Third quarter 2024 compared to third quarter 2023

Besides the expected lower tonnes mined and changes in metal grades and recoveries for the three months ended September 30, 2024, as compared to the same period in 2023, the results of which were considered in the 2024 guidance disclosed in the 2023 Annual Report, the key drivers of the production and financial results relate to the issues the Company faced especially in the third quarter of 2024, including the issues with equipment availability due to the age and condition of some of the critical mining equipment, the decreasing cash and working capital, and the unprecedented weather and high humidity affecting our sales and production.

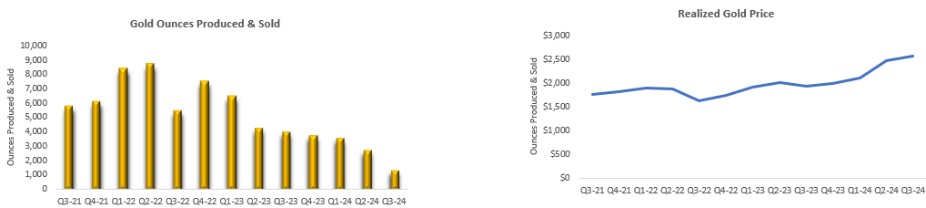

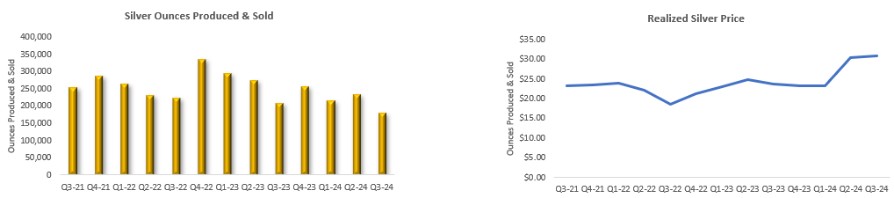

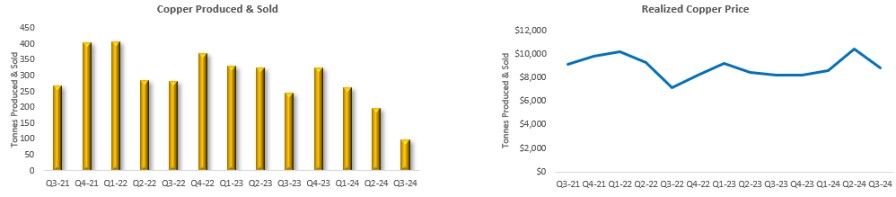

Metal Sold

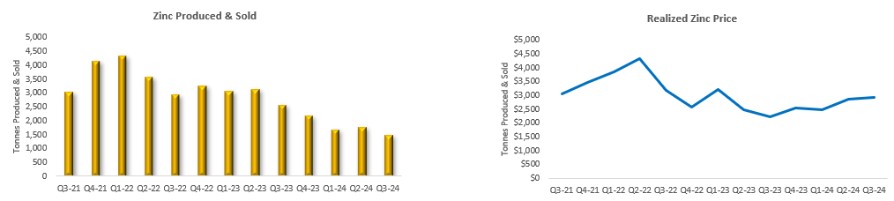

During the three months ended September 30, 2024, gold sales of 1,357 ounces, silver sales of 181,434 ounces, copper sales of 98 tonnes, lead sales of 467 tonnes, and zinc sales of 1,473 tonnes decreased by 66%, 13%, 60%, 51%, and 43%, respectively, as compared to the same period in 2023. The lower metal production was partially expected due to mine sequencing, but challenges with equipment availability, the lack of multiple faces to mine, and the unusually wet hurricane season at the mine site also negatively affected the Company’s metal sales and production.

Average metal prices realized

During the three months ended September 30, 2024, the average metal prices were $2,561 per ounce for gold, $30.61 per ounce for silver, $8,832 per tonne for copper, $2,065 per tonne for lead, and $2,854 per tonne for zinc. Compared to the same period in 2023, the average metal price for gold and silver increased by 32% and 30%, respectively. The average metal price for copper and zinc also increased by 8% and 30%, respectively, while the average metal price for lead decreased by 6%.

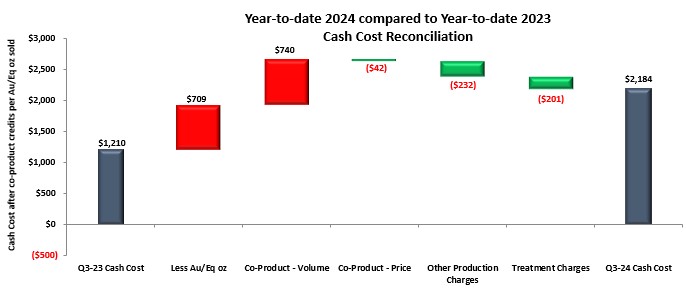

Year-to-date 2024 compared to year-to-date 2023

Besides the expected lower tonnes mined and changes in metal grades and recoveries for the nine months ended September 30, 2024, as compared to the same period in 2023, the results of which were considered in the 2024 guidance disclosed in the 2023 Annual Report, the key drivers of the production and financial results relate to the issues the Company faced in 2024, including the issues with equipment availability due to the age and condition of some of the critical mining equipment, the decreasing cash and working capital, and the unprecedented weather and high humidity affecting our sales and production. Narrower mining equipment would also be advantageous to reduce dilution.

Metal Sold

During the nine months ended September 30, 2024, gold sales of 7,638 ounces, silver sales of 632,529 ounces, copper sales of 559 tonnes, lead sales of 1,625 tonnes, and zinc sales of 4,926 tonnes decreased by 48%, 19%, 38%, 56%, and 44%, respectively, as compared to the same period in 2023. The lower metal production was partially expected due to mine sequencing, but challenges with equipment availability, the lack of multiple faces to mine, the unusually wet hurricane season at the mine site, and decreased cash as a result of prior production shortfalls, also negatively affected the Company’s metal sales and production.

Average metal prices realized

During the nine months ended September 30, 2024, the average metal prices were $2,309 per ounce for gold, $28.06 per ounce for silver, $9,260 per tonne for copper, $2,080 per tonne for lead, and $2,733 per tonne for zinc. Compared to the same period in 2023, the average metal price for gold, silver, copper and zinc increased by 19%, 18%, 7%, and 3%, respectively, while the average metal price for lead decreased by 4%.