17

WuXi: Excessive Valuation on Aggressive Assumptions

„ Proposed WX acquisition price is excessive at 16x 2010 EBITDA — nearly 56x “cash” earnings(1) — and

relative to CRL’s high single-digit EBITDA multiple valuation

§ Compounded by issuing stock well below intrinsic value(2) and when preclinical earnings down 50%

§ WX CEO sold stock more than 50% below CRL offer price; offer price is minimal premium to post-IPO

private equity investor initial cost, suggesting future standalone business prospects are very

challenging

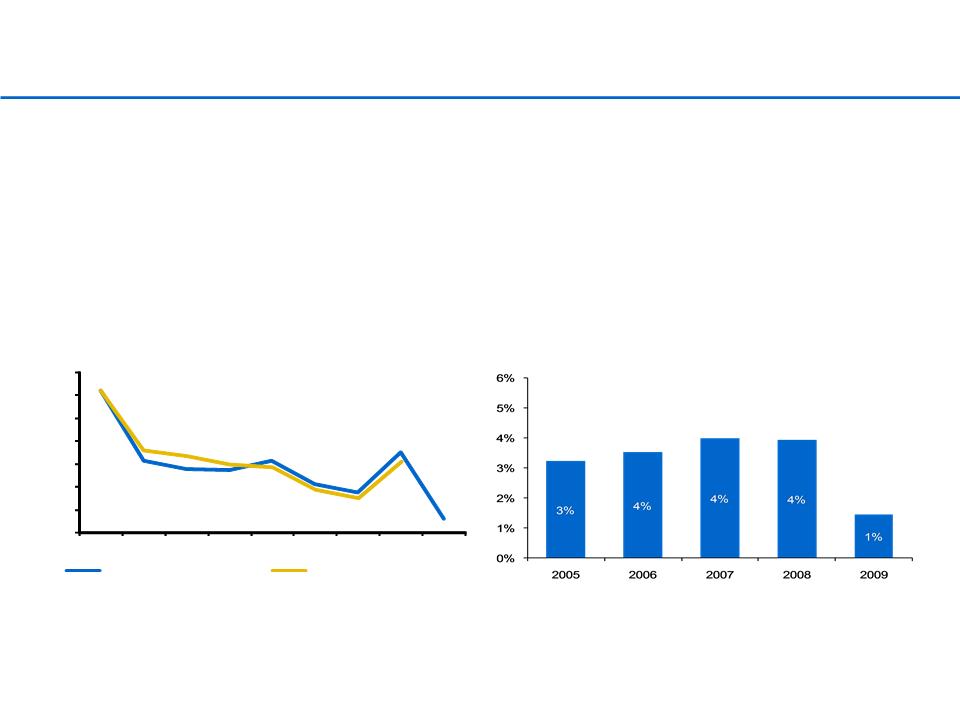

„ Despite raising 2010 guidance, WX projections are aggressive, requiring reversal of negative trends and

robust results from unproven businesses

§ Assume reacceleration in revenue growth (after deceleration) and margin improvement (gross margin

declining annually since 2003 with management guiding a further decline for 2010) despite labor cost

inflation in China pressuring margins

§ “To reach expectations will require sustainable Lab services growth and successful execution in two

relatively early stage businesses (tox and manufacturing) while driving margin expansion in the face of

pricing pressure.”(3)

§ “WX's new guidance is still well below the forecasts given…This makes the 6/1 proxy forecasts

aggressive.”(4)

„ WX’s primary competitive advantages of scale and cost and are not sustainable, putting projections at risk

§ Chinese competitors reaching scale (#2 competitor employing almost half the chemists as WX)

impacting WX margins

§ India offers a promising new geography given lower labor costs and highly skilled workforce

(1) See JANA 13D, June 16, 2010 for “cash” earnings calculation.

(2) “[A] split of CRL could unlock shareholder value that is equivalent to $47 per share”; “CRL: Time to unlock value; we see $6/share from recap, $11/share from an RMS/PCS split”;

Stephen Unger, William Hite; Lazard Capital Markets, Inc., June 17, 2010.

(3) “Merger assumptions leave little room for error”; Eric Lo, Eric H. Chang; Bank of America Merrill Lynch, June 2, 2010.

(4) “Pre-announcement Adds Arrow to CRL Quiver”; David Windley, Timothy C. Evans, Andrew Hilgenbrink; Jefferies & Company Inc., July, 15 2010.

Even assuming strategic benefits from the WuXi deal, excessive price destroys shareholder value.