UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________

FORM 20-F

(Mark One)

| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 |

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-34983

PROMOTORA DE INFORMACIONES, S.A.

(Exact Name of Registrant as Specified in Its Charter)

PROMOTER OF INFORMATION, S.A.

(Translation of Registrant’s name into English)

KINGDOM OF SPAIN

(Jurisdiction of incorporation or organization)

Gran Vía, 32

28013 Madrid, Spain

(Address of principal executive offices)

Iñigo Dago Elorza

General Counsel

Gran Vía, 32

28013 Madrid, Spain

Tel: +34 (91) 330 10 00

Fax: +34 (91) 330 10 70

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

_____________

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| American Depositary Shares, each representing four (4) Class A ordinary shares | New York Stock Exchange |

Class A ordinary shares, nominal value €0.10 per share* | |

| American Depositary Shares, each representing four (4) Class B convertible non-voting shares | New York Stock Exchange |

Class B convertible non-voting shares, nominal value €0.10 per share* | |

| * Listed not for trading or quotation purposes, but only in connection with the registration of the American Depositary Shares (“ADSs”) pursuant to the requirements of the Securities and Exchange Commission. | |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Class A Ordinary Shares: 459,650,730Class B convertible non-voting shares: 388,210,428

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No ý

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý Accelerated filer o Non-accelerated filero

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAPoInternational Financial Reporting Standards as Issued by the International Accounting Standards Board ý Othero

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 o Item 18 o

If this is an annual report indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No ý

2

| Page | ||

| PART I | ||

| Item 1. | 8 | |

| A. | 8 | |

| B. | 8 | |

| C. | 8 | |

| Item 2. | 8 | |

| Item 3. | 8 | |

| A. | 8 | |

| B. | 11 | |

| C. | 11 | |

| D. | 11 | |

| — | 11 | |

| — | 14 | |

| — | 20 | |

| Item 4. | 21 | |

| A. | 21 | |

| B. | 24 | |

| C. | 46 | |

| D. | 27 | |

| Item 4A. | 47 | |

| Item 5. | 47 | |

| A. | 48 | |

| B. | 63 | |

| C. | 69 | |

| D. | 71 | |

| E. | 73 | |

| F. | 73 | |

| Item 6. | 74 | |

| A. | 74 | |

| B. | 82 | |

| C. | 89 | |

| D. | 96 | |

| E. | 96 | |

| Item 7. | 98 | |

| A. | 98 | |

| B. | 102 | |

| C. | 104 | |

| Item 8. | 104 | |

| A. | 104 | |

| B. | 108 | |

| Item 9. | 108 | |

| A. | 108 | |

| B. | 110 | |

| C. | 110 | |

| D. | 110 |

3

| E. | 110 | |

| F. | 110 | |

| Item 10. | 110 | |

| A. | 110 | |

| B. | 110 | |

| C. | 118 | |

| D. | 118 | |

| E. | 119 | |

| F. | 123 | |

| G. | 123 | |

| H. | 123 | |

| I. | 123 | |

| Item 11. | 123 | |

| Item 12. | 127 | |

| A. | 127 | |

| B. | 127 | |

| C. | 127 | |

| D. | 127 |

4

| PART II | ||

| Item 13. | 129 | |

| Item 14. | 129 | |

| Item 15. | 129 | |

| Item 16. | [Reserved] | |

| Item 16A. | 130 | |

| Item 16B. | 130 | |

| Item 16C. | 130 | |

| Item 16D. | 132 | |

| Item 16E. | 132 | |

| Item 16F. | 132 | |

| Item 16G. | 132 | |

| Item 16H. | 132 | |

| PART III | ||

| Item 17. | 134 | |

| Item 18. | 134 | |

| Item 19. | 134 | |

5

CURRENCIES

In this annual report, unless otherwise specified or the context otherwise requires:

● | ‘‘$,” “US$” and “U.S. dollar” each refer to the United States dollar; and |

● | ‘‘€,” “EUR” and “euro” each refer to the euro, the single currency established for members of the European Economic and Monetary Union since January 1, 1999. |

IMPORTANT INFORMATION ABOUT GAAP AND NON-GAAP FINANCIAL MEASURES

Our audited financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board and referred to in this annual report as “IFRS.”

Adjusted EBITDA, as presented in this annual report, is a supplemental measure of performance that is not required by, or presented in accordance with, IFRS. It is not a measurement of financial performance under IFRS and should not be considered as (i) an alternative to operating or net income or cash flows from operating activities, in each case determined in accordance with IFRS, (ii) an indicator of cash flow or (iii) a measure of liquidity.

We define “Adjusted EBITDA” as profit from operations, as shown on our financial statements, plus asset depreciation expense, plus changes in operating allowances, plus impairment of assets and plus goodwill deterioration. We use Adjusted EBITDA as a financial measure to assess the performance of our businesses. We present Adjusted EBITDA because we believe Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties in evaluating similar issuers, a significant number of which present Adjusted EBITDA (or a similar measure) when reporting their results.

Although we use Adjusted EBITDA as a financial measure to assess the performance of our businesses, the use of Adjusted EBITDA has important limitations, including that Adjusted EBITDA:

● | does not represent funds available for dividends, reinvestment or other discretionary uses; |

● | does not reflect cash outlays for capital expenditures or contractual commitments; |

● | does not reflect changes in, or cash requirements for, working capital; |

● | does not reflect the interest expense or the cash requirements necessary to service interest or principal payments on indebtedness; |

● | does not reflect income tax expense or the cash necessary to pay income taxes; |

● | excludes depreciation and amortization and, although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future; |

● | does not reflect cash requirements for such replacements; and |

● | may be calculated differently by other companies, including other companies in our industry, limiting its usefulness as a comparative measure. |

Because of these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our businesses. We compensatefor these limitations by relying primarily on IFRS results and using Adjusted EBITDA measures only supplementally. See “Operating and Financial Review and Prospects” and the consolidated financial statements contained elsewhere in this annual report.

We also occasionally use “EBIT” as another name for the IFRS measure profit from operations, as shown in our audited financial statements and accompanying notes.

INDUSTRY AND MARKET DATA

In this annual report, we rely on and refer to information and statistics regarding market shares in the sectors in which we compete and other industry data. We obtained this information and statistics from third-party sources, such as independent industry publications, government publications or reports by market research firms, such as Zenith Optimedia, TNS Sofres and Marktest. We have supplemented this information where necessary with information from various other third-party sources, discussions with our customers and our own internal estimates taking into account publicly available information about other industry participants and our management’s best view as to information that is not publicly available. We believe that these third-party sources are reliable, but we have not independently verified the information and statistics obtained from them.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains statements that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements in this annual report can be identified, in some instances, by the use of words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking. These statements appear in a number of places in this annual report including, without limitation, certain statements made in “Item 3. Key Information—Risk Factors,” “Item 4. Information about Prisa,” “Item 5. Operating and Financial Review and Prospects” and “Item 11. Quantitative and Qualitative Disclosures About Market Risk” and include statements regarding our intent, belief or current expectations with respect to, among other things:

● | the effect on our results of operations of competition in the markets in which we operate; |

● | trends affecting our financial condition or results of operations; |

● | acquisitions or investments that we may make in the future; |

● | our capital expenditures plan; |

● | our ability to repay debt with estimated future cash flows; |

● | supervision and regulation of the sectors where we have significant operations; |

● | our strategic partnerships; and |

● | the potential for growth and competition in current and anticipated areas of our business. |

Such forward-looking statements are not guarantees of future performance and involve numerous risks and uncertainties, and actual results may differ materially from those anticipated in the forward-looking statements as a result of various factors. The risks and uncertainties involved in our business that could affect the matters referred to in such forward-looking statements include but are not limited to:

● | changes in general economic, business or political conditions in the domestic or international markets (particularly in Latin America) in which we operate or have material investments that may affect demand for our services; |

| ● | changes in currency exchange rates, interest rates or in credit risk in our treasury investments or in some of our financial transactions; |

| ● | general economic conditions in the countries in which we operate; |

| ● | existing or worsening conditions in the international financial markets; |

| ● | the actions of existing and potential competitors in each of our markets; |

| ● | the impact of current, pending or future legislation and regulation in countries in which we operate; |

| ● | failure to renew or obtain the necessary licenses, authorizations and concessions to carry out our operations; and |

| ● | the outcome of pending litigation. |

PART I

Not applicable.

| B. |

Not applicable.

| C. |

Not applicable.

Not applicable.

| Item 3. |

The following table presents financial data as of and for the years ended December 31, 2011, 2010, 2009, 2008 and 2007. You should read this information in conjunction with our historical consolidated financial statements, including the related notes. Our financial data as of and for the years ended December 31, 2011, 2010 and 2009 are derived from our audited consolidated financial statements for those years included elsewhere in this annual report. Our financial data as of and for the years ended December 31, 2008 and 2007 are derived from our audited financial statements for those years that are not included in this annual report. The historical results below and elsewhere in this annual report may not be indicative of our future performance.

Our consolidated financial statements are presented in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB, and as approved by the European Union, and the year-end financial statements have been audited. The IFRS approved by the European Union differ in some aspects to IFRS published by the IASB; however, these differences do not have a relevant impact on our consolidated financial statements for the years presented. Accordingly, they present fairly our consolidated equity and financial position at December 31, 2011. For additional information see our financial statements and the accompanying notes in this annual report.

Spanish free-to-air TV “Cuatro”: In 2010, due to the restructuring process (spin-off) of the Spanish free-to-air TV business, and after the sale of Sociedad General de Televisión Cuatro, S.A. on December 28, 2010, we presented the results of Spanish free-to-air TV in “Loss after tax from discontinued operations” on the consolidated income statement. For comparison effects, the consolidated income statements and the selected financial data for the years ended December 31, 2009 and 2008 present the results of operations of Cuatro as discontinued operations.

In the selected financial data for the year ended December 31, 2007,Cuatro’s figures are classified as continued operations, because of the unreasonable effort and expense involved to supply this information on a restated basis.

| For the Year Ended December 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (thousands of euros, except per share data) | ||||||||||||||||||||

| Consolidated Statements of Operations Data: | ||||||||||||||||||||

Operating Income | 2,724,450 | 2,822,731 | 2,975,120 | 3,694,738 | 3,696,028 | |||||||||||||||

Operating Expenses | (2,760,186 | ) | (2,486,579 | ) | (2,594,656 | ) | (2,946,031 | ) | (3,176,097 | ) | ||||||||||

Profit (loss) from Operations | (35,736 | ) | 336,152 | 380,464 | 748,707 | 519,931 | ||||||||||||||

Financial Loss | (195,152 | ) | (159,211 | ) | (214,269 | ) | (397,068 | ) | (195,263 | ) | ||||||||||

Result of companies accounted for using the equity method | (19,694 | ) | (99,553 | ) | (20,158 | ) | (7,592 | ) | (32,056 | ) | ||||||||||

Profit (loss) from other investments | 5,867 | (4,302 | ) | (4,256 | ) | (1,350 | ) | (3,612 | ) | |||||||||||

Profit (loss) before tax from continuing operations | (244,715 | ) | 73,086 | 141,781 | 342,697 | 289,000 | ||||||||||||||

Income tax | (147,973 | ) | (73,024 | ) | (67,068 | ) | (105,590 | ) | (26,919 | ) | ||||||||||

Profit (loss) from continuing operations | (392,688 | ) | 62 | 74,713 | 237,107 | 262,081 | ||||||||||||||

Loss after tax from discontinued operations | (2,646 | ) | (35,011 | ) | (9,888 | ) | (110,707 | ) | ||||||||||||

Consolidated profit for the year | (395,334 | ) | (34,949 | ) | 64,825 | 126,400 | 262,081 | |||||||||||||

Profit attributable to non-controlling interests | (55,884 | ) | (37,921 | ) | (14,346 | ) | (43,404 | ) | (70,108 | ) | ||||||||||

Profit (loss) attributable to the parent | (451,218 | ) | (72,870 | ) | 50,479 | 82,996 | 191,973 | |||||||||||||

Earning (loss) per share from continuing operations | € | (0.61 | ) | € | (0.16 | ) | € | 0.28 | € | 0.86 | € | 0.92 | ||||||||

Basic earnings per share | € | (0.62 | ) | € | (0.28 | ) | € | 0.23 | € | 0.38 | € | 0.92 | ||||||||

Cash dividend per share (ordinary shares) | — | — | — | — | € | 0.18 | ||||||||||||||

Cash dividend per share (Class B shares) | € | 0.175 | € | 0.0146 | — | — | ||||||||||||||

| As of December 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (thousands of euros, except per share data) | ||||||||||||||||||||

| Consolidated Balance Sheet Data: | ||||||||||||||||||||

| ASSETS | ||||||||||||||||||||

Non-Current Assets | 6,178,703 | 6,293,489 | 6,420,766 | 6,512,270 | 4,832,055 | |||||||||||||||

Property, Plant and Equipment | 307,441 | 295,560 | 345,754 | 397,932 | 423,163 | |||||||||||||||

Investment Property | 422 | 430 | 1 | 28 | 85 | |||||||||||||||

Goodwill | 3,645,077 | 3,903,514 | 4,319,603 | 4,302,739 | 2,420,078 | |||||||||||||||

Intangible assets | 331,260 | 360,512 | 365,670 | 400,084 | 444,337 | |||||||||||||||

Non-current financial assets | 121,688 | 70,611 | 57,218 | 93,344 | 157,166 | |||||||||||||||

Investments accounted for using the equity method | 604,082 | 613,542 | 13,644 | 12,936 | 13,248 | |||||||||||||||

Deferred tax assets | 1,166,694 | 1,046,030 | 1,313,820 | 1,298,475 | 1,364,975 | |||||||||||||||

Other non-current assets | 2,039 | 3,290 | 5,056 | 6,732 | 9,003 | |||||||||||||||

Current Assets | 1,699,696 | 1,854,312 | 1,514,898 | 1,594,297 | 1,621,418 | |||||||||||||||

Inventories | 275,403 | 203,152 | 218,066 | 306,079 | 325,160 | |||||||||||||||

Trade and other receivables | 1,269,641 | 1,245,687 | 1,207,204 | 1,237,723 | 1,215,684 | |||||||||||||||

Current financial assets | 56,494 | 160,260 | 6,593 | 838 | 7,456 | |||||||||||||||

Cash and cash equivalents | 98,158 | 244,988 | 82,810 | 49,432 | 72,827 | |||||||||||||||

Other current assets | — | 225 | 225 | 225 | 291 | |||||||||||||||

Assets Held For Sale | 125 | 3,653 | 257,388 | 519 | 72,887 | |||||||||||||||

Total Assets | 7,878,524 | 8,151,454 | 8,193,052 | 8,107,086 | 6,526,360 | |||||||||||||||

| EQUITY AND LIABILITIES | ||||||||||||||||||||

| Equity | 2,218,035 | 2,650,185 | 1,373,019 | 1,258,236 | 1,353,547 | |||||||||||||||

Share Capital | 84,786 | 84,698 | 21,914 | 21,914 | 22,036 | |||||||||||||||

Other Reserves | 1,152,640 | 1,120,539 | 833,697 | 779,225 | 721,503 | |||||||||||||||

Accumulated Profit | 380,282 | 798,876 | 403,478 | 398,975 | 440,972 | |||||||||||||||

From prior years | 831,500 | 871,746 | 352,999 | 315,979 | 248,999 | |||||||||||||||

For the year: Profit attributable to the Parent | (451,218 | ) | (72,870 | ) | 50,479 | 82,996 | 191,973 | |||||||||||||

Treasury Shares | (2,505 | ) | (4,804 | ) | (3,044 | ) | (24,726 | ) | (39,101 | ) | ||||||||||

Exchange Differences | 9,755 | 20,213 | (1,561 | ) | (18,422 | ) | (3,475 | ) | ||||||||||||

Non-controlling interests | 593,077 | 630,663 | 118,535 | 101,270 | 211,612 | |||||||||||||||

Non-Current Liabilities | 3,882,329 | 3,526,496 | 2,351,466 | 2,751,369 | 3,124,842 | |||||||||||||||

Exchangeable Bond in Issue | — | — | — | — | 158,408 | |||||||||||||||

Non-Current Bank Borrowings | 3,176,491 | 2,931,190 | 1,917,963 | 2,348,078 | 2,558,372 | |||||||||||||||

Non-Current Financial Liabilities | 302,864 | 362,754 | 249,538 | 232,565 | 202,378 | |||||||||||||||

Deferred Tax Liabilities | 30,409 | 28,555 | 72,799 | 79,278 | 112,931 | |||||||||||||||

Long-Term Provisions | 356,520 | 185,592 | 90,150 | 74,807 | 67,346 | |||||||||||||||

Other Non-Current Liabilities | 16,045 | 18,405 | 21,016 | 16,641 | 25,407 | |||||||||||||||

Current Liabilities | 1,778,160 | 1,974,773 | 4,263,133 | 4,097,481 | 2,047,971 | |||||||||||||||

Trade Payables | 1,180,075 | 1,234,846 | 1,181,437 | 1,257,945 | 1,233,136 | |||||||||||||||

Payable to Associates | 13,870 | 16,361 | 10,955 | 27,296 | 25,913 | |||||||||||||||

Other Non-Trade Payables | 115,865 | 99,583 | 107,693 | 142,568 | 137,863 | |||||||||||||||

Current Bank Borrowings | 223,625 | 411,109 | 2,796,362 | 2,532,091 | 536,046 | |||||||||||||||

Current Financial Liabilities | 88,853 | 17,788 | 3,295 | 21,676 | — | |||||||||||||||

Payable to Public Authorities | 114,814 | 154,879 | 124,288 | 79,972 | 73,245 | |||||||||||||||

Provisions for Returns | 8,686 | 9,804 | 9,417 | 9,369 | 8,457 | |||||||||||||||

Other Current Liabilities | 32,372 | 30,403 | 29,686 | 26,564 | 33,311 | |||||||||||||||

Liabilities Held For Sale | — | — | 205,434 | — | — | |||||||||||||||

Total Equity and Liabilities | 7,878,524 | 8,151,454 | 8,193,052 | 8,107,086 | 6,526,360 | |||||||||||||||

Book value per share | € | 1.92 | € | 2.39 | € | 5.74 | € | 5.39 | € | 5.36 | ||||||||||

Exchange Rate Information

The following table provides, for the periods and dates indicated, information concerning the exchange rate between the U.S. dollar and the euro. These rates may differ from the rates we use in the presentation of our financial statements or other financial information appearing in this annual report.

The data provided in the following tables are expressed in U.S. dollars per euro and are based on the closing spot rates as published by Bloomberg at 5:00 p.m. (New York time) (the “Closing Rate”) on each business day during the period. The Closing Rate on April 25, 2012 was $1.320 = €1.00.

| High | Low | Average (1) | Period End | |||||||||||||

| Annual Data (Year Ended December, 31) | (U.S. dollars per euro) | |||||||||||||||

2007 | 1.487 | 1.289 | 1.371 | 1.459 | ||||||||||||

2008 | 1.599 | 1.245 | 1.471 | 1.397 | ||||||||||||

2009 | 1.513 | 1.253 | 1.395 | 1.433 | ||||||||||||

2010 | 1.458 | 1.188 | 1.327 | 1.326 | ||||||||||||

2011 | 1.494 | 1.286 | 1.400 | 1.296 | ||||||||||||

| (1) | The average rates for the annual periods were calculated by taking the simple average of the exchange rates on the last business day of each month during relevant period. |

| High | Low | |||||||

| Recent Monthly Data | (U.S. dollars per euro) | |||||||

September 2011 | 1.4413 | 1.3363 | ||||||

| October 2011 | 1.4248 | 1.3146 | ||||||

November 2011 | 1.3950 | 1.3212 | ||||||

December 2011 | 1.355 | 1.286 | ||||||

January 2012 | 1.324 | 1.262 | ||||||

February 2012 | 1.349 | 1.297 | ||||||

March 2012 | 1.339 | 1.300 | ||||||

Not applicable.

Not applicable.

In addition to the other information contained in this annual report, prospective investors should carefully consider the risks described below before making any investment decision. The risks described below are not the only ones that we face. Additional risks not currently known to us or that we currently deem immaterial may also impair our business and results of operations. Our business, financial condition, results of operations and cash flow could be materially adversely affected by any of these risks, and investors could lose all or part of their investment.

We have a significant amount of indebtedness, which may adversely affect our cash flow and our ability to operate our businesses, remain in compliance with debt covenants and make payments on our indebtedness and remain in compliance with Class B convertible non-voting shares minimum dividend.

We have significant financial obligations, as summarized in “Operating and Financial Review and Prospects—Liquidity and Capital Resources.” As of December 31, 2011, our bank borrowings amounted to €3,400 million (December 31, 2010: €3,342 million). Our borrowing levels pose significant risks, including:

| · | increasing our vulnerability to general economic downturns and adverse industry conditions; |

| · | requiring a substantial portion of cash flow from operations to be dedicated to the payment of interest on the indebtedness, therefore reducing our ability to use our cash flow to fund short term operations, working capital requirements, capital expenditures and future business operations; |

| · | exposing us to the risk of increased interest rates, as most of the borrowings are at variable rates of interest; and |

| · | limiting our ability to adjust to changing market conditions and placing us at a disadvantage compared to competitors who have less debt. |

Further, if our operating cash flow and capital resources are insufficient to service our debt obligations or Class B shares minimum dividend, we may be forced to sell assets, seek additional equity or debt capital or further restructure our debt. However, these measures might be unsuccessful or inadequate in permitting us to meet scheduled debt service obligations.

Restrictive covenants in our agreements governing our indebtedness could adversely affect our businesses and operating results by limiting flexibility.

The agreements governing the terms of our indebtedness contain restrictive covenants and requirements to comply with certain leverage and other financial maintenance tests. Many of these agreements also include cross default provisions applicable to other agreements, meaning that a default under any one of these agreements could result in a default under our other debt agreements. These covenants and requirements limit our ability to take various actions, including incurring additional debt, guaranteeing indebtedness and engaging in various types of transactions, including mergers, acquisitions and sales of assets. On December 26, 2011 we signed an agreement to refinance our bank borrowings, extending the different maturities of the loans to 2014/2015 and eliminating the schedule for amortizations previously established for the syndicated loan to transform it into a bullet loan. This agreement also modified our financial covenants in order to permit our compliance at year-end 2011 and to adapt the future level of covenants to the new financial estimation. These covenants could place us at a disadvantage compared to competitors, who may have fewer restrictive covenants and may not be required to operate under these restrictions. Further, these covenants could adversely impact our businesses by limiting our ability to take advantage of financing, mergers and acquisitions or other opportunities.

Our loans are subject to fluctuations in interest rates which may not be adequately protected, or protected at all, by our hedging strategies.

The terms of our bank debt provide exclusively for variable interest rates, and therefore we are exposed to fluctuations in interest rates (see “Operating and Financial Review and Prospects—Liquidity and Capital Resources”). Consequently, we arrange interest rate hedges through contracts providing for interest rate caps (interest rate swap agreements and combination of options) as far as there are lines of credit available. There can be no certainty that our hedging activities will be successful or fully protect us from interest rate exposure. If we cannot arrange interest rate hedges or our hedging strategy is inadequate or the counterparties to the hedging agreements become insolvent, we may not be capable of fully or partially neutralizing the risks associated with changes in interest rates, which would adversely impact our results of operations and financial condition.

At the date of this filing, €284 million of our outstanding debt is hedged.

Fluctuations in foreign exchange rates could have an adverse effect on our results of operations.

We are exposed to fluctuations in the exchange rates of the various countries in which we operate. Our foreign currency risk relates mainly to operating income (revenues) generated outside of the European market, resulting from operations carried on in non-euro zone countries which are tied to the performance of their respective currencies, the acquisition of audiovisual rights from international suppliers of television content and financial investments made to acquire ownership interests in foreign companies. Our principal foreign currencies are the U.S. dollar, Brazilian real, Mexican peso, Argentine peso, Chilean peso and Colombian peso. In order to mitigate this risk and, as far as there are credit lines available, we arrange hedges to cover the risk of changes in exchange rates (mainly foreign currency hedges and forwards) on the basis of our projections and budgets. If our hedging strategy is inadequate or the counterparties in the hedging arrangements become insolvent, we may not be capable of fully or partially neutralizing the risks associated with the changes in the exchange rate, which would adversely impact our results of operations and financial condition.

We have negative working capital at the end of the year

We have closed 2011 period with negative working capital, mainly due to payments of past due suppliers. This situation may be repeated in 2012 due to the same reasons.

If we are not able to generate positive short term cash flow, enough to cover those payments, we may be forced to sell assets, seek additional equity or debt capital or further restructure our debt. However, these measures might be unsuccessful or inadequate in permitting us to meet the short term liabilities.

We have significant minority interests in some cash generating companies

Although we full consolidate all our businesses, we have significant minority interests in some cash generating companies, to highlight the 44% minority interests in DTS. The parent company has access to DTS cash through dividends. The evolution of operations and financial condition of DTS will directly affect the dividends received by the parent company. To the extent the dividend is part of the cash flow of the parent company, among other sources, in case those dividends were not enough, Prisa cash flow might be adversely affected and make more difficult the attendance of its obligation.

Fluctuations in the price of paper could have an adverse effect on our results of operations and financial condition.

We are exposed to the possibility of fluctuations in our results due to changes in the price of paper, an essential raw material for certain of our production processes. Paper is the main raw material of our printed media. In 2011 and in 2010, paper purchase expenses represented 3.1% and 3.6%, respectively, of our total consolidated operating expenses in those years (without considering charges for depreciation and amortization or impairment losses). We have established a program for strategically monitoring changes in paper prices, the aim of which, bearing in mind the cyclical nature of changes in paper prices, is to hedge the price of a percentage of the volume of paper that we expect to consume in the medium term. However, an increase in those prices or an interruption of supply could adversely affect our press and book publishing businesses and, therefore, adversely impact our businesses, results of operations and financial position.

We have tax credits for export activities discussed by tax authorities

A significant portion of the tax credits for export activities generated by the Group in the past, totaling €253 million, has been questioned in various tax audits, since the tax authorities considered that the requirements for use of this tax benefit had not been met. We do not concur with the position of the tax authorities and have appealed.

To cover a probable unfavorable ruling on the issues in question, we have recorded a provision of €183 million. The outcome of the current proceedings could adversely affect our results of operations and financial condition.

We have significant tax assets (tax losses and tax credits) that we may not be able to use if the company or tax group at which the tax asset arose does not generate sufficient income.

As of December 31, 2011, we have recognized tax assets amounting to €1,167 million in our consolidated financial statements. Of this amount, €823 million relates to tax assets recorded at a 30% rate arising from tax loss carryforwards as a result mainly of prior years’ losses (totaling €2,537 million) of the Prisa Televisión (formerly Sogecable) companies. The deadline for recovering these tax assets by offsetting them against future profits, according to the new tax law approved in August 2011, is 18 years from the tax year in which they were generated (or of the year in which the company concerned first earns a profit, which is the case with DTS). This new law states than only in 2011, 2012 and 2013, compensation of tax losses is limited to the 50% of the amount of the tax income carryforward which has been generated previously to the compensation. Since these assets were earned mainly by companies outside the scope of the Prisa consolidated tax group, they will have to be recovered outside of this scope, i.e., they will have to be offset against the individual profits of each company at which they arose.

Of the remainder, €344 million (including unused tax credits for export activities amounting to €207 million out of the €253 million mentioned above), relates mainly to investment tax credits which are deducted from the income tax charge. The deadline for taking these credits against future profits, in accordance with the Corporation Tax Law, is ten years from the date on which they were earned. In addition to this deadline, restrictions apply as to the amount that may be used each year, to the extent that, of the balances available for use, credits corresponding to only 35% of the gross tax payable (resulting, in turn, from 30% of the taxable profit less double taxation tax credits) in that year may be used.

Should our businesses fail to produce sufficient profits in the future against which these tax assets (tax loss carryforwards and tax credits) may be used within the time horizon indicated, such credits would be lost, which could significantly impact our results of operations and financial condition.

Deferred tax assets and liabilities recognized are reassessed at the end of each reporting period in order to ascertain whether they still exist, and the appropriate adjustments are made on the basis of the findings of the analyses performed and the tax rate then in force.

Future Generation of Tax assets for nondeductible Financial Expenses in the Spanish Corporate Tax

As a result of the tax reform published the 31st of March, the deductibility of the financial expenses is limited to the 30% of the adjustment EBITDA, for tax purpose. The amount of nondeductible financial expenses can be offset, under the same conditions, and with the same limit, against future profits in the corporate tax of the following eighteen years. Therefore, that amount not deducted could generate a future tax asset.

With the current structure of financial debt in the Group Prisa, this tax reform will generate a tax asset for the amount of nondeductible financial expenses each tax year.

The measure approved does not mean, in the current situation of our businesses, any further cash out in the Prisa tax group in year 2012, nor it is expected to have any cash impact in the following tax years, and it is not expected to have an impact on the Profit and loss account either in the next years.

As it happens with the other tax assets, should our businesses fail to produce sufficient profits in the future against which these tax assets may be used within the time horizon indicated, could generate the consequences mentioned in the third paragraph of the previous factor risk.

We have guaranteed certain significant obligations of Dédalo Grupo Gráfico, S.L., and our financial position and results of operations could be significantly affected if these guarantees were to be called.

We account for our 40% investment in Dédalo, the head of a group of companies engaged in the printing and copying of texts and mechanical binding, using the equity method. In recent years, Dédalo’s subsidiaries, which are engaged in the printing of books and in the printing of magazines and sales brochures using offsetting and photogravure, have incurred ongoing losses, primarily as a result of increased competition in the printing markets in which they operate and restructuring costs that they incurred in relation to these activities to adjust to the demand in those markets.

In 2008, Dédalo and its subsidiaries entered into a syndicated loan and credit agreement for €130 million, principally to cover restructuring costs and operating losses of the photogravure and offsetting businesses. We have guaranteed the full amount outstanding under the agreement and the related hedges since November 2009. As of December 31, 2011, the outstanding debt of this loan amounts to €105 million.

Additionally in March 2010, Prisa entered with the other shareholders of Dédalo Grupo Gráfico, S.L., into a reciprocal purchase and sale agreement for the shares of Dédalo Grupo Gráfico, S.L. Under this agreement, on the one hand, Prisa had a call option, on the additional 60% of Dédalo Grupo Gráfico, S.L. and, on the other, the other shareholders could exercise their put option if any of the Dédalo Group companies were to become subject to insolvency proceedings. The strike price for both the options was EUR 1. The circumstance is not met at December, 2011.

From April, 1, 2012 the call option described above is exercisable. Consequently, according to the IFRS, Prisa has to full consolidate its investment in Dédalo Grupo Gráfico from that date on. This integration has not a significant impact in the consolidated financial statement of Grupo Prisa.

If any of the Dédalo companies were to fail to comply with their financial obligations or to successfully restructure the printing business, this could adversely impact our businesses, results of operations and financial position.

Economic conditions may adversely affect our businesses and customers, which could adversely affect our results of operations and financial condition.

Spain and other countries in which we operate have experienced slowdowns and volatility in their economies. This downturn has led to and could lead to further lower spending on our products and services by customers, including advertisers, subscribers, licensees, retailers and other consumers of our content offerings and services. In addition, in unfavorable economic environments, our business customers may have difficulties obtaining capital to finance their ongoing businesses and operations and may face insolvency, all of which could impair their ability to make timely payments and continue operations. We cannot predict the duration and severity of weakened economic conditions and such conditions and resultant effects could adversely impact our businesses, results of operations and financial condition.

A decline in advertising expenditures could cause our revenue and operating results to decline significantly in any given period or in specific markets.

A significant portion of our operating income (revenues) depends on the revenues generated from the advertising market through our press, radio and audiovisual businesses, together with the digital business activities that we operate across all business areas. Expenditures by advertisers tend to be cyclical, reflecting overall economic conditions, as well as budgeting and buying patterns. A decline in the economic prospects of advertisers or the economy in general could alter current or prospective advertisers’ spending priorities. Demand for our products is also a factor in determining advertising rates. For example, ratings points for our radio stations, television audience levels and circulation levels for our newspapers are factors that are weighed when determining advertising rates. A drop in advertising revenue could adversely impact our businesses, results of operations and financial condition.

The use of alternative means of delivery for newspapers and magazines may adversely affect our businesses.

Revenue in the newspaper and magazine publishing industry is dependent primarily upon advertising revenue, subscription fees and sale of copies. The use of alternative means of delivery, such as free Internet sites, for news and other content has increased significantly in recent years. Should significant numbers of customers choose to receive content using these alternative delivery sources rather than through our product offerings, we may face a long-term decline in circulation, which may adversely impact our results of operations and financial condition.

The industries in which we operate are highly competitive and we may not successfully react to competitors’ actions.

The press, radio, education, audiovisual, digital, media distribution, advertising and publishing industries in which we operate are highly competitive. To compete effectively in these industries we must successfully market our products and react appropriately to our competitors’ actions, both by launching new products or services and by adjusting our pricing strategies. Such rigorous competition poses an ongoing challenge to our ability to increase audience share, increase sales, retain our present customers, attract new customers and improve our profit margins.

Furthermore, the regulatory policies of many countries in which we conduct business tend, where possible, to enable increased competition in most of the industries in which we operate. These countries have in the past granted, and can be expected to continue to grant, new licenses enabling the entry of new competitors into the marketplace. Such entries have the potential to reduce our revenues or make our operations less profitable.

We may not be capable of competing successfully with current or future industry participants, and the entry of new competitors into the industries in which we currently operate may reduce our revenue, market share or profitability. Any of these events could have an adverse impact on our businesses, results of operations and financial condition.

We may fail to adequately evolve our business strategy as the industry segments in which we compete further mature.

Our principal lines of business, specifically press, radio, education, audiovisual, media distribution, advertising and publishing, are conducted in mature industry segments typified by moderate growth rates (or, in some cases, declining demand), standardized product offerings, a significant number of competitors and difficulties in developing and offering new products and services to consumers.

Advertising revenues represent a significant portion of our revenue (23% of our 2011 operating income). According to December 2011 Zenith Optimedia estimates, advertising expenditure in Spain is expected to decline by 2.0% in 2012 (-5.8% according to i2P) and is expected to grow by 4.0% and 7.0% in 2013 and 2014, respectively, which represents a 5.47% compound annual rate for 2012-2014. This same source estimates that advertising expenditure in television in Portugal will grow by 1.1%, 5.5% and 5.5% in 2012, 2013 and 2014 respectively and advertising expenditure in radio in Latin America will grow by 4.8%, 4.8% and 5.4% in 2012, 2013 and 2014 respectively.

According to the PricewaterhouseCoopers Global Entertainment and Media Outlook 2011-2015 Report, the digital component of newspaper advertising revenue in Spain is estimated to grow at a 11.1% compound annual rate. However, daily newspaper paid print unit circulation in Spain is expected to decline at a 1.6% compound annual rate.

Sales of books and training represented 26% of our operating income for the year ended December 31, 2011. Regarding the total spending in the print educational book market, the report shows that Spain is expected to grow in the period 2011-2015 (+1.3%). In Latin America, the report expects a 3.4% compound annual rate over the same period.

Revenue from subscribers represented 33% of our operating income for the year ended December 31, 2011. In relation to the pay television subscription market, the report states that the subscription market in the EMEA (Europe, Middle East and Africa) region competes with free multichannel services and free satellite services in several countries, so even though in terms of penetration there is still room to grow, the market is effectively close to saturation in terms of available households not currently served by multichannel television. Consequently, subscription services are investing in their infrastructure to provide more channels, including HD, enhancing their VOD offerings and launching applications to allow subscribers watch programs online or on mobile devices. The report states that growth for 2011-2015 will average 4.1% compounded annually, including increases of less than 4% in 2014 and 2015.

We must adopt new strategies to adequately address the challenges posed by this competitive climate. These new strategies may include capturing the benefits of economies of scale, cost reduction, better use of production capacity, increased employee productivity and achieving product and service differentiation through innovative marketing, product design, customer service and organization, among others, to provide us with a competitive edge over other industry participants and enhance the effectiveness of our response to customer demands.

Our failure to adapt strategically to the continuing maturity of the industries in which we operate or to adopt appropriate business strategies in the future could result in the loss of our current market share and, consequently, could adversely impact our businesses, results of operations and financial condition.

We are exposed to liability stemming from the content of our publications and programming.

Although we attempt to verify the lawfulness of the content of our publications, programs and broadcasts, we cannot guarantee that third parties will not bring claims against us in connection with our public dissemination of publications and the broadcasting of programs. We could be required to publish corrections to any such broadcasts or publications.

We could be ordered to pay damages, retract statements or restrict the content of our publications or programs if we are found to have infringed third party rights, any of which could adversely impact our businesses, results of operations and financial condition.

We operate in highly regulated industries and are therefore exposed to legislative, administrative and regulatory risks that could adversely impact our businesses.

Our businesses are subject to comprehensive regulations including the requirement to maintain concessions and licenses for our operations in our Audiovisual and Radio segments. Changes in applicable laws or regulations, or in their interpretation, may occur and may substantially impact our business operations, including by requiring changes to our business methods, increasing our costs of doing business or by forcing us to cease conducting business in those segments. There can be no assurance that the regulatory environment in which we operate will not change significantly and adversely in the future.

Television & Radio

Our radio and television operations in both Europe and Latin America are subject to government regulation and are conducted under revocable administrative concessions or licenses. Applicable radio and television regulations cover, among other matters, minimum coverage, necessary technical specifications, program content and permissible advertising. The regulations also cover the ownership and transfer of equity interests in companies engaged in the regulated activities.

We provide a considerable portion of our services under licenses or concessions granted by the governments and administrative bodies of the countries in which we operate. These licenses and concessions require us to comply with the imposed terms and conditions, including with specified investment commitments and established geographic coverage requirements, and to meet established service quality standards. The performance of such obligations is frequently secured by guarantees. In the event of any failure to comply with applicable law or the terms and conditions of a license or a concession, supervising authorities may review or revoke the license or concession or impose penalties on us. The continuity and the terms of the licenses and concessions may be subject to review by the relevant regulatory bodies and the regulators may also construe, amend or terminate a license or a concession. In the event of termination of a concession or license, we may not have access to any meaningful means of redress and termination could significantly adversely affect our business, results of its operations and financial condition.

Our business and our ability to meet the targets established by our strategic plan would be adversely affected in the event that any new legislation or regulations impose more restrictive provisions or more burdensome compliance requirements than those presently in effect or otherwise significantly quantitatively or qualitatively impact any of our licenses or concessions, or if such licenses or concessions were not to be renewed or are revoked, thereby negatively impacting our businesses, results of operations and financial condition.

Publishing

Our book publishing operations are subject to both general legislation applicable to book publishing as well as legislation regulating the publication of educational materials specifically applicable to textbooks. In addition, in Spain, Autonomous Community legislation (legislation by principal governmental bodies responsible for primary and secondary education, universities and higher education and other state-funded education) imposes various obligations on publishers of educational material and textbooks, and the legislation enacted in support of these functions is extensive. Should we breach any of our statutory obligations with respect to the publication of educational materials and textbooks, penalties could be imposed on us and our textbooks and other educational material could be declared unsuitable. Should the adoption of book lending in schools by the Spanish Autonomous Communities increase, the sale of textbooks and other educational material would be reduced. Any of these developments could adversely impact our businesses, results of operations and financial condition.

Our operations outside of Spain subject us to risks typical to investments in countries with emerging economies.

For the year ended December 31, 2011 approximately 24% of our operating revenues was derived from operations in Latin America.

Various risks typical to investments in countries with emerging economies could adversely affect our operations and investments in Latin America, the most significant of which include:

| · | the possible devaluation of foreign currencies or introduction of exchange restrictions, or other restrictions imposed on the free flow of capital across borders; |

| · | the potential effects of inflation and/or the possible devaluation of local currencies, which could lead to equity deficits at our subsidiaries operating in these countries and require us either to recapitalize the affected subsidiaries or wind up the operations of any such affected subsidiary; |

| · | the potential for foreign government expropriation or nationalization of our foreign assets; |

| · | the potential for substantial changes in applicable foreign tax levels or the introduction of new foreign taxes or levies; |

| · | the possibility of changes in policies and/or regulations affecting the economic climate or business conditions of the foreign markets in which we operate; and |

| · | the possibility of economic crises, economic instability or public unrest, which could have an adverse effect on our operations in those countries. |

Any of the above circumstances could adversely impact both our ability to grow our operations in the affected countries and our results of operations and financial position.

If we do not successfully respond to the rapid technological changes that characterize our businesses, our competitive position may be adversely impacted.

In order to maintain and grow our business, we must adapt to technological advances, for which research and development are key factors. Technological changes could give rise to new competitors in our various businesses and provide new opportunities for existing competitors to increase market share at our expense. Consequently, should we fail to keep sufficiently abreast of the current and future technological developments in the industry, this could adversely impact our businesses, results of operations and financial condition, as well as our capacity to achieve our business, strategic and financial objectives.

Losses in excess of insurance, or losses resulting in increases to insurance premiums or failure to renew, could have an adverse effect on our business, financial condition or results of operations.

Although all of our companies maintain insurance policies with scope and coverage which we believe to be consistent with industry practices, our business, financial condition or results of operations could be significantly adversely affected by any exposure to a significant uninsured risk, any incurrence of losses significantly exceeding our insurance coverage, or any considerable increase in our insurance premiums due to claims in any given year significantly exceeding the historical level of claims.

Furthermore, as our insurance policies are subject to annual renewal, we may not be able to renew our existing policies on similar or favorable terms and conditions, if at all.

We are subject to material litigation that, if unfavorably determined, could adversely impact our results of operations or financial condition.

As of the date of this annual report, we are a party to various lawsuits. Since these proceedings are in progress, we cannot reliably anticipate the outcome thereof, nor can we fully assess the consequences of potential judgments. A judgment adverse to our interests could adversely impact our businesses, results of operations and financial condition. Moreover, even if claims brought against us are unsuccessful or without merit, we are required to defend ourselves against such claims. The defense of any such actions may be time-consuming and costly and may distract our management’s attention from executing our business plan.

We depend significantly on our pay television business and negative developments in this market could have an adverse effect on our results of operations.

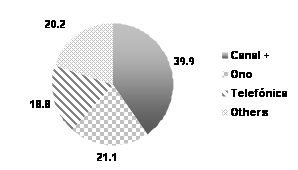

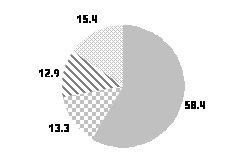

In 2011, revenue from the Spanish pay television market through Canal+ (formerly known as Digital+) accounted for 36.6% of our operating income. Our share of the total pay television market in Spain in terms of revenues is 58.6%, according to the Spanish Telecommunication Market Commission (CMT) 3Q report 2011. The growth and profitability of the Canal+ business are dependent on developments in the pay television industry as a whole, as well as on changes in the film production and distribution industry. Industry developments impact:

| · | our ability to stimulate pay television consumption, win new subscribers and increase the rate of penetration of pay television among homes with televisions; and |

| · | our ability to ensure the future continuity of the supply of television programming produced by third parties, specially the soccer rights since our current contract terminates by the end of season 2011/2012. |

Should the market for pay television suffer a downturn or a significant reduction in subscribers, this would adversely impact our results of operations and financial condition.

Our business depends on a number of third-party infrastructures and technological systems for the provision of services to subscribers and any breakdown thereof could interrupt those services.

Currently, Prisa Televisión has contracts for the supply of satellite transmission services with the operators Hispasat, S.A. and Société Européenne des Satellites, S.A., or SES ASTRA. The provision by Prisa Televisión of satellite television services through Canal+ depends on these supply contracts remaining in force. The revocation, termination or failure to renew these contracts could prevent Prisa Televisión from providing its subscribers with satellite television services and could lead to an interruption in these services and adversely impact our businesses, results of operations and financial condition.

The ongoing European sovereign debt crisis and a possible recession in the Eurozone could adversely affect our results of operations and financial condition.

Since late 2009, the sovereign debt markets of the Eurozone have undergone substantial stress, especially with respect to Greece, Ireland, Italy, Portugal and Spain. The sovereign debt crisis has contributed to a weakening of the business environment and financial markets in the Eurozone, raising the possibility that Europe may currently be in a recession. Austerity programs introduced by a number of countries across the Eurozone in response to the sovereign debt crisis may also be contributing to a decline in economic growth. If European policymakers are unable to resolve the sovereign debt crisis, our results of operations and financial position would likely be materially and adversely affected. As described above, weak economic conditions may adversely affect our business and our customers. In addition, efforts by our lenders to preserve capital in the face of sovereign debt write-downs and increased regulatory capital requirements has reduced overall lending and could material adversely affect our ability to refinance our outstanding indebtedness.

Furthermore, one or more members of the Eurozone could leave the common currency, which could have unpredictable financial, legal, political and social consequences, and could result in a widespread loss of investor confidence.

Our systems to operate and protect our digital activities may be insufficient to protect against service interruptions or fraudulent activities.

Our digital activities generated €55 million in revenues in 2011, a 6.7% increase over 2010. Our digital activity depends on Internet Service Providers (“ISPs”), online service providers and our system infrastructure to allow users to access the sites we operate, as well as on technologies and network systems to handle transactions and user information securely over the Internet. Any system failure, including network, software or hardware failure, which causes a delay or interruption in access to our sites could have a material adverse effect on our results of operations and financial condition. Our security and network systems could also be tested and subject to attack by third parties seeking to commit fraud. Any such attack could cause delay, interruption or financial loss, which could have a material adverse effect on our results of operations and financial condition.

The failure of our controlling shareholder group to continue to hold, directly or indirectly, at least 30% of our share capital may trigger change of control provisions contained in a material shareholders agreement among shareholders of DTS.

If holders of a sufficient number of Prisa Class B convertible non-voting shares convert their shares into Prisa Class A ordinary shares and our existing controlling shareholder group does not exercise a sufficient number of its warrants to maintain ownership of, directly or indirectly, at least 30% of Prisa’s Class A ordinary shares, then the change of control provision contained in a material agreement may be triggered pursuant to the definition of “change of control” as defined in such agreement.

The terms of the shareholders agreement among the shareholders of DTS (Prisa Televisión, Telefónica and Telecinco) provide that, within 15 days of learning of a change of control of Prisa, each of Telefónica and/or Telecinco may require Prisa Televisión to sell all of its shares in DTS to Telefónica and/or Telecinco, pro rata, at a purchase price to be determined by internationally recognized investment banks chosen by each party. In the event of a change of control, through Prisa Televisión, we could lose our stake in our pay television business.

A change of control of Prisa is defined in the shareholders agreement as (i) the Prisa controlling shareholder group ceasing to own at least 30% of Prisa’s share capital or (ii) the existence of an individual Prisa shareholder or a group of Prisa shareholders (acting jointly through one or more voting agreements) holding an ownership interest in Prisa greater than the ownership interest held by the Prisa controlling shareholder group.

Additionally the shareholders agreement provides minority shareholders first refusal and veto rights, among other usual rights in this kind of transactions.

The loss of our stake in our pay television business would adversely impact our results of operations and financial condition.

Supermajority and other voting provisions in our bylaws, along with the existence of a controlling shareholder group, may have the effect of discouraging potentially interested parties from seeking to acquire us or otherwise influence the outcome of significant matters affecting our shareholders.

Our bylaws require a 75% supermajority shareholder vote to approve bylaw amendments, increases or reductions in our share capital, mergers and similar extraordinary transactions and, in some cases, the election of directors not nominated by our board of directors. Our controlling shareholder group currently controls over 30% of our total voting power. As a result, these bylaw provisions may have the effect of rendering more difficult or discouraging an acquisition of Prisa not supported by the controlling shareholder group or otherwise precluding corporate actions that the controlling shareholder group opposes, even if supported by a majority of our voting shares.

Because Prisa is a holding company and its assets are held primarily by its subsidiaries, we may not be able to pay dividends on our Class B convertible non-voting shares, even if we have sufficient distributable profits on a consolidated basis to make such payments.

The Prisa Class B convertible non-voting shares issued in connection with the business combination are entitled to receive a minimum annual dividend of €0.175, but only to the extent that Prisa has sufficient “distributable profits” for the applicable year, as that term is defined by the 2010 Spanish Companies Act (the "Spanish Companies Act"), or sufficient premium reserve created by the issuance of the Prisa Class B convertible non-voting shares. If Prisa has no distributable profits in a given year or insufficient premium reserve created by the issuance of the Prisa Class B convertible non-voting shares, then no dividend will be payable for such year, and if Prisa has distributable profits in a given year or premium reserve created by the issuance of the Prisa Class B convertible non-voting shares which are insufficient to pay the annual dividend in full, then a partial dividend will be paid for such year, up to the amount of such distributable profits and premium reserve created by the issuance of the Prisa Class B convertible non-voting shares (so long as there is no legal restriction against such payment). Any unpaid dividends will accumulate from year to year.

Under Spanish law, the determination of whether Prisa has distributable profits does not take into account the assets or profits of any of Prisa’s subsidiaries. Prisa is a holding company with no significant operating assets other than through its ownership of shares of, or other interests in, its subsidiaries. Prisa receives substantially all of its operating income from its subsidiaries. Prisa’s subsidiaries are separate and distinct legal entities and they will have no obligation, contingent or otherwise, to pay dividends or distribute any amounts to Prisa, or to otherwise make any funds available to Prisa, to allow Prisa to pay dividends on the Prisa Class B convertible non-voting shares. In addition, the ability of Prisa’s subsidiaries to pay dividends or make distributions to Prisa may be subject to, among other things, applicable laws and/or restrictions contained in agreements or debt instruments to which such subsidiaries are bound. In addition, third parties own substantial interests in certain of Prisa’s subsidiaries and, accordingly, Prisa must share with minority shareholders any dividends paid by these subsidiaries. Prisa had, on a non-consolidated basis, a loss of approximately €617 million in 2011, a distributable profit of €9.3 million in 2010 and a loss in 2009.

Although Prisa has agreed to propose to its shareholders a resolution requiring Prisa to exercise its voting rights to cause its subsidiaries to deliver distributable profits to Prisa, there can be no assurance that the subsidiaries will be able to distribute such profits to Prisa, or that the amount of the distributable profits will be enough to allow Prisa to pay the minimum annual dividend on the Prisa Class B convertible non-voting shares. As a result, Prisa may not be able to pay all or a portion of the dividend payable on the Prisa Class B convertible non-voting shares, even if Prisa and its subsidiaries, on a consolidated basis, have profits in an amount greater than that needed to pay the minimum annual dividend.

The amount of the premium reserve created by the issuance of the Prisa Class B convertible non-voting shares was fixed prior to closing of the business combination as the difference between the issuance price of the Prisa Class B convertible non-voting shares and the nominal amount of such shares (€0.10). The premium reserve created by the issuance of the Prisa Class B convertible non-voting shares may be reduced as a result of losses in Prisa.

In addition any remaining accumulated dividends at the time of conversion (whether voluntary or automatic at the 42-month anniversary of issuance) will be paid on or before the date on which Prisa Class A ordinary shares are delivered in exchange for the converted Prisa Class B convertible non-voting shares to the extent there are distributable profits for the year of conversion or the previous year (if the minimum dividend for such year has not been declared) that are permitted by applicable law to be paid out. At that time, Prisa will determine and pay both the amount of the annual dividend payable for the portion of the year of conversion during which the shares subject to conversion remained outstanding and the amount of dividend that remained accrued at the time of conversion. Any such dividends (whether for the portion of the year of, or accrued at the time of, conversion) that do not become payable at that time due to the lack of sufficient distributable profits for that year or lack of available premium reserve will not thereafter become payable or be paid. Based on the number of Prisa Class B convertible non-voting shares issued in the business combination (approximately 403 million shares), an aggregate annual minimum dividend of €70.5 million would have been payable on the Prisa Class B convertible non-voting shares for each of 2009, 2010 and 2011. For 2009, since Prisa did not have distributable profits for the year, Prisa would have been obligated to pay the entire €70.5 million out of a charge against the premium reserve.For 2010, Prisa is obligated to pay €0.014583 per Class B convertible non-voting share. For 2011, Prisa is obligated to pay the entire of approximately €70 million out of a charge against the premium reserve.

According to article 99 of the Spanish Corporate Enterprises Act, if the minimum dividend is not paid up, the non voting shares shall be entitled to the voting right under the same terms and conditions as ordinary shares until it is fully paid.

You may have to pay taxes on constructive distributions without receiving a corresponding distribution of cash or property.

If the conversion ratio of the Prisa Class B convertible non-voting shares into Prisa Class A common shares is increased, as provided in the terms of the Prisa Class B convertible non-voting shares, holders of Prisa ADS-NVs may be treated as having received a constructive distribution if such increase in the conversion ratio has the effect of increasing the proportionate interest of such holders in Prisa’s earnings and profits or assets. In such a case, holders may be required to include an amount in income for U.S. federal income tax purposes, notwithstanding that they do not receive such distributions.

| Item 4. | INFORMATION ABOUT PRISA |

Overview

Promotora de Informaciones, S.A., which operates under the commercial name “Prisa,” was incorporated in the city of Madrid on January 18, 1972. We are the leading multimedia group in Spain and Portugal and we believe we are one of the leading multimedia groups in the Spanish-speaking world. We operate in more than 20 countries, including Brazil, Mexico and Argentina as well as many other Latin American countries and the United States.

History

The following are certain significant events in the development of Prisa:

1972

| · | Prisa founded, but does not begin operations. |

1976

| · | El País first issue. |

1980s

| · | We acquire Cadena SER. |

| · | We acquire Cinco Días. |

1990

| · | Sogecable (currently Prisa TV), 25.0% owned by Prisa, is awarded a television license to operate Canal+, first experience of pay TV in the country. |

1996

| · | We acquire a controlling equity interest in AS and launches websites for El País, Canal+, AS and Cadena SER. |

1997

| · | Sogecable launches Canal Satélite Digital, Spain’s leading multi-channel digital direct-to-home platform. |

1999

| · | We expand our activities into the music market by founding Gran Vía Musical. |

| · | We acquire our equity interest in Caracol, S.A., or “Radio Caracol”—the largest radio group in Colombia—and create Participaciones de Radio Latinoamericana S.L., or “PRL,” through which we carry out our radio operations in Chile, Costa Rica, Panama, the United States and France. |

2000

| · | We launch our initial public offering and our shares begin trading through the Spanish stock market interconnection system. |

| · | We expand our activities to media advertising sales through the acquisition of GDM (currently Prisa Brand Solutions). |

| · | We expand our activities to book publishing and printing through Santillana and Dédalo, respectively. |

2001

| · | We establish audiovisual producer Plural Entertainment, to develop and produce audiovisual content. |

| · | We enter the radio market in Mexico through an agreement with Grupo Televisa A.B., or Televisa, to develop the radio market in Mexico, which involved the acquisition of a 50.0% equity interest in Sistema Radiópolis, S.A. de C.V., which is referred to as“Radiópolis.” Management is run by Prisa. |

| · | We acquire Editora Moderna Ltda., or “Editora Moderna,” in Brazil. |

2002

| · | We organize Grupo Latino de Radio S.A., or “GLR,” as a holding company to restructure our radio businesses in Latin America, and our equity interests in PRL, Radiópolis and Grupo Caracol are transferred to GLR. |

2005

| · | We enter the Portuguese media market through the acquisition of 100.0% of the equity of Vertix, which owns 33.0% of the equity of Media Capital. |

2006

| · | We increase our ownership interest in Sogecable to 42.9%. |

| · | We combine our ratio activities in Latin America and Spain into Unión Radio (currently Prisa Radio). |

2007

| · | We acquire all of the shares of Iberoamericana Radio Chile, S.A. through GLR Chile, Ltda. |

| · | We increase our ownership interest in Media Capital to 94.7% |

2008

| · | We acquire the remaining outstanding share capital of Sogecable, increasing our ownership interest to 100%. |

| · | 3i Group plc enters the shareholder structure of Unión Radio (currently Prisa Radio) with an 8.14% stake. |

2010

| · | We signed an agreement (“Business Combination Agreement” or “BCA”) on March 5, 2010, with the US company Liberty Acquisition Holdings Corp (which had the legal form of a “special purpose acquisition company”), consolidated into a new text called the “Amended and Restated Business Combination Agreement”, in August 2010. |

Under this agreement, we carried out the following capital increases, which were approved by the extraordinary shareholders’ meeting of Prisa of November 27, 2010: |

i) Capital increase by issuance of 241,049,050 Class A ordinary shares, issued in exchange for a cash consideration with preemption rights implemented through warrants. |

| ii) Capital increase by issuance of 224,855,520 Class A Shares and 402,987,000 non-voting convertible Class B shares, issued by compensation in kind, which was subscribed by contribution of all common shares and warrants of Liberty Acquisition Holdings, Corp., once absorbed by its subsidiary, Liberty Acquisitions Holdings Virginia, Inc. |

As a result of this capital increases we obtained €650 million in cash. After this transaction, the investors of Liberty Acquisition Holdings Corp become Prisa shareholders. At the same time, Prisa shareholders before November 23rd are granted Prisa warrants. In connection with this transaction, we list our shares, in the form of American Depositary Shares, on the New York Stock Exchange. Our new shares start trading on the NYSE and on the Spanish stock exchanges in December. Our warrants are also traded on the Spanish stock exchanges. |

| · | We sell a 25% stake in Santillana to DLJ SAP Publishing Cöoperatief, UA.. |

| · | Through Prisa Televisión (formerly Sogecable), we sell a 44% stake in DTS to Telefónica (22%) and Telecinco (22%) for €976 million in cash, which is mainly used for debt amortization. |

| · | On December 28, 2010, Prisa Televisión sells 100% of Sociedad General de Televisión Cuatro, S.A. and subsidiaries to Gestevisión Telecinco, S.A. This sale is carried out through the subscription by Prisa Televisión of a 17.336% stake in Gestevisión Telecinco, S.A. in non-cash capital increase approved by the shareholders of Gestevisión Telecinco, S.A. in their general meeting held on December 24, 2010. The market value of this investment on subscription was €590 million. As a result of this transaction, we consolidate Gestevisión Telecinco, S.A. Group and subsidiaries using the equity method. |

2011

| · | We sell a 10% stake of Grupo Media Capital to PortQuay West I B.V., a company which is controlled by Miguel Pais do Amaral. |

Business areas

Our principal business operations are:

| · | Audiovisual, which includes pay television, free-to-air television and television and film production; |

| · | Education, which includes the publishing and sale of general books and educational material; |

| · | Radio, which includes the sale of advertising on our networks; and |

| · | Press, which includes the publishing of newspapers and magazines and the sale of advertising in such publications. |

We operate a digital platform that provides services and support to each of these principal business operations. We also sell media advertising and promote and produce musical events. We are the leader in Spain, and we believe we are one of the leaders in the Spanish-speaking world, in daily newspapers through El País, in radio through Cadena SER, and in education and publishing through Santillana. Through Prisa Televisión and its digital platform,Canal+, we are also the leader in pay television in Spain. In specialized press, we are ranked second in sports press through AS and are ranked second in financial press through Cinco Días.

Media Capital, our subsidiary, operates TVI, the leading free-to-air television network in Portugal. Media Capital also operates an audiovisual production business as well as a radio network, produces music recordings and distributes films and video/DVDs.

Prisa is domiciled in Spain, its legal form is a public limited liability company and its activity is subject to Spanish legislation and particularly to the Spanish Companies Act. It has been in continuous operation since its public deed of incorporation was executed, and now has perpetual existence. Our registered office is located at Gran Vía 32, 28013 Madrid, Spain. Our telephone number is +34 (91) 330 10 00.

Capital expenditures and disposals