UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 001-15244

(Translation of registrant’s name into English)

Paradeplatz 8, CH 8001 Zurich, Switzerland

(Address of principal executive office)

Commission File Number 001-33434

(Translation of registrant’s name into English)

Paradeplatz 8, CH 8001 Zurich, Switzerland

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or

Form 40-F.

Form 20-F  Form 40-F

Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

This report includes the media release and the slides for the presentation to investors in connection with the 4Q18 and full year 2018 results.

Media Release Zurich, 14 February, 2019 | |

Full year and fourth quarter 2018 financial results

Completes three year restructuring and achieves first annual post-tax profit since 2014 of CHF 2.1 billion

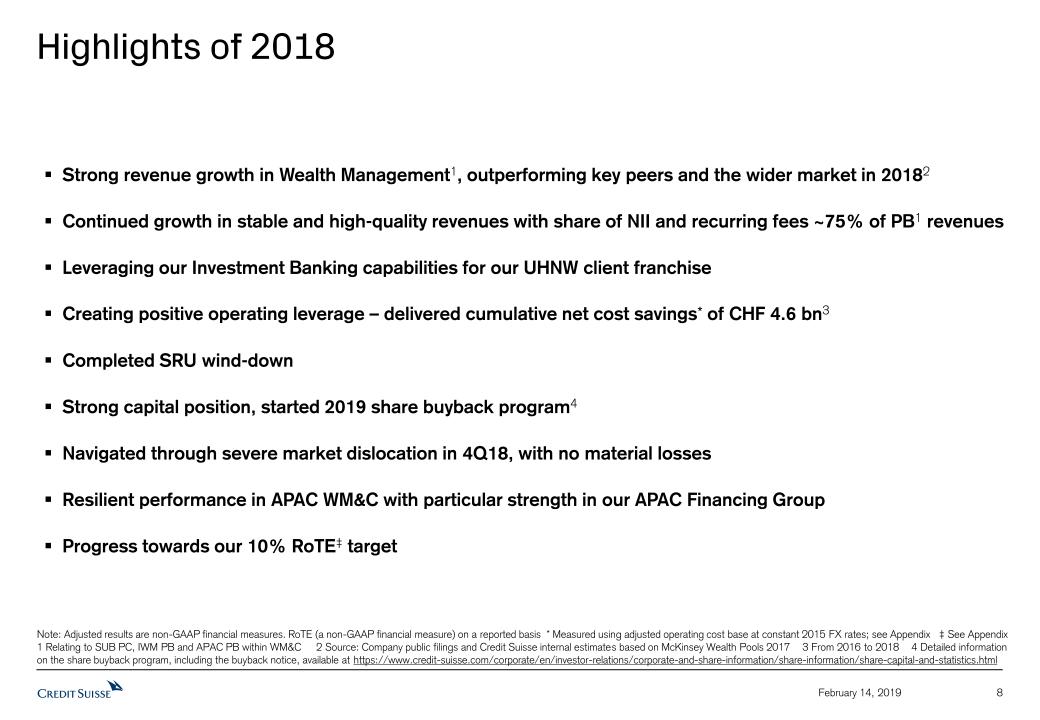

Full year 2018 highlights:

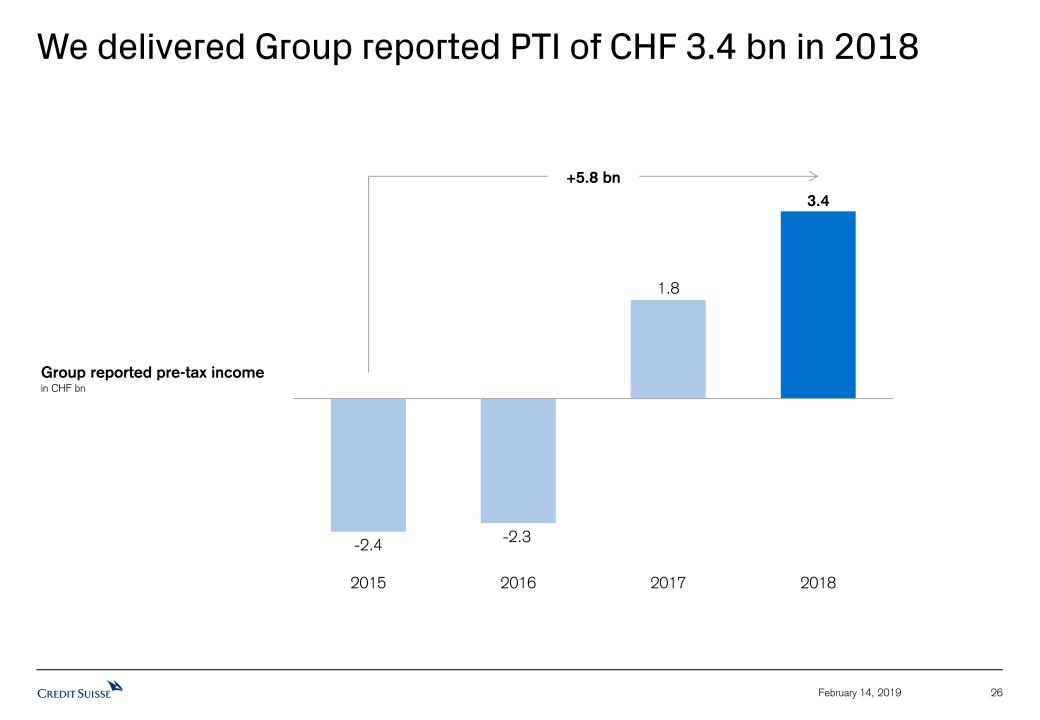

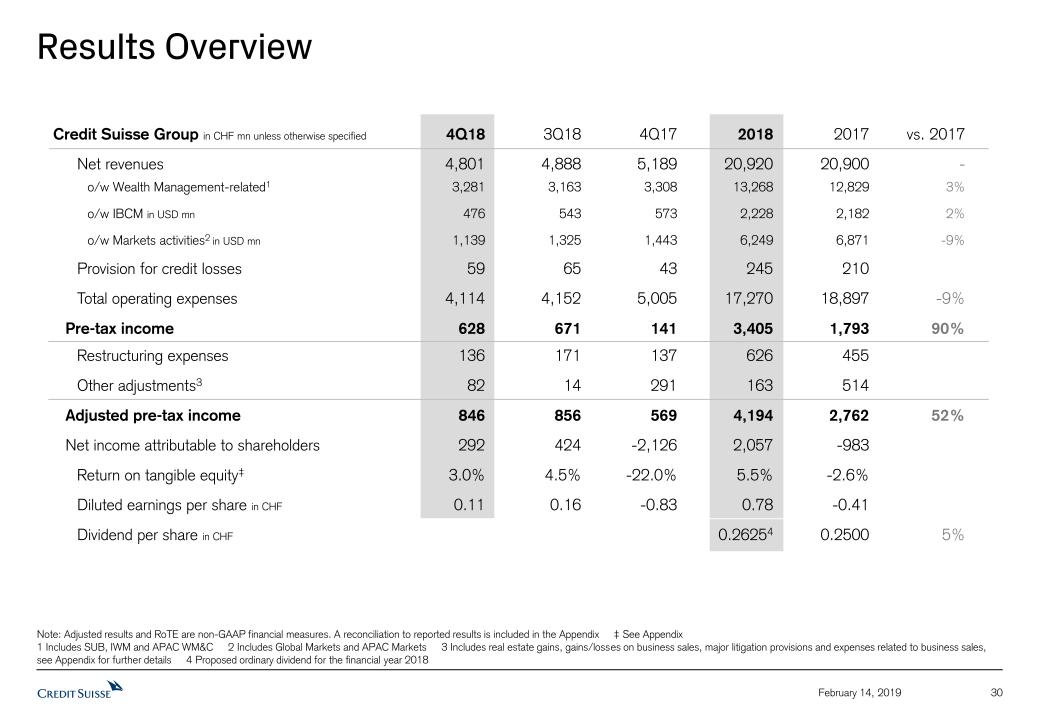

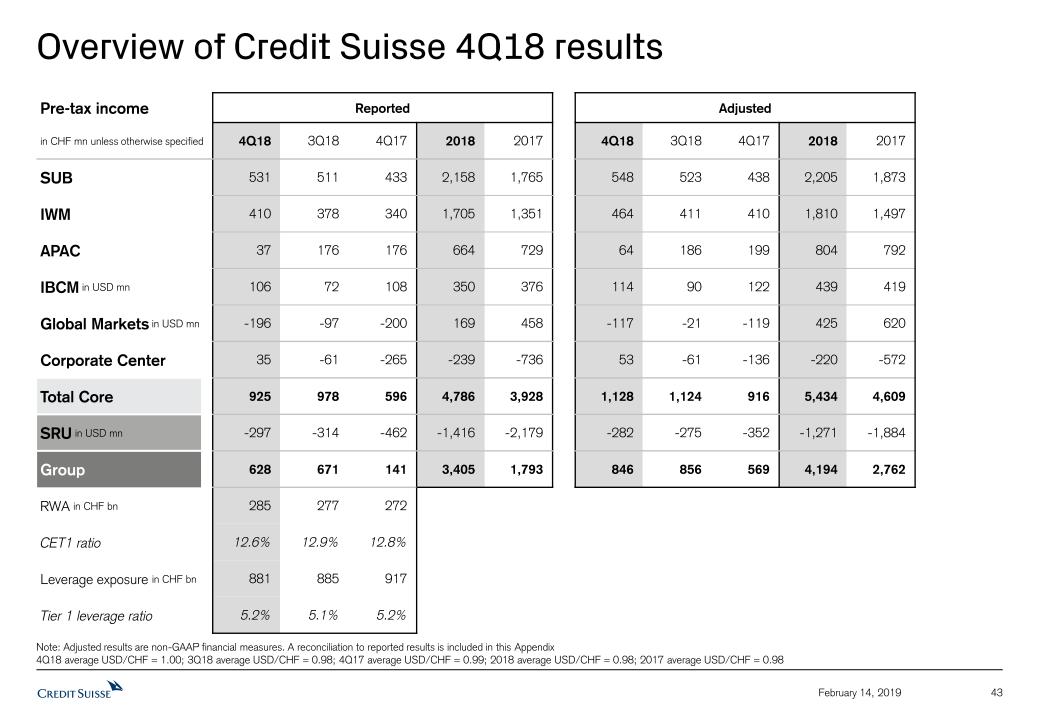

| ■ | Group annual reported pre-tax income of CHF 3.4 billion, up 90% against 2017 reported pre-tax income of CHF 1.8 billion |

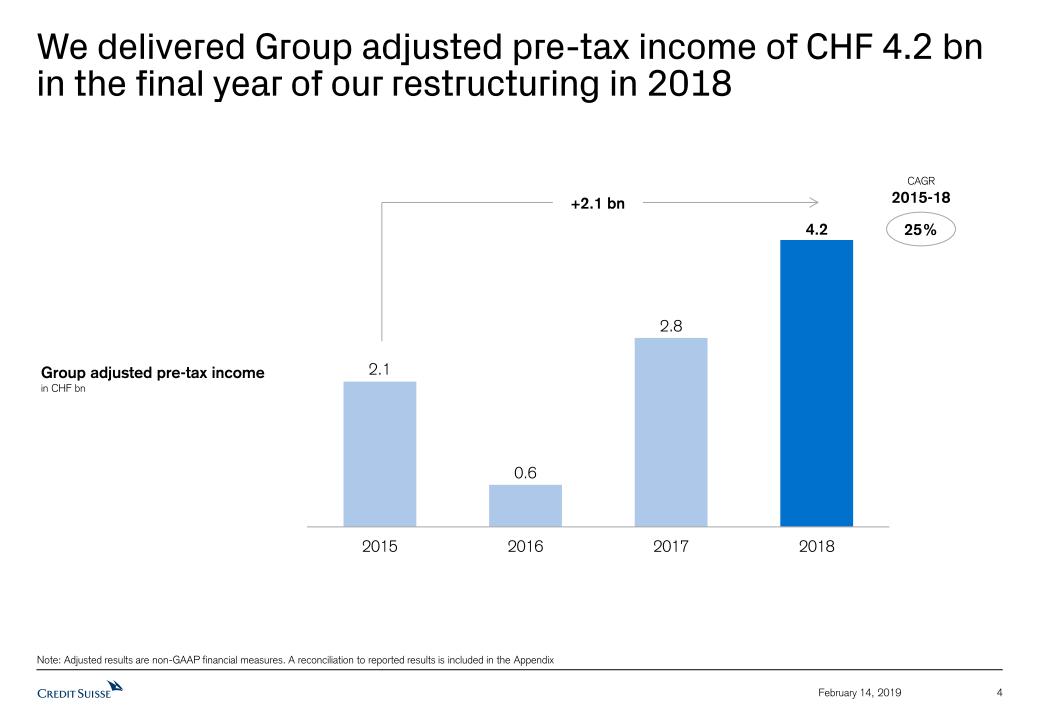

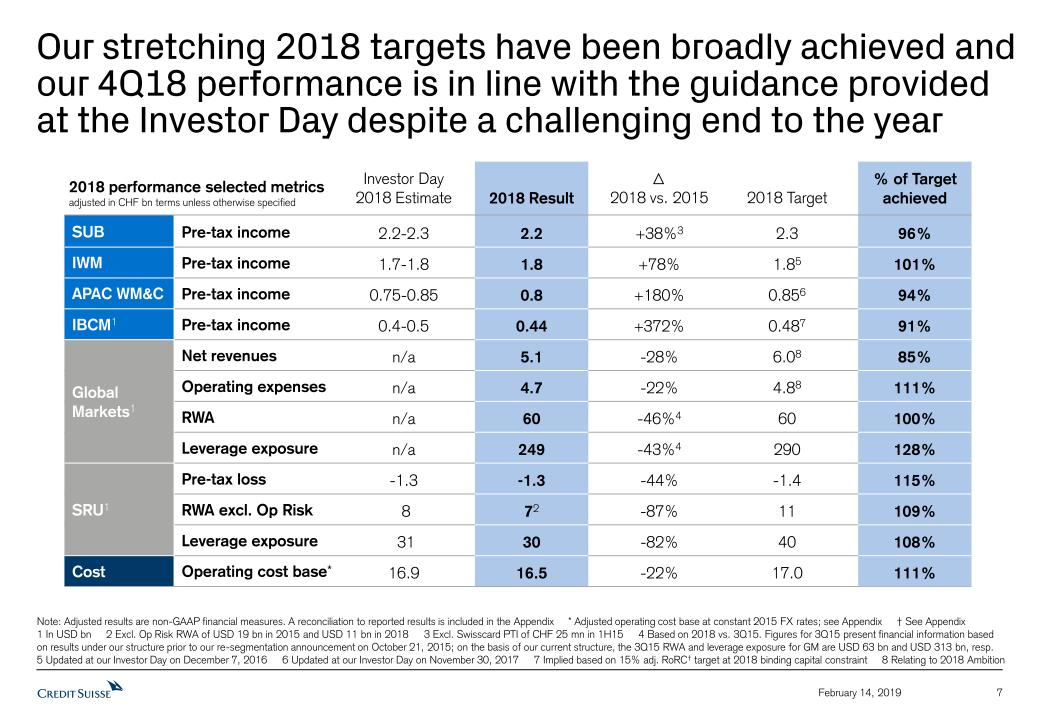

| ■ | Adjusted* pre-tax income of CHF 4.2 billion, 52% higher than 2017 |

| ■ | Net income attributable to shareholders of CHF 2.1 billion for 2018, delivering first annual post-tax profit since 2014; achieving diluted earnings of CHF 0.78 per share |

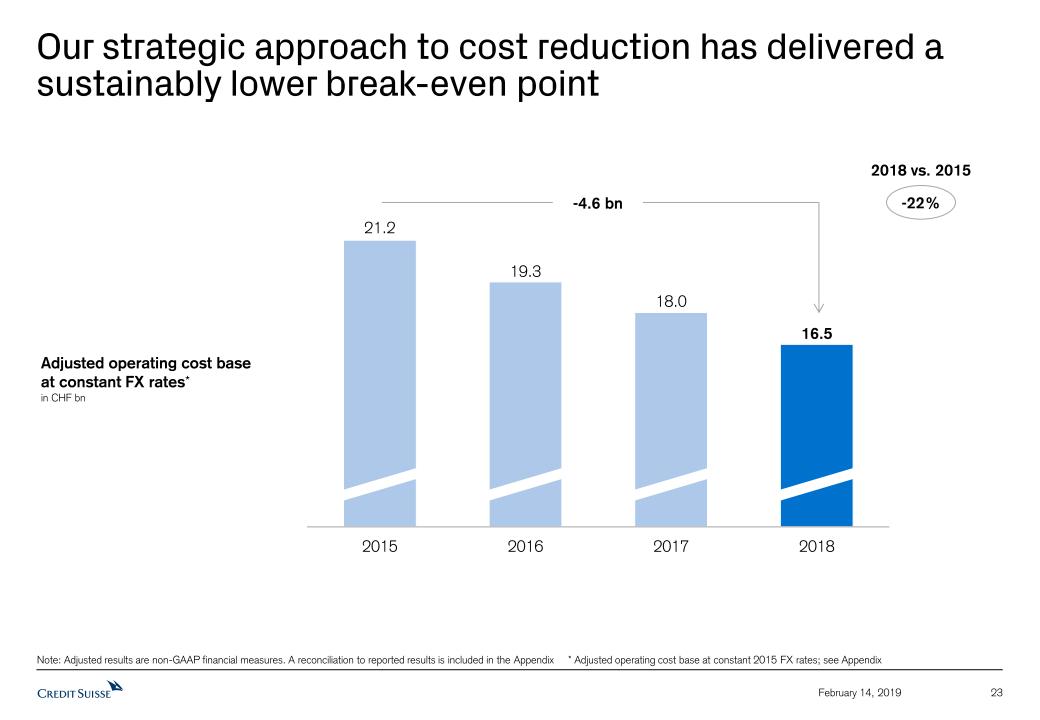

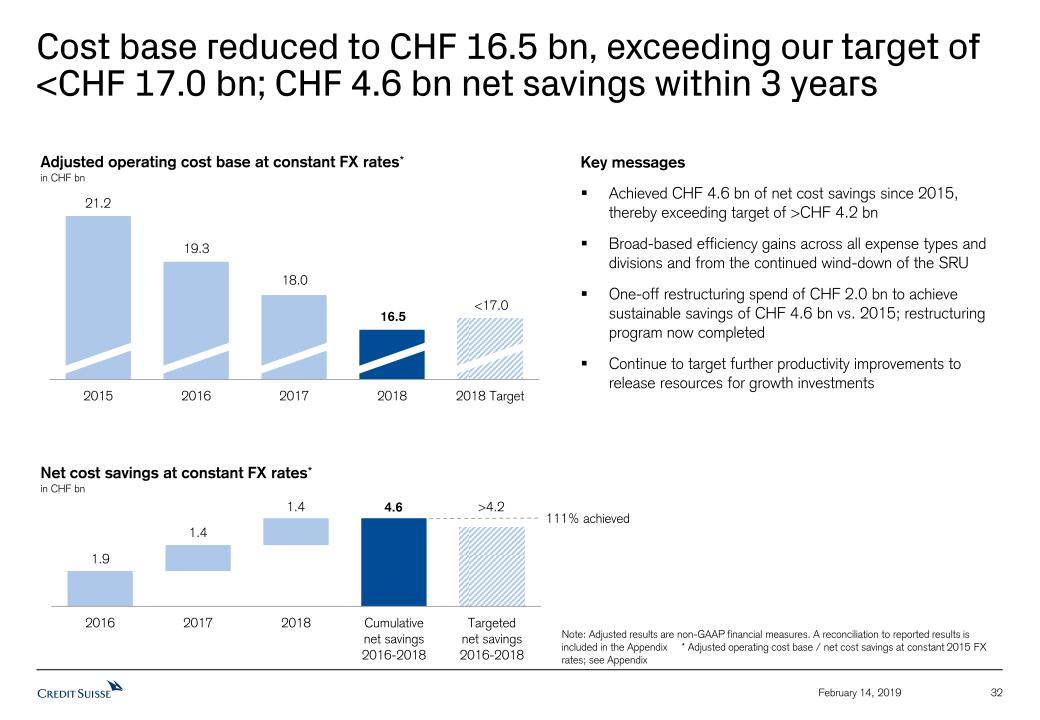

| ■ | Adjusted* operating cost base of CHF 16.5 billion for 2018, beating the target of CHF 17 billion by end-2018; cumulative net cost savings of CHF 4.6 billion since end-2015, exceeding target of greater than CHF 4.2 billion by 11% |

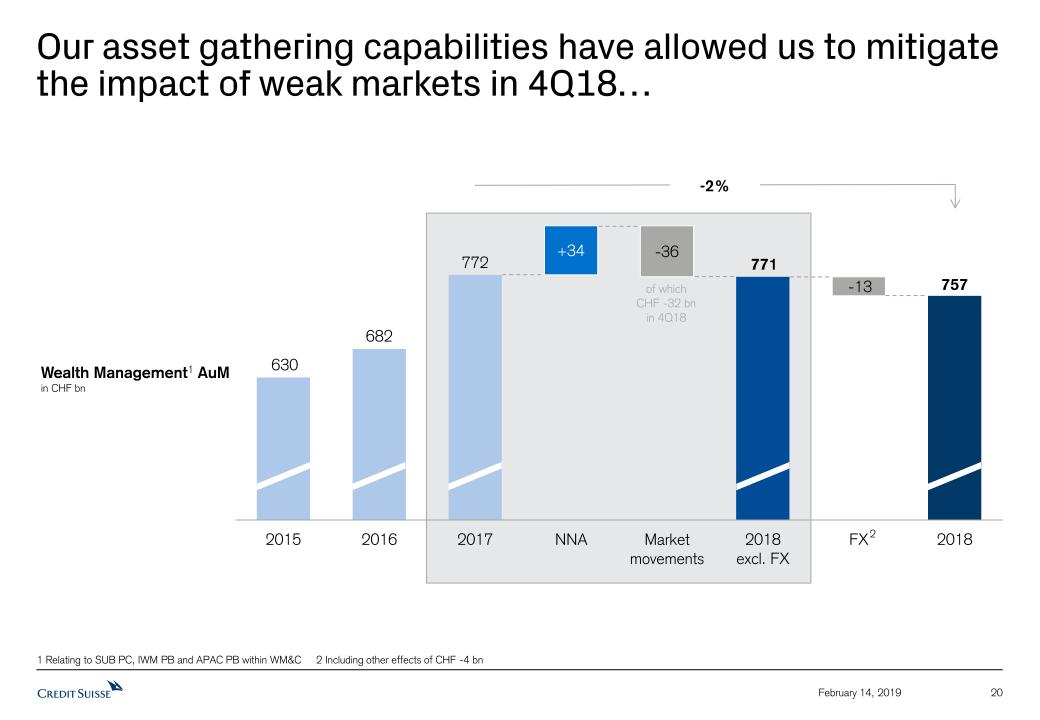

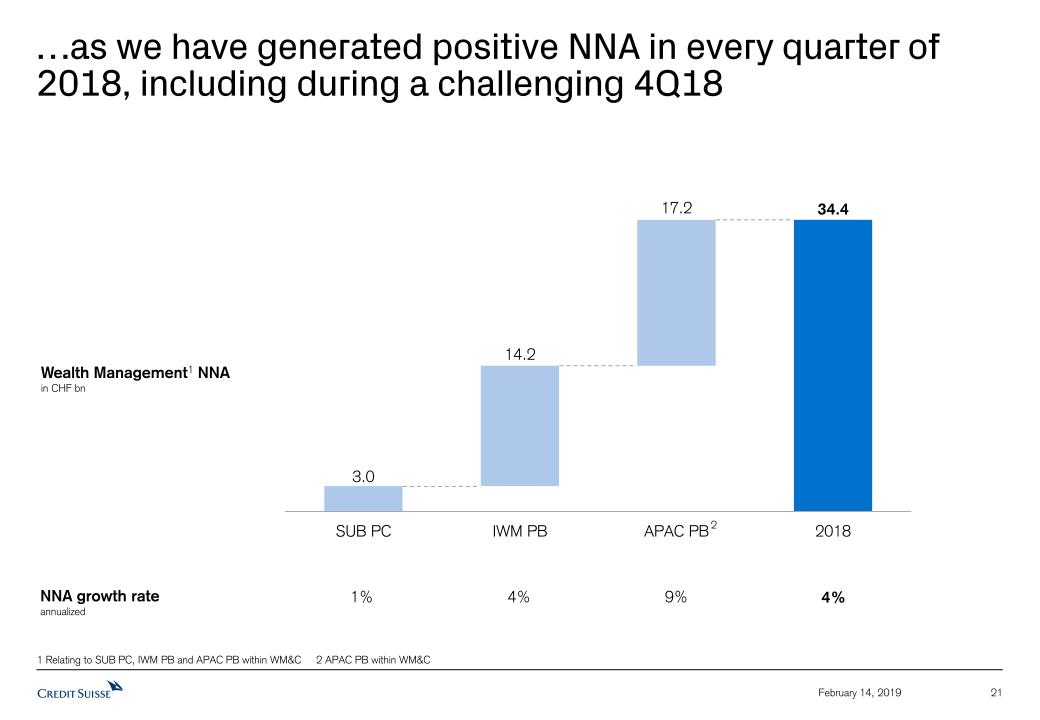

| ■ | Strong annual inflows with CHF 34.4 billion of Wealth Management Net New Assets (NNA) in 2018, the result of inflows in each quarter; total NNA of CHF 56.5 billion, up 49% against 2017 |

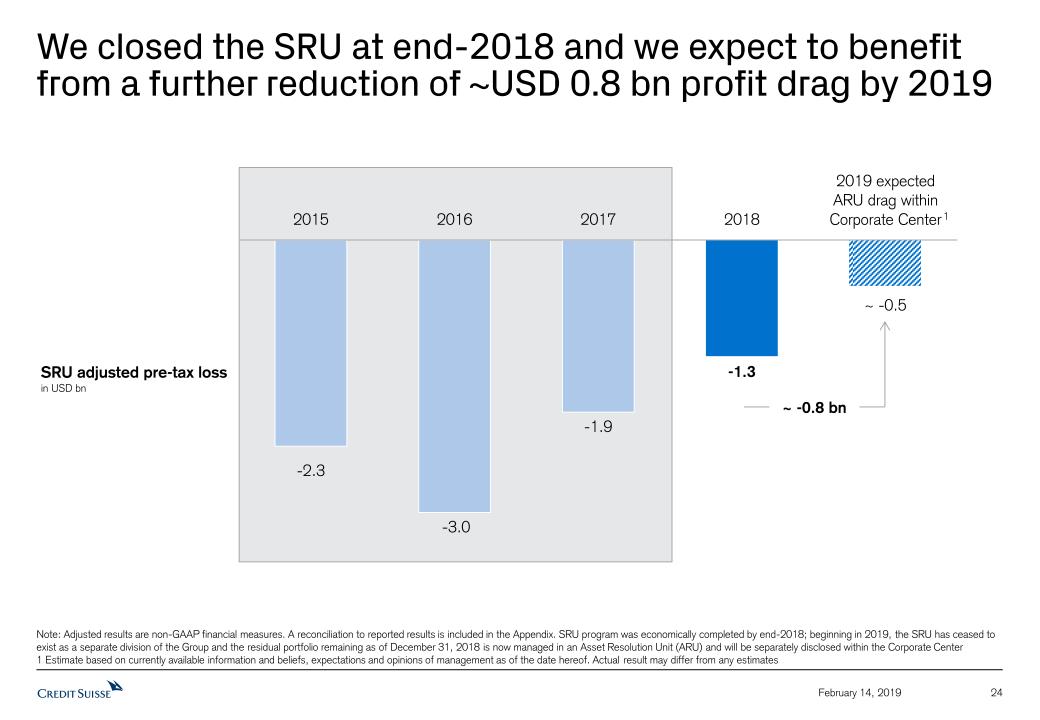

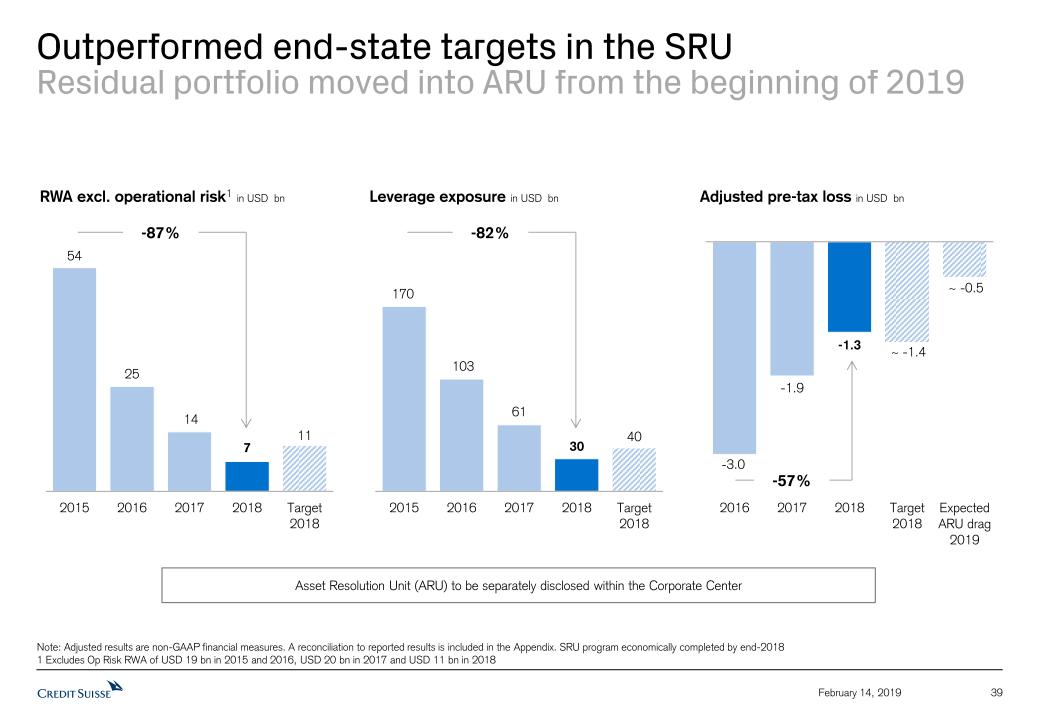

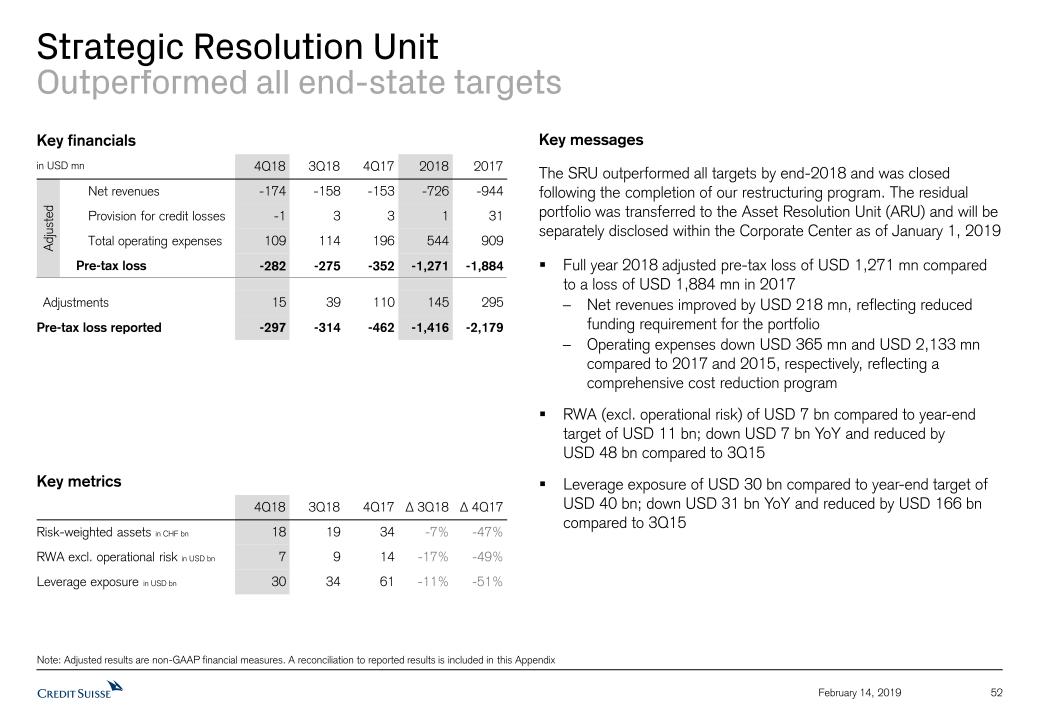

| ■ | Strategic Resolution Unit (SRU) successfully closed, outperforming end-state targets; adjusted* annual pre-tax loss of USD 1.3 billion compared to USD 3.0 billion in 2016; projected to fall to an adjusted* pre-tax loss of approximately USD 0.5 billion in 2019 |

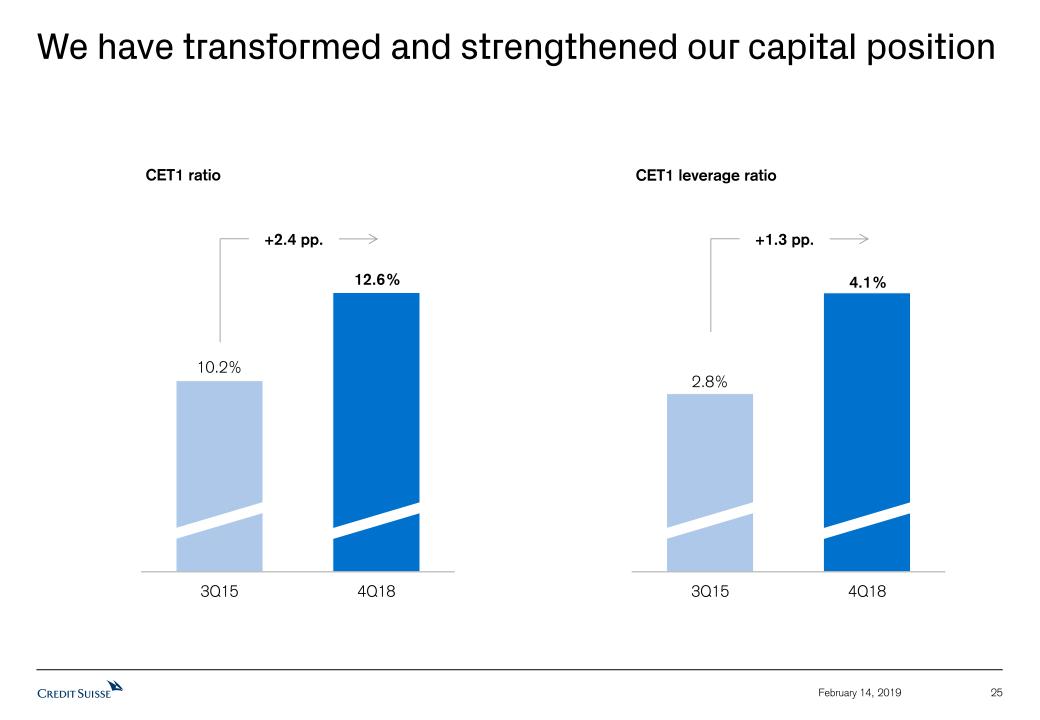

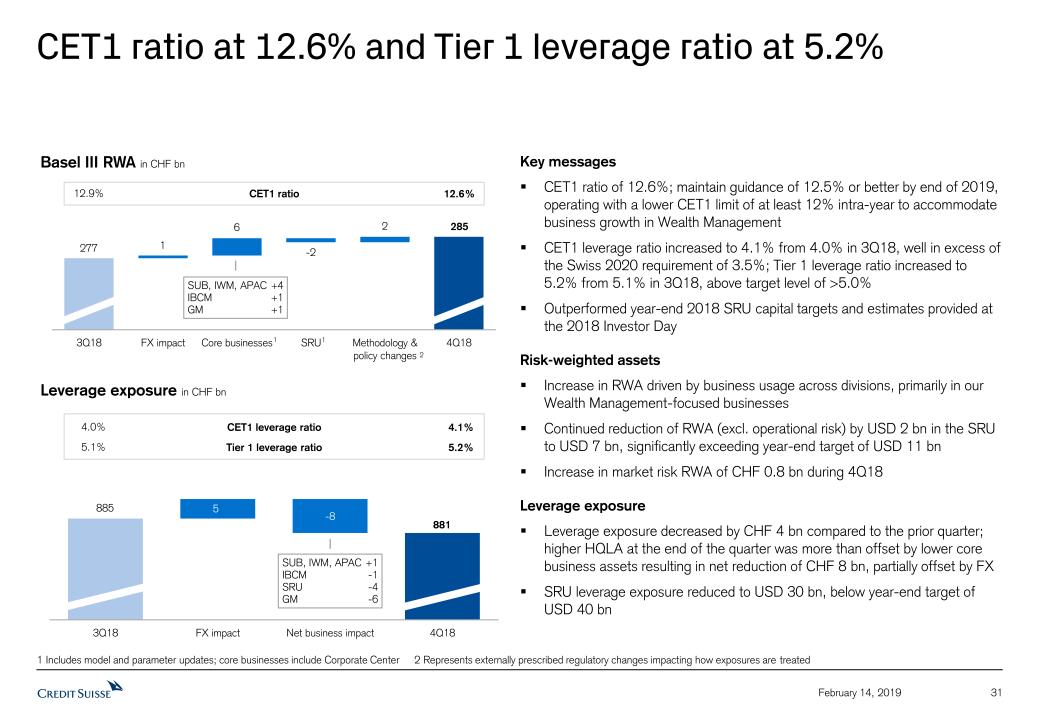

| ■ | Strong capital position; CET1 ratio of 12.6%; look-through Tier 1 leverage ratio of 5.2%, up from 5.1% at end-3Q18 |

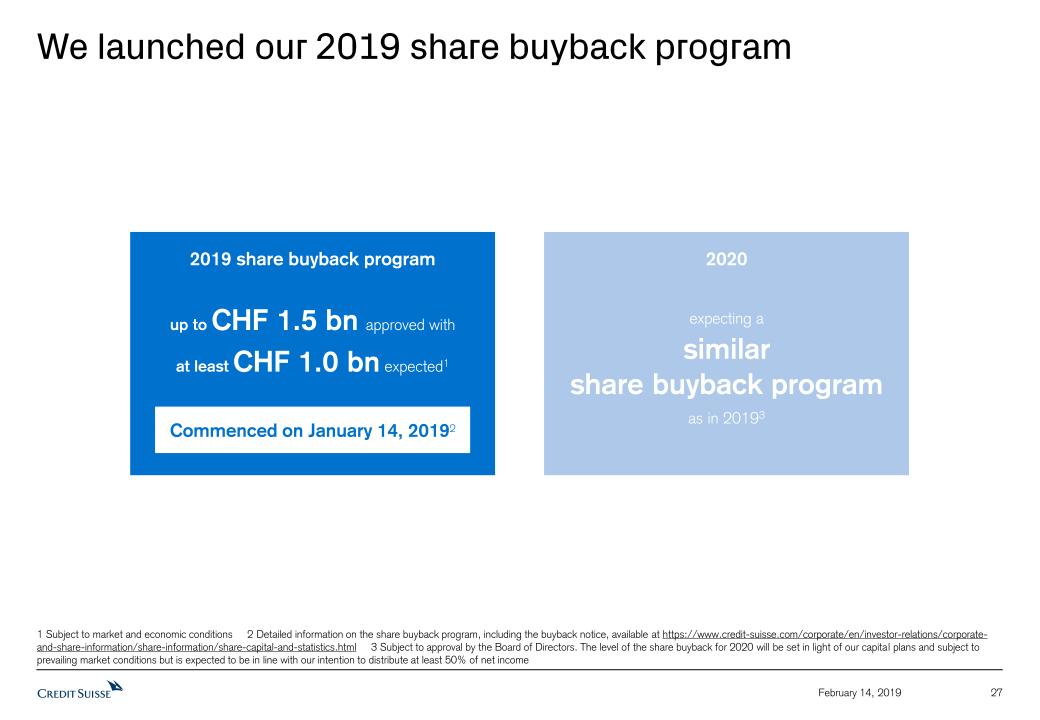

| ■ | Share buyback announced in December 2018 and up to CHF 1.5 billion in 2019 approved, with at least CHF 1.0 billion expected, subject to market and economic conditions; 13.9 million shares, worth CHF 170 million, repurchased in January 2019 |

Page 1

Media Release Zurich, 14 February, 2019 | |

Fourth quarter 2018 highlights:

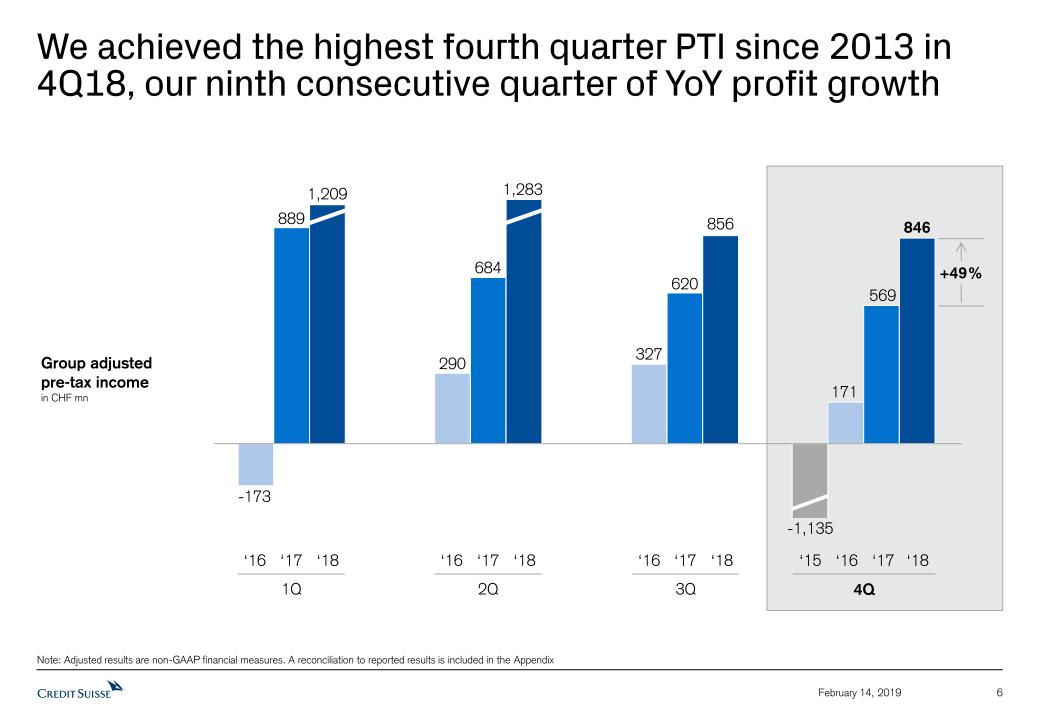

| ■ | Highest fourth quarter adjusted* pre-tax income since 2013; adjusted* pre-tax income of CHF 846 million, 49% higher than the fourth quarter of 2017; reported pre-tax income of CHF 628 million, a more than four-fold increase year on year |

| ■ | Eleventh consecutive profitable quarter, and ninth consecutive quarter of year on year profit increase, both on an adjusted* basis |

| ■ | Lowest quarterly adjusted* operating expenses in last five years, at CHF 3.9 billion |

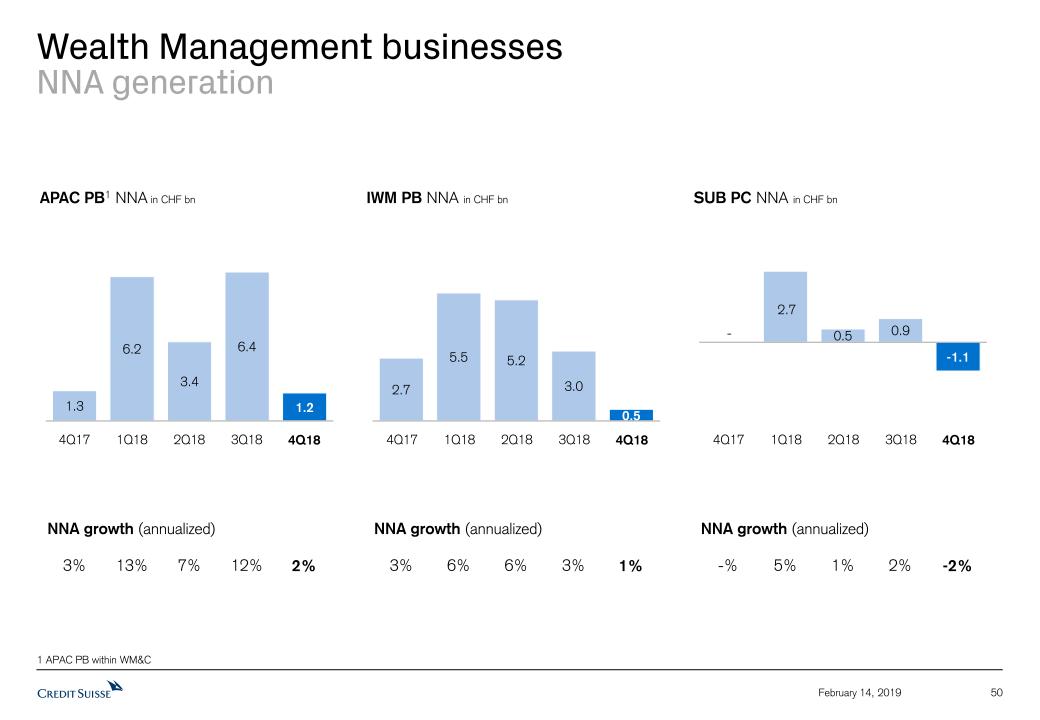

| ■ | Total Wealth Management NNA of CHF 600 million in the quarter, comprising CHF 1.2 billion of NNA in APAC Private Banking in spite of material deleveraging, CHF 0.5 billion in IWM Private Banking, and an outflow of CHF 1.1 billion in SUB Private Clients reflecting seasonal patterns |

| ■ | Total Wealth Management-related NNA of CHF 3.4 billion for the quarter; total Assets under Management (AuM) of CHF 1.35 trillion at the end of the quarter |

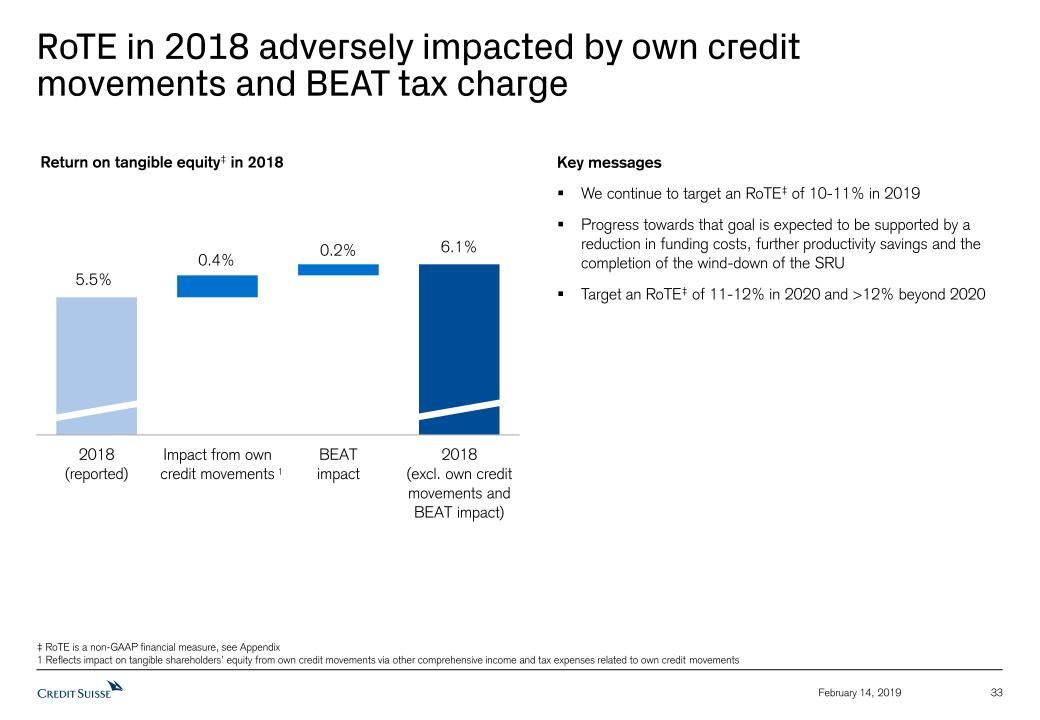

| ■ | Net income attributable to shareholders of CHF 292 million for the quarter, reflecting substantially greater tax charge as a result of a higher effective tax rate and CHF 65 million for the impact from US Base Erosion and Anti-Abuse Tax (BEAT), leading to an effective tax rate for 2018 of 40% |

Key metrics

In CHF millions

| | 2018 | 2017 | 4Q18 | 4Q17 |

| Net revenues | 20,920 | 20,900 | 4,801 | 5,189 |

Of which Wealth Management-related | 13,268 | 12,829 | 3,281 | 3,308 |

| Of which IBCM | 2,177 | 2,139 | 475 | 565 |

| Of which Markets activities | 6,083 | 6,733 | 1,136 | 1,422 |

| Total operating expenses | 17,270 | 18,897 | 4,114 | 5,005 |

| Pre-tax income | 3,405 | 1,793 | 628 | 141 |

| Adjusted* net revenues | 20,821 | 20,913 | 4,786 | 5,217 |

| Adjusted* total operating expenses | 16,382 | 17,941 | 3,881 | 4,605 |

| Adjusted* pre-tax income | 4,194 | 2,762 | 846 | 569 |

| Net income attributable to shareholders | 2,057 | -983 | 292 | -2,126 |

Page 2

Media Release Zurich, 14 February, 2019 | |

Tidjane Thiam, Chief Executive Officer of Credit Suisse, commented:

“We have achieved Group reported pre-tax income of CHF 3.4 billion, 90% higher than in 2017. Net income attributable to shareholders reached CHF 2.1 billion. This is our first annual post-tax profit since 2014 and it was only achieved thanks to the support of our clients, investors and other key stakeholders and the hard work of our teams.

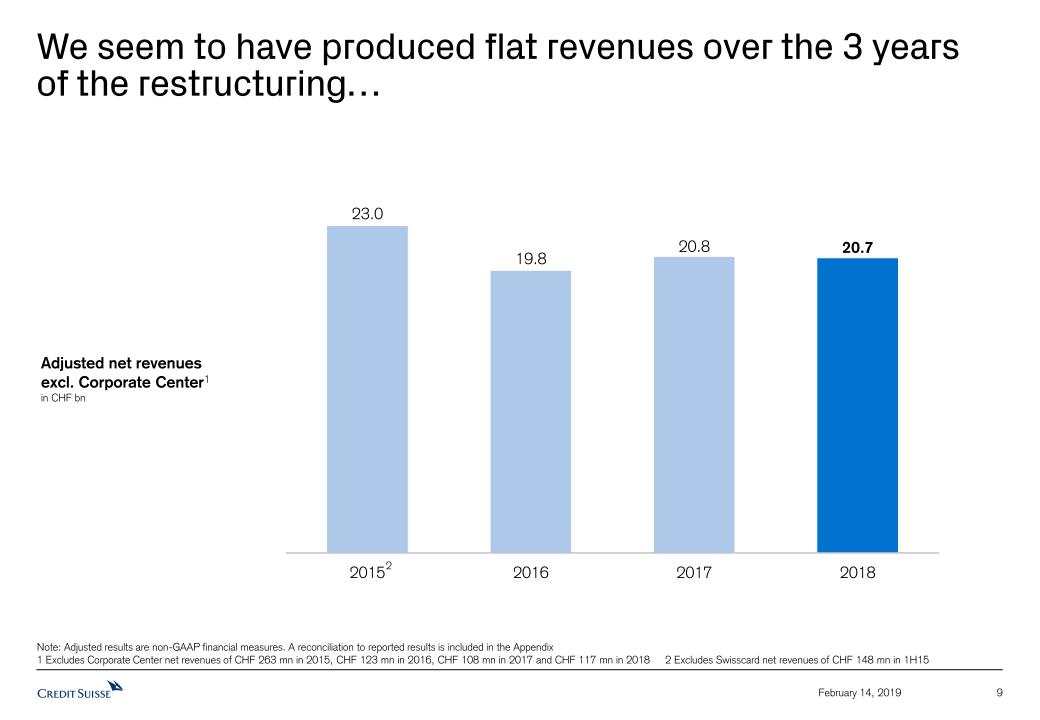

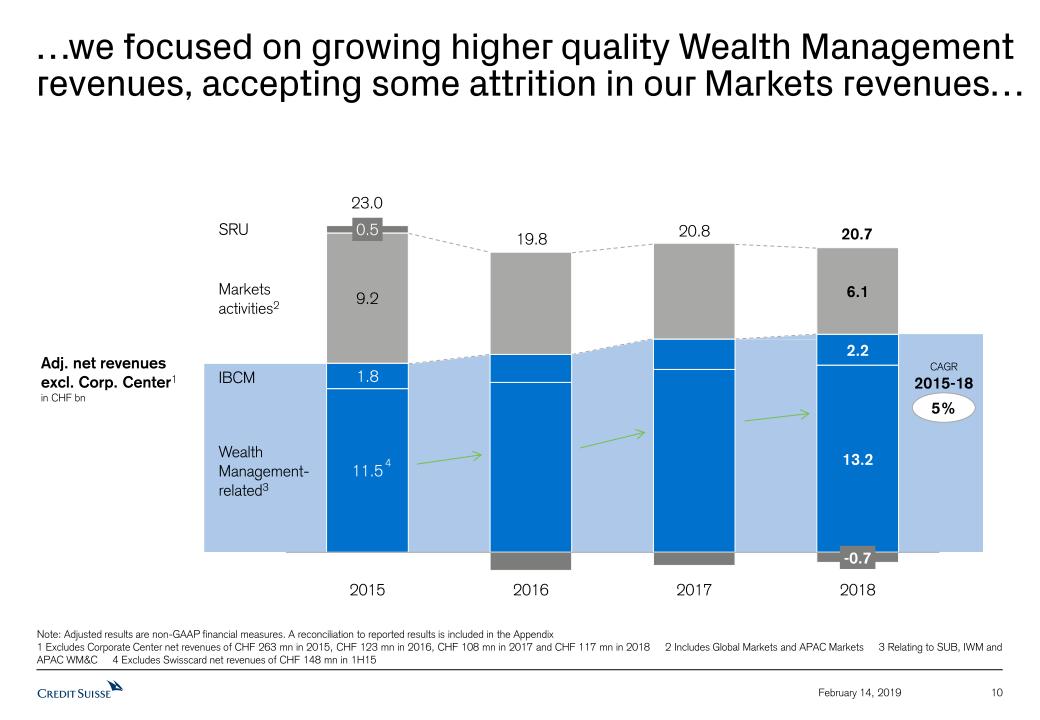

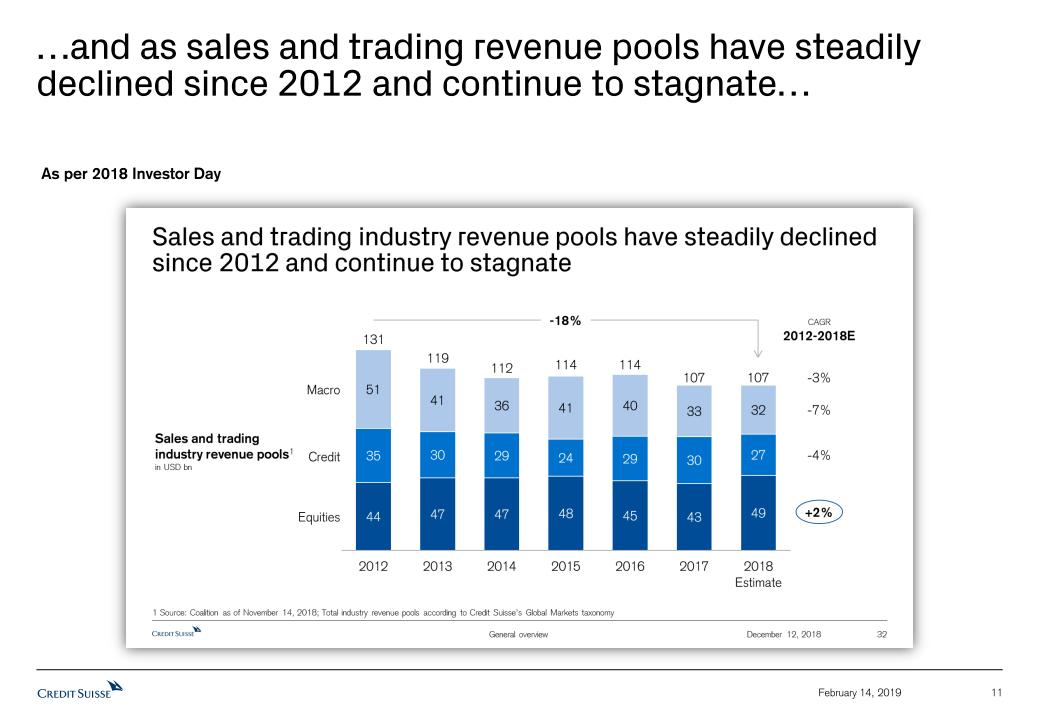

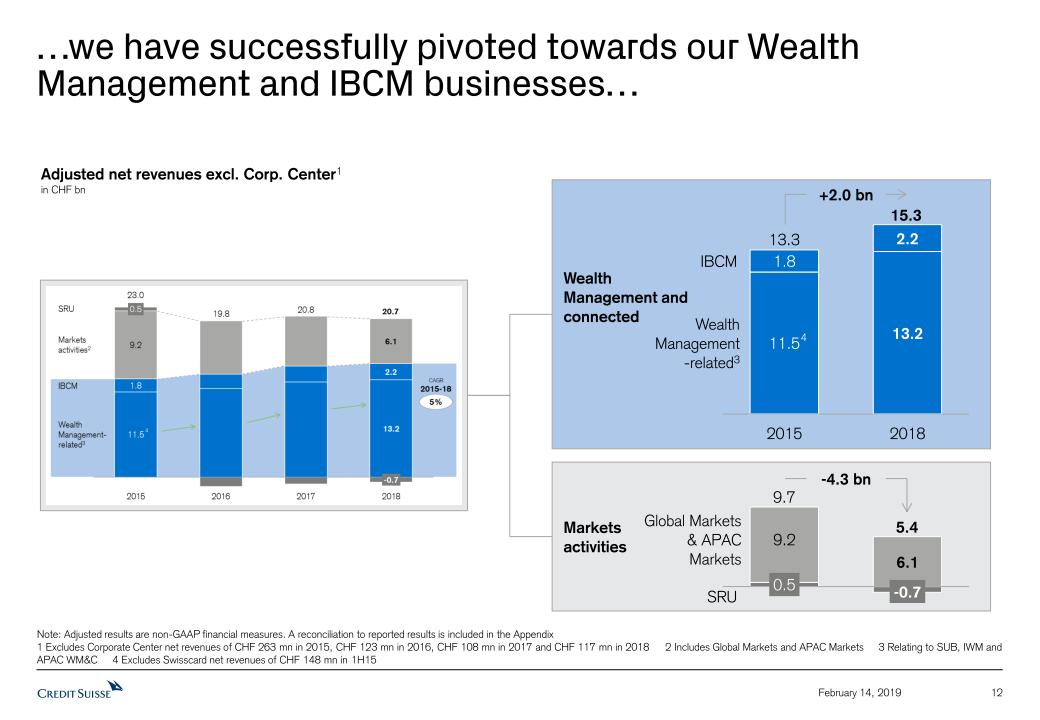

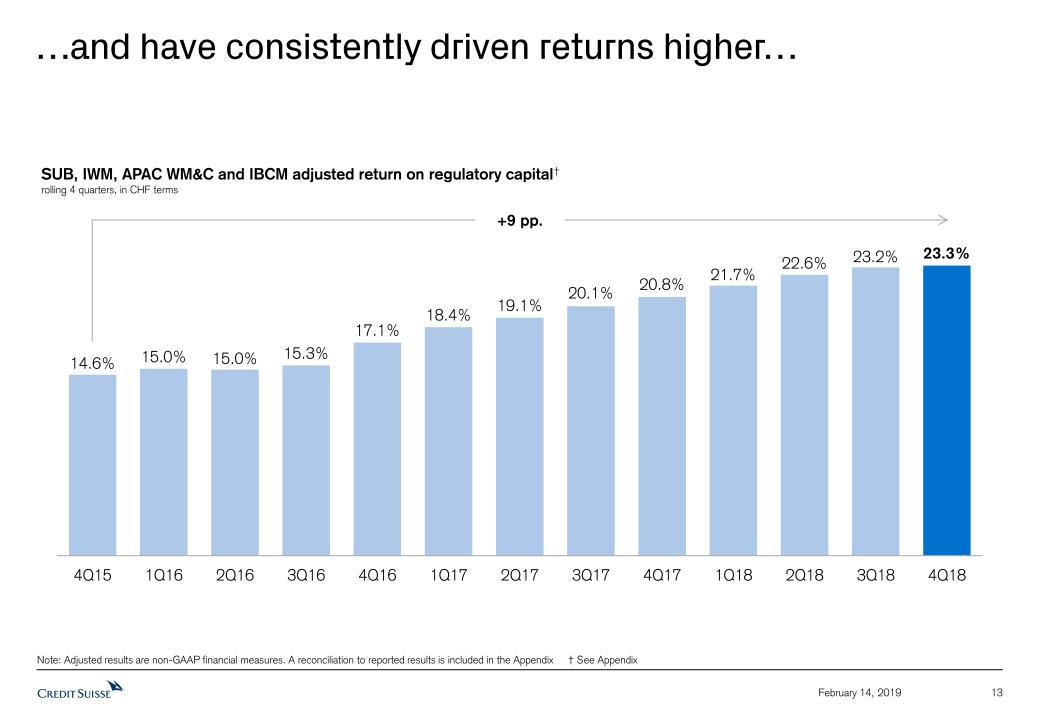

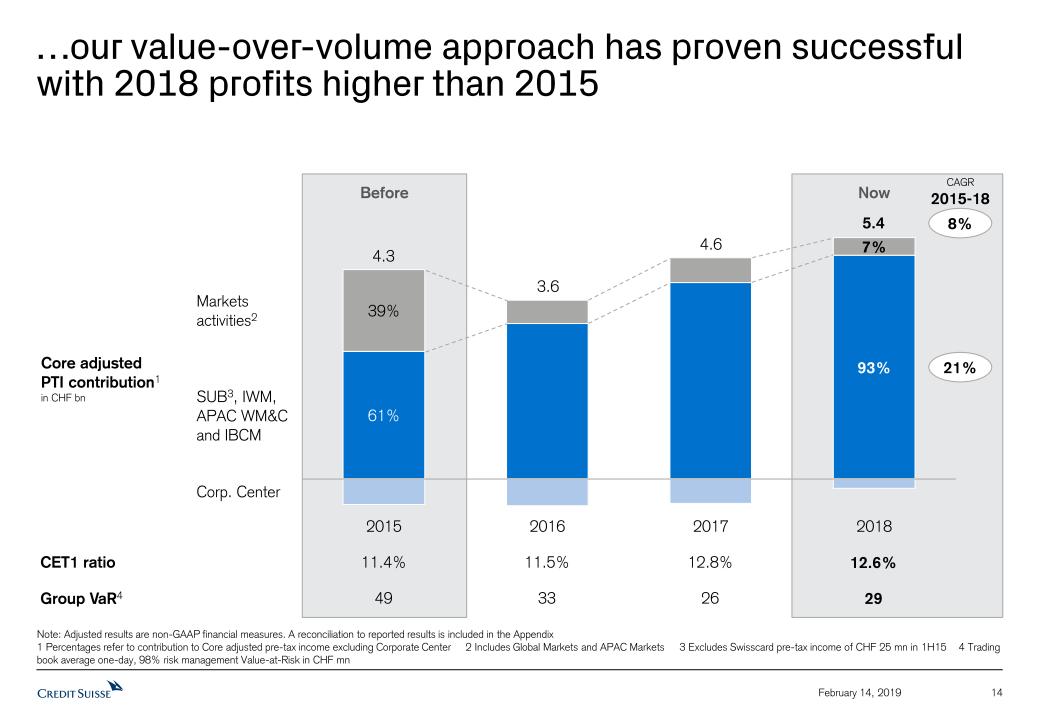

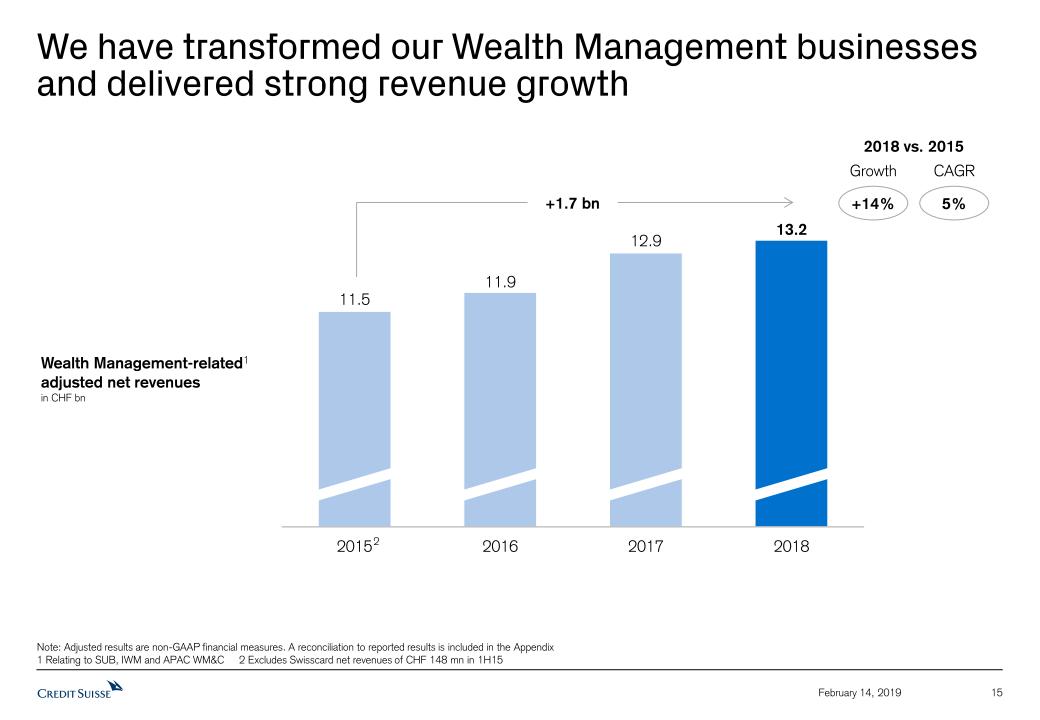

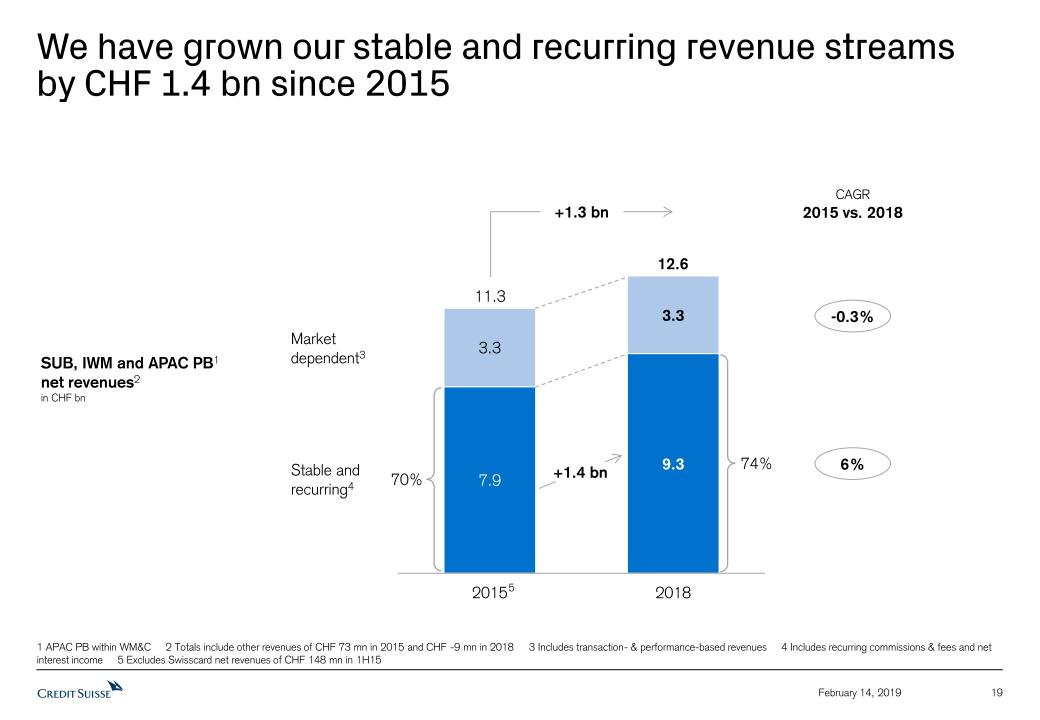

“Our restructuring, initiated in the fourth quarter of 2015, three years ago, was aimed at making the bank more resilient in challenging times by reducing risks, cutting costs and strengthening our capital base. We also wanted to grow our Wealth Management-related revenues and our relatively stable streams of income: we wanted to go back to profitable, compliant, quality growth. We wanted to right-size our more market dependent activities and deal resolutely with our largest legacy issues. These objectives have broadly been achieved and our performance in the final quarter of 2018, our best fourth quarter since 2013, illustrates how much the bank has changed since 2015.

“We saw during the fourth quarter the continued benefits of positive operating leverage in challenging market conditions as well as the benefits of our de-risking efforts as we recorded no material losses in our credit activities, in spite of large increases in spreads. We delivered a profit in one of our most challenging fourth quarters in years, with an adjusted* pre-tax income of CHF 846 million, up 49% year on year. The fourth quarter of 2018 was our ninth consecutive quarter of year on year profit growth and our eleventh consecutive profitable quarter, both on adjusted* basis. Our focus on risk and control helped ensure we remained resilient when navigating headwinds.

“The share buyback programme, which we announced at our 2018 Investor Day, began in January. We see the buyback – of up to CHF 1.5 billion in 2019, with at least CHF 1 billion expected – as a further signal that we have returned the bank to a solid footing.

“With lower costs, lower risks and more capital than at the start of our restructuring in 2015, we believe that the bank is now well positioned to withstand challenging market conditions when they arise, to capitalise on positive trends in the world economy and to grow revenue and profits, by meeting our clients’ needs.”

Outlook

In the fourth quarter of 2018, we experienced widespread volatility and lower activity levels across the market. This has improved so far this year, with signs of normalisation in the first six weeks of 2019, leading to a less negative trading environment than in the fourth quarter but still weaker than in the first quarter of 2018.

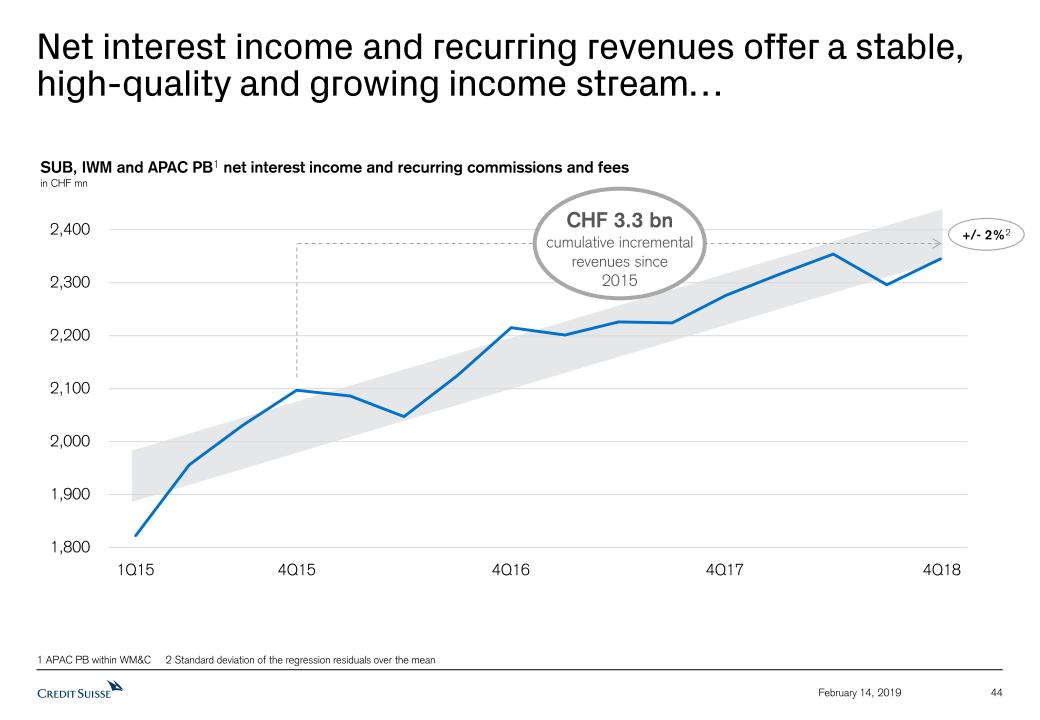

With the growth of our Wealth Management-related activities, our revenues increasingly come from more stable, more recurring and less market dependent sources and our Assets under Management have proven resilient. We have seen a recovery in Assets under Management during the month of January, and are now back to November levels, erasing the sharp falls experienced during the December dislocation.

In markets, the year began with a pronounced recovery in equity and debt markets from a very challenging December. Corporate earnings for the fourth quarter have been largely positive and commentary from the US Federal Reserve has been more cautious regarding future rate increases, underpinning a significant improvement in the credit markets. However, concerns over a US government shutdown, the US-China trade dispute and Brexit remain. This has resulted in a very slow

Media Release Zurich, 14 February, 2019 | |

start to the year in terms of Street fees across debt and equity products. There is a significant degree of uncertainty on the evolution during the rest of the first quarter and of the year.

The uncertain political climate in a number of major world economies and the resultant potential disruptions to world trade are clear concerns. With our lower cost base, the reduction of our risk profile, our flexible and diversified model and the benefits flowing from the closure of our Strategic Resolution Unit, we expect to remain resilient in the face of downside risks, and believe we are well positioned to take advantage of any potential upside.

Our strategy of focusing on our unique wealth management franchise with strong investment banking capabilities, low risk and a strong balance sheet is working, and should allow us to continue to support our clients and create growing value for our shareholders.

Page 4

Media Release Zurich, 14 February, 2019 | |

Changes to the Board of Directors

The Board of Directors of Credit Suisse Group AG is proposing Christian Gellerstad and Shan Li for election as new non-executive members of the Board of Directors at the Annual General Meeting on April 26, 2019.

Andreas Koopmann will not stand for re-election at the Annual General Meeting and Alexandre Zeller will step down from the Board of Directors with effect from February 28, 2019. All other members of the Board of Directors will stand for re-election for a further term of office of one year.

Regarding the nominations of Christian Gellerstad and Shan Li, Urs Rohner, Chairman of the Board of Directors of Credit Suisse Group, commented: “Christian Gellerstad, former CEO of Pictet Wealth Management, is a recognised professional with over twenty years of experience and has an excellent international knowledge of running a private banking business in mature as well as developing markets. He has extensive expertise in various leadership functions at Pictet in Switzerland and internationally. Shan Li, Chief Executive Officer of Silk Road Finance Corporation Limited, Hong Kong, has an excellent track record in the financial services industry, particularly in our important Chinese market. Shan Li started his career at Credit Suisse First Boston and for over two decades, held several executive management level positions including Chief International Business Advisor of the China Development Bank, Vice Chairman of UBS Investment Bank Asia, Chief Executive Officer of Bank of China International Holdings, and Chief China Economist at Goldman Sachs. Christian Gellerstad and Shan Li will ideally complement the strengths of the Board of Directors with their great expertise and long experience in their respective fields.”

Regarding the end of Andreas Koopmann's and Alexandre Zeller's tenure as members of the Board of Directors, Urs Rohner stated: “After 10 years on the Board of Directors of Credit Suisse Group and a total of more than two decades in various board and advisory functions at diverse Group entities, Andreas Koopmann will not stand for re-election at the Annual General Meeting. Following Alexandre Zeller's notification that he will join Lombard Odier as Managing Partner, the Board of Directors accepted his resignation from his functions at Credit Suisse Group AG and Credit Suisse (Schweiz) AG, with effect from February 28, 2019, to avoid conflicts of interest. We are very grateful to Andreas Koopmann and Alexandre Zeller for their important contributions to the Group, in particular during the recent restructuring of our bank. It has been a privilege for me and my colleagues to work with them on the Board and the various Committees. I wish both Andreas Koopmann and Alexandre Zeller all the best in their future endeavours."

Dividend

The Board of Directors will propose to shareholders at the Annual General Meeting on April 26, 2019 a distribution of CHF 0.2625 per share out of capital contribution reserves for the financial year 2018. This is in line with our intention to increase the ordinary dividend by at least 5% per annum. The distribution will be free of Swiss withholding tax and will not be subject to income tax for Swiss resident individuals holding the shares as a private investment. The distribution will be payable in cash.

Page 5

Media Release Zurich, 14 February, 2019 | |

Full year overview

At the end of 2018, Credit Suisse completed its three-year restructuring programme. When we announced the programme in October 2015, we had three main objectives. Firstly, there were some urgent matters to be addressed, namely our capital position, absolute level of risk, and our fixed cost base. Secondly, we defined a strategy for sustainable, compliant and profitable growth. Thirdly, our goal was to significantly upgrade our risk and compliance controls and improve our culture.

We have significantly strengthened our capital position since the end of 2015, we have lowered our operating cost base and exceeded our ambitious adjusted* operating cost base target of less than CHF 17 billion, and we have closed the SRU and significantly derisked our Global Markets business.

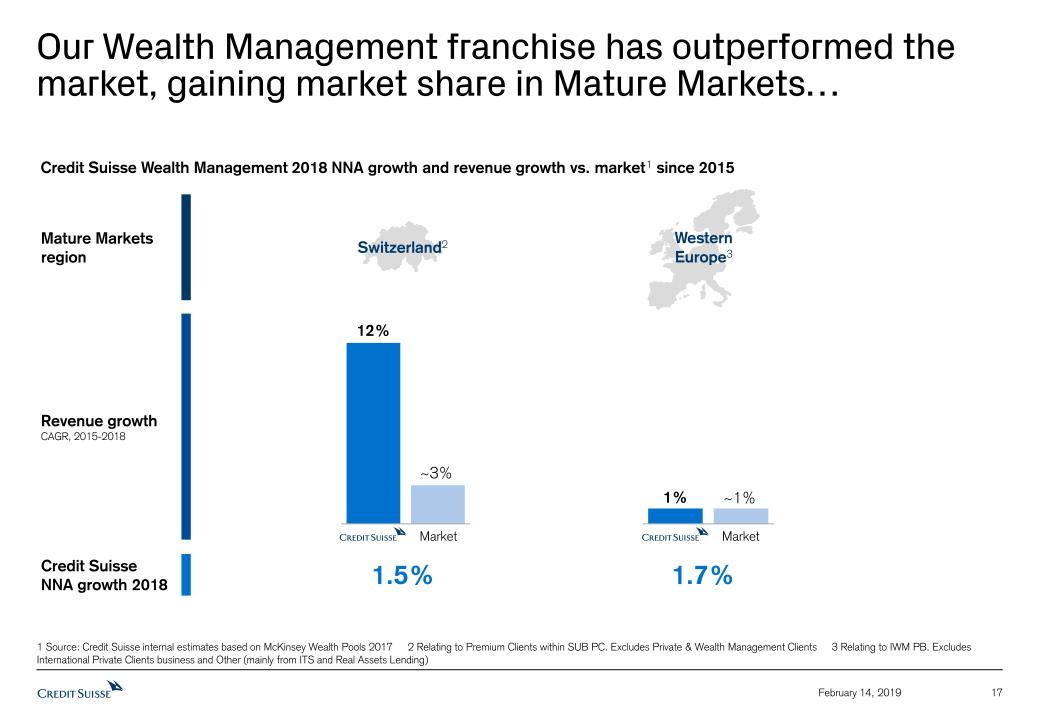

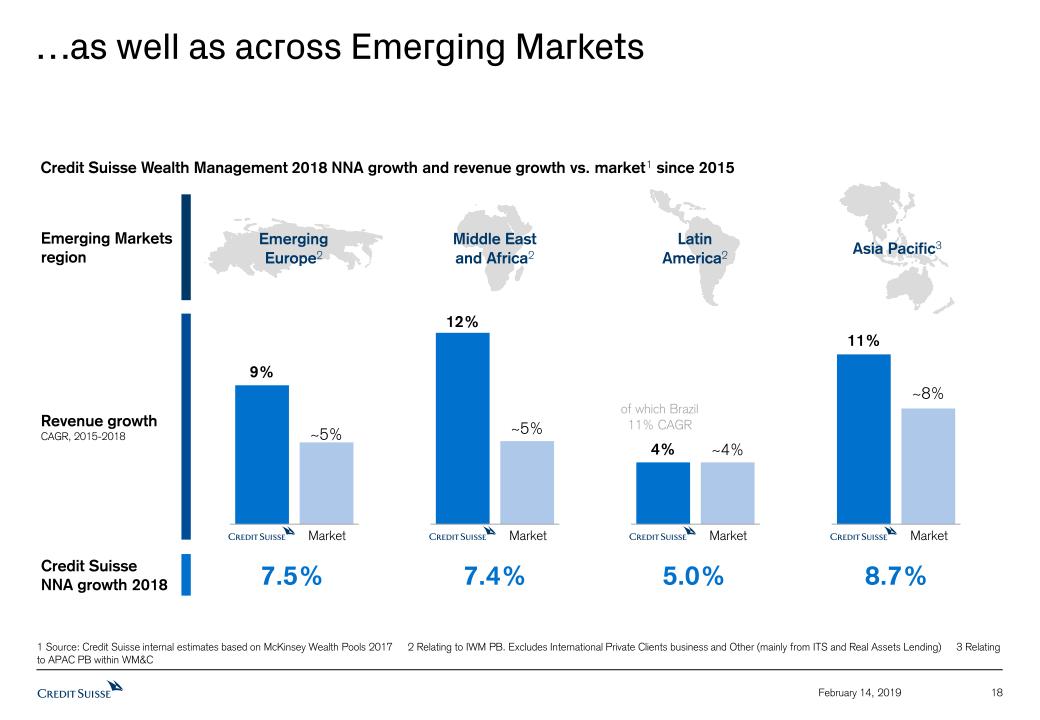

The continued growth of our Wealth Management-related businesses remained a key focus during 2018, attracting CHF 34.4 billion of Wealth Management NNA last year and delivering net inflows in each quarter. In our Wealth Management franchises, annualised NNA growth was 9% in Private Banking within APAC Wealth Management & Connected, 4% in Private Banking within International Wealth Management and 1% in Private Clients within Swiss Universal Bank. Across the Group, we attracted total NNA of CHF 56.5 billion, up 49% year on year.

Our focus on reducing costs in order to strengthen our ability to withstand a drop in revenues in a volatile industry continued in 2018, with an adjusted* operating cost base, at constant 2015 foreign exchange (FX) rates, of CHF 16.5 billion, compared to CHF 21.2 billion in 2015, a reduction of 22%, and well ahead of our target of less than CHF 17 billion by the end of 2018.

At the same time as growing our revenues and reducing our costs, we have reduced the overall level of risk. The SRU, which was closed on schedule at the end of the year, recorded an adjusted* pre-tax loss of USD 1.3 billion in 2018, down from USD 3.0 billion in 2016. Its residual portfolio, which was transferred to the Asset Resolution Unit, and will be separately disclosed within the Corporate Center as of January 1, 2019, is expected to have a pre-tax profit drag of approximately USD 0.5 billion in 2019.

At a Group-wide level, we exceeded our targets for our CET1 and leverage ratios and our US intermediate holding company completed its first public CCAR stress test in 2018, with the Board of Governors of the Federal Reserve System not objecting to its 2018 capital plan. Given the uncertain macro-economic environment over the last three years, these achievements underscore both the balance and resilience of our new operating model.

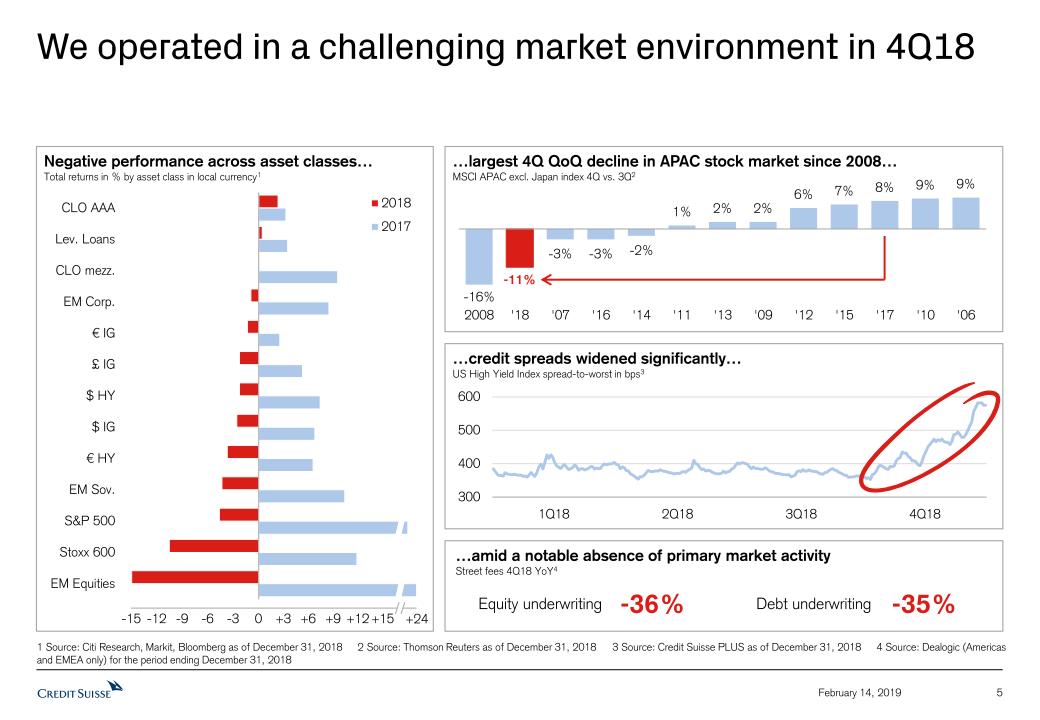

During 2018, we continued to deliver successfully on our objectives, against a backdrop of mixed market conditions. In the first half of 2018, markets were favourable and we experienced strong client activity levels. In the second half of the year, we faced more challenging market conditions and a significant drop in client activity resulting from a combination of factors, including increasing trade tensions, rising US interest rates and a rise in geopolitical uncertainty.

Despite this turbulence, we have reported full year pre-tax income of CHF 3.4 billion, up 90% from the previous year. This performance demonstrates the earnings power of the bank now that we have completed the restructuring programme and established Credit Suisse as a leading wealth manager with strong investment banking capabilities. We are well positioned to take advantage of a number of macro trends that we believe will remain supportive over the long term.

Page 6

Media Release Zurich, 14 February, 2019 | |

Detailed divisional summaries

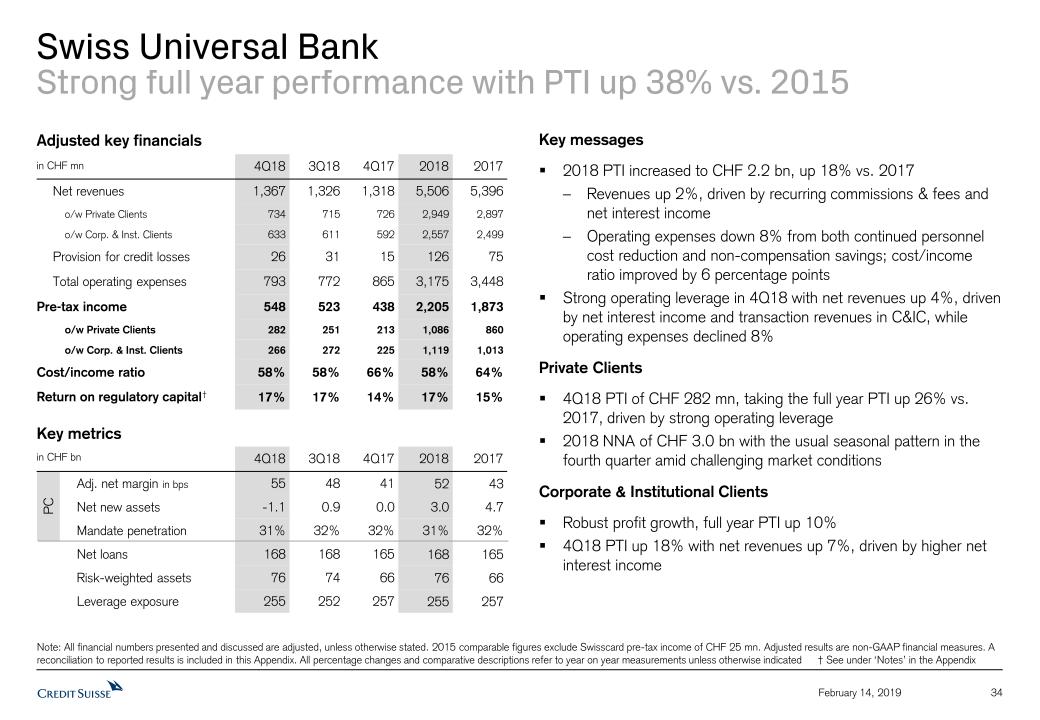

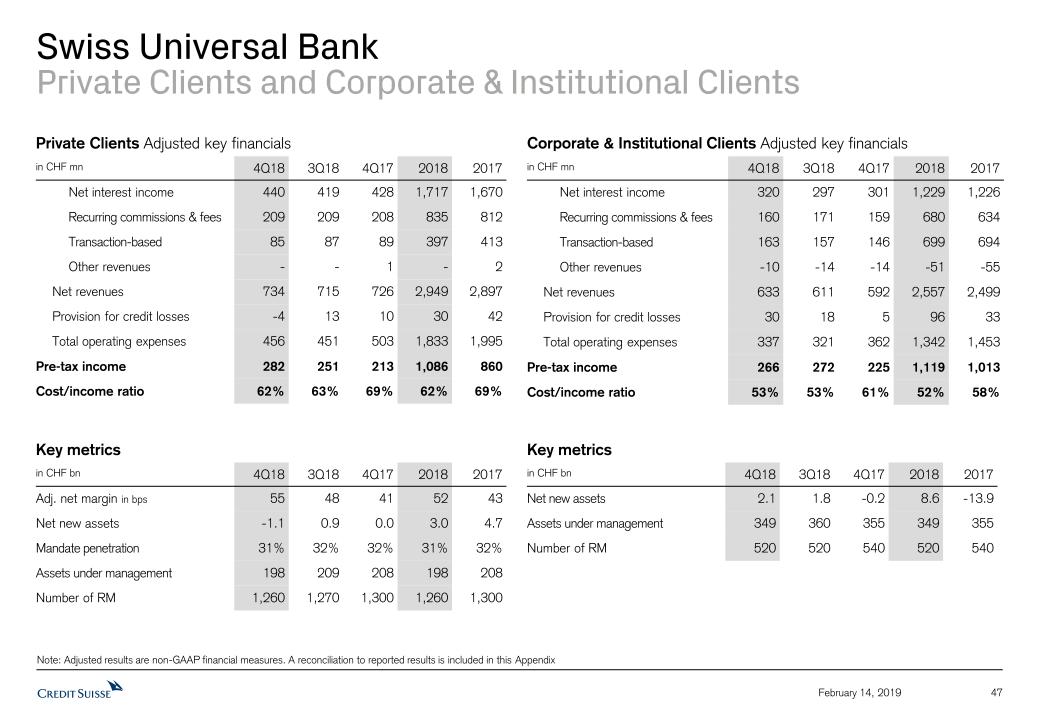

Swiss Universal Bank (SUB) had a strong FY18 with adjusted* pre-tax income up 18% at CHF 2.2 billion and an increase of 38%1 since the communication of our strategy at the end of 2015. Adjusted* pre-tax income totaled CHF 548 million for the quarter, up 25%, reflecting strong operating leverage. Adjusted* net revenues rose 2%, to CHF 5.5 billion in 2018, mainly due to higher recurring commissions and fees and higher net interest income. Adjusted* operating expenses decreased by 8%, with continued headcount reductions and further efficiency gains from digitalisation and automatisation. Digital onboarding of our clients, the automatisation for standard processes or our online mortgage renewal and our online leasing tool are some examples of our growing digital capabilities. We had strong NNA of CHF 11.6 billion in FY18, with contributions from both segments of the business, reflecting the strength of our franchise.

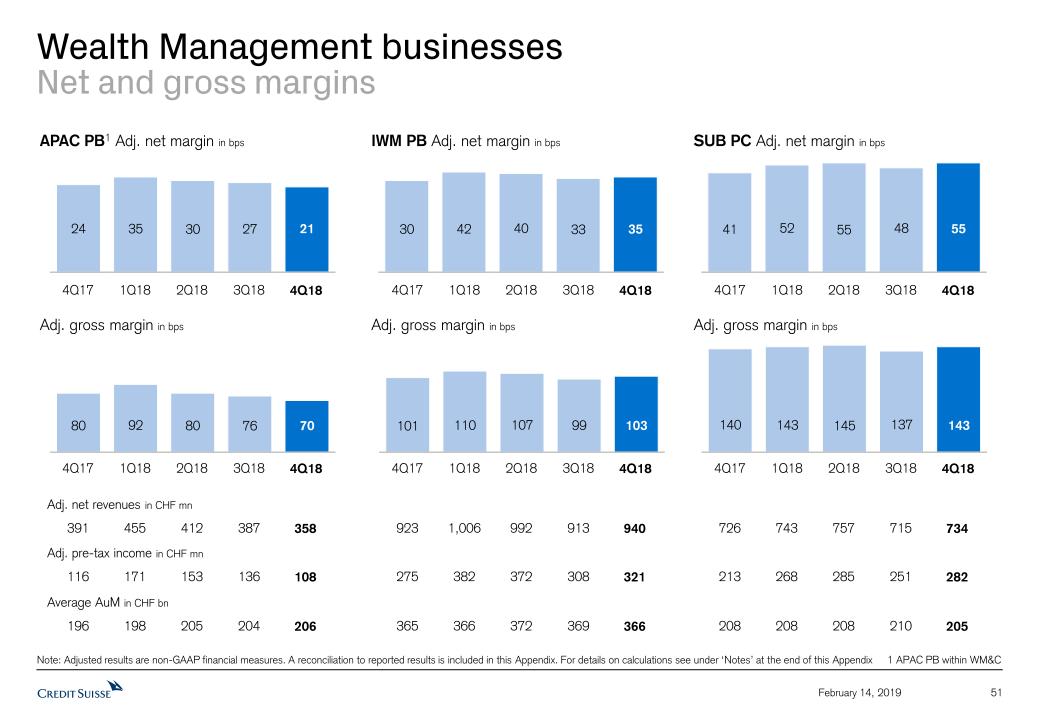

Private Clients reported adjusted* pre-tax income of CHF 282 million in 4Q18, contributing to FY18 adjusted* pre-tax income of CHF 1.1 billion, up 26%. This increase was primarily driven by solid net interest income and rigorous cost discipline, resulting in continued positive operating leverage. AuM were CHF 198 billion, down 5%, mainly driven by unfavourable market movements. However this was partially offset by NNA of CHF 3.0 billion in FY18, representing contributions from across the business.

In Corporate & Institutional Clients, adjusted* pre-tax income for FY18 rose 10% to CHF 1.1 billion, also supported by the strong NNA momentum in our pension business. For 4Q18, adjusted* pre-tax income was up 18% at CHF 266 million with net revenues up 7% at CHF 633 million. This was mainly driven by resilient net interest income and strong performance in our Swiss investment banking business. Adjusted* total operating expenses were CHF 337 million in 4Q18, down 7%, and were CHF 1.3 billion in FY18, down 8%, benefitting from continued digitalisation efforts.

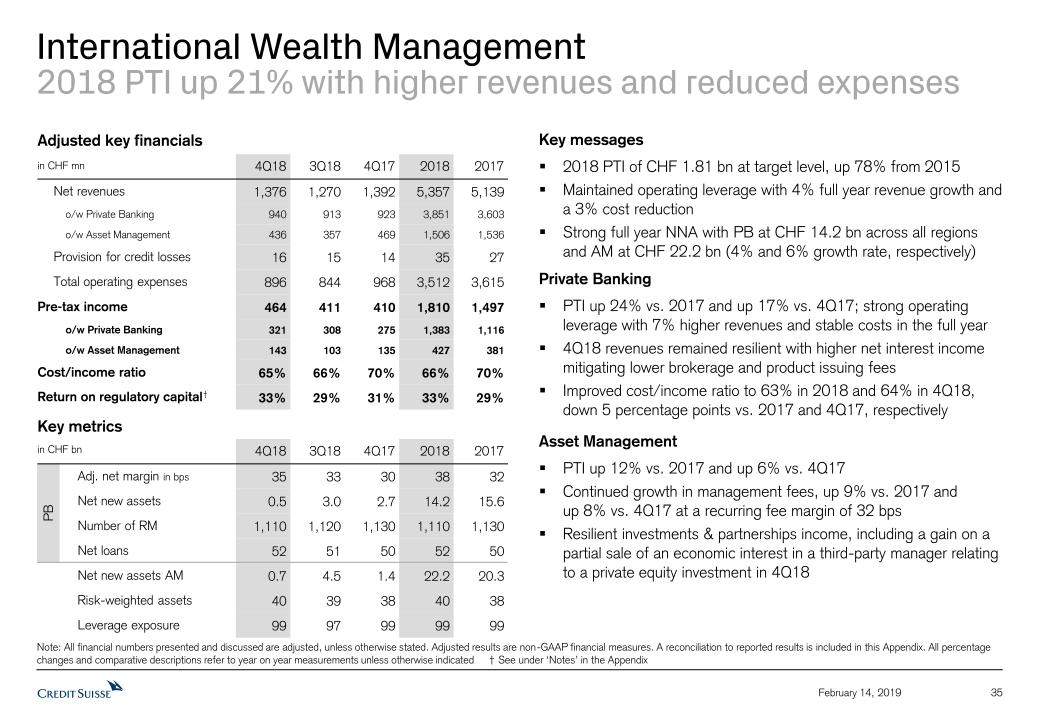

International Wealth Management (IWM) had a successful year with adjusted* pre-tax income up 21%, reaching our target of CHF 1.8 billion. Continued adjusted* revenue growth for FY18 of 4%, to CHF 5.4 billion, and an adjusted* total operating expense reduction of 3% were the drivers of this step change in profitability. Adjusted* pre-tax income for 4Q18 was CHF 464 million, up 13% compared to 4Q17, as we kept adjusted* net revenues stable in a more challenging environment and reduced adjusted* total operating expenses by 7%. Adjusted* return on regulatory capital reached 33% both in 4Q18 and FY18, while the adjusted* cost/income ratio improved to 65% for the quarter and 66% for the year.

In Private Banking, adjusted* pre-tax income was up 24% at CHF 1.4 billion for FY18 driven by 7% revenue growth, with higher revenues across all major categories, as well as stable adjusted* total operating expenses. Adjusted* pre-tax income for the quarter was CHF 321 million, up 17% from 4Q17, with higher net interest income offsetting lower brokerage and product issuing fees. Our FY18

adjusted* net margin was 38 basis points, up 6 basis points year on year. NNA in FY18 totaled CHF 14.2 billion, representing a growth rate of 4%, with solid inflows, especially from emerging markets.

In Asset Management, adjusted* pre-tax income in FY18 grew by 12% to CHF 427 million, mostly reflecting lower adjusted* total operating expenses that were down 7% year on year. Adjusted* net revenues for FY18 were down 2% year on year, as continued growth in management fees, of 9%, at resilient margins, was offset by lower performance fees and investment-related gains, with a market correction across asset classes in the fourth quarter. NNA for the year stood at CHF 22.2 billion,

Page 7

Media Release Zurich, 14 February, 2019 | |

representing a growth rate of 6% with broadly distributed contributions from traditional and alternative investments.

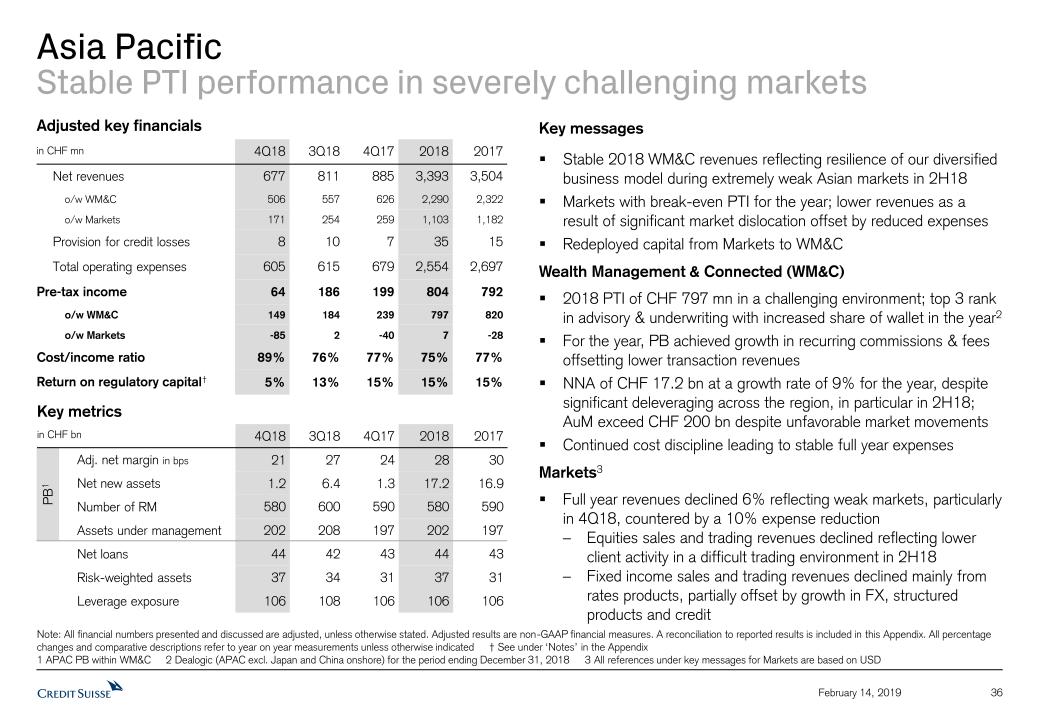

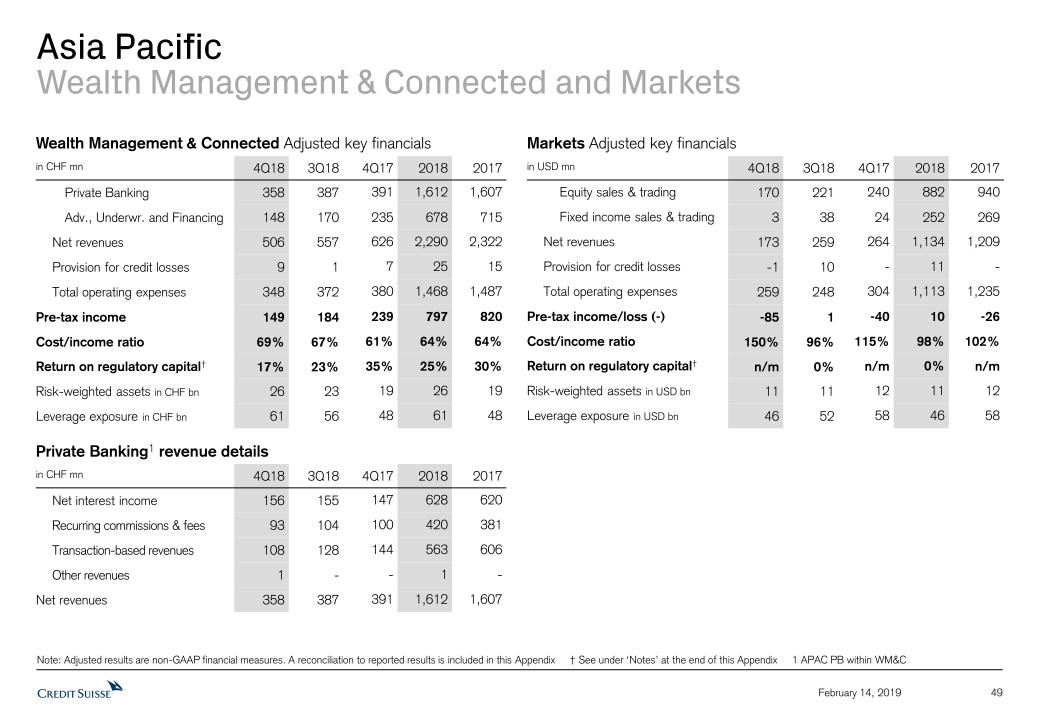

Asia Pacific (APAC) generated adjusted* pre-tax income of CHF 804 million in FY18, slightly higher than the prior year, and delivered adjusted* return on regulatory capital of 15%. Our performance in 2018 reflects the resilience of our wealth management strategy and our leading business franchises within APAC, despite significant dislocation across Asian markets, particularly in the second half of the year. Adjusted* pre-tax income for 4Q18 was CHF 64 million, compared to CHF 199 million in 4Q17.

APAC Wealth Management & Connected (WM&C) reported adjusted* pre-tax income of CHF 797 million in FY18, down 3%, and maintained stable revenues in challenging market conditions. Private Banking achieved higher recurring commissions and fees for FY18, largely offsetting lower transaction-based revenues. It ended the year with AuM of CHF 202 billion and NNA of CHF 17.2 billion, with net new assets offsetting negative market movements. Advisory, underwriting, and financing revenues for FY18 were down 5% year on year, mainly driven by lower financing revenues, while fees from M&A transactions and equity underwriting revenues were higher. APAC advisory and underwriting maintained its top 3 ranking2 in terms of share of wallet.

APAC Markets reported adjusted* pre-tax income of USD 10 million in FY18, an improvement from the adjusted* pre-tax loss of USD 26 million in FY17, despite more challenging market conditions in 2018, particularly in the second half. Performance was supported by continued cost discipline, with adjusted* operating expenses down 10%, while revenues for FY18 were USD 1.1 billion, down 6%, which is in line with the guidance we provided at our 2018 Investor Day of 8% to 10% lower than FY17.

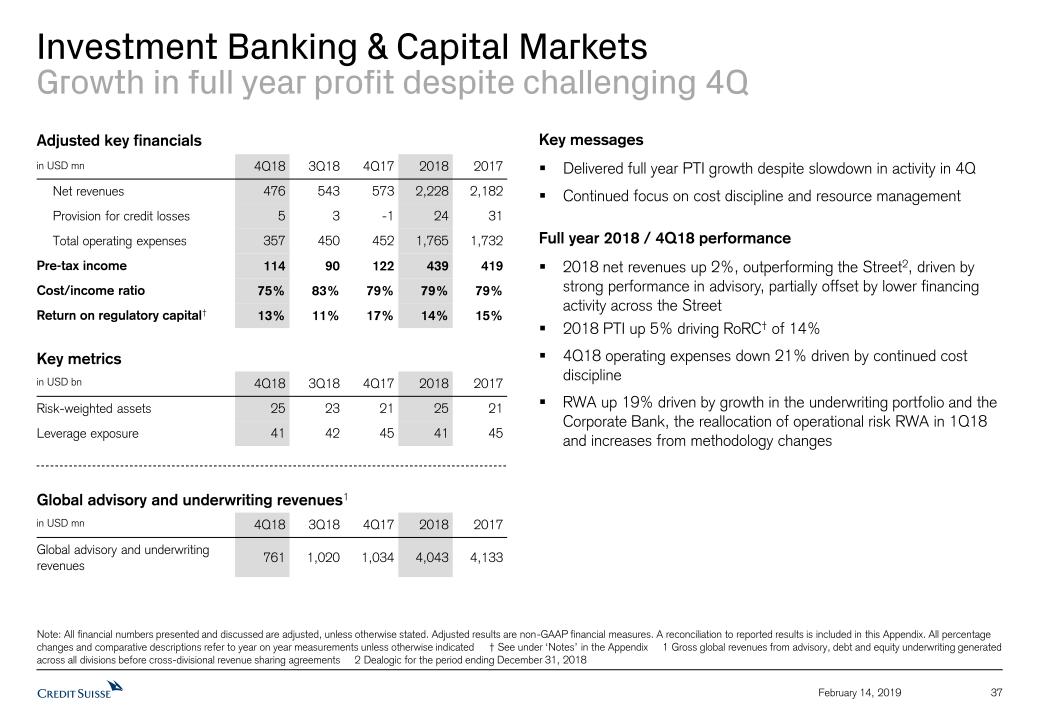

Investment Banking and Capital Markets (IBCM) delivered year on year growth in adjusted* pre-tax income and net revenues in FY18, despite a market slowdown in 4Q18. Total global advisory and underwriting revenues3 for FY18 were USD 4.0 billion, down 2% year on year, but outperforming the Street4 in a challenging market environment.

Adjusted* pre-tax income rose 5% to USD 439 million in FY18, including 4Q18 adjusted* pre-tax income of USD 114 million. Additionally, our adjusted* return on regulatory capital was 13.6% for FY18 and our leverage exposure was down 9% at USD 41 billion. Net revenues in FY18 rose 2% year on year, driven by strong performance in advisory but partially offset by lower financing activity, in line with the Street5. Our continued focus on cost discipline led to our adjusted* operating expenses remaining broadly flat with a 2% increase year on year.

Advisory revenues were up 23%, at USD 970 million, for FY18, outperforming the Street5, with 4Q18 being the strongest quarter since 2012. This was mainly driven by higher revenues from completed M&A transactions as well as higher levels of client activity, particularly in the Americas.

Debt underwriting revenues were down 9%, at USD 960 million, for FY18, in line with the Street5. Debt underwriting’s performance was driven by lower leveraged finance and debt capital market revenues but was partially offset by strong performance in the derivatives financing business. However, we still maintained our leading position in leveraged finance5.

Equity underwriting revenues were down 18%, at USD 323 million, for FY18, underperforming the Street5 due to lower client activity and a loss on a block trade in 4Q18.

Page 8

Media Release Zurich, 14 February, 2019 | |

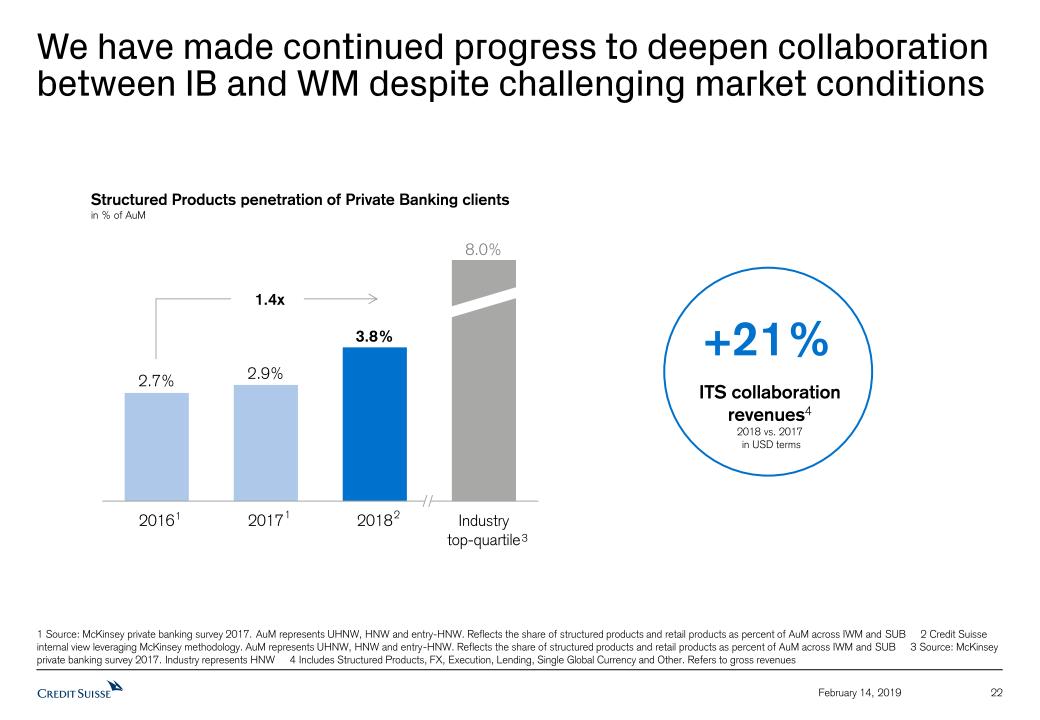

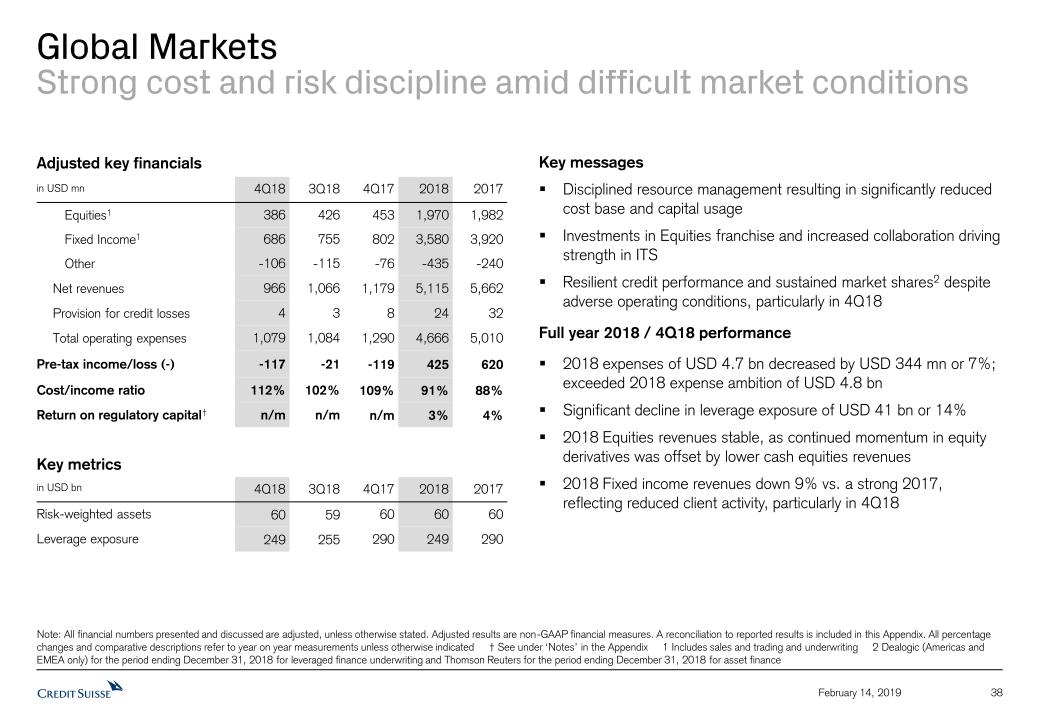

In 2018, Global Markets (GM) demonstrated strict resource and risk discipline in a challenging operating environment characterised by high levels of volatility and widening credit spreads, particularly in the second half of the year. Adjusted* total operating expenses of USD 4.7 billion decreased by 7% compared to FY17, below our 2018 goal of USD 4.8 billion. In addition, GM maintained its dynamic approach to capital management as leverage exposure decreased by 14% or USD 41 billion. GM recorded an adjusted* pre-tax income of USD 425 million with an adjusted* return on regulatory capital of 3.1% in 2018. In that context, net revenues decreased 10% compared to FY17, reflecting lower results in our fixed income businesses partially offset by strength in our International Trading Solutions (ITS) franchise. In the fourth quarter, GM recorded an adjusted* pre-tax loss of USD 117 million.

Equities revenues of USD 2.0 billion were stable compared to FY17, as continued momentum in equity derivatives was offset mainly by lower cash equities revenues. During the year we continued to invest in equities, particularly in equity derivatives, driving increased collaboration with IWM through the ITS franchise as we continued serving our wealth management clients.

Fixed Income revenues of USD 3.6 billion were down 9%, compared to a strong comparable period in 2017, reflecting reduced client activity across our credit franchise due to challenging operating conditions, particularly in the last quarter. Despite this decline, the Fixed Income franchise remained resilient as we maintained our leading market share in our asset finance and leveraged finance underwriting franchises6.

Page 9

Media Release Zurich, 14 February, 2019 | |

Credit Suisse and sustainable finance

2018 was the first full year of operation for our Impact Advisory & Finance (IAF) department, which aims to facilitate projects and initiatives for clients that have a positive economic and social impact while generating a financial return. IAF is generating significant momentum across both wealth management and corporate and investment banking. IAF is also playing a part in codifying this relatively new but rapidly growing sector, including consulting with the International Finance Corporation to launch the Principles for Impact Management at the International Monetary Fund meeting in October and becoming a founding member of Bloomberg’s US Alliance for Sustainable Finance in December.

Highlights for the fourth quarter include a landmark of surpassing USD 1 billion of sustainable investments under management in the APAC region, the successful seeding of PG Impact Investments Fund I, which raised USD 210 million to help underserved people globally, and acting for the Israeli aMoon 2 Life Sciences Venture Fund, which to date has raised over CHF 600 million to invest in accelerating cures for life-threatening diseases. In addition, we are seeing significant client appetite for our launch of the RobecoSAM SMART Mobility Fund, which is investing in the electric vehicles value chain.

In November, APAC executed a USD 440 million ESG mandate for a regional institutional client, just one example of how we help clients to align their new or existing mandates with their sustainability objectives. Our international green bond franchise continues to thrive, with underwriting increasing five-fold in 20187.

2018 marked the ten-year anniversary of the bank’s Global Initiatives in Financial Inclusion and Financial Education, the two central themes of Corporate Citizenship funding and employee engagement, with a focus on sector development and innovation. Highlights included three Sustainable Development Goals-focused industry thought leadership events and highly visible internal and external communication measures.

Through Sustainability Affairs, the bank convened three industry roundtables on environmental and social risk management and disclosure of climate-related financial risks, and supported the publication of an investor climate guide. Moreover, the bank updated its Statement on Sustainability and participated in consultations with policymakers on emerging sustainable finance regulation and continued to engage with investors and civil society representatives on topical issues.

Page 10

Media Release Zurich, 14 February, 2019 | |

Biographies of the proposed new non-executive Board members

Christian Gellerstad is a recognised wealth management professional with over 20 years of experience in the Swiss private banking industry. He looks back on a long and successful career at the Pictet Group, at which he most recently held the position of CEO, Pictet Wealth Management from 2007 to 2018. He was also an Executive Committee Member of Banque Pictet & Cie, Geneva, between 2013 and 2018, and an Equity Partner at the Pictet Group from 2006 until 2018. Christian Gellerstad served as CEO and Managing Director of Banque Pictet & Cie (Europe) in Luxembourg between 2000 and 2007 and prior to that, as Deputy CEO and Senior Vice President of Pictet Bank & Trust in the Bahamas from 1996 to 2000. Christian Gellerstad began his career at Pictet in 1994 as a Financial Analyst and Portfolio Manager in Geneva. Prior to joining the Pictet Group, he worked as an Emerging Markets Trader at Cargill International. Christian Gellerstad currently serves as a non-executive Board Member of Banque Pictet & Cie SA, Geneva, Banque Pictet & Cie (Europe) SA, Luxembourg, and Bank Pictet & Cie (Asia) Ltd., Singapore and as the non-executive Chairman of Pictet Bank & Trust Ltd. Subject to his election as a Board Member at Credit Suisse Group, Christian Gellerstad plans to step down from his directorships at Pictet. Furthermore, he is an independent director of the family-owned industrial companies FAVI SA (since 2015) and AFICA SA (since 2013), both based in France. Christian Gellerstad holds a Masters of Business Administration and Economics from the University of St. Gallen, Switzerland, and is a Certified International Investment Analyst and Certified Portfolio Manager and Financial Analyst. Christian Gellerstad is a Swiss and Swedish citizen and resides in Switzerland.

Shan Li is an economist and investment expert, who has held executive management level positions in international financial institutions in the US, Europe and Asia over the past two decades. He began his career as an Associate in foreign exchange trading with Credit Suisse First Boston in New York and then worked as an International Economist and Executive Director at Goldman Sachs in New York, Hong Kong, and London between 1993 and 1998. Following that, Shan Li moved to the China Development Bank in Beijing, where he served as the Deputy Head of the Investment Bank Preparation Leading Group from 1998 to 1999. Between 1999 and 2001, he held the position of Head of China Investment Banking at Lehman Brothers in Hong Kong and following that, he served for four years as the CEO of Bank of China International Holdings. In 2005, Shan Li founded San Shan Capital Partners, a private investment firm based in Hong Kong, at which he continues to serve as the Founding Partner. Between 2010 and 2011, Shan Li held the position of Vice Chairman of UBS Asia Investment Bank and from 2013 to 2015, he returned to the China Development Bank in Beijing as the Chief International Business Advisor. Since 2015, Shan Li is the CEO of the Silk Road Finance Corporation. He furthermore serves as Chairman and CEO of Chinastone Capital Management, an investment firm based in Shanghai, a position he’s held since 2010. Shan Li holds a Bachelor of Science in Management Information Systems from Tsinghua University (Beijing), a Master’s degree in Economics from the University of California, Davis, and a PhD in Economics from the Massachusetts Institute of Technology (Cambridge). Shan Li is a Chinese citizen and permanent resident of Hong Kong.

Page 11

Media Release Zurich, 14 February, 2019 | |

Contact details

Adam Gishen, Investor Relations, Credit Suisse Tel: +41 44 333 71 49 Email: investor.relations@credit-suisse.com |

James Quinn, Corporate Communications, Credit Suisse Tel: +41 844 33 88 44 E-mail: media.relations@credit-suisse.com |

The Earnings Release, Presentation Slides and Time Series spreadsheets for the full year 2018 and fourth quarter 2018 are available to download from 7:00 CET today at: https://www.credit-suisse.com/results Credit Suisse’s annual report is expected to be published on March 22, 2019. Note: Our estimates, ambitions, objectives and targets often include metrics that are non-GAAP financial measures and are unaudited. A reconciliation of the estimates, ambitions, objectives and targets to the nearest GAAP measures is unavailable without unreasonable efforts. Adjusted* results exclude goodwill impairment, major litigation charges, real estate gains and other revenue and expense items included in our reported results, all of which are unavailable on a prospective basis. Such estimates, ambitions, objectives and targets are calculated in a manner that is consistent with the accounting policies applied by us in preparing our financial statements. |

Page 12

Media Release Zurich, 14 February, 2019 | |

Presentation of FY18/4Q18 results – Thursday, February 14, 2019

| Event | Analyst Call | Media Call |

| Time | 08:15 Zurich 07:15 London 02:15 New York | 10:15 Zurich 09:15 London 04:15 New York |

| Speakers | Tidjane Thiam, Chief Executive Officer David Mathers, Chief Financial Officer Adam Gishen, Group Head of Investor Relations and Corporate Communications | Tidjane Thiam, Chief Executive Officer David Mathers, Chief Financial Officer Adam Gishen, Group Head of Investor Relations and Corporate Communications |

| Language | English | English with simultaneous German translation |

| Access | Switzerland: +41 44 580 48 73 Europe: +44 207 192 8007 US: +1 866 597 37 99 Reference: Credit Suisse Analysts and Investors call Conference ID: 3993575 Please dial in 15 minutes before the start of the call | Switzerland: +41 44 580 48 73 Europe: +44 207 192 8007 US: +1 866 597 37 99 Reference: Credit Suisse Media Call Conference ID English: 5436429 Conference ID German: 3673987 Please dial in 10 minutes before the start of the call |

| Q&A Session | Following the presentation, you will have the opportunity to ask the speakers questions | Following the presentation, you will have the opportunity to ask the speakers questions |

| Playback | Replay available approximately one hour after the event Switzerland: +41 44 580 40 26 Europe: +44 3333 00 97 85 US: +1 917 677 75 32 Conference ID: 3993575 | Replay available approximately one hour after the event Switzerland: +41 44 580 40 26 Europe: +44 3333 00 97 85 US: +1 917 677 75 32 Conference ID English: 5436429 Conference ID German: 3673987 |

Until the end of 2018, the results of Credit Suisse Group comprised the results of our six reporting segments, including the Strategic Resolution Unit, and the Corporate Center. Core results excluded revenues and expenses from our Strategic Resolution Unit.

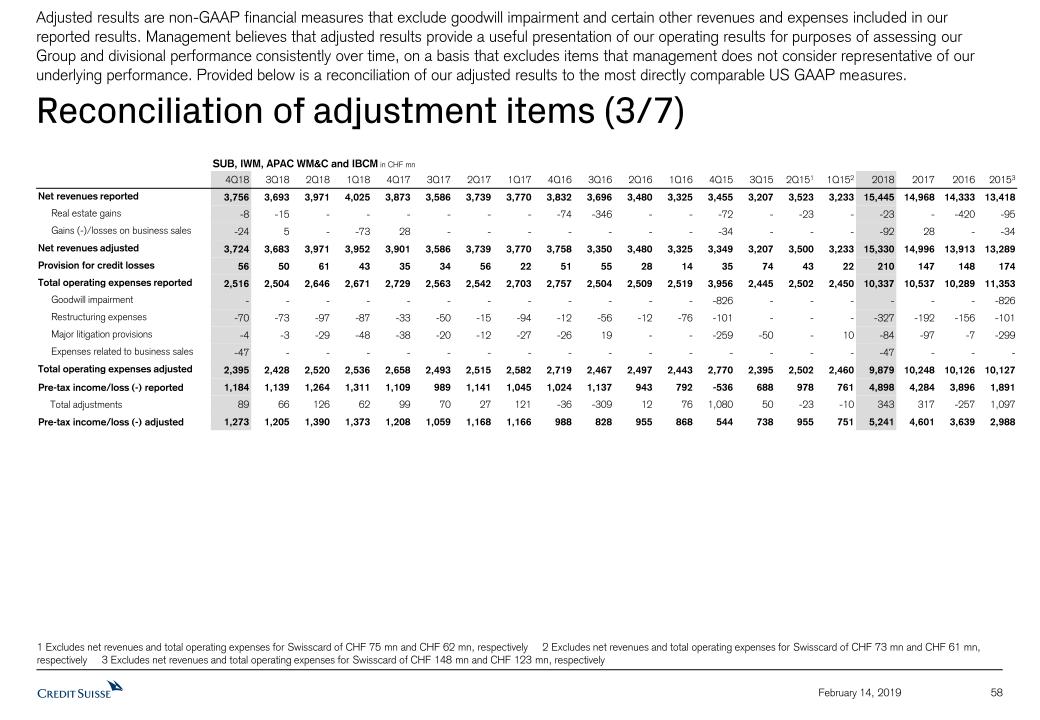

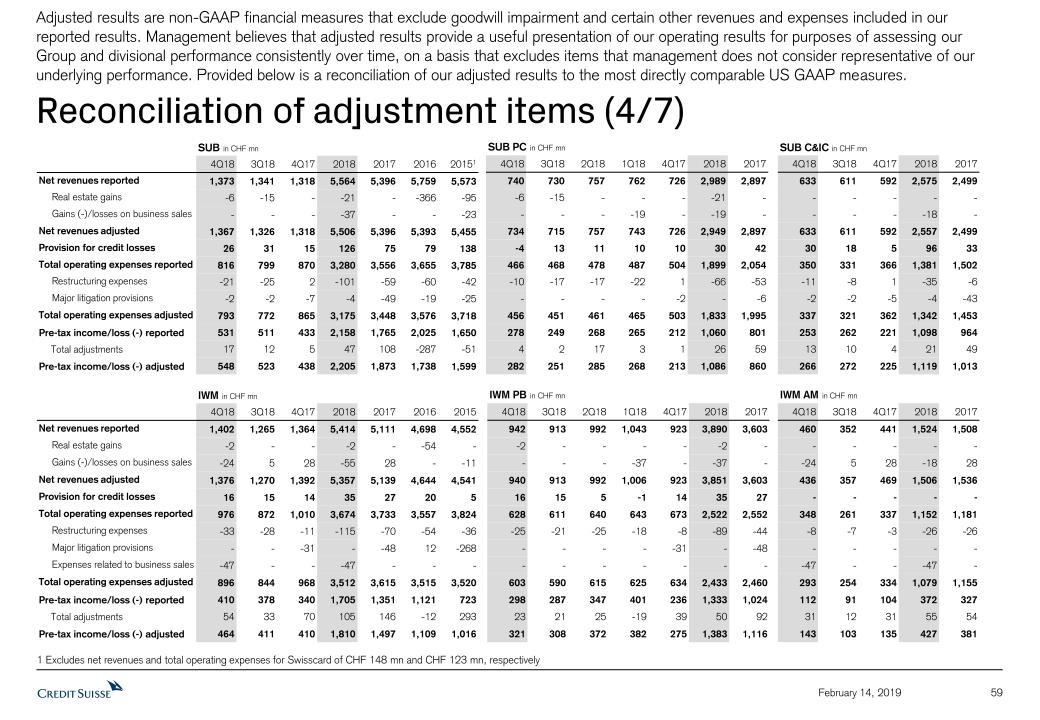

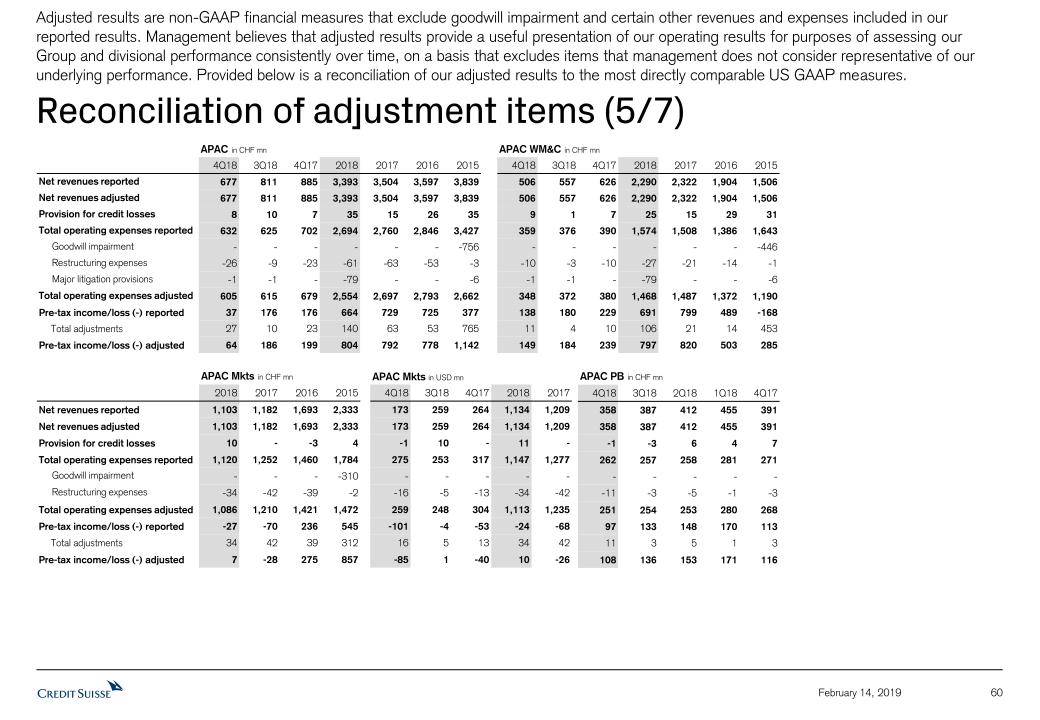

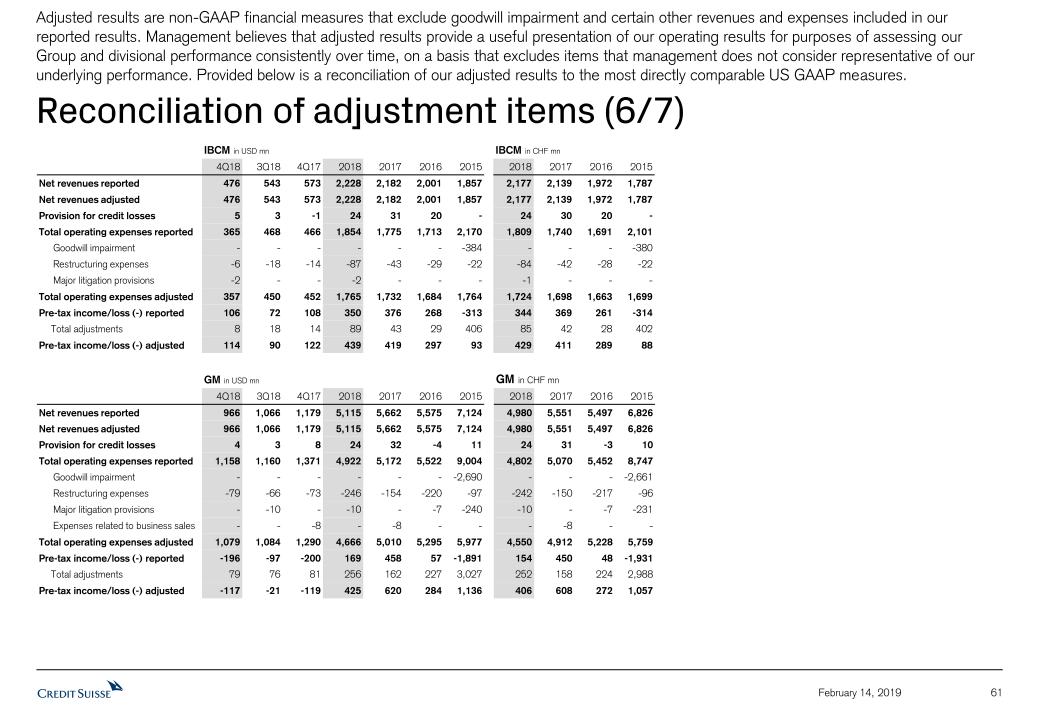

During the implementation of our strategy, it was important to measure the progress achieved by our underlying business performance in a consistent manner. To achieve this, we focused our analyses on adjusted results.

Adjusted results referred to in this Media Release are non-GAAP financial measures that exclude goodwill impairment and certain other revenues and expenses included in our reported results. Management believes that adjusted results provide a useful presentation of our operating results for the purposes of assessing our Group and divisional performance consistently over time, on a basis that excludes items that management does not consider representative of our underlying performance.

Page 13

Media Release Zurich, 14 February, 2019 | |

We reported quarterly on the same adjusted* basis for the Group, Core and divisional results until end-2018 to allow investors to monitor our progress in implementing our strategy, given the material restructuring charges we incurred and other items which were not reflective of our underlying performance but were to be borne during the three-year restructuring programme. Tables in the Appendix of this Media Release provide the detailed reconciliation between reported and adjusted results for the Group, Core businesses and the individual divisions.

Footnotes

1 2015 comparable figure of CHF 1,599 million (excludes Swisscard pre-tax income of CHF 25 million)

2 Source: Dealogic data (APAC excluding Japan and excluding onshore China) for the period ending December 31, 2018

3 Gross global revenues from advisory, debt and equity underwriting generated across all divisions before cross divisional revenue sharing agreements

4 Source: Dealogic data (Global) for the period ending December 31, 2018

5 Source: Dealogic data (Americas and EMEA) for the period ending December 31, 2018

6 Source: Dealogic data (Americas and EMEA) for the period ending December 31, 2018 and Thomson Reuters for the period ending December 31, 2018

7 Source: Bloomberg as of January 1, 2019; in 2018, Credit Suisse underwrote approximately USD 6.1 billion of green financing compared to 2017, when Credit Suisse underwrote approximately USD 1.2 billion

Abbreviations

APAC – Asia Pacific; ASU – Accounting Standards Update; AuM – assets under management; BCBS – Basel Committee on Banking Supervision; BEAT – Base Erosion and Anti-Abuse Tax; BIS – Bank of International Settlements; CCAR – Comprehensive Capital Analysis and Review; CHF – Swiss francs; CET1 – common equity tier 1; DVA - Debit valuation adjustments; EMEA – Europe, Middle East and Africa; ESG – environmental, social and governance; FINMA – Swiss Financial Market Supervisory Authority; FX – foreign exchange; GM – Global Markets; HNW – high-net-worth; IAF – Impact Advisory and Finance department; IBCM – Investment Banking & Capital Markets; ITS – International Trading Solutions; IWM – International Wealth Management; M&A – mergers and acquisitions; NNA – net new assets; PB – Private Banking; PC – Private Clients; RWA – risk-weighted assets; SEC – Securities and Exchange Commission; SRU – Strategic Resolution Unit; SUB – Swiss Universal Bank; USD – US dollar; GAAP – Generally accepted accounting principles; WM&C – Wealth Management & Connected

Important information

This Media Release contains select information from the full 4Q18 Earnings Release and 4Q18 Results Presentation slides that Credit Suisse believes is of particular interest to media professionals. The complete 4Q18 Earnings Release and 4Q18 Results Presentation slides, which have been distributed simultaneously, contain more comprehensive information about our results and operations for the reporting quarter, as well as important information about our reporting methodology and some of the terms used in these documents. The complete 4Q18 Earnings Release and 4Q18 Results Presentation slides are not incorporated by reference into this Media Release.

Credit Suisse has not finalised its 2018 Annual Report and Credit Suisse’s independent registered public accounting firm has not completed its audit of the consolidated financial statements for the period. Accordingly, the financial information contained in this Media Release is subject to completion of year-end procedures, which may result in changes to that information.

Information referenced in this Media Release, whether via website links or otherwise, is not incorporated into this Media Release.

Our cost savings programme, until the end of 2018, is measured using an adjusted operating cost base at constant 2015 FX rates. “Adjusted operating cost base at constant FX rates” includes adjustments as made in all our disclosures for restructuring expenses, major litigation expenses, expenses related to business sales and a goodwill impairment taken in 4Q15 as well as adjustments for debit valuation adjustments (DVA) related volatility, FX and for certain accounting changes (which had not been in place at the launch of the cost savings programme). Adjustments for certain accounting changes have been restated to reflect grossed up expenses in the Corporate Center and, starting in 1Q18, also include adjustments for changes from ASU 2014-09 “Revenue from Contracts with Customers”, which is described further in our 1Q18, 2Q18 and 3Q18 Financial Reports. Adjustments for FX apply unweighted currency exchange rates, i.e., a straight line average of monthly rates, consistently for the periods under review. Starting from 1Q19, we intend to express our operating cost base at constant 2018 FX rates and to adjust for significant litigation costs, expenses related to business and real estate sales, as well as DVA related volatility, but not for restructuring expenses and certain accounting changes. Adjustments for FX will continue to apply unweighted currency exchange rates.

Regulatory capital is calculated as the worst of 10% of RWA and 3.5% of leverage exposure. Return on regulatory capital is calculated using (adjusted) income / (loss) after tax and assumes a tax rate of 30% and capital allocated based on the worst of 10% of average RWA and 3.5% of average leverage exposure. For the Markets business within the APAC division and for the Global Markets and Investment Banking & Capital Markets divisions, return on regulatory capital is based on US dollar denominated numbers. Adjusted return on regulatory capital is calculated using adjusted results, applying the same methodology to calculate return on regulatory capital.

We may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions, changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives.

Page 14

Media Release Zurich, 14 February, 2019 | |

In particular, the terms “Estimate”, “Illustrative”, “Ambition”, “Objective”, “Outlook” and “Goal” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such estimates, illustrations, ambitions, objectives, outlooks and goals are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. These risks, assumptions and uncertainties include, but are not limited to, general market conditions, market volatility, interest rate volatility and levels, global and regional economic conditions, political uncertainty, changes in tax policies, regulatory changes, changes in levels of client activity as a result of any of the foregoing and other factors. Accordingly, this information should not be relied on for any purpose. We do not intend to update these estimates, illustrations, ambitions, objectives, outlooks or goals.

In preparing this media release, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Annualised numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this media release may also be subject to rounding adjustments. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information.

This document contains certain unaudited interim financial information for the first quarter of 2019. This information has been derived from management accounts, is preliminary in nature, does not reflect the complete results of the first quarter of 2019 and is subject to change, including as a result of any normal quarterly adjustments in relation to the financial statements for the first quarter of 2019. This information has not been subject to any review by our independent registered public accounting firm. There can be no assurance that the final results for these periods will not differ from these preliminary results, and any such differences could be material. Quarterly financial results for the first quarter of 2019 will be included in our 1Q19 Financial Report. These interim results of operations are not necessarily indicative of the results to be achieved for the remainder of 1Q19 or the full first quarter of 2019.

As of January 1, 2013, Basel III was implemented in Switzerland along with the Swiss “Too Big to Fail” legislation and regulations thereunder (in each case, subject to certain phase-in periods). As of January 1, 2015, the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS), was implemented in Switzerland by the Swiss Financial Market Supervisory Authority FINMA (FINMA). Our related disclosures are in accordance with our interpretation of such requirements, including relevant assumptions. Changes in the interpretation of these requirements in Switzerland or in any of our assumptions or estimates could result in different numbers from those shown in this media release.

Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. The look-through tier 1 leverage ratio and CET1 leverage ratio are calculated as look-through BIS tier 1 capital and CET1 capital, respectively, divided by period end leverage exposure. Swiss leverage ratios are measured on the same period-end basis as the leverage exposure for the BIS leverage ratio.

Gross margin is calculated by dividing net revenues by average assets under management. Net margin is calculated by dividing income before taxes by average assets under management. Adjusted margins are calculated using adjusted results, applying the same methodology used to calculate gross and net margin.

References to Wealth Management mean SUB PC, IWM PB and APAC PB within WM&C or their combined results. References to Wealth Management-related mean SUB, IWM and APAC WM&C or their combined results. References to Markets mean Global Markets and APAC Markets or their combined results.

References to global advisory and underwriting include global revenues from advisory, debt and equity underwriting generated across all divisions before cross-divisional revenue sharing agreements.

Generic references to profit and costs in this media release refer to pre-tax income and operating expenses, respectively.

Investors and others should note that we announce material information (including quarterly earnings releases and financial reports) to the investing public using press releases, SEC and Swiss ad hoc filings, our website and public conference calls and webcasts. We intend to also use our Twitter account @creditsuisse (https://twitter.com/creditsuisse) to excerpt key messages from our public disclosures, including earnings releases. We may retweet such messages through certain of our regional Twitter accounts, including @csschweiz (https://twitter.com/csschweiz) and @csapac (https://twitter.com/csapac). Investors and others should take care to consider such abbreviated messages in the context of the disclosures from which they are excerpted. The information we post on these Twitter accounts is not a part of this Media Release.

In various tables, use of “–” indicates not meaningful or not applicable.

Page 15

| Key metrics |

| | in / end of | | % change | | in / end of | | % change | |

| | 4Q18 | | 3Q18 | | 4Q17 | | QoQ | | YoY | | 2018 | | 2017 | | YoY | |

| Credit Suisse Group results (CHF million) |

| Net revenues | | 4,801 | | 4,888 | | 5,189 | | (2) | | (7) | | 20,920 | | 20,900 | | 0 | |

| Provision for credit losses | | 59 | | 65 | | 43 | | (9) | | 37 | | 245 | | 210 | | 17 | |

| Total operating expenses | | 4,114 | | 4,152 | | 5,005 | | (1) | | (18) | | 17,270 | | 18,897 | | (9) | |

| Income before taxes | | 628 | | 671 | | 141 | | (6) | | 345 | | 3,405 | | 1,793 | | 90 | |

| Net income/(loss) attributable to shareholders | | 292 | | 424 | | (2,126) | | (31) | | – | | 2,057 | | (983) | | – | |

| Assets under management and net new assets (CHF million) |

| Assets under management | | 1,347.3 | | 1,404.7 | | 1,376.1 | | (4.1) | | (2.1) | | 1,347.3 | | 1,376.1 | | (2.1) | |

| Net new assets | | 0.5 | | 15.7 | | 3.1 | | (96.8) | | (83.9) | | 56.5 | | 37.8 | | 49.5 | |

| Basel III regulatory capital and leverage statistics |

| CET1 ratio (%) | | 12.6 | | 12.9 | | 13.5 | | – | | – | | 12.6 | | 13.5 | | – | |

| Look-through CET1 ratio (%) | | 12.6 | | 12.9 | | 12.8 | | – | | – | | 12.6 | | 12.8 | | – | |

| Look-through CET1 leverage ratio (%) | | 4.1 | | 4.0 | | 3.8 | | – | | – | | 4.1 | | 3.8 | | – | |

| Look-through tier 1 leverage ratio (%) | | 5.2 | | 5.1 | | 5.2 | | – | | – | | 5.2 | | 5.2 | | – | |

| Credit Suisse and Core Results |

| | Core Results | | Strategic Resolution Unit | | Credit Suisse | |

| in / end of | | 4Q18 | | 3Q18 | | 4Q17 | | 4Q18 | | 3Q18 | | 4Q17 | | 4Q18 | | 3Q18 | | 4Q17 | |

| Statements of operations (CHF million) |

| Net revenues | | 4,976 | | 5,042 | | 5,340 | | (175) | | (154) | | (151) | | 4,801 | | 4,888 | | 5,189 | |

| Provision for credit losses | | 60 | | 62 | | 40 | | (1) | | 3 | | 3 | | 59 | | 65 | | 43 | |

| Compensation and benefits | | 2,084 | | 2,333 | | 2,503 | | 57 | | 61 | | 65 | | 2,141 | | 2,394 | | 2,568 | |

| General and administrative expenses | | 1,442 | | 1,243 | | 1,726 | | 94 | | 58 | | 209 | | 1,536 | | 1,301 | | 1,935 | |

| Commission expenses | | 298 | | 283 | | 356 | | 3 | | 3 | | 9 | | 301 | | 286 | | 365 | |

| Restructuring expenses | | 167 | | 143 | | 119 | | (31) | | 28 | | 18 | | 136 | | 171 | | 137 | |

| Total other operating expenses | | 1,907 | | 1,669 | | 2,201 | | 66 | | 89 | | 236 | | 1,973 | | 1,758 | | 2,437 | |

| Total operating expenses | | 3,991 | | 4,002 | | 4,704 | | 123 | | 150 | | 301 | | 4,114 | | 4,152 | | 5,005 | |

| Income/(loss) before taxes | | 925 | | 978 | | 596 | | (297) | | (307) | | (455) | | 628 | | 671 | | 141 | |

| Statement of operations metrics (%) |

| Return on regulatory capital | | 8.7 | | 9.0 | | 5.6 | | – | | – | | – | | 5.7 | | 6.0 | | 1.2 | |

| Balance sheet statistics (CHF million) |

| Total assets | | 748,042 | | 745,486 | | 750,660 | | 20,874 | | 23,058 | | 45,629 | | 768,916 | | 768,544 | | 796,289 | |

| Risk-weighted assets 1 | | 266,656 | | 257,310 | | 238,067 | | 17,926 | | 19,297 | | 33,613 | | 284,582 | | 276,607 | | 271,680 | |

| Leverage exposure 1 | | 851,807 | | 852,092 | | 856,591 | | 29,579 | | 32,860 | | 59,934 | | 881,386 | | 884,952 | | 916,525 | |

| Credit Suisse and Core Results |

| | Core Results | | Strategic Resolution Unit | | Credit Suisse | |

| in / end of | | 2018 | | 2017 | | 2018 | | 2017 | | 2018 | | 2017 | |

| Statements of operations (CHF million) |

| Net revenues | | 21,628 | | 21,786 | | (708) | | (886) | | 20,920 | | 20,900 | |

| Provision for credit losses | | 244 | | 178 | | 1 | | 32 | | 245 | | 210 | |

| Compensation and benefits | | 9,366 | | 10,035 | | 254 | | 332 | | 9,620 | | 10,367 | |

| General and administrative expenses | | 5,380 | | 5,849 | | 385 | | 796 | | 5,765 | | 6,645 | |

| Commission expenses | | 1,247 | | 1,398 | | 12 | | 32 | | 1,259 | | 1,430 | |

| Restructuring expenses | | 605 | | 398 | | 21 | | 57 | | 626 | | 455 | |

| Total other operating expenses | | 7,232 | | 7,645 | | 418 | | 885 | | 7,650 | | 8,530 | |

| Total operating expenses | | 16,598 | | 17,680 | | 672 | | 1,217 | | 17,270 | | 18,897 | |

| Income/(loss) before taxes | | 4,786 | | 3,928 | | (1,381) | | (2,135) | | 3,405 | | 1,793 | |

| Statement of operations metrics (%) |

| Return on regulatory capital | | 11.1 | | 9.3 | | – | | – | | 7.5 | | 3.9 | |

1 Disclosed on a look-through basis. |

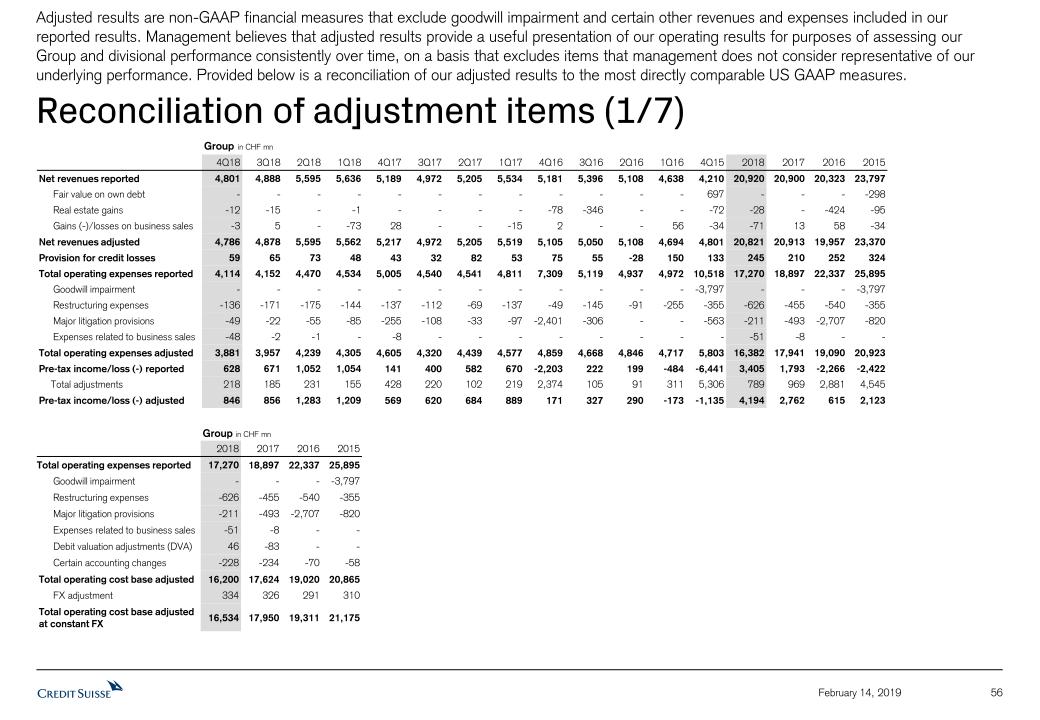

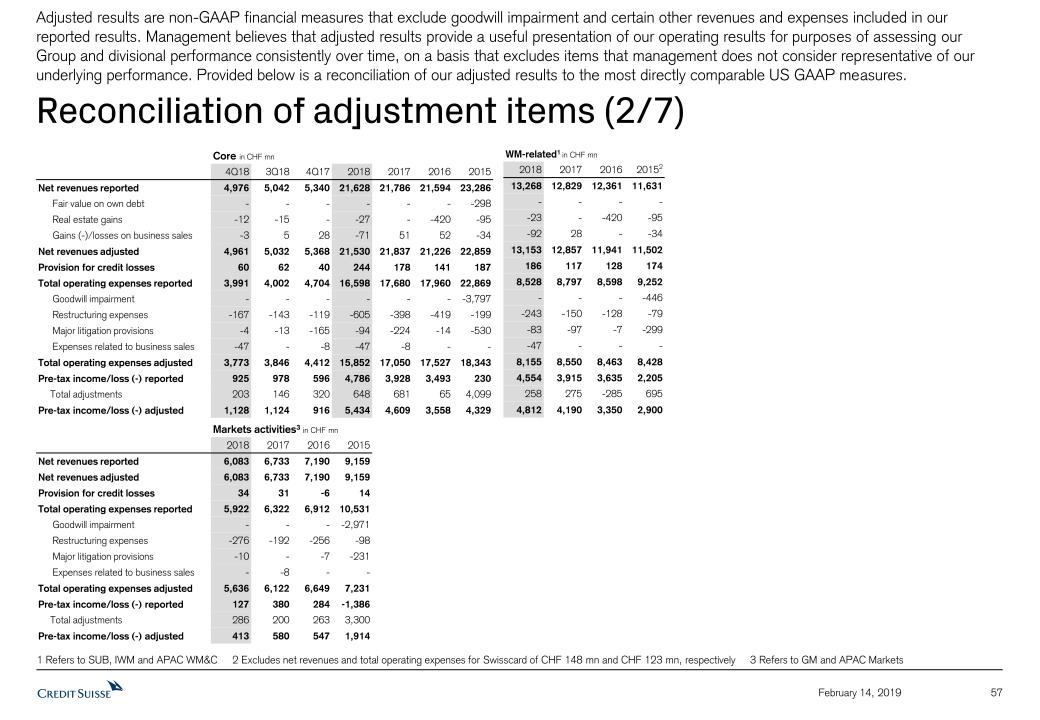

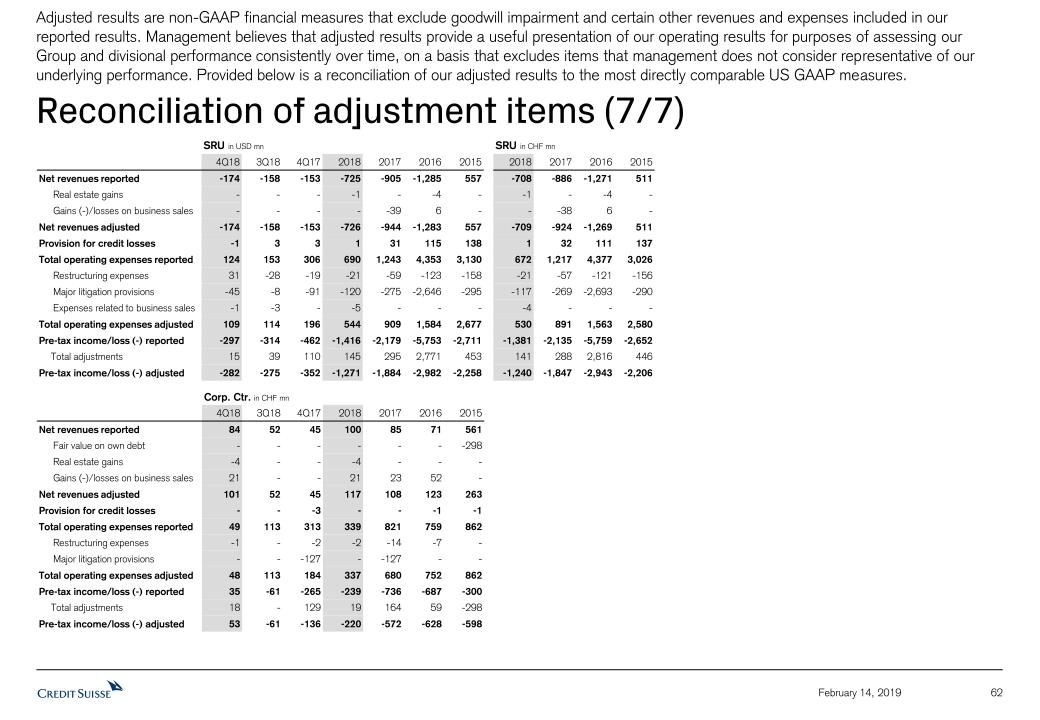

Adjusted results referred to in this media release are non-GAAP financial measures that exclude goodwill impairment and certain other revenues and expenses included in our reported results. Management believes that adjusted results provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance over time, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation of our adjusted results to the most directly comparable US GAAP measures.

| Reconciliation of adjusted results |

| | Core Results | | Strategic Resolution Unit | | Credit Suisse | |

| in | | 4Q18 | | 3Q18 | | 4Q17 | | 4Q18 | | 3Q18 | | 4Q17 | | 4Q18 | | 3Q18 | | 4Q17 | |

| Reconciliation of adjusted results (CHF million) |

| Net revenues | | 4,976 | | 5,042 | | 5,340 | | (175) | | (154) | | (151) | | 4,801 | | 4,888 | | 5,189 | |

| Real estate gains | | (12) | | (15) | | 0 | | 0 | | 0 | | 0 | | (12) | | (15) | | 0 | |

| (Gains)/losses on business sales | | (3) | | 5 | | 28 | | 0 | | 0 | | 0 | | (3) | | 5 | | 28 | |

| Adjusted net revenues | | 4,961 | | 5,032 | | 5,368 | | (175) | | (154) | | (151) | | 4,786 | | 4,878 | | 5,217 | |

| Provision for credit losses | | 60 | | 62 | | 40 | | (1) | | 3 | | 3 | | 59 | | 65 | | 43 | |

| Total operating expenses | | 3,991 | | 4,002 | | 4,704 | | 123 | | 150 | | 301 | | 4,114 | | 4,152 | | 5,005 | |

| Restructuring expenses | | (167) | | (143) | | (119) | | 31 | | (28) | | (18) | | (136) | | (171) | | (137) | |

| Major litigation provisions | | (4) | | (13) | | (165) | | (45) | | (9) | | (90) | | (49) | | (22) | | (255) | |

| Expenses related to business sales | | (47) | | 0 | | (8) | | (1) | | (2) | | 0 | | (48) | | (2) | | (8) | |

| Adjusted total operating expenses | | 3,773 | | 3,846 | | 4,412 | | 108 | | 111 | | 193 | | 3,881 | | 3,957 | | 4,605 | |

| Income/(loss) before taxes | | 925 | | 978 | | 596 | | (297) | | (307) | | (455) | | 628 | | 671 | | 141 | |

| Total adjustments | | 203 | | 146 | | 320 | | 15 | | 39 | | 108 | | 218 | | 185 | | 428 | |

| Adjusted income/(loss) before taxes | | 1,128 | | 1,124 | | 916 | | (282) | | (268) | | (347) | | 846 | | 856 | | 569 | |

| Adjusted return on regulatory capital (%) | | 10.6 | | 10.4 | | 8.6 | | – | | – | | – | | 7.7 | | 7.6 | | 5.0 | |

| | Core Results | | Strategic Resolution Unit | | Credit Suisse | |

| in | | 2018 | | 2017 | | 2018 | | 2017 | | 2018 | | 2017 | |

| Reconciliation of adjusted results (CHF million) |

| Net revenues | | 21,628 | | 21,786 | | (708) | | (886) | | 20,920 | | 20,900 | |

| Real estate gains | | (27) | | 0 | | (1) | | 0 | | (28) | | 0 | |

| (Gains)/losses on business sales | | (71) | | 51 | | 0 | | (38) | | (71) | | 13 | |

| Adjusted net revenues | | 21,530 | | 21,837 | | (709) | | (924) | | 20,821 | | 20,913 | |

| Provision for credit losses | | 244 | | 178 | | 1 | | 32 | | 245 | | 210 | |

| Total operating expenses | | 16,598 | | 17,680 | | 672 | | 1,217 | | 17,270 | | 18,897 | |

| Restructuring expenses | | (605) | | (398) | | (21) | | (57) | | (626) | | (455) | |

| Major litigation provisions | | (94) | | (224) | | (117) | | (269) | | (211) | | (493) | |

| Expenses related to business sales | | (47) | | (8) | | (4) | | 0 | | (51) | | (8) | |

| Adjusted total operating expenses | | 15,852 | | 17,050 | | 530 | | 891 | | 16,382 | | 17,941 | |

| Income/(loss) before taxes | | 4,786 | | 3,928 | | (1,381) | | (2,135) | | 3,405 | | 1,793 | |

| Total adjustments | | 648 | | 681 | | 141 | | 288 | | 789 | | 969 | |

| Adjusted income/(loss) before taxes | | 5,434 | | 4,609 | | (1,240) | | (1,847) | | 4,194 | | 2,762 | |

| Adjusted return on regulatory capital (%) | | 12.5 | | 10.9 | | – | | – | | 9.2 | | 6.0 | |

| Reconciliation of adjusted results |

| | Credit Suisse | |

| in | | 2Q18 | | 1Q18 | | 4Q17 | | 3Q17 | | 2Q17 | | 1Q17 | | 4Q16 | | 3Q16 | | 2Q16 | | 1Q16 | |

| Reconciliation of adjusted results (CHF million, except where indicated) |

| Net revenues | | 5,595 | | 5,636 | | 5,189 | | 4,972 | | 5,205 | | 5,534 | | 5,181 | | 5,396 | | 5,108 | | 4,638 | |

| Real estate gains | | 0 | | (1) | | 0 | | 0 | | 0 | | 0 | | (78) | | (346) | | 0 | | 0 | |

| (Gains)/losses on business sales | | 0 | | (73) | | 28 | | 0 | | 0 | | (15) | | 2 | | 0 | | 0 | | 56 | |

| Adjusted net revenues | | 5,595 | | 5,562 | | 5,217 | | 4,972 | | 5,205 | | 5,519 | | 5,105 | | 5,050 | | 5,108 | | 4,694 | |

| Provision for credit losses | | 73 | | 48 | | 43 | | 32 | | 82 | | 53 | | 75 | | 55 | | (28) | | 150 | |

| Total operating expenses | | 4,470 | | 4,534 | | 5,005 | | 4,540 | | 4,541 | | 4,811 | | 7,309 | | 5,119 | | 4,937 | | 4,972 | |

| Restructuring expenses | | (175) | | (144) | | (137) | | (112) | | (69) | | (137) | | (49) | | (145) | | (91) | | (255) | |

| Major litigation provisions | | (55) | | (85) | | (255) | | (108) | | (33) | | (97) | | (2,401) | | (306) | | 0 | | 0 | |

| Expenses related to business sales | | (1) | | 0 | | (8) | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| Adjusted total operating expenses | | 4,239 | | 4,305 | | 4,605 | | 4,320 | | 4,439 | | 4,577 | | 4,859 | | 4,668 | | 4,846 | | 4,717 | |

| Income/(loss) before taxes | | 1,052 | | 1,054 | | 141 | | 400 | | 582 | | 670 | | (2,203) | | 222 | | 199 | | (484) | |

| Total adjustments | | 231 | | 155 | | 428 | | 220 | | 102 | | 219 | | 2,374 | | 105 | | 91 | | 311 | |

| Adjusted income/(loss) before taxes | | 1,283 | | 1,209 | | 569 | | 620 | | 684 | | 889 | | 171 | | 327 | | 290 | | (173) | |

| Reconciliation of adjusted results (continued) |

| | Credit Suisse | |

| in | | 4Q15 | | 3Q15 | | 2Q15 | | 1Q15 | | 4Q14 | | 3Q14 | | 2Q14 | | 1Q14 | |

| Reconciliation of adjusted results (CHF million, except where indicated) |

| Net revenues | | 4,210 | | 5,985 | | 6,955 | | 6,647 | | 6,372 | | 6,578 | | 6,463 | | 6,829 | |

| Fair value on own debt | | 697 | | (623) | | (228) | | (144) | | (297) | | (318) | | (17) | | 89 | |

| Real estate gains | | (72) | | 0 | | (23) | | 0 | | (375) | | 0 | | (5) | | (34) | |

| (Gains)/losses on business sales | | (34) | | 0 | | 0 | | 0 | | (101) | | 0 | | 0 | | 0 | |

| Adjusted net revenues | | 4,801 | | 5,362 | | 6,704 | | 6,503 | | 5,599 | | 6,260 | | 6,441 | | 6,884 | |

| Provision for credit losses | | 133 | | 110 | | 51 | | 30 | | 75 | | 59 | | 18 | | 34 | |

| Total operating expenses | | 10,518 | | 5,023 | | 5,248 | | 5,106 | | 5,405 | | 5,181 | | 6,791 | | 5,052 | |

| Goodwill impairment | | (3,797) | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | | 0 | |

| Restructuring expenses | | (355) | | – | | – | | – | | – | | – | | – | | – | |

| Major litigation provisions | | (563) | | (204) | | (63) | | 10 | | (393) | | (290) | | (1,711) | | (42) | |

| Adjusted total operating expenses | | 5,803 | | 4,819 | | 5,185 | | 5,116 | | 5,012 | | 4,891 | | 5,080 | | 5,010 | |

| Income/(loss) before taxes | | (6,441) | | 852 | | 1,656 | | 1,511 | | 892 | | 1,338 | | (346) | | 1,743 | |

| Total adjustments | | 5,306 | | (419) | | (188) | | (154) | | (380) | | (28) | | 1,689 | | 97 | |

| Adjusted income/(loss) before taxes | | (1,135) | | 433 | | 1,468 | | 1,357 | | 512 | | 1,310 | | 1,343 | | 1,840 | |

| Reconciliation of adjusted results |

| | SUB, IWM and APAC WM&C | |

| in | | 2018 | | 2017 | | 2016 | | 2015 | 1 |

| Adjusted results (CHF million) |

| Net revenues | | 13,268 | | 12,829 | | 12,361 | | 11,631 | |

| Real estate gains | | (23) | | 0 | | (420) | | (95) | |

| (Gains)/losses on business sales | | (92) | | 28 | | 0 | | (34) | |

| Adjusted net revenues | | 13,153 | | 12,857 | | 11,941 | | 11,502 | |

| Provision for credit losses | | 186 | | 117 | | 128 | | 174 | |

| Total operating expenses | | 8,528 | | 8,797 | | 8,598 | | 9,252 | |

| Goodwill impairment | | 0 | | 0 | | 0 | | (446) | |

| Restructuring expenses | | (243) | | (150) | | (128) | | (79) | |

| Major litigation provisions | | (83) | | (97) | | (7) | | (299) | |

| Expenses related to business sales | | (47) | | 0 | | 0 | | 0 | |

| Adjusted total operating expenses | | 8,155 | | 8,550 | | 8,463 | | 8,428 | |

| Income before taxes | | 4,554 | | 3,915 | | 3,635 | | 2,205 | |

| Total adjustments | | 258 | | 275 | | (285) | | 695 | |

| Adjusted income before taxes | | 4,812 | | 4,190 | | 3,350 | | 2,900 | |

1 Excludes net revenues and total operating expenses for Swisscard of CHF 148 million and CHF 123 million, respectively. |

| Reconciliation of adjustment items |

| | Group | |

| in | | 2018 | | 2017 | | 2016 | | 2015 | |

| Adjusted results (CHF million) |

| Total operating expenses | | 17,270 | | 18,897 | | 22,337 | | 25,895 | |

| Goodwill impairment | | 0 | | 0 | | 0 | | (3,797) | |

| Restructuring expenses | | (626) | | (455) | | (540) | | (355) | |

| Major litigation provisions | | (211) | | (493) | | (2,707) | | (820) | |

| Expenses related to business sales | | (51) | | (8) | | 0 | | 0 | |

| Debit valuation adjustments (DVA) | | 46 | | (83) | | 0 | | 0 | |

| Certain accounting changes | | (228) | | (234) | | (70) | | (58) | |

| Adjusted operating cost base | | 16,200 | | 17,624 | | 19,020 | | 20,865 | |

| FX adjustment | | 334 | | 326 | | 291 | | 310 | |

| Adjusted FX-neutral operating cost base | | 16,534 | | 17,950 | | 19,311 | | 21,175 | |

| Swiss Universal Bank |

| | in / end of | | % change | | in / end of % change | |

| | 4Q18 | | 3Q18 | | 4Q17 | | QoQ | | YoY | | 2018 | | 2017 | | YoY | |

| Results (CHF million) |

| Net revenues | | 1,373 | | 1,341 | | 1,318 | | 2 | | 4 | | 5,564 | | 5,396 | | 3 | |

| of which Private Clients | | 740 | | 730 | | 726 | | 1 | | 2 | | 2,989 | | 2,897 | | 3 | |

| of which Corporate & Institutional Clients | | 633 | | 611 | | 592 | | 4 | | 7 | | 2,575 | | 2,499 | | 3 | |

| Provision for credit losses | | 26 | | 31 | | 15 | | (16) | | 73 | | 126 | | 75 | | 68 | |

| Total operating expenses | | 816 | | 799 | | 870 | | 2 | | (6) | | 3,280 | | 3,556 | | (8) | |

| Income before taxes | | 531 | | 511 | | 433 | | 4 | | 23 | | 2,158 | | 1,765 | | 22 | |

| of which Private Clients | | 278 | | 249 | | 212 | | 12 | | 31 | | 1,060 | | 801 | | 32 | |

| of which Corporate & Institutional Clients | | 253 | | 262 | | 221 | | (3) | | 14 | | 1,098 | | 964 | | 14 | |

| Metrics (%) |

| Return on regulatory capital | | 16.7 | | 16.2 | | 13.5 | | – | | – | | 17.1 | | 13.7 | | – | |

| Cost/income ratio | | 59.4 | | 59.6 | | 66.0 | | – | | – | | 59.0 | | 65.9 | | – | |

| Private Clients |

| Assets under management (CHF billion) | | 198.0 | | 209.3 | | 208.3 | | (5.4) | | (4.9) | | 198.0 | | 208.3 | | (4.9) | |

| Net new assets (CHF billion) | | (1.1) | | 0.9 | | 0.0 | | – | | – | | 3.0 | | 4.7 | | – | |

| Gross margin (annualized) (bp) | | 144 | | 139 | | 140 | | – | | – | | 144 | | 143 | | – | |

| Net margin (annualized) (bp) | | 54 | | 48 | | 41 | | – | | – | | 51 | | 40 | | – | |

| Corporate & Institutional Clients |

| Assets under management (CHF billion) | | 348.7 | | 360.2 | | 354.7 | | (3.2) | | (1.7) | | 348.7 | | 354.7 | | (1.7) | |

| Net new assets (CHF billion) | | 2.1 | | 1.8 | | (0.2) | | – | | – | | 8.6 | | (13.9) | | – | |

| Reconciliation of adjusted results |

| | Private Clients | | Corporate & Institutional Clients | | Swiss Universal Bank | |

| in | | 4Q18 | | 3Q18 | | 4Q17 | | 4Q18 | | 3Q18 | | 4Q17 | | 4Q18 | | 3Q18 | | 4Q17 | |

| Adjusted results (CHF million) |

| Net revenues | | 740 | | 730 | | 726 | | 633 | | 611 | | 592 | | 1,373 | | 1,341 | | 1,318 | |

| Real estate gains | | (6) | | (15) | | 0 | | 0 | | 0 | | 0 | | (6) | | (15) | | 0 | |

| Adjusted net revenues | | 734 | | 715 | | 726 | | 633 | | 611 | | 592 | | 1,367 | | 1,326 | | 1,318 | |

| Provision for credit losses | | (4) | | 13 | | 10 | | 30 | | 18 | | 5 | | 26 | | 31 | | 15 | |

| Total operating expenses | | 466 | | 468 | | 504 | | 350 | | 331 | | 366 | | 816 | | 799 | | 870 | |

| Restructuring expenses | | (10) | | (17) | | 1 | | (11) | | (8) | | 1 | | (21) | | (25) | | 2 | |

| Major litigation provisions | | 0 | | 0 | | (2) | | (2) | | (2) | | (5) | | (2) | | (2) | | (7) | |

| Adjusted total operating expenses | | 456 | | 451 | | 503 | | 337 | | 321 | | 362 | | 793 | | 772 | | 865 | |

| Income before taxes | | 278 | | 249 | | 212 | | 253 | | 262 | | 221 | | 531 | | 511 | | 433 | |

| Total adjustments | | 4 | | 2 | | 1 | | 13 | | 10 | | 4 | | 17 | | 12 | | 5 | |

| Adjusted income before taxes | | 282 | | 251 | | 213 | | 266 | | 272 | | 225 | | 548 | | 523 | | 438 | |

| Adjusted return on regulatory capital (%) | | – | | – | | – | | – | | – | | – | | 17.2 | | 16.6 | | 13.7 | |

| |

Private Clients | | Corporate &

Institutional Clients | |

Swiss Universal Bank | |

| in | | 2018 | | 2017 | | 2018 | | 2017 | | 2018 | | 2017 | | 2015 | 1 |

| Adjusted results (CHF million) |

| Net revenues | | 2,989 | | 2,897 | | 2,575 | | 2,499 | | 5,564 | | 5,396 | | 5,573 | |

| Real estate gains | | (21) | | 0 | | 0 | | 0 | | (21) | | 0 | | (95) | |

| Gains on business sales | | (19) | | 0 | | (18) | | 0 | | (37) | | 0 | | (23) | |

| Adjusted net revenues | | 2,949 | | 2,897 | | 2,557 | | 2,499 | | 5,506 | | 5,396 | | 5,455 | |

| Provision for credit losses | | 30 | | 42 | | 96 | | 33 | | 126 | | 75 | | 138 | |

| Total operating expenses | | 1,899 | | 2,054 | | 1,381 | | 1,502 | | 3,280 | | 3,556 | | 3,785 | |

| Restructuring expenses | | (66) | | (53) | | (35) | | (6) | | (101) | | (59) | | (42) | |

| Major litigation provisions | | 0 | | (6) | | (4) | | (43) | | (4) | | (49) | | (25) | |

| Adjusted total operating expenses | | 1,833 | | 1,995 | | 1,342 | | 1,453 | | 3,175 | | 3,448 | | 3,718 | |

| Income before taxes | | 1,060 | | 801 | | 1,098 | | 964 | | 2,158 | | 1,765 | | 1,650 | |

| Total adjustments | | 26 | | 59 | | 21 | | 49 | | 47 | | 108 | | (51) | |

| Adjusted income before taxes | | 1,086 | | 860 | | 1,119 | | 1,013 | | 2,205 | | 1,873 | | 1,599 | |

| Adjusted return on regulatory capital (%) | | – | | – | | – | | – | | 17.4 | | 14.6 | | 13.2 | |

1 Excludes net revenues and total operating expenses for Swisscard of CHF 148 million and CHF 123 million, respectively. |

| International Wealth Management |

| | in / end of | | % change | | in / end of | | % change | |

| | 4Q18 | | 3Q18 | | 4Q17 | | QoQ | | YoY | | 2018 | | 2017 | | YoY | |

| Results (CHF million) |

| Net revenues | | 1,402 | | 1,265 | | 1,364 | | 11 | | 3 | | 5,414 | | 5,111 | | 6 | |

| of which Private Banking | | 942 | | 913 | | 923 | | 3 | | 2 | | 3,890 | | 3,603 | | 8 | |

| of which Asset Management | | 460 | | 352 | | 441 | | 31 | | 4 | | 1,524 | | 1,508 | | 1 | |

| Provision for credit losses | | 16 | | 15 | | 14 | | 7 | | 14 | | 35 | | 27 | | 30 | |

| Total operating expenses | | 976 | | 872 | | 1,010 | | 12 | | (3) | | 3,674 | | 3,733 | | (2) | |

| Income before taxes | | 410 | | 378 | | 340 | | 8 | | 21 | | 1,705 | | 1,351 | | 26 | |

| of which Private Banking | | 298 | | 287 | | 236 | | 4 | | 26 | | 1,333 | | 1,024 | | 30 | |

| of which Asset Management | | 112 | | 91 | | 104 | | 23 | | 8 | | 372 | | 327 | | 14 | |

| Metrics (%) |

| Return on regulatory capital | | 28.9 | | 27.1 | | 25.2 | | – | | – | | 30.7 | | 25.8 | | – | |

| Cost/income ratio | | 69.6 | | 68.9 | | 74.0 | | – | | – | | 67.9 | | 73.0 | | – | |

| Private Banking |

| Assets under management (CHF billion) | | 357.5 | | 368.4 | | 366.9 | | (3.0) | | (2.6) | | 357.5 | | 366.9 | | (2.6) | |

| Net new assets (CHF billion) | | 0.5 | | 3.0 | | 2.7 | | – | | – | | 14.2 | | 15.6 | | – | |

| Gross margin (annualized) (bp) | | 103 | | 99 | | 101 | | – | | – | | 106 | | 105 | | – | |

| Net margin (annualized) (bp) | | 33 | | 31 | | 26 | | – | | – | | 36 | | 30 | | – | |

| Asset Management |

| Assets under management (CHF billion) | | 388.7 | | 403.7 | | 385.6 | | (3.7) | | 0.8 | | 388.7 | | 385.6 | | 0.8 | |

| Net new assets (CHF billion) | | 0.7 | | 4.5 | | 1.4 | | – | | – | | 22.2 | | 20.3 | | – | |

| Reconciliation of adjusted results |

| | Private Banking | | Asset Management | | International Wealth Management | |

| in | | 4Q18 | | 3Q18 | | 4Q17 | | 4Q18 | | 3Q18 | | 4Q17 | | 4Q18 | | 3Q18 | | 4Q17 | |

| Adjusted results (CHF million) |

| Net revenues | | 942 | | 913 | | 923 | | 460 | | 352 | | 441 | | 1,402 | | 1,265 | | 1,364 | |

| Real estate gains | | (2) | | 0 | | 0 | | 0 | | 0 | | 0 | | (2) | | 0 | | 0 | |

| (Gains)/losses on business sales | | 0 | | 0 | | 0 | | (24) | | 5 | | 28 | | (24) | | 5 | | 28 | |

| Adjusted net revenues | | 940 | | 913 | | 923 | | 436 | | 357 | | 469 | | 1,376 | | 1,270 | | 1,392 | |

| Provision for credit losses | | 16 | | 15 | | 14 | | 0 | | 0 | | 0 | | 16 | | 15 | | 14 | |

| Total operating expenses | | 628 | | 611 | | 673 | | 348 | | 261 | | 337 | | 976 | | 872 | | 1,010 | |

| Restructuring expenses | | (25) | | (21) | | (8) | | (8) | | (7) | | (3) | | (33) | | (28) | | (11) | |

| Major litigation provisions | | 0 | | 0 | | (31) | | 0 | | 0 | | 0 | | 0 | | 0 | | (31) | |

| Expenses related to business sales | | 0 | | 0 | | 0 | | (47) | | 0 | | 0 | | (47) | | 0 | | 0 | |

| Adjusted total operating expenses | | 603 | | 590 | | 634 | | 293 | | 254 | | 334 | | 896 | | 844 | | 968 | |

| Income before taxes | | 298 | | 287 | | 236 | | 112 | | 91 | | 104 | | 410 | | 378 | | 340 | |

| Total adjustments | | 23 | | 21 | | 39 | | 31 | | 12 | | 31 | | 54 | | 33 | | 70 | |

| Adjusted income before taxes | | 321 | | 308 | | 275 | | 143 | | 103 | | 135 | | 464 | | 411 | | 410 | |

| Adjusted return on regulatory capital (%) | | – | | – | | – | | – | | – | | – | | 32.7 | | 29.4 | | 30.5 | |

| | Private

Banking | | Asset

Management | | International

Wealth Management | |

| in | | 2018 | | 2017 | | 2018 | | 2017 | | 2018 | | 2017 | |

| Adjusted results (CHF million) |

| Net revenues | | 3,890 | | 3,603 | | 1,524 | | 1,508 | | 5,414 | | 5,111 | |

| Real estate gains | | (2) | | 0 | | 0 | | 0 | | (2) | | 0 | |

| (Gains)/losses on business sales | | (37) | | 0 | | (18) | | 28 | | (55) | | 28 | |

| Adjusted net revenues | | 3,851 | | 3,603 | | 1,506 | | 1,536 | | 5,357 | | 5,139 | |

| Provision for credit losses | | 35 | | 27 | | 0 | | 0 | | 35 | | 27 | |

| Total operating expenses | | 2,522 | | 2,552 | | 1,152 | | 1,181 | | 3,674 | | 3,733 | |

| Restructuring expenses | | (89) | | (44) | | (26) | | (26) | | (115) | | (70) | |

| Major litigation provisions | | 0 | | (48) | | 0 | | 0 | | 0 | | (48) | |

| Expenses related to business sales | | 0 | | 0 | | (47) | | 0 | | (47) | | 0 | |

| Adjusted total operating expenses | | 2,433 | | 2,460 | | 1,079 | | 1,155 | | 3,512 | | 3,615 | |

| Income before taxes | | 1,333 | | 1,024 | | 372 | | 327 | | 1,705 | | 1,351 | |

| Total adjustments | | 50 | | 92 | | 55 | | 54 | | 105 | | 146 | |

| Adjusted income before taxes | | 1,383 | | 1,116 | | 427 | | 381 | | 1,810 | | 1,497 | |

| Adjusted return on regulatory capital (%) | | – | | – | | – | | – | | 32.6 | | 28.6 | |

| Asia Pacific |

| | in / end of | | % change | | in / end of | | % change | |

| | 4Q18 | | 3Q18 | | 4Q17 | | QoQ | | YoY | | 2018 | | 2017 | | YoY | |

| Results (CHF million) |

| Net revenues | | 677 | | 811 | | 885 | | (17) | | (24) | | 3,393 | | 3,504 | | (3) | |

| of which Wealth Management & Connected | | 506 | | 557 | | 626 | | (9) | | (19) | | 2,290 | | 2,322 | | (1) | |

| of which Markets | | 171 | | 254 | | 259 | | (33) | | (34) | | 1,103 | | 1,182 | | (7) | |

| Provision for credit losses | | 8 | | 10 | | 7 | | (20) | | 14 | | 35 | | 15 | | 133 | |

| Total operating expenses | | 632 | | 625 | | 702 | | 1 | | (10) | | 2,694 | | 2,760 | | (2) | |

| Income before taxes | | 37 | | 176 | | 176 | | (79) | | (79) | | 664 | | 729 | | (9) | |

| of which Wealth Management & Connected | | 138 | | 180 | | 229 | | (23) | | (40) | | 691 | | 799 | | (14) | |

| of which Markets | | (101) | | (4) | | (53) | | – | | 91 | | (27) | | (70) | | (61) | |

| Metrics (%) |

| Return on regulatory capital | | 2.7 | | 12.5 | | 13.3 | | – | | – | | 12.0 | | 13.8 | | – | |

| Cost/income ratio | | 93.4 | | 77.1 | | 79.3 | | – | | – | | 79.4 | | 78.8 | | – | |

| Wealth Management & Connected – Private Banking |

| Assets under management (CHF billion) | | 201.7 | | 207.5 | | 196.8 | | (2.8) | | 2.5 | | 201.7 | | 196.8 | | 2.5 | |

| Net new assets (CHF billion) | | 1.2 | | 6.4 | | 1.3 | | – | | – | | 17.2 | | 16.9 | | – | |

| Gross margin (annualized) (bp) | | 70 | | 76 | | 80 | | – | | – | | 79 | | 88 | | – | |

| Net margin (annualized) (bp) | | 19 | | 26 | | 23 | | – | | – | | 27 | | 30 | | – | |

| Reconciliation of adjusted results |

| | Wealth Management & Connected | | Markets | | Asia Pacific | |

| in | | 4Q18 | | 3Q18 | | 4Q17 | | 4Q18 | | 3Q18 | | 4Q17 | | 4Q18 | | 3Q18 | | 4Q17 | |

| Adjusted results (CHF million) |

| Net revenues | | 506 | | 557 | | 626 | | 171 | | 254 | | 259 | | 677 | | 811 | | 885 | |

| Provision for credit losses | | 9 | | 1 | | 7 | | (1) | | 9 | | 0 | | 8 | | 10 | | 7 | |

| Total operating expenses | | 359 | | 376 | | 390 | | 273 | | 249 | | 312 | | 632 | | 625 | | 702 | |

| Restructuring expenses | | (10) | | (3) | | (10) | | (16) | | (6) | | (13) | | (26) | | (9) | | (23) | |

| Major litigation provisions | | (1) | | (1) | | 0 | | 0 | | 0 | | 0 | | (1) | | (1) | | 0 | |

| Adjusted total operating expenses | | 348 | | 372 | | 380 | | 257 | | 243 | | 299 | | 605 | | 615 | | 679 | |

| Income/(loss) before taxes | | 138 | | 180 | | 229 | | (101) | | (4) | | (53) | | 37 | | 176 | | 176 | |

| Total adjustments | | 11 | | 4 | | 10 | | 16 | | 6 | | 13 | | 27 | | 10 | | 23 | |

| Adjusted income/(loss) before taxes | | 149 | | 184 | | 239 | | (85) | | 2 | | (40) | | 64 | | 186 | | 199 | |

| Adjusted return on regulatory capital (%) | | – | | – | | – | | – | | – | | – | | 4.7 | | 13.2 | | 15.0 | |

| | Wealth Management

& Connected | |

Markets | |

Asia Pacific | |

| in | | 2018 | | 2017 | | 2018 | | 2017 | | 2018 | | 2017 | |

| Adjusted results (CHF million) |

| Net revenues | | 2,290 | | 2,322 | | 1,103 | | 1,182 | | 3,393 | | 3,504 | |

| Provision for credit losses | | 25 | | 15 | | 10 | | 0 | | 35 | | 15 | |

| Total operating expenses | | 1,574 | | 1,508 | | 1,120 | | 1,252 | | 2,694 | | 2,760 | |

| Restructuring expenses | | (27) | | (21) | | (34) | | (42) | | (61) | | (63) | |

| Major litigation provisions | | (79) | | 0 | | 0 | | 0 | | (79) | | 0 | |

| Adjusted total operating expenses | | 1,468 | | 1,487 | | 1,086 | | 1,210 | | 2,554 | | 2,697 | |

| Income/(loss) before taxes | | 691 | | 799 | | (27) | | (70) | | 664 | | 729 | |

| Total adjustments | | 106 | | 21 | | 34 | | 42 | | 140 | | 63 | |

| Adjusted income/(loss) before taxes | | 797 | | 820 | | 7 | | (28) | | 804 | | 792 | |

| Adjusted return on regulatory capital (%) | | – | | – | | – | | – | | 14.5 | | 15.0 | |

| | APAC Markets | |

| in | | 4Q18 | | 4Q17 | | 2018 | | 2017 | |

| Adjusted results (USD million) |

| Net revenues | | 173 | | 264 | | 1,134 | | 1,209 | |

| Total operating expenses | | 275 | | 317 | | 1,147 | | 1,277 | |

| Restructuring expenses | | (16) | | (13) | | (34) | | (42) | |

| Adjusted total operating expenses | | 259 | | 304 | | 1,113 | | 1,235 | |

| Income before taxes | | (101) | | (53) | | (24) | | (68) | |

| Total adjustments | | 16 | | 13 | | 34 | | 42 | |

| Adjusted income before taxes | | (85) | | (40) | | 10 | | (26) | |

| Global Markets |

| | in / end of | | % change | | in / end of | | % change | |

| | 4Q18 | | 3Q18 | | 4Q17 | | QoQ | | YoY | | 2018 | | 2017 | | YoY | |

| Results (CHF million) |

| Net revenues | | 965 | | 1,043 | | 1,163 | | (7) | | (17) | | 4,980 | | 5,551 | | (10) | |

| Provision for credit losses | | 5 | | 3 | | 8 | | 67 | | (38) | | 24 | | 31 | | (23) | |

| Total operating expenses | | 1,153 | | 1,136 | | 1,350 | | 1 | | (15) | | 4,802 | | 5,070 | | (5) | |

| Income/(loss) before taxes | | (193) | | (96) | | (195) | | 101 | | (1) | | 154 | | 450 | | (66) | |

| Metrics (%) |

| Return on regulatory capital | | (6.2) | | (3.0) | | (5.5) | | – | | – | | 1.2 | | 3.2 | | – | |

| Cost/income ratio | | 119.5 | | 108.9 | | 116.1 | | – | | – | | 96.4 | | 91.3 | | – | |

| Reconciliation of adjusted results |

| | Global Markets | |

| in | | 4Q18 | | 3Q18 | | 4Q17 | | 2018 | | 2017 | |

| Adjusted results (CHF million) |