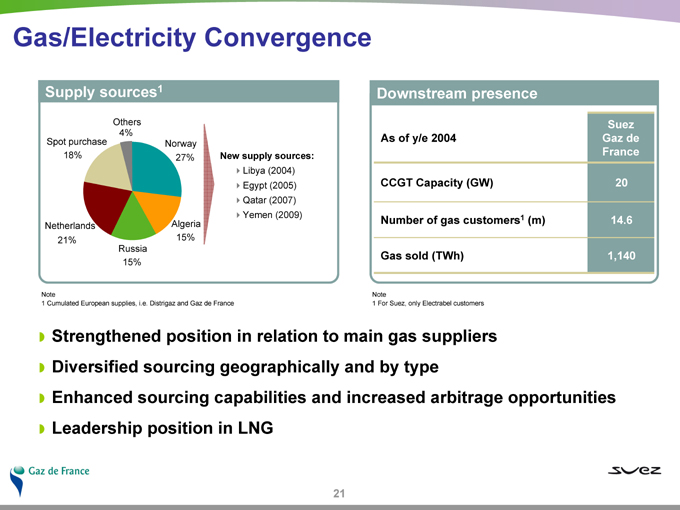

Gas/Electricity Convergence

Supply sources1

Others 4%

Spot purchase 18%

Netherlands 21%

Russia 15%

Norway 27%

Algeria 15%

New supply sources:

Libya (2004) Egypt (2005) Qatar (2007) Yemen (2009)

Note

1 | | Cumulated European supplies, i.e. Distrigaz and Gaz de France |

Downstream presence

As of y/e 2004 Suez Gaz de France

CCGT Capacity (GW) 20

Number of gas customers1 (m) 14.6

Gas sold (TWh) 1,140

Note

1 | | For Suez, only Electrabel customers |

Strengthened position in relation to main gas suppliers Diversified sourcing geographically and by type

Enhanced sourcing capabilities and increased arbitrage opportunities Leadership position in LNG

21

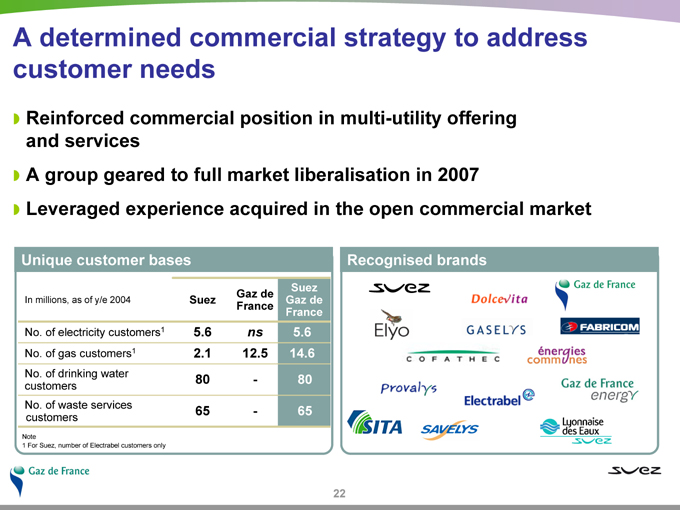

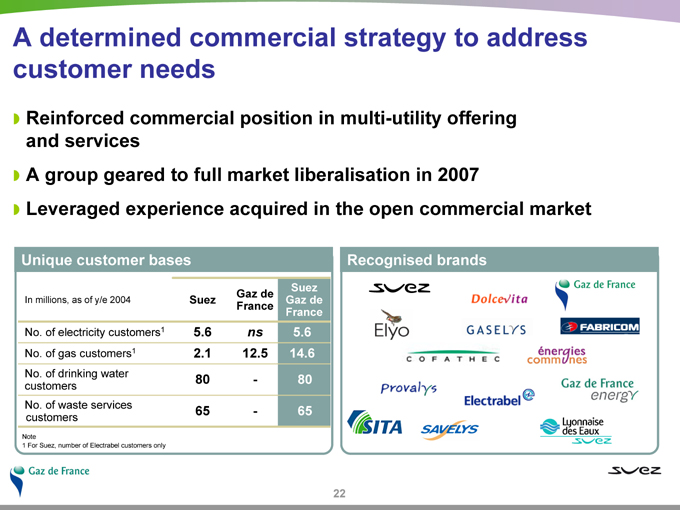

A determined commercial strategy to address customer needs

Reinforced commercial position in multi-utility offering and services A group geared to full market liberalisation in 2007 Leveraged experience acquired in the open commercial market

Unique customer bases

In millions, as of y/e 2004 Suez Gaz de France Suez Gaz de France

No. of electricity customers1 5.6 ns 5.6

No. of gas customers1 2.1 12.5 14.6

No. of drinking water customers 80 — 80

No. of waste services customers 65 — 65

Note

1 | | For Suez, number of Electrabel customers only |

Recognised brands

22

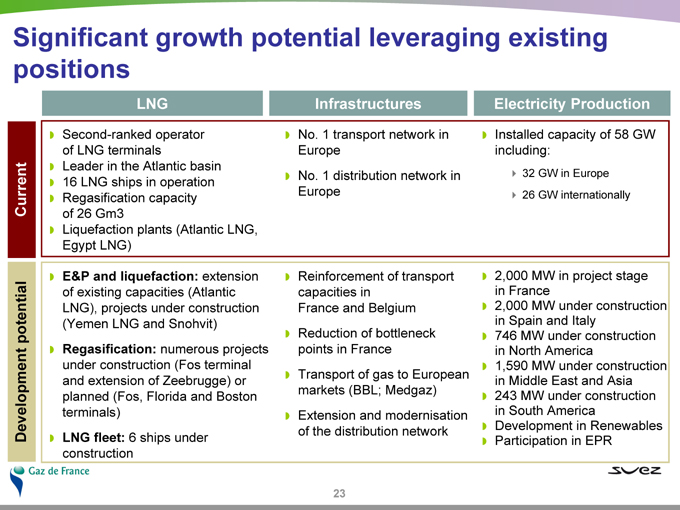

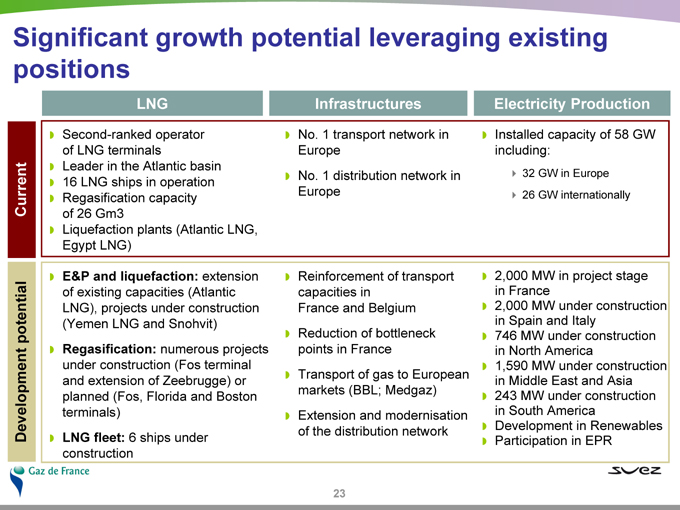

Significant growth potential leveraging existing positions

LNG

Current

Second-ranked operator of LNG terminals Leader in the Atlantic basin 16 LNG ships in operation Regasification capacity of 26 Gm3 Liquefaction plants (Atlantic LNG, Egypt LNG)

Infrastructures

No. 1 transport network in Europe No. 1 distribution network in Europe

Electricity Production

Installed capacity of 58 GW including:

32 GW in Europe 26 GW internationally

Development potential

E&P and liquefaction: extension of existing capacities (Atlantic LNG), projects under construction (Yemen LNG and Snohvit)

Regasification: numerous projects under construction (Fos terminal and extension of Zeebrugge) or planned (Fos, Florida and Boston terminals)

LNG fleet: 6 ships under construction

Reinforcement of transport capacities in France and Belgium Reduction of bottleneck points in France Transport of gas to European markets (BBL; Medgaz) Extension and modernisation of the distribution network

2,000 MW in project stage in France 2,000 MW under construction in Spain and Italy 746 MW under construction in North America 1,590 MW under construction in Middle East and Asia 243 MW under construction in South America Development in Renewables Participation in EPR

23

3. A transaction to create value

24

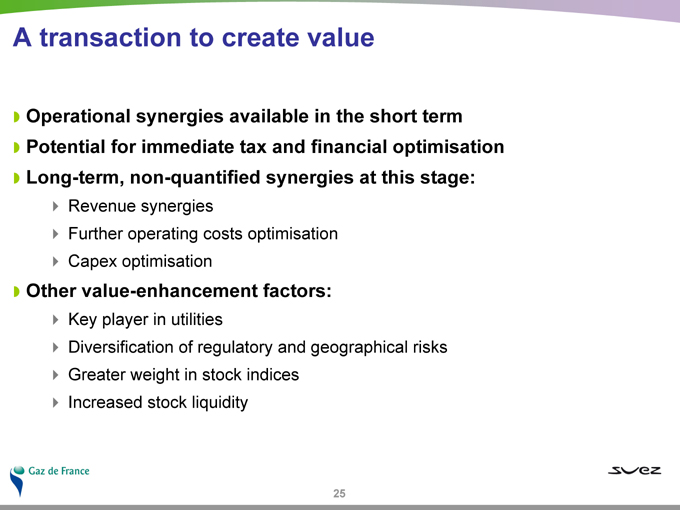

A transaction to create value

Operational synergies available in the short term Potential for immediate tax and financial optimisation Long-term, non-quantified synergies at this stage:

Revenue synergies

Further operating costs optimisation Capex optimisation

Other value-enhancement factors:

Key player in utilities

Diversification of regulatory and geographical risks Greater weight in stock indices Increased stock liquidity

25

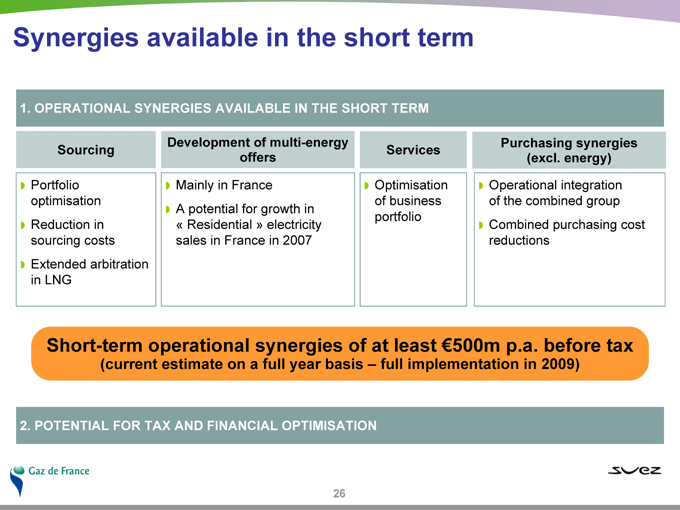

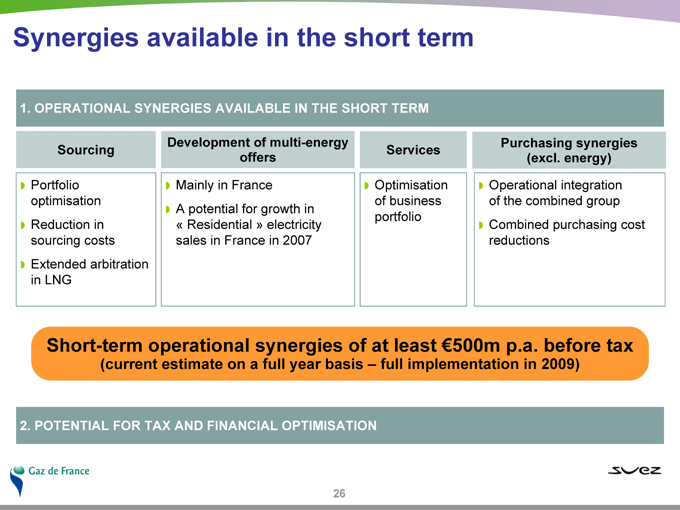

Synergies available in the short term

1. OPERATIONAL SYNERGIES AVAILABLE IN THE SHORT TERM

Sourcing

Portfolio optimisation Reduction in sourcing costs Extended arbitration in LNG

Development of multi-energy offers

Mainly in France A potential for growth in

« Residential » electricity sales in France in 2007

Services

Optimisation of business portfolio

Purchasing synergies (excl. energy)

Operational integration of the combined group Combined purchasing cost reductions

Short-term operational synergies of at least €500m p.a. before tax

(current estimate on a full year basis – full implementation in 2009)

2. POTENTIAL FOR TAX AND FINANCIAL OPTIMISATION

26

4. Main transaction terms

27

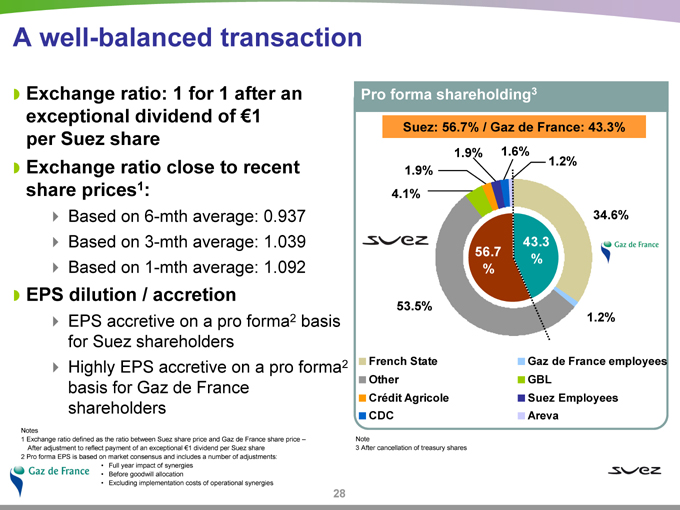

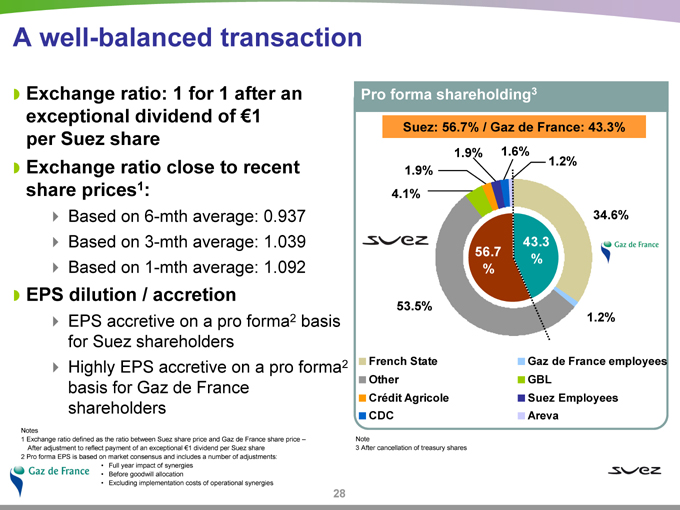

A well-balanced transaction

Exchange ratio: 1 for 1 after an exceptional dividend of €1 per Suez share Exchange ratio close to recent share prices1:

Based on 6-mth average: 0.937 Based on 3-mth average: 1.039 Based on 1-mth average: 1.092

EPS dilution / accretion

EPS accretive on a pro forma2 basis for Suez shareholders Highly EPS accretive on a pro forma2 basis for Gaz de France shareholders

Notes

1 Exchange ratio defined as the ratio between Suez share price and Gaz de France share price –After adjustment to reflect payment of an exceptional €1 dividend per Suez share 2 Pro forma EPS is based on market consensus and includes a number of adjustments:

• Full year impact of synergies

• Before goodwill allocation

• Excluding implementation costs of operational synergies

Pro forma shareholding3

Suez: 56.7% / Gaz de France: 43.3%

1.9% 4.1%

1.9%

1.6%

1.2%

34.6%

56.7 %

43.3 %

53.5%

1.2%

French State Other Crédit Agricole CDC

Gaz de France employees GBL

Suez Employees Areva

Note

3 | | After cancellation of treasury shares |

28

Strict financial discipline

Track record in controlled investment plans

Respect of strict investment criteria consistent with best practices of both groups

Return on capital employed Dilution / accretion Free cash flow generation

29

A strong cash flow generation

Visibility and growth due to a balanced asset mix with presence in both regulated and unregulated segments

A cash flow profile allowing dynamic investment and dividend policies

Optimisation of financial structure

Potential for dynamic dividend policy offering a competitive yield Potential for additional return (dividends, share buybacks) Rating target: > A

Medium term objectives

To be announced shortly

30

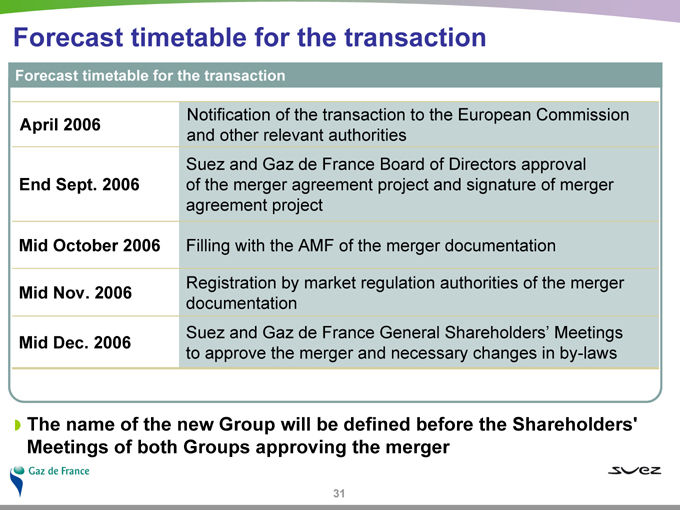

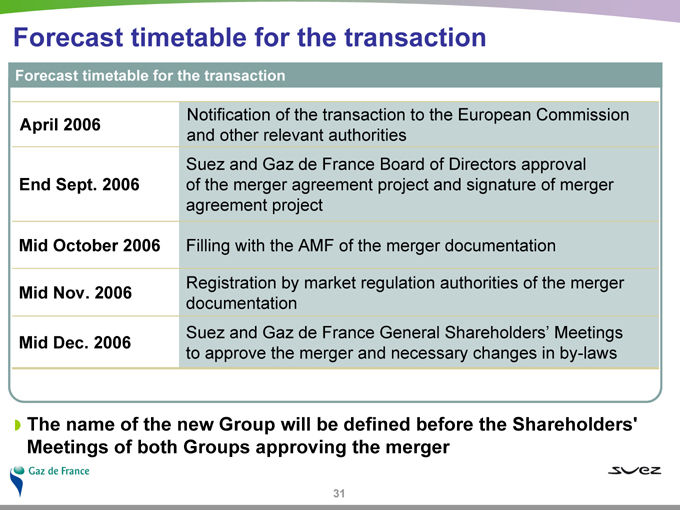

Forecast timetable for the transaction

Forecast timetable for the transaction

Notification of the transaction to the European Commission April 2006 and other relevant authorities Suez and Gaz de France Board of Directors approval End Sept. 2006 of the merger agreement project and signature of merger agreement project Mid October 2006 Filling with the AMF of the merger documentation Registration by market regulation authorities of the merger Mid Nov. 2006 documentation Suez and Gaz de France General Shareholders’ Meetings Mid Dec. 2006 to approve the merger and necessary changes in by-laws

The name of the new Group will be defined before the Shareholders’ Meetings of both Groups approving the merger

31

5. Conclusion

32

A merger to serve a shared strategic vision

A leader in Energy and Environment Reinforcement of positions anchored in France and Benelux High potential for growth in Europe and internationally Strong synergies in energy businesses Combined competencies of over 200,000 employees

33

Information meeting

Creation of a World Leader in Energy and Environment