Any amount withheld under these rules will be creditable against the US holder’s federal income tax liability. A US holder who does not provide a correct taxpayer identification number may be subject to certain penalties.

The documents concerning us which are referred to herein may be inspected at the Securities and Exchange Commission (“SEC”). You may read and copy any document filed or furnished by us at the SEC’s public reference rooms in Washington D.C., New York and Chicago, Illinois. Please call the SEC at 1-800-SEC-0330 for further information on the reference rooms. The SEC also maintains a website at www.sec.gov which contains, in electronic form, each of the reports and other information that we have filed electronically with the SEC.

Lloyds TSB Group plc is a public limited company incorporated under the laws of Scotland. Most of Lloyds TSB Group plc’s directors and executive officers and certain of the experts named herein are residents of the United Kingdom. A substantial portion of the assets of Lloyds TSB Group plc, and a substantial portion of the assets of such persons, are located outside the United States. As a result, it may not be possible for investors to effect service of process within the United States upon all such persons or to enforce against them in the United Kingdom judgements of US courts, including judgements predicated upon the civil liability provisions of the federal securities laws of the United States. Furthermore, Lloyds TSB Group plc has been advised by its English solicitors that there is doubt as to the enforceability in the United Kingdom, in original action or in actions for enforcement of judgements of US courts, of certain civil liabilities, including those predicated solely upon the federal securities laws of the United States.

RISK FACTORS

Set out below are certain risk factors which could affect the Lloyds TSB Group’s future results and cause them to be materially different from expected results. The Lloyds TSB Group’s results could also be affected by competition and other factors. The factors discussed below should not be regarded as a complete and comprehensive statement of all potential risks and uncertainties the Lloyds TSB Group’s businesses face.

Lloyds TSB Group’s businesses are subject to inherent risks concerning borrower credit quality as well as general UK and international economic conditions. The development of adverse conditions in the UK or in other major economies could cause profitability to decline

Lloyds TSB Group’s businesses are subject to inherent risks regarding borrower credit quality as well as general UK economic conditions. Each of these can change the level of demand for, and supply of, Lloyds TSB Group’s products and services. Changes in the credit quality of Lloyds TSB Group’s UK and/or international borrowers and counterparties could reduce the value of Lloyds TSB Group’s assets, and increase allowances for impairment losses. In addition, changes in economic conditions may result in a deterioration in the value of security held against lending exposures and increase the risk of loss in the event of borrower default. Furthermore, a general deterioration in the UK economy would also reduce Lloyds TSB Group’s profit from both its UK banking and financial services businesses. A general deterioration in any other major world economy could also adversely impact Lloyds TSB Group’s profitability. See ‘Operating and financial review and prospects – Risk management – Credit risk’.

Lloyds TSB Group’s businesses are inherently subject to the risk of market fluctuations, which could reduce profitability

Lloyds TSB Group’s businesses are inherently subject to the risk of market fluctuations. The most significant market risks Lloyds TSB Group faces are those that impact the Group’s pension schemes principally equity risk and interest rate risk; adverse market movements would have an effect upon the financial condition of the pension schemes which would be reflected in the Lloyds TSB Group’s financial statements. Interest rate risk and foreign exchange risk arises from banking activities while equity risk is present in the insurance businesses. See ‘Operating and financial review and prospects – Risk management – Market risk’ for a discussion of these risks.

Lloyds TSB Group’s insurance businesses are subject to inherent risks relating to changing demographic developments, changing customer behaviour, adverse weather and similar contingencies outside its control. Development of adverse conditions could reduce profitability

Lloyds TSB Group’s insurance businesses are subject to inherent risk relating to changing demographic developments (including mortality), changing customer behaviour, adverse weather and similar contingencies outside its control, both in the UK and overseas. Such contingencies can change the risk profile and profitability of such products and services.

Adverse experience in the operations risks inherent in Lloyds TSB Group’s businesses could have a negative impact on its results of operations

Operations risks are present in Lloyds TSB Group’s businesses. Lloyds TSB Group’s businesses are dependent on their ability to process accurately and efficiently a high volume of complex transactions across numerous and diverse products and services, in different currencies and subject to a number of different legal and regulatory regimes. Lloyds TSB Group’s systems and processes are designed to ensure that the operations risks associated with its activities are appropriately controlled, but Lloyds TSB Group realises that any weakness in these systems could have a negative impact on its results of operations during the affected period. See ‘Operating and financial review and prospects – Risk management – Operational risk’.

Terrorist acts and other acts of war could have a negative impact on the business and results of operations of Lloyds TSB Group

Terrorist acts, and other acts of war or hostility and responses to those acts, may create economic and political uncertainties, which could have a negative impact on UK and international economic conditions generally, and more specifically on the business and results of operations of Lloyds TSB Group in ways that cannot be predicted.

Lloyds TSB Group’s businesses are subject to substantial regulation, and regulatory and governmental oversight. Any significant adverse regulatory developments or changes in government policy could have a negative impact on Lloyds TSB Group’s results of operations

Lloyds TSB Group conducts its businesses subject to ongoing regulation and associated regulatory risks, including the effects of changes in the laws, regulations, policies, voluntary codes of practice and interpretations in the UK and the other markets where it operates. Future changes in regulation, fiscal or other policies are unpredictable and beyond the control of Lloyds TSB Group. For additional information, see ‘Regulation’.

In addition, in the UK and elsewhere, there is continuing political and regulatory scrutiny of banking and, in particular, retail banking. In the UK, the OFT is carrying out several inquiries, which are referred to in the ‘Competitive environment’ section on page 11.

In recent years there have been several issues in the UK financial services industry in which the FSA has intervened directly, including the sale of personal pensions and the sale of mortgage-related endowments. More recently, the FSA has carried out industry-wide investigations into sales of contracted-out pensions and sales and terms of reviewable

111

policies. New areas of industry risk may be indentified, or the FSA may intervene in relation to the areas of industry risk already identified, which could adversely affect the Lloyds TSB Group.

Lloyds TSB Group is exposed to various forms of legal risk including the risk of misselling financial products, acting in breach of legal or regulatory principles or requirements and giving negligent advice, any of which could have a negative impact on its results or its relations with its customers

Some of these issues involve the possibility of alleged misselling of retail financial products. There is a risk that further provisions may be required as a result of these issues.

Lloyds TSB Group is exposed to many forms of legal risk, which may arise in a number of ways. Primarily:

| |

i) | certain aspects of the Lloyds TSB Group’s business may be determined by the authorities, the Financial Ombudsman Service (“FOS”) or the courts as not being conducted in accordance with applicable laws or, in the case of the FOS, what is fair and reasonable in the Ombudsman’s opinion; |

| |

ii) | contractual obligations may either not be enforceable as intended or may be enforced against Lloyds TSB Group in an adverse way; |

| |

iii) | the intellectual property of Lloyds TSB Group (such as its trade names) may not be adequately protected; and |

| |

iv) | Lloyds TSB Group may be liable for damages to third parties harmed by the conduct of its business. |

In addition, Lloyds TSB Group faces risk where legal proceedings or FOS complaints are brought against it. Regardless of whether or not such claims have merit, the outcome of such proceedings or complaints is inherently uncertain and if extended more broadly could have a material adverse effect on Lloyds TSB Group’s operations and/or financial condition.

Although Lloyds TSB has policies around the management of legal risk, failure to manage legal risks could impact Lloyds TSB Group adversely, both financially and reputationally.

Tax risk is the risk associated with changes in, or errors in the interpretation of, taxation rates or law. This could result in increased charges or financial loss.

Although Lloyds TSB Group devotes considerable resources to managing tax risk, failure to manage this risk could impact Lloyds TSB Group adversely.

Lloyds TSB Group’s businesses are conducted in highly competitive environments. Creation of an appropriate return for shareholders depends upon management’s ability to respond effectively to competitive pressures

The market for UK financial services and the other markets within which Lloyds TSB Group operates are highly competitive, and management expects such competition to intensify in response to consumer demand, technological changes, the impact of consolidation, regulatory actions and other factors, which could result in a reduction in profit margins. Lloyds TSB Group’s ability to generate an appropriate return for its shareholders depends significantly upon the competitive environment and management’s response to it. See ‘Business – Competitive environment’.

Lloyds TSB Group is devoting considerable time and resources to securing new customers and developing more business from existing customers. If Lloyds TSB Group is unsuccessful, its organic growth prospects will decline

Lloyds TSB Group seeks to achieve further organic growth by securing new customers and developing more business from existing customers. Lloyds TSB Group is currently expending significant resources and effort to bring about this growth, particularly with respect to its UK retail financial services business. If these expenditures and efforts do not meet with success, its operating results would grow more slowly or decline.

Lloyds TSB Group’s strategic plans and related risks

Lloyds TSB Group devotes considerable management and planning resources to developing strategic plans for organic growth and identifying possible acquisitions which would provide further opportunities for growth. If these strategic plans do not meet with success, Lloyds TSB Group’s earnings could grow more slowly or decline.

Lloyds TSB Group’s businesses are conducted in a marketplace that is consolidating and significant cross-border mergers and acquisitions may happen in the coming years. Lloyds TSB Group’s ability to generate an appropriate return for its shareholders over the long-term may depend upon whether management is able to achieve value creating acquisitions and/or mergers at the appropriate times and prices. Lloyds TSB Group cannot be sure that it will ultimately be able to make such mergers or acquisitions or that if it does, such mergers or acquisitions will be integrated successfully or realise anticipated benefits.

112

FORWARD LOOKING STATEMENTS

This annual report includes certain forward-looking statements with respect to the business, strategy and plans of Lloyds TSB Group and its current goals and expectations relating to its future financial condition and performance. Statements that are not historical facts, including statements about Lloyds TSB Group’s or management’s beliefs and expectations, are forward-looking statements. Words such as “believes”, “anticipates”, “estimates”, “expects”, “intends”, “aims”, “potential”, “will”, “could”, “considered”, “likely”, “estimate” and variations of these words and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend upon circumstances that will occur in the future.

Examples of such forward-looking statements include, but are not limited to:

| |

• | projections or expectations of profit attributable to shareholders, provisions, economic profit, dividends, capital structure or any other financial items or ratios; |

| |

• | statements of plans, objectives or goals of Lloyds TSB Group or its management; |

| |

• | statements about the future trends in interest rates, stock market levels and demographic trends and any impact on Lloyds TSB Group; |

| |

• | statements concerning any future UK or other economic environment or performance, including in particular any such statements included in this annual report in “Operating and Financial Review and Prospects”; |

| |

• | statements about strategic goals, competition, regulation, dispositions and consolidation or technological developments in the financial services industry; and |

| |

• | statements of assumptions underlying such statements. |

| |

Factors that could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements made by Lloyds TSB Group or on Lloyds TSB Group’s behalf include, but are not limited to: |

| |

• | general economic conditions in the UK and internationally; |

| |

• | inflation, interest rate, exchange rate, market and monetary fluctuations; |

| |

• | changing demographic developments, adverse weather and similar contingencies outside the Lloyds TSB Group’s control; |

| |

• | inadequate or failed internal or external processes, people and systems; |

| |

• | terrorist acts and other acts of war or hostility and responses to those acts; |

| |

• | changes in laws, regulations or taxation; |

| |

• | changes in competition and pricing environments; |

| |

• | the ability to secure new customers and develop more business from existing customers; |

| |

• | the ability to achieve value-creating mergers and/or acquisitions at the appropriate time and prices; and |

| |

• | the success of the Lloyds TSB Group in managing the risks of the foregoing. |

Lloyds TSB Group plc may also make or disclose written and/or oral forward-looking statements in reports filed with or furnished to the US Securities and Exchange Commission, Lloyds TSB Group plc’s annual report and accounts to shareholders, proxy statements, offering circulars, prospectuses, press releases and other written materials and in oral statements made by the directors, officers or employees of Lloyds TSB Group plc to third parties, including financial analysts. The forward-looking statements contained in this annual report are made as of the date hereof, and Lloyds TSB Group undertakes no obligation to update any of its forward-looking statements.

113

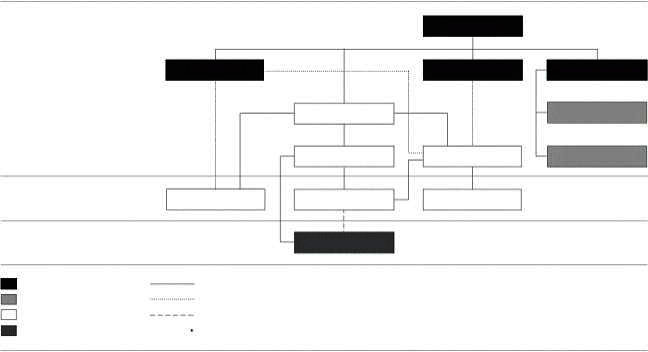

LLOYDS TSB GROUP STRUCTURE

The following is a list of the principal subsidiaries of Lloyds TSB Group plc at 31 December 2005. The audited consolidated accounts of Lloyds TSB Group plc for the year ended 31 December 2005 include the audited accounts of each of these companies.

| | | | | | | | |

Name of subsidiary undertaking | | Country of

registration/

incorporation | | Percentage of

equity share

capital and voting

rights held | | Nature of business | | Registered office |

|

Lloyds TSB Bank plc | | England | | 100% | | Banking and financial services | | 25 Gresham Street London EC2V 7HN |

|

Cheltenham & Gloucester plc | | England | | 100%* | | Mortgage lending and retail investments | | Barnett Way

Gloucester GL4 3RL |

|

Lloyds TSB Commercial Finance Limited | | England | | 100%* | | Credit factoring | | Beaumont House Beaumont Road, Banbury Oxfordshire OX16 7RN |

|

Lloyds TSB Leasing Limited | | England | | 100%* | | Financial leasing | | 25 Gresham Street

London EC2V 7HN |

|

Lloyds TSB Private Banking Limited | | England | | 100%* | | Private banking | | 25 Gresham Street

London EC2V 7HN |

|

The Agricultural Mortgage Corporation PLC | | England | | 100%* | | Long-term agricultural finance | | Charlton Place

Charlton Road

Andover

Hampshire SP10 1RE |

|

Lloyds TSB Offshore Limited | | Jersey | | 100%* | | Banking and financial services | | 25 New Street

St Helier

Jersey JE4 8RG |

|

Lloyds TSB Scotland plc | | Scotland | | 100%* | | Banking and financial services | | Henry Duncan House

120 George Street

Edinburgh EH2 4LH |

|

Lloyds TSB General Insurance Limited | | England | | 100%* | | General insurance | | 25 Gresham Street

London EC2V 7HN |

|

Scottish Widows Investment Partnership Group Limited | | England | | 100%* | | Investment management | | 10 Fleet Place

London EC4M 7RH |

|

Abbey Life Assurance

Company Limited | | England | | 100%* | | Life assurance | | 80 Holdenhurst Road

Bournemouth Dorset BH8 8ZQ |

|

Lloyds TSB Insurance Services Limited | | England | | 100%* | | Insurance broking | | 25 Gresham Street London EC2V 7HN |

|

Lloyds TSB Asset Finance Division Limited | | England | | 100%* | | Consumer credit, leasing and related services | | 25 Gresham Street London EC2V 7HN |

|

Black Horse Limited | | England | | 100%* | | Consumer credit, leasing and related services | | 25 Gresham Street London EC2V 7HN |

|

Scottish Widows plc | | Scotland | | 100%* | | Life assurance | | 69 Morrison Street Edinburgh EH3 8YF |

|

Scottish Widows Annuities Limited | | Scotland | | 100%* | | Life assurance | | 69 Morrison Street Edinburgh EH3 8YF |

|

114

INDEX TO THE CONSOLIDATED FINANCIAL STATEMENTS

F-1

Report of the independent Registered Public Accounting Firm

To the Shareholders of Lloyds TSB Group plc:

We have audited the accompanying consolidated balance sheets of Lloyds TSB Group plc and its subsidiaries as of 31 December 2005 and 31 December 2004, and the related consolidated income statement, consolidated balance sheet, consolidated statement of changes in equity and consolidated cash flow statement for each of the two years in the period ended 31 December 2005. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Lloyds TSB Group plc and its subsidiary undertakings at 31 December 2005 and 31 December 2004, and the results of their operations and their cash flows for each of the two years in the period ended 31 December 2005 in conformity with International Financial Reporting Standards (IFRS) as adopted by the European Union (EU).

As discussed in Note 1 ‘Accounting Policies’ of the consolidated financial statements, the Group adopted International Accounting Standard (IAS) 32 ‘Financial Instruments: Disclosure and Presentation’, IAS 39 ‘Financial Instruments: Recognition and Measurement’ and IFRS 4 ‘Insurance Contracts’ in accordance with IFRS as adopted by the EU. The change has been accounted for with effect from 1 January 2005.

Accounting principles in conformity with IFRS as adopted by the EU vary in certain significant respects from accounting principles generally accepted in the United States. Information relating to the nature and effect of such differences is presented in Note 56 to the consolidated financial statements.

PricewaterhouseCoopers LLP

Southampton, England

23 February 2006, except for Note 56, as to which the date is 6 June 2006.

F-2

Consolidated income statement

for the year ended 31 December 2005

| | | | | | | | | | |

| | | Note | | | 2005

£ million | | | 2004

£ million | |

|

Interest and similar income | | | | | | 12,589 | | | 10,707 | |

Interest and similar expense | | | | | | (6,918 | ) | | (5,597 | ) |

|

|

|

|

|

|

|

|

|

|

|

Net interest income | | | 4 | | | 5,671 | | | 5,110 | |

Fees and commission income | | | | | | 2,990 | | | 3,054 | |

Fees and commission expense | | | | | | (842 | ) | | (844 | ) |

|

|

|

|

|

|

|

|

|

|

|

Net fees and commission income | | | 5 | | | 2,148 | | | 2,210 | |

Net trading income | | | 6 | | | 9,298 | | | 5,036 | |

Insurance premium income | | | 7 | | | 4,469 | | | 6,070 | |

Other operating income | | | 8 | | | 1,140 | | | 857 | |

Other income | | | | | | 17,055 | | | 14,173 | |

|

|

|

|

|

|

|

|

|

|

|

Total income | | | | | | 22,726 | | | 19,283 | |

Insurance claims | | | 9 | | | (12,186 | ) | | (9,622 | ) |

|

|

|

|

|

|

|

|

|

|

|

Total income, net of insurance claims | | | | | | 10,540 | | | 9,661 | |

Operating expenses | | | 10 | | | (5,471 | ) | | (5,297 | ) |

|

|

|

|

|

|

|

|

|

|

|

Trading surplus | | | | | | 5,069 | | | 4,364 | |

Impairment losses on loans and advances | | | 11 | | | (1,299 | ) | | (866 | ) |

Profit (loss) on sale and closure of businesses | | | 12 | | | 50 | | | (21 | ) |

|

|

|

|

|

|

|

|

|

|

|

Profit before tax | | | | | | 3,820 | | | 3,477 | |

Taxation | | | 13 | | | (1,265 | ) | | (1,018 | ) |

|

|

|

|

|

|

|

|

|

|

|

Profit for the year | | | | | | 2,555 | | | 2,459 | |

|

|

|

|

|

|

|

|

|

|

|

Profit attributable to minority interests | | | | | | 62 | | | 67 | |

Profit attributable to equity shareholders | | | | | | 2,493 | | | 2,392 | |

|

|

|

|

|

|

|

|

|

|

|

Profit for the year | | | | | | 2,555 | | | 2,459 | |

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share | | | 14 | | | 44.6 | p | | 42.8 | p |

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share | | | 14 | | | 44.2 | p | | 42.5 | p |

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of the consolidated financial statements.

F-3

Consolidated balance sheet

at 31 December 2005

| | | | | | | | | | |

| | | Note | | | 2005

£ million | | | 2004

£ million | |

|

Assets | | | | | | | | | | |

Cash and balances at central banks | | | | | | 1,156 | | | 1,078 | |

Items in the course of collection from banks | | | | | | 1,310 | | | 1,462 | |

Treasury bills and other eligible bills | | | 15 | | | | | | 92 | |

Trading securities and other financial assets at fair value through profit or loss | | | 16 | | | 60,374 | | | | |

|

Derivative financial instruments | | | 17 | | | 5,878 | | | | |

Loans and advances to banks | | | 18 | | | 31,655 | | | 31,848 | |

Loans and advances to customers | | | 19 | | | 174,944 | | | 155,318 | |

Debt securities | | | 21 | | | | | | 43,485 | |

|

Equity shares | | | 22 | | | | | | 27,310 | |

Available-for-sale financial assets | | | 23 | | | 14,940 | | | | |

Investment property | | | 24 | | | 4,260 | | | 3,776 | |

Goodwill | | | 25 | | | 2,373 | | | 2,469 | |

Value of in-force business | | | 26 | | | 2,922 | | | 4,363 | |

Other intangible assets | | | 27 | | | 50 | | | 28 | |

Tangible fixed assets | | | 28 | | | 4,291 | | | 4,180 | |

Other assets | | | 30 | | | 5,601 | | | 9,013 | |

|

|

|

|

|

|

|

|

|

|

|

Total assets | | | | | | 309,754 | | | 284,422 | |

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of the consolidated financial statements.

F-4

Consolidated balance sheet

at 31 December 2005

| | | | | | | | | | |

Equity and liabilities | | | Note | | | 2005

£ million | | | 2004

£ million | |

|

|

|

|

|

|

|

|

|

|

|

Liabilities | | | | | | | | | | |

Deposits from banks | | | 31 | | | 31,527 | | | 39,723 | |

Customer accounts | | | 32 | | | 131,070 | | | 119,811 | |

Items in course of transmission to banks | | | | | | 658 | | | 631 | |

Derivative financial instruments and other trading liabilities | | | 17 | | | 6,396 | | | | |

Debt securities in issue | | | 33 | | | 39,346 | | | 28,770 | |

Liabilities arising from insurance contracts and participating investment contracts | | | 34 | | | 40,550 | | | 52,289 | |

Liabilities arising from non-participating investment contracts | | | 35 | | | 21,839 | | | | |

Unallocated surplus within insurance businesses | | | 36 | | | 518 | | | 1,362 | |

Other liabilities | | | 37 | | | 9,843 | | | 14,457 | |

Retirement benefit obligations | | | 38 | | | 2,910 | | | 3,075 | |

Current tax liabilities | | | | | | 552 | | | 459 | |

Deferred tax liabilities | | | 39 | | | 1,145 | | | 1,704 | |

Other provisions | | | 40 | | | 368 | | | 211 | |

Subordinated liabilities | | | 41 | | | 12,402 | | | 10,252 | |

|

|

|

|

|

|

|

|

|

|

|

Total liabilities | | | | | | 299,124 | | | 272,744 | |

| | | | | | | | | | |

| | | | | | | | | | |

Equity | | | | | | | | | | |

Share capital | | | 42 | | | 1,420 | | | 1,419 | |

Share premium account | | | 43 | | | 1,170 | | | 1,145 | |

Other reserves | | | 44 | | | 383 | | | 343 | |

Retained profits | | | 45 | | | 7,222 | | | 8,140 | |

| | | | | | | | | | |

Shareholders’ equity | | | | | | 10,195 | | | 11,047 | |

Minority interests | | | 48 | | | 435 | | | 631 | |

|

|

|

|

|

|

|

|

|

|

|

Total equity | | | | | | 10,630 | | | 11,678 | |

|

|

|

|

|

|

|

|

|

|

|

Total equity and liabilities | | | | | | 309,754 | | | 284,422 | |

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of the consolidated financial statements.

F-5

Consolidated statement of changes in equity

| | | | | | | | | | | | | | | | | | | |

| | Attributable to equity shareholders | | | | | | | | | | |

|

| | | Share capital

and premium

£ million | | | Other

reserves

£ million | | | Retained

profits

£ million | | | Total

£ million | | | Minority

interests

£ million | | | Total

£ million | |

|

Balance at 1 January 2004 (note 54) | | | 2,554 | | | 343 | | | 7,646 | | | 10,543 | | | 782 | | | 11,325 | |

Currency translation differences | | | — | | | — | | | (12 | ) | | (12 | ) | | 1 | | | (11 | ) |

Profit for the year | | | — | | | — | | | 2,392 | | | 2,392 | | | 67 | | | 2,459 | |

Total recognised income for 2004 | | | — | | | — | | | 2,380 | | | 2,380 | | | 68 | | | 2,448 | |

Dividends | | | — | | | — | | | (1,913 | ) | | (1,913 | ) | | (68 | ) | | (1,981 | ) |

Purchase/sale of treasury shares | | | — | | | — | | | 8 | | | 8 | | | — | | | 8 | |

Employee share option schemes: | | | | | | | | | | | | | | | | | | | |

– value of employee services | | | — | | | — | | | 19 | | | 19 | | | — | | | 19 | |

– proceeds from shares issued | | | 10 | | | — | | | — | | | 10 | | | — | | | 10 | |

Change in minority interests | | | — | | | — | | | — | | | — | | | (151 | ) | | (151 | ) |

|

Balance at 31 December 2004 (note 54) | | | 2,564 | | | 343 | | | 8,140 | | | 11,047 | | | 631 | | | 11,678 | |

Adjustments on transition to IAS 32, IAS 39 and IFRS 4 (note 54) | | | — | | | 28 | | | (1,586 | ) | | (1,558 | ) | | (550 | ) | | (2,108 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restated balance at 1 January 2005 (note 54) | | | 2,564 | | | 371 | | | 6,554 | | | 9,489 | | | 81 | | | 9,570 | |

Movement in available-for-sale financial assets, net of tax | | | — | | | 8 | | | — | | | 8 | | | — | | | 8 | |

Movement in cash flow hedges, net of tax | | | — | | | 11 | | | — | | | 11 | | | — | | | 11 | |

Currency translation differences | | | — | | | (7 | ) | | 24 | | | 17 | | | — | | | 17 | |

Net income recognised directly in equity | | | — | | | 12 | | | 24 | | | 36 | | | — | | | 36 | |

Profit for the year | | | — | | | — | | | 2,493 | | | 2,493 | | | 62 | | | 2,555 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total recognised income for 2005 | | | — | | | 12 | | | 2,517 | | | 2,529 | | | 62 | | | 2,591 | |

Dividends | | | — | | | — | | | (1,914 | ) | | (1,914 | ) | | (37 | ) | | (1,951 | ) |

Purchase/sale of treasury shares | | | — | | | — | | | 18 | | | 18 | | | — | | | 18 | |

Employee share option schemes: | | | | | | | | | | | | | | | | | | | |

– value of employee services | | | — | | | — | | | 47 | | | 47 | | | — | | | 47 | |

– proceeds from shares issued | | | 26 | | | — | | | — | | | 26 | | | — | | | 26 | |

Change in minority interests | | | — | | | — | | | — | | | — | | | 329 | | | 329 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at 31 December 2005 | | | 2,590 | | | 383 | | | 7,222 | | | 10,195 | | | 435 | | | 10,630 | |

|

The accompanying notes are an integral part of the consolidated financial statements.

F-6

Consolidated cash flow statement

for the year ended 31 December 2005

| | | | | | | | | | |

| | | Note | | | 2005

£ million | | | 2004

£ million | |

|

|

|

|

|

|

|

|

|

|

|

Net cash (used in) provided by operating activities | | | 53 | a | | (331 | ) | | 12,214 | |

Cash flows from investing activities: | | | | | | | | | | |

Purchase of fixed asset investments | | | | | | | | | (10,088 | ) |

|

Proceeds from sale and maturity of fixed asset investments | | | | | | | | | 9,732 | |

Purchase of available-for-sale financial assets | | | | | | (10,108 | ) | | | |

|

Proceeds from sale and maturity of available-for-sale financial assets | | | | | | 10,266 | | | | |

Purchase of fixed assets | | | | | | (1,843 | ) | | (1,565 | ) |

Proceeds from sale of fixed assets | | | | | | 1,073 | | | 698 | |

Acquisition of businesses, net of cash acquired | | | 53 | e | | (27 | ) | | (16 | ) |

Disposal of businesses, net of cash disposed | | | 53 | f | | (4 | ) | | (25 | ) |

|

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities | | | | | | (643 | ) | | (1,264 | ) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: | | | | | | | | | | |

Dividends paid to equity shareholders | | | | | | (1,914 | ) | | (1,913 | ) |

Dividends paid to minority interests | | | 53 | d | | (37 | ) | | (68 | ) |

Proceeds from issue of subordinated liabilities | | | 53 | d | | 1,361 | | | 699 | |

Proceeds from issue of ordinary shares and transactions in own shares

held in respect of employee share schemes | | | 53 | d | | 26 | | | 11 | |

Repayment of subordinated liabilities (loan capital) | | | 53 | d | | (232 | ) | | (764 | ) |

Capital element of finance lease rental payments | | | 53 | d | | (2 | ) | | (1 | ) |

Change in minority investment in subsidiaries | | | 53 | d | | 329 | | | (151 | ) |

|

|

|

|

|

|

|

|

|

|

|

Net cash used in financing activities | | | | | | (469 | ) | | (2,187 | ) |

|

|

|

|

|

|

|

|

|

|

|

Change in cash and cash equivalents | | | | | | (1,443 | ) | | 8,763 | |

Cash and cash equivalents at beginning of year | | | | | | 28,196 | | | 19,433 | |

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of year | | | 53 | b | | 26,753 | | | 28,196 | |

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents comprise cash and balances at central banks (excluding mandatory deposits) and amounts due from banks with a maturity of less than three months.

The accompanying notes are an integral part of the consolidated financial statements.

F-7

Notes to the accounts

In accordance with the requirements of Regulation (EC) No 1606/2002 of the European Parliament, the Group has applied International Financial Reporting Standards (‘IFRS’) as adopted by the European Union (EU) in its financial statements for the year ended 31 December 2005. The rules for first time adoption of IFRS are set out in IFRS 1 ‘First-time Adoption of International Financial Reporting Standards’. On 1 January 2004, the date of transition, the opening IFRS balance sheet position has been determined in accordance with IFRS 1 which requires IFRS accounting policies to be applied on a retrospective basis with certain exceptions and exemptions detailed below.

| | |

Mandatory exception | | Impact |

|

|

|

Estimates | | The Group’s estimates at the date of transition are consistent with those under UK GAAP. |

|

|

|

Assets held for sale and discontinued operations | | The Group has no transactions prior to 1 January 2005 that are affected by the transitional requirements of IFRS 5. |

|

|

|

Derecognition of financial instruments | | Financial instruments derecognised before 1 January 2004 have not been re-recognised by the Group under IFRS. |

|

|

|

Hedge accounting | | IFRS compliant hedge accounting is applied by the Group from 1 January 2005. |

|

|

|

Voluntary exemption | | |

|

|

|

Business combinations | | By electing to apply IFRS 3 on a prospective basis from 1 January 2004, the Group has not restated past acquisitions and mergers. Goodwill previously written off to reserves has not been reinstated and no additional intangible assets have been recognised in this regard. |

|

|

|

Retirement benefits | | Under UK GAAP, the Group has recognised all cumulative actuarial gains and losses and elects to apply this treatment at the date of transition to IFRS. |

|

|

|

Cumulative translation adjustment | | The Group has opted to reset the cumulative translation difference on adoption of IFRS to zero. |

|

|

|

Comparatives for financial instruments and designation of financial assets | | The Group has chosen not to restate comparatives for IAS 32 and IAS 39, but to reflect the impact of these standards through adjustments to shareholders’ equity as at 1 January 2005. At this date the Group has designated various financial assets as at fair value through profit or loss or as available-for-sale. The Group has applied UK GAAP to financial instruments and hedging transactions for its 2004 comparatives. |

|

|

|

Share-based payments | | The Group has elected to apply IFRS 2 to equity instruments that were granted before 7 November 2002. |

|

|

|

Insurance contracts | | The Group has chosen not to restate its comparatives for IFRS 4 but to reflect the impact of this standard through adjustments to shareholders’ equity at 1 January 2005. The Group has applied UK GAAP for its 2004 comparatives. |

|

|

|

The Group has also adopted the requirements of Financial Reporting Standard (‘FRS’) 27 ‘Life Assurance’ issued by the UK Accounting Standards Board. FRS 27 has been applied from 1 January 2005; comparative figures have not been restated.

The financial information has been prepared under the historical cost convention, as modified by the revaluation of investment properties, available-for-sale financial assets, trading securities and other financial assets at fair value through profit or loss and all derivative contracts, on the basis of IFRS as adopted by the EU. IFRS comprises accounting standards prefixed IFRS issued by the International Accounting Standards Board (‘IASB’) and those prefixed IAS issued by the IASB’s predecessor body as well as interpretations issued by the International Financial Reporting Interpretations Committee and its predecessor body.

The EU endorsed version of IAS 39 which is operative for years commencing 1 January 2005 relaxes some of the hedge accounting requirements; the Group has not taken advantage of this relaxation.

Further information on the principal differences between IFRS and FRS 27 and the Group’s previous accounting policies and the effect of their adoption on the Group’s previously published information is given in note 54.

F-8

1 Accounting policies (continued)

The Group’s accounting policies are set out below.

(a) Consolidation

The assets, liabilities and results of Group undertakings (including special purpose entities) are included in the financial statements on the basis of accounts made up to the reporting date. Group undertakings include all entities over which the Group has the power to govern the financial and operating policies which generally accompanies a shareholding of more than one half of the voting rights. The existence and effect of potential voting rights that are currently exercisable or convertible are considered when assessing whether the Group controls another entity. Group undertakings are fully consolidated from the date on which control is transferred to the Group; they are de-consolidated from the date that control ceases. Open Ended Investment Companies (OEICs) and unit trusts where the Group, through the Group’s life funds, has a controlling interest are consolidated; the unit holders’ interest is reported in other liabilities. Intra-Group transactions, balances and unrealised gains and losses on transactions between Group companies are eliminated.

(b) Goodwill

Goodwill represents the excess of the cost of an acquisition over the fair value of the Group’s share of the identifiable net assets of the acquired entity at the date of acquisition. Goodwill is recognised as an asset at cost and is tested at least annually for impairment. If an impairment is identified the carrying value of the goodwill is written down immediately through the income statement and is not subsequently reversed. At the date of disposal of a Group undertaking, the carrying value of attributable goodwill is included in the calculation of the profit or loss on disposal.

Goodwill arising on acquisitions prior to 1 January 2004, the date of transition to IFRS, has been retained at the balance sheet amount at that date and has been tested for impairment at that date. Goodwill previously written off directly to reserves under UK GAAP has not been reinstated and will not be included in calculating any subsequent profit or loss on disposal.

(c) Revenue recognition

Interest income and expense are recognised in the income statement for all interest-bearing financial instruments, including loans and advances, using the effective interest method. The effective interest method is a method of calculating the amortised cost of a financial asset or liability and of allocating the interest income or interest expense. The effective interest rate is the rate that exactly discounts the estimated future cash payments or receipts over the expected life of the instrument or, when appropriate, a shorter period, to the net carrying amount of the financial asset or financial liability. The effective interest rate is calculated on initial recognition of the financial asset or liability, estimating the future cash flows after considering all the contractual terms of the instrument but not future credit losses. The calculation includes all amounts paid or received by the Group that are an integral part of the overall return, direct incremental transaction costs related to the acquisition, issue or disposal of a financial instrument and all other premiums or discounts. Once a financial asset or a group of similar financial assets has been written down as a result of an impairment loss, interest income is recognised using the rate of interest used to discount the future cash flows for the purpose of measuring the impairment loss (see i).

Fees and commissions which are not an integral part of the effective interest rate are generally recognised when the service has been provided. Loan commitment fees for loans that are likely to be drawn down are deferred (together with related direct costs) and recognised as an adjustment to the effective interest rate on the loan. Loan syndication fees are recognised as revenue when the syndication has been completed and the Group retains no part of the loan package for itself or retains a part at the same effective interest rate for all interest-bearing financial instruments, including loans and advances, as for the other participants.

The Group receives investment management fees in respect of services rendered in conjunction with the issue and management of investment contracts where the Group actively manages the consideration received from its customers to fund a return that is based on the investment profile that the customer selected on origination of the instrument. These services comprise an indeterminate number of acts over the lives of the individual contracts and, therefore, the Group recognises these fees on a straight-line basis over the estimated lives of the contracts.

Revenue recognition policies specific to life assurance and general insurance business, except for investment management fees as noted above, are detailed below (see q).

(d) Trading securities, other financial assets at fair value through profit or loss, and available-for-sale financial assets

Debt securities and equity shares acquired principally for the purpose of selling in the short term or which are part of a portfolio which is managed for short-term gains are classified as trading securities and recognised in the balance sheet at their fair value. Gains and losses arising from changes in their fair value are recognised in the income statement in the period in which they occur.

F-9

1 Accounting policies (continued)

Other financial assets at fair value through profit or loss are designated as such by management upon initial recognition. Such assets are carried in the balance sheet at their fair value and gains and losses recognised in the income statement in the period in which they occur. Financial assets are only designated as at fair value through profit or loss when doing so results in more relevant information because it eliminates or significantly reduces the inconsistent treatment that would otherwise arise from measuring the assets or recognising gains or losses on them on a different basis. No use is currently made of the option to designate financial liabilities at fair value through profit or loss.

The fair value of assets traded in active markets is based on current bid prices. If the market is not active the Group establishes a fair value by using valuation techniques. These include the use of recent arm’s-length transactions, reference to other instruments that are substantially the same, discounted cash flow analysis, option pricing models and other valuation techniques commonly used by market participants.

Debt securities and equity shares, other than those classified as trading securities or at fair value through profit or loss, are classified as available-for-sale and recognised in the balance sheet at their fair value. Gains and losses arising from changes in the fair value of investments classified as available-for-sale are recognised directly in equity, until the financial asset is either sold, becomes impaired or matures, at which time the cumulative gain or loss previously recognised in equity is recognised in the income statement. Interest calculated using the effective interest method is recognised in the income statement; dividends on available-for-sale equity instruments are recognised in the income statement when the Group’s right to receive payment is established.

Purchases and sales of securities and other financial assets are recognised on trade date, being the date that the Group is committed to purchase or sell an asset. Trading securities and other financial assets at fair value through profit or loss are initially recognised at fair value. Available-for-sale financial assets are initially recognised at fair value inclusive of transaction costs. These financial assets are derecognised when the rights to receive cash flows from the financial assets have expired or where the Group has transferred substantially all risks and rewards of ownership.

(e) Loans and advances to banks and customers

Loans and advances to banks and customers are accounted for at amortised cost using the effective interest method, except those which the Group intends to sell in the short term and which are accounted for at fair value, with the gains and losses arising from changes in their fair value reflected in the income statement. Loans and advances are initially recognised when cash is advanced to the borrowers at fair value inclusive of transaction costs. Loans and advances are derecognised when the rights to receive cash flows from them have expired or where the Group has transferred substantially all risks and rewards of ownership.

(f) Sale and repurchase agreements

Securities sold subject to repurchase agreements (‘repos’) are reclassified in the financial statements as assets pledged when the transferee has the right by contract or custom to sell or repledge the collateral; the counterparty liability is included in deposits from banks or customer accounts, as appropriate. Securities purchased under agreements to resell (‘reverse repos’) are recorded as loans and advances to banks or customers, as appropriate. The difference between sale and repurchase price is treated as interest and accrued over the life of the agreements using the effective interest method. Securities lent to counterparties are also retained in the financial statements.

Securities borrowed are not recognised in the financial statements, unless these are sold to third parties, in which case the obligation to return them is recorded at fair value as a trading liability.

(g) Derivative financial instruments and hedge accounting

All derivatives are recognised at their fair value. Fair values are obtained from quoted market prices in active markets, including recent market transactions, and using valuation techniques, including discounted cash flow and options pricing models, as appropriate. Derivatives are carried in the balance sheet as assets when their fair value is positive and as liabilities when their fair value is negative.

The method of recognising the movements in the fair value of the derivatives depends on whether they are designated as hedging instruments, and if so, the nature of the item being hedged. Derivatives may only be designated as hedges provided certain strict criteria are met. At the inception of a hedge its terms must be clearly documented and there must be an expectation that the derivative will be highly effective in offsetting changes in the fair value or cash flow of the hedged risk. The effectiveness of the hedging relationship must be tested throughout its life and if at any point it is concluded that it is no longer highly effective in achieving its objective the hedge relationship is terminated.

The Group designates certain derivatives as either: (1) hedges of the fair value of the interest rate risk inherent in recognised assets or liabilities (fair value hedges); or (2) hedges of highly probable future cash flows attributable to recognised assets or liabilities (cash flow hedges). These are accounted for as follows:

F-10

1 Accounting policies (continued)

(1) Fair value hedges

Changes in the fair value of derivatives that are designated and qualify as fair value hedges are recorded in the income statement, together with the changes in the fair value of the hedged asset or liability that are attributable to the hedged risk. If the hedge no longer meets the criteria for hedge accounting, changes in the fair value of the hedged risk are no longer recognised in the income statement; the adjustment that has been made to the carrying amount of a hedged item is amortised to the income statement over the period to maturity.

(2) Cash flow hedges

The effective portion of changes in the fair value of derivatives that are designated and qualify as cash flow hedges is recognised in equity. The gain or loss relating to the ineffective portion is recognised immediately in the income statement. Amounts accumulated in equity are recycled to the income statement in the periods in which the hedged item affects profit or loss. When a hedging instrument expires or is sold, or when a hedge no longer meets the criteria for hedge accounting, any cumulative gain or loss existing in equity at that time remains in equity and is recognised when the forecast transaction is ultimately recognised in the income statement. When a forecast transaction is no longer expected to occur, the cumulative gain or loss that was reported in equity is immediately transferred to the income statement.

Changes in the fair value of any derivative instrument that is not part of a hedging relationship are recognised immediately in the income statement.

Derivatives embedded in financial instruments and insurance contracts (unless the embedded derivative is itself an insurance contract) are treated as separate derivatives when their economic characteristics and risks are not closely related to those of the host contract and the host contract is not carried at fair value through profit or loss. These embedded derivatives are measured at fair value with changes in fair value recognised in the income statement.

(h) Offset

Financial assets and liabilities are offset and the net amount reported in the balance sheet when there is a legally enforceable right of set-off and there is an intention to settle on a net basis, or realise the asset and settle the liability simultaneously.

(i) Impairment

(1) Assets accounted for at amortised cost

At each balance sheet date the Group assesses whether, as a result of one or more events occurring after initial recognition, there is objective evidence that a financial asset or group of financial assets has become impaired. Evidence of impairment may include indications that the borrower or group of borrowers is experiencing significant financial difficulty, default or delinquency in interest or principal payments, or the fact that the debt is being restructured to reduce the burden on the borrower.

If there is objective evidence that an impairment loss has been incurred, a provision is established which is calculated as the difference between the balance sheet carrying value of the asset and the present value of estimated future cash flows discounted at that asset’s original effective interest rate. For the Group’s portfolios of smaller balance homogenous loans, such as the residential mortgage, personal lending and credit card portfolios, provisions are calculated for groups of assets taking into account historical cash flow experience. For the Group’s other lending portfolios, provisions are established on a case-by-case basis. If an asset has a variable interest rate, the discount rate used for measuring the impairment loss is the current effective interest rate. The calculation of the present value of the estimated future cash flows of a collateralised asset or group of assets reflects the cash flows that may result from foreclosure less the costs of obtaining and selling the collateral, whether or not foreclosure is probable.

If there is no objective evidence of individual impairment the asset is included in a group of financial assets with similar credit risk characteristics and collectively assessed for impairment. Segmentation takes into account such factors as the type of asset, industry, geographical location, collateral type, past-due status and other relevant factors. These characteristics are relevant to the estimation of future cash flows for groups of such assets as they are indicative of the borrower’s ability to pay all amounts due according to the contractual terms of the assets being evaluated. Future cash flows are estimated on the basis of the contractual cash flows of the assets in the group and historical loss experience for assets with similar credit risk characteristics. Historical loss experience is adjusted on the basis of current observable data to reflect the effects of current conditions that did not affect the period on which the historical loss experience is based and to remove the effects of conditions in the historical period that do not exist currently. The methodology and assumptions used for estimating future cash flows are reviewed regularly by the Group to reduce any differences between loss estimates and actual loss experience.

If, in a subsequent period, the amount of the impairment loss decreases and the decrease can be related objectively to an event occurring after the impairment was recognised, such as an improvement in the borrower’s credit rating, the provision is adjusted and the amount of the reversal is recognised in the income statement.

F-11

1 Accounting policies (continued)

When a loan or advance is uncollectable, it is written off against the related provision once all the necessary procedures have been completed and the amount of the loss has been determined. Subsequent recoveries of amounts previously written off decrease the amount of impairment losses recorded in the income statement.

(2) Available-for-sale assets

The Group assesses at each balance sheet date whether there is objective evidence that an available-for-sale asset is impaired. In addition to the factors set out above, a significant or prolonged decline in the fair value of the asset below its cost is considered in determining whether an impairment loss has been incurred. If an impairment loss has been incurred, the cumulative loss measured as the difference between the original cost and the current fair value, less any impairment loss on that asset previously recognised, is removed from equity and recognised in the income statement. If, in a subsequent period, the fair value of a debt instrument classified as available-for-sale increases and the increase can be objectively related to an event occurring after the impairment loss was recognised, the impairment loss is reversed through the income statement. Impairment losses recognised in the income statement on equity instruments are not reversed through the income statement.

(j) Investment property

Property held for long-term rental yields and capital appreciation within the long-term assurance funds is classified as investment property. Investment property comprises freehold and long leasehold land and buildings and is carried in the balance sheet at fair value. Fair value is based on active market prices, adjusted, if necessary, for any difference in the nature, location or condition of the specific asset. If this information is not available, the Group uses alternative valuation methods such as discounted cash flow projections or recent prices on less active markets. These valuations are reviewed at least annually by an independent valuation expert. Investment property being redeveloped for continuing use as investment property, or for which the market has become less active, continues to be measured at fair value. Changes in fair values are recorded in the income statement.

(k) Tangible fixed assets

Tangible fixed assets are included at cost less depreciation. The value of land (included in premises) is not depreciated. Depreciation on other assets is calculated using the straight-line method to allocate the difference between the cost and the residual value over their estimated useful lives, as follows:

Premises (excluding land):

| |

• | Freehold/long and short leasehold premises: shorter of 50 years or the remaining period of the lease |

| |

• | Leasehold improvements: shorter of 10 years or the remaining period of the lease |

| |

Equipment: |

|

• | Fixtures and furnishings: 10-20 years |

| |

• | Other equipment and motor vehicles: 3-8 years |

The assets’ residual values and useful lives are reviewed, and adjusted if appropriate, at each balance sheet date.

Assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. In the event that an asset’s carrying amount is determined to be greater than its recoverable amount it is written down immediately.

(l) Leases

(1) As lessee

The leases entered into by the Group are primarily operating leases. Operating lease rentals are charged to the income statement on a straight-line basis over the period of the lease.

When an operating lease is terminated before the end of the lease period, any payment made to the lessor by way of penalty is recognised as an expense in the period of termination.

(2) As lessor

Assets leased to customers are classified as finance leases if the lease agreements transfer substantially all the risks and rewards of ownership to the lessee; all other leases are classified as operating leases. When assets are subject to finance leases, the present value of the lease payments is recognised as a receivable within loans and advances to banks and customers. Finance lease income is recognised over the term of the lease using the net investment method (before tax) reflecting a constant periodic rate of return.

Operating lease assets are included within fixed assets at cost and depreciated over the life of the lease after taking into account anticipated residual values. Operating lease rental income is recognised on a straight line basis over the life of the lease.

F-12

1 Accounting policies (continued)

(m) Borrowings

Borrowings are recognised initially at fair value, being their issue proceeds net of transaction costs incurred. Borrowings are subsequently stated at amortised cost using the effective interest method.

Preference shares and other instruments which carry a mandatory coupon or are redeemable on a specific date are classified as financial liabilities. The coupon on these instruments is recognised in the income statement as interest expense.

(n) Pensions and other post-retirement benefits

The Group operates a number of post-retirement benefit schemes for its employees including both defined benefit and defined contribution pension plans. A defined benefit scheme is a pension plan that defines an amount of pension benefit that an employee will receive on retirement, dependent on one or more factors such as age, years of service and salary. A defined contribution plan is a pension plan into which the Group pays fixed contributions; there is no legal or constructive obligation to pay further contributions.

Full actuarial valuations of the Group’s principal defined benefit schemes are carried out every three years with interim reviews in the intervening years; these valuations are updated to 31 December each year by qualified independent actuaries, or in the case of the Scottish Widows Retirement Benefits Scheme, by a qualified actuary employed by Scottish Widows. For the purposes of these annual updates scheme assets are included at their fair value and scheme liabilities are measured on an actuarial basis using the projected unit credit method adjusted for unrecognised actuarial gains and losses. The defined benefit scheme liabilities are discounted using rates equivalent to the market yields at the balance sheet date on high-quality corporate bonds that are denominated in the currency in which the benefits will be paid, and that have terms to maturity approximating to the terms of the related pension liability. The resulting net surplus or deficit is included in the Group’s balance sheet. Surpluses are only recognised to the extent that they are recoverable through reduced contributions in the future or through refunds from the schemes.

The Group’s income statement includes the current service cost of providing pension benefits, the expected return on the schemes’ assets, net of expected administration costs, and the interest cost on the schemes’ liabilities. Actuarial gains and losses arising from experience adjustments and changes in actuarial assumptions are not recognised unless the cumulative unrecognised gain or loss at the end of the previous reporting period exceeds the greater of 10 per cent of the scheme assets or liabilities. In these circumstances the excess is charged or credited to the income statement over the employees’ expected average remaining working lives. Past-service costs are charged immediately to the income statement, unless the charges are conditional on the employees remaining in service for a specified period of time (the vesting period). In this case, the past-service costs are amortised on a straight-line basis over the vesting period.

The costs of the Group’s defined contribution plans are charged to the income statement in the period in which they fall due.

(o) Share-based compensation

The Group operates a number of equity-settled, share-based compensation plans. The value of the employee services received in exchange for equity instruments granted under these plans is recognised as an expense over the vesting period of the instruments, with a corresponding increase in equity. This expense is determined by reference to the fair value of the number of equity instruments that are expected to vest. The fair value of equity instruments granted is based on market prices, if available, at the date of grant. In the absence of market prices, the fair value of the instruments at the date of grant is estimated using an appropriate valuation technique, such as a Black-Scholes option pricing model. The determination of fair values excludes the impact of any non-market vesting conditions, which are included in the assumptions used to estimate the number of options that are expected to vest. At each balance sheet date, this estimate is reassessed and if necessary revised. Any revision of the original estimate is recognised in the income statement over the remaining vesting period, together with a corresponding adjustment to equity.

(p) Income taxes, including deferred income taxes

Current income tax which is payable on taxable profits is recognised as an expense in the period in which the profits arise.

For the Group’s long-term assurance businesses, the tax charge is analysed between tax that is payable in respect of policyholders’ returns and tax that is payable on equity holders’ returns. This allocation is based on an assessment of the rates of tax which will be applied to the returns under current UK tax rules.

Deferred tax is provided in full, using the liability method, on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the consolidated financial statements. However, deferred income tax is not accounted for if it arises from initial recognition of an asset or liability in a transaction other than a business combination that at the time of the transaction affects neither accounting nor taxable profit or loss. Deferred tax is determined using tax rates that have been enacted or substantially enacted by the balance sheet date which are expected to apply when the related deferred tax asset is realised or the deferred tax liability is settled.

F-13

1 Accounting policies (continued)

Deferred tax assets are recognised where it is probable that future taxable profit will be available against which the temporary differences can be utilised. Deferred tax is provided on temporary differences arising from investments in subsidiaries and associates, except where the timing of the reversal of the temporary difference is controlled by the Group and it is probable that the difference will not reverse in the foreseeable future. Income tax payable on profits is recognised as an expense in the period in which those profits arise. The tax effects of losses available for carry forward are recognised as an asset when it is probable that future taxable profits will be available against which these losses can be utilised. Deferred tax related to fair value re-measurement of available-for-sale investments and cash flow hedges, which are charged or credited directly to equity, is also credited or charged directly to equity and is subsequently recognised in the income statement together with the deferred gain or loss.

Deferred and current tax assets and liabilities are offset when they arise in the same tax reporting group and where there is both a legal right of offset and the intention to settle on a net basis or to realise the asset and settle the liability simultaneously.

(q) Insurance

The Group undertakes both life assurance and general insurance business. The general insurance business issues insurance contracts only. The life assurance business issues insurance contracts and investment contracts. Insurance contracts are those contracts which transfer significant insurance risk. As a general guideline, the Group defines as significant insurance risk the possibility of having to pay benefits on the occurrence of an insured event which are more than the benefits payable if the insured event were not to occur. Investment contracts are those contracts which carry no significant insurance risk.

A number of insurance and investment contracts contain a discretionary participation feature which entitles the holder to receive, as a supplement to guaranteed benefits, additional benefits or bonuses that are likely to be a significant portion of the total contractual benefits and whose amount or timing is contractually at the discretion of the Group and based on the performance of specified assets. Contracts containing a discretionary participation feature are referred to as participating contracts.

IFRS 4 allows entities to continue with existing accounting policies for insurance and participating investment contracts, subject to certain criteria; the Group continues to apply UK GAAP for such contracts. For insurance and participating contracts issued by the life assurance business, this includes continued application of the embedded value basis of accounting although, as described below, the underlying contracts are presented separately from the value of in-force life assurance business in respect of those contracts. Investment contracts that are non-participating are accounted for as financial instruments.

(1) Life assurance business

(i) Accounting for life insurance contracts and participating investment contracts

The majority of the life insurance contracts issued by the Group are long-term life assurance contracts. The Group also issues life insurance contracts to protect customers from the consequences of events (such as death, critical illness or disability) that would affect the ability of the customer or their dependants to maintain their current level of income. Guaranteed claims paid on occurrence of the specified insurance event are either fixed or linked to the extent of the economic loss suffered by the policyholder.

Premiums and claims

Premiums received in respect of life insurance contracts and participating investment contracts are recognised as revenue when due and are shown before deduction of commission.

Claims are recorded as an expense when they are incurred.

Liabilities

– life insurance contracts or participating investment contracts in the Group’s With-Profits Fund

Liabilities of the Group’s With-Profits Fund, including guarantees and options embedded within products written by that fund, are stated at their realistic values in accordance with the Financial Services Authority’s realistic capital regime.

– life insurance contracts or participating investment contracts which are not unit-linked or in the Group’s With-Profits Fund

A liability for contractual benefits that are expected to be incurred in the future is recorded when the premiums are recognised. The liability is calculated by estimating the future cash flows over the duration of in-force policies and discounting them back to the valuation date allowing for probabilities of occurrence. The liability will vary with movements in interest rates and with the cost of life assurance and annuity benefits where future mortality is uncertain. Assumptions are made in respect of all material factors affecting future cash flows, including future interest rates, mortality and costs.

F-14

1 Accounting policies (continued)

– life insurance contracts or participating investment contracts which are unit-linked

Allocated premiums in respect of unit-linked contracts that are either life insurance contracts or participating investment contracts are recognised as liabilities. These liabilities are increased or reduced by the change in the unit prices and are reduced by policy administration fees, mortality and surrender charges and any withdrawals. The mortality charges deducted in each period from the policyholders as a group are considered adequate to cover the expected total death benefit claims in excess of the contract account balances in each period and hence no additional liability is established for these claims. Revenue consists of fees deducted for mortality, policy administration and surrender charges. Interest or changes in the unit prices credited to the account balances and excess benefit claims in excess of the account balances incurred in the period are charged as expenses in the income statement.

Unallocated surplus

The Group has an obligation to pay policyholders a specified portion of all interest and realised gains and losses arising from the assets backing participating contracts. Any amounts not yet determined as being due to policyholders are recognised as an unallocated surplus which is shown separately from other liabilities.

Value of in-force life assurance business

The Group recognises as an asset the value of in-force life assurance business in respect of life insurance contracts and participating investment contracts. The asset, which represents the present value of future profits expected to arise from these contracts, is determined by projecting the future surpluses and other cash flows arising from life insurance contract and participating investment contract business written by the balance sheet date but excluding any future investment margins, using appropriate economic and actuarial assumptions; the value of future cash flows on with-profits policies has been reduced, where necessary, to allow for the realistic value of options and guarantees. The result is discounted at a rate which removes investment risk margins and reflects the Group’s overall risk premium attributable to this business. The asset in the consolidated balance sheet is shown gross of attributable tax and movements in the asset are reflected within other operating income in the income statement.

Receivables and payables

Receivables and payables are recognised when due. These include amounts due to and from agents, brokers and insurance contract holders.

(ii) Accounting for non-participating investment contracts

All of the Group’s non-participating investment contracts are unit-linked. In accordance with industry practice, these contracts are accounted for as financial liabilities whose value is contractually linked to the fair values of financial assets within the Group’s unitised investment funds. The value of the unit-linked financial liabilities is determined using current unit prices multiplied by the number of units attributed to the contract holders at the balance sheet date. Their value is never less than the amount payable on surrender, discounted for the required notice period where applicable.

The element of premiums and claims in respect of non-participating investment contracts which is invested on behalf of the contract holder is excluded from the income statement, with all movements in the contract holder liability and related assets recorded in the balance sheet. Details of the basis of revenue recognition for the related investment management fees are set out above (see c).

Directly incremental commissions that vary with and are related to either securing new or renewing existing non-participating investment contracts are deferred; all other costs are recognised as expenses when incurred. This asset is subsequently amortised over the period of the provision of investment management services and is reviewed for impairment in circumstances where its carrying amount may not be recoverable. If the asset is greater than its recoverable amount it is written down immediately.

(2) General insurance business

The Group both underwrites and acts as intermediary in the sale of general insurance products. Underwriting premiums are included, net of refunds, in the period in which insurance cover is provided to the customer; premiums received relating to future periods are deferred and only credited to the income statement when earned. Broking commission is recognised when the underwriter accepts the risk of providing insurance cover to the customer. Where appropriate, provision is made for the effect of future policy terminations based upon past experience.

The underwriting business makes provision for the estimated cost of claims notified but not settled and claims incurred but not reported at the balance sheet date. The provision for the cost of claims notified but not settled is based upon a best estimate of the cost of settling the outstanding claims after taking into account all known facts. In those cases where there is insufficient information to determine the required provision, statistical techniques are used which take into account the cost of claims that have recently been settled and make assumptions about the future development of the outstanding cases. Similar statistical techniques are used to determine the provision for claims incurred but not reported at the balance sheet date.

F-15

1 Accounting policies (continued)

(3) Liability adequacy test

At each balance sheet date liability adequacy tests are performed to ensure the adequacy of insurance and participating investment contract liabilities. In performing these tests current best estimates of future contractual cash flows and claims handling and administration expenses, as well as investment income from the assets backing such liabilities, are used. Any deficiency is immediately charged to profit or loss by establishing a provision for losses arising from liability adequacy tests.

(4) Reinsurance

Contracts entered into by the Group with reinsurers under which the Group is compensated for losses on one or more contracts issued by the Group and that meet the classification requirements for insurance contracts are classified as reinsurance contracts held. Insurance contracts entered into by the Group under which the contract holder is another insurer (inwards reinsurance) are included with insurance contracts.