These statements are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in particular circumstances. However, whether actual results and developments will meet our expectations and predictions depends on a number of risks and uncertainties, which could |

|

- i - |

|

|

|

cause actual results to differ materially from our expectations. These risks are more fully described in the section entitled "Item 3. Key Information - Risk Factors". |

|

Consequently, all of the forward-looking statements made in this annual report are qualified by these cautionary statements. We cannot assure you that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected effect on us or our business or operations. |

|

Unless otherwise indicated, statistical and market trend information, as well as statements related to market position and competitive data, are based on our internal statistics and/or estimates gathered from our own research and/or various publicly available sources. |

|

CERTAIN TERMS AND CONVENTIONS |

|

Translations of amounts in this annual report from Renminbi into U.S. dollars and vice versa have been made at the rate of RMB7.2946 to US$1.00, which was the noon buying rate in the New York City for cable transfers in Renminbi per U.S. dollar as certified for customs purposes by the Federal Reserve Bank of New York on December 31, 2007. You should not construe these translations as representations that the Renminbi amounts actually represent U.S. dollar amounts or could be converted into U.S. dollars at that rate or at all. See "Item 3. Key Information - Exchange Rate Information" for information regarding the noon buying rates from January 1, 2003 through June 20, 2008. |

|

We publish our financial statements in Renminbi. |

|

Various amounts and percentages set out in this document have been rounded and, accordingly, are not the exact figures and may not total. |

|

Unless the context otherwise requires, references in this annual report to: |

|

"A Shares" are to the domestic ordinary shares, with a nominal value of RMB1.00 each; |

|

"Alcoa"are to Alcoa International (Asia) Ltd., a company incorporated under the laws of Hong Kong; |

|

"alumina-to-silica ratio"are to the ratio of alumina to silica by weight found in bauxite; |

|

"aluminum fabrication" are to the process of taking primary aluminum and converting it into plates, strips, bars, tubes, etc. which can be further converted into consumer or other end products; |

|

"bauxite"are to mineral ores whose composition is principally alumina; |

|

"Baotou Aluminum"are to Baotou Aluminum Co., Ltd. On December 28, 2007, it became our wholly-owned subsidiary after the completion of shares exchange. |

|

"Bayer process"are to a refining process employed to extract alumina from ground bauxite with a strong solution of caustic soda at an elevated temperature; |

|

"brownfield development" are to development projects at existing plants or facilities; |

|

"CCB"are to China Construction Bank, a PRC state-owned bank established pursuant to PRC government approval; |

|

"Chalco," "the Company", "the Group", "our company," "we," "our" and "us"are to Aluminum Corporation of China Limited and its subsidiaries and, where appropriate, to its predecessors; |

|

"Chalco Mining" are to Chalco Mining Co., Ltd, our subsidiary that is established under PRC law; |

|

"Chalco Nanhai"are to Chalco Nanhai Alloy Company, our subsidiary that is established under PRC law; |

|

"Chalco Trading" are to China Aluminum International Trading Corporation Limited, our subsidiary that is established under PRC law; |

|

"China"and the"PRC" are to the People's Republic of China, excluding for purposes of this annual report, Hong Kong Special Administrative Region, Macao Special Administrative Region and Taiwan; |

|

"China Cinda"are to China Cinda Asset Management Corporation, a PRC state-owned financial enterprise established pursuant to PRC government approval; |

|

"China Development Bank" are to a PRC state-owned bank established pursuant to PRC government approval; |

|

- ii - |

|

|

|

"Chinalco", "Chinalco Group" and the"ultimate holding company" are to our controlling shareholder, Aluminum Corporation of China and its subsidiaries (other than Chalco and its subsidiaries) and, where appropriate, to its predecessors; |

|

"China Orient" are to China Orient Asset Management Corporation, a PRC state-owned financial enterprise established pursuant to PRC government approval; |

|

"diasporite"are to a mineral of bauxite deposits with the chemical composition of Al(2)O(3) * H(2)O; |

|

"Exchange Act" are to The Securities Exchange Act of 1934, as amended; |

|

"fabricating ingots" are to the primary aluminum or aluminum alloy ingots that may be used directly in the aluminum fabrication process; |

|

"Fushun Aluminum"are to Fushun Aluminum Company Limited, our subsidiary that is established under PRC law; |

|

"Gansu Hualu"are to Gansu Hualu Aluminum Company Limited, our subsidiary that is established under PRC law; |

|

"gibbsitic"are to a mineral of bauxite deposits with the chemical composition of Al(2)O(3) * 3H(2)O; |

|

"greenfield investment" are to investment projects to construct new plants or facilities; |

|

"Guangxi Baise" are to Guangxi Baise Yinhai Aluminum Company Limited, a subsidiary of Guangxi Investment; |

|

"Guangxi Huayin" are to Guangxi Huayin Aluminum Company Limited, a PRC entity in which we hold 33% equity interest. |

|

"Guangxi Investment"are to Guangxi Investment (Group) Co., Ltd., formerly known as Guangxi Development and Investment Co., Ltd., a PRC state-owned enterprise established in the PRC and one of our promoters and shareholders; |

|

"Guizhou Development"are to Guizhou Provincial Materials Development and Investment Corporation, a PRC state-owned enterprise established in the PRC and one of our promoters and shareholders; |

|

"HK$"and"HK dollars"are to Hong Kong dollars, the lawful currency of the Hong Kong Special Administrative Region of the PRC; |

|

"H Shares"are to overseas listed foreign shares of par value RMB1.00 each, which are listed on the Hong Kong Stock Exchange and traded in HK dollars; |

|

"Hong Kong Stock Exchange"are to The Stock Exchange of Hong Kong Limited; |

|

"hybrid Bayer-sintering process"are to the refining process developed in China which involves the application of the Bayer process and the sintering process in combination to extract alumina from bauxite more efficiently; |

|

"ingots" and "remelt ingots" are to the international standard primary metal products from an aluminum smelter. Remelt ingots are the aluminum ingots generally remelted before being cast into alloyed products or used for aluminum fabrication; |

|

"Jiaozuo Wanfang"are to Jiaozuo Wanfang Aluminum Manufacturing Co. Ltd., our associated company that is established under PRC law, in which we hold 29% of its equity interest; |

|

"kA"are to kiloamperes, a unit for measuring the strength of an electric current, with one kiloampere equal to 1,000 amperes; |

|

"kWh"are to kilowatt hours, a unit of electrical power, meaning one kilowatt of power for one hour; |

|

"Lanzhou Aluminum"are to Lanzhou Aluminum Co., Ltd., previously our associated company that was a joint stock limited company established under the PRC law, whose A Shares were traded on the Shanghai Stock Exchange. On April 24, 2007, we completed the merger of Lanzhou Aluminum by way of share exchange and Lanzhou Aluminum became our wholly-owned subsidiary. Its shares ceased to be traded on the Shanghai Stock Exchange. In June 2007, Lanzhou Aluminum was divided into two wholly-owned branches: Lanzhou branch and Northwest Aluminum Fabrication Plant, which are mainly engaged in producing primary aluminum products and fabricated aluminum products, respectively; |

|

- iii - |

|

|

|

"Listing Rules"are to the Rules Governing the Listing of Securities on the Hong Kong Stock Exchange (as amended from time to time); |

|

"LME"are to the London Metal Exchange Limited; |

|

"NYSE"are to New York Stock Exchange Inc.; |

|

"ore-dressing Bayer process"are to a refining process we developed which involves the treatment of bauxite in order to increase its alumina-to-silica ratio so as to allow the Bayer process to then be applied; |

|

"provinces" are to provinces and to provincial-level autonomous regions and municipalities in China, excluding Hong Kong Special Administrative Region, Macao Special Administrative Region, and Taiwan, which are directly under the supervision of the central PRC government; |

|

"refining" are to the chemical process required to produce alumina from bauxite; |

|

"Research Institute" are to Zhengzhou Research Institute, our wholly-owned branch mainly providing research and development services; |

|

"RMB"are to Renminbi, the lawful currency of the PRC; |

|

"NDRC"are to China National Development and Reform Commission; |

|

"Northwest Aluminum" are to Northwest Aluminum Fabrication Plant, our wholly-owned branch; |

|

"SASAC" are to State-owned Assets Supervision and Administration Commission of the State Council; |

|

"Shandong Aluminum" are to Shandong Aluminum Industry Co., Limited, previously our majority owned subsidiary that was established under PRC law, whose A Shares were traded on the Shanghai Stock Exchange. On April 24, 2007, we completed the merger of Shandong Aluminum by way of share exchange and Shandong Aluminum became our wholly-owned subsidiary. Its shares ceased to be traded on the Shanghai Stock Exchange. In September 2007, Shandong Aluminum was changed into Shandong branch, our wholly-owned branch. |

|

"Shanxi Coal" are to Shanxi Huatai Coal Co., Ltd., our subsidiary that is established under PRC law; |

|

"Shanxi Huasheng"are to Shanxi Huasheng Aluminum Company Limited, our subsidiary that is established under PRC law; |

|

"Shandong Huayu" are to Shandong Huayu Aluminum and Power Company Limited, our subsidiary that is established under PRC law; |

|

"Shanxi Huaze"are to Shanxi Huaze Aluminum and Power Co., Limited, our subsidiary that is established under PRC law; |

|

"Shanxi Zhangze"are to Shanxi Zhangzhe Electricity Company Limited, an entity established under PRC law; |

|

"sintering process"are to a refining process employed to extract alumina from ground bauxite by mixing with supplemental materials and burning in a coal fired kiln; |

|

"smelting" are to the electrolytic process required to produce molten aluminum from alumina; |

|

"tonne" are to the metric ton, a unit of weight, with one metric ton equal to 1,000 kilograms or 2,204.6 pounds; |

|

"US$" are to U.S. dollars, the lawful currency of the United States of America; |

|

"WTO" are to World Trade Organization; and |

|

"Zunyi Aluminum"are to Zunyi Aluminum Company Limited, our subsidiary that is established under PRC law. |

|

PART I |

|

* | Our alumina products are mainly delivered by rail or truck, and our primary aluminum products are transported to our customers mostly by rail. If we are unable to make on-time delivery due to logistics and transportation problems, our results of operations may be adversely affected. |

| |

* | A main objective of our research and development projects is to develop new methods and new processes to improve the efficiency of extracting alumina from bauxite that has relatively low alumina-to-silica ratios. If China's supply of bauxite with high alumina-to-silica ratios declines, our failure to achieve technological improvements or to implement such improvements in commercial applications could impede our efforts to reduce unit production costs and to compete with major international producers. |

| |

* | The bauxite reserve data on which we base our production, revenue and expenditure plans are estimates that we have developed internally and may be inaccurate. There are numerous uncertainties inherent in estimating quantities of reserves, including many factors beyond our control. If these estimates are inaccurate or the indicated tonnages are not recovered, our business, financial condition, and results of operations may be materially and adversely affected. |

| |

* | We rely on short-term borrowings to meet part of our financing needs. If we fail to achieve timely rollover, extension or refinancing of our short-term debts, we may be unable to meet our obligations in connection with debt servicing, accounts payable and/or other liabilities when they become due and payable. In addition, we may be exposed to changes in interest rates. If interest rates increase substantially, our results of operations could be adversely affected. |

| |

* | Our primary sources of funding are cash generated by operating activities, short-term and long-term bank borrowings, proceeds from shares offerings, and proceeds from short-term bond and long-term bond offerings. In 2007, we required our customers to make prepayments or deposits for purchases of alumina. The total amount of prepayments and deposits was approximately RMB1,053 million as of December 31, 2007. We have relied on prepayments and deposits received from customers as a source of liquidity. In the event that demand for our alumina declines significantly, we may not be able to require such prepayments and deposits from customers, in which case this source of liquidity may not be available to us. |

| |

* | Chinalco, a state-owned enterprise, as of December 31, 2007 owned 38.56% of our issued share capital and is our largest shareholder. The interest of Chinalco may conflict or even compete with our interest and that of our public shareholders. Chinalco may take actions that favor the interest of its subsidiaries, associates and other related entities over ours and that of our public shareholders. In addition, Chinalco and some of its subsidiaries and associates provide a range of services to us, including engineering and construction services, social services, land and property leasing and supply of raw and supplemental materials. Some of the services Chinalco provides to us, such as educational and medical care services for our employees, would be difficult to obtain from other sources. Our cost of operations may increase if Chinalco becomes unable to provide such services to us. |

| |

* | Chinalco has substantial financial obligations relating to the businesses, operations and personnel that it retained in the reorganization. While Chinalco generates significant operating revenue and receives government support, it may also rely on dividends received from us as a means of funding these obligations. Subject to the relevant provisions of the PRC Company Law and our Articles of Association, Chinalco may seek to influence our decision as to the amount of dividends we pay out in order to satisfy its cash flow requirements. Any increase in our dividend payout resulting from Chinalco's influence could reduce funds available for reinvestment in our businesses and thus may materially reduce our future financial strength and adversely affect our future results of operations. |

| |

* | Our alumina and primary aluminum production operations are subject to environmental protection laws and regulations in China, which impose such penalties as waste discharge fees, fines or closure of non-compliant plants. Each of our alumina and primary aluminum production plants has |

| |

| implemented a system to control its emissions and to oversee its compliance with PRC environmental regulations. However, the PRC government has taken steps, and may take additional steps, towards more rigorous enforcement of applicable laws, and/or adoption of more stringent environmental standards. If the PRC national or local authorities enact additional regulations or enforce existing or new regulations in a more rigorous manner, we may be required to make additional environmental expenditures, which could have an materially adverse impact on our financial condition and results of operations. |

| |

* | We may experience major accidents in the course of our operations, which may cause significant property damage and personal injuries. Significant industry-related accidents and natural disasters may cause interruptions to various parts of our operations, or could result in property or environmental damage, increase in operating expenses or loss of revenue. The occurrence of such accidents and the resulting consequences may not be covered adequately, or at all, by the insurance policies we carry. In accordance with customary practice in China, we do not carry any business interruption insurance or third party liability insurance for personal injury or environmental damage arising from accidents on our property or relating to our operations other than our automobiles. Losses or payments incurred by us as a result of major accidents or natural disasters may have a material adverse effect on our operating performance if such losses or payments are not fully insured. |

| |

* | The licenses to mine bauxite in some of our bauxite mines have expired and lapsed. While we are seeking to renew those expired licenses, we may be subject to administrative fines for operating mines without a valid license, or we may be ordered to cease our mining operations all together until we obtain the renewed licenses. The failure to renew those expired mining licenses may adversely affect our financial condition and results of operations. |

| |

* | Our H Shares became a Hang Seng Index constituent stock on June 10, 2008, which may attract buying interests of so-called "Hang Seng Index funds" aiming to maintain their investment portfolio parallel to that of the Hang Seng Index. We have no control of the selection of the Hang Seng Index constituent stocks and may not be able to continue to maintain our H Shares as a Hang Seng Index constituent stock. If our H shares are deselected from the Hang Seng Index, the market's interests in investing in our H shares may correspondingly wane, and our share price may materially decline. | | |

* | As of May 6, 2008, 2,500,684,890 A Shares that had previously been subject to a trading moratorium became available for trading on the Shanghai Stock Exchange. If all or a significant portion of these tradable shares are offered for sale on the Shanghai Stock Exchange, the A Share price may materially decrease due to the over-supply of the A Shares on the market. | | |

* | We are also subject to a number of risks relating to the PRC, including the following: |

| |

Our alumina production capacity has increased rapidly in the past few years. From 2002 to 2007, our annual alumina production capacity increased from 5,410,000 tonnes to approximately 10,200,000 tonnes. |

|

We produced 2,800,000 tonnes of primary aluminum in 2007, which accounted for approximately 22.3% of China's domestic primary aluminum production for 2007. From 2002 to 2007, our annual primary aluminum production increased from 750,000 tonnes to 2,800,000 tonnes. |

|

Our key operating assets include one subsidiary mainly engaged in mining bauxite products, four integrated alumina and primary aluminum production plants, two alumina refineries, one research institute and 12 primary aluminum smelters, including Jiaozuo Wanfang. Our Research Institute also provides products for commercial sales. Most of our refineries are located in reasonable proximity to abundant bauxite reserves and, as of December 31, 2007, had annual production capacities ranging from 850,000 to 2,217,000 tonnes. Our primary aluminum smelters had annual production capacities ranging from 56,000 to 412,000 tonnes as of December 31, 2007. Since December 31, 2004, all of our production facilities have been operated under the ISO9001:2000, OHSAS 18001:1999 and GB/T 28001-2001 standards. |

|

Recent domestic developments |

|

On April 24, 2007, we issued 1,236,731,739 A Shares by way of share exchange with the other shareholders of Shandong Aluminum and Lanzhou Aluminum, including providing cash alternative to those shareholders. This share exchange resulted in the merger of Shangdong Aluminum and Lanzhou Aluminum. This issuance was approved by the shareholders at an Extraordinary General Meeting held on February 27, 2007. This mergers optimized resource allocation, improved our corporate governance structure and upgraded our platform for capital operations. |

|

On December 28, 2007, we issued 637,880,000 A Shares in exchange 100% equity interest in Baotou Aluminum. Baotou Aluminum had an annual production capacity of approximately 307,000 tonnes of aluminum as of December 31, 2007. Our acquisition of Baotou Aluminum reduced the business competition with our controlling shareholder Chinalco. |

|

As approved at our 2008 Extraordinary General Meeting, we submitted to the China Beijing Equity Exchange on May 12, 2008 the application to acquire 100% of the equity interest in Lanzhou Liancheng Longxing Aluminum Company Limited, 100% of the equity interest in Chinalco Southwest Aluminum Cold Rolling Company Limited, 84.02% of the equity interest in Chinalco Henan Aluminum Company Limited, 75% of the equity interest in Chinalco Ruimin Company Limited, 60% of the equity interest in Chinalco Southwest Aluminum Company Limited and 56.86% of the equity interest in Huaxi Aluminum Company Limited from Aluminum Corporation of China and China Nonferrous Metals Processing Technology Company Limited ("Transferors"). The equity interests of the above companies are listed on the China Beijing Equity Exchange for bidding at a consideration of RMB4,175 million. On May 13, 2008, we received the confirmation from the China Beijing Equity Exchange and became the ultimate transferee of the above equity interests. On May 21, 2008, we entered into an acquisition agreement with Transferors for the acquisition of the equity interests of the above companies. The acquisition was complete in early June 2008. |

|

On June 20, 2008 the Company announced that based on the initial calculation on its financial information for the first half of 2008 in accordance with the Accounting Standards for Business Enterprises issued by the Ministry of Finance of the PRC, the net profit (attributable to the equity holders of the Company) for the six months from January 1, 2008 to June 30, 2008 was forecast to decrease by over 50% as compared with the same period last year. For comparison purpose, the audited net profit and earnings per share under PRC GAAP for the first half of 2007 were RMB6.397 billion and RMB0.53, respectively. The Company's announcement was made pursuant to PRC laws governing the listing of it's A Shares on the Shanghai Stock Exchange. |

|

As of June 23, 2008, due to the expiration of the trading moratorium of 2,500,684,890 shares of our restricted A Shares on May 6, 2008, our total share capital of 13,524,487,892 ordinary shares comprised 5,649,217,045 restricted A Shares, 3,931,304,879 unrestricted A shares, and 3,943,965,968 H Shares. Chinalco's equity interest in us remained 38.56%. |

|

BUSINESS OVERVIEW |

|

Our Principal Products |

|

We manage our operations according to our two principal business segments: alumina and primary aluminum. Our alumina segment includes the production and sale of our alumina-related products, namely, alumina and alumina chemical products, including alumina hydrate, alumina-based industrial chemical products and gallium. Our primary aluminum segment includes the production and sale of our primary aluminum-related products, namely, primary aluminum (including both ingots and other primary aluminum products) and carbon products. External sales of our alumina and primary aluminum segments accounted for approximately 27.3% and 70.5%, respectively, of our total revenue in 2007. Alumina is refined from bauxite through a chemical process and is the key raw material for producing primary aluminum, which in turn is a key raw material for aluminum fabrication. |

|

Our alumina segment products consist primarily of alumina, which accounted for approximately 93.8% of our total alumina segment output based on total production volume in 2007. Other alumina segment products consist primarily of alumina chemical products, which are used in the production of chemical, pharmaceutical, ceramic and construction materials. In the process of refining bauxite into alumina, we also produce small amount of gallium, which is a related product and a high-value rare metal with special usage in the electronics and telecommunications industries. |

|

Our most important primary aluminum product is ingots, which accounted for approximately 82.9% of our total primary aluminum output in 2007. Our standard ingots are 20-kilogram remelt ingots used for general aluminum fabrication primarily for the automotive, construction, power and consumer goods industries. In addition, we also produce high value-added and high profit margin primary aluminum products, such as electrical aluminum and aluminum alloys used for special industrial applications. In 2007, we continued to adjust our product mix and increased the production of high value-added primary aluminum such as aluminum alloys by approximately 44.9% from 2006 to capture the higher profit margin of such products. Our primary aluminum plants also produce carbon products (principally carbon anodes and cathodes) used in smelting operations. |

|

- 19 - |

|

|

|

The carbon we produce supplies substantially all of the carbon products required for our smelters. We also sell some of our carbon products to external smelters. |

|

We began to recycle scrap materials for our primary aluminum production in 2003. In 2007 our Shandong branch used recycled materials to produce approximately 74,000 tonnes of primary aluminum products. At present, only our Shandong branch has the capability to produce primary aluminum products from recycled materials. |

|

Our Production Capacity |

|

The following table sets forth the production capacity of alumina and primary aluminum for each of our plants as of December 31, 2007: |

|

Overseas Development |

|

To implement our international development strategy, we initiated a research program on overseas development projects in 2004. On October 3, 2007, we entered into a memorandum of understandy ("MOU") to jointly construct a primary aluminum plant in Saudi Arabia with an annual capacity of one million tonnes with the MMC and SBG. On November 24, 2007, the parties to the MOU officially entered into a cooperation framework agreement and received the project permit issued by the Saudi Arabia General Investment Authority. The cooperation framework agreement provides that the project will utilize our technologies and major equipment manufactured in China. On May 9, 2008, we entered into a joint venture arrangement with MMC and SBG, according to which, the joint venture will be established in Saudi Arabia and will develop and operate a primary aluminum plant with a planned annual capacity of approximately one million tonnes as well as a self-owned power plant with a planned capacity of 1,860MW. We will hold 40% a nd 20% equity interest in the primary aluminum plant and self-owned power plant respectively, and as a result, will become the largest shareholder in the aluminum project and the smallest shareholder in the self-owned power plant. The project is located in an area with abundant low-cost energy supplies including heavy crude oil for generating electricity, where primary aluminum can be produced at a competitive cost. We commenced the feasibility study in early 2008. |

|

Raw Materials |

|

Alumina |

|

Bauxite is the principal raw material for the production of alumina. Most of the bauxite in China is AL2O3.H2O mineral, which is an uncommon kind of mineral in other parts of the world, where AL2O3.3H2O is prevailing. Aluminum deposits run through a broad area in central China and are especially abundant in the southern and northern parts of central China. The largest aluminum deposit lies in Shanxi Province. |

|

Our aluminum deposits, except those of Guangxi Pingguo Mine which is an accumulation deposit due to original erosion, usually have similar stratigraphical sequences. Primary bauxite deposit, as a type of sedimentary AL2O3.H2O of Carboniferous or Permian age, is contained in clay rock, limestone or coal seams. A zonary red shale is usually located at the bottom of the bauxite and the red seam distributes over the irregular "karst-type" erosion face on the top of Ordovician limestone. Aluminum deposits in northern China are usually covered with a very thick Quaternary weathering. |

|

The thickness and quality of deposits vary with locations. Quality is usually consistent in smooth sections but changes sharply in karst "billabong" terrain. The level of hardness of minerals also varies. A sequence that includes a seam of hard bauxite of fine quality in the middle and soft bauxite of inferior quality on the bottom and top seams is common in deposits. |

|

Generally, deposits are horizontal or with an obliquity of 0-8o, but there are also steep deposits at an angle of 75o, such as the Guizhou No. 2 Mine. Most of the original mineralization is not influenced by folds and faults, and some fractures of a low obliquity and folds emerge in certain deposits, which is evident in the Guizhou No. 2 Mine area where the underground mining method must be used due to the obliquity of its bauxite body reaching 70o with the influence of folds and several meters of dislocation arising from partial faults. |

|

The systematic and accurate method of test boring, inspection pit, trial trench, density, tonnage analysis and calculation applied to the geological work of bauxite in China is an appropriate method to analyze these types of deposits. |

|

On average, our refineries consume approximately 2.0 tonnes of bauxite to produce one tonne of alumina. We used approximately 15,800,000 tonnes,18,760,000 tonnes and 20,242,900 of bauxite in our alumina production in 2005, 2006 and 2007, respectively. In 2007, bauxite cost represented approximately 25.5%, as compared to 23.0% in 2006 of our per unit alumina production costs. |

|

Supply. The predominant use of bauxite is for alumina production. Except for our Shandong branch, all of our refineries are located in the four provinces where over 90% of China's potentially mineable bauxite has been found. We generally source our bauxite from mines close to our refineries to save transportation costs. We procure our bauxite supply principally from three sources: |

|

| | | | Mining | License | |

Branch/Subsidiary | Mine | Location | Name of Joint Operator | Method | Renewal Date | Material Terms |

| | | | | | |

Guizhou | Goujiang | Zunyi, Guizhou Province | Guojiang Economic Development Mining Co., Ltd. | Open pit | August 2011 | This mine is 100% owned by Guojiang Economic Development Mining Co., Ltd. We provide mining services in return for the exclusive purchase rights to the mined bauxite for a period of 10 years starting from 1998. |

| Maige | Guiyang, Guizhou Province | n/a(1) | Open pit | October 2012 | This mine is 100% owned and operated by Qingzhen City Xinfeng Mining Co., Ltd. We possess the exclusive purchase rights to the mined bauxite for 15 years starting from 2000. |

| Zhijin | Bijie, Guizhou Province | n/a(1) | Open pit | September 2005 | This mine is 100% owned and operated by Guizhou Chengjin Mining Co., Ltd. We possess the exclusive purchase rights to the mined bauxite for 15 years starting from 2001. |

| Tuanxi | Zunyi, Guizhou Province | n/a(1) | Open pit | May 2009 | This mine is 100% owned by Qingzhen City Xingwang Mining Co., Ltd. We possess the exclusive purchase rights of the mined bauxite for 30 years starting from 2003. |

| | | | | | |

Shanxi | Wenquan Town | Lvliang, Shanxi Province | n/a(1) | Open pit | April 2007 | We are the sole owner of these mines and are |

| Shangtan | Changzhi, Shanxi Province | n/a(1) | Open pit | December 2009 | conducting research on the |

| Yangpo | Changzhi, Shanxi Province | n/a(1) | Open pit | July 2008 | development plan of these mines |

| Shaping | Changzhi, Shanxi Province | n/a(1) | Open pit | January 2010 | and searching for operators for |

| Jindui | Guxian Jindui, Shanxi Province | n/a(1) | Open pit | January 2010 | future development. |

| Shicao | Luofan Shicao, Shanxi Province | n/a(1) | Open pit | August 2008 | We are the sole owner of these mines and are conducting research on the development plan of these mines and searching for operators for future development. |

| Nanpo | Yangcheng Nanpo, Shanxi Province | n/a(1) | Open pit | July 2010 | We fully own these mines and are conducting research on the development plan of these mines and searching for operators for future development. |

| Sunjiata | Lin Xian Company | n/a(1) | Underground | December 2009 | We are the sole owner of these mines and are conducting research on the development plan of these mines and searching for operators for future development. |

| | | | | | |

Chalco Mining | Shanchuan | Zhengzhou, Henan Province | n/a(1) | Open pit | November 2008 | We are the sole owner of these mines and are conducting research on the development plan of these mines. We are searching for operators for future development. |

| Jiyuan | Yuxiang mining Co. Ltd. | Shandong Alumina Corporation | Open pit | October 2011 | We are the sole owner of this mine and have contracted with Yuxiang Mining Co. Ltd. for its provision of mining services. |

| | | | | | |

Shandong | Yuanping | Xinzhou, Shanxi Province | Yuanpinggao Alumina mine | Open pit / Underground | December 2007 | We established a joint venture with Yuanpinggao Alumina mine, in which we hold 51% equity interest. |

| Dayu | Yangquan, Shanxi Province | n/a(1) | Open pit | June 2007 | We are the sole owner of these mines and are conducting research on the development plan of these mines. We are searching for operators for future development. |

| | | | | | |

We have implemented efforts to improve and upgrade several of our mines in the year ended December 31, 2007. These upgrade plans include: (i) RMB2,559 million in Phase III of the Guangxi alumina project; (ii) RMB1,814 million in Phase IV of the Guizhou alumina project for the expansion and (iii) RMB617 million in the 800,000 tonnes alumina construction project. |

|

Primary Aluminum |

|

An average of approximately 2.0 tonnes of alumina and 14,500 kWh of electricity are required to produce one tonne of primary aluminum. Alumina and electricity, the two principal components of costs in the smelting process, accounted for approximately 43.2% and 33.7%, respectively, of our unit primary aluminum production costs in 2007. In addition, we also require carbon anodes, carbon cathodes and sodium fluoride in the smelting process. |

|

Alumina is the main raw material in the production of primary aluminum. Our Shandong, Henan, Guizhou and Guangxi smelters have historically sourced all or substantially all of the alumina they required from their respective integrated refineries. All our plants which do not have integrated alumina refining operations on site have obtained alumina internally from our own alumina refineries located elsewhere. |

|

| Due to mergers and consolidations, there were 52 primary aluminum smelters each with an annual production volume not less than 100,000 tonnes in the PRC as of December 31, 2007. The average production volume of these primary aluminum smelters is approximately 130,000 tonnes. With the development of the primary aluminum industry, our competitiveness has been enhanced. In 2007, the total amount of alumina consumed by our smelters was approximately 4,740,000 tonnes. |

|

Supplemental Materials, Electricity and Fuel |

|

The main fuel used by our mining and manufacturing equipment. We are able to purchase diesel supplies from the public markets. |

|

We source our water mainly from local rivers, lakes or underground water resources. |

|

- 28 - |

|

|

|

Alumina |

|

Electricity, coal, alkali (caustic soda or soda ash) and heavy oil are the other principal items required for our alumina production. We established a supplies department in our headquarters to control and coordinate the budgeting and procurement for all major items required for our production. In addition, to raise the efficiency of materials flow, a distribution center has been set up at each production facility. However, our efforts to reduce unit costs by improving the efficiency of material supplies by the procurement system were to a certain extent offset by the significantly increased prices for coal and fuel in the market in 2007. |

|

Electricity.Electricity is one of the principal forms of energy used in our refining process. Electricity represented approximately 7.6% of our unit alumina production cost in 2007. |

|

To the extent that power produced by the joint operation facility is insufficient to meet a refinery's total power requirements, we purchase the shortfall from regional power grids at government-mandated rates pursuant to power supply agreements. Power prices in China can vary, sometimes substantially, from one region to another, based on power production costs in the region as well as the consuming community's ability to pay. Accordingly, power costs for our various plants differ. Most of our electricity supply agreements are one to three year renewable contracts with regional power grids. |

|

Coal.Large quantities of coal are used as a reducing agent and as fuel to produce steam and gas in the alumina refining process. The coal we consumed directly in the alumina refining process in 2007 represented 5.8% of our unit alumina production costs. |

|

To secure our coal supply, we entered into a joint venture agreement with Jiaozuo Coal (Group) Co., Ltd. ("Jiaozuo Coal") on April 12, 2004 to establish a joint venture company in Henan Province to operate coal mines and manage coal processing business on May 15, 2004. We contributed 30% of the total registered capital in the amount of RMB45.0 million by way of cash and Jiaozuo Coal contributed 70% of the total registered capital in the amount of RMB105.0 million by way of cash and revalued coal mining rights in respect of Zhaogu mine. Zhaogu mine is currently under construction and the construction is expected to be completed by the end of 2008. According to the joint venture agreement, we are entitled to all of the slack coal produced by the joint venture company. |

|

Alkali. Alkali is used as a supplemental material in alumina refining. The sintering process and the hybrid Bayer-sintering process require soda ash while caustic soda is used in the Bayer process. We purchase all of our alkali from third party suppliers. Alkali accounted for 8.0% of our unit alumina production cost in 2007. |

|

Fuel Oil.Fuel oil is used as fuel in the calcination of aluminum hydroxide to make alumina. Most of our refineries use heavy oil. Heavy oil represented approximately 3.8% of our unit alumina production cost in 2007. |

|

There is no governmental regulation on the prices of fuel oil, alkali or coal. The prices are set at market rates or through negotiations. We have not experienced difficulty in obtaining these materials in sufficient quantity and at acceptable prices. |

|

Deliveries of raw materials and supplemental materials are generally made on a monthly basis. Our suppliers arrange for railway transportation of these raw materials by submitting to local bureaus of the Ministry of Railways their annual and monthly transportation plans. These local bureaus then arrange for appropriate rail transportation to transport such raw materials or fuel to our refineries. |

|

Primary Aluminum |

|

Electricity. Smelting primary aluminum requires a substantial and continuous supply of electricity. In 2007, we consumed 34.9 billion kWh of electricity for our primary aluminum production and the cost of electricity represented 33.7% of the unit cost of primary aluminum. Therefore, the availability and price of electricity are key considerations in our primary aluminum production operations. Costs of electricity have increased periodically in the recent years due to severe shortage of electric power in China. In 2007, electricity prices increased due to the government adjustment. Accordingly, our electricity purchase price increased 3.2% compared to 2006. In October, 2007, Chinese government issued "Notice to Further Solutions to Difference in Electricity Rates", according to which the preferential electricity price originally enjoyed by Chinese primary aluminum enterprises ended at the end of 2007. The implementation of this Notice has further increased the costs for primary aluminum enterprises in China. In addition, several Chinese provinces experienced power shortage in the first quarter of 2008 mainly due to damages to power lines caused by the severe weather conditions. We believe the price of electricity will increase in 2008. |

|

We have expedited the implementation of integrated energy-saving technology, mainly by streamlining production workflow and improving our product structure. In 2007, aggregate energy consumption of primary aluminum production decreased by 1.38%, compared to 2006. |

|

We purchase electricity from the regional power grids for our smelter operations. Prices for electricity supplied by the power grids under power supply contracts are set by the government based on the power generation |

|

- 29 - |

|

|

|

cost in the region and the consumers' ability to pay. Industrial users within each region are generally subject to a common electricity tariff schedule, but prices vary, sometimes substantially, across regions. Each regional power grid serves a region comprising several provinces. The regional power grids generally rely on multiple power sources to generate electricity, with coal and hydro power being the two most common sources. We believe that the different types of power sources do not imply different degrees of reliability of supply, and that our power supply from the grids is generally not reliant upon any particular generation facility supplying the grid. |

|

Electricity purchased from different power grids is subject to different tariff levels in 2007. Our smelters' average electricity cost was RMB0.359 /kWh in 2007. |

|

Carbon Products. Carbon anodes and cathodes are key elements of the smelting process. As of December 31, 2007, carbon anodes represented 11.7% of our unit primary aluminum production costs. Each of our smelters produces carbon products other than carbon cathodes, such as carbon anodes. Only our Guizhou plant has a carbon cathode production facility, which supplies all of our smelters with the carbon cathodes required and sells any excess domestically to third-party smelters. |

|

Suppliers |

|

We purchase some raw materials including bauxite, coal, fuel oil and alkali from outside suppliers. The amount of raw materials provided by our five largest suppliers for alumina products and primary aluminum products accounted for 27.3% and 20.2%, respectively, of our total cost of raw materials for 2007. The cost of raw materials supplied by our largest supplier accounted for 11.6% and 6.3% of our total cost of raw materials for alumina and primary aluminum production, respectively, in 2007. All payments to our suppliers are in Renminbi. |

|

Sales and Marketing |

|

We coordinate our major sales and marketing activities at our corporate headquarters. We set uniform prices for our alumina products and set minimum prices for primary aluminum products in each region where our primary aluminum products are sold. We have consolidated the networks of our branch offices to eliminate overlapping of administrative support and to reduce sales costs. In response to increasingly intensified competition, we established Shandong Alumina Chemicals Sales Department to centralize the sales of our alumina chemical products nationwide. Our subsidiaries have also played an important role in improving our after-sales services and enhancing our influence in the marketplace. |

|

In 2003, as part of our centralized management program, we required all sales of alumina and primary aluminum to be settled upon delivery. However, due to the increased number of the subsidiaries acquired by us, our net trade receivables increased from RMB2,282.2 million as of December 31, 2006 to RMB2,975.7 million as of December 31, 2007. Since 2004, we have required our customers to make prepayments and deposits for purchases of alumina. The total amount of deposits and prepayments received was RMB1,052.9 million as of December 31, 2007. We expect to continue this policy so long as market demand remains strong. |

|

Alumina |

|

We sell a majority of our alumina output to third-party customers and the remaining portion to our own aluminum smelters. In 2007, we used approximately 4.8 million tonnes of alumina produced by ourselves , which represented approximately 46.7% of our total alumina production. All of our output of alumina chemical products are sold to third-party customers. |

|

- 30 - |

|

|

|

Sales |

|

We coordinate sales of alumina at our corporate headquarters. In the fourth quarter of each year, we organize a national alumina sales conference with our domestic primary aluminum smelter customers in order to match our supply with their requirements for the following year. At such annual conferences, based on our production capacity for the following year, we first reserve the amount of alumina needed for primary aluminum production by our smelters before we determine the amount available for sale to third party primary aluminum smelters. After that, we allocate our alumina to smelters with whom we have long-standing relationships and that have good credit and a good payment history. We consider other smelters only if we have additional alumina to allocate. Approximately 95.0% of our sales of alumina are made through these annual conferences. |

|

Based on the sales allocations we make at the annual conference, we and our customers typically enter into one-year sales agreements that set forth their total allocation and delivery schedules. At the time of entering into these one-year sales agreements, prices are left open and determined at or near the time of delivery at the then prevailing market price. We apply uniform prices to alumina sales regardless of where the alumina is produced. If a customer does not accept our price near the time of delivery, it may refuse to take delivery despite the one-year agreement. We began selling a portion of our alumina pursuant to long-term sales contracts which have terms longer than one year in 2001. Since January 1, 2004, we have gradually enter into three-year to five-year sales contracts for alumina. The volume of sales to third party customers under these long-term sales contracts accounts for approximately 37.3% of the total sales volume in 2007. Under such a long-term sales contract, the sales volume is fixed, and the price is linked to an index of three-month futures price of primary aluminum quoted at the Shanghai Futures Exchange. |

|

Customers |

|

We sell our alumina to smelters throughout China. Sales to our five largest third party customers accounted for 12.9%, 13.0% and 10.1% of our total alumina revenue from third party customers for 2005, 2006 and 2007, respectively. Sales to our largest customer accounted for 3.6%, 4.0% and 3.4%, respectively, of our total external alumina revenue for the same periods. All of our major third party customers in the last three years have been domestic smelters. |

|

Pricing |

|

We sell our alumina products by way of spot sales or under long-term contracts. Pricing for our alumina products is determined by the nature of the sale as described below. |

|

Spot sales.We set, and adjust as necessary, uniform sales prices for alumina produced by any of our refineries. In 2007, The highest and lowest spot price of domestic alumina was RMB4,200 per tonne and RMB2,400 per tonne, respectively. The annual average selling price of our alumina was RMB3,412.0 per tonne, representing a year-on-year decrease of 16.92%. We set uniform prices for all our sales of alumina to third party customers by reference to import costs of alumina, the market supply and demand conditions, as well as our short-term and mid-term projections. Our pricing generally takes into account: |

|

As part of our sales integration and centralization efforts, we set minimum prices with respect to each region in China where our primary aluminum is sold. These minimum prices are expressed by reference to the Shanghai Futures Exchange spot price for primary aluminum, not including transportation. The minimum prices may differ from region to region, but all of our primary aluminum sold into a region, regardless of the plant or warehouse from which it originates or is shipped, is sold at or generally above the minimum price applicable to that region. Those of our smelter plants filling particular orders are principally involved in discussions with the customer as to the pricing and delivery arrangements for specific transactions. They are required to comply with the minimum pricing guidelines unless prior approval from our corporate headquarters is obtained. In general, we supply each region with products from our nearest smelters to minimize transportation costs. |

|

Alumina Chemical Products and Gallium |

|

Alumina chemical products and gallium are intermediate products of, or otherwise related to, our alumina production. Our production levels for these products are based on market demand for them. We sell all of our alumina chemical products and gallium to third party customers, mostly domestically but some internationally. Prices for our alumina chemical products and gallium are set according to market demand or by agreement with our customers. |

|

Delivery |

|

Alumina |

|

Delivery of alumina is made from our refineries by rail or truck. Our sales price is normally exclusive of transportation costs. For long-distance delivery, we have spur lines connecting our plants to the national railway routes. We are responsible for the maintenance of these spur lines. The price of shipping on the national railway system is fixed by the government. |

|

Primary Aluminum |

|

Our primary aluminum products are transported to our customers mostly by rail. In view of the substantial distances that separate our smelter plants from southern and eastern China where most of the aluminum fabrication plants are concentrated, we have subsidiaries (often with warehousing capacity leased from third parties) in major cities in eastern and southern China to facilitate deliveries and coordination. |

|

Our Facilities |

|

Our core facilities include 17 production plants and our Research Institute. Set forth below is a plant-by-plant description of our facilities. Our production operations are organized and managed according to our two business segments, alumina and primary aluminum. See "Item 4 - History and Development of the Company-Overview" for details of the plants under construction. All of our facilities are accessible via railroads or highways. |

|

Guangxi Branch |

|

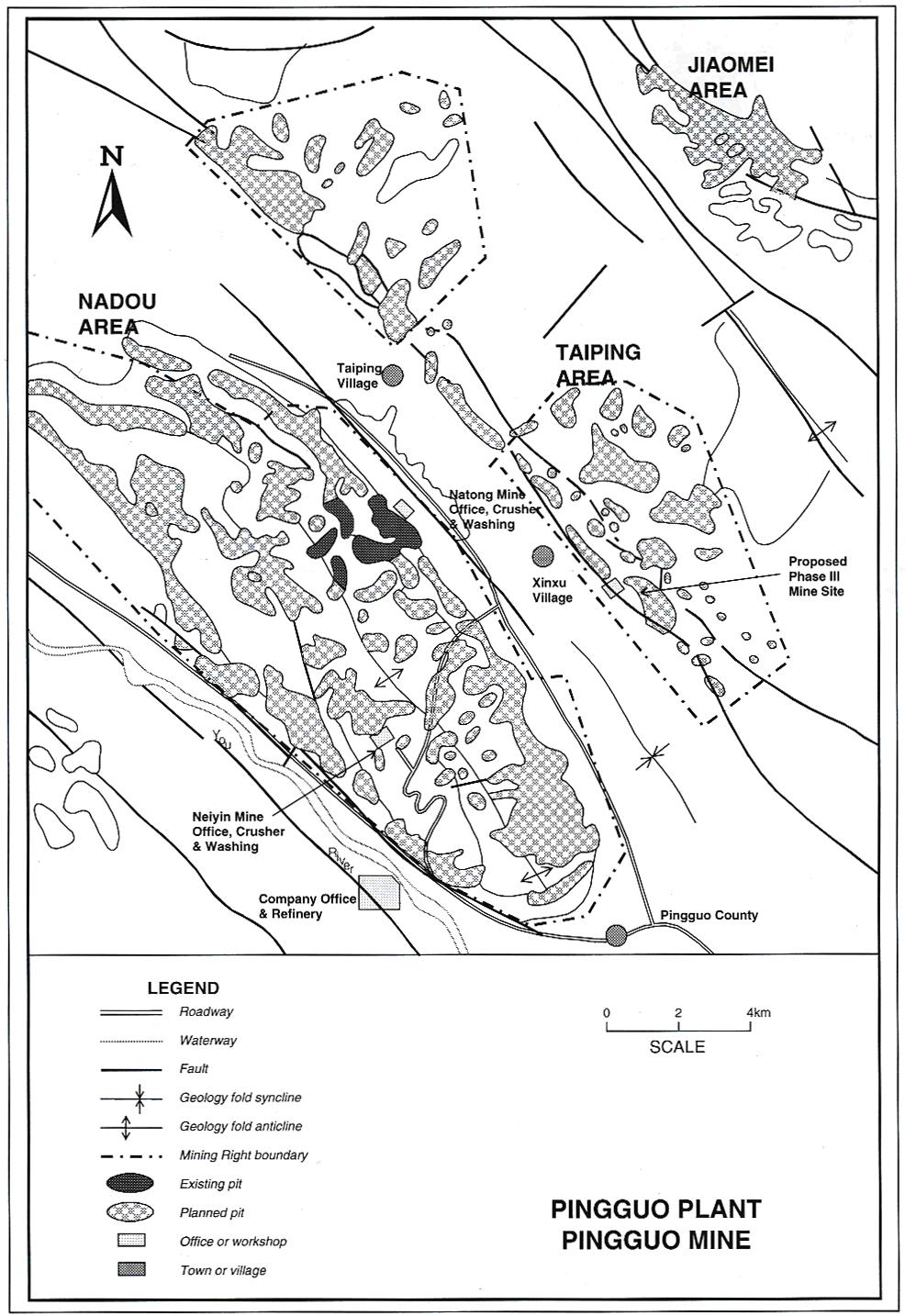

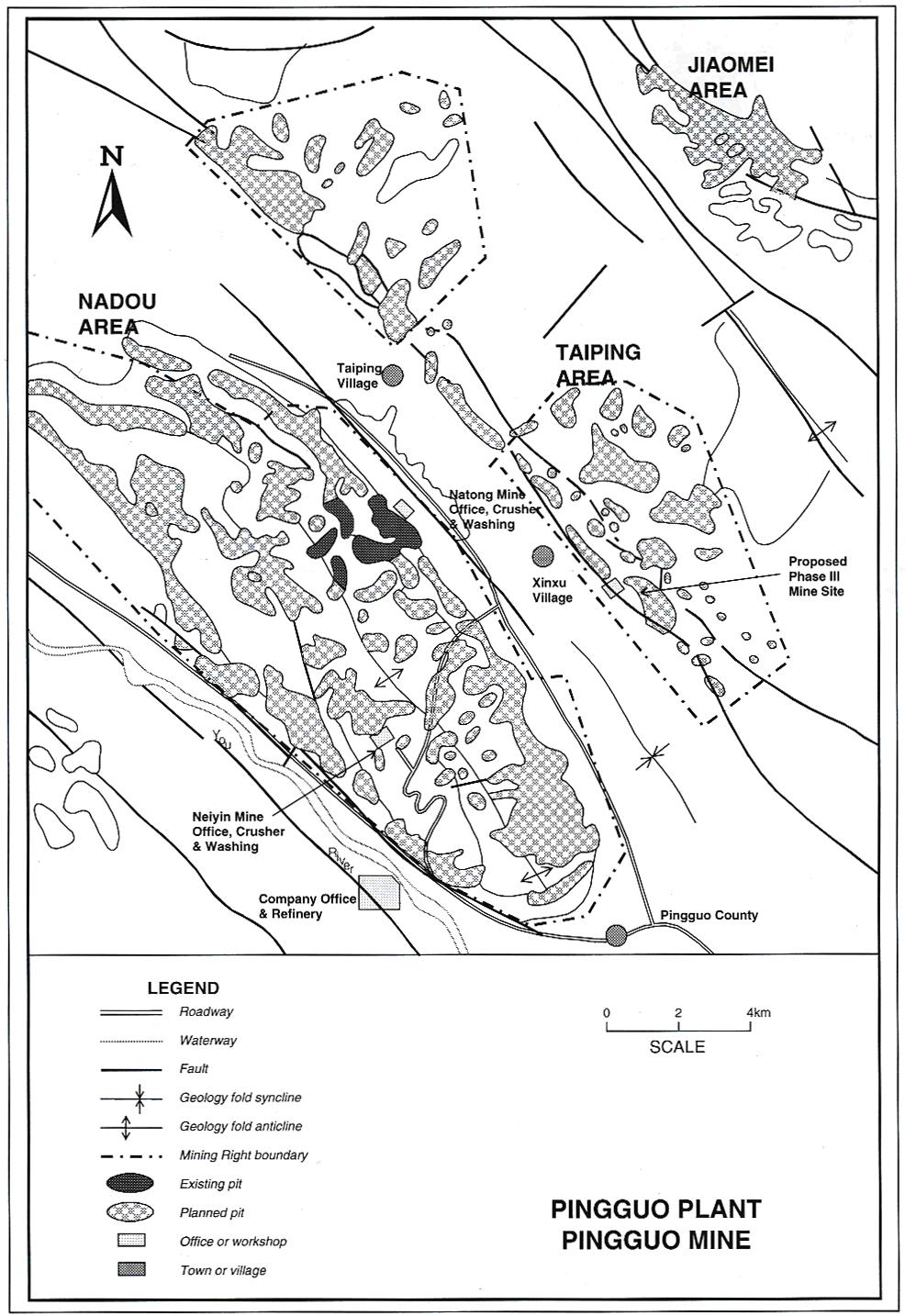

The Guangxi branch commenced operations in 1994 and is located in the Guangxi Zhuang Autonomous Region in southwestern China, an area rich in bauxite resources. The Guangxi branch receives bauxite for production via highway from the Pingguo mine, located in Guangxi Pingguo. The Guangxi branch is our newest alumina and primary aluminum plant, and is equipped with imported production facilities and technology. |

|

- 33 - |

|

|

|

Our Guangxi branch is situated within 17 kilometers of our own mines that contain large, easily exploitable high alumina-to-silica ratio bauxite reserves. The Guangxi branch is our only refinery that uses the Bayer method exclusively. With imported European technology and production equipment, our Guangxi refinery features a high level of automation and energy efficiency. Since its inception, we have increased the Guangxi branch's original designed production capacity by removing production bottlenecks and capacity expansions. As of December 31, 2007, its production capacity reached 850,000 tonnes of alumina per annum. Most of its alumina output is used in the primary aluminum smelter at our Guangxi branch and the remainder is sold to third party smelters. The Phase III construction of Guangxi Alumina, with a production capacity of 880,000 tonnes, commenced in March 2006 and is expected to be completed in the second quarter of 2008, and the plant has already test-produced aluminum products. |

|

Our Guangxi branch also uses advanced 160 kA and 320 kA pre-bake reduction pot-lines developed by ourselves for its primary aluminum production. As of December 31, 2007, the branch's production capacity reached 139,500 tonnes of primary aluminum per annum. All primary aluminum it produces is sold to third party customers. |

|

Guizhou Branch |

|

Our primary aluminum production facilities in Guizhou Province, which possesses integrated alumina and primary aluminum production facilities, commenced operations in 1966. |

|

Our Guizhou alumina refinery commenced operations in 1978 and is one of the most advanced facilities of its kind in China, as many of its key technologies and equipment are imported. It uses the hybrid Bayer-sintering process for its alumina production and relies on our own third party and outside suppliers for bauxite supply. Bauxite from our own nearby mines is delivered to the refinery by cable cars and train. Its alumina output is mostly used in the primary aluminum production at the same plant and the remainder is sold to third party smelters. As of December 31, 2007, the production capacity of our Guizhou branch reached 1,200,000 tonnes of alumina per annum, after completion of an environmental protection management project in at the end of 2007, which increased the annual alumina production capacity of Guizhou branch by 400,000 tonnes. The primary aluminum facilities at our Guizhou branch consist of large-scale pre-bake reduction pot-lines, ranging from 160 kA to 186 kA. As a result of technologica l innovations and overhauls since its inception, our Guizhou smelter plant is among the most technologically advanced smelters in China. In 2007, the annual production capacity of primary aluminum of our Guizhou branch was 403,700 tonnes. |

|

Our Guizhou branch also contains a modern carbon production facility which produces carbon anodes as well as carbon cathodes. It is our only facility that produces carbon cathodes and supplies all of the carbon cathodes required by seven of our facilities and our Research Institute. Its carbon cathodes are also sold to third party customers throughout China. |

|

Henan Branch |

|

Our Henan branch is located in Zhengzhou, Henan Province, a province rich in bauxite resources. Bauxite is delivered to our Henan Branch for production via railway and highway from the following mines: Xiaoguan mine located in Zhengzhou; Luoyang mine in Luoyang; Yanchi mine in Sanmenxia; Yuzhong mine in Zhengzhou; and Jiaozuo mine in Jiaozuo. Its alumina and primary aluminum production commenced and primary aluminum in 1966 and 1967, respectively. Our Henan branch was the first refinery in China to develop the hybrid Bayer-sintering process. We commenced the operation of a new alumina production line in February 2004 using the ore-dressing Bayer process that we have developed in recent years to refine low alumina-to-silica ratio bauxite. Since its inception, the Henan branch's production facilities have undergone substantial technological upgrades, based on equipment imported from Germany and Denmark. The refinery has also benefited from its access to high alumina-to-silica ratio bauxite from our own mine s and through local market purchases. Its alumina output is first used to satisfy its primary aluminum production, and the remainder is sold to our other smelters and third party customers. The designed annual production capacity of alumina of our Henan branch was 2,050,000 tonnes in 2007. |

|

We upgraded a portion of the primary aluminum facilities at this branch, which now utilizes 85 kA pre-bake reduction pot-lines. Its carbon plant produces high quality carbon products for sales to third party customers in China as well |

|

- 34 - |

|

|

|

as for export, after meeting the needs of our various smelting operations. As of December 31, 2007, the plant's production capacity reached 56,000 tonnes of primary aluminum per annum. |

|

Shandong Branch |

|

The Shandong branch commenced operations in 1954 and has the capacity to produce both alumina and primary aluminum. Bauxite is delivered to our Shandong branch for production via railway and highway from the Yangquan mine in Shanxi Yangquan. Its refinery was China's first production facility for alumina. Both the refinery and smelter are owned and operated by Shandong Aluminum, which became our wholly-owned subsidiary after our A Shares issuance and exchange on April 30, 2007. It produces the majority of its alumina through the sintering process, but has a small production line to produce alumina through the Bayer process using imported bauxite. During 2002, the Bayer production line was converted into an ore-dressing sintering operation. The Shandong branch purchases the majority of the bauxite required for its production from small third party mines in Henan and Shanxi Provinces. Its alumina output is first used to satisfy its primary aluminum production, and the remainder is sold to our other smelters as well as third party customers. As of December 31, 2007, the annual capacity of alumina of our Shangdong branch reached 1,500,000 tonnes. |

|

Our Shandong branch's primary aluminum operations have undergone technological and equipment upgrades, with the majority of its original equipment having been replaced by more advanced equipment. As of December 31, 2007, its production capacity reached 75,000 tonnes of primary aluminum per annum. |

|

In addition, our Shandong branch also produces substantial amounts of alumina chemical products. It is the largest and most technologically advanced alumina chemical products production facility, and produces the most varieties of these products in China. Alumina chemical products produced by our Shandong branch are used in the jewelry, ceramics and other industries. Its alumina chemicals products are sold both domestically and internationally. |

|

Qinghai Branch |

|

Located in Qinghai Province, our Qinghai branch is a stand-alone primary aluminum production facility and is also China's second largest smelter in terms of production capacity. This branch commenced operations in 1987 and is one of the most technologically advanced primary aluminum smelters in China. It operates 160 kA automated pre-bake anode reduction pot-lines that were developed domestically. It benefits from relatively low electricity costs in Qinghai Province resulting from substantial hydroelectric power stations in the region. Historically, the branch has relied on our Shanxi, Shandong, Henan and Zhongzhou branches for its alumina supply. Because of its relatively remote location, it incurs higher average transportation costs for both raw materials and its primary aluminum products than our other branches. The Qinghai branch's designed annual production capacity of primary aluminum was 367,000 tonnes in 2007. |

|

Shanxi Branch |

|

The Shanxi branch commenced operations in 1987 and is located in Shanxi Province, a province with rich bauxite deposits in China. Bauxite is transported to our Shanxi branch for production via railway and highway from the Xiaoyi mine in Shanxi Province. Our Shanxi branch is a stand-alone alumina plant and is currently China's largest alumina plant in terms of production capacity. |

|

The Shanxi branch's production facilities are primarily imported and are more technologically advanced than our other domestic alumina refineries. Shanxi branch relies on bauxite from our own mines as well as third party suppliers. Due to its close proximity to large coal mines and substantial water resources, it currently has the largest power generation capacity of all of our alumina manufacturing facilities. The total alumina production capacity of our Shanxi branch reached 2,217,000 tonnes in 2007. |

|

Zhongzhou Branch |

|

Situated in Henan Province, our Zhongzhou branch is a stand-alone alumina plant, located near bauxite, coal and water supplies. It commenced operations in 1993 and is equipped with imported and self-developed technology and has undergone various improvements and upgrades, including improved sintering technology. We purchase bauxite supplies from Henan and Shanxi Provinces. In 2007, following the completion of a project involving the upgrade of the sintering process, as well as a project involving alumina |

|

- 35 - |

|

|

|

concentration with added bauxite after digestion of the ore-dressing Bayer process, its production capacity reached 1,830,000 tonnes of alumina per annum. |

|

Lanzhou Branch |

|

Our Lanzhou branch is situated in Lanzhou city in Gansu Province and is a stand-alone primary aluminum plant. It was part of Lanzhou Aluminum before June 2007, whose A Shares were listed on Shanghai Stock Exchange until April 24, 2007, when we merged with Lanzhou Aluminum through share exchange. See "Item 4 - History and Development of the Company - The A Shares Offering". In June 2007, Lanzhou Aluminum was divided into two wholly-owned branches: Lanzhou branch and Northwest Aluminum. Our Lanzhou branch owns a primary aluminum smelting plant with a designed annual production capacity of approximately 428,000 tonnes after completion of a new primary aluminum project by the end of 2007. |

|

Northwest Aluminum |

|

Northwest Aluminum is situated in Lanzhou city in Gansu Province and is an aluminum fabrication plant. It was part of Lanzhou Aluminum before June 2007, whose A Shares were listed on Shanghai Stock Exchange until April 24, 2007, when we merged with Lanzhou Aluminum through share exchange. See "Item 4 - History and Development of the Company - The A Shares Offering". In June 2007, Lanzhou Aluminum was divided into two wholly-owned branches: Lanzhou branch and Northwest Aluminum. Northwest Aluminum has an annual production capacity for aluminum fabrication products of approximately 80,000 tonnes. |

|

Jiaozuo Wanfang |

|

Jiaozuo Wanfang is situated in Jiaozuo city in Henan Province and is a stand-alone primary aluminum plant. Jiaozuo Wanfang Plant was established in 1993, whose shares were listed on the Shenzhen Stock Exchange in 1996. In May, 2006, we entered into a Sale and Purchase Agreement with Jiaozuo Wanfang Group to acquire 29% of the issued share capital, or 139,251,064 State-owned legal person shares held by Jiaozuo Wanfang Group in the issued share capital of Jiaozuo Wanfang Aluminum Manufacturing Co., Ltd. ("Jiaozuo Wanfang"), and thus became its largest shareholder. Jiaozuo Wanfang completed a new primary aluminum project by the end of 2007 and increased its designed annual production capacity for primary aluminum to 428,000 tonnes per annum. |

|

Shanxi Huaze |

|

Shanxi Huaze is situated in Shanxi Province. On March 30, 2003, we established a joint venture company, Shanxi Huaze Aluminum & Power Co., Ltd., with Shanxi Zhangze Electricity Company Limited to commence the construction of a primary aluminum production facility. In 2007, the designed annual production capacity of primary aluminum of Shanxi Huaze reached 280,000 tonnes. Shanxi Huaze has undertaken an expansion project to increase its aluminum alloy annual production capacity by 100,000 tonnes to reach 380,000 tonnes. This project is expected to be completed by the end of 2008. See "- Property, Plant and Equipment - Our Expansion - Shanxi Huaze Project". |

|

Shanxi Huasheng |

|

Shanxi Huasheng Aluminum is situated in Shanxi Province. On December 6, 2005, we entered into a joint venture agreement with Shanxi Guanlv Co., Ltd. to establish a joint venture company, Shanxi Huasheng Aluminum Company Ltd. The joint venture company commenced operations in March 2006. In 2007, the designed annual production capacity of primary aluminum reached approximately 220,000 tonnes. The joint venture company has a total investment of RMB2,379.4 million and a registered capital of RMB1,000 million, of which we committed RMB510 million. We currently hold a 51% equity interest in Shanxi Huasheng. |

|

Zunyi Aluminum |

|

Zunyi Aluminum is situated in Guizhou Province. In June 2006, we entered into a share purchase agreement with Guizhou Wujiang Hydropower Development Co., Ltd. and eight other companies, which are the |

|

- 36 - |

|

|

|

shareholders of Zunyi Aluminum, to purchase part of the equity interest from Guizhou Wujiang Hydropower Development Co., Ltd. and all the equity interest held by the other eight companies. We have completed our purchase and currently hold a 61.29% equity interest in Zunyi Aluminum. Zunyi Aluminum has a designed annual production capacity of 110,000 tonnes of primary aluminum. A new primary aluminum project with production capacity of 235,000 tonnes is expected to be completed by the end of 2008. |

|

Fushun Aluminum |

|

Fushun Aluminum is situated in Liaoning Province, and is a stand-alone primary aluminum plant. It has an annual production capacity of 140,000 tonnes. In March 2006, we entered into a share transfer agreement with Liaoning Fushun Aluminum Plant to acquire the 100% equity interests in Fushun Aluminum for a consideration of RMB500 million. Fushun Aluminum's primary business is the production of primary aluminum and carbon products. A new primary aluminum project with a production capacity of 1,000,000 tonnes is expected to be completed by the end of 2008. |

|

Shandong Huayu |

|

Shandong Huayu is situated in Shandong Province and is a stand-alone primary aluminum plant. In July 2006, we entered into a share transfer agreement with Shandong Huasheng Jiangquan Group to acquire a 55% equity interest of Shandong Huayu, a subsidiary of Shandong Huasheng Jiangquan Group. Shandong Huayu has a designed annual production capacity of 100,000 tonnes of primary aluminum, and also has other supporting facilities and two 135MW coal-fired generators. |

|

Gansu Hualu |

|

Gansu Hualu is situated in Gansu Province, and is a stand-alone primary aluminum plant. In August 2006, we entered into a share transfer agreement with Baiyin Nonferrous Metal (Group) Co., Ltd. ("Baiyin Nonferrous") and Baiyin Ibis Aluminum Co., Ltd. ("Baiyin Ibis"). Baiyin Nonferrous contributed 127,000 tonnes of primary aluminum smelting and supporting facilities owned by Baiyin Ibis as capital contribution and holds a 49% equity interest in Gansu Hualu, a subsidiary of Baiyin Ibis, and we hold a 51% equity interest in Gansu Hualu. The joint venture has a designed annual production capacity of 140,000 tonnes of primary aluminum in 2007. |

|

Baotou Aluminum |

|

Baotou Aluminum is located in Inner Mongolia Autonomous Region, and is a stand-alone primary aluminum plant. On December 28, 2007, through A Shares issuance and exchange for Baotou Aluminum shares, we acquired 100% of its equity interest of Baotou Aluminum. Baotou Aluminum had a designed annual production capacity of 307,000 tonnes in 2007. Baotou Aluminum has undertaken an expansion project to increase its annual production capacity by 150,000 tonnes. This project is expected to be completed by the end of 2008. |

|

Research Institute |

|

Established in August 1965 and located in Zhengzhou, Henan Province, the Research Institute specializes in aluminum smelting-related research and development. It is the only research institute in China dedicated to light metals research, and has played a key role in bringing about technological innovations in China's aluminum industry. The Research Institute is central to our research and development efforts. The Research Institute operates test facilities, which produce alumina chemical products and primary aluminum. It also provides research and development services to third parties on a contractual basis. Approved by the Ministry of Science and Technology of the PRC in December 2003, Research Institute established National Research Center of Aluminum Refinery Technologies and Engineering. |

|

Competition |

|

- 37 - |

|

|

|

Alumina |

|

As the largest producer of alumina in China, we believe that we will not face significant competition from domestic alumina producers in the immediate future for the following reasons: |

|

International Competition |

|

The tariff rate for alumina and primary aluminum imports has been reduced to nil since January 1, 2008 and August 1, 2007, respectively. China had a net export of approximately 49,400 tonnes of primary aluminum in 2007, representing a 91.0% decrease from 2006. Competition from international suppliers of alumina and primary aluminum is expected to increase. Such competitors are likely to be large, efficient international companies, which generally have lower unit production costs than we do. Some competitors may also consider establishing joint venture companies with local producers in China to gain access to the resources in China and to lower transportation costs. However, certain PRC governmental policies directed at promoting the growth of larger domestic smelters are likely to be retained, and the PRC government encourages large domestic smelters to explore overseas markets. |

|

Research and Development |

|

Our research and development efforts over the years have facilitated the expansion of our production capacity and reduced our unit production costs. We have successfully commercialized our previous research and development results in various technologies. In 2007, we made significant progress in research and development of new methods and technologies, including: various technologies to improve our energy efficiency and decrease production costs, as well as refinery method utilizing low-grade bauxite. We further strengthened the intellectual property management and protection by filing a total of 297 patent applications during the year. |

|

As of December 31, 2007, we owned 406 patents. The major registered patents relate primarily to technologies and know-how, equipment and new products. Once registered, a patent in China for a new invention is valid for 20 years and for a new function or a new design is valid for 10 years from the date of the patent application. |

|

As of December 31, 2007, we owned 26 trademarks, which are used to identify our businesses and products. The trademarks have a term of 10 years. We have entered into a Trademarks License Agreement with Chinalco for the non-exclusive use by Chinalco of two of our trademarks relating to aluminum fabrication. |

|

- 39 - |

|

|

|

Although the PRC has been steadily amending its patent, trademark, and license laws to comply with various international agreements, its laws are still evolving. In its current form, Chinese intellectual property law differs from United States intellectual property law in many significant ways. For instance, the State Intellectual Property Office of the PRC may grant a compulsory license on a patent if it is unable to obtain a license from the patent owner for reasonable terms and within a reasonable time frame. Chinese patent law also provides immunity from damages for an entity that uses or sells a patented product without knowing that it was made or sold without the patentee's permission so long as it proves that the infringing product was obtained from a legitimate source. United States patent law does not offer such provisions. Chinese law also awards patents on a first-to-file system as opposed to the United States' first-to-invent system. Chinese trademark law is similarly based on a first-to-regis ter system as opposed to the United States' first-to-use system. |

|

Moreover, the PRC government and its courts have limited experience in enforcing its intellectual property laws. The current PRC patent and trademark laws have only been in effect for approximately 20 years. Courts in China do not have the same level of experience in enforcing and interpreting intellectual property laws as the courts in the United States. However, the PRC government has created administrative bureaus to resolve administrative and judicial matters relating to patent and trademark infringement disputes. These administrative bureaus also have the power to order an infringing party to cease and desist from such use. |

|

We do not regard any single patent, license, or trademark to be material to our sales and operations as a whole. We have no material patents, licenses, or trademarks the duration of which cannot, in the judgment of our management, be extended as necessary. We are neither involved in any material intellectual property disputes against us nor are we pursuing any legislation relating to intellectual property rights against any party. |

|

Environmental Protection |

|

We are subject to PRC national environmental laws and regulations as well as environmental regulations promulgated by the local governments where we operate. These include regulations on waste discharge, land repair, emissions disposal and mining control. For example, national regulations promulgated by the PRC government set discharge standards for emissions into the air and water. National environmental protection enforcement authorities also promulgate discharge fees for various waste substances. These schedules usually provide for discharge fee increases for each incremental increase of the amount of discharge up to a specified level set by the PRC government or the local government. For any discharge exceeding the specified level, the relevant PRC government agencies may order any of our facilities to rectify certain behavior causing environmental damage, and subject to PRC government approval, the local government has the authority to order any of our facilities to close for failure to comply with e xisting regulations. |

|

Our bauxite mining operations are subject to relevant environmental laws and regulations promulgated by national and local governments, including regulations on waste discharge, land repair, emission management and mining control. |

|

The pollutants discharged from our alumina refining process include red mud, waste water and waste emission of gases and dust. Our primary aluminum production process generates fluorides, pitch fume and dust. It is illegal for such waste to be released into the atmosphere without first being processed. Once processed, the amount of pollutants that can be released is subject to national or local discharge limits. |

|

Each of our alumina refineries and primary aluminum smelters has its own waste treatment facilities on site or has developed other methods to dispose of the industrial waste. In 2006, our Shandong branch, Henan branch, Shanxi branch, Zhongzhou branch, Guangxi branch, Qinghai branch and Lanzhou Aluminum received awards from local governments for their outstanding performances in environment protection. |

|

In 2007, our comprehensive energy consumption of alumina and comprehensive alternating current consumption of aluminum decreased by 1.24% and 1.38%, respectively, as compared with the corresponding period in the previous year, mainly due to our energy-saving efforts by using new production techniques and technologies. |

|

Our total expenditures for environmental protection was RMB69.8 million, RMB105.5 million and RMB533.0 million for the years ended December 31, 2005, 2006 and 2007, respectively. We have been granted ISO14001:1996 accreditations issued by The International Certification Network on December 31, 2004. We believe that our operations are substantially in compliance with currently applicable national and provincial environmental regulations. |

|

- 40 - |

|

|

|

Insurance |

|

We currently maintain insurance coverage on our property, plant and equipment, our transportation vehicles and various assets that we consider to be subject to significant operating risks. |

|

We paid a total of RMB47.4 million, RMB54.6 million and RMB57.6 million in insurance premiums in 2005, 2006 and 2007, respectively. |

|

We are covered under the injury and accidental death insurance provided by the local government labor departments and do not purchase separate insurance policies from commercial insurers with respect to such risks. |

|