Exhibit 99.2

Highly Confidential Information Provided Pursuant to Confidentiality Agreement Subject to FRE 408

Appvion

Presentation to Secured Noteholders

September 7, 2017

Forward-Looking Statements

This presentation contains forward-looking statements. The words “will,” “may,” “should,” “believes,”

“anticipates,” “intends,” “estimates,” “expects,” “projects,” “plans,” “seek” or similar expressions are intended to identify forward-looking statements. All statements in this news release, other than statements of historical fact, including statements which address Appvion’s strategy, future operations, future financial position, estimated revenues, projected costs, prospects, plans and objectives of management and events or developments that Appvion expects or anticipates will occur, are forward-looking statements. All forward-looking statements speak only as of the date on which they are made. They rely on a number of assumptions concerning future events and are subject to a number of risks and uncertainties, many of which are outside the Company’s control that could cause actual results to differ materially from such statements. These risks and uncertainties include, but are not limited to, the factors listed under “Item 1A—Risk Factors” in the Annual Report on Form10-K for the year ended December 31, 2016, as amended by the10-Q for the period ending June 30, 2017. Many of these factors are beyond Appvion’s ability to control or predict. Given these uncertainties, you should not place undue reliance on the forward-looking statements. Neither Appvion nor any of its advisors (including Guggenheim Securities) undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Senior Management

CEO since August 2015 and previously joined Appvion in June 2014 as president of Kevin Gilligan Appvion’s paper division Chief Executive Officer & ï,— Director on Appvion’s board since January 2016

Board Director

Prior to joining Appvion, served on the executive committee for H.B. Fuller as VP Asia Pacific and VP Global Operations

CFO effective June 2017 and previously joined Appvion in March 2016 as Corporate Luke Kelly Controller and responsible for Appvion’s financial reporting and planning, treasury and tax management

VP of Finance & Chief

Financial Officer Prior to joining Appvion, served as SVP of Finance & IT for The Manitowoc Company’s foodservice segment

SVP of administration and general counsel since August 2015

Tami Van Straten

Prior to joining Appvion, served as law clerk to the Honorable N. Patrick Crooks of the Sr. VP of Administration Wisconsin Supreme Court and also worked in private legal practice and General Counsel

Justin Merritt SVP of sales, marketing, and research and development since September 2016 and previously joined Appvion as VP of thermal in April 2015

Sr. VP of Sales,

Marketing, and Research Prior to joining Appvion, served as VP of corporate accounts for the dairy and and Development beverage/brewery segments of Ecolab, Inc

3

Table of Contents

1. Executive Summary

2. Company Overview a) Thermal Segment Overview b) Carbonless Segment Overview

3. Financial Summary

4

Executive Summary

5

Executive Summary

Headquartered in Appleton, Wisconsin, Appvion, Inc. (“Appvion” or the “Company”) is a leading

manufacturer of specialty, high value added coated paper products, including thermal, carbonless and

security papers

The Company operates through two primary segments: Thermal Papers (~59% of 2016 Net Sales) and

Carbonless Paper (~41% of 2016 Net Sales)

Following a challenging year in FY 2015 driven primarily by a soft pricing environment in Thermal Point of

Sale (“POS”), Appvion successfully executed on its business plan in FY 2016, which resulted in a ~20%

YoY Adj. EBITDA improvement

Key drivers of the performance improvement in FY 2016 included cost/performance initiatives in manufacturing

operations, targeted SG&A savings and continued growth in Thermal Tag, Label and Entertainment (“TLE”)

As of LTM Q2 FY ‘17, Appvion generated Net Sales, Adj. EBITDA and Pro Forma (“PF”) Adjusted EBITDA(1)

of $667 million, $59 million and $80 million, respectively

In order to position the Company to execute on its business plan, the Company is exploring potential refinancing and deleveraging strategies

The Company has received initial indications of interest from third parties regarding a new ABL and Term Loan

facility

The timing and structure of a balance sheet transaction will be impacted by the Company’s near-term

liquidity (to be discussed separately)

Will likely require incremental liquidity to fund the Company and may be needed on an expedited basis

1. Incorporates certain business improvement initiatives designed to cut costs.

6

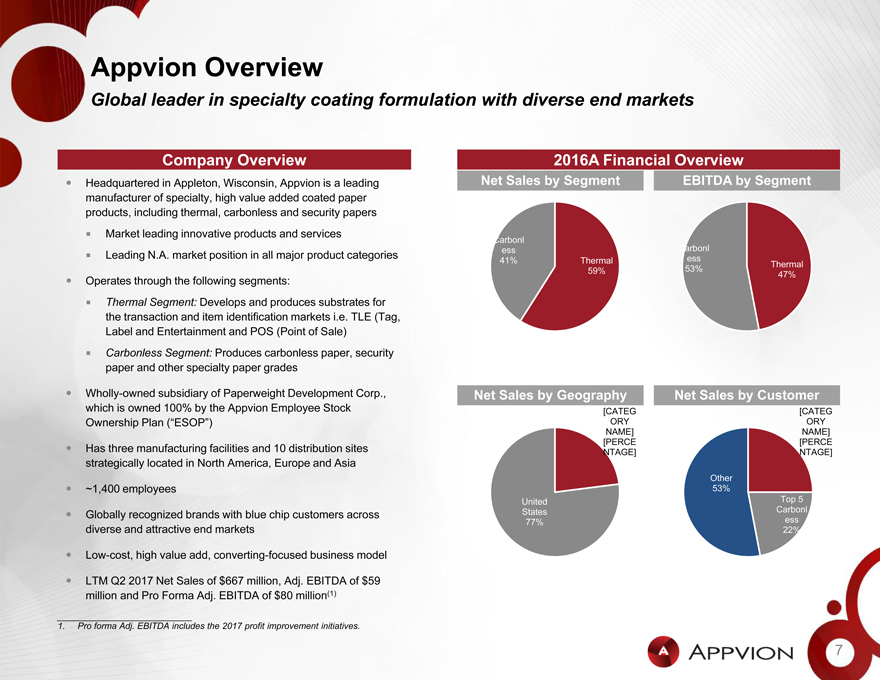

Appvion Overview

Global leader in specialty coating formulation with diverse end markets

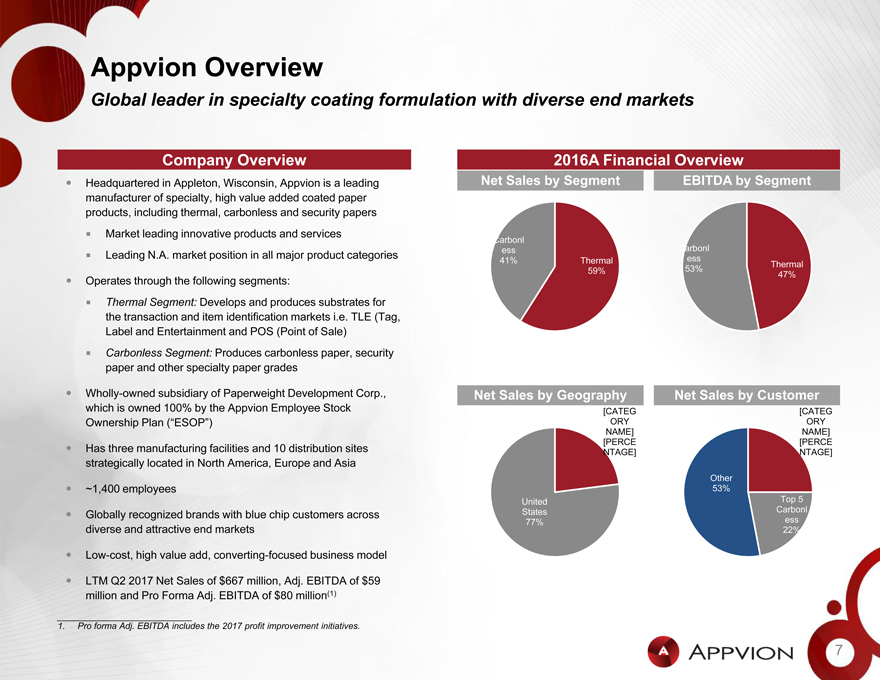

Company Overview

Headquartered in Appleton, Wisconsin, Appvion is a leading manufacturer of specialty, high value added coated paper products, including thermal, carbonless and security papers Market leading innovative products and services Leading N.A. market position in all major product categories

Operates through the following segments:

Thermal Segment: Develops and produces substrates for the transaction and item identification markets i.e. TLE (Tag, Label and Entertainment and POS (Point of Sale) Carbonless Segment: Produces carbonless paper, security paper and other specialty paper grades

Wholly-owned subsidiary of Paperweight Development Corp., which is owned 100% by the Appvion Employee Stock Ownership Plan (“ESOP”)

Has three manufacturing facilities and 10 distribution sites strategically located in North America, Europe and Asia

~1,400 employees

Globally recognized brands with blue chip customers across diverse and attractive end markets

Low-cost, high value add, converting-focused business model

LTM Q2 2017 Net Sales of $667 million, Adj. EBITDA of $59 million and Pro Forma Adj. EBITDA of $80 million(1)

2016A Financial Overview

Net Sales by Segment EBITDA by Segment

Carbonl Carbonl

ess ess

41% Thermal 53% Thermal

59% 47%

Net Sales by Geography Net Sales by Customer

[CATEG [CATEG

ORY ORY

NAME] NAME]

[PERCE [PERCE

NTAGE] NTAGE]

Other

53%

United Top 5

States Carbonl

77% ess

22%

1. Pro forma Adj. EBITDA includes the 2017 profit improvement initiatives.

7

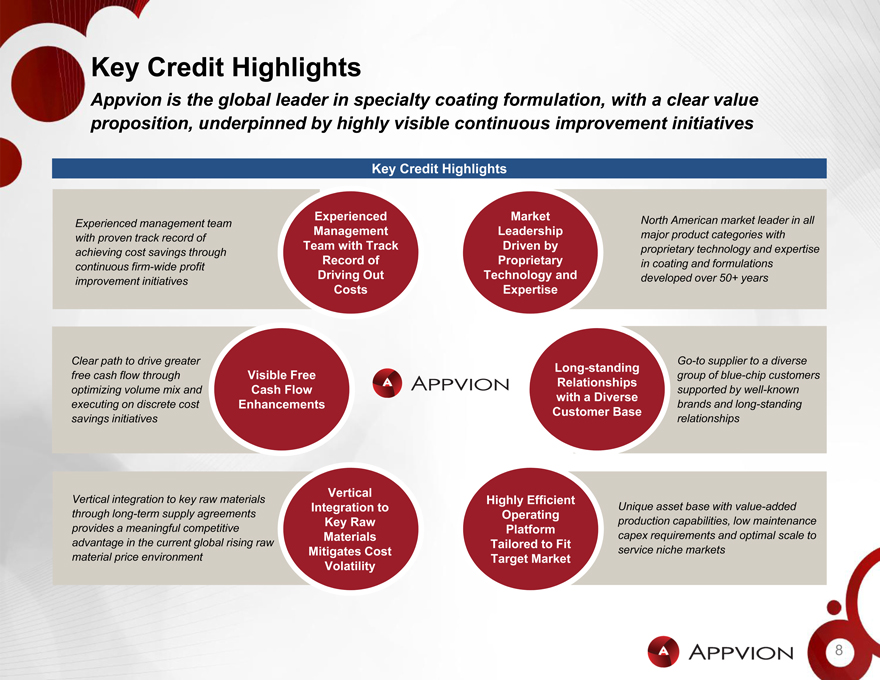

Key Credit Highlights

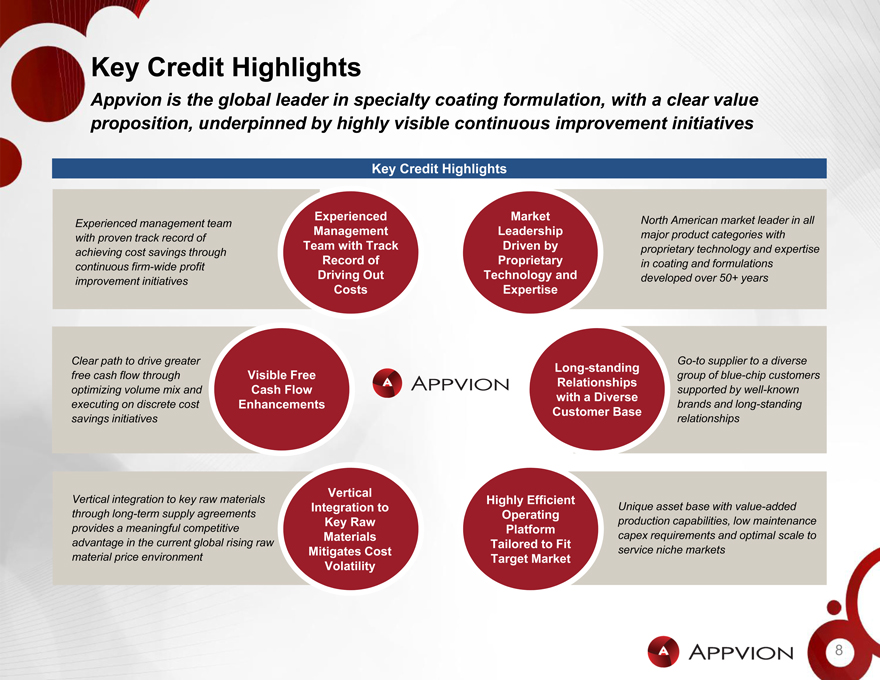

Appvion is the global leader in specialty coating formulation, with a clear value proposition, underpinned by highly visible continuous improvement initiatives

Key Credit Highlights

Experienced Market North American market leader in all Experienced management team Management Leadership major product categories with with proven track record of Team with Track Driven by proprietary technology and expertise achieving cost savings through Record of Proprietary in coating and formulations continuous firm-wide profit

Driving Out Technology and developed over 50+ years improvement initiatives

Costs Expertise

Clear path to drive greaterGo-to supplier to a diverse

Long-standing free cash flow through Visible Free group of blue-chip customers

Relationships optimizing volume mix and Cash Flow supported by well-known with a Diverse executing on discrete cost Enhancements brands and long-standing

Customer Base savings initiatives relationships

Vertical

Vertical integration to key raw materials Highly Efficient

Integration to Unique asset base with value-added through long-term supply agreements Operating Key Raw production capabilities, low maintenance provides a meaningful competitive Platform Materials capex requirements and optimal scale to advantage in the current global rising raw Tailored to Fit Mitigates Cost service niche markets material price environment Target Market Volatility

8

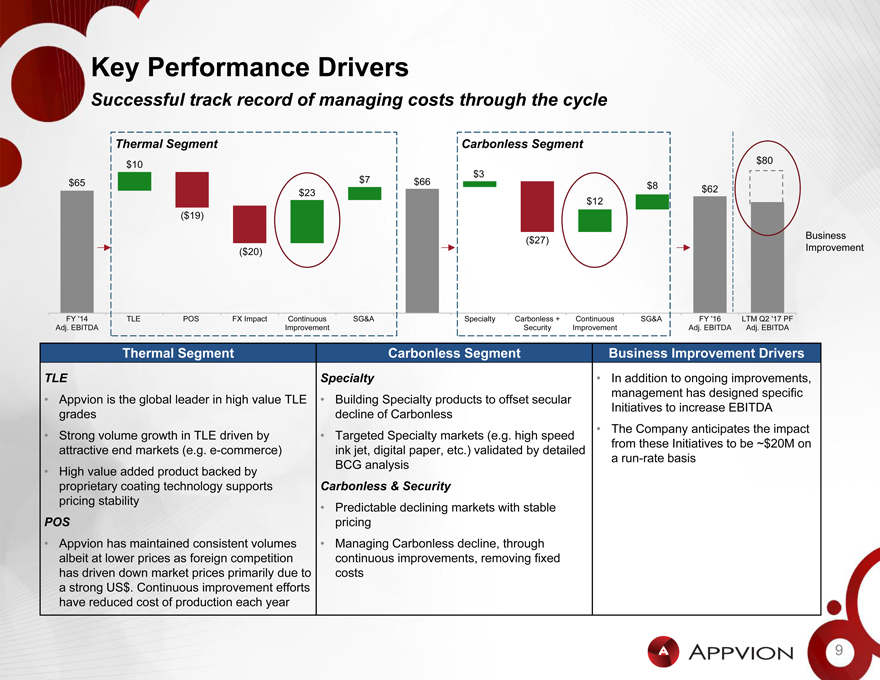

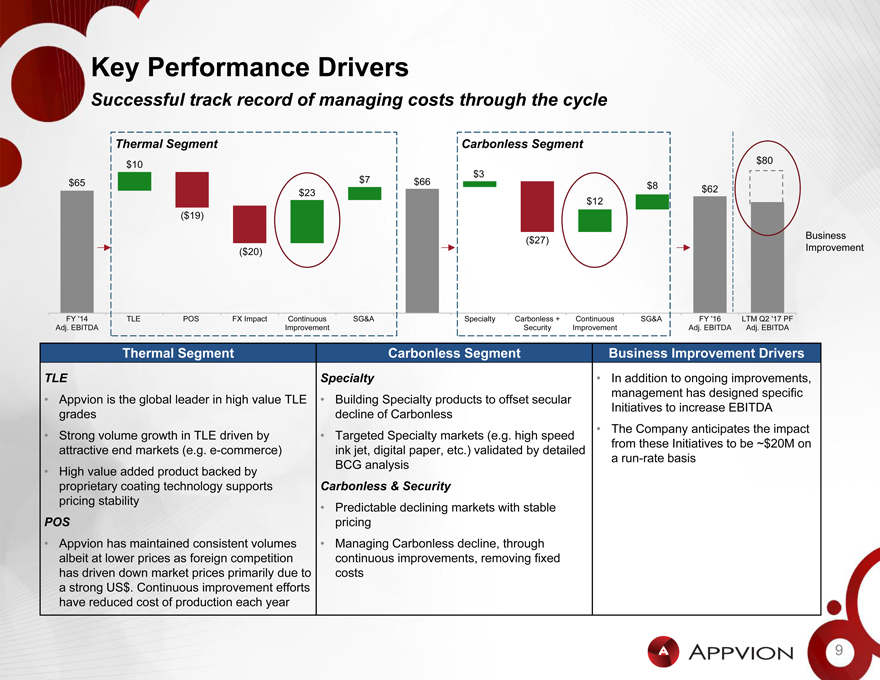

Key Performance Drivers

Successful track record of managing costs through the cycle

Thermal Segment

$10

$65 $7 $23

($19)

($20)

FY ‘14 TLE POS FX Impact Continuous SG&A Adj. EBITDA Improvement

Carbonless Segment

$3

$66 $8 $12

($27)

Specialty Carbonless + Continuous SG&A Security Improvement

$80

$62

Business Improvement

FY ‘16 LTM Q2 ‘17 PF Adj. EBITDA Adj. EBITDA

Thermal Segment Carbonless Segment Business Improvement Drivers

TLE Specialty In addition to ongoing improvements,

management has designed specific

Appvion is the global leader in high value TLE Building Specialty products to offset secular

Initiatives to increase EBITDA

grades decline of Carbonless

The Company anticipates the impact

Strong volume growth in TLE driven by Targeted Specialty markets (e.g. high speed

from these Initiatives to be ~$20M on

attractive end markets (e.g.e-commerce) ink jet, digital paper, etc.) validated by detailed

arun-rate basis

BCG analysis

High value added product backed by

proprietary coating technology supports Carbonless & Security

pricing stability

Predictable declining markets with stable

POS pricing

Appvion has maintained consistent volumes Managing Carbonless decline, through

albeit at lower prices as foreign competition continuous improvements, removing fixed

has driven down market prices primarily due to costs a strong US$. Continuous improvement efforts

have reduced cost of production each year

9

Company Overview

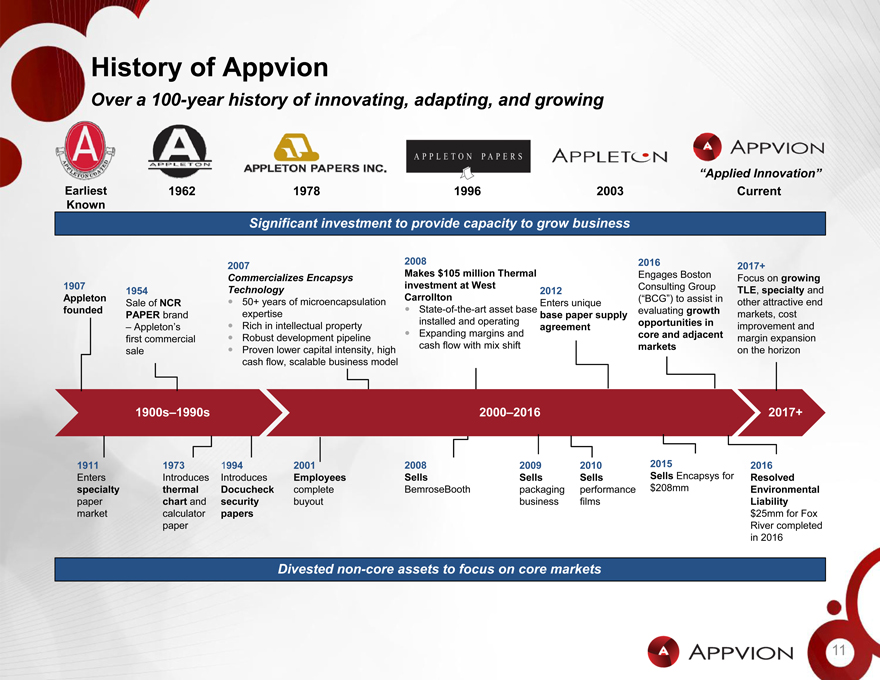

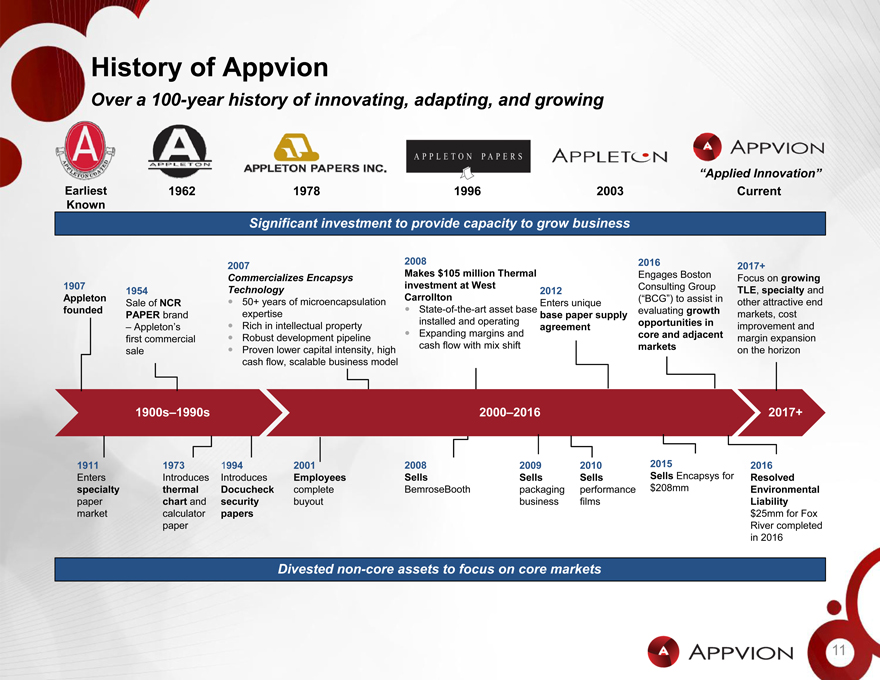

History of Appvion

Over a100-year history of innovating, adapting, and growing

“Applied Innovation”

Earliest 1962 1978 1996 2003 Current

Known

Significant investment to provide capacity to grow business

2008 2016

2007 2017+

Makes $105 million Thermal Engages Boston

Commercializes Encapsys Focus on growing

1907 investment at West Consulting Group

1954 Technology 2012 TLE, specialty and

Appleton Carrollton (“BCG”) to assist in

Sale of NCR 50+ years of microencapsulation Enters unique other attractive end

foundedState-of-the-art asset base evaluating growth

PAPER brand expertise base paper supply markets, cost

installed and operating opportunities in

– Appleton’s Rich in intellectual property agreement improvement and

Expanding margins and core and adjacent

first commercial Robust development pipeline margin expansion

cash flow with mix shift markets

saleï,— Proven lower capital intensity, high on the horizon

cash flow, scalable business model

1900s–1990s 2000–2016 2017+

1911 1973 1994 2001 2008 2009 2010 2015 2016

Enters Introduces Introduces Employees Sells Sells Sells Sells Encapsys for Resolved

specialty thermal Docucheck complete BemroseBooth packaging performance $208mm Environmental

paper chart and security buyout business films Liability

market calculator papers $25mm for Fox

paper River completed in 2016

Divestednon-core assets to focus on core markets

11

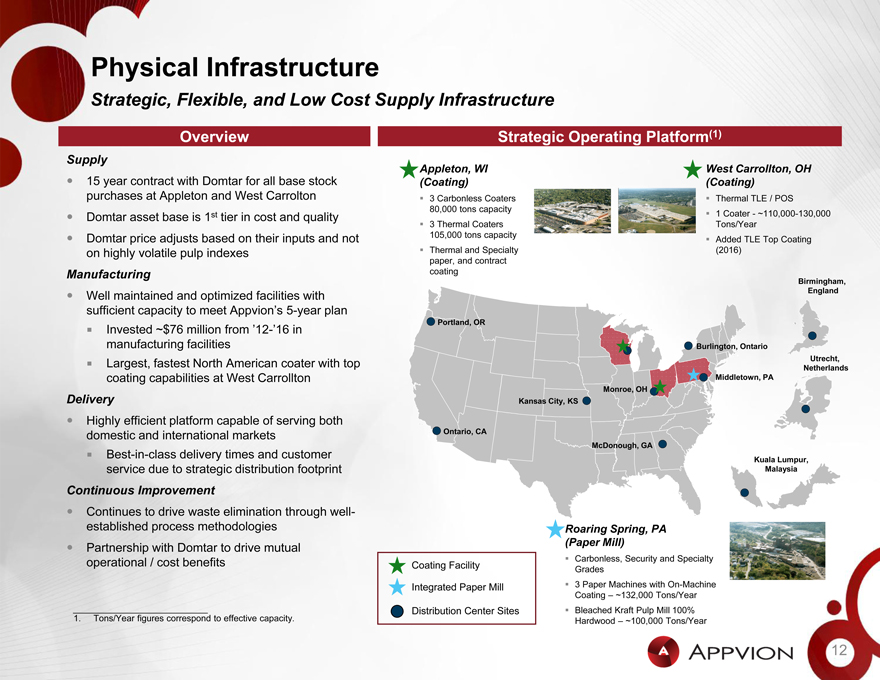

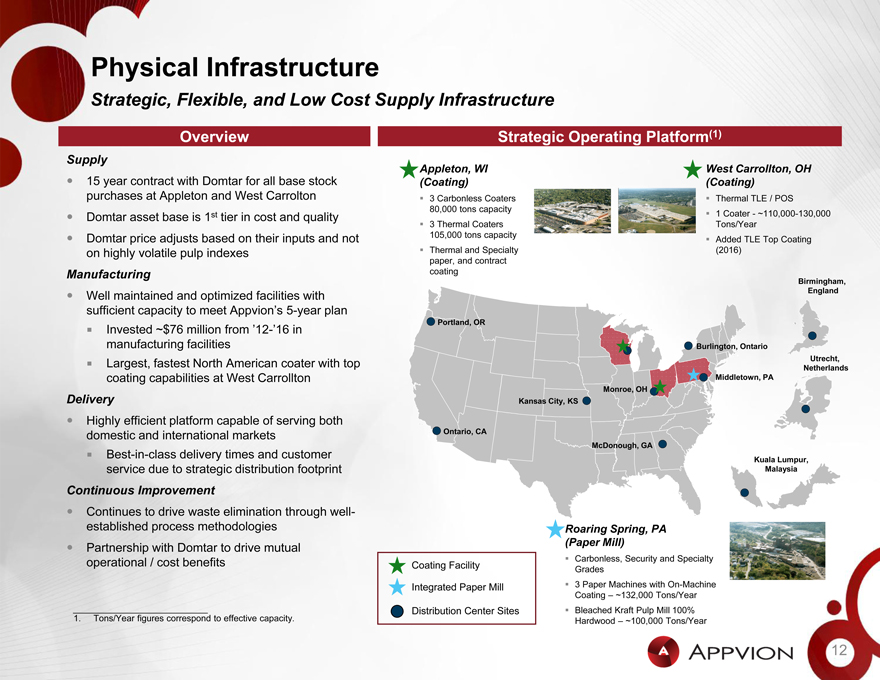

Physical Infrastructure

Strategic, Flexible, and Low Cost Supply Infrastructure

Overview Strategic Operating Platform(1)

Supply

Appleton, WI West Carrollton, OH

15 year contract with Domtar for all base stock (Coating) (Coating)

purchases at Appleton and West Carrolton 3 Carbonless Coaters Thermal TLE / POS

80,000 tons capacity

Domtar asset base is 1st tier in cost and quality1Coater—~110,000-130,000

3 Thermal Coaters Tons/Year

105,000 tons capacity

Domtar price adjusts based on their inputs and not Added TLE Top Coating

on highly volatile pulp indexes Thermal and Specialty (2016)

paper, and contract

Manufacturing coating

Birmingham,

Well maintained and optimized facilities with England

sufficient capacity to meet Appvion’s5-year plan

Portland, OR

Invested ~$76 million from’12-’16 in

manufacturing facilities Burlington, Ontario

American coater with top Utrecht,

Largest, fastest North Netherlands

coating capabilities at West Carrollton Middletown, PA

Delivery Monroe, OH

Kansas City, KS

Highly efficient platform capable of serving both

domestic and international markets Ontario, CA

McDonough, GA

Best-in-class delivery times and customer

Kuala Lumpur,

service due to strategic distribution footprint Malaysia

Continuous Improvement

Continues to drive waste elimination through well-

established process methodologies Roaring Spring, PA

to drive mutual (Paper Mill)

Partnership with Domtar

operational / cost benefits Carbonless, Security and Specialty

Coating Facility Grades

Integrated Paper Mill 3 Paper Machines withOn-Machine

Coating ~132,000 Tons/Year

Distribution Center Sites Bleached Kraft Pulp Mill 100%

1. Tons/Year figures correspond to effective capacity. Hardwood – ~100,000 Tons/Year

12

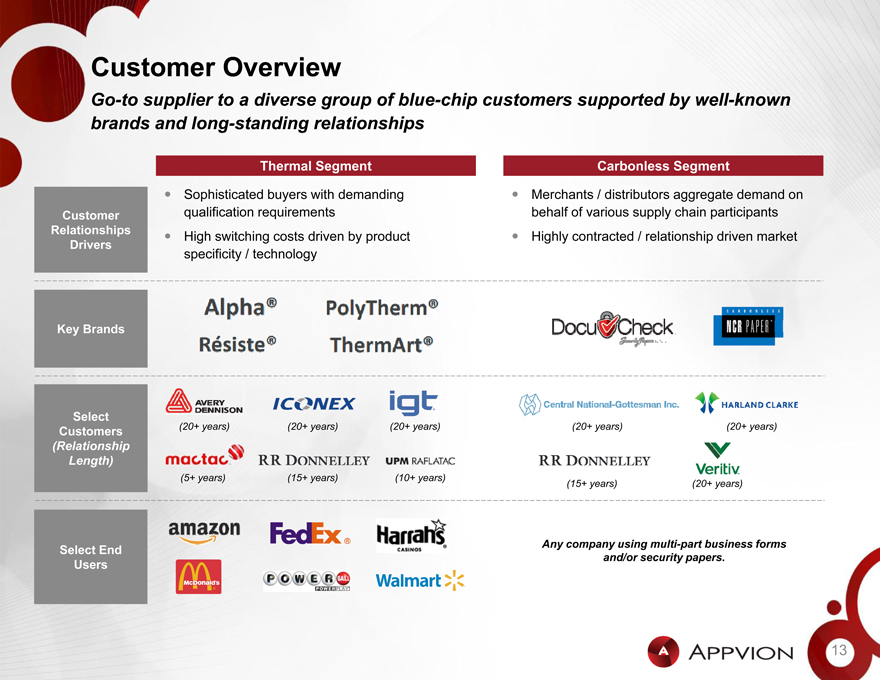

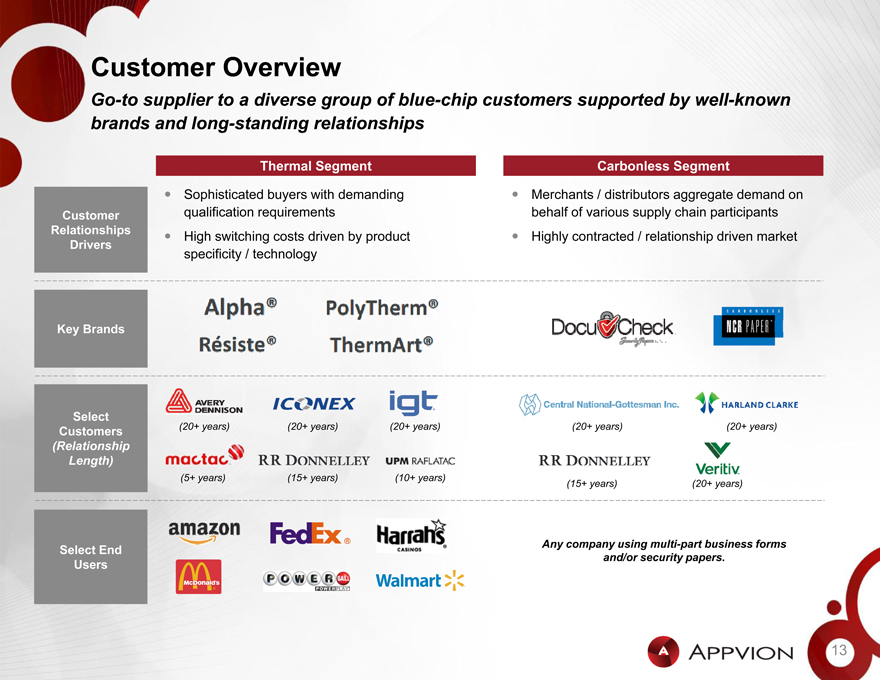

Customer Overview

Go-to supplier to a diverse group of blue-chip customers supported by well-known brands and long-standing relationships

Thermal Segment Carbonless Segment

Sophisticated buyers with demanding Merchants / distributors aggregate demand on Customer qualification requirements behalf of various supply chain participants

Relationships

High switching costs driven by product Highly contracted / relationship driven market

Drivers specificity / technology

Key Brands

Select (20+ years) (20+ years) (20+ years) (20+ years) (20+ years)

Customers

(Relationship Length)

(5+ years) (15+ years) (10+ years)

(15+ years) (20+ years)

Any company using multi-part business forms

Select End and/or security papers.

Users

13

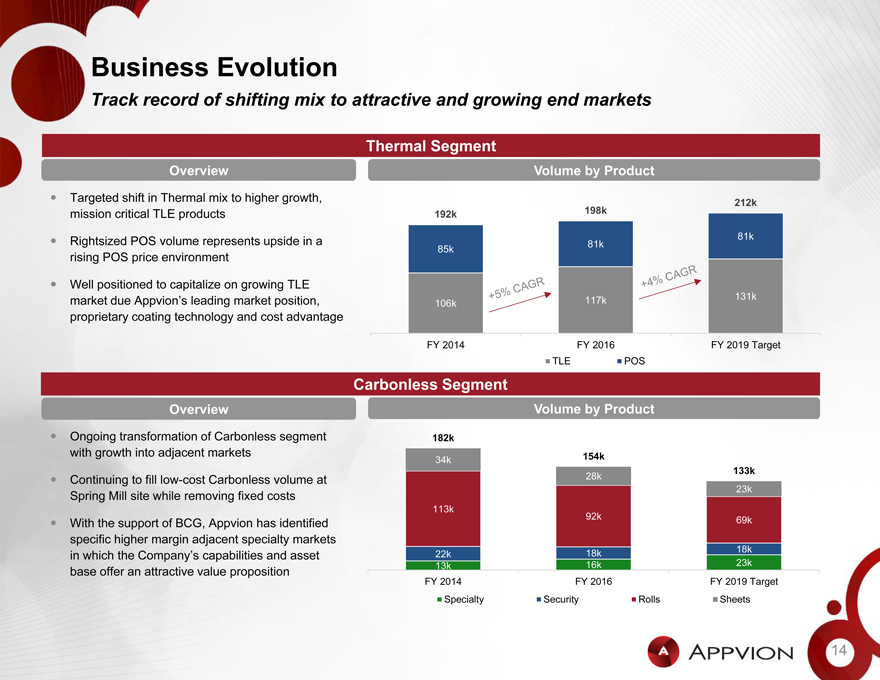

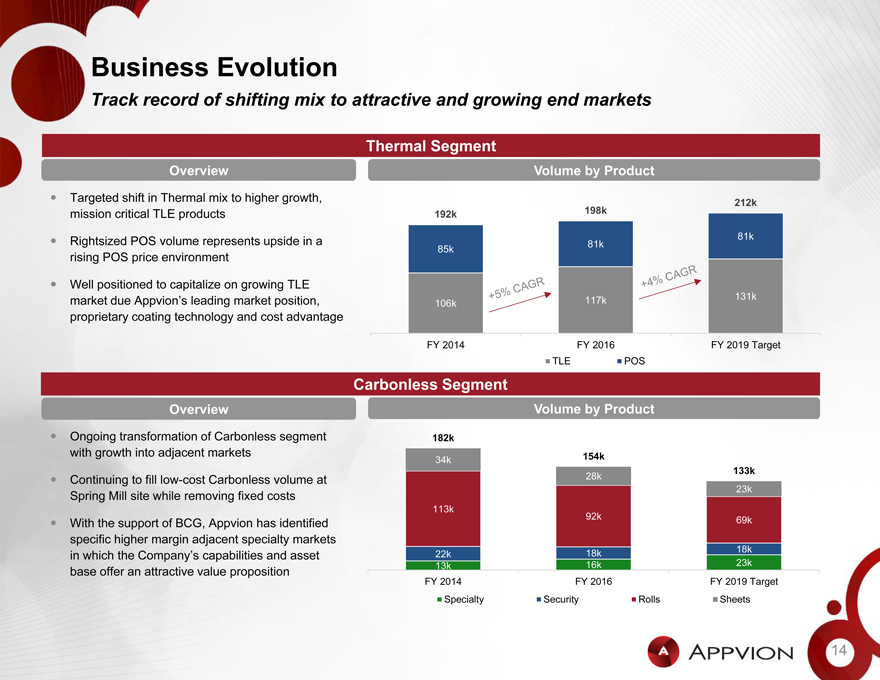

Business Evolution

Track record of shifting mix to attractive and growing end markets

Thermal Segment

Overview Volume by Product

ï,— Targeted shift in Thermal mix to higher growth, 212k mission critical TLE products 192k 198kï,— Rightsized POS volume represents upside in a 81k 81k 85k rising POS price environment

ï,— Well positioned to capitalize on growing TLE market due Appvion’s leading market position, 117k 131k 106k proprietary coating technology and cost advantage

FY 2014 FY 2016 FY 2019 Target TLE POS

Carbonless Segment

Overview Volume by Product

Ongoing transformation of Carbonless segment 182k with growth into adjacent markets 154k

34k

133k

Continuing to filllow-cost Carbonless volume at 28kst

23k

Spring Mill site while removing fixed costs

113k

92k 69k

With the support of BCG, Appvion has identified specific higher margin adjacent specialty markets 18k in which the Company’s capabilities and asset 22k 18k

13k 16k 23k

base offer an attractive value proposition FY 2014 FY 2016 FY 2019 Target

Specialty Security Rolls Sheets

14

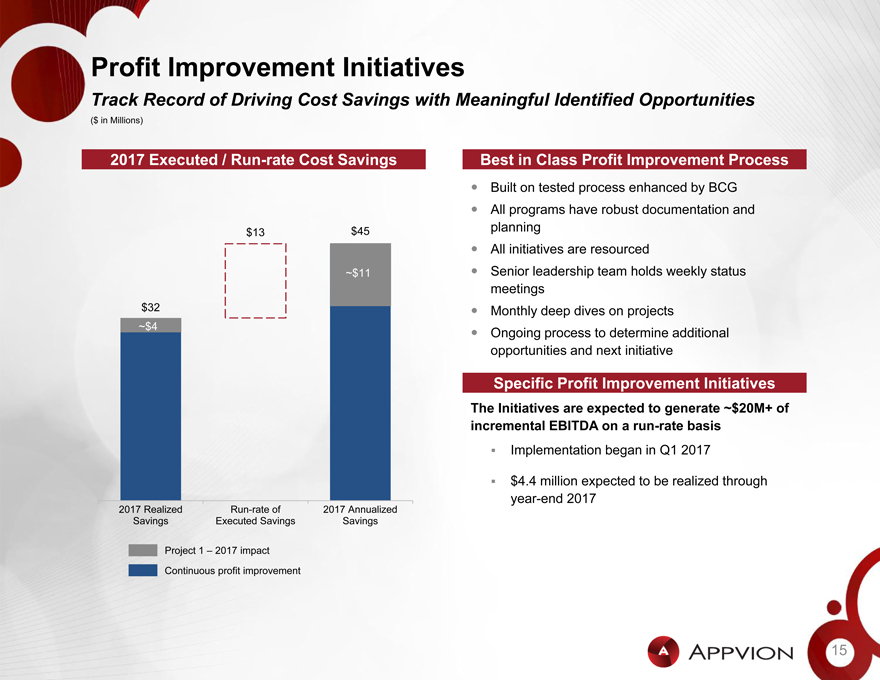

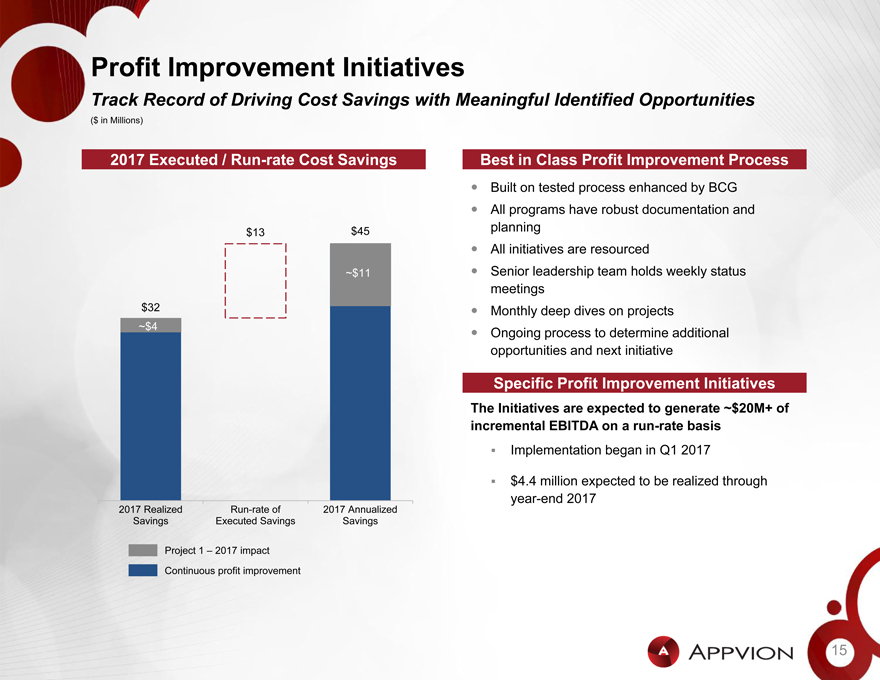

Profit Improvement Initiatives

Track Record of Driving Cost Savings with Meaningful Identified Opportunities

($ in Millions)

2017 Executed /Run-rate Cost Savings Best in Class Profit Improvement Process

Built on tested process enhanced by BCG All programs have robust documentation and

$13 $45 planning

All initiatives are resourced

~$11 Senior leadership team holds weekly status meetings

$32 Monthly deep dives on projects

~$4

Ongoing process to determine additional opportunities and next initiative

Specific Profit Improvement Initiatives

The Initiatives are expected to generate ~$20M+ of incremental EBITDA on arun-rate basis

Implementation began in Q1 2017

$4.4 million expected to be realized throughyear-end 2017

2017 RealizedRun-rate of 2017 Annualized Savings Executed Savings Savings

Project 1 – 2017 impact Continuous profit improvement

15

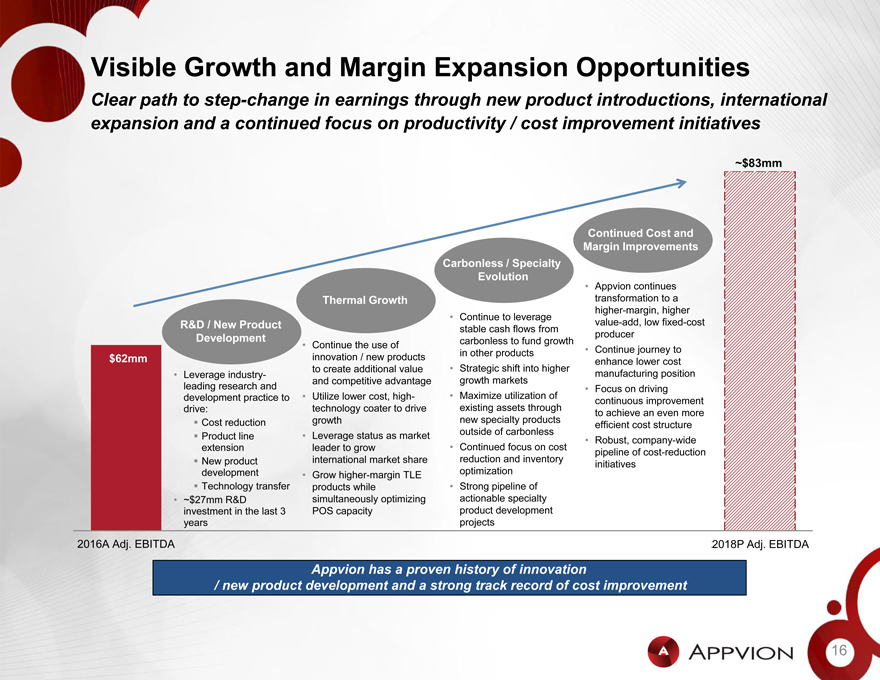

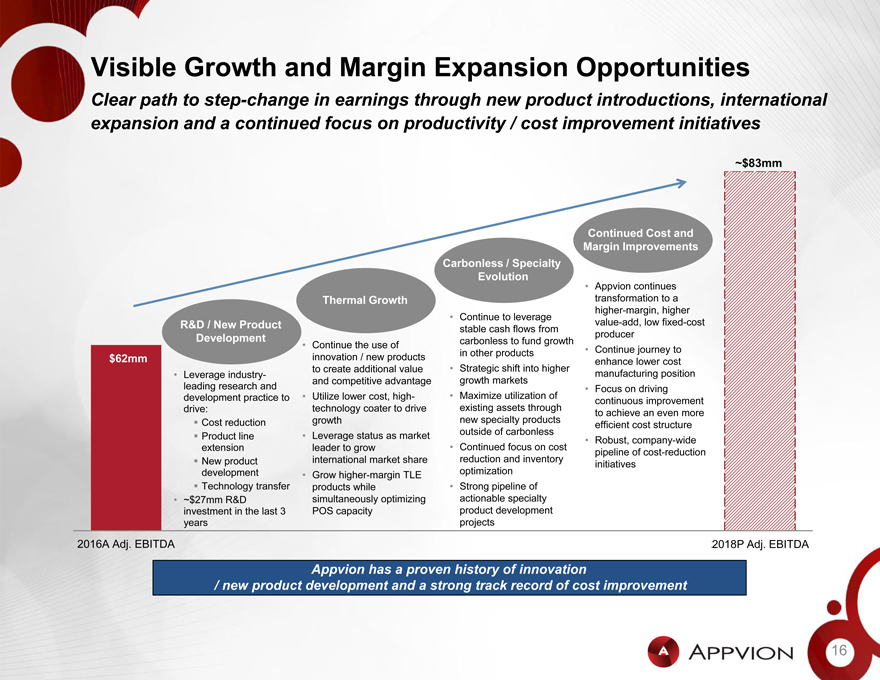

Visible Growth and Margin Expansion Opportunities

Clear path to step-change in earnings through new product introductions, international expansion and a continued focus on productivity / cost improvement initiatives

~$83mm

Continued Cost and

Margin Improvements

Carbonless / Specialty

Evolution Appvion continues

Thermal Growth transformation to a

higher-margin, higher

Continue to leverage

R&D / New Productvalue-add, low fixed-cost

stable cash flows from

Development producer

Continue the use of carbonless to fund growth Continue journey to

innovation / new products in other products

$62mm Strategic shift into higher enhance lower cost

to create additional value

Leverage industry- manufacturing position

and competitive advantage growth markets

leading research and Maximize utilization of Focus on driving

development practice to Utilize lower cost, high-

continuous improvement

drive: technology coater to drive existing assets through

to achieve an even more

Cost reduction growth new specialty products

efficient cost structure

Leverage status as market outside of carbonless

Product line Robust, company-wide

extension leader to grow Continued focus on cost

pipeline of cost-reduction

New product international market share reduction and inventory

initiatives

development Grow higher-margin TLE optimization

Technology transfer products while Strong pipeline of

~$27mm R&D simultaneously optimizing actionable specialty

investment in the last 3 POS capacity product development

years projects

2016A Adj. EBITDA 2018P Adj. EBITDA

Appvion has a proven history of innovation

/ new product development and a strong track record of cost improvement

16

Thermal Paper Segment Overview

17

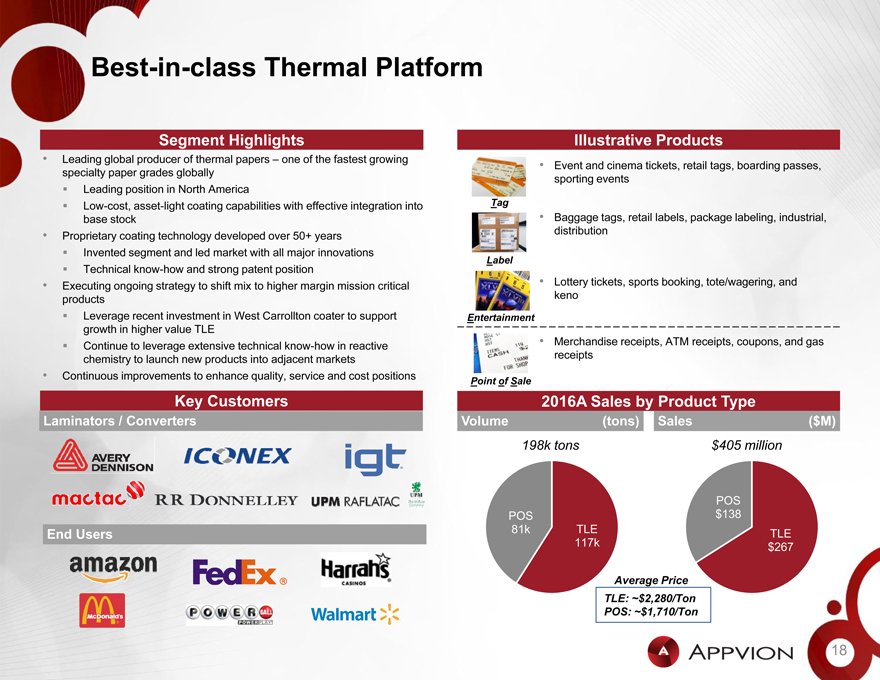

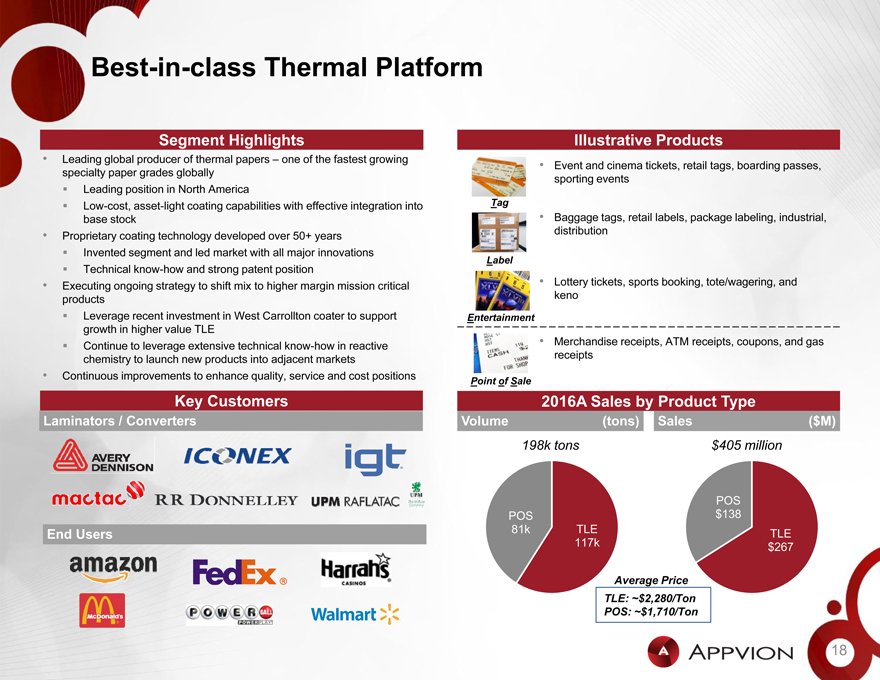

Best-in-class Thermal Platform

Segment Highlights Illustrative Products

Leading global producer of thermal papers – one of the fastest growing

Event and cinema tickets, retail tags, boarding passes, specialty paper grades globally Leading position in North America sporting eventsLow-cost, asset-light coating capabilities with effective integration into Tag base stock Baggage tags, retail labels, package labeling, industrial, distribution

Proprietary coating technology developed over 50+ years Invented segment and led market with all major innovations

Label

Technicalknow-how and strong patent position

Executing ongoing strategy to shift mix to higher margin mission critical Lottery tickets, sports booking, tote/wagering, and products kenoï,§ Leverage recent investment in West Carrollton coater to support Entertainment growth in higher value TLE Continue to leverage extensive technicalknow-how in reactive Merchandise receipts, ATM receipts, coupons, and gas chemistry to launch new products into adjacent markets receipts

Continuous improvements to enhance quality, service and cost positions

Point of Sale

Key Customers 2016A Sales by Product Type

Laminators / Converters Volume (tons) Sales ($M)

198k tons $405 million

POS POS $138

End Users 81k TLE TLE 117k $267

Average Price TLE: ~$2,280/Ton POS: ~$1,710/Ton

18

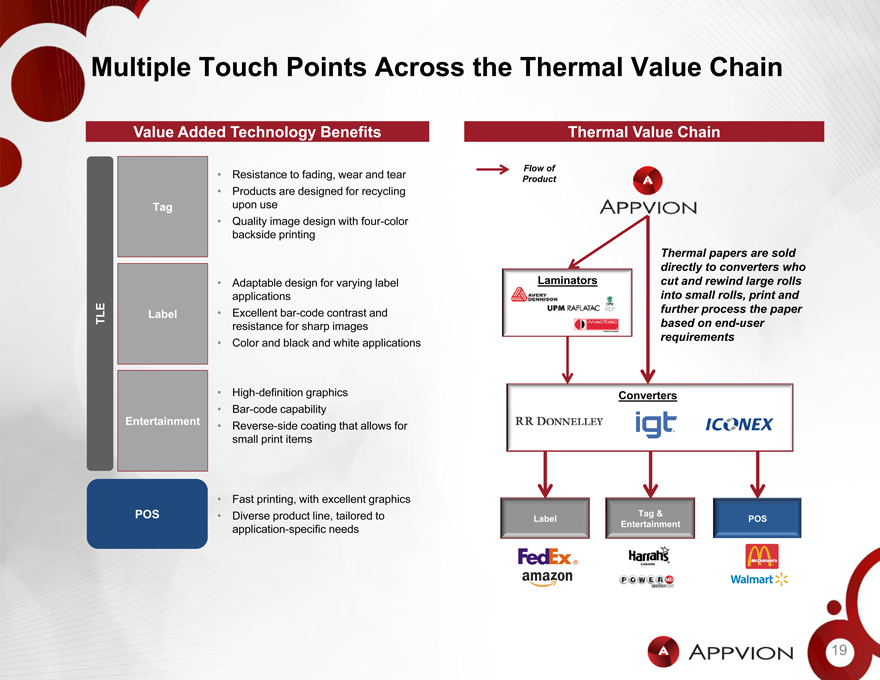

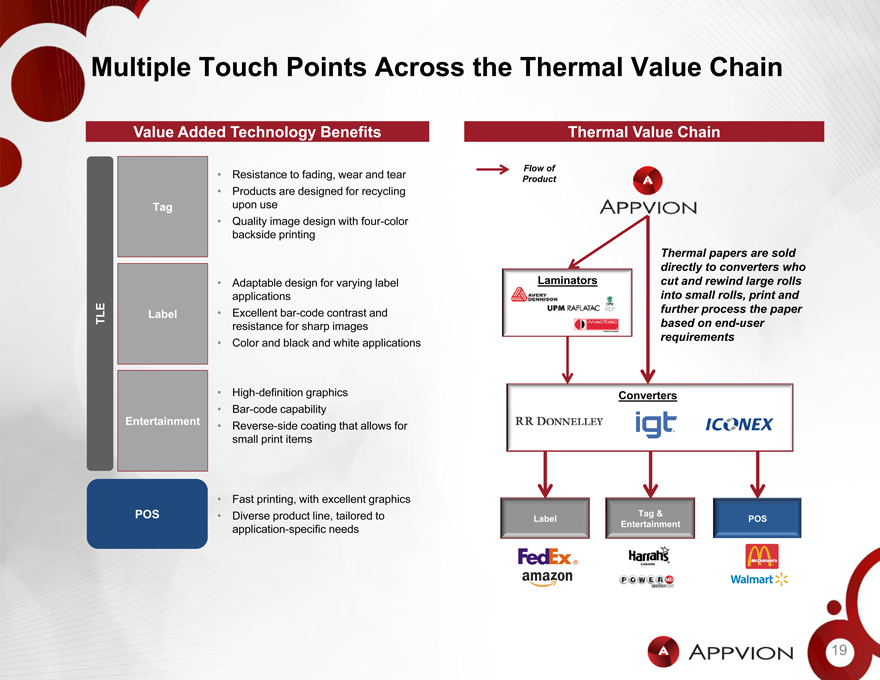

Multiple Touch Points Across the Thermal Value Chain

Value Added Technology Benefits

Resistance to fading, wear and tear

Products are designed for recycling

Tag upon use

Quality image design with four-color

backside printing

Adaptable design for varying label

applications

TLE Label Excellentbar-code contrast and

resistance for sharp images

Color and black and white applications

High-definition graphics

Bar-code capability

Entertainment Reverse-side coating that allows for

small print items

Fast printing, with excellent graphics

POS Diverse product line, tailored to

application-specific needs

Thermal Value Chain

Flow of Product

Thermal papers are sold directly to converters who Laminators cut and rewind large rolls into small rolls, print and further process the paper based onend-user requirements

Converters

Tag &

Label POS Entertainment

19

Carbonless Segment Overview

20

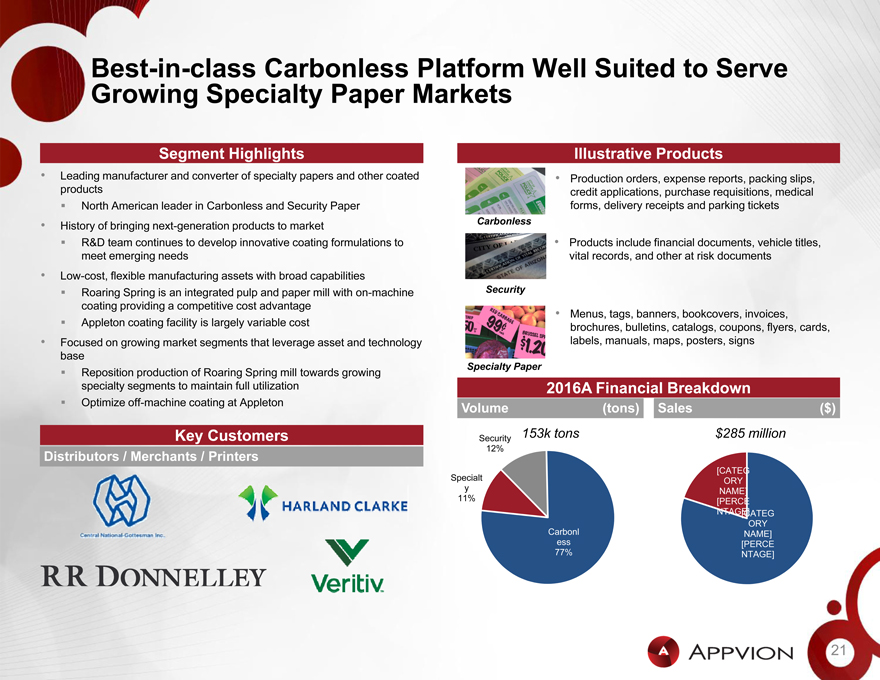

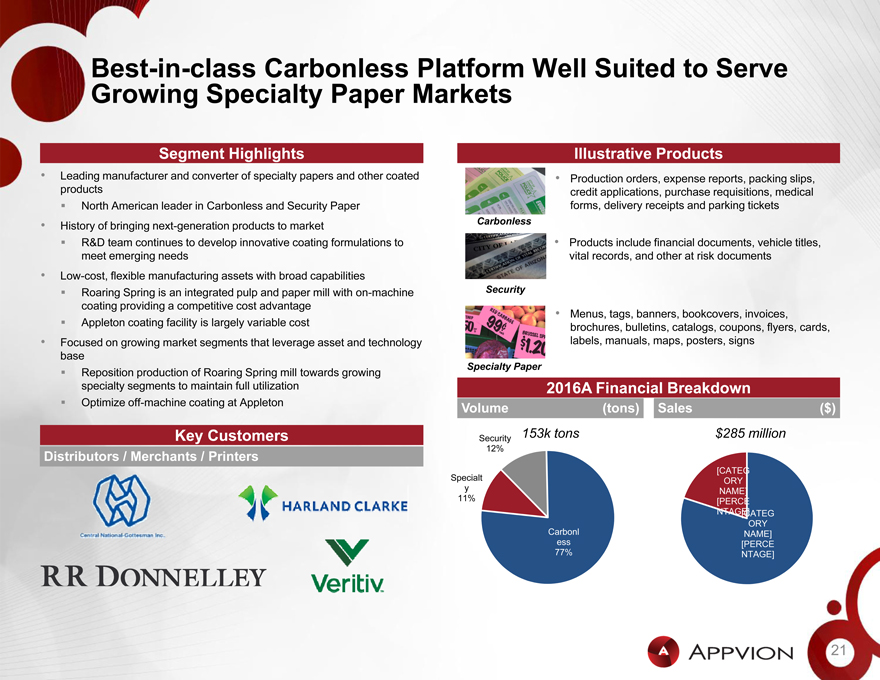

Best-in-class Carbonless Platform Well Suited to Serve Growing Specialty Paper Markets

Segment Highlights

Leading manufacturer and converter of specialty papers and other coated products North American leader in Carbonless and Security Paper

History of bringing next-generation products to market

R&D team continues to develop innovative coating formulations to meet emerging needs

Low-cost, flexible manufacturing assets with broad capabilities

Roaring Spring is an integrated pulp and paper mill withon-machine coating providing a competitive cost advantage Appleton coating facility is largely variable cost

Focused on growing market segments that leverage asset and technology base Reposition production of Roaring Spring mill towards growing specialty segments to maintain full utilization Optimizeoff-machine coating at Appleton

Key Customers

Distributors / Merchants / Printers

Illustrative Products

Production orders, expense reports, packing slips, credit applications, purchase requisitions, medical forms, delivery receipts and parking tickets

Carbonless

Products include financial documents, vehicle titles, vital records, and other at risk documents

Security

Menus, tags, banners, bookcovers, invoices, brochures, bulletins, catalogs, coupons, flyers, cards, labels, manuals, maps, posters, signs

Specialty Paper

2016A Financial Breakdown

Volume (tons) Sales ($)

Security 153k tons $285 million

12%

[CATEG Specialt ORY y NAME] 11% [PERCE

NTAGE] [CATEG Carbonl ORY ess NAME] 77% [PERCE

NTAGE]

21

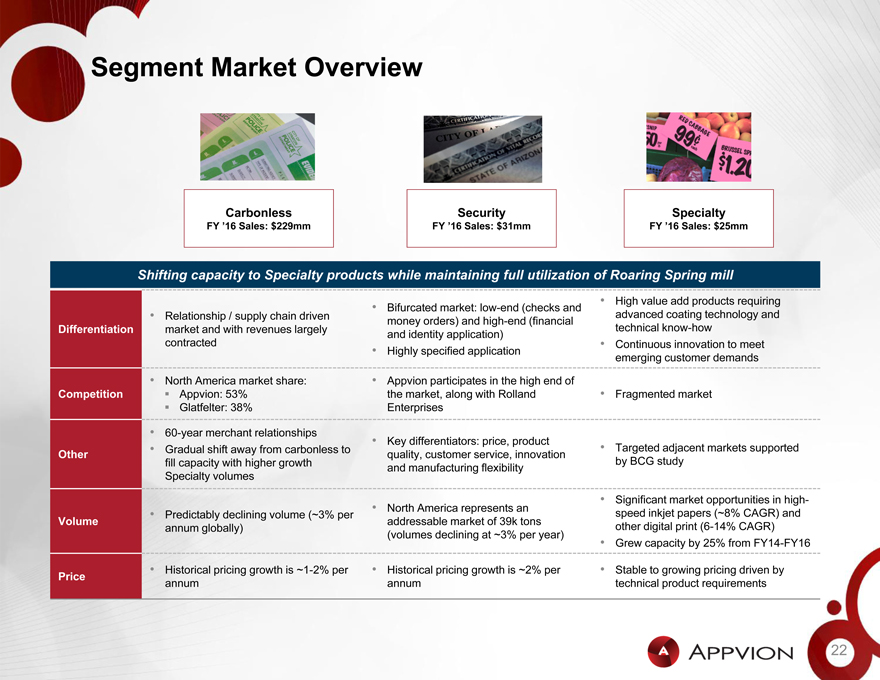

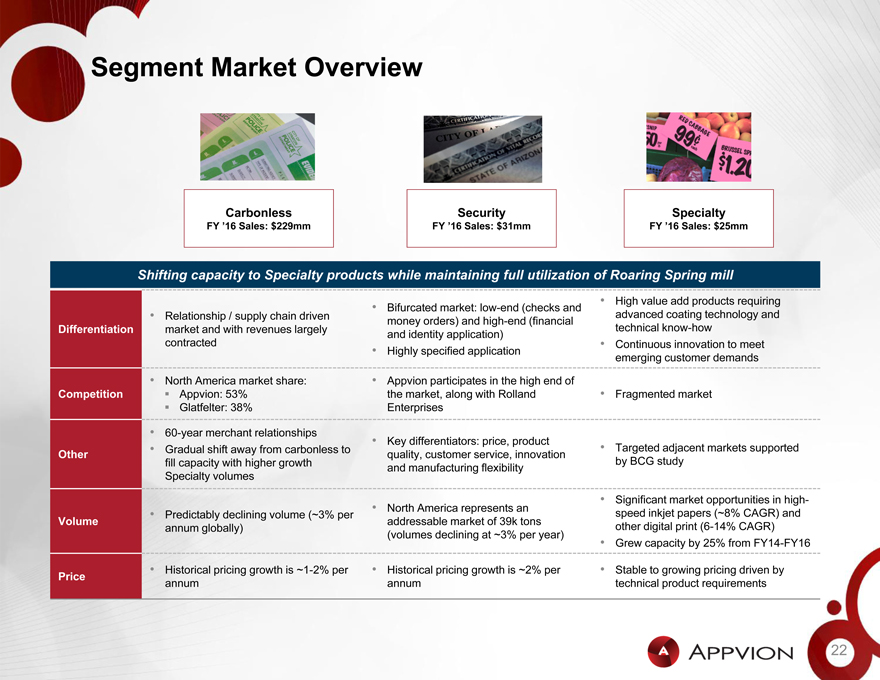

Segment Market Overview

Carbonless Security Specialty

FY ’16 Sales: $229mm FY ’16 Sales: $31mm FY ’16 Sales: $25mm

Shifting capacity to Specialty products while maintaining full utilization of Roaring Spring mill

High value add products requiring

Bifurcated market:low-end (checks and

Relationship / supply chain driven advanced coating technology and

money orders) andhigh-end (financial

Differentiation market and with revenues largely technicalknow-how

and identity application)

contracted Continuous innovation to meet

Highly specified application

emerging customer demands

North America market share: Appvion participates in the high end of

Competitionï,§ Appvion: 53% the market, along with Rolland Fragmented market

Glatfelter: 38% Enterprises

60-year merchant relationships

Key differentiators: price, product

Gradual shift away from carbonless to Targeted adjacent markets supported

Other quality, customer service, innovation

fill capacity with higher growth by BCG study

and manufacturing flexibility

Specialty volumes

Significant market opportunities in high-

North America represents an speed inkjet papers (~8% CAGR) and

Predictably declining volume (~3% per

Volume addressable market of 39k tons other digital print(6-14% CAGR)

annum globally)

(volumes declining at ~3% per year)

Grew capacity by 25% from FY14-FY16

Historical pricing growth is~1-2% per Historical pricing growth is ~2% per Stable to growing pricing driven by

Price

annum annum technical product requirements

22

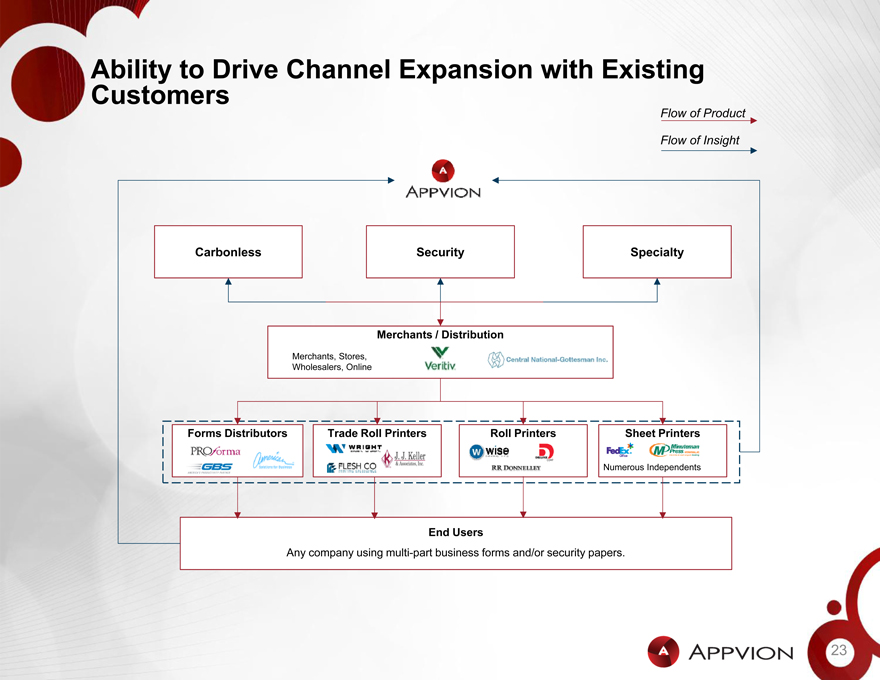

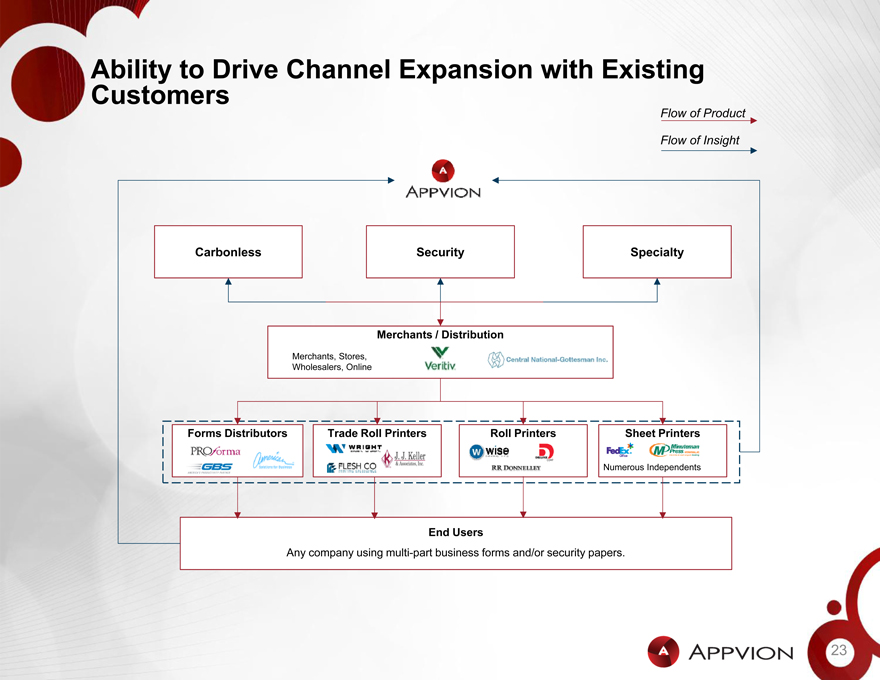

Ability to Drive Channel Expansion with Existing Customers

Flow of Product

Flow of Insight

Carbonless Security Specialty

Merchants / Distribution

Merchants, Stores, Wholesalers, Online

Forms Distributors Trade Roll Printers Roll Printers Sheet Printers

Numerous Independents

End Users

Any company using multi-part business forms and/or security papers.

23

Historical Financial Summary

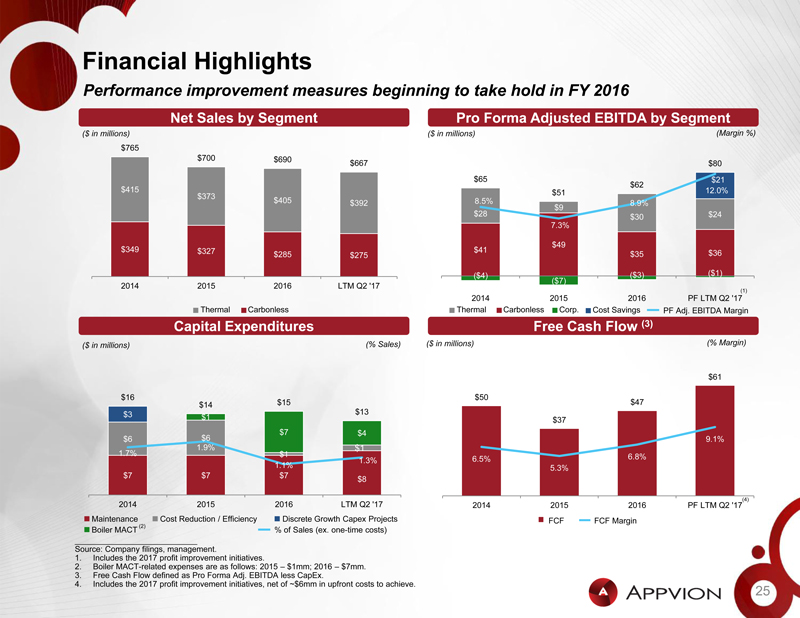

Financial Highlights

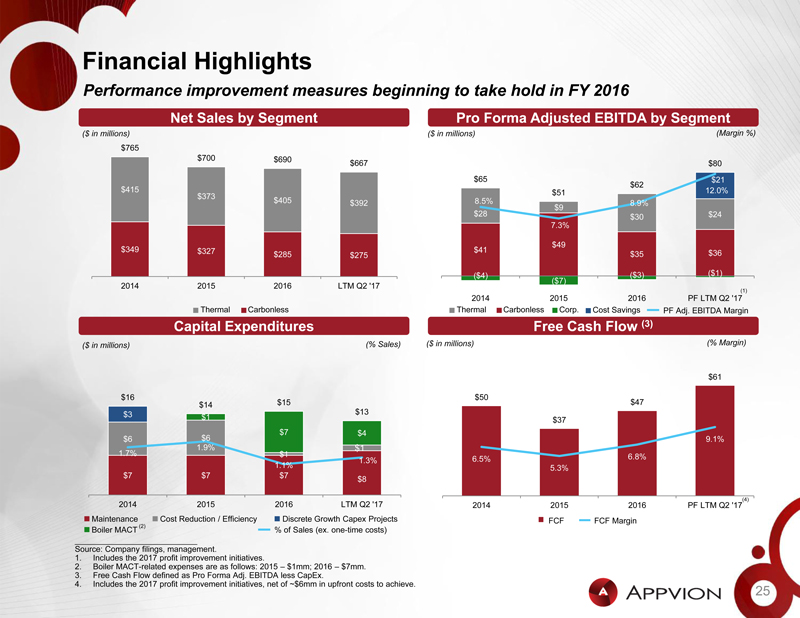

Performance improvement measures beginning to take hold in FY 2016

Net Sales by Segment Pro Forma Adjusted EBITDA by Segment

($ in millions) ($ in millions) (Margin %) $765 $700 $690 $667 $80

$65 $21 $62 $415 $51 12.0% $373 $405 $392 8.5% $9 8.9%

$28 $30 $24 7.3%

$49 $349 $327 $41 $36 $285 $275 $35

($4) ($7) ($3) ($1) 2014 2015 2016 LTM Q2 ‘17

(1)

2014 2015 2016 PF LTM Q2 ‘17 Thermal Carbonless Thermal Carbonless Corp. Cost Savings PF Adj. EBITDA Margin

Capital Expenditures Free Cash Flow (3)

($ in millions) (% Sales) ($ in millions) (% Margin)

$61

$16 $50

$14 $15 $47

$3 $13

$1 $37

$7 $4

$6 $6 9.1% 1.9% $1 1.7% $1 6.8% 1.3% 6.5% 1.1% 5.3%

$7 $7 $7 $8

(4)

2014 2015 2016 LTM Q2 ‘17 2014 2015 2016 PF LTM Q2 ‘17 Maintenance Cost Reduction / Efficiency Discrete Growth Capex Projects FCF FCF Margin Boiler MACT (2) % of Sales (ex.one-time costs Source: Company filings, management.

1. Includes the 2017 profit improvement initiatives.

2. Boiler MACT-related expenses are as follows: 2015 – $1mm; 2016 – $7mm.

3. Free Cash Flow defined as Pro Forma Adj. EBITDA less CapEx.

4. Includes the 2017 profit improvement initiatives, net of ~$6mm in upfront costs to achieve.

25

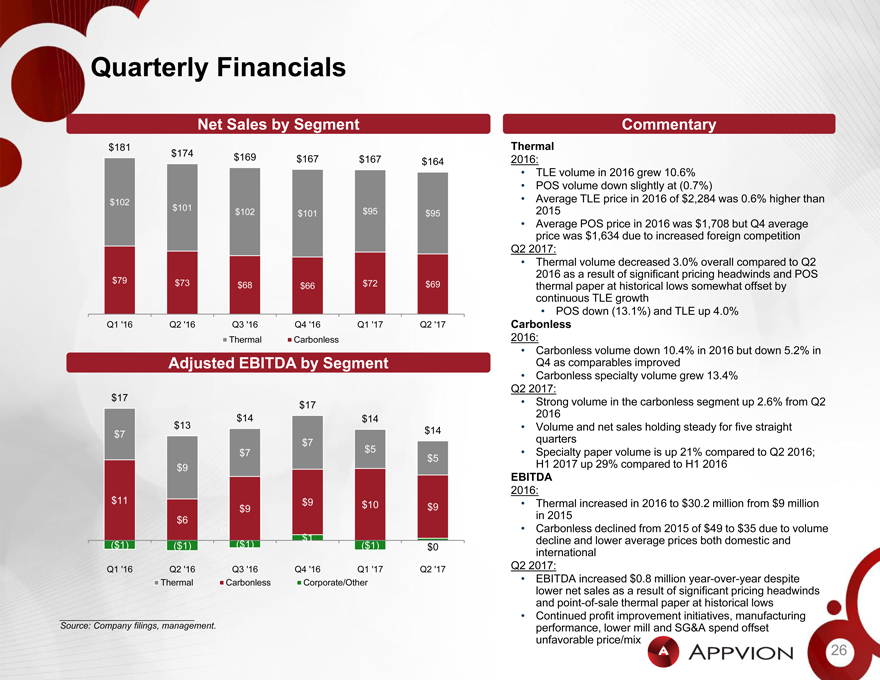

Quarterly Financials

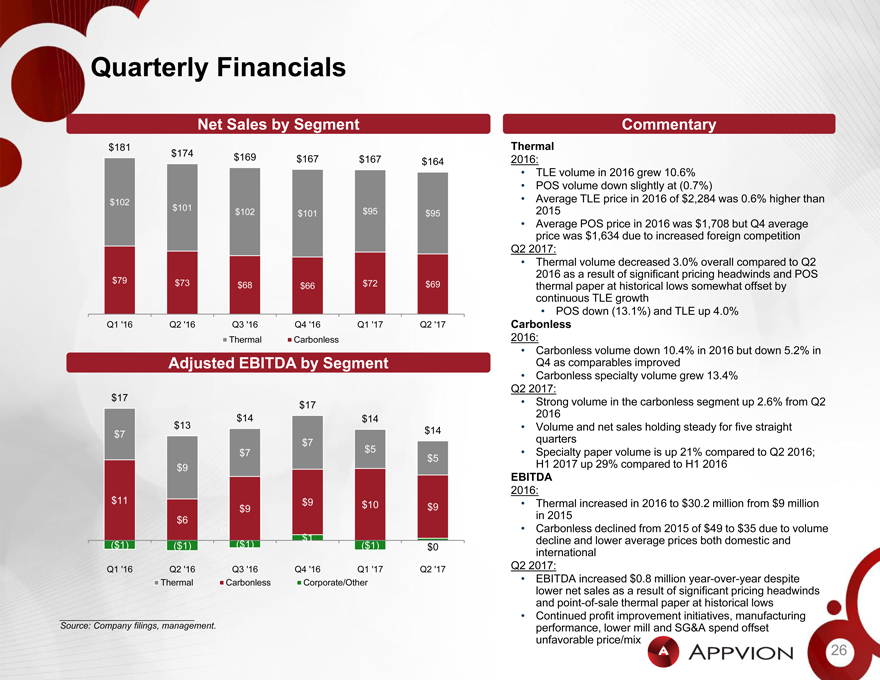

Net Sales by Segment Commentary

$181 Thermal $174 $169 $167 $167 $164 2016:

TLE volume in 2016 grew 10.6%

POS volume down slightly at (0.7%) $102 $101 Average TLE price in 2016 of $2,284 was 0.6% higher than $102 $101 $95 $95 2015

Average POS price in 2016 was $1,708 but Q4 average price was $1,634 due to increased foreign competition Q2 2017:

Thermal volume decreased 3.0% overall compared to Q2 2016 as a result of significant pricing headwinds and POS

$79 $73 $72 $69

$68 $66 thermal paper at historical lows somewhat offset by continuous TLE growth

POS down (13.1%) and TLE up 4.0%

Q1 ‘16 Q2 ‘16 Q3 ‘16 Q4 ‘16 Q1 ‘17 Q2 ‘17 Carbonless Thermal Carbonless 2016:

Carbonless volume down 10.4% in 2016 but down 5.2% in Adjusted EBITDA by Segment Q4 as comparables improved

Carbonless specialty volume grew 13.4%

$17 Q2 2017:

$17 Strong volume in the carbonless segment up 2.6% from Q2

$14 2016 $14

$13 Volume and net sales holding steady for five straight

$7 $14 $7 quarters

$7 $5 $5 Specialty paper volume is up 21% compared to Q2 2016;

$9 H1 2017 up 29% compared to H1 2016

EBITDA

2016:

$11 $9 $10 Thermal increased in 2016 to $30.2 million from $9 million

$9 $9 $6 in 2015

(1) Carbonless declined from 2015 of $49 to $35 due to volume $1 decline and lower average prices both domestic and

($1) ($1) ($1) ($1) $0 international

Q1 ‘16 Q2 ‘16 Q3 ‘16 Q4 ‘16 Q1 ‘17 Q2 ‘17 Q2 2017:

Thermal Carbonless Corporate/Other EBITDA increased $0.8 million year-over-year despite lower net sales as a result of significant pricing headwinds andpoint-of-sale thermal paper at historical lows

Continued profit improvement initiatives, manufacturing Source: Company filings, management. performance, lower mill and SG&A spend offset unfavorable price/mix

26

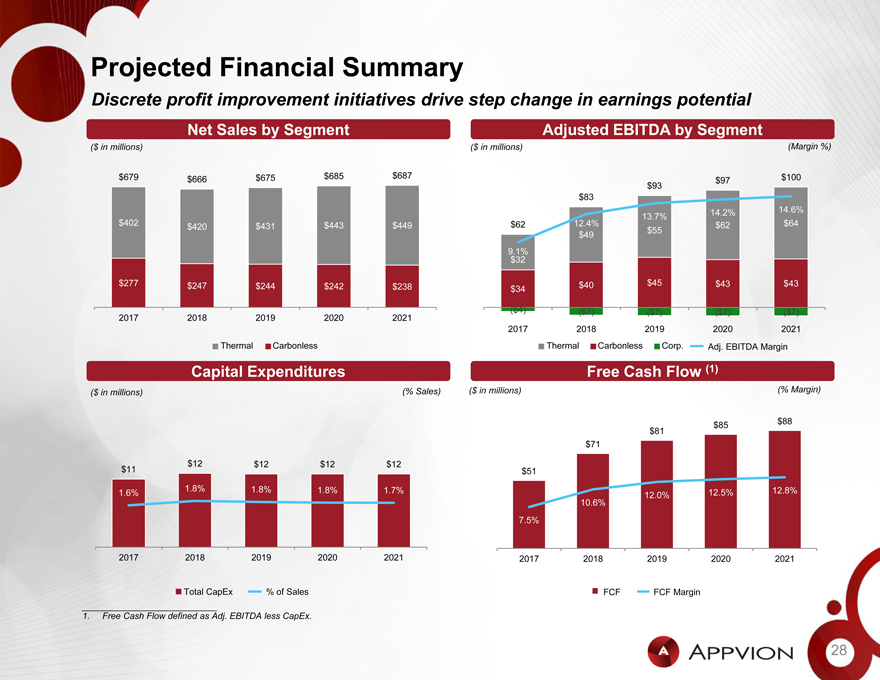

Projected Financial Summary

27

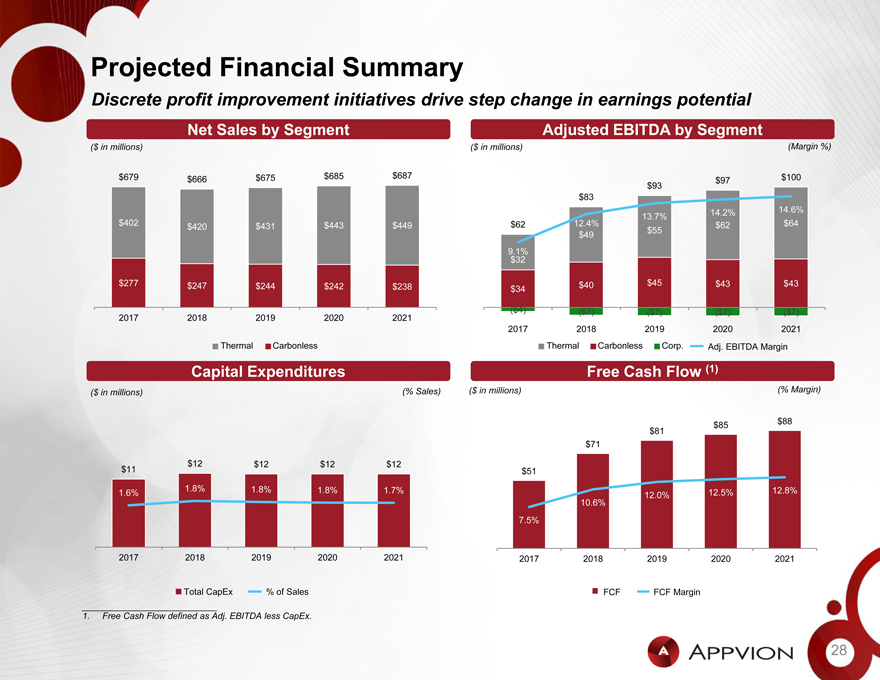

Projected Financial Summary

Discrete profit improvement initiatives drive step change in earnings potential

Net Sales by Segment Adjusted EBITDA by Segment

($ in millions) ($ in millions) (Margin %)

$679 $666 $675 $685 $687 $100 $97 $93 $83

14.2% 14.6%

13.7% $402 $420 $431 $443 $449 $62 12.4% $55 $62 $64 $49

9$ .1% 32 $277 $247 $244 $242 $238 $40 $45 $43 $43 $34

2017 2018 2019 2020 2021 ($4) ($7) ($7) ($7) ($7) 2017 2018 2019 2020 2021 Thermal Carbonless Thermal Carbonless Corp. Adj. EBITDA Margin

Capital Expenditures Free Cash Flow (1)

($ in millions) (% Sales) ($ in millions) (% Margin)

$85 $88 $81 $71

$12 $12 $12 $12

$11 $51

1.8% 1.8% 1.8% 1.7% 12.8%

1.6% 12.0% 12.5%

10.6%

7.5%

2017 2018 2019 2020 2021 2017 2018 2019 2020 2021

Total CapEx % of Sales FCF FCF Margin

1. Free Cash Flow defined as Adj. EBITDA less CapEx.

28

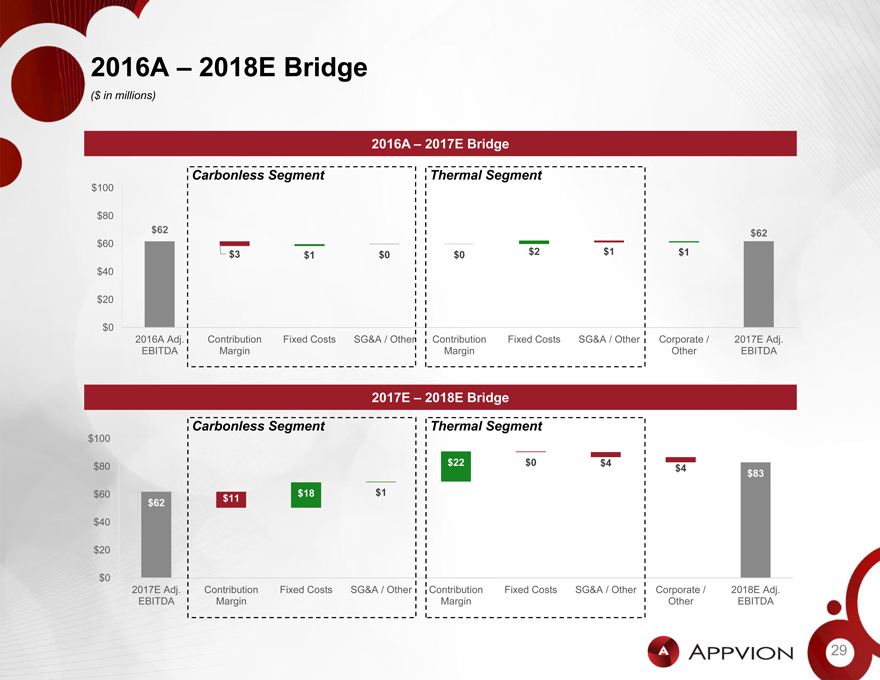

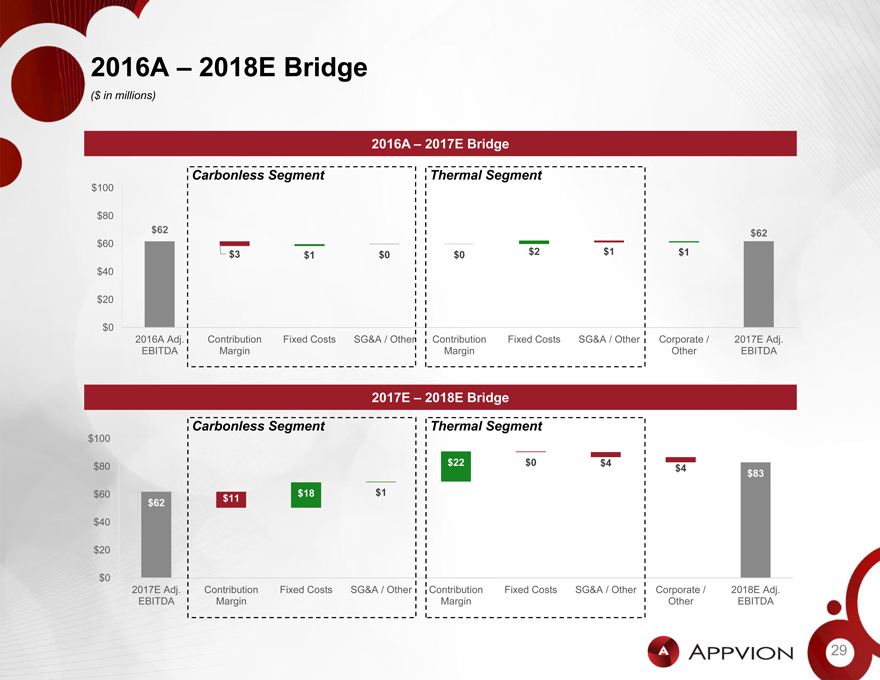

2016A – 2018E Bridge

($ in millions)

2016A – 2017E Bridge

Carbonless Segment Thermal Segment

$100

$80

$62 $62

$60

$3 $1 $0 $0 $2 $1 $1

$40

$20

$0

2016A Adj. Contribution Fixed Costs SG&A / Other Contribution Fixed Costs SG&A / Other Corporate / 2017E Adj.

EBITDA Margin Margin Other EBITDA

2017E – 2018E Bridge

Carbonless Segment Thermal Segment

$100

$80 $22 $0 $4

$4

$83

$60 $18 $1

$11

$62

$40

$20

$0

2017E Adj. Contribution Fixed Costs SG&A / Other Contribution Fixed Costs SG&A / Other Corporate / 2018E Adj.

EBITDA Margin Margin Other EBITDA

29

Notice to Investors

This Presentation (together with any and all attendant oral information, the “Presentation”) has been prepared by Paperweight Development Corp. and its affiliates (“Appvion”, the “Company,” “we” or “us,” as the context may require) solely as a summary document for informational purposes (as further described below). The disclosure of this Presentation to each recipient hereof is subject to the terms and conditions of that certainnon-disclosure agreement (“NDA”) previously executed between the Company and such recipient. We understand the recipient to be a financial advisor to certain of the Company’s secured noteholders, each of whom is a sophisticated institutional “accredited investor” within the meaning of rule 501(a) under the US Securities Act of 1933, as amended (the “Securities Act”) and an “institutional account” (as defined in Rule 4512(c) of the Financial Industry Regulatory Authority). We ask that the recipient inform us immediately if that is not the case.

This Presentation and any associated information and materials provided heretofore, herewith or hereafter, whether communicated in written, electronic or oral form (collectively, the “Materials”), are being furnished solely for the purpose of enabling the recipient to determine whether it wishes to proceed with any further investigation of the Company and/or any transaction therewith (each, a “Transaction”). The Materials are not intended to form the basis of any investment decision and do not attempt to present all the information that prospective investors may require for purposes of making an investment decision. The Company anticipates providing prospective investors with the opportunity to ask questions, receive answers, obtain additional information and complete their own due diligence review concerning the Company prior to entering into any definitive agreement relating to any possible Transaction among the Company and such investors. By accepting delivery of these Materials, each recipient of the Materials agrees to undertake and rely on its own independent investigation and analysis and consult with its own attorneys, accountants and other professional advisors regarding the Company and the merits and risks of participating in any Transaction, including all related legal, investment, tax and other matters.

Each recipient acknowledges that: (a) all information included in the Materials and otherwise furnished in connection with any transaction is submitted to such recipient on a strictly and permanently confidential basis, except as otherwise expressly agreed by the Company, (b) any reproduction or further distribution of the Materials or any such information is prohibited, (c) by accepting delivery of this Presentation, each recipient of Materials agrees that neither such recipient nor any of its employees, agents or advisors will use the Materials or any such information for any purpose other than evaluating the Company and any Transaction, (d) except as indicated below or otherwise expressly agreed by the Company, each recipient of Materials also agrees not to disclose to any person the fact that such recipient has been furnished with Materials or any such information or any terms, conditions or other information with respect to the Company or any Transaction, and (e) by accepting delivery of this Presentation, each recipient of Materials agrees that, if such recipient decides not to further evaluate the Company or any Transaction, or if the Company or its financial advisor, Guggenheim Securities, LLC (“Guggenheim Securities”), so requests at any time, such recipient will promptly return to the Company or Guggenheim Securities all Materials furnished to it in connection the Transaction without retaining any copies thereof.

None of Guggenheim Securities or any of its subsidiaries, affiliates, directors, officers, employees, representatives, consultants, legal counsel and/or agents has independently verified the accuracy and/or completeness of this Presentation and any other Materials, including without limitation any estimates or financial forecasts or projections. None of the Company, Guggenheim Securities or any of their respective subsidiaries, affiliates, directors, officers, employees, representatives, consultants, legal counsel and/or agents (i) makes any representation, guaranty or warranty (express or implied) as to the accuracy or completeness of this Presentation or any other Materials, including without limitation any estimates or financial forecasts or projections; or (ii) will have any responsibility, obligation or liability with respect to any information contained in, or for any omissions from, this Presentation or any other

Materials and/or any other written or oral communication transmitted to the recipient in the course of such recipient’s investigation and evaluation of the Company and any Transaction.

Until the execution of definitive documentation relating to any Transaction, the Company reserves the right, in its sole discretion and for any reason, to modify or amend the terms of such Transaction, to approve or disapprove any prospective lender or other investor, to accept or reject, in whole or in part, any request by an investor to participate as lender, participant or otherwise in such Transaction, to allocate to any investor a smaller portion of such Transaction than the amount sought by such investor and to withdraw from any further discussions, negotiations or transaction. None of the Company or Guggenheim Securities will have any liability or obligation whatsoever to any prospective investor in the event of any of the foregoing.

30

Notice to Investors (Continued)

This Presentation speaks as of the date hereof. Neither the delivery of this Presentation nor any eventual consummation of any Transaction shall, under any circumstances, imply that the information contained herein is correct as of any future date or that there has been no change in the affairs of the Company after the date hereof. Nothing contained herein is, or should be relied upon as, a promise or representation as to future performance. None of the Company or Guggenheim Securities undertakes any obligation to update, correct or otherwise revise this Presentation or any other Materials.

This Presentation is intended solely for the use of the recipient to whom it is initially provided. This Presentation does not constitute an offer to sell to or solicitation of an offer to purchase from any investor or in any jurisdiction in which such an offer or solicitation is not authorized or would be unlawful. Each investor must comply with all legal requirements in each jurisdiction in which it purchases, offers or sells any portion of any Transaction or possesses this Presentation or any other Materials, and must independently obtain any consent, approval or permission required by it in connection with any Transaction. The Company and Guggenheim Securities make no representation or warranty regarding, and shall have no responsibility for, the legality of an investment or other participation in any Transaction under any investment, securities or similar laws. Prospective investors are not to construe the contents of this Presentation or any other Materials as investment, legal, business or tax advice of any kind.

This Presentation may contain descriptions of a Transaction and certain other documents relevant to a Transaction that do not set forth all the information that is included in or may be derived from those documents. Prospective investors should read the complete text of the documents carefully and in their entirety prior to making any investment decision. Copies of documents may be requested from Guggenheim Securities.

By accepting delivery of this Presentation, each recipient will be deemed to acknowledge and agree to the matters above. In addition, and without limiting the foregoing, as the Company’s financial advisor, Guggenheim Securities has obligations solely to the Company and will be entitled to be paid a fee or fees upon the successful consummation of certain Transactions or otherwise pursuant to the terms of its engagement letter. By accepting this Presentation, each recipient hereby acknowledges and agrees that neither Guggenheim Securities nor any of its subsidiaries, affiliates, directors, officers, employees, representatives, consultants, legal counsel and/or agents (i) is acting as a financial advisor, private placement agent, arranger or in any other advisory capacity to such recipient (with respect to any Transaction or otherwise) or (ii) owes such recipient any duty of loyalty or care (whether in contract, in tort or otherwise) with respect to the Presentation, any other Materials or any Transaction, in all cases notwithstanding any commercial relationship that may currently exist or have previously existed between such recipient and Guggenheim Securities or any of its subsidiaries, affiliates, directors, officers, employees, representatives or consultants, legal counsel and/or agents.