UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| |

(Mark One) | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended February 2, 2013 |

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ______________ to ________________ |

Commission File Number: 001-15274

| | | | |

| | | | |

| | J. C. PENNEY COMPANY, INC. | | |

| | (Exact name of registrant as specified in its charter) | | |

Delaware | | | 26-0037077 |

(State or other jurisdiction of incorporation or organization) | | | (I.R.S. Employer Identification No.) |

| 6501 Legacy Drive, Plano, Texas 75024-3698 | |

| | (Address of principal executive offices) | | |

| | (Zip Code) | | |

| | (972)-431-1000 | | |

| | (Registrant's telephone number, including area code) | | |

| Securities registered pursuant to Section 12(b) of the Act: | |

Title of each class | | | | Name of each exchange on which registered |

Common Stock of 50 cents par value | | | | New York Stock Exchange |

| Securities registered pursuant to Section 12(g) of the Act: | |

| | None | | |

| | (Title of class) | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation SـT (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10ـK or any amendment to this Form 10ـK. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer o Non-accelerated filer o Smaller reporting company o

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter (July 28, 2012). $3,570,280,064

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

219,754,016 shares of Common Stock of 50 cents par value, as of March 18, 2013.

| | |

DOCUMENTS INCORPORATED BY REFERENCE |

Documents from which portions are incorporated by reference | | Parts of the Form 10-K into which incorporated |

J. C. Penney Company, Inc. 2013 Proxy Statement | | Part III |

INDEX

PART I

Item 1. Business

Business Overview

J. C. Penney Company, Inc. is a holding company whose principal operating subsidiary is J. C. Penney Corporation, Inc. (JCP). JCP was incorporated in Delaware in 1924, and J. C. Penney Company, Inc. was incorporated in Delaware in 2002, when the holding company structure was implemented. The new holding company assumed the name J. C. Penney Company, Inc. (Company). The holding company has no independent assets or operations, and no direct subsidiaries other than JCP. Common stock of the Company is publicly traded under the symbol “JCP” on the New York Stock Exchange. The Company is a co-obligor (or guarantor, as appropriate) regarding the payment of principal and interest on JCP’s outstanding debt securities. The guarantee by the Company of certain of JCP’s outstanding debt securities is full and unconditional. The holding company and its consolidated subsidiaries, including JCP, are collectively referred to in this Annual Report on Form 10-K as “we,” “us,” “our,” “ourselves,” “Company” or “jcpenney.”

Since our founding by James Cash Penney in 1902, we have grown to be a major retailer, operating 1,104 department stores in 49 states and Puerto Rico as of February 2, 2013. Our fiscal year ends on the Saturday closest to January 31. Unless otherwise stated, references to years in this report relate to fiscal years, rather than to calendar years. Fiscal year 2012 ended on February 2, 2013; fiscal year 2011 ended on January 28, 2012; and fiscal year 2010 ended on January 29, 2011. Fiscal year 2012 consisted of 53 weeks and fiscal years 2011 and 2010 consisted of 52 weeks.

Our business consists of selling merchandise and services to consumers through our department stores and through our Internet website at jcp.com. Department stores and Internet generally serve the same type of customers and provide virtually the same mix of merchandise, and department stores accept returns from sales made in stores and via the Internet. We sell family apparel and footwear, accessories, fine and fashion jewelry, beauty products through Sephora inside jcpenney and home furnishings. In addition, our department stores provide our customers with services such as styling salon, optical, portrait photography and custom decorating.

Our merchandise mix of total net sales over the last three years was as follows:

| | | | | | |

| | | | | | |

| | 2012 | | 2011 | | 2010 |

Women’s apparel | | 23% | | 25% | | 24% |

Men’s apparel and accessories | | 21% | | 20% | | 20% |

Home | | 12% | | 15% | | 18% |

Women’s accessories, including Sephora | | 13% | | 12% | | 12% |

Children’s apparel | | 12% | | 12% | | 11% |

Family footwear | | 7% | | 7% | | 7% |

Fine jewelry | | 7% | | 4% | | 4% |

Services and other | | 5% | | 5% | | 4% |

| | 100% | | 100% | | 100% |

| | | | | | |

Business Strategy

At the beginning of 2012, we announced our plans to become America’s favorite store by creating a specialty department store experience. During our first year of transformation, we focused on building a new foundation for the future by reimagining all aspects of our business, including product, presentation, pricing and promotion.

We are making substantial changes in our merchandise and continue to edit and introduce more global brands into our merchandise assortment. We are re-organizing our department stores into separately curated unique specialty stores known as The Shops. The Shops will be organized around a pathway through our stores known as The StreetTM, a bold new interface for retail, which includes places to relax, refresh, engage and check out. The Street will surround The SquareTM, a dynamic seasonal space that will provide engaging experiences for our customers. Our pricing strategy is founded on providing merchandise at low everyday prices and delivering even more exciting value through sales, promotions and rewards.

During the first year of transformation we opened shops under the Levi's ®, Izod®, Liz Claiborne®, The Original Arizona Jean Co.®, and jcp™ brands. We also opened 78 Sephora inside jcpenney stores, bringing the total to 386.

Competition and Seasonality

The business of marketing merchandise and services is highly competitive. We are one of the largest department store and e-commerce retailers in the United States, and we have numerous competitors, as further described in Item 1A, Risk Factors. Many factors enter into the competition for the consumer’s patronage, including price, quality, style, service, product mix, convenience and credit availability. Our annual earnings depend to a great extent on the results of operations for the last quarter of the fiscal year, which includes the holiday season, when a significant portion of our sales and profits are recorded.

Trademarks

The jcpenney®, Fair and SquareTM, jcp®, monet®, Liz Claiborne®, Okie Dokie®, Worthington®, a.n.a®, St. John’s Bay®, The Original Arizona Jean Company®, Ambrielle®, Decree®, Linden Street™, Stafford®, J. Ferrar®, jcpenney Home Collection® and Studio by jcpenney Home Collection® trademarks, as well as certain other trademarks, have been registered, or are the subject of pending trademark applications with the United States Patent and Trademark Office and with the registries of many foreign countries and/or are protected by common law. We consider our marks and the accompanying name recognition to be valuable to our business.

Website Availability

We maintain an Internet website at www.jcp.com and make available free of charge through this website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all related amendments to those reports, as soon as reasonably practicable after the materials are electronically filed with or furnished to the Securities and Exchange Commission. In addition, our website provides press releases, access to webcasts of management presentations and other materials useful in evaluating our Company.

Suppliers

We have a diversified supplier base, both domestic and foreign, and are not dependent to any significant degree on any single supplier. We purchase our merchandise from over 2,500 domestic and foreign suppliers, many of which have done business with us for many years. In addition to our Plano, Texas home office, we, through our international purchasing subsidiary, maintained buying and quality assurance offices in 12 foreign countries as of February 2, 2013.

Employment

The Company and its consolidated subsidiaries employed approximately 116,000 full-time and part-time employees as of February 2, 2013.

Environmental Matters

Environmental protection requirements did not have a material effect upon our operations during 2012. It is possible that compliance with such requirements (including any new requirements) would lengthen lead time in expansion or renovation plans and increase construction costs, and therefore operating costs, due in part to the expense and time required to conduct environmental and ecological studies and any required remediation.

As of February 2, 2013, we estimated our total potential environmental liabilities to range from $30 million to $36 million and recorded our best estimate of $30 million in other liabilities in the Consolidated Balance Sheet as of that date. This estimate covered potential liabilities primarily related to underground storage tanks, remediation of environmental conditions involving our former drugstore locations and asbestos removal in connection with approved plans to renovate or dispose of our facilities. We continue to assess required remediation and the adequacy of environmental reserves as new information becomes available and known conditions are further delineated. If we were to incur losses at the upper end of the estimated range, we do not believe that such losses would have a material effect on our financial condition, results of operations or liquidity.

Executive Officers of the Registrant

The following is a list, as of March 5, 2013, of the names and ages of the executive officers of J. C. Penney Company, Inc. and of the offices and other positions held by each such person with the Company. These officers hold identical positions with JCP. There is no family relationship between any of the named persons.

| | | | |

| | | | |

Name | | Offices and Other Positions Held With the Company | | Age |

Ronald B. Johnson | | Chief Executive Officer | | 54 |

Michael W. Kramer | | Chief Operating Officer | | 48 |

Daniel E. Walker | | Chief Talent Officer | | 62 |

Kenneth H. Hannah | | Executive Vice President and Chief Financial Officer | | 44 |

Janet Dhillon | | Executive Vice President, General Counsel and Secretary | | 50 |

Mark R. Sweeney | | Senior Vice President and Controller | | 51 |

| | | | |

Mr. Johnson has served as Chief Executive Officer of the Company since November 2011. He previously served as Senior Vice President, Retail of Apple, Inc. Prior to joining Apple in 2000, he held a variety of positions with Target Corporation, including Senior Vice President of Merchandising. During his tenure at Target, Mr. Johnson had responsibility for such categories as Men’s Apparel, Women’s Apparel and Accessories, Children’s and Home. He has served as a director of the Company and as a director of JCP since 2011.

Mr. Kramer has served as Chief Operating Officer of the Company since December 2011. Prior to joining the Company, he was President and Chief Executive Officer of Kellwood Company. From 2005 to 2008, Mr. Kramer was Executive Vice President and Chief Financial Officer at Abercrombie & Fitch. From 2000 to 2005, he was at Apple, Inc., where he served as Chief Financial Officer of Apple retail. Mr. Kramer previously held key financial leadership roles with The Limited, Pizza Hut and Einstein Noah Bagel Corporation.

Mr. Walker has served as Chief Talent Officer of the Company since November 2011. He served as Chief Talent Officer for Apple, Inc. from 2000 to 2004 and as Vice President of Human Resources at Gap from 1986 to 1992. Mr. Walker founded and led The Human Revolution Studios prior to joining the Company, and Daniel Walker and Associates, an executive search and consulting firm, prior to joining Apple. Prior to joining Gap, he was Director of Human Resources for the Specialty Retail Group at General Mills and worked for Lazarus Department Stores, a division of Federated Department Stores.

Mr. Hannah has served as Executive Vice President and Chief Financial Officer since May 2012. Prior to joining the Company, he was Executive Vice President and President-Solar Energy of MEMC Electronic Materials, Inc. and had previously served as Executive Vice President and President-Solar Materials from 2009 to 2012 and Senior Vice President and Chief Financial Officer from 2006 to 2009. Mr. Hannah previously held key financial leadership positions at The Home Depot, Inc., The Boeing Company and General Electric Company. He has served as a director of JCP since 2012.

Ms. Dhillon has served as Executive Vice President, General Counsel and Secretary of the Company since 2009. Prior to joining the Company, she served as Senior Vice President and General Counsel and Chief Compliance Officer of US Airways Group, Inc. and US Airways, Inc. from 2006 to 2009. Ms. Dhillon joined US Airways, Inc. in 2004 as Managing Director and Associate General Counsel and served as Vice President and Deputy General Counsel of US Airways Group, Inc. and US Airways, Inc. from 2005 to 2006. Ms. Dhillon was with the law firm of Skadden, Arps, Slate, Meagher & Flom LLP from 1991 to 2004. She has served as a director of JCP since 2009.

Mr. Sweeney has served as Senior Vice President and Controller since September 2012. Prior to joining the Company, he was Vice President and Operational Controller of General Electric Company from 2008 to 2012. He previously served as Chief Financial Officer of GE-Hitachi Nuclear Energy, LLC from 2004 to 2008 and Global Controller of General Electric’s Energy Division from 1997 to 2004. Prior to joining General Electric, Mr. Sweeney held financial leadership positions with PepsiCo, Inc. from 1995 to 1997 and previously was a senior manager with KPMG LLP.

Item 1A. Risk Factors

The following risk factors should be read carefully in connection with evaluating our business and the forward-looking information contained in this Annual Report on Form 10-K. Any of the following risks could materially adversely affect our business, operating results, financial condition and the actual outcome of matters as to which forward-looking statements are made in this Annual Report on Form 10-K.

The success of our transformation is subject to both the risks affecting our business generally and the inherent difficulties associated with implementing our new strategies.

Our ability to improve our operating results depends upon a significant number of factors, some of which are beyond our control, including:

· | customer acceptance of our marketing and merchandise strategies; |

· | our ability to respond to any increased competitive pressures in our industry; |

· | the extent to which our management team has properly understood the dynamics and demands of our market in crafting the transformation; |

· | our ability to achieve profitable sales and to make adjustments in response to changing conditions; |

· | our ability to effectively manage inventory; |

· | the success of our strategic initiatives and cost reduction initiatives; |

· | the time to complete, and cost increases associated with, the Company’s capital improvements; |

· | our ability to respond to any unanticipated changes in expected cash flows, liquidity, cash needs and cash expenditures, including our ability to obtain any additional financing or other liquidity enhancing transactions, if and when needed; |

· | our ability to achieve positive cash flow, particularly during our peak inventory build-ups in advance of principal selling seasons; |

· | our employees’ ability to adapt to our new strategic initiatives and organizational structure; |

· | our management team’s ability to execute our new strategic initiatives in a cost-effective manner; |

· | our ability to access adequate and uninterrupted supply of merchandise from suppliers at expected levels and on acceptable terms; and |

· | general economic conditions. |

There is no assurance that we will be able to successfully implement our strategic initiatives, which could have an adverse impact on our results of operations.

Our strategies to transform our business may not achieve the improvements we expect in our operating results.

We are executing a number of strategic initiatives as part of our transformation, including changes in our pricing strategy, corporate branding, marketing, store layout and merchandise assortments. During this transition period, changes to our pricing and marketing strategies have resulted in a prolonged decline in sales and our results of operations have been significantly below our expectations. It may take longer than expected or planned to recover from our negative sales trends and operating results, and actual results may be materially less than planned. As certain of these strategic initiatives such as the Shops and the Street are focused on our largest stores, they may not have the same impact on all of our stores. We may need to adjust any one or more of these strategic initiatives depending upon our customers’ reactions to and acceptance of these initiatives. Any changes to our strategies could be substantial, and if implemented, could result in significant additional costs. Adjustments may also create confusion among our customers, divert management and employees’ attention from other business concerns or otherwise disrupt our business. There is no assurance that our pricing, branding, store layout, marketing and merchandising strategies, or any future adjustments to our strategies, will improve our operating results.

We operate in a highly competitive industry that includes significant promotional activity, which could adversely impact our sales and profitability.

The retail industry is highly competitive, with few barriers to entry. We compete with many other local, regional and national retailers for customers, employees, locations, merchandise, services and other important aspects of our business. Those competitors include other department stores, discounters, home furnishing stores, specialty retailers, wholesale clubs, direct-to-consumer businesses, including the Internet, and other forms of retail commerce. Some competitors are larger than jcpenney, and/or have greater financial resources available to them, and, as a result, may be able to devote greater resources to sourcing, promoting and selling their products. Competition is characterized by many factors, including merchandise assortment, advertising, price, quality, service, location, reputation and credit availability. During the first year of our transformation, we discontinued our former promotional strategy and encountered difficulties in communicating our value proposition. Although we have re-introduced certain promotional activities, there can be no assurance that increased promotional activity will result in increased sales and profitability. We have experienced, and anticipate that we will continue to experience for at least the foreseeable future, significant competition from promotional activities of our competitors. The performance of competitors as well as changes in their pricing and promotional policies, marketing activities, new store openings, launches of Internet websites, brand launches and other merchandise and operational strategies could cause us to have lower sales, lower gross margin and/or higher operating expenses such as marketing costs and other selling, general and administrative expenses, which in turn could have an adverse impact on our profitability.

Our sales and operating results depend on our ability to develop merchandise offerings that resonate with our existing customers and help to attract new customers.

Our sales and operating results depend in part on our ability to predict and respond to changes in fashion trends and customer preferences in a timely manner by consistently offering stylish, quality merchandise assortments at competitive prices. We continuously assess emerging styles and trends and focus on developing a merchandise assortment to meet customer preferences. Even with these efforts, we cannot be certain that we will be able to successfully meet constantly changing customer demands. One of our strategic initiatives is to transform our largest stores into a collection of Shops showcasing major apparel and brands. Our goal is for our transformed merchandise and brand image to expand our customer base while continuing to appeal to our traditional, core customer. To the extent our predictions regarding our merchandise or the vendors selected for our Shops differ from our customers’ preferences, we may be faced with reduced sales and excess inventories for some products and/or missed opportunities for others. Any sustained failure to identify and respond to emerging trends in lifestyle and customer preferences and buying trends could have an adverse impact on our business. In addition, merchandise misjudgments may adversely impact the perception or reputation of our Company, which could result in declines in customer loyalty and vendor relationship issues, and ultimately have a material adverse effect on our business, financial condition and results of operations.

Our ability to increase sales and store productivity is largely dependent upon our ability to increase customer traffic.

Customer traffic depends upon our ability to successfully market compelling merchandise assortments as well as present an appealing shopping environment and experience to existing customers and new customers. In the first year of our transformation, our store customer traffic significantly decreased compared to the prior year. As part of the re-imagination of our stores, we are changing our merchandise assortment, building new Shops and creating the Street in our largest stores. These changes are designed to increase customer traffic and the amount of time that our customers spend in our stores. There can be no assurance that our efforts to increase customer traffic and visit time in our stores will be successful or will result in increased sales. We may need to respond to any declines in customer traffic by increasing markdowns or changing marketing strategies to attract customers to our stores, which could adversely impact our gross margins, operating results and cash flows from operating activities.

If we are unable to manage our inventory effectively, our gross margins could be adversely affected.

Our profitability depends upon our ability to manage appropriate inventory levels and respond quickly to shifts in consumer demand patterns. We must properly execute our inventory management strategies by appropriately allocating merchandise among our stores, timely and efficiently distributing inventory to stores, maintaining an appropriate mix and level of inventory in stores, appropriately changing the allocation of floor space of stores among product categories to respond to customer demand and effectively managing pricing and markdowns. If we overestimate customer demand for our merchandise, we will likely need to record inventory markdowns and move the excess inventory to be sold at clearance prices which would negatively impact our gross margins and operating results. If we underestimate customer demand for our merchandise, we may experience inventory shortages which may result in missed sales opportunities and have a negative impact on customer loyalty.

The implementation of our new store layout may result in reduced sales or profitability.

Our new store layout is focused on presenting a streamlined visual display for our customers. A number of strategic initiatives related to our store layout have the effect of reducing the amount of merchandise displayed in our stores. Our Shops initiative showcases a curated selection of merchandise, which will require us to promptly replenish inventory and maintain the Shops’ distinctive, organized appearance. Our Street initiative will devote significant space to customer experiences, which will decrease the square footage allocated to merchandise in our stores. During the transformation, a portion of our stores will be under construction, which could also reduce the amount of space available to display merchandise and have an adverse impact on our appealing shopping environment. There is no assurance that the execution of strategies to transform our new store layout will result in increased sales or profitability.

We cannot assure that our internal and external sources of liquidity will at all times be sufficient for our cash requirements.

We must have sufficient sources of liquidity to fund our working capital requirements, capital improvement plans, service our outstanding indebtedness and finance investment opportunities. The principal sources of our liquidity are funds generated from operating activities, available cash and cash equivalents, borrowings under our credit facilities, other debt financings and sales of non-operating assets. Our operating losses during the first year of our transformation have limited our capital resources. Our ability to achieve our business and cash flow plans is based on a number of assumptions which involve significant judgments and estimates of future performance, borrowing capacity and credit availability, which cannot at all times be assured. In addition, we are seeking a declaratory judgment that we are not in breach of our Indenture dated April 1, 1994, which if decided unfavorably, could have an adverse impact on our liquidity. See “Risk Factors – Legal and regulatory proceedings could have an adverse impact on our results of operations” Accordingly, we cannot assure that cash flows and other internal and external sources of liquidity will at all times be sufficient for our cash requirements. If necessary, we may need to consider actions and steps to improve our cash position and

mitigate any potential liquidity shortfall, such as modifying our business plan, pursuing additional financing to the extent available, reducing capital expenditures, pursuing and evaluating other alternatives and opportunities to obtain additional sources of liquidity and other potential actions seeking to reduce costs, which we cannot assure would be successful. We cannot assure that any of these actions would be sufficient or available or available on favorable terms. Any inability to generate or obtain sufficient levels of liquidity to meet our cash requirements at the level and times needed could have a material adverse impact on our business, liquidity and financial position.

Our ability to obtain any additional financing or any refinancing of our debt, if needed at any time, depends upon many factors, including our existing level of indebtedness and restrictions in our debt facilities, historical business performance, financial projections, prospects and creditworthiness and external economic conditions and general liquidity in the credit and capital markets. Any additional debt, equity or equity-linked financing may require modification of our existing debt agreements, which we cannot assure would be obtainable. Any additional financing or refinancing could also be at higher costs and require us to satisfy more restrictive covenants, which could further limit or restrict our business and results of operations, or be dilutive to our stockholders.

The failure to retain, attract and motivate our employees, including employees in key positions, could have an adverse impact on our results of operations.

Our results depend on the contributions of our employees, including our senior management team and other key employees. This depends to a great extent on our ability to retain, attract and motivate talented employees throughout the organization, many of whom, particularly in the stores, are in entry level or part-time positions with historically high rates of turnover. The transformational changes to our business model will require new competencies in some positions, which may be difficult to obtain at a reasonable cost, if at all. Our ability to meet our changing labor needs while controlling our costs is also subject to external factors such as unemployment levels, competing wages and potential union organizing efforts. Because of our lower than expected operating results during the first year of our transformation, we have not generally paid bonuses, and salary increases and incentive compensation opportunities could be limited. Any prolonged inability to provide salary increases or incentive compensation opportunities during our transformation could have an adverse impact on our ability to attract, retain and motivate our employees. If we are unable to retain, attract and motivate talented employees with the appropriate skill sets for our new business model, or if the changes to our organizational structure or business model adversely affect morale or retention, we may not achieve our objectives and our results of operations could be adversely impacted. In addition, the loss of one or more of our key personnel or the inability to effectively identify a suitable successor to a key role in our senior management could have a material adverse effect on our business.

The reduction and restructuring of our workforce may adversely impact our operating efficiency.

As part of our cost reduction initiatives, we have significantly reduced our corporate and operations headcount, including management level employees, and distribution and field employees. These reductions, combined with our voluntary early retirement plan initiated in 2011 and voluntary departures of employees, have resulted in a substantial amount of turnover of officers and line managers with specific knowledge relating to us, our operations and our industry that could be difficult to replace. We now operate with significantly fewer individuals who have assumed additional duties and responsibilities and we could have additional workforce reductions in the future. In addition, our business has shifted towards a decentralized management structure that distributes significant control and decision-making powers among our senior management team and other key employees, some of whom are located in satellite offices. These workforce changes may negatively impact communication, morale, management cohesiveness and effective decision-making, which could have an adverse impact on our operating efficiency.

Actions taken under our cost reduction initiatives may not produce the savings expected.

As part of our transformation, we have implemented cost reduction initiatives, including significant workforce reductions, significant reductions in projected marketing spend and other cost and spend reductions. We have forecasted substantial cost savings from these initiatives based on a number of assumptions and expectations which, if achieved, would improve our profitability and cash flows from operating activities. There can be no assurance that actual results achieved will not vary materially from what we have assumed and forecasted, which could have a material adverse impact on our results of operations, liquidity and financial position.

We must protect against security breaches or other disclosures of private data of our customers as well as of our employees and other third parties.

As part of our normal operations, we receive and maintain personal information about our customers, our employees and other third parties. The confidentiality of all of our internal private data must at all times be protected against security breaches or other disclosure. We have systems and processes in place that are designed to protect information and protect against security and data breaches as well as fraudulent transactions and other activities. Despite our safeguards and security processes and protections, we cannot be assured that all of our systems and processes are free from vulnerability to security breaches or inadvertent data disclosure by third parties or us. Any failure to protect the confidential data of our customers or of our employees or other third parties could

materially damage our brand and reputation as well as result in significant damage claims, any of which could have a material adverse impact on our business and results of operations.

Our operations are dependent on information technology systems; disruptions in those systems or increased costs relating to their implementation could have an adverse impact on our results of operations.

Our operations are dependent upon the integrity, security and consistent operation of various systems and data centers, including the point-of-sale systems in the stores, our Internet website, data centers that process transactions, communication systems and various software applications used throughout our Company to track inventory flow, process transactions and generate performance and financial reports.

In July 2012, we announced plans to implement an integrated suite of products from a third party vendor to simplify our processes and reduce our use of customized existing legacy systems. We expect to implement the initial phase of these systems in May 2013. Implementing new systems carries substantial risk, including implementation delays, cost overruns, disruption of operations, potential loss of data or information, lower customer satisfaction resulting in lost customers or sales, inability to deliver merchandise to our stores or our customers, and the potential inability to meet reporting requirements. There can be no assurances that we will successfully launch the new systems as planned, that the new systems will perform as expected or that the new systems will be implemented without disruptions to our operations, any of which may cause critical information upon which we rely to be delayed, unreliable, corrupted, insufficient or inaccessible.

We also outsource various information technology functions to third party service providers and may outsource other functions in the future. We rely on those third party service providers to provide services on a timely and effective basis and their failure to perform as expected or as required by contract could result in disruptions and costs to our operations.

We are also implementing other technologies including programs that enable our employees to provide high quality service to our customers and to provide our customers a better experience, including the use of mobile point-of-service and an enhanced standard point-of-service technology. We may not be able to effectively implement new technology-driven products and services or be successful in marketing these products and services to our customers. Our new or upgraded technology might not provide the anticipated benefits, it might take longer than expected to realize the anticipated benefits, may cost more than the expected costs to implement or the technology might fail altogether.

Disruptions in our Internet website could have an adverse impact on our sales and results of operations.

We sell merchandise over the Internet through our website, www.jcp.com. Our Internet operations are subject to numerous risks, including rapid technological change and the implementation of new systems and platforms; liability for online content; violations of state or federal laws, including those relating to online privacy; credit card fraud; problems associated with the operation of our website and related support systems; computer viruses; telecommunications failures; electronic break-ins and similar disruptions; and the allocation of inventory between our website and department stores. The failure of our website to perform could result in disruptions and costs to our operations and make it more difficult for customers to purchase merchandise online, which could have an adverse impact on our sales and results of operations.

Changes in our credit ratings may limit our access to capital markets and adversely affect our liquidity.

The credit rating agencies periodically review our capital structure and the quality and stability of our earnings, as a result of which we have experienced multiple corporate credit ratings downgrades. These downgrades, and any future downgrades, to our long-term credit ratings could result in reduced access to the credit and capital markets and higher interest costs on future financings. The future availability of financing will depend on a variety of factors, such as economic and market conditions, the availability of credit and our credit ratings, as well as the possibility that lenders could develop a negative perception of us. If required, we may not be able to obtain additional financing, on favorable terms or at all.

Our profitability depends on our ability to source merchandise and deliver it to our customers in a timely and cost-effective manner.

Our merchandise is sourced from a wide variety of suppliers, and our business depends on being able to find qualified suppliers and access products in a timely and efficient manner. Inflationary pressures on commodity prices and other input costs could increase our cost of goods, and an inability to pass such cost increases on to our customers or a change in our merchandise mix as a result of such cost increases could have an adverse impact on our profitability. Additionally, the impact of current and future economic conditions on our suppliers cannot be predicted and may cause our suppliers to be unable to access financing or become insolvent and thus become unable to supply us with products.

Our arrangements with our suppliers and vendors may be impacted by our financial results or financial position.

Substantially all of our merchandise suppliers and vendors sell to us on open account purchase terms. There is a risk that our suppliers and vendors could respond to any actual or apparent decrease in or any concern with our financial results or liquidity by requiring or conditioning their sale of merchandise to us on more stringent payment terms, such as by requiring standby letters of credit, earlier or advance payment of invoices, payment upon delivery or other assurances or credit support or by choosing not to sell merchandise to us at all. There can be no assurance that one or more of our suppliers may not slow or cease merchandise shipments or require or condition their sale or shipment of merchandise on more stringent payment terms. If any of the above circumstances were to occur, our need for additional liquidity in the near term could significantly increase. Such circumstances, if they were to occur, could materially disrupt our supply of merchandise which could have a material adverse effect on our sales, customer satisfaction, cash flows, liquidity and financial position.

Our revolving credit facility limits our borrowing capacity to the value of certain of our assets and contains provisions that could restrict our operations.

Our borrowing capacity under our revolving credit facility varies according to the Company’s inventory levels, accounts receivable and credit card receivables, net of certain reserves. In the event of any material decrease in the amount of or appraised value of these assets, our borrowing capacity would similarly decrease, which could adversely impact our business and liquidity.

Our revolving credit facility contains customary affirmative and negative covenants and certain restrictions on operations become applicable if our availability falls below certain thresholds. These covenants could impose significant operating and financial limitations and restrictions on us, including restrictions on our ability to enter into particular transactions and to engage in other actions that we may believe are advisable or necessary for our business. In addition, the revolving credit facility provides for a springing fixed charge coverage ratio if our availability falls below a specified threshold.

In the event of a default that is not cured or waived within any applicable cure periods, the lenders’ commitment to extend further credit under our revolving credit facility could be terminated, our outstanding obligations could become immediately due and payable, outstanding letters of credit may be required to be cash collateralized and remedies may be exercised against the collateral, which generally consists of the Company’s inventory, accounts receivable and deposit accounts and cash credited thereto. If we are unable to borrow under our revolving credit facility, we may not have the necessary cash resources for our operations and, if any event of default occurs, there is no assurance that we would have the cash resources available to repay such accelerated obligations or cash collateralize our letters of credit, which would have a material adverse effect on our business, financial condition and liquidity.

Operating results and cash flows at the store level may cause us to incur asset impairment charges.

Long-lived assets, primarily property and equipment, are reviewed at the store level at least annually for impairment, or whenever changes in circumstances indicate that a full recovery of net asset values through future cash flows is in question. Our impairment review requires us to make estimates and projections regarding, but not limited to, sales, operating profit and future cash flows. If these estimates or projections change or prove incorrect, we may be required to record asset impairment charges on certain store locations and other property and equipment. In fiscal 2012, we began shifting our business model from a promotional department store to a specialty department store and our sales and operating profit declined significantly. If our operating performance begins to reflect a sustained decline and actual results are not consistent with our estimates and projections, we may be exposed to significant asset impairment charges in the future, which could be material to our results of operations.

We are subject to risks associated with importing merchandise from foreign countries.

A substantial portion of our merchandise is sourced by our vendors and by us outside of the United States. All of our suppliers must comply with our supplier legal compliance program and applicable laws, including consumer and product safety laws. Although we diversify our sourcing and production by country and supplier, the failure of a supplier to produce and deliver our goods on time, to meet our quality standards and adhere to our product safety requirements or to meet the requirements of our supplier compliance program or applicable laws, or our inability to flow merchandise to our stores or through the Internet channel in the right quantities at the right time could adversely affect our profitability and could result in damage to our reputation.

Although we have implemented policies and procedures designed to facilitate compliance with laws and regulations relating to doing business in foreign markets and importing merchandise from abroad, there can be no assurance that suppliers and other third parties with whom we do business will not violate such laws and regulations or our policies, which could subject us to liability and could adversely affect our results of operations.

We are subject to the various risks of importing merchandise from abroad and purchasing product made in foreign countries, such as

· | potential disruptions in manufacturing, logistics and supply; |

· | changes in duties, tariffs, quotas and voluntary export restrictions on imported merchandise; |

· | strikes and other events affecting delivery; |

· | consumer perceptions of the safety of imported merchandise; |

· | product compliance with laws and regulations of the destination country; |

· | product liability claims from customers or penalties from government agencies relating to products that are recalled, defective or otherwise noncompliant or alleged to be harmful; |

· | concerns about human rights, working conditions and other labor rights and conditions and environmental impact in foreign countries where merchandise is produced and raw materials or components are sourced, and changing labor, environmental and other laws in these countries; |

· | compliance with laws and regulations concerning ethical business practices, such as the U.S. Foreign Corrupt Practices Act; and |

· | economic, political or other problems in countries from or through which merchandise is imported. |

Political or financial instability, trade restrictions, tariffs, currency exchange rates, labor conditions, transport capacity and costs, systems issues, problems in third party distribution and warehousing and other interruptions of the supply chain, compliance with U.S. and foreign laws and regulations and other factors relating to international trade and imported merchandise beyond our control could affect the availability and the price of our inventory. A significant amount of merchandise we offer for sale is made in China and accordingly, a revaluation of the Chinese currency, or increased market flexibility in the exchange rate for that currency, increasing its value relative to the U.S. dollar, could potentially result in a significant increase in the cost of inventory. These risks and other factors relating to foreign trade could subject us to liability or hinder our ability to access suitable merchandise on acceptable terms, which could adversely impact our results of operations.

Our Company’s growth and profitability depend on the levels of consumer confidence and spending.

Our results of operations are sensitive to changes in overall economic and political conditions that impact consumer spending, including discretionary spending. Many economic factors outside of our control, including the housing market, interest rates, recession, inflation and deflation, energy costs and availability, consumer credit availability and terms, consumer debt levels, tax rates and policy, and unemployment trends influence consumer confidence and spending. The domestic and international political situation and actions also affect consumer confidence and spending. Additional events that could impact our performance include pandemics, terrorist threats and activities, worldwide military and domestic disturbances and conflicts, political instability and civil unrest. Declines in the level of consumer spending could adversely affect our growth and profitability.

Our business is seasonal, which impacts our results of operations.

Our annual earnings and cash flows depend to a great extent on the results of operations for the last quarter of our fiscal year, which includes the holiday season. Our fiscal fourth-quarter results may fluctuate significantly, based on many factors, including holiday spending patterns and weather conditions. This seasonality causes our operating results to vary considerably from quarter to quarter.

Our profitability may be impacted by weather conditions.

Our merchandise assortments reflect assumptions regarding expected weather patterns and our profitability depends on our ability to timely deliver seasonally appropriate inventory. Unseasonable or unexpected weather conditions such as warm temperatures during the winter season or prolonged or extreme periods of warm or cold temperatures could render a portion of our inventory incompatible with consumer needs. Extreme weather or natural disasters could also severely hinder our ability to timely deliver seasonally appropriate merchandise, delay capital improvements or cause us to close stores. A reduction in the demand for or supply of our seasonal merchandise could have an adverse effect on our inventory levels, gross margins and results of operations.

Changes in federal, state or local laws and regulations could increase our expenses and adversely affect our results of operations.

Our business is subject to a wide array of laws and regulations. The current political environment, financial reform legislation, the current high level of government intervention and activism, regulatory reform and stockholder activism may result in substantial new regulations and disclosure obligations, which may lead to additional compliance costs as well as the diversion of our management’s time and attention from strategic initiatives. If we fail to comply with applicable laws and regulations we could be subject to legal risk, including government enforcement action and class action civil litigation that could increase our cost of doing business. Changes in the regulatory environment regarding topics such as privacy and information security, product safety or environmental protection,

including regulations in response to concerns regarding climate change, collective bargaining agreements and health care mandates, among others, could also cause our compliance costs to increase and adversely affect our results of operations.

Legal and regulatory proceedings could have an adverse impact on our results of operations.

Our Company is subject to various legal and regulatory proceedings relating to our business, certain of which may involve jurisdictions with reputations for aggressive application of laws and procedures against corporate defendants. We are impacted by trends in litigation, including class action litigation brought under various consumer protection, employment, and privacy and information security laws. In addition, litigation risks related to claims that technologies we use infringe intellectual property rights of third parties have been amplified by the increase in third parties whose primary business is to assert such claims. Reserves are established based on our best estimates of our potential liability. However, we cannot accurately predict the ultimate outcome of any such proceedings due to the inherent uncertainties of litigation. Regardless of the outcome or whether the claims are meritorious, legal and regulatory proceedings may require that we devote substantial time and expense to defend our Company. Unfavorable rulings could result in a material adverse impact on our business, financial condition or results of operations.

On February 4, 2013, we received a purported notice of default from a law firm (Bondholders’ Counsel) claiming to represent certain holders of our 7.4% Debentures due 2037 (the Debentures) issued under an Indenture dated April 1, 1994 (the Indenture). The notice of default asserted that the Company violated the equal and ratable lien covenant in the Indenture by entering into our revolving credit agreement and granting a lien on our inventory. We do not believe that the notice of default was valid and are seeking injunctive relief and a declaratory judgment that the Company is not in breach of the Indenture. As of March 5, 2013, approximately $326 million in principal amount of the Debentures was outstanding. On March 18, 2013, Bondholders’ Counsel withdrew its notice of default.

As of March 5, 2013, approximately $2.868 billion of long-term debt was outstanding under the Company's indentures. If the Company were to be found to be in breach of an indenture and such breach is not timely cured, then holders of a certain percentage of such debt instruments may declare such obligations immediately due and payable. If outstanding debt instruments are, or are permitted to be, declared due and payable prior to their scheduled maturity, such event could constitute an event of default under our credit facility. If any debt outstanding under our indentures is declared due and payable or an event of default occurs under our credit facility, there is no assurance that we would have the cash resources available to repay such accelerated obligations, which would have a material adverse effect on our business, financial condition and liquidity.

Significant changes in discount rates, actual investment return on pension assets, and other factors could affect our earnings, equity, and pension contributions in future periods.

Our earnings may be positively or negatively impacted by the amount of income or expense recorded for our qualified pension plan. Generally accepted accounting principles in the United States of America (GAAP) require that income or expense for the plan be calculated at the annual measurement date using actuarial assumptions and calculations. The most significant assumptions relate to the capital markets, interest rates and other economic conditions. Changes in key economic indicators can change the assumptions. Two critical assumptions used to estimate pension income or expense for the year are the expected long-term rate of return on plan assets and the discount rate. In addition, at the measurement date, we must also reflect the funded status of the plan (assets and liabilities) on the balance sheet, which may result in a significant change to equity through a reduction or increase to other comprehensive income. Although GAAP expense and pension contributions are not directly related, the key economic factors that affect GAAP expense would also likely affect the amount of cash we could be required to contribute to the pension plan. Potential pension contributions include both mandatory amounts required under federal law and discretionary contributions to improve a plan’s funded status.

As a result of their ownership stakes in the Company, our largest stockholders have the ability to materially influence actions to be taken or approved by our stockholders. These stockholders are represented on our Board of Directors and, therefore, also have the ability to materially influence actions to be taken or approved by our Board.

As of March 5, 2013, Pershing Square Capital Management L.P., PS Management GP, LLC and Pershing Square GP, LLC (together Pershing Square) beneficially owned approximately 17.8% of the outstanding shares of our common stock. Pershing Square has additional economic exposure to approximately 7.3% of the outstanding shares of our common stock under cash-settled total return swaps, bringing their total aggregate economic exposure to approximately 25.1% of the outstanding shares of our common stock. William A. Ackman, Chief Executive Officer of Pershing Square Capital Management, is one of our directors.

As of March 5, 2013, Vornado Realty Trust, Vornado Realty L.P., VNO Fashion LLC, VSPS I L.L.C., Two Penn Plaza REIT, Inc., Two Penn Plaza REIT JP Fashion LLC, CESC H Street LLC, H Street Building Corporation, H Street JP Fashion LLC, Vornado RTR, Inc. and PCJ I Inc. (together Vornado) beneficially owned approximately 6.1% of the outstanding shares of our common stock. Steven Roth, Chairman of the Board of Trustees of Vornado Realty Trust, is one of our directors.

Together, Pershing Square and Vornado owned approximately 23.9% of our outstanding shares as of March 5, 2013 and had aggregate economic exposure to approximately 31.2% of our outstanding shares. Pershing Square and Vornado have each stated that they intend to consult with each other in connection with their respective investments in our common stock. Pershing Square and Vornado have the ability to materially influence actions to be taken or approved by our stockholders, including the election of directors and any transactions involving a change of control. Pershing Square and Vornado also have the ability to materially influence actions to be taken or approved by our Board.

We are party to a stockholder agreement with Pershing Square that, among other things, prohibits Pershing Square from purchasing shares of our common stock and derivative securities whose value is derived from the value of our common stock in excess of 26.1% of the shares of our common stock outstanding and permits Pershing Square to designate one member of our Board of Directors. Pursuant to the stockholder agreement, Pershing Square is able to direct the vote of 15% of the shares of our common stock outstanding and is required to vote the number of any excess shares of our common stock that they beneficially own to be present and voted at stockholder meetings either as recommended by our Board of Directors or in direct proportion to how all other stockholders vote.

In addition, we are party to a stockholder agreement with Vornado that, among other things, prohibits Vornado from purchasing shares of our common stock and derivative securities whose value is derived from the value of our common stock in excess of 15.4% of the shares of our common stock outstanding and permits Vornado to designate one member of our Board of Directors. Pursuant to the stockholder agreement, Vornado may vote the number of shares that it owns up to a maximum of 9.9% of the shares of our common stock outstanding and is required to vote the number of any excess shares of our common stock that they beneficially own to be present and voted at stockholder meetings either as recommended by our Board of Directors or in direct proportion to how all other stockholders vote.

Our stock price has been and may continue to be volatile.

The market price of our common stock has fluctuated substantially and may continue to fluctuate significantly. Future announcements or disclosures concerning us or any of our competitors, our strategic initiatives, our sales and profitability, any quarterly variations in actual or anticipated operating results or comparable sales, any failure to meet analysts’ expectations and sales of large blocks of our common stock, among other factors, could cause the market price of our common stock to fluctuate substantially. In addition, the stock market has experienced price and volume fluctuations that have affected the market price of many retail and other stocks and that have often been unrelated or disproportionate to the operating performance of these companies. Securities class action litigation has often been instituted against companies following periods of volatility in the overall market and in the market price of a company’s securities. Such litigation, if instituted against us, could result in substantial costs, divert our management’s attention and resources and have an adverse effect on our business, results of operations and financial condition. This volatility could affect the price at which you could sell shares of our common stock.

The Company’s ability to use net operating loss carryforwards to offset future taxable income for U.S. federal income tax purposes may be limited.

In fiscal 2012, the Company incurred a federal net operating loss (NOL) of approximately $1.5 billion of which approximately $284 million is available for carryback. The remaining NOL carryforward (expiring between 2013 and 2032) is available to offset future taxable income. Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”) imposes an annual limitation on the amount of taxable income that may be offset if a corporation experiences an ”ownership change” as defined in Section 382 of the Code. An ownership change occurs when the Company’s “five-percent shareholders” (as defined in Section 382 of the Code) collectively increase their ownership in the Company by more than 50 percentage points (by value) over a rolling three-year period. This is different from a change in beneficial ownership under applicable securities laws. While the Company expects to be able to realize the total NOL prior to its expiration, if an ownership change occurs the Company’s ability to use the NOL to offset future taxable income will be subject to an annual limitation and will depend on the amount of taxable income generated by the Company in future periods. There is no assurance that the Company will be able to fully utilize the NOL and the Company could be required to record a valuation allowance related to the amount of the NOL that may not be realized, which could impact the Company’s net results of operations.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

At February 2, 2013, we operated 1,104 department stores throughout the continental United States, Alaska and Puerto Rico, of which 429 were owned, including 123 stores located on ground leases. The following table lists the number of stores operating by state as of February 2, 2013:

| | | | | | | |

Alabama | 22 | | Maine | 6 | | Oklahoma | 19 |

Alaska | 1 | | Maryland | 19 | | Oregon | 14 |

Arizona | 22 | | Massachusetts | 13 | | Pennsylvania | 43 |

Arkansas | 16 | | Michigan | 43 | | Rhode Island | 3 |

California | 80 | | Minnesota | 26 | | South Carolina | 18 |

Colorado | 22 | | Mississippi | 18 | | South Dakota | 8 |

Connecticut | 10 | | Missouri | 26 | | Tennessee | 26 |

Delaware | 3 | | Montana | 9 | | Texas | 94 |

Florida | 59 | | Nebraska | 11 | | Utah | 9 |

Georgia | 30 | | Nevada | 7 | | Vermont | 6 |

Idaho | 9 | | New Hampshire | 9 | | Virginia | 28 |

Illinois | 41 | | New Jersey | 17 | | Washington | 24 |

Indiana | 30 | | New Mexico | 10 | | West Virginia | 9 |

Iowa | 19 | | New York | 43 | | Wisconsin | 22 |

Kansas | 19 | | North Carolina | 36 | | Wyoming | 5 |

Kentucky | 22 | | North Dakota | 8 | | Puerto Rico | 7 |

Louisiana | 16 | | Ohio | 47 | | | |

Total square feet | 111.6 | million | | | | | |

At February 2, 2013, our supply chain network operated 24 facilities at 15 locations, of which nine were owned, with multiple types of distribution activities housed in certain owned locations. Our network includes 11 store merchandise distribution centers, five regional warehouses, four jcp.com fulfillment centers and four furniture distribution centers as indicated in the following table:

| | | | |

| | | | Square Footage |

Facility / Location | | Leased/Owned | | (in thousands) |

Store Merchandise Distribution Centers | | | | |

Forest Park, Georgia | | Owned | | 530 |

Buena Park, California | | Owned | | 543 |

Cedar Hill, Texas | | Leased | | 433 |

Columbus, Ohio | | Owned | | 386 |

Lakeland, Florida | | Leased | | 360 |

Lenexa, Kansas | | Owned | | 322 |

Manchester, Connecticut | | Owned | | 898 |

Wauwatosa, Wisconsin | | Owned | | 507 |

Spanish Fork, Utah | | Leased | | 400 |

Statesville, North Carolina | | Owned | | 313 |

Sumner, Washington | | Leased | | 350 |

Total store merchandise distribution centers | | | | 5,042 |

| | | | |

Regional Warehouses | | | | |

Haslet, Texas | | Owned | | 1,063 |

Forest Park, Georgia | | Owned | | 427 |

Buena Park, California | | Owned | | 146 |

Lathrop, California | | Leased | | 436 |

Statesville, North Carolina | | Owned | | 131 |

Total regional warehouses | | | | 2,203 |

| | | | |

jcp.com Fulfillment Centers | | | | |

Columbus, Ohio | | Owned | | 1,516 |

Lenexa, Kansas | | Owned | | 1,622 |

Manchester, Connecticut(1) | | Owned | | 888 |

Reno, Nevada | | Owned | | 1,660 |

Total jcp.com fulfillment centers | | | | 5,686 |

| | | | |

Furniture Distribution Centers | | | | |

Forest Park, Georgia | | Owned | | 343 |

Chino, California | | Leased | | 325 |

Manchester, Connecticut | | Owned | | 291 |

Wauwatosa, Wisconsin | | Owned | | 592 |

Total furniture distribution centers | | | | 1,551 |

Total supply chain network | | | | 14,482 |

(1) As of February 2, 2013, this portion of the facility was not operating.

We also own our home office facility in Plano, Texas, and approximately 240 acres of property adjacent to the facility.

Item 3. Legal Proceedings

Bond Litigation

On February 4, 2013, the Company received a letter (the Letter) from counsel (Bondholders’ Counsel) for certain holders of the Company’s 7.4% Debentures issued under an Indenture dated April 1, 1994 (the Indenture), purporting to be a Notice of Default under the Indenture. The Company believes that the Letter does not constitute a valid Notice of Default and filed suit on February 4, 2013, in Delaware Chancery Court against U.S. Bank National Association, as Indenture Trustee under the Indenture. The Company is seeking injunctive relief to prevent the Indenture Trustee from declaring an event of default and from taking any action based on such purported breach. The Company is also asking the Court to affirm that the Company is not in breach of the Indenture. The Company intends to vigorously seek the requested relief from the Court. On March 18, 2013, the Court ordered a hearing on the Company’s motions for summary judgment and the Company’s application for a preliminary injunction during the week of April 1. Immediately after the hearing, the Company received a withdrawal of the notice of default from Bondholders’ Counsel.

Macy’s Litigation

On August 16, 2012, Macy’s, Inc. and Macy’s Merchandising Group, Inc. (together the Plaintiffs) filed suit against J. C. Penney Corporation, Inc. in the Supreme Court of the State of New York, County of New York, alleging that the Company tortiously interfered with, and engaged in unfair competition relating to a 2006 agreement between Macy’s and Martha Stewart Living Omnimedia, Inc. (MSLO) by entering into a partnership agreement with MSLO in December 2011. The Plaintiffs seek primarily to prevent the Company from implementing our partnership agreement with MSLO as it relates to products in the bedding, bath, kitchen and cookware categories. The suit was consolidated with an already-existing breach of contract lawsuit by the Plaintiffs against MSLO, and a bench trial commenced on February 20, 2013. On March 7, 2013, the judge adjourned the trial until April 8, 2013, and ordered the parties into mediation. While no assurance can be given as to the ultimate outcome of this matter, we currently believe that the final resolution of this action will not have a material adverse effect on our results of operations, financial position, liquidity or capital resources.

Ozenne Derivative Lawsuit

On January 19, 2012, a purported shareholder of the Company, Everett Ozenne, filed a shareholder derivative lawsuit in the 193rd District Court of Dallas County, Texas, against certain of the Company’s Board of Directors and former executives. The Company is a nominal defendant in the suit. The lawsuit alleges breaches of fiduciary duties, corporate waste and unjust enrichment involving decisions regarding executive compensation, specifically that compensation paid to certain executive officers from 2008 to 2011 was too high in light of the Company’s financial performance. The suit seeks damages including unspecified compensatory damages, disgorgement by the former officers of allegedly excessive compensation, and equitable relief to reform the Company’s compensation practices. The Company and the named individuals filed an Answer and Special Exceptions to the lawsuit, arguing primarily that the plaintiff could not proceed with his suit because he failed to make demand on the Company’s Board of Directors, and that because demand on the Board would not be futile, demand is not excused. The trial court heard arguments on the Special Exceptions on June 25, 2012, and denied them. The Company and named individuals have filed a mandamus proceeding in the Fifth District Court of Appeals challenging the trial court’s decision. In the interim, the parties entered into a Memorandum of Understanding to settle the litigation. The plaintiff is currently engaging in confirmatory discovery. In light of these events, the appellate court has stayed issuance of its decision. While no assurance can be given as to the ultimate outcome of this matter, we currently believe that the final resolution of this action will not have a material adverse effect on our results of operations, financial position, liquidity or capital resources.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market for Registrant’s Common Equity

Our common stock is traded principally on the New York Stock Exchange (NYSE) under the symbol “JCP.” The number of stockholders of record at March 18, 2013, was 28,776. In addition to common stock, we have authorized 25 million shares of preferred stock, of which no shares were issued and outstanding at February 2, 2013.

The table below sets forth the quoted high and low market prices of our common stock on the NYSE for each quarterly period indicated, the quarter-end closing market price of our common stock, as well as the quarterly cash dividends declared per share of common stock:

| | | | | | | |

Fiscal Year 2012 | First Quarter | | Second Quarter | | Third Quarter | | Fourth Quarter |

Per share: Dividend | $ 0.20 | | $ - | | $ - | | $ - |

Market price: | | | | | | | |

High | $ 43.18 | | $ 36.75 | | $ 32.55 | | $ 25.61 |

Low | $ 32.51 | | $ 19.06 | | $ 20.40 | | $ 15.69 |

Close | $ 36.72 | | $ 23.00 | | $ 25.46 | | $ 19.88 |

| | | | | | | |

Fiscal Year 2011 | First Quarter | | Second Quarter | | Third Quarter | | Fourth Quarter |

Per share: Dividend | $ �� 0.20 | | $ 0.20 | | $ 0.20 | | $ 0.20 |

Market price: | | | | | | | |

High | $ 39.24 | | $ 41.00 | | $ 34.50 | | $ 41.86 |

Low | $ 30.71 | | $ 29.82 | | $ 23.44 | | $ 29.55 |

Close | $ 38.45 | | $ 30.76 | | $ 33.08 | | $ 41.42 |

Our Board of Directors (Board) periodically reviews the dividend policy and rate, taking into consideration the overall financial and strategic outlook for our earnings, liquidity and cash flow projections, as well as competitive factors. On May 15, 2012, we announced that we had discontinued the quarterly $0.20 per share dividend.

Additional information relating to the common stock and preferred stock is included in this Annual Report on Form 10-K in the Consolidated Statements of Stockholders’ Equity and in Note 12 to the consolidated financial statements.

Issuer Purchases of Securities

No repurchases of common stock were made during the fourth quarter of 2012 and no amounts remained authorized for share repurchases as of February 2, 2013.

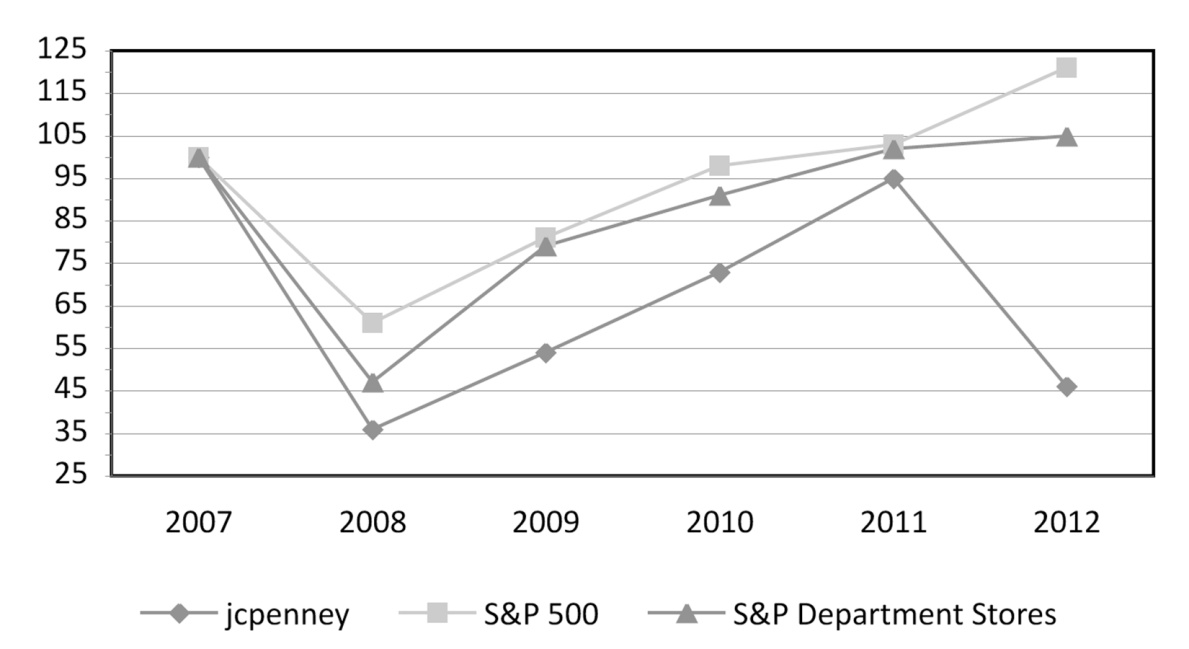

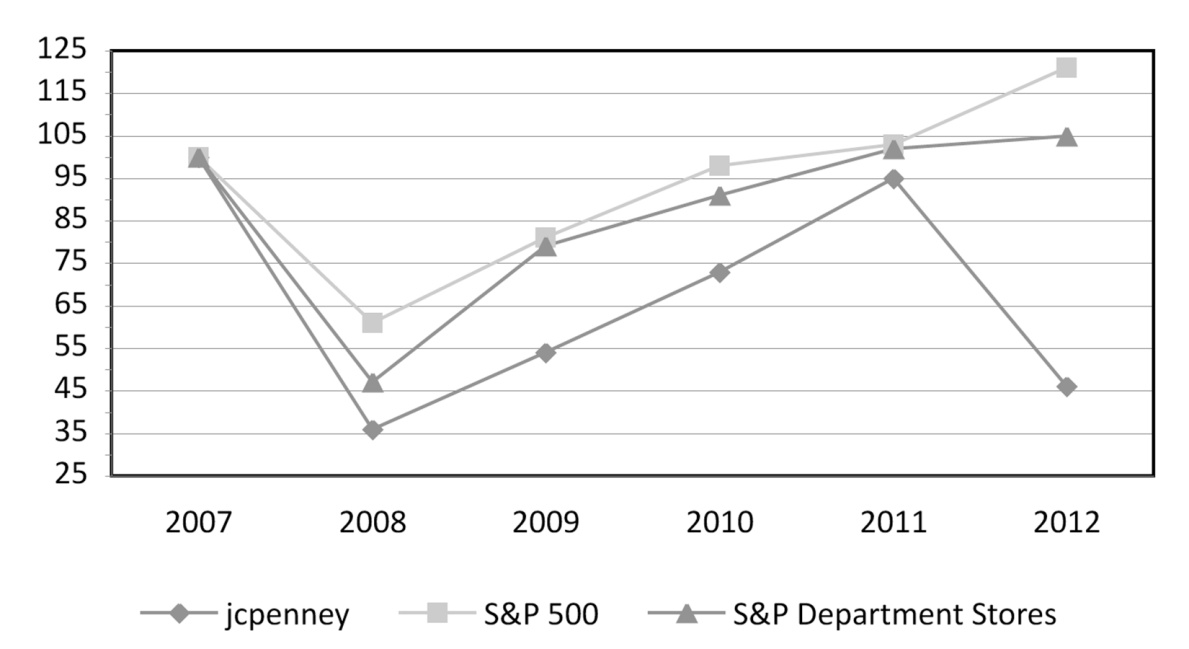

Five-Year Total Stockholder Return Comparison

The following presentation compares our cumulative stockholder returns for the past five fiscal years with the returns of the S&P 500 Stock Index and the S&P 500 Retail Index for Department Stores over the same period. A list of these companies follows the graph below. The graph assumes $100 invested at the closing price of our common stock on the NYSE and each index as of the last trading day of our fiscal year 2007 and assumes that all dividends were reinvested on the date paid. The points on the graph represent fiscal year-end amounts based on the last trading day of each fiscal year. The following graph and related information shall not be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

|

S&P Department Stores: jcpenney, Dillard’s, Macy’s, Kohl’s, Nordstrom, Sears |

| | | | | | | | | | | |

| 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 |

jcpenney | 100 | | 36 | | 54 | | 73 | | 95 | | 46 |

S&P 500 | 100 | | 61 | | 81 | | 98 | | 103 | | 121 |

S&P Department Stores | 100 | | 47 | | 79 | | 91 | | 102 | | 105 |

The stockholder returns shown are neither determinative nor indicative of future performance.

Item 6. Selected Financial Data

Five-Year Financial Summary

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

($ in millions, except per share data) | 2012 | | 2011 | | 2010 | | 2009 | | 2008 |

Results for the year | | | | | | | | | | | | | | |

Total net sales | $ | 12,985 | | $ | 17,260 | | $ | 17,759 | | $ | 17,556 | | $ | 18,486 |

Sales percent increase/(decrease): | | | | | | | | | | | | | | |

Total net sales | | (24.8)% | (1) | | (2.8)% | | | 1.2% | | | (5.0)% | | | (6.9)% |

Comparable store sales(2) | | (25.2)% | | | 0.2% | | | 2.5% | | | (6.3)% | | | (8.5)% |

Operating income/(loss) | | (1,310) | | | (2) | | | 832 | | | 663 | | | 1,135 |

As a percent of sales | | (10.1)% | | | (0.0)% | | | 4.7% | | | 3.8% | | | 6.1% |

Adjusted operating income/(loss) (non-GAAP)(3) | | (939) | | | 536 | | | 1,085 | | | 961 | | | 1,002 |

As a percent of sales (non-GAAP)(3) | | (7.2)% | | | 3.1% | | | 6.1% | | | 5.5% | | | 5.4% |

Income/(loss) from continuing operations | | (985) | | | (152) | | | 378 | | | 249 | | | 567 |

Adjusted income/(loss) from continuing operations (non-GAAP)(3) | | (766) | | | 207 | | | 533 | | | 433 | | | 484 |

| | | | | | | | | | | | | | |

Per common share | | | | | | | | | | | | | | |

Income/(loss) from continuing operations, diluted | $ | (4.49) | | $ | (0.70) | | $ | 1.59 | | $ | 1.07 | | $ | 2.54 |

Adjusted income/(loss) from continuing operations, diluted (non-GAAP)(3) | | (3.49) | | | 0.94 | | | 2.24 | | | 1.86 | | | 2.17 |

Dividends declared(4) | | 0.20 | | | 0.80 | | | 0.80 | | | 0.80 | | | 0.80 |

| | | | | | | | | | | | | | |

Financial position and cash flow | | | | | | | | | | | | | | |

Total assets | $ | 9,781 | | $ | 11,424 | | $ | 13,068 | | $ | 12,609 | | $ | 12,039 |

Cash and cash equivalents | | 930 | | | 1,507 | | | 2,622 | | | 3,011 | | | 2,352 |

Long-term debt, including capital leases, note payable and current maturities | | 2,982 | | | 3,102 | | | 3,099 | | | 3,392 | | | 3,505 |

Free cash flow (non-GAAP)(3) | | (906) | | | 23 | | | 158 | | | 677 | | | 22 |

(1) Includes the effect of the 53rd week in 2012. Excluding sales of $163 million for the 53rd week in 2012, total net sales decreased 25.7%.

(2) Comparable store sales are presented on a 52-week basis and include sales from new and relocated stores that have been opened for 12 consecutive full fiscal months and Internet sales. Stores closed for an extended period are not included in comparable store sales calculations, while stores remodeled and minor expansions not requiring store closures remain in the calculations. Our definition and calculation of comparable store sales may differ from other companies in the retail industry.

(3) See Non-GAAP Financial Measures beginning on the following page for additional information and reconciliation to the most directly comparable GAAP financial measure.

(4) On May 15, 2012, we announced that we had discontinued the quarterly $0.20 per share dividend.

Five-Year Operations Summary

| | | | | | | | | | | | | | |

| 2012 | | 2011 | | 2010 | | 2009 | | 2008 |

Number of department stores: | | | | | | | | | | | | | | |

Beginning of year | | 1,102 | | | 1,106 | | | 1,108 | | | 1,093 | | | 1,067 |

Openings | | 9 | | | 3 | | | 2 | | | 17 | | | 35 |

Closings(1) | | (7) | | | (7) | | | (4) | | | (2) | | | (9) |

End of year | | 1,104 | | | 1,102 | | | 1,106 | | | 1,108 | | | 1,093 |

Gross selling space (square feet in millions) | | 111.6 | | | 111.2 | | | 111.6 | | | 111.7 | | | 109.9 |

Sales per gross square foot(2) | $ | 116 | | $ | 154 | | $ | 153 | | $ | 149 | | $ | 160 |

Sales per net selling square foot(2) | $ | 161 | | $ | 212 | | $ | 210 | | $ | 206 | | $ | 223 |

| | | | | | | | | | | | | | |

Number of the Foundry Big and Tall Supply Co. stores(3) | | 10 | | | 10 | | | - | | | - | | | - |

(1) Includes relocations of 3,-, -, 1, and 7 respectively.

(2) Calculation includes the sales and square footage of jcpenney department stores that were open for the full fiscal year and sales for jcp.com.

(3) All stores opened during 2011. Gross selling space was 51 thousand square feet as of February 2, 2013 and January 28, 2012.

Non-GAAP Financial Measures