The following power point presentation was made available on Suez’s website on June 16, 2008.

Important Information

This communication does not constitute an offer to purchase, sell, or exchange or the solicitation of an offer to sell, purchase, or exchange any securities of Suez, Suez Environnement Company or Gaz de France, nor shall there be any offer, solicitation, purchase, sale or exchange of securities in any jurisdiction (including the United States, Canada, Germany, Italy and Japan) in which such offer, solicitation, purchase, sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares which would be issued in connection with the proposed business combination to holders of Suez ordinary shares (including Suez ordinary shares represented by Suez American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration. The Suez Environnement Company shares have not been and will not be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an exemption from registration.

In connection with the proposed transactions, the required information document has been filed with and certified by the Autorité des marchés financiers (“AMF”). Gaz de France has registered certain Gaz de France ordinary shares to be issued in connection with the business combination in the United States. For this purpose, on June 16, 2008, Gaz de France filed a registration statement on Form F-4, which includes a prospectus, with the United States Securities and Exchange Commission (“SEC”). Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information. When filed, investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s web site at www.sec.gov and will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of Suez securities may obtain free copies of documents filed with the AMF at the AMF’s website at www.amf-france.org or directly from Gaz de France on its web site at www.gazdefrance.com or directly from Suez on its website at www.suez.com, as the case may be.

Forward-Looking Statements

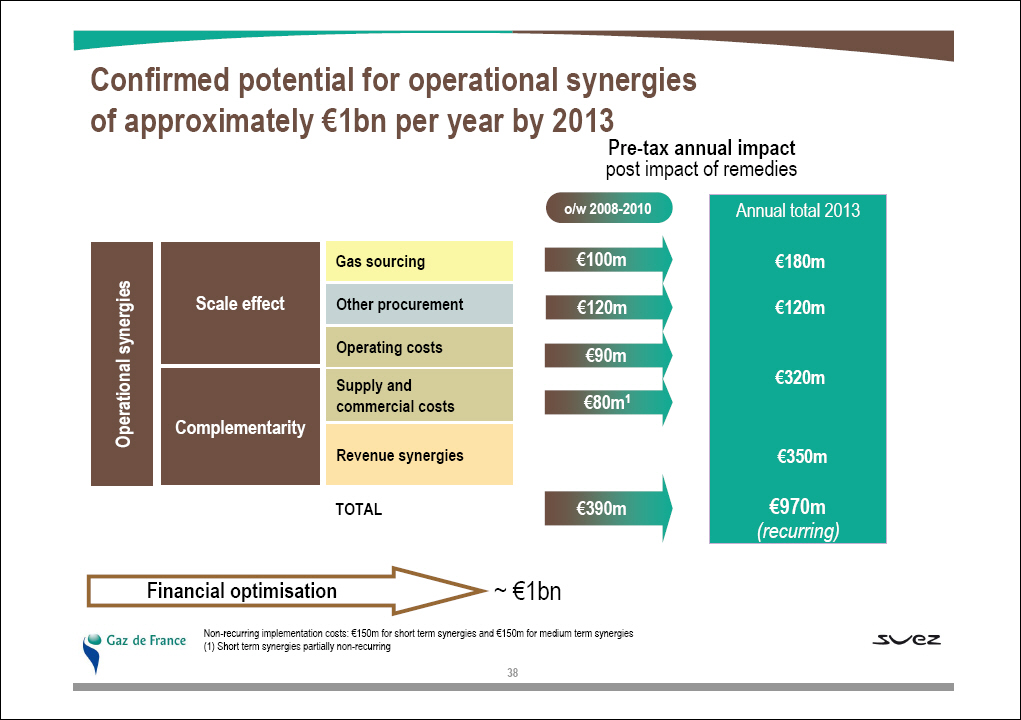

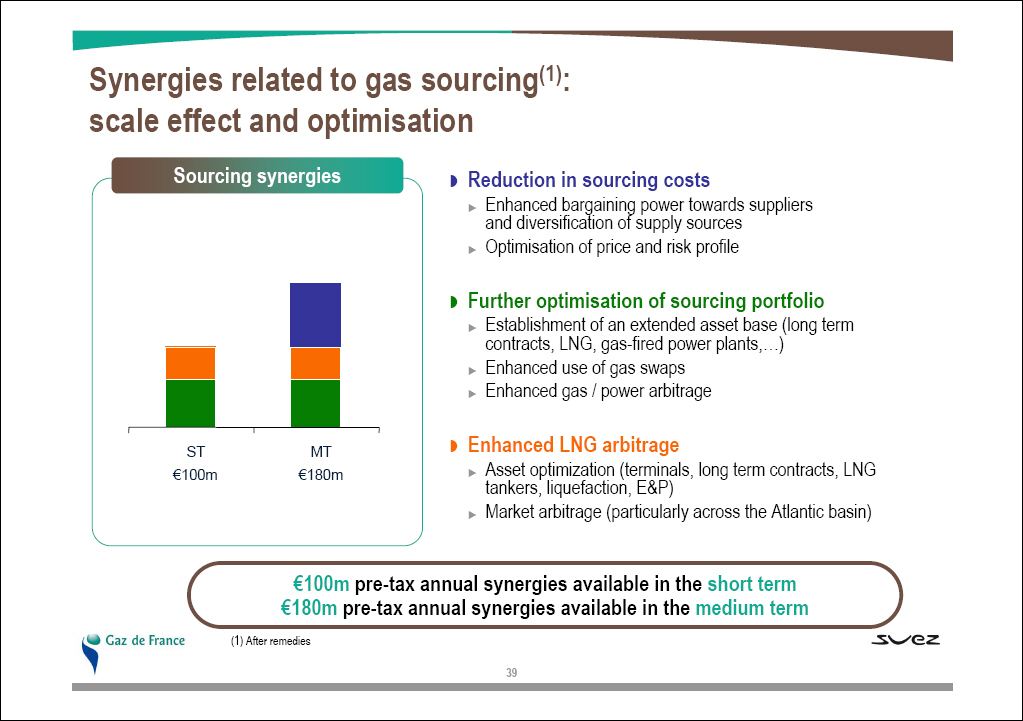

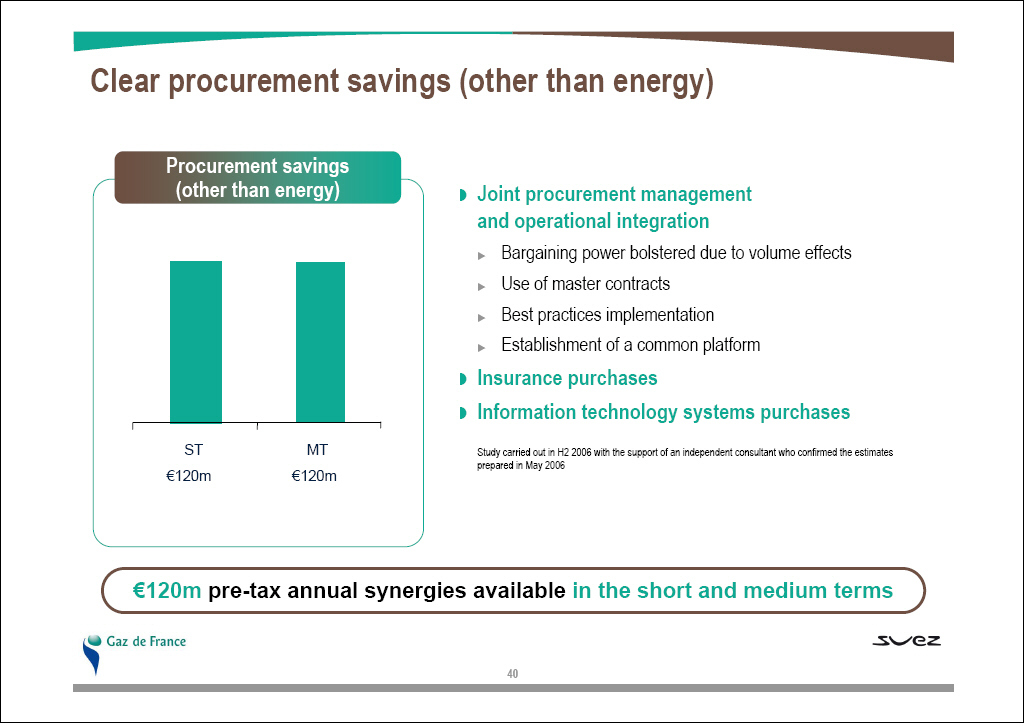

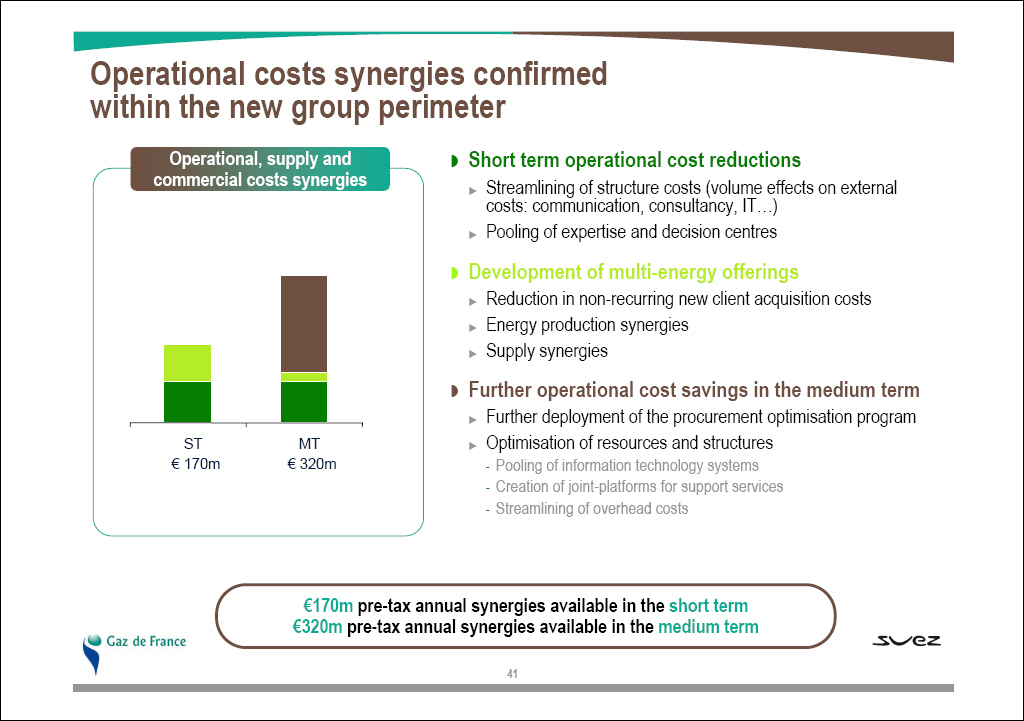

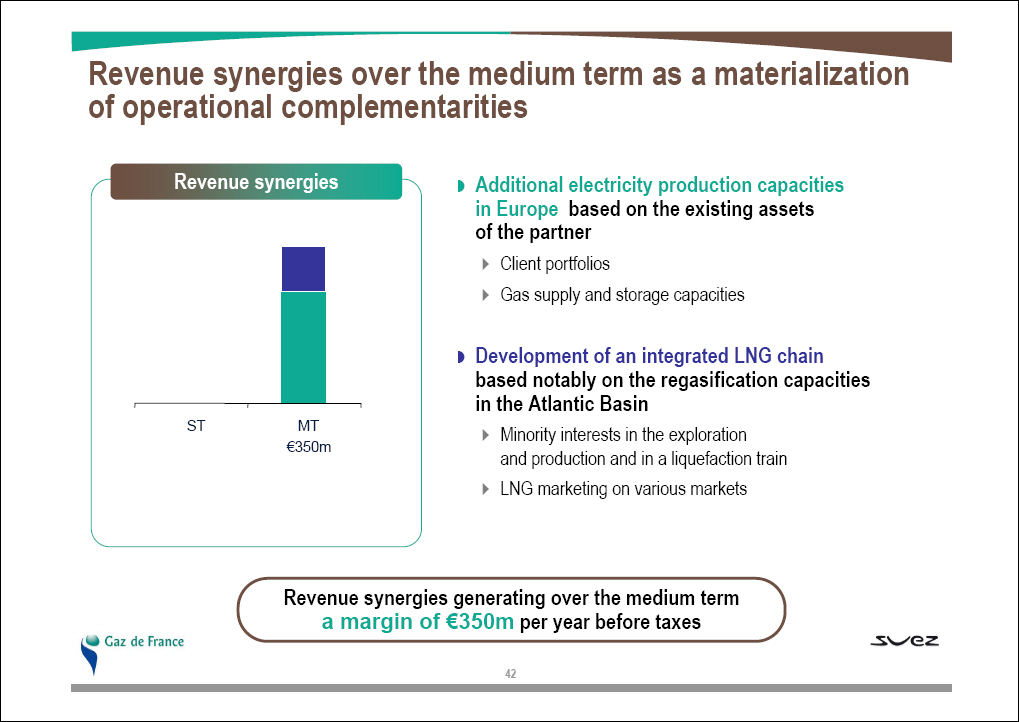

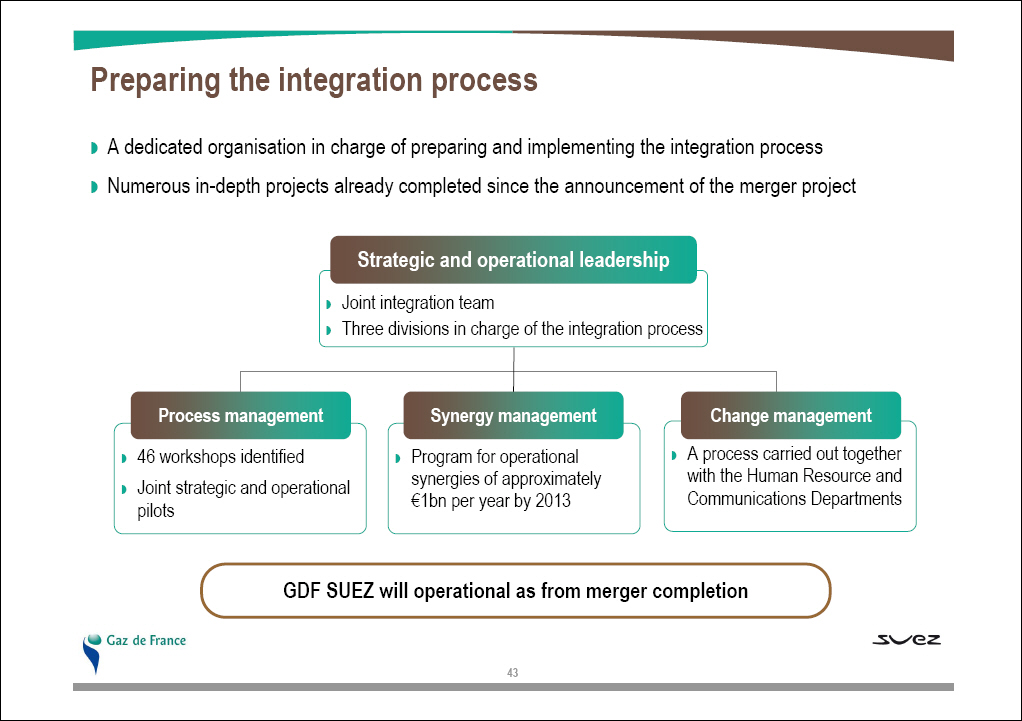

This communication contains forward-looking information and statements about Gaz de France, Suez, Suez Environment and their combined businesses after completion of the proposed transactions. Forward-looking statements are statements that are not historical facts. These statements include financial projections, synergies, cost-savings and estimates and their underlying assumptions, statements regarding plans,

objectives, savings, expectations and benefits from the transaction and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares are cautioned that forward-looking information and statements are not guarantees of future performances and are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results, developments, synergies, savings and benefits from the proposed transactions to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings made by Suez, Gaz de France and Suez Environnement Company with the AMF, including those listed under “Facteurs de Risques” (Risk factors) sections in the Document de Référence filed by Gaz de France with the AMF on May 15, 2008 (under no: R.08-056), in the the Document de Référence filed by Suez on March 18, 2008 (under no: D.08-0122) and its update filed on June 13, 2008 (under no: 08-0122-A01), in the prospectus prepared for the issue and admission for listing of GDF SUEZ shares resulting from the merger takeover of Suez by Gaz de France filed with the AMF on June 13, 2008 (under no: 08-126), the prospectus relating to the Suez Environnement Company shares filed with the AMF on June 13, 2008 (under no: 08-127), as well as documents filed by Suez with the SEC, including those listed under “Risk Factors” in the Annual Report on Form 20-F for 2006 that Suez filed with the SEC on June 29, 2007. Investors and holders of the Gaz de France, Suez or Suez Environnement Company securities should consider that the occurrence of some or all of these risks may have a material adverse effect on Gaz de France, Suez and/or Suez Environnement Company.