Filed by: Gaz de France

pursuant to Rule 165 and Rule 425(a)

under the Securities Act of 1933, as amended

Subject Company: SUEZ

Exchange Act File Number: 001-15232

Date: June 25, 2008

On June 16, 2008 the following slide show was presented by Gaz de France and Suez during a telephone conference with financial analysts concerning the proposed merger of Gaz de France and Suez. This slide show is available on Gaz de France’s web site.

Important Information

This communication does not constitute an offer to purchase, sell, or exchange or the solicitation of an offer to sell, purchase, or exchange any securities of Suez, Suez Environment (or any company holding the Suez Environment Shares) or Gaz de France, nor shall there be any offer, solicitation, purchase, sale or exchange of securities in any jurisdiction (including the United States, Germany, Italy and Japan) in which such offer, solicitation, purchase, sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France and Suez disclaim any responsibility or liability for the violation of such restrictions by any person.

The Gaz de France ordinary shares which would be issued in connection with the proposed business combination to holders of Suez ordinary shares (including Suez ordinary shares represented by Suez American Depositary Shares) may not be offered or sold in the United States except pursuant to an effective registration statement under the United States Securities Act of 1933, as amended, or pursuant to a valid exemption from registration. The Suez Environment shares (or the shares of any company holding the Suez Environment shares) have not been and will not be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an exemption from registration.

In connection with the proposed transactions, the required information document has been filed with, and certified by theAutorité des marchés financiers(“AMF”). Gaz de France has registered certain Gaz de France ordinary shares to be issued in connection with the business combination in the United States, and for this purpose, has filed on June 16, 2008, with the United States Securities and Exchange Commission (“SEC”), a registration statement on Form F-4 , which includes a prospectus.Investors are strongly advised to read the information document filed with the AMF, the registration statement and the prospectus, and any other relevant documents filed with the SEC and/or the AMF, as well as any amendments and supplements to those documents, because they will contain important information.Investors may obtain free copies of the registration statement, the prospectus as well as other relevant documents filed with the SEC, at the SEC’s web site atwww.sec.gov and will receive information at an appropriate time on how to obtain these transaction-related documents for free from Gaz de France or its duly designated agent. Investors and holders of Suez securities may obtain free copies of documents filed with the AMF at the AMF’s website atwww.amf-france.org or directly from Gaz de France on its web site atwww.gazdefrance.com or directly from Suez on its website atwww.suez.com, as the case may be.

Forward-Looking Statements

This communication contains forward-looking information and statements about Gaz de France, Suez, Suez Environment and their combined businesses after completion of the proposed transactions. Forward-looking statements are statements that are not historical facts. These statements include financial projections, synergies, cost-savings and estimates and their underlying assumptions, statements regarding plans, objectives, savings, expectations and benefits from the transaction and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expect,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Gaz de France and Suez believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France and Suez ordinary shares are cautioned that forward-looking information and statements are not guarantees of future performances and are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Gaz de France and Suez, that could cause actual results, developments, synergies, savings and benefits from the proposed transactions to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with theAutorité des marchés financiers(“AMF”) made by Gaz de France and Suez, including those listed under “Facteurs de Risques” in theDocument de Référencefiled by Gaz de France with the AMF on May 15, 2008 (under no: R.08-0056) and any update thereto and in the Form F-4 filed with the SEC on June 16, 2008, as well as any other documents filed by Gaz de France with the SEC; and in theDocument de Référencefiled by Suez on March 18, 2008 (under no: D.08-0122) and its update filed on June 13, 2008 (under no: 08/126), the prospectus relating to Suez Environnement Company shares filed with the AMF on June 13, 2008 (under no: 08-127), as well as documents filed by Suez with the SEC, including those listed under “Risk Factors” in the Annual Report on Form 20-F for 2006 that Suez filed with the SEC on June 29, 2007. Investors and holders of Gaz de France, Suez or Suez Environnement Company securities should consider that the occurrence of some or all of these risks may have a material adverse effect on Gaz de France, Suez and/or Suez Environnement Company.

* * * *

June 2008 A new World Leader in Energy |

2 Disclaimer Important Information This communication does not constitute an offer or the solicitation of an offer to purchase, sell, or exchange any securities of SUEZ, SUEZ Environnement Company securities or Gaz de France, nor shall there be any offer, solicitation, purchase, sale or exchange of securities in any jurisdiction (including the U.S., Canada, Germany, Italy, Australia and Japan) in which it would be unlawful prior to registration or qualification under the laws of such jurisdiction. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, Gaz de France, SUEZ and SUEZ Environnement Company disclaim any responsibility or liability for the violation of such restrictions by any person. The Gaz de France ordinary shares which would be issued in connection with the proposed merger to holders of SUEZ ordinary shares (including SUEZ American Depositary Shares (ADRs)) may not be offered or sold in the U.S. except pursuant to an effective registration statement under the U.S. Securities Act of 1933, as amended, or pursuant to a valid exemption from registration. SUEZ Environnement Company shares have not been and will not be registered under the US Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an exemption from registration. In connection with the proposed transactions, the required information documents have been filed with and certified by the Autorité des marchés financiers (AMF). Gaz de France is planning to register certain Gaz de France ordinary shares to be issued in connection with the merger in the U.S. and for this purpose will file with the U.S. Securities and Exchange Commission (SEC), a registration statement on Form F-4, which will include a prospectus. Investors are strongly advised to read the information documents that have been or will be filed with or certified by the AMF, the prospectus, and the U.S. registration statement, when available, and any other relevant documents filed with the SEC and/or the AMF, as well as any related amendments, if any, and/or supplements, because they will contain important information. Investors may obtain free copies of the U.S. registration statement and other relevant documents filed with the SEC at www.sec.gov. Investors and holders of SUEZ or Gaz de France securities may obtain free copies of documents filed with and certified by the AMF at www.amf-france.org or directly from Gaz de France, SUEZ and SUEZ Environnement Company at www.gazdefrance.com; www.suez.com or www.suez-environnement.com. Forward-Looking statements This communication contains forward-looking information and statements. These statements include financial projections, synergies, cost-savings and estimates and their underlying assumptions, statements regarding plans, objectives, savings, expectations and benefits from the transaction and expectations with respect to future operations, products and services, and statements regarding future performance. Although the management of SUEZ and Gaz de France believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Gaz de France, SUEZ or SUEZ Environnement Company ordinary shares are cautioned that forward-looking information and statements are not guarantees of future performances and are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of SUEZ, Gaz de France and SUEZ Environnement Company, that could cause actual results, developments, synergies, savings and benefits from the transaction to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings made by SUEZ, Gaz de France and SUEZ Environnement Company with the AMF, including those listed under “Facteurs de Risques” (Risk factors) sections in the Document de Référence filed by Gaz de France with the AMF on May 15, 2008 (under no: R.08-056), in the Document de Référence filed by SUEZ on March 18, 2008 (under no: D.08-0122) and its update filed on June 13, 2008 (under no: 08-0122-A01), in the prospectus prepared for the issue and admission for listing of GDF SUEZ shares resulting from the merger takeover of Suez by Gaz de France filed with the AMF on June 13, 2008 (under n°: 08-126 and the prospectus relating to the SUEZ Environnement Company shares filed with the AMF on June 13, 2008 (under no: 08-127). Investors and holders of Gaz de France, SUEZ or SUEZ Environnement Company securities should consider that the occurrence of some or all of these risks may have a material adverse effect on Gaz de France, SUEZ or/and SUEZ Environnement Company. |

3 Table of contents 1. July 2008: birth of a new World Leader in Energy 2. An ambitious and value-creating industrial development 3. Communications calendar 4. Conclusion |

July 2008: birth of a World Leader in Energy 1 |

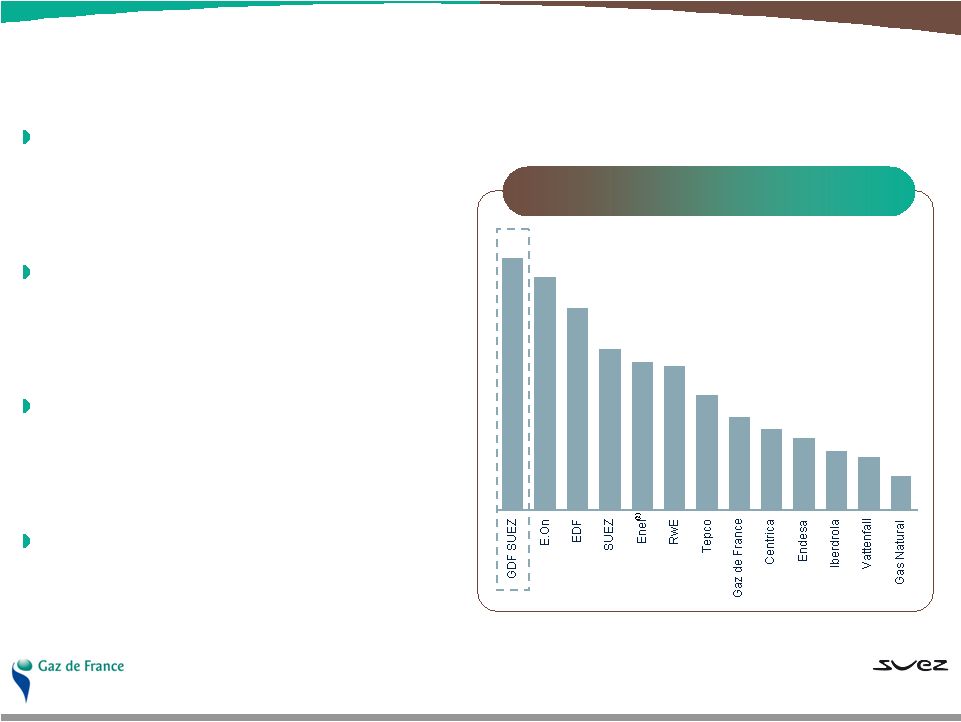

5 Birth of a World Leader in Energy Leader in natural gas in Europe A # 1 purchaser A # 1 transmission and distribution network A # 2 European storage operator Leader in electricity A # 5 power producer and supplier in Europe A # 2 French power producer A World leader in IPPs (1) World leader in LNG A # 1 importer and buyer in Europe A # 2 LNG terminal operator A Leader in the Atlantic basin European leader in energy services (1) Independent Power Producers (1) Published data (2) Proportional consolidation of Endesa as from October, 2007 74 69 60 47 44 43 34 27 24 21 17 16 10 2007 revenues (1) - € billion Main utilities in the world |

6 An industrial player with powerful assets A unique combination of businesses A Active in the entire energy value chain A Multi-energy offering A Strategy fit between the energy and services businesses Strong flexibility in energy generation and supply A Diversified and efficient power generation mix A Strong capacity for gas-electricity arbitrage A Diversified gas supplies with a strong LNG component A Optimisation at a global scale (LNG) and on the European market (storage) A major player in sustainable development A CO 2 light generation capacities A High portion of renewable energies A unique opportunity to strengthen commercial development opportunities of both Groups and to increase their strategic leverage in a sector undergoing major changes |

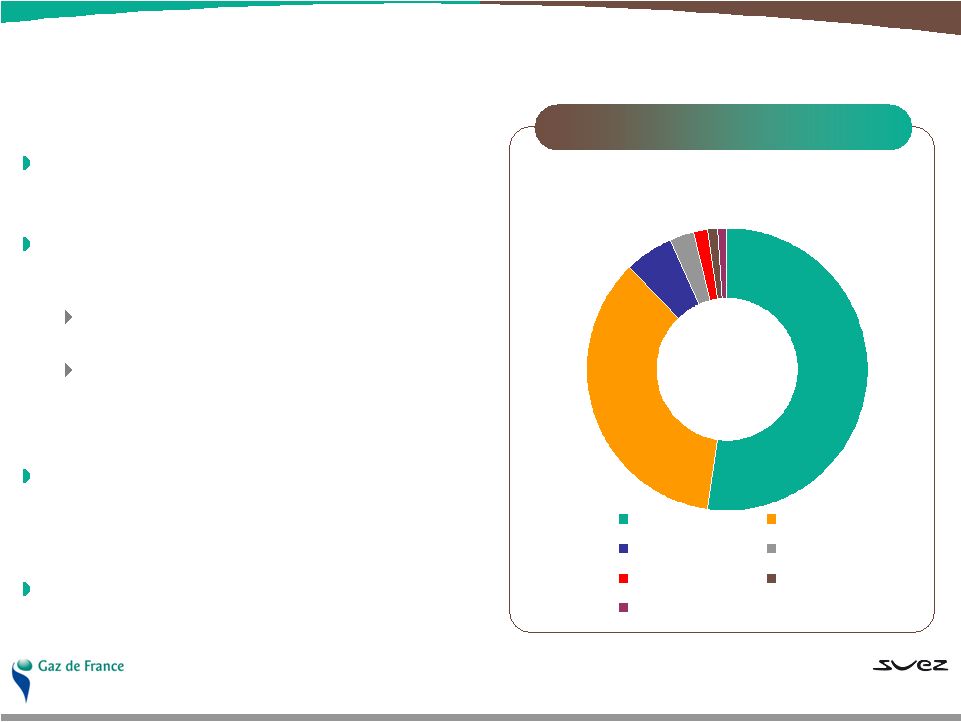

7 Merger terms subject to the vote of the EGMs 21 Gaz de France shares for 22 SUEZ shares Simultaneous distribution of 65% of the shares of SUEZ Environnement to SUEZ shareholders 1 SUEZ Environnement share for 4 SUEZ shares State approval regarding the fiscal neutrality (1) of the distribution of 65% of SUEZ Environnement (2) Number of shares for the new Group: 2,19bn (3) (including 28.5 millions treasury stocks) Ticker of the new Group: GSZ Proforma shareholding structure (3) 1.7% 2.8% 1.2% 1.1% 5.3% 52.2% 35.7% Others State GBL Employees CDC Areva CNP Assurances (1) In this respect, GDF SUEZ and SUEZ “main shareholders” (GBL, CDC, Sofina, CNP Assurances, Areva) have to keep their SUEZ Envrionnement shares for a 3-year period (2) Neutral for French shareholders and no French withholding tax for non residents shareholders (3) On a non-diluted basis as of May 22, 2008, detailed in appendices |

8 A merger in July 2008 Information relative to the merger and on the listing of SUEZ Environnement are available in the Prospectus registered with the AMF on June 13, 2008 Planned calendar and next steps Extraordinary and Ordinary General Meeting of the shareholders of SUEZ Completion of the merger by absorption of SUEZ within Gaz de France Listing of the GDF SUEZ shares July 16, 2008 July 22, 2008 Extraordinary and Ordinary General Meeting of the shareholders of Gaz de France July 16, 2008 Listing of the SUEZ Environnement shares on the Euronext Paris and Euronext Brussels markets |

9 GDF SUEZ will be in working order as soon as the merger is effective GDF SUEZ organization now defined A Role of the different management levels Headquarter - Divisions - Business units A Definition of the management process of functional departments Divisional and functional organization project now stabilized Operating interfaces between different Divisions already prepared Managers appointed before the merger Action plan for change management |

10 Remedies implementation status (1) Disposal of the 57.25% SUEZ stake in Distrigas for €2.7bn A Agreement signed with ENI on May 29, 2008 Implementation of Fluxys related commitments: stake in Fluxys to be brought down to 45% (and disposal of Gaz de France stake in Segeo to Fluxys) A Increase of the stake of the Group in the Zeebrugge terminal to 60% with the creation of Fluxys International Disposal of Cofathec Coriance for €44.6m A Agreement signed with A2A on May 29, 2008 Disposal of the 25.5% Gaz de France stake in SPE A Exclusivity period with EDF (1) Contingent on the completion of the merger Commitments to the European Commission on other remedies are being implemented in agreement with the Commission Implementation of the remedies in compliance with the commitments to the European Commission |

11 Acquisition of ENI energy assets Virtual power production (VPP) capacity of 1,100 MW in Italy for 20-years A Total production capacity of the Group in Italy raised to 4,600 MW, an increase of approximately 1/3 A Acquisition price of €1.2bn Natural gas distribution network of the city of Roma A 5,300 km of gas lines, 1.5bcm/year and 1.2 million access points A Acquisition price of €1.1bn Exploration & Production Assets A United Kingdom, Gulf of Mexico, Egypt, Indonesia A Acquisition price of €273m Supply contract for 4bcm/year of natural gas in Italy over 20 years A Option for an additional supply contract for delivery in Germany of 2.5bcm/year over 11 years Supply contract for 900 millions cm/year of LNG in the Gulf of Mexico over 20 years The new Group strengthens its footprint in Italy and in upstream gas activities |

12 Governance: composition of the new Board of Directors 10 directors proposed by Suez including 10 directors proposed by Gaz de France including 4 employee representatives including 3 representatives elected by the employees and 1 representative of the employee shareholders elected by the General Meeting Vice-Chairman and President Jean-François Cirelli 7 State representatives nominated by order, in accordance with the law Chairman and CEO Gérard Mestrallet 5 Board committees all chaired by an independent director Audit Committee, Appointments Committee, Compensation Committee, Ethics, Environment and Sustainable development Committee, and Strategy and Investments Committee Board of Directors consisting of 24 members: |

2 An ambitious and value-creating industrial development |

14 An ambitious development strategy Consolidate leadership positions in domestic markets: A France A Benelux Leverage complementarities to strengthen customer offerings: A Dual gas/electricity offers A Innovative energy services Boost its ambitious strategy of industrial development, notably in: A Upstream gas activities (E&P, LNG) A Infrastructures A Power generation, in particular nuclear and new & renewable energies Accelerate growth in all businesses lines in Europe Strengthen development areas internationally (Brazil, Thailand, the USA, Middle East, Turkey, Russia...) A Development of the IPP business in new fast-growing markets A combination consistent with both Groups’ strategies and allowing to boost their development |

15 A steady and consistent industrial development Development in natural gas, LNG and infrastructures Development in energy services In Energy services, many new contracts France and Belgium: green electricity from biogas contract (Aix en Provence), Fabricom GTI preferred bidder for construction and maintenance of electromagnetic devices of the Antwerp Ring In Europe, heating and cooling network (Amsterdam), creation of Fabricom Offshore Services in the UK, aiming at strengthening the offshore engineering offers, service contracts (Nuoro hospital in Sardegna) Middle East: strategic partnership in Qatar for the development of new cities Acquisition of new natural gas reserves and discovery of natural gas at West el Burullus in Egypt, beginning of operation of gas fields of Njord, Fram and Snovhit in Norway and Minke in the UK LNG supply contracts: extension of the Sonatrach contract, new supply contracts of 3.2 bcm of natural gas with Norsk Hydro over 4 years in the UK and of 10 bcm with Shell LNG terminals: doubling of the capacities at Zeebrugge (from 4.5 to 9 bcm), start of the construction of the LNG terminal in Mejillones (COD early 2010, Chile), long-term access to the Freeport terminal (Texas), construction of the Fos Cavaou terminal (8.25 bcm) and Montoir extension in France (from 10 up to 16.5 bcm) COD of a new gas tanker (Gaselys) Extension of storage capacity in the UK and in Romania |

16 A steady and consistent industrial development Increase in power generation capacity Development in environment Water Europe: many new contracts in France (SIAEP of Bas Languedoc, Grasse, Brasserie Kronenbourg,…) and developments in Spain (acquisition of the minority interests of AGBAR and acquisition of 33% of Aguas de Valencia) and in Chile via AGBAR (Essal) Waste Europe: many new contracts in France (Airbus, Rambouillet…), development in recycling in France (JV SITA/Renault to develop end of life vehicle recycling and JV SITA/Michelin for tires) and in waste to energy business (EVI, Baviro...), acquisitions in Germany (BellandVision) and in Sweden (buy-out of minority interests of Sita Sverige) International: management contract with the city of Jeddah, acquisition of Utility Service Company and successful renewals of Jersey city and Gary contracts in the USA, acquisition of 7.5% of Chongqing Water Group in China, Degrémont contracts in India and Middle-East Hydraulic capacities: Jirau (3,300 MW) and Ponte de Pedra (176 MW) in Brazil, La Verna in France Thermal capacities: CCGT power plant of Teesside Power Limited in England (1,875 MW), Ras Laffan project in Qatar (2,730 MW and desalination of 286,000 cm/day), Astoria in New York (575 MW), coal-fired power plant in Thailand (660 MW), CCGT France (Cycofos, Montoir) and peak power plant at Saint Brieuc Acquisition of 79% of Elettrogrees, operator in the electricity wholesale market in Italy Wind capacities: Canada, France and Portugal Co-generation capacities: 6 power plants in Italy (370 MW) Securization of supply needs in enriched uranium: ownership interest agreement in George Besse II plant |

17 A strong financial profile 2007 IFRS proforma (1) unaudited data In €bn Revenues 74.3 EBITDA 13.1 Current operating income 8.3 Net income group share 5.6 Net income group share per share €2.56/share Capex 9.2 (2) Net financial debt 15.8 Shareholders’ equity 67 A financial structure that sustains the ambitious strategy of industrial growth A Low gearing A Strong potential for cash flow generation A key stock in the energy sector A Among the top 3 listed utilities Accounting consequence from the merger A Allocation of €14.3bn goodwill to the assets of Gaz de France (from an accounting perspective, reverse acquisition of Gaz de France by SUEZ) A Post allocation, residual goodwill amounts to €17.1bn (1) A Generation of an amortization charge (1) of approximately €750m/year on average (1) Definition in appendices; On the basis of a preliminary allocation of the purchase price (2) 07 SUEZ CAPEX + 07 Gaz de France CAPEX Financial profile GDF SUEZ |

18 Strong prospects for profitable growth EBITDA (1) target of €17bn in 2010 Potential for operational synergies of approximately €1bn per year in 2013 Average annual capex of €10bn (2) between 2008–10 Strict financial discipline Ratings target: Strong A Confirmation of medium-term financial objectives of the new Group (1) Proforma GDF SUEZ EBITDA definition (2) Industrial investments (maintenance and development) which mainly relate to organic growth |

19 An attractive shareholder remuneration policy Dynamic dividend policy targeting an attractive yield compared to the sector average A Target payout ratio: above 50% of Group recurring net income A Average annual growth in dividend per share of 10% to 15% between dividend paid in 2007 (1) and dividend paid in 2010 Additional shareholder return through: A Exceptional dividends A Share buy backs (1) Based on the Gaz de France dividend paid in 2007 and related to fiscal year 2006 ( €1.1 per share); SUEZ shareholders will also benefit from dividends distributed by SUEZ Environnement from 2009 for fiscal year 2008 |

21 2008 Half-Year Results August 31, 2008 A Presentation of H1 2008 results of SUEZ and Gaz de France (on a stand alone basis) A Presentation of H1 2008 pro forma results of GDF SUEZ (on a non segmented basis) Planned communication calendar 2008 GDF SUEZ Investor Day: Q4 2008 A Strategic update post-merger, notably on integration, synergies, investments program and mid-term outlook for GDF SUEZ A Presentation of GDF SUEZ pro forma results by Division |

23 A merger on track Creation of a World Leader in Energy A strong value-creating potential for industrial development A dynamic remuneration policy for shareholders GDF SUEZ in working order as soon as the merger is effective |

5 Appendices 1. Financial Data 2. Governance and organisation 3. Prospects and industrial strategy 4. Integration |

25 Definition of EBITDA applied to the new Group 8,339 Current Operating Income (combined proforma) (1) 4,197 + Depreciation, amortization and provisions (1) 123 + Share-based payments 481 + Net disbursements under concession contracts 13,140 Combined unaudited pro forma EBITDA of GDF SUEZ (2007 scope) (1) Post impact of preliminary estimate of "Purchase Price Allocation" (+€750m in depreciation & amortization) 2007 pro forma unaudited data in €m |

26 From previous published numbers to EBITDA of the new Group 7,965 EBITDA published by SUEZ 126 - Pensions and other similar provisions reversals / accruals (1) (200) - Financial income (excluding interests received) (458) - Share in net income of associates 7,433 = SUEZ EBITDA based on the new Group definition (1) Items reported under interest income excluded 5,666 EBITDA published by Gaz de France (64) - Capital gains / losses from tangible and intangible assets sales 87 - Mark-to-Market of operating financial instruments 16 + Provision accruals on current assets 2 - Restructuring costs 5,707 = Gaz de France EBITDA based on the new Group definition 13,140 Pro forma EBITDA of GDF SUEZ - unaudited 2007 pro forma unaudited data (in €m) |

27 New Group pro forma summary P&L 74,252 Revenues (35,397) Purchases (10,767) Personnel costs (4,197) Depreciation, amortization and provisions (15,552) Other operating income (loss) 8,339 Current operating income (19) Mark-to-Market on commodity contracts other than trading instruments (146) Impairment (45) Restructuring costs 403 Disposals of assets, net 8,532 Income from operating activities (1) (797) Net financial cost (210) Other financial income (expense) (1,409) Income tax 527 Share in net income of associates 6,643 Net income 5,566 o/w attributable to parent company shareholder 1,077 o/w minority interest 2007 pro forma unaudited data (in €m) (1) Current operating income defined as operating income before mark-to-market on commodity contracts other than trading instruments, impairment, restructuring costs and disposals of assets, net |

28 Preliminary allocation of acquisition goodwill (in €Bn) Step-up concession assets Net assets historical costs Initial goodwill Residual goodwill Net assets fair value Step-up tangible assets Step-up intangible assets Step-up associates Deferred tax (liability) 16.2 26.2 6.3 5.3 2.3 0.4 30.5 11.9 5.2 17.1 25.3 |

29 Shareholding structure of Gaz de France and SUEZ (1) In % Million shares 79.8% 785 French State 2.0% 19.7 Gaz de France employees 11.0% 108.4 Institutional investors 1.0% 9.8 SUEZ 4.7% 42.3 Individual investors 98.5% 965.2 Total, excluding treasury stock 1.5% 18.7 Treasury stock 100.0% 983.9 Total In % Million shares 3.0% 38.9 SUEZ employees 9.4% 122.8 GBL 1.2% 15.9 Crédit Agricole Group 2.9% 38.4 CDC Group 2.1% 27.6 Areva 1.9% 24.8 CNP Assurances Group 1.3% 16.5 Sofina 0.6% 8.0 Gaz de France 74.9% 980.4 Other 97.3% 1,273.2 Total, excluding treasury stock 2,7% 35,7 Treasury stock 100,0% 1,308.9 Total (1) Shareholding as of May 22, 2008 Gaz de France shareholders (undiluted) SUEZ shareholders (undiluted) |

30 Proforma GDF SUEZ shareholding structure Million shares In % State 781.4 35.7% Gaz de France employees 24.8 1.1% Institutional investors 108.4 4.9% Gaz de France public 40.7 1.9% SUEZ employees 37.1 1.7% GBL 117.2 5.3% Crédit Agricole Group 15.1 0.7% CDC Group 36.7 1.7% Areva 26.4 1.2% CNP Assurances Group 23.6 1.1% Sofina 15.8 0.7% SUEZ other 935.9 42.7% Option-related dilution - - Total, excluding treasury stock 2,163.0 98.7% Treasury stock 28.5 1.3% Total 2,191.5 100.0% Million shares In % State 781.4 35.0% Gaz de France employees 24.8 1.1% Institutional investors 108.4 4.9% Gaz de France public 40.7 1.8% SUEZ employees 37.1 1.7% GBL 117.2 5.2% Crédit Agricole Group 15.1 0.7% CDC Group 36.7 1.6% Areva 26.4 1.2% CNP Assurances Group 23.6 1.1% Sofina 15.8 0.7% SUEZ other 935.9 41.9% Dilution 50.6 2.3% Total, excluding treasury stock 2,213.6 99.0% Treasury stock 21.3 1.0% Total 2,234.9 100.0% Notes (1) Based on the shareholding structure of SUEZ and Gaz de France as of May 22, 2008 (2) Taking into account the bonus shares of Gaz de France: grant of 3.6 million bonus Gaz de France shares transferred from the State to the Gaz de France employees and 1.5 million Gaz de France shares granted to the employees of Gaz de France and bought back on the market For SUEZ, grant of 6.8 million SUEZ shares paid in treasury stock (3) SUEZ treasury stock and ownership interest of Gaz de France in SUEZ not exchanged in GDF SUEZ shares (4) Taking into account of dilutive instruments: For Gaz de France, no dilutive instruments For SUEZ, taking into account stock options post operation Undiluted GDF SUEZ shareholding structure (1,2,3) Diluted GDF SUEZ shareholding structure (1,2,3,4) |

31 Composition of the Board of Directors Initially 24 members* Gérard Mestrallet (2012) Paul Desmarais Jr (2012) René Carron (2011) Thierry de Rudder (2011) Etienne Davignon (2010) Edmond Alphandery (2011) Jacques Lagarde (2012) Anne Lauvergeon (2012) Lord Simon of Highbury (2012) Aldo Cardoso (2011) State Representative Philippe Lemoine (2012) (2) Richard Goblet d’Alviella (2012) (2) Representative of the employees (1) * reduced to 22 members in 2010 SUEZ Gaz de France (censor) (censor) (1) Nominated within 6 months after the merger (2) Consultative (non-voting) Shareholders Albert Frère (2011) Jean-François Cirelli (2012) Jean-Louis Beffa (2012) State Representative State Representative State Representative State Representative State Representative State Representative Representative of the employees (1) Representative of the employees (1) Representative of the employees (1) |

32 Committees of the Board of Directors 3 to 5 members 1/2 independent members at least 3 to 5 members 1/2 independent members at least Meetings: once a year at least Strategy and Investments committee 3 to 6 members 2/3 independent members at least (in accordance with the Bouton Report Meetings: 4 times a year at least, in particular before each half year and annual closing Audit committee All committees chaired by an independent director 3 to 5 members 1/2 independent members at least Meetings: twice a year at least Compensation committee 3 to 5 members 1/2 independent members at least Meetings: once a year at least Appointments committee Ethics, Environement and Sustainable development committee |

33 Operational structure of GDF SUEZ Chairman and CEO – Gérard Mestrallet Vice-Chairman, President – Jean-François Cirelli Energy Policy Committee Jean-Pierre Hansen Dirk Beeuwsaert (deputy) Energy France Henri Ducré Energy Europe & International Global Gas and LNG Jean-Marie Dauger Infrastructures Yves Colliou Energy services Jérôme Tolot Environment Jean-Louis Chaussade Energy Benelux - Germany Jean-Pierre Hansen Energy Europe Pierre Clavel Energy International Dirk Beeuwsaert |

34 Stable shareholding structure for SUEZ Environnement Shareholders' agreement between GDF SUEZ (35% of the capital of SUEZ Environnement) and some of the main shareholders (1) of SUEZ representing approximately 47% of the capital of SUEZ Environnement Initial duration of 5 years Reciprocal preemption right of the parties to the agreement Commitment of the parties not to acquire SUEZ Environnement shares in excess of the threshold triggering the filing of a mandatory takeover bid Effective control of GDF SUEZ over SUEZ Environnement GDF SUEZ will name half the members of the Board of Directors The Chairman of the Board of Directors, who will have a casting vote, will be nominated by the Board of Directors, based on the proposal of GDF SUEZ Full consolidation in the financial statements of GDF SUEZ Stable ownership interest and effective control of GDF SUEZ over SUEZ Environnement (1) Shareholders' agreement between, in addition to GDF SUEZ: Areva, CDC, GBL, Groupe CNP Assurances and Sofina |

35 The State will be a shareholder of the new Group (approximately 35.7% of capital) Representation of the State at the Board of Directors (7 Directors) (1) Clear separation between the State as a shareholder and as a regulator Specific right of the State: Right to veto decisions related to disposal of assets located in France that could negatively impact French national interests in the Energy sector Assets at stake: gas pipelines, assets related to distribution, underground storage and LNG terminals A clearly defined role of the French State (1) 6 in May 2010 |

36 Ambitious industrial objectives in all businesses Develop multi- energy offerings Reach 20% market share of “retail” power market Increase generation capacity Priority given to development in Europe Strengthening of development areas internationally Development of generation capacity Target reserves of 1,500 mboe (1) Continue diversifying and optimizing gas sourcing portfolio Reinforce the group’s leading position in LNG in the Atlantic basing Grow contracted volumes by 30% Grow unloading capacity in the Atlantic basin by 85% Increase regasification capacity in France and in Belgium to 44 bcm³ / year in 2013 Expand storage capacity in Europe (+35% between 2006 and 2013) Increase the group’s transmission capacities by 15% Leverage the strategic fit between Gaz de France and SUEZ on the short term Accelerate profitable development on the basis of: Strong know-how in optimizing energy facilities Complete multi-service offers A unique European network Growth strategy focused on Europe Grow selectively internationally through the implementation of new business models: Management contracts Long term joint ventures/partnerships Innovative financial arrangements (1) Mainly through external growth (2) Includes Tricastin and Chooz Energy France Energy Europe & International Global Gas and LNG Infrastructures Energy services Environment Objective: 100 GW managed capacity by 2013, of which more than 10 GW (2) in France |

37 A sustained industrial capex program Indicative split of annual capex (¹) , average between 2008-2010 1.5-2.0 1.0-1.5 4.0-4.5 0.3-0.5 ~ 1.5 1.0-1.5 In €bn Average annual capex of €10bn (1) between 2008-10 and more than €8bn (1) capex in 2008 (1) Industrial investments (maintenance and development) which mainly relate to organic growth capex Energy France Energy Europe & International Global Gas and LNG Infrastructures Services Energy Environment |

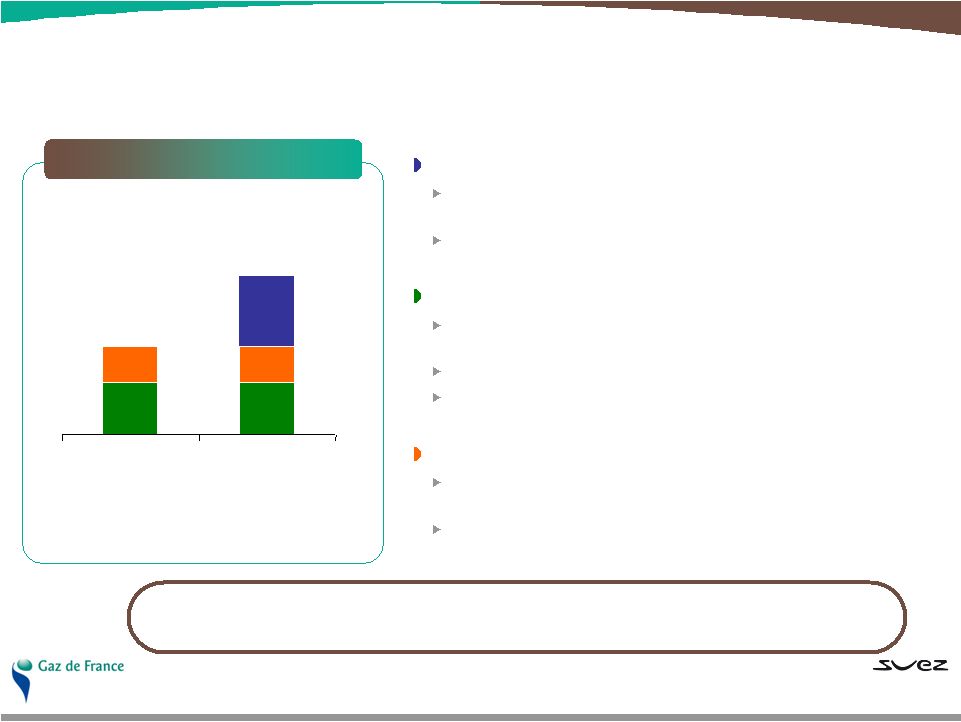

38 Confirmed potential for operational synergies of approximately €1bn per year by 2013 Scale effect Complementarity o/w 2008-2010 Operating costs Revenue synergies Supply and commercial costs Annual total 2013 €970m (recurring) €320m €100m €90m €120m €390m €80m TOTAL Non-recurring implementation costs: €150m for short term synergies and €150m for medium term synergies (1) Short term synergies partially non-recurring Pre-tax annual impact post impact of remedies €180m Gas sourcing Other procurement Financial optimisation ~ €1bn €350m €120m 1 |

39 Synergies related to gas sourcing (1) : scale effect and optimisation Reduction in sourcing costs Enhanced bargaining power towards suppliers and diversification of supply sources Optimisation of price and risk profile Further optimisation of sourcing portfolio Establishment of an extended asset base (long term contracts, LNG, gas-fired power plants,…) Enhanced use of gas swaps Enhanced gas / power arbitrage Enhanced LNG arbitrage Asset optimization (terminals, long term contracts, LNG tankers, liquefaction, E&P) Market arbitrage (particularly across the Atlantic basin) €100m pre-tax annual synergies available in the short term €180m pre-tax annual synergies available in the medium term (1) After remedies ST €100m MT €180m Sourcing synergies |

40 Clear procurement savings (other than energy) Joint procurement management and operational integration Bargaining power bolstered due to volume effects Use of master contracts Best practices implementation Establishment of a common platform Insurance purchases Information technology systems purchases Study carried out in H2 2006 with the support of an independent consultant who confirmed the estimates prepared in May 2006 ST €120m MT €120m €120m pre-tax annual synergies available in the short and medium terms Procurement savings (other than energy) |

41 Operational costs synergies confirmed within the new group perimeter Short term operational cost reductions Streamlining of structure costs (volume effects on external costs: communication, consultancy, IT…) Pooling of expertise and decision centres Development of multi-energy offerings Reduction in non-recurring new client acquisition costs Energy production synergies Supply synergies Further operational cost savings in the medium term Further deployment of the procurement optimisation program Optimisation of resources and structures - Pooling of information technology systems - Creation of joint-platforms for support services - Streamlining of overhead costs €170m pre-tax annual synergies available in the short term €320m pre-tax annual synergies available in the medium term ST € 170m MT € 320m Operational, supply and commercial costs synergies |

42 Revenue synergies over the medium term as a materialization of operational complementarities Additional electricity production capacities in Europe based on the existing assets of the partner Client portfolios Gas supply and storage capacities Development of an integrated LNG chain based notably on the regasification capacities in the Atlantic Basin Minority interests in the exploration and production and in a liquefaction train LNG marketing on various markets Revenue synergies generating over the medium term a margin of €350m per year before taxes ST MT €350m Revenue synergies |

43 Joint integration team Three divisions in charge of the integration process Preparing the integration process A dedicated organisation in charge of preparing and implementing the integration process Numerous in-depth projects already completed since the announcement of the merger project A process carried out together with the Human Resource and Communications Departments Program for operational synergies of approximately €1bn per year by 2013 46 workshops identified Joint strategic and operational pilots Process management Synergy management Change management Strategic and operational leadership GDF SUEZ will operational as from merger completion |

44 Opinions on transaction consideration Opinions to Gaz de France Opinions to SUEZ Fairness opinion on exchange terms issued by BNP Paribas and JP Morgan as advisor to SUEZ Fairness opinion on exchange terms issued by HSBC as advisor to SUEZ Board « Attestation d’équité» (fairness opinion) from Oddo as an independant expert Report by Messrs Ledouble, Ricol et Baillot, « commissaires à la fusion » Report by Messrs Ledouble, Ricol et Baillot, « commissaires à la fusion » Fairness opinion on exchange terms issued by Merrill Lynch and Lazard Frères as advisor to Gaz de France and fairness bank to Gaz de France board Fairness opinion on exchange terms issued by Goldman Sachs International as fairness bank to Gaz de France board |

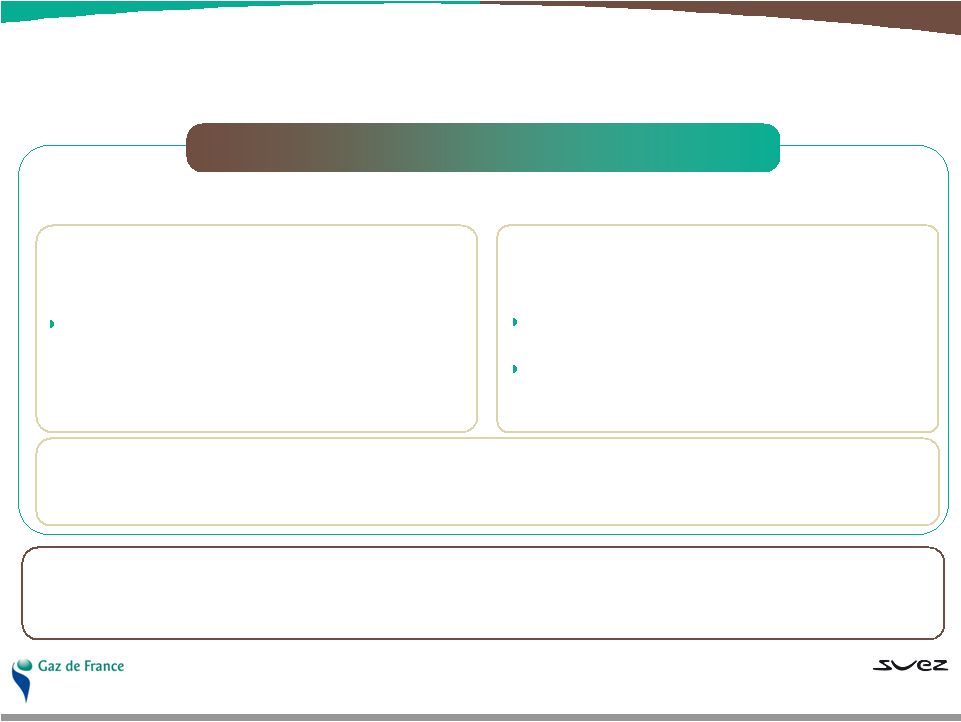

45 Merger legal steps Gaz de France Shareholders 100% SUEZ Shareholders Merger-absorbtion of Rivolam by Suez Contribution by SUEZ to SEC of 100% of SUEZ Environnement shares 100% Distribution by SUEZ to its shareholders (other than itself) of 65% of SEC shares post-contribution GDF SUEZ merger Rivolam 100% 1 2 3 4 |