UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

S ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2005,

OR

£ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO .

Commission

File Number

| Registrants, State of Incorporation,

Address, and Telephone Number

| I.R.S. Employer

Identification No.

|

| | 001-09120 | | PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

(A New Jersey Corporation)

80 Park Plaza, P.O. Box 1171

Newark, New Jersey 07101-1171

973 430-7000

http://www.pseg.com | | 22-2625848 | |

| | 001-00973 | | PUBLIC SERVICE ELECTRIC AND GAS COMPANY

(A New Jersey Corporation)

80 Park Plaza, P.O. Box 570

Newark, New Jersey 07101-0570

973 430-7000

http://www.pseg.com | | 22-1212800 | |

| | 000-49614 | | PSEG POWER LLC

(A Delaware Limited Liability Company)

80 Park Plaza—T25

Newark, New Jersey 07102-4194

973 430-7000

http://www.pseg.com | | 22-3663480 | |

| | 000-32503 | | PSEG ENERGY HOLDINGS L.L.C.

(A New Jersey Limited Liability Company)

80 Park Plaza—T20

Newark, New Jersey 07102-4194

973 430-7000

http://www.pseg.com | | 42-1544079 | |

Securities registered pursuant to Section 12(b) of the Act:

Registrant

| | Title of Each Class

| | Name of Each Exchange

On Which Registered

|

Public Service Enterprise

Group Incorporated | | Common Stock without

par value | | New York Stock Exchange |

5.381% Preferred Trust Securities, $50 liquidation amount per Preferred Trust Security, issued by PSEG Funding Trust I (Registrant) and listed on the New York Stock Exchange.

Trust Originated Preferred Securities (Guaranteed Preferred Beneficial Interest in PSEG's Debentures), $25 par value at 8.75%, issued by PSEG Funding Trust II (Registrant) and listed on the New York Stock Exchange.

Registrant

| | Title of Each Class

| | Title of Each Class

| | Name of Each Exchange

On Which Registered

|

Public Service Electric and

Gas Company | | Cumulative Preferred Stock

$100 par value Series: | | First and Refunding

Mortgage Bonds: | | |

| | | | | | | Series | | Due | | |

| | | 4.08% | | 91⁄4% | | CC | | 2021 | | |

| | | 4.18% | | 63⁄4% | | UU | | 2006 | | |

| | | 4.30% | | 63⁄4% | | VV | | 2016 | | New York Stock Exchange |

| | | 5.05% | | 61⁄4% | | WW | | 2007 | | |

| | | 5.28% | | 63⁄8% | | YY | | 2023 | | |

| | | | | 8% | | | | 2037 | | |

| | | | | 5% | | | | 2037 | | |

(Cover continued on next page)

(Cover continued from previous page)

Securities registered pursuant to Section 12(g) of the Act:

Registrant

| | Title of Class

|

| Public Service Enterprise Group Incorporated | | Floating Rate Capital Securities (Guaranteed Preferred Beneficial Interest in PSEG's Debentures), $1,000 par value issued by Enterprise Capital Trust II (Registrant), LIBOR plus 1.22% |

| | | Floating Rate Notes, Series A |

| Public Service Electric and Gas Company | | 6.92% Cumulative Preferred Stock $100 par value

Medium-Term Notes, Series A

Medium-Term Notes, Series B

Medium-Term Notes, Series C

Medium-Term Notes, Series D |

| PSEG Power LLC | | Limited Liability Company Membership Interest |

| PSEG Energy Holdings L.L.C. | | Limited Liability Company Membership Interest |

Indicate by check mark whether each registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| | Public Service Enterprise Group Incorporated | | Yes S | | No £ |

| | Public Service Electric and Gas Company | | Yes £ | | No S |

| | PSEG Power LLC | | Yes £ | | No S |

| | PSEG Energy Holdings L.L.C. | | Yes £ | | No S |

Indicate by check mark if each of the registrants is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes £ No S

Indicate by check mark whether each of the registrants (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants were required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes S No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. S

Indicate by check mark whether each registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act).

| | Public Service Enterprise Group Incorporated | | Yes S | | No £ |

| | Public Service Electric and Gas Company | | Yes £ | | No S |

| | PSEG Power LLC | | Yes £ | | No S |

| | PSEG Energy Holdings L.L.C. | | Yes £ | | No S |

Indicate by check mark whether any of the registrants is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes £ No S

The aggregate market value of the Common Stock of Public Service Enterprise Group Incorporated held by non-affiliates as of June 30, 2005 was $14,247,381,923 based upon the New York Stock Exchange Composite Transaction closing price.

The number of shares outstanding of Public Service Enterprise Group Incorporated's sole class of Common Stock, as of the latest practicable date, was as follows:

Class

| | Outstanding at January 31, 2006

|

| Common Stock, without par value | | 251,168,819 |

As of January 31, 2006, Public Service Electric and Gas Company had issued and outstanding 132,450,344 shares of Common Stock, without nominal or par value, all of which were privately held, beneficially and of record by Public Service Enterprise Group Incorporated.

PSEG Power LLC and PSEG Energy Holdings L.L.C. are wholly owned subsidiaries of Public Service Enterprise Group Incorporated and meet the conditions set forth in General Instruction I(1)(a) and (b) of Form 10-K and are filing their respective Annual Reports on Form 10-K with the reduced disclosure format authorized by General Instruction I.

DOCUMENTS INCORPORATED BY REFERENCE—NONE

TABLE OF CONTENTS

i

Page

ii

FORWARD-LOOKING STATEMENTS

Certain of the matters discussed in this report constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from those anticipated. Such statements are based on management's beliefs as well as assumptions made by and information currently available to management. When used herein, the words “anticipate,” “intend,” “estimate,” “believe,” “expect,” “plan,” “hypothetical,” “potential,” “forecast,” “project,” variations of such words and similar expressions are intended to identify forward-looking statements. Public Service Enterprise Group Incorporated (PSEG), Public Service Electric and Gas Company (PSE&G), PSEG Power LLC (Power) and PSEG Energy Holdings L.L.C. (Energy Holdings) undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The following review should not be construed as a complete list of factors that could effect forward-looking statements. In addition to any assumptions and other factors referred to specifically in connection with such forward-looking statements discussed above, factors that could cause actual results to differ materially from those contemplated in any forward-looking statements include, among others, the following:

| • | business conditions, financial market, credit rating, regulatory and other risks resulting from the pending merger with Exelon Corporation; |

| |

| • | regulatory issues that significantly impact operations; |

| |

| • | operating performance or cash flow from investments falling below projected levels; |

| |

| • | credit, commodity, interest rate, counterparty and other financial market risks; |

| |

| • | liquidity and the ability to access capital and maintain adequate credit ratings; |

| |

| • | adverse or unanticipated weather conditions that significantly impact costs and/or operations, including generation; |

| |

| • | changes in the electric industry, including changes to power pools; |

| |

| • | changes in demand resulting from changes in prices; |

| |

| • | changes in the number of market participants and the risk profiles of such participants; |

| |

| • | changes in technology that make generation, transmission and/or distribution assets less competitive; |

| |

| • | availability of power transmission facilities that impact the ability to deliver output to customers; |

| |

| • | growth in costs and expenses; |

| |

| • | environmental regulations that significantly impact operations; |

| |

| • | changes in rates of return on overall debt and equity markets that could adversely impact the value of pension and other postretirement benefits assets and liabilities and the Nuclear Decommissioning Trust Funds; |

| |

| • | ability to maintain satisfactory regulatory results; |

| |

| • | changes in political conditions, recession, acts of war or terrorism; |

| |

| • | continued availability of insurance coverage at commercially reasonable rates; |

| |

| • | involvement in lawsuits, including liability claims and commercial disputes; |

| |

| • | inability to attract and retain management and other key employees, particularly in view of the pending merger with Exelon Corporation; |

| |

| • | acquisitions, divestitures, mergers, restructurings or strategic initiatives that change PSEG's, PSE&G's, Power's and Energy Holdings' strategy or structure; |

| |

| • | business combinations among competitors and major customers; |

| |

| • | general economic conditions, including inflation or deflation; |

| |

| • | changes to accounting standards or accounting principles generally accepted in the U.S., which may require adjustments to financial statements; |

| |

| • | changes in tax laws and regulations; |

| |

| • | ability to recover investments or service debt as a result of any of the risks or uncertainties mentioned herein; |

iii

PSEG, PSE&G and Energy Holdings

| • | ability to obtain adequate and timely rate relief; |

PSEG, Power and Energy Holdings

| • | inability to effectively manage portfolios of electric generation assets, gas supply contracts and electric and gas supply obligations; |

| |

| • | energy transmission constraints or lack thereof; |

| |

| • | adverse changes in the market for energy, capacity, natural gas, emissions credits, congestion credits and other commodity prices, especially during significant price movements for natural gas and power; |

| |

| • | surplus of energy capacity and excess supply; |

| |

| • | substantial competition in the worldwide energy markets; |

| |

| • | margin posting requirements, especially during significant price movements for natural gas and power; |

| |

| • | availability of fuel and timely transportation at reasonable prices; |

| |

| • | effects on competitive position of actions involving competitors or major customers; |

| |

| • | changes in product or sourcing mix; |

| |

| • | delays, cost escalations or unsuccessful construction and development; |

PSEG and Power

| • | changes in regulation and safety and security measures at nuclear facilities; |

PSEG and Energy Holdings

| • | changes in foreign currency exchange rates; |

| |

| • | deterioration in the credit of lessees and their ability to adequately service lease rentals; |

| |

| • | ability to realize tax benefits; |

| |

| • | changes in political regimes in foreign countries; and |

| |

| • | international developments negatively impacting business. |

Consequently, all of the forward-looking statements made in this report are qualified by these cautionary statements and PSEG, PSE&G, Power and Energy Holdings cannot assure you that the results or developments anticipated by management will be realized, or even if realized, will have the expected consequences to, or effects on, PSEG, PSE&G, Power and Energy Holdings or their respective business prospects, financial condition or results of operations. Undue reliance should not be placed on these forward-looking statements in making any investment decision. Each of PSEG, PSE&G, Power and Energy Holdings expressly disclaims any obligation or undertaking to release publicly any updates or revisions to these forward-looking statements to reflect events or circumstances that occur or arise or are anticipated to occur or arise after the date hereof. In making any investment decision regarding PSEG's, PSE&G's, Power's and Energy Holdings' securities, PSEG, PSE&G, Power and Energy Holdings are not making, and you should not infer, any representation about the likely existence of any particular future set of facts or circumstances. The forward-looking statements contained in this report are intended to qualify for the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

iv

WHERE TO FIND MORE INFORMATION

Public Service Enterprise Group Incorporated (PSEG), Public Service Electric and Gas Company (PSE&G), PSEG Power LLC (Power) and PSEG Energy Holdings L.L.C. (Energy Holdings) file annual, quarterly and special reports, proxy statements and other information with the Securities and Exchange Commission (SEC). You may read and copy any document that PSEG, PSE&G, Power and Energy Holdings file at the Public Reference Room of the SEC at 450 Fifth Street, N.W., Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. You may also obtain PSEG's, PSE&G's, Power's and Energy Holdings' filings on the Internet at the SEC's website at www.sec.gov or at PSEG's website, www.pseg.com. PSEG's Common Stock is listed on the New York Stock Exchange under the ticker symbol “PEG.” You can obtain information about PSEG at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005.

PART I

This combined Annual Report on Form 10-K is separately filed by PSEG, PSE&G, Power and Energy Holdings. Information contained herein relating to any individual company is filed by such company on its own behalf. PSE&G, Power and Energy Holdings each makes representations only as to itself and its subsidiaries and makes no other representations whatsoever as to any other company.

ITEM 1. BUSINESS

GENERAL

PSEG, PSE&G, Power and Energy Holdings

PSEG was incorporated under the laws of the State of New Jersey in 1985 and has its principal executive offices located at 80 Park Plaza, Newark, New Jersey 07102. PSEG was an exempt public utility holding company under the Public Utility Holding Company Act of 1935 (PUHCA) prior to its repeal. The Energy Policy Act of 2005 (Energy Policy Act), among other things, repealed PUHCA as of February 8, 2006 and enacted the Public Utility Holding Company Act of 2005 (PUHCA 2005). PSEG is in the process of evaluating the compliance requirements under PUHCA 2005.

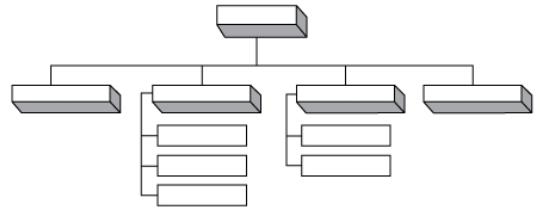

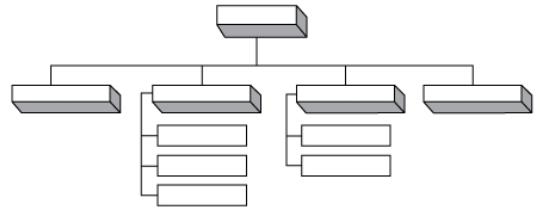

PSEG has four principal direct wholly owned subsidiaries: PSE&G, Power, Energy Holdings and PSEG Services Corporation (Services). The following organization chart shows PSEG and its principal subsidiaries, as well as the principal operating subsidiaries of Power: PSEG Fossil LLC (Fossil), PSEG Nuclear LLC (Nuclear) and PSEG Energy Resources & Trade LLC (ER&T); and of Energy Holdings: PSEG Global L.L.C. (Global) and PSEG Resources L.L.C. (Resources):

PSEG

PSE&G

Power

Energy Holdings

Services

Fossil

Nuclear

ER&T

Global

Resources

The regulatory structure that has historically governed the electric and gas utility industries in the United States (U.S.) has changed dramatically in recent years. Actions by state regulators and the Federal Energy Regulatory Commission (FERC) and the implementation of the National Energy Policy Act of 1992 have afforded power marketers, merchant generators, Exempt Wholesale Generators (EWGs) and utilities the opportunity to compete actively in wholesale energy markets and have allowed consumers the right to choose

1

their energy suppliers. The deregulation and restructuring of the nation's energy markets, the unbundling of energy and related services, the diverse strategies within the industry related to holding, building, buying or selling generation capacity and consolidation within the industry have had, and are likely to continue to have, a significant effect on PSEG and its subsidiaries, providing them with new opportunities and exposing them to new risks.

As energy markets have changed dramatically in recent years, PSEG and its subsidiaries have transitioned from a vertically-integrated utility to an energy company with a diversified business mix. PSEG realigned its organizational structure to address the competitive environment brought about by the deregulation of the electric generation industry and evolved from primarily being a state-regulated New Jersey utility to operating as a competitive energy company with operations primarily in the Northeastern U.S. and in other select markets. As the competitive portion of PSEG's business has grown, the resulting financial risks and rewards have become greater, causing financial requirements to change and increasing the volatility of earnings and cash flows.

PSEG seeks to reduce future volatility of earnings and cash flows principally by entering into longer-term contracts for material portions of its anticipated energy output. PSEG may also reduce exposure to its international businesses by seeking to opportunistically monetize investments of Energy Holdings that may no longer have a strategic fit. PSEG also expects a gradual decline in earnings from Resources' leveraged leasing business due to the maturation of its investment portfolio. For additional information, see Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A)—Overview of 2005 and Future Outlook.

PENDING MERGER

PSEG, PSE&G, Power and Energy Holdings

As previously disclosed, on December 20, 2004, PSEG entered into an agreement and plan of merger (Merger Agreement) with Exelon Corporation (Exelon), a public utility holding company headquartered in Chicago, Illinois, whereby PSEG will be merged with and into Exelon (Merger). Under the Merger Agreement, each share of PSEG Common Stock will be converted into 1.225 shares of Exelon Common Stock.

The Merger Agreement has been unanimously approved by both companies' Boards of Directors. On July 19, 2005, shareholders of PSEG voted to approve the Merger and on July 22, 2005, shareholders of Exelon voted to approve the issuance of common shares to PSEG shareholders to effect the Merger.

Completion of the Merger is subject to approval by a number of governmental authorities, some of which have already been obtained. The authorities may impose conditions on completion of the Merger, require changes to the terms of the Merger or fail to approve the Merger. For additional information related to the Merger, see Item 3. Legal Proceedings, Item 7. MD&A—Pending Merger and Note 23. Pending Merger of the Notes to the Consolidated Financial Statements (Notes).

PSE&G

PSE&G is a New Jersey corporation, incorporated in 1924, and has principal executive offices at 80 Park Plaza, Newark, New Jersey 07102. PSE&G is an operating public utility company engaged principally in the transmission and distribution of electric energy and gas in New Jersey. PSE&G, pursuant to an order of the New Jersey Board of Public Utilities (BPU) issued under the provisions of the New Jersey Electric Discount and Energy Competition Act (EDECA), transferred all of its electric generation facilities, plant, equipment and wholesale power trading contracts to Power and its subsidiaries in August 2000 for approximately $2.8 billion. Also, pursuant to a BPU order, PSE&G transferred its gas supply business, including its inventories and supply contracts, to Power in May 2002 for approximately $183 million. PSE&G continues to own and operate its electric and gas transmission and distribution business. In addition, PSE&G owns PSE&G Transition Funding LLC (Transition Funding) and PSE&G Transition Funding II LLC (Transition Funding II), which are bankruptcy-remote entities that purchased the rights to receive certain non-bypassable amounts per Kilowatt-hour (kWh) of energy delivered to PSE&G customers and issued transition bonds secured by such property.

PSE&G provides electric and gas service in areas of New Jersey in which approximately 5.5 million people, about 70% of the state's population, reside. PSE&G's electric and gas service area is a corridor of

2

approximately 2,600 square miles running diagonally across New Jersey from Bergen County in the northeast to an area below the city of Camden in the southwest. The greater portion of this area is served with both electricity and gas, but some parts are served with electricity only and other parts with gas only. This heavily populated, commercialized and industrialized territory encompasses most of New Jersey's largest municipalities, including its six largest cities—Newark, Jersey City, Paterson, Elizabeth, Trenton and Camden—in addition to approximately 300 suburban and rural communities. This service territory contains a diversified mix of commerce and industry, including major facilities of many nationally prominent corporations. PSE&G's load requirements are split among residential, commercial and industrial customers, described below under customers. PSE&G believes that it has all the franchise rights (including consents) necessary for its electric and gas distribution operations in the territory it serves. Such franchise rights are not exclusive.

PSE&G distributes electric energy and gas to end-use customers within its designated service territory. All electric and gas customers in New Jersey have the ability to choose an electric energy and/or gas supplier. Pursuant to BPU requirements, PSE&G serves as the supplier of last resort for electric and gas customers within its service territory. PSE&G earns no margin on the commodity portion of its electric and gas sales. PSE&G earns margins through the transmission and distribution of electricity and gas. PSE&G's revenues for these services are based upon tariffs approved by the BPU and FERC. The demand for electric energy and gas by PSE&G's customers is affected by customer conservation, economic conditions, weather and other factors not within PSE&G's control.

Electric Supply

New Jersey's Electric Distribution Companies (EDCs), including PSE&G, provide two types of Basic Generation Service (BGS). BGS is the default electric supply service for customers who do not choose a third party to source their electric supply requirements. BGS-Fixed Price (FP) provides supply for smaller commercial and residential customers at seasonally-adjusted fixed prices. BGS-FP rates change annually on June 1, and are based on the average BGS price obtained at auctions in the current year and two prior years. BGS-Commercial and Industrial Energy Price (CIEP) provides supply for larger customers at hourly PJM Interconnection, L.L.C. (PJM) real-time market prices for a term of 12 months. BGS-FP and BGS-CIEP represent approximately 84% and 16%, respectively, of PSE&G's BGS-eligible load. Customers may obtain their electric supply through either the BGS default electric supply service or through competitive third-party electric suppliers.

New Jersey's EDCs jointly procure the supply to meet their BGS obligations through two concurrent auctions authorized by the BPU for New Jersey's total BGS requirement. Results of these auctions determine which energy suppliers are authorized to supply BGS to New Jersey's EDCs. Certain conditions are required to participate in these auctions. Energy suppliers must agree to execute the BGS Master Service Agreement, provide required security within three days of BPU certification of auction results and satisfy certain creditworthiness requirements.

PSE&G's total BGS-FP load is approximately 8,600 megawatts (MW). Approximately one-third of this total load is expected to be auctioned each year for a three-year term. The current pricing is as follows:

| | | | Term Ending

|

| | | | May 2006(a)

| | May 2007(b)

| | May 2008(a)

| | May 2009(c)

|

| | Term

| | 12 months

| | 34 months

| | 36 months

| | 36 months

|

| | Load (MW) | | | 2,900 | | | | 2,840 | | | | 2,840 | | | | 2,882 | |

| | $ per kWh | | $ | 0.05560 | | | $ | 0.05515 | | | $ | 0.06541 | | | $ | 0.10251 | |

| | | | | | | | | | | | | | | | | | |

| (a) | | Prices set in the February 2005 BGS auction. |

| (b) | | Prices set in the February 2004 BGS auction. |

| (c) | | Prices set in the February 2006 BGS auction, which becomes effective on June 1, 2006 when the agreements for the 12-month (May 2006) BGS-FP supply agreements expire. |

3

The February 2006 BGS-FP auction sought approximately one-third of PSE&G's BGS-FP eligible load (2,882 MW), since contracts for the other two-thirds were procured through the 2004 and 2005 auctions. The 2006 clearing price for PSE&G's BGS-FP load was 10.251 cents per kWh, an increase of approximately 57% over the 2005 auction price. The term of the supply period is from June 2006 through May 2009. Due to the stabilizing effect of the portfolio approach (blending this year's price with the prices set in the auctions in 2005 and 2004), residential customers' bills are expected to increase by approximately 14% beginning June 1, 2006.

The 2006 BGS-CIEP auction was not fully subscribed. Of the 1,830 MW offered, only 1,153 MW, approximately 63%, was filled by BGS-CIEP suppliers for the period June 2006 through May 2007. Since nearly 85% of BGS-CIEP load has migrated to third party suppliers on a spot market basis, PSE&G expects its required supply obligation to be approximately 110 MW of BGS-CIEP load, although it could vary if migration amounts change in response to changing market prices. PSE&G expects to be able to meet this requirement. PSE&G has filed a contingency plan, which was approved by the BPU, which covered instances where the auction volume for either BGS-FP or BGS-CIEP was reduced. The process calls for those reduced volumes to be served by the EDC from PJM administered markets with full cost recovery from customers. However, it is PSE&G's responsibility to carry out that obligation in a prudent manner to insure full cost recovery.

Gas Supply

PSE&G has a full requirements contract through 2007 with Power to meet the supply requirements of PSE&G's gas customers. Power charges PSE&G for gas commodity costs which PSE&G recovers from its customers. Any difference between rates charged by Power under the Basic Gas Supply Service (BGSS) contract and rates charged to PSE&G's customers are deferred and collected or refunded through adjustments in future rates.

Market Price Environment

There has been a significant increase in commodity prices, including fuel, emission allowances and electricity over the past year. For example, both natural gas and electric prices in PJM have more than doubled. Price increases of this magnitude are much greater than have been experienced in recent history and could continue to have considerable impacts.

For PSE&G, a rising commodity price environment results in higher delivered electric and gas rates for end use customers, and may result in decreased demand by end users of both electricity and gas, increased regulatory pressures and greater working capital requirements as the collection of higher commodity costs may be deferred under PSEG's regulated rate structure. For additional information see Item 7. MD&A.

Competitive Environment

The electric and gas transmission and distribution business has minimal risks from competitors. PSE&G's transmission and distribution business is minimally impacted when customers choose alternate electric or gas suppliers since PSE&G earns its return by providing transmission and distribution service, not by supplying the commodity.

Customers

As of December 31, 2005, PSE&G provided service to approximately 2.1 million electric customers and approximately 1.7 million gas customers, detailed below. In addition to its transmission and distribution business, PSE&G also offers appliance services and repairs to customers throughout its service territory.

| | | | % of Sales

|

| | Customer Type

| | Electric

| | Gas

|

| | Commercial | | | 54% | | | | 27% | |

| | Residential | | | 32% | | | | 55% | |

| | Industrial | | | 14% | | | | 18% | |

| | | | |

| | | |

| |

| | Total | | | 100% | | | | 100% | |

| | | | |

| | | |

| |

| | | | | | | | | | |

4

Employee Relations

As of December 31, 2005, PSE&G had 6,335 employees. PSE&G has six-year collective bargaining agreements, which were ratified in 2005, with four unions representing 5,043 employees. PSE&G believes that it maintains satisfactory relationships with its employees.

Power

Power is a Delaware limited liability company, formed in 1999, and has its principal executive offices at 80 Park Plaza, Newark, New Jersey 07102. Power is a multi-regional, wholesale energy supply company that integrates its generating asset operations with its wholesale energy, fuel supply, energy trading and marketing and risk management functions through three principal direct wholly owned subsidiaries: Nuclear, Fossil and ER&T.

As of December 31, 2005, Power's generation portfolio consisted of approximately 13,846 MW of installed capacity which is diversified by fuel source and market segment. For additional information, see Item 2. Properties.

As a merchant generator, Power's profit is derived from selling under contract or on the spot market a range of diverse products such as energy, capacity, emissions credits, congestion credits and a series of energy-related products used to optimize the operation of the energy grid, known as ancillary services.

Through its operating subsidiaries, Power competes as an independent wholesale electric generating company, primarily in the Northeast U.S. Most of Power's generating assets are strategically located within PJM, one of the nation's largest and most developed energy markets.

In addition to the electric generation business described above, Power's revenues include gas supply sales under the BGSS contract with PSE&G.

Nuclear

Nuclear has an ownership interest in five nuclear generating units: the Salem Nuclear Generating Station, Units 1 and 2 (Salem 1 and 2), each owned 57.41% by Nuclear and 42.59% by Exelon Generation Company LLC (Exelon Generation); the Hope Creek Nuclear Generating Station (Hope Creek), which is owned 100% by Nuclear; and, the Peach Bottom Atomic Power Station Units 2 and 3 (Peach Bottom 2 and 3), each of which is operated by Exelon Generation and owned 50% by Nuclear. For additional information, see Item 2. Properties—Power.

For a discussion of recent operational issues, see Regulatory Issues—Nuclear Regulatory Commission (NRC).

Nuclear unit capacity and availability factors for 2005 were as follows:

| | Unit

| | Capacity

Factor*

| | Availability

Factor

|

| | Salem Unit 1 | | | 93.0 | % | | | 92.5 | % |

| | Salem Unit 2 | | | 90.9 | % | | | 90.1 | % |

| | Hope Creek | | | 82.8 | % | | | 84.2 | % |

| | Peach Bottom Unit 2 | | | 98.7 | % | | | 97.8 | % |

| | Peach Bottom Unit 3 | | | 90.8 | % | | | 92.6 | % |

| | | | |

| | | |

| |

| | Total Power Ownership | | | 90.1 | % | | | 90.3 | % |

| | | | |

| | | |

| |

| | | | | | | | | | |

* Maximum Dependable Capacity (MDC) net.

Nuclear has several long-term purchase contracts with uranium suppliers, converters, enrichers and fabricators to meet the currently projected fuel requirements for the Salem and Hope Creek nuclear power plants. Nuclear has been advised by Exelon Generation that it has similar purchase contracts to satisfy the annual fuel requirements for Peach Bottom. For additional information, see Item 7. MD&A—Overview of 2005 and Future Outlook—Power and Note 12. Commitments and Contingent Liabilities of the Notes.

Concurrent with the Merger Agreement, Nuclear entered into an Operating Services Contract (OSC) with Exelon Generation, which commenced on January 17, 2005, relating to the operation of the Salem and Hope Creek nuclear generating stations. The OSC requires Exelon Generation to provide a chief nuclear

5

officer and other key personnel to oversee daily plant operations at the Hope Creek and Salem nuclear generating stations and to implement the Exelon operating model, which defines practices that Exelon has used to manage its own nuclear performance program. Nuclear continues as the license holder with exclusive legal authority to operate and maintain the plants, retains responsibility for management oversight and has full authority with respect to the marketing of its share of the output from the facilities. The OSC has a term of two years, subject to earlier termination in certain circumstances. In the event of termination, Exelon Generation will continue to provide services under the OSC for a transition period of at least 180 days and up to two years at the election of Nuclear. This period may be further extended by Nuclear for up to an additional twelve months if Nuclear determines that additional time is necessary to complete required activities during the transition period.

In May 2005, a scheduled refueling outage at Salem Unit 2 was completed ahead of schedule while meeting self-imposed nuclear safety targets. In November 2005, Salem Unit 1 returned to service, completing a scheduled refueling outage with a reactor head replacement in world record time. During 2005, Salem Unit 1 and Salem Unit 2 experienced their longest continuous on-line running days at nearly 100% capacity.

Fossil

Fossil has an ownership interest in 12 generating stations in New Jersey, one in New York, two in Connecticut, two in Pennsylvania and one in Indiana. For additional information, see Item 2. Properties—Power.

Since 1999, Fossil has added units to its fleet, including the Bergen 2 station in New Jersey, the Bridgeport Harbor and New Haven Harbor facilities in Connecticut, the Lawrenceburg station in Indiana and the Bethlehem Energy Center in New York, which was completed and placed in service on July 18, 2005, replacing the Albany Station. In addition, Fossil is currently in final stages of construction for its Linden, New Jersey plant, which is scheduled to be operational in the second quarter of 2006. During 2005, Fossil sold its Waterford, Ohio plant, which commenced commercial operation in August 2003. For additional information see Note 4. Discontinued Operations, Dispositions and Acquisitions of the Notes.

Fossil uses coal, natural gas and oil for electric generation. These fuels are purchased through various contracts and in the spot market and represent a significant portion of Power's working capital requirements. The majority of Power's fossil generating stations obtain their fuel supply from within the U.S. In order to minimize emissions levels, the Bridgeport generating facility uses a specific type of coal, which is obtained from Indonesia through a fixed-price supply contract that runs through 2008. If the supply of coal from Indonesia or equivalent coal from other sources was not available for the Connecticut facilities, additional material capital expenditures could be required to modify the existing plants to enable their continued operation. Power believes it has sufficient fuel supply, including transportation, for its facilities over the next several years. For additional information, see Item 7. MD&A—Overview of 2005 and Future Outlook—Power and Note 12. Commitments and Contingent Liabilities of the Notes.

ER&T

ER&T purchases the capacity and energy produced by each of the generation subsidiaries of Power. In conjunction with these purchases, ER&T uses commodity and financial instruments designed to cover estimated commitments for BGS and other bilateral contract agreements. ER&T also markets electricity, capacity, ancillary services and natural gas products on a wholesale basis. ER&T is a fully integrated wholesale energy marketing and trading organization that is active in the long-term and spot wholesale energy and energy-related markets. In anticipation of the proposed Merger with Exelon and a resulting reduction in personnel, ER&T has recently de-emphasized the proprietary trading component of its business to narrow its focus on its asset-based opportunities, including BGS and other load-related contracts, BGSS, capacity, emissions and congestion related products such as firm transmission rights (FTRs) and auction revenue rights.

Electric Supply

Power's generation capacity is sourced from a diverse mix of fuels comprised of approximately 45% gas, 25% nuclear, 17% coal, 12% oil and 1% pumped storage. Power's fuel diversity serves to mitigate risks associated with fuel price volatility and market demand cycles. The following table indicates the MWh output of Power's generating stations by fuel type in 2005, based on actual output of approximately 50,000 MWhs,

6

and its estimated MWh output by fuel type for 2006, based on anticipated output of approximately 52,000 MWhs.

Generation by Fuel Type

| | Actual

2005

| | Estimated

2006(A)

|

Nuclear: | | | | | | | | |

New Jersey facilities | | | 37 | % | | | 36 | % |

Pennsylvania facilities | | | 18 | % | | | 17 | % |

Fossil: | | | | | | | | |

Coal: | | | | | | | | |

New Jersey facilities | | | 13 | % | | | 13 | % |

Pennsylvania facilities | | | 12 | % | | | 12 | % |

Connecticut facilities | | | 6 | % | | | 5 | % |

Oil and Natural Gas: | | | | | | | | |

New Jersey facilities | | | 9 | % | | | 11 | % |

New York facilities | | | 2 | % | | | 4 | % |

Connecticut facilities | | | 2 | % | | | 2 | % |

Pumped Storage: | | | 1 | % | | | — | |

| | | |

| | | |

| |

Total | | | 100 | % | | | 100 | % |

| | | |

| | | |

| |

| | | | | | | | |

(A) No assurances can be given that actual 2006 output by source will match estimates.

For a discussion of Power's management and hedging strategy relating to its energy sales supply and fuel needs, see Market Price Environment and Item 7A. MD&A—Overview of 2005 and Future Outlook—Power.

Gas Supply

As described above, Power sells gas to PSE&G under the BGSS contract. Additionally, based upon availability, Power sells gas to others. About 42% of PSE&G's peak daily gas requirements are provided through firm transportation, which is available every day of the year. The remainder comes from field storage, liquefied natural gas, seasonal purchases, contract peaking supply, propane and refinery and landfill gas. Power purchases gas for its gas operations directly from natural gas producers and marketers. These supplies are transported to New Jersey by four interstate pipeline suppliers.

Power has approximately 1.16 billion cubic-feet-per-day of firm transportation capacity under contract to meet the primary needs of the gas consumers of PSE&G and the needs of its generation fleet. In addition, Power supplements that supply with a total storage capacity of 80 billion cubic feet that provides a maximum of 0.91 billion cubic feet-per-day of gas during the winter season.

Power expects to be able to meet the energy-related demands of its firm natural gas customers. However, the ability to maintain an adequate supply could be affected by several factors not within Power's control, including curtailments of natural gas by its suppliers, severe weather and the availability of feedstocks for the production of supplements to its natural gas supply. In addition, supply of all types of gas is affected by the nationwide availability of all sources of fuel for energy production.

Market Price Environment

There has been a significant increase in commodity prices, including fuel, emission allowances and electricity over the past year. For example, both natural gas and electric prices in PJM have more than doubled. Price increases of this magnitude are much greater than have been experienced in recent history and could continue to have considerable impacts.

System operators in the markets in which Power participates will generally dispatch the lowest cost units in the system first, with higher cost units dispatched as demand increases. As such, nuclear units, with their low variable cost operation, will generally be dispatched whenever they are available. Coal units generally follow next in the merit order of dispatch and gas and oil units generally follow to meet the total amount of demand. The price that all dispatched units receive is set by the last, or marginal unit that is dispatched.

7

This method of determining supply and pricing creates an environment where natural gas prices often have a major impact on the price that generators will receive for their output, especially in periods of relatively strong demand. As such, significant increases in the price of natural gas will often translate into significant increases in the price of electricity.

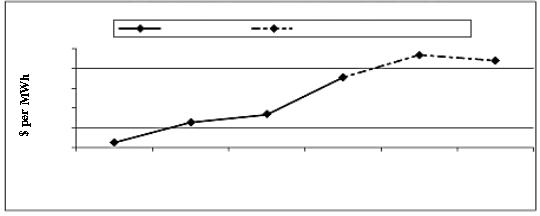

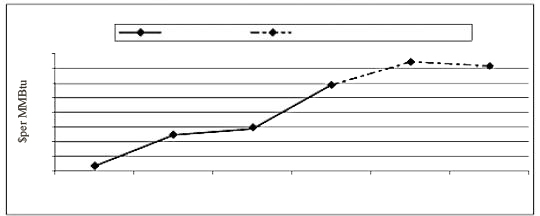

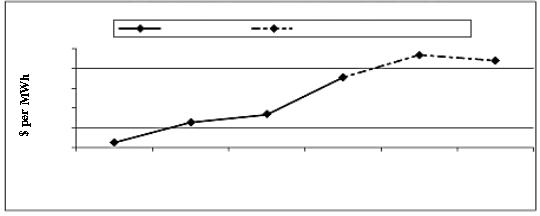

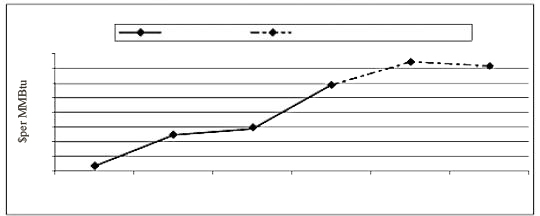

As a merchant generator, Power's profit is derived from selling under contract or on the spot market a range of diverse products such as energy, capacity, emissions credits, congestion credits and a series of energy-related products that the system operator uses to optimize the operation of the energy grid, known as ancillary services. Accordingly, commodity prices, such as electricity, gas, coal and emissions, as well as the availability of Power's diverse fleet of generation units to produce these products, when necessary, have a considerable effect on Power's profitability. Recently, the price of many of these products has increased dramatically. For example, the spot price of electricity at the quoted PJM West market has increased from $25 per MWh for 2002 to $60 per MWh in 2005. Similarly, the price of natural gas at the Henry Hub terminal has increased from an average of about $5 per one million British Thermal Units (MMBtu) for 2002 to 2004 to about $9 per MMBtu in 2005. The prices at which transactions are entered into for future delivery of these products, as evidenced through the market for forward contracts at points such as PJM West, have escalated as well. The historical spot prices and forward prices as of year-end 2005 are reflected in the graphs below:

Historical and Forward PJM Western Hub RTC Prices

$75

$65

$55

$45

$35

$25

2002

2003

2004

2005

2006

2007

WH Historical Prices

(Source: PJM)

WH Forward Prices as of December 31, 2005

(Source: NYMEX)

Year

$11

$10

$9

$8

$7

$6

$5

$4

$3

2002

2003

2004

2005

2006

2007

Historical Gas Prices

(Source: Energy Information Administration)

Forward Gas Prices as of December 31, 2005

(Source: NYMEX)

Historical and Forward Henry Hub Gas Prices

Year

While these prices do not necessarily represent prices at which Power has contracted, they are representative of market prices at relatively liquid hubs, with nearer term forward pricing generally resulting from more liquid markets than pricing for later years. While they provide some perspective on past and future prices, the forward prices are highly volatile, and there is no assurance that such prices will remain in effect nor that Power will be able to contract its output at these forward prices.

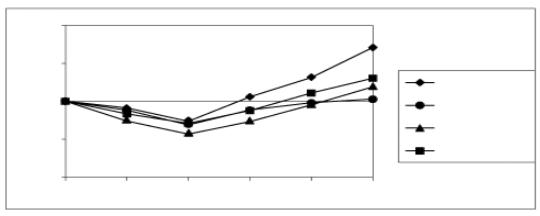

8

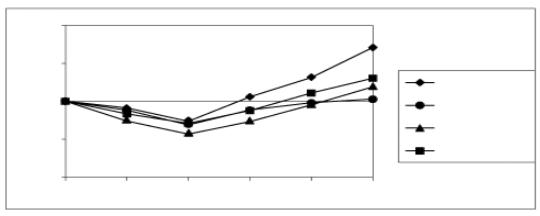

Another of the products from which Power derives revenue is capacity. In PJM, New York and the New England Power Pool (NEPOOL), the market provides a payment for the capability to provide electricity, known as a capacity payment. This payment is reflective of the value to the grid for having the assurance of sufficient generating capacity to meet system reliability and energy requirements, and to encourage the future investment in adequate sources of new generation to meet system demand. A substantial increase in the construction of new capacity in each of these markets in recent years has created a surplus of capacity, depressing capacity prices. For example, capacity prices in PJM have recently averaged well below $10 per kW-year as compared to an average price of more than $25 per kW-yr during the period from 1999 to 2001.

While there is generally an abundance of capacity in the markets in which Power operates, there are certain areas in these markets where there are constraints in the transmission system, causing concerns for reliability and a more acute need for capacity. Some generators, including Power, recently announced the retirement of certain older generating facilities in these constrained areas due to insufficient energy and capacity revenues to support their continued operation. In separate instances, both PJM and NEPOOL have responded with fixed payments to the owners of these facilities to enable their continued availability. These Reliability-Must-Run (RMR) contracts for certain units provide their owners with fixed payments which, while not necessarily reflective of the full value of those units' contribution to reliability (e.g. they are cost-based), are nonetheless significant. Such payment structure by its nature acknowledges that these units provide a reliability service that is not compensated in the existing markets. It also suggests that fixed periodic payments, as would be provided in a capacity market, are an appropriate form of compensation for such units for this service. Power has received RMR payments in each of PJM and NEPOOL.

In addition, discussions are currently taking place that may result in changes in the nature of capacity payments on a prospective basis in each of PJM and NEPOOL. In PJM, a new capacity-pricing regime known as the Reliability Pricing Model (RPM), if approved, would provide generators with differentiated capacity payments based upon the location and operating characteristics of their respective facilities. Similarly, the Locational Installed Capacity (LICAP) proposal currently being discussed in NEPOOL provides for locational capacity payments. Both proposals are based in part on the premise that a more structured, forward-looking, transparent pricing scheme would give prospective investors in new generating facilities more clarity on the future value of capacity, sending a pricing signal to encourage expansion of capacity for future market demands. There is widespread debate in each of these areas, with many market participants having different views and divergent interests on the appropriate mechanisms to prospectively conduct market activities. Power supports capacity markets in general, and the recognition of locational capacity value, as the market value for capacity should reflect the fact that reliability, or supply adequacy, often manifests itself on a locational basis. Power believes that much of its nearly 14,000 MW of generating capacity may experience changes in value from aspects of market design currently being discussed. While Power believes there is potential additional revenue from these changes, it cannot predict the outcome of potential changes in either market.

For additional information on Power's collection of RMR payments in PJM and NEPOOL and the RPM and LICAP proposals, see Regulatory Issues—Federal Regulation.

Competitive Environment

Power's competitors include merchant generators with or without trading capabilities, including banks, funds, and other financial entities, utilities that have generating capability or have formed generation and/or trading affiliates, aggregators, wholesale power marketers and developers of transmission and Demand Side Management (DSM) projects and combinations thereof. These participants compete with Power and one another buying and selling in wholesale power pools, entering into bilateral contracts and/or selling to aggregated retail customers.

In the PJM market, the pricing of energy is based upon the locational marginal price (LMP) set through power providers' bids. Due to transmission constraints, the LMP may be higher in congested areas during peak demand periods reflecting the bid prices of the higher cost units that are dispatched to supply demand. This typically occurs in the eastern portion of PJM, where many of Power's plants are located, relative to the more liquid PJM West market location. Power also tends to contract a considerable amount of its production into this area, including its participation in the BGS auctions conducted in New Jersey. At various times, depending upon its production and its obligations, this price differential can serve to increase or decrease profitability.

9

The New England market has excess capacity and is also undergoing changes. The existence of reliability-based payments, coupled with the anticipated start of locational capacity markets in 2006, could enhance the value of Power's generation assets in Connecticut.

The Midwest has excess capacity due to recent additions, which will continue to negatively impact the expected returns of Power's Lawrenceburg facility. The drivers to reduce the excess capacity will be load growth, the retirement of certain inefficient plants, particularly older plants of competitors, and increased costs associated with higher levels of environmental compliance.

In addition, there has been a significant increase in commodity prices, including fuel and emission allowances, resulting in increased costs to produce electricity, which could potentially alter the dispatch order of units based upon fuel choice and efficiency.

For additional information regarding increased commodity prices and proposed changes to capacity markets, see Market Price Environment.

Power's businesses are also under competitive pressure due to technological advances in the power industry and increased efficiency in certain energy markets. It is possible that advances in technology, such as distributed generation, will reduce the cost of alternative methods of producing electricity to a level that is competitive with that of most central station electric production.

There is also a risk to Power if states should decide to turn away from competition and allow regulated utilities to continue to own or reacquire and operate generating stations in a regulated and potentially uneconomical manner. This has already occurred in certain states. The lack of consistent rules in markets outside of PJM can negatively impact the competitiveness of Power's plants. Also, regional inconsistencies in environmental regulations, particularly those related to emissions, have put some of Power's plants which are located in the Northeast, where rules are more stringent, at an economic disadvantage compared to its competitors in certain Midwest states.

Customers

As EWGs, Power's subsidiaries do not directly serve retail customers. Power uses its generation facilities primarily for the production of electricity for sale at the wholesale level. Power's customers consist mainly of wholesale buyers, primarily within PJM, but also in New York, Connecticut and the Midwest. Power is at times a direct or indirect supplier of New Jersey's EDCs, including PSE&G, depending on the positions it takes in the New Jersey BGS auction. In February 2006, the BPU approved the results of the most recent BGS auction for New Jersey customers, in which each bidder was limited to a third of each EDC's total load. Power was a successful bidder in the FP auction, which serves the state's residential and small industrial and commercial customers for a three-year period. In prior years, Power had also been a bidder in the CIEP auction, which serves large industrial and commercial customers at hourly PJM real-time market prices for a term of 12 months. Power has also extended into the New England Power Market by securing a three-year contract with a Connecticut utility expiring December 31, 2006. These contracts are full requirements contracts, where Power is responsible to serve a percentage of the full supply needs of the customer class being served, including energy, capacity, congestion and ancillary services. In addition, Power has four-year contracts with two Pennsylvania utilities expiring in 2008 and is considering pursuing similar opportunities in other states.

Power has also entered into a full requirements contract with PSE&G under which Power provides the gas supply services needed to meet PSE&G's BGSS and other contractual requirements through March 2007.

For the year ended December 31, 2005, approximately 34% of Power's revenue was comprised of billings to PSE&G for BGS and BGSS. See Note 21. Related-Party Transactions for additional information.

Employee Relations

As of December 31, 2005, Power had 2,590 employees, of which 1,414 employees (694 employees for Fossil and 720 employees for Nuclear) are union members. Power has six-year collective bargaining agreements with three union groups, which were ratified in February, July and August 2005, respectively. Power believes that it maintains satisfactory relationships with its employees.

10

Energy Holdings

Energy Holdings is a New Jersey limited liability company and is the successor to PSEG Energy Holdings Inc., which was incorporated in 1989. Energy Holdings' principal executive offices are located at 80 Park Plaza, Newark, New Jersey 07102. Energy Holdings has two principal direct wholly owned subsidiaries, which are also its segments: Global and Resources.

Energy Holdings pursued investment opportunities in the domestic and international energy markets, with Global focusing on the operating segments of the electric industries and Resources primarily making financial investments in these industries. Global and Resources have more than 70 financial and operating investments.

Energy Holdings' portfolio is diversified by number, type and geographic location of investments. As of December 31, 2005, its assets were comprised of the following types:

| | | | As of

December 31, 2005

|

| | Leveraged Leases (mainly energy-related) | | | 39 | % |

| | International Electric Distribution Facilities | | | 26 | % |

| | International Electric Generation Plants | | | 7 | % |

| | Domestic Electric Generation Plants | | | 12 | % |

| | Other(1) | | | 16 | % |

| | | | |

| |

| | Total | | | 100 | % |

| | | | |

| |

| | | | | | |

| (1) | | Primarily includes assets of Elektrocieplownia Chorzow Sp. Z o.o. (Elcho) and Elektrownia Skawina SA (Skawina), which are classified as Discontinued Operations. Also includes notes receivable from affiliates, and property, plant and equipment that are not related to specific electric distribution and generation plants and facilities. |

The characteristics of each of these investment types are described in more detail below.

Global

Global owns investments in power producers and distributors that own and operate electric generation and distribution facilities in selected domestic and international markets.

Global's assets include consolidated projects and those accounted for under the equity method. As of December 31, 2005, Global's share of project MW and number of customers by region are as follows:

| | | As of

December 31, 2005

|

| | | Assets

| | MW

| | Number of

Customers

|

| | | (Millions) | | | | | | | | |

Generation: | | | | | | | | | | | | |

North America | | $ | 882 | | | | 2,404 | | | | N/A | |

South America(1) | | | 329 | | | | 402 | | | | N/A | |

Other(2) | | | 123 | | | | 201 | | | | 47,000 | |

Distribution: | | | | | | | | | | | | |

South America | | | 1,838 | | | | N/A | | | | 2,978,000 | |

Other: | | | | | | | | | | | | |

Other(3) | | | 627 | | | | N/A | | | | N/A | |

| | | |

| | | |

| | | |

| |

Total | | $ | 3,799 | | | | 3,007 | | | | 3,025,000 | |

| | | |

| | | |

| | | |

| |

| | | | | | | | | | | | |

| (1) | | Includes 35 MW for a project in advanced development at Electroandes S.A. (Electroandes) in Peru. |

| (2) | | Excludes capacity related to investments in Elcho and Skawina, which were reclassified as Discontinued Operations in December 2005. For additional information relating to the sale, see Note 4. Discontinued Operations, Dispositions and Acquisitions of the Notes. |

| (3) | | Primarily includes assets of Elcho and Skawina, which are classified as Discontinued Operations, and deferred tax assets. |

11

Global's near-term emphasis is on maintaining adequate liquidity and improving profitability of currently held investments. Beginning in 2003, Global has been reviewing its portfolio for the purpose of opportunistically monetizing investments that no longer have a strategic fit. As part of this strategy, in May 2004, Global completed the sale of its majority interest in Carthage Power Company (CPC) in Rades, Tunisia. In December 2004, Global completed the sale of its 50% equity interest in Meiya Power Company Limited (MPC). Consistent with this strategy, Global entered into an agreement with CEZ a.s. on January 31, 2006 to sell its interests in Elcho and Skawina. For additional information relating to these dispositions, see Note 4. Discontinued Operations, Dispositions and Acquisitions of the Notes.

While Global still expects certain of its investments in South America to contribute significantly to its earnings in the future, adverse political and economic risks associated with this region could have a material adverse impact on such investments. To the extent practical, Global attempts to limit its financial exposure associated with each operating subsidiary to mitigate development risk, foreign currency exposure, interest rate risk and operating risk, including exposure to fuel costs, through financial and commodity contracts. For additional information related to these risks, see Item 7A. Qualitative and Quantitative Disclosures About Market Risk. In addition, project loan agreements are generally structured on a non-recourse basis. Further, Global generally structures non-recourse financings so that a default under one will have no effect on the loan agreements of other operating subsidiaries or on Energy Holdings' debt.

See Item 2. Properties—Energy Holdings for discussion of individual investments, including significant power purchase agreements (PPAs), fuel supply agreements, financing structures and other matters.

Resources

Resources invests in energy-related financial transactions and manages a diversified portfolio of assets, including leveraged leases, operating leases, leveraged buyout funds, limited partnerships and marketable securities. Established in 1985, Resources has a portfolio of approximately 50 separate investments. Based on current market conditions and Energy Holdings' intent to limit capital expenditures, it is unlikely that Resources will make significant additional investments in the near term.

Resources also owns and manages a DSM business. DSM revenues are earned principally from monthly payments received from utilities, which represent shared electricity savings from the installation of the energy efficient equipment.

The major components of Resources' investment portfolio as a percent of its total assets as of December 31, 2005 were:

| | | As of December 31, 2005

|

| | | Amount

| | % of

Resources'

Total Assets

|

| | | (Millions) | | | | |

Leveraged Leases | | | | | | | | |

Energy-Related | | | | | | | | |

Foreign | | $ | 1,017 | | | | 35 | % |

Domestic | | | 1,422 | | | | 50 | % |

Real Estate—Domestic | | | 193 | | | | 7 | % |

Commuter Railcars—Foreign | | | 88 | | | | 3 | % |

| | | |

| | | |

| |

Total Leveraged Leases | | | 2,720 | | | | 95 | % |

| | | |

| | | |

| |

| | | | | | | | |

Limited Partnerships | | | 15 | | | | 1 | % |

Other Investments(A) | | | 9 | | | | — | |

Owned Property | | | 116 | | | | 4 | % |

Current and Other Assets | | | 14 | | | | — | |

| | | |

| | | |

| |

Total Resources' Assets | | $ | 2,874 | | | | 100 | % |

| | | |

| | | |

| |

(A) Primarily includes investment in DSM business.

As of December 31, 2005, no single investment represented more than 9% of Resources' total assets.

Leveraged Lease Investments

Resources maintains a portfolio that is designed to provide a fixed rate of return. Income on leveraged leases is recognized by a method which produces a constant rate of return on the outstanding investment in the lease, net of the related deferred tax liability, in the years in which the net investment is positive. Any

12

gains or losses incurred as a result of a lease termination are recorded as Operating Revenues as these events occur in the ordinary course of business of managing the investment portfolio.

In a leveraged lease, the lessor acquires an asset by obtaining equity representing approximately 15% to 20% of the cost of the asset and incurring non-recourse lease debt for the balance. The lessor acquires economic and tax ownership of the asset and then leases it to the lessee for a period of time no greater than 80% of its remaining useful life. As the owner, the lessor is entitled to depreciate the asset under applicable federal and state tax guidelines. In addition, the lessor receives income from lease payments made by the lessee during the term of the lease and from tax benefits associated with interest and depreciation deductions with respect to the leased property. The ability of Resources to realize these tax benefits is dependent on operating gains generated by its affiliates and allocated pursuant to PSEG's consolidated tax sharing agreement. Lease rental payments are unconditional obligations of the lessee and are set at levels at least sufficient to service the non-recourse lease debt. The lessor is also entitled to any residual value associated with the leased asset at the end of the lease term. An evaluation of the after-tax cash flows to the lessor determines the return on the investment. Under accounting principles generally accepted in the U.S. (GAAP), the lease investment is recorded on a net basis and income is recognized as a constant return on the net unrecovered investment.

Resources has evaluated the lease investments it has made against specific risk factors. The assumed residual-value risk, if any, is analyzed and verified by third parties at the time an investment is made. Credit risk is assessed and, in some cases, mitigated or eliminated through various structuring techniques, such as defeasance mechanisms and letters of credit. Resources has not taken currency risk in its cross-border lease investments. Transactions have been structured with rental payments denominated and payable in U.S. Dollars. Resources, as a passive lessor or investor, has not taken operating risk with respect to the assets it owns, so leveraged leases have been structured with the lessee having an absolute obligation to make rental payments whether or not the related assets operate. The assets subject to lease are an integral element in Resources' overall security and collateral position. If the recorded amount of such assets were to be impaired, the rate of return on a particular transaction could be affected. The operating characteristics and the business environment in which the assets operate are, therefore, important and must be understood and periodically evaluated. For this reason, Resources will retain, as necessary, experts to conduct appraisals on the assets it owns and leases.

On December 28, 2005, Resources sold its interest in the Seminole Generation Station Unit 2 in Palatka, Florida. For additional information relating to this disposition, see Note 4. Discontinued Operations, Dispositions and Acquisitions of the Notes.

13

Resources' ten largest lease investments as of December 31, 2005 were as follows:

Investment

| | Description

| | Recorded

Investment Balances

as of

December 31, 2005

| | % of

Resources'

Total Assets

|

| | | | | (Millions) | | | | |

Reliant Energy MidAtlantic Power Holdings, LLC | | Three generating stations (Keystone, Conemaugh and Shawville) | | $ | 271 | | | | 9 | % |

Dynegy Holdings Inc | | Two electric generating stations (Danskammer and Roseton) | | | 224 | | | | 8 | % |

Midwest Generation (Guaranteed by Edison Mission Energy) | | Two electric generating stations (Powerton and Joliet) | | | 198 | | | | 7 | % |

ENECO | | Gas distribution network (Netherlands) | | | 161 | | | | 6 | % |

ESG | | Electric distribution system (Austria) | | | 135 | | | | 5 | % |

Merrill Creek | | Merrill Creek Reservoir Project | | | 133 | | | | 5 | % |

Grand Gulf | | Nuclear generating station (U.S.) | | | 129 | | | | 4 | % |

EZH | | Electric generating station (Netherlands) | | | 128 | | | | 4 | % |

Nuon | | Gas distribution network (Netherlands) | | | 105 | | | | 4 | % |

EDON | | Gas distribution network (Netherlands) | | | 99 | | | | 3 | % |

| | | | | |

| | | |

| |

| | | | $ | 1,583 | | | | 55 | % |

| | | | | |

| | | |

| |

For additional information on leases, including credit, tax and accounting risk related to certain lessees, see Item 7. MD&A—Results of Operations—Energy Holdings and Item 7A. Qualitative and Quantitative Disclosures About Market Risk—Credit Risk—Energy Holdings and Note 12. Commitments and Contingent Liabilities of the Notes.

As of December 31, 2005, Resources has a remaining net investment in four leased aircraft of approximately $32 million. On September 14, 2005, Delta Airlines (Delta) and Northwest Airlines (Northwest), the lessees for Resources' four remaining aircraft, filed for Chapter 11 bankruptcy protection. This had no material effect on Energy Holdings as it continues to believe that it will be able to recover the recorded amount of its investments in these aircraft as of December 31, 2005. In 2004 and 2005, Resources successfully restructured the leases and converted the Delta and Northwest leases from leveraged leases to operating leases. Energy Holdings expects to recover its investment through cash flows from the operating leases.

Other Subsidiaries

Enterprise Group Development Corporation (EGDC), a commercial real estate property management business, is conducting a controlled exit from its real estate business. Total assets of EGDC as of December 31, 2005 and 2004 were $71 million and $72 million, respectively, and include developed land in New Jersey, Maryland and Virginia and an 80% partnership interest in buildings and land in New Jersey.

Competitive Environment

Energy Holdings and its subsidiaries continue to experience substantial competition, both in the U.S. and in international markets. In the U.S., an overbuild in generation facilities has led to a large capacity surplus in several regions. This has resulted in reduced operating margins for both independent power producers and

14

utility generators where the marketplace has been evolving from a rate-regulated structure to a competitive environment. These matters in Texas showed improvement in 2005, evidenced by improved margins and increased utilization of Global's facilities.

With respect to Global's distribution businesses in Chile, Peru, Brazil and Oman these investments are rate-regulated and are exposed to minimal market risks from competitors. See Regulatory Issues—International Regulation for additional information.

Customers

Global has ownership interests in four distribution companies in South America which serve approximately three million customers and has developed or acquired interests in electric generation facilities which sell energy, capacity and ancillary services to numerous customers through PPAs, as well as into the wholesale market. For additional information, see Item 2. Properties—Energy Holdings.

Employee Relations

As of December 31, 2005, Energy Holdings had 61 employees. Energy Holdings believes that it maintains satisfactory relationships with its employees.

Services

Services is a New Jersey corporation with its principal executive offices at 80 Park Plaza, Newark, New Jersey 07102. Services provides management and administrative services to PSEG and its subsidiaries. These include accounting, legal, communications, federal affairs, human resources, information technology, treasury and financial, investor relations, stockholder services, real estate, insurance, risk management, tax, library, research and information services, security, corporate secretarial and certain planning, budgeting and forecasting services. Services charges PSEG and its subsidiaries for the cost of work performed and services provided pursuant to the terms and conditions of intercompany service agreements. As of December 31, 2005, Services had 1,039 employees, including 107 unionized employees. A new six-year collective bargaining agreement with the union group representing these employees was ratified in February 2005. Services believes that it maintains satisfactory relationships with its employees.

REGULATORY ISSUES

Federal Regulation

PUHCA

PSEG, PSE&G, Power and Energy Holdings

PSEG has claimed an exemption from regulation by the SEC as a registered holding company under PUHCA, except for Section 9(a)(2) thereof, which relates to the acquisition of 5% or more of the voting securities of an electric or gas utility company. Fossil, Nuclear, certain subsidiaries of Fossil and certain subsidiaries of Energy Holdings with domestic operations are EWGs. In addition, several of Energy Holdings' investments include foreign utility companies (FUCOs) under PUHCA and Qualifying Facilities (QFs) under the Public Utility Regulatory Policies Act of 1978 (PURPA). The Energy Policy Act, which became law on August 8, 2005, repealed PUHCA as of February 8, 2006 and established PUHCA 2005. Companies subject to the provisions of PUHCA 2005 must provide state regulators access to their books and records. PSEG, PSE&G, Power and Energy Holdings do not expect PUHCA 2005 to materially affect their respective businesses, prospects or properties. For additional information on the impact of PUHCA repeal, see State Regulation.

Environmental

PSEG, PSE&G, Power and Energy Holdings

PSEG and its subsidiaries are subject to the rules and regulations relating to environmental issues promulgated by the U.S. Environmental Protection Agency (EPA), the U.S. Department of Energy (DOE) and other regulators. For information on environmental regulation, see Environmental Matters.

15

FERC

PSEG, PSE&G, Power and Energy Holdings

FERC is an independent federal agency that regulates the transmission of electric energy and sale of electric energy at wholesale prices in interstate commerce pursuant to the Federal Power Act (FPA). FERC also regulates the interstate transportation of, as well as certain wholesale sales of, natural gas pursuant to the Natural Gas Act. Several PSEG subsidiaries including PSE&G, Fossil, Nuclear, ER&T and certain subsidiaries of Fossil and certain subsidiaries of Energy Holdings with domestic operations are public utilities subject to regulation by FERC. FERC's regulation of public utilities is comprehensive and governs such matters as rates, services, mergers, financings, affiliate transactions, market behaviors and reporting. FERC is also responsible under PURPA for administering PURPA's requirements for QFs.

Mandatory Reliability Standards

On September 27, 2005, PSEG joined ReliabilityFirst, a reliability organization that, as of January 1, 2006, consolidated three independent regional reliability councils that had promoted the reliability of the bulk power electric system throughout the Mid-Atlantic and portions of the Midwestern U.S.

The Energy Policy Act requires FERC to empower a single, national Electric Reliability Organization (ERO) to develop and enforce national and regional reliability standards for the U.S. bulk power system.

When FERC designates a single ERO, which is expected in the near future, PSEG may be subject to additional regulation by this entity or by FERC, which may now enforce reliability standards on its own initiative or by complaint. PSEG, PSE&G, Power and Energy Holdings do not expect any significant impacts resulting from additional regulation by the ERO or FERC on these issues since they are currently subject to, and comply with, certain reliability standards already in effect, however, no assurances can be given.

Market Power

Under FERC regulations, public utilities may sell power at cost-based rates or apply to FERC for authority to sell at market-based rates (MBR). PSE&G, Fossil, Nuclear, ER&T and certain subsidiaries of Fossil and Energy Holdings, have applied for and received MBR authority from FERC. Power is scheduled for its next triennial market power review in 2006.

In April 2004, FERC issued a final order revising its generation market power screen, which it uses to determine whether power sellers may have the ability to exercise market power. Upon application by a power seller, if FERC determines that a seller is not able to exercise market power under the screen, and the seller passes other tests, FERC's rules permit the seller to sell power at MBR. Failing FERC's revised screen will not conclusively determine whether an entity has market power and applicants failing the test will have the ability to demonstrate that they do not possess market power despite the screen failure. The screen includes two separate analyses: (1) an uncommitted pivotal supplier analysis and (2) a market share analysis that is to be prepared on a seasonal basis. FERC eliminated an exemption that previously existed for generators in Regional Transmission Organizations (RTOs) and Independent System Operators (ISOs), such as PJM and New York ISO (NYISO), and will require all entities that wish to sell at MBR to comply with the revised market power screen.

PSEG Lawrenceburg Energy Company LLC (Lawrenceburg), an indirect wholly owned subsidiary of Power, is authorized by FERC order to sell wholesale power at MBR. The order requires Lawrenceburg to file a revised market power analysis within 30 days of the closing of the pending merger with Exelon and to treat Exelon as an affiliate for purposes of Exelon's MBR codes of conduct, which are on file with FERC, to guard against cross-subsidization between business units.

Expanded Merger Review Authority

The Energy Policy Act expands FERC's authority to review mergers and acquisitions under the FPA. It extends the scope of FERC's authority to require prior FERC approval regarding transactions involving certain transfers of generation facilities, certain holding companies' transactions, and utility mergers and consolidations of any value. The Energy Policy Act requires that FERC, when reviewing proposed transactions, examine cross-subsidization and pledges or encumbrances of utility assets. This new authority does not apply to the pending Merger between PSEG and Exelon. PSEG, PSE&G, Power and Energy

16

Holdings are unable to predict the effect of this authority on any potential future transactions in which they may be involved.

PSEG, PSE&G and Power

Regional through and out rates (RTOR)

RTOR are separate transmission rates for transactions where electricity originated in one transmission control area transmitted to a point outside that control area. Both the Midwest Independent Transmission System Operator, Inc. (MISO) and PJM charged RTORs through December 1, 2004. FERC approved a new regional rate design, which became effective December 1, 2004 for the entire PJM/MISO region and approved the continuation of license plate rates and a transitional Seams Elimination Charge/Cost Adjustment/Assignment (SECA) methodology effective from December 1, 2004 through March 2006.