Filed by: SUEZ

pursuant to Rule 165 and Rule 425(a)

under the Securities Act of 1933, as amended

Subject Company: SUEZ

Exchange Act File Number: 001-15232

Date: September 3, 2007

On September 3, 2007, Gaz de France and Suez presented the following slide show at a joint press conference held in Paris, France. On the same day, Suez made the slide show available on its website at www.suez.com.

Important Information

This communication does not constitute an offer to purchase, sell, or exchange or the solicitation of an offer to sell, purchase, or exchange any securities of Suez, Suez Environment (or any company holding the Suez Environment Shares) or Gaz de France, nor shall there be any offer, solicitation, purchase, sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation, purchase, sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares which would be issued in connection with the proposed business combination to holders of Suez ordinary shares (including Suez ordinary shares represented by Suez American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration.

In connection with the proposed transactions, the required information document will be filed with the Autorité des marchés financiers (“AMF”) and, to the extent Gaz de France is required or otherwise decides to register the Gaz de France ordinary shares to be issued in connection with the business combination in the United States, Gaz de France may file with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4, which will include a prospectus. Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, if and when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information. If and when filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s web site at www.sec.gov and will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of Suez securities may obtain free copies of documents filed with the AMF at the AMF’s website at www.amf-france.org or directly from Gaz de France on its web site at www.gazdefrance.com or directly from Suez on its website at www.suez.com, as the case may be.

Forward-Looking Statements

This communication contains forward-looking information and statements about Gaz de France, Suez, Suez Environment and their combined businesses after completion of the proposed transactions. Forward-looking statements are statements that are not historical facts. These statements include financial projections, synergies, cost-savings and estimates and their underlying assumptions, statements regarding plans, objectives, savings, expectations and benefits from the transaction and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares are cautioned that forward-looking information and statements are not guarantees of future performances and are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results, developments, synergies, savings and benefits from the proposed transactions to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with the Autorité des marchés financiers (“AMF”) made by Gaz de France and Suez, including those listed under “Facteurs de Risques” in the Document de Référence filed by Gaz de France with the AMF on April 27, 2007 (under no: R.07-046) and in the Document de Référence and its update filed by Suez on April 4, 2007 (under no: D.07-0272), as well as documents filed by Suez with the SEC, including those listed under “Risk Factors” in the Annual Report on Form 20-F for 2006 that Suez filed with the SEC on June 29, 2007. Except as required by applicable law, neither Gaz de France nor Suez undertakes any obligation to update any forward-looking information or statements.

* * * *

Gaz de France Suez

- ------------- ----

Creation of a World Leader in Energy

September 3, 2007

1

| | |

GDF Suez

- ------------- ----

Creation of a World Leader in Energy

September 3, 2007

2

| | |

Important Information

This communication does not constitute an offer to purchase or exchange or the

solicitation of an offer to sell or exchange any securities of Suez, Suez

Environment securities (or securities of any company holding the Suez

Environment Shares) or Gaz de France, nor shall there be any sale or exchange

of securities in any jurisdiction (including the United States, Germany, Italy

and Japan) in which such offer, solicitation or sale or exchange would be

unlawful prior to the registration or qualification under the laws of such

jurisdiction. The distribution of this communication may, in some countries, be

restricted by law or regulation. Accordingly, persons who come into possession

of this document should inform themselves of and observe these restrictions. To

the fullest extent permitted by applicable law, Gaz de France and Suez disclaim

any responsibility or liability for the violation of such restrictions by any

person.

The Gaz de France ordinary shares which would be issued in connection with the

proposed business combination to holders of Suez ordinary shares (including

Suez ordinary shares represented by Suez American Depositary Shares) may not be

offered or sold in the United States except pursuant to an effective

registration statement under the United States Securities Act of 1933, as

amended, or pursuant to a valid exemption from registration. The Suez

Environment Shares (or the shares of any company holding the Suez Environment

Shares) have not been and will not be registered under the US Securities Act of

1933, as amended, and may not be offered or sold in the United States absent

registration or an exemption from registration.

In connection with the proposed transactions, the required information document

will be filed with the Autorite des marches financiers ("AMF") and, to the

extent Gaz de France is required or otherwise decides to register the Gaz de

France ordinary shares to be issued in connection with the business combination

in the United States, Gaz de France may file with the United States Securities

and Exchange Commission ("SEC"), a registration statement on Form F-4, which

will include a prospectus. Investors are strongly advised to read the

information document filed with the AMF, the registration statement and the

prospectus, if and when available, and any other relevant documents filed with

the SEC and/or the AMF, as well as any amendments and supplements to those

documents, because they will contain important information. If and when filed,

investors may obtain free copies of the registration statement, the prospectus

as well as other relevant documents filed with the SEC, at the SEC's web site

at www.sec.gov and will receive information at an appropriate time on how to

obtain these transaction-related documents for free from Gaz de France or its

duly designated agent. Investors and holders of Suez securities may obtain free

copies of documents filed with the AMF at the AMF's website at

www.amf-france.org or directly from Gaz de France on its web site at:

www.gazdefrance.com or directly from Suez on its website at: www.suez.com, as

the case may be.

Forward-Looking Statements

This communication contains forward-looking information and statements about

Gaz de France, Suez and their combined businesses after completion of the

proposed business combination. Forward-looking statements are statements that

are not historical facts. These statements include financial projections,

synergies, cost-savings and estimates and their underlying assumptions,

statements regarding plans, objectives, savings, expectations and benefits from

the transaction and expectations with respect to future operations, products

and services, and statements regarding future performance. Forward-looking

statements are generally identified by the words "expect," "anticipates,"

"believes," "intends," "estimates" and similar expressions. Although the

managements of Gaz de France and Suez believe that the expectations reflected

in such forward-looking statements are reasonable, investors and holders of Gaz

de France and Suez ordinary shares are cautioned that forward-looking

information and statements are not guarantees of future performances and are

subject to various risks and uncertainties, many of which are difficult to

predict and generally beyond the control of Gaz de France and Suez, that could

cause actual results, developments, synergies, savings and benefits from the

transaction to differ materially from those expressed in, or implied or

projected by, the forward-looking information and statements. These risks and

uncertainties include those discussed or identified in the public filings with

the Autorite des marches financiers ("AMF") made by Gaz de France and Suez,

including those listed under "Facteurs de Risques" in the Document de Reference

filed by Gaz de France with the AMF on April 27,2007 (under no: R.07-046) and

in the Document de Reference and its update filed by Suez on April 4, 2007

(under no: D.07-0272), as well as documents filed by Suez with the SEC,

including those listed under "Risk Factors" in the Annual Report on Form 20-F

for 2006 that Suez filed with the SEC on June 29, 2007. Except as required by

applicable law, neither Gaz de France nor Suez undertakes any obligation to

update any forward-looking information or statements.

Gaz de France Suez

3

| | |

1. Transaction summary

2. Creation of a global leader specialised in energy

3. A value-creating transaction for all stakeholders

4. Well-balanced and fair merger terms

5. Floatation of SUEZ's Environment business, one of the world leader in

water and waste services

6. A business organisation geared towards efficiency and action

7. Conclusion

Gaz de France Suez

4

| | |

1 _____________________________________

Transaction summary

5

| | |

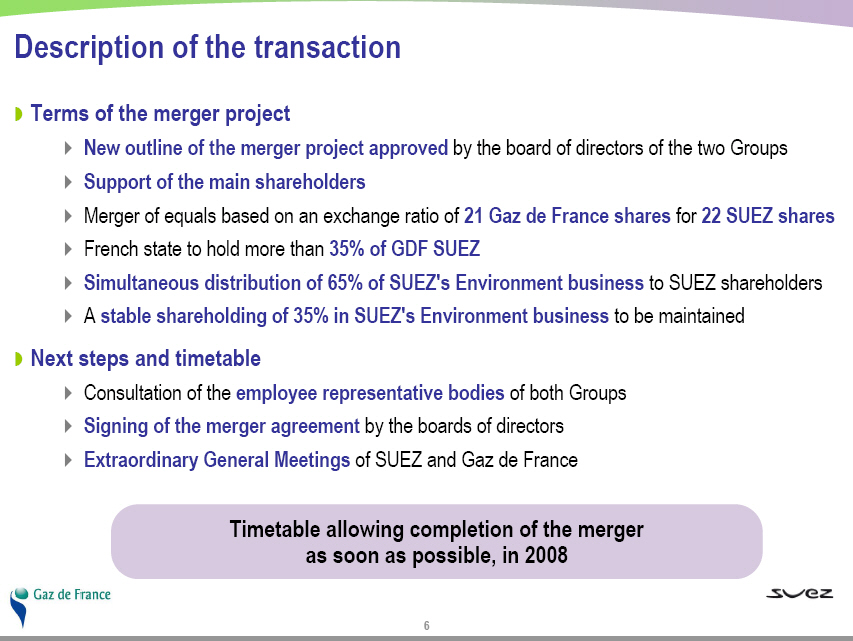

Description of the transaction

o Terms of the merger project

. New outline of the merger project approved by the board of directors of

the two Groups

. Support of the main shareholders

. Merger of equals based on an exchange ratio of 21 Gaz de France shares

for 22 SUEZ shares

. French state to hold more than 35% of GDF SUEZ

. Simultaneous distribution of 65% of SUEZ's Environment business to

SUEZ shareholders

. A stable shareholding of 35% in SUEZ's Environment business to be maintained

o Next steps and timetable

. Consultation of the employee representative bodies of both Groups

. Signing of the merger agreement by the boards of directors

. Extraordinary General Meetings of SUEZ and Gaz de France

Timetable allowing completion of the merger

as soon as possible, in 2008

6

| | |

Creation of a global leader specialised in energy

o Leader in natural gas in Europe

. #1 purchaser & supplier

. #1 transmission & distribution network

. #2 storage operator

o Leader in electricity

. #5 power producer and supplier in Europe

. #2 French power producer

. World leader in IPPs, strong positions in the United States, Brazil,

Thailand, and the Middle East

o World leader in LNG

. #1 importer & buyer in Europe

. #1 LNG terminal operator

. Leader in the Atlantic bassin

0 European leader in energy services

7

| | |

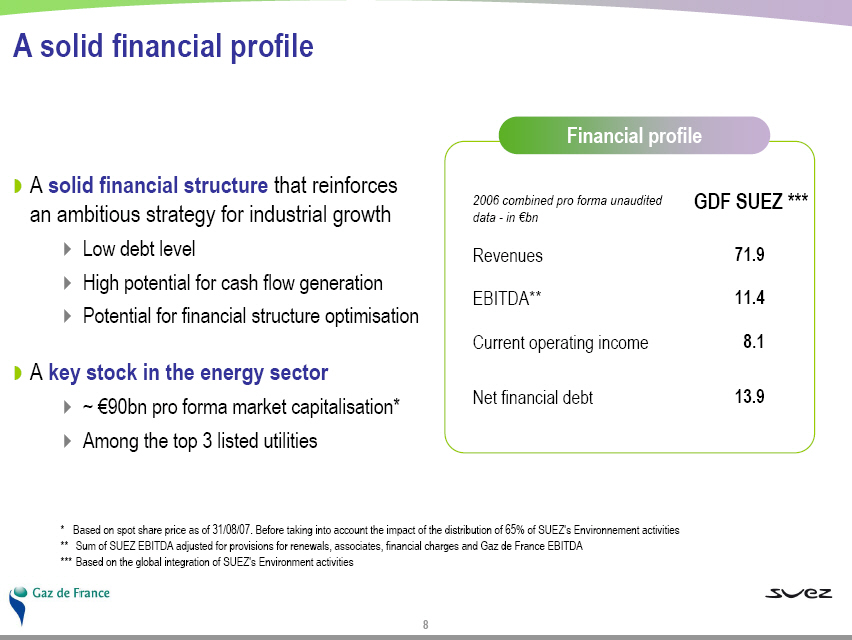

A solid financial profile

o A solid financial structure that reinforces an ambitious strategy for

industrial growth data -in (euro)bn

. Low debt level Revenues

. High potential for cash flow generation

. Potential for financial structure optimisation

o A key stock in the energy sector

. ~ Euro 90bn pro formamarket capitalisation* Net financial debt

. Among the top 3 listed utilities

Financial profile

2006 combined pro forma unaudited data - in Euro bn GDF SUEZ***

Revenues 71.9

EBITDA** 11.4

Current operating income 8.1

Net financial debt 13.9

* Based on spot share price as of 31/08/07. Before taking into account

the impact of the distribution of 65% of SUEZ's Environnement

activities

** Sum of SUEZ EBITDA adjusted for provisions for renewals, associates,

financial charges and Gaz de France EBITDA

*** Based on the global integration of SUEZ's Environment activities

8

| | |

A clear and ambitious strategy

o Consolidate leadership positions in domestic markets (France and Benelux)

o Leverage complementarities to strengthen offers (dual gas/electricity offers,

innovatingenergy services)

o Priority given to growth in Europe in all business lines

o Strengthen development outside Europe notably in fast-growing markets

o Acceleration of an ambitious strategy of industrial development notably in

upstream gas activities (E&P, LNG, etc.), infrastructures, and power generation

A combination consistent with both Groups' strategies

allowing to boost their development.

9

| | |

2 ______________________________________________________

Creation of a global leader specialised in energy

10

| | |

A common strategic vision underpinned by the acceleration of changes in the energy sector

o Supply security and diversification in a context of growing energy dependence

o Sustainable development and renewable energies challenges

o Investment requirements in upstream gas activities, infrastructures, and electricity

production

o Acceleration in sector consolidation

o Increased competition among gas suppliers

o Complete deregulation of the energy-markets in Europe in July 2007

Recent changes in the energy sector have confirmed

the relevance of the merger

11

| | |

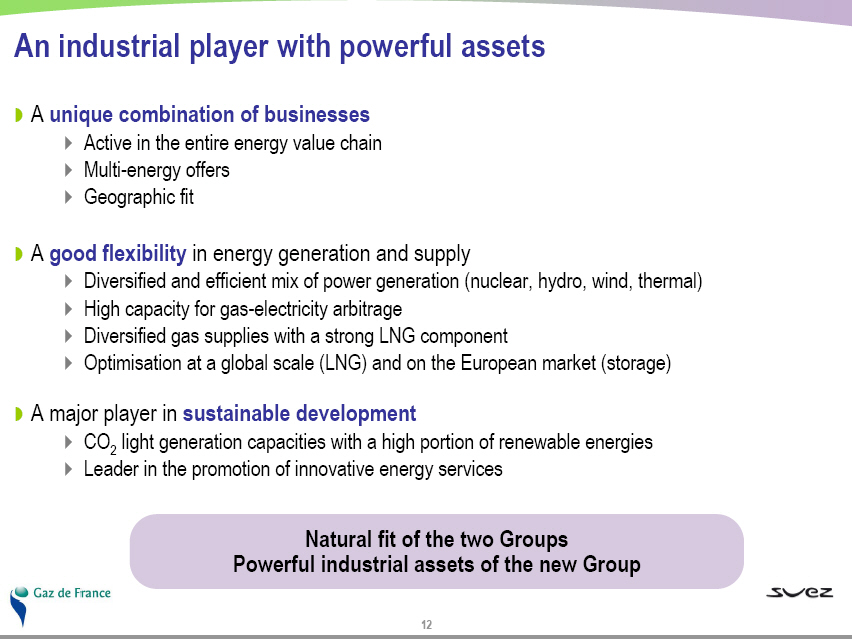

An industrial player with powerful assets

o A unique combination of businesses

. Active in the entire energy value chain

. Multi-energy offers

. Geographic fit

o A good flexibility in energy generation and supply

. Diversified and efficient mix of power generation (nuclear, hydro, wind,

thermal)

. High capacity for gas-electricity arbitrage

. Diversified gas supplies with a strong LNG component

. Optimisation at a global scale (LNG) and on the European market (storage)

o A major player in sustainable development

. CO2 light generation capacities with a high portion of renewable energies

. Leader in the promotion of innovative energy services

Natural fit of the two Groups

Powerful industrial assets of the new Group

12

| | |

Coherent industrial developments

Gaz de France

o Continued development in LNG: renewal of LNG tanker fleet, access to new

markets (US and UK), commissioning of Fos Cavaou LNG terminal in early 2008,

projects in development phase in Canada, Italy and India

o Increase in storage capacities: 400bcm capacity in France, new capacities in

Germany, Romania and the UK

o Expansion in E&P: Njord field brought into production; first deliveries of

LNG from Sn0hvit expected by end of 2007

SUEZ

o Increase in generation capacities worldwide

o Development in nuclear production: R&D partnership with CEA, project

studies in the UK, in Romania

o Further expansion in LNG: permits obtained for offshore terminal off the

coast of Boston

o Numerous energy services agreements signed

o Strengthening of partnerships in Spain: increased stake in Gas Natural to 11.3%,

acquisition of Crespo y Blasco

Industrial development over the last months consistent

with the strategy of the merged entity

13

| | |

Growth factors Development opportunities

Strong growth prospects for the Group o Further strengthen a diversified, long-

term gas supply portfolio

o Strong demand for gas in Europe o Develop in Exploration & Production

o Necessity to secure gas supplies o Expand storage capacities

o Need for new infrastructures Participate in infrastructure projects

o Globalisation of gas market through o Increase positions at all levels of

LNG the LNG chain

o Growing role of LNG as a means of o Global management of LNG resources

diversifying gas supplies

o Strengthen diversified production

o Strong demand for electricity mix: nuclear, renewables, thermal

worldwide o Targeted development outside Europe,

o Need for electricity production based on existing strongholds

capacities in Europe o Balanced positions between generation

o Challenges of sustainable development and supply

o New third-generation nuclear capacities

o Complete deregulation of the energy

market in Europe o New development opportunities

o Multi-energy offers

o Outsourcing and demand for energy

efficiency o Development of a global energy services

offer

14

| | |

3 _____________________________________________

A value-creating transaction for all stakeholders

15

| | |

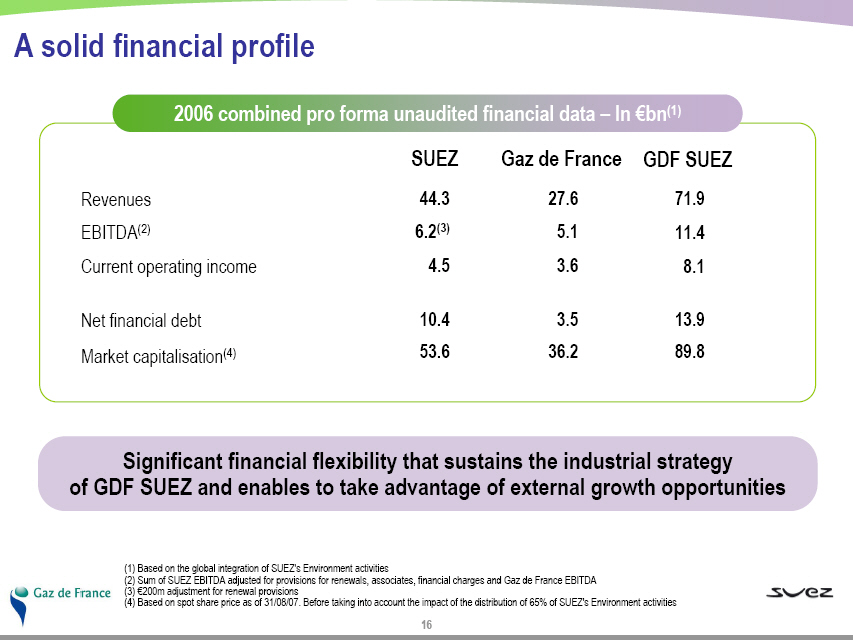

A solid financial profile

2006 combined pro forma unaudited financial data -- In Euro bn(1)

SUEZ Gaz de France GDF SUEZ

Revenues 44.3 27.6 71.9

EBITDA(2) 6.2(3) 5.1 11.4

Current operating income 4.5 3.6 8.1

Net financial debt 10.4 3.5 13.9

Market capitalisation(4) 53.6 36.2 89.8

Significant financial flexibility that sustains the industrial strategy

of GDF SUEZ and enables to take advantage of external growth opportunities

(1) Based on the global integration of SUEZ's Environment activities

(2) Sum of SUEZ EBITDA adjusted for provisions for renewals, associates, financial charges

and Gaz de France EBITDA

(3) (euro)200m adjustment for renewal provisions

(4) Based on spot share price as of 31/08/07. Before taking into account the impact of

the distribution of 65% of SUEZ's Environment activities

16

| | |

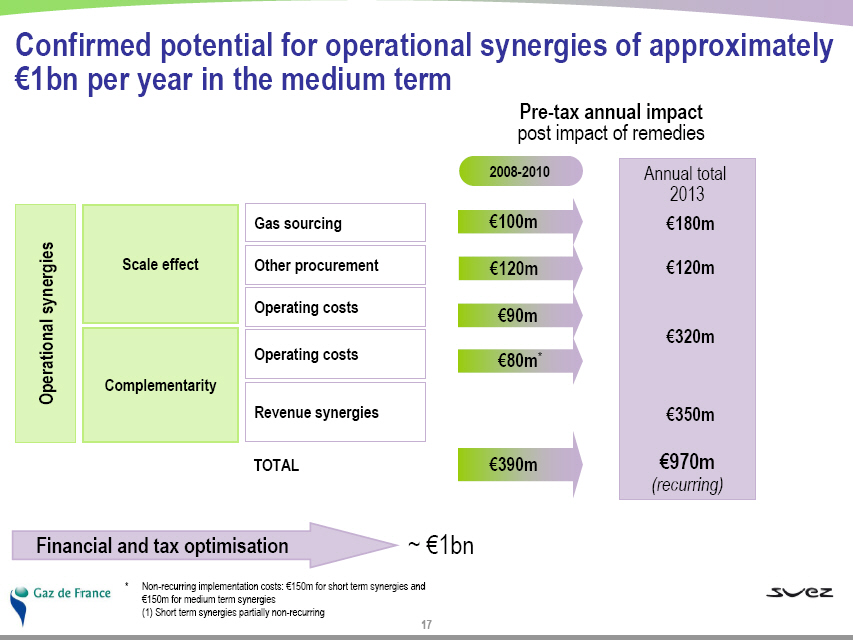

Confirmed potential for operational synergies of approximately (euro)1bn per

year in the medium term

Pre-tax annual impact post

impact of remedies

Annual total

2008-2010 2013

Gas sourcing euro100m euro180m

Scale effect Other procurement euro120m euro120m

Operating costs euro90m

--------------------------------------------- euro320m

Operating costs euro80m

Operational

synergies Complementarity Revenue synergies euro350m

---------------------------------------------

TOTAL euro390 euro970

Financial and tax optimisation ~ (euro)1bn

* Non-recurring implementation costs: (euro)150m for short term synergies

and (euro)150m for medium term synergies

(1) Short term synergies partially non-recurring

17

| | |

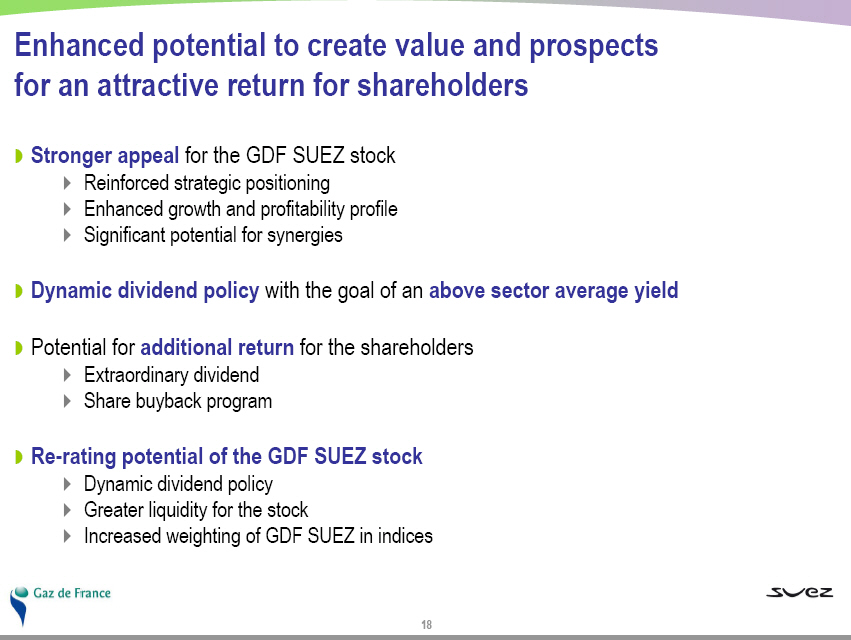

Enhanced potential to create value and prospects for an attractive return for shareholders

o Stronger appeal for the GDF SUEZ stock

. Reinforced strategic positioning

. Enhanced growth and profitability profile

. Significant potential for synergies

o Dynamic dividend policy with the goal of an above sector average yield

o Potential for additional return for the shareholders

. Extraordinary dividend

. Share buyback program

o Re-rating potential of the GDF SUEZ stock

. Dynamic dividend policy _ Greater liquidity for the stock

. Increased weighting of GDF SUEZ in indices

18

| | |

4 ----------------------------------------------------------

Well-balanced and fair merger terms

19

| | |

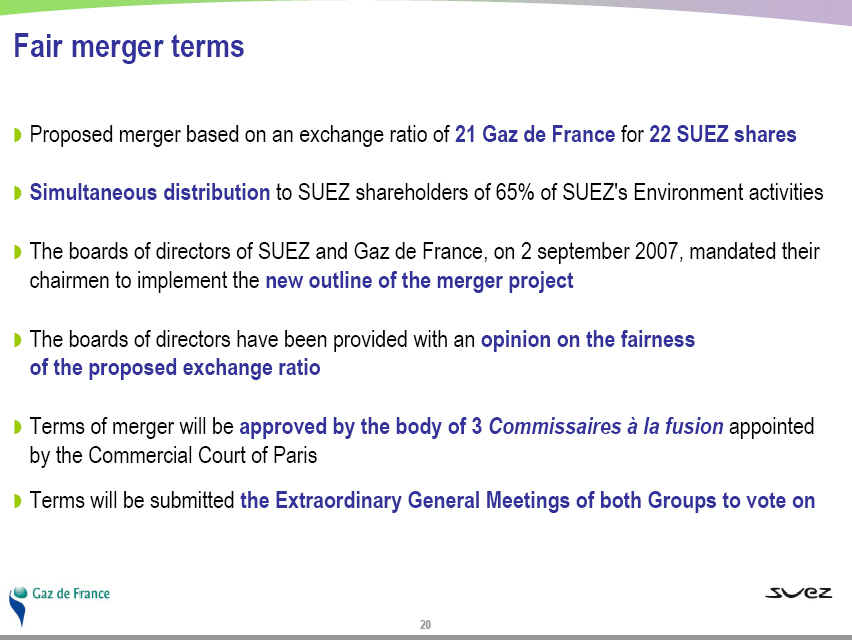

Fair merger terms

o Proposed merger based on an exchange ratio of 21 Gaz de France for 22 SUEZ shares

o Simultaneous distribution to SUEZ shareholders of 65% of SUEZ's Environment activities

o The boards of directors of SUEZ and Gaz de France, on 2 september 2007,

mandated their chairmen to implement the new outline of the merger project

o The boards of directors have been provided with an opinion on the fairness

of the proposed exchange ratio

o Terms of merger will be approved by the body of 3 Commissaires a la fusion

appointed by the Commercial Court of Paris

o Terms will be submitted the Extraordinary General Meetings of both Groups to vote on

20

| | |

A merger of equals

o Shareholders of the new entity

. 55%* of former SUEZ shareholders

. 45%* of former Gaz de France shareholders

o The French state, largest shareholder of the new Group

. Shareholding of more than 35%* of the new Group

Pro forma shareholding structure*

* On a non diluted basis

21

| | |

Indicative timetable and next steps

Indicative timetable for the transaction

Extraordinary General Meetings of SUEZ and Gaz de France to approve the merger

Merger completion and simultaneous IPO of the Environment Business

Steps already completed

Approval of the proposed merger by the Belgian government October 6, 2006 Vote

by the French Parliament on the privatisation law of Gaz de France November 8,

2006 Authorisation of the transaction by the European Commission November 14,

2006

Decision of the Conseil Constitutionnel authorizing the privatisation of Gaz de

France starting July 1, 2007 November 30, 2006 Promulgation of the Gaz de France

privatisation law December 7, 2006 Request submitted to the European Commission

to delay the implementation of the remedies August 30, 2007

Next steps before completion of the merger

Opinion of employee representative bodies of SUEZ, Gaz de France,

and SUEZ Environment

Registration by stock market authorities of the merger documentation and the

documentation related to the IPO of the Environment business of SUEZ

The merger is expected to be completed as early as possible in 2008

22

| | |

Floatation of SUEZ's Environment business,

one of the world leader in water

and waste services

| | |

A stable shareholding of GDF SUEZ

Post-transaction shareholding structure of

SUEZ's Environment business

Free float 52%

Main SUEZ shareholders 12%

GDF SUEZ 35%

Shareholders' agreement 47%

Stable shareholding of 35%

Execution of a shareholders' agreement covering 47% of the capital of GDF SUEZ

Stable shareholding structure

Employment guarantees

Corporate governance

Current management of the Environnement

business of SUEZ to remain in place

Full consolidation in GDF SUEZ accounts

24

| | |

SUEZ's Environment business, attractive growth prospects

Attractive growth opportunities in favorable market conditions

Growing demand for environmental solutions in context of climate change

(water resources management, waste recycling...)

Increasingly stringent environmental norms

Strong demand for cutting edge value added solutions

Water: desalination, sludge treatment, leakage reduction

Waste: metals recycling, mechanical biological treatment...

Acceleration of development sustained by global leadership position

Strong sales force supported by historical partnership approach

Ability to acquire and integrate profitable external growth opportunities

2010e EBITDA target at = (euro)3bn

(+ 50% vs. 2006)

25

| | |

A business organisation geared towards efficiency and action

| | |

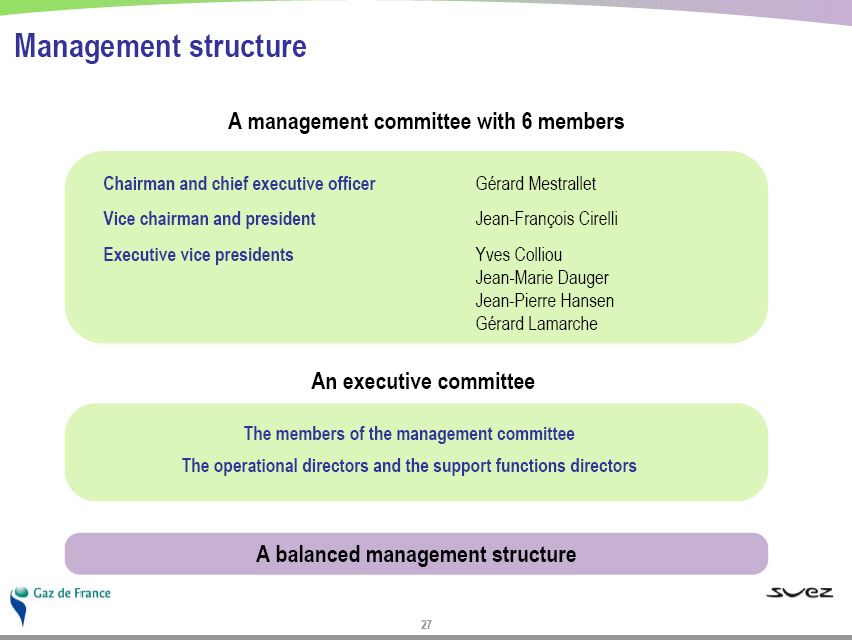

Management structure

A management committee with 6 members

Chairman and chief executive officer Gerard Mestrallet

Vice chairman and president Jean-Francois Cirelli

Executive vice presidents Yves Colliou

Jean-Marie Dauger

Jean-Pierre Hansen

Gerard Lamarche

An executive committee

The members of the management committee

The operational directors and the support functions directors

A balanced management structure

27

| | |

Organisational structure of the new Group

Chairman and chief executive officer - Gerard Mestrallet

Vice chairman and president - Jean-Francois Cirelli

Energy Policy Committee

Energy France Henri Ducre

Energy Europe & International Jean-Pierre Hansen

Global Gas & LNG Jean-Marie Dauger

Infrastructures Yves Colliou

Energy Services Jerome Tolot

Environment Jean-Louis Chaussade

28

| | |

Creation of a global leader in Energy

An ambitious industrial project, stregthened by the swift changes in the sector

A truly European project benefiting all stakeholders

For our customers: through high-performances, innovative, and competitive offers

For our employees: a unifying project that will create jobs over time

For our shareholders: a value-creative project

An agreement on the new outline of the merger project

Fair financial terms and conditions for both shareholder groups

Transparent governance in line with best practices

A Group ready to move as soon as the merger is completed

30

| | |

32

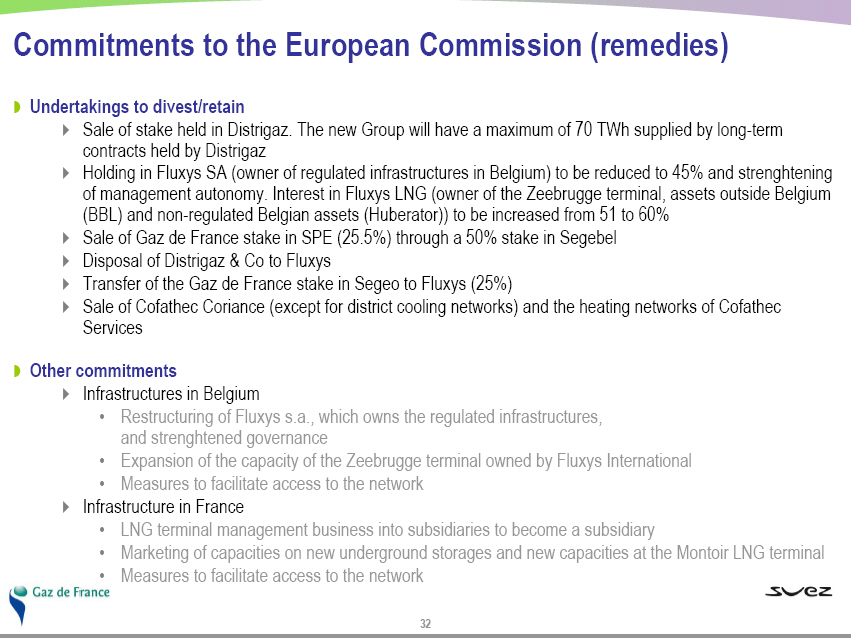

Commitments to the European Commission (remedies)

Undertakings to divest/retain

Sale of stake held in Distrigaz. The new Group will have a maximum of 70 TWh

supplied by long-term contracts held by Distrigaz

Holding in Fluxys SA (owner of regulated infrastructures in Belgium) to be

reduced to 45% and strenghtening of management autonomy. Interest in Fluxys LNG

(owner of the Zeebrugge terminal, assets outside Belgium (BBL) and non-regulated

Belgian assets (Huberator)) to be increased from 51 to 60%

Sale of Gaz de France stake in SPE (25.5%) through a 50% stake in Segebel

Disposal of Distrigaz & Co to Fluxys

Transfer of the Gaz de France stake in Segeo to Fluxys (25%)

Sale of Cofathec Coriance (except for district cooling networks) and the heating

networks of Cofathec Services

Other commitments

Infrastructures in Belgium

o Restructuring of Fluxys s.a., which owns the regulated infrastructures, and

strenghtened governance

o Expansion of the capacity of the Zeebrugge terminal owned by Fluxys

International

o Measures to facilitate access to the network

Infrastructure in France

o LNG terminal management business into subsidiaries to become a subsidiary

o Marketing of capacities on new underground storages and new capacities at

the Montoir LNG terminal

o Measures to facilitate access to the network

32

| | |

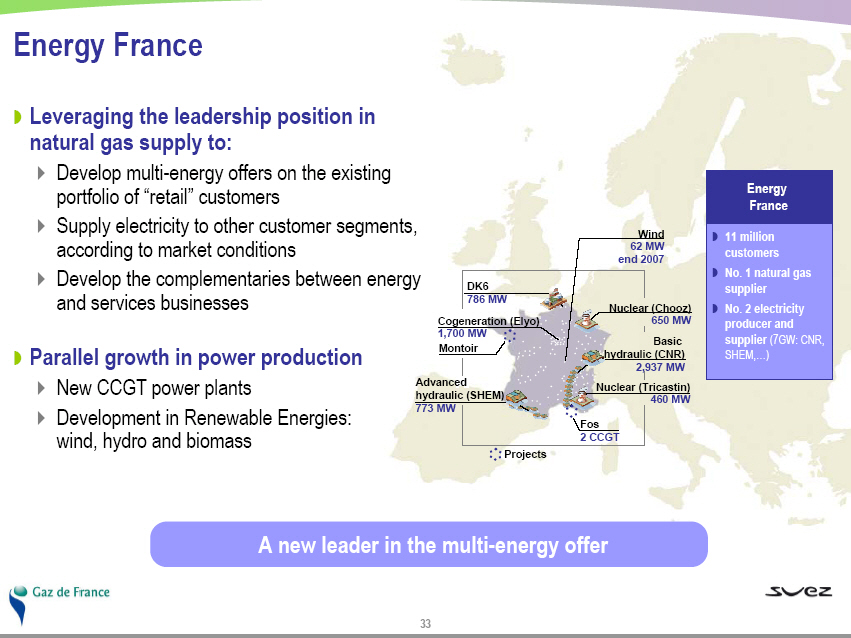

Energy France

Leveraging the leadership position in natural gas supply to: .. Develop

multi-energy offers on the existing portfolio of "retail" customers .. Supply

electricity to other customer segments, according to market conditions ..

Develop the complementaries between energy and services businesses .. Parallel

growth in power production

New CCGT power plants

Development in Renewable

Energies: wind, hydro and biomass

DK6 786 MW

Cogeneration (Elyo) 1,700 MW

Montoir

Advanced hydraulic (SHEM) 773 MW

Wind 62 MW end 2007

Nuclear (Chooz) 650 MW

Basic hydraulic (CNR) 2,937 MW

Nuclear (Tricastin) 460 MW

Fos 2 CCGT

Projects

Energy France

11 million customers

No. 1 natural gas supplier

No. 2 electricity producer and supplier (7GW:

CNR, SHEM,...)

A new leader in the multi-energy offer

33

| | |

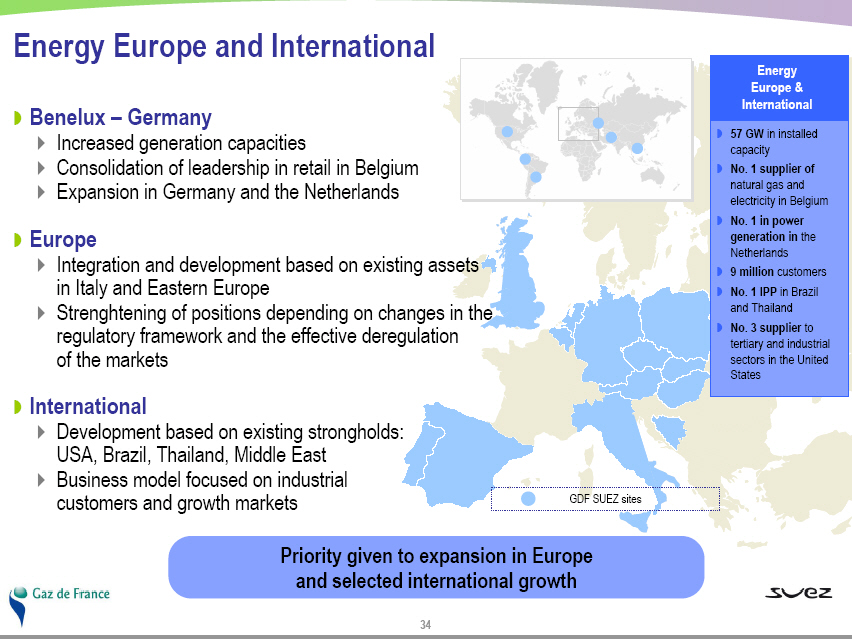

Energy Europe and International

Benelux - Germany

Increased generation capacities

Consolidation of leadership in retail in Belgium

Expansion in Germany and the Netherlands

Europe

Integration and development based on existing assets in Italy and Eastern Europe

Strenghtening of positions depending on changes in the regulatory framework and

the effective deregulation of the markets

International

Development based on existing strongholds: USA, Brazil, Thailand, Middle East

Business model focused on industrial customers and growth markets

Energy

Europe &

International

57 GW in installed capacity

No. 1 supplier of natural gas and electricity in Belgium

No. 1 in power generation in the Netherlands

9 million customers

No. 1 IPP in Brazil and Thailand

No. 3 supplier to tertiary and industrial sectors in the United States

GDF SUEZ sites

Priority given to expansion in Europe

and selected international growth

34

| | |

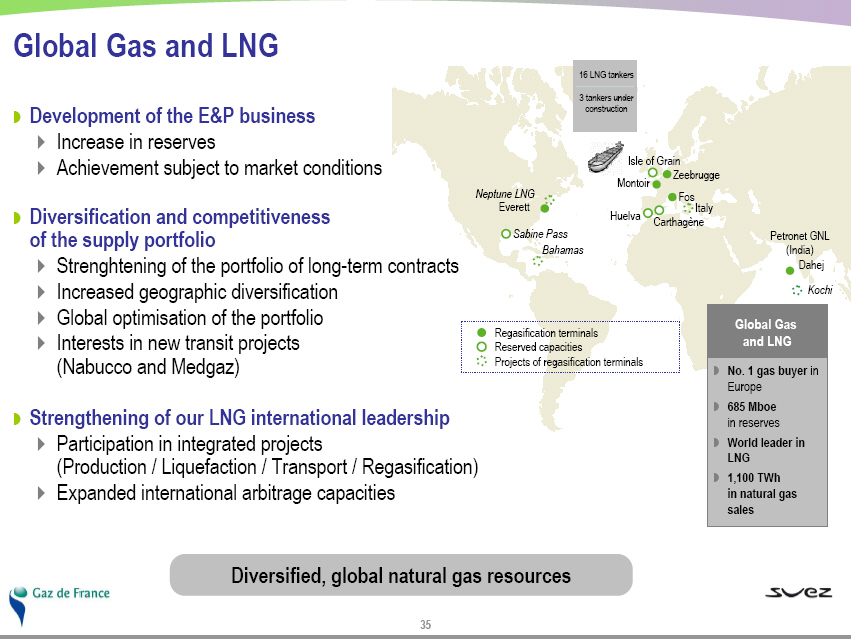

Global Gas and LNG

Development of the E&P business

Increase in reserves

Achievement subject to market conditions

Diversification and competitiveness of the supply portfolio

Strenghtening of the portfolio of long-term contracts

Increased geographic diversification

Global optimisation of the portfolio

Interests in new transit projects (Nabucco and Medgaz)

Strengthening of our LNG international leadership

Participation in integrated projects (Production / Liquefaction / Transport /

Regasification)

Expanded international arbitrage capacities Diversified, global natural gas

resources Global Gas and LNG

16 LNG tankers

3 tankers under construction

Neptune LNG

Bahamas

Everett

Dahej

Kochi

Petronet GNL (India)

Zeebrugge Montoir

Fos

Isle of Grain

Huelva

Italy

Carthagene

Sabine Pass

Regasification terminals

Reserved capacities

Projects of regasification terminals

Global Gas and LNG

No. 1 gas buyer in Europe

685 Mboe in reserves

World leader in LNG

1,100 TWh in natural gas sales

35

| | |

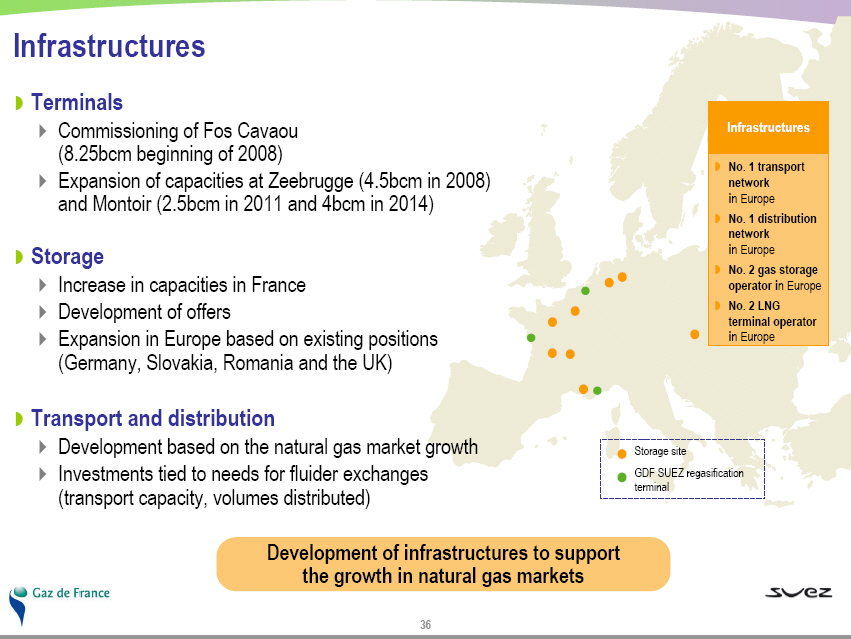

Infrastructures

Terminals

Commissioning of Fos Cavaou (8.25bcm beginning of 2008)

Expansion of capacities at Zeebrugge (4.5bcm in 2008) and Montoir (2.5bcm in

2011 and 4bcm in 2014)

Storage

Increase in capacities in France

Development of offers

Expansion in Europe based on existing positions

(Germany, Slovakia, Romania and the UK)

Transport and distribution

Development based on the natural gas market growth

Investments tied to needs for fluider exchanges (transport capacity, volumes

distributed) Development of infrastructures to support the growth in natural gas

markets

Infrastructures

No. 1 transport network in Europe

No. 1 distribution network in Europe

No. 2 gas storage operator in Europe

No. 2 LNG terminal operator in Europe

Storage site

GDF SUEZ regasification terminal

36

| | |

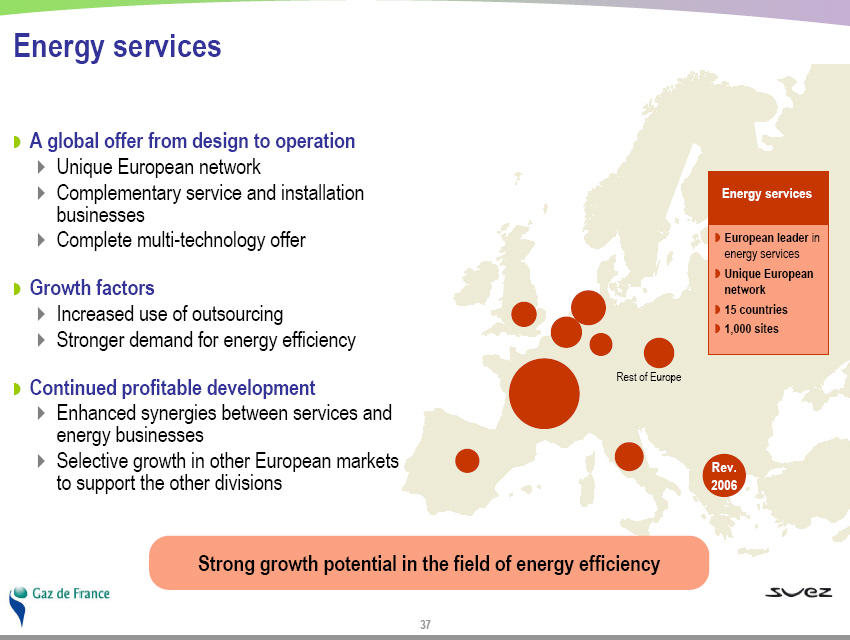

Energy services

A global offer from design to operation

Unique European network

Complementary service and installation businesses

Complete multi-technology offer

Growth factors

Increased use of outsourcing

Stronger demand for

energy efficiency

Continued profitable development

Enhanced synergies

between services and energy businesses

Selective growth in other European markets to support the other divisions

Energy services

European leader in energy services

Unique European network

15 countries

1,000 sites

Rest of Europe

Rev. 2006

Strong growth potential in the field of energy efficiency

37

| | |

Confirmation of the operational synergies program of approximately (euro)1

billion per year in the medium term

Size effect

Reduction in sourcing costs: enhanced buying position towards suppliers,

optimised sourcing portfolio, etc.

Economies of scale on non-energy purchases

Optimisation of operating costs: pooling of networks and services

Optimisation of resources and structures

Effect of complementary businesses

Enlarged commercial offer

Non-duplication of entry "tickets" (marketing costs and investments) to markets

Accelereted commercial development TYPE OF SYNERGIES DESCRIPTION

38

| | |

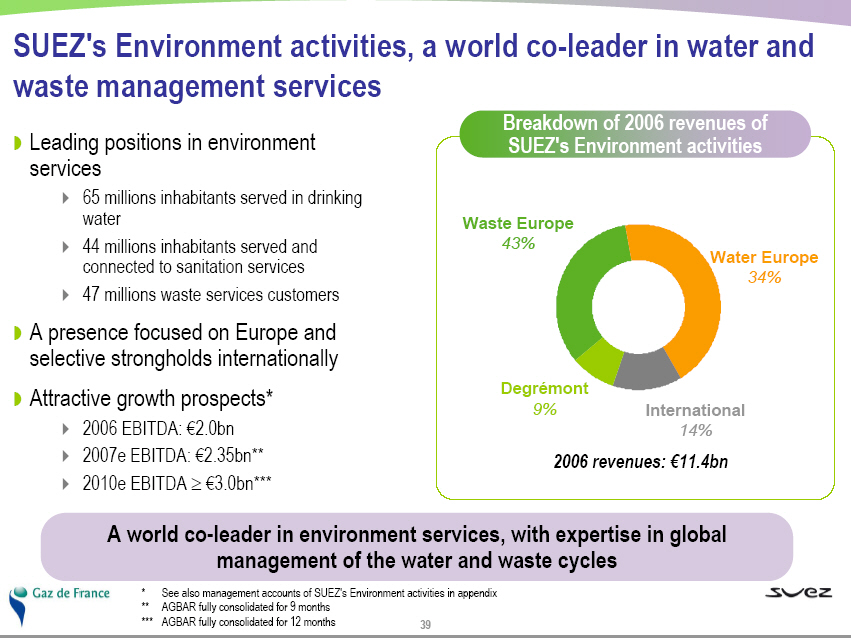

SUEZ's Environment activities, a world co-leader in water and waste management

services

Breakdown of 2006 revenues of SUEZ's Environment activities

Waste Europe 43%

Water Europe 34%

International 14%

Degremont 9%

2006 revenues: (euro)11.4bn

Leading positions in environment services

65 millions inhabitants served in drinking water

44 millions inhabitants served and connected to sanitation services

47 millions waste services customers

A presence focused on Europe and selective strongholds internationally

Attractive growth prospects*

2006 EBITDA: (euro)2.0bn

2007e EBITDA: (euro)2.35bn**

2010e EBITDA = (euro)3.0bn***

* See also management accounts of SUEZ's Environment activities in appendix

** AGBAR fully consolidated for 9 months

*** AGBAR fully consolidated for 12 months

A world co-leader in environment services, with expertise in global

management of the water and waste cycles

39

| | |

SUEZ's Environment activities

Leadership in the full water and waste cycle enhanced by:

Controlled and up to date expertise

Differentiating technologies

Capacity to offer integrated solutions

Ongoing research of innovative products and segments

Growth primarily targeted to developed countries

85% of revenues recorded in countries where the long-term investment is

protected by mature political and legal systems

Increasingly stringent regulation to promote economic growth that protects the

environment

High cost of raw materials and fossil fuels which encourage recycling

Selective international expansion with the development of new business models

Management contracts (e.g. Algiers)

Long-term capital partnerships (e.g. China)

Innovative financial arrangements in partnerships

(e.g. PFI)

Environment

Global leader in environmental services

65 million inhabitants supplied with water

47 million inhabitants benefit from waste services

Rev. 2006

Country / Geographic zone

Leadership built on a solid European base

Global and healthy growth

40

| | |

SUEZ's Environment activities: increased visibility

SUEZ Environment business is on top form

Recognised expertise, knowhow in differenciating technologies

Increased commercial dynamism

Excellent operational and financial performance

Well-experienced management team

A dynamic development strategy

Development strategy through external growth and targeted acquisitions

Support from a stable shareholder base .. Direct access to the financial markets

Investment program of (euro)4.0bn to (euro)4.5bn over 2007/09 to be fully

self-financed

Maintain its development strategy through partnerships with the Energy

businesses

Creation of a world co-leader in environment services benefiting from

an attractive stock market positioning

41

| | |

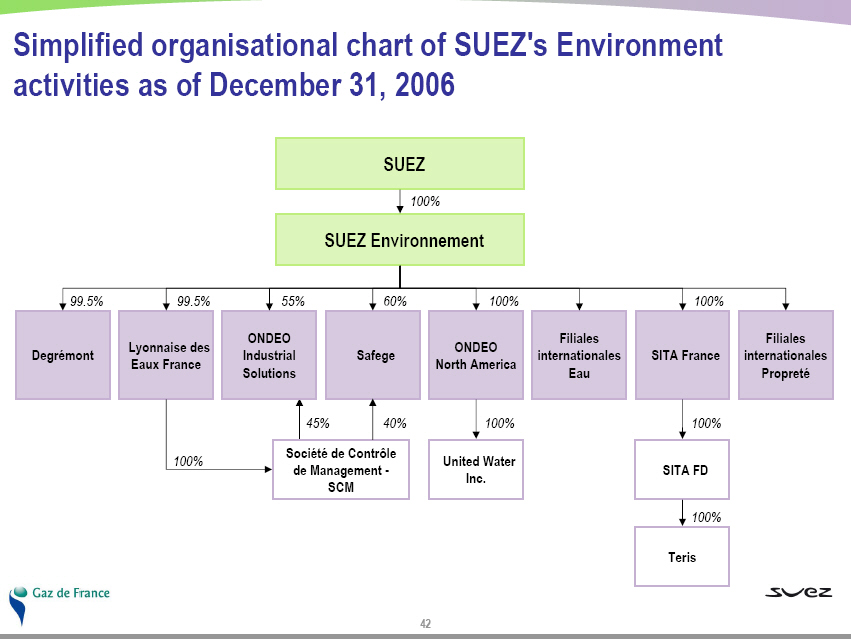

Simplified organisational chart of SUEZ's Environment activities as of December

31, 2006

SUEZ 100%

SUEZ Environnement

Degremont 99.5%

Lyonnaise des Eaux France 99.5% 100%

ONDEO Industrial Solutions 55%

Safege 60%

ONDEO North America 100%

Filiales internationales Eau

SITA France 100%

Filiales internationales Proprete

Societe de Controle de Management - SCM 45% 40%

United Water Inc. 100%

SITA FD 100%

Teris 100%

42

| | |