- DB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

FWP Filing

Deutsche Bank (DB) FWPFree writing prospectus

Filed: 9 Dec 10, 12:00am

|

Issuer Free Writing Prospectus

Filed pursuant to Rule 433

Registration Statement No. 333-162195

Dated: December 9, 2010

ELVIS(TM)

Equity Long Volatility Investment Strategy(TM)

November 30, 2010

A Passion to Perform.

Page 1

|

|

BBG:

DBVELVIS

- --------------------------------------------------------------------------------

ELVIS(TM)

Hedging with Volatility

ELVIS is designed to be a more efficient hedging strategy

[] The strategy aims to achieve two objectives:

-- Capture volatility spikes that often accompany market sell-offs

-- Reduce hedging carry-costs during bull markets or periods of calm

[] The strategy seeks to accomplish this by:

-- Avoiding paying the "risk premium" often associated with options and

other hedging products

-- Trading implied volatility on the volatility term structure where it

is generally relatively flat

-- Reducing the frequency of rolling necessary to maintain the hedge

ELVIS quick facts

- -- Bloomberg: DBVELVIS Index

- -- Strategy seeks to address medium and long-term hedging needs (3

months+)

- -- Targets a consistent exposure to changes in volatility regardless of

market levels

- -- Calculations based on listed option prices

- -- Convenient, transparent access to volatility investing

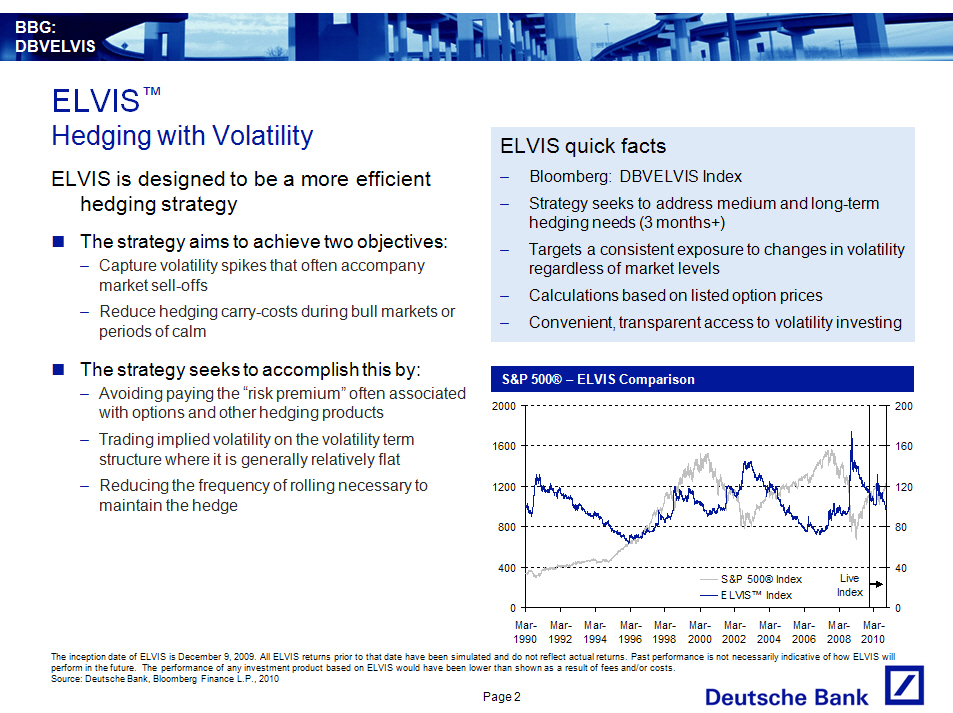

S and P 500[R] -- ELVIS Comparison

- ----------------------------------

[GRAPHIC OMITTED]

The inception date of ELVIS is December 9, 2009. All ELVIS returns prior to

that date have been simulated and do not reflect actual returns. Past

performance is not necessarily indicative of how ELVIS will perform in the

future. The performance of any investment product based on ELVIS would have

been lower than shown as a result of fees and/or costs.

Source: Deutsche Bank, Bloomberg Finance L.P., 2010

Page 2

|

|

BBG:

DBVELVIS

- --------------------------------------------------------------------------------

ELVIS(TM)

Hedging with Volatility

ELVIS is a hedging strategy for equity long-only and long-short portfolios

[] Based on retrospective analysis, adding ELVIS to a long-only portfolio can

enhance returns and lower volatility

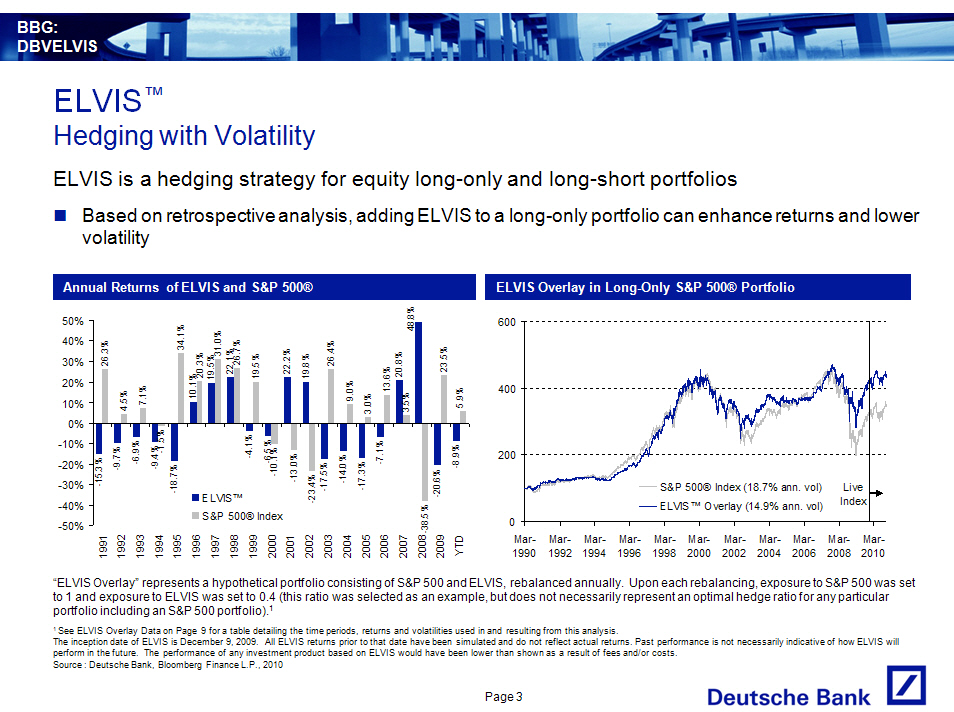

Annual Returns of ELVIS and S and P 500[R]

- ------------------------------------------

[GRAPHIC OMITTED]

ELVIS Overlay in Long-Only S and P 500[R] Portfolio

- ---------------------------------------------------

[GRAPHIC OMITTED]

"ELVIS Overlay" represents a hypothetical portfolio consisting of S and P 500

and ELVIS, rebalanced annually. Upon each rebalancing, exposure to S and P 500

was set to 1 and exposure to ELVIS was set to 0.4 (this ratio was selected as an

example, but does not necessarily represent an optimal hedge ratio for any

particular portfolio including an S and P 500 portfolio).(1)

(1) See ELVIS Overlay Data on Page 9 for a table detailing the time periods,

returns and volatilities used in and resulting from this analysis. The inception

date of ELVIS is December 9, 2009. All ELVIS returns prior to that date have

been simulated and do not reflect actual returns. Past performance is not

necessarily indicative of how ELVIS will perform in the future. The performance

of any investment product based on ELVIS would have been lower than shown as a

result of fees and/or costs.

Source : Deutsche Bank, Bloomberg Finance L.P., 2010

Page 3

|

|

BBG:

DBVELVIS

- --------------------------------------------------------------------------------

ELVIS(TM)

Hedging Performance Stats

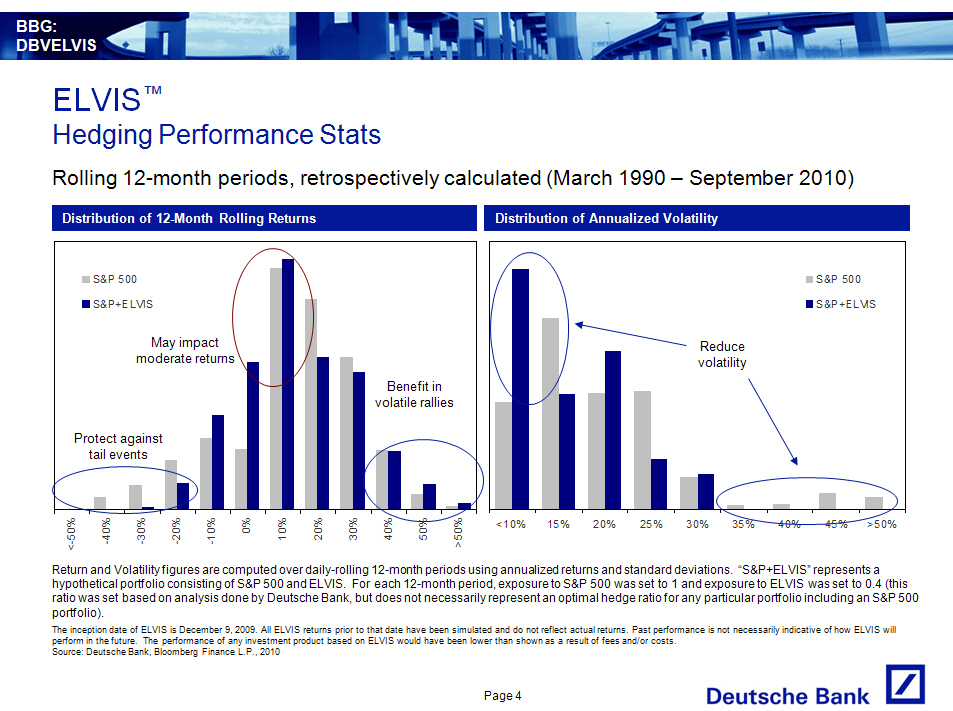

Rolling 12-month periods, retrospectively calculated (March 1990 -- September

2010)

Distribution of 12-Month Rolling Returns

- ----------------------------------------

[GRAPHIC OMITTED]

Distribution of Annualized Volatility

- -------------------------------------

[GRAPHIC OMITTED]

Return and Volatility figures are computed over daily-rolling 12-month periods

using annualized returns and standard deviations. "S and P+ELVIS" represents a

hypothetical portfolio consisting of S and P 500 and ELVIS. For each 12-month

period, exposure to S and P 500 was set to 1 and exposure to ELVIS was set to

0.4 (this ratio was set based on analysis done by Deutsche Bank, but does not

necessarily represent an optimal hedge ratio for any particular portfolio

including an S and P 500 portfolio).

The inception date of ELVIS is December 9, 2009. All ELVIS returns prior to

that date have been simulated and do not reflect actual returns. Past

performance is not necessarily indicative of how ELVIS will perform in the

future. The performance of any investment product based on ELVIS would have

been lower than shown as a result of fees and/or costs.

Source: Deutsche Bank, Bloomberg Finance L.P., 2010

Page 4

|

|

BBG:

DBVELVIS

- --------------------------------------------------------------------------------

ELVIS(TM)

Index Construction

How ELVIS works

The index is long exposure to future S and P 500 volatility

- -- The strategy is implemented via notional volatility derivatives (6-month

variance swaps forward -starting in 3 months) which are rolled at each

quarterly listed option expiry as they become spot (current -starting)

variance swaps The strategy's performance during a given quarterly roll

period depends on changes in S and P 500 implied volatility: an increase in

implied volatility should lead to index gains; a decrease in implied

volatility should lead to index losses

- -- The index re-calibrates notional every roll-date to target consistent

volatility exposure: less exposure in a high-volatility environment; more

exposure in a low-volatility environment

- -- Entry and exit variance swap levels are derived from S and P 500 listed

option market prices using established market methodology for pricing

variance swaps

- -- Because the variance swap strike levels are based on mid-market option

prices, they do not take into account the transaction costs (bid-offer

spreads) that would be associated with trading variance swaps. To account

for this, a cost equivalent to 1.5% of the 9 month spot variance swap

strike level is deducted from the index over each roll period (see Appendix

III for more detail)

Why forward -starting

- -- By rolling the position before the notional variance swaps start recording

observations, ELVIS avoids exposure to S and P 500 volatility actually

realized by the index

- -- Instead, ELVIS delivers exposure to changes in S and P 500 implied

volatility

- -- By removing exposure to realized volatility, ELVIS aims to avoid paying a

volatility "risk premium," which option sellers usually demand from option

buyers. The volatility risk premium has manifested itself through a spread

between implied volatility and volatility subsequently realized by the S

and P 500

Page 5

|

|

BBG:

DBVELVIS

- --------------------------------------------------------------------------------

ELVIS(TM)

Index Construction

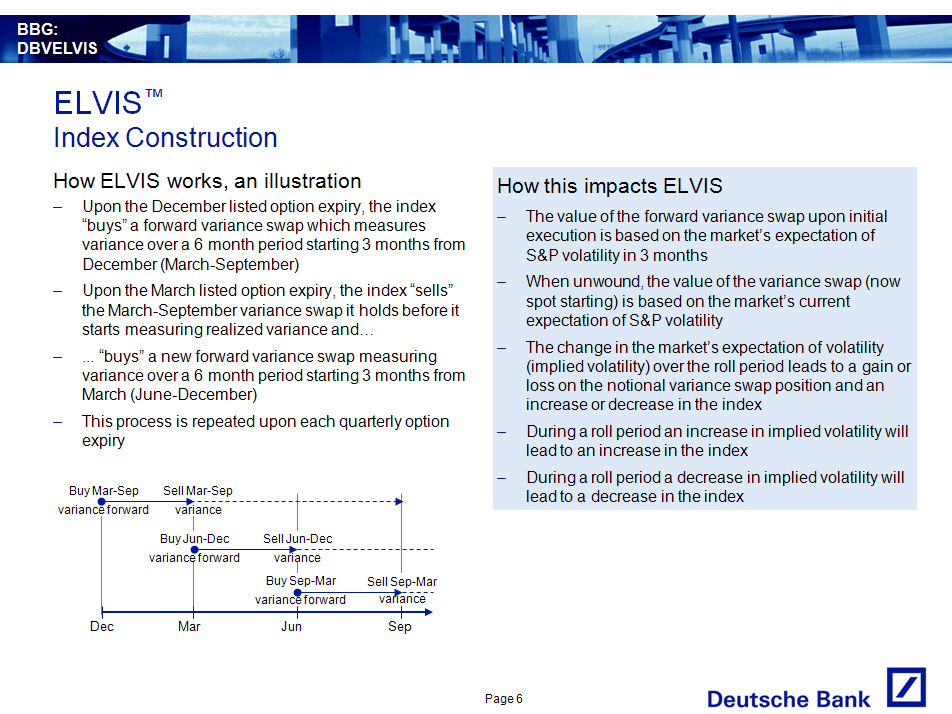

How ELVIS works, an illustration

- -- Upon the December listed option expiry, the index "buys" a forward variance

swap which measures variance over a 6 month period starting 3 months from

December (March -September)

- -- Upon the March listed option expiry, the index "sells" the March-September

variance swap it holds before it starts measuring realized variance and[]

- -- ... "buys" a new forward variance swap measuring variance over a 6 month

period starting 3 months from March (June-December)

- -- This process is repeated upon each quarterly option expiry

[GRAPHIC OMITTED]

How this impacts ELVIS

- -- The value of the forward variance swap upon initial execution is based on

the market's expectation of S and P volatility in 3 months

- -- When unwound, the value of the variance swap (now spot starting) is based

on the market's current expectation of S and P volatility

- -- The change in the market's expectation of volatility (implied volatility)

over the roll period leads to a gain or loss on the notional variance swap

position and an increase or decrease in the index

- -- During a roll period an increase in implied volatility will lead to an

increase in the index

- -- During a roll period a decrease in implied volatility will lead to a

decrease in the index

Page 6

|

|

BBG:

DBVELVIS

- --------------------------------------------------------------------------------

ELVIS(TM)

Comparison to Other Hedging Strategies

[GRAPHIC OMITTED]

Which implied volatility to trade

- -- ELVIS systematically invests in future volatility over a medium -term

horizon

- -- A medium -term strategy may have worked better than either a very

short-term or a very long-term strategy across different market regimes

- -- A very short-term strategy (e.g., 1-month variance swaps forward -starting

in 1 months) can be highly sensitive to spikes in implied volatility but

also costly to carry when markets are calm (this would be similar to

rolling front month VIX futures)

- -- A very long-term strategy (e.g., 9-month variance swaps forward -starting

in 9 months) can be relatively cheap to carry but may not react to spikes

in implied volatility enough

"ELVIS 1mx1m" represents a hypothetical version of ELVIS constructed using

1-month forward 1-month variance swaps. "ELVIS 9mx9m" represents a hypothetical

version of ELVIS constructed using 9-month forward 9-month variance swaps. "S

and P+ELVIS", "S and P+'ELVIS 1mx1m'" and "S and P+'ELVIS 9mx9m'" each represent

a hypothetical portfolio consisting of S and P 500 and ELVIS or hypothetical

ELVIS hedging strategy, rebalanced annually. Upon each rebalancing, exposure to

S and P 500 was set to 1 while exposure to ELVIS and 'ELVIS 9mx9m' was set to

0.4 and 'ELVIS 1mx1m' was set to 0.2 (these ratios were set based on analyses

done by Deutsche Bank, but do not necessarily represent optimal hedge ratios for

any particular portfolio including an S and P 500 portfolio) .

The inception date of ELVIS is December 9, 2009. All ELVIS returns prior to

that date have been simulated and do not reflect actual returns. Past

performance is not necessarily indicative of how ELVIS will perform in the

future. The performance of any investment product based on ELVIS would have

been lower than shown as a result of fees and/or costs.

Source: Deutsche Bank, Bloomberg Finance L.P., 2010

Page 7

|

|

BBG:

DBVELVIS

- --------------------------------------------------------------------------------

ELVIS(TM)

Comparison to Other Hedging Strategies

[GRAPHIC OMITTED]

Page 8

|

|

BBG:

DBVELVIS

- --------------------------------------------------------------------------------

ELVIS([]) Overlay Data

ELVIS[] Overlay S and P 500[R] ELVIS[] Overlay S and P 500[R]

- ------------------------------------------------------- -------------------------------------------------------

Start Date End Date Return Volatility Return Volatility Start Date End Date Return Volatility Return Volatility

- ------------------------------------------------------- -------------------------------------------------------

3/16/1990 3/15/1991 16.3% 15.0% 9.3% 16.5% 3/16/2001 3/15/2002 7.7% 17.5% 1.4% 20.1%

3/15/1991 3/20/1992 8.7% 11.8% 10.1% 13.0% 3/15/2002 3/21/2003 -13.9% 21.5% -23.2% 26.8%

3/20/1992 3/19/1993 4.1% 9.3% 9.5% 10.0% 3/21/2003 3/19/2004 20.2% 12.5% 23.9% 14.2%

3/19/1993 3/18/1994 1.6% 8.5% 4.6% 8.4% 3/19/2004 3/18/2005 -1.9% 8.5% 7.2% 10.7%

3/18/1994 3/17/1995 -1.2% 9.9% 5.2% 9.4% 3/18/2005 3/17/2006 2.4% 7.0% 9.9% 10.2%

3/17/1995 3/15/1996 26.1% 8.5% 29.4% 9.7% 3/17/2006 3/16/2007 6.2% 6.6% 6.1% 10.5%

3/15/1996 3/21/1997 26.1% 9.7% 22.2% 11.9% 3/16/2007 3/20/2008 7.3% 10.8% -4.1% 18.9%

3/21/1997 3/20/1998 44.3% 16.2% 40.2% 18.7% 3/20/2008 3/20/2009 -26.8% 29.5% -42.2% 43.6%

3/20/1998 3/19/1999 28.9% 17.5% 18.2% 21.4% 3/20/2009 3/19/2010 39.1% 19.3% 50.9% 21.1%

3/19/1999 3/17/2000 10.5% 17.0% 12.7% 19.6% 3/19/2010 11/30/2010 1.3% 10.7% 1.8% 19.6%

-------------------------------------------------------

3/17/2000 3/16/2001 -23.2% 19.8% -21.4% 21.8%

- ------------------------------------------------------- -------------------------------------------------------

3/16/1990 11/30/2010 336.4% 14.9% 245.3% 18.7%

-------------------------------------------------------

"ELVIS Overlay" represents a hypothetical portfolio consisting of S and P 500 and

ELVIS, rebalanced annually. Upon each rebalancing, exposure to S and P 500 was set

to 1 and exposure to ELVIS was set to 0.4 (this ratio was set based on analysis

done by Deutsche Bank, but does not necessarily represent an optimal hedge

ratio for any particular portfolio including an S and P 500 portfolio) .

Source: Deutsche Bank, Bloomberg Finance L.P., 2010

Page 9

|

|

BBG:

DBVELVIS

- --------------------------------------------------------------------------------

Index Description

[] The Deutsche Bank Equity Long Volatility Investment Strategy ("ELVIS" and

the "Index") tracks the performance of a long position in a 3-month ("3M")

forward 6-month ("6M") variance swap on the S and P 500 Index. The Index

was created by Deutsche Bank AG, the Index Sponsor, on December 9, 2009 and

is calculated, maintained and published by the Index Sponsor. The closing

level of ELVIS was set to 100 on March 16, 1990 (the "Index Base Date").

ELVIS is denominated in U.S. dollars.

[] Investment Strategy and Index Construction

[] Investment Strategy

[] ELVIS is a strategy that aims to capture and monetize the movements of

equity market implied volatility through a long position in 3M-forward

6M variance swaps on the S and P 500 Index. A forward variance swap

obligates its holder to enter into a spot (or current starting)

variance swap at a later date at a pre-specified variance swap strike

price. A 3M-forward 6M variance swap is a variance swap starting in 3

months and lasting for 6 months. Forward variance swaps are used to

take a view on future movements of implied volatility. When sold or

unwound prior to the variance swap start date, the gain or loss on the

forward variance swap will only relate to changes in implied

volatility and not to any realized volatility of the underlying, which

would otherwise be measured during the life of the variance swap.

[] Volatility is a statistical measure of the amount of movement of the

price of an asset over a period of time and is the market standard for

expressing the riskiness of an asset. Volatility is generally

calculated based on the natural log return of an asset between each

observation. Implied volatility is a market estimate of the volatility

an asset will realize over a future period of time. Implied volatility

is determined from the market prices of listed options on the asset.

[] Variance is the square of volatility and is used in certain products

in the over-the-counter (OTC) derivatives market in place of

volatility due to mathematical properties that make it more convenient

for financial institutions to value and hedge those products. ELVIS

primarily uses variance in its calculations for this reason, but uses

and refers to volatility as a standard reference measure consistent

with market practice.

Page 10

|

|

BBG:

DBVELVIS

- --------------------------------------------------------------------------------

Index Description

[] Index Construction

[] ELVIS tracks the performance of a notional investment in 3M-forward 6M

variance swaps on the S and P 500 Index. Since variance is additive in

time (i.e. a 6-month variance swap is equivalent to two consecutive

3-month variance swaps), the 3M-forward 6M variance swap strike is

calculated as the time-weighted difference between the strikes of the

9-month ("9M") and 3M variance swaps. The 3M-forward 6M variance swap

can therefore be replicated by a portfolio holding a roughly 1/2 short

position in 3M spot variance swap and a roughly 3/2 long position in

9M spot variance swap. The expiry dates of the 3M and 9M spot variance

swaps in the replicating portfolio are the same as the 3M-forward 6M

variance swap start date and end date, respectively.

[] The variance swap strikes for the 3M and 9M spot variance swaps are

calculated from mid-market prices of all available S and P 500[R]

listed out-of-the-money options with both bid and ask prices greater

than $0.20 with the same expiry. Because the variance swap strike

levels are based on mid-market prices, they do not take into account

transaction costs (bid-offer spreads) that would be associated with

trading variance swaps. To account for this, the strike of the

prevailing 9M spot variance swap in the replicating portfolio is

raised to 101.5% of the fair level. This implies an increase on the

3M-forward 6M variance swap strike, which will be deducted from the

index level as a running cost over the period to the next rebalancing

day.

[] The Index rebalances on March, June, September and December option

expiry days, i.e. the 3rd Friday of the relevant month if it is a

business day, otherwise the previous business day. On each rebalancing

day, the forward variance swap becomes a spot variance swap. However,

the now-6M spot variance swap is unwound and a new 3M-forward 6M

variance swap is entered into. The swap start date of the new contract

is the 3rd Friday of the 3rd month after the rebalancing date. The

swap end date of the new contract is the 3rd Friday of the 9th month

after the rebalancing date. If either of these two Fridays is a

holiday, the previous business day is used instead.

[] On each rebalancing day, the forward variance swap notional is

calculated so that it is proportional to the prevailing index level

and inversely proportional to the prevailing 3M-forward 6M variance

swap level.

[] On each index calculation day, the change in the index level is

calculated as the difference between the prevailing forward variance

swap level and the strike variance level set on the previous

rebalancing day, reduced by the daily running cost described above.

[] ELVIS index calculates on all weekdays that are not US equity market

holidays.

Page 11

|

|

BBG:

DBVELVIS

- --------------------------------------------------------------------------------

Index Costs

[] Because the variance swap strike levels used in the calculation of ELVIS

are based on mid-market option prices, they do not take into account the

transaction costs (bid-offer spreads) that would be associated with

trading, or hedging, variance swaps. To account for this, a cost equivalent

to 1.5% of the 9-month spot variance strike level is deducted from the

index over each roll period.

[] The forward variance strike level for the 3-month forward 6-month variance

swap is determined based on variance strike levels of the 3-month and

9-month spot variance swaps (Note: all variance swap strike levels are

quoted in volatility points, not variance). These variance strike levels

are "time-weighted" as follows to determine the forward variance strike

level:

9m x T2 / (T2 -- T1) -- 3m x T1 / (T2 -- T1), where

"9m" is the 9-month spot variance strike; "3m" is the 3-month spot variance

strike; "T1" is the time to maturity, in trading days, of the 3-month spot

variance swap; and "T2" is the time to maturity, in trading days of the

9-month spot variance swap.

[] Based on this calculation, raising the 9-month spot variance strike level

by 1.5% of the fair strike level is approximately equal to increasing the

3-month forward 6-month variance strike level by 2.25% of the fair strike

level (the exact amount will depend of the number trading days in each

period and the relative levels of the 3-month and 9-month spot variance

strikes).

[] As an example, if the forward variance strike is 20, the cost applied to

the index over the quarterly roll period would be approximately 0.45

volatility points. Since each forward variance swap is both bought and

sold, resulting in two transactions per roll period, the effective rolling

cost in such a scenario is 0.225 volatility points per transaction.

[] Historically, this cost factor would have amounted to approximately 1 basis

point (0.01%) per day.

Page 12

|

|

BBG:

DBVELVIS

- --------------------------------------------------------------------------------

Risk Factors

STRATEGY RISK -- ELVIS may not achieve its desired objectives. Various market

factors and circumstances at any time over any period could cause, and have

caused, ELVIS's strategy to fail to perform as expected. Deutsche Bank provides

no assurance that this strategy is or will remain profitable.

DEUTSCHE BANK AG, LONDON BRANCH, AS THE SPONSOR OF ELVIS, MAY ADJUST THE INDEX

IN A WAY THAT AFFECTS ITS LEVEL AND MAY HAVE CONFLICTS OF INTEREST -- Deutsche

Bank AG, London Branch is the sponsor of ELVIS (the "Index Sponsor") and will

determine whether there has been a market disruption event with respect to

ELVIS. In the event of any such market disruption event, the Index Sponsor may

use an alternate method to calculate the closing level of ELVIS. The Index

Sponsor carries out calculations necessary to promulgate ELVIS and maintains

some discretion as to how such calculations are made. In particular, the Index

Sponsor has discretion in selecting among methods of how to calculate ELVIS in

the event the regular means of determinin g ELVIS are unavailable at the time a

determination is scheduled to take place. There can be no assurance that any

determination made by the Index Sponsor in these various capacities will not

affect the level of ELVIS. Any of these actions could adversely affect the

value of securities or options linked to ELVIS. The Index Sponsor has no

obligation to consider the interests of holders of securities linked to ELVIS

in calculating or revising ELVIS.

Furthermore, Deutsche Bank AG, London Branch or one or more of its affiliates

may have published, and may in the future publish, research reports on ELVIS or

investment strategies reflected by ELVIS (or any transaction, product or

security related to ELVIS or any components thereof ). This research is

modified from time to time without notice and may express opinions or provide

recommendations that are inconsistent with purchasing or holding of

transactions, products or securities related to ELVIS. Any of these activities

may affect ELVIS or transactions, products or securities related to ELVIS.

Investors should make their own independent investigation of the merits of

investing in contracts or products related to ELVIS.

ELVIS HAS VERY LIMITED PERFORMANCE HISTORY -- Calculation of ELVIS began on

December 9, 2009. Therefore, ELVIS has very limited performance history and no

actual investment which allowed tracking of the performance of ELVIS was

possible before that date. The ELVIS performance data prior to this date shown

in this presentation have been retrospectively calculated using historical data

and the current ELVIS methodology and do not reflect actual ELVIS performance.

Page 13

|

|

Important Notes

The distribution of this document and the availability of some of the products

and services referred to herein may be restricted by law in certain

jurisdictions. Some products and services referred to herein are not eligible

for sale in all countries and in any event may only be sold to qualified

investors. Deutsche Bank will not offer or sell any products or services to any

persons prohibited by the law in their country of origin or in any other

relevant country from engaging in any such transactions.

Prospective investors should understand and discuss with their professional

tax, legal, accounting and other advisors the effect of entering into or

purchasing any transaction, product or security related to ELVIS (each, a

"Structured Product") . Before investing in any Structured Product you should

take steps to ensure that you understand and have assessed with your financial

advisor, or made an independent assessment of, the appropriateness of the

transaction in the light of your own objectives and circumstances, including

the possible risks and benefits of investing in such Structured Product.

Structured Products are not suitable for all investors due to illiquidity,

optionality, time to redemption, and payoff nature of the strategy.

Deutsche Bank or persons associated with Deutsche Bank and their affiliates

may: maintain a long or short position in securities referenced herein or in

related futures or options; purchase, sell or maintain inventory; engage in any

other transaction involving such securities; and earn brokerage or other

compensation.

Any payout information, scenario analysis, and hypothetical calculations should

in no case be construed as an indication of expected payout on an actual

investment and/or expected behavior of an actual Structured Product.

Calculations of returns on Structured Products may be linked to a referenced

index or interest rate. As such, the Structured Products may not be suitable

for persons unfamiliar with such index or interest rate, or unwilling or unable

to bear the risks associated with the transaction. Structured Product

denominated in a currency, other than the investor's home currency, will be

subject to changes in exchange rates, which may have an adverse effect on the

value, price or income return of the products. These Structured Product may not

be readily realizable investments and are not traded on any regulated market.

Structured Products involve risk, which may include interest rate, index,

currency, credit, political, liquidity, time value, commodity and market risk

and are not suitable for all investors.

The past performance of an index, securities or other instruments does not

guarantee or predict future performance. The distribution of this document and

availability of these products and services in certain jurisdictions may be

restricted by law.

Deutsche Bank does not provide accounting, tax or legal advice.

BEFORE ENTERING INTO ANY TRANSACTION YOU SHOULD TAKE STEPS TO ENSURE THAT YOU

UNDERSTAND AND HAVE MADE AN INDEPENDENT ASSESSMENT OF THE APPROPRIATENESS OF

THE STRUCTURED PRODUCT IN LIGHT OF YOUR OWN OBJECTIVES AND CIRCUMSTANCES,

INCLUDING THE POSSIBLE RISKS AND BENEFITS OF ENTERING INTO SUCH STRUCTURED

PRODUCT. YOU SHOULD ALSO CONSIDER MAKING SUCH INDEPENDENT INVESTIGATIONS AS YOU

CONSIDER NECESSARY OR APPROPRIATE FOR SUCH PURPOSE.

"Deutsche Bank" means Deutsche Bank AG and its affiliated companies, as the

context requires. Deutsche Bank Private Wealth Management refers to Deutsche

Bank's wealth management activities for high-net-worth clients around the

world. Deutsche Bank Alex Brown is a division of Deutsche Bank Securities Inc.

Backtested, hypothetical or simulated performance results presented herein have

inherent limitations. Unlike a performance record based on trading actual

client portfolios, simulated results are achieved by means of the retroactive

application of a backtested model designed with the benefit of hindsight.

Taking into account historical events the backtesting of performance also

differs from actual account performance because an actual investment strategy

may be adjusted any time, for any reason, including a response to material,

economic or market factors. The backtested performance includes hypothetical

results that do not reflect the reinvestment of dividends and other earnings or

the deduction of advisory fees, brokerage or other commissions, and any other

expenses that a client would have paid or actually paid. No representation is

made that any trading strategy or account will or is likely to achieve profits

or losses similar to those shown. Alternative modeling techniques or

assumptions might produce significantly different results and prove to be more

appropriate. Past hypothetical backtest results are neither an indicator nor a

guarantee of future returns. Actual results will vary, perhaps materially, from

the analysis.

Page 14

|

|

Important Notes

Structured Products linked to ELVIS discussed herein are not insured or

guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other

governmental agency. These Structured Products are not insured by any statutory

scheme or governmental agency of the United Kingdom.

These Structured Products typically involve a high degree of risk, are not

readily transferable and typically will not be listed or traded on any exchange

and are intended for sale only to investors who are capable of understandin g

and assuming the risks involved. The market value of any Structured Product may

be affected by changes in economic, financial and political factors (including,

but not limited to, spot and forward interest and exchange rates), time to

maturity, market conditions and volatility and the equity prices and credit

quality of any issuer or reference issuer.

Additional information may be available upon request. Any results shown do not

reflect the impact of commission and/or fees, unless stated.

Deutsche Bank AG has filed a registration statement (including a prospectus)

with the SEC for the offerings to which this communication relates. Before you

invest, you should read the prospectus in that registration statement and other

documents the issuer has filed with the SEC for more complete information about

the issuer and this offering. You may get these documents for free by visiting

EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any

underwriter or any dealer participating in the offering will arrange to send

you the prospectus if you request it by calling toll-free 1-800-311-4409.

License Agreement with S and P

Any Structured Products are not sponsored, endorsed, sold or promoted by

Standard and Poor's, a division of the McGraw -Hill Companies, Inc., which we

refer to as S and P. S and P makes no representation or warranty, express or

implied, to the owners of the Structured Products or any member of the public

regarding the advisability of investing in securities generally or in the

Structured Products particularly, or the ability of the S and P 500[R] to track

general stock market performance. S and P's only relationship to Deutsche Bank

AG is the licensing of certain trademarks and trade names of S and P without

regard to Deutsche Bank AG or the Structured Products. S and P has no obligation

to take the needs of Deutsche Bank AG or the holders of the Structured Products

into consideration in determining, composing or calculating the S and P 500[R].

S and P is not responsible for and has not participated in the determination of

the timing, price or quantity of the Structured Products to be issued or in the

determination or calculation of the amount due at maturity of the Structured

Products. S and P has no obligation or liability in connection with the

administration, marketing or trading of the Structured Products.

S and P DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE S and P

500[R] OR ANY DATA INCLUDED THEREIN AND S and P SHALL HAVE NO LIABILITY FOR ANY

ERRORS, OMISSIONS OR INTERRUPTIONS THEREIN. S and P MAKES NO WARRANTY, EXPRESS

OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY DEUTSCHE BANK AG, HOLDERS OF THE

STRUCTURED PRODUCTS OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE S and P

500[R] INDEX OR ANY DATA INCLUDED THEREIN. S and P MAKES NO EXPRESS OR IMPLIED

WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS

FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE S and P 500[R] OR ANY DATA

INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL S and

P HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT OR CONSEQUENTIAL

DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH

DAMAGES.

"STANDARD and POOR'S", "S and P", "S and P 500" AND "500" ARE TRADEMARKS OF THE

MCGRAW -HILL COMPANIES, INC. AND HAVE BEEN LICENSED FOR USE BY DEUTSCHE BANK AG.

STRUCTURED PRODUCTS ARE NOT SPONSORED, ENDORSED, SOLD OR PROMOTED BY S and P AND

S and P MAKES NO REPRESENTATION REGARDING THE ADVISABILITY OF PURCHASING ANY OF

THE STRUCTURED PRODUCTS.

Page 15

|