Table of Contents

As filed with the Securities and Exchange Commission on September 30, 2005

Registration No. 333-126907

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Amendment No. 2 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

iROBOT CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 8731 | 77-0259 335 | ||

| (State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

63 South Avenue

Burlington, Massachusetts 01803

(781) 345-0200

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

Colin M. Angle

Chief Executive Officer

iRobot Corporation

63 South Avenue

Burlington, Massachusetts 01803

(781) 345-0200

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent For Service)

Copies to:

| Mark T. Bettencourt, Esq. Edward A. King, Esq. Goodwin Procter LLP Exchange Place Boston, Massachusetts 02109 (617) 570-1000 | Mark G. Borden, Esq. Omar White, Esq. Wilmer Cutler Pickering Hale and Dorr LLP 60 State Street Boston, Massachusetts 02109 (617) 526-6000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), shall determine.

Table of Contents

| The information contained in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer or sale is not permitted. |

PROSPECTUS (Subject to Completion)

Issued , 2005

| Shares |

COMMON STOCK

iRobot Corporation is offering shares of its common stock, and the selling stockholders are offering shares of common stock. We will not receive any proceeds from the sale of shares by the selling stockholders. This is our initial public offering, and no public market currently exists for our shares. We anticipate that the initial public offering price will be between $ and $ per share.

We have applied to list our common stock on the NASDAQ National Market under the symbol “IRBT.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 6.

PRICE$ A SHARE

| Underwriting | Proceeds to | Proceeds to | ||||||||||||||

| Price to | Discounts and | iRobot | Selling | |||||||||||||

| Public | Commissions | Corporation | Stockholders | |||||||||||||

Per Share | $ | $ | $ | $ | ||||||||||||

Total | $ | $ | $ | $ | ||||||||||||

Selling stockholders have granted the underwriters the right to purchase up to an additional shares to cover over-allotments.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on , 2005.

| MORGAN STANLEY | JPMORGAN |

FIRST ALBANY CAPITAL

NEEDHAM & COMPANY, LLC

ADAMS HARKNESS

, 2005

Table of Contents

Table of Contents

Table of Contents

TABLE OF CONTENTS

| Page | ||||||||

| 1 | ||||||||

| 6 | ||||||||

| 24 | ||||||||

| 25 | ||||||||

| 25 | ||||||||

| 26 | ||||||||

| 27 | ||||||||

| 28 | ||||||||

| 30 | ||||||||

| 48 | ||||||||

| 67 | ||||||||

| 77 | ||||||||

| 79 | ||||||||

| 81 | ||||||||

| 85 | ||||||||

| 87 | ||||||||

| 91 | ||||||||

| 91 | ||||||||

| 91 | ||||||||

| F-1 | ||||||||

| Ex-10.2 Form of Indemnification Agreement | ||||||||

| Ex-10.18 2005 Stock Option and Incentive Plan | ||||||||

| Ex-23.2 Consent of PricewaterhouseCoopers LLP | ||||||||

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. We and the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

Until , 2005 (25 days after the commencement of this offering), all dealers that buy, sell or trade shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

Table of Contents

PROSPECTUS SUMMARY

| This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors” beginning on page 6, and the consolidated financial statements and notes to those consolidated financial statements, before making an investment decision. |

iROBOT CORPORATION

Overview

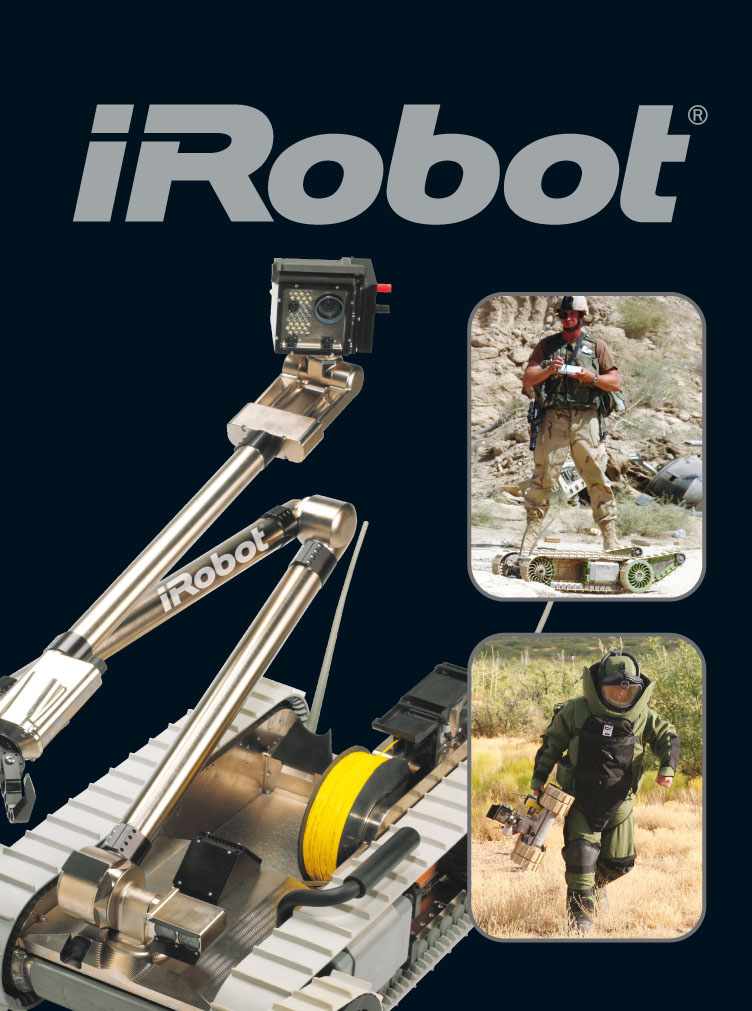

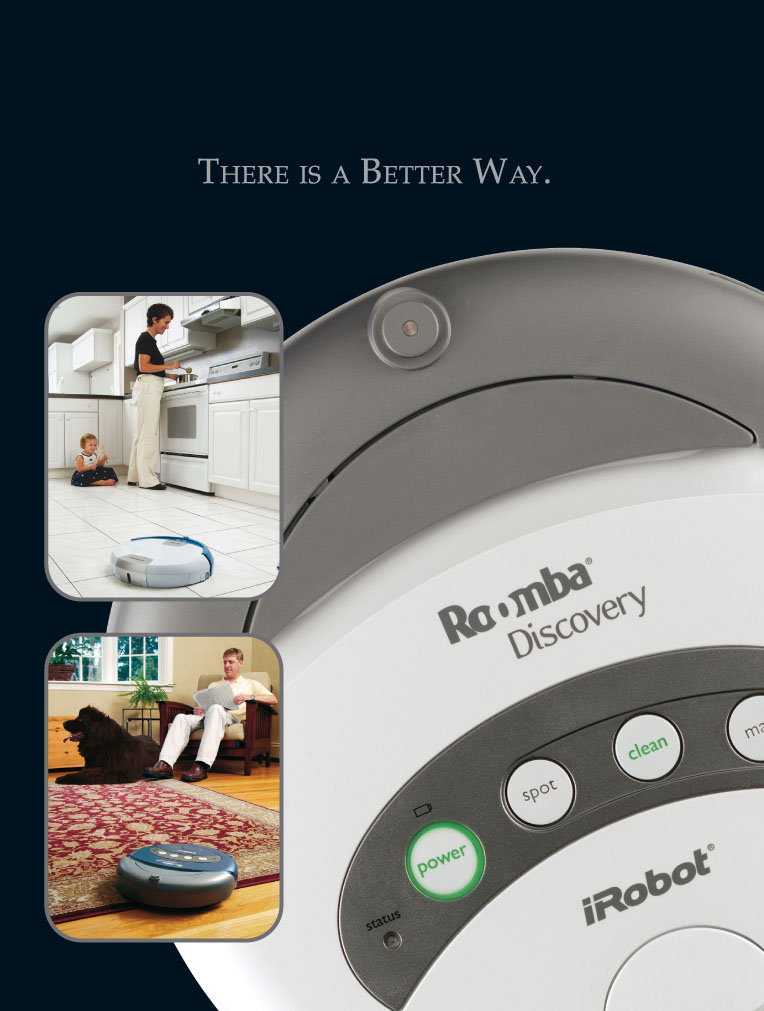

| iRobot provides robots that enable people to complete complex tasks in a better way. Founded in 1990 by roboticists who performed research at the Massachusetts Institute of Technology, we have developed proprietary technology incorporating advanced concepts in navigation, mobility, manipulation and artificial intelligence to build industry-leading robots. Our Roomba floor vacuuming robot and recently announced Scooba floor washing robot perform time-consuming domestic chores, and our PackBot tactical military robots perform battlefield reconnaissance and bomb disposal. In addition, we are developing the Small Unmanned Ground Vehicle reconnaissance robot for the U.S. Army’s transformational Future Combat Systems program and, in conjunction with Deere & Company, the R-Gator unmanned ground vehicle. We sell our robots to consumers through a variety of distribution channels, including over 7,000 retail locations and our on-line store, and to the U.S. military and other government agencies worldwide. | |

| As of July 2, 2005, we had 214 full-time employees, of whom over half are engineers specializing in the design of robots. We have developed expertise in all the disciplines necessary to build durable, high-performance and cost-effective robots through the close integration of software, electronics and hardware. Our core technologies serve as reusable building blocks that we adapt and expand to develop next generation and new products, reducing the time, cost and risk of product development. Our significant expertise in robot design and engineering, combined with our management team’s experience in military and consumer markets, positions us to capitalize on the expected growth in the market for robots. | |

| Over the past three years, we sold more than 1.2 million of our Roomba floor vacuuming robots. We also sold to the U.S. military during that time more than 200 of our PackBot tactical military robots, most of which have been deployed on missions in Afghanistan and Iraq. |

Market Opportunity

| Over the past several decades, the desire to continue to improve productivity and quality of life has led to the development of robots. Historical attempts at producing robots have had limited success due to the inherent complexities in integrating multiple technologies to deliver truly functional robots at affordable prices. Behavior-based robots, which represent a new generation of robots, can effectively deal with dynamic and changing environments, and are particularly well suited for consumer, military and industrial tasks that are repetitive, physically demanding or dangerous. The need for robots has increased in parallel with the evolution of robot technology. | |

| We believe that the demand for robots that can complete domestic chores is developing rapidly due to demographic trends, including the aging population, increasing prevalence of dual-income households, declining birth rates and ongoing reduction in people’s “free” time. According to the 2004 United Nations Economic Commission for Europe in cooperation with the International Federation of Robotics, there will be approximately $2.6 billion spent worldwide on household robots from 2004 through 2007. |

The worldwide need for security and the transformation of the military are driving the market opportunity in the defense and government sector for automated and unmanned systems. The shift to less traditional warfare, a declining pool of available military personnel, increasing costs of military personnel, and political ramifications of personnel casualties are driving the military to develop alternatives to its human-capital resources. Warfare modernization directives incorporate the use of robots in accordance with the National Defense Authorization Act of 2001, which stated the goal that “by 2015, one-third of the operational ground combat vehicles of the Armed Forces are unmanned.”

1

Table of Contents

We believe that the sophisticated technologies in our existing consumer and military applications are adaptable to a broad array of markets such as law enforcement, homeland security, commercial cleaning, elderly care, oil services, home automation, landscaping, agriculture and construction.

Our Solution

Innovation is at the core of iRobot. Our innovation engine, comprised of our robot technology, roboticists and robot market experience, enables us to design and introduce new products rapidly in a wide range of markets. Our robots are designed to perform complex tasks in a better way.

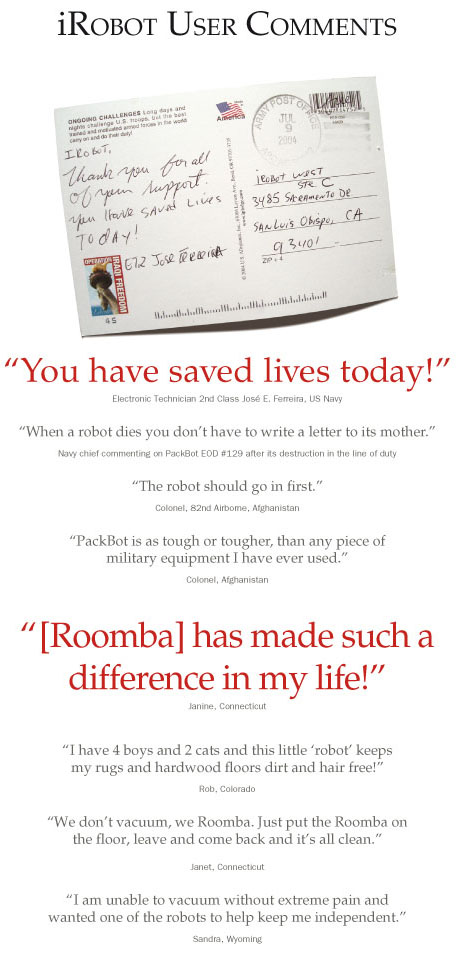

Better Results. Our robots help perform dull, dirty or dangerous missions with better results. Our Roomba floor vacuuming robot cleans under beds and other furniture, resulting in significantly cleaner floors because it can access more of the floor than standard upright vacuum cleaners. Our PackBot tactical military robot is credited with saving the lives of U.S. service personnel in Afghanistan and Iraq by performing dangerous military missions that would otherwise have been performed by soldiers.

Easy-to-Use. Our robots encompass advanced technology and a user-friendly design that make them easy to set up, operate and maintain. Our Roomba robots work at the touch of a single button, appealing to consumers’ intuition and requiring extremely limited set-up and learning time. Our PackBot robots, while entailing greater user interaction, require only a few hours of training for their users.

Cost-Effective. We believe our robots deliver high value for their cost. Our PackBot robots cost relatively little when compared to the value of saving the lives of armed forces personnel. Our Roomba robots reduce the time spent by customers to clean rooms quickly and effectively, and are priced competitively with traditional vacuum cleaners.

Safe and Durable. Safety and durability are key design objectives of all our products. For example, our PackBot robots have been developed with a patented, safe-firing circuit designed to prevent accidental discharge or detonation. Our Roomba robots have a triple-redundant system to prevent them from falling down stairs and undergo severe quality control tests that include compression and drop tests.

Our Strategy

Our objective is to rapidly invent, design, market and support innovative robots that will expand our leadership globally in our existing markets and newly addressable markets. Key elements of our strategy to achieve this objective include:

| • | Deliver Great Products and Continue to Expand Our Existing Markets. Our strategy is to deliver innovative products rapidly at economical price points and continue to extend our consumer and military product offerings. | |

| • | Innovate to Penetrate New Markets. Our culture of innovation and experience enables us to rapidly develop robots for use in a broad range of applications and to penetrate new market segments globally. | |

| • | Complement Our Core Competencies With Strategic Alliances. We rely on strategic alliances to provide complementary competencies and enhance our ability to enter and compete in new markets. | |

| • | Leverage Our Research and Development Efforts Across Different Products and Markets. By using our research and development across all our products and markets, our strategy is to develop cost-effective robots and rapidly bring them to market. | |

| • | Build a Community of Third-Party Developers Around Our Platforms. Our extendable product platforms with open interfaces allow us to foster a community of third-party developers that we believe will enable us to expand our footprint while maintaining market leadership. | |

| • | Continue to Strengthen Our Brand. To strengthen our brand, we will reinforce our message of innovation, reliability, safety and value through continued investment in our marketing programs. | |

| • | Continue to Invest Aggressively in Our Business and Our People. We will maximize long-term profitability by continuing to invest significant resources over the next several years in our product development and sales efforts, and in training highly-qualified personnel. |

2

Table of Contents

Risks Associated with Our Business

Our business is subject to numerous risks, as more fully described under “Risk Factors” beginning on page 6, which you should carefully consider prior to deciding whether to invest in our common stock. For example:

| • | we have incurred significant losses since inception, including net losses of $10.8 million, $7.4 million and $7.2 million in the years ended December 31, 2002 and 2003 and the six months ended July 2, 2005, respectively, resulting in an accumulated deficit of $34.0 million at July 2, 2005, and our future profitability is uncertain; | |

| • | we operate in an emerging market, which makes it difficult to evaluate our business and future prospects; | |

| • | we have generated, and expect to continue to generate, more than half of our revenue from our Roomba line of floor vacuuming robots; and | |

| • | we depend on the U.S. federal government for a significant portion of our revenue. |

Our Corporate Information

We were incorporated in California in August 1990 under the name IS Robotics, Inc. and reincorporated as IS Robotics Corporation in Massachusetts in June 1994. We reincorporated in Delaware as iRobot Corporation in December 2000. Our corporate headquarters are located at 63 South Avenue, Burlington, Massachusetts 01803, and telephone number is (781) 345-0200. Our website address iswww.irobot.com. The information on, or that can be accessed through, our website is not part of this prospectus.

iRobot, Roomba, Scooba, PackBot and AWARE are trademarks of iRobot Corporation. Gator, M-Gator and R-Gator are trademarks of Deere & Company. This prospectus also includes other registered and unregistered trademarks of iRobot Corporation and other persons.

3

Table of Contents

THE OFFERING

| Common stock offered by iRobot | shares | ||||

| Common stock offered by the selling stockholders | shares | ||||

| Total | shares | ||||

| Over-allotment option offered by selling stockholders | shares | ||||

| Common stock to be outstanding after this offering | shares | ||||

| Use of proceeds | We intend to use the net proceeds to us from this offering for working capital and other general corporate purposes, including to finance the development of new products, sales and marketing activities, capital expenditures and the costs of operating as a public company. We will not receive any proceeds from the sale of shares by the selling stockholders. See “Use of Proceeds” for more information. | |

| Risk factors | You should read the “Risk Factors” section of this prospectus for a discussion of factors that you should consider carefully before deciding to invest in shares of our common stock. | |

| Proposed NASDAQ National Market symbol | “IRBT” |

The number of shares of our common stock to be outstanding following this offering is based on 19,894,820 shares of our common stock outstanding as of July 2, 2005, and excludes:

| • | 2,954,233 shares of common stock issuable upon exercise of options outstanding as of July 2, 2005 at a weighted average exercise price of $2.39 per share; | |

| • | 613,623 shares of common stock reserved as of July 2, 2005 for future issuance under our stock-based compensation plans; and | |

| • | 18,000 shares of common stock issuable upon the exercise of a warrant, with an approximate exercise price of $3.74 per share. |

Unless otherwise indicated, this prospectus reflects and assumes the following:

| • | the automatic conversion of all outstanding shares of our preferred stock into 9,557,246 shares of common stock, upon the closing of the offering; | |

| • | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated by-laws immediately prior to the effectiveness of this offering; and | |

| • | no exercise by the underwriters of their over-allotment option. |

4

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The tables below summarize our consolidated financial information for the periods indicated. You should read the following information together with the more detailed information contained in “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the accompanying notes.

| Six Months Ended | ||||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||||

| June 30, | July 2, | |||||||||||||||||||||

| 2002 | 2003 | 2004 | 2004 | 2005 | ||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||||

Consolidated Statement of Operations: | ||||||||||||||||||||||

| Revenue | ||||||||||||||||||||||

Product revenue(1) | $ | 6,955 | $ | 45,896 | $ | 82,147 | $ | 23,087 | $ | 34,723 | ||||||||||||

| Contract revenue | 7,223 | 7,661 | 12,365 | 5,039 | 8,233 | |||||||||||||||||

| Royalty revenue | 639 | 759 | 531 | 483 | 62 | |||||||||||||||||

| Total revenue | 14,817 | 54,316 | 95,043 | 28,609 | 43,018 | |||||||||||||||||

| Cost of Revenue | ||||||||||||||||||||||

| Cost of product revenue | 4,896 | 31,194 | 59,321 | 16,471 | 26,750 | |||||||||||||||||

| Cost of contract revenue | 11,861 | 6,143 | 8,371 | 3,345 | 5,770 | |||||||||||||||||

| Total cost of revenue | 16,757 | 37,337 | 67,692 | 19,816 | 32,520 | |||||||||||||||||

Gross Profit (Loss)(1) | (1,940 | ) | 16,979 | 27,351 | 8,793 | 10,498 | ||||||||||||||||

| Operating Expenses | ||||||||||||||||||||||

| Research and development | 1,736 | 3,848 | 5,504 | 2,563 | 5,713 | |||||||||||||||||

| Selling, general and administrative | 7,128 | 20,521 | 21,404 | 9,188 | 12,061 | |||||||||||||||||

| Stock-based compensation | — | — | — | — | 90 | |||||||||||||||||

| Total operating expenses | 8,864 | 24,369 | 26,908 | 11,751 | 17,864 | |||||||||||||||||

| Operating Income (Loss) | (10,804 | ) | (7,390 | ) | 443 | (2,958 | ) | (7,366 | ) | |||||||||||||

| Net Income (Loss) | (10,774 | ) | (7,411 | ) | 219 | (3,000 | ) | (7,157 | ) | |||||||||||||

| Net Income (Loss) Per Share | ||||||||||||||||||||||

| Basic | $ | (2.00 | ) | $ | (0.79 | ) | $ | 0.01 | $ | (0.31 | ) | $ | (0.72 | ) | ||||||||

| Diluted | $ | (2.00 | ) | $ | (0.79 | ) | $ | 0.01 | $ | (0.31 | ) | $ | (0.72 | ) | ||||||||

| Number of Shares Used in Per Share Calculations | ||||||||||||||||||||||

| Basic | 5,391 | 9,352 | 9,660 | 9,530 | 10,008 | |||||||||||||||||

| Diluted | 5,391 | 9,352 | 19,183 | 9,530 | 10,008 | |||||||||||||||||

Pro Forma Net Income (Loss) Data(2): | ||||||||||||||||||||||

| Pro Forma Net Income (Loss) Per Share | ||||||||||||||||||||||

| Basic | $ | 0.01 | $ | (0.37 | ) | |||||||||||||||||

| Diluted | $ | 0.01 | $ | (0.37 | ) | |||||||||||||||||

| Number of Shares Used in Pro Forma Per Share Calculations | ||||||||||||||||||||||

| Basic | 18,002 | 19,565 | ||||||||||||||||||||

| Diluted | 19,183 | 19,565 | ||||||||||||||||||||

| (1) | Beginning in the first quarter of 2004, we converted from recognizing revenue from U.S. consumer product sales on a “sell-through” basis (when retail stores sold our robots) to a “sell-in” basis (when our robots are shipped to retail stores). As a result of this conversion, our revenue and gross profit in the first quarter of 2004 included $5.7 million and $2.5 million, respectively, from robots shipped prior to 2004. |

| (2) | We have computed the pro forma net income (loss) per share and the pro forma weighted-average shares outstanding included in the statement of operations data as we describe in Note 2 of the notes to our consolidated financial statements. |

The as adjusted balance sheet data in the table below reflects the conversion of our convertible preferred stock and our receipt of estimated net proceeds from our sale of shares of common stock that we are offering at an assumed public offering price of $ per share, after deducting estimated discounts and commissions and estimated offering expenses payable by us.

| July 2, 2005 | ||||||||

| Actual | As Adjusted | |||||||

| (unaudited) | ||||||||

| (in thousands) | ||||||||

Consolidated Balance Sheet Data: | ||||||||

| Cash and cash equivalents | $ | 15,090 | $ | |||||

| Total assets | 40,336 | |||||||

| Total liabilities | 33,672 | |||||||

| Total redeemable convertible preferred stock | 37,506 | |||||||

| Total stockholders’ equity (deficit) | (30,843 | ) | ||||||

5

Table of Contents

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as the other information in this prospectus, before deciding whether to invest in our common stock. If any of the following risks actually materializes, our business, financial condition and results of operations would suffer. The trading price of our common stock could decline as a result of any of these risks, and you might lose all or part of your investment in our common stock. You should read the section entitled “Forward-Looking Statements” immediately following these risk factors for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this prospectus.

Risks Related to Our Business

Our future profitability is uncertain, and we have a limited operating history on which you can base your evaluation of our business.

We have incurred significant losses since inception, including net losses of $10.8 million, $7.4 million and $7.2 million in the years ended December 31, 2002 and 2003 and the six months ended July 2, 2005, respectively. As a result of ongoing operating losses, we had an accumulated deficit of $34.0 million at July 2, 2005. Because we operate in a rapidly evolving industry, we have difficulty predicting our future operating results, and we cannot be certain that our revenue will grow at rates that will allow us to maintain profitability on a quarterly or annual basis. In addition, we only have a limited operating history on which you can base your evaluation of our business. If we fail to maintain profitability, the market price of our common stock will likely fall.

We operate in an emerging market, which makes it difficult to evaluate our business and future prospects.

Robots represent a new and emerging market. Accordingly, our business and future prospects are difficult to evaluate. We cannot accurately predict the extent to which demand for consumer robots will increase, if at all. Moreover, there are only a limited number of major programs under which the U.S. federal government is currently funding the development or purchase of military robots. You should consider the challenges, risks and uncertainties frequently encountered by companies using new and unproven business models in rapidly evolving markets. These challenges include our ability to:

| • | generate sufficient revenue to maintain profitability; | |

| • | acquire and maintain market share in our consumer and military markets; | |

| • | manage growth in our operations; | |

| • | attract and retain customers of our consumer robots; | |

| • | develop and renew government contracts for our military robots; | |

| • | attract and retain additional roboticists and other highly-qualified personnel; | |

| • | adapt to new or changing policies and spending priorities of governments and government agencies; and | |

| • | access additional capital when required and on reasonable terms. |

If we fail to successfully address these and other challenges, risks and uncertainties, our business, results of operations and financial condition would be materially harmed.

Our financial results often vary significantly from quarter-to-quarter due to a number of factors, which may lead to volatility in our stock price.

Our quarterly revenue and other operating results have varied in the past and are likely to continue to vary significantly from quarter-to-quarter. For instance, our consumer product revenue is significantly seasonal and, historically, as much as 73% of our revenue from sales of consumer products has been generated in the second

6

Table of Contents

half of the year. This variability may lead to volatility in our stock price as equity research analysts and investors respond to these quarterly fluctuations. These fluctuations will be due to numerous factors including:

| • | seasonality in the sales of our consumer products; | |

| • | the size and timing of orders from military and other government agencies; | |

| • | the mix of products that we sell in the period; | |

| • | disruption of supply of our products from our manufacturers; | |

| • | the inability to attract and retain qualified, revenue-generating personnel; | |

| • | unanticipated costs incurred in the introduction of new products; | |

| • | costs of labor and raw materials; | |

| • | our ability to introduce new products and enhancements to our existing products on a timely basis; | |

| • | price reductions; | |

| • | the amount of government funding and the political, budgetary and purchasing constraints of our government agency customers; and | |

| • | cancellations, delays or contract amendments by government agency customers. |

Revenue for any particular quarter and revenue from sales of our consumer products are difficult to predict. Because of quarterly fluctuations, we believe that quarter-to-quarter comparisons of our operating results are not necessarily meaningful. Moreover, our operating results may not meet expectations of equity research analysts or investors. If this occurs, the trading price of our common stock could fall substantially either suddenly or over time.

A majority of our business currently depends on our consumer robots, and our sales growth and operating results would be negatively impacted if we are unable to enhance our current consumer robots or develop new consumer robots at competitive prices or in a timely manner.

For the year ended December 31, 2004, we derived 73.8% of our revenue from our Roomba floor vacuuming robots. For the foreseeable future, we expect that a majority of our revenue will continue to be derived from sales of consumer home floor care products. Accordingly, our future success depends upon our ability to further penetrate the consumer home floor care market, to enhance our current consumer products and develop and introduce new consumer products offering enhanced performance and functionality at competitive prices. The development and application of new technologies involve time, substantial costs and risks. For example, we have devoted significant time and incurred significant expenses in connection with developing our Scooba robot, which is designed to sweep, wash, scrub and dry hard floors, and we plan to commence selling our Scooba robot in late 2005. Our results in the fourth quarter of 2005 and in 2006 will depend in part on the success of this new product line, and there can be no assurance that we will not incur delays in the introduction of our Scooba floor washing robot or that it will attain market acceptance. Our inability, for technological or other reasons, to introduce or achieve significant sales of our Scooba robot, or to enhance, develop and introduce other products in a timely manner, or at all, would materially harm our sales growth and operating results.

We depend on the U.S. federal government for a significant portion of our revenue, and any reduction in the amount of business that we do with the U.S. federal government would negatively impact our operating results and financial condition.

For the year ended December 31, 2004 and for the six months ended July 2, 2005, we derived 20.1% and 47.6%, respectively, of our revenue, directly or indirectly, from the U.S. federal government and its agencies. Any reduction in the amount of revenue that we derive from the U.S. federal government without an offsetting increase in new sales to other customers would have a material adverse effect on our operating results.

7

Table of Contents

Our participation in specific major U.S. federal government programs is critical to both the development and sale of our military robots. For example, in the year ended December 31, 2004, 35.9% of our contract revenue was derived from our participation in the U.S. Army’s Future Combat Systems program. Future sales of our PackBot robots will depend largely on our ability to secure contracts with the U.S. Army under its robot programs. We expect that there will continue to be only a limited number of major programs under which U.S. federal government agencies will seek to fund the development of, or purchase, robots. Our business will, therefore, suffer if we are not awarded, either directly or indirectly through third-party contractors, government contracts for robots that we are qualified to develop or build. In addition, if the U.S. federal government or government agencies terminate or reduce the related prime contract under which we serve as a subcontractor, revenues that we derive under that contract could be lost, which would negatively impact our business and financial results. Moreover, it is difficult to predict the timing of the award of government contracts and our revenue could fluctuate significantly based on the timing of any such awards.

Even if we continue to receive funding for research and development under these contracts, there can be no assurance that we will successfully complete the development of robots pursuant to these contracts or that, if successfully developed, the U.S. federal government or any other customer will purchase these robots from us. The U.S. federal government has the right when it contracts to use the technology developed by us to have robots supplied by third parties. Any failure by us to complete the development of these robots, or to achieve successful sales of these robots, would harm our business and results of operations.

Our contracts with the U.S. federal government contain certain provisions that may be unfavorable to us and subject us to government audits, which could materially harm our business and results of operations.

Our contracts and subcontracts with the U.S. federal government subject us to certain risks and give the U.S. federal government rights and remedies not typically found in commercial contracts, including rights that allow the U.S. federal government to:

| • | terminate contracts for convenience, in whole or in part, at any time and for any reason; | |

| • | reduce or modify contracts or subcontracts if its requirements or budgetary constraints change; | |

| • | cancel multi-year contracts and related orders if funds for contract performance for any subsequent year become unavailable; | |

| • | exercise production priorities, which allow it to require that we accept government purchase orders or produce products under its contracts before we produce products under other contracts, which may displace or delay production of more profitable orders; | |

| • | claim certain rights in products provided by us; and | |

| • | control or prohibit the export of certain of our products. |

Several of our prime contracts with the U.S. federal government do not contain a limitation of liability provision, creating a risk of responsibility for direct and consequential damages. Several subcontracts with prime contractors hold the prime contractor harmless against liability that stems from our work and do not contain a limitation of liability. These provisions could cause substantial liability for us, especially given the use to which our products may be put.

In addition, we are subject to audits by the U.S. federal government as part of routine audits of government contracts. As part of an audit, these agencies may review our performance on contracts, cost structures and compliance with applicable laws, regulations and standards. If any of our costs are found to be allocated improperly to a specific contract, the costs may not be reimbursed and any costs already reimbursed for such contract may have to be refunded. Accordingly, an audit could result in a material adjustment to our revenue and results of operations. Moreover, if an audit uncovers improper or illegal activities, we may be subject to civil and criminal penalties and administrative sanctions, including termination of contracts, forfeiture of profits, suspension of payments, fines and suspension or debarment from doing business with the government.

8

Table of Contents

If any of the foregoing were to occur, or if the U.S. federal government otherwise ceased doing business with us or decreased the amount of business with us, our business and operating results could be materially harmed and the value of your investment in our common stock could be impaired.

Some of our contracts with the U.S. federal government allow it to use inventions developed under the contracts and to disclose technical data to third parties, which could harm our ability to compete.

Some of our contracts allow the U.S. federal government rights to use, or have others use, patented inventions developed under those contracts on behalf of the government. Some of the contracts allow the federal government to disclose technical data without constraining the recipient in how that data is used. The ability of third parties to use patents and technical data for government purposes creates the possibility that the government could attempt to establish additional sources for the products we provide that stem from these contracts. It may also allow the government the ability to negotiate with us to reduce our prices for products we provide to it. The potential that the government may release some of the technical data without constraint creates the possibility that third parties may be able to use this data to compete with us in the commercial sector.

Government contracts are subject to a competitive bidding process that can consume significant resources without generating any revenue.

Government contracts are frequently awarded only after formal competitive bidding processes, which are protracted. In many cases, unsuccessful bidders for government agency contracts are provided the opportunity to protest certain contract awards through various agency, administrative and judicial channels. If any of the government contracts awarded to us are protested, we may be required to expend substantial time, effort and financial resources without realizing any revenue with respect to the potential contract. The protest process may substantially delay our contract performance, distract management and result in cancellation of the contract award entirely.

We depend on single source manufacturers, and our reputation and results of operations would be harmed if these manufacturers fail to meet our requirements.

We currently depend on one contract manufacturer, Jetta Company Limited, to manufacture our consumer products at a single plant in China and rely on one contract manufacturer, Gem City Engineering Corporation, to manufacture our military products at a single plant in the United States. Moreover, we do not have a long-term contract with Jetta Company Limited and the manufacture of our consumer products is provided on a purchase-order basis. These manufacturers supply substantially all of the raw materials and provide all facilities and labor required to manufacture our products. If these companies were to terminate their arrangements with us or fail to provide the required capacity and quality on a timely basis, we would be unable to manufacture our products until replacement contract manufacturing services could be obtained. To qualify a new contract manufacturer, familiarize it with our products, quality standards and other requirements, and commence volume production is a costly and time-consuming process. We cannot assure you that we would be able to establish alternative manufacturing relationships on acceptable terms.

Our reliance on these contract manufacturers involves certain risks, including the following:

| • | lack of direct control over production capacity and delivery schedules; | |

| • | lack of direct control over quality assurance, manufacturing yields and production costs; | |

| • | lack of enforceable contractual provisions over the production and costs of consumer products; | |

| • | risk of loss of inventory while in transit from China; and | |

| • | risks associated with international commerce with China, including unexpected changes in legal and regulatory requirements, changes in tariffs and trade policies, risks associated with the protection of intellectual property and political and economic instability. |

9

Table of Contents

Any interruption in the manufacture of our products would be likely to result in delays in shipment, lost sales and revenue and damage to our reputation in the market, all of which would harm our business and results of operations. In addition, while our contract obligations with our contract manufacturer in China are typically denominated in U.S. dollars, changes in currency exchange rates could impact our suppliers and increase our prices. In particular, the Chinese government recently announced that the Chinese yuan has moved to a managed floating exchange rate regime, which could lead to our suppliers in China negotiating increased pricing terms with us.

Any efforts to expand our product offerings beyond our current markets may not succeed, which could negatively impact our operating results.

We have focused on selling our robots in the consumer and military markets. We plan to expand into other markets. Efforts to expand our product offerings beyond the two markets that we currently serve, however, may divert management resources from existing operations and require us to commit significant financial resources to an unproven business, either of which could significantly impair our operating results. Moreover, efforts to expand beyond our existing markets may never result in new products that achieve market acceptance, create additional revenue or become profitable.

If we are unable to implement appropriate controls and procedures to manage our growth, we may not be able to successfully implement our business plan.

Our headcount and operations are growing rapidly. This rapid growth has placed, and will continue to place, a significant strain on our management, administrative, operational and financial infrastructure. From December 31, 2004 to July 2, 2005, the number of our employees increased from 148 to approximately 214. We anticipate further growth will be required to address increases in our product offerings and the geographic scope of our customer base. Our success will depend in part upon the ability of our senior management to manage this growth effectively. To do so, we must continue to hire, train, manage and integrate a significant number of qualified managers and engineers. If our new employees perform poorly, or if we are unsuccessful in hiring, training, managing and integrating these new employees, or retaining these or our existing employees, our business may suffer.

In addition, to manage the expected continued growth of our headcount and operations, we will need to continue to improve our information technology infrastructure, operational, financial and management controls and reporting systems and procedures, and manage expanded operations in geographically distributed locations. Our expected additional headcount and capital investments will increase our costs, which will make it more difficult for us to offset any future revenue shortfalls by offsetting expense reductions in the short term. If we fail to successfully manage our growth we will be unable to successfully execute our business plan, which could have a negative impact on our business, financial condition or results of operations.

If the consumer robot market does not experience significant growth or if our products do not achieve broad acceptance, we will not be able to achieve our anticipated level of growth.

We derive a substantial portion of our revenue from sales of our consumer robots. For the year ended December 31, 2004, consumer robots accounted for 73.8% of total revenue. We cannot accurately predict the future growth rate or the size of the consumer robot market. Demand for consumer robots may not increase, or may decrease, either generally or in specific geographic markets, for particular types of robots or during particular time periods. The expansion of the consumer robot market and the market for our products depends on a number of factors, such as:

| • | the cost, performance and reliability of our products and products offered by our competitors; | |

| • | public perceptions regarding the effectiveness and value of robots; | |

| • | customer satisfaction with robots; and | |

| • | marketing efforts and publicity regarding robots. |

10

Table of Contents

Even if consumer robots gain wide market acceptance, our robots may not adequately address market requirements and may not continue to gain market acceptance. If robots generally, or our robots specifically, do not gain wide market acceptance, we may not be able to achieve our anticipated level of growth, and our revenue and results of operations would suffer.

Our business and results of operations could be adversely affected by significant changes in the policies and spending priorities of governments and government agencies.

We derive a substantial portion of our revenue from sales to and contracts with U.S. federal, state and local governments and government agencies, and subcontracts under federal government prime contracts. For the year ended December 31, 2004 and the six months ended July 2, 2005, U.S. federal government orders, contracts and subcontracts accounted for 20.1% and 47.6% of total revenue, respectively. We believe that the success and growth of our business will continue to depend on our successful procurement of government contracts either directly or through prime contractors. Many of our government customers are subject to stringent budgetary constraints and our continued performance under these contracts, or award of additional contracts from these agencies, could be jeopardized by spending reductions or budget cutbacks at these agencies. We cannot assure you that future levels of expenditures and authorizations will continue for governmental programs in which we provide products and services. A significant decline in government expenditures generally, or with respect to programs for which we provide products, could adversely affect our government product and funded research and development revenues and prospects, which would harm our business, financial condition and operating results. Our operating results may also be negatively impacted by other developments that affect these governments and government agencies generally, including:

| • | changes in government programs that are related to our products and services; | |

| • | adoption of new laws or regulations relating to government contracting or changes to existing laws or regulations; | |

| • | changes in political or public support for security and defense programs; | |

| • | delays or changes in the government appropriations process; | |

| • | uncertainties associated with the war on terror and other geo-political matters; and | |

| • | delays in the payment of our invoices by government payment offices. |

These developments and other factors could cause governments and governmental agencies, or prime contractors that use us as a subcontractor, to reduce their purchases under existing contracts, to exercise their rights to terminate contracts at-will or to abstain from renewing contracts, any of which would cause our revenue to decline and could otherwise harm our business, financial condition and results of operations.

We face intense competition from other providers of robots, including diversified technology providers, as well as competition from providers offering alternative products, which could negatively impact our results of operations and cause our market share to decline.

We believe that a number of companies have developed or are developing robots that will compete directly with our product offerings. Additionally, large and small companies, government-sponsored laboratories and universities are aggressively pursuing contracts for robot-focused research and development. Many current and potential competitors have substantially greater financial, marketing, research and manufacturing resources than we possess, and there can be no assurance that our current and future competitors will not be more successful than us. Moreover, while we believe many of our customers purchase our floor vacuuming robots as a supplement to, rather than a replacement for, their traditional vacuum cleaners, we also compete in some cases with providers of traditional vacuum cleaners. Our current principal competitors include:

| • | developers of robotic floor care products such as AB Electrolux, Alfred Kärcher GmbH & Co., Samsung Electronics Co., Ltd., Koolatron Corp. and Yujin Robotic Co. Ltd.; |

11

Table of Contents

| • | developers of small unmanned ground vehicles such as Foster-Miller, Inc.— a wholly owned subsidiary of QinetiQ North America, Inc., Allen-Vanguard Corporation, and Remotec— a division of Northrop Grumman Corporation; and | |

| • | established government contractors working on unmanned systems such as Lockheed Martin Corporation, BAE Systems, Inc. and General Dynamics Corporation. |

In the event that the robot market expands, we expect that competition will intensify as additional competitors enter the market and current competitors expand their product lines. Companies competing with us may introduce products that are competitively priced, have increased performance or functionality, or incorporate technological advances that we have not yet developed or implemented. Increased competitive pressure could result in a loss of sales or market share or cause us to lower prices for our products, any of which would harm our business and operating results.

The market for robots is highly competitive, rapidly evolving and subject to changing technologies, shifting customer needs and expectations and the likely increased introduction of new products. Our ability to remain competitive will depend to a great extent upon our ongoing performance in the areas of product development and customer support. We cannot assure you that our products will continue to compete favorably or that we will be successful in the face of increasing competition from new products and enhancements introduced by existing competitors or new companies entering the markets in which we provide products. Our failure to compete successfully could cause our revenue and market share to decline, which would negatively impact our results of operations and financial condition.

Our business is significantly seasonal and, because many of our expenses are based on anticipated levels of annual revenue, our business and operating results will suffer if we do not achieve revenue consistent with our expectations.

Our consumer product revenue is significantly seasonal. Historically, as much as 73% of our revenue from sales of consumer products has been, and a majority of such revenue is expected to continue to be, generated in the second half of the year. As a result of this seasonality, we believe that quarter-to-quarter comparisons of our operating results are not necessarily meaningful and that these comparisons cannot be relied upon as indicators of future performance.

We base our current and future expense levels on our internal operating plans and sales forecasts, including forecasts of holiday sales for our consumer products. Most of our operating expenses, such as research and development expenses, advertising and promotional expenses and employee wages and salaries, do not vary directly with sales and are difficult to adjust in the short term. As a result, if sales for a quarter, particularly the final quarter of a fiscal year, are below our expectations, we might not be able to reduce operating expenses for that quarter and would not be able to reduce our operating expenses for earlier periods during the fiscal year. Accordingly, a sales shortfall during a fiscal quarter, and in particular the fourth quarter of a fiscal year, could have a disproportionate effect on our operating results for that quarter or that year. As a result of these factors, we may report operating results that do not meet the expectations of equity research analysts and investors. This could cause the trading price of our common stock to decline.

If critical components of our products that we currently purchase from a small number of suppliers become unavailable, we may incur delays in shipment, which could damage our business.

We and our outsourced manufacturers obtain hardware components, various subsystems and raw materials from a limited group of suppliers. We do not have any long-term agreements with these suppliers obligating them to continue to sell components or products to us. Our reliance on these suppliers involves significant risks and uncertainties, including whether our suppliers will provide an adequate supply of required components of sufficient quality, will increase prices for the components and will perform their obligations on a timely basis. If we or our outsourced manufacturers are unable to obtain components from third-party suppliers in the quantities and of the quality that we require, on a timely basis and at acceptable prices, we may not be able to deliver our products on a timely or cost-effective basis to our customers, which could cause customers to terminate their contracts with us, reduce our gross profit and seriously harm our business, results

12

Table of Contents

of operations and financial condition. Moreover, if any of our suppliers become financially unstable, we may have to find new suppliers. It may take several months to locate alternative suppliers, if required, or to re-tool our products to accommodate components from different suppliers. We may experience significant delays in manufacturing and shipping our products to customers and incur additional development, manufacturing and other costs to establish alternative sources of supply if we lose any of these sources. We cannot predict if we will be able to obtain replacement components within the time frames that we require at an affordable cost, or at all.

Our products are complex and could have unknown defects or errors, which may give rise to claims against us, diminish our brand or divert our resources from other purposes.

Our robots rely on the interplay among behavior-based artificially intelligent systems, real-world dynamic sensors, friendly user interfaces and tightly-integrated, electromechanical designs to accomplish their missions. Despite testing, our new or existing products have contained defects and errors and may in the future contain defects, errors or performance problems when first introduced, when new versions or enhancements are released, or even after these products have been used by our customers for a period of time. These problems could result in expensive and time-consuming design modifications or warranty charges, delays in the introduction of new products or enhancements, significant increases in our service and maintenance costs, exposure to liability for damages, damaged customer relationships and harm to our reputation, any of which could materially harm our results of operations and ability to achieve market acceptance. In addition, increased development and warranty costs could be substantial and could reduce our operating margins. For instance, we are engaged in a dispute relating to a contract, entered into in 2001, with a UK government agency that is claiming it is entitled to a refund of all payments made by it for the design and development of a robot for ordnance disposal. Moreover, because military robots are used in dangerous situations, the failure or malfunction of any of these robots, including our own, could significantly damage our reputation and support for robot solutions in general. The existence of any defects, errors, or failures in our products could also lead to product liability claims or lawsuits against us. A successful product liability claim could result in substantial cost, diminish our brand and divert management’s attention and resources, which could have a negative impact on our business, financial condition and results of operations.

The robot industry is and will likely continue to be characterized by rapid technological change, which will require us to develop new products and product enhancements, and could render our existing products obsolete.

Continuing technological changes in the robot industry and in the markets in which we sell our robots could undermine our competitive position or make our robots obsolete, either generally or for particular types of services. Our future success will depend upon our ability to develop and introduce a variety of new capabilities and enhancements to our existing product offerings, as well as introduce a variety of new product offerings, to address the changing needs of the markets in which we offer our robots. Delays in introducing new products and enhancements, the failure to choose correctly among technical alternatives or the failure to offer innovative products or enhancements at competitive prices may cause existing and potential customers to forego purchases of our products and purchase our competitors’ products. Moreover, the development of new products has required, and will require, that we expend significant financial and management resources. We have incurred, and expect to continue to incur, significant research and development expenses in connection with our efforts to expand our product offerings. If we are unable to devote adequate resources to develop new products or cannot otherwise successfully develop new products or enhancements that meet customer requirements on a timely basis, our products could lose market share, our revenue and profits could decline, or we could experience operating losses. Moreover, if we are unable to offset our product development costs through sales of existing or new products or product enhancements, our operating results and gross margins would be negatively impacted.

If we are unable to attract and retain additional skilled personnel, we may be unable to grow our business.

To execute our growth plan, we must attract and retain additional highly-qualified personnel. Competition for hiring these employees is intense, especially with regard to engineers with high levels of

13

Table of Contents

experience in designing, developing and integrating robots. Many of the companies with which we compete for hiring experienced employees have greater resources than we have. In addition, in making employment decisions, particularly in the high-technology industries, job candidates often consider the value of the equity they are to receive in connection with their employment. Therefore, significant volatility in the price of our stock after this offering may adversely affect our ability to attract or retain technical personnel. Furthermore, changes to accounting principles generally accepted in the United States relating to the expensing of stock options may discourage us from granting the sizes or types of stock options that job candidates may require to accept our offer of employment. If we fail to attract new technical personnel or fail to retain and motivate our current employees, our business and future growth prospects could be severely harmed.

We may be sued by third parties for alleged infringement of their proprietary rights, which could be costly, time-consuming and limit our ability to use certain technologies in the future.

If the size of our markets increases, we would be more likely to be subject to claims that our technologies infringe upon the intellectual property or other proprietary rights of third parties. In addition, the vendors from which we license technology used in our products could become subject to similar infringement claims. Our vendors or we may not be able to withstand third-party infringement claims. Any claims, with or without merit, could be time-consuming and expensive, and could divert our management’s attention away from the execution of our business plan. Moreover, any settlement or adverse judgment resulting from the claim could require us to pay substantial amounts or obtain a license to continue to use the technology that is the subject of the claim, or otherwise restrict or prohibit our use of the technology. There can be no assurance that we would be able to obtain a license from the third party asserting the claim on commercially reasonable terms, if at all, that we would be able to develop alternative technology on a timely basis, if at all, or that we would be able to obtain a license to use a suitable alternative technology to permit us to continue offering, and our customers to continue using, our affected product. In addition, we may be required to indemnify our retail and distribution partners for third-party intellectual property infringement claims, which would increase the cost to us of an adverse ruling in such a claim. An adverse determination could also prevent us from offering our products to others. Infringement claims asserted against us or our vendors may have a material adverse effect on our business, results of operations or financial condition.

If we fail to maintain or increase our consumer robot sales through our primary distribution channels, which include third-party retailers, our product sales and results of operations would be negatively impacted.

Chain stores are the primary distribution channels for our consumer robots and accounted for approximately 55.3% and 30.8%, respectively, of our revenue for the year ended December 31, 2004 and the six months ended July 2, 2005. We do not have long-term contracts regarding purchase volumes with any of our distributors. As a result, purchases generally occur on an order-by-order basis, and the relationships, as well as particular orders, can generally be terminated or otherwise materially changed at any time by our distributors. A decision by a major retail distributor, whether motivated by competitive considerations, financial difficulties, economic conditions or otherwise, to decrease its purchases from us, to reduce the shelf space for our products or to change its manner of doing business with us could significantly damage our consumer product sales and negatively impact our business, financial condition and results of operations. In addition, during recent years, various retailers, including some of our distributors, have experienced significant changes and difficulties, including consolidation of ownership, increased centralization of purchasing decisions, restructurings, bankruptcies and liquidations. These and other financial problems of some of our retailers increase the risk of extending credit to these retailers. A significant adverse change in a retail distributor relationship with us or in a retail distributor’s financial position could cause us to limit or discontinue business with that distributor, require us to assume more credit risk relating to that distributor’s receivables or limit our ability to collect amounts related to previous purchases by that distributor, all of which could harm our business and financial condition. Disruption of the iRobot on-line store could also decrease our consumer robot sales.

14

Table of Contents

If we fail to enhance our brand, our ability to expand our customer base will be impaired and our operating results may suffer.

We believe that developing and maintaining awareness of the iRobot brand is critical to achieving widespread acceptance of our existing and future products and is an important element in attracting new customers. Furthermore, we expect the importance of global brand recognition to increase as competition develops. Successful promotion of our brand will depend largely on the effectiveness of our marketing efforts, including our mass media outreach, in-store training and presentations and public relations, and our ability to provide customers with reliable and technically sophisticated robots at competitive prices. If customers do not perceive our products to be of high quality, our brand and reputation could be harmed, which could adversely impact our financial results. In addition, brand promotion efforts may not yield significant revenue or increased revenue sufficient to offset the additional expenses incurred in building our brand. If we incur substantial expenses to promote and maintain our brand, we may fail to attract sufficient customers to realize a return on our brand-building efforts, and our business would suffer.

If our existing collaborations are unsuccessful or we fail to establish new collaborations, our ability to develop and commercialize additional products could be significantly harmed.

If we cannot maintain our existing collaborations or establish new collaborations, we may not be able to develop additional products. We anticipate that some of our future products will be developed and commercialized in collaboration with companies that have expertise outside the robot field. For example, we are currently collaborating with Deere & Company on the development of the R-Gator unmanned ground vehicle, and The Clorox Company on the cleaning solution to be used in our Scooba floor washing robot. Under these collaborations, we may be dependent on our collaborators to fund some portion of development of the product or to manufacture and market either the primary product that is developed pursuant to the collaboration or complementary products required in order to operate our products. In addition, we cannot assure you that we will be able to establish additional collaborative relationships on acceptable terms.

Our existing collaborations and any future collaborations with third parties may not be scientifically or commercially successful. Factors that may affect the success of our collaborations include the following:

| • | our collaborators may not devote the resources necessary or may otherwise be unable to complete development and commercialization of these potential products; | |

| • | our existing collaborations are and future collaborations may be subject to termination on short notice; | |

| • | our collaborators may be pursuing alternative technologies or developing alternative products, either on their own or in collaboration with others, that may be competitive with our products, which could affect our collaborators’ commitment to the collaboration with us; | |

| • | reductions in marketing or sales efforts or a discontinuation of marketing or sales of our products by our collaborators could reduce our revenue; | |

| • | our collaborators may terminate their collaborations with us, which could make it difficult for us to attract new collaborators or harm our reputation in the business and financial communities; and | |

| • | our collaborators may pursue higher priority programs or change the focus of their development programs, which would weaken our collaborators’ commitment to us. |

We depend on the experience and expertise of our senior management team and key technical employees, and the loss of any key employee may impair our ability to operate effectively.

Our success depends upon the continued services of our senior management team and key technical employees, such as our project management personnel and roboticists. Moreover, we often must comply with provisions in government contracts that require employment of persons with specified levels of education and work experience. Each of our executive officers, key technical personnel and other employees could terminate his or her relationship with us at any time. The loss of any member of our senior management team might significantly delay or prevent the achievement of our business objectives and could materially harm our

15

Table of Contents

business and customer relationships. In addition, because of the highly technical nature of our robots, the loss of any significant number of our existing engineering and project management personnel could have a material adverse effect on our business and operating results.

We are subject to extensive U.S. federal government regulation, and our failure to comply with applicable regulations could subject us to penalties that may restrict our ability to conduct our business.

As a contractor and subcontractor to the U.S. federal government, we are subject to and must comply with various government regulations that impact our operating costs, profit margins and the internal organization and operation of our business. Among the most significant regulations affecting our business are:

| • | the Federal Acquisition Regulations and supplemental agency regulations, which comprehensively regulate the formation and administration of, and performance under government contracts; | |

| • | the Truth in Negotiations Act, which requires certification and disclosure of all cost and pricing data in connection with contract negotiations; | |

| • | the Cost Accounting Standards, which impose accounting requirements that govern our right to reimbursement under cost-based government contracts; | |

| • | the Foreign Corrupt Practices Act, which prohibits U.S. companies from providing anything of value to a foreign official to help obtain, retain or direct business, or obtain any unfair advantage; | |

| • | the False Claims Act and the False Statements Act, which, respectively, impose penalties for payments made on the basis of false facts provided to the government, and impose penalties on the basis of false statements, even if they do not result in a payment; and | |

| • | laws, regulations and executive orders restricting the use and dissemination of information classified for national security purposes and the exportation of certain products and technical data. |

Also, we need special clearances to continue working on and advancing certain of our projects with the U.S. federal government. For example, if we were to lose our security clearance, we would be unable to continue to participate in the U.S. Army’s Future Combat Systems program. Classified programs generally will require that we comply with various Executive Orders, federal laws and regulations and customer security requirements that may include restrictions on how we develop, store, protect and share information, and may require our employees to obtain government clearances.

Our failure to comply with applicable regulations, rules and approvals could result in the imposition of penalties, the loss of our government contracts or our suspension or debarment from contracting with the federal government generally, any of which would harm our business, financial condition and results of operations.

If we fail to protect, or incur significant costs in defending, our intellectual property and other proprietary rights, our business and results of operations could be materially harmed.

Our success depends on our ability to protect our intellectual property and other proprietary rights. We rely primarily on patents, trademarks, copyrights, trade secrets and unfair competition laws, as well as license agreements and other contractual provisions, to protect our intellectual property and other proprietary rights. Significant technology used in our products, however, is not the subject of any patent protection, and we may be unable to obtain patent protection on such technology in the future. Moreover, existing U.S. legal standards relating to the validity, enforceability and scope of protection of intellectual property rights offer only limited protection, may not provide us with any competitive advantages, and may be challenged by third parties. In addition, the laws of countries other than the United States in which we market our products may afford little or no effective protection of our intellectual property. Accordingly, despite our efforts, we may be unable to prevent third parties from infringing upon or misappropriating our intellectual property or otherwise gaining access to our technology. Unauthorized third parties may try to copy or reverse engineer our products or portions of our products or otherwise obtain and use our intellectual property. Some of our contracts with the U.S. federal government allow the federal government to disclose technical data regarding the products

16

Table of Contents

developed on behalf of the government under the contract without constraining the recipient on how it is used. This ability of the government creates the potential that third parties may be able to use this data to compete with us in the commercial sector. If we fail to protect our intellectual property and other proprietary rights, our business, results of operations or financial condition could be materially harmed.

In addition, defending our intellectual property rights may entail significant expense. We believe that certain products in the marketplace may infringe our existing intellectual property rights. We have, from time to time, resorted to legal proceedings to protect our intellectual property and may continue to do so in the future. We may be required to expend significant resources to monitor and protect our intellectual property rights. Any of our intellectual property rights may be challenged by others or invalidated through administrative processes or litigation. If we resort to legal proceedings to enforce our intellectual property rights or to determine the validity and scope of the intellectual property or other proprietary rights of others, the proceedings could result in significant expense to us and divert the attention and efforts of our management and technical employees, even if we were to prevail.

Potential future acquisitions could be difficult to integrate, divert the attention of key personnel, disrupt our business, dilute stockholder value and impair our financial results.

As part of our business strategy, we intend to consider acquisitions of companies, technologies and products that we believe could accelerate our ability to compete in our core markets or allow us to enter new markets. Acquisitions involve numerous risks, any of which could harm our business, including:

| • | difficulties in integrating the operations, technologies, products, existing contracts, accounting and personnel of the target company and realizing the anticipated synergies of the combined businesses; | |

| • | difficulties in supporting and transitioning customers, if any, of the target company; | |

| • | diversion of financial and management resources from existing operations; | |

| • | the price we pay or other resources that we devote may exceed the value we realize, or the value we could have realized if we had allocated the purchase price or other resources to another opportunity; | |

| • | risks of entering new markets in which we have limited or no experience; | |

| • | potential loss of key employees, customers and strategic alliances from either our current business or the target company’s business; | |

| • | assumption of unanticipated problems or latent liabilities, such as problems with the quality of the target company’s products; and | |

| • | inability to generate sufficient revenue to offset acquisition costs. |

Acquisitions also frequently result in the recording of goodwill and other intangible assets which are subject to potential impairments in the future that could harm our financial results. In addition, if we finance acquisitions by issuing convertible debt or equity securities, our existing stockholders may be diluted, which could lower the market price of our common stock. As a result, if we fail to properly evaluate acquisitions or investments, we may not achieve the anticipated benefits of any such acquisitions, and we may incur costs in excess of what we anticipate. The failure to successfully evaluate and execute acquisitions or investments or otherwise adequately address these risks could materially harm our business and financial results.

We will incur significant increased costs as a result of operating as a public company, and our management will be required to devote substantial time to new compliance initiatives.

We have never operated as a public company. As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. In addition, the Sarbanes-Oxley Act of 2002, as well as new rules subsequently implemented by the Securities and Exchange Commission and the NASDAQ National Market, have imposed various new requirements on public companies, including requiring changes in corporate governance practices. Our management and other personnel will need to devote a substantial amount of time to these new compliance initiatives. Moreover,

17

Table of Contents

these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly. For example, we expect these new rules and regulations to make it more difficult and more expensive for us to obtain director and officer liability insurance, and we may be required to incur substantial costs to maintain the same or similar coverage.