Exhibit 10.1 NEWMONT SECTION 16 OFFICER AND SENIOR EXECUTIVE SHORT-TERM INCENTIVE PROGRAM (Effective January 1, 2024)

1 NEWMONT SECTION 16 OFFICER AND SENIOR EXECUTIVE SHORT-TERM INCENTIVE PROGRAM (Effective January 1, 2024) PURPOSE This Section 16 Officer and Senior Executive Short-Term Incentive Program (STIP) includes the Corporate Performance Bonus program. This program is a restatement of the Section 16 Officer and Senior Executive Short-Term Incentive Program effective on January 1, 2023. The purpose of the Corporate Performance Bonus program is to provide to those employees of Newmont Corporation and its Affiliated Entities that participate in this program a more direct interest in the success of the operations of Newmont Corporation. Employees of Newmont Corporation and participating Affiliated Entities will be rewarded in accordance with the terms and conditions described below. This program is intended to be a program described in Department of Labor Regulation Sections 2510.31(b) and 2510.3-2(c) and shall not be considered a plan subject to the Employee Retirement Income Security Act of 1974, as amended. SECTION I-DEFINITIONS 1.1 “Affiliated Entity(ies)” means any corporation or other entity, now or hereafter formed, that is or shall become affiliated with Newmont Corporation (“Newmont”), either directly or indirectly, through stock ownership or control, and which is (a) included in the controlled group of corporations (within the meaning of Code Section 1563(a) without regard to Code Section 1563(a)(4) and Code Section 1563(e)(3)(C)) in which Newmont is also included and (b) included in the group of entities (whether or not incorporated) under common control (within the meaning of Code Section 414(c)) in which Newmont is also included. 1.2 “Board” means the Board of Directors of Newmont or its delegate. 1.3 “Bonus Eligible Earnings” means an Employee’s base salary as reflected in the records of Newmont or a Participating Employer as of December 31 of the calendar year for which a Corporate Performance Bonus is made; provided, however, that Newmont or a Participating Employer shall have the discretion to adjust an Employee’s Bonus Eligible Earnings based on any periods of unpaid leave or other periods in the calendar year during which an Employee was not working or was otherwise not fully engaged in their duties and responsibilities (including if an Employee commenced employment after the beginning of the calendar year, in which case such Employee’s Bonus Eligible Earnings will be calculated on a pro-rata basis based on their base salary as of December 31). If an Employee dies during the calendar year, the “Bonus Eligible Earnings” for such Terminated Eligible Employee will be determined by their base salary as of the date of death in such calendar year and the Bonus will be calculated on a pro-rata basis. In the event of a Change of Control, the Bonus Eligible Earnings of each eligible Employee shall be equal to such Employee’s base salary, on an annualized basis, as of the date immediately preceding the Change of Control. In the case of a Terminated Eligible Employee, such Employee’s Bonus

2 Eligible Earnings will be determined by their base salary as of the date of termination of employment and the Bonus shall be calculated on a pro-rata basis. In all cases, an Employee’s “Bonus Eligible Earnings” shall be determined before reduction for pretax contributions to an employee benefit plan of Newmont pursuant to Section 401(k) or Section 125 of the Code. 1.4 “Cash Sustaining Costs per Gold Equivalent Ounce” means annual approved STIP adjusted cash sustaining costs for the Performance Period on a consolidated basis and measured on a per gold equivalent ounce basis, as adjusted for metal prices, fuel and exchange rates, one- time adjustments or other items as approved by the Leadership Development and Compensation Committee of the Board of Directors (“LDCC”), compared to actual adjusted cash sustaining costs per gold equivalent ounce, and subject to metric adjustments provided with the performance targets as approved by the LDCC. 1.5 “Change of Control” means the occurrence of any of the following events: (i) The acquisition in one or a series of transactions by any individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) (a “Person”) of beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of 20% or more of either (x) the then outstanding shares of common stock of Newmont (the “Outstanding Company Common Stock”) or (y) the combined voting power of the then outstanding voting securities of Newmont entitled to vote generally in the election of directors (the “Outstanding Company Voting Securities”); provided, however, that for purposes of this subsection (i), the following acquisitions shall not constitute a Change of Control: (A) any acquisition directly from Newmont other than an acquisition by virtue of the exercise of a conversion privilege, unless the security being so converted was itself acquired directly from Newmont, (B) any acquisition by Newmont, (C) any acquisition by any employee benefits plan (or related trust) sponsored or maintained by Newmont or any corporation controlled by Newmont or (D) any acquisition by any corporation pursuant to a transaction which complies with clauses (A), (B) and (C) of paragraph (iii) below; or (ii) Individuals who, as of the Effective Date, constitute the Board of Directors of Newmont (“Incumbent Board”) cease for any reason to constitute at least a majority of the Board of Directors of Newmont; provided, however, that any individual becoming a director subsequent to the Effective Date whose election, or nomination for election by Newmont’s shareholders, was approved by a vote of at least a majority of the directors then comprising the Incumbent Board shall be considered as though such individual were a member of the Incumbent Board, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of an actual or threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a Person other than the Board of Directors of Newmont; or (iii) Consummation of a reorganization, merger or consolidation or sale or other disposition of all or substantially all of the assets of Newmont or an acquisition of assets of another entity (a “Business Combination”), in each case, unless, following such Business Combination, (A) all or substantially all of the individuals and entities who were the

3 beneficial owners, respectively, of the Outstanding Company Common Stock and Outstanding Company Voting Securities immediately prior to such Business Combination beneficially own, directly or indirectly, more than 50% of, respectively, the then outstanding shares of common stock (or, for a non-corporate entity, equivalent securities) and the combined voting power of the then outstanding voting securities entitled to vote generally in the election of directors (or for a non-corporate entity, equivalent governing body), as the case may be, of the entity resulting from such Business Combination (including, without limitation, an entity which as a result of such transaction owns Newmont or all or substantially all of Newmont’s assets either directly or through one or more subsidiaries (a “Parent Company”)) in substantially the same proportions as their ownership, immediately prior to such Business Combination, of the Outstanding Company Common Stock and Outstanding Company Voting Securities, as the case may be, (B) no person or entity (excluding Newmont, any entity resulting from such Business Combination, any employee benefit plan (or related trust) of Newmont or its Affiliate or any entity resulting from such Business Combination or, if reference was made to equity ownership of any Parent Company for purposes of determining whether clause (A) above is satisfied in connection with the applicable Business Combination, such Parent Company) beneficially owns, directly or indirectly, 20% or more of, respectively, the then outstanding shares of common stock (or, for a non-corporate entity, equivalent securities of the entity) resulting from such Business Combination or the combined voting power of the then outstanding voting securities of such entity entitled to vote generally in the election of directors (or, for a non-corporate entity, equivalent governing body) of the entity, unless such ownership resulted solely from ownership of securities of Newmont, prior to the Business Combination and (C) at least a majority of the members of the board of directors of the corporation resulting from such Business Combination (or, if reference was made to equity ownership of any Parent Company for purposes of determining whether clause (A) above is satisfied in connection with the applicable Business Combination, of the Parent Company) were members of the Incumbent Board at the time of the execution of the initial agreement, or of the action of the Board of Directors of Newmont, providing for such Business Combination; or (iv) Approval by the stockholders of Newmont of a complete liquidation or dissolution of Newmont. 1.6 “Code” means the Internal Revenue Code of 1986, as amended from time to time. 1.7 “Corporate Performance Bonus” means the bonus payable to an Employee pursuant to Section III. 1.8 “Disability” means a condition such that the salaried Employee has terminated employment with Newmont or Affiliated Entities with a disability and has begun receiving benefits from the Long-Term Disability Plan of Newmont (or Affiliated Entity) or a successor plan. 1.9 “Economic Performance Drivers” mean, Financial (Free Cash Flow, Cash Sustaining Costs per Gold Equivalent Ounce, and Newcrest Integration Synergy), and Sustainability (Fatality Risk Management, Local/Indigenous Persons Employment, and Operating Sites Water Consumption Efficiency), as reflected in Appendix A.

4 1.10 “Employee” means an employee of Newmont or an Affiliated Entity who satisfies the conditions for this program and who is not (a) an individual who performs services for Newmont or an Affiliated Entity under an agreement, contract or arrangement (which may be written or oral) between the employer and the individual or with any other organization that provides the services of the individual to the Employer pursuant to which the individual is initially classified or treated as an independent contractor or whose remuneration for services has not been treated initially as subject to the withholding of federal income tax pursuant to Code § 3401, or who is otherwise treated as an employee of an entity other than Newmont or an Affiliated Entity, irrespective of whether they are treated as an employee of Newmont or an Affiliated Entity under common law employment principles or pursuant to the provisions of Code § 414(m), 414(n) or 414(o), even if the individual is subsequently reclassified as a common law employee as a result of a final decree of a court of competent jurisdiction, the settlement of an administrative or judicial proceeding or a determination by the Internal Revenue Service, the Department of the Treasury or the Department of Labor, (b) an individual who is a leased employee, (c) a temporary employee, or (d) an individual covered by a collective bargaining agreement unless otherwise provided for in such agreement. 1.11 “Free Cash Flow” means annual approved STIP free cash flow for the Performance Period on an attributable basis, as adjusted for metal prices, fuel and exchange rates, one-time adjustments or other items as approved by the Board, to actual attributable free cash flow. 1.12 “Leadership Development and Compensation Committee or LDCC” means the Leadership Development and Compensation Committee of the Board of Directors of Newmont. 1.13 “Level” means the Level of Work assigned to the job, as reflected in Appendix C. 1.14 “Newcrest Integration Synergy” means an integration metric measured against an integration target metric, as adjusted from time to time, as approved by the LDCC. 1.15 “Newmont” means Newmont Corporation. 1.16 Participating Employer” means Newmont and any Affiliated Entity. 1.17 “Pay Grade” means globally graded jobs that share common salary ranges, as designated by the Board or its delegate, which may be adjusted from time to time, as reflected in Appendix C. 1.18 “Performance Period” means the relevant time period which the LDCC will utilize to calculate and determine the Corporate Performance Bonus. 1.19 “Retirement” means at least age 55, and, at least 5 years of continuous employment with Newmont and/or an Affiliated Entity, and a total of at least 65 when adding age plus years of employment. 1.20 “Sustainability” means selected sustainability metrics measured against target selected sustainability metrics, as adjusted from time to time as approved by the LDCC.

5 1.21 “Section 16 Officer” means an officer as defined in Section 16(b) of the Securities Exchange Act of 1934. 1.22 “Terminated Eligible Employee” means an eligible Employee employed in a position located in Colorado or any Employee in an Executive grade level position who terminates employment with Newmont and/or a Participating Employer during the calendar year on account of death, Retirement, Disability or involuntary termination entitling the Employee to benefits under the Executive Severance Plan of Newmont. However, if an eligible Employee is terminated between January 1 and March 31 of any calendar year, and entitled to benefits under the Executive Severance Plan of Newmont, Employee shall not qualify for any bonus under this program for the period of January 1 to March 31 for the calendar year of the termination. SECTION II-ELIGIBILITY All Employees of a Participating Employer who participate in the Senior Executive Compensation Program of Newmont (in other words, Section 16 Officers in Pay Grades E-1, E-2, E-3 or Levels 6 and 7, as well as non-Section 16 employees in Pay Grades E-4) and Section 16 Officers in Pay Grade E-5 or Level 5 not participating in the Senior Executive Compensation Program of Newmont are potentially eligible to receive a bonus payment under the Corporate Performance Bonus program, provided (i) they are on the payroll of a Participating Employer as of the last day of the calendar year, and on the payroll of a Participating Employer at the time of payment, or (ii) they are a Terminated Eligible Employee with respect to such calendar year. SECTION III-CORPORATE PERFORMANCE BONUS 3.1 Eligibility for Corporate Performance Bonus. For the calendar year, the Corporate Performance Bonus will be determined pursuant to this section for each eligible Employee. For the calendar year, the performance bonus for each eligible Employee who is not assigned to the corporate office will have certain regional performance factors weighted into the Corporate Performance Bonus as stated in Appendix B. Each operating site shall develop its own critical performance indicators for this purpose. 3.2 Target Amounts for Economic Performance Drivers. The LDCC shall establish both the targets and the minimum and maximum amounts for each Economic Performance Driver on an annual basis. 3.3 Actual Performance for Economic Performance Drivers. As soon as possible after the end of each calendar year, the LDCC shall certify the extent to which actual performance met the target amounts for each Economic Performance Driver, following a report from the Internal Audit department, or an external audit firm. 3.4 Aggregate Payout Percentage. An aggregate payout factor (the “Aggregate Payout Percentage”) will be calculated based upon the funding schedule as approved by the LDCC. (a) Calculating the Performance Percentage for each Economic Performance Driver. For each Economic Performance Driver, actual performance will be compared to

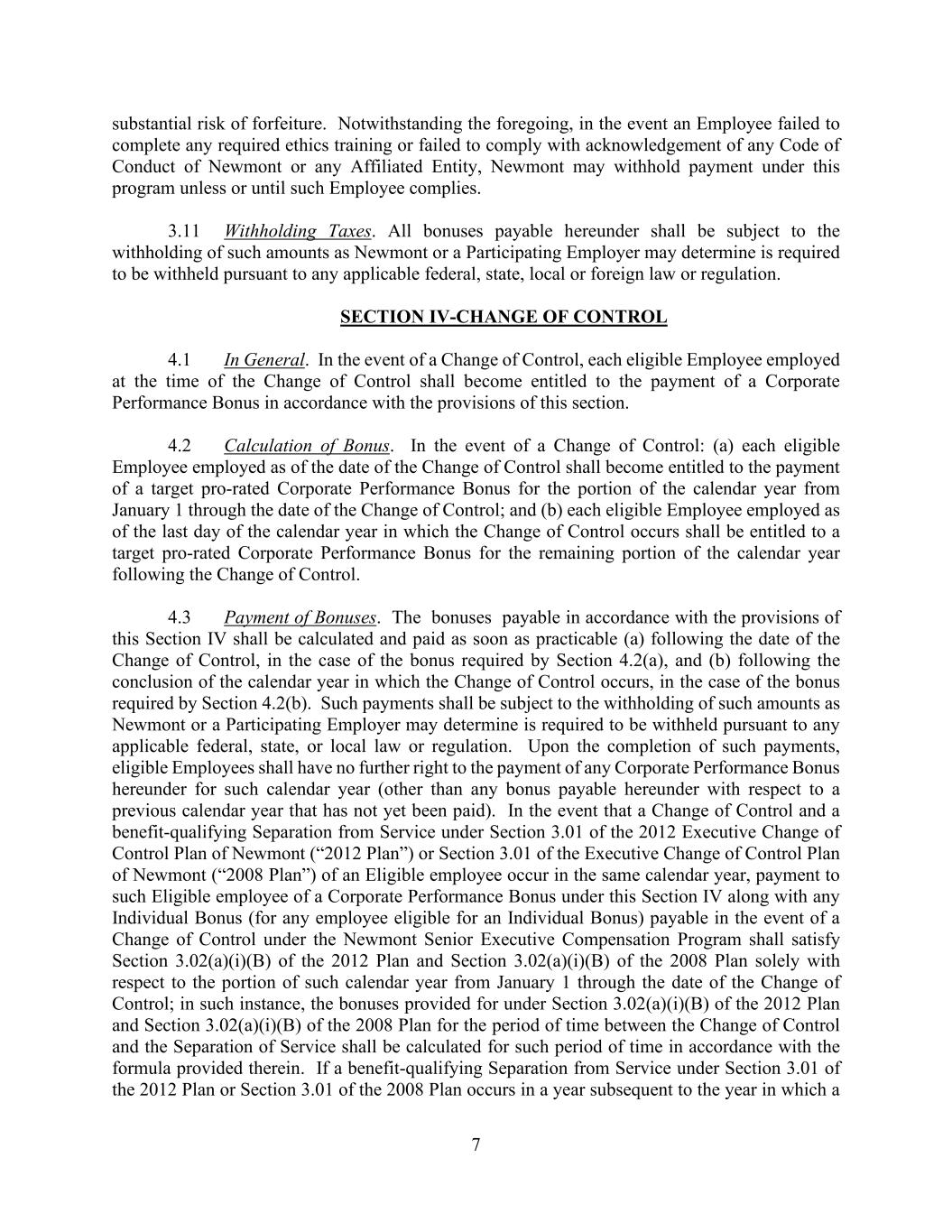

6 the target, minimum and maximum amounts to arrive at a performance percentage (“Performance Percentage”). (b) Calculating the Payout Percentage for each Economic Performance Driver. The payout percentage for each Economic Performance Driver is the product of the Performance Percentage times the applicable weighting factor as listed in Appendix A (“Payout Percentage for each Economic Performance Driver”). However, repeat significant potential events may modify the payout for the Fatality Risk Management metric. (c) Calculating the Aggregate Payout Percentage. The Aggregate Payout Percentage is the sum of the Payout Percentages for each Performance Factor. 3.5 Determination of Target Performance Level. An Employee’s Target Performance Level is determined by the Employee’s Pay Grade or Level pursuant to the table in Appendix B. 3.6 Determination of the Corporate Performance Bonus. The Corporate Performance Bonus for each eligible Employee is the product of the Aggregate Payout Percentage, times the Employee’s Target Performance Level, times the Employee’s Bonus Eligible Earnings. 3.7 Terminated Eligible Employees. Terminated Eligible Employees shall be eligible to receive a Corporate Performance Bonus; provided, that a Terminated Eligible Employee who has an involuntary termination entitling the employee to benefits under the Executive Severance Plan of Newmont must execute a Waiver and Release pursuant to the terms of such plan in order to receive payment of a Corporate Performance Bonus. This bonus will be calculated according to Section III of this program, and pro-rated for the portion of the calendar year that Employee maintained employment with a Participating Employer. 3.8 Adjustments. The LDCC may adjust the Performance Percentage or any measure or otherwise increase or decrease the Corporate Performance Bonus otherwise payable in order to reflect changed circumstances or such other matters as the LDCC deems appropriate. 3.9 Pay Grade/Level. If an eligible Employee was in more than one Pay Grade or Level during the calendar year, the bonus payable to such eligible Employee shall be calculated on a pro- rata basis in accordance with the amount of time spent by such eligible Employee in each Pay Grade or Level during the calendar year; provided, however, that if an eligible Employee who is in Pay Grade E-4 changes to a Level 5 during the calendar year, the Newmont Short-Term Incentive Program will apply during the time period that they are a Level 5, and not this Program. 3.10 Time and Method of Payment. Any bonus payable under this program shall be payable to each eligible Employee in cash as soon as practicable following approval of bonuses by the LDCC for Section 16 Officers (except for the CEO, whose bonus is approved by the Board), and review by LDCC for non-Section 16 Officers. All payments and the timing of such payments shall be made in accordance with practices and procedures established by the Participating Employer. Payment under this program will be made no later than the 15th day of the third month following the calendar year in which an Employee’s right to payment is no longer subject to a

7 substantial risk of forfeiture. Notwithstanding the foregoing, in the event an Employee failed to complete any required ethics training or failed to comply with acknowledgement of any Code of Conduct of Newmont or any Affiliated Entity, Newmont may withhold payment under this program unless or until such Employee complies. 3.11 Withholding Taxes. All bonuses payable hereunder shall be subject to the withholding of such amounts as Newmont or a Participating Employer may determine is required to be withheld pursuant to any applicable federal, state, local or foreign law or regulation. SECTION IV-CHANGE OF CONTROL 4.1 In General. In the event of a Change of Control, each eligible Employee employed at the time of the Change of Control shall become entitled to the payment of a Corporate Performance Bonus in accordance with the provisions of this section. 4.2 Calculation of Bonus. In the event of a Change of Control: (a) each eligible Employee employed as of the date of the Change of Control shall become entitled to the payment of a target pro-rated Corporate Performance Bonus for the portion of the calendar year from January 1 through the date of the Change of Control; and (b) each eligible Employee employed as of the last day of the calendar year in which the Change of Control occurs shall be entitled to a target pro-rated Corporate Performance Bonus for the remaining portion of the calendar year following the Change of Control. 4.3 Payment of Bonuses. The bonuses payable in accordance with the provisions of this Section IV shall be calculated and paid as soon as practicable (a) following the date of the Change of Control, in the case of the bonus required by Section 4.2(a), and (b) following the conclusion of the calendar year in which the Change of Control occurs, in the case of the bonus required by Section 4.2(b). Such payments shall be subject to the withholding of such amounts as Newmont or a Participating Employer may determine is required to be withheld pursuant to any applicable federal, state, or local law or regulation. Upon the completion of such payments, eligible Employees shall have no further right to the payment of any Corporate Performance Bonus hereunder for such calendar year (other than any bonus payable hereunder with respect to a previous calendar year that has not yet been paid). In the event that a Change of Control and a benefit-qualifying Separation from Service under Section 3.01 of the 2012 Executive Change of Control Plan of Newmont (“2012 Plan”) or Section 3.01 of the Executive Change of Control Plan of Newmont (“2008 Plan”) of an Eligible employee occur in the same calendar year, payment to such Eligible employee of a Corporate Performance Bonus under this Section IV along with any Individual Bonus (for any employee eligible for an Individual Bonus) payable in the event of a Change of Control under the Newmont Senior Executive Compensation Program shall satisfy Section 3.02(a)(i)(B) of the 2012 Plan and Section 3.02(a)(i)(B) of the 2008 Plan solely with respect to the portion of such calendar year from January 1 through the date of the Change of Control; in such instance, the bonuses provided for under Section 3.02(a)(i)(B) of the 2012 Plan and Section 3.02(a)(i)(B) of the 2008 Plan for the period of time between the Change of Control and the Separation of Service shall be calculated for such period of time in accordance with the formula provided therein. If a benefit-qualifying Separation from Service under Section 3.01 of the 2012 Plan or Section 3.01 of the 2008 Plan occurs in a year subsequent to the year in which a

8 Change of Control occurs, any payments made under this Section IV shall not in any way satisfy Section 3.02(a)(i)(B) of the 2012 Plan or Section 3.02(a)(i)(B) of the 2008 Plan. SECTION V-GENERAL PROVISIONS 5.1 Amount Payable Upon Death of Employee. If an eligible Employee who is entitled to payment hereunder dies after becoming eligible for payment but before receiving full payment of the amount due, or if an eligible Employee dies and becomes a Terminated Eligible Employee, all amounts due shall be paid as soon as practicable after the death of the eligible Employee, in a cash lump sum, to the beneficiary or beneficiaries designated by the eligible Employee to receive life insurance proceeds under Group Life and Accidental Death & Dismemberment Plan of Newmont USA Limited (or a successor plan) or a similar plan of a Participating Employer. In the absence of an effective beneficiary designation under said plan, any amount payable hereunder following the death of an eligible Employee shall be paid to the eligible Employee’s estate. 5.2 Right of Offset. To the extent permitted by applicable law, Newmont or a Participating Employer may, in its sole discretion, apply any bonus payments otherwise due and payable under this program against any eligible Employee or Terminated Eligible Employee loans outstanding to Newmont, an Affiliated Entity, or Participating Employer, or other debts of the eligible Employee or Terminated Eligible Employee to Newmont, an Affiliated Entity, or Participating Employer. By accepting payments under this program, the eligible Employee consents to the reduction of any compensation paid to the eligible Employee by Newmont, an Affiliated Entity, or Participating Employer to the extent the eligible Employee receives an overpayment from this program. 5.3 Termination. The LDCC or Board may at any time amend, modify, suspend or terminate this program. However, upon or following a Change of Control, Section IV of this program may not be amended, suspended, or terminated until the obligations of Section IV of this program have been fully satisfied with respect to such Change of Control. 5.4 Payments Due Minors or Incapacitated Persons. If any person entitled to a payment under this program is a minor, or if the LDCC or its delegate determines that any such person is incapacitated by reason of physical or mental disability, whether or not legally adjudicated as incompetent, the LDCC or its delegate shall have the power to cause the payment becoming due to such person to be made to another for their benefit, without responsibility of the LDCC or its delegate, Newmont, or any other person or entity to see to the application of such payment. Payments made pursuant to such power shall operate as a complete discharge of the LDCC, this program, Newmont, and Affiliated Entity or Participating Employer. 5.5 Severability. If any section, subsection, or specific provision is found to be illegal or invalid for any reason, such illegality or invalidity shall not affect the remaining provisions of this program, and this program shall be construed and enforced as if such illegal and invalid provision had never been set forth in this program. 5.6 No Right to Employment. The establishment of this program shall not be deemed to confer upon any person any legal right to be employed by, or to be retained in the employ of, Newmont, any Affiliated Entity, any Participating Employer, or to give any Employee or any

9 person any right to receive any payment whatsoever, except as provided under this program. All Employees shall remain subject to discharge from employment to the same extent as if this program had never been adopted. 5.7 Transferability. Any bonus payable hereunder is personal to the Eligible Employee or Terminated Eligible Employee and may not be sold, exchanged, transferred, pledged, assigned, or otherwise disposed of except by will or by the laws of descent and distribution. 5.8 Successors. This program shall be binding upon and inure to the benefit of Newmont, the Participating Employers and the eligible Employees and Terminated Eligible Employees and their respective heirs, representatives, and successors. 5.9 Governing Law. This program and all agreements hereunder shall be construed in accordance with and governed by the laws of the State of Colorado, unless superseded by federal law. 5.10 Reimbursement. The LDCC, to the full extent permitted by governing law, shall have the discretion to require reimbursement of any portion of the Corporate Performance Bonus previously paid to an eligible Employee pursuant to the terms of this compensation program if: a) the amount of such Corporate Performance Bonus was calculated based upon the achievement of certain financial results that were subsequently the subject of a restatement; b) the amount of such Corporate Performance Bonus that would have been awarded to the eligible Employee had the financial results been reported as in the restatement would have been lower than the Corporate Performance Bonus actually awarded, or; c) a reimbursement is permitted or required by any clawback standard adopted by Newmont, including a standard adopted after the effective date of this Program. Additionally, the LDCC, to the full extent permitted by governing law, shall have the discretion to require reimbursement of any portion of a Corporate Performance Bonus previously paid to an eligible Employee pursuant to the terms of this compensation program if the eligible Employee is terminated for cause as defined in the Executive Change of Control Plan of Newmont or as defined in the Executive Severance Plan of Newmont. 5.11 Section 409A. It is the intention of Newmont that payments under this compensation program comply with or be exempt from Section 409A of the Code and the regulations and guidance promulgated thereunder (collectively “Code Section 409A”), and Newmont shall have complete discretion to interpret and construe this program and any related plan or agreement in any manner that establishes an exemption from (or compliance with) the requirements of Code Section 409A. If for any reason, such as imprecision in drafting, any provision of this program and/or any such plan or agreement does not accurately reflect its intended establishment of an exemption from (or compliance with) Code Section 409A, as demonstrated by consistent interpretations or other evidence of intent, such provision shall be considered ambiguous as to its exemption from (or compliance with) Code Section 409A and shall be interpreted by Newmont in a manner consistent with such intent, as determined in the discretion of Newmont. None of Newmont nor any other Participating Employer shall be liable to any eligible Employee or any other person (i) if any provisions of this program do not satisfy an exemption from, or the conditions of, Code Section 409A, or (ii) as to any tax consequence expected, but not realized, by any eligible Employee or other person due to the any payment under this program.

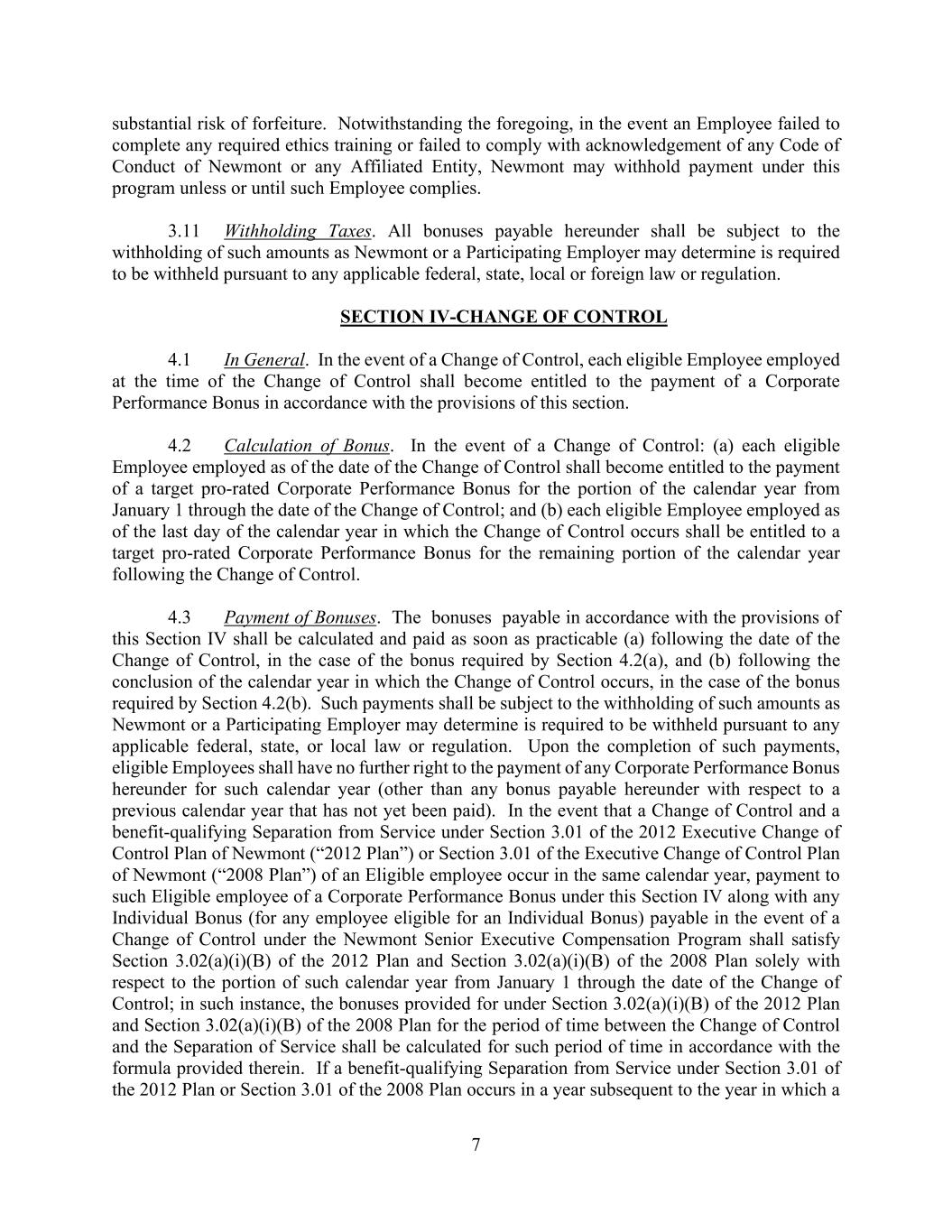

10 APPENDIX A Economic Performance Drivers and Weighting Factors for Each Sustainability Fatality Risk Management (with modifier for Repeat Significant Potential Events) Sustainability Operating Sites Water Consumption Efficiency Sustainability Local/Indigenous Persons Employment Financial Cash Sustaining Costs per Gold Equivalent Ounce (CSC/GEO) Financial Free Cash Flow Financial Newcrest Integration Synergy 20% 5% 5% 30% 30% 10%

11 APPENDIX B Target STIP Corporate Performance Bonus1 Grade / Level Percentage of Bonus Eligible Earnings E-1 / Level 7 150% E-2/E-3 Range / Level 6 (based on executive role) 75% - 125% E-4 / Level 5(excluding Managing Directors (“MD”) of business units)2 Up to 52.5% E-4 MD/ Level 5 52.5% Total—Weighted as Below: Corporate STIP—30%(15.7% of base salary) Regional STIP—70% (36.6% of base salary) Section 16 Officer who is E-5 / Level 5 30% 1 The E-1, E-2 and E-3 roles are all Section 16 officer roles, which are eligible only for a Corporate Performance Bonus, and not an Individual Performance Bonus. 2 To the extent that eligible Employees who were in Pay Grade E-4 during calendar year 2023 converted to Level 5 or some other Level during the calendar year, they are not covered by this Program as of the date that they converted to Level 5 or some other lower Level—instead, they are covered by the Newmont Short-Term Incentive Program.

12 APPENDIX C If an Employee is mapped to a Level in lieu of a Pay Grade in calendar year 2023 or in a later calendar year, the Employee shall be eligible for a Corporate Performance Bonus for the Employee’s Level, with any Corporate Performance Bonus paid pro rata based on the respective time periods during the calendar year in which the Employee is assigned to a Pay Grade versus a Level, if there is a difference in the targets for the Pay Grade versus the Level. By way of example, and for avoidance of doubt, if an Employee is in a Pay Grade between January 1 and June 30 of a particular calendar year for which their target Corporate Performance Bonus is 30% of their bonus eligible earnings, and their target Individual Performance Bonus is 30% of their bonus eligible earnings, and then, as of July 1 of such calendar year, the Employee is mapped to a Level that provides that their target Corporate Performance Bonus is 42% of their bonus eligible earnings and their target Individual Performance Bonus is 18% of their bonus eligible earnings, the Employee’s Corporate Performance Bonus and Individual Performance Bonus pay-out for the entire calendar year will be pro-rated for the first six months based on the Pay Grade percentages, and for the second six months based on the Level percentages. By way of another example, and for avoidance of doubt, if an employee is in Pay Grade E-4 between January 1 and July 31 of a particular calendar year that provides that their Corporate Performance Bonus is based on the performance of the Economic Performance Drivers in Appendix A of this Program, and then as of August 1 of such calendar year, the Employee is mapped to Level 5 that provides that their Corporate Performance Bonus is based on the Economic Performance Drivers in the Newmont Short-Term Incentive Program, the Employee’s Corporate Performance Bonus pay-out for the entire calendar year will be pro-rated for the first seven months based on the Pay Grade Economic Performance Drivers in this Program, and for the second five months based on the Level Economic Performance Drivers in the Newmont Short-Term Incentive Program.