- OIBZQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

-

Shorts

-

6-K Filing

Oi (OIBZQ) 6-KOI20190514_6K1

Filed: 15 May 19, 12:00am

Exhibit 1 |

HON. MR. MR. JUDGE OF LAW OF THE 7TH BUSINESS COURT OF THE DISTRICT OF THE CAPITAL OF THE STATE OF RIO DE JANEIRO

Case n° 0203711-65.2016.8.19.0001

Judicial Reorganization of Oi S.A and others

TheJUDICIAL ADMINISTRATOR (Arnoldo Wald Law Firm), appointed in the process of Judicial Reorganization ofOi S.A. and others, respectfully requests you to submit a petition to the Court of Appeals. Please determine the Monthly Activity Report ("RMA") attachment for the month of February 2019.

Rio de Janeiro, April 15 2019

|

|

|

"Court-Appointed Administrator":

Law Office Arnoldo Wald

Av. Pres. Juscelino Kubitschek, 510. 8th floor, CEP 04543-906, São Paulo, SP phone: +55 11 3074 6000 waldsp@wald.com.br | Franklin Roosevelt Avenue: 115 4th floor, CEP 20021-120, Rio de Janeiro, RJ phone: +55 21 2272 9300 waldrj@wald.com.br | SCN, Court 04, number 100 Block B, Petala D, 702 B | Varig Business Centre | CEP 70714-900 Brasilia. DF | tel: +55 61 3410 4700 walddf@wald.com.br |

REPORT

EXECUTIVE

1 | Introduction | 03 | |

2 | Organigram of the Oi Group / Companies in Recovery | 05 | |

3 | Relevant Facts & Notices to the Market published | 09 | |

4 | Financial Information (Consolidated for Recoveries) | 13 | |

| 4.1. | Management Cash Flow Statement | 14 |

| 4.2. | Balance Sheet for Recoveries | 20 |

| 4.3 | Statement of Income from Recoveries | 29 |

5 | Attendance to creditors | 32 | |

6 | Demonstrations presented by AJ | 33 | |

7 | Supervision and Compliance with the PRJ | 35 | |

2

1 Introduction; | REPORT EXECUTIVE |

INTRODUCTION

Dear Mr. . Judge of the 7th Business Court of the Capital of the State of Rio de Janeiro

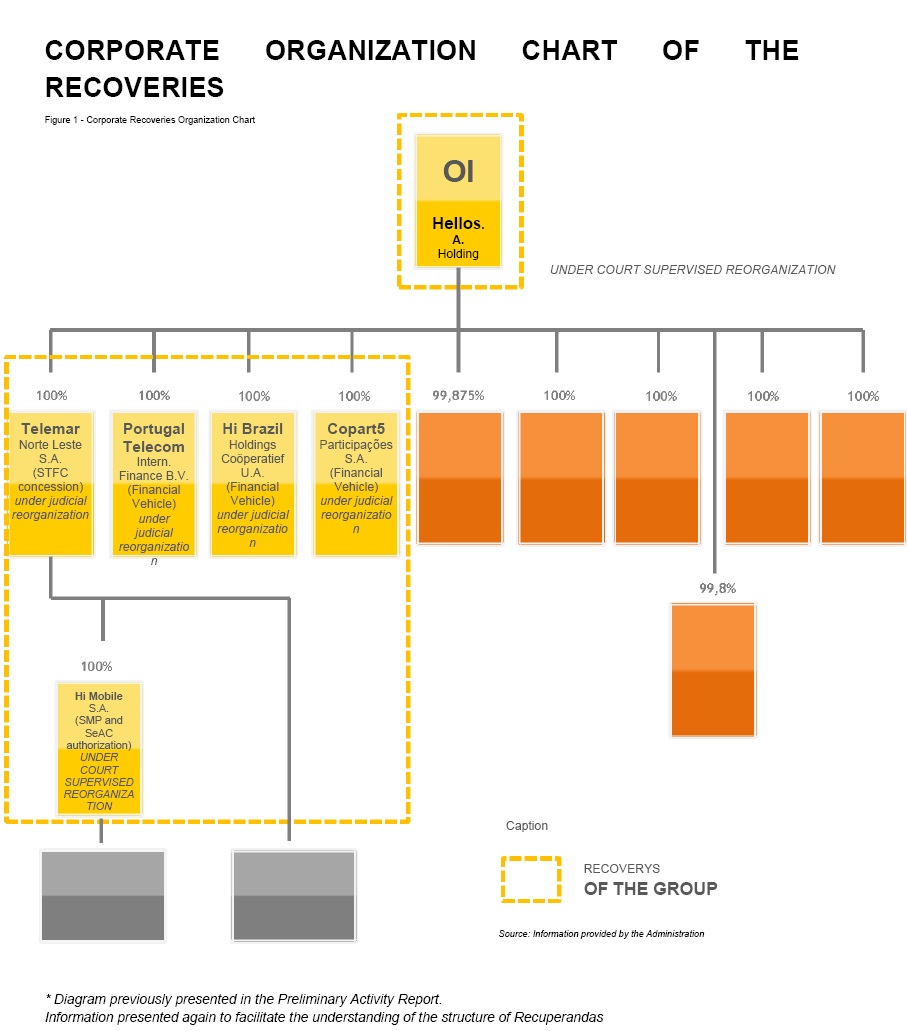

The Judicial Administrator, Arnoldo Wald ("Wald" or "AJ"), appointed in the records of the Judicial Reorganization of the Oi Group (case number 0203711- 65.2016.8.19.0001), and RC Consultores, subcontracted by AJ to assist you in the preparation of the Monthly Activity Report ("RMA"), come, respectfully, to your presence, pursuant to your decision of fls. 91.223 / 91,224, present the RMA for the month of February 2019 and the fourth quarter of 2018.

As we know, Judicial Reorganization involves the following companies:

Ÿ Oi S.A. - in Judicial Reorganization ("Oi S.A.");

Ÿ Telemar Norte Leste S.A. - in receivership ("Telemar Norte Leste");

Ÿ Oi Móvel S.A. - Under Judicial Reorganization ("Oi Móvel");

Ÿ Copart4 Participações S.A. - under judicial reorganization ("Copart4");

Ÿ Copart5 Participações S.A. - under judicial reorganization ("Copart5");

Ÿ Portugal Telecom International Finance B.V. - in Judicial Reorganisation ("PTIF"); and

Ÿ Oi Brasil Holdings Coöperatief U.A. -under Judicial Reorganization ("Oi Coop").

This report, which includes financial information based mainly on information provided by Recuperandas up to April 15, 2019, contains data referring to February 2019, and should be analyzed together with the preliminary report of activities, as well as with the other RMA's previously presented.

The RMA will have a chapter specifically focused on the consolidated financial information on Recoveries, which in this Report will cover the Managerial Cash Flow Statement for the referred month, presented in the tables in comparison with the immediately preceding month, in addition to the information related to the Balance Sheet and the Recoveries Statement of Income, the analysis being based on the quarterly comparison between the 4th quarter of 2018 and the 3rd quarter of 2018. The report will highlight the main variations occurred in the period in question, presenting the clarifications provided by the Recovery Administration.

3

1 Introduction; | REPORT EXECUTIVE |

This report, prepared through analytical procedures and discussions with the Company's management, aims to provide the Court and interested parties with information on the financial situation of the Recoveries and the relevant operations carried out by them, as well as a summary of the activities carried out by AJ up to the end of this report.

The information presented below is based mainly on data and elements submitted by Recoveries. The individual financial statements of all Recoveries, as well as the consolidated financial statements of the Oi Group (which include but are not limited to Recoveries) are audited annually by independent auditors. Limited review procedures are applied by the auditors for the filing with the CVM of Quarterly Financial Information ("ITRs") Oi Group's consolidated financial statements. With respect to the individual financial information of each Recovering Company, prepared in monthly periods other than those that comprise the ITRs delivered to CVM, they are not subject to independent audit review, either by the auditors hired by Oi Group or by the AJ.

The AJ, honored with the charge assigned, is available for further clarification on the information contained in this report or other additional information.

Yours sincerely,

|  |

Arnoldo Wald Filho Samantha Mendes Long Shareholders Tel: +55 (11) 3074-6000 | Marcel Augusto Caparoz Tel: +55 (11) 3053-0003 |

4

2 Corporate Recoveries Organisation Chart | REPORT EXECUTIVE |

5

2 Corporate Recoveries Organisation Chart | REPORT EXECUTIVE |

6

2 Corporate Recoveries Organisation Chart | REPORT EXECUTIVE |

7

2 Brief description of Recoverables | REPORT EXECUTIVE |

8

3 Relevant Facts & Notices to the Market published | REPORT EXECUTIVE |

RELEVANT FACTS & ANNOUNCEMENTS TO THE MARKET

The following are some of the relevant facts and announcements to the market disclosed by the Oi Group that are directly related to Recoveries:

Material Facts and Announcements to the Market in the month ofFEBRUARY/19

08 February - Repurchase of preferred shares

Oi S.A. - In Judicial Reorganization ("Company"), in compliance with art. 157, paragraph 4 of Law 6,404/76 and pursuant to CVM Instruction 358/02, informed its shareholders and the market in general that the Company's Board of Directors approved, pursuant to CVM Instruction 567/15, the acquisition of preferred shares issued by the Company itself, under the following conditions ("Repurchase"):

1. Objective: The purpose of the Repurchase is to ensure compliance with the commitment assumed by the Company to transfer shares of its issuance held in treasury to Bratel S.À.R.L. ("Bratel"), a wholly owned subsidiary of Pharol SGPS, S.A., in the context of an agreement entered into between them, subject to a Material Fact of January 8, 2019 ("Agreement");

2. Quantity 1.800,000 preferred shares issued by the Company, representing, on this date, approximately 1.14% of the total number of preferred shares and 0.03% of the total number of outstanding shares of the Company, pursuant to Instruction 567/15;

3. Price: the preferred shares will be acquired at market prices on the dates of the respective acquisitions, in operations conducted on the organized market of the B3 S.A. - Brazil stock exchange, Bag, Counter ("B3");

4. Term: the Repurchase will remain in effect as of this date until the date set forth in the Agreement for the delivery of the treasury shares to Bratel, which will occur within four business days as of the date of ratification of the Agreement by the Judicial Reorganization Court;

5. Intermediate institution: The acquisitions will be carried out in the trading session of the organized market of the B3 stock exchange, with the intermediation of the institution BTG PACTUAL CORRETORA DE TÍTULOS E VALORES MOBILIÁRIOS S.A.

Additional information on Repurchase, pursuant to Attachment 30-XXXVI of CVM Instruction 480/09, is available on the Company's Investor Relations page, on the CVM's Empresas.NET System (www.cvm.gov.br), in addition to the B3 website (www.b3.com.br), as an attachment to the minutes of the Board of Directors Meeting held on this date.

The relevant fact can be accessed on:

http://ri.oi.com.br/oi2012/web/conteudo_pt.asp?idioma=0&conta=28&tipo=43700

9

3 Relevant Facts & Notices to the Market published | REPORT EXECUTIVE |

RELEVANT FACTS & ANNOUNCEMENTS TO THE MARKET

Material Facts and Announcements to the Market in the month ofFEBRUARY/19

28 February - Arbitration Decision - Unitel

Oi S.A. - In Judicial Reorganization ("Oi" or "Company"), under the terms of article. 157, paragraph 4, of Law No. 6404/76 and CVM Instruction No. 358/02, informed its shareholders and the market in general that on February 27, 2019, it became aware of the final decision dated February 20, 2019, rendered by the Arbitration Court constituted within the scope of the arbitration initiated in the International Chamber of Commerce ("ICC") by PT Ventures, SGPS S.A. ("PT Ventures"), an indirect subsidiary of the Company and holder of a 25% interest in the capital stock of the Angolan telecommunications company Unitel S.A. ("Unitel"), against the other shareholders of Unitel ("Other Shareholders of Unitel"), based on the shareholders' agreement between PT Ventures and the Other Shareholders of Unitel ("Shareholders' Agreement").

Based on a preliminary analysis, Oi points out that..:

- The Arbitration Court found that the Other Shareholders of Unitel violated several provisions of the Shareholders' Agreement by (i) denying PT Ventures the right to appoint a majority of the members of Unitel's Board of Directors since June 2006; (ii) entering into transactions for its own benefit; (iii) failing to ensure that Unitel would keep PT Ventures informed of the main corporate issues and transactions; and (iv) unreasonably seeking to suspend PT Ventures' rights as a shareholder.

- The Arbitration Court found that the repeated violations of the Shareholders' Agreement by the Other Shareholders of Unitel led to a significant reduction in the value of PT Ventures' interest in Unitel. Based on this, the Court determined that Other Unitel Shareholders pay PT Ventures, jointly and severally, the amount of US$ 339.4 million, corresponding to the loss of PT Ventures' stake in Unitel, plus interest from 20 February 2019 until the date of full payment by Other Unitel Shareholders, at the U.S. dollar (USD) LIBOR rate 12 months + 2%, with annual capitalisation.

- The Arbitration Court ruled that the Other Shareholders of Unitel failed to ensure, after November 2012, that PT Ventures received the same amount of dividends in foreign currency as the other foreign shareholder of Unitel. The Arbitration Court determined that the Other Shareholders of Unitel pay PT Ventures, jointly and severally, the amount of US$ 314.8 million, corresponding to the resulting damages, plus simple interest from the different dates on which PT Ventures should have received such dividends, at an annual rate of 7%.

- The Arbitration Court determined that Other Unitel Shareholders pay a substantial portion of the legal fees and costs incurred by PT Ventures, corresponding to a net payment to PT Ventures in excess of US$ 12 million, as well as 80% of the administrative and arbitration fees and expenses, corresponding to a net payment to PT Ventures in excess of US$ 1 million.

- The Arbitration Tribunal rejected the counterclaims of the Other Shareholders of Unitel in their entirety.

- Overall, the decision results in a reaffirmation of PT Ventures' rights as a shareholder holding 25% of Unitel's capital under the terms of the Shareholders' Agreement. PT Ventures retains all of its rights under the Shareholders' Agreement, including the right to appoint the majority of the members of Unitel's Board of Directors and the right to receive past and future dividends from Unitel.

The relevant fact can be accessed on:

https://www.oi.com.br/ri/conteudo_pt.asp?idioma=0&conta=28&tipo=43700

10

3 Relevant Facts & Notices to the Market published | REPORT EXECUTIVE |

RELEVANT FACTS & ANNOUNCEMENTS TO THE MARKET

Material Facts and Announcements to the Market in the month ofMARCH/19

19 March - New Board of Directors Unitel

Oi S.A. - Oi S.A. - In Judicial Reorganization ("Oi"), informed its shareholders and the market in general that a General Meeting of the Angolan telecommunications company Unitel S.A. ("Unitel") was held on that date, in which a new Board of Directors was elected, composed of five members, two of whom were appointed by PT Ventures SGPS S.A. ("PT Ventures"), an indirect subsidiary of Oi.

He also informed that, among the two members appointed by PT Ventures, one of them will hold the position of General Manager of Unitel, a position that had been held until this date by Mr. Carlos de Souza. Antony Dolton.

In this way, the Board of Directors of Unitel will be able to count on Mr. António Miguel Ferreira Geraldes (General Manager) and with Mr. António Miguel Ferreira Geraldes (General Manager). Luiz Henrique Soares Rosa, both nominated by PT Ventures. In addition to them, the following were also elected to the Board of Directors of Unitel.João Boa Francisco Quipa, Isabel José dos Santos and Amílcar Frederico Safeca.

The announcement to the market can be accessed on:

https://www.oi.com.br/ri/conteudo_pt.asp?idioma=0&tipo=43089&conta=28&id=256681

11

3 Relevant Facts & Notices to the Market published | REPORT EXECUTIVE |

RELEVANT FACTS & ANNOUNCEMENTS TO THE MARKET

Material Facts and Announcements to the Market in the month ofABRIL/19

03 April - Homologation of the Agreement between Oi and Pharol

Oi S.A. - In Judicial Reorganization ("Oi" or "Company") comes, in addition to the Material Fact disclosed by Oi and the Notice disclosed by its indirect shareholder Pharol SGPS S.A. ("Pharol"), both on January 9, 2019, to inform the market that the Approval of the Instrument became effective, pursuant to the Agreement entered into on January 8, 2019 between Oi, its direct shareholder Bratel S.à.r.l. ("Bratel") and Pharol (jointly) (jointly).

Thus, as determined in the Agreement, the term for compliance with the second part of the obligations provided for both Parties to the Agreement begins on this date, including (a) the request for termination of all disputes involving the Parties indicated in the instrument of the Agreement ("Disputes") and (b) the delivery to Bratel of 33.8 million shares of Oi that are in its Treasury, being 32 million common shares and 1.8 million preferred shares.

In addition, several obligations and rights of the Parties described in the Material Fact disclosed by Oi and in the Notice disclosed by Pharol, both on January 9, 2019, which, under the Agreement, could be resolved in case of non-validation by the Judicial Reorganization Court, are fully improved.

The announcement to the market can be accessed on:

https://www.oi.com.br/ri/conteudo_pt.asp?tipo=43700&id=0&idioma=0&conta=28&idsecao=43852&ano=2019&mes=04

12

4 Financial Information (Consolidated for Recoveries) | REPORT EXECUTIVE |

FINANCIAL INFORMATION

4.1 Management Cash Flow Statement

4.2 Balance Sheet for Recoveries

4.3 Statement of Income from Recoveries

13

4.1 MANAGEMENT CASH FLOW STATEMENT Consolidated Monthly Recoveries (unaudited) | REPORT EXECUTIVE |

MANAGEMENT CASH FLOW STATEMENT

HIGHLIGHTS

| Demo |

01 to 28 fromFEBRUARY2019 |

○ Generation of Net Operating Cash from Recoveries was negative by R$ 887 million in February/19

○ The itemsMediation and Financial Operations had a cash outflow of R$ 1,127 million jointly in February 19

○ Investments reached the level of R$ 482 million in February 19

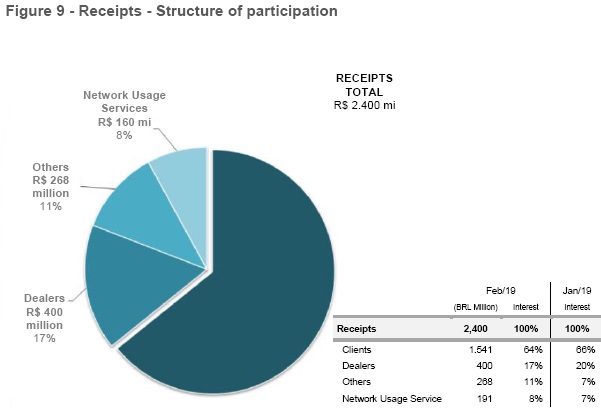

○ Receipts were reduced by R$ 63 million in February 19, totaling R$ 2,400 million

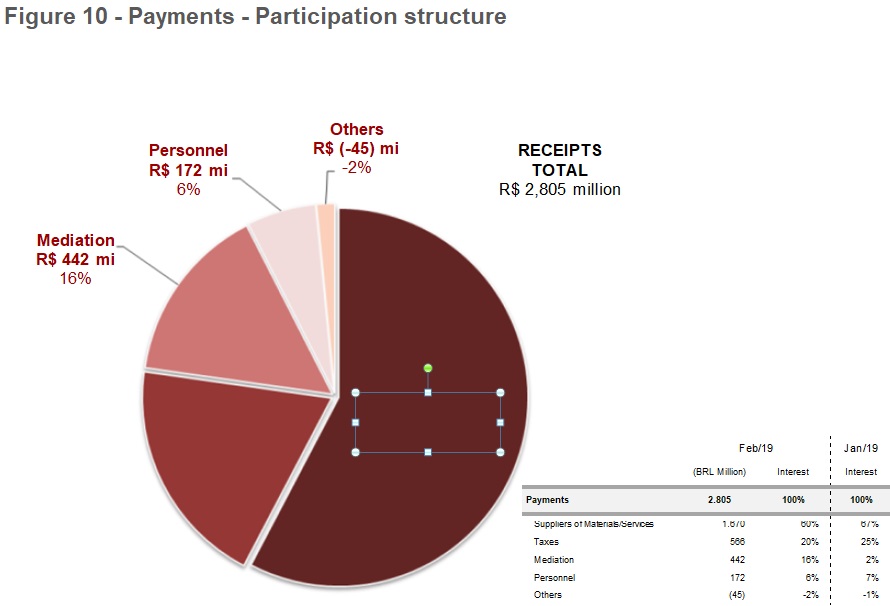

○ ThePayments account increased by R$ 72 million in February 19, reaching a level of R$ 2,805 million

○ TheFinal Balance of Caixa Financeiro das Recuperandas shrank R$ 1,572 million in February 19, totaling R$ 5,943 million

14

4.1 MANAGEMENT CASH FLOW STATEMENT Consolidated Monthly Recoveries (unaudited) | REPORT EXECUTIVE |

15

4.1 MANAGEMENT CASH FLOW STATEMENT Consolidated Monthly Recoveries (unaudited) | REPORT EXECUTIVE |

| Demo |

01 to 28 fromFEBRUARY2019 |

Table 1 - Managerial Cash Flow Statement - Feb/19

(BRL Million) | (A) December 14, 2015 Jan/18 | (B) - (A) Variation | B. December 14, 2015 Feb/19 |

| RECEIPTS Receipts fell back in February 19 In February 19 there was a reduction of R$ 63 million in the Receipts account when compared to the previous month (-2.6%), reaching the figure of R$ 2,400 million. The heading Customers recorded a retraction of R$ 87 million in February 19, totaling R$ 1,541 million, before collection of R$ 1,628 million in January 19. The Dealers account, on the other hand, fell by R$ 98 million in February 19, totaling R$ 400 million, compared to R$ 498 million in the previous month. ○ Management stated that the decrease in Customer Receipts in February 19 is related to the lower number of working days in the month in relation to January 19 (Feb 19: 20 d.m. and Jan/19: 22 d.u.) ○ Management also informed that the reduction in the cash inflow under the heading Dealers in February 19 is also justified by the lower number of working days in the month of February 19 in relation to January 19. On the other hand, the heading Other Receipts increased by R$ 108 million in February 19, reaching a level of R$ 268 million. Finally, the heading Network Use Services registered an increase of R$ 14 million in February 19, totaling R$ 191 million. ○ Management stated that the increase in Other Receipts in February 19 is explained by the increase in Intercompany Interconnection Receipts between the companies under judicial reorganization, and that the effect is cancelled out under the caption "Other services/payments". |

|

|

|

| ||

INITIAL Balance - Financial Box | 4.469 | 3.046 | 7.515 | ||

|

|

|

| ||

Clients | 1.628 | (97) | 1.541 | ||

Network Usage Services | 177 | 14 | 191 | ||

Dealers | 498 | (98) | 400 | ||

Others | 160 | 108 | 268 | ||

Receipts (1) | 2.463 | (63) | 2,400 | ||

Personnel | 200. | (28) | 172. | ||

Suppliers of Materials/Services | 1.829. | 159 | 1.670. | ||

Taxes | (683) | (117) | 566. | ||

Deposits with the Courts | 34 | 17 | 51 | ||

Contingencies | (5) | (1) | (6) | ||

Mediation | (50) | 392 | 442. | ||

Payments (2) | 2.733. | 72 | 2.805. | ||

Telemar | 234 | 26 | 208 | ||

Hi S.A. | (103) | 20 | (83) | ||

Hi Mobile | (266) | 75 | (191) | ||

Investments (3) | 603 | 121 | (482) | ||

|

|

|

| ||

Net Operating Income (1+2+3) | 873 | (14) | 887 | ||

|

|

|

| ||

Capital Increase | 4.007 | 4.007. | - | ||

Pharol Agreement | (106) | 106 | - | ||

Intra Group Operations | - | - | - | ||

Financial Operations | 18 | 703 | 685 | ||

Dividends and JCP | - | - | - | ||

|

|

|

| ||

FINAL Balance - Financial Box | 7.515 | 107 | 5.943 |

16

4.1 MANAGEMENT CASH FLOW STATEMENT Consolidated Monthly Recoveries (unaudited) | REPORT EXECUTIVE |

| Demo |

01 to 28 fromFEBRUARY2019 |

Table 1 - Managerial Cash Flow Statement - Feb/19

(BRL Million) | (A) December 14, 2015 Jan/18 | (B) - (A) Variation | B. December 14, 2015 Feb/19 | PAYMENTS Increase in Payments in February/19 Payments totaled R$ 2,805 million in February 19, an increase of R$ 72 million in relation to the previous month, when the balance was R$ 2,733 million. The main responsible for the largest cash outflow with Payments was theMediation item, which rose R$ 392 million in the month, reaching R$ 442 million.Contingencies, on the other hand, registered a cash outflow of R$ 6 million, compared to R$ 5 million in the previous month ○ According to Management, the increase in theMediationaccount in February 19 reflects the payment of the first installment to Partner Suppliers, as described in the Judicial Reorganization Plan. The other items of Payments presented a reduction in February 19.Suppliers of Materials/Serviceshad a decrease of R$ 159 million in the month, totaling R$ 1,670 million. TheTaxesitem, on the other hand, registered a reduction of R$ 117 million in February 19, reaching a level of R$ 566 million. ○ According to Management, the decrease in the headingSuppliers of Materials/Servicesin February 19 is mainly a reflection of the reduction in payments for maintenance services of the installed plant, consulting and attorney's fees. ○ In relation totaxes,the Management informed that the fall in February 1989 is justified by the payment in January 19 of Income Tax and PIS/COFINS on Own Capital Interest, which increased the item in the previous month. In the same vein, thePersonnelitem registered a reduction in February 19, reaching a level of R$ 172 million, compared to R$ 200 million in the previous month.Judicial deposits, on the other hand, had the highest cash inflow in February 19, rising from R$ 34 million in January 19 to R$ 51 million in February 19. ○ Management informed that the lower cash outflow of payments related toPersonnelin February 19 is explained by the payment in January 19 of the advance of 0.5 salary of PPR 2018, approved in collective agreement 2018/2019, and that in February 19 there was no extra payment. ○ In relation toJudicial Deposits,the Administration emphasized that in February 19 there was a higher redemption of deposits and release of funds in relation to the previous month. | |

|

|

|

| ||

INITIAL Balance - Financial Box | 4.469 | 3.046 | 7.515 | ||

|

|

|

| ||

Clients | 1.628 | (97) | 1.541 | ||

Network Usage Services | 177 | 14 | 191 | ||

Dealers | 498 | (98) | 400 | ||

Others | 160 | 108 | 268 | ||

Receipts (1) | 2.463 | (63) | 2,400 | ||

Personnel | 200. | (28) | 172. | ||

Suppliers of Materials/Services | 1.829. | 159 | 1.670. | ||

Taxes | (683) | (117) | 566. | ||

Deposits with the Courts | 34 | 17 | 51 | ||

Contingencies | (5) | (1) | (6) | ||

Mediation | (50) | 392 | 442. | ||

Payments (2) | 2.733. | 72 | 2.805. | ||

Telemar | 234 | 26 | 208 | ||

Hi S.A. | (103) | 20 | (83) | ||

Hi Mobile | (266) | 75 | (191) | ||

Investments (3) | 603 | 121 | (482) | ||

|

|

|

| ||

Net Operating Income (1+2+3) | 873 | (14) | 887 | ||

|

|

|

| ||

Capital Increase | 4.007 | 4.007. | - | ||

Pharol Agreement | (106) | 106 | - | ||

Intra Group Operations | - | - | - | ||

Financial Operations | 18 | 703 | 685 | ||

Dividends and JCP | - | - | - | ||

|

|

|

| ||

FINAL Balance - Financial Box | 7.515 | 107 | 5.943 |

17

4.1 MANAGEMENT CASH FLOW STATEMENT Consolidated Monthly Recoveries (unaudited) | REPORT EXECUTIVE |

| Demo |

01 to 28 fromFEBRUARY2019 |

Table 1 - Managerial Cash Flow Statement - Feb/19

(BRL Million) | (A) December 14, 2015 Jan/18 | (B) - (A) Variation | B. December 14, 2015 Feb/19 | INVESTMENTS Recoveries recordedInvestmentPayments of R$ 482 million in February 19, a reduction of 20% in relation to the previous month, when there was a cash outflow withInvestmentsof R$ 603 million. Investments related to Telemar S.A. had a drop of R$ 26 million, totaling R$ 208 million in February/19. Investments in Oi Móvel S.A. decreased R$ 75 million, totaling R$ 191 million, while Investments in Oi S.A. decreased from R$ 103 million in January/19 to R$ 83 million in February/19. ○ Management pointed out that despite the negative oscillation in February 19 compared to the previous month, the result is within the strategic plan to accelerate the company's investments, mainly in optical fiber and the expansion of the mobile network. NET OPERATING INCOME The level ofReceiptsin February 19, of R$ 2,400 million, was lower than the total sum ofPayments(R$ 2,805 million) and cash outflows withInvestments(R$ 482 million) in the month, which directly contributed to the negative balance of R$ 887 million in the Net Operational Generation of Recoverables in the month. ○ Management informed that the result is in line with the flow foreseen in the Judicial Reorganization Plan. CLOSING BALANCE - CASH ON HAND Financial Operationsregistered a negative result of R$ 685 million in February 19, a decrease of R$ 703 million in relation to the previous month. The other items remained at zero. ○ Management informed that the cash outflow fromFinancial Operationsis mainly due to the payment of interest to Bondholders, as agreed in the Judicial Reorganization Plan. Thus, adding the outflow of R$ 685 million fromFinancial Operationsto the negative balance of R$ 887 million from Net Operating Cash Generation, the Final Balance of Caixa Financeiro das Recuperandas was reduced by R$ 1,572 million in relation to the previous month (drop of 21%), totaling R$ 5,943 million. ○ Management pointed out that, as provided for in the guidelines of the Judicial Reorganization Plan, oscillations are expected, up and down, in the Company's cash throughout the year. | |

|

|

|

| ||

INITIAL Balance - Financial Box | 4.469 | 3.046 | 7.515 | ||

|

|

|

| ||

Clients | 1.628 | (97) | 1.541 | ||

Network Usage Services | 177 | 14 | 191 | ||

Dealers | 498 | (98) | 400 | ||

Others | 160 | 108 | 268 | ||

Receipts (1) | 2.463 | (63) | 2,400 | ||

Personnel | 200. | (28) | 172. | ||

Suppliers of Materials/Services | 1.829. | 159 | 1.670. | ||

Taxes | (683) | (117) | 566. | ||

Deposits with the Courts | 34 | 17 | 51 | ||

Contingencies | (5) | (1) | (6) | ||

Mediation | (50) | 392 | 442. | ||

Payments (2) | 2.733. | 72 | 2.805. | ||

Telemar | 234 | 26 | 208 | ||

Hi S.A. | (103) | 20 | (83) | ||

Hi Mobile | (266) | 75 | (191) | ||

Investments (3) | 603 | 121 | (482) | ||

|

|

|

| ||

Net Operating Income (1+2+3) | 873 | (14) | 887 | ||

|

|

|

| ||

Capital Increase | 4.007 | 4.007. | - | ||

Pharol Agreement | (106) | 106 | - | ||

Intra Group Operations | - | - | - | ||

Financial Operations | 18 | 703 | 685 | ||

Dividends and JCP | - | - | - | ||

|

|

|

| ||

FINAL Balance - Financial Box | 7.515 | 107 | 5.943 |

18

4.1 MANAGEMENT CASH FLOW STATEMENT Consolidated Monthly Recoveries (unaudited) | REPORT EXECUTIVE |

| Demo |

01 to 28 fromFEBRUARY2019 |

Table 2 - Direct Cash Flow

R$ million

CONSOLIDATED RECOVERIES | SEP/15 | OUT/17 | NOV/17 | DEC/17 | JAN/18 | FEB/18 | MAR/18 | ABR/18 | MAY/18 | JUN/18 | JUL/18 | AGO/18 | SET/18 | OUT/18 | NOV/18 | DEC/18 | JAN/19 | FEV/19 |

Opening Balance - Financial Box | 7.295 | 7.524 | 7.324 | 6,877 | 6.881 | 6.128 | 5.909 | 5.831 | 4.820 | 4.602 | 4.819 | 4.677 | 4.721 | 4.815 | 4.379 | 4.362 | 4.469 | 7.515 |

Receipts | 2.682 | 2.893 | 2.689 | 2.716 | 2.816 | 2.758 | 2.646 | 2.619 | 2.386 | 2.736 | 2.589 | 2.659 | 2.694 | 2.898 | 2.815 | 2.645 | 2.463 | 2,400 |

Clients | 1.873 | 1.946 | 1.873 | 1.905 | 1.825 | 1.691 | 1.855 | 1.780 | 1.799 | 1.734 | 1.836 | 1.731 | 1.681 | 1.756 | 1.807 | 1.697 | 1.628 | 1.541 |

Network Usage Services | 223 | 144 | 190 | 197 | 201 | 209 | 212 | 234 | 3 | 467 | 228 | 210 | 205 | 204 | 192 | 192 | 177 | 191 |

Dealers | 430 | 488 | 467 | 420 | 524 | 411 | 456 | 461 | 491 | 471 | 431 | 518 | 420 | 466 | 478 | 412 | 498 | 400 |

Others | 156 | 315 | 159 | 194 | 266 | 447 | 123 | 144 | 93 | 64 | 94 | 200 | 388 | 472 | 338 | 344 | 160 | 268 |

Payments | 2.210. | 2.721 | 2.752 | 2.560. | 3.239. | 2.578. | 2.231. | 3.109. | 2.213. | 2.223. | 2.383 | 2.279. | 2.276. | 2.751. | 2.432. | 2.285. | 2.733. | 2.805. |

Personnel | 135 | 135 | 142. | 236 | 234 | 177. | 140. | 303 | 179 | (147) | 186 | 170. | 140. | (137) | (133) | 244 | 200. | 172. |

Suppliers of Materials and Services | 1.430. | 1.796. | 1.839. | 1.422. | 2.421. | 1.789. | 1.488. | 1.641. | 1.332. | 1,568 | 1.698. | 1.604. | 1.640. | 2,048 | 1,775 | 1.508. | 1.829. | 1.670. |

Materials/Services | 1.201. | (1.651) | 1.645. | 1.222. | 2.215. | 1.575. | 1.277. | 1.401 | 1.325. | 1.101. | (1.470) | 1.393. | 1.433. | 1.842. | 1.581. | 1.315. | 1.649. | 1.478. |

Plant Maintenance | (103) | 88 | 324 | 345 | ‘341’ | (309) | 331 | 375. | (302) | (283) | 312. | 297. | 299 | (332) | 347 | 425 | 406. | 344 |

RENTS | (192) | (191) | 213 | (139) | 386. | 210). | 259 | 248 | (245) | 260 | 322 | (349) | 329 | 336. | 338 | 297. | 401. | 438. |

Data Processing/Graphics | (106) | 116 | (129) | (113) | (127) | (122) | 140. | (122) | 111 | (108) | 132 | (122) | (103) | 134 | (129) | (97) | 134 | (122) |

Call Center Customer Service/Billing | (79) | 123 | 228 | 157. | (147) | 126 | 188 | 143. | (128) | (104) | 140. | (138) | (104) | (138) | (147) | 163. | (129) | 155. |

Dealers | (97) | (98) | (102) | (105) | (103) | (105) | (104) | (101) | (105) | (99) | 111 | (108) | 109 | (112) | 116 | (110) | (115) | (115) |

Consultancy / Audits / Fees | (25) | (62) | (78) | (31) | 55. | 67 | (50) | (56) | (50) | (35) | (75) | (71) | (45) | (96) | (74) | (52) | 124 | (50) |

Other Services/Payments | 599. | 973. | 571. | (332) | (1.056) | 636). | (205) | 356. | 384 | 212 | 378. | (308) | 444 | 694. | 430. | 171. | 340 | (254) |

Network Usage Services | 229 | 145. | 194). | 200. | 206 | 214 | 211. | 240 | (7) | 467 | 228 | 211. | 207 | 206 | 194). | (193) | (180) | (192) |

Taxes | 655 | (688) | 652. | 633 | 621. | 628. | 527. | 1.172. | (698) | 518. | 531. | 507. | 516. | 551. | 543. | 576. | (683) | 566. |

Deposits with the Courts | 28 | 29 | 20 | (224) | 43 | 53 | (11) | 8 | (4) | 11 | 50 | 46 | 40 | 41 | 55 | 75 | 34 | 51 |

Contingencies | - | (5) | - | 1 | (1) | - | (12) | - | - | (1) | (8) | - | (4) | (2) | (1) | (12) | (5) | (6) |

Mediation | (18) | 126 | (139) | (46) | (5) | (37) | 53 | (1) | - | - | (10) | (44) | (16) | 54): | (35) | (20) | (50) | 442. |

Investments | 290 | 410 | 391. | 190 | 554 | 430 | 519. | 536. | (434) | 377. | 370. | 363. | 339 | 582. | 421 | 344 | 603 | (482) |

Telemar | 150. | 188 | 184 | (89) | 272 | 200. | (215) | (278) | (182) | 170. | 154. | 178) | (147) | 222 | (193) | 174. | 234 | 208 |

Hi S.A. | 59 | (63) | (45) | (25) | (70) | (63) | (81) | (70) | (66) | (63) | (52) | (47) | (64) | (76) | (58) | (46) | (103) | (83) |

Hi Mobile | (81) | (159) | 162. | (76) | 212 | 167. | (223) | 188 | 186 | 144. | (164) | (138) | (128) | 284 | 170. | 124 | (266) | (191) |

Operational Generation | 182 | 238 | 454 | (34) | 977. | 250 | (104) | 1.026. | (261) | 136 | (164) | 17 | 79 | 435 | (38) | 16 | 873 | 887 |

Capital Increase | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 4.007 | - |

Pharol Agreement | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | (106) | - |

Intra Group Operations | - | - | - | - | - | - | - | - | 28 | 55 | 3 | (1) | - | - | - | 14 | - | - |

Financial Operations | 47 | 38 | 7 | 38 | 32 | 24 | 26 | 15 | 15 | 26 | 19 | 28 | 15 | (1) | 21 | 23 | 18 | 685 |

Dividends and JCP | - | - | - | - | 192 | 7 | - | - | - | - | - | -- | - | - | - | 54 | - | - |

Closing Balance - Financial Box | 7.524 | 7.324 | 6,877 | 6.881 | 6.128 | 5.909 | 5.831 | 4.820 | 4.602 | 4.819 | 4.677 | 4.721 | 4.815 | 4.379 | 4.362 | 4.469 | 7.515 | 5.943 |

19

4.2 BALANCE SHEET FOR RECOVERIES Consolidated Quarterly Recoveries (unaudited) | REPORT EXECUTIVE |

BALANCE SHEET FOR RECOVERIES

HIGHLIGHTS

| Demo |

4thTRIMESTRE 2018 |

○ Caixa Contabil das Recuperandas registered a drop of R$ 374.2 million in the quarter, reaching R$ 4,472 million

○ Accounts receivable fell by R$ 749.3 million in the quarter

○ Other Non-Current Liability Taxes on Recoveries fell by R$ 3,349 million in the fourth quarter of 2018

○ Other long-term liabilities increased by R$ 3,997 million in the fourth quarter of 2018

20

4.2 BALANCE SHEET FOR RECOVERIES Consolidated Quarterly Recoveries (unaudited) | REPORT EXECUTIVE |

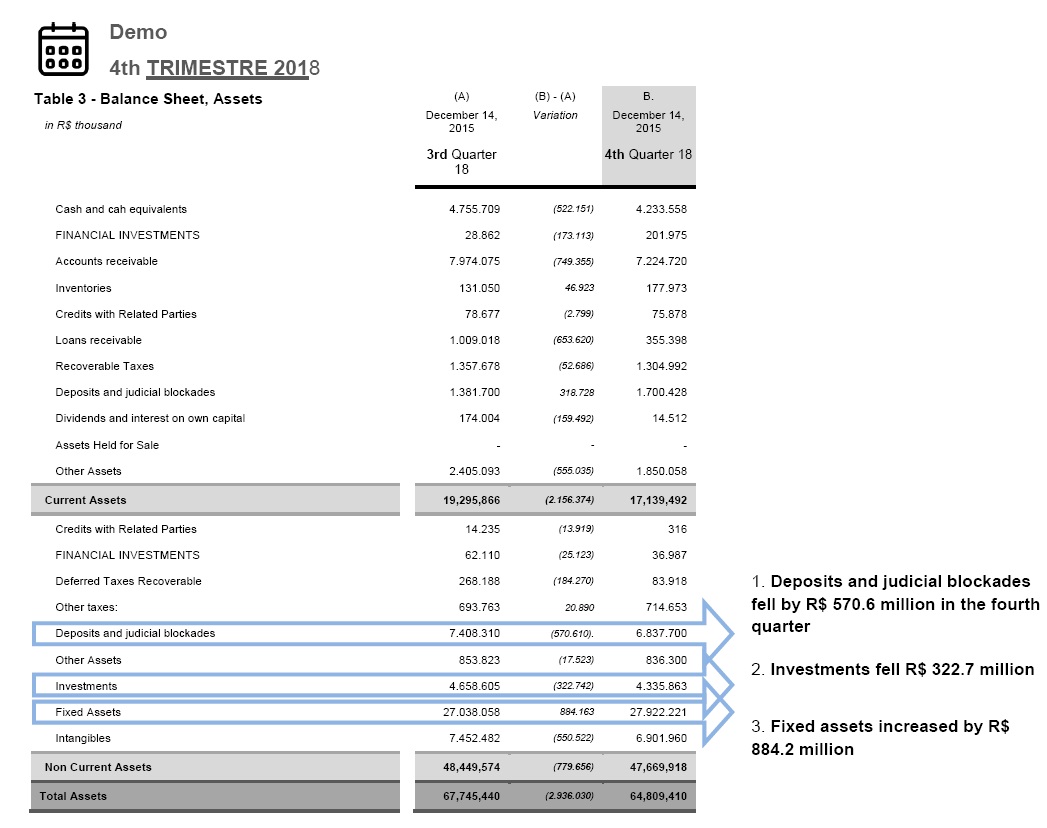

Current Assets(pag. 1 of 2)

Caixa Contábil das Recuperandas fell by R$ 374.2 million in the fourth quarter of 2018

The Total Assets of Recoverables showed a retraction of R$ 2,936 million in the fourth quarter of 2018 compared to the previous quarter, due to the decrease of R$ 2,156 million in Current Assets and the retraction of R$ 779.7 million in Non-Current Assets. The decrease of R$ 2,156 million in theCurrent Assetswas influenced by:

○ 1. Cash for Recoveries (resulting from the sum of Cash and Cash Equivalents, Current Financial Investments and Non-Current Financial Investments) presented a drop of R$ 374.2 million in the fourth quarter (a drop of 7.7%), totaling R$ 4,472 million. According to Management, the reduction in cash in the quarter was mainly due to the acceleration of investments, in addition to specific obligations related to the implementation of the Judicial Reorganization Plan, including payments to labor creditors and debt novation debts. The Company also added that there was a reduction in tax offset, which resulted in an increase in the payment of PIS and COFINS on a quarterly comparison.

21

4.2 BALANCE SHEET FOR RECOVERIES Consolidated Quarterly Recoveries (unaudited) | REPORT EXECUTIVE |

Current Assets(pag. 2 of 2)

Accounts receivable fell by R$ 749.3 million in the fourth quarter of 2018

The Total Assets of Recoverables showed a retraction of R$ 2,936 million in the fourth quarter of 2018 compared to the previous quarter, due to the decrease of R$ 2,156 million in Current Assets and the retraction of R$ 779.7 million in Non-Current Assets. The decrease of R$ 2,156 million in theCurrent Assetswas influenced by:

○ 2.Accounts Receivablefrom Recoverables registered a drop of R$ 749.3 million (a drop of 9.4%), totaling R$ 7,225 million. Management reported that the reduction observed was mainly due to an increase in the volume of write-offs due to tax collection and an increase in the provision for losses on government accounts receivable.

○ 3.Loans receivablefrom recoveries, on the other hand, fell by R$ 653.6 million (down 64.8%), totaling R$ 355.4 million. Management informed that the reduction presented refers mainly to the settlement of intercompany loans.

○ 4. The itemOther Assetsfor Recovered presented a drop of R$ 555.0 million (decrease of 23.1%), totaling R$ 1,850 million. The Company informed that the reduction observed refers to the deferral of the anticipated expense related to the payment of the Fistel rate for the year 2018, in addition to the settlement of advances made by Recuperandas, which were converted into a capital increase.

22

4.2 BALANCE SHEET FOR RECOVERIES Consolidated Quarterly Recoveries (unaudited) | REPORT EXECUTIVE |

Non-Current Assets(pag. 1 of 1)

Deposits and judicial blockades increased R$ 570.6 million in the fourth quarter of 2018

The Total Assets of Recoverables showed a retraction of R$ 2,936 million in the fourth quarter of 2018 compared to the previous quarter, due to the decrease of R$ 2,156 million in Current Assets and the retraction of R$ 779.7 million in Non-Current Assets. The decrease of R$ 779.7 million in theNon-Current Assetswas influenced by:

○ 1.Deposits and judicial blockadesof recoveries retracted R$ 570.6 million in the fourth quarter of 2018 compared to the third quarter, totaling R$ 6,838 million. According to information provided by Management, the decrease observed refers to transfers made from the long to the short term, in addition to redemptions in favor of the Company.

○ 2.Investmentsalso showed a drop of R$ 322.7 million in the same period (6.9% retraction), totaling R$ 4,336 million. According to Management, the decrease observed refers to the recording of negative results of other domestic and foreign subsidiaries, which are not eliminated in the Consolidated Balance Sheet of Recovered Companies.

○ 3.Fixed assets, on the other hand, rose R$ 884.2 million in the quarter (up 3.3%), totaling R$ 27,922 million. According to Management, this increase reflects the acceleration of investments foreseen in the Judicial Reorganization Plan in the fourth quarter of 2018, which will allow the advancement of high-speed broadband service projects, mainly through optical fiber and the expansion of the mobile access network.

23

4.2 BALANCE SHEET FOR RECOVERIES Consolidated Quarterly Recoveries (unaudited) | REPORT EXECUTIVE |

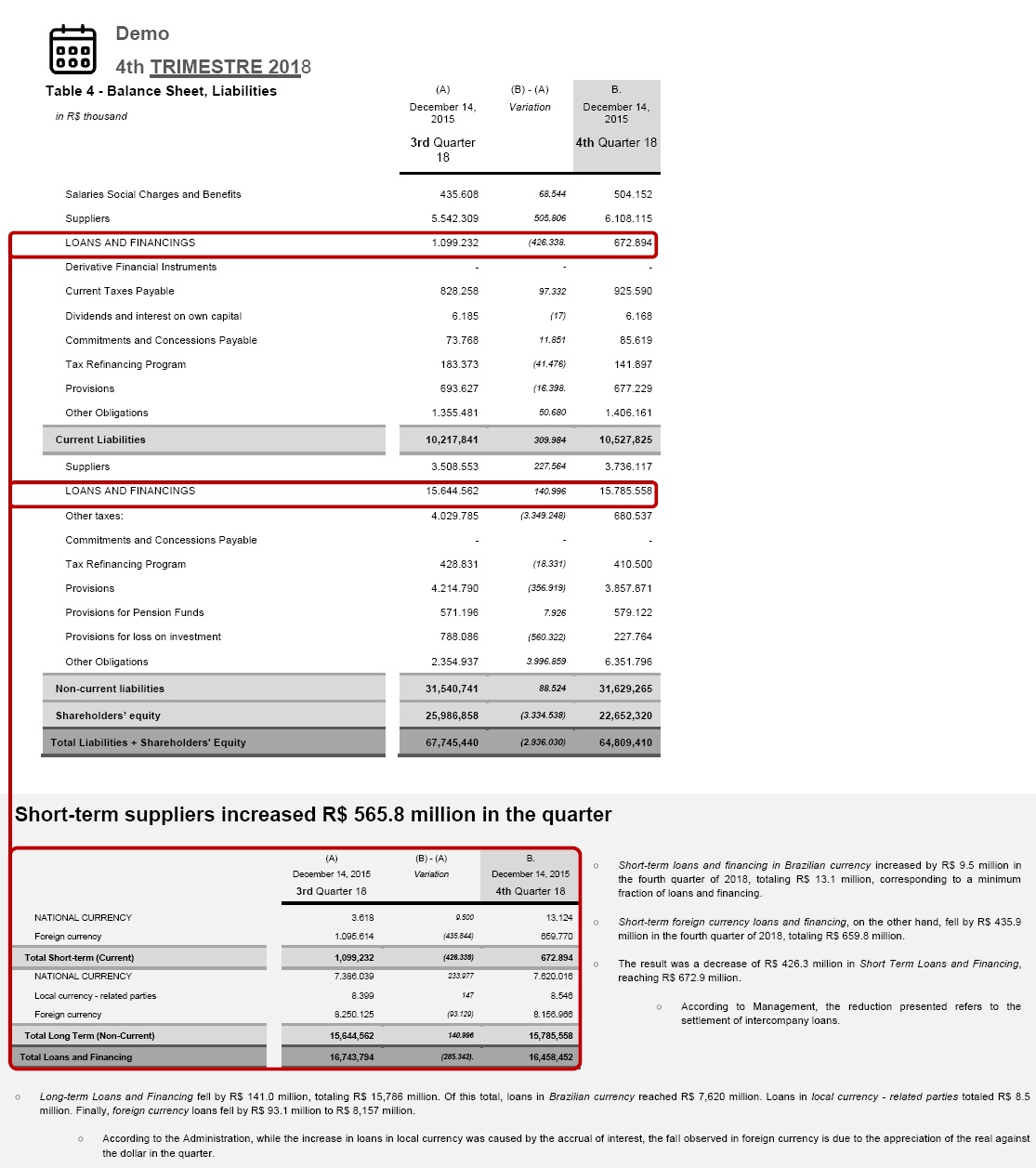

Current Liabilities(pag. 1 of 1)

Short-term suppliers increased R$ 565.8 million in the quarter

Total Liabilities for Recoverables decreased by R$ 2,936 million in the fourth quarter of 2018 compared to the previous quarter, due to the increase of R$ 310.0 million in Current Liabilities, increase of R$ 88.5 million in Non-Current Liabilities and the retraction of R$ 3,334 million in Shareholders' Equity. The increase of R$ 310.0 million in theCurrent Liabilitieswas influenced by:

○ 1. Short-term suppliersincreased R$ 565.8 million (up 10.2%), totaling R$ 6,108 million. According to Management, the increase in the heading is justified by the acceleration of the investments provided for in the Judicial Reorganization Plan.

○ 2.Other short-term liabilitiesincreased R$ 50.7 million (up 3.7%), totaling R$ 1,406 million. According to Management, the increase is mainly due to the realization of the provision for pension funds due to the incorporation of BrTPREV into the TCSPREV plan (both of Fundação Atlântico de Seguridade Social). The Company also noted the recognition of an onerous obligation to contract for the supply of telecommunications signal transmission capacity through submarine cables.

24

4.2 BALANCE SHEET FOR RECOVERIES Consolidated Quarterly Recoveries (unaudited) | REPORT EXECUTIVE |

25

4.2 BALANCE SHEET FOR RECOVERIES Consolidated Quarterly Recoveries (unaudited) | REPORT EXECUTIVE |

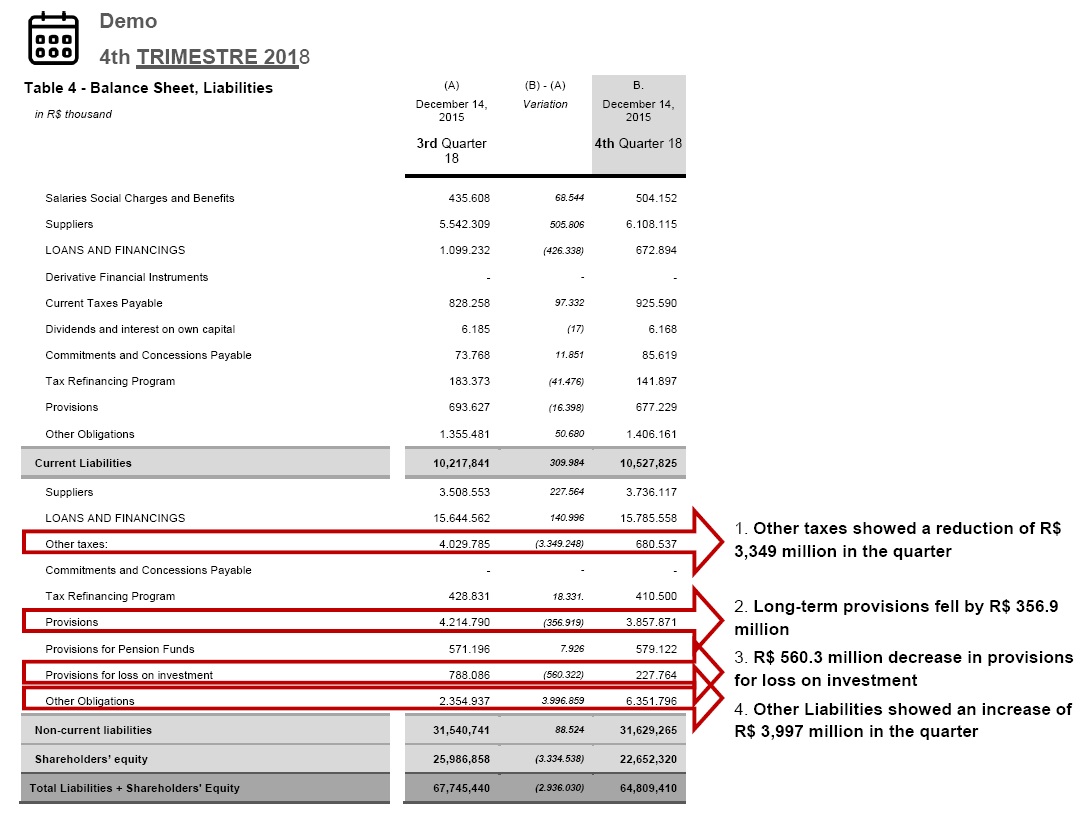

Non-Current Liabilities(pag. 1 of 2)

Other taxes fell by R$ 3,349 million in the fourth quarter of 2018

Total Liabilities for Recoverables decreased by R$ 2,936 million in the fourth quarter of 2018 compared to the previous quarter, due to the increase of R$ 310.0 million in Current Liabilities, increase of R$ 88.5 million in Non-Current Liabilities and the retraction of R$ 3,334 million in Shareholders' Equity. The high of R$ 88.5 million in theNon-Current Liabilitieswas influenced by:

○ 1.Other taxesfell by R$ 3,349 million in the quarter, totaling R$ 680.5 million. According to the Company, the strong reduction observed in the quarter is due to the reversal of the provision for deferred tax liabilities, based on the annual study conducted by the Company, in which the estimated realization of deferred tax taxes was revised. The effect of this reversal can be observed in the variation of the "IR/CSLL Deferred" in the Statement of Income for the quarter.

○ 2. Long-termprovisionsfell by R$ 356.9 million in the quarter (a reduction of 8.5%), totaling R$ 3,858 million. The Company informed that the reduction observed in the quarter refers to the reversal of provisions for contingencies, due to the conclusion of some processes and the progress of the accounting review of contingencies.

26

4.2 BALANCE SHEET FOR RECOVERIES Consolidated Quarterly Recoveries (unaudited) | REPORT EXECUTIVE |

Non-Current Liabilities(pag. 2 of 2

Other long-term liabilities increased by R$ 3,997 million in the fourth quarter of 2018

Total liabilities from recoveries decreased by R$ 2,936 million in the fourth quarter of 2018 compared to the previous quarter, due to the increase of R$ 310.0 million in current liabilities, increase of R$ 88.5 million in non-current liabilities and the retraction of R$ 3,334 million in shareholders' equity. The high of R$ 88.5 million in theNon-Current Liabilitieswas influenced by:

○ 3.Provisions for loss on investmentfell by R$ 560.3 million in the quarter, totaling R$ 227.8 million. According to the Company, the retraction observed is mostly justified by the capital increase in December 2018, as presented in the caption "Other assets" (page 22).

○ 4.Other long-term liabilities, on the other hand, increased by R$ 3,997 million in the quarter, totaling R$ 6,352 million. The Company informed that the increase in the caption is justified by the recognition of an onerous obligation of a contract for the supply of telecommunications signal transmission capacity through submarine cables.

27

4.2 BALANCE SHEET FOR RECOVERIES Consolidated Quarterly Recoveries (unaudited) | REPORT EXECUTIVE |

Shareholders' Equity(pag. 1 of 1)

Items of stockholders' equity with observable variations:

○ 1.Other Comprehensive Resultsreached a negative value of R$ 183.6 million in the fourth quarter of 2018, compared to a negative result of R$ 254.2 million in the previous quarter. According to the Company, the variation observed refers to the recording of actuarial gain net of taxes.

28

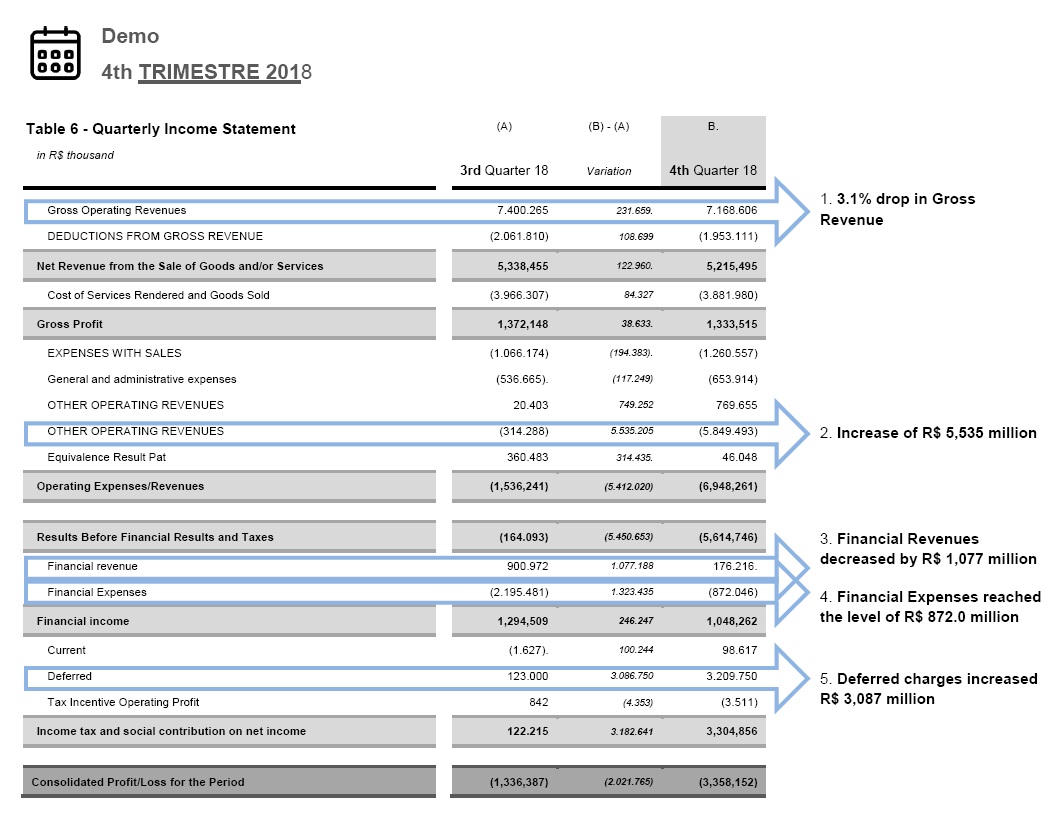

4.3 STATEMENT OF INCOME FROM RECOVERIES Consolidated Quarterly Recoveries (unaudited) | REPORT EXECUTIVE |

STATEMENT OF INCOME FROM RECOVERIES

HIGHLIGHTS

| Demo |

4thTRIMESTRE 2018 |

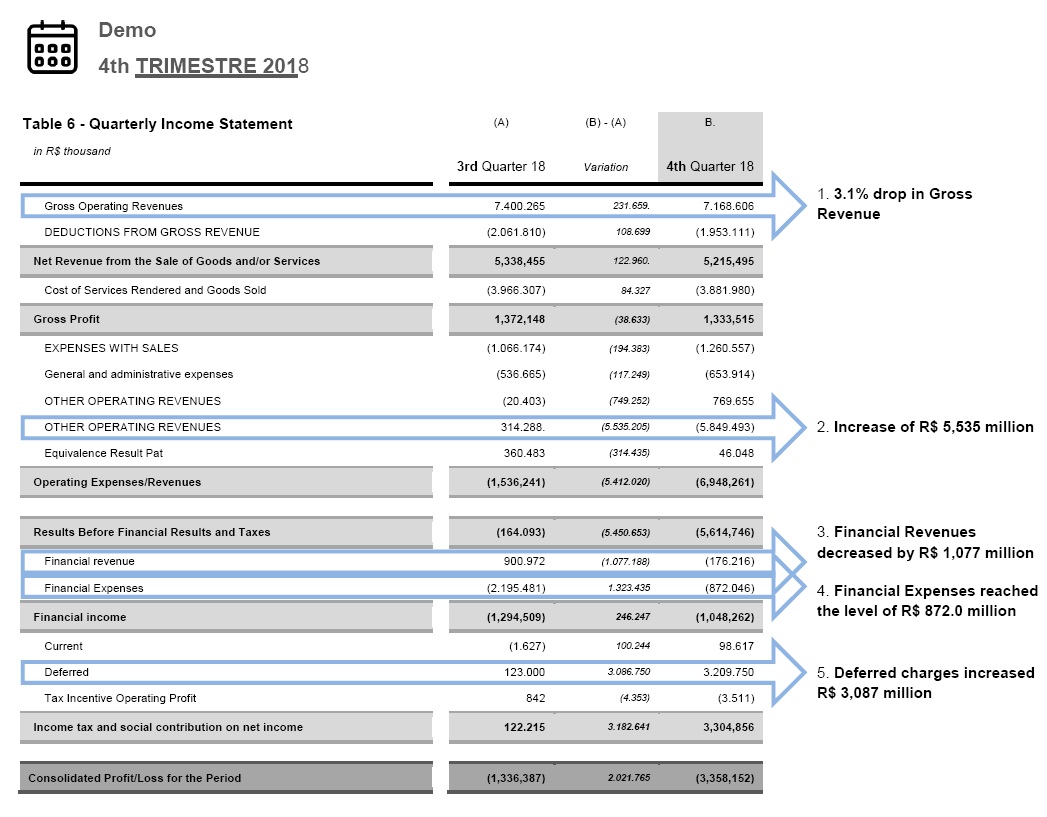

○ Gross Operating Revenue from Recoveries fell by 3.1% in the quarter

○ Other Operating Expensesfrom Recovering recorded an increase of R$ 5,535 million in the fourth quarter of 2018 compared to the previous quarter

○ Results before financial results andrecovery taxeswere negative in the amount of R$ 5,615 million

○ Recovery Financial Resultsclosed the 4th quarter of 2018 with a negative value of R$ 1,048 million

○ The Consolidated Losson Recoverables in the 4th quarter of 2018 was R$ 3,358 million

29

4.3 STATEMENT OF INCOME FROM RECOVERIES Consolidated Quarterly Recoveries (unaudited) | REPORT EXECUTIVE |

Quarterly Income Statement(pag. 1 of 2)

The Consolidated Loss of R$ 3,358 million recorded by the Recovered Companies in the 4th Quarter of 2018 was influenced by:

○ 1. TheGross Operating Revenuefrom Recoverables fell by R$ 231.7 million (down 3.1%) in the fourth quarter of 2018 compared to the previous quarter, totaling R$ 7,169 million. According to information provided by Management, the drop in Gross Revenue is due to the reduction in the fixed telephony base, following the natural tendency of the market of decline in the use of voice, and the consequent drop in average revenue per user (ARPU). The Company also pointed out that the prepay segment maintained its downward trend in mobility revenues, impacted by high unemployment rates, in addition to the reduction in interconnection rates.

○ 2.Other Operating Expensesfrom Recoverables increased by R$ 5,535 million in the quarter, totaling R$ 5,849 million. According to the Board of Directors, the strong increase in the caption is justified by the recognition of an onerous obligation to contract for the supply of telecommunications signal transmission capacity through submarine cables. The Company also highlighted the amortization of the capital gain from the acquisition of control of Brasil Telecom S.A..

Added to the other operating items, the Recoveries presented a negativeResult Before Financial Results and Taxesin the amount of R$ 5,615 million in the fourth quarter of 2018.

30

4.3 STATEMENT OF INCOME FROM RECOVERIES Consolidated Quarterly Recoveries (unaudited) | REPORT EXECUTIVE |

Quarterly Income Statement(pag. 2 of 2

The Consolidated Loss of R$ 3,358 million recorded by the Recovered Companies in the 4th Quarter of 2018 was influenced by:

○ 3. TheFinancial Incomefrom Recoverables shrank by R$ 1,077 million, from a positive result of R$ 900.9 million in the third quarter to a negative result of R$ 176.2 million in the fourth quarter of 2018. According to information provided by Management, the decrease observed is due to the reversal of interest on judicial deposits occurred due to the advance of the accounting review of contingencies and the effect of the exchange variation of the appreciation of the Brazilian real against the U.S. dollar in the quarter.

○ 4.Financial Expenses, in turn, reached a level of R$ 872.0 million in the fourth quarter of 2018, against R$ 2,195 million in the previous quarter. According to Management, the reduction in this item was mainly due to lower monetary and exchange variation expenses on loans payable to third parties, resulting from the appreciation of the real against the U.S. dollar in the quarter.

○ 5. TheDeferredRecoverables account increased by R$ 3,087 million in relation to the previous quarter, totaling R$ 3,210 million in the fourth quarter of 2018. According to information provided by Management, the significant increase observed in the caption was due to the reversal of the provision for deferred tax liabilities, based on the annual study conducted by the Company, which reviewed the estimated recovery of deferred tax assets, also reflected in "Other taxes" of non-current liabilities.

31

5 Attendance to creditors | REPORT EXECUTIVE |

CREDITOR CARE

AJ continues to support this MM. Judge in the organization of the numerous letters received from other Judges requesting authorization to constrict the assets of the Recuperandas for payment of extra-competition claims, in a procedure that, on the one hand, unites speed and security for the benefit of the Creditors, and, on the other hand, allows the rise of Grupo Oi and compliance with the PRJ.

For this purpose, this Management has published a list of the letters received in the last month by the 7th Business Court and the list of extra-contributory credits paid by the Oi Group, which is already available for consultation on the judicial reorganization website (www.recuperacaojudicaloi.com.br), and which currently totals, 763.752 hits.

In relation to tender claims, the AJ remains focused on clarifying doubts about clauses and compliance with the approved Judicial Reorganization Plan, being constantly contacted by national and international creditors, either by telephone, through the line +55 (21) 2272-9300, either by e-mail credoroi@wald.com.br.

The AJ reports that, throughout the month, it followed the mediation procedure related to the procedural incidents, pursuant to the decision of fls. 341.970/341.973. The aim of this mediation is to stimulate a composition between creditors and debtors to define the value of the credits, from an online platform, which already has more than 1,933 signed agreements.

In addition, as determined by this MM. Judge, the AJ reviewed the approximately 19,000 procedural incidents in order to verify the cases involving PEX credits not eligible for mediation currently in progress, as well as the incidents in which the Creditors did not accept mediation, in order to provoke the resumption of the progress of the events.

In addition, this Management makes available monthly the updated General List of Creditors on the site of the judicial reorganization (www.recuperacaojudicaloi.com.br), considering the incidents of qualifications and challenges that have already been judged on the merits.

32

6 Demonstrations presented by AJ | REPORT EXECUTIVE |

SUMMARY OF THE MANIFESTATIONS OF AJ IN THE FILE

Below, AJ lists the manifestations presented in the records of the electronic process after the last Monthly Activity Report, with an indication of the respective pages.

Page 367.437/367.463 | Monthly report on the activities performed by Recovered Companies (for the month of December 2018). | 3.15.2019 |

Page | AJ's Demonstration on..: (i) Partial subrogation of the claims of BNP Paribas Fortis AS/NV; (ii) Tereza dos Santos Moura's request for payment of extra-concursory credit; III. Petition from several bondholder creditors requesting the return of the deadline to make the choice of payment option; (iv) Application from several bondholder creditors reporting issues related to the bond liquidation procedure; and (V) ANATEL's Board of Directors' Appellate Decision on the prior consent for the implementation of the new Oi Group Board of Directors' decision. | 3.25.2019 |

Procedural incident n. 0061693 Dec 1, 2015 | Manifestation on the sale of Cabo Verde Telecom S.A. | 03.28.2019 |

33

6 Demonstrations presented by AJ | REPORT EXECUTIVE |

SUMMARY OF THE MANIFESTATIONS OF AJ IN THE FILE

Appeals in which the Judicial Administrator submitted a statement:

0007394-92.2019.8.19.0000 | Appeal brought by Mario José Brandão against the decision rejecting the request for reopening the time-limit for the choice of the payment option. | 03.25.2019 |

In addition, in response to letters and requests addressed directly to the AJ by the most diverse Courts of the country, the Judicial Administrator presented several manifestations in cases filed against the Recuperandas.

34

7 Monitoring compliance with the Judicial Reorganization Plan | REPORT EXECUTIVE |

MONITORING COMPLIANCE WITH THE JUDICIAL REORGANIZATION PLAN

The Judicial Reorganization Plan ("PRJ") presented by the Recovered Companies was approved by the Creditors present at the General Meeting of Creditors held on December 19, 2017, being ratified, with reservations, by this MM. Judgement, under the terms of the court's decision of fls. 254.741/254.756.

Accordingly, this Management remains focused on the inspection of compliance with the obligations for the recovery of the approved PRJ, having held periodic meetings with the Company and analyzed all pertinent documentation.

As a result of this inspection, the AJ makes available below, the illustrative spreadsheet of the obligations that were due in the month ofFebruary 2019:

Clause . | Class | Classification: | Obligation | Deadline | Comments | Deadline PRJ | Status |

6 | - | Capital Increase | Issue of New Common Shares II | February 28,2019 | Backstop Contract (R$ 4 billion) | (up to 02/28/2019) | ü |

4.3.5 | III and IV | Creditors' credits Suppliers Partners | Payment | February 26,2019 | First tranche of the remaining balance | February 28,2019 | ü |

With regard to mediation with illiquid credits, which already has 4,226 agreements signed, the AJ informs that it has been following the procedure and the operation of the FGV Platform, available for access since 26 July 2018.

35

| |

Franklin Roosevelt Avenue, | Juscelino Kubitschek Avenue, |

n. 115 4th floor | n. 510 8th floor |

CEP 20021-120 | CEP 04543-906 |

Rio de Janeiro, RJ - Brazil | São Paulo: SP - Brazil |

| ||

| James Joule Street, |

|

| nº 92 10th floor |

|

| Brooklyn New, |

|

| CEP 04576-080 |

|

| São Paulo: SP - Brazil |

|

36