UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-10571

BLUE CHIP INVESTOR FUNDS

(Exact name of registrant as specified in charter)

1939 Friendship Drive, Suite C, El Cajon, CA 92020

(Address of principal executive offices) (Zip code)

Ross C. Provence

1939 Friendship Drive, Suite C, El Cajon, CA 92020

(Name and address of agent for service)

Registrant's telephone number, including area code: (619) 588-9700

Date of fiscal year end: December 31

Date of reporting period: December 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e -1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number.

Item 1. Reports to Stockholders.

BLUE CHIP INVESTOR FUND

ANNUAL REPORT

December 31, 2017

Blue Chip Investor Fund

Annual Report

December 31, 2017

Dear Shareholders,

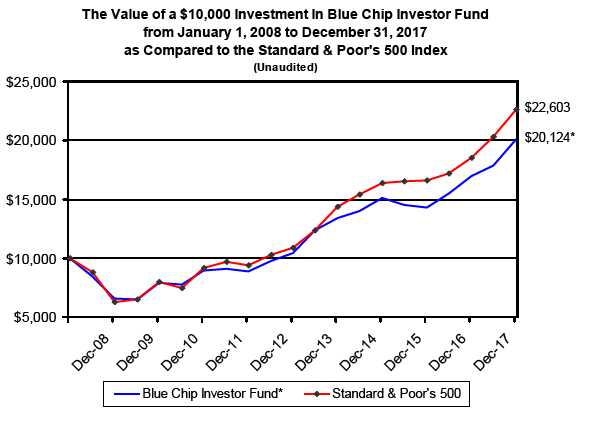

The Blue Chip Investor Fund (the “Fund”) gained 18.50% in 2017, compared to a 21.83% return for the S&P 500. Our trailing five-year and ten-year average annual returns are 14.14% and 7.24%, respectively. These results compare to 15.79% and 8.50%, respectively, for the S&P 500.

We’re generally pleased with these results. The Fund is managed according to “value” investing principles—with an emphasis on price paid versus value received—and this approach can often lag in rapidly rising markets, as participants tend to bid up stock prices with less concern for valuation.

In 2017, stocks went in one direction: up. For the first time in the S&P 500’s over-90-year history, the index rose in every single month of the calendar year. This lack of volatility provides us with a bit of a headwind, as we seek to take advantage of stock market fluctuations, but we nevertheless found more than a few reasonably prudent actions to take during the year.

During 2017 we sold six stocks—CarMax, Cognizant, Harley-Davidson, US Bancorp, Verizon and Wyndham—resulting in realized gains of $1,925,695 against realized losses of $24,530. The Fund’s only realized loss was Verizon, but when dividends are included, this was a profitable investment. Despite these sales, our portfolio turnover was approximately 24%, which is roughly in line with our five-year average. In other words, we believe we continue to manage the Fund tax-efficiently.

While a steadily rising market makes it tough to find undervalued businesses, we managed to acquire seven promising stocks during the year: AutoNation, AutoZone, Brookfield Asset Management, Chipotle Mexican Grill, Cimpress, Cognizant and LKQ. (Cognizant was the only stock we both bought and sold in 2017.) Our recent purchases are typical of our investment approach: buy exceptional businesses, run by first-class management teams, when they’re selling at bargain prices. We already have sizeable gains in most of our new holdings.

At year-end, the Fund held one position with an unrealized loss greater than 10% of our purchase price—IBM. We first acquired the stock in late 2012 and made several purchases since then at prices ranging from $191 to $123, giving us an average cost of $178.39. Including dividends, we’ve just about broken even on IBM, but given its performance relative to the market during our ownership, this stock has been disappointing. That said, we think the company remains an attractive holding. IBM’s mission-critical software and services should remain relevant for years to come, and the firm continues to gain momentum in its “Strategic Imperatives” (cloud, analytics, mobile, security and social) which now account for over 45% of total revenues. Trading at a P/E of 11, with a dividend of 3.6%, we think IBM is cheap.

In prior years, we have dedicated a portion of this letter to review our investment strategy, and we feel it’s important to do so again:

The Fund buys and sells stocks with a business-owner mentality. We view each purchase as if we were buying 100% of the company and retaining management. We try to buy stocks when the cash-on-cash yield is high (prices are low) and sell stocks when the cash-on-cash yield is low (prices are high). This rational, commonsense approach works in dealing with privately held businesses, and we’ve found that it works equally well—if not better—when applied to the stock market.

The types of companies we pursue generally operate easy-to-understand businesses (with fairly predictable futures) in mature industries featuring slow rates of change, and sell products or services likely to remain in high demand for decades. Moreover, these companies typically maintain an edge over the competition—a durable competitive advantage, such as ongoing lower costs, economies of scale, or “high switching costs”—that’s hard to replicate. This competitive edge enables businesses to generate stable cashflow and high returns on capital over the long run. Furthermore, we desire companies that are shrewdly operated and shareholder-friendly. Indeed, we like to partner with management teams that have long-tenures and a sizeable ownership stake in the business. We’ve found that this better aligns their interests with ours, often leading to greater returns.

2017 Annual Report 1

Our recent purchases, described briefly below, fit within this acquisition framework.

AutoNation (AN)

We bought shares of AutoNation, the country’s largest automotive retailer, in mid-2017 at $41.90. At the time of our purchase, concerns regarding declining new-vehicle sales had intensified. Investors didn’t want to be left holding the stock as revenues declined. Our viewpoint is somewhat contrarian. While we agree that the number of new cars sold will likely fall, we think the decline will be moderate, given strong replacement demand (the average vehicle in the U.S. is about 11.5 years old), low unemployment, high consumer confidence and easily available credit.

Additionally, we believe the economics of an auto dealership are largely misunderstood. While the majority of revenues come from selling new vehicles, most of the profits come from parts and services—itself a stable business that generates lots of excess cash in good economic times and bad. (Even during the depths of the financial crisis, AutoNation remained profitable.) Also, while the business requires fairly large investments in real estate and inventory, it needs very little equity capital, which means almost all of the earnings can be used to acquire more dealerships, pay dividends or buyback stock.

AutoNation is led by industry-legend Mike Jackson, who boasts a track record of opportunistically deploying capital in ways that create shareholder value. Since 1998, the firm has repurchased over 80% of its outstanding shares—an amazing feat that highlights the attractive, free-cashflow-producing nature of the business.

AutoZone (AZO)

AutoZone, the nation’s largest auto-parts retailer, is an ideal holding—a high-margin, high-return-on-capital business that’s basically recession-proof. In fact, AutoZone was one of the very few companies that grew revenue and earnings while the economy fell apart in 2008 and 2009. (It was also one of the rare stocks that increased in market value during this period.)

We acquired AZO at an average price of $566.72 after it sold off dramatically following a slowdown in same-store sales, which coincided with increasing competitive pressures from online retailers, like Amazon. Ultimately, we believe Amazon’s attempt to expand into this category will be no easy task. Auto-part sales are very time-sensitive: Most people cannot go a couple hours, let alone a couple of days, without their car. Furthermore, most shoppers require a great deal of customer service. Together, we think these factors represent vital aspects of the auto-part buying experience that online retailers will struggle to match. As for AutoZone’s somewhat sluggish sales growth in 2017, our view is that this had more to do with back-to-back warm winters (which hurts demand for failure and maintenance related parts) than rising threats from e-commerce competitors.

Brookfield Asset Management (BAM)

Brookfield Asset Management is a leading global asset manager, with over $260B under management, specializing in owning and operating long-life, physical assets, including real estate, infrastructure and renewable energy. The firm is exceedingly profitable, maintains a rock-solid balance sheet and is well-managed by an owner-operator, Bruce Flatt, who’s somewhat reminiscent of Warren Buffett. Flatt is a billionaire living in a two-story brick townhouse in a Toronto suburb. Since taking the reins in 2002, Flatt has generated annualized returns of nearly 20%. We acquired the stock at $41.87 —a significant discount to our estimates of intrinsic value—and we think it’s highly likely that the Fund will hold BAM shares for a very long time.

Chipotle Mexican Grill (CMG)

Buffett once said, “The best thing that happens to us is when a great company gets into temporary trouble. We want to buy them when they’re on the operating table.” Well, we think Chipotle is currently in the ER but will eventually exit with its health fully restored.

Chipotle pioneered the “fast casual” restaurant concept, serving meals with simple but high-quality (natural, organic) ingredients, prepared using classic cooking methods, yet served quickly and affordably. The company operates over 2,300 locations and enjoys per-unit economics that are among the best in the industry. Prior to its well-publicized food-safety setbacks (including an E.coli outbreak and several norovirus incidents), Chipotle generated store-level returns on invested capital north of 50%.

2017 Annual Report 2

It’s hard to pinpoint exactly when Chipotle’s business will normalize, but we’re confident that the customers who defected will return. We also think the firm will benefit from recently increasing its prices (long overdue), an expanding digital offering, a largely untapped catering capability and the introduction of new menu items.

While Chipotle appears expensive based on its current P/E ratio, we believe the firm is cheap based on our conservative estimates of future cashflow. We bought the stock at $319.21 and think this represents a good value. Chipotle is exactly the type of company we look for: an easy-to-understand business with mouthwatering economics, a strong balance sheet (debt-free), and a temporary (fixable) challenge that has created an attractive purchase price.

Cimpress (CMPR)

Cimpress—a leading online print firm that specializes in marketing material for individuals and small businesses—exemplifies one of our favorite investment opportunities. The firm dominates a massive industry that’s highly fragmented. This creates a large platform upon which CMPR can produce steady long-term growth as it steals marketshare from disadvantaged competitors.

Cimpress is wisely managed by founder Robert Keane, who owns over 10% of the company. Keane and his team are laser-focused on growing the firm’s intrinsic value over the long term. He has demonstrated a clear, rational approach to capital allocation, with an impressive track record of opportunistically buying back stock, making value-added acquisitions and reinvesting in the business. Keane is among the best managers in our portfolio, and we were able to become partners with him at a good price. Our shares were purchased at $85.72.

LKQ Corp (LKQ)

LKQ a leading global distributor of aftermarket and recycled automotive replacement parts. We like this business: It’s simple, predictable and recession-resistant. This is an industry in which cost-competitiveness and availability drive sales; LKQ has virtually no rivals in either area. The firm is roughly 20 times larger than its closest competitor, and it’s the only distributor with a national footprint. Like Cimpress, LKQ operates in a large, highly fragmented market. This provides a sizeable “open field” in which the firm can grow for several decades.

After dominating the U.S. market, LKQ is now replicating its success in Europe. Thanks to a couple of large acquisitions and solid organic growth, it’s already one of the largest European distributors. LKQ’s management team has been in place for nearly 20 years, and they’re very shareholder-oriented. We bought our shares at $31.52.

Outlook

The stock market has now risen for nine consecutive years. The S&P 500, Dow Jones Industrial Average and NASDAQ Composite are at all-time highs. This situation naturally raises the question: “Aren’t we due for a major correction?” Our response to such inquiries remains as it has always been. We don’t pretend to know where the market is going over the short or intermediate term. We’re fairly confident, however, that the market will be higher five years from now. We’re also quite sure that if we remain patient and disciplined, we’ll be able to identify and acquire shares of multiple undervalued businesses that can provide consistent, long-term growth.

The Fund is entering 2018 with a portfolio that is comprised of what we believe are better-than-average companies (the portfolio’s return on equity is 24% versus the S&P 500’s 13%), selling at lower-than-average prices (the portfolio’s P/E is 14 versus the S&P 500’s 18). Consequently, we think the Fund is positioned to deliver superior returns.

As always, thank you for entrusting us with your capital. We consider it both a serious responsibility and a great privilege.

Sincerely,

| Steven G. Check | Ryan Kinney |

| Co-Portfolio Manager | Co-Portfolio Manager |

2017 Annual Report 3

Blue Chip Investor Fund

PERFORMANCE INFORMATION (Unaudited)

12/31/17 NAV $180.09

AVERAGE ANNUAL RATE OF RETURN (%) FOR THE PERIODS ENDED DECEMBER 31, 2017

| 1 Year(A) | 5 Year(A) | 10 Year(A) | ||||

| Blue Chip Investor Fund | 18.50% | 14.14% | 7.24% | |||

| S&P 500(B) | 21.83% | 15.79% | 8.50% |

The Fund’s total annual fund operating expense ratio, gross of any fee waivers or expense reimbursements, as stated in the fee table of the Prospectus dated May 1, 2017, was 1.44% (net of fee waivers or expense reimbursements it was 1.01%) . The Total Annual Fund Operating Expenses in this fee table will not correlate to the expense ratio in the Fund’s financial highlights because (a) the financial highlights include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in acquired funds, and (b) the gross expense ratio may fluctuate due to changes in net assets and actual expenses incurred during the reported period.

(A) The 1 Year, 5 Year and 10 Year returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions.

(B) The S&P 500 is a broad market-weighted average dominated by blue-chip stocks and is an unmanaged group of stocks whose composition is different from the Fund.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAN THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-877-59-FUNDS.

2017 Annual Report 4

Blue Chip Investor Fund

BLUE CHIP INVESTOR FUND

by Sectors (Unaudited)

(as a percentage of Total Assets)

Proxy Voting Guidelines

(Unaudited)

Check Capital Management, Inc., the Fund’s Advisor, is responsible for exercising the voting rights associated with the securities held by the Fund. A description of the policies and procedures used by the Advisor in fulfilling this responsibility is available without charge on the Fund’s website at www.bluechipinvestorfund.com. It is also included in the Fund’s Statement of Additional Information, which is available on the Securities and Exchange Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies, Form N-PX, relating to portfolio securities during the most recent 12-month period ended June 30th is available without charge, upon request, by calling our toll free number(1-877-59-FUNDS). This information is also available on the Securities and Exchange Commission’s website at http://www.sec.gov.

Availability of Quarterly Schedule of Investments

(Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC’s web site at http://www.sec.gov. The Fund’s Form N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

2017 Annual Report 5

Disclosure of Expenses

(Unaudited)

Shareholders of this Fund incur ongoing costs, including investment advisor fees and other Fund expenses. Although the Fund charges no sales loads or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by Mutual Shareholder Services, LLC, the Fund’s transfer agent. IRA accounts will be charged an $8.00 annual maintenance fee. The following example is intended to help you understand your ongoing costs of investing in the Fund and to compare these costs with similar costs of investing in other mutual funds. The example is based on an investment of $1,000 invested in the Fund on July 1, 2017 and held through December 31, 2017.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6) and then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid by a shareholder for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds' shareholder reports.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as the annual maintenance fee charged to IRA accounts or exchange fees or the expenses of underlying funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Expenses Paid | ||||||

| Beginning | Ending | During the Period* | ||||

| Account Value | Account Value | July 1, 2017 to | ||||

| July 1, 2017 | December 31, 2017 | December 31, 2017 | ||||

| Actual | $1,000.00 | $1,128.98 | $5.37 | |||

| Hypothetical | $1,000.00 | $1,020.16 | $5.09 | |||

| (5% annual return | ||||||

| before expenses) | ||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

2017 Annual Report 6

| Blue Chip Investor Fund | |||||||

| Schedule of Investments | |||||||

| December 31, 2017 | |||||||

| Shares | Fair Value | % of Net Assets | |||||

| COMMON STOCKS | |||||||

| Air Courier Services | |||||||

| 9,000 | FedEx Corporation | $ | 2,245,860 | 5.60 | % | ||

| Asset Manager | |||||||

| 44,000 | Brookfield Asset Management Inc. Class A (Canada) | 1,915,760 | 4.78 | % | |||

| Commercial Printing | |||||||

| 12,000 | Cimpress N.V. (Netherlands) * | 1,438,560 | 3.59 | % | |||

| Communications Equipment | |||||||

| 16,000 | QUALCOMM Incorporated | 1,024,320 | 2.56 | % | |||

| Consumer Finance | |||||||

| 10,000 | American Express Company | 993,100 | 2.48 | % | |||

| Diversified Bank | |||||||

| 30,000 | Wells Fargo & Co. | 1,820,100 | 4.54 | % | |||

| Diversified Companies | |||||||

| 40 | Berkshire Hathaway Inc. Class A * (a) | 11,904,000 | 29.70 | % | |||

| Grain Mill Products | |||||||

| 13,000 | Ingredion Incorporated | 1,817,400 | 4.53 | % | |||

| Household Products | |||||||

| 16,000 | Spectrum Brands Holdings, Inc. | 1,798,400 | 4.49 | % | |||

| Integrated Oil & Gas | |||||||

| 30,000 | Suncor Energy Inc. (Canada) | 1,101,600 | 2.75 | % | |||

| IT Consulting & Other Services | |||||||

| 6,000 | International Business Machines Corporation | 920,520 | 2.30 | % | |||

| Pharmacy Benefit Management | |||||||

| 23,000 | Express Scripts Holding Company * | 1,716,720 | 4.28 | % | |||

| Retail - Apparel & Accessory Stores | |||||||

| 110,000 | Hanesbrands Inc. | 2,300,100 | 5.74 | % | |||

| Retail - Auto & Home Supply Stores | |||||||

| 2,700 | AutoZone, Inc. * | 1,920,699 | 4.79 | % | |||

| Retail - Auto Dealers & Gasoline Stations | |||||||

| 26,000 | AutoNation, Inc. * | 1,334,580 | 3.33 | % | |||

| Retail - Eating Places | |||||||

| 3,600 | Chipotle Mexican Grill, Inc. * | 1,040,508 | 2.60 | % | |||

| Services - Medical Laboratories | |||||||

| 10,000 | Laboratory Corporation of America Holdings * | 1,595,100 | 3.98 | % | |||

| Wholesale - Motor Vehicles & Motor Vehicle Parts & Supplies | |||||||

| 32,000 | LKQ Corporation * | 1,301,440 | 3.25 | % | |||

| Total for Common Stocks (Cost $24,603,476) | 38,188,767 | 95.29 | % | ||||

| Money Market Funds | |||||||

| 1,904,447 | Fidelity Investments Money Market Funds Government | ||||||

| Portfolio Class I 1.15% ** | 1,904,447 | 4.75 | % | ||||

| (Cost - $1,904,447) | |||||||

| Total Investments | 40,093,214 | 100.04 | % | ||||

| (Cost - $26,507,923) | |||||||

| Liabilities in Excess of Other Assets | (17,451 | ) | -0.04 | % | |||

| Net Assets | $ | 40,075,763 | 100.00 | % | |||

| * Non-Income Producing Securities. ** The yield rate shown represents the rate at December 31, 2017. (a) The company's 2016 annual report is available at www.berkshirehathaway.com/reports.html. |

| The accompanying notes are an integral part of these financial statements. |

2017 Annual Report 7

| Blue Chip Investor Fund | |||

| Statement of Assets and Liabilities | |||

| December 31, 2017 | |||

| Assets: | |||

| Investments at Fair Value | $ | 40,093,214 | |

| (Cost - $26,507,923) | |||

| Cash | 5,236 | ||

| Interest Receivable | 1,747 | ||

| Dividends Receivable | 13,224 | ||

| Prepaid Expenses | 3,000 | ||

| Receivable for Shareholder Purchases | 23,625 | ||

| Total Assets | 40,140,046 | ||

| Liabilities: | |||

| Investment Advisory Fee Payable | 26,160 | ||

| Administration Fee Payable | 2,387 | ||

| Other Accrued Expenses | 21,842 | ||

| Payable for Shareholder Redemptions | 13,894 | ||

| Total Liabilities | 64,283 | ||

| Net Assets | $ | 40,075,763 | |

| Net Assets Consist of: | |||

| Paid In Capital | $ | 26,475,865 | |

| Accumulated Undistributed Realized Gain on Investments - Net | 14,607 | ||

| Unrealized Appreciation in Value of Investments Based on Cost - Net | 13,585,291 | ||

| Net Assets, for 222,529 Shares Outstanding | $ | 40,075,763 | |

| (Unlimited shares authorized, without par value) | |||

| Net Asset Value, Offering Price and Redemption Price | |||

| Per Share ($40,075,763/222,529 shares) | $ | 180.09 | |

| Statement of Operations | |||

| For the fiscal year ended December 31, 2017 | |||

| Investment Income: | |||

| Dividends (Net of foreign withholding tax of $5,381) | $ | 299,326 | |

| Interest | 25,105 | ||

| Total Investment Income | 324,431 | ||

| Expenses: | |||

| Investment Advisory Fees | 360,473 | ||

| Transfer Agent & Accounting Fees | 40,104 | ||

| Administration Fees | 25,304 | ||

| Legal Fees | 18,000 | ||

| Audit & Tax Fees | 18,000 | ||

| Custody Fees | 8,393 | ||

| Registration Fees | 8,361 | ||

| Trustee Fees | 4,000 | ||

| Other Fees | 2,326 | ||

| Insurance Expense | 1,065 | ||

| Printing and Postage Expense | 809 | ||

| Total Expenses | 486,835 | ||

| Less: Advisory Fee Waiver | (126,362 | ) | |

| Net Expenses | 360,473 | ||

| Net Investment Loss | (36,042 | ) | |

| Realized and Unrealized Gain on Investments: | |||

| Net Realized Gain on Investments | 2,262,920 | ||

| Net Change in Unrealized Appreciation on Investments | 4,078,791 | ||

| Net Realized and Unrealized Gain on Investments | 6,341,711 | ||

| Net Increase in Net Assets from Operations | $ | 6,305,669 | |

| The accompanying notes are an integral part of these financial statements. |

2017 Annual Report 8

| Blue Chip Investor Fund | ||||||||

| Statements of Changes in Net Assets | ||||||||

| 1/1/2017 | 1/1/2016 | |||||||

| to | to | |||||||

| 12/31/2017 | 12/31/2016 | |||||||

| From Operations: | ||||||||

| Net Investment Income (Loss) | $ | (36,042 | ) | $ | 93,753 | |||

| Net Realized Gain on Investments | 2,262,920 | 1,812,871 | ||||||

| Net Change in Unrealized Appreciation on Investments | 4,078,791 | 3,158,771 | ||||||

| Net Increase in Net Assets from Operations | 6,305,669 | 5,065,395 | ||||||

| From Distributions to Shareholders: | ||||||||

| Net Investment Income | (16,581 | ) | (83,582 | ) | ||||

| Net Realized Gain from Investment Transactions | (2,212,271 | ) | (1,812,869 | ) | ||||

| Change in Net Assets from Distributions | (2,228,852 | ) | (1,896,451 | ) | ||||

| From Capital Share Transactions: | ||||||||

| Proceeds From Sale of Shares | 4,440,228 | 3,533,573 | ||||||

| Shares Issued on Reinvestment of Dividends | 2,228,852 | 1,896,451 | ||||||

| Cost of Shares Redeemed | (3,019,376 | ) | (2,867,886 | ) | ||||

| Net Increase from Shareholder Activity | 3,649,704 | 2,562,138 | ||||||

| Net Increase in Net Assets | 7,726,521 | 5,731,082 | ||||||

| Net Assets at Beginning of Period | 32,349,242 | 26,618,160 | ||||||

| Net Assets at End of Period (Including accumulated undistributed | $ | 40,075,763 | $ | 32,349,242 | ||||

| net investment income of $0 and $16,581, respectively) | ||||||||

| Share Transactions: | ||||||||

| Issued | 26,551 | 22,994 | ||||||

| Reinvested | 12,325 | 11,768 | ||||||

| Redeemed | (17,497 | ) | (18,562 | ) | ||||

| Net Increase in Shares | 21,379 | 16,200 | ||||||

| Shares Outstanding Beginning of Period | 201,150 | 184,950 | ||||||

| Shares Outstanding End of Period | 222,529 | 201,150 | ||||||

| Financial Highlights | ||||||||||||||||||||

| Selected data for a share outstanding | 1/1/2017 | 1/1/2016 | 1/1/2015 | 1/1/2014 | 1/1/2013 | |||||||||||||||

| throughout the period: | to | to | to | to | to | |||||||||||||||

| 12/31/2017 | 12/31/2016 | 12/31/2015 | 12/31/2014 | 12/31/2013 | ||||||||||||||||

| Net Asset Value - | ||||||||||||||||||||

| Beginning of Period | $ | 160.82 | $ | 143.92 | $ | 161.10 | $ | 147.46 | $ | 114.51 | ||||||||||

| Net Investment Income (Loss) (a) | (0.17 | ) | 0.50 | 0.10 | (0.10 | ) | (0.39 | ) | ||||||||||||

| Net Gains or (Losses) on Investments | ||||||||||||||||||||

| (realized and unrealized) | 29.97 | 26.33 | (8.06 | ) | 18.78 | 33.34 | ||||||||||||||

| Total from Investment Operations | 29.80 | 26.83 | (7.96 | ) | 18.68 | 32.95 | ||||||||||||||

| Distributions (From Net Investment Income) | (0.08 | ) | (0.44 | ) | (0.06 | ) | 0.00 | 0.00 | + | |||||||||||

| Distributions (From Capital Gains) | (10.45 | ) | (9.49 | ) | (9.16 | ) | (5.04 | ) | 0.00 | |||||||||||

| Total Distributions | (10.53 | ) | (9.93 | ) | (9.22 | ) | (5.04 | ) | 0.00 | |||||||||||

| Net Asset Value - | ||||||||||||||||||||

| End of Period | $ | 180.09 | $ | 160.82 | $ | 143.92 | $ | 161.10 | $ | 147.46 | ||||||||||

| Total Return ++ | 18.50% | 18.63% | (5.01)% | 12.64% | 28.78% | |||||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net Assets - End of Period (Thousands) | $ | 40,076 | $ | 32,349 | $ | 26,618 | $ | 26,631 | $ | 22,742 | ||||||||||

| Before Reimbursement | ||||||||||||||||||||

| Ratio of Expenses to Average Net Assets | 1.35% | 1.43% | 1.47% | 1.46% | 1.57% | |||||||||||||||

| Ratio of Net Investment Income (Loss) to | ||||||||||||||||||||

| Average Net Assets | -0.45% | -0.11% | -0.40% | -0.46% | -0.60% | |||||||||||||||

| After Reimbursement | ||||||||||||||||||||

| Ratio of Expenses to Average Net Assets | 1.00% | 1.00% | 1.00% | 1.08% | 1.27% | |||||||||||||||

| Ratio of Net Investment Income (Loss) to | ||||||||||||||||||||

| Average Net Assets | -0.10% | 0.32% | 0.06% | -0.07% | -0.29% | |||||||||||||||

| Portfolio Turnover Rate | 24.16% | 20.72% | 20.41% | 20.07% | 22.66% | |||||||||||||||

| (a) Per share amounts calculated using the average shares method. + Per share amount less than $0.005. ++ Total return represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of all dividends and distributions. |

| The accompanying notes are an integral part of these financial statements. |

2017 Annual Report 9

NOTES TO FINANCIAL STATEMENTS

BLUE CHIP INVESTOR FUND

December 31, 2017

1.) ORGANIZATION

Blue Chip Investor Fund (the “Fund”) is a non-diversified series of the Blue Chip Investor Funds (the “Trust”), formerly Premier Funds. The Trust is an open-end investment company. The Trust was organized in Ohio as a business trust on November 1, 2001 and may offer shares of beneficial interest in a number of separate series, each series representing a distinct fund with its own investment objectives and policies. The Fund commenced operations on January 1, 2002. At present, the Fund is the only series authorized by the Trust. The Fund’s investment objective is to seek long-term growth of capital. The Advisor to the Fund is Check Capital Management, Inc. (the “Advisor”).

2.) SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows the significant accounting policies described in this section.

SECURITY VALUATION

All investments in securities are recorded at their estimated fair value, as described in Note 3.

FEDERAL INCOME TAXES

The Fund’s policy is to continue to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all of its taxable income to shareholders. Therefore, no federal income tax provision is required. It is the Fund’s policy to distribute annually, prior to the end of the calendar year, dividends sufficient to satisfy excise tax requirements of the Internal Revenue Code. This Internal Revenue Code requirement may cause an excess of distributions over the book year-end accumulated income. In addition, it is the Fund’s policy to distribute annually, after the end of the fiscal year, any remaining net investment income and net realized capital gains.

The Fund recognizes the tax benefits of certain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years. The Fund identifies its major tax jurisdictions as U.S. Federal tax authorities; however the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the fiscal year ended December 31, 2017, the Fund did not incur any interest or penalties.

SHARE VALUATION

The net asset value (the “NAV”) is generally calculated as of the close of trading on the New York Stock Exchange (the “Exchange”) (normally 4:00 p.m. Eastern time) every day the Exchange is open. The NAV is calculated by taking the total value of the Fund’s assets, subtracting its liabilities, and then dividing by the total number of shares outstanding, rounded to the nearest cent. The offering price and redemption price per share are equal to the net asset value per share.

DISTRIBUTIONS TO SHAREHOLDERS

Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expenses or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value per share of the Fund. At December 31, 2017, the following permanent adjustments were recorded. Such adjustments were attributed to the reclassification of net investment loss.

| Accumulated Undistributed Net Investment Income | $36,042 | ||

| Accumulated Undistributed Realized Gain on Investments - Net | ($36,042 | ) |

2017 Annual Report 10

Notes to Financial Statements - continued

USE OF ESTIMATES

The financial statements are prepared in accordance with GAAP, which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

OTHER

The Fund records security transactions based on trade date. Dividend income is recognized on the ex-dividend date. Interest income and expense is recognized on an accrual basis. The Fund uses the specific identification method in computing gain or loss on sale of investment securities. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations.

3.) SECURITIES VALUATIONS

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 - Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

FAIR VALUE MEASUREMENTS

A description of the valuation techniques applied to the Fund’s major categories of assets measured at fair value on a recurring basis follows.

Equity securities (common stocks). Equity securities generally are valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Advisor believes such prices accurately reflect the fair value of such securities. Securities that are traded on any stock exchange or on the NASDAQ over-the-counter market are generally valued by the pricing service at the last quoted sale price. Lacking a last sale price, an equity security is generally valued by the pricing service at its last bid price. Generally, if the security is traded in an active market and is valued at the last sale price, the security is categorized as a level 1 security. When market quotations are not readily available, when the Advisor determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or when restricted securities are being valued, such securities are valued as determined in good faith by the Advisor, subject to review of the Board of Trustees (the “Trustees” or the “Board”) and are categorized in level 2 or level 3, when appropriate.

Money market funds. Money market funds are valued at net asset value and are classified in level 1 of the fair value hierarchy.

2017 Annual Report 11

Notes to Financial Statements - continued

In accordance with the Trust’s good faith pricing guidelines, the Advisor is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. There is no single standard for determining fair value, since fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Advisor would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods.

The following table summarizes the inputs used to value the Fund’s assets measured at fair value as of December 31, 2017:

| Valuation Inputs of Assets | Level 1 | Level 2 | Level 3 | Total | ||||

| Common Stocks | $38,188,767 | $0 | $0 | $38,188,767 | ||||

| Money Market Funds | 1,904,447 | 0 | 0 | 1,904,447 | ||||

| Total | $40,093,214 | $0 | $0 | $40,093,214 |

Refer to the Fund’s Schedule of Investments for a listing of securities by industry. The Fund did not hold any level 2 or level 3 assets during the fiscal year ended December 31, 2017. There were no transfers into or out of the levels during the fiscal year ended December 31, 2017. It is the Fund’s policy to consider transfers into or out of each level as of the end of the reporting period.

The Fund did not invest in any derivative instruments during the fiscal year ended December 31, 2017.

4.) INVESTMENT ADVISORY AGREEMENT

The Fund has entered into an investment advisory agreement (the “Management Agreement”) with the Advisor, Check Capital Management, Inc. Under the terms of the Management Agreement, the Advisor manages the investment portfolio of the Fund, subject to policies adopted by the Trustees. Under the Management Agreement, the Advisor, at its own expense and without reimbursement from the Trust, furnishes office space and all necessary office facilities, equipment and executive personnel necessary for managing the assets of the Fund. The Advisor also pays the salaries and fees of all of its officers and employees that serve as officers and trustees of the Trust. For its services, the Advisor receives an annual investment management fee from the Fund of 1.00% of the average daily net assets of the Fund which is payable monthly. As a result of the above calculation, for the fiscal year ended December 31, 2017, the Advisor earned management fees totaling $360,473, before the waiver of fees and/or reimbursement of expenses described below. Effective May 1, 2014, the Advisor has contractually agreed to waive management fees and reimburse expenses to the extent necessary to maintain total annual operating expenses of the Fund (excluding brokerage fees, commissions, interest and other borrowing expenses, taxes, extraordinary expenses and the indirect costs of investing in acquired funds) at 1.00% of its average daily net assets through April 30, 2018. There are no provisions for recoupment for any of the contractual waivers entered into by the Advisor. The Advisor waived and/or reimbursed expenses of $126,362 for the fiscal year ended December 31, 2017. At December 31, 2017, the Fund owed the Advisor $26,160.

5.) RELATED PARTY TRANSACTIONS

The Fund has entered into an administration servicing agreement with Premier Fund Solutions, Inc. (the “Administrator”). The Fund pays 0.07% on the first $200 million of assets, 0.05% on the next $500 million of assets and 0.03% on assets above $500 million subject to a minimum monthly fee of $2,000. The Fund also pays all out-of-pocket expenses directly attributable to the Fund. Jeffrey R. Provence of the Administrator is also an officer and trustee of the Fund. For the fiscal year ended December 31, 2017, the Administrator earned $25,304. At December 31, 2017, the Fund owed the Administrator $2,387.

6.) PURCHASES AND SALES OF SECURITIES

For the fiscal year ended December 31, 2017, purchases and sales of investment securities other than U.S. Government obligations and short-term investments aggregated $9,934,504 and $7,928,864, respectively. Purchases and sales of U.S. Government obligations aggregated $0 and $0, respectively.

2017 Annual Report 12

Notes to Financial Statements - continued

7.) CONTROL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of December 31, 2017, Charles Schwab & Co. Inc., located in San Francisco, California, held for the benefit of others, in aggregate, 60.29% of the Fund, and thus may be deemed to control the Fund. Also, National Financial Services, LLC, located at 200 Liberty Street, New York, New York, held for the benefit of others, in aggregate, 38.55% of the Fund, and thus may be deemed to control the Fund.

8.) TAX MATTERS

For Federal income tax purposes, the cost of investments owned at December 31, 2017 was $26,507,923. At December 31, 2017, the composition of unrealized appreciation (the excess of value over tax cost) and depreciation (the excess of tax cost over value) was as follows:

| Appreciation | (Depreciation) | Net Appreciation | |||

| $14,344,542 | ($759,251) | $13,585,291 |

As of December 31, 2017, there were no differences between book basis and tax basis. The tax character of distributions paid during fiscal year 2017 and 2016 was as follows. Distributions paid from:

| 2017 | 2016 | ||||

| Ordinary Income | $ | 1,119,919 | $ | 289,742 | |

| Long-term Capital Gains | 1,108,933 | 1,606,709 | |||

| $ | 2,228,852 | $ | 1,896,451 |

As of December 31, 2017, the components of distributable earnings on a tax basis were as follows:

| Accumulated Undistributed Ordinary Income | $ | 14,607 |

| Unrealized Appreciation | 13,585,291 | |

| $ | 13,599,898 |

9.) LOAN AGREEMENT

A loan agreement, subject to certain covenants and restrictions, is in place between the Fund and its custodian, U.S. Bank, N.A. The Fund may seek to obtain loans for the purpose of funding redemptions or purchasing securities up to the lesser of $6,500,000 or the maximum amount that the Fund is permitted to borrow under the Investment Company Act of 1940 using the securities in its portfolio as collateral and allowing U.S. Bank, N.A. the right to setoff to those securities. The maximum interest rate of such loans is set at a rate per annum equal to U.S. Bank’s prime–lending rate (which is 4.50%) . During the fiscal year ended December 31, 2017 the Fund had an average loan balance of $0. As of December 31, 2017 there was no outstanding loan balance. No compensating balances are required. The loan matured on February 11, 2018. The loan was renewed through February 10, 2019 and the line of credit was increased to $10,000,000.

10.) SUBSEQUENT EVENTS

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has concluded that there is no impact requiring adjustment to or disclosure in the financial statements, except as disclosed in Note 9.

2017 Annual Report 13

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

Blue Chip Investor Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Blue Chip Investor Fund (the “Fund”) as of December 31, 2017, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the five years in the period then ended, (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of Blue Chip Investor Fund as of December 31, 2017, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits include performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and confirmation of securities owned as of December 31, 2017, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion. We have served as the Fund’s auditor since 2004.

COHEN & COMPANY, LTD.

Cleveland, Ohio

February 16, 2018

2017 Annual Report 14

ADDITIONAL INFORMATION

December 31, 2017

(UNAUDITED)

APPROVAL OF INVESTMENT ADVISORY AGREEMENT

On December 7, 2017 the Board of Trustees (the “Board” or the “Trustees”) considered the renewal of the Management Agreement (the “Agreement”) between the Advisor and the Trust, on behalf of the Fund. The Board reviewed the memorandum provided by legal counsel, noting that, in consideration of the continuance of the management agreement, the Board should review as much information as is reasonably necessary to evaluate the terms of the contract and determine whether it is fair to the Fund and its shareholders. The Board also reviewed the information provided by the Advisor to the Trustees for evaluation of continuance of the Agreement.

In renewing the Management Agreement, the Board of Trustees received material from the Advisor (the “Report”) addressing the following factors: (i) the investment performance of the Fund and the Advisor; (ii) the nature, extent and quality of the services provided by the investment Advisor to the Fund; (iii) the cost of the services to be provided and the profits to be realized by the Advisor and its affiliates from the relationship with the Fund; (iv) the extent to which economies of scale will be realized as the fund grows; and (v) whether the fee levels reflect these economies of scale to the benefit of shareholders.

As to the performance of the Fund, the Report included information regarding the performance of the Fund compared to a group of funds of similar size, style and objective (the “Peer Group”) as well as the Morningstar category average for the Fund. The Report also included comparative performance information for other accounts managed by the Advisor and the Fund’s benchmark index, the S&P 500® Index (the “Index”), and the Peer Group for the period ended September 30, 2017. The data showed that the Fund lagged the Index for the one, three, five and ten year periods. The data showed that the Fund’s performance was above the Peer Group for the one, three, five and ten year periods. The data also showed that the Fund’s performance was above the category average for the three year period while the Fund slightly lagged the category average for the one, five and ten year periods. The Trustees reviewed the information and concluded that the Fund’s performance was acceptable.

As for the nature, extent and quality of the services provided by the Advisor, the Trustees discussed the Advisor’s experience and capabilities. The representatives of the Advisor reviewed and discussed with the Board the Advisor’s Form ADV and the 17j-1 certifications. They summarized the information provided in the Report regarding matters such as the Advisor’s financial condition and investment personnel. The Trustees noted that while the Advisor employs a line of credit, it did not represent excessive leverage. They also discussed each portfolio manager’s background and investment management experience. Furthermore, they reviewed the Advisor’s financial information and discussed the firm’s ability to meet its obligations under the Agreement. The Board concluded that the nature and extent of the services provided by the Advisor were consistent with their expectations, that they were satisfied with the quality of services provided by the Advisor, and that the Advisor has the resources to meet its obligations under the Agreement. They noted that both the portfolio management and the Chief Compliance Officer services were acceptable.

As to the fee charged and costs of the services provided, the Board reviewed the fees under the Agreement compared to the Peer Group, the Fund’s category average and fees charged to other clients of the Advisor. The Board noted that the current net expense ratio was below the Peer Group and similar to the category average. The information showed that the management fee was above the Peer Group, but within the range of the Peer Group. The Board concluded that the advisory fee was reasonable, particularly in light of the Fund’s size and the net management fees received after waivers. The Board also reviewed a profit and loss analysis prepared by the Advisor that analyzed the expenses incurred by the Advisor in managing the Fund and the total revenue derived by the Advisor from the Fund. The Trustees noted that the Advisor did not utilize an affiliated broker and received no soft dollar benefits. The Trustees concluded that the Advisor was not overly profitable.

2017 Annual Report 15

Additional Information (Unaudited) - continued

As to the economies of scale, it was noted that the Advisor capped the Fund’s expenses during the previous period, excluding certain expenses, and will cap the Fund’s expenses for an additional one year period. The Trustees also noted they will revisit the issue of economies of scale as Fund assets grow. Next, the independent Trustees met in executive session to discuss the continuation of the Agreement. The officers of the Trust were excused during this discussion.

Upon reconvening the meeting, it was the consensus of the Trustees, including the disinterested Trustees, that renewal of the Management Agreement would be in the best interests of the Fund and the shareholders. Resolutions were then approved by unanimous vote of the disinterested Trustees and thereafter all the Trustees.

2017 Annual Report 16

This page was intentionally left blank.

2017 Annual Report 17

TRUSTEES AND OFFICERS

(Unaudited)

The Board of Trustees supervises the business activities of the Trust. The names of the Trustees and executive officers of the Trust are shown below. Each Trustee who is an “interested person” of the Trust, as defined in the Investment Company Act of 1940, is indicated by an asterisk. Each Trustee serves until the Trustee sooner dies, resigns, retires or is removed. Officers hold office for one year and until their respective successors are chosen and qualified.

The trustees and officers of the Trust and their principal business activities during the past five years are:

Interested Trustees and Officers

| Other | |||||

| Principal | Number of | Directorships | |||

| Name, | Position | Length of | Occupation(s) | Portfolios | Held By |

| Address, | with the | Time Served | During | Overseen | Trustee During |

| and Year of Birth | Trust | Past 5 Years | By Trustee | the | |

| Past 5 Years | |||||

| Ross C. Provence*, (1938) | President, | Since 2001 | General Partner and Portfolio | 1 | PFS Funds |

| 1939 Friendship Drive, | Trustee and | Manager for Value Trend Capital | |||

| Suite C, El Cajon, | Chairman | Management, LP (1995 to current). | |||

| California 92020 | Estate planning attorney (1963 to | ||||

| current). | |||||

| Jeffrey R. Provence*, | Secretary, | Since 2001 | CEO, Premier Fund Solutions, Inc. | 1 | PFS Funds |

| (1969) | Treasurer | (2001-Present). General Partner and | Meeder Funds | ||

| 1939 Friendship Drive, | and Trustee | Portfolio Manager for Value Trend | |||

| Suite C, El Cajon, | Capital Management, LP (1995 to | ||||

| California 92020 | current). | ||||

| Jock Meeks, (1956) | Chief | Since 2004 | Client Services Director for Check | N/A | N/A |

| 575 Anton Blvd., Ste. 500 | Compliance | Capital Management (2004 to cur- | |||

| Costa Mesa, CA 92626 | Officer | rent). | |||

* Ross C. Provence and Jeffrey R. Provence are considered "interested persons" as defined in Section 2(a)(19) of the Investment

Company Act of 1940 due to their positions as officers of the Trust. Ross C. Provence is the father of Jeffrey R. Provence.

Independent Trustees

| Other | |||||

| Principal | Directorships | ||||

| Name, | Position | Length of | Occupation(s) | Number of | Held By |

| Address, | with the | Time Served | During | Portfolios | Trustee During |

| and Year of Birth | Trust | Past 5 Years | Overseen | the | |

| By Trustee | Past 5 Years | ||||

| Allen C. Brown, (1943) | Independent | Since 2001 | Law Office of Allen C. Brown, | 1 | PFS Funds |

| 222 West Madison Ave., | Trustee | Estate planning and business | |||

| El Cajon, California 92020 | attorney (1970 to current). | ||||

| George Cossolias, | Independent | Since 2001 | Partner of CWDL, CPAs (February | 1 | PFS Funds |

| CPA, (1935) | Trustee | 1, 2014 to current). Owner of | |||

| 5151 Murphy Canyon | George Cossolias & Company, | ||||

| Road, Suite 135, | CPAs (1972 to January 31, 2014). | ||||

| San Diego, CA 92123 | President of Lubrication Specialists, | ||||

| Inc. (1996 to current). | |||||

The Statement of Additional Information contains additional and more detailed information about the trustees and is available without charge by calling the transfer agent at 1-877-59-FUNDS.

2017 Annual Report 18

Board of Trustees

|

| This report is provided for the general information of the shareholders of the Blue Chip Investor Fund. This report is not intended for distribution to prospective investors in the Fund, unless preceded or accompanied by an effective prospectus. |

BLUE CHIP INVESTOR FUND

575 Anton Boulevard, Suite 500

Costa Mesa, California 92626

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and the principal financial officer. The registrant has not made any amendments to its code of ethics during the covered period. The registrant has not granted any waivers from any provisions of the code of ethics during the covered period. A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees has determined that George Cossolias is an audit committee finical expert. Mr. Cossolias is independent for purposes of this Item 3.

Item 4. Principal Accountant Fees and Services.

(a-d) The following table details the aggregate fees billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant to the registrant. The principal accountant has provided no services to the adviser or any entity controlled by, or under common control with the adviser that provides ongoing services to the registrant.

| FYE 12/31/17 | FYE 12/31/16 | |||

| Audit Fees | $14,750 | $14,750 | ||

| Audit-Related Fees | $0 | $0 | ||

| Tax Fees | $2,500 | $2,500 | ||

| All Other Fees | $750 | $750 |

Nature of Tax Fees: preparation of Excise Tax Statement and 1120 RIC.

Nature of All Other Fees: Review of Semi-Annual Report.

(e) (1) The audit committee approves all audit and non-audit related services and, therefore, has not adopted pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X.

(e) (2) None of the services described in paragraph (b) through (d) of this Item were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g) The following table indicates the aggregate non-audit fees billed by the registrant’s principal accountant for services to the registrant , the registrant’s investment adviser (not sub-adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant, for the last two years.

| Non-Audit Fees | FYE 12/31/17 | FYE 12/31/16 | ||

| Registrant | $3,250 | $3,250 | ||

| Registrant’s Investment Adviser | $0 | $0 |

(h) The principal accountant provided no services to the investment adviser or any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant.

Item 5. Audit Committee of Listed Companies. Not applicable.

Item 6. Schedule of Investments. Schedule filed with Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. Not applicable.

Item 8. Portfolio Managers of Closed End Management Investment Companies. Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Companies and Affiliated Purchasers. Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant has not adopted procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 11. Controls and Procedures.

(a) The registrant’s president and chief financial officer concluded that the disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) were effective as of a date within 90 days of the filing date of this report, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the Act.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the registrant’s second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Code of Ethics. Filed herewith.

(a)(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(a)(3) Not applicable.

(b) Certification pursuant to Section 906 Certification of the Sarbanes-Oxley Act of 2002. Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Blue Chip Investor Funds |

| By: /s/Ross C. Provence Ross C. Provence President |

| Date: 2/22/18 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: /s/Ross C. Provence Ross C. Provence President |

| Date: 2/22/18 |

By: /s/Jeffrey R. Provence |

| Date: 2/22/18 |