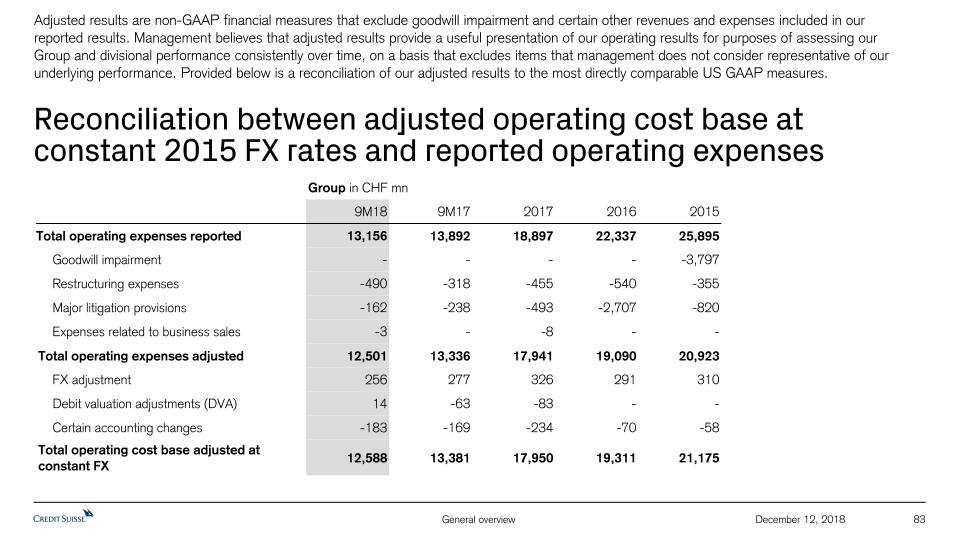

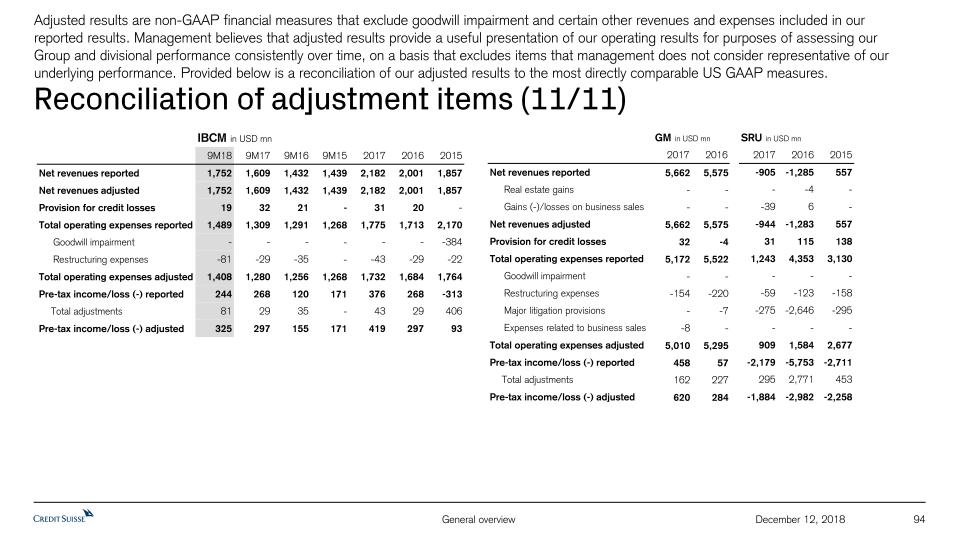

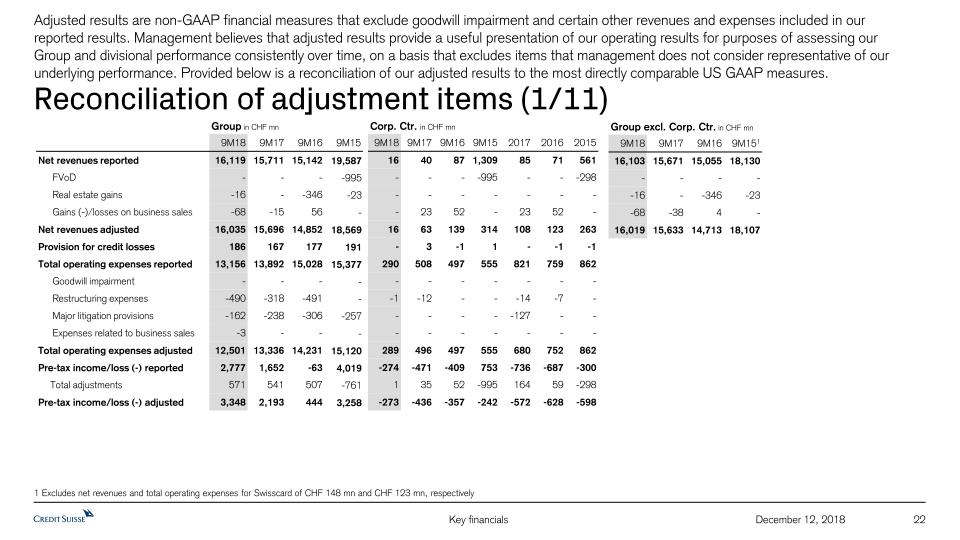

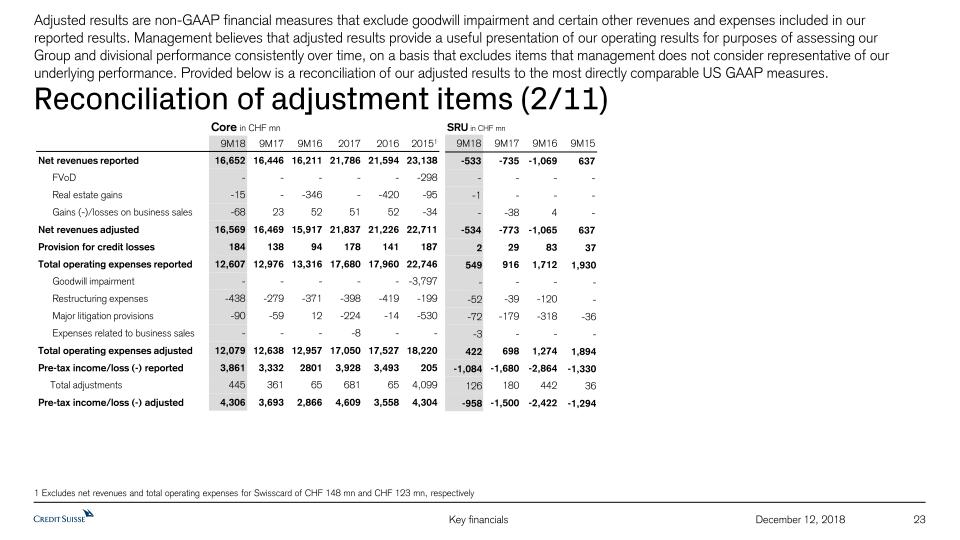

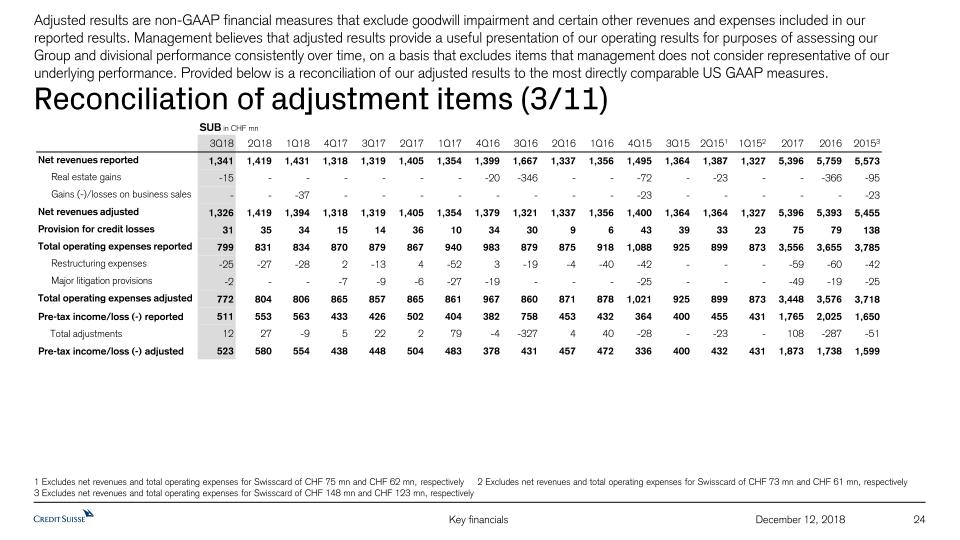

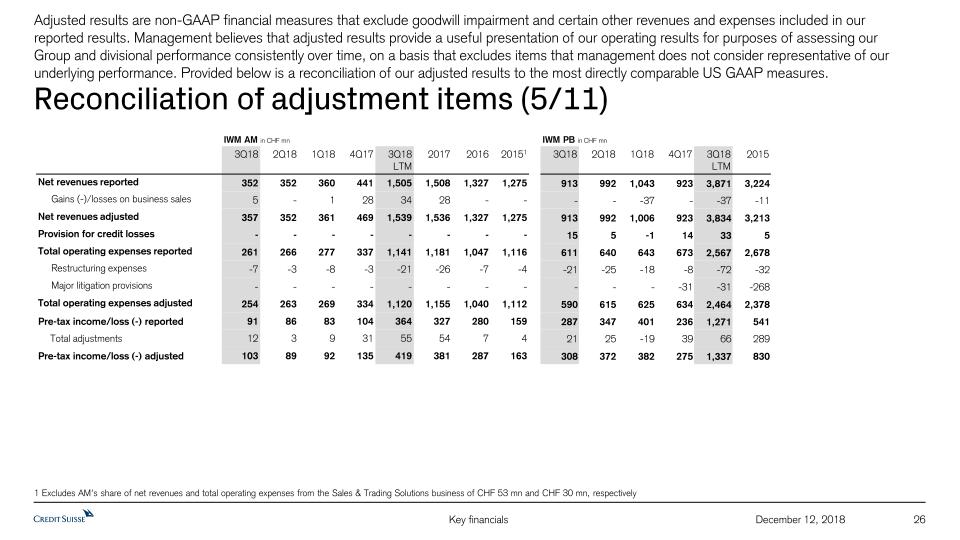

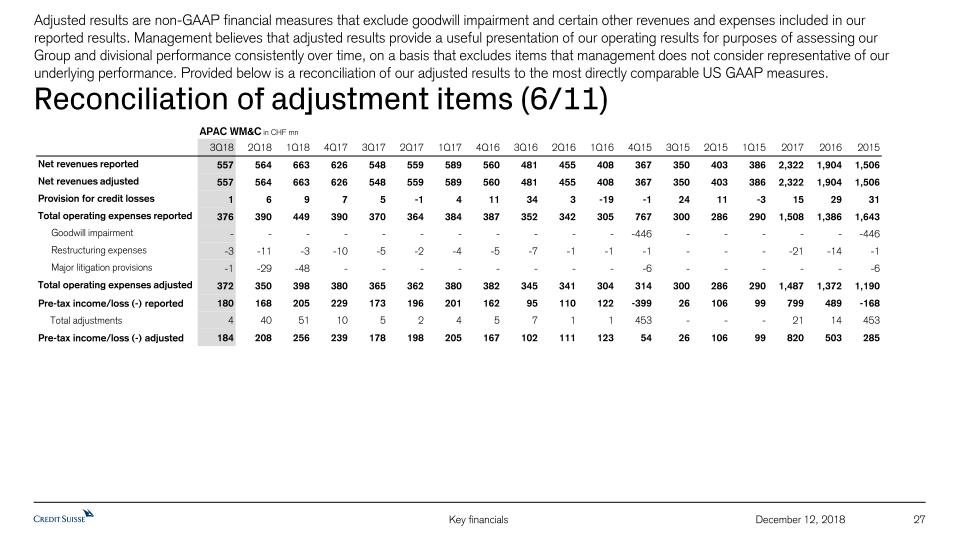

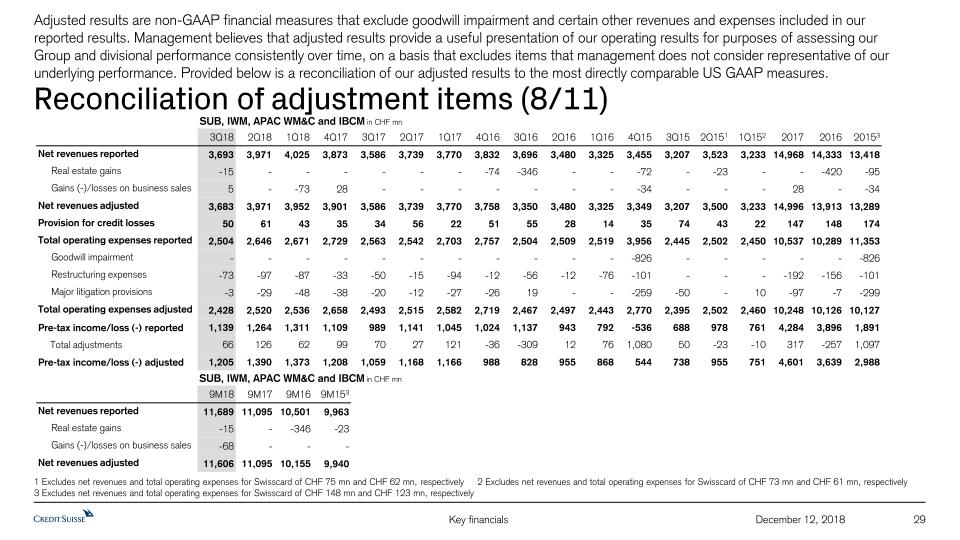

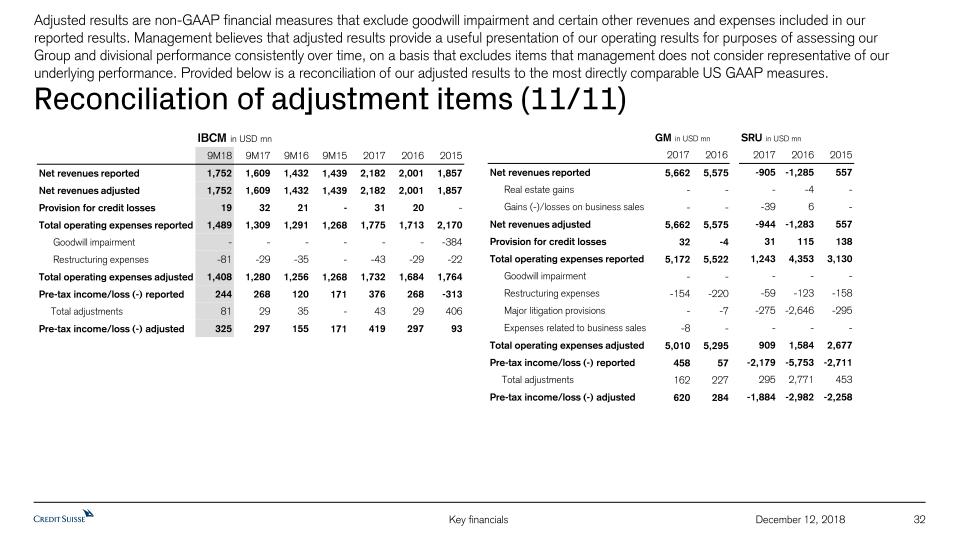

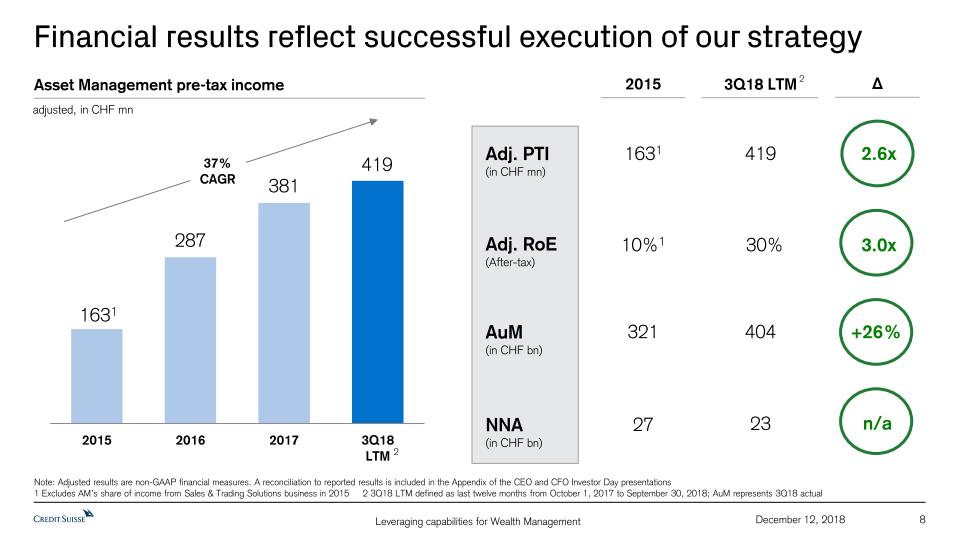

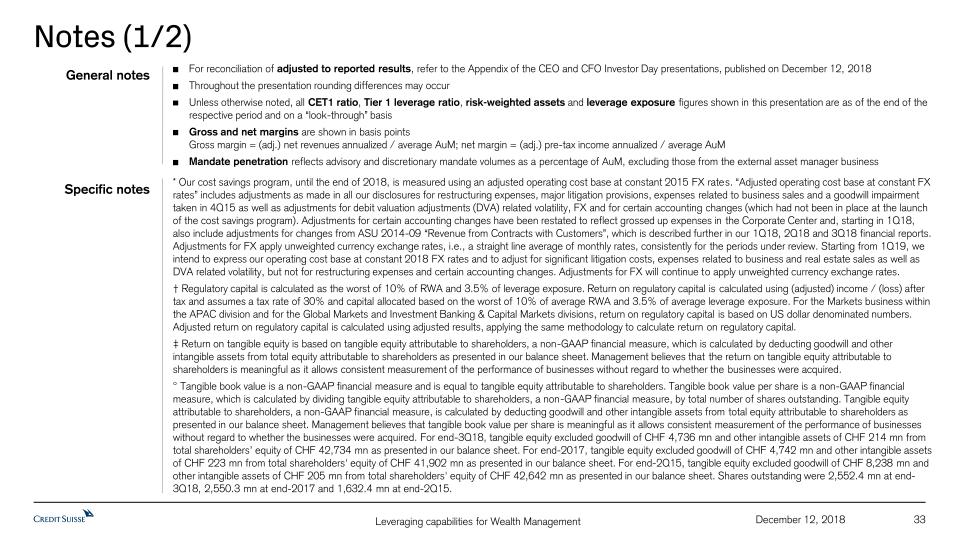

91 December 12, 2018 Reconciliation of adjustment items (8/11) Adjusted results are non-GAAP financial measures that exclude goodwill impairment and certain other revenues and expenses included in our reported results. Management believes that adjusted results provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance consistently over time, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation of our adjusted results to the most directly comparable US GAAP measures. 1 Excludes net revenues and total operating expenses for Swisscard of CHF 75 mn and CHF 62 mn, respectively 2 Excludes net revenues and total operating expenses for Swisscard of CHF 73 mn and CHF 61 mn, respectively 3 Excludes net revenues and total operating expenses for Swisscard of CHF 148 mn and CHF 123 mn, respectively SUB, IWM, APAC WM&C and IBCM in CHF mn 3Q18 2Q18 1Q18 4Q17 3Q17 2Q17 1Q17 4Q16 3Q16 2Q16 1Q16 4Q15 3Q15 2Q151 1Q152 2017 2016 20153 Net revenues reported 3,693 3,971 4,025 3,873 3,586 3,739 3,770 3,832 3,696 3,480 3,325 3,455 3,207 3,523 3,233 14,968 14,333 13,418 Real estate gains -15 - - - - - - -74 -346 - - -72 - -23 - - -420 -95 Gains (-)/losses on business sales 5 - -73 28 - - - - - - - -34 - - - 28 - -34 Net revenues adjusted 3,683 3,971 3,952 3,901 3,586 3,739 3,770 3,758 3,350 3,480 3,325 3,349 3,207 3,500 3,233 14,996 13,913 13,289 Provision for credit losses 50 61 43 35 34 56 22 51 55 28 14 35 74 43 22 147 148 174 Total operating expenses reported 2,504 2,646 2,671 2,729 2,563 2,542 2,703 2,757 2,504 2,509 2,519 3,956 2,445 2,502 2,450 10,537 10,289 11,353 Goodwill impairment - - - - - - - - - - - -826 - - - - - -826 Restructuring expenses -73 -97 -87 -33 -50 -15 -94 ��-12 -56 -12 -76 -101 - - - -192 -156 -101 Major litigation provisions -3 -29 -48 -38 -20 -12 -27 -26 19 - - -259 -50 - 10 -97 -7 -299 Total operating expenses adjusted 2,428 2,520 2,536 2,658 2,493 2,515 2,582 2,719 2,467 2,497 2,443 2,770 2,395 2,502 2,460 10,248 10,126 10,127 Pre-tax income/loss (-) reported 1,139 1,264 1,311 1,109 989 1,141 1,045 1,024 1,137 943 792 -536 688 978 761 4,284 3,896 1,891 Total adjustments 66 126 62 99 70 27 121 -36 -309 12 76 1,080 50 -23 -10 317 -257 1,097 Pre-tax income/loss (-) adjusted 1,205 1,390 1,373 1,208 1,059 1,168 1,166 988 828 955 868 544 738 955 751 4,601 3,639 2,988 SUB, IWM, APAC WM&C and IBCM in CHF mn 9M18 9M17 9M16 9M153 Net revenues reported 11,689 11,095 10,501 9,963 Real estate gains -15 - -346 -23 Gains (-)/losses on business sales -68 - - - Net revenues adjusted 11,606 11,095 10,155 9,940