| Writer’s Direct Number | Writer’s E-mail Address |

| 212.756.2376 | eleazer.klein@srz.com |

November 3, 2017

VIA EDGAR AND ELECTRONIC MAIL

Nicholas P. Panos Senior Special Counsel, Office of Mergers and Acquisitions Division of Corporate Finance U.S. Securities and Exchange Commission 100 F Street, NE Washington, D.C. 20549 | |

| | Re: | EQT Corporation (“EQT” or the “Company”) DFAN14A definitive additional soliciting materials filed on Schedule 14A Filed on October 27, 2017 by JANA Partners LLC et al. File No. 001-03551 |

Dear Mr. Panos:

On behalf of JANA Partners LLC et al. (“JANA” or the “Filing Persons”), we are responding to your letter dated October 31, 2017 (the “SEC Comment Letter”) in connection with the definitive additional soliciting materials on Schedule 14A filed on October 27, 2017 (the “Shareholder Presentation Addendum”) in connection with the Company’s solicitation of proxies for the purposes of calling a special meeting of EQT shareholders (the “Special Meeting Solicitation”) to approve the issuance of shares of common stock of the Company in connection with the proposed merger between Eagle Merger Sub I, Inc., an indirect, wholly owned subsidiary of EQT, and Rice Energy Inc. (the merger party, “Rice,” the merger, the “Merger”). We have reviewed the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) and respond below. For your convenience, the comments are restated below in italics, with our responses following.

Nicholas P. Panos, Esq.

November 3, 2017

Page 2

DFAN14A | Definitive Additional Soliciting Materials

| 1. | Refer to the following statement appearing on page three of the slide presentation: “EQT has acknowledged the acquisition is insufficient to achieve its synergy claims, while also continuing to disclose inconsistent and irreconcilable synergy totals.” Please provide us with the factual foundation for the multiple assertions in each clause of the quoted statement. Alternatively, please publish corrective statements in the next communication disseminated to EQT shareholders. See Note b. to Rule 14a-9. |

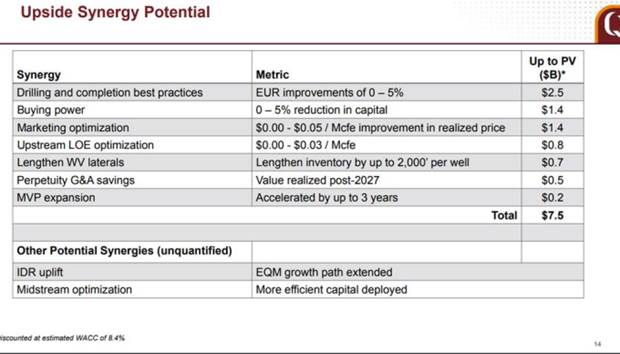

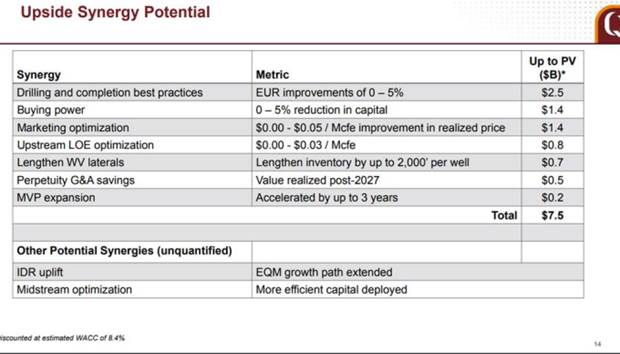

In response to the Staff’s Comment, the Filing Persons respectfully note as background that the Company’s July presentation to investors (the “July Investor Presentation”)1 indicates synergies for the Merger would include $2.5 billion of base synergies and up to $7.5 billion of “Upside Synergy” potential. For ease of reference, the relevant slides from the July Investor Presentation are attached hereto asExhibit A.

Despite this, the Company itself has acknowledged that the Merger is likely insufficient to achieve the Company’s purported synergy potentials, stating that the $7.5 billion of potential synergies are speculative and merely “potential” and that it would be “difficult to demonstrate” how much of the Company’s stated upside synergies actually could be achieved. On a July 27, 2017 earnings call (the “July 27 Earnings Call”),2 the Company’s Chief Executive Officer, Steven Schlotterbeck (“Mr. Schlotterbeck”), stated:

Well, if you look at the slide 14 [of the July Investor Presentation], it’s actually an additional $7.5 billion of potential. So I do want to be clear. The numbers that are shown on that page are all the numbers at the high-end of the ranges. AndI think it’s probably a bit optimistic to assume that we could capture all of that. So I don’t want anyone to take away from this that we’re saying we’re going to get another $7.5 billion on the top of the $2.5 billion.” (emphasis added)

Mr. Schlotterbeck’s above remarks that the Company’s own estimates are “probably a bit optimistic” is obviously troubling. If the CEO himself concedes that estimates by management at the Company are too optimistic, this can only call into question by all investors’ the other synergy claims made by the Company.

Mr. Schlotterbeck’s language was similarly wavering when asked by an analyst on the July 27 Earnings Call about the timing of the “Upside Synergies,” to which Mr. Schlotterbeck responded:

I do fully expect we will getsome amount probably from each of these [Upside Synergy] categories. One of the reasons that we didn’t provide these upfront is [. . . .] these are far more difficult to prove and to do a look back on and demonstrate that we captured it [. . . .] These will be much more difficult to demonstrate how much we were able to get.

_______________________

1 The July Investor Presentation was filed by the Company on July 27, 2017 under cover of Form 425 and pursuant to Rule 14a-12.

2A transcript was filed with the Commission under cover of Form 425 on July 28, 2017 (also available at https://seekingalpha.com/article/4091421-eqt-eqt-q2-2017-results-earnings-call-transcript?part=single), relevant portions of which are attached hereto asExhibit B.

Nicholas P. Panos, Esq.

November 3, 2017

Page 3

The words “some amount probably” almost explicitly concede EQT management’s position that there is a considerable probability that such “Upside Synergies” of the Merger may not be realized. In addition, Mr. Schlotterbeck’s admission that such “Upside Synergies” will be “much more difficult to demonstrate” casts into serious doubt the potential existence of such synergies, simply due to the fact that if one cannot demonstrate synergies, it is difficult to prove that such synergies exist. This makes the inclusion of the upside scenario in the Company's materials filed with the Commission and provided to its shareholders of great concern. Given the foregoing, along with Mr. Schlotterbeck’s status as the CEO of the Company and that he was addressing the Company’s investors on an earnings call as a representatives of the Company, the Filing Persons have provided a sufficient rational basis for stating that the Company has acknowledged that the Merger will likely be insufficient to achieve its synergy claims.

In addition, the figures presented by the Company in support of its claims about synergies are also inconsistent and irreconcilable. On slide 8 of the Company’s June presentation to investors (the “June Investor Presentation”),3 the Company had included the claimed $2.5 billion of synergies, which it called “Total Synergies,” while the other $7.5 billion of additional synergy potential is noticeably absent. A copy of such slide from the June Investor Presentation is reproduced below:

The $7.5 billion of “Upside Synergy” potential was only later disclosed as potential synergies, after the Filing Persons noted their concerns with the Merger. Aside from Mr. Schlotterbeck’s admission that the Company does not wish for investors to think “we’re saying we’re going to get another $7.5 billion on the top of the $2.5 billion,” despite the fact that this is exactly what was put in front of its investors, the Company has not yet clarified in an investor presentation or otherwise its final projection for “Total Synergies,” leaving investors to wonder if the “Total Synergy” figure will be $2.5 billion, $7.5 billion, or something in between $2.5 billion and $10 billion.

_______________________

3The June Investor Presentation was filed by the Company on June 19, 2017 as the attached Exhibit 99.2 to the Form 8-K.

Nicholas P. Panos, Esq.

November 3, 2017

Page 4

Aside from the Company’s lack of clarity about total synergies, the Filing Persons are even concerned about the Company’s claimed $2.5 billion of base synergies. With regard to such claimed base synergies, the Filing Persons have calculated that such estimation could, in fact, fall short by $1.3 billion. As depicted in the calculations attached hereto asExhibit C, it would be highly unlikely for the Company to achieve $2.5 billion of base synergies given the pre-tax net present value (NPV) of the synergies being equal to approximately $1.5 billion. Thus, in addition to the Company providing inconsistent synergy predictions between the June Investor Presentation and the July Investor Presentation, the Company’s claimed $2.5 billion of base synergies are irreconcilable as a standalone figure. Therefore, the Filing Persons respectfully note that it has a reasonable factual foundation for making such statements to the EQT shareholders.

The Filing Persons also note the Staff’s request to “publish corrective statements in the next communication disseminated to EQT shareholders.” In light of recent developments, the Filing Persons have decided to withdraw their proxy solicitation and no longer intend to continue soliciting proxies pursuant to the Filing Persons’ definitive proxy statement, filed on Schedule 14A on October 13, 2017. Therefore, besides making certain filings related to the withdrawal of its solicitation efforts, the Filing Persons do not anticipate making any additional filings of additional soliciting material in connection with the Special Meeting Solicitation or Merger.

| 2. | Refer to the following statement appearing on page seven of the slide presentation: “EQT’s comments this week only confirm that it cannot achieve 12,000 foot laterals solely as a result of the RICE transaction, and any effort to do so will involve[ ] substantial additional time, expense, and execution risk, even after overpaying for RICE and a massively-diluted issuance of EQT stock.” Please provide us with the factual foundation for the assertion that EQT made comments that, in effect, confirmed the participants’ beliefs as articulated in the balance of the quoted statement. Alternatively, please publish corrective statements in the next communication disseminated to EQT shareholders. See Note b. to Rule 14a-9. |

In response to the Staff’s Comment, the Filing Persons respectfully note that, on an October 26, 2017 earnings call (the “October 26 Earnings Call”),4 Mr. Schlotterbeck stated that the Merger alone cannot achieve 12,000 foot laterals, but instead the Company will need to virtually “get started from scratch” to drill the 12,000 foot laterals referenced by the Filing Persons:

Well, extremely confident. I just gave you one stat that supports that confidence, where we’re going to come out of the gate above the average. And that’s – I think that’s pretty remarkable,given that we have to re-permit all this. We have to get started from scratch. [. . . .] After the Rice transaction, EQT will control 212,000 of those [370,000 acres in Greene County].So

_______________________

4A transcript was filed with the Commission under cover of Form 425 on October 26, 2017 (also available at https://seekingalpha.com/article/4117030-eqt-corporations-eqt-ceo-steven-schlotterbeck-q3-2017-results-earnings-call-transcript), relevant portions of which are attached hereto asExhibit D.

Nicholas P. Panos, Esq.

November 3, 2017

Page 5

57% of the county will be under the control of EQT, where 80% of that is remaining to be drilled. So there’s lots of remaining inventory acreage. Tremendous amount of resource in place. So very, very confident in our ability to deliver on that synergy. (emphasis added)

As emphasized above, Mr. Schlotterbeck has acknowledged that the Company will need to “re-permit” and “get started from scratch” with regard to making the acreage in the Merger contiguous, which undoubtedly requires the Company to shoulder extra time, resources, and risk. As Mr. Schlotterbeck indicates, extra work must be done as there is a lot “of remaining inventory acreage” constituting “inventory acreage” that the Company must prepare for drilling. Therefore, in light of the foregoing, the Filing Persons assert a reasonable factual foundation for stating that the Company cannot achieve 12,000 foot laterals solely as a result of the Merger.

The Filing Persons also respectfully incorporate by reference the last paragraph from its response to Staff’s Comment 1, provided above, into its response provided herein.

| 3. | Rule 14a-6(b), by its terms, requires that the definitive additional soliciting materials be filed with “the Commission no later than the date they are first sent or given to security holders.” Advise us why the slides are dated October 26, 2017 and the filing date of the slides under cover of Schedule 14A is October 27, 2017. |

In response to the Staff’s Comment, the Filing Persons note that while the above-referenced presentation was prepared internally and therefore dated October 26, 2017, such soliciting materials were not disseminated to security holders until October 27, 2017, and therefore the Filing Persons’ filing of such materials under cover of Schedule 14A on October 27, 2017 meets the requirements set forth by Rule 14a-6(b).

Nicholas P. Panos, Esq.

November 3, 2017

Page 6

* * *

Thank you for your attention to this matter. Should you have any questions or comments, or require any further information with respect to the foregoing, please do not hesitate to call me at (212) 756-2376.

| | Very truly yours, |

| | |

| | |

| | /s/ Eleazer Klein |

| | Eleazer Klein |

EXHIBIT A

EXHIBIT B

Neal D. Dingmann - SunTrust Robinson Humphrey, Inc.

Good morning, gentlemen. Steve, I don’t want to belabor the synergies, but it’s such a positive important part. I just want to make sure I’m clear on that slide 14. Generally, timing on – you walked pretty detailed through the $2.5 billion. Just wondering that additional $5 billion. I mean is that a year or so after Rice closes too? I’m just trying to get a very general sense of how you kind of envision the timing of those other $5 billion?

Steven Schlotterbeck - EQT Corp.

Yeah. Well, if you look at the slide 14, it’s actually an additional $7.5 billion of potential. So I do want to be clear. The numbers that are shown on that page are all the numbers at the high-end of the ranges. And I think it’s probably a bit optimistic to assume that we could capture all of that. So I don’t want anyone to take away from this that we’re saying we’re going to get another $7.5 billion on the top of the $2.5 billion.

I do fully expect we will get some amount probably from each of those categories. And it’s probably a good time to mention this. One of the reasons that we didn’t provide these upfront is these – to your question, Neal, these are far more difficult to prove and to do a look back on and demonstrate that we captured it and to quantify how much we got and when we got it, because of the nature of them versus the two categories of synergies that we talked about initially, which, A, we have extremely high confidence we will get at least that much, and, 2, We will easily be able to demonstrate how we performed versus those estimates. These will be much more difficult to demonstrate how much we were able to get.

So, with that caveat, these were all – so the ones that are related to a development program, so like incremental EUR improvements, that was to get to the $2.5 billion, I’d assume 5% of every well point forward. So, that assumes starting day one, so that’s probably frankly a bit aggressive. It will take a little time to study the – to get the data in, have the engineers look at it, implement new practices, but that applies to several thousand wells. So if we missed a first few dozen, it probably doesn’t change the value that much. And most of them are similar. It assumes applying that improvement on the pro forma development plan.

[. . . .]

Drew E. Venker - Morgan Stanley & Co. LLC

No. That’s great. All the color really helps actually. So, just to follow-up on the West Virginia piece, with that – seeing as laterals involved swaps or some unitization or something, is that partly of what factor into how successful that upside is?

Steven Schlotterbeck - EQT Corp.

Yes. It would frankly be doing more of what we’re already doing, but having more time to do it. So, swaps for sure. We have a lot of acreage that overlaps with one of our big competitors down there. But swaps are particularly difficult to work out. You have different acreage dedications to different midstream companies. You have different net revenue interest, different terms in the leases. So, it takes a lot of effort to get the swaps done.

It also gives us more time to work on the joint development and co-tenancy legislation in West Virginia that we still feel needs to happen in West Virginia. And we still remain cautiously optimistic that with more time we will get that legislation through. That would be a big improvement for West Virginia lateral lengths and economics will make West Virginia more competitive in certain areas with our Pennsylvania opportunity. So, having more time to work on that before we drill the wells is certainly a big advantage.

EXHIBIT C

EXHIBIT D

Arun Jayaram – JPMorgan Securities LLC

Yes, Steve, I wanted to see if you could dig down a little bit. Obviously, a lot of focus recently on kind of acreage maps and interpretations of how many long-lateral locations you long-lateral locations you have on a pro forma basis. I just wondering if you could, again, just maybe go through your confidence around the 1,200 number on a pro forma basis.

Steven Schlotterbeck – EQT Corp.

Well, extremely confident. I just gave you one stat that supports that confidence, where we’re going to come out of the gate above the average. And that’s – I think that’s pretty remarkable, given that we have to re-permit all this. We have to get started from scratch. So high, high confidence. And I’ll give you a couple other stats that maybe will relay some confidence, especially in contrast to some of the noise that’s been out there. In Greene County, which is where the bulk of this acreage is – there’s lot in Washington, too, but if you just focus on Greene County for a second.

Greene County has a total acreage of 370,000 acres. To date, over the last 11 years, 75,000 of those acres have been developed. So the gas is being drained from 75,000 acres. At least 295,000 acres in Greene County alone that un-yet – are, as of now, undrilled and undeveloped and undrained. That’s about 80% of the acreage in Greene County still is available to produce gas. And one other stat for us and for Greene County, again, there’s 370,000 acres. After the Rice transaction, EQT will control 212,000 of those acres. So 57% of the county will be under the control of EQT, where 80% of that is remaining to be drilled. So there’s lots of remaining inventory acreage. Tremendous amount of resource in place. So very, very confident in our ability to deliver on that synergy.