| Writer’s Direct Number | Writer’s E-mail Address |

| 212.756.2376 | eleazer.klein@srz.com |

October 12, 2017

VIA EDGAR AND ELECTRONIC MAIL

Nicholas P. Panos Senior Special Counsel, Office of Mergers and Acquisitions Division of Corporate Finance U.S. Securities and Exchange Commission 100 F Street, NE Washington, D.C. 20549 | | |

| | | Re: | EQT Corporation Amendment No. 1 to PREC14A preliminary proxy statement filing made on Schedule 14A Filed on September 26, 2017 by JANA Partners LLC File No. 001-03551 |

| | | | | | |

Dear Mr. Panos:

On behalf of JANA Partners LLC (“JANA” or the “Filing Person”), we are responding to your letter dated October 11, 2017 (the “SEC Comment Letter”) in connection with the Amendment No. 1 to the proxy statement on Schedule 14A filed on September 26, 2017 (“Revised Preliminary Proxy Statement”) with respect to EQT Corporation (“EQT” or the “Company”). We have reviewed the comment of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) and respond below.

For your convenience, the comment is restated below in italics, with our response following. Capitalized terms used but not defined herein have the meaning ascribed to such terms in the Revised Preliminary Proxy Statement.

Nicholas P. Panos, Esq.

October 12, 2017

Proposal 1: Share Issuance Proposal

Reasons to Vote Against the Proposed Acquisition

The Rice Acquisition Would Destroy Shareholder Value, page 3

Overstatement of Financial Benefits of the Acquisition, page 3

| 1. | Refer to the statement under this heading that EQT management “has admitted that these additional synergies may be worth $0,” which you represent, per footnote 5, is supported by EQT management’s own statements provided on the company’s second quarter earnings conference call conducted June 19, 2017. Please advise us how your quoted assertion is consistent with the opinion offered by EQT’s CEO on such call regarding additional synergies in which he predicted, “I think you will also conclude that our original estimate of $2.5 billion in synergies is very conservative, and we expect to be able to exceed that amount by a fair margin.” In addition, please provide us with the factual foundation for the quoted assertion made in your proxy statement, or delete the reference. Refer to Note b. of Rule 14a-9. |

In response to the Staff’s Comment, the Filing Persons respectfully note that the reference to “additional synergies” is separate and distinct from EQT’s claim of $2.5 billion in [base] synergies, which was the figure used by the Company when it announced the Rice transaction (the “Rice Transaction”) on June 19, 2017 and thus is not the additional synergy valuation being addressed in footnote 5 of the Revised Preliminary Proxy Statement.[1]Therefore, the statement by EQT’s Chief Executive Officer, Steven Schlotterbeck —“I think you will also conclude that our original estimate of $2.5 billion in synergies is very conservative, and we expect to be able to exceed that amount by a fair margin” (the “Schlotterbeck Quote”)—is not responsive to the statement supported by footnote 5 in the Revised Preliminary Proxy. Rather, the statement by Mr. Schlotterbeck that the Company “expects to be able to exceed” the $2.5 billion in synergies is precisely subject to the concern expressed by the Filing Persons in the Revised Preliminary Proxy Statement—that such expectations could in fact come to nothing.

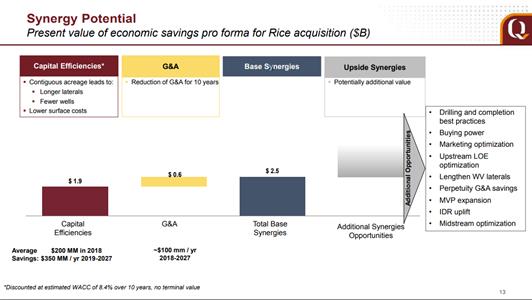

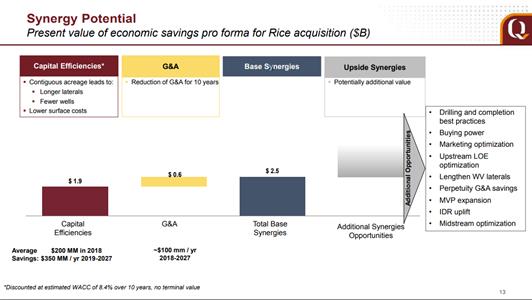

As noted on slide 13 of EQT’s presentation to investors (the “Investor Presentation”) filed under cover of Form 425 and pursuant to Rule 14a-12 and reproduced below, EQT has classified its claimed synergies for the Rice Transaction into groups: $2.5 billion in “Base Synergies” and “up to” $7.5 billion in present value of “Upside Synergies” or “Additional Synergies,” which are the synergies being referenced in the Schlotterbeck Quote.

__________________________

[1]SeeForm 8-K filed by the Company on June 19, 2017 (the “June 19 8-K”);see alsoslide 8 to the Company’s Investor Presentation, filed as Exhibit 99.2 to the June 19 8-K.

Nicholas P. Panos, Esq.

October 12, 2017

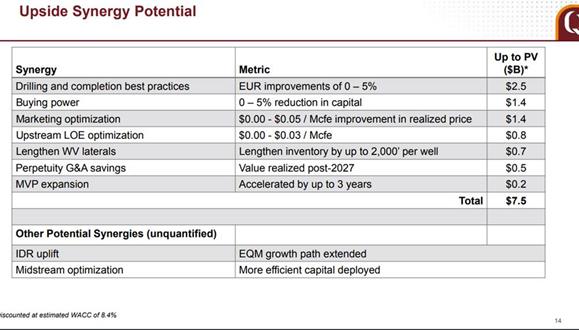

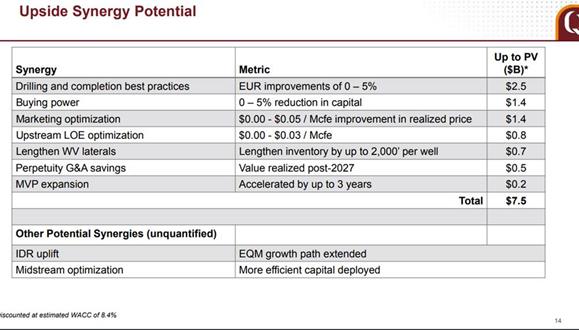

As an acknowledgment that the “Upside Synergies” might not have any value, EQT notably does not indicate a value on slide 13 and simply says they represent “potentially additional value.” Slide 13 of the Investor Presentation EQT breaks down what it claims to be potential “Upside Synergies” into seven categories: (i) Drilling and completion best practices, (ii) buying power, (iii) marketing optimization, (iv) upstream LOE optimization, (v) lengthen WV laterals, (vi) perpetuity G&A savings, and (vii) MVP expansion. This breakdown is repeated on slide 14 of the Investor Presentation, where the Company claims that it can provide “up to” $7.5 billion in additional synergistic value, which provide a ceiling, rather than a floor for the upside synergistic value.

Nicholas P. Panos, Esq.

October 12, 2017

EQT management itself has acknowledged that such potential synergies are merely speculative and representative of a ceiling: on a July 27, 2017 earnings call (the “July 27 Earnings Call”),[2] Mr. Schlotterbeck stated:

Well, if you look at the slide 14, it's actually an additional $7.5 billion ofpotential. So I do want to be clear.The numbers that are shown on that page are all the numbers at the high-end of the ranges. And I think it's probably a bit optimistic to assume that we could capture all of that.So I don't want anyone to take away from this that we're saying we're going to get another $7.5 billion on the top of the $2.5 billion.” (emphasis added)

Mr. Schlotterbeck’s language was similarly wavering when asked by an analyst on the July 27 Earnings Call about the timing of the “Upside Synergies,” to which Mr. Schlotterbeck responded,

I do fullyexpect we will getsome amount probablyfrom each of these [Upside Synergy] categories. One of the reasons that we didn't provide these upfront is [. . . .]these are far more difficult to prove and to do a look back on and demonstrate that we captured it and to quantify how much we got and when we got it, because of the nature of them versus the two categories of synergies that we talked about initially, which, A, we have extremely high confidence we will get at least that much, and, 2, we will easily be able to demonstrate how we performed versus those estimates.These will be much more difficult to demonstrate how much we were able to get. (emphasis added).

The words “some amount probably” almost explicitly concede EQT management’s position that there is a considerable probability that such “Upside Synergies” may not be realized. In addition, Mr. Schlotterbeck’s admission that such “Upside Synergies” will be “much more difficult to demonstrate” casts into serious doubt the potential existence of such synergies, simply due to the fact that if one cannot demonstrate synergies, it is difficult to prove that such synergies exist. Therefore, any prediction aimed at estimating future synergies one cannot even later measure strongly appears as empty rhetoric to a discerning investor.

The numbers presented on slide 14 provide a narrative that supports the Filing Persons’ concerns. In the central column, EQT expressly acknowledges that the value of the synergies in the first four categories may be $0 when it notes that the low end of the ranges of EUR improvements, reduction in capital, improvement in realized price and upstream LOE optimization are “0” or “$0.00.”

Regarding the “lengthen WV lateral” synergy, on the July 27 Earnings Call, EQT management acknowledged that any lengthening of the inventory would require a change to West Virginia’s legislation and regulations, implicitly acknowledging that there would be no increase if there is no change in legislation.[3] With respect to the “perpetuity G&A savings” synergy, EQT management

__________________________

[2] A transcript of which is filed under cover of Form 425 on July 28, 2017 (also available at https://seekingalpha.com/article/4091421-eqt-eqt-q2-2017-results-earnings-call-transcript?part=single), relevant portions of which are attached hereto asExhibit A.

[3]Steven Schlotterbeck - EQT Corp.: “It also gives us more time to work on the joint development and co-tenancy legislation in West Virginia that we still feel needs to happen in West Virginia. And we still remain cautiously optimistic that with more time we will get that legislation through. That would be a big improvement for West Virginia lateral lengths and economics will make West Virginia more competitive in certain areas with our Pennsylvania opportunity. So, having more time to work on that before we drill the wells is certainly a big advantage.” (emphasis added)

Nicholas P. Panos, Esq.

October 12, 2017

expressly acknowledged that while it quoted $500 million on slide 14, in reality EQT management’s own estimate is “more conservative.[4] Lastly, with respect to the “MVP expansion” category of synergy, EQT management simply says that “it’s possible that that expansion opportunity could be accelerated.”[5] EQT management thus implies that the MVP expansion could also not be accelerated, acknowledging that there would be $0 in pulled forward present value.

In light of the above, and using EQT management’s own low end of the ranges that EQT itself provided and acknowledged would be “hard to quantify,” the total value of the “Upside Synergies” or “Additional Synergies” thus very well may be $0. Accordingly, the Filing Persons believe that their statement that EQT management “has admitted that these additional synergies may be worth $0”has a proper factual foundation in accordance with Rule 14a-9. The Filing Persons therefore do not believe an amendment to the Revised Preliminary Proxy Statement would be appropriate.

* * *

Thank you for your attention to this matter. Should you have any questions or comments, or require any further information with respect to the foregoing, please do not hesitate to call me at (212) 756-2376.

Very truly yours,

/s/ Eleazer Klein

Eleazer Klein

__________________________________________________________________________________

[4]Steven Schlotterbeck - EQT Corp.: “LOE optimization is again – we haven't built that into our synergies. But clearly because of the operational overlap of the two companies, we would fully expect to realize some unit LOE improvements. And we've quoted a $0.03 improvement in yields, $800 million in additional value. We talked about the G&A. We've only discounted that for 10 years. If you assume that that continues in perpetuity it's another $0.5 billion, but we tend to be more conservative on our estimate.”

[5]July 27 Earnings Call.

Exhibit A

Neal D. Dingmann - SunTrust Robinson Humphrey, Inc.

Good morning, gentlemen. Steve, I don't want to belabor the synergies, but it's such a positive important part. I just want to make sure I'm clear on that slide 14. Generally, timing on – you walked pretty detailed through the $2.5 billion. Just wondering that additional $5 billion. I mean is that a year or so after Rice closes too? I'm just trying to get a very general sense of how you kind of envision the timing of those other $5 billion?

Steven Schlotterbeck - EQT Corp.

Yeah. Well, if you look at the slide 14, it's actually an additional $7.5 billion of potential. So I do want to be clear.The numbers that are shown on that page are all the numbers at the high-end of the ranges. And I think it's probably a bit optimistic to assume that we could capture all of that. So I don't want anyone to take away from this that we're saying we're going to get another $7.5 billion on the top of the $2.5 billion.

I do fully expect we will get some amount probably from each of those categories. And it's probably a good time to mention this. One of the reasons that we didn't provide these upfront is these – to your question, Neal, these are far more difficult to prove and to do a look back on and demonstrate that we captured it and to quantify how much we got and when we got it, because of the nature of them versus the two categories of synergies that we talked about initially, which, A, we have extremely high confidence we will get at least that much, and, 2, We will easily be able to demonstrate how we performed versus those estimates. These will be much more difficult to demonstrate how much we were able to get.

So, with that caveat, these were all – so the ones that are related to a development program, so like incremental EUR improvements, that was to get to the $2.5 billion, I'd assume 5% of every well point forward. So, that assumes starting day one, so that's probably frankly a bit aggressive. It will take a little time to study the – to get the data in, have the engineers look at it, implement new practices, but that applies to several thousand wells. So if we missed a first few dozen, it probably doesn't change the value that much. And most of them are similar. It assumes applying that improvement on the pro forma development plan.

[. . . .]

Drew E. Venker - Morgan Stanley & Co. LLC

No. That's great. All the color really helps actually. So, just to follow-up on the West Virginia piece, with that – seeing as laterals involved swaps or some unitization or something, is that partly of what factor into how successful that upside is?

Steven Schlotterbeck - EQT Corp.

Yes. It would frankly be doing more of what we're already doing, but having more time to do it. So, swaps for sure. We have a lot of acreage that overlaps with one of our big competitors down there. But swaps are particularly difficult to work out. You have different acreage dedications to different midstream companies. You have different net revenue interest, different terms in the leases. So, it takes a lot of effort to get the swaps done.

It also gives us more time to work on the joint development and co-tenancy legislation in West Virginia that we still feel needs to happen in West Virginia. And we still remain cautiously optimistic that with more time we will get that legislation through. That would be a big improvement for West Virginia lateral lengths and economics will make West Virginia more competitive in certain areas

with our Pennsylvania opportunity. So, having more time to work on that before we drill the wells is certainly a big advantage.