UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number811-10571

BLUE CHIP INVESTOR FUNDS

(Exact name of registrant as specified in charter)

1939 Friendship Drive, Suite C, El Cajon, CA 92020

(Address of principal executive offices) (Zip code)

Ross C. Provence

1939 Friendship Drive, Suite C, El Cajon, CA 92020

(Name and address of agent for service)

Registrant’s telephone number, including area code:(619) 588-9700

Date of fiscal year end:December 31

Date of reporting period:December 31, 2018

Item 1. Reports to Stockholders.

BLUECHIPINVESTORFUND

ANNUALREPORT

December 31, 2018

IMPORTANT NOTE:Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically by calling or sending an email request.

You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling or sending an email request. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Blue Chip Investor Fund Annual Report December 31, 2018 |

Dear Shareholders,

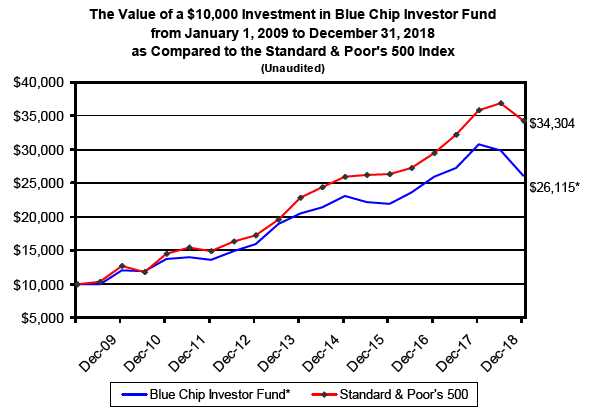

The Blue Chip Investor Fund (the “Fund”) decreased 15.2% in 2018, while the S&P 500 Index (the “S&P 500”) declined 4.4% . Our trailing five-year and ten-year annualized returns are 5.0% and 10.1%, respectively. These results compare to 8.5% and 13.1%, respectively, for the S&P 500.

It was a frustrating year for the Fund. We certainly made some mistakes in 2018—for example, buying General Electric (discussed later)—but we believe our recent underperformance primarily derives from a significant disconnect between the price and value of many of our holdings.

At year-end, the Fund owned a handful of stocks that were selling at or near five-year lows, despite earnings beingat or near all-time highs. The most egregious example is Alliance Data Systems (ADS). During the last five years, the firm has increased its earnings 127% (excluding non-cash items), yet its stock price over this period has declined 43%. In 2018 alone, shares were down 41% while earnings likely grew more than 15% (full-year results still pending).

Consequently, our portfolio is now trading at a price-to-earnings (P/E) ratio of 11 versus the S&P 500’s P/E of 16, notwithstanding the Fund being comprised of better-than-average companies (when comparing objective measurements, such as marketshare and return-on-equity) that achieve above-average growth.

The situation is unpleasant, but we remain optimistic that it’ll correct itself in due course. We gain solace from Ben Graham’s well-known maxim: “In the short-run the market is a voting machine, but in the long-run it’s a weighing machine.” Ultimately, a company’s earnings drive its stock price, though the movement of the two will seldom be in lockstep.

YEAR IN REVIEW

The stock market was fairly turbulent in 2018. On two separate occasions, the S&P 500 suffered a peak-to-trough decline of 10% or more. In fact, the most recent decline, which began in late September and ended on Christmas Eve, reached 20% (intra-day), pushing the S&P 500 into “Bear Market” territory1. Furthermore, during the year,over halfof the companies in the S&P 500 at some point fell at least30%from their highs.

While history suggests that this level of market volatility isn’t abnormal, it was a dramatic reversal from 2017, a year in which the greatest drop was only 2.8% . To put this in perspective, in 2018, there were multipledaysthat concluded with the market down over 2.8%, with the biggest single-day decline being 4.1% .

Seasoned shareholders know that we’re undisturbed by such market swings and generally respond with overall equanimity. Better still, we seek to take advantage of volatility, which provides us with opportunities to buy stocks for less—sometimesfarless—than what a knowledgeable buyer would be able to pay for the entire business in a private transaction.

PORTFOLIO ACTIVITY

During the year, the Fund purchased six new stocks—Alliance Data Systems, CarMax, General Electric, Naspers, T. Rowe Price and U.S. Bancorp—four of which we continue to hold. We provide some high-level commentary on these holdings later on.

In addition to buying a few new stocks, the volatile market allowed us to acquire more shares of stocks we already owned at even cheaper prices. Throughout the year, we added to Brookfield Asset Management, LKQ Corp, Spectrum Brands and Suncor.

Annual turnover for the Fund remains relatively low at 27%. In 2018, we sold six stocks—AutoZone, Chipotle, Express Scripts (acquired by Cigna), General Electric, LabCorp and U.S. Bancorp—resulting in realized gains of $2,013,194 versus realized losses of $199,275. The Fund’s only loser was General Electric, which we bought in early 2018 at $14.66 and sold on October 1 at $12.20, resulting in a loss of 16% (including dividends).

1A “Bear Market” is defined as a decline of 20% or more.

2018 Annual Report 1

Our rationale for buying General Electric was straightforward: GE is among the best-known and well-respected companies in the world, with leading franchises in power turbines, jet engines and medical equipment: oligopoly markets that feature attractive economics and high barriers to entry.

We recognized that the firm’s Power unit faced severe challenges (a turbine market with much more supply than demand), but we believed management had a solid plan to stabilize the business and return to growth within 12 to 18 months. In the meantime, we thought: a) the jet engine and medical device units—which are one-of-a-kind assets—would enable the firm to generate strong cashflow, b) non-core asset sales totaling $20 billion would sufficiently strengthen the balance sheet, and c) incoming CEO John Flannery was the right man for the job.

In hindsight, we were wrong…

The Power unit’s problems escalated because of weaker-than-expected demand and reports of turbine failures. On October 1, GE announced a $23 billion write-down on GE Power, lower expected full-year earnings and the ouster of John Flannery. This news came as a major blow. We initially believed the Power issues were more cyclical than secular, but we’re now unsure. We don’t know how long GE Power will take to turn around, and we don’t know what the “normalized” earnings will be. In the end, if we can’t estimate a company’s future earnings, we can’t value it, and what we can’t value we can no longer buy or continue to hold.

To be clear, we don’t believe a negative outcome in and of itself means a mistake was made. Consider: If you were given 3-to-1 odds on a coin flip and lost, you’d experience a bad outcome but the decision to bet would’ve still been good. This is a very attractive proposition: Each time you’re wrong you lose $1, but when you’re right you win $3 and the odds are that you’ll winhalfyour bets. Given enough chances, you’d eventually win a lot of money, while assuming minimal risk. (The mistake would be to pass up such a deal.)

InThinking in Bets—a book we strongly recommend—author (and former professional poker player) Annie Duke explains, “What makes a decision great is not that it has a great outcome. A great decision is the result of a good process.” And naturally a good process will, over time, lead to more great outcomes.

General Electric was a mistake not because we lost money but because we drifted from one of our core principles: investing only in businesses with reasonably predictable futures. GE’s fortunes ended up being much harder to forecast than we imagined.

INVESTMENT STRATEGY

In prior years, we’ve dedicated a portion of this letter to a review our investment strategy and will continue doing so because of the benefits to our investors:

The Fund employs a value-oriented, long-term investment approach. We buy and sell stocks with abusiness-ownermentality, essentially viewing each purchase as if we were buying the entire business and retaining management.

When making investment decisions, we ignore political and macroeconomic forecasts. There are no attempts to “time the market”, i.e., try to predict near-term stock price movements (a fool’s errand). Instead, we focus on identifying exceptional, hard-to-replicate businesses—run by shrewd, shareholder-friendly management teams—capable of delivering consistent, long-term growth. Even when such companies are identified, their stocks are only purchased when selling at a discount to our estimates of their intrinsic value.

We disregard conventional diversification dogma and instead concentrate on our most promising investment opportunities. The Fund currently owns 18 stocks, with the top 10 positions accounting for75%of the portfolio. (Statistics show that a portfolio of only 16 stocks captures 93% of the diversification benefits arising from owning the entire market.) We generally hold our stocks for three-to-five years or longer. For instance, we’ve owned Berkshire Hathaway and Wells Fargo for over 15 years.

The stocks we purchased last year were prototypical of our investment strategy:

2018 Annual Report 2

Alliance Data Systems (ADS) – 4% of Assets

While not a household name, Alliance Data Systems touches millions of people’s lives every day. The firm is a leading issuer of private-label credit cards, boasting over 40 million active accounts. It also manages loyalty rewards programs and data-driven marketing campaigns for more than 1,000 companies around the world, including the ubiquitous loyalty program, AIR MILES, which countstwo-thirdsof Canadian households as participants.

ADS is a free-cashflow-generating, high-return-on-capital business, possessing what we think is a strong and durable competitive position. It has a long track record of steadily advancing earnings-per-share, and two trends suggest that this growth can endure. First, more consumers are turning to store-branded cards when making a purchase, given the rewards and savings associated with such cards. Second, merchants are increasingly promoting their store-branded cards because it allows them to both a) circumvent lofty (1% to 3%) credit-card transaction fees and b) collect valuable consumer data that can be used in targeted advertisements.

We believe fears concerning the firm’s exposure to struggling brick-and-mortar retailers is exaggerated. While these distressed legacy clients will continue to be a drag on performance, large new accounts (e.g., Ikea, Wayfair and Viking Cruises) should more than offset this headwind. We expect ADS to produce double-digit growth for years to come, making its current P/E ratio of 7 seem woefully inadequate. Longtime CEO Ed Heffernan—who has proven to be a wise manager and capital allocator—publicly acknowledged this price-to-value disconnect and is looking for ways to unlock value.

Already the firm has announced plans to sell its marketing unit, Epsilon. Based on recent comparables, we think this business could fetch $5 billion or so. ADS intends to use the first $1.9 billion of the proceeds to retire debt and the remainder for share buybacks—a move that could reduce share count by over 25%. We’re quick to point out that this wouldn’t be the first time Heffernan took advantage of a temporarily undervalued stock price. During the financial crisis, while most of its peers were paralyzed with fear, Alliance Data Systems had the financial strength and fortitude to aggressively repurchase its own stock, retiring30%of outstanding shares.

We acquired ADS at an average price of $230.16.

CarMax (KMX) – 5% of Assets

This is our second time owning CarMax, the nation’s leading used-car dealer, following a successful result the first time around. Having sold the shares in October 2017 at $75, we were happy to reinvest roughly six months later at $63.01,aftera change in U.S. tax law considerably improved the firm’s earning power.

Founded in 1994, CarMax was created specifically to meet the needs of millions of disgruntled consumers who were fed up with the car-buying process. The firm’s customer-friendly business model—featuring low, no-haggle prices, transparent trade-ins and a non-adversarial salesforce—directly addresses people’s grievances and has enabled CarMax to achieve exceptional results.

Despite operating in a mundane, slow-changing industry, the firm has delivered consistent growth that’s anything but ordinary: Since going public in 2002, CarMax has increased earnings-per-share at an annualized rate of18%. What’s more, we believe this growth is sustainable. For one, many competitors have tried to recreate CarMax’s unique, customer-centric approach, yet none have succeeded. And second, even though it’s the industry-leader by a wide margin, CarMax controls only3%of the nation’s used-car market.

We also like the firm’s lending unit, CarMax Auto Finance. It generates high returns on equity capital and fairly predictable cashflow, bolstered by minimal loan defaults. (Net credit losses peaked at 1.7% during the financial crisis.) In fact, research shows that when borrowers face extreme financial hardship, they’re more likely to default on their mortgage than their auto loan. As the saying goes, “You can sleep in your car, but you can’t drive your house to work.”

At less than 15 times earnings, we think KMX is a bargain. Though the growth won’t necessarily be smooth, we believe CarMax is capable of increasing earnings-per-share 15% annually over the next decade, as it 1) doubles its store count (expanding roughly 7% per year), 2) grows same-store sales by stealing marketshare from competitively disadvantaged peers, 3)

2018 Annual Report 3

develops its online-sales/home-delivery capabilities and 4) continues to opportunistically repurchase shares.

As Warren Buffett says, “When a company grows and outstanding shares shrink, good things happen for shareholders.”

Naspers (NPSNY) – 3% of Assets

In 1915, Naspers—a South African company—began life as a newspaper-and-magazine publisher. However, as the world evolved, the firm transitioned into cable TV, then added various internet-based ventures, including online classifieds and mobile-order food delivery. While Naspers owns several valuable businesses, the firm’s most important asset is its 31% stake in Tencent: a Chinese internet giant that operates WeChat, China’s largest communication platform, which serves overone billionactive monthly users.

We bought Naspers at $49.95, a meaningful discount to the value of its publicly traded stake in Tencent, plus we got the firm’s cash and other assets for free. Note, too, we think Tencent is reasonably priced, if not undervalued, and is perhaps one of the most competitively advantaged firms we’ve studied. WeChat—China’s so-called “super app”—can be used to send messages, play games, shop online, read the news, watch videos, listen to music, summon a taxi, send money to friends, engage in social media, and even make instore or online payments. The network effects associated with this product are extraordinary, and they’re getting stronger every day. Given the app’s virtually endless features and widespread usage among both consumers and businesses, WeChat has practically become China’s mobile internet.

| Assets (as of 9/30/18) | $ Value Per Share | ||

| Net Cash | $4.16 | ||

| Tencent2 | $54.04 | ||

| Venture Capital Investments | $6.93 | ||

| Operating Company (Pay TV, etc.) | $3.23 | ||

| Fair Value | $68.36 | ||

| Stock Price | $39.66 | ||

| Price/Value | 58 | % | |

We don’t expect the current discount to go to zero, given the potential tax impact on any sales of Tencent stock (among other issues), but shares shouldn’t be trading at58%of net assets. We’re encouraged by management’s recent efforts to close this gap, including stepped up engagement with the investment community at large and announced plans to spin off the Pay TV business.

We expect Naspers to continue to increase its net asset value, driven largely by growth of its Tencent stock. We also think the present discount will narrow significantly.

T. Rowe Price (TROW) – 3% of Assets

T. Rowe Price is one of the world’s largest investment managers, with$1 trillionin assets under management (AUM). We’ve followed and admired the company for several decades but have never owned the stock until now. We bought our shares late last year for $94.41.

The economics behind a first-class asset manager like T. Rowe Price are very compelling. With virtually no capital needs to speak of (e.g., real estate, equipment, inventory, etc.), the firm’s earnings—which are fee-based and highly recurring—are freely distributable to shareholders. T. Rowe uses this excess cash to pay a healthy dividend and repurchase stock, while maintaining a rock-solid, debt-free balance sheet. The firm’s cash and investments total $3.7 billion, more than $15 per share.

For years now, there’s been a secular shift from active money management to passive (mainly investing in index funds), which has weighed on the results of most mutual fund managers. Nonetheless, T. Rowe Price has continued to organically grow its business, thanks in large part to 1) its sterling reputation as a top asset manager (built upon a long track record of achieving above-average results), and 2) the fast growth of its “Target Date Retirement” funds, which now account for nearly 25% of total AUM.

| 2Naspers owns 2.96 billion Tencent shares worth $117 billion, based on the 12/31/18 stock price of $39.47. |

2018 Annual Report 4

If there’s a general stock-market selloff, the firm’s business will temporarily suffer, but profits will likely trend higher as AUM steadily grows over time. Our opinion is that, trading at 10 times earnings (net of cash), T. Rowe Price is cheap.

OUTLOOK

Shareholders frequently ask us what we think the stock market will do next year, and our response remains the same:We don’t know(and we’re skeptical of other people’s forecasts, which are almost always incorrect). Also, especially more recently, we’re asked if there’ll be a recession in 2019. Again, we don’t know. The U.S. has had seven recessions in the last 50 years and will certainly have more—but nobody knows when. (The old joke that “economists have predictednineof the lastfiverecessions” isn’t far from the truth.)

What we do know, however, is that if you own a stock portfolio of excellent, well-run businesses and maintain a long-term perspective, you needn’t worry about the returns in any single year. Remember: The market typically ends down in one of every five years, and occasionally the decline will be big (20%+), but stocks generally trend higher as profits rise, inexorably driven by productivity gains and population growth.

Frankly, we believe the Fund’s long-term prospects are as attractive today as they’ve ever been. The portfolio is chock-full of exceptional, growing businesses that are trading, in many cases, at extremely low valuations. This bodes well for future returns.

As always, thank you for trusting us with your capital. We consider it both a serious responsibility and a great privilege.

Sincerely,

Steven G. Check | Ryan Kinney |

2018 Annual Report 5

Blue Chip Investor Fund

PERFORMANCE INFORMATION (Unaudited)

12/31/18 NAV $144.68

AVERAGE ANNUAL RATE OF RETURN (%) FOR THE PERIODS ENDED DECEMBER 31, 2018

| 1 Year(A) | 5 Year(A) | 10 Year(A) | ||||

| Blue Chip Investor Fund | -15.15% | 5.00% | 10.08% | |||

| S&P 500(B) | -4.38% | 8.49% | 13.12% |

The Fund’s total annual fund operating expense ratio, gross of any fee waivers or expense reimbursements, as stated in the fee table of the Prospectus dated May 1, 2018, was 1.37% (net of fee waivers or expense reimbursements it was 1.02%) . The Total Annual Fund Operating Expenses in this fee table will not correlate to the expense ratio in the Fund’s financial highlights because (a) the financial highlights include only the direct operating expenses incurred by the Fund, not the indirect costs of investing in acquired funds, and (b) the gross expense ratio may fluctuate due to changes in net assets and actual expenses incurred during the reported period.

(A)The 1 Year, 5 Year and 10 Year returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions.

(B)The S&P 500 is a broad market-weighted average dominated by blue-chip stocks and is an unmanaged group of stocks whose composition is different from the Fund.

PASTPERFORMANCEDOESNOTGUARANTEEFUTURERESULTS. INVESTMENTRETURNANDPRINCIPALVALUEWILLFLUCTUATESOTHATSHARES, WHENREDEEMED, MAYBEWORTHMOREORLESSTHANTHEIRORIGINALCOST. RETURNSDONOTREFLECTTHEDEDUCTIONOFTAXESTHATA SHAREHOLDERWOULDPAYONFUNDDISTRIBUTIONSORTHEREDEMPTIONOFFUNDSHARES. CURRENTPERFORMANCEMAYBELOWERORHIGHERTHANTHEPERFORMANCEDATAQUOTED. TOOBTAINPERFORMANCEDATACURRENTTOTHEMOSTRECENTMONTHEND, PLEASECALL1-877-59-FUNDS.

2018 Annual Report 6

Blue Chip Investor Fund

BLUE CHIP INVESTOR FUND

by Sectors (Unaudited)

(as a percentage of Investments)

| Proxy Voting Guidelines (Unaudited) |

Check Capital Management, Inc., the Fund’s Advisor, is responsible for exercising the voting rights associated with the securities held by the Fund. A description of the policies and procedures used by the Advisor in fulfilling this responsibility is available without charge on the Fund’s website at www.bluechipinvestorfund.com. It is also included in the Fund’s Statement of Additional Information, which is available on the Securities and Exchange Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies, Form N-PX, relating to portfolio securities during the most recent 12-month period ended June 30th is available without charge, upon request, by calling our toll free number(1-877-59-FUNDS). This information is also available on the Securities and Exchange Commission’s website at http://www.sec.gov.

| Availability of Quarterly Schedule of Investments (Unaudited) |

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC’s web site at http://www.sec.gov. The Fund’s Form N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

2018 Annual Report 7

| Disclosure of Expenses (Unaudited) |

Shareholders of this Fund incur ongoing costs, including investment advisor fees and other Fund expenses. Although the Fund charges no sales loads or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by Mutual Shareholder Services, LLC, the Fund’s transfer agent. IRA accounts will be charged an $8.00 annual maintenance fee. The following example is intended to help you understand your ongoing costs of investing in the Fund and to compare these costs with similar costs of investing in other mutual funds. The example is based on an investment of $1,000 invested in the Fund on July 1, 2018 and held through December 31, 2018.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6) and then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid by a shareholder for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds' shareholder reports.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as the annual maintenance fee charged to IRA accounts or exchange fees or the expenses of underlying funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Expenses Paid | ||||||

| Beginning | Ending | During the Period* | ||||

| Account Value | Account Value | July 1, 2018 to | ||||

| July 1, 2018 | December 31, 2018 | December 31, 2018 | ||||

| Actual | $1,000.00 | $874.98 | $5.48 | |||

| Hypothetical | $1,000.00 | $1,019.36 | $5.90 | |||

| (5% annual return | ||||||

| before expenses) | ||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.16%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

2018 Annual Report 8

| Blue Chip Investor Fund | ||||||

| Schedule of Investments | ||||||

| December 31, 2018 | ||||||

| Shares | Fair Value | % of Net Assets | ||||

| COMMON STOCKS | ||||||

| Air Courier Services | ||||||

| 9,000 | FedEx Corporation | $ | 1,451,970 | 4.31 | % | |

| Asset Manager | ||||||

| 47,000 | Brookfield Asset Management Inc. Class A (Canada) | 1,802,450 | ||||

| 12,000 | T. Rowe Price Group, Inc. | 1,107,840 | ||||

| 2,910,290 | 8.64 | % | ||||

| Commercial Printing | ||||||

| 12,000 | Cimpress N.V. (Netherlands) * | 1,241,040 | 3.68 | % | ||

| Communications Equipment | ||||||

| 16,000 | QUALCOMM Incorporated | 910,560 | 2.70 | % | ||

| Consumer Finance | ||||||

| 9,000 | Alliance Data Systems Corporation | 1,350,720 | ||||

| 10,000 | American Express Company | 953,200 | ||||

| 2,303,920 | 6.84 | % | ||||

| Diversified Bank | ||||||

| 30,000 | Wells Fargo & Co. | 1,382,400 | 4.10 | % | ||

| Diversified Companies | ||||||

| 40 | Berkshire Hathaway Inc. Class A * (a) | 12,240,000 | 36.31 | % | ||

| Grain Mill Products | ||||||

| 13,000 | Ingredion Incorporated | 1,188,200 | 3.52 | % | ||

| Household Products | ||||||

| 24,000 | Spectrum Brands Holdings, Inc. | 1,014,000 | 3.01 | % | ||

| Integrated Oil & Gas | ||||||

| 40,000 | Suncor Energy Inc. (Canada) | 1,118,800 | 3.32 | % | ||

| IT Consulting & Other Services | ||||||

| 6,000 | International Business Machines Corporation | 682,020 | 2.02 | % | ||

| Retail - Apparel & Accessory Stores | ||||||

| 110,000 | Hanesbrands Inc. | 1,378,300 | 4.09 | % | ||

| Retail - Auto Dealers & Gasoline Stations | ||||||

| 26,000 | AutoNation, Inc. * | 928,200 | ||||

| 29,000 | CarMax, Inc. * | 1,819,170 | ||||

| 2,747,370 | 8.15 | % | ||||

| Services - Advertising | ||||||

| 24,000 | Naspers Limited Class N ** | 951,720 | 2.82 | % | ||

| Wholesale - Motor Vehicles & Motor Vehicle Parts & Supplies | ||||||

| 62,000 | LKQ Corporation * | 1,471,260 | 4.36 | % | ||

| Total for Common Stocks (Cost $27,309,016) | 32,991,850 | 97.87 | % | |||

| Money Market Funds | ||||||

| 576,790 | Fidelity Investments Money Market Funds Government | |||||

| Portfolio Class I 2.25% *** | 576,790 | 1.71 | % | |||

| (Cost - $576,790) | ||||||

| Total Investments | 33,568,640 | 99.58 | % | |||

| (Cost - $27,885,806) | ||||||

| Other Assets in Excess of Liabilities | 142,312 | 0.42 | % | |||

| Net Assets | $ | 33,710,952 | 100.00 | % | ||

| * Non-Income Producing Securities. ** ADR - American Depositary Receipt. *** The yield rate shown represents the 7-day yield at December 31, 2018. (a) The company’s 2017 annual report is available at www.berkshirehathaway.com/reports.html. |

| The accompanying notes are an integral part of these financial statements. |

2018 Annual Report 9

| Blue Chip Investor Fund | |||

| Statement of Assets and Liabilities | |||

| December 31, 2018 | |||

| Assets: | |||

| Investments at Fair Value | $ | 33,568,640 | |

| (Cost - $27,885,806) | |||

| Cash | 5,992 | ||

| Dividends Receivable | 16,864 | ||

| Prepaid Expenses | 11,000 | ||

| Receivable for Shareholder Purchases | 170,921 | ||

| Total Assets | 33,773,417 | ||

| Liabilities: | |||

| Investment Advisory Fee Payable | 16,205 | ||

| Interest Payable | 175 | ||

| Administration Fee Payable | 2,082 | ||

| Other Accrued Expenses | 21,842 | ||

| Payable for Shareholder Redemptions | 22,161 | ||

| Total Liabilities | 62,465 | ||

| Net Assets | $ | 33,710,952 | |

| Net Assets Consist of: | |||

| Paid In Capital | $ | 28,005,497 | |

| Total Distributable Earnings | 5,705,455 | ||

| Net Assets, for 233,003 Shares Outstanding | $ | 33,710,952 | |

| (Unlimited shares authorized, without par value) | |||

| Net Asset Value, Offering Price and Redemption Price | |||

| Per Share ($33,710,952/233,003 shares) | $ | 144.68 | |

| Statement of Operations | |||

| For the fiscal year ended December 31, 2018 | |||

| Investment Income: | |||

| Dividends (Net of foreign withholding tax of $10,778) | $ | 432,679 | |

| Total Investment Income | 432,679 | ||

| Expenses: | |||

| Investment Advisory Fees | 394,299 | ||

| Interest Expense | 62,753 | ||

| Transfer Agent & Accounting Fees | 40,104 | ||

| Administration Fees | 27,601 | ||

| Registration Fees | 26,033 | ||

| Legal Fees | 18,000 | ||

| Audit & Tax Fees | 18,000 | ||

| Custody Fees | 8,544 | ||

| Other Fees | 7,288 | ||

| Trustee Fees | 4,000 | ||

| Insurance Expense | 1,181 | ||

| Printing and Postage Expense | 1,100 | ||

| Total Expenses | 608,903 | ||

| Less: Advisory Fee Waiver | (151,851 | ) | |

| Net Expenses | 457,052 | ||

| Net Investment Loss | (24,373 | ) | |

| Net Realized and Unrealized Gain (Loss) on Investments: | |||

| Net Realized Gain on Investments | 1,813,919 | ||

| Net Change in Unrealized Appreciation on Investments | (7,902,457 | ) | |

| Net Realized and Unrealized Loss on Investments | (6,088,538 | ) | |

| Net Decrease in Net Assets from Operations | $ | (6,112,911 | ) |

| The accompanying notes are an integral part of these financial statements. |

2018 Annual Report 10

| Blue Chip Investor Fund | ||||||||

| Statements of Changes in Net Assets | ||||||||

| 1/1/2018 | 1/1/2017 | |||||||

| to | to | |||||||

| 12/31/2018 | 12/31/2017 | |||||||

| From Operations: | ||||||||

| Net Investment Loss | $ | (24,373 | ) | $ | (36,042 | ) | ||

| Net Realized Gain on Investments | 1,813,919 | 2,262,920 | ||||||

| Net Change in Unrealized Appreciation on Investments | (7,902,457 | ) | 4,078,791 | |||||

| Net Increase (Decrease) in Net Assets from Operations | (6,112,911 | ) | 6,305,669 | |||||

| From Distributions to Shareholders: | (1,781,532 | ) | (2,228,852 | ) | (a) | |||

| From Capital Share Transactions: | ||||||||

| Proceeds From Sale of Shares | 4,104,097 | 4,440,228 | ||||||

| Shares Issued on Reinvestment of Dividends | 1,781,532 | 2,228,852 | ||||||

| Cost of Shares Redeemed | (4,355,997 | ) | (3,019,376 | ) | ||||

| Net Increase from Shareholder Activity | 1,529,632 | 3,649,704 | ||||||

| Net Increase (Decrease) in Net Assets | (6,364,811 | ) | 7,726,521 | |||||

| Net Assets at Beginning of Period | 40,075,763 | 32,349,242 | ||||||

| Net Assets at End of Period | $ | 33,710,952 | $ | 40,075,763 | (a) | |||

| Share Transactions: | ||||||||

| Issued | 22,894 | 26,551 | ||||||

| Reinvested | 12,402 | 12,325 | ||||||

| Redeemed | (24,822 | ) | (17,497 | ) | ||||

| Net Increase in Shares | 10,474 | 21,379 | ||||||

| Shares Outstanding Beginning of Period | 222,529 | 201,150 | ||||||

| Shares Outstanding End of Period | 233,003 | 222,529 | ||||||

| Financial Highlights | |||||||||||||||||||

| Selected data for a share outstanding | 1/1/2018 | 1/1/2017 | 1/1/2016 | 1/1/2015 | 1/1/2014 | ||||||||||||||

| throughout the period: | to | to | to | to | to | ||||||||||||||

| 12/31/2018 | 12/31/2017 | 12/31/2016 | 12/31/2015 | 12/31/2014 | |||||||||||||||

| Net Asset Value - | |||||||||||||||||||

| Beginning of Period | $ | 180.09 | $ | 160.82 | $ | 143.92 | $ | 161.10 | $ | 147.46 | |||||||||

| Net Investment Income (Loss)(b) | (0.11 | ) | (0.17 | ) | 0.50 | 0.10 | (0.10 | ) | |||||||||||

| Net Gains or (Losses) on Investments | |||||||||||||||||||

| (realized and unrealized) | (27.23 | ) | 29.97 | 26.33 | (8.06 | ) | 18.78 | ||||||||||||

| Total from Investment Operations | (27.34 | ) | 29.80 | 26.83 | (7.96 | ) | 18.68 | ||||||||||||

| Distributions (From Net Investment Income) | 0.00 | (0.08 | ) | (0.44 | ) | (0.06 | ) | 0.00 | |||||||||||

| Distributions (From Capital Gains) | (8.07 | ) | (10.45 | ) | (9.49 | ) | (9.16 | ) | (5.04 | ) | |||||||||

| Total Distributions | (8.07 | ) | (10.53 | ) | (9.93 | ) | (9.22 | ) | (5.04 | ) | |||||||||

| Net Asset Value - | |||||||||||||||||||

| End of Period | $ | 144.68 | $ | 180.09 | $ | 160.82 | $ | 143.92 | $ | 161.10 | |||||||||

| Total Return(c) | (15.15)% | 18.50% | 18.63% | (5.01)% | 12.64% | ||||||||||||||

| Ratios/Supplemental Data | |||||||||||||||||||

| Net Assets - End of Period (Thousands) | $ | 33,711 | $ | 40,076 | $ | 32,349 | $ | 26,618 | $ | 26,631 | |||||||||

| Before Reimbursement | |||||||||||||||||||

| Ratio of Expenses to Average Net Assets | 1.54% | 1.35% | 1.43% | 1.47% | 1.46% | ||||||||||||||

| Ratio of Net Investment Income (Loss) to | |||||||||||||||||||

| Average Net Assets | -0.45% | -0.45% | -0.11% | -0.40% | -0.46% | ||||||||||||||

| After Reimbursement | |||||||||||||||||||

| Ratio of Expenses to Average Net Assets | 1.16% | (d) | 1.00% | 1.00% | 1.00% | 1.08% | |||||||||||||

| Ratio of Net Investment Income (Loss) to | |||||||||||||||||||

| Average Net Assets | -0.06% | (d) | -0.10% | 0.32% | 0.06% | -0.07% | |||||||||||||

| Portfolio Turnover Rate | 26.80% | 24.16 | 20.72% | 20.41% | 20.07% | ||||||||||||||

| (a) For the prior year ended December 31, 2017, $16,581 was paid from Net Investment Income and $2,212,271 was paid from Capital Gains. As of December 31, 2017, Accumulated Net Investment Income was $0. (b) Per share amounts calculated using the average shares method. (c) Total return represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of all dividends and distributions. (d) The ratio of expenses to average net assets include interest expenses. The after reimbursement ratio of expense excluding interest expense is 1.00% . The after reimbursement ratio of net investment income (loss) excluding interest expense is 0.10% . |

| The accompanying notes are an integral part of these financial statements. |

2018 Annual Report 11

| NOTES TOFINANCIALSTATEMENTS BLUECHIPINVESTORFUND December 31, 2018 |

1.) ORGANIZATION

Blue Chip Investor Fund (the “Fund”) is a non-diversified series of the Blue Chip Investor Funds (the “Trust”), formerly Premier Funds. The Trust is an open-end investment company. The Trust was organized in Ohio as a business trust on November 1, 2001 and may offer shares of beneficial interest in a number of separate series, each series representing a distinct fund with its own investment objectives and policies. The Fund commenced operations on January 1, 2002. At present, the Fund is the only series authorized by the Trust. The Fund’s investment objective is to seek long-term growth of capital. The Advisor to the Fund is Check Capital Management, Inc. (the “Advisor”).

2.) SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946Financial Services - Investment Companies. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows the significant accounting policies described in this section.

SECURITY VALUATION

All investments in securities are recorded at their estimated fair value, as described in Note 3.

FEDERAL INCOME TAXES

The Fund’s policy is to continue to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all of its taxable income to shareholders. Therefore, no federal income tax provision is required. It is the Fund’s policy to distribute annually, prior to the end of the calendar year, dividends sufficient to satisfy excise tax requirements of the Internal Revenue Code. This Internal Revenue Code requirement may cause an excess of distributions over the book year-end accumulated income. In addition, it is the Fund’s policy to distribute annually, after the end of the fiscal year, any remaining net investment income and net realized capital gains.

The Fund recognizes the tax benefits of certain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years. The Fund identifies its major tax jurisdictions as U.S. Federal tax authorities; however the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the fiscal year ended December 31, 2018, the Fund did not incur any interest or penalties.

SHARE VALUATION

The net asset value (the “NAV”) is generally calculated as of the close of trading on the New York Stock Exchange (the “Exchange”) (normally 4:00 p.m. Eastern time) every day the Exchange is open. The NAV is calculated by taking the total value of the Fund’s assets, subtracting its liabilities, and then dividing by the total number of shares outstanding, rounded to the nearest cent. The offering price and redemption price per share are equal to the net asset value per share.

DISTRIBUTIONS TO SHAREHOLDERS

Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expenses or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value per share of the Fund.

USE OF ESTIMATES

The financial statements are prepared in accordance with GAAP, which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported

2018 Annual Report 12

Notes to Financial Statements - continued

amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

OTHER

The Fund records security transactions based on trade date. Dividend income is recognized on the ex-dividend date. Interest income and interest expense, if any, are recognized on an accrual basis. The Fund uses the specific identification method in computing gain or loss on sale of investment securities. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations.

3.) SECURITIES VALUATIONS

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 - Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

FAIR VALUE MEASUREMENTS

A description of the valuation techniques applied to the Fund’s major categories of assets measured at fair value on a recurring basis follows.

Equity securities (common stocks, including ADRs). Equity securities generally are valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Advisor believes such prices accurately reflect the fair value of such securities. Securities that are traded on any stock exchange or on the NASDAQ over-the-counter market are generally valued by the pricing service at the last quoted sale price. Lacking a last sale price, an equity security is generally valued by the pricing service at its last bid price. Generally, if the security is traded in an active market and is valued at the last sale price, the security is categorized as a level 1 security. When market quotations are not readily available, when the Advisor determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or when restricted securities are being valued, such securities are valued as determined in good faith by the Advisor, subject to review of the Board of Trustees (the “Trustees” or the “Board”) and are categorized in level 2 or level 3, when appropriate.

Money market funds.Money market funds are valued at net asset value and are classified in level 1 of the fair value hierarchy.

In accordance with the Trust’s good faith pricing guidelines, the Advisor is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. There is no single standard for determining fair value, since fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Advisor would

2018 Annual Report 13

Notes to Financial Statements - continued

appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods.

The following table summarizes the inputs used to value the Fund’s assets measured at fair value as of December 31, 2018:

| Valuation Inputs of Assets | Level 1 | Level 2 | Level 3 | Total | ||||

| Common Stocks | $ 32,991,850 | $0 | $0 | $ 32,991,850 | ||||

| Money Market Funds | 576,790 | 0 | 0 | 576,790 | ||||

| Total | $ 33,568,640 | $0 | $0 | $ 33,568,640 |

Refer to the Fund’s Schedule of Investments for a listing of securities by industry. The Fund did not hold any level 2 or level 3 assets during the fiscal year ended December 31, 2018. There were no transfers into or out of the levels during the fiscal year ended December 31, 2018. It is the Fund’s policy to consider transfers into or out of each level as of the end of the reporting period.

The Fund did not invest in any derivative instruments during the fiscal year ended December 31, 2018.

4.) INVESTMENT ADVISORY AGREEMENT

The Fund has entered into an investment advisory agreement (the “Management Agreement”) with the Advisor, Check Capital Management, Inc. Under the terms of the Management Agreement, the Advisor manages the investment portfolio of the Fund, subject to policies adopted by the Trustees. Under the Management Agreement, the Advisor, at its own expense and without reimbursement from the Trust, furnishes office space and all necessary office facilities, equipment and executive personnel necessary for managing the assets of the Fund. The Advisor also pays the salaries and fees of all of its officers and employees that serve as officers and trustees of the Trust. For its services, the Advisor receives an annual investment management fee from the Fund of 1.00% of the average daily net assets of the Fund which is payable monthly. As a result of the above calculation, for the fiscal year ended December 31, 2018, the Advisor earned management fees totaling $394,299, before the waiver of fees and/or reimbursement of expenses described below. Effective May 1, 2014, the Advisor has contractually agreed to waive management fees and reimburse expenses to the extent necessary to maintain total annual operating expenses of the Fund (excluding brokerage fees, commissions, interest and other borrowing expenses, taxes, extraordinary expenses and the indirect costs of investing in acquired funds) at 1.00% of its average daily net assets through April 30, 2019. There are no provisions for recoupment for any of the contractual waivers entered into by the Advisor. The Advisor waived and/or reimbursed expenses of $151,851 for the fiscal year ended December 31, 2018. At December 31, 2018, the Fund owed the Advisor $16,205.

5.) RELATED PARTY TRANSACTIONS

The Fund has entered into an administration servicing agreement with Premier Fund Solutions, Inc. (the “Administrator”). The Fund pays 0.07% on the first $200 million of assets, 0.05% on the next $500 million of assets and 0.03% on assets above $500 million subject to a minimum monthly fee of $2,000. The Fund also pays all out-of-pocket expenses directly attributable to the Fund. Jeffrey R. Provence of the Administrator is also an Officer and Trustee of the Fund. For the fiscal year ended December 31, 2018, the Administrator earned $27,601. At December 31, 2018, the Fund owed the Administrator $2,082.

6.) PURCHASES AND SALES OF SECURITIES

For the fiscal year ended December 31, 2018, purchases and sales of investment securities other than U.S. Government obligations and short-term investments aggregated $11,563,282 and $10,680,781, respectively. Purchases and sales of U.S. Government obligations aggregated $0 and $0, respectively.

7.) CONTROL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of December 31, 2018, Charles Schwab & Co. Inc., located at 101 Montgomery Street, San Francisco, California, held for the benefit of others, in aggregate, 60.44% of the Fund, and thus may be deemed to control the Fund. Also, National Financial Services, LLC, located at

2018 Annual Report 14

Notes to Financial Statements - continued

200 Liberty Street, New York, New York, held for the benefit of others, in aggregate, 38.21% of the Fund, and thus may be deemed to control the Fund.

8.) TAX MATTERS

For Federal income tax purposes, the cost of investments owned at December 31, 2018 was $27,885,806. At December 31, 2018, the composition of unrealized appreciation (the excess of value over tax cost) and depreciation (the excess of tax cost over value) was as follows:

| Appreciation | (Depreciation) | Net Appreciation | |||

| $10,572,208 | ($4,889,374) | $5,682,834 |

As of December 31, 2018, there were no differences between book basis and tax basis.

The tax character of distributions paid during fiscal years 2018 and 2017 was as follows:

| 2018 | 2017 | ||||

| Ordinary Income | $ 34,207 | $ 1,119,919 | |||

| Long-term Capital Gains | 1,747,325 | 1,108,933 | |||

| $ 1,781,532 | $ 2,228,852 |

As of December 31, 2018, the components of distributable earnings on a tax basis were as follows:

| Accumulated Undistributed Ordinary Income | $ 22,621 | |

| Unrealized Appreciation | 5,682,834 | |

| $ 5,705,455 |

9.) LOAN AGREEMENT

A loan agreement, subject to certain covenants and restrictions, is in place between the Fund and its custodian, U.S. Bank, N.A. The Fund may seek to obtain loans for the purpose of funding redemptions or purchasing securities up to the lesser of $10,000,000 or the maximum amount that the Fund is permitted to borrow under the Investment Company Act of 1940 using the securities in its portfolio as collateral and allowing U.S. Bank, N.A. the right to setoff to those securities. The maximum interest rate of such loans is set at a rate per annum equal to U.S. Bank’s prime–lending rate (which was 5.50% as of December 31, 2018). During the fiscal year ended December 31, 2018, the Fund had an average loan balance of $1,264,247 and paid an average interest rate of 4.92% . Additionally, the maximum borrowing during the period was $3,300,000. As of December 31, 2018 there was no outstanding loan balance. No compensating balances are required. The loan matured on February 10, 2019. The loan was renewed through February 9, 2020 and the line of credit was decreased to $8,500,000 at a rate per annum equal to the Prime Rate less 0.50% .

10.) SUBSEQUENT EVENTS

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has concluded that there is no impact requiring adjustment to or disclosure in the financial statements, except as disclosed in Note 9.

2018 Annual Report 15

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

Blue Chip Investor Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Blue Chip Investor Fund (the “Fund”) as of December 31, 2018, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the five years in the period then ended, (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of Blue Chip Investor Fund as of December 31, 2018, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2018, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2004.

COHEN & COMPANY, LTD.

Cleveland, Ohio

February 22, 2019

2018 Annual Report 16

| ADDITIONALINFORMATION December 31, 2018 (UNAUDITED) |

APPROVAL OF INVESTMENT ADVISORY AGREEMENT

On December 4, 2018 the Board of Trustees (the “Board” or the “Trustees”) considered the renewal of the Management Agreement (the “Agreement”) between the Advisor and the Trust, on behalf of the Fund. The Board reviewed the memorandum provided by legal counsel, noting that, in consideration of the continuance of the management agreement, the Board should review as much information as is reasonably necessary to evaluate the terms of the contract and determine whether it is fair to the Fund and its shareholders. The Board also reviewed the information provided by the Advisor to the Trustees for evaluation of continuance of the Agreement.

In renewing the Management Agreement, the Board of Trustees received material from the Advisor (the “Report”) addressing the following factors: (i) the investment performance of the Fund and the Advisor; (ii) the nature, extent and quality of the services provided by the investment Advisor to the Fund; (iii) the cost of the services to be provided and the profits to be realized by the Advisor and its affiliates from the relationship with the Fund; (iv) the extent to which economies of scale will be realized as the fund grows; and (v) whether the fee levels reflect these economies of scale to the benefit of shareholders.

As to the performance of the Fund, the Report included information regarding the performance of the Fund compared to a group of funds of similar size, style and objective (the “Peer Group”) as well as the Morningstar category average for the Fund. The Report also included comparative performance information for other accounts managed by the Advisor and the Fund’s benchmark index, the S&P 500® Index (the “Index”), and the Peer Group for the period ended September 30, 2018. The data showed that the Fund lagged the Index for the one, three, five and ten year periods. The data showed that the Fund’s performance was below the Peer Group for the one, three, five and ten year periods, but within the performance range of the Peer Group. The data also showed that the Fund’s performance was below the category average for the one, three, five and ten year periods, but within the performance range of the category. The Trustees reviewed the information and concluded that the Fund’s performance was acceptable.

As for the nature, extent and quality of the services provided by the Advisor, the Trustees discussed the Advisor’s experience and capabilities. The representatives of the Advisor reviewed and discussed with the Board the Advisor’s Form ADV and the 17j-1 certifications. They summarized the information provided in the Report regarding matters such as the Advisor’s financial condition and investment personnel. The Trustees noted that while the Advisor employs a line of credit, it did not represent excessive leverage. They also discussed each portfolio manager’s background and investment management experience. Furthermore, they reviewed the Advisor’s financial information and discussed the firm’s ability to meet its obligations under the Agreement. The Board concluded that the nature and extent of the services provided by the Advisor were consistent with their expectations, that they were satisfied with the quality of services provided by the Advisor, and that the Advisor has the resources to meet its obligations under the Agreement. They noted that both the portfolio management and the Chief Compliance Officer services were acceptable.

As to the fee charged and costs of the services provided, the Board reviewed the fees under the Agreement compared to the Peer Group, the Fund’s category average and fees charged to other clients of the Advisor. The Board noted that the current net expense ratio was below the Peer Group and similar to the category average. The information showed that the management fee was above the Peer Group, but within the range of the Peer Group. The Board concluded that the advisory fee was reasonable, particularly in light of the Fund’s size and the net management fees received after waivers. The Board also reviewed a profit and loss analysis prepared by the Advisor that analyzed the expenses incurred by the Advisor in managing the Fund and the total revenue derived by the Advisor from the Fund. The Trustees noted that the Advisor did not utilize an affiliated broker and received no soft dollar benefits. The Trustees concluded that the Advisor was not overly profitable.

As to the economies of scale, it was noted that the Advisor capped the Fund’s expenses during the period, excluding certain expenses, and will cap the Fund’s expenses for an additional one year period. The Trustees also noted they will revisit the issue of economies of scale as Fund assets grow. Next, the Independent Trustees met in executive session to discuss the continuation of the Agreement. The Officers of the Trust were excused during this discussion.

Upon reconvening the meeting, it was the consensus of the Trustees, including the disinterested Trustees, that renewal of the Management Agreement would be in the best interests of the Fund and the shareholders. Resolutions were then approved by unanimous vote of the disinterested Trustees and thereafter all the Trustees.

2018 Annual Report 17

| TRUSTEES AND OFFICERS (Unaudited) |

The Board of Trustees supervises the business activities of the Trust. The names of the Trustees and executive officers of the Trust are shown below. Each Trustee who is an “interested person” of the Trust, as defined in the Investment Company Act of 1940, is indicated by an asterisk. Each Trustee serves until the Trustee sooner dies, resigns, retires or is removed. Officers hold office for one year and until their respective successors are chosen and qualified.

The trustees and officers of the Trust and their principal business activities during the past five years are:

Interested Trustees and Officers

| Other | |||||

| Principal | Number of | Directorships | |||

| Name, | Position | Length of | Occupation(s) | Portfolios | Held By |

| Address, | with the | Time Served | During | Overseen | Trustee During |

| and Year of Birth | Trust | Past 5 Years | By Trustee | the | |

| Past 5 Years | |||||

| Ross C. Provence*, (1938) | President, | Since 2001 | General Partner and Portfolio | 1 | PFS Funds |

| 1939 Friendship Drive, | Trustee and | Manager for Value Trend Capital | |||

| Suite C, El Cajon, | Chairman | Management, LP (1995 to current). | |||

| California 92020 | Estate planning attorney (1963 to | ||||

| current). | |||||

| Jeffrey R. Provence*, | Secretary, | Since 2001 | CEO, Premier Fund Solutions, Inc. | 1 | PFS Funds |

| (1969) | Treasurer | (2001-Present). General Partner and | Meeder Funds | ||

| 1939 Friendship Drive, | and Trustee | Portfolio Manager for Value Trend | |||

| Suite C, El Cajon, | Capital Management, LP (1995 to | ||||

| California 92020 | current). | ||||

| Jock Meeks, (1956) | Chief | Since 2004 | Client Services Director for Check | N/A | N/A |

| 575 Anton Blvd., Ste. 500 | Compliance | Capital Management (2004 to cur- | |||

| Costa Mesa, CA 92626 | Officer | rent). | |||

| * Ross C. Provence and Jeffrey R. Provence are considered “interested persons” as defined in Section 2(a)(19) of the Investment Company Act of 1940 due to their positions as officers of the Trust. Ross C. Provence is the father of Jeffrey R. Provence. Independent Trustees |

| Other | |||||

| Principal | Directorships | ||||

| Name, | Position | Length of | Occupation(s) | Number of | Held By |

| Address, | with the | Time Served | During | Portfolios | Trustee During |

| and Year of Birth | Trust | Past 5 Years | Overseen | the | |

| By Trustee | Past 5 Years | ||||

| Allen C. Brown, (1943) | Independent | Since 2001 | Law Office of Allen C. Brown, | 1 | PFS Funds |

| 222 West Madison Ave., | Trustee | Estate planning and business | |||

| El Cajon, California 92020 | attorney (1970 to current). | ||||

| George Cossolias, | Independent | Since 2001 | Partner of CWDL, CPAs (February | 1 | PFS Funds |

| CPA, (1935) | Trustee | 1, 2014 to current). Owner of | |||

| 5151 Murphy Canyon | George Cossolias & Company, | ||||

| Road, Suite 135, | CPAs (1972 to January 31, 2014). | ||||

| San Diego, CA 92123 | President of Lubrication Specialists, | ||||

| Inc. (1996 to current). | |||||

The Statement of Additional Information contains additional and more detailed information about the trustees and is available without charge by calling the transfer agent at 1-877-59-FUNDS.

2018 Annual Report 18

Board of Trustees

|

| This report is provided for the general information of the shareholders of the Blue Chip Investor Fund. This report is not intended for distribution to prospective investors in the Fund, unless preceded or accompanied by an effective prospectus. |

| BLUECHIPINVESTORFUND 575 Anton Boulevard, Suite 500 Costa Mesa, California 92626 |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and the principal financial officer. The registrant has not made any amendments to its code of ethics during the covered period. The registrant has not granted any waivers from any provisions of the code of ethics during the covered period. A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees has determined that George Cossolias is an audit committee finical expert. Mr. Cossolias is independent for purposes of this Item 3.

Item 4. Principal Accountant Fees and Services.

(a-d) The following table details the aggregate fees billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant to the registrant. The principal accountant has provided no services to the adviser or any entity controlled by, or under common control with the adviser that provides ongoing services to the registrant.

| FYE 12/31/18 | FYE 12/31/17 | |||

| Audit Fees | $14,750 | $14,750 | ||

| Audit-Related Fees | $0 | $0 | ||

| Tax Fees | $2,500 | $2,500 | ||

| All Other Fees | $750 | $750 |

Nature of Tax Fees: preparation of Excise Tax Statement and 1120 RIC.

All Other Fees: Semi-Annual Report Review

(e) (1) The audit committee approves all audit and non-audit related services and, therefore, has not adopted pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X.

(e) (2) None of the services described in paragraph (b) through (d) of this Item were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g) The following table indicates the aggregate non-audit fees billed by the registrant’s principal accountant for services to the registrant , the registrant’s investment adviser (not sub-adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant, for the last two years.

| Non-Audit Fees | FYE 12/31/18 | FYE 12/31/17 | ||

| Registrant | $3,250 | $3,250 | ||

| Registrant’s Investment Adviser | $0 | $0 |

(h) The principal accountant provided no services to the investment adviser or any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant.

Item 5. Audit Committee of Listed Companies.Not applicable.

Item 6. Investments.

(a) Not applicable. Schedule filed with Item 1.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.Not applicable.

Item 8. Portfolio Managers of Closed End Management Investment Companies.Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Companies and Affiliated Purchasers.Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant has not adopted procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 11. Controls and Procedures.

(a) The Registrant’s president and chief financial officer concluded that the disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act (17 CFR 270.30a -3(c))) as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the Act (17 CFR 270.30a -3(b)) and Rules 13a-15(b) or 15d-15(b) under the Exchange Act (17 CFR 240.13a -15(b) or 240.15d -15(b)).

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act (17 CFR 270.30a -3(d)) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 13. Exhibits.

(a)(1) Code of Ethics. Filed herewith.

(a)(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.Filed herewith.

(a)(3)Not applicable.

(a)(4) Not applicable.

(b)Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.Filed herewith.

| SIGNATURES |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Blue Chip Investor Funds |

| By:/s/Ross C. Provence Ross C. Provence President |

| Date: 2/26/19 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By:/s/Ross C. Provence Ross C. Provence President |

Date: 2/26/19

|

| By:/s/Jeffrey R. Provence Jeffrey R. Provence Chief Financial Officer |

| Date: 2/26/19 |