UNITED STATES SECURITIES AND EXCHANGE COMMISSION

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 001-15244

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

Commission File Number 001-33434

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F  Form 40-F

Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

This report includes the media release and the slides for the presentation to investors in connection with the 2Q22 results.

Ad hoc announcement pursuant to Art. 53 LR

Credit Suisse reports net revenues of CHF 3.6 bn and pre-tax loss of CHF 1.2 bn along with a CET1 ratio of 13.5% in 2Q22

“Our results for the second quarter of 2022 are disappointing, especially in the Investment Bank, and were also impacted by higher litigation provisions and other adjusting items. The bank’s performance was significantly affected by a number of external factors, including geopolitical, macroeconomic and market headwinds. These challenging circumstances led to results which overshadow the strength of our leading client franchises in all four divisions of the bank. The urgency for decisive action is clear and a comprehensive review to strengthen our pivot to the Wealth Management, Swiss Bank and Asset Management businesses, supported by a fundamental transformation of our Investment Bank, is underway. Further, we have now launched a broader cost efficiency and digital transformation program to reduce our absolute cost base to less than CHF 15.5 bn in the medium term. Today marks a leadership change for Credit Suisse. It has been an absolute privilege and honor to serve Credit Suisse over these past 23 years. It has been my passion since day one to deliver best-in-class service to our clients. As a leader, since joining the Executive Board in 2015, I was focused on delivering results and embracing our values, including partnership, accountability and integrity.” Thomas Gottstein, Chief Executive Officer of Credit Suisse Group AG

Please refer to the additional media release published on July 27, 2022, concerning the management change and comprehensive strategic review.

|

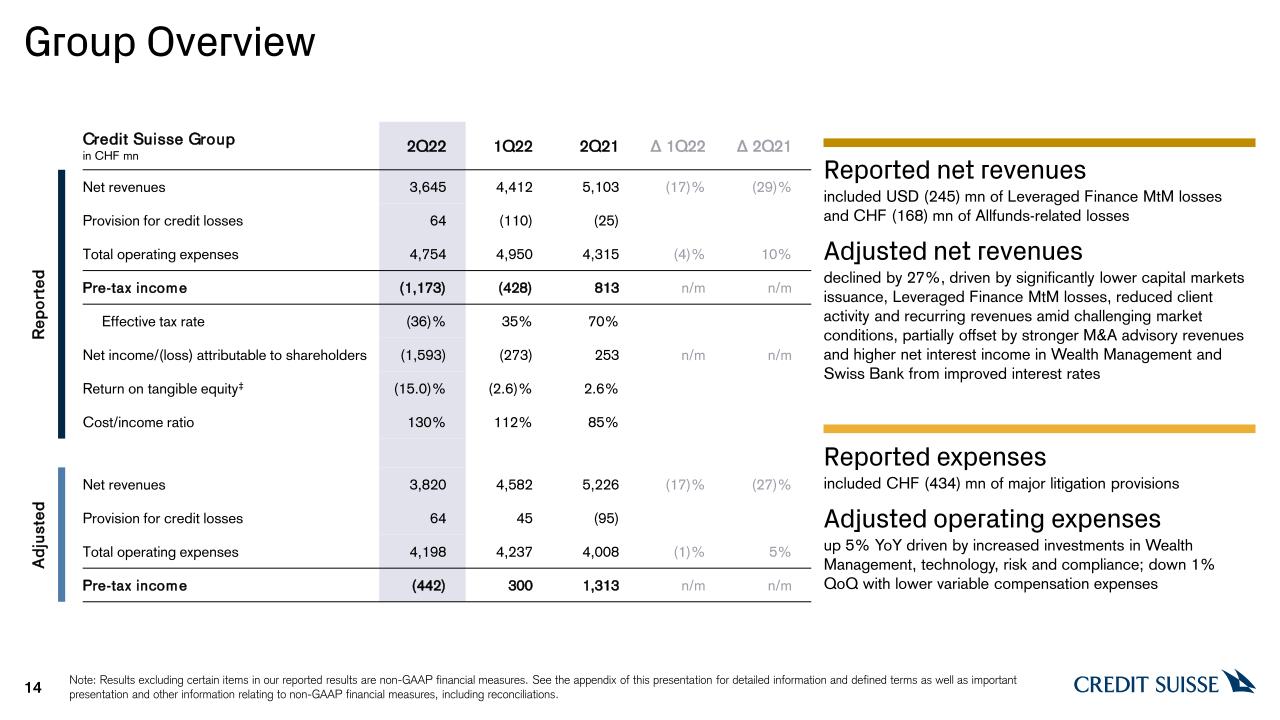

Credit Suisse Group results for 2Q22

Reported (CHF mn) | 2Q22 | 1Q22 | 2Q21 | Δ1Q22 | Δ2Q21 | 1H22 | 1H21 | Δ1H21 |

| Net revenues | 3,645 | 4,412 | 5,103 | (17)% | (29)% | 8,057 | 12,677 | (36)% |

| Provision for credit losses | 64 | (110) | (25) | - | - | (46) | 4,369 | - |

| Total operating expenses | 4,754 | 4,950 | 4,315 | (4)% | 10% | 9,704 | 8,252 | 18% |

| Pre-tax income/(loss) | (1,173) | (428) | 813 | - | - | (1,601) | 56 | - |

| Effective tax rate | (36)% | 35% | 70% | - | - | (17)% | 71% | - |

| Net income/(loss) attributable to shareholders | (1,593) | (273) | 253 | - | - | (1,866) | 1 | - |

| Return on tangible equity | (15.0)% | (2.6)% | 2.6% | - | - | (8.9)% | 0.0% | - |

| Cost/income ratio | 130% | 112% | 85% | - | - | 120% | 65% | - |

| Net New Assets (NNA) in CHF bn | (7.7) | 7.9 | (4.7) | - | - | 0.2 | 23.7 | - |

| Assets under Management (AuM) in CHF bn | 1,454 | 1,555 | 1,632 | - | - | 1,454 | 1,632 | - |

Adjusted* (CHF mn) | 2Q22 | 1Q22 | 2Q21 | Δ1Q22 | Δ2Q21 | 1H22 | 1H21 | Δ1H21 |

| Net revenues | 3,820 | 4,582 | 5,226 | (17)% | (27)% | 8,402 | 12,656 | (34)% |

| Provision for credit losses | 64 | 45 | (95) | - | - | 109 | (131) | - |

| Total operating expenses | 4,198 | 4,237 | 4,008 | (1)% | 5% | 8,435 | 7,878 | 7% |

| Pre-tax income/(loss) | (442) | 300 | 1,313 | - | - | (142) | 4,909 | - |

Capital ratios for 2Q22

| | |

| CET1 ratio vs. 13.7% in 2Q21 | CET1 leverage ratio vs. 4.2% in 2Q21

| Tier 1 leverage ratio vs. 6.0% in 2Q21

|

Summary of 2Q22 performance

As stated in our Trading Update on June 8, 2022, the second quarter was marked by challenging economic and market conditions. The combination of the current geopolitical situation following Russia’s invasion of Ukraine and significant monetary tightening by major central banks in response to the substantial increase in inflation have resulted in continued heightened market volatility, weak customer flows and ongoing client deleveraging.

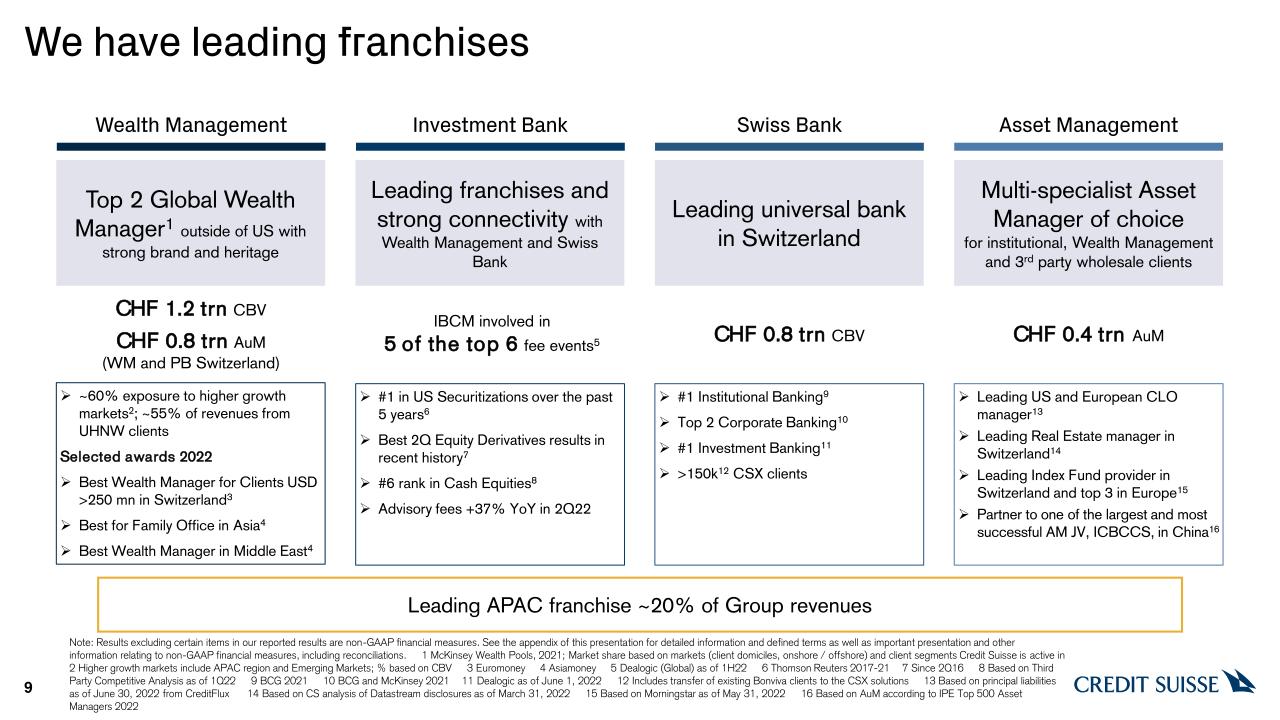

Our performance in the Investment Bank (IB) was impacted by significantly lower capital markets issuance activity as well as reduced client activity, partly offset by stronger M&A advisory revenues. The IB’s franchise positioning was not geared towards benefiting from the volatile market conditions and our areas of strength, such as capital markets, were significantly impacted.

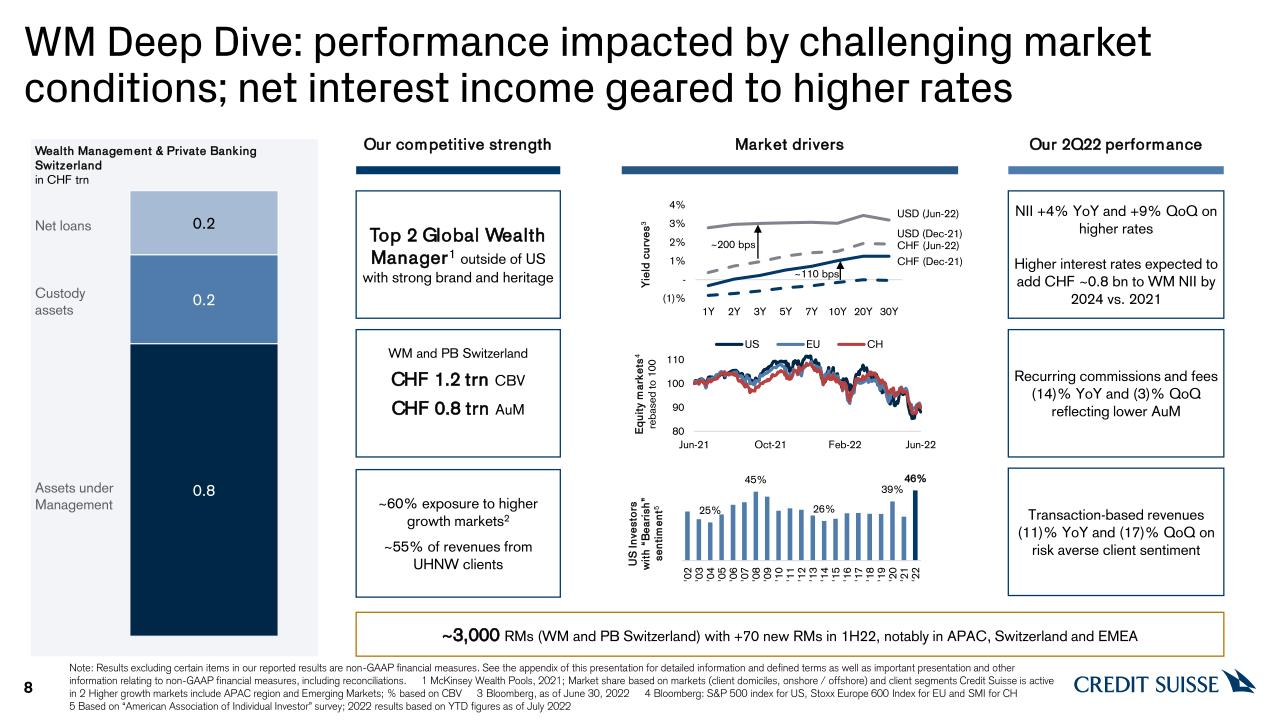

Our performance in Wealth Management (WM) was strained due to lower client activity, volumes and recurring revenues. However, WM and Swiss Bank (SB) benefited from the improved rates environment leading to higher net interest income.

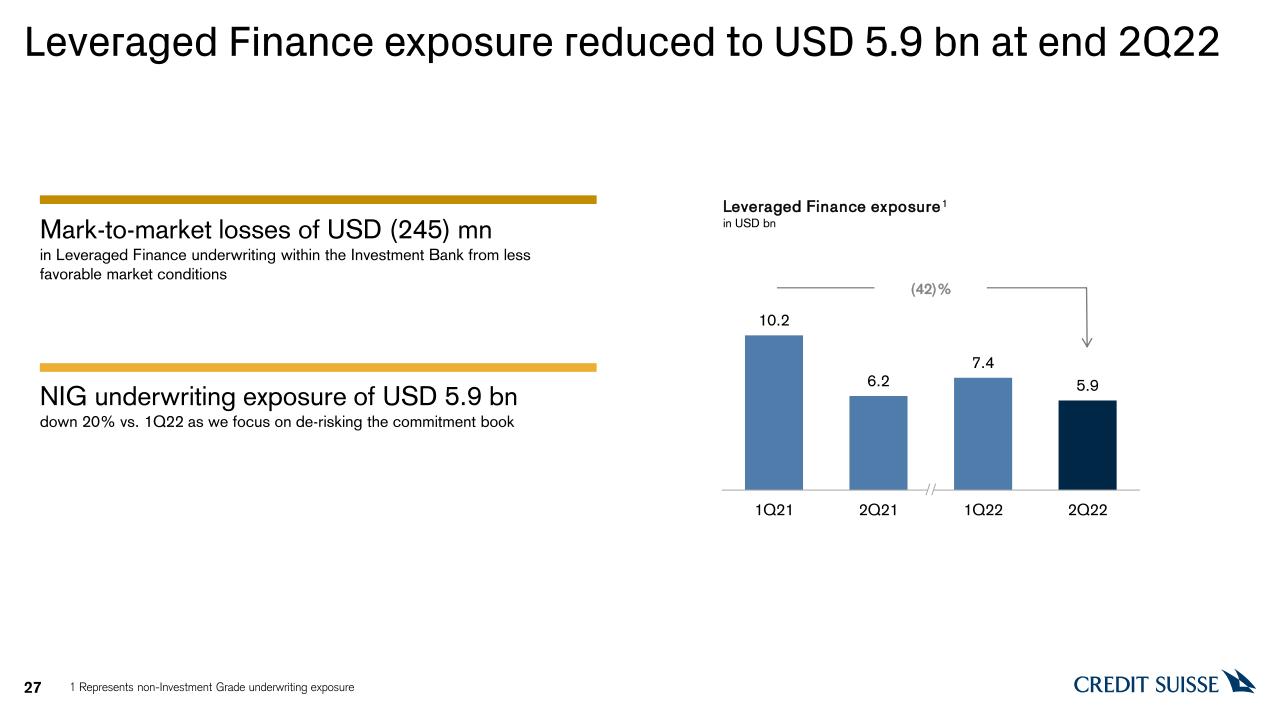

In 2Q22 we saw net revenues decrease by 29% year on year, driven by a decline in IB net revenues, down 43%, on a USD basis; a decline in WM net revenues, down 34%; as well as a decline in Asset Management (AM) net revenues, down 25%. We had a net revenue increase in SB, up 3% year on year. Reported net revenues included a valuation loss of CHF 168 mn from our equity investment in Allfunds Group. We had adjusted* net revenues of CHF 3.8 bn, down 27% year on year; these include mark-to-market losses of USD 245 mn in | Leveraged Finance within the IB as a result of less favorable market conditions.

Reported operating expenses of CHF 4.8 bn were up 10% year on year and included major litigation provisions of CHF 434 mn, primarily relating to developments in a number of previously disclosed legal matters, including a matter concerning compliance with records preservation requirements relating to business communications sent over unapproved electronic messaging channels. Our adjusted* operating expenses of CHF 4.2 bn were up 5%, primarily driven by incremental investment spend.

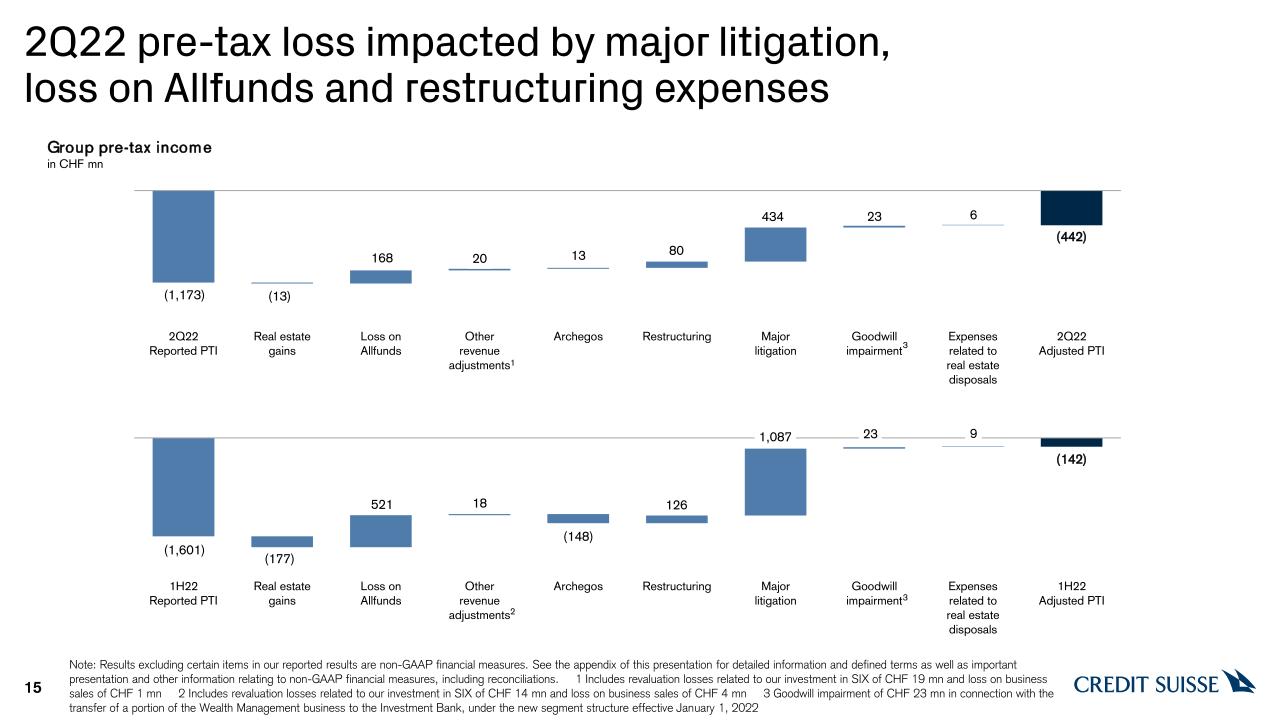

We reported a pre-tax loss of CHF 1.2 bn compared to a pre-tax income of CHF 813 mn in 2Q21. Our adjusted* pre-tax loss for 2Q22 was CHF 442 mn, down significantly compared to 2Q21. We reported a net loss attributable to shareholders of CHF 1.6 bn, compared to net income attributable to shareholders of CHF 253 mn in 2Q21.

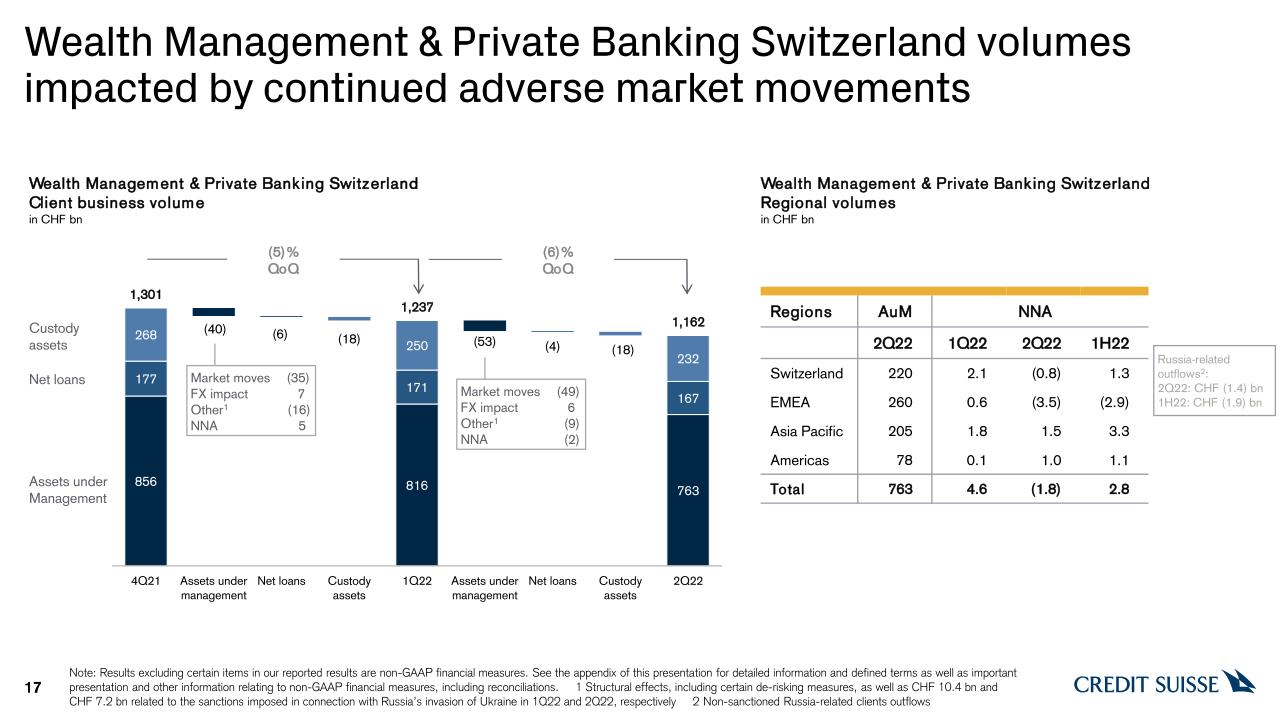

We had Group net asset outflows of CHF 7.7 bn in 2Q22, compared to net asset outflows of CHF 4.7 bn in 2Q21. Our global wealth management, which includes our WM division and Private Banking Switzerland, had moderate net asset outflows for 2Q22 of CHF 1.8 bn; this was driven primarily by net asset outflows in EMEA and Switzerland partially offset by net inflows across Asia Pacific and Americas. Group AuM for 2Q22, stood at CHF 1.5 trn, down from CHF 1.6 trn at the end of 1Q22.

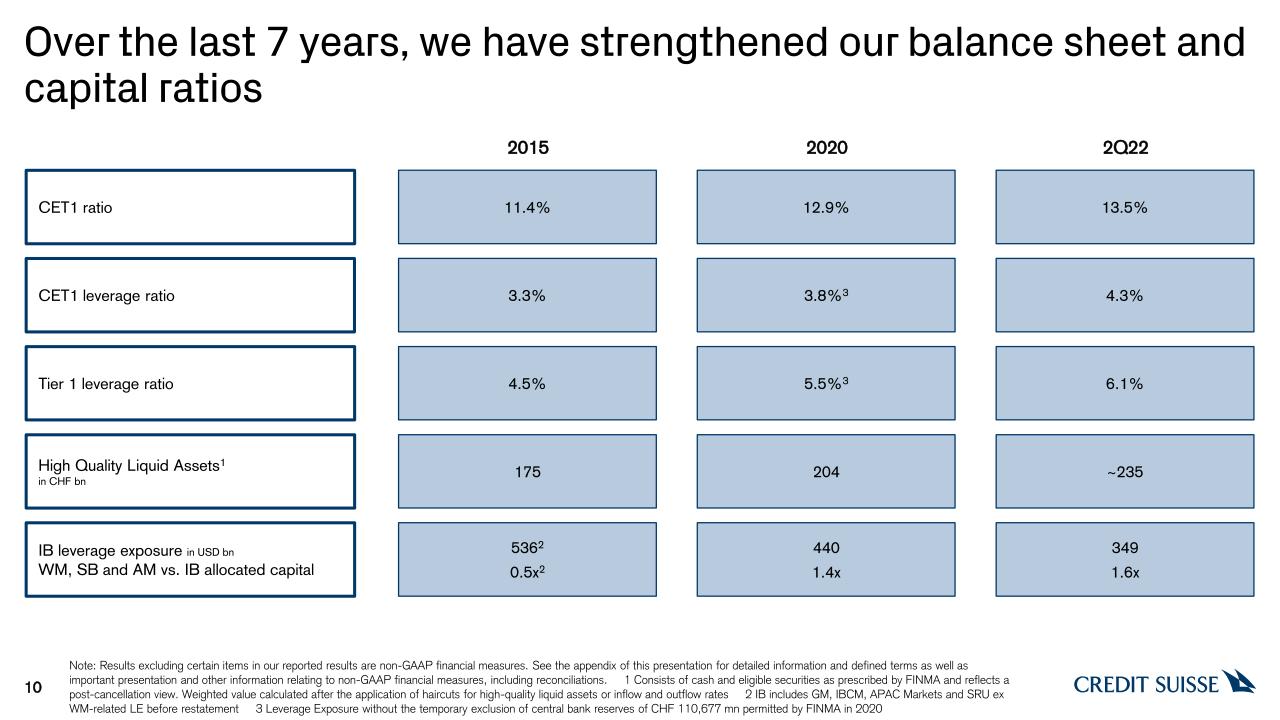

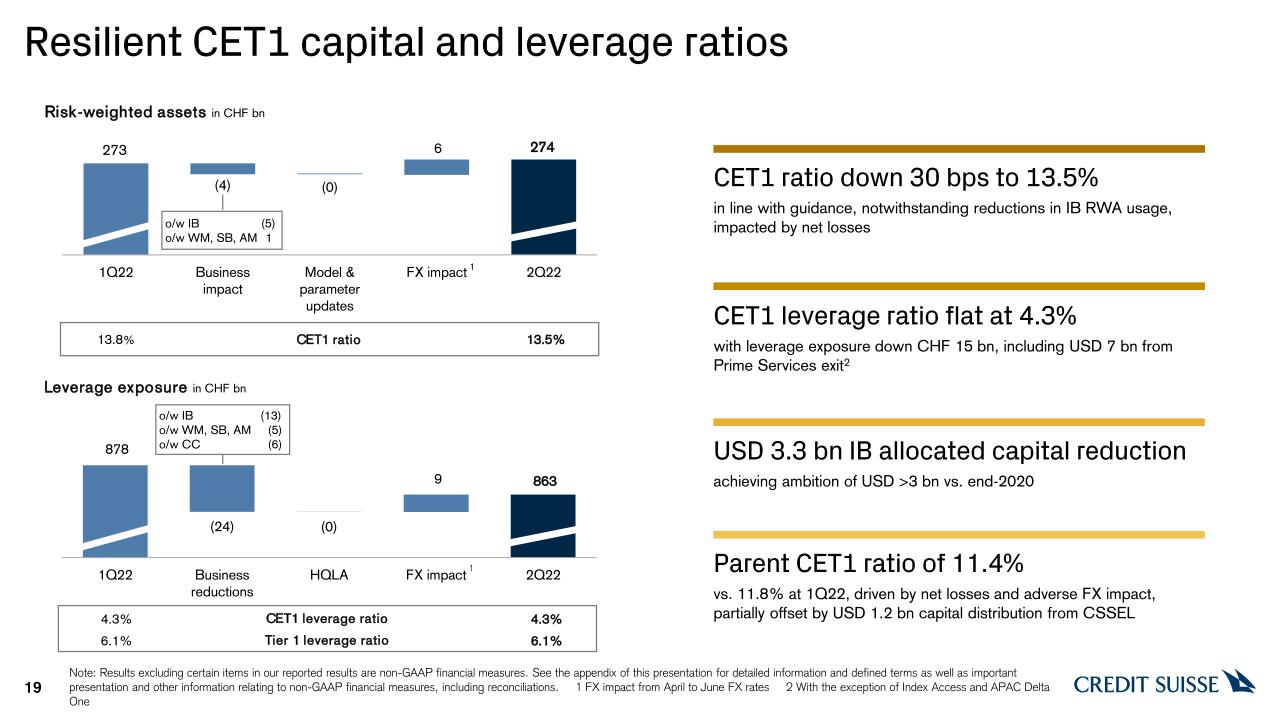

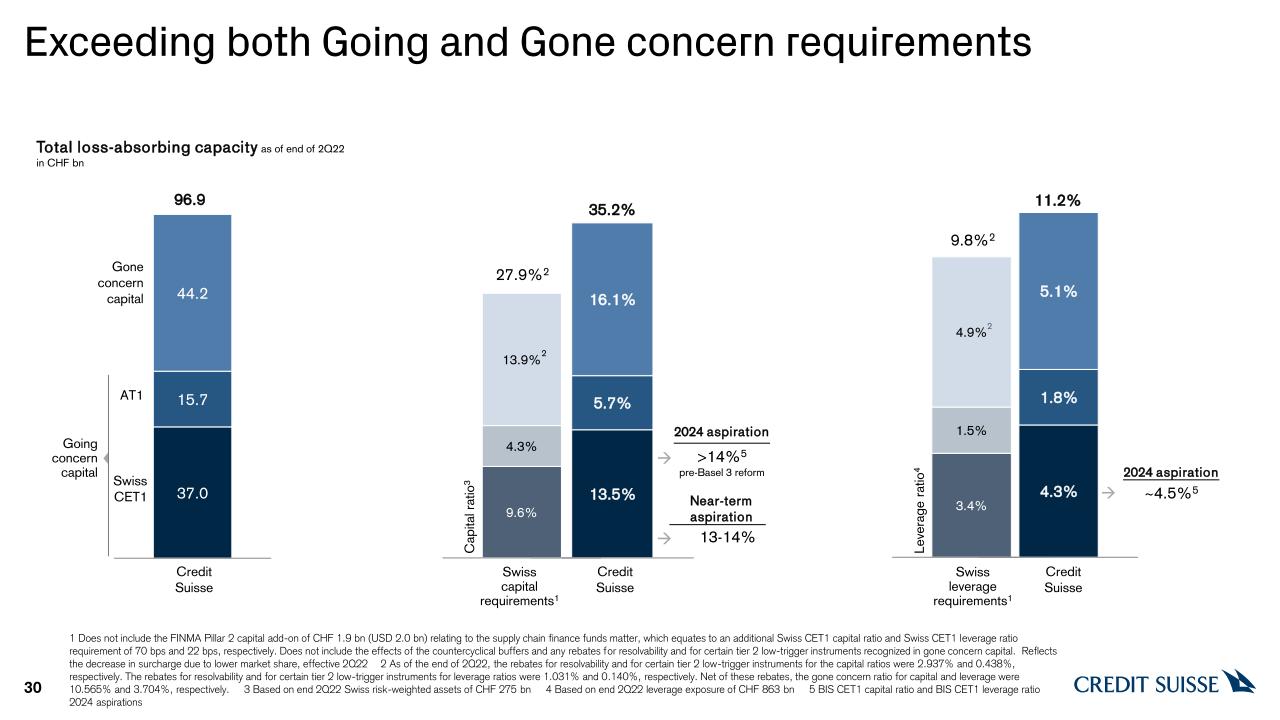

We maintained a resilient capital base with our CET1 capital ratio at 13.5% as of the end of 2Q22, in line with our guidance. Our CET1 leverage ratio, and our Tier 1 leverage ratio remained flat at 4.3% and 6.1%, respectively, as of the end of 2Q22. |

| |

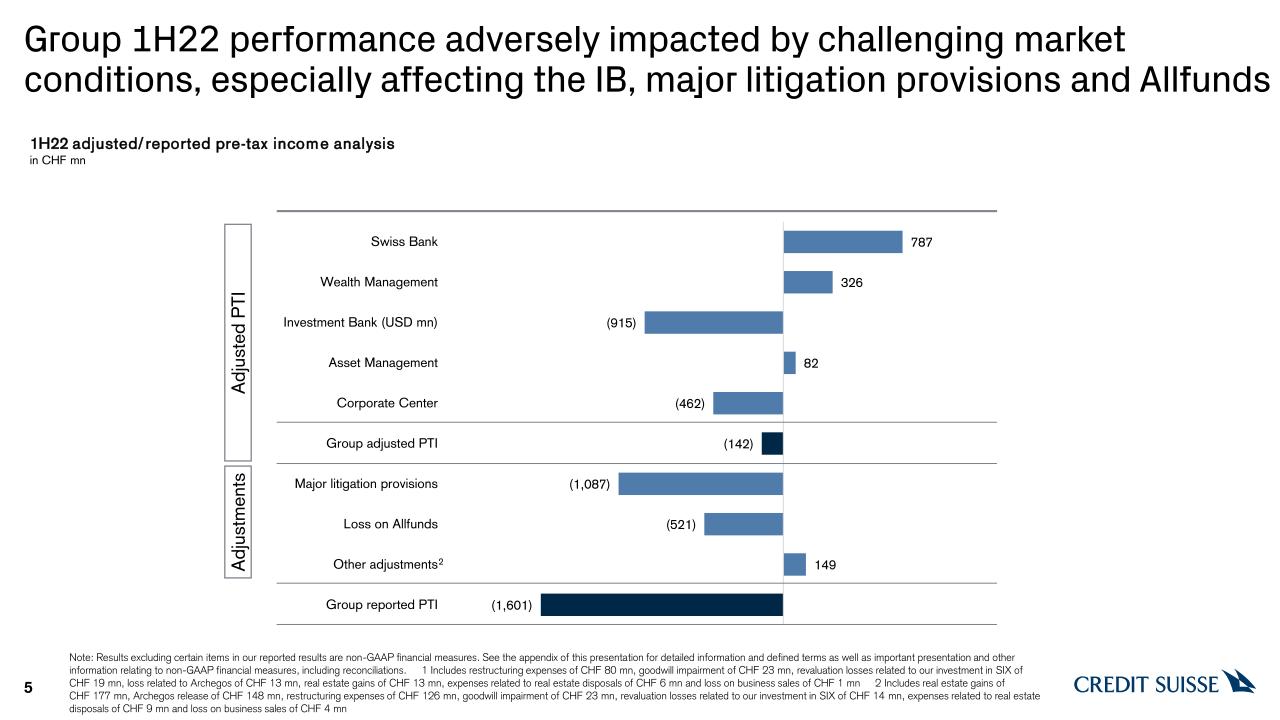

Summary of 1H22 performanceFor the first half of 2022 we saw net revenues decrease by 36% year on year, driven by a decline in IB net revenues, down 48%, on a USD basis, and a decline in WM net revenues, down 39%. We also saw a decline in AM net revenues, down 18% year on year, whereas net revenues in SB were up 5% for 1H22. Our reported net revenues of CHF 8.1 bn included real estate gains of CHF 177 mn, partially offset by a valuation loss of CHF 521 mn related to our equity investment in Allfunds Group. We had adjusted* net revenues of CHF 8.4 bn, down 34% year on year. The bank’s performance was impacted by the ongoing macro-economic and geopolitical challenges and market headwinds. | We had reported operating expenses of CHF 9.7 bn, up 18% year on year, primarily driven by litigation provisions of CHF 1.1 bn. Our adjusted* operating expenses were CHF 8.4 bn, up 7%, driven by increased incremental investment spend of CHF 331 mn relating to our Group strategy, as well as increased remediation spend in Risk, Compliance and Infrastructure.

We reported a pre-tax loss of CHF 1.6 bn for 1H22, compared to a pre-tax income of CHF 56 mn for the same period in 2021. Our adjusted* pre-tax loss for the first half of 2022 was CHF 142 mn, which compares to an exceptionally strong adjusted* pre-tax income of CHF 4.9 bn in the first half of 2021.

Our Group NNA for 1H22 was CHF 0.2 bn, compared to CHF 23.7 bn for the same period in 2021. |

| |

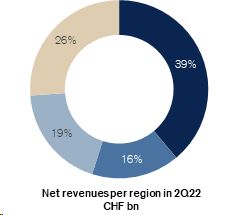

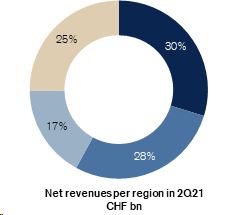

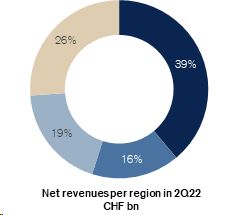

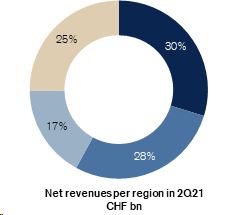

Net revenues for 2Q22 and 2Q21 by region

| | Switzerland |  | | | Switzerland |  |

| | EMEA | | EMEA |

| | Asia Pacific | | Asia Pacific |

| | Americas | | Americas |

| | | | |

| | | | |

| | | | |

| Outlook |

Our financial results for 1H22 have been significantly affected by the challenging economic and market environment, as well as legacy litigation provisions and losses resulting from the fall in the market value of our investment in Allfunds. The combination of the geopolitical situation following Russia’s invasion of Ukraine and significant monetary tightening by major central banks in response to inflation concerns have continued to result in heightened volatility and client risk aversion so far this year. The Swiss Bank continues to deliver a resilient performance and Wealth Management is benefiting from higher interest rates. In our Investment Bank, Equity Derivatives delivered its best second quarter results in recent history1, advisory revenues increased and our Securitized Products business delivered a resilient performance, given the more difficult environment. However, the current market environment has had an adverse impact on client activity across both Wealth Management and the Investment Bank. The Investment Bank has been particularly adversely affected by the industry-wide reduction in capital market volumes and by the widening in credit spreads, which have resulted in mark-to-market losses of USD 245 mn in 2Q22 in our Leveraged Finance portfolio, primarily in unfunded loans. Furthermore, the Investment Bank has relatively limited exposure to business areas, such as interest rate trading, which have benefited from the current monetary environment. We would expect these market conditions to continue for the coming months. In the Investment Bank, while we have a robust pipeline of transactions, these may prove difficult to execute in the current market environment. Trading so far in 3Q22 has been marked by a continued weakness in client activity, exacerbating normal seasonal declines, and we would expect this division to report a further loss this quarter. However, we would expect our Swiss Bank to continue to deliver a resilient performance, notwithstanding the decision by the SNB to increase CHF interest rates. Furthermore, while client activity remains subdued in our Wealth Management businesses and recurring revenues are expected to continue to reflect lower market levels, this division is already benefiting from higher interest rates, particularly related to our USD exposures. We would also expect an improvement in our Asset Management results in the second half of the year. In this environment, expense discipline is of particular importance and, as has been announced separately, the Board of Directors and the Executive Board, have now launched a broader cost efficiency and digital transformation program to reduce our absolute cost base to less than CHF 15.5 bn in the medium-term. Credit Suisse will provide further details on the progress of the strategic review, including specific performance goals, with its third quarter 2022 results. With regard to our capital position, we would expect to operate with a CET1 ratio of between 13% and 14% for the balance of 2022 supported by continued discipline around capital usage. |

Selected Group strategy execution measures and progress

As stated at our Investor Deep Dive in June, we remain firmly focused on the execution of our strategic plan throughout 2022 and on reinforcing our risk culture – crucially, while staying close to our clients.

Addressing our cost base remains a priority. We have announced a broader cost efficiency and digital transformation program to reduce our absolute cost base to less than CHF 15.5 bn in the medium-term. The digital transformation program includes measures such as the simplification of front to back processes, reduction in manual data handling and duplication as well as increase the use of scalable cloud-based infrastructure. The new absolute cost base ambition is net of investment spend that we continue to allocate to our core businesses. Credit Suisse will provide further details on the progress of the strategic review, including specific performance goals, with its third quarter 2022 results. | Over the course of 2Q22 we have achieved the following relating to our Group strategy:

• Achieved USD 3.3 bn of our ambition to release more than USD 3 bn of allocated capital in the IB by year end 2022 ahead of schedule

• Achieved a 7% year on year reduction in our Group credit portfolio, including 15% reduction in our non-investment grade portfolio, an 18% reduction in our Emerging Markets portfolio as well as a more than 70% reduction to our Russia net credit exposure since the end of 2021

• Took CHF 0.4 bn in major litigation provisions in 2Q22; proactive approach to resolving legal cases

• Credit Suisse has further announced that a comprehensive review to strengthen its pivot to Wealth Management, Swiss Bank and Asset Management, supported by a transformation of the Investment Bank, is underway |

| |

Divisional summaries

|

|

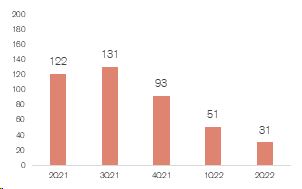

Adjusted* pre-tax income QoQ in CHF million

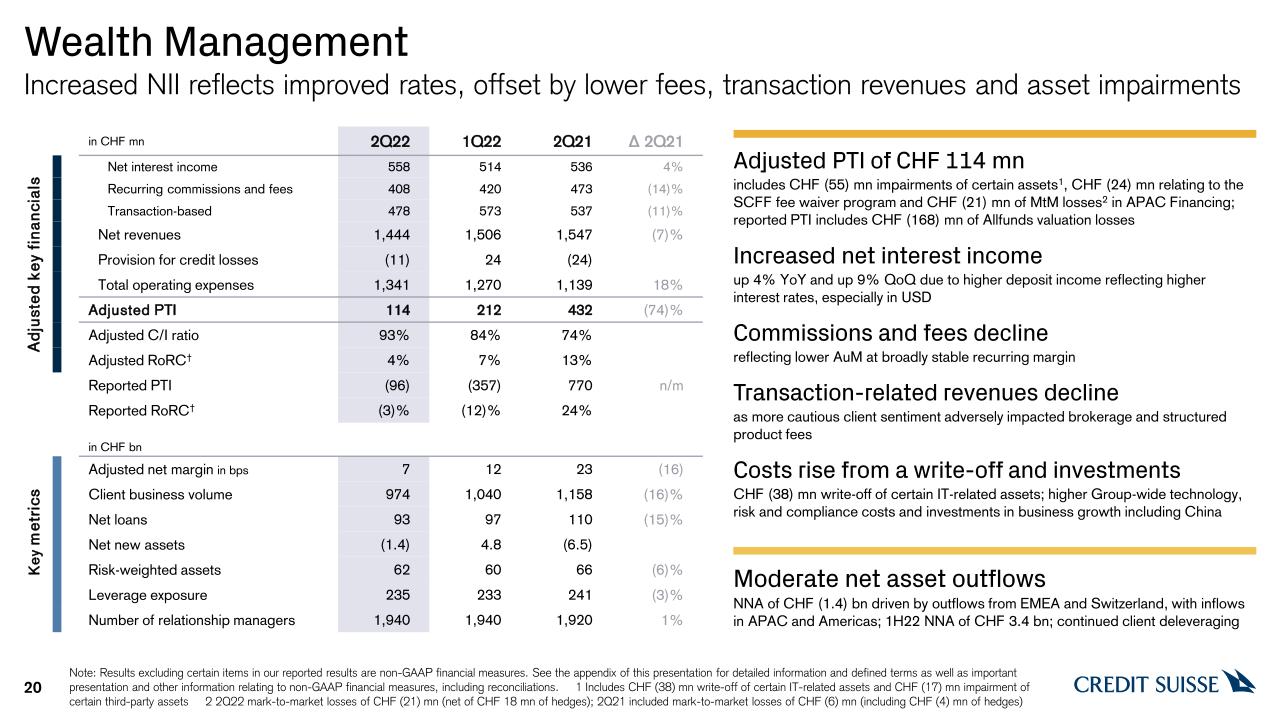

| 2Q22On an adjusted* basis, WM’s pre-tax income fell to CHF 114 mn, down from CHF 432 mn or 74% year on year due to reduced client activity, lower volumes impacting revenues and higher costs. Adjusted* pre-tax income was adversely impacted by certain asset impairments and non-operational charges, including CHF 17 mn relating to certain third-party assets, mark-to-market losses in APAC Financing of CHF 21 mn, CHF 24 mn relating to the Supply Chain Finance Fund (SCFF) fee waiver program and, impacting expenses, a CHF 38 mn write-off of certain IT-related assets. The reported pre-tax loss for the quarter of CHF 96 mn, mainly reflects a valuation loss on the equity investment in Allfunds Group of CHF 168 mn.

WM had reported net revenues of CHF 1.3 bn, down 34% year on year. Adjusted* net revenues of CHF 1.4 bn were down 7% due to lower recurring commission and fees, down 14%, reflecting lower AuM at broadly stable margins, as well as lower transaction- and performance-based revenues, down 11%, due to more cautious client sentiment adversely impacting brokerage and structured product fees. These were slightly offset by higher net interest income, up 4%, primarily driven by higher deposit income reflecting higher interest rates, especially in USD.

WM had higher adjusted* operating expenses, up 18%, reflecting an impairment of CHF 38 mn related to certain IT assets, higher Group-wide technology, risk, and compliance investments as well as investments in business growth including China.

WM had net asset outflows of CHF 1.4 bn in 2Q22 mainly driven by outflows from EMEA and Switzerland, including client deleveraging, partially offset by inflows from Asia Pacific and Americas. WM recorded AuM of CHF 662 bn, compared to CHF 769 bn in 2Q21 and CHF 707 bn in 1Q22, mainly reflecting unfavorable markets movements and structural effects. Additionally, WM had client business volume of CHF 974 bn, down 16% year on year, and down 6% quarter on quarter, due to the challenging market environment.

1H22 On an adjusted* basis, WM’s pre-tax income fell to CHF 326 mn, down 74% year on year. Adjusted* pre-tax income included negative impacts of CHF 50 mn relating to the SCFF fee waiver program. WM had lower adjusted* net revenues, down 15%, as well as higher adjusted* operating expenses, up 17%.

WM had reported net revenues of CHF 2.4 bn, down 39% year on year. The decline in reported net revenues was driven by a valuation loss of CHF 521 mn on the equity investment in Allfunds Group, compared to a valuation gain of CHF 461 mn in the first half of 2021. Adjusted* net revenues of CHF 3.0 bn were down 15% year on year, due to lower transaction- and performance-based revenues, down 28%, mainly from lower brokerage and product issuing fees and lower Global Trading Solutions (GTS) revenues; lower recurring commission and fees, down 10%, reflecting lower AuM as well as lower net interest income, down 2%.

WM had NNA of CHF 3.4 bn for the half year at annualized growth rate of 1%. |

| Investment Bank (IB) | |

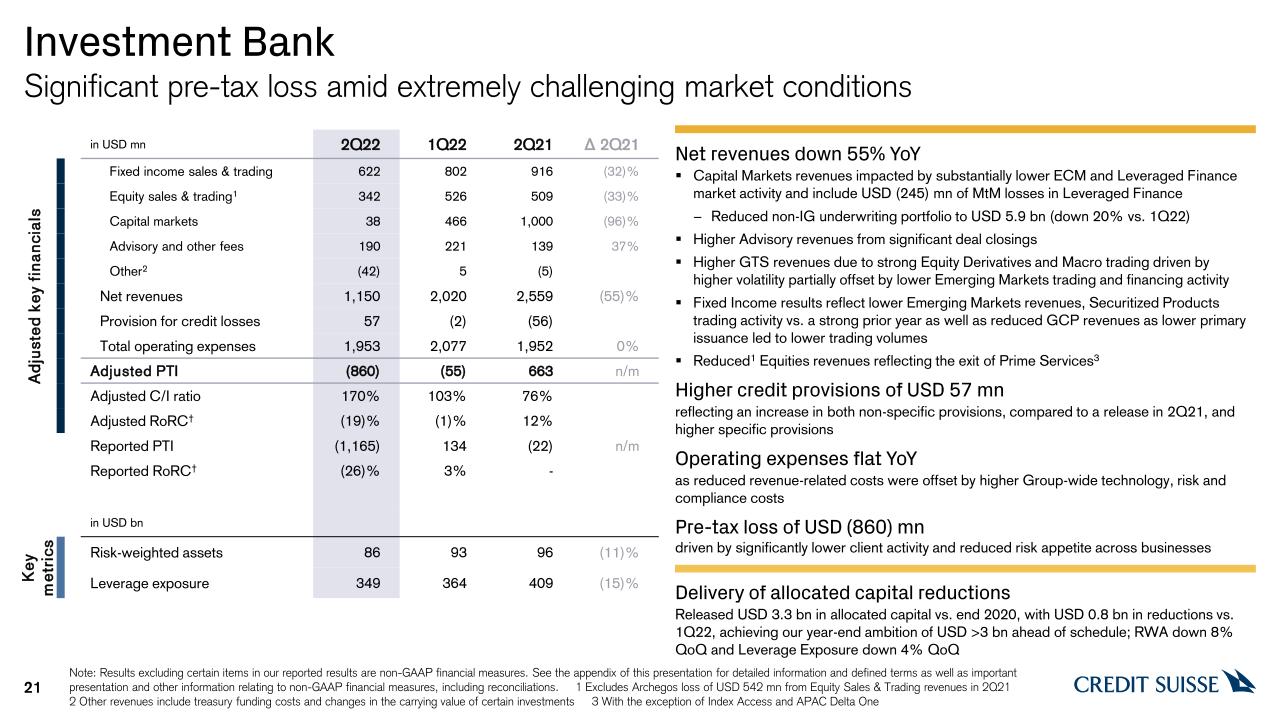

Adjusted* pre-tax income/loss QoQ in USD million

| 2Q22 On an adjusted* basis the IB posted a significant pre-tax loss of USD 860 mn, down from a pre-tax income of USD 663 mn in 2Q21, reflecting extremely challenging market conditions, particularly in capital markets. The reported pre-tax loss was USD 1.2 bn. The division’s reported net revenues were USD 1.2 bn for 2Q22, down 43% year on year due to a strong comparable in 2Q21; on an adjusted* basis, net revenues were down 55% year on year. Total reported operating expenses were up 12% and included USD 200 mn of major litigation provisions, mainly in connection with a previously disclosed matter concerning compliance with records preservation requirements relating to business communications sent over unapproved electronic messaging channels, as well as restructuring costs of USD 63 mn. Adjusted* operating expenses were flat year on year, as reduced revenue-related costs were offset by higher Group-wide technology, risk and compliance costs.

Capital markets revenues decreased 96% year on year, impacted by substantially lower ECM and Leveraged Finance market activity and including mark-to-market losses in Leveraged Finance of USD 245 mn. We saw an increase in Advisory revenues, up 37%, from significant deal closings. Revenues in our Fixed Income Sales & Trading business were down 32%, reflecting lower Emerging Markets trading and financing activity as well as lower securitized products and global credit products revenues. On an adjusted* basis, Equity Sales & Trading revenues declined by 33%2 mainly driven by the exit of Prime Services3 that has been largely completed in the quarter. GTS revenues increased year on year due to strong equity derivatives and macro trading activity driven by increased market volatility, partially offset by lower activity in Emerging Markets trading and financing.

We reduced allocated capital by USD 0.8 bn in 2Q22, releasing USD 3.3 bn in aggregate since the end of 2020, achieving ahead of schedule our ambition of more than USD 3 bn capital release by year end 2022.

1H22 On an adjusted* basis the IB recorded a pre-tax loss of USD 915 mn compared to a pre-tax income of USD 3.0 bn in the first half of 2021. This is largely due to significantly lower client activity, particularly in capital markets, compared to a strong first half of 2021, amid challenging markets as well as the cumulative impact of our reduced risk appetite and exit of Prime Services4.

The division’s reported net revenues were USD 3.2 bn, down 48% year on year, largely driven by significantly lower Capital Markets revenues and lower Fixed Income and Equity Sales & Trading revenues. We had slightly higher Advisory revenues, up 4% year on year. Total reported operating expenses were up 9% year on year; on an adjusted* basis they were up 3%, largely driven by increased Group-wide technology, risk and compliance costs partially offset by lower commissions and revenue-related expenses. |

Swiss Bank (SB) |

|

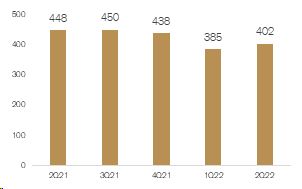

Adjusted* pre-tax income QoQ in CHF million

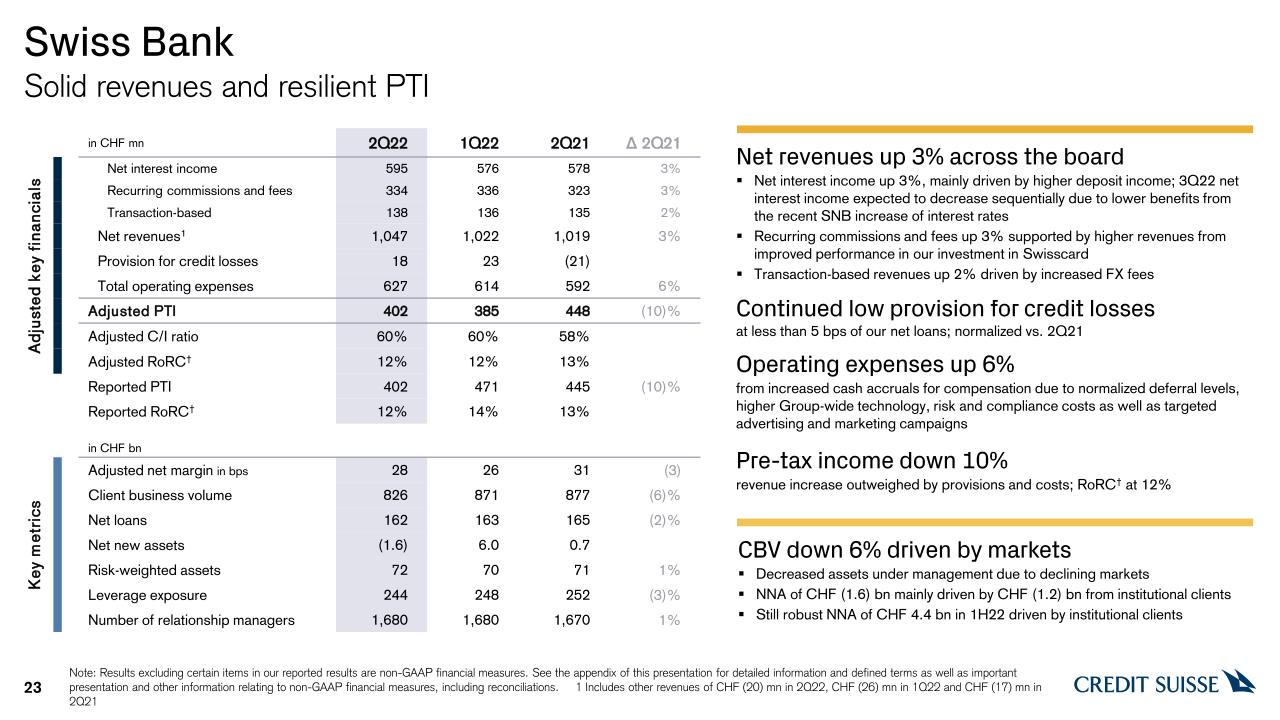

| 2Q22 SB had good revenues in 2Q22 with increases across all major revenue segments. Provision for credit losses continued at a low level.

SB had an adjusted* pre-tax income of CHF 402 mn, down 10% year on year, with higher revenues outweighed by provision for credit losses and higher operating expenses. Adjusted* operating expenses were up 6%, from increased cash accruals for compensation due to normalized deferral levels, Group-wide technology, risk and compliance costs as well as targeted advertising and marketing campaigns.

SB’s reported net revenues were CHF 1.1 bn, up 3% year on year; adjusted* net revenues were also up 3%. Net interest income increased by 3% year on year driven by higher deposit income; recurring commissions and fees were up 3% mainly driven by improved performance in our investment in Swisscard; and transaction-based revenues were up 2%, due to higher revenues from foreign exchange (FX) transactions.

SB had net asset outflows of CHF 1.6 bn driven primarily by outflows of CHF 1.2 bn by our institutional clients. The division’s AuM as of the end of 2Q22 was CHF 545 bn, down from CHF 588 bn at the end of 2Q21 and compared to CHF 583 bn at the end of 1Q22 primarily due to declining markets. SB had client business volume of CHF 826 bn in 2Q22, down 6% year on year.

1H22 SB had an adjusted* pre-tax income of CHF 787 mn for the first half of 2022, down 9% year on year mainly driven by higher adjusted* operating expenses, up 5% due to higher Group-wide technology, risk and compliance costs as well as increased cash accruals for compensation due to normalized deferral levels. SB’s reported net revenues were CHF 2.2 bn for the first half of 2022, up 5% year on year, these included real estate gains of CHF 97 mn. Adjusted* net revenues were stable, up 1%, driven by higher recurring commission and fees, up 5%, with stable net interest income and stable transaction-based revenues, down 1%.

SB had NNA of CHF 4.4 bn for the first half of 2022, driven by our institutional clients. |

Asset Management (AM) | |

Adjusted* pre-tax income QoQ in CHF million

| 2Q22 AM had an adjusted* pre-tax income of CHF 31 mn for 2Q22, down 75% year on year, driven by lower adjusted* net revenue, down 25%, partially offset by slightly lower adjusted* operating expenses, down 5%. Lower pre-tax income reflects declining market levels, reduced client risk appetite and declining activity levels. Adjusted* operating expenses were down due to the release of certain expense provisions related to the SCFF matter, partially offset by higher Group-wide technology, risk and compliance costs as well as higher deferred compensation expenses.

AM’s reported net revenues were down 25% year on year at CHF 311 mn. The decrease in revenues was mainly due to lower performance, transaction and placement revenues, down 94% year on year, reflecting investment related losses, declining performance fees and reduced placement fees. Net revenues also reflected reduced recurring management fees, down 9%, resulting from lower average AuM and increased investor bias towards passive products. Finally, investment and partnership income was also down 9% year on year primarily due to lower equity participation income, partially offset by increased investment related gains related to a single investment.

AM had net asset outflows of CHF 6.1 bn for the quarter across both traditional and alternative investments, partly offset by inflows from investments and partnerships. AM had AuM of CHF 427 bn at the end of 2Q22, down 9% year on year or CHF 44 bn, of which CHF 41 bn is due to market and FX-related movements.

1H22 AM had adjusted* pre-tax income of CHF 82 mn for the first half of 2022, down 68% year on year due to lower adjusted* net revenues, down 18%, coupled with higher adjusted* operating expenses, up 4%.

AM’s reported net revenues were down 18% year on year at CHF 672 mn. The decrease in revenues were driven by lower performance, transaction and placement revenues, down 70%, primarily due to investment related losses, reduced performance fees and declining placement fees, as well as lower recurring management fees, down 6%. These declines were partially offset by higher investment & partnership revenues, up 11% year on year.

AM had net asset outflows of CHF 6.7 bn in the first half of 2022, down compared to NNA of CHF 11.6 bn in the same period in 2021. |

Progress on our sustainability ambitions and strategy

Credit Suisse continued to focus on its sustainability strategy, driving activity across divisions and functions in 2Q22. The bank continues to emphasize the importance of sustainability as a core element of its value proposition for its clients, shareholders, employees and society.

Summary of recent sustainability-related activity:

• 2Q22 Sustainable AuM of CHF 134 bn5, up from CHF 133 bn in 2Q21, resulting in a penetration of 9.2% of total AuM as of June 30, 2022

• Number of Wealth Management ESG funds6 at 162 as of the end of 2Q22 compared to 138 at the end of 2Q21

• Hosted the 9th annual Credit Suisse Conservation Finance conference on May 12, 2022, focusing on the ‘Super Year for Nature’, highlighting the importance of nature and conservation finance in 2022

• Hosted the 6th annual Global Women’s Financial Forum on June 28-29, 2022, with a diverse line up of thought leaders covering critical topics such as geopolitics or sustainability across industries | • Published the Credit Suisse Nuclear Energy Report 2022 on July 14, 2022, which considers the efficiency and environmental merits, challenges, and political discord around nuclear technology

|

Contact details

Kinner Lakhani, Investor Relations, Credit Suisse

Tel: +41 44 333 71 49

Email: investor.relations@credit-suisse.com

Dominik von Arx, Corporate Communications, Credit Suisse

Tel: +41 844 33 88 44

Email: media.relations@credit-suisse.com

The Earnings Release and Presentation for 2Q22 and 1H22 are available to download from 06:45 CEST today at:

www.credit-suisse.com/results

Presentation of 2Q22 results

Wednesday, July 27, 2022

| Event | Analyst Call | Media Call |

| Time | 08:15 CEST (Zurich) 07:15 BST (London) 02:15 EDT (New York) | 10:30 CEST (Zurich) 09:30 BST (London) 04:30 EDT (New York) |

| Language | English | English |

| Access | Switzerland +41 (0) 58 310 51 26 UK +44 (0) 121 281 8012 USA +1 631 232 7997 Reference: Credit Suisse Analysts and Investors Call Conference ID: 20220428 Please dial in 10 minutes before the start of the call. When dialing in please enter the Passcode/Conference ID and leave your first, last name and company name after the tone. You will be joined automatically to the conference. Webcast link here. | Switzerland +41 (0) 58 310 51 26 UK +44 (0) 121 281 8012 USA +1 631 232 7997 Reference: Credit Suisse Media Call Conference ID: 20220429 Please dial in 10 minutes before the start of the call. When dialing in please enter the Passcode/Conference ID and leave your first, last name and company name after the tone. You will be joined automatically to the conference. Webcast link here. |

| Q&A Session | Following the presentation, you will have the opportunity to ask the speakers questions | Following the presentation, you will have the opportunity to ask the speakers questions |

| Playback | Replay available at the webcast link. | Replay available at the webcast link. |

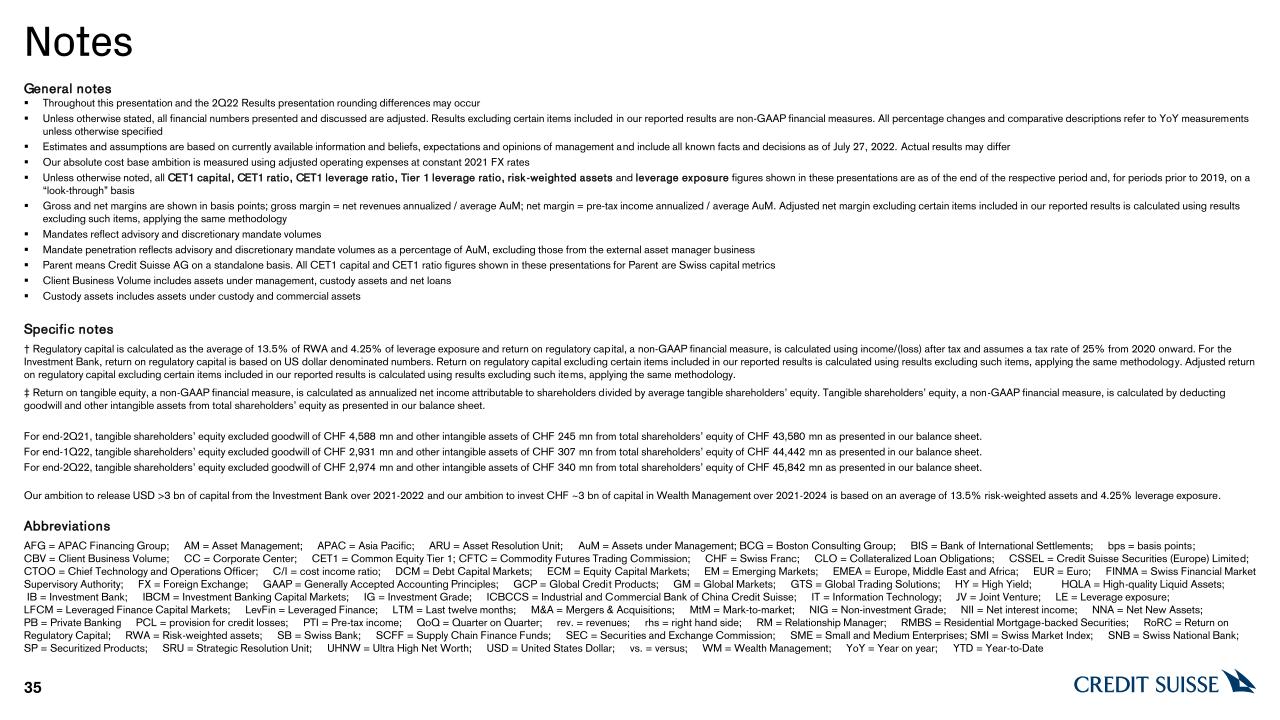

Abbreviations AM – Asset Management; APAC – Asia Pacific; AuM – assets under management; bn – billion; CET1 – common equity tier 1; CHF – Swiss francs; ECM – Equity Capital Markets; EMEA – Europe, Middle East and Africa; ESG – Environmental, Social and Governance; FINMA – Swiss Financial Market Supervisory Authority FINMA; FX – Foreign Exchange; GAAP – Generally accepted accounting principles; GTS – Global Trading Solutions; IB – Investment Bank; IT – Information Technology; mn – million; M&A – Mergers & Acquisitions; NNA – net new assets; QoQ – Quarter on Quarter; RWA – risk weighted assets; SB – Swiss Bank; SCFF – Supply Chain Finance Funds; SEC – US Securities and Exchange Commission; trn – trillion; (U)HNW – (Ultra) high-net-worth; UK – United Kingdom; US – United States; USD – US dollar; WM – Wealth Management

Important information This document contains select information from the full 2Q22 Earnings Release and 2Q22 Results Presentation slides that Credit Suisse believes is of particular interest to media professionals. The complete 2Q22 Earnings Release and 2Q22 Results Presentation slides, which have been distributed simultaneously, contain more comprehensive information about our results and operations for the reporting quarter, as well as important information about our reporting methodology and some of the terms used in these documents. The complete 2Q22 Earnings Release and 2Q22 Results Presentation slides are not incorporated by reference into this document.

Credit Suisse has not finalized its 2Q22 Financial Report and Credit Suisse’s independent registered public accounting firm has not completed its review of the condensed consolidated financial statements (unaudited) for the period. Accordingly, the financial information contained in this document is subject to completion of quarter-end procedures, which may result in changes to that information.

This document contains certain unaudited interim financial information for the third quarter of 2022. This information has been derived from management accounts, is preliminary in nature, does not reflect the complete results of the third quarter of 2022 and is subject to change, including as a result of any normal quarterly adjustments in relation to the financial statements for the third quarter of 2022. This information has not been subject to any review by our independent registered public accounting firm. There can be no assurance that the final results for these periods will not differ from these preliminary results, and any such differences could be material. Quarterly financial results for the third quarter of 2022 will be included in our 3Q22 Financial Report. These interim results of operations are not necessarily indicative of the results to be achieved for the remainder of or the full third quarter of 2022.

Our ambition to release over USD 3 billion of capital from the Investment Bank over 2021-2022 and our ambition to invest approximately CHF 3 billion of capital in Wealth Management over 2021-2024 is based on an average of 13.5% risk-weighted assets and 4.25% leverage exposure.

Our absolute cost base ambition is measured using adjusted operating expenses at constant 2021 FX rates.

We may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions (including macroeconomic and other challenges and uncertainties, for example, resulting from Russia’s invasion of Ukraine), changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives.

In particular, the terms “Estimate”, “Illustrative”, “Ambition”, “Objective”, “Outlook”, “Goal”, “Commitment” and “Aspiration” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such estimates, illustrations, ambitions, objectives, outlooks, goals, commitments and aspirations are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. These risks, assumptions and uncertainties include, but are not limited to, general market conditions, market volatility, increased inflation, interest rate volatility and levels, global and regional economic conditions, challenges and uncertainties resulting from Russia’s invasion of Ukraine, political uncertainty, changes in tax policies, scientific or technological developments, evolving sustainability strategies, changes in the nature or scope of our operations, changes in carbon markets, regulatory changes, changes in levels of client activity as a result of any of the foregoing and other factors. Accordingly, these | statements, which speak only as of the date made, are not guarantees of future performance and should not be relied on for any purpose. We do not intend to update these estimates, illustrations, ambitions, objectives, outlooks, goals, commitments, aspirations or any other forward-looking statements. For these reasons, we caution you not to place undue reliance upon any forward-looking statements.

In preparing this document, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Annualized numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this document may also be subject to rounding adjustments. All opinions and views constitute good faith judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information.

Our estimates, ambitions, objectives and targets often include metrics that are non-GAAP financial measures and are unaudited. A reconciliation of the estimates, ambitions, objectives and targets to the nearest GAAP measures is unavailable without unreasonable efforts. Adjusted results exclude goodwill impairment, major litigation provisions, real estate gains and other revenue and expense items included in our reported results, all of which are unavailable on a prospective basis. Such estimates, ambitions, objectives and targets are calculated in a manner that is consistent with the accounting policies applied by us in preparing our financial statements.

Return on tangible equity, a non-GAAP financial measure, is calculated as annualized net income attributable to shareholders divided by average tangible shareholders’ equity. Tangible shareholders’ equity, a non-GAAP financial measure, is calculated by deducting goodwill and other intangible assets from total shareholders’ equity as presented in our balance sheet. Management believes that return on tangible equity is meaningful as it is a measure used and relied upon by industry analysts and investors to assess valuations and capital adequacy. Adjusted return on tangible equity excluding certain items included in our reported results is calculated using results excluding such items, applying the same methodology. For end 2Q22, tangible shareholders’ equity excluded goodwill of CHF 2,974 million and other intangible assets of CHF 340 million from total shareholders’ equity of CHF 45,842 million as presented in our balance sheet. For end 1Q22, tangible shareholders’ equity excluded goodwill of CHF 2,931 million and other intangible assets of CHF 307 million from total shareholders’ equity of CHF 44,442 million as presented in our balance sheet. For end 2Q21, tangible shareholders’ equity excluded goodwill of CHF 4,588 million and other intangible assets of CHF 245 million from total shareholders’ equity of CHF 43,580 million as presented in our balance sheet.

Regulatory capital is calculated as the average of 13.5% of RWA and 4.25% of leverage exposure and return on regulatory capital, a non-GAAP financial measure, is calculated using income/(loss) after tax and assumes a tax rate of 30% for periods prior to 2020 and 25% from 2020 onward. For the Investment Bank division, return on regulatory capital is based on US dollar denominated numbers. Adjusted return on regulatory capital excluding certain items included in our reported results is calculated using results excluding such items, applying the same methodology.

The Group’s economic profit is a non-GAAP financial measure, calculated using income/(loss) before tax applying a 25% tax rate less a capital charge. The capital charge is calculated based on the sum of (i) a cost of capital applied to the average regulatory capital of each of the four divisions; and (ii) a 10% cost of capital applied to the residual of the Group’s average tangible equity less the sum of the regulatory capital of the four divisions. The applied cost of capital for the divisions is 8% for Wealth Management, the Swiss Bank and Asset Management and 12% for the Investment Bank. Adjusted economic profit excluding certain items included in our reported results is calculated using results excluding such items, applying the same methodology.

Credit Suisse is subject to the Basel framework, as implemented in Switzerland, as well as Swiss legislation and regulations for systemically important banks, which include capital, liquidity, leverage and large exposure requirements and rules for emergency plans designed to maintain systemically relevant functions in the event of threatened insolvency. Credit Suisse has adopted the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS) and implemented in Switzerland by the Swiss Financial Market Supervisory Authority FINMA (FINMA). |

Unless otherwise noted, all CET1 ratio, CET1 leverage ratio, Tier-1 leverage ratio, risk-weighted assets and leverage exposure figures in this document are as of the end of the respective period.

Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. The tier 1 leverage ratio and CET1 leverage ratio are calculated as BIS tier 1 capital and CET1 capital, respectively, divided by period end leverage exposure.

Client business volume includes assets under management, custody assets (including assets under custody and commercial assets) and net loans.

Investors and others should note that we announce important company information (including quarterly earnings releases and financial reports as well as our annual sustainability report) to the investing public using press releases, SEC and Swiss ad hoc filings, our website and public conference calls and webcasts. We also routinely use our Twitter account @creditsuisse (https://twitter.com/creditsuisse), our LinkedIn account (https://www.linkedin.com/company/credit-suisse/), our Instagram accounts (https://www.instagram.com/creditsuisse_careers/ and https://www.instagram.com/creditsuisse_ch/), our Facebook account (https://www.facebook.com/creditsuisse/) and other social media channels as | additional means to disclose public information, including to excerpt key messages from our public disclosures. We may share or retweet such messages through certain of our regional accounts, including through Twitter at @csschweiz (https://twitter.com/csschweiz) and @csapac (https://twitter.com/csapac). Investors and others should take care to consider such abbreviated messages in the context of the disclosures from which they are excerpted. The information we post on these social media accounts is not a part of this document.

Information referenced in this document, whether via website links or otherwise, is not incorporated into this document.

Certain material in this document has been prepared by Credit Suisse on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Credit Suisse has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness, reasonableness or reliability of such information.

In various tables, use of “–” indicates not meaningful or not applicable.

The English language version of this document is the controlling version. |

* Refers to results excluding certain items included in our reported results. These are non-GAAP financial measures. For a reconciliation to the most directly comparable US GAAP measures, see the Appendix of this Media Release

1 Best 2Q result for Equity Derivatives since 2Q16 2 Excludes Archegos loss of USD 542 mn from Equity Sales & Trading revenues in 2Q21 3 With the exception of Index Access and APAC Delta One 4 With the exception of Index Access and APAC Delta One | 5 Refers to Credit Suisse’s assets managed according to the Credit Suisse Sustainable Investment Framework (Sustainable AuM). This includes only AuM balances from managed solutions that to date have been mapped to a sustainability rating of 2 and higher, based on the Framework scale (0-5). The movement vs. 2Q21 reflects a combination of onboarding of new sustainable funds, net sales and further product classifications, partially offset by market and FX movements 6 Includes funds of our Wealth Management Lead Offering that as of June 30, 2022 have been mapped to a sustainability rating of 2 and higher, based on our internal Sustainable Investment Framework scale (0-5) |

| Key metrics |

| | in / end of | | % change | | in / end of | | % change | |

| | 2Q22 | | 1Q22 | | 2Q21 | | QoQ | | YoY | | 6M22 | | 6M21 | | YoY | |

| Credit Suisse Group results (CHF million) |

| Net revenues | | 3,645 | | 4,412 | | 5,103 | | (17) | | (29) | | 8,057 | | 12,677 | | (36) | |

| Provision for credit losses | | 64 | | (110) | | (25) | | – | | – | | (46) | | 4,369 | | – | |

| Compensation and benefits | | 2,392 | | 2,458 | | 2,356 | | (3) | | 2 | | 4,850 | | 4,563 | | 6 | |

| General and administrative expenses | | 2,005 | | 2,148 | | 1,589 | | (7) | | 26 | | 4,153 | | 2,965 | | 40 | |

| Commission expenses | | 254 | | 298 | | 325 | | (15) | | (22) | | 552 | | 654 | | (16) | |

| Restructuring expenses | | 80 | | 46 | | 45 | | 74 | | 78 | | 126 | | 70 | | 80 | |

| Total other operating expenses | | 2,362 | | 2,492 | | 1,959 | | (5) | | 21 | | 4,854 | | 3,689 | | 32 | |

| Total operating expenses | | 4,754 | | 4,950 | | 4,315 | | (4) | | 10 | | 9,704 | | 8,252 | | 18 | |

| Income/(loss) before taxes | | (1,173) | | (428) | | 813 | | 174 | | – | | (1,601) | | 56 | | – | |

| Net income/(loss) attributable to shareholders | | (1,593) | | (273) | | 253 | | 484 | | – | | (1,866) | | 1 | | – | |

| Balance sheet statistics (CHF million) |

| Total assets | | 727,365 | | 739,554 | | 810,952 | | (2) | | (10) | | 727,365 | | 810,952 | | (10) | |

| Risk-weighted assets | | 274,442 | | 273,043 | | 283,611 | | 1 | | (3) | | 274,442 | | 283,611 | | (3) | |

| Leverage exposure | | 862,737 | | 878,023 | | 931,041 | | (2) | | (7) | | 862,737 | | 931,041 | | (7) | |

| Assets under management and net new assets (CHF billion) |

| Assets under management | | 1,453.9 | | 1,554.9 | | 1,632.0 | | (6.5) | | (10.9) | | 1,453.9 | | 1,632.0 | | (10.9) | |

| Net new assets | | (7.7) | | 7.9 | | (4.7) | | – | | 63.8 | | 0.2 | | 23.7 | | (99.2) | |

| Basel III regulatory capital and leverage statistics (%) |

| CET1 ratio | | 13.5 | | 13.8 | | 13.7 | | – | | – | | 13.5 | | 13.7 | | – | |

| CET1 leverage ratio | | 4.3 | | 4.3 | | 4.2 | | – | | – | | 4.3 | | 4.2 | | – | |

| Tier 1 leverage ratio | | 6.1 | | 6.1 | | 5.9 | | – | | – | | 6.1 | | 5.9 | | – | |

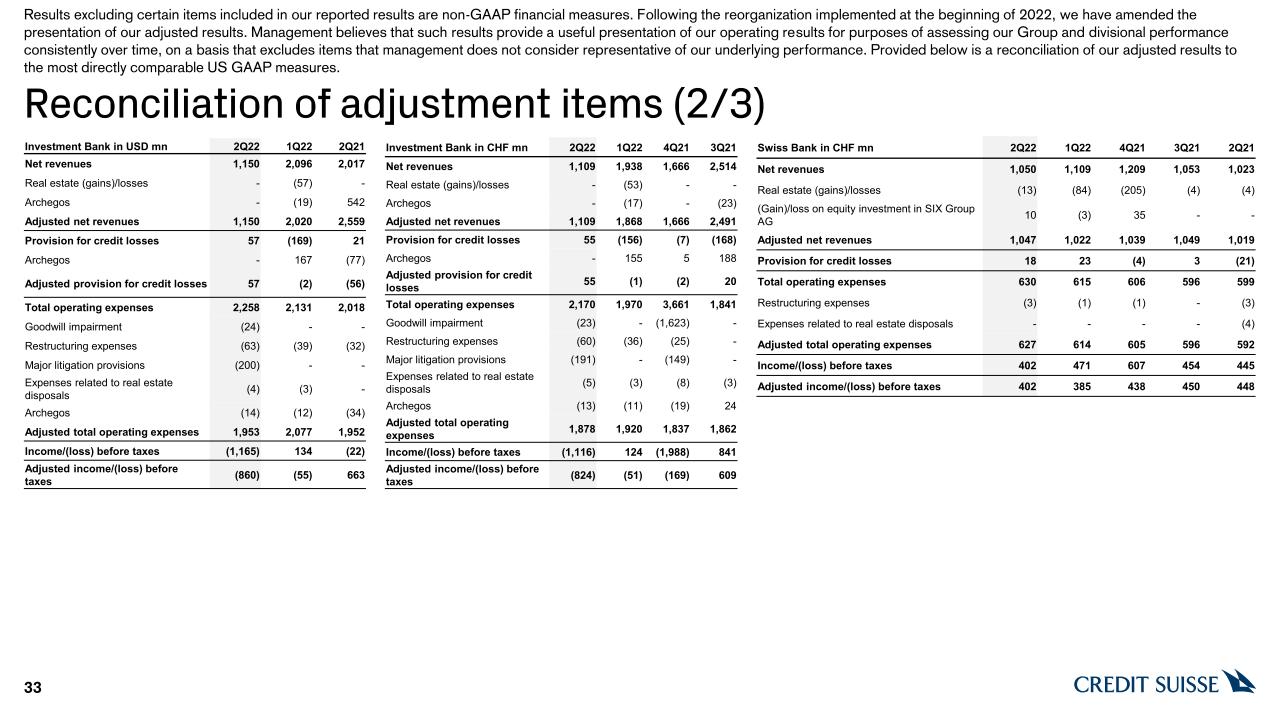

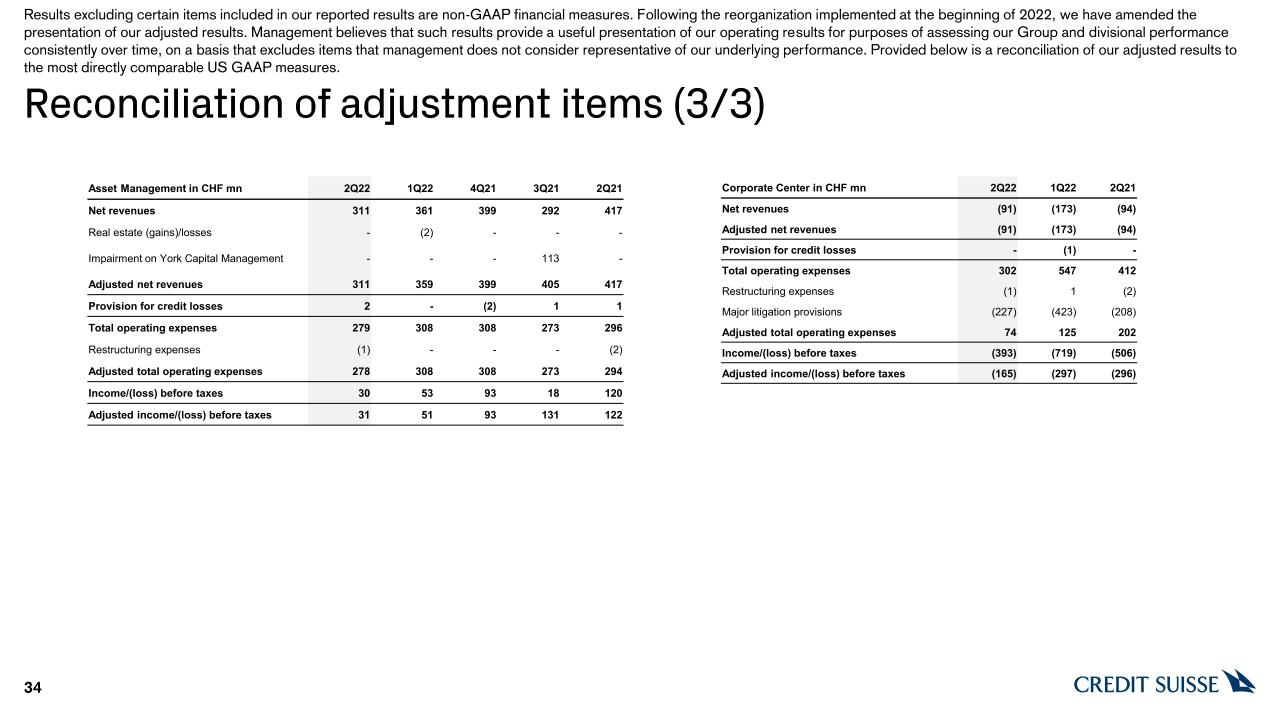

Results excluding certain items included in our reported results are non-GAAP financial measures. Following the reorganization implemented at the beginning of 2022, we have amended the presentation of our adjusted results. Management believes that such results provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance consistently over time, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation to the most directly comparable US GAAP measures.

| Reconciliation of adjustment items |

| | Group | |

| in | | 2Q22 | | 1Q22 | | 2Q21 | | 6M22 | | 6M21 | |

| Results (CHF million) |

| Net revenues | | 3,645 | | 4,412 | | 5,103 | | 8,057 | | 12,677 | |

| Real estate (gains)/losses | | (13) | | (164) | | (4) | | (177) | | (4) | |

| (Gains)/losses on business sales | | 1 | | 3 | | 0 | | 4 | | 0 | |

| Major litigation recovery | | 0 | | 0 | | (49) | | 0 | | (49) | |

| (Gain)/loss on equity investment in Allfunds Group | | 168 | | 353 | | (317) | | 521 | | (461) | |

| (Gain)/loss on equity investment in SIX Group AG | | 19 | | (5) | | 0 | | 14 | | 0 | |

| Archegos | | 0 | | (17) | | 493 | | (17) | | 493 | |

| Adjusted net revenues | | 3,820 | | 4,582 | | 5,226 | | 8,402 | | 12,656 | |

| Provision for credit losses | | 64 | | (110) | | (25) | | (46) | | 4,369 | |

| Archegos | | 0 | | 155 | | (70) | | 155 | | (4,500) | |

| Adjusted provision for credit losses | | 64 | | 45 | | (95) | | 109 | | (131) | |

| Total operating expenses | | 4,754 | | 4,950 | | 4,315 | | 9,704 | | 8,252 | |

| Goodwill impairment | | (23) | | 0 | | 0 | | (23) | | 0 | |

| Restructuring expenses | | (80) | | (46) | | (45) | | (126) | | (70) | |

| Major litigation provisions | | (434) | | (653) | | (208) | | (1,087) | | (212) | |

| Expenses related to real estate disposals | | (6) | | (3) | | (4) | | (9) | | (42) | |

| Expenses related to equity investment in Allfunds Group | | 0 | | 0 | | (19) | | 0 | | (19) | |

| Archegos | | (13) | | (11) | | (31) | | (24) | | (31) | |

| Adjusted total operating expenses | | 4,198 | | 4,237 | | 4,008 | | 8,435 | | 7,878 | |

| Income/(loss) before taxes | | (1,173) | | (428) | | 813 | | (1,601) | | 56 | |

| Adjusted income/(loss) before taxes | | (442) | | 300 | | 1,313 | | (142) | | 4,909 | |

| Adjusted economic profit | | (1,383) | | (786) | | (52) | | (2,169) | | 1,674 | |

| Adjusted return on tangible equity (%) | | (8.1) | | 4.3 | | 6.6 | | (2.0) | | 20.0 | |

| Wealth Management |

| | in / end of | | % change | | in / end of | | % change | |

| | 2Q22 | | 1Q22 | | 2Q21 | | QoQ | | YoY | | 6M22 | | 6M21 | | YoY | |

| Results (CHF million) |

| Net revenues | | 1,266 | | 1,177 | | 1,913 | | 8 | | (34) | | 2,443 | | 3,998 | | (39) | |

| Provision for credit losses | | (11) | | 24 | | (24) | | – | | (54) | | 13 | | (11) | | – | |

| Total operating expenses | | 1,373 | | 1,510 | | 1,167 | | (9) | | 18 | | 2,883 | | 2,261 | | 28 | |

| Income/(loss) before taxes | | (96) | | (357) | | 770 | | (73) | | – | | (453) | | 1,748 | | – | |

| Metrics |

| Economic profit (CHF million) | | (254) | | (448) | | 383 | | (43) | | – | | (702) | | 927 | | – | |

| Cost/income ratio (%) | | 108.5 | | 128.3 | | 61.0 | | – | | – | | 118.0 | | 56.6 | | – | |

| Assets under management (CHF billion) | | 661.5 | | 707.0 | | 769.4 | | (6.4) | | (14.0) | | 661.5 | | 769.4 | | (14.0) | |

| Net new assets (CHF billion) | | (1.4) | | 4.8 | | (6.5) | | – | | – | | 3.4 | | 8.0 | | – | |

| Gross margin (annualized) (bp) | | 73 | | 65 | | 101 | | – | | – | | 69 | | 108 | | – | |

| Net margin (annualized) (bp) | | (6) | | (20) | | 41 | | – | | – | | (13) | | 47 | | – | |

| Reconciliation of adjustment items |

| | Wealth Management | |

| in | | 2Q22 | | 1Q22 | | 2Q21 | | 6M22 | | 6M21 | |

| Results (CHF million) |

| Net revenues | | 1,266 | | 1,177 | | 1,913 | | 2,443 | | 3,998 | |

| Real estate (gains)/losses | | 0 | | (25) | 1 | 0 | | (25) | | 0 | |

| (Gains)/losses on business sales | | 1 | | 3 | | 0 | | 4 | | 0 | |

| Major litigation recovery | | 0 | | 0 | | (49) | | 0 | | (49) | |

| (Gain)/loss on equity investment in Allfunds Group | | 168 | | 353 | | (317) | | 521 | | (461) | |

| (Gain)/loss on equity investment in SIX Group AG | | 9 | | (2) | | 0 | | 7 | | 0 | |

| Adjusted net revenues | | 1,444 | | 1,506 | | 1,547 | | 2,950 | | 3,488 | |

| Provision for credit losses | | (11) | | 24 | | (24) | | 13 | | (11) | |

| Total operating expenses | | 1,373 | | 1,510 | | 1,167 | | 2,883 | | 2,261 | |

| Restructuring expenses | | (15) | | (10) | | (9) | | (25) | | (12) | |

| Major litigation provisions | | (16) | | (230) | | 0 | | (246) | | 11 | |

| Expenses related to real estate disposals | | (1) | | 0 | | 0 | | (1) | | (4) | |

| Expenses related to equity investment in Allfunds Group | | 0 | | 0 | | (19) | | 0 | | (19) | |

| Adjusted total operating expenses | | 1,341 | | 1,270 | | 1,139 | | 2,611 | | 2,237 | |

| Income/(loss) before taxes | | (96) | | (357) | | 770 | | (453) | | 1,748 | |

| Adjusted income before taxes | | 114 | | 212 | | 432 | | 326 | | 1,262 | |

| Adjusted economic profit | | (97) | | (21) | | 130 | | (118) | | 563 | |

| Adjusted return on regulatory capital (%) | | 3.8 | | 7.1 | | 13.4 | | 5.4 | | 19.9 | |

1 Of which CHF 20 million is reflected in other revenues and CHF 5 million is reflected in transaction- and performance-based revenues. |

| Investment Bank |

| | in / end of | | % change | | in / end of | | % change | |

| | 2Q22 | | 1Q22 | | 2Q21 | | QoQ | | YoY | | 6M22 | | 6M21 | | YoY | |

| Results (CHF million) |

| Net revenues | | 1,109 | | 1,938 | | 1,844 | | (43) | | (40) | | 3,047 | | 5,728 | | (47) | |

| Provision for credit losses | | 55 | | (156) | | 19 | | – | | 189 | | (101) | | 4,384 | | – | |

| Total operating expenses | | 2,170 | | 1,970 | | 1,841 | | 10 | | 18 | | 4,140 | | 3,670 | | 13 | |

| Income/(loss) before taxes | | (1,116) | | 124 | | (16) | | – | | – | | (992) | | (2,326) | | (57) | |

| Metrics |

| Economic profit (CHF million) | | (1,220) | | (297) | | (467) | | 311 | | 161 | | (1,517) | | (2,661) | | (43) | |

| Cost/income ratio (%) | | 195.7 | | 101.7 | | 99.8 | | – | | – | | 135.9 | | 64.1 | | – | |

| Results (USD million) |

| Net revenues | | 1,150 | | 2,096 | | 2,017 | | (45) | | (43) | | 3,246 | | 6,280 | | (48) | |

| Provision for credit losses | | 57 | | (169) | | 21 | | – | | 171 | | (112) | | 4,656 | | – | |

| Total operating expenses | | 2,258 | | 2,131 | | 2,018 | | 6 | | 12 | | 4,389 | | 4,033 | | 9 | |

| Income/(loss) before taxes | | (1,165) | | 134 | | (22) | | – | | – | | (1,031) | | (2,409) | | (57) | |

| Net revenue detail |

| in / end of | | 2Q22 | | 1Q22 | | 2Q21 | | 6M22 | | 6M21 | |

| Net revenue detail (USD million) |

| Fixed income sales and trading | | 622 | | 802 | | 916 | | 1,424 | | 2,532 | |

| Equity sales and trading | | 342 | | 545 | | (33) | | 887 | | 997 | |

| Capital markets | | 38 | | 466 | | 1,000 | | 504 | | 2,361 | |

| Advisory and other fees | | 190 | | 221 | | 139 | | 411 | | 396 | |

| Other revenues | | (42) | | 62 | | (5) | | 20 | | (6) | |

| Net revenues | | 1,150 | | 2,096 | | 2,017 | | 3,246 | | 6,280 | |

| Reconciliation of adjustment items |

| | Investment Bank | |

| in | | 2Q22 | | 1Q22 | | 2Q21 | | 6M22 | | 6M21 | |

| Results (CHF million) |

| Net revenues | | 1,109 | | 1,938 | | 1,844 | | 3,047 | | 5,728 | |

| Real estate (gains)/losses | | 0 | | (53) | | 0 | | (53) | | 0 | |

| Archegos | | 0 | | (17) | | 493 | | (17) | | 493 | |

| Adjusted net revenues | | 1,109 | | 1,868 | | 2,337 | | 2,977 | | 6,221 | |

| Provision for credit losses | | 55 | | (156) | | 19 | | (101) | | 4,384 | |

| Archegos | | 0 | | 155 | | (70) | | 155 | | (4,500) | |

| Adjusted provision for credit losses | | 55 | | (1) | | (51) | | 54 | | (116) | |

| Total operating expenses | | 2,170 | | 1,970 | | 1,841 | | 4,140 | | 3,670 | |

| Goodwill impairment | | (23) | | 0 | | 0 | | (23) | | 0 | |

| Restructuring expenses | | (60) | | (36) | | (29) | | (96) | | (46) | |

| Major litigation provisions | | (191) | | 0 | | 0 | | (191) | | 0 | |

| Expenses related to real estate disposals | | (5) | | (3) | | 0 | | (8) | | (33) | |

| Archegos | | (13) | | (11) | | (31) | | (24) | | (31) | |

| Adjusted total operating expenses | | 1,878 | | 1,920 | | 1,781 | | 3,798 | | 3,560 | |

| Income/(loss) before taxes | | (1,116) | | 124 | | (16) | | (992) | | (2,326) | |

| Adjusted income/(loss) before taxes | | (824) | | (51) | | 607 | | (875) | | 2,777 | |

| Adjusted economic profit | | (1,001) | | (428) | | 1 | | (1,429) | | 1,166 | |

| Adjusted return on regulatory capital (%) | | (19.0) | | (1.2) | | 12.3 | | (9.9) | | 27.9 | |

| Reconciliation of adjustment items |

| | Investment Bank | |

| in | | 2Q22 | | 1Q22 | | 2Q21 | | 6M22 | | 6M21 | |

| Results (USD million) |

| Net revenues | | 1,150 | | 2,096 | | 2,017 | | 3,246 | | 6,280 | |

| Real estate (gains)/losses | | 0 | | (57) | | 0 | | (57) | | 0 | |

| Archegos | | 0 | | (19) | | 542 | | (19) | | 542 | |

| Adjusted net revenues | | 1,150 | | 2,020 | | 2,559 | | 3,170 | | 6,822 | |

| Provision for credit losses | | 57 | | (169) | | 21 | | (112) | | 4,656 | |

| Archegos | | 0 | | 167 | | (77) | | 167 | | (4,784) | |

| Adjusted provision for credit losses | | 57 | | (2) | | (56) | | 55 | | (128) | |

| Total operating expenses | | 2,258 | | 2,131 | | 2,018 | | 4,389 | | 4,033 | |

| Goodwill impairment | | (24) | | – | | – | | (24) | | – | |

| Restructuring expenses | | (63) | | (39) | | (32) | | (102) | | (51) | |

| Major litigation provisions | | (200) | | 0 | | 0 | | (200) | | 0 | |

| Expenses related to real estate disposals | | (4) | | (3) | | 0 | | (7) | | (35) | |

| Archegos | | (14) | | (12) | | (34) | | (26) | | (34) | |

| Adjusted total operating expenses | | 1,953 | | 2,077 | | 1,952 | | 4,030 | | 3,913 | |

| Income/(loss) before taxes | | (1,165) | | 134 | | (22) | | (1,031) | | (2,409) | |

| Adjusted income/(loss) before taxes | | (860) | | (55) | | 663 | | (915) | | 3,037 | |

| Adjusted economic profit | | (1,053) | | (466) | | 11 | | (1,519) | | 1,285 | |

| Adjusted return on regulatory capital (%) | | (19.0) | | (1.2) | | 12.3 | | (9.9) | | 27.9 | |

| Swiss Bank |

| | in / end of | | % change | | in / end of | | % change | |

| | 2Q22 | | 1Q22 | | 2Q21 | | QoQ | | YoY | | 6M22 | | 6M21 | | YoY | |

| Results (CHF million) |

| Net revenues | | 1,050 | | 1,109 | | 1,023 | | (5) | | 3 | | 2,159 | | 2,054 | | 5 | |

| Provision for credit losses | | 18 | | 23 | | (21) | | (22) | | – | | 41 | | 5 | | – | |

| Total operating expenses | | 630 | | 615 | | 599 | | 2 | | 5 | | 1,245 | | 1,192 | | 4 | |

| Income before taxes | | 402 | | 471 | | 445 | | (15) | | (10) | | 873 | | 857 | | 2 | |

| Metrics |

| Economic profit (CHF million) | | 101 | | 154 | | 129 | | (34) | | (22) | | 255 | | 234 | | 9 | |

| Cost/income ratio (%) | | 60.0 | | 55.5 | | 58.6 | | – | | – | | 57.7 | | 58.0 | | – | |

| Assets under management (CHF billion) | | 544.5 | | 582.5 | | 588.2 | | (6.5) | | (7.4) | | 544.5 | | 588.2 | | (7.4) | |

| Net new assets (CHF billion) | | (1.6) | | 6.0 | | 0.7 | | – | | – | | 4.4 | | 4.5 | | – | |

| Gross margin (annualized) (bp) | | 74 | | 75 | | 71 | | – | | – | | 75 | | 72 | | – | |

| Net margin (annualized) (bp) | | 28 | | 32 | | 31 | | – | | – | | 30 | | 30 | | – | |

| Reconciliation of adjustment items |

| | Swiss Bank | |

| in | | 2Q22 | | 1Q22 | | 2Q21 | | 6M22 | | 6M21 | |

| Results (CHF million) |

| Net revenues | | 1,050 | | 1,109 | | 1,023 | | 2,159 | | 2,054 | |

| Real estate (gains)/losses | | (13) | | (84) | | (4) | | (97) | | (4) | |

| (Gain)/loss on equity investment in SIX Group AG | | 10 | | (3) | | 0 | | 7 | | 0 | |

| Adjusted net revenues | | 1,047 | | 1,022 | | 1,019 | | 2,069 | | 2,050 | |

| Provision for credit losses | | 18 | | 23 | | (21) | | 41 | | 5 | |

| Total operating expenses | | 630 | | 615 | | 599 | | 1,245 | | 1,192 | |

| Restructuring expenses | | (3) | | (1) | | (3) | | (4) | | (10) | |

| Expenses related to real estate disposals | | – | | – | | (4) | | – | | (4) | |

| Adjusted total operating expenses | | 627 | | 614 | | 592 | | 1,241 | | 1,178 | |

| Income before taxes | | 402 | | 471 | | 445 | | 873 | | 857 | |

| Adjusted income before taxes | | 402 | | 385 | | 448 | | 787 | | 867 | |

| Adjusted economic profit | | 101 | | 90 | | 130 | | 191 | | 241 | |

| Adjusted return on regulatory capital (%) | | 12.0 | | 11.6 | | 13.1 | | 11.8 | | 12.8 | |

| Asset Management |

| | in / end of | | % change | | in / end of | | % change | |

| | 2Q22 | | 1Q22 | | 2Q21 | | QoQ | | YoY | | 6M22 | | 6M21 | | YoY | |

| Results (CHF million) |

| Net revenues | | 311 | | 361 | | 417 | | (14) | | (25) | | 672 | | 817 | | (18) | |

| Provision for credit losses | | 2 | | 0 | | 1 | | – | | 100 | | 2 | | 1 | | 100 | |

| Total operating expenses | | 279 | | 308 | | 296 | | (9) | | (6) | | 587 | | 565 | | 4 | |

| Income before taxes | | 30 | | 53 | | 120 | | (43) | | (75) | | 83 | | 251 | | (67) | |

| Metrics |

| Economic profit (CHF million) | | 9 | | 28 | | 74 | | (68) | | (88) | | 37 | | 158 | | (77) | |

| Cost/income ratio (%) | | 89.7 | | 85.3 | | 71.0 | | – | | – | | 87.4 | | 69.2 | | – | |

| Reconciliation of adjustment items |

| | Asset Management | |

| in | | 2Q22 | | 1Q22 | | 2Q21 | | 6M22 | | 6M21 | |

| Results (CHF million) |

| Net revenues | | 311 | | 361 | | 417 | | 672 | | 817 | |

| Real estate (gains)/losses | | 0 | | (2) | | 0 | | (2) | | 0 | |

| Adjusted net revenues | | 311 | | 359 | | 417 | | 670 | | 817 | |

| Provision for credit losses | | 2 | | 0 | | 1 | | 2 | | 1 | |

| Total operating expenses | | 279 | | 308 | | 296 | | 587 | | 565 | |

| Restructuring expenses | | (1) | | 0 | | (2) | | (1) | | (3) | |

| Expenses related to real estate disposals | | 0 | | 0 | | 0 | | 0 | | (1) | |

| Adjusted total operating expenses | | 278 | | 308 | | 294 | | 586 | | 561 | |

| Income before taxes | | 30 | | 53 | | 120 | | 83 | | 251 | |

| Adjusted income before taxes | | 31 | | 51 | | 122 | | 82 | | 255 | |

| Adjusted economic profit | | 10 | | 27 | | 76 | | 37 | | 162 | |

| Adjusted return on regulatory capital (%) | | 14.6 | | 25.3 | | 49.1 | | 19.8 | | 52.1 | |

Cautionary statement regarding forward-looking information

This document contains statements that constitute forward-looking statements. In addition, in the future we, and others on our behalf, may make statements that constitute forward-looking statements. Such forward-looking statements may include, without limitation, statements relating to the following:

■ our plans, targets or goals;

■ our future economic performance or prospects;

■ the potential effect on our future performance of certain contingencies; and

■ assumptions underlying any such statements.

Words such as “believes,” “anticipates,” “expects,” “intends” and “plans” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. We do not intend to update these forward-looking statements.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that predictions, forecasts, projections and other outcomes described or implied in forward-looking statements will not be achieved. We caution you that a number of important factors could cause results to differ materially from the plans, targets, goals, expectations, estimates and intentions expressed in such forward-looking statements. These factors include, but are not limited to:

■ the ability to maintain sufficient liquidity and access capital markets;

■ market volatility, increases in inflation and interest rate fluctuations or developments affecting interest rate levels;

■ the ongoing significant negative consequences, including reputational harm, of the Archegos and supply chain finance funds matters, as well as other recent events, and our ability to successfully resolve these matters;

■ our ability to improve our risk management procedures and policies and hedging strategies;

■ the strength of the global economy in general and the strength of the economies of the countries in which we conduct our operations, in particular, but not limited to, the risk of negative impacts of COVID-19 on the global economy and financial markets, Russia’s invasion of Ukraine, the resulting sanctions from the US, EU, UK, Switzerland and other countries and the risk of continued slow economic recovery or downturn in the EU, the US or other developed countries or in emerging markets in 2022 and beyond;

■ the emergence of widespread health emergencies, infectious diseases or pandemics, such as COVID-19, and the actions that may be taken by governmental authorities to contain the outbreak or to counter its impact;

■ potential risks and uncertainties relating to the severity of impacts from COVID-19 and the duration of the pandemic, including potential material adverse effects on our business, financial condition and results of operations;

■ the direct and indirect impacts of deterioration or slow recovery in residential and commercial real estate markets;

■ adverse rating actions by credit rating agencies in respect of us, sovereign issuers, structured credit products or other credit-related exposures;

■ the ability to achieve our strategic initiatives, including those related to our targets, ambitions and goals, such as our financial ambitions as well as various goals and commitments to incorporate certain environmental, social and governance considerations into our business strategy, products, services and risk management processes;

■ the ability of counterparties to meet their obligations to us and the adequacy of our allowance for credit losses;

■ the effects of, and changes in, fiscal, monetary, exchange rate, trade and tax policies;

■ the effects of currency fluctuations, including the related impact on our business, financial condition and results of operations due to moves in foreign exchange rates;

■ geopolitical and diplomatic tensions, instabilities and conflicts, including war, civil unrest, terrorist activity, sanctions or other geopolitical events or escalations of hostilities, such as Russia’s invasion of Ukraine;

■ political, social and environmental developments, including climate change;

■ the ability to appropriately address social, environmental and sustainability concerns that may arise from our business activities;

■ the effects of, and the uncertainty arising from, the UK’s withdrawal from the EU;

■ the possibility of foreign exchange controls, expropriation, nationalization or confiscation of assets in countries in which we conduct our operations;

■ operational factors such as systems failure, human error, or the failure to implement procedures properly;

■ the risk of cyber attacks, information or security breaches or technology failures on our reputation, business or operations, the risk of which is increased while large portions of our employees work remotely;

■ the adverse resolution of litigation, regulatory proceedings and other contingencies;

■ actions taken by regulators with respect to our business and practices and possible resulting changes to our business organization, practices and policies in countries in which we conduct our operations;

■ the effects of changes in laws, regulations or accounting or tax standards, policies or practices in countries in which we conduct our operations;

■ the discontinuation of LIBOR and other interbank offered rates and the transition to alternative reference rates;

■ the potential effects of changes in our legal entity structure;

■ competition or changes in our competitive position in geographic and business areas in which we conduct our operations;

■ the ability to retain and recruit qualified personnel;

■ the ability to protect our reputation and promote our brand;

■ the ability to increase market share and control expenses;

■ technological changes instituted by us, our counterparties or competitors;

■ the timely development and acceptance of our new products and services and the perceived overall value of these products and services by users;

■ acquisitions, including the ability to integrate acquired businesses successfully, and divestitures, including the ability to sell non-core assets; and

■ other unforeseen or unexpected events and our success at managing these and the risks involved in the foregoing.

We caution you that the foregoing list of important factors is not exclusive. When evaluating forward-looking statements, you should carefully consider the foregoing factors and other uncertainties and events, including the information set forth in “Risk factors” in I – Information on the company in our Annual Report 2021.

2Q22 Results Analyst and Investor Call Thomas Gottstein Chief Executive OfficerDavid Mathers Chief Financial OfficerJuly 27, 2022

Disclaimer (1/2) 2 Credit Suisse has not finalized its 2Q22 Financial Report and Credit Suisse’s independent registered public accounting firm has not completed its review of the condensed consolidated financial statements (unaudited) for the period. Accordingly, the financial information contained in this document is subject to completion of quarter-end procedures, which may result in changes to that information.This material does not purport to contain all of the information that you may wish to consider. This material is not to be relied upon as such or used in substitution for the exercise of independent judgment. Please also refer to our 2Q22 Earnings Release for additional information.Cautionary statement regarding forward-looking statements This document contains forward-looking statements that involve inherent risks and uncertainties, and we might not be able to achieve the predictions, forecasts, projections and other outcomes we describe or imply in forward-looking statements. A number of important factors could cause results to differ materially from the plans, targets, goals, expectations, estimates and intentions we express in these forward-looking statements, including those we identify in "Risk factors” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2021 and in the “Cautionary statement regarding forward-looking information" in our 2Q22 Earnings Release published on July 27, 2022 and submitted to the US Securities and Exchange Commission, and in other public filings and press releases. We do not intend to update these forward-looking statements. In particular, the terms “Estimate”, “Illustrative”, “Ambition”, “Objective”, “Outlook”, “Goal”, “Commitment” and “Aspiration” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such estimates, illustrations, ambitions, objectives, outlooks, goals, commitments and aspirations are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. These risks, assumptions and uncertainties include, but are not limited to, general market conditions, market volatility, increased inflation, interest rate volatility and levels, global and regional economic conditions, challenges and uncertainties resulting from Russia’s invasion of Ukraine, political uncertainty, changes in tax policies, scientific or technological developments, evolving sustainability strategies, changes in the nature or scope of our operations, changes in carbon markets, regulatory changes, changes in levels of client activity as a result of any of the foregoing and other factors. Accordingly, these statements, which speak only as of the date made, are not guarantees of future performance and should not be relied on for any purpose. We do not intend to update these estimates, illustrations, ambitions, objectives, outlooks, goals, commitments, aspirations or any other forward-looking statements. For these reasons, we caution you not to place undue reliance upon any forward-looking statements. We may not achieve the benefits of our strategic initiativesWe may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions (including macroeconomic and other challenges and uncertainties, for example, resulting from Russia’s invasion of Ukraine), changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives. Estimates and assumptionsIn preparing this document, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Annualized numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this document may also be subject to rounding adjustments. All opinions and views constitute good faith judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information.Statement regarding non-GAAP financial measuresThis document contains non-GAAP financial measures, including results excluding certain items included in our reported resultsas well as return on regulatory capital and return on tangible equity (which is based on tangible shareholders’ equity). Further details and information needed to reconcile such non-GAAP financial measures to the most directly comparable measures under US GAAP can be found in the Appendix as well as in the 2Q22 Earnings Release, which is available on our website at www.credit-suisse.com. Our estimates, ambitions, objectives, aspirations and targets often include metrics that are non-GAAP financial measures and are unaudited. A reconciliation of the estimates, ambitions, objectives, aspirations and targets to the nearest GAAP measures is unavailable without unreasonable efforts. Results excluding certain items included in our reported results do not include items such as goodwill impairment, major litigation provisions, real estate gains, impacts from foreign exchange and other revenue and expense items included in our reported results, all of which are unavailable on a prospective basis. Such estimates, ambitions, objectives and targets are calculated in a manner that is consistent with the accounting policies applied by us in preparing our financial statements.

Disclaimer (2/2) 3 Statement regarding capital, liquidity and leverageCredit Suisse is subject to the Basel framework, as implemented in Switzerland, as well as Swiss legislation and regulations for systemically important banks, which include capital, liquidity, leverage and large exposure requirements and rules for emergency plans designed to maintain systemically relevant functions in the event of threatened insolvency. Credit Suisse has adopted the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS) and implemented in Switzerland by the Swiss Financial Market Supervisory Authority FINMA.Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. The tier 1 leverage ratio and CET1 leverage ratio are calculated as BIS tier 1 capital and CET1 capital, respectively, divided by period-end leverage exposure.SourcesCertain material in this document has been prepared by Credit Suisse on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Credit Suisse has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness, reasonableness or reliability of such information.

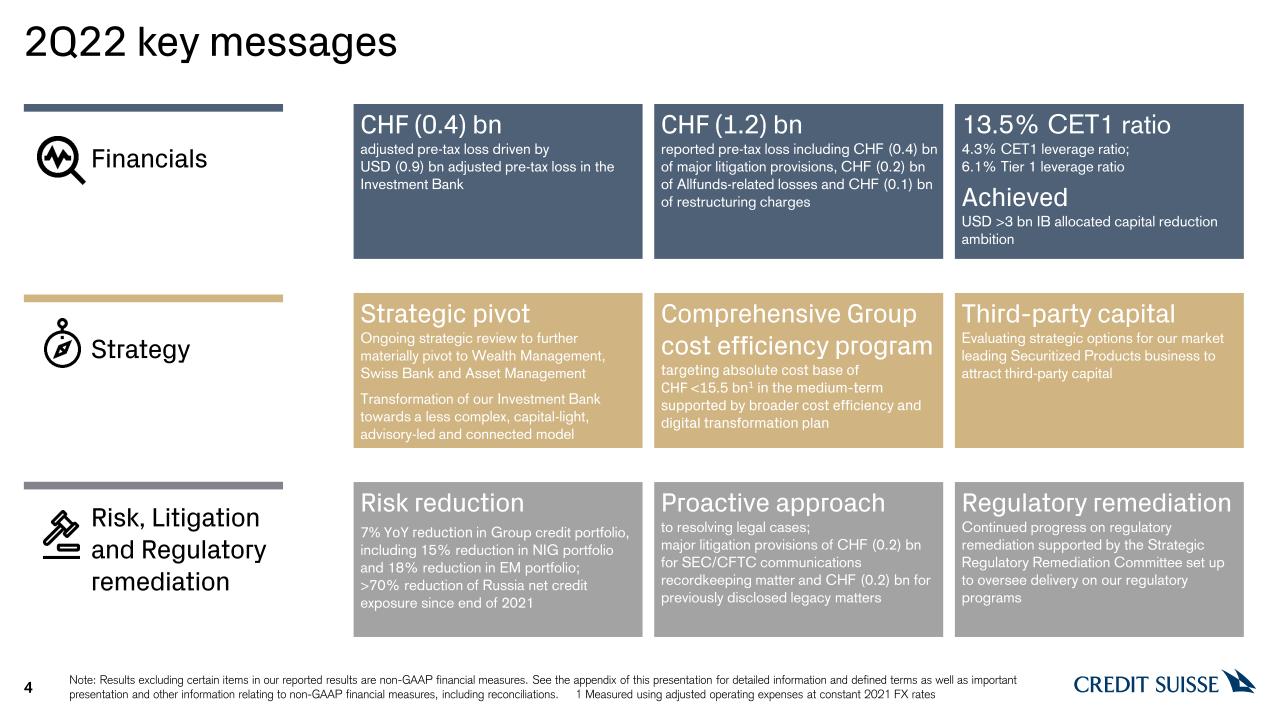

2Q22 key messages 4 CHF (1.2) bn reported pre-tax loss including CHF (0.4) bn of major litigation provisions, CHF (0.2) bn of Allfunds-related losses and CHF (0.1) bn of restructuring charges CHF (0.4) bnadjusted pre-tax loss driven by USD (0.9) bn adjusted pre-tax loss in the Investment Bank 13.5% CET1 ratio4.3% CET1 leverage ratio;6.1% Tier 1 leverage ratioAchievedUSD >3 bn IB allocated capital reduction ambition Comprehensive Group cost efficiency programtargeting absolute cost base of CHF <15.5 bn1 in the medium-term supported by broader cost efficiency and digital transformation plan Third-party capitalEvaluating strategic options for our market leading Securitized Products business to attract third-party capital Risk reduction7% YoY reduction in Group credit portfolio, including 15% reduction in NIG portfolio and 18% reduction in EM portfolio; >70% reduction of Russia net credit exposure since end of 2021 Proactive approach to resolving legal cases;major litigation provisions of CHF (0.2) bn for SEC/CFTC communications recordkeeping matter and CHF (0.2) bn for previously disclosed legacy matters Regulatory remediationContinued progress on regulatory remediation supported by the Strategic Regulatory Remediation Committee set up to oversee delivery on our regulatory programs Strategic pivotOngoing strategic review to further materially pivot to Wealth Management, Swiss Bank and Asset ManagementTransformation of our Investment Bank towards a less complex, capital-light, advisory-led and connected model Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Measured using adjusted operating expenses at constant 2021 FX rates Strategy Risk, Litigation and Regulatory remediation Financials

Group 1H22 performance adversely impacted by challenging market conditions, especially affecting the IB, major litigation provisions and Allfunds 5 1H22 adjusted/reported pre-tax income analysisin CHF mn Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Includes restructuring expenses of CHF 80 mn, goodwill impairment of CHF 23 mn, revaluation losses related to our investment in SIX of CHF 19 mn, loss related to Archegos of CHF 13 mn, real estate gains of CHF 13 mn, expenses related to real estate disposals of CHF 6 mn and loss on business sales of CHF 1 mn 2 Includes real estate gains of CHF 177 mn, Archegos release of CHF 148 mn, restructuring expenses of CHF 126 mn, goodwill impairment of CHF 23 mn, revaluation losses related to our investment in SIX of CHF 14 mn, expenses related to real estate disposals of CHF 9 mn and loss on business sales of CHF 4 mn Adjusted PTI Adjustments 2

Significant markets impact on our Investment Bank and Wealth Management while Swiss Bank remained resilient 6 Adjusted PTI 2Q22 commentary WMin CHF mn IBin USD mn SBin CHF mn AMin CHF mn CCin CHF mn Improving NII from higher rates offset by lower recurring fees and transaction-based revenuesContinued investments in relationship managers, Group-wide technology, risk and compliance and in business growth including China resulting in 18% higher operating expensesNet inflows in APAC and Americas offset by outflows in EMEA and Switzerland; 1H22 NNA of CHF 3.4 bn (including CHF 1.9 bn of Russia-related outflows) o/w Russia (99)o/w AFG1 (34)o/w SCFF fee waiver (27) o/w Russia (101) Capital Markets revenues impacted by substantially lower ECM, Leveraged Finance market activity and Leveraged Finance mark-to-market losses Higher Advisory revenues and strong Equity Derivatives and Macro trading Net revenues up 3% across all major revenue lines, offset by normalized provisions for credit losses and higher operating expenses from increased deferred compensation, investments and marketing expenses; RoRC† at 12% PTI adversely impacted by a challenging market environment, partially offset by lower operating expenses reflecting the release of certain expense provisions related to the SCFF matterNet asset outflows across both traditional and alternative investments, partially offset by inflows from investments and partnerships Pre-tax losses decreased mostly due to lower operating expenses, notwithstanding volatile interest rate environment 2Q21 1Q22 2Q22 o/w Asset impairments (55)2o/w SCFF fee waiver (24)o/w AFG1 (21) o/w LevFin MtM (245) Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Includes MtM losses in APAC Financing 2 Includes CHF (38) mn write-off of certainIT-related assets and CHF (17) mn impairments relating to certain third-party assets