- DB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

FWP Filing

Deutsche Bank (DB) FWPFree writing prospectus

Filed: 2 Dec 10, 12:00am

December 2010

- --------------------------------------------------------------------------------

Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Statement No. 333-162195

Dated December 2, 2010

Deutsche Bank Commodity Indices

December 2010

[GRAPHIC OMITTED]

1

|  |

Contents

Section

1 Optimum Yield Indices

* DB Commodity Booster - DJUBS Index

* DB Commodity Booster DJUBS - TV14 Index

* DB Commodity Booster - Benchmark Index

2 Mean Reversion Indices

* DBLCI - MR Index

* DBLCI - Mean Reversion Enhanced Index

* DB MR Enhanced 15 Index

* DBLCI - MR+ Index

3 Market Neutral Indices

* DB Commodity Harvest Index

* DB Commodity Harvest - 10 Index

4 DB Commodity Allocator Index

Appendix

1 Appendix

2

|  |

Executive Summary

The Evolution of Commodity Markets

[] Commodities are an asset class in their own right and exhibit unique

characteristics such as historically low correlation with traditional asset

classes and a positive correlation with inflation

[] An investment in a commodity index is a simple way for investors to gain

exposure to the asset class while insulating them from the mechanics of

rolling futures and posting collateral. This transparent, rule-based roll

mechanism eliminates human intervention

[] Deutsche Bank is one of the largest providers of non-benchmark commodity

indices with a comprehensive suite of commodity index products aimed at

enhancing beta returns and extracting market neutral alpha returns in the

commodity space

[] As the commodity market has evolved, Deutsche Bank has created new indices

that may benefit from the special features of the asset class

3

|  |

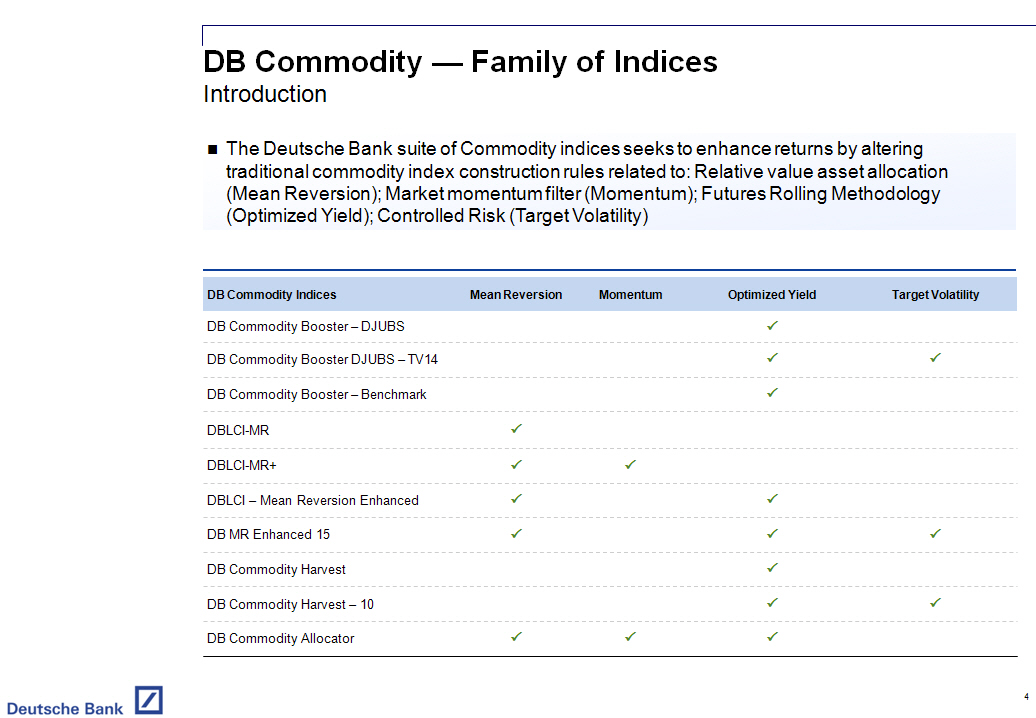

DB Commodity -- Family of Indices

Introduction

[] The Deutsche Bank suite of Commodity indices seeks to enhance returns by

altering traditional commodity index construction rules related to:

Relative value asset allocation (Mean Reversion); Market momentum filter

(Momentum); Futures Rolling Methodology (Optimized Yield); Controlled Risk

(Target Volatility)

- -----------------------------------------------------------------------------------------------

DB Commodity Indices Mean Reversion Momentum Optimized Yield Target Volatility

- -----------------------------------------------------------------------------------------------

DB Commodity Booster -- DJUBS []

DB Commodity Booster DJUBS -- TV14 [] []

DB Commodity Booster -- Benchmark []

DBLCI-MR []

DBLCI-MR+ [] []

DBLCI -- Mean Reversion Enhanced [] []

DB MR Enhanced 15 [] [] []

DB Commodity Harvest []

DB Commodity Harvest -- 10 [] []

DB Commodity Allocator [] [] []

- -----------------------------------------------------------------------------------------------

4

|  |

Optimum Yield Indices

Section 1

[GRAPHIC OMITTED]

5

|  |

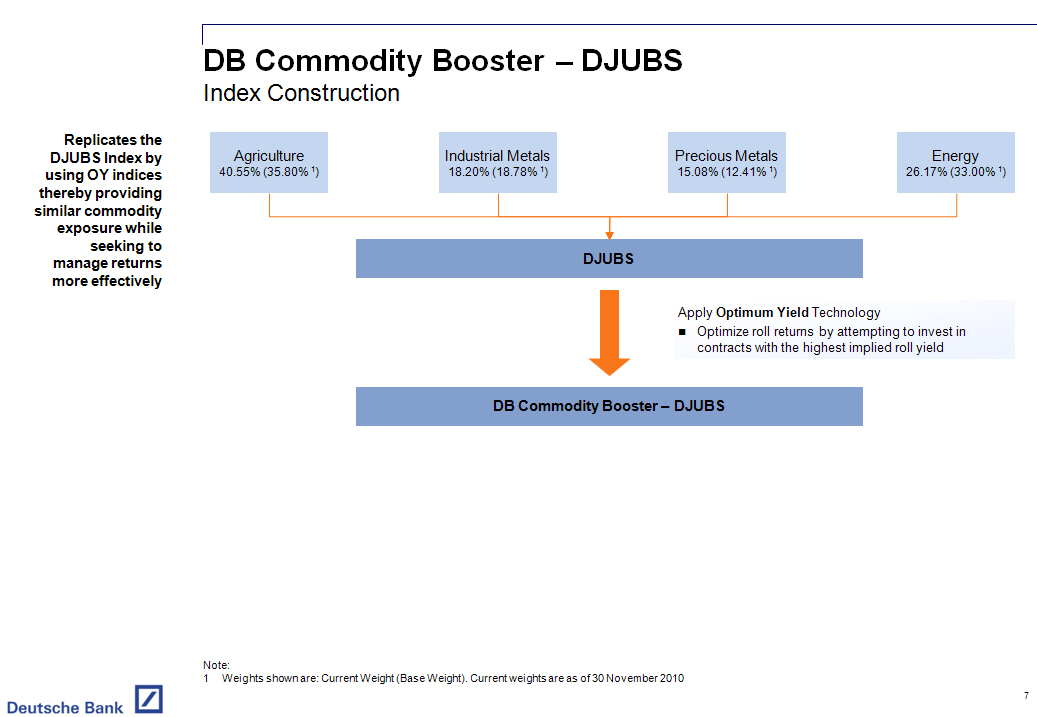

DB Commodity Booster -- DJUBS

Index Summary

[] Composition of DB Commodity Booster DJUBS Index: The DB Commodity Booster

-- DJUBS Index has the same base weights as the DJUBS Index. Weights are

rebalanced annually

[] Optimizing Roll Returns: Employs Deutsche Bank's proprietary optimum yield

("OY") technology, which rolls an expiring contract into the contract that

maximizes positive roll yield (in a backwardated market) or minimizes

negative roll yield (in a contango market) from the list of tradable

futures which expire in the next 13 months

[] Transparency: Rule-based index with the closing level and weights published

daily on Bloomberg (DBCMBDEU)

6

|  |

DB Commodity Booster -- DJUBS

Index Construction

Replicates the DJUBS Index by using OY indices thereby providing similar

commodity exposure while seeking to manage returns more effectively

[GRAPHIC OMITTED]

Note:

1 Weights shown are: Current Weight (Base Weight) . Current weights are as of

30 November 2010

7

|  |

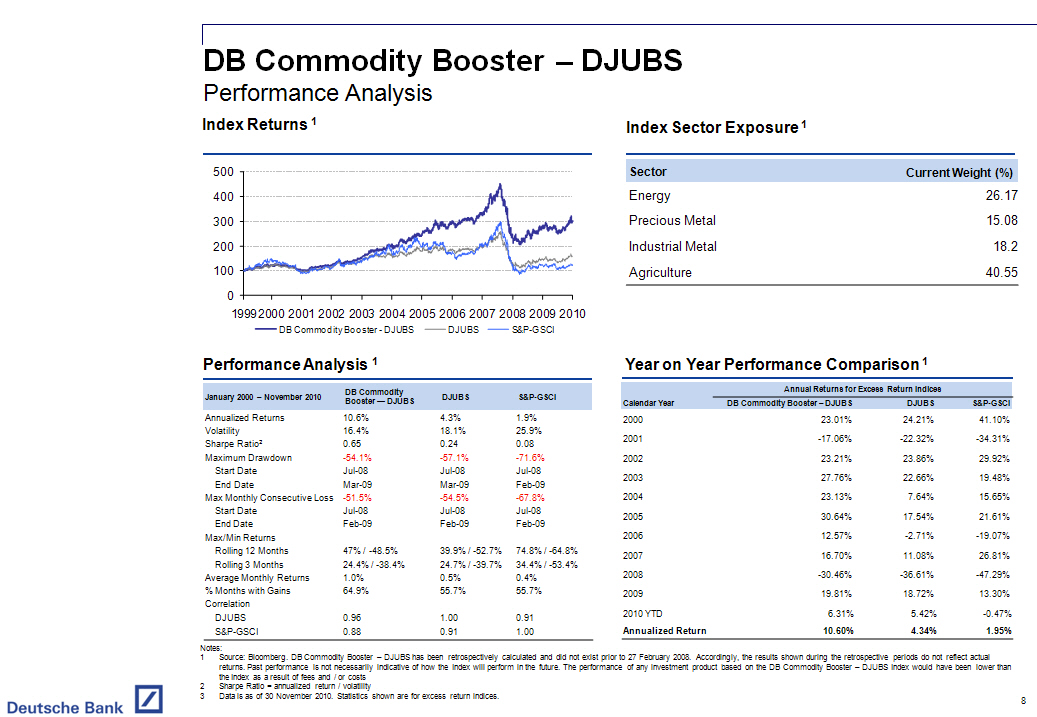

DB Commodity Booster -- DJUBS

Performance Analysis

Index Returns 1

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Index Sector Exposure 1

- --------------------------------------------------------------------------------

Sector Current Weight (%)

Energy 26.17

Precious Metal 15.08

Industrial Metal 18.2

Agriculture 40.55

- --------------------------------------------------------------------------------

Performance Analysis 1

- --------------------------------------------------------------------------------

DB Commodity

January 2000 -- November 2010 Booster -- DJUBS DJUBS SandP-GSCI

- --------------------------------------------------------------------------------

Annualized Returns 10.6% 4.3% 1.9%

Volatility 16.4% 18.1% 25.9%

Sharpe Ratio(2) 0.65 0.24 0.08

Maximum Drawdown -54.1% -57.1% -71.6%

Start Date Jul-08 Jul-08 Jul-08

End Date Mar-09 Mar-09 Feb-09

Max Monthly Consecutive Loss -51.5% -54.5% -67.8%

Start Date Jul-08 Jul-08 Jul-08

End Date Feb-09 Feb-09 Feb-09

Max/Min Returns

Rolling 12 Months 47% / -48.5% 39.9% / -52.7% 74.8% / -64.8%

Rolling 3 Months 24.4% / -38.4% 24.7% / -39.7% 34.4% / -53.4%

Average Monthly Returns 1.0% 0.5% 0.4%

% Months with Gains 64.9% 55.7% 55.7%

Correlation

DJUBS 0.96 1.00 0.91

SandP-GSCI 0.88 0.91 1.00

- --------------------------------------------------------------------------------

Year on Year Performance Comparison 1

- --------------------------------------------------------------------------------

Annual Returns for Excess Return Indices

--------------------------------------------------------------

Calendar Year DB Commodity Booster -- DJUBS DJUBS SandP-GSCI

- --------------------------------------------------------------------------------

2000 23.01% 24.21% 41.10%

2001 -17.06% -22.32% -34.31%

2002 23.21% 23.86% 29.92%

2003 27.76% 22.66% 19.48%

2004 23.13% 7.64% 15.65%

2005 30.64% 17.54% 21.61%

2006 12.57% -2.71% -19.07%

2007 16.70% 11.08% 26.81%

2008 -30.46% -36.61% -47.29%

2009 19.81% 18.72% 13.30%

2010 YTD 6.31% 5.42% -0.47%

Annualized Return 10.60% 4.34% 1.95%

- --------------------------------------------------------------------------------

Notes:

1 Source: Bloomberg. DB Commodity Booster -- DJUBS has been retrospectively

calculated and did not exist prior to 27 February 2008. Accordingly, the

results shown during the retrospective periods do not reflect actual

returns. Past performance is not necessarily indicative of how the Index

will perform in the future. The performance of any investment product based

on the DB Commodity Booster -- DJUBS Index would have been lower than the

Index as a result of fees and / or costs

2 Sharpe Ratio = annualized return / volatility

3 Data is as of 30 November 2010. Statistics shown are for excess return

indices.

8

|  |

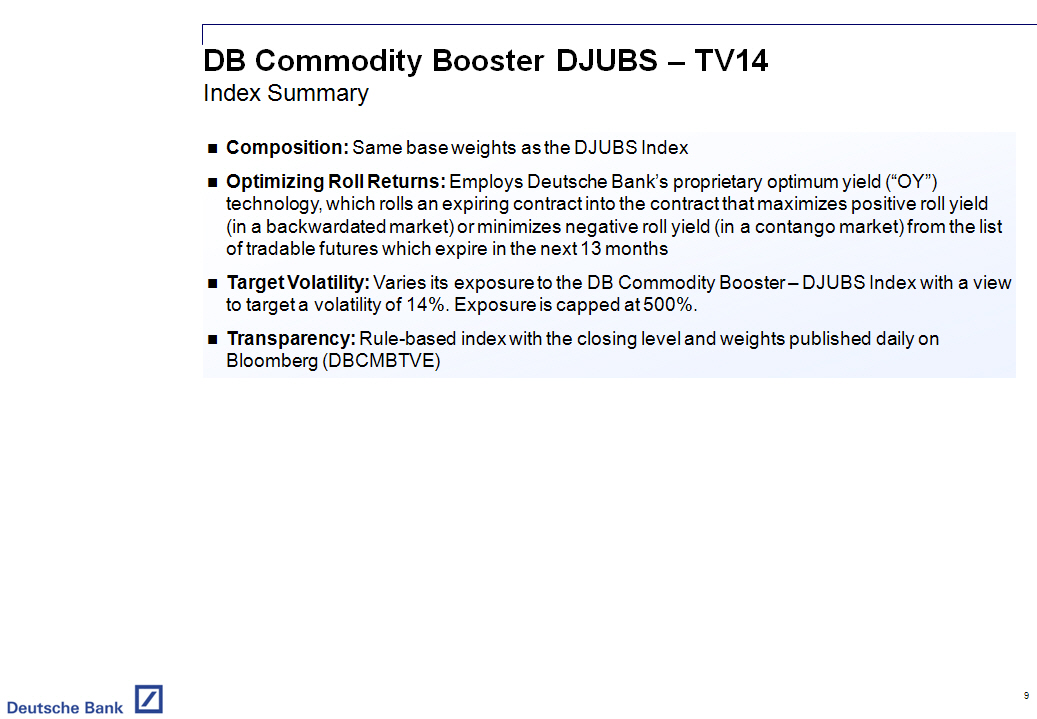

DB Commodity Booster DJUBS -- TV14

Index Summary

[] Composition: Same base weights as the DJUBS Index

[] Optimizing Roll Returns: Employs Deutsche Bank's proprietary optimum yield

("OY") technology, which rolls an expiring contract into the contract that

maximizes positive roll yield (in a backwardated market) or minimizes

negative roll yield (in a contango market) from the list of tradable

futures which expire in the next 13 months

[] Target Volatility: Varies its exposure to the DB Commodity Booster -- DJUBS

Index with a view to target a volatility of 14%. Exposure is capped at

500%.

[] Transparency: Rule-based index with the closing level and weights published

daily on Bloomberg (DBCMBTVE)

9

|  |

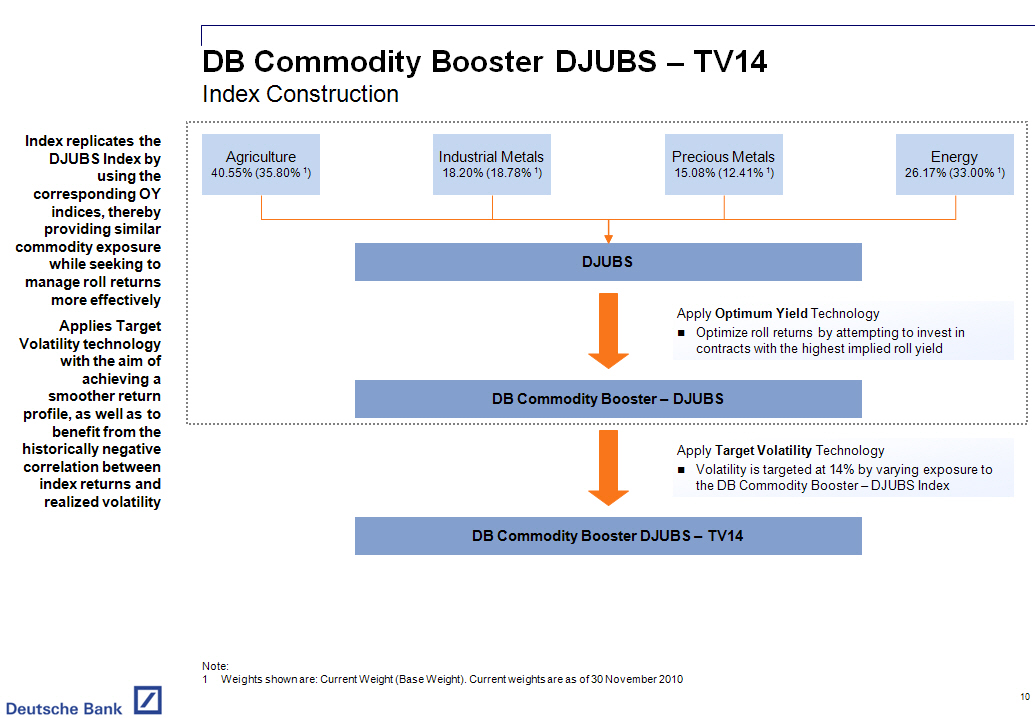

DB Commodity Booster DJUBS -- TV14

Index Construction

Index replicates the DJUBS Index by using the corresponding OY indices, thereby

providing similar commodity exposure while seeking to manage roll returns more

effectively Applies Target Volatility technology with the aim of achieving a

smoother return profile, as well as to benefit from the historically negative

correlation between index returns and realized volatility

[GRAPHIC OMITTED]

Note:

1 Weights shown are: Current Weight (Base Weight) . Current weights are as of

30 November 2010

10

|  |

DB Commodity Booster DJUBS -- TV14

Performance Analysis

Index Returns 1

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Index Exposure 1

- --------------------------------------------------------------------------------

Current Exposure to DB

Commodity Booster -- DJUBS 78.21%

- --------------------------------------------------------------------------------

Underlying Sector Current Weight (%)

Energy 26.17

Precious Metal 15.08

Industrial Metal 18.2

Agriculture 40.55

- --------------------------------------------------------------------------------

Performance Analysis 1

- --------------------------------------------------------------------------------

DB Commodity DB Commodity

January 2000 -- November 2010 Booster DJUBS - TV 14 Booster -- DJUBS DJUBS

- --------------------------------------------------------------------------------

Annualized Returns 14.0% 10.6% 4.3%

Volatility 14.7% 16.4% 18.1%

Sharpe Ratio 0.95 0.65 0.24

Maximum Drawdown -35.0% -54.1% -57.1%

Start Date Jul-08 Jul-08 Jul-08

End Date Mar-09 Mar-09 Mar-09

Max Monthly Consecutive Loss -32.8% -51.5% -54.5%

Start Date Jul-08 Jul-08 Jul-08

End Date Feb-09 Feb-09 Feb-09

Max/Min Returns

Rolling 12 Months 59.6% / -31.1% 47% / -48.5% 39.9% / -52.7%

Rolling 3 Months 27.8% / -23.5% 24.4% / -38.4% 24.7% / -39.7%

Average Monthly Returns 1.2% 1.0% 0.5%

% Months with Gains 64.9% 64.9% 55.7%

Correlation

DB Commodity Booster -- DJUBS 0.94 1.00 0.96

DJUBS 0.91 0.96 1.00

- --------------------------------------------------------------------------------

Year on Year Performance Comparison 1

- --------------------------------------------------------------------------------

Annual Returns for Excess Return Indices

--------------------------------------------------------------

DB Commodity Booster DB Commodity Booster

- --------------------------------------------------------------------------------

Calendar Year DJUBS - TV 14 -- DJUBS DJUBS

2000 26.38% 23.01% 24.21%

2001 -21.43% -17.06% -22.32%

2002 29.64% 23.21% 23.86%

2003 46.67% 27.76% 22.66%

2004 27.08% 23.13% 7.64%

2005 30.40% 30.64% 17.54%

2006 11.01% 12.57% -2.71%

2007 16.73% 16.70% 11.08%

2008 -15.61% -30.46% -36.61%

2009 13.52% 19.81% 18.72%

2010 YTD 7.99% 6.31% 5.42%

Annualized Return 14.03% 10.60% 4.34%

- --------------------------------------------------------------------------------

Notes:

1 Source: Bloomberg. DB Commodity Booster -- DJUBS and DB Commodity Booster

DJUBS -- TV14 have been retrospectively calculated and did not exist prior

to 27 February 2008 and 8 August 2009 respectively. Accordingly, the

results shown during the retrospective periods do not reflect actual

returns. Past performance is not necessarily indicative of how the Index

will perform in the future. The performance of any investment product based

on the DB Commodity Booster DJUBS -- TV14 Index would have been lower than

the Index as a result of fees and / or costs

2 Data is as of 30 November 2010. Statistics shown are for excess return

indices. Current weights shown are for DB Commodity Booster -- DJUBS Index

11

|  |

DB Commodity Booster -- Benchmark

Index Summary

[] Composition: Same base weights as the SandP GSCI Index

[] Optimizing Roll Returns: Employs Deutsche Bank's proprietary optimum yield

("OY") technology, which rolls an expiring contract into the contract that

maximizes positive roll yield (in a backwardated market) or minimizes

negative roll yield (in a contango market) from the list of tradable

futures which expire in the next 13 months

[] Transparency: Rule-based index with the closing level and weights published

daily on Bloomberg (DBCMBSEU)

12

|  |

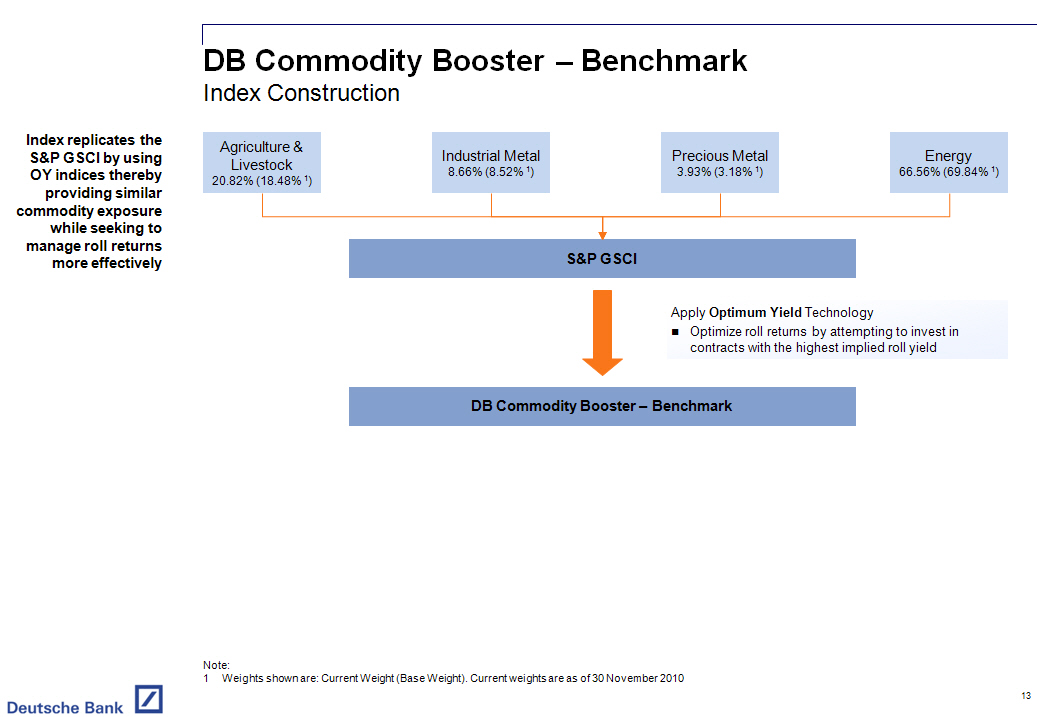

DB Commodity Booster -- Benchmark

Index Construction

Index replicates the SandP GSCI by using OY indices thereby providing similar

commodity exposure while seeking to manage roll returns more effectively

[GRAPHIC OMITTED]

Note:

1 Weights shown are: Current Weight (Base Weight) . Current weights are as of

30 November 2010

13

|  |

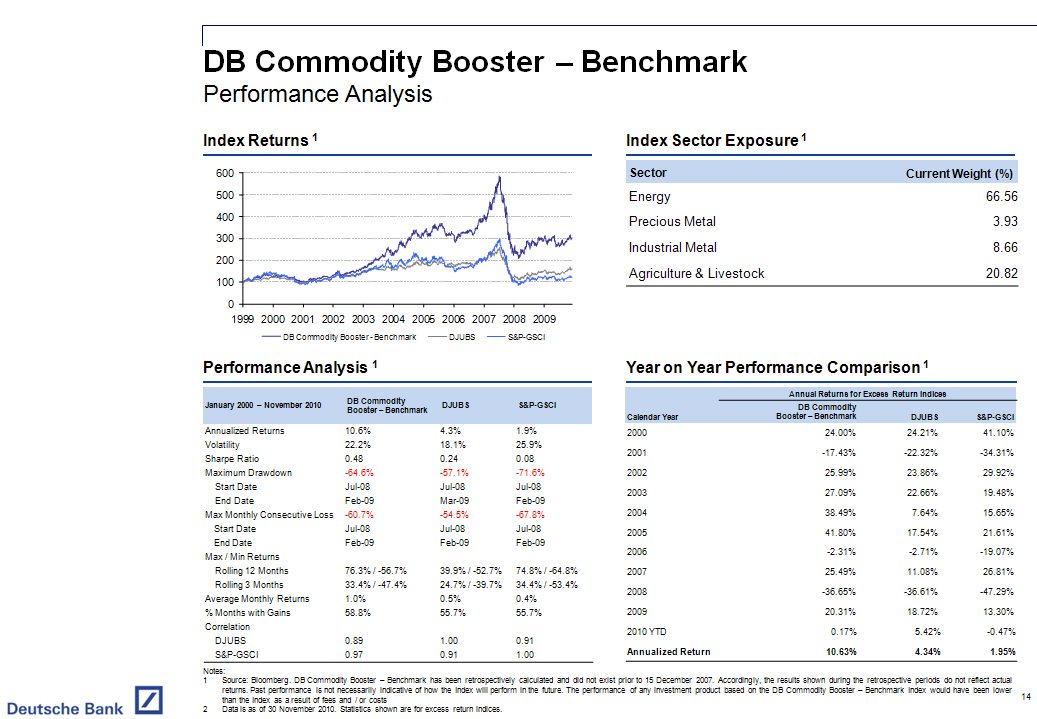

DB Commodity Booster -- Benchmark

Performance Analysis

Index Returns 1

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Index Sector Exposure 1

- --------------------------------------------------------------------------------

Sector Current Weight (%)

Energy 66.56

Precious Metal 3.93

Industrial Metal 8.66

Agriculture and Livestock 20.82

- --------------------------------------------------------------------------------

Performance Analysis 1

- --------------------------------------------------------------------------------

DB Commodity

January 2000 -- November 2010 Booster -- Benchmark DJUBS SandP-GSCI

- --------------------------------------------------------------------------------

Annualized Returns 10.6% 4.3% 1.9%

Volatility 22.2% 18.1% 25.9%

Sharpe Ratio 0.48 0.24 0.08

Maximum Drawdown -64.6% -57.1% -71.6%

Start Date Jul-08 Jul-08 Jul-08

End Date Feb-09 Mar-09 Feb-09

Max Monthly Consecutive Loss -60.7% -54.5% -67.8%

Start Date Jul-08 Jul-08 Jul-08

End Date Feb-09 Feb-09 Feb-09

Max / Min Returns

Rolling 12 Months 76.3% / -56.7% 39.9% / -52.7% 74.8% / -64.8%

Rolling 3 Months 33.4% / -47.4% 24.7% / -39.7% 34.4% / -53.4%

Average Monthly Returns 1.0% 0.5% 0.4%

% Months with Gains 58.8% 55.7% 55.7%

Correlation

DJUBS 0.89 1.00 0.91

SandP-GSCI 0.97 0.91 1.00

- --------------------------------------------------------------------------------

Year on Year Performance Comparison 1

- --------------------------------------------------------------------------------

Annual Returns for Excess Return Indices

--------------------------------------------------------------

DB Commodity

Calendar Year Booster -- Benchmark DJUBS SandP-GSCI

- --------------------------------------------------------------------------------

2000 24.00% 24.21% 41.10%

2001 -17.43% -22.32% -34.31%

2002 25.99% 23.86% 29.92%

2003 27.09% 22.66% 19.48%

2004 38.49% 7.64% 15.65%

2005 41.80% 17.54% 21.61%

2006 -2.31% -2.71% -19.07%

2007 25.49% 11.08% 26.81%

2008 -36.65% -36.61% -47.29%

2009 20.31% 18.72% 13.30%

2010 YTD 0.17% 5.42% -0.47%

Annualized Return 10.63% 4.34% 1.95%

- --------------------------------------------------------------------------------

Notes:

1 Source: Bloomberg. DB Commodity Booster -- Benchmark has been

retrospectively calculated and did not exist prior to 15 December 2007.

Accordingly, the results shown during the retrospective periods do not

reflect actual returns. Past performance is not necessarily indicative of

how the Index will perform in the future. The performance of any investment

product based on the DB Commodity Booster -- Benchmark Index would have

been lower than the Index as a result of fees and / or costs

2 Data is as of 30 November 2010. Statistics shown are for excess return

indices.

14

|  |

Mean Reversion Indices

Section 2

15

|  |

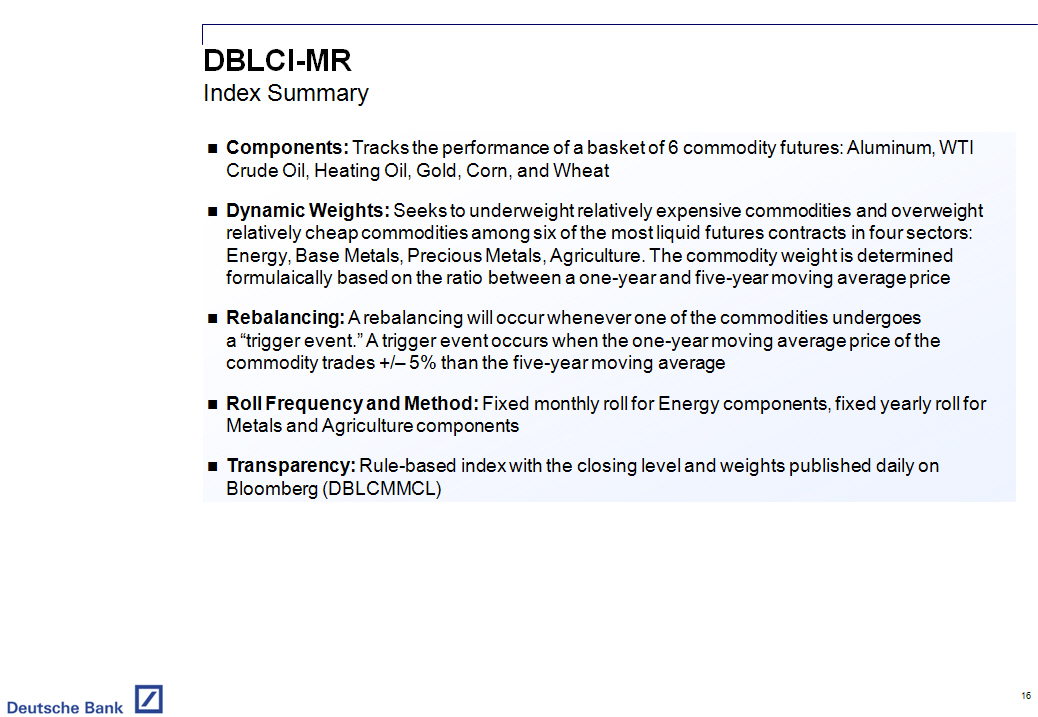

DBLCI -MR

Index Summary

[] Components: Tracks the performance of a basket of 6 commodity futures:

Aluminum, WTI Crude Oil, Heating Oil, Gold, Corn, and Wheat

[] Dynamic Weights: Seeks to underweight relatively expensive commodities and

overweight relatively cheap commodities among six of the most liquid

futures contracts in four sectors: Energy, Base Metals, Precious Metals,

Agriculture. The commodity weight is determined formulaically based on the

ratio between a one-year and five-year moving average price

[] Rebalancing: A rebalancing will occur whenever one of the commodities

undergoes a "trigger event. " A trigger event occurs when the one-year

moving average price of the commodity trades +/-- 5% than the five-year

moving average

[] Roll Frequency and Method: Fixed monthly roll for Energy components, fixed

yearly roll for Metals and Agriculture components

[] Transparency: Rule-based index with the closing level and weights published

daily on Bloomberg (DBLCMMCL)

16

|  |

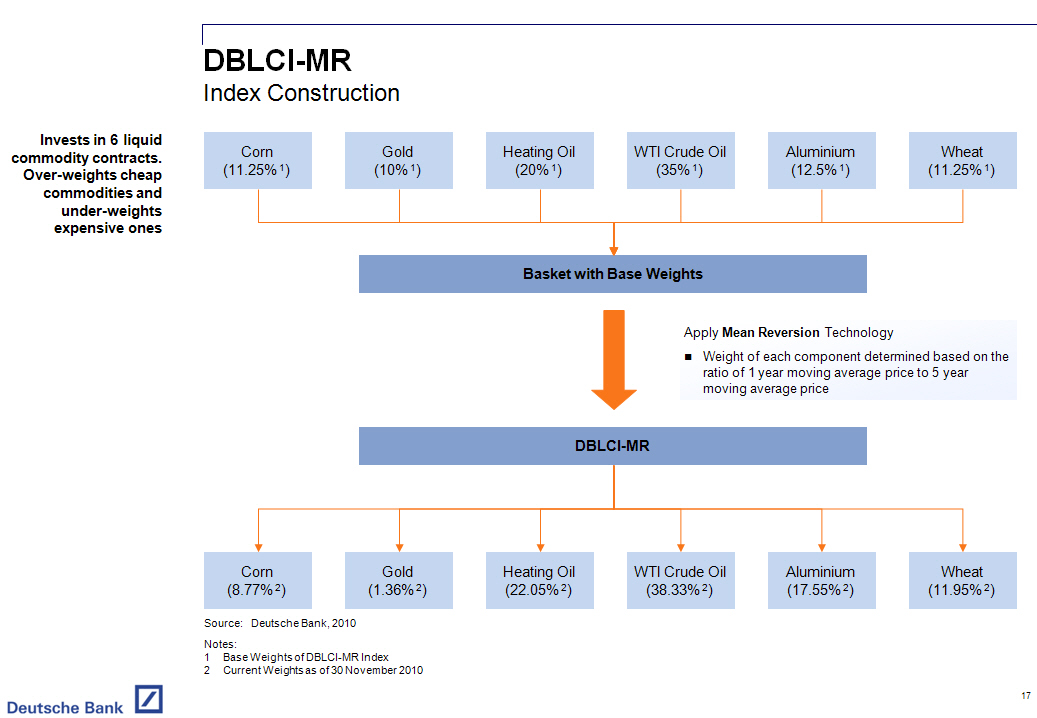

DBLCI -MR

Index Construction

Invests in 6 liquid commodity contracts. Over-weights cheap commodities and

under-weights expensive ones

[GRAPHIC OMITTED]

Source: Deutsche Bank, 2010 Notes:

1 Base Weights of DBLCI-MR Index

2 Current Weights as of 30 November 2010

17

|  |

DBLCI -MR

Performance Analysis

Index Returns 1

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Historical Weighting 1

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Performance Analysis 1

- --------------------------------------------------------------------------------

January 2000 -- November 2010 DBLCI-MR DBLCI DJUBS

- --------------------------------------------------------------------------------

Annualized Returns 9.9% 7.3% 4.3%

Volatility 20.1% 23.9% 18.1%

Sharpe Ratio 0.49 0.30 0.24

Maximum Drawdown -62.8% -65.2% -57.1%

Start Date Jul-08 Jul-08 Jul-08

End Date Feb-09 Feb-09 Mar-09

Max Monthly Consecutive Loss -59.0% -61.9% -54.5%

Start Date Jul-08 Jul-08 Jul-08

End Date Feb-09 Feb-09 Feb-09

Max / Min Returns

Rolling 12 Months 84% / -56.3% 83.1% / -60.7% 39.9% / -52.7%

Rolling 3 Months 33.3% / -43.1% 28.8% / -47.4% 24.7% / -39.7%

Average Monthly Returns 0.9% 0.8% 0.5%

% Months with Gains 58.0% 55.7% 55.7%

Correlation

DBLCI 0.86 1.00 0.88

DJUBS 0.82 0.88 1.00

- --------------------------------------------------------------------------------

Year on Year Performance Comparison 1

- --------------------------------------------------------------------------------

Annual Returns for Excess Return Indices

---------------------------------------------------

Calendar Year DBLCI-MR DBLCI DJUBS

2000 2.16% 24.95% 24.21%

2001 -16.35% -22.61% -22.32%

2002 27.73% 32.14% 23.86%

2003 21.21% 22.42% 22.66%

2004 25.85% 26.11% 7.64%

2005 2.96% 13.89% 17.54%

2006 39.22% 3.06% -2.71%

2007 42.49% 34.67% 11.08%

2008 -35.43% -39.60% -36.61%

2009 22.29% 10.17% 18.72%

2010 YTD 4.28% 3.67% 5.42%

Annualized Return 9.89% 7.27% 4.34%

- --------------------------------------------------------------------------------

Notes:

1 Source: Deutsche Bank, 2010, Bloomberg. DBLCI-MR has been retrospectively

calculated and did not exist prior to 28 February 2003. Accordingly, the

results shown during the retrospective periods do not reflect actual

returns. Past performance is not necessarily indicative of how the Index

will perform in the future. The performance of any investment product based

on the DBLCI-MR Index would have been lower than the Index as a result of

fees and / or costs

2 Data is as of 30 November 2010. Statistics shown are for excess return

indices.

18

|  |

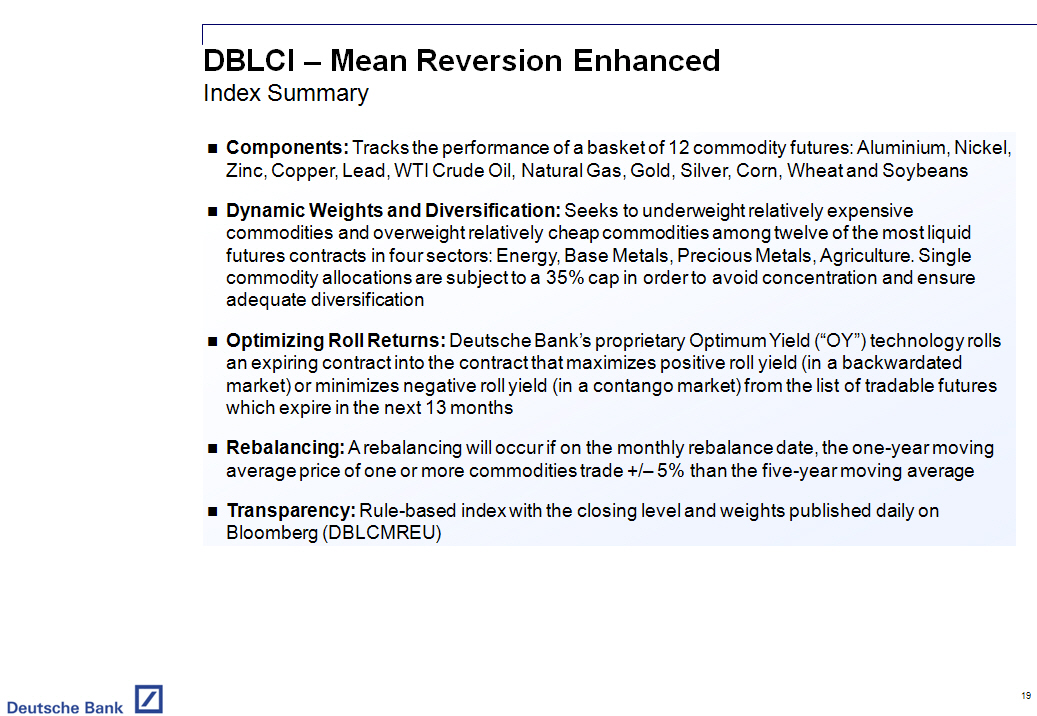

DBLCI -- Mean Reversion Enhanced

Index Summary

[] Components: Tracks the performance of a basket of 12 commodity futures:

Aluminium, Nickel, Zinc, Copper, Lead, WTI Crude Oil, Natural Gas, Gold,

Silver, Corn, Wheat and Soybeans

[] Dynamic Weights and Diversification: Seeks to underweight relatively

expensive commodities and overweight relatively cheap commodities among

twelve of the most liquid futures contracts in four sectors: Energy, Base

Metals, Precious Metals, Agriculture. Single commodity allocations are

subject to a 35% cap in order to avoid concentration and ensure adequate

diversification

[] Optimizing Roll Returns: Deutsche Bank's proprietary Optimum Yield ("OY")

technology rolls an expiring contract into the contract that maximizes

positive roll yield (in a backwardated market) or minimizes negative roll

yield (in a contango market) from the list of tradable futures which expire

in the next 13 months

[] Rebalancing: A rebalancing will occur if on the monthly rebalance date, the

one-year moving average price of one or more commodities trade +/-- 5% than

the five-year moving average

[] Transparency: Rule-based index with the closing level and weights published

daily on Bloomberg (DBLCMREU)

19

|  |

DBLCI -- Mean Reversion Enhanced

Index Construction

Invests in 12 liquid commodity contracts. Over-weights cheap commodities and

under-weights expensive ones

Employs OY technology seeking to maximize roll yield by selecting the optimum

futures contract

[GRAPHIC OMITTED]

Source: Deutsche Bank, 2010 Notes:

1 Base Weights of DBLCI-MR Enhanced Index

2 Current Weights as of 30 November 2010

20

|  |

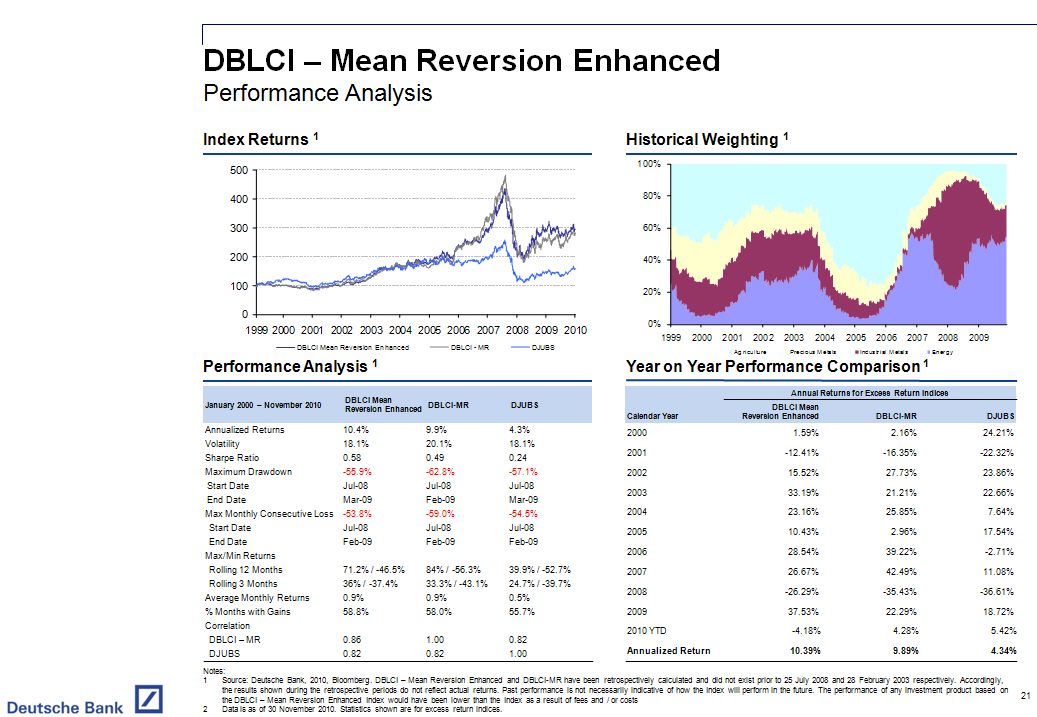

DBLCI -- Mean Reversion Enhanced

Performance Analysis

Index Returns 1

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Historical Weighting 1

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Performance Analysis 1

- --------------------------------------------------------------------------------

DBLCI Mean

January 2000 -- November 2010 Reversion Enhanced DBLCI-MR DJUBS

- --------------------------------------------------------------------------------

Annualized Returns 10.4% 9.9% 4.3%

Volatility 18.1% 20.1% 18.1%

Sharpe Ratio 0.58 0.49 0.24

Maximum Drawdown -55.9% -62.8% -57.1%

Start Date Jul-08 Jul-08 Jul-08

End Date Mar-09 Feb-09 Mar-09

Max Monthly Consecutive Loss -53.8% -59.0% -54.5%

Start Date Jul-08 Jul-08 Jul-08

End Date Feb-09 Feb-09 Feb-09

Max/Min Returns

Rolling 12 Months 71.2% / -46.5% 84% / -56.3% 39.9% / -52.7%

Rolling 3 Months 36% / -37.4% 33.3% / -43.1% 24.7% / -39.7%

Average Monthly Returns 0.9% 0.9% 0.5%

% Months with Gains 58.8% 58.0% 55.7%

Correlation

DBLCI -- MR 0.86 1.00 0.82

DJUBS 0.82 0.82 1.00

- --------------------------------------------------------------------------------

Year on Year Performance Comparison 1

- --------------------------------------------------------------------------------

Annual Returns for Excess Return Indices

-------------------------------------------------------------

DBLCI Mean

Calendar Year Reversion Enhanced DBLCI-MR DJUBS

- --------------------------------------------------------------------------------

2000 1.59% 2.16% 24.21%

2001 -12.41% -16.35% -22.32%

2002 15.52% 27.73% 23.86%

2003 33.19% 21.21% 22.66%

2004 23.16% 25.85% 7.64%

2005 10.43% 2.96% 17.54%

2006 28.54% 39.22% -2.71%

2007 26.67% 42.49% 11.08%

2008 -26.29% -35.43% -36.61%

2009 37.53% 22.29% 18.72%

2010 YTD -4.18% 4.28% 5.42%

Annualized Return 10.39% 9.89% 4.34%

- --------------------------------------------------------------------------------

Notes:

1 Source: Deutsche Bank, 2010, Bloomberg. DBLCI -- Mean Reversion Enhanced

and DBLCI-MR have been retrospectively calculated and did not exist prior

to 25 July 2008 and 28 February 2003 respectively. Accordingly, the results

shown during the retrospective periods do not reflect actual returns. Past

performance is not necessarily indicative of how the Index will perform in

the future. The performance of any investment product based on the DBLCI --

Mean Reversion Enhanced Index would have been lower than the Index as a

result of fees and / or costs

2 Data is as of 30 November 2010. Statistics shown are for excess return

indices.

21

|  |

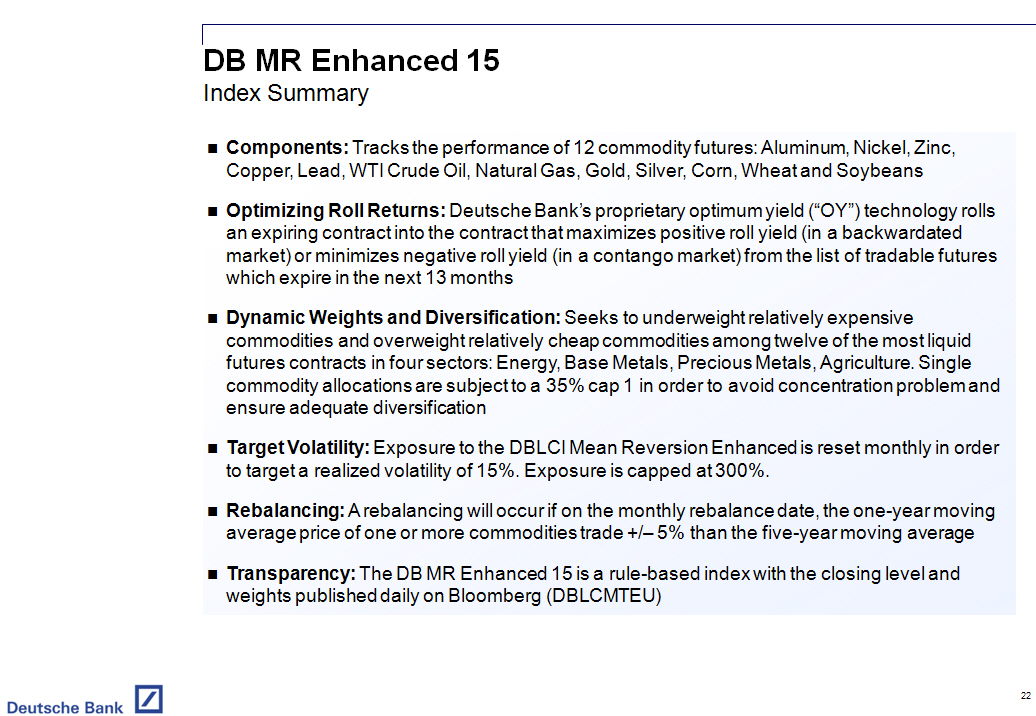

DB MR Enhanced 15

Index Summary

[] Components: Tracks the performance of 12 commodity futures: Aluminum,

Nickel, Zinc, Copper, Lead, WTI Crude Oil, Natural Gas, Gold, Silver, Corn,

Wheat and Soybeans

[] Optimizing Roll Returns: Deutsche Bank's proprietary optimum yield ("OY")

technology rolls an expiring contract into the contract that maximizes

positive roll yield (in a backwardated market) or minimizes negative roll

yield (in a contango market) from the list of tradable futures which expire

in the next 13 months

[] Dynamic Weights and Diversification: Seeks to underweight relatively

expensive commodities and overweight relatively cheap commodities among

twelve of the most liquid futures contracts in four sectors: Energy, Base

Metals, Precious Metals, Agriculture. Single commodity allocations are

subject to a 35% cap 1 in order to avoid concentration problem and ensure

adequate diversification

[] Target Volatility: Exposure to the DBLCI Mean Reversion Enhanced is reset

monthly in order to target a realized volatility of 15%. Exposure is capped

at 300%.

[] Rebalancing: A rebalancing will occur if on the monthly rebalance date, the

one-year moving average price of one or more commodities trade +/-- 5% than

the five-year moving average

[] Transparency: The DB MR Enhanced 15 is a rule-based index with the closing

level and weights published daily on Bloomberg (DBLCMTEU)

22

|  |

DB MR Enhanced 15

Index Construction

Invests in 12 liquid commodity contracts. Over-weights cheap commodities and

under-weights expensive ones

Employs OY technology seeking to maximize roll yield and Target Volatility

technology with the aim of obtaining a smoother return profile

[GRAPHIC OMITTED]

Note:

1 Base Weights of DBLCI -- Mean Reversion Enhanced Index

2 Current Weights of DBLCI-Mean Reversion Enhanced Index as of 30 November

2010

23

|  |

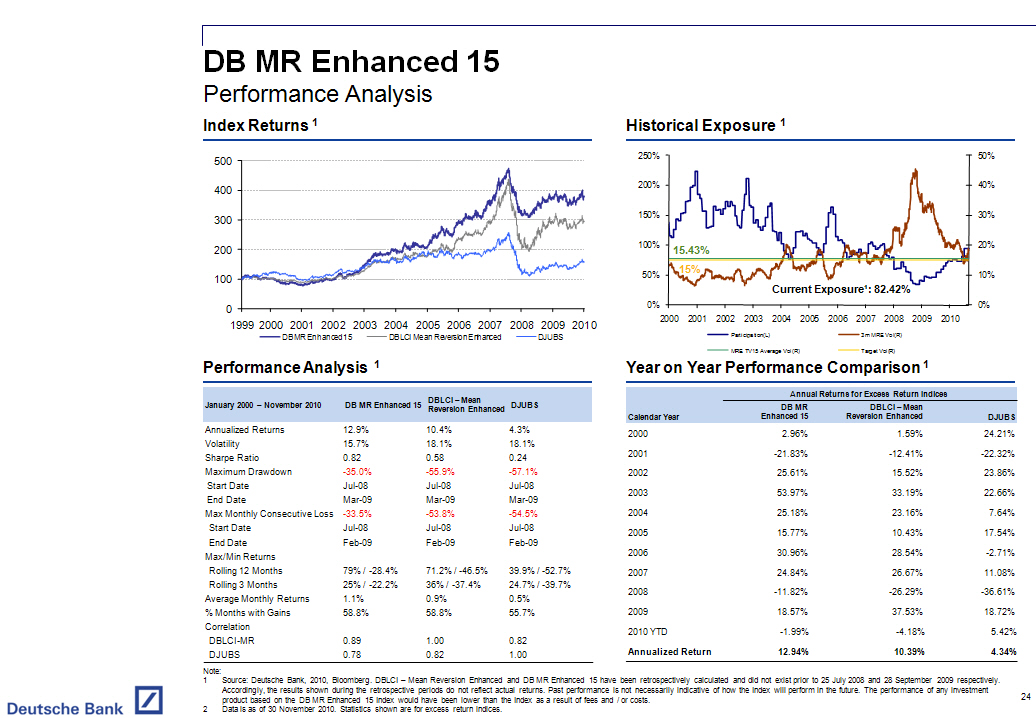

DB MR Enhanced 15

Performance Analysis

Index Returns 1

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Historical Exposure 1

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Performance Analysis 1

- --------------------------------------------------------------------------------

DBLCI -- Mean

January 2000 -- November 2010 DB MR Enhanced 15 Reversion Enhanced DJUBS

- --------------------------------------------------------------------------------

Annualized Returns 12.9% 10.4% 4.3%

Volatility 15.7% 18.1% 18.1%

Sharpe Ratio 0.82 0.58 0.24

Maximum Drawdown -35.0% -55.9% -57.1%

Start Date Jul-08 Jul-08 Jul-08

End Date Mar-09 Mar-09 Mar-09

Max Monthly Consecutive Loss -33.5% -53.8% -54.5%

Start Date Jul-08 Jul-08 Jul-08

End Date Feb-09 Feb-09 Feb-09

Max/Min Returns

Rolling 12 Months 79% / -28.4% 71.2% / -46.5% 39.9% / -52.7%

Rolling 3 Months 25% / -22.2% 36% / -37.4% 24.7% / -39.7%

Average Monthly Returns 1.1% 0.9% 0.5%

% Months with Gains 58.8% 58.8% 55.7%

Correlation

DBLCI-MR 0.89 1.00 0.82

DJUBS 0.78 0.82 1.00

- --------------------------------------------------------------------------------

Year on Year Performance Comparison 1

- --------------------------------------------------------------------------------

Annual Returns for Excess Return Indices

--------------------------------------------------

DB MR DBLCI -- Mean

Calendar Year Enhanced 15 Reversion Enhanced DJUBS

- --------------------------------------------------------------------------------

2000 2.96% 1.59% 24.21%

2001 -21.83% -12.41% -22.32%

2002 25.61% 15.52% 23.86%

2003 53.97% 33.19% 22.66%

2004 25.18% 23.16% 7.64%

2005 15.77% 10.43% 17.54%

2006 30.96% 28.54% -2.71%

2007 24.84% 26.67% 11.08%

2008 -11.82% -26.29% -36.61%

2009 18.57% 37.53% 18.72%

2010 YTD -1.99% -4.18% 5.42%

Annualized Return 12.94% 10.39% 4.34%

- --------------------------------------------------------------------------------

Note:

1 Source: Deutsche Bank, 2010, Bloomberg. DBLCI -- Mean Reversion Enhanced

and DB MR Enhanced 15 have been retrospectively calculated and did not

exist prior to 25 July 2008 and 28 September 2009 respectively.

Accordingly, the results shown during the retrospective periods do not

reflect actual returns. Past performance is not necessarily indicative of

how the Index will perform in the future. The performance of any investment

product based on the DB MR Enhanced 15 Index would have been lower than the

Index as a result of fees and / or costs.

2 Data is as of 30 November 2010. Statistics shown are for excess return

indices.

24

|  |

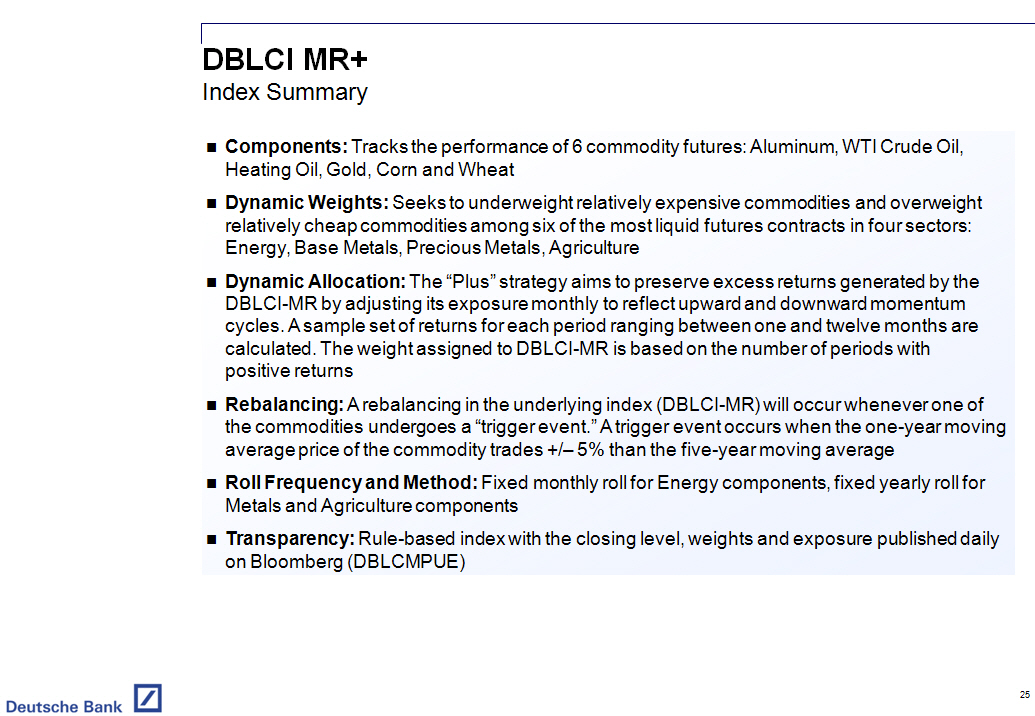

DBLCI MR+

Index Summary

[] Components: Tracks the performance of 6 commodity futures: Aluminum, WTI

Crude Oil, Heating Oil, Gold, Corn and Wheat

[] Dynamic Weights: Seeks to underweight relatively expensive commodities and

overweight relatively cheap commodities among six of the most liquid

futures contracts in four sectors: Energy, Base Metals, Precious Metals,

Agriculture

[] Dynamic Allocation: The "Plus" strategy aims to preserve excess returns

generated by the DBLCI-MR by adjusting its exposure monthly to reflect

upward and downward momentum cycles. A sample set of returns for each

period ranging between one and twelve months are calculated. The weight

assigned to DBLCI-MR is based on the number of periods with positive

returns

[] Rebalancing: A rebalancing in the underlying index (DBLCI-MR) will occur

whenever one of the commodities undergoes a "trigger event. " A trigger

event occurs when the one-year moving average price of the commodity trades

+/-- 5% than the five-year moving average

[] Roll Frequency and Method: Fixed monthly roll for Energy components, fixed

yearly roll for Metals and Agriculture components

[] Transparency: Rule-based index with the closing level, weights and exposure

published daily on Bloomberg (DBLCMPUE)

25

|  |

DBLCI MR+

Index Construction

Invests in 6 liquid commodity contracts. Over-weights cheap commodities and

under-weights expensive ones

Aims to offer upside exposure to DBLCI-MR but limit potential drawdowns by

employing a momentum algorithm

[GRAPHIC OMITTED]

Note:

1 Base Weights of DBLCI-MR Index

2 Current Weights of DBLCI-MR Index as of 30 November 2010

3 Returns are calculated as of 6(th) business day of each month, from November

2009 to November 2010.

26

|  |

DBLCI MR+

Performance Analysis

Index Returns (1)

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Historical Weighting 1

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Performance Analysis 1

- --------------------------------------------------------------------------------

January 2000 -- November 2010 DBLCI MR+ DBLCI-MR DJUBS

- --------------------------------------------------------------------------------

Annualized Returns 9.5% 9.9% 4.3%

Volatility 14.8% 20.1% 18.1%

Sharpe Ratio 0.64 0.49 0.24

Maximum Drawdown -33.8% -62.8% -57.1%

Start Date Jul-08 Jul-08 Jul-08

End Date Jun-10 Feb-09 Mar-09

Max Monthly Consecutive Loss -27.1% -59.0% -54.5%

Start Date Jul-08 Jul-08 Jul-08

End Date Nov-08 Feb-09 Feb-09

Max/Min Returns

Rolling 12 Months 81.8% / -31.4% 84% / -56.3% 39.9% / -52.7%

Rolling 3 Months 28.4% / -26.7% 33.3% / -43.1% 24.7% / -39.7%

Average Monthly Returns 0.8% 0.9% 0.5%

% Months with Gains 52.7% 58.0% 55.7%

Correlation

DBLCI -- MR 0.86 1.00 0.82

DJUBS 0.69 0.82 1.00

- --------------------------------------------------------------------------------

Year on Year Performance Comparison 1

- --------------------------------------------------------------------------------

Annual Returns for Excess Return Indices

--------------------------------------------------

Calendar Year DBLCI MR+ DBLCI-MR DJUBS

2000 0.90% 2.16% 24.21%

2001 -2.40% -16.35% -22.32%

2002 13.21% 27.73% 23.86%

2003 15.56% 21.21% 22.66%

2004 24.07% 25.85% 7.64%

2005 -4.53% 2.96% 17.54%

2006 24.53% 39.22% -2.71%

2007 38.57% 42.49% 11.08%

2008 -0.67% -35.43% -36.61%

2009 8.87% 22.29% 18.72%

2010 YTD -5.74% 4.28% 5.42%

Annualized Return 9.46% 9.89% 4.34%

- --------------------------------------------------------------------------------

Notes:

1 Source: Deutsche Bank, 2010, Bloomberg. DBLCI-MR and DBLCI-MR+ have been

retrospectively calculated and did not exist prior to 28 February 2003 and

20 June 2007 respectively. Accordingly, the results shown during the

retrospective periods do not reflect actual returns. Past performance is

not necessarily indicative of how the Index will perform in the future. The

performance of any investment product based on the DBLCI-MR+ Index would

have been lower than the Index as a result of fees and / or costs

2 Data is as of 30 November 2010. Statistics shown are for excess return

indices.

27

|  |

Market Neutral Indices

Section 3

28

|  |

DB Commodity Harvest

Index Summary

[] Market Neutral Strategy: The DB Commodity Harvest Index goes short the

SandP Goldman Sachs Light Energy Index and long the DB Commodity Booster --

Benchmark Light Energy Index, an Optimum Yield version of the SandP Goldman

Sachs Light Energy Index, in an attempt to provide market-neutral exposure,

and to generate returns from DB's optimum yield technology

[] Optimizing Roll Returns: Deutsche Bank's proprietary optimum yield ("OY")

technology rolls an expiring contract into the contract that maximizes

positive roll yield (in a backwardated market) or minimizes negative roll

yield (in a contango market) from the list of tradable futures which expire

in the next 13 months

[] Transparency: Rule based index with the closing level and weights published

daily on Bloomberg (DBCMHLEU)

29

|  |

DB Commodity Harvest

Index Construction

Strategy aims to generate alpha from roll returns by going long the OY index and

short the benchmark index

[GRAPHIC OMITTED]

Note:

1 Weights shown are: Current Weight (Base Weight) . Current weights are as of

30 November 2010

30

|  |

DB Commodity Harvest

Performance Analysis

Index Returns (1)

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Index Constituents (1)

- --------------------------------------------------------------------------------

Index Current Weight (%)

DB Commodity Booster -- Benchmark 100

Light Energy

SandP Goldman Sachs Light Energy Index -100

- --------------------------------------------------------------------------------

Performance Analysis (1)

- --------------------------------------------------------------------------------

DB Commodity Booster

DB Commodity -- Benchmark SandP-GSCI

January 2000 -- November 2010 Harvest Light Energy Light Energy

- --------------------------------------------------------------------------------

Annualized Returns 5.2% 6.8% 1.2%

Volatility 3.6% 16.8% 18.6%

Sharpe Ratio 1.43 0.40 0.07

Maximum Drawdown -6.1% -56.8% -60.9%

Start Date May-07 Jul-08 Jul-08

End Date Sep-07 Mar-09 Feb-09

Max Monthly Consecutive Loss -5.3% -53.8% -58.0%

Start Date Oct-00 Jul-08 Jul-08

End Date Dec-00 Feb-09 Feb-09

Max / Min Returns

Rolling 12 Months 17.7% / -5.4% 51.7% / -50.3% 48.2% / -55.8%

Rolling 3 Months 6.6% / -5.8% 24.8% / -42.4% 26.1% / -44.6%

Average Monthly Returns 0.4% 0.7% 0.2%

% Months with Gains 70.2% 59.5% 55.0%

Correlation

DB Commodity Booster --

Benchmark Light Energy -0.41 1.00 0.97

SandP-GSCI Light Energy -0.55 0.97 1.00

- --------------------------------------------------------------------------------

Year on Year Performance Comparison 1

- --------------------------------------------------------------------------------

Annual Returns for Excess Return Indices

--------------------------------------------------------------

DB DB Commodity Booster -- SandP-GSCI

Calendar Year Commodity Harvest Benchmark Light Energy Light Energy

- --------------------------------------------------------------------------------

2000 -5.20% 9.01% 14.79%

2001 11.85% -17.11% -26.22%

2002 -2.05% 13.10% 15.09%

2003 4.47% 20.91% 15.41%

2004 13.51% 22.05% 7.31%

2005 10.84% 28.51% 15.51%

2006 12.98% 9.15% -3.77%

2007 0.15% 17.49% 17.16%

2008 11.28% -33.20% -40.39%

2009 1.18% 17.02% 15.17%

2010 YTD -0.36% 5.43% 5.72%

Annualized Return 5.16% 6.78% 1.21%

- --------------------------------------------------------------------------------

Notes:

1 Source: Bloomberg. DB Commodity Harvest and DB Commodity Booster --

Benchmark Light Energy have been retrospectively calculated and did not

exist prior to 15 December 2007. Accordingly, the results shown during the

retrospective periods do not reflect actual returns. Past performance is

not necessarily indicative of how the Index will perform in the future. The

performance of any investment product based on the DB Commodity Harvest

Index have been lower than the Index as a result of fees and / or costs

2 Statistics shown are for excess return indices. Data is as of 30 November

2010

31

|  |

DB Commodity Harvest -- 10

Index Summary

[] Market Neutral Strategy: The DB Commodity Harvest Index goes short the

SandP Goldman Sachs Light Energy Index and long the DB Commodity Booster --

Benchmark Light Energy Index, an Optimum Yield version of the SandP Goldman

Sachs Light Energy Index, in an attempt to provide market-neutral exposure,

and to generate returns from DB's optimum yield technology

[] Optimizing Roll Returns: Deutsche Bank's proprietary optimum yield ("OY")

technology rolls an expiring contract into the contract that maximizes

positive roll yield (in a backwardated market) or minimizes negative roll

yield (in a contango market) from the list of tradable futures which expire

in the next 13 months

[] Target Volatility: Varies exposure to the DB Commodity Harvest Index with a

view to target a volatility of 10%. Exposure is capped at 500%.

[] Transparency: Rule based index with the closing level and weights published

daily on Bloomberg (DBCMHVEA)

32

|  |

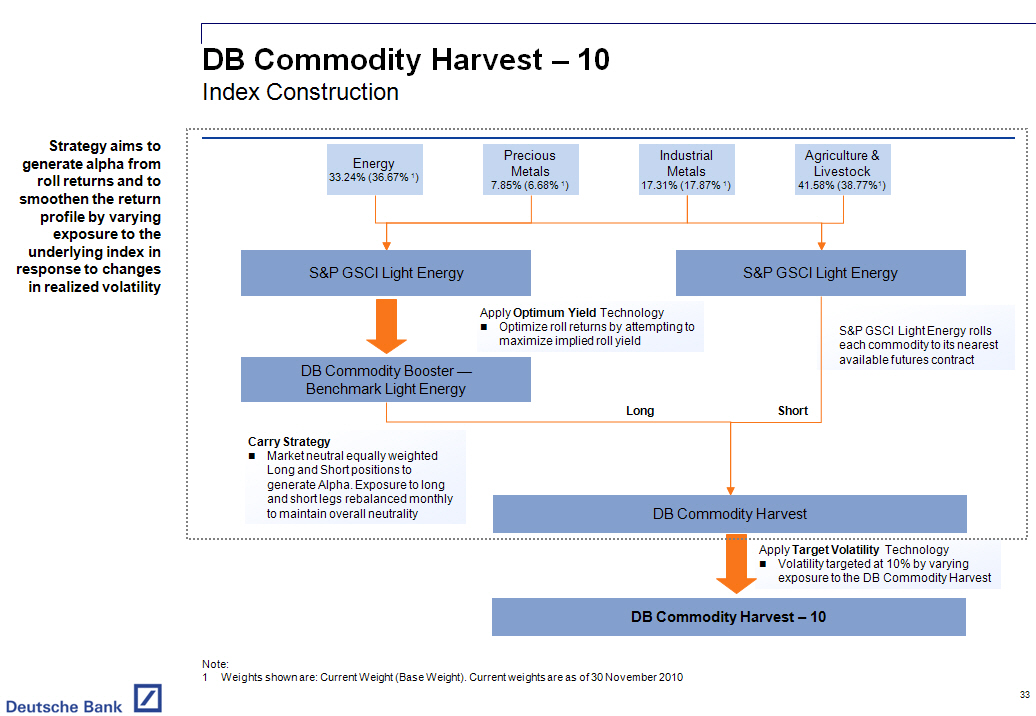

DB Commodity Harvest -- 10

Index Construction

Strategy aims to generate alpha from roll returns and to smoothen the return

profile by varying exposure to the underlying index in response to changes in

realized volatility

[GRAPHIC OMITTED]

Note:

1 Weights shown are: Current Weight (Base Weight) . Current weights are as of

30 November 2010

33

|  |

DB Commodity Harvest -- 10

Performance Analysis

Index Returns 1

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Historical Exposure

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Performance Analysis 1

- --------------------------------------------------------------------------------

January 2000 -- November 2010 DB Commodity DB SandP-GSCI

Harvest -- 10 Commodity Harvest Light Energy

- --------------------------------------------------------------------------------

Annualized Returns 15.9% 5.2% 1.2%

Volatility 10.9% 3.6% 18.6%

Sharpe Ratio 1.45 1.43 0.07

Maximum Drawdown -19.5% -6.1% -60.9%

Start Date May-07 May-07 Jul-08

End Date Sep-07 Sep-07 Feb-09

Max Monthly Consecutive Loss -16.6% -5.3% -58.0%

Start Date Jun-07 Oct-00 Jul-08

End Date Sep-07 Dec-00 Feb-09

Max / Min Returns

Rolling 12 Months 69.1% / -14% 17.7% / -5.4% 48.2% / -55.8%

Rolling 3 Months 21.4% / -17% 6.6% / -5.8% 26.1% / -44.6%

Average Monthly Returns 1.3% 0.4% 0.2%

% Months with Gains 70.2% 70.2% 55.0%

Correlation

DB Commodity Harvest 0.95 1.00 -0.55

SandP-GSCI Light Energy -0.55 -0.55 1.00

- --------------------------------------------------------------------------------

Year on Year Performance Comparison 1

- --------------------------------------------------------------------------------

Annual Returns for Excess Return Indices

--------------------------------------------------------------

DB Commodity DB SandP-GSCI

Calendar Year Harvest -- 10 Commodity Harvest Light Energy

- --------------------------------------------------------------------------------

2000 -12.89% -5.20% 14.79%

2001 33.72% 11.85% -26.22%

2002 -6.40% -2.05% 15.09%

2003 11.52% 4.47% 15.41%

2004 49.88% 13.51% 7.31%

2005 36.78% 10.84% 15.51%

2006 39.07% 12.98% -3.77%

2007 -0.50% 0.15% 17.16%

2008 42.72% 11.28% -40.39%

2009 3.57% 1.18% 15.17%

2010 YTD -1.74% -0.36% 5.72%

Annualized Return 15.89% 5.16% 1.21%

- --------------------------------------------------------------------------------

Notes:

1 Source: Bloomberg. DB Commodity Harvest - 10 and DB Commodity Harvest have

been retrospectively calculated and did not exist prior to 14 October 2008

and 15 December 2007 respectively. Accordingly, the results shown during

the retrospective periods do not reflect actual returns. Past performance

is not necessarily indicative of how the Index will perform in the future.

The performance of any investment product based on the DB Commodity Harvest

- 10 Index have been lower than the Index as a result of fees and / or

costs.

2 Statistics shown are for excess return indices. Data is as of 30 November

2010

34

|  |

DB Commodity Allocator Index

Section 4

35

|  |

DB Commodity Allocator

Index Summary

[] Components: Uses a rule based methodology to allocate between Beta (the DB

MR Enhanced ERAC (1) Index) and Alpha (the DB Commodity Harvest USD ERAC

Index), allowing investors access to a strategy that aims to be fully

allocated to alpha during periods of commodities downturns

[] Optimizing Roll Returns: Deutsche Bank's proprietary optimum yield ("OY")

technology rolls an expiring contract into the contract that maximizes

positive roll yield (in a backwardated market) or minimizes negative roll

yield (in a contango market) from the list of tradable futures which expire

in the next 13 months

[] Dynamic Allocation: Aims to preserve excess returns generated by the DB MR

Enhanced ERAC Index by adjusting exposure to underlying indices monthly to

reflect upward and downward momentum cycles. A sample set of returns for

each period ranging between one and twelve months are calculated. The

weight assigned to DB MR Enhanced ERAC Index is based on the number of

periods with positive returns. The remaining weight is leveraged 3 times

and assigned to the DB Commodity Harvest ERAC Index

[] Rebalancing: Each month, the index adjusts its exposure to each underlying

index based on the momentum of the DB MR Enhanced ERAC Index.

[] Transparency: Rule-based index with the closing level and weights published

daily on Bloomberg (DBLCABER)

Note:

1 ERAC: Excess Return After Cost

36

|  |

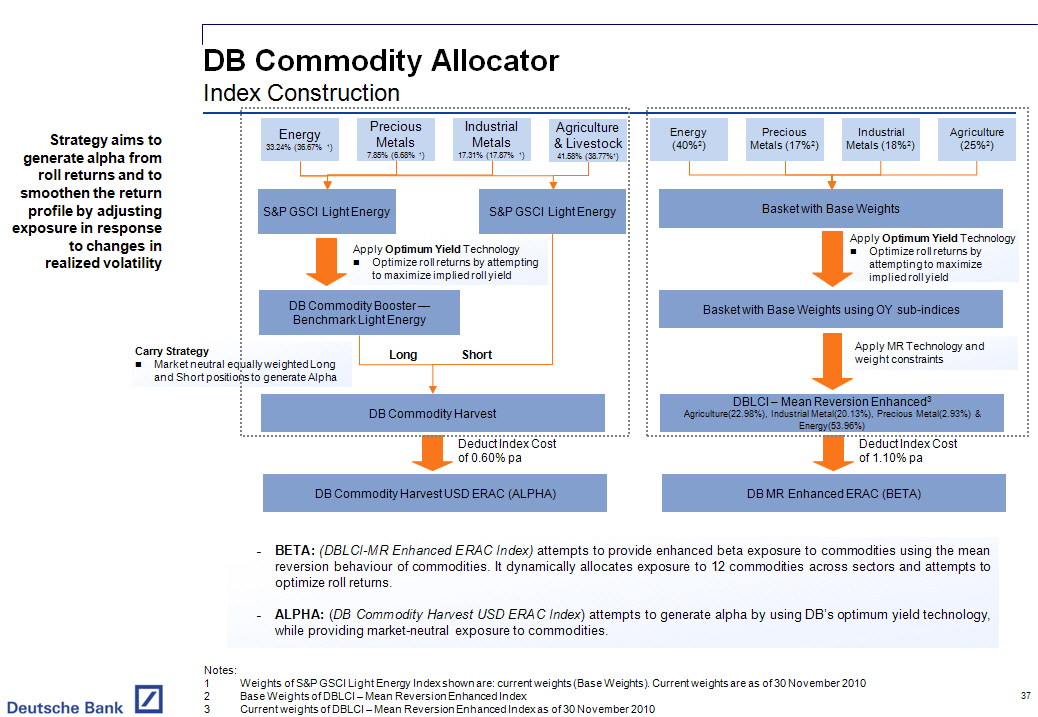

DB Commodity Allocator

Index Construction

Strategy aims to generate alpha from roll returns and to smoothen the return

profile by adjusting exposure in response to changes in realized volatility

[GRAPHIC OMITTED]

- - BETA: (DBLCI -MR Enhanced ERAC Index) attempts to provide enhanced beta

exposure to commodities using the mean reversion behaviour of commodities.

It dynamically allocates exposure to 12 commodities across sectors and

attempts to optimize roll returns.

- - ALPHA: (DB Commodity Harvest USD ERAC Index) attempts to generate alpha by

using DB's optimum yield technology, while providing market -neutral

exposure to commodities.

Notes:

1 Weights of SandP GSCI Light Energy Index shown are: current weights (Base

Weights). Current weights are as of 30 November 2010

2 Base Weights of DBLCI -- Mean Reversion Enhanced Index

3 Current weights of DBLCI -- Mean Reversion Enhanced Index as of 30 November

2010

37

|  |

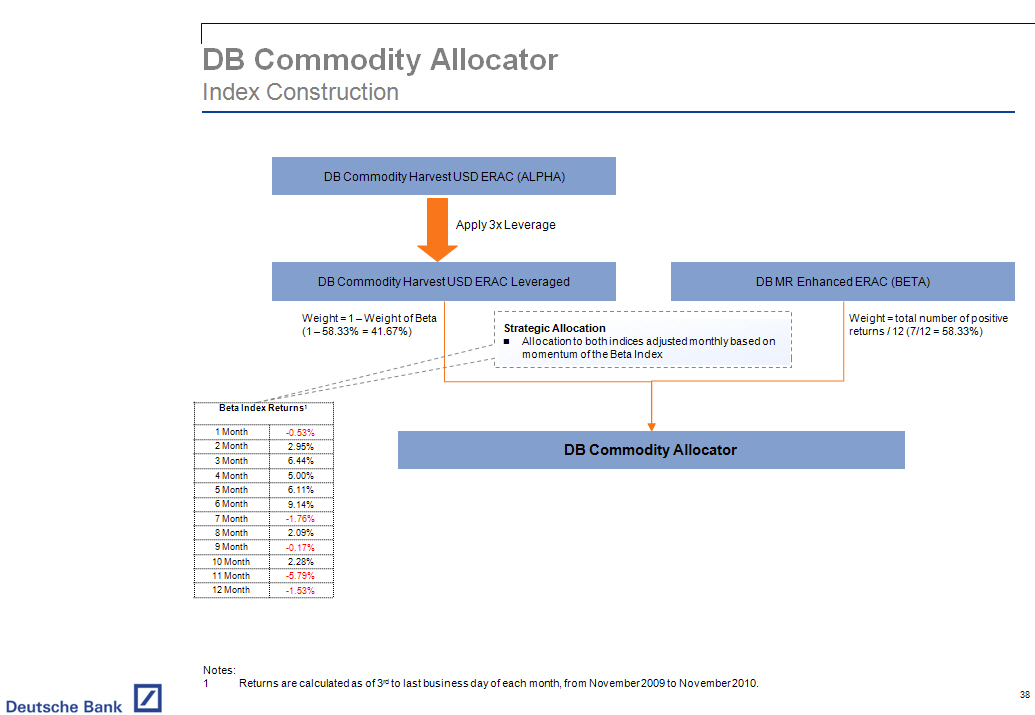

DB Commodity Allocator

Index Construction

[GRAPHIC OMITTED]

Notes:

1 Returns are calculated as of 3(rd) to last business day of each month, from

November 2009 to November 2010.

38

|  |

DB Commodity Allocator

Performance Analysis

Index Returns (1)

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Historical Exposure

- --------------------------------------------------------------------------------

[GRAPHIC OMITTED]

Performance Analysis 1

- --------------------------------------------------------------------------------

January 2000 -- November 2010 DB Commodity DB Commodity DB MR

Allocator Harvest USD ERAC Enhanced ERAC

- --------------------------------------------------------------------------------

Annualized Returns 12.6% 4.5% 9.2%

Volatility 13.7% 3.6% 18.1%

Sharpe Ratio 0.92 1.26 0.51

Maximum Drawdown -29.9% -6.5% -56.2%

Start Date Jul-08 Jan-00 Jul-08

End Date Oct-08 Dec-00 Mar-09

Max Monthly Consecutive Loss -27.6% -5.4% -54.1%

Start Date Jul-08 Oct-00 Jul-08

End Date Oct-08 Dec-00 Feb-09

Max / Min Returns

Rolling 12 Months 57.5% / -15.6% 17% / -6% 69.3% / -47.1%

Rolling 3 Months 28.8% / -23.9% 6.4% / -5.9% 35.7% / -37.9%

Average Monthly Returns 1.1% 0.4% 0.9%

% Months with Gains 64.1% 69.5% 58.0%

Correlation

DB Commodity Harvest

USD ERAC 0.00 1.00 -0.33

DB MR Enhanced ERAC 0.72 -0.33 1.00

- --------------------------------------------------------------------------------

Year on Year Performance Comparison 1

- --------------------------------------------------------------------------------

Annual Returns for Excess Return Indices

------------------------------------------------

DB Commodity DB Commodity DB MR

Calendar Year Allocator Harvest USD ERAC Enhanced ERAC

- --------------------------------------------------------------------------------

2000 -13.68% -5.78% 0.47%

2001 29.55% 11.17% -13.38%

2002 4.02% -2.63% 14.25%

2003 28.16% 3.84% 31.72%

2004 21.76% 12.84% 21.81%

2005 13.87% 10.17% 9.22%

2006 26.67% 12.30% 27.12%

2007 15.86% -0.44% 25.28%

2008 12.72% 10.61% -27.10%

2009 25.34% 0.58% 36.02%

2010 YTD -14.87% -0.91% -5.14%

Annualized Return 12.58% 4.53% 9.18%

- --------------------------------------------------------------------------------

Notes:

1 Source: Bloomberg. DB Commodity Allocator index has been retrospectively

calculated and did not exist prior to 24 October 2009. Accordingly, the

results shown during the retrospective periods do not reflect actual

returns. Past performance is not necessarily indicative of how the Index

will perform in the future. The performance of any investment product based

on the DB Commodity Allocator Index would have been lower than the Index as

a result of fees and / or costs.

2 Statistics shown are for excess return indices. Data is as of 30 November

2010

39

|  |

Appendix

Appendix 1

40

|  |

TYPES OF RETURNS IN A COMMODITY INDEX

Total Return vs. Excess Return

Stock and Bond returns come from two sources:

[] Underlying price movement

[] Dividends (Stocks) or Coupons (Bonds)

COMMODITY RETURNS COME FROM THREE SOURCES:

[] Collateral Yield -- Interest earned on capital held as collateral -- Spot

Return -- Change in front month futures contract

[] Roll Return -- Process of buying a futures contract at a premium (negative

roll) or discount (positive roll) to the spot price

Excess Return = Spot Return + Roll Return

Total Return = Excess Return + Collateral Yield

Collateral yield of 3-Month US Treasury Bills is added to the DB Commodity

excess version indices to create the DB Commodity total return version

41

|  |

[] The mean reversion methodology overweights "cheap" commodities and

underweights "expensive" commodities based on their respective 5y moving

average price vs. 1y moving average price

HISTORICAL COMMODITY ALLOCATION OF THE DBLCI -MR SINCE 2006

[GRAPHIC OMITTED]

Source: Bloomberg Notes:

1 Past performance is not a guarantee of future results

2 The Mean Reversion strategy may not always result in outperformance to

benchmark commodity indices. As a long-only commodity index, if all

underlying commodity prices fall, the DBLCI -- Mean Reversion will also

likely result in a negative performance

3 Data is as of 29 October 2010. DBLCI and DBLCI-MR are calculated

retrospectively prior to their Index Live Dates

42

|  |

[] DBLCI-MR Plus TM Excess Return is a dynamic allocation strategy based on the

performance of the DBLCI-MR TM Excess Return Index

[] Mandatory rebalancing takes place on a monthly basis

[] At each monthly rebalancing, the allocation in the DBLCI-MR TM Excess Return

strategy is determined based on the performance of the DBLCI-MR TM Excess

Return over the previous 12 months

[] Twelve performance indicators are built, reflecting the performance of

DBLCI-MR TM Excess Return over previous 12-months, 11-months, 10-months

3-months, 2-months, 1-month

[] The allocation or component weight to commodities is proportional to the

number of times the DBCLI-MR TM Excess Return performance is greater than

zero. The current allocation is 100% (see table)

[] Rules based momentum strategy with no human intervention, only execution

[] The allocation can be as low as 0% and as high as 100%

RETROSPECTIVE LOOKBACK OVER 12 PERIODS

[GRAPHIC OMITTED]

DBLCI-MR (LOOKBACK RETURNS AS OF 8(TH) NOV 2010)

- ----------------------------------------------------------------------

1 Month 4%

- ----------------------------------------------------------------------

2 Month 13%

- ----------------------------------------------------------------------

3 Month 9%

======================================================================

4 Month 20%

- ----------------------------------------------------------------------

5 Month 28%

- ----------------------------------------------------------------------

6 Month 15%

- ----------------------------------------------------------------------

7 Month 8%

- ----------------------------------------------------------------------

8 Month 12%

- ----------------------------------------------------------------------

9 Month 23%

- ----------------------------------------------------------------------

10 Month 6%

======================================================================

11 Month 16%

- ----------------------------------------------------------------------

12 Month 13%

Notes: Returns are calculated as of 6(th) business day of each month, from

November 2009 to November 2010.

43

|  |

OPTIMIZED YIELD

CONTRACT SELECTION TO CREATE AN "OPTIMAL YIELD"

Contract selection and roll return can have a significant impact in the overall

return of the index

[] Deutsche Bank's proprietary optimum yieldeld ("OY") technology rolls into

the contract that maximizes positive roll yield (in a backwardated market)

or minimizes negative roll yield (in a contango market) from the list of

tradable futures which expire in the next 13 months

[GRAPHIC OMITTED]

[] Longer dated contracts typically have less negative carry when the curve

slopes upward (contango)

[] Shorter dated contracts typically offer greater positive carry when the

curve slopes downward (backwardation)

44

|  |

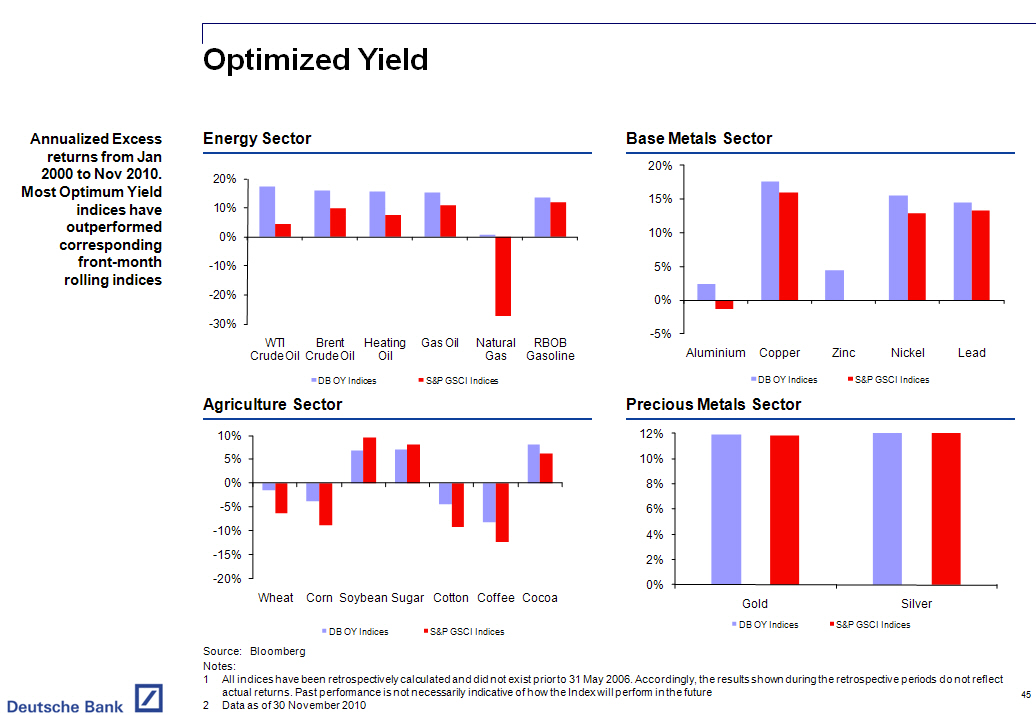

OPTIMIZED YIELD

ANNUALIZED EXCESS RETURNS FROM JAN 2000 TO NOV 2010.

MOST OPTIMUM YIELD INDICES HAVE OUTPERFORMED CORRESPONDING FRONT-MONTH ROLLING

INDICES

ENERGY SECTOR BASE METALS SECTOR

[GRAPHIC OMITTED] [GRAPHIC OMITTED]

AGRICULTURE SECTOR PRECIOUS METALS SECTOR

[GRAPHIC OMITTED] [GRAPHIC OMITTED]

Source: Bloomberg Notes:

1 All indices have been retrospectively calculated and did not exist prior to

31 May 2006. Accordingly, the results shown during the retrospective periods

do not reflect actual returns. Past performance is not necessarily

indicative of how the Index will perform in the future

2 Data as of 30 November 2010

45

|  |

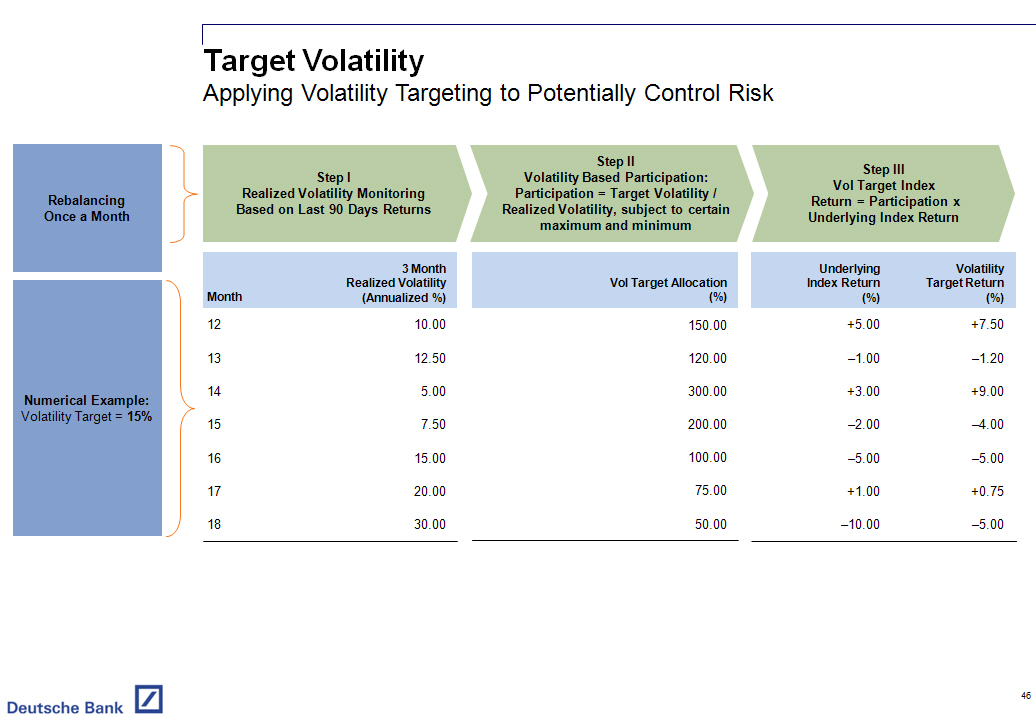

TARGET VOLATILITY

Applying Volatility Targeting to Potentially Control Risk

[GRAPHIC OMITTED]

46

|  |

- ---------------------------------------------------------------------------------------------------

COMPARATIVE PERFORMANCE STATISTICS

- ---------------------------------------------------------------------------------------------------

Annualized Returns for Various Indices

-----------------------------------------------------------------

YTD 1 Year 3 Year 5 Year 10 Year

Return[1] Return Return Return Return Volatility[1] Sharpe

(%) (%) (%) (%) (%) (%) Ratio(3)

- ---------------------------------------------------------------------------------------------------

Beta Allocation Indices

DBLCI (TM) 3.67% 3.31% 10.01% 0.03% 4.59% 23.47% 0.20

SandP GSCI (TM) -0.47% 0.39% 14.40% -8.95% -1.58% 25.80% -0.06

DJ-UBSCI (SM) 5.42% 7.50% -6.10% -2.48% 2.77% 18.17% 0.15

Optimum Yield Based Indices

DB Commodity Booster -- DJUBS 6.31% 7.45% -2.47% 4.16% 9.36% 16.40% 0.57

DB Commodity Booster DJUBS -- TV14 7.99% 8.78% 2.75% 7.13% 12.76% 14.42% 0.88

DB Commodity Booster -- Benchmark 0.17% -0.21% -6.78% -0.32% 8.57% 22.13% 0.39

Mean Reversion Based Indices

DBLCI-MR 4.28% 7.35% -4.47% 11.48% 10.71% 20.25% 0.53

DBLCI -- Mean Reversion Enhanced -4.18% 0.23% 1.18% 10.88% 11.22% 18.26% 0.61

DBLCI MR Enhanced 15 -1.99% 0.69% 2.68% 12.84% 13.88% 15.50% 0.90

DBLCI MR+ -5.74% -3.19% 2.53% 12.21% 10.30% 14.79% 0.70

Market Neutral Indices

DB Commodity Harvest -0.36% -1.51% 4.00% 5.19% 6.00% 3.57% 1.68

DB Commodity Harvest -- 10 -1.74% -5.64% 13.66% 15.69% 18.74% 10.65% 1.76

DB Commodity Allocator Index -14.87% -11.03% 8.44% 13.04% 15.00% 13.68% 1.10

Other Asset Classes

Equities (SandP 500) 7.86% 9.94% -5.14% 0.98% 0.81% 21.56% 0.04

Fixed Income (US Govt. All Total

Return) 4.80% 3.68% 4.97% 4.94% 5.16% 2.83% 1.82

- --------------------------------------------------------------------------------------------------

Source: Bloomberg. Data as of 30 November 2010

Notes: Statistics shown for "Other asset classes" are computed using Total

Return Indices. Sharpe Ratio for these indices is computed using a threshold

return of zero All indices have been retrospectively calculated and did not

exist prior to their respective Index Live Date. Accordingly, the results

shown during the retrospective periods do not reflect actual returns. Past

performance is not necessarily indicative of how the Index will perform in

the future

1 Annualised return based on total return and excess return

2 Annualised vol of the daily lognormal returns

47

|  |

MARKET DATA SOURCES

Bloomberg Tickers and Index Live Dates

- ---------------------------------------------------------------------------------------------

BLOOMBERG TICKER INDEX LIVE DATE

- ---------------------------------------------------------------------------------------------

SandP GSCI Index SPGCCIP[Index]

SandP GSCI Light Energy SPGSLEP[Index]

DJUBS DJUBS [Index]

DBLCI DBLCMACL [Index] 28 February 03

DBLCI-MR DBLCMMCL [Index] 28 February 03

DBLCI -- Mean Reversion Enhanced DBLCMREU [Index] 25 July 08

DB MR Enhanced 15 DBLCMTEU [Index] 28 September 09

DBLCI-MR+ DBLCMPUE [Index] 20 June 07

DB Commodity Booster -- Benchmark DBCMBSEU [Index] 15 December 07

DB Commodity Booster -- Benchmark Light Energy DBCMBLEU [Index] 15 December 07

DB Commodity Booster -- DJUBS DBCMBDEU [Index] 27 February 08

DB Commodity Booster DJUBS -- TV14 DBCMBTVE [Index] 08 August 09

DB Commodity Harvest DBCMHLEU [Index] 15 December 07

DB Commodity Harvest -- 10 DBCMHVEA [Index] 14 October 08

DB Commodity Allocator DBLCABER [Index] 24 October 09

DB Commodity Harvest USD ERAC DBLCHNUE [Index] 13 October 08

DB MR Enhanced ERAC DBLCMREN [Index] 24 October 09

Equities (SandP 500) Total Return SPTR [Index]

Fixed Income Total Return JHDCGBIG [Index]

- ---------------------------------------------------------------------------------------------

48

|  |

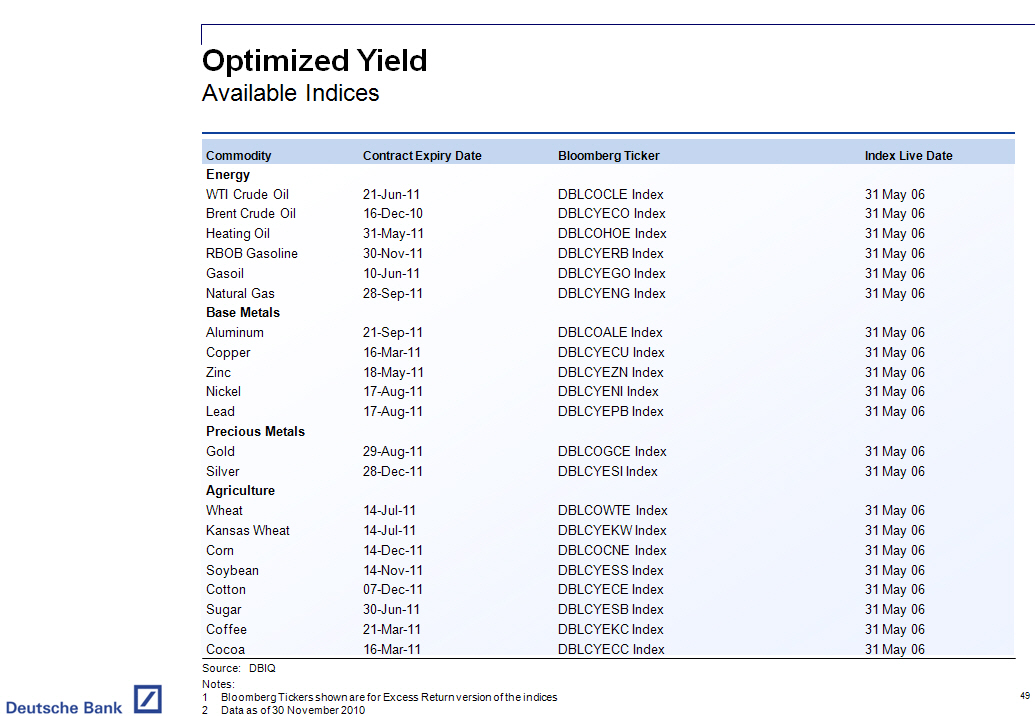

Optimized Yield

Available Indices

- --------------------------------------------------------------------------------------------

Commodity Contract Expiry Date Bloomberg Ticker Index Live Date

Energy

WTI Crude Oil 21-Jun-11 DBLCOCLE Index 31 May 06

Brent Crude Oil 16-Dec-10 DBLCYECO Index 31 May 06

Heating Oil 31-May-11 DBLCOHOE Index 31 May 06

RBOB Gasoline 30-Nov-11 DBLCYERB Index 31 May 06

Gasoil 10-Jun-11 DBLCYEGO Index 31 May 06

Natural Gas 28-Sep-11 DBLCYENG Index 31 May 06

Base Metals

Aluminum 21-Sep-11 DBLCOALE Index 31 May 06

Copper 16-Mar-11 DBLCYECU Index 31 May 06

Zinc 18-May-11 DBLCYEZN Index 31 May 06

Nickel 17-Aug-11 DBLCYENI Index 31 May 06

Lead 17-Aug-11 DBLCYEPB Index 31 May 06

Precious Metals

Gold 29-Aug-11 DBLCOGCE Index 31 May 06

Silver 28-Dec-11 DBLCYESI Index 31 May 06

Agriculture

Wheat 14-Jul-11 DBLCOWTE Index 31 May 06

Kansas Wheat 14-Jul-11 DBLCYEKW Index 31 May 06

Corn 14-Dec-11 DBLCOCNE Index 31 May 06

Soybean 14-Nov-11 DBLCYESS Index 31 May 06

Cotton 07-Dec-11 DBLCYECE Index 31 May 06

Sugar 30-Jun-11 DBLCYESB Index 31 May 06

Coffee 21-Mar-11 DBLCYEKC Index 31 May 06

Cocoa 16-Mar-11 DBLCYECC Index 31 May 06

- --------------------------------------------------------------------------------------------

Source: DBIQ

Notes:

1 Bloomberg Tickers shown are for Excess Return version of the indices

2 Data as of 30 November 2010

49

|  |

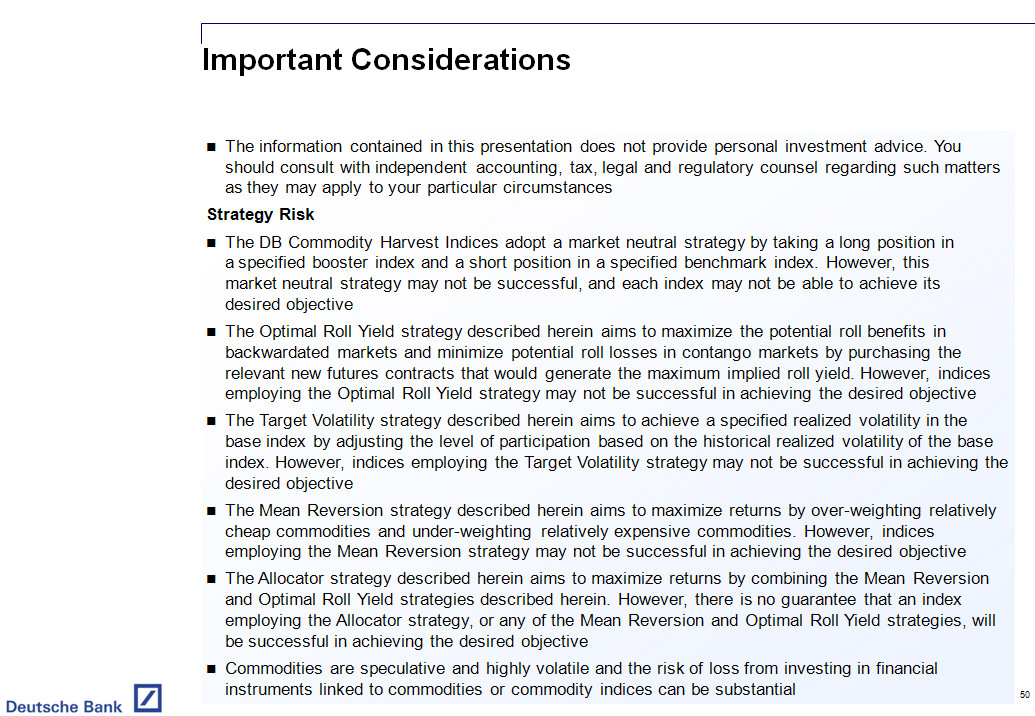

IMPORTANT CONSIDERATIONS

[] The information contained in this presentation does not provide personal

investment advice. You should consult with independent accounting, tax,

legal and regulatory counsel regarding such matters as they may apply to

your particular circumstances

STRATEGY RISK

[] The DB Commodity Harvest Indices adopt a market neutral strategy by taking a

long position in a specified booster index and a short position in a

specified benchmark index. However, this market neutral strategy may not be

successful, and each index may not be able to achieve its desired objective

[] The Optimal Roll Yield strategy described herein aims to maximize the

potential roll benefits in backwardated markets and minimize potential roll

losses in contango markets by purchasing the relevant new futures contracts

that would generate the maximum implied roll yield. However, indices

employing the Optimal Roll Yield strategy may not be successful in achieving

the desired objective

[] The Target Volatility strategy described herein aims to achieve a specified

realized volatility in the base index by adjusting the level of

participation based on the historical realized volatility of the base index.

However, indices employing the Target Volatility strategy may not be

successful in achieving the desired objective

[] The Mean Reversion strategy described herein aims to maximize returns by

over-weighting relatively cheap commodities and under-weighting relatively

expensive commodities. However, indices employing the Mean Reversion

strategy may not be successful in achieving the desired objective

[] The Allocator strategy described herein aims to maximize returns by

combining the Mean Reversion and Optimal Roll Yield strategies described

herein. However, there is no guarantee that an index employing the Allocator

strategy, or any of the Mean Reversion and Optimal Roll Yield strategies,

will be successful in achieving the desired objective

[] Commodities are speculative and highly volatile and the risk of loss from

investing in financial instruments linked to commodities or commodity

indices can be substantial

50

|  |

IMPORTANT CONSIDERATIONS (CONT'D)

Past Performance

[] An index's performance is unpredictable, and past performance is not

indicative of future performance. We give no representation or warranty as

to the future performance of any index or investment

[] Some of the indices described herein have very limited performance history

BACKTESTING

[] Backtested, hypothetical or simulated performance results discussed herein

have inherent limitations. Unlike actual historical performances, simulated

results are achieved by means of the retroactive application of a backtested

model itself designed with the benefit of hindsight. Taking into account

historical events, the backtesting of performance also differs from actual

account performance because an actual investment strategy may be adjusted

any time, for any reason, including a response to material, economic or

market factors. The backtested performance includes hypothetical results

that do not reflect the deduction of advisory fees, brokerage or other

commissions, and any other expenses that a client would have paid or

actually paid. Past hypothetical backtest results are neither an indicator

nor guarantee of future returns. Actual results will vary, perhaps

materially, from the analysis contained herein

FREE WRITING PROSPECTUS

[] Deutsche Bank AG has filed a registration statement (including a prospectus)

with the Securities and Exchange Commission, or SEC, for the offering to

which this communication relates. Before you invest, you should read the

prospectus in that registration statement and other documents that Deutsche

Bank AG has filed with the SEC for more complete information about Deutsche

Bank AG and any such offering. You may obtain these documents without cost

by visiting EDGAR on the SEC website at www. sec. gov. Alternatively,

Deutsche Bank AG, any agent or any dealer participating in the offering will

arrange to send you the prospectus if you so request by calling toll-free

1-800-311-4409

51

|  |

DISCLAIMER

SANDP GSCI SM DISCLAIMER

Any securities Deutsche Bank AG may issue from time to time and this

presentation are not sponsored, endorsed, sold or promoted by Standard and

Poor's, a division of The McGraw -Hill Companies, Inc. ("SandP") . Standard and

Poor's does not make any representation or warranty, express or implied, to the

owners of any securities or any member of the public regarding the advisability

of investing in any securities or the ability of SandP GSCI Index to track

general commodity market performance. SandP's only relationship to Deutsche Bank

AG is the licensing of certain trademarks and trade names of SandP and of SandP

GSCI Index, which indices are determined, composed and calculated by SandP

without regard to Deutsche Bank AG or any securities. SandP has no obligation to

take the needs of Deutsche Bank AG or the owners of any securities into

consideration in determining, composing or calculating SandP GSCI Index. SandP

is not responsible for and have not participated in the determination of the

timing of, prices at, or quantities of any securities to be issued or in the

determination or calculation of the equation by which the SandP GSCI Index is to

be converted into cash. SandP has no obligation or liability in connection with

the administration, marketing or trading of any securities.

SandP DOES NOT GUARANTEE THE ACCURACY AND / OR THE COMPLETENESS OF SandP GSCI

INDEX OR ANY DATA INCLUDED THEREIN AND SandP SHALL HAVE NO LIABILITY FOR ANY

ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. SandP MAKES NO WARRANTY, EXPRESS OR

IMPLIED, AS TO RESULTS TO BE OBTAINED BY DEUTSCHE BANK AG, OWNERS OF SECURITIES

OR ANY OTHER PERSON OR ENTITY FROM THE USE OF SandP GSCI INDEX OR ANY DATA

INCLUDED THEREIN. SandP MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY

DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE

OR USE WITH RESPECT TO THE SandP INDICES OR DEUTSCHE BANK'S VARIATIONS OF SandP

INDICES OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN

NO EVENT SHALL SandP HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR

CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE

POSSIBILITY OF SUCH DAMAGES.

SandP GSCI Index is a trademark of The McGraw -Hill Companies, Inc. and has been

licensed for use by Deutsche Bank AG.

DJ-UBSCISM DISCLAIMER

"Dow Jones[R]", "DJ", "UBS," "DJ-UBSCISM" are service marks of Dow Jones and

Company, Inc. ("Dow Jones") and UBS AG ("UBS AG"), as the case may be, and have

been licensed for use for certain purposes by Deutsche Bank AG

Any securities which Deutsche Bank AG may offer from time to time are not

sponsored, endorsed, sold or promoted by Dow Jones, UBS AG, UBS Securities LLC

("UBS Securities") or any of their subsidiaries or affiliates. None of Dow

Jones, UBS AG, UBS Securities or any of their subsidiaries or affiliates makes

any representation or warranty, express or implied, to the owners of or

counterparts to any securities or any member of the public regarding the

advisability of investing in any securities or commodities. The only

relationship of Dow Jones, UBS AG, UBS Securities or any of their subsidiaries

or affiliates to the Licensee is the licensing of certain trademarks, trade

names and service marks and of the DJ-UBSCISM, which is determined, composed

and calculated by Dow Jones in conjunction withth UBS Securities wiithout thout

regard to Deutsche Bank AG or any securities. Dow Jones and UBS Securities have

no obligation to take the needs of Deutsche Bank AG or the owners of any

securities into consideration in determining, composing or calculating

DJ-UBSCISM. None of Dow Jones, UBS AG, UBS Securities or any of their

respective subsidiaries or affiliates is responsible for or has participated in

the determination of the timing of, prices at, or quantities of any securities

to be issued or in the determination or calculation of the equation by which

any securities are to be converted into cash. None of Dow Jones, UBS AG, UBS

Securities or any of their subsidiaries or affiliates shall have any obligation

or liability, including, without limitation, to securities' customers, in

connection with the administration, marketing or trading of any securities.

Notwithstanding the foregoing, UBS AG, UBS Securities and their respective

subsidiaries and affiliates may independently issue and/or sponsor financial

products unrelated to any securities issued by Licensee, but which may be

similar to and competitive with such securities. In addition, UBS AG, UBS

Securities and their subsidiaries and affiliates actively trade commodities,

commodity indexes and commodity futures (including the Dow Jones-UBS Commodity

IndexSM and Dow Jones-UBS Commodity Index Total ReturnSM), as well as swaps,

options and derivatives which are linked to the performance of such

commodities, commodity indexes and commodity futures. It is possible that this

trading activity will affect the value of the Dow Jones-UBS Commodity IndexSM

and any securities Deutsche Bank AG may issue from time to time.

NONE OF DOW JONES, UBS AG, UBS SECURITIES OR ANY OF THEIR SUBSIDIARIES OR

AFFILIATES GUARANTEES THE ACCURACY AND/OR THE COMPLETENESS OF THE DOW JONES

- -UBS COMMODITY INDEXSM OR ANY DATA RELATED THERETO, AND NONE OF DOW JONES, UBS

AG, UBS SECURITIES OR ANY OF THEIR SUBSIDIARIES OR AFFILIATES SHALL HAVE ANY

LIABILITY FOR ANY ERRORS, OMISSIONS OR INTERRUPTIONS THEREIN. NONE OF DOW

JONES, UBS AG, UBS SECURITIES OR ANY OF THEIR SUBSIDIARIES OR AFFILIATES MAKES

ANY WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY DEUTSCHE BANK

AG, OWNERS OF ANY SECURITIES OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE

DOW JONES -UBS COMMODITY INDEXSM OR ANY DATA RELATED THERETO. NONE OF DOW

JONES, UBS AG, UBS SECURITIES OR ANY OF THEIR SUBSIDIARIES OR AFFILIATES MAKES

ANY EXPRESS OR IMPLIED WARRANTIES AND EXPRESSLY DISCLAIMS ALL WARRANTIES OF

MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE

DOW JONES -UBS COMMODITY INDEXSM OR ANY DATA RELATED THERETO. WITHOUT LIMITING

ANY OF THE FOREGOING, IN NO EVENT SHALL DOW JONES,

UBS AG, UBS SECURITIES OR ANY OF THEIR SUBSIDIARIES OR AFFILIATES HAVE ANY

LIABILITY FOR ANY LOST PROFITS OR INDIRECT, PUNITIVE, SPECIAL OR CONSEQUENTIAL

DAMAGES OR LOSSES, EVEN IF NOTIFIED OF THE POSSIBILITY THEREOF. THERE ARE NO

THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS AMONG DOW JONES, UBS

SECURITIES AND DEUTSCHE BANK AG, OTHER THAN UBS AG.

"Dow Jones[R]", "DJ", "UBS[R]" "Dow Jones-UBS Commodity IndexSM" are service

marks of Dow Jones and Company, Inc. and UBS AG, as the case may be, and have

been licensed for use for certain purposes by Deutsche Bank. The DB Commodity

Harvest -- DJUBS and DB Commodity Booster -- DJUBS, which is based in part on

the Dow Jones-UBS Commodity Index, is not sponsored or endorsed by Dow Jones and

Company, Inc. or UBS Securities LLC, but is published with their consent.

52

|  |