- DB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

FWP Filing

Deutsche Bank (DB) FWPFree writing prospectus

Filed: 6 Dec 10, 12:00am

|

Issuer Free Writing Prospectus

Filed pursuant to Rule 433

Registration Statement No. 333-162195

Dated: December 6, 2010

EMERALD(tm)

Equity MEan Reversion ALpha inDex(tm)

[GRAPHIC OMITTED]

A Passion to Perform. Deutsche Bank [GRAPHIC OMITTED]

slide00

|

|

[GRAPHIC OMITTED]

EMERALD []

Equity MEan Reversion ALpha inDex(TM)

EMERALD(TM) seeks to capture returns from mean -reversion of the SandP 500[R]

Index during the course of a single week

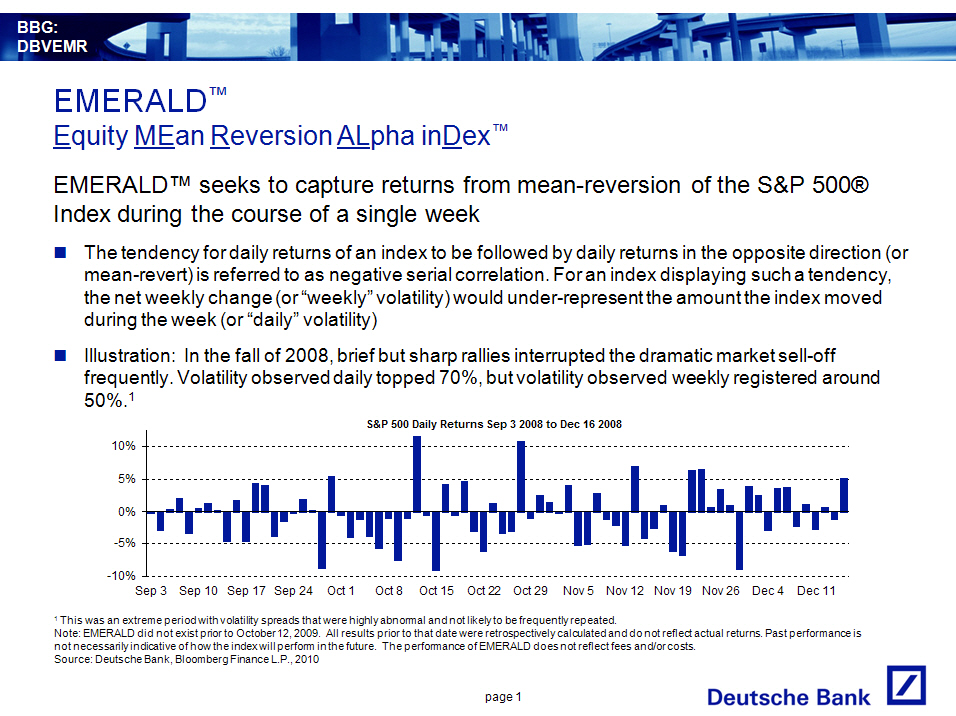

[] The tendency for daily returns of an index to be followed by daily returns

in the opposite direction (or mean-revert) is referred to as negative

serial correlation. For an index displaying such a tendency, the net weekly

change (or "weekly" volatility) would under-represent the amount the index

moved during the week (or "daily" volatility)

[] Illustration: In the fall of 2008, brief but sharp rallies interrupted the

dramatic market sell-off frequently. Volatility observed daily topped 70%,

but volatility observed weekly registered around 50%.(1)

[GRAPHIC OMITTED]

(1) This was an extreme period with volatility spreads that were highly

abnormal and not likely to be frequently repeated.

Note: EMERALD did not exist prior to October 12, 2009. All results prior to

that date were retrospectively calculated and do not reflect actual returns.

Past performance is not necessarily indicative of how the index will perform in

the future. The performance of EMERALD does not reflect fees and/or costs.

Source: Deutsche Bank, Bloomberg Finance L.P., 2010

page 1

Deutsche Bank [GRAPHIC OMITTED]

slice01

|

|

[GRAPHIC OMITTED]

EMERALD(TM)

Equity MEan Reversion ALpha inDex(TM)

EMERALD's performance is tied to the spread between "daily" volatility and

"weekly" volatility

[] In the SandP 500[R], volatility observed daily has exceeded volatility

observed weekly over the past 11 years approx. 87% of the time 1

[] EMERALD seeks to monetize this negative serial correlation through a

strategy that periodically buys "daily" volatility and sells "weekly"

volatility on the SandP 500[R] in equal notional amounts

[] The strategy offers a unique risk profile that may offset market risk

-- EMERALD has risen steadily with infrequent drawdowns that were

generally quickly recovered

-- Significant positive returns in 2007 -2008 (based on retrospective

calculation, not actual returns) demonstrate the value EMERALD can

offer during periods of market turmoil (see chart on next page)

(1) Daily and weekly volatilities of the SandP 500[R] Index were observed over

rolling 6-month periods from March 1998 to December 2009.

Note: EMERALD did not exist prior to October 12, 2009. All results prior to

that date were retrospectively calculated and do not reflect actual returns.

Past performance is not necessarily indicative of how the index will perform in

the future. The performance of EMERALD does not reflect fees and/or costs.

Source: Deutsche Bank, 2010.

page 2

Deutsche Bank [GRAPHIC OMITTED]

slide02

|

|

[GRAPHIC OMITTED]

EMERALD(TM)

Index Returns (from March 16, 1998) Annual Returns

[GRAPHIC OMITTED] [GRAPHIC OMITTED]

Performance Analysis (from March 16, 1998)

=======================================================

DB EMERALD SandP 500[R]

- ---------------------------- ------------- ------------

Annualized Returns 5.8% 0.7%

- ---------------------------- ------------- ------------

Volatility(Weekly Returns) 7.7% 19.6%

- ---------------------------- ------------- ------------

Sharpe Ratio (3.2%) 0.75 N/A

- ---------------------------- ------------- ------------

Maximum Drawdown

(Monthly Returns) -7.8% -52.6%

- ---------------------------- ------------- ------------

Start Date Jul-98 Nov-07

- ---------------------------- ------------- ------------

End Date Sep-98 Mar-10

- ---------------------------- ------------- ------------

Max/Min Returns

- ---------------------------- ------------- ------------

Rolling 12 Months 38.5%/-7.1% 68.3%/-47.7%

- ---------------------------- ------------- ------------

Rolling 3 Months 25.5%/-8.4% 39.3%/-41%

- ---------------------------- ------------- ------------

Rolling 12 Months

- ---------------------------- ------------- ------------

% Positive 88% 62%

- ---------------------------- ------------- ------------

% Negative 12% 38%

- ---------------------------- ------------- ------------

Average 6.5% 1.8%

- ---------------------------- ------------- ------------

Median 4.2% 6.6%

- ---------------------------- ------------- ------------

Correlation (Weekly Returns) 0.21

- ---------------------------- ------------- ------------

Monthly Returns Analysis (shaded area is actual historical results)

===============================================================================

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

- ---- ----- ----- ----- ----- ---- ----- ----- ----- ---- ----- ---- ----- -----

Jan 0.3% 2.0% 3.9% 2.2% -0.4% 1.2% 0.0% -0.3% 1.1% -1.6% 0.5% -0.8%

- ---- ----- ----- ----- ----- ---------- ----- ---------- ---------- -----------

Feb 1.8% 1.1% -0.7% 0.9% 0.9% 0.8% 1.0% 0.2% -0.4% 0.6% 0.2% 1.7%

- ---- ----- ----- ----------- ---- ----- ----- ----- ---------- ---- ----- -----

Mar 0.3% -0.3% 0.5% -0.6% -0.8% -0.5% -0.2% 0.4% -2.6% 4.2% -0.5% -0.8%

- ---- ----- ----------- ---------------------------- ---------- ----------------

Apr 0.0% -1.1% 2.3% 1.0% 0.4% 1.9% -0.2% 2.1% 0.4% -0.6% 0.4% 2.0% 1.8%

- ---- ----------- ----- ----- ---- ----------- ----- ---------- ---- ----- -----

May 0.5% 1.7% 0.4% -0.5% 4.1% 0.2% 0.3% -0.2% -2.1% 1.0% 0.2% 0.8% 1.7%

- ---- ----- ----- ----------- ---- ----- ---------------- ----- ---- ----- -----

Jun 0.5% -0.9% -0.3% -0.3% 0.2% -0.1% 1.1% 0.3% 2.5% 1.0% 1.0% 0.3% -0.3%

- ---- ----------------------- ---------- ----- ----- ---- ----- ---- -----------

Jul -0.2% -1.2% -0.1% 0.9% -5.5% 2.5% 0.3% 0.6% 0.3% -1.6% 3.2% -2.3% -0.8%

- ---- ----------------- ---------- ----- ----- ----- ---------- ----------------

Aug -7.5% -1.0% 0.2% 0.1% 2.8% -0.1% -0.1% 1.4% -0.5% 5.7% 3.5% 0.3% 0.2%

- ---- ----------- ----- ----- ---------------- ---------- ----- ---- ----- -----

Sep 10.7% 1.3% 1.1% -6.7% 0.5% 0.0% 0.9% 0.3% 0.1% 0.7% 17.5% -0.7% 0.0%

- ---- ----- ----- ----------- ---- ----- ----- ----- ---- ---------------- -----

Oct -2.1% -2.6% 0.9% -0.4% 0.0% 0.1% -1.4% 2.3% 0.3% 0.2% -1.4% 0.9% 0.7%

- ---- ----------- ----------- ---- ----------- ----- ---- ---------- ----- -----

Nov -1.2% 0.4% 0.4% 0.6% 1.4% 0.5% -1.0% -2.0% 0.8% 2.6% 1.3% 0.5% 0.1%

- ---- ----- ----- ----- ----- ---- ----------------- ---- ----- ---- ----- -----

Dec 0.2% 0.6% 0.6% 0.3% 0.7% 0.1% 1.5% 0.9% 0.1% 0.6% 2.5% 0.4%

- ---- ----- ----- ----- ----- ---- ----- ----- ----- ---- ----- ---- ----- -----

Ann

Rtn -0.1% -0.4% 8.6% -1.7% 7.0% 4.6% 2.9% 6.7% 2.2% 7.9% 34.7% 2.4% 3.4%

- ---- ----------- ----------- ---- ----- ----- ----- ---- ---------- ----- -----

Note: EMERALD did not exist prior to October 12, 2009. All results prior to

that date were retrospectively calculated and do not reflect actual returns.

Past performance is not necessarily indicative of how the index will perform in

the future. The performance of EMERALD does not reflect fees and/or costs.

Source: Deutsche Bank, Bloomberg Finance L.P., 2010

page 3

Deutsche Bank [GRAPHIC OMITTED]

slide03

|

|

[GRAPHIC OMITTED]

EMERALD(TM)

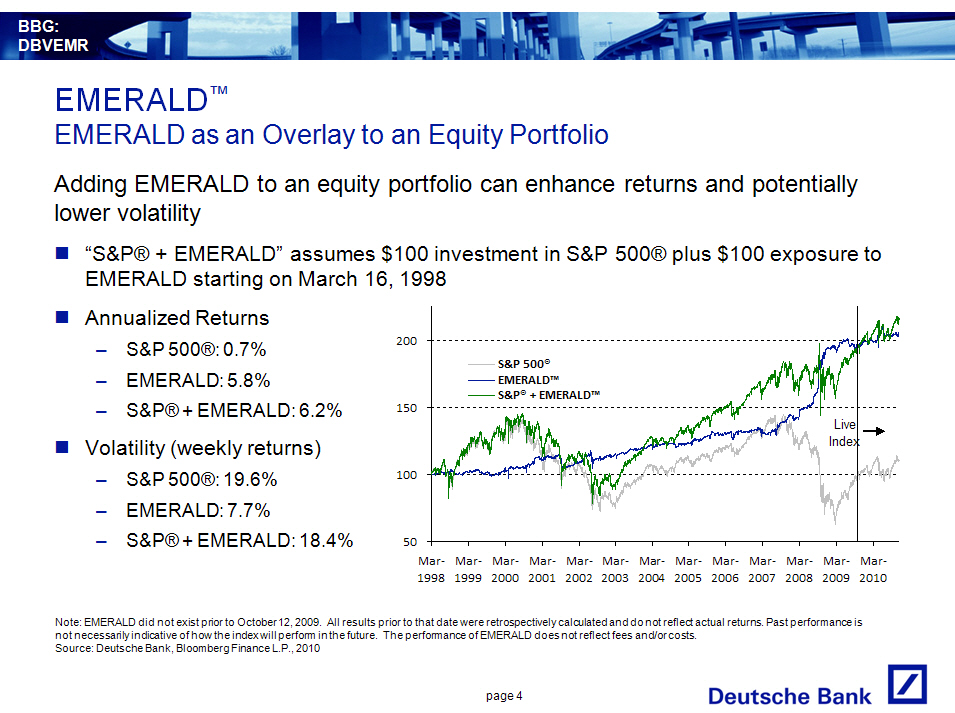

EMERALD as an Overlay to an Equity Portfolio

Adding EMERALD to an equity portfolio can enhance returns and potentially lower

volatility

[] "SandP[R] + EMERALD" assumes $100 investment in SandP 500[R] plus $100

exposure to EMERALD starting on March 16, 1998

[] Annualized Returns

-- SandP 500[R]: 0.7%

-- EMERALD: 5.8%

-- SandP[R] + EMERALD: 6.2% [GRAPHIC OMITTED]

[] Volatility (weekly returns)

-- SandP 500[R]: 19.6% EMERALD: 7.7%

-- SandP[R] + EMERALD: 18.4%

Note: EMERALD did not exist prior to October 12, 2009. All results prior to

that date were retrospectively calculated and do not reflect actual returns.

Past performance is not necessarily indicative of how the index will perform in

the future. The performance of EMERALD does not reflect fees and/or costs.

Source: Deutsche Bank, Bloomberg Finance L.P., 2010

page 4

Deutsche Bank [GRAPHIC OMITTED]

slide04

|

|

[GRAPHIC OMITTED]

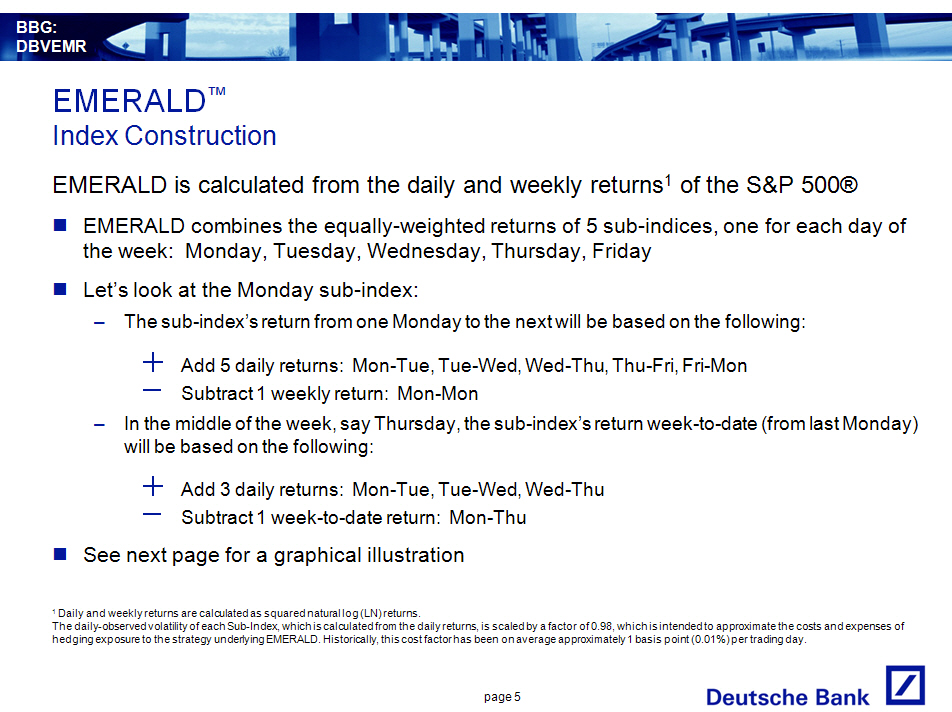

EMERALD(TM)

Index Construction

EMERALD is calculated from the daily and weekly returns (1) of the SandP 500[R]

[] EMERALD combines the equally -weighted returns of 5 sub-indices, one for

each day of the week: Monday, Tuesday, Wednesday, Thursday, Friday

[] Let's look at the Monday sub-index:

-- The sub-index's return from one Monday to the next will be based on

the following:

+ Add 5 daily returns: Mon-Tue, Tue-Wed, Wed-Thu, Thu-Fri, Fri-Mon

-- Subtract 1 weekly return: Mon-Mon

-- In the middle of the week, say Thursday, the sub-index's return

week-to-date (from last Monday) will be based on the following:

+ [] Add 3 daily returns: Mon-Tue, Tue-Wed, Wed-Thu

-- Subtract 1 week-to-date return: Mon-Thu

[] See next page for a graphical illustration

(1) Daily and weekly returns are calculated as squared natural log (LN) returns.

The daily-observed volatility of each Sub-Index, which is calculated from the

daily returns, is scaled by a factor of 0.98, which is intended to approximate

the costs and expenses of hedging exposure to the strategy underlying EMERALD.

Historically, this cost factor has been on average approximately 1 basis point

(0.01%) per trading day.

page 5

Deutsche Bank [GRAPHIC OMITTED]

slide05

|

|

[GRAPHIC OMITTED]

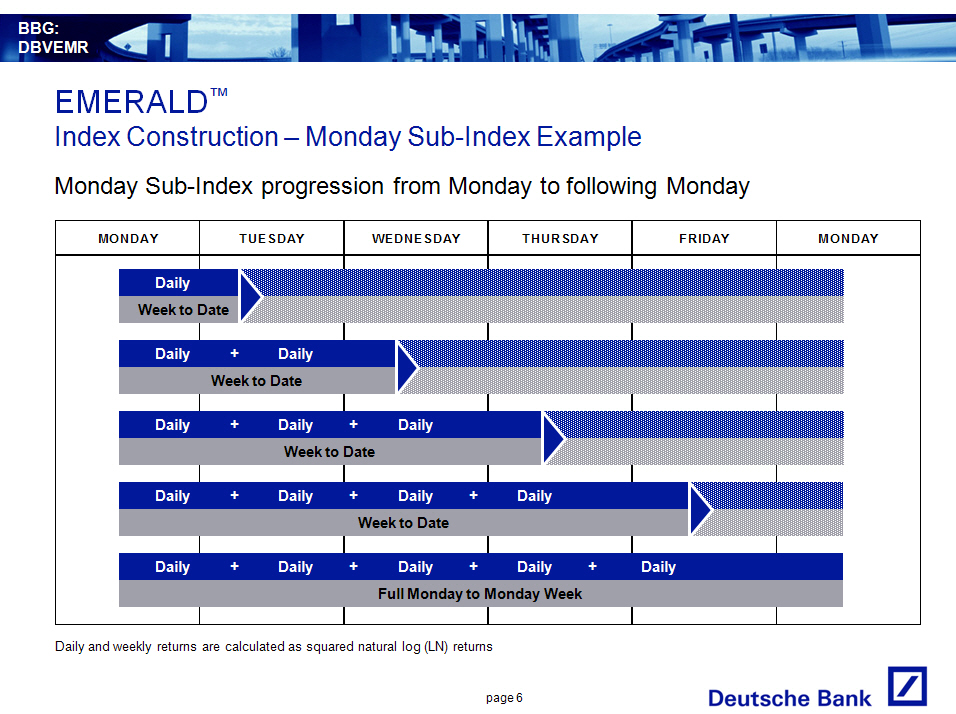

EMERALD(TM)

Index Construction -- Monday Sub-Index Example

Monday Sub-Index progression from Monday to following Monday

[GRAPHIC OMITTED]

Daily and weekly returns are calculated as squared natural log (LN) returns

page 6

Deutsche Bank [GRAPHIC OMITTED]

slide06

|

|

[GRAPHIC OMITTED]

EMERALD(TM)

Index Construction -- Volatility Control

EMERALD rebalances frequently to maintain a consistent exposure through periods

of changing volatility

[] The notional of each sub-index is rebalanced weekly based on volatility

levels at the time

[] Exposure is decreased when volatility is high and increased when volatility

is low

[] This seeks to stabilize the volatility of EMERALD and limit dramatic

fluctuations in highly volatile markets while continuing to generate

returns during periods of low volatility

[GRAPHIC OMITTED]

Note: EMERALD did not exist prior to October 12, 2009. All results prior to

that date were retrospectively calculated and do not reflect actual returns.

Past performance is not necessarily indicative of how the index will perform in

the future. The performance of EMERALD does not reflect fees and/or costs.

Source: Deutsche Bank, Bloomberg Finance L.P., 2010

page 7

Deutsche Bank [GRAPHIC OMITTED]

slide07

|

|

[GRAPHIC OMITTED]

EMERALD(TM

Comparison of EMERALD and SandP 500[R] During Various Market Periods

#1 - Tech Rally (post-Russia/LTCM) : Following the Russia default and subsequent

LTCM crisis, the SandP rallied strongly but did not exhibit strong or consistent

mean-reversion causing EMERALD to trade in a tight range of about 6.5%, going

from 102.19 on October 8, 1998 to a low of 98.52 (-3.6% return) and back to a

high of 105.23 on March 15, 2000 (3% return). Although it would not have added

anything to an SandP 500[R] investment, EMERALD would also not have taken away,

having been basically flat over the period (-0.09%) .

Return over Period

- ------ ---------- -------- -------------------

Period Start Date End Date SandP 500[R] EMERALD

- ------ ---------- -------- ---------- --------

1 10/8/98 3/24/00 59.20% -0.09%

- ------ ---------- -------- ---------- --------

2 9/5/00 10/9/02 -48.46% 6.74%

- ------ ---------- -------- ---------- --------

3 3/11/03 10/9/07 95.47% 21.67%

- ------ ---------- -------- ---------- --------

4 10/9/07 3/9/09 -56.78% 39.14%

- ------ ---------- -------- ---------- --------

5 3/9/09 4/23/10 79.93% 2.90%

- ------ ---------- -------- ---------- --------

#2 - Tech Bubble Bursts : Following it's peak in March of 2000 (and a period of

range-trading) the SandP dropped to a low of 776.76 on October 9, 2002. Although

it did exhibit periods of mean-reversion, the SandP also exhibited strong periods

of trending which erased much of the gains EMERALD had shown up to those points.

Starting from a level of 102.1, EMERALD rallied over 12% to 114.65 on August 28,

2001, but then fell to 102.24 on September 21, 2001 following the market drop

related to 9/11. EMERALD climbed to 112.2 on October 9, 2002, but this was also

punctuated by a steeper climb and steep drop in between. Overall, although

EMERALD would have added almost 10%, the somewhat slow-and-steady drop of the

SandP didn't exhibit enough mean-reversion to generate substantial enough returns

in EMERALD to offset the losses in the SandP.

#3 - Easy Credit/Housing Rally: Starting in March of 2003, the SandP began a long

rally fueled by easy credit and rapidly rising housing prices, peaking on

October 9, 2007 at 1565.15. Although the rally seemed near-continuous, the SandP

exhibited fairly strong mean-reversion throughout most of it and EMERALD also

rallied strongly, punctuated by a few small, sharp drops that were recovered

fairly quickly. Overall, EMERALD would have contributed significant "alpha" to

an SandP investment.

#4 - Credit/Housing Bubble Bursts : Starting in October of 2007 and following

through the credit crisis in Fall 2008, the SandP dropped over 55% to 676.53 on

March 9, 2009. Again, although the drop seemed near-continuous, the SandP

exhibited extremely strong mean-reversion overall and EMERALD was up

significantly during this period, despite some periods of high volatility and up

and down spikes. In this environment, EMERALD would have acted as an excellent

hedge to the SandP, offsetting over 70% of the drop in the SandP.

#5 - Post-Credit Crisis Rally: Most recently, the SandP rallied strongly from

its lows in March 2009 to a peak of 1217.28 on April 23 and exhibited both

periods of mean-reversion and trending. EMERALD, similarly to the Tech Rally

period, traded in a fairly narrow range of about 6% from 193.80 on March 9,

2009, to a low of 190.64 on March 18, 2009, and then to a high of 201.07 on

February 9, 2010 with some peaks and troughs in between. Overall, EMERALD posted

modest gains and would have added valuable "alpha" to an SandP investment.

Note: EMERALD did not exist prior to October 12, 2009. All results prior to

that date were retrospectively calculated and do not reflect actual returns.

Past performance is not necessarily indicative of how the index will perform in

the future. The performance of EMERALD does not reflect fees and/or costs.

Source: Deutsche Bank, 2010.

page 8

Deutsche Bank [GRAPHIC OMITTED]

slide08

|

|

[GRAPHIC OMITTED]

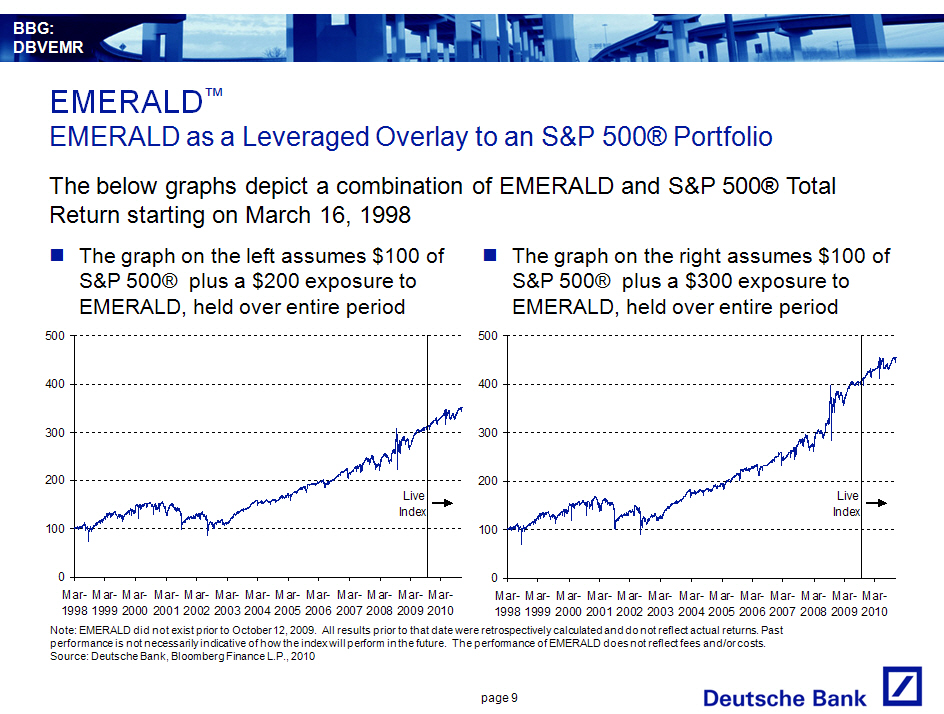

EMERALD(TM)

EMERALD as a Leveraged Overlay to an SandP 500[R] Portfolio

The below graphs depict a combination of EMERALD and SandP 500[R] Total Return

starting on March 16, 1998

[] The graph on the left assumes $100 of SandP 500[R] plus a $200 exposure to

EMERALD, held over entire period

[GRAPHIC OMITTED]

[] The graph on the right assumes $100 of SandP 500[R] plus a $300 exposure to

EMERALD, held over entire period

[GRAPHIC OMITTED]

Note: EMERALD did not exist prior to October 12, 2009. All results prior to

that date were retrospectively calculated and do not reflect actual returns.

Past performance is not necessarily indicative of how the index will perform in

the future. The performance of EMERALD does not reflect fees and/or costs.

Source: Deutsche Bank, Bloomberg Finance L.P., 2010

page 9

Deutsche Bank [GRAPHIC OMITTED]

slide09

|

|

[GRAPHIC OMITTED]

Risk Factors

NEGATIVE SERIAL CORRELATION STRATEGY RISK -- The tendency of daily returns of an

index level to be followed by daily returns in the opposite direction is

referred to as negative serial correlation. The net weekly change of an index

exhibiting negative serial correlation would under-represent the amount by which

the index moved during the week, and realized volatility measured from daily

returns of such an index would exceed realized volatility measured from weekly

returns. EMERALD reflects a strategy that aims to monetize any negative serial

correlation exhibited by the SandP 500[R] Index by periodically buying daily

volatility and selling weekly volatility on the SandP 500[R] Index in equal

notional amounts. EMERALD will appreciate if daily realized volatility exceeds

weekly realized volatility over a given week, and decline if daily realized

volatility is less than weekly realized volatility over a given week. There is

no assurance that any negative serial correlation of daily returns of the SandP

500[R] Index will exist at any time, and thus no assurance that EMERALD will

appreciate. Various market factors and circumstances at any time and over any

period could cause, and have in the past caused, EMERALD's strategy to fail to

perform as expected. Furthermore, EMERALD employs the methodology described

herein to implement its underlying strategy. The return on any securities linked

to EMERALD is not linked to any other formula or measure that could be employed

to monetize negative serial correlation of daily returns of the SandP 500[R]

Index. Investors in such securities linked to EMERALD will not benefit from any

results determined on the basis of any such alternative measure.

DEUTSCHE BANK AG, LONDON BRANCH, AS THE SPONSOR OF EMERALD, MAY ADJUST THE INDEX

IN A WAY THAT AFFECTS ITS LEVEL AND MAY HAVE CONFLICTS OF INTEREST -- Deutsche

Bank AG, London Branch is the sponsor of EMERALD (the "Index Sponsor") and will

determine whether there has been a market disruption event with respect to

EMERALD. In the event of any such market disruption event, the Index Sponsor may

use an alternate method to calculate the closing level of EMERALD. The Index

Sponsor carries out calculations necessary to promulgate EMERALD and maintains

some discretion as to how such calculations are made. In particular, the Index

Sponsor has discretion in selecting among methods of how to calculate EMERALD in

the event the regular means of determining EMERALD are unavailable at the time a

determination is scheduled to take place. There can be no assurance that any

determinations made by the Index Sponsor in these various capacities will not

affect the value of the levels of EMERALD. Any of these actions could adversely

affect the value of securities or options linked to EMERALD. The Index Sponsor

has no obligation to consider the interests of holders of securities linked to

EMERALD in calculating or revising EMERALD.

Furthermore, Deutsche Bank AG, London Branch or one or more of its affiliates

may have published, and may in the future publish, research reports on EMERALD

or investment strategies reflected by EMERALD (or any transaction, product or

security related to EMERALD or any components thereof) . This research is

modified from time to time without notice and may express opinions or provide

recommendations that are inconsistent with purchasing or holding of

transactions, products or securities related to EMERALD. Any of these activities

may affect EMERALD or transactions, products or securities related to EMERALD.

Investors should make their own independent investigation of the merits of

investing in contracts or products related to EMERALD.

EMERALD HAS VERY LIMITED PERFORMANCE HISTORY -- Calculation of EMERALD began on

October 12, 2009. Therefore, EMERALD has very limited performance history and no

actual investment which allowed tracking of the performance of EMERALD was

possible before that date. The EMERALD performance data prior to this date shown

in this presentation have been retrospectively calculated using historical data

and the current EMERALD methodology and do not reflect actual EMERALD

performance.

page 10

Deutsche Bank [GRAPHIC OMITTED]

slide11

|

|

[GRAPHIC OMITTED]

Important Notes

The distribution of this document and the availability of some of the products

and services referred to herein may be restricted by law in certain

jurisdictions. Some products and services referred to herein are not eligible

for sale in all countries and in any event may only be sold to qualified

investors. Deutsche Bank will not offer or sell any products or services to any

persons prohibited by the law in their country of origin or in any other

relevant country from engaging in any such transactions.

Prospective investors should understand and discuss with their professional tax,

legal, accounting and other advisors the effect of entering into or purchasing

any transaction, product or security related to EMERALD (each, a "Structured

Product") . Before entering into any Structured Product you should take steps to

ensure that you understand and have assessed with your financial advisor, or

made an independent assessment of, the appropriateness of the transaction in the

light of your own objectives and circumstances, including the possible risks and

benefits of entering into such Structured Product.

Structured Products are not suitable for all investors due to illiquidity,

optionality, time to redemption, and payoff nature of the strategy.

Deutsche Bank or persons associated with Deutsche Bank and their affiliates may:

maintain a long or short position in securities referenced herein or in related

futures or options; purchase, sell or maintain inventory; engage in any other

transaction involving such securities; and earn brokerage or other compensation.

Any payout information, scenario analysis, and hypothetical calculations should

in no case be construed as an indication of expected payout on an actual

investment and/or expected behavior of an actual Structured Product.

Calculations of returns on Structured Products may be linked to a referenced

index or interest rate. As such, the Structured Products may not be suitable for

persons unfamiliar with such index or interest rate, or unwilling or unable to

bear the risks associated with the transaction. Structured Product denominated

in a currency, other than the investor's home currency, will be subject to

changes in exchange rates, which may have an adverse effect on the value, price

or income return of the products. These Structured Product may not be readily

realizable investments and are not traded on any regulated market. Structured

Products involve risk, which may include interest rate, index, currency, credit,

political, liquidity, time value, commodity and market risk and are not suitable

for all investors.

The past performance of an index, securities or other instruments does not

guarantee or predict future performance. The distribution of this document and

availability of these products and services in certain jurisdictions may be

restricted by law.

Deutsche Bank does not provide accounting, tax or legal advice.

BEFORE ENTERING INTO ANY TRANSACTION YOU SHOULD TAKE STEPS TO ENSURE THAT YOU

UNDERSTAND AND HAVE MADE AN INDEPENDENT ASSESSMENT OF THE APPROPRIATENESS OF THE

STRUCTURED PRODUCT IN LIGHT OF YOUR OWN OBJECTIVES AND CIRCUMSTANCES, INCLUDING

THE POSSIBLE RISKS AND BENEFITS OF ENTERING INTO SUCH STRUCTURED PRODUCT. YOU

SHOULD ALSO CONSIDER MAKING SUCH INDEPENDENT INVESTIGATIONS AS YOU CONSIDER

NECESSARY OR APPROPRIATE FOR SUCH PURPOSE.

Deutsche Bank" means Deutsche Bank AG and its affiliated companies, as the

context requires. Deutsche Bank Private Wealth Management refers to Deutsche

Bank's wealth management activities for high-net-worth clients around the world.

Deutsche Bank Alex Brown is a division of Deutsche Bank Securities Inc.

Backtested, hypothetical or simulated performance results presented herein have

inherent limitations. Unlike an actual performance record based on trading

actual client portfolios, simulated results are achieved by means of the

retroactive application of a backtested model itself designed with the benefit

of hindsight. Taking into account historical events the backtesting of

performance also differs from actual account performance because an actual

investment strategy may be adjusted any time, for any reason, including a

response to material, economic or market factors. The backtested performance

includes hypothetical results that do not reflect the reinvestment of dividends

and other earnings or the deduction of advisory fees, brokerage or other

commissions, and any other expenses that a client would have paid or actually

paid. No representation is made that any trading strategy or account will or is

likely to achieve profits or losses similar to those shown. Alternative modeling

techniques or assumptions might produce significantly different results and

prove to be more appropriate. Past hypothetical backtest results are neither an

indicator nor guarantee of future returns. Actual results will vary, perhaps

materially, from the analysis.

page 11

Deutsche Bank [GRAPHIC OMITTED]

slide11

|

|

[GRAPHIC OMITTED]

Important Notes

Structured Products linked to EMERALD discussed herein are not insured by the

Federal Deposit Insurance Corporation (FDIC) or any other US governmental

agency. These Structured Products are not insured by any statutory scheme or

governmental agency of the United Kingdom.

These Structured Products typically involve a high degree of risk, are not

readily transferable and typically will not be listed or traded on any exchange

and are intended for sale only to investors who are capable of understanding and

assuming the risks involved. The market value of any Structured Product may be

affected by changes in economic, financial and political factors (including, but

not limited to, spot and forward interest and exchange rates), time to maturity,

market conditions and volatility and the equity prices and credit quality of any

issuer or reference issuer.

Additional information may be available upon request. Any results shown do not

reflect the impact of commission and/or fees, unless stated.

Deutsche Bank AG has filed a registration statement (including a prospectus)

with the SEC for the offerings to which this communication relates. Before you

invest, you should read the prospectus in that registration statement and other

documents the issuer has filed with the SEC for more complete information about

the issuer and this offering. You may get these documents for free by visiting

EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any

underwriter or any dealer participating in the offering will arrange to send you

the prospectus if you request it by calling toll-free 1-800-311-4409.

License Agreement with SandP

Any Structured Products are not sponsored, endorsed, sold or promoted by

Standard and Poor's, a division of the McGraw -Hill Companies, Inc., which we

refer to as SandP. SandP makes no representation or warranty, express or

implied, to the owners of the Structured Products or any member of the public

regarding the advisability of investing in securities generally or in the

Structured Products particularly, or the ability of the SandP 500[R] to track

general stock market performance. SandP's only relationship to Deutsche Bank AG

is the licensing of certain trademarks and trade names of SandP without regard

to Deutsche Bank AG or the Structured Products. SandP has no obligation to take

the needs of Deutsche Bank AG or the holders of the Structured Products into

consideration in determining, composing or calculating the SandP 500[R]. SandP

is not responsible for and has not participated in the determination of the

timing, price or quantity of the Structured Products to be issued or in the

determination or calculation of the amount due at maturity of the Structured

Products. SandP has no obligation or liability in connection with the

administration, marketing or trading of the Structured Products.

SandP DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE SandP

500[R] OR ANY DATA INCLUDED THEREIN AND SandP SHALL HAVE NO LIABILITY FOR ANY

ERRORS, OMISSIONS OR INTERRUPTIONS THEREIN. SandP MAKES NO WARRANTY, EXPRESS OR

IMPLIED, AS TO RESULTS TO BE OBTAINED BY DEUTSCHE BANK AG, HOLDERS OF THE

STRUCTURED PRODUCTS OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE SandP

500[R] INDEX OR ANY DATA INCLUDED THEREIN. SandP MAKES NO EXPRESS OR IMPLIED

WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS

FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE SandP 500[R] OR ANY DATA

INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL SandP

HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT OR CONSEQUENTIAL DAMAGES

(INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

"STANDARD and POOR'S", "SandP", "SandP 500" AND "500" ARE TRADEMARKS OF THE

MCGRAW -HILL COMPANIES, INC. AND HAVE BEEN LICENSED FOR USE BY DEUTSCHE BANK AG.

STRUCTURED PRODUCTS ARE NOT SPONSORED, ENDORSED, SOLD OR PROMOTED BY SandP AND

SandP MAKES NO REPRESENTATION REGARDING THE ADVISABILITY OF PURCHASING ANY OF

THE STRUCTURED PRODUCTS.

page 12

Deutsche Bank [GRAPHIC OMITTED]

slide12

|