| Writer’s Direct Number | Writer’s E-mail Address |

| 212.756.2376 | Eleazar.Klein@srz.com |

March 4, 2022

VIA E-MAIL AND EDGAR

Mr. Daniel Duchovny Special Counsel Office of Mergers and Acquisitions U.S. Securities and Exchange Commission 100 F Street, NE Washington, D.C. 20549 | |

| | | Re: | Zendesk, Inc. Soliciting Materials filed pursuant to Rule 14a-12 on February 16 and 28, 2022 Filed by JANA Partners LLC, JANA Special Situations Management, LP, Barry Rosenstein, Quincy Allen, Felicia Alvaro, Jeff Fox, and Scott Ostfeld File No. 001-36456 |

| | | | | |

Dear Mr. Duchovny:

On behalf of JANA Partners LLC and its affiliates (collectively, “JANA”) and the other filing persons (together with JANA, the “Filing Persons”) we are responding to your letter dated March 1, 2022 (the “SEC Comment Letter”) in connection with the soliciting material filed on DFAN14A, filed on February 16, 2022 (the “February 16 DFAN14A”) and on February 28, 2022 (the “February 28 DFAN14A”) with respect to Zendesk, Inc. (“Zendesk” or the “Company”).

For your convenience, the comments of the staff (the “Staff”) of the Securities and Exchange Commission are restated below in italics, with our responses following.

Soliciting Materials filed pursuant to Rule 14a-12 on February 16, 2022

Soliciting Materials filed February 16, 2022, page 1

1. Each statement or assertion of opinion or belief must be clearly characterized as such, and a reasonable factual basis must exist for each such opinion or belief. Support for opinions or beliefs should be self-evident, disclosed in the proxy statement or provided to the staff on a supplemental basis. Provide support for your disclosure that entering into the agreement with Momentive has caused “lasting damage” and your belief that “the board has all but assured that Zendesk will suffer a persistent discount to its intrinsic value,” the board’s actions have “reinforced concerns about its history of refusing to engage with interested strategic and financial buyers for the Company” and your belief that “shareholders are perpetually in danger of what Glass Lewis characterized as the board’s “ready, fire, aim” process” (footnote omitted).

Mr. Duchovny Page 2 March 4, 2022 | | |

In response to the Staff’s comment, the Filing Persons respectfully submit the following support and factual bases for the soliciting material quoted by the Staff in its comment.

| · | “[E]ntering into the agreement with Momentive has caused ‘lasting damage.’” |

The Filing Persons respectfully note that the Staff refers to a statement that employs passive voice and, in full context, reads: “However, lasting damage has been done.” The “lasting damage” that the Filing Persons refer to here are the ten downgrades that Zendesk received from the fourteen analysts that cover its stock following the October 28, 2021 announcement of its proposed acquisition of Momentive Global, Inc. (the company, “Momentive,” the proposed acquisition, the “Momentive Acquisition”), including negative Wall Street analyst commentary raising concerns about the Momentive Acquisition. The day of the announcement, analysts at Wolfe Research, LLC reported that Zendesk stock was down 16% after hours because investors did not “understand the merits of the deal…trust management’s ability to execute on the stated plan effectively, and [didn’t] understand the structure or timing of the deal given recent history of consistent execution challenges.” The following day, on October 29, 2021, analysts at Cowen, Inc. reported that the “[Momentive Acquisition] seems to be out of left field and we think many investors are ‘head-scratching’ the rationale.” For several months following the announcement of the Momentive Acquisition Zendesk stock continued to underperform as compared to the S&P 500 and the NASDAQ, and as of January 26, 2022, Zendesk ranks 15/19 and 14/18 in total shareholder return on a 1-year and 2-year basis, respectively, against its proxy peer group. On February 28, 2022 analysts at William Blair & Company reported: “[w]e also believe that it may take investors some time to move past the events of the last few months and for sentiment to turn positive as the Zendesk story resets...”

| · | “[T]he board has all but assured that Zendesk will suffer a persistent discount to its intrinsic value[.]” |

In connection with the Momentive Acquisition, the board of directors (the “Board”) approved the issuance of what JANA estimated was approximately $6 billion of intrinsic value of its equity to Momentive for $4 billion, or $124/share. A standalone fairness opinion drafted by Goldman Sachs, as financial advisor to Zendesk, in connection with preparation of the signing of the definitive agreements for the Momentive Acquisition and filed in connection with the announcement of the Momentive Acquisition provided a midpoint fair value for Zendesk stock of approximately $176/share, representing a value of approximately 40% greater than the $124/share consideration offered by the Momentive Acquisition. As of February 16, 2022, the closing price of Zendesk common stock was $118/share, 49% below the $176/share midpoint fair value provided by Goldman Sachs. As of March 1, 2022 Zendesk stock closed at $116.80/share. Moreover, it is widely understood by the investment community that if a Board has approved the issuance of stock at a discounted price, then the market will tend to believe that the issuing company values its stock at that price and thus its stock will continue to trade at a discount for protracted periods of time afterwards.

| · | “[T]he board’s actions have ‘reinforced concerns about its history of refusing to engage with interested strategic and financial buyers for the Company.’” |

The Filing Persons believe that the Momentive Acquisition would have chilled interest from potential acquirers by making the company too large to buy or otherwise unattractive. Notably, per the “Background of the [Momentive

Mr. Duchovny Page 3 March 4, 2022 | | |

Acquisition]” section of Amendment No. 1 to the Registration Statement, filed by Zendesk on January 5, 2022, there had been no strategic acquirors interested in making an offer for Momentive other than Zendesk, and financial buyers would have considered the combined company too large by comparison to prior software transactions.1 In addition, the Filing Persons note that a May 17, 2016 Salesforce.com board presentation on potential M&A targets (which was leaked publicly when Salesforce.com board member and former Secretary of State Colin Powell’s emails were hacked) noted in the status line for Zendesk that the Zendesk “CEO has no interest” in selling the company. Furthermore, on February 10, 2022, Zendesk took the atypical step of issuing a press release indicating that they had rejected an unsolicited acquisition proposal from a consortium of private equity firms when no such disclosure was necessary.

| · | “[S]hareholders are perpetually in danger of what Glass Lewis characterized as the board’s ‘ready, fire, aim’ process” (footnote omitted). |

The Filing Persons respectfully note that the ‘ready, fire, aim’ process is further characterized thus by Glass Lewis: “[W]e believe a fair read of the primary materials suggests Zendesk entered Momentive’s process late, completed diligence over a questionably brief period and offered a wealth of undervalued equity, seemingly on the supposition that a broad strokes strategic framework and fairly aspirational financial objectives would be sufficient to mollify investors dubious of Zendesk’s ability to step well beyond its acquisitive bona fides.” The Filing Persons note also that the incumbent Board approved the Momentive Acquisition, a transaction that, according to data from Institutional Shareholder Services, received the lowest level of shareholder support of any disclosed deal-related shareholder vote (buyer or seller) in the Russell 3000 in the last 20 years. Therefore, it is reasonable to expect that the incumbent Board may act in a similar fashion and approve future transactions—that are also not supported by shareholders, financial experts and analysts and that may similarly cause the stock price to dive—in a manner similar to its approval of the Momentive Acquisition, as it is reasonable to infer (or expect a “danger” of) something happening in the future under similar conditions when such thing has already happened in the past.

Soliciting Materials filed February 28, 2022

Soliciting Materials filed February 28, 2022, page 1

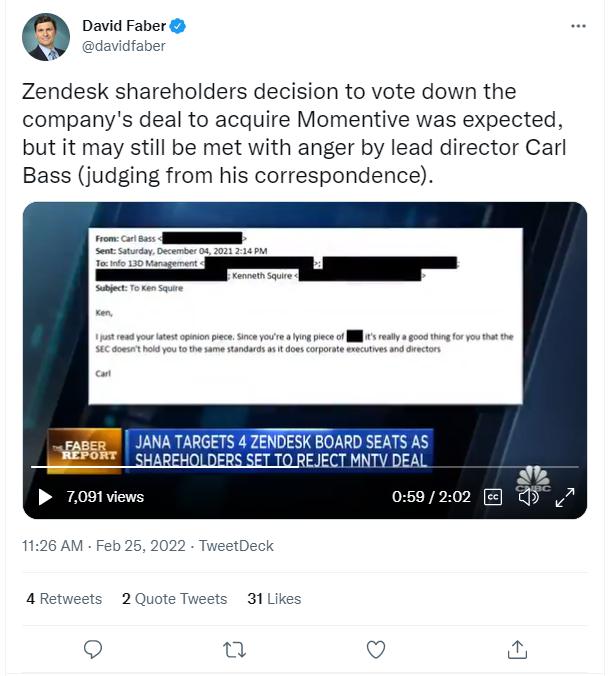

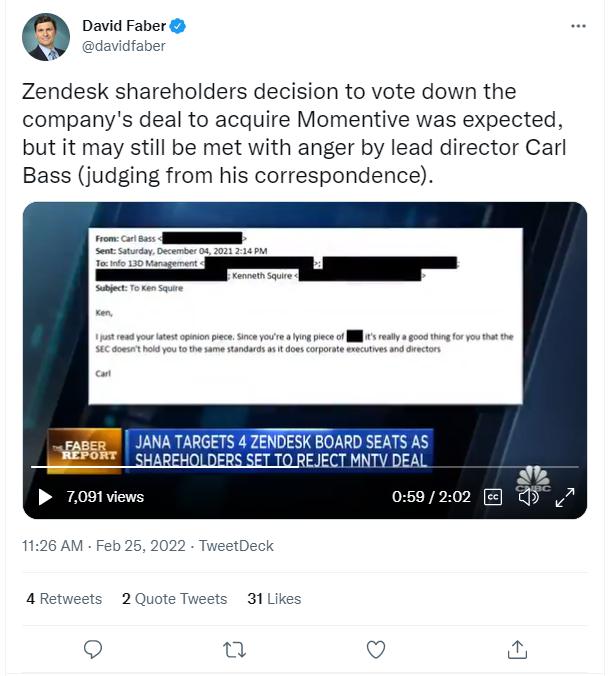

2. Please provide support for your statements relating the email purportedly sent by the company’s lead independent director to a CNBC contributor.

The Filing Persons respectfully note that they are referring to an email sent by Carl Bass, the Lead Independent Director of Zendesk, to CNBC contributor Kenneth Squire, which was showcased on CNBC’s Faber Report

________________________________

1 Assuming a Zendesk stock price of $124 (the approximate 15 day VWAP price Zendesk used in setting its exchange ratio for Momentive to support its headline $28 offer price per Momentive share, as disclosed at time of announcement), the Momentive Acquisition would have valued the combined company at more than $19 billion. Application of a standard control premium of at least 20% would result in a combined company value of more than $23 billion. In contrast, the largest take private of software companies consummated by financial buyers in at least the last five (5) years have resulted in companies valued at between $10 and $14 billion.

Mr. Duchovny Page 4 March 4, 2022 | | |

on February 25, 2022. A tweet by David Faber referencing the email is provided below, along with a transcript of a discussion of the email with CNBC’s Jim Cramer, with relevant text in bold:

DAVID FABER: There were plenty of directors who were in favor of doing this Momentive deal. And, in fact, one of them is actually already involved in the fight; and that is this gentleman Carl Bass. He is the lead director here at Zendesk and I’m aware of certain correspondence that took place, guys, that I found kind of curious on the part of Mr. Bass. He was into it when he was running Autodesk. He got into it with the activists, maybe he’s got some bad memories. But my friend Ken Squire, who writes a column for CNBC.com, he is a contributor, 13D Monitor, of course, wrote a story back on December 4th — there it is — saying, you know, “This is what Jana is thinking, this is how people are thinking about the Momentive deal and this is sort of where things stand right now.” I share this because I think it’s relevant. Mr. Bass didn’t like that column. Sent Ken an e-mail that Ken shared with me and said the following: “I just read your latest opinion piece and since you’re a lying piece of…,” [. . . .] “…lying piece of…” [excrement,] “it’s really a good thing for you that the SEC doesn’t hold you to the same standards as it does corporate executives and directors.” Just goes to show that people do get emotional in these kinds of situations. That is the lead director of Zendesk sending that in an e-mail to Ken Squire who shared it with me. It shows you how emotional this can get.

***

Mr. Duchovny Page 5 March 4, 2022 | | |

Thank you for your attention to this matter. Should you have any questions or comments, or require any further information with respect to the foregoing, please do not hesitate to call me at (212) 756-2376.

Very truly yours,

/s/ Eleazer Klein

Eleazer Klein