6

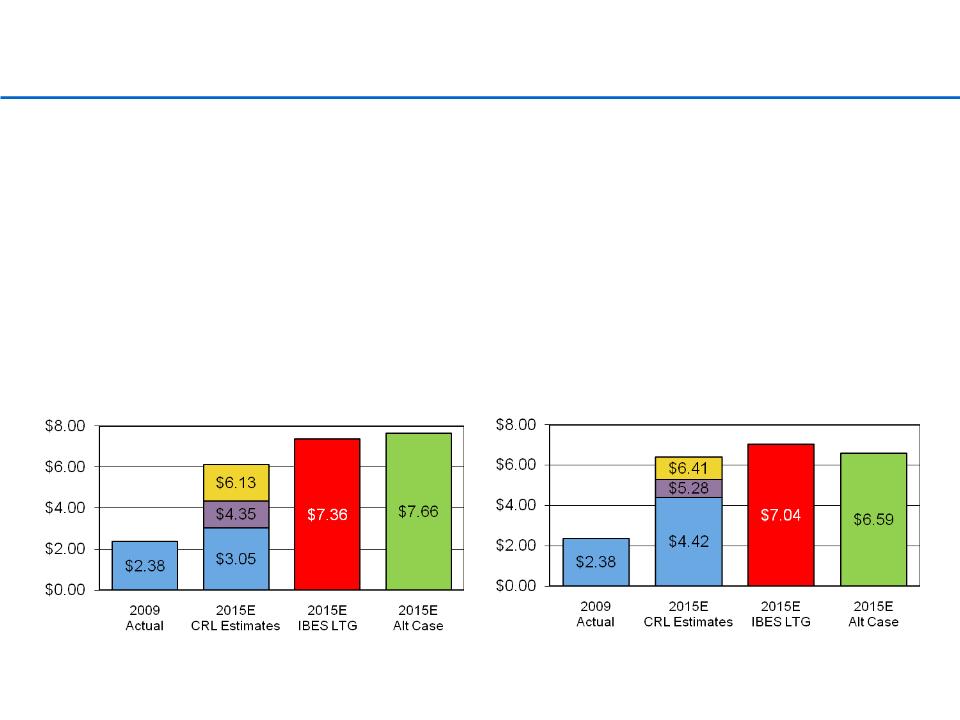

„ CRL’s standalone earnings prospects are highly attractive given recovery from cyclical low in preclinical (and

minimal reinvestment requirements), yet CRL relies on overly conservative assumptions to understate this potential

§ “Consensus” I/B/E/S long-term growth rate is inconsistently applied. WX’s 17.2% rate is used in WX projections, but

CRL’s 12.6% rate (which is cited by CRL in its analysis on page 5 and is consistent with CRL’s disclosed internal

forecast) is discarded in projecting CRL earnings growth(1)

§ CRL standalone growth rate assumptions of 0% or 5% for both revenues and EPS are preposterous given that CRL’s

own standalone high single-digit revenue growth guidance suggests double-digit EPS growth with operational leverage,

and that consensus estimates and CRL’s own standalone 2011 EPS forecast of $2.70 have a higher EPS growth

trajectory

§ Also, implied core earnings would decline under 0% revenue growth case, which is indefensible given that the preclinical

business is at a cyclical low and that debt pay downs and growth in balance sheet cash will also drive earnings growth

„ However, CRL uses highly aggressive WX assumptions to inflate potential earnings accretion from a WX acquisition

§ WX 2010-2012 projections were prepared by WX without any adjustment from CRL and are well above Street projections

§ CRL applies 17.2% long-term growth rate to these already aggressive 2012 WX estimates, yet the average growth in

2012-2015 operating EPS for analysts who project this period is only 12%(2)

§ CRL assumes that only WX will benefit from operating leverage, with projections assuming material operating leverage

(2012 revenue growth of 15% compared to operating income growth of 21%)

„ Buyback assumptions understate earnings potential of standalone buyback

§ Share repurchase scenario (which provides for a substantially larger 2011 buyback than share repurchase combined with

a WX transaction scenario given debt limitation) is assumed to occur at $41.75 (5% premium to CRL’s 4/23/10 stock

price), which is a staggering 23% premium to CRL’s current stock price. A buyback at a 5% premium to 7/21/10 price

increases standalone buyback scenario 2015 EPS accretion by 12%-15% leaving all other assumptions constant

Invalid and Unreasonable Assumptions

(1) See CRL 8-K filed with the SEC on June 25, 2010 for internal forecast.

(2) Based on Goldman Sachs, Morgan Stanley and Jefferies 2012-2015 growth rates of 19%, 12%, and 6% respectively.

Charles River Assertion: “The Transaction Adds Meaningfully to CRL’s Standalone Long-Term Earnings Growth ” (page 7)

Fact: Higher projected earnings from WX transaction are derived from invalid and unreasonable assumptions