Exhibit 99.6

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

Provided Pursuant to Confidentiality Agreement Subject to FRE 408

Project Aptitude

Preliminary Transaction Analyses

September 6, 2017

Guggenheim Securities

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

Certain Disclosures and Other Considerations

This presentation, any supplemental information or documents provided herewith and any attendant oral commentary (collectively, this “Presentation”) (i) have been prepared for discussion purposes only by Guggenheim Securities, LLC (“Guggenheim Securities”), (ii) are intended solely for review by the Recipients in connection with the Recipients’ (as defined below) consideration of the potential transaction or transactions (each, a “Transaction”) involving Appvion, Inc. (the “Company”) as described in this Presentation and (iii) may not be relied upon by any Recipient, whether in connection with any Transaction or otherwise. Guggenheim Securities has been engaged by and is acting as a financial advisor and investment banker solely to the Company and no other party in connection with the

Company’s consideration of a potential Transaction. None of Guggenheim Securities or its affiliates, directors, officers, employees, attorneys, advisors, consultants, agents or representatives assumes any responsibility, obligation or liability (whether direct or indirect, in contract or tort or otherwise) to any Recipient of this Presentation in relation to the content of this Presentation, any potential Transaction or otherwise. Any written materials which comprise this Presentation are incomplete without reference to the attendant oral commentary by Guggenheim Securities in connection herewith. Each Recipient understands that (i) this Presentation is confidential and proprietary and, without the prior written consent of Guggenheim Securities, may not be reproduced, disseminated, quoted from or referred to, in whole or in part, at any time, in any manner or for any purpose and (ii) no public references to Guggenheim Securities may be made by any Recipient without Guggenheim Securities’ prior written consent. If you are not a Recipient as designated below, then please immediately delete or destroy all copies of this Presentation in your possession. Herein, the term “Recipients” refers to 2L Noteholders, Houlihan Lokey and Stroock & Stroock & Lavan LLP (and such of their respective professionals that are advising on the Transactions), in their capacity as financial or legal advisors to certain holders of indebtedness issued by Appvion, Inc.

This Presentation does not represent a commitment on the part of the Company to participate in any potential Transaction described herein. Any such commitment, if forthcoming, would only be pursuant to definitive documentation and may contain terms and conditions different than those set forth in this Presentation.

This Presentation supersedes any oral or written presentation delivered by Guggenheim Securities in connection with any proposed Transaction, and Guggenheim Securities assumes no obligation or liability (in each case, express or implied) for updating or otherwise revising this Presentation. Guggenheim Securities has been engaged as financial advisor and investment banker to Appvion, Inc. With respect to the matters discussed in this Presentation, Guggenheim Securities has assumed that there is no divergence or conflict in the interests of Appvion, Inc. with respect to any Transaction. However, without limiting the foregoing, the alternatives and strategies outlined in this presentation could actually have differing impacts on the interests of each of the aforementioned entities and should be analyzed by and for each such entity based on applicable law and fiduciary duties, with the advice of relevant legal counsel. Each Recipient understands that Guggenheim Securities does not have any obligation or responsibility to provide, nor will Guggenheim Securities be deemed to have provided, any financial, legal, regulatory, tax, accounting, investment, actuarial or other such advice for or to any Recipient, and this Presentation does not constitute financial, legal, regulatory, tax, accounting, investment, actuarial or other such advice. Accordingly, each Recipient should (i) consult with and rely solely on its own financial advisors, legal counsel, regulatory counsel, tax advisors, accountants, investment advisors, actuaries and similar expert advisors for all financial, legal, regulatory, tax, accounting, audit, investment, actuarial and other such advice, (including, without limitation, for purposes of (1) determining whether any potential Transaction described herein is in the Recipient’s best interests and (2) confirming that the alternatives and strategies outlined in this Presentation comply with the specific provisions of such applicable credit agreements, indentures and/or other relevant agreements and contracts to which Appvion, Inc. may be a party), and (ii) make an independent analysis and decision regarding any such Transaction based on such advice.

The industry, business, financial, legal, regulatory, tax, accounting, actuarial and other information (including, without limitation, any financial projections, synergy estimates, other estimates and/or other

forward-looking information) (collectively, the “Information” and, specifically with respect to the foregoing parenthetical, the “Forward-Looking Information”) contained in or otherwise underlying this

Presentation was (i) provided to or discussed with Guggenheim Securities by the Company and certain transaction counterparties or other participants which are currently or may in the future be directly involved in any Transaction(s) (together with the Company, “Transaction Participants”) and their respective officers, directors, employees, affiliates, appraisers, independent accountants, legal counsel and other agents, consultants and advisors (collectively with respect to any person or entity, its “Representatives”) or (ii) obtained by Guggenheim Securities from public sources, data suppliers and other third parties. In preparing this Presentation, Guggenheim Securities (i) has relied upon and assumed the accuracy, completeness and reasonableness of all such Information (including, without limitation, any Forward-Looking Information); (ii) does not assume any responsibility, obligation or liability (whether direct or indirect, in contract or tort or otherwise) for the accuracy, completeness, reasonableness, achievability or independent verification of, and Guggenheim Securities has not independently verified, any such Information (including, without limitation, any Forward-Looking Information); (iii) has relied upon the assurances of Transaction Participants and their respective Representatives that they are unaware of any facts or circumstances that would make any such Information (including, without limitation, any Forward-Looking Information) incomplete, inaccurate or misleading; (iv) has not performed or obtained any independent appraisal of the assets or liabilities (including any contingent, derivative oroff-balance sheet assets and liabilities) of any Transaction Participant or been provided with any such appraisals; and (v) has no responsibility or obligation to evaluate the solvency of any Transaction Participant or any other party under any US federal, state or foreign laws relating to bankruptcy, insolvency or similar matters or the impact of any such laws on any Transaction or the matters discussed in this Presentation. Specifically, with respect to the impact of such laws on any Transaction Guggenheim Securities has assumed that there is no divergence or conflict in the interests of Appvion, Inc. In addition, with respect to all (i) Forward-Looking Information provided to or discussed with Guggenheim Securities by any of the Transaction Participants and their respective Representatives, Guggenheim Securities (a) has assumed that such Forward-Looking Information has been reasonably prepared on bases reflecting the best currently available estimates and judgments of each Transaction Participant’s senior management as to the expected future performance of the relevant company or entity and the realization of any synergies included in such Forward-Looking Information and (b) expresses no view, opinion, representation, guaranty or warranty (in each case, express or implied) regarding the reasonableness or achievability of such Forward-Looking Information and (ii) Information obtained by Guggenheim Securities from public sources, data suppliers and other third parties, Guggenheim Securities has assumed that such

Information is reasonable and reliable. Guggenheim Securities’ role in connection with any due diligence investigation is limited solely to performing such review as it deems necessary to support its own financial advice and analyses and is not on behalf of the Company, any Recipient or any other party.

1 Guggenheim Securities

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

Certain Disclosures and Other Considerations (cont’d)

In connection with this Presentation, Guggenheim Securities expresses no view or opinion as to the price or range of prices at which the shares of common stock or other securities (including debt securities) of any Transaction Participant may trade at any time, including, without limitation, subsequent to the announcement or consummation of any Transaction.

This Presentation does not (i) constitute a recommendation to the Company, any Recipient or any other party in connection with any Transaction; (ii) constitute advice or a recommendation to the Company, any Recipient, any Transaction Participant or any other party as to (a) whether to tender any such securities pursuant to any tender offer or exchange offer related to any Transaction, (b) how to vote or act in connection with any Transaction or otherwise or (c) whether to buy or sell any assets or securities of any company, entity or person involved in any such Transaction; or (iii) address (a) the Company’s, any Recipient’s or any other party’s underlying business and/or financial decision to pursue any Transaction, (b) the relative merits of any such Transaction as compared to any alternative business or financial strategies that might exist for the Company, any Recipient or any other party, (c) the terms of any Transaction or (d) the effects of any other transaction in which the Company, any Recipient or any other party might engage.

Unless otherwise indicated herein, this Presentation has been prepared and submitted as of the date on the cover of this Presentation, reflects Information made available to Guggenheim Securities as of or prior to such date and is based on economic, capital markets and other conditions as of such date.

This Presentation does not constitute an offer to sell or the solicitation of an offer to buy any security, nor does such Presentation constitute or imply any offer or commitment whatsoever by Guggenheim Securities or its affiliates, including, without limitation, any offer or commitment to (i) lend, syndicate or arrange any financing or to purchase, sell, underwrite the sale of or hold any security, investment, loan or other financial product unless and only to the extent that such commitment is set out in a definitive agreement that is legally binding on Guggenheim Securities or its affiliates (as applicable) and subject to the conditions in such agreement or (ii) enter into any type of fiduciary relationship with any Recipient.

Guggenheim Securities and its affiliates engage in a wide range of financial services activities for their own accounts and the accounts of their customers, including asset and investment management, investment banking, corporate finance, mergers and acquisitions, restructuring, merchant banking, fixed income and equity sales, trading and research, derivatives, foreign exchange and futures. In the ordinary course of these activities, Guggenheim Securities or its affiliates may (i) provide such financial services to the Transaction Participants for which services Guggenheim Securities or its affiliates may have received, and may receive, compensation and (ii) directly or indirectly, hold long or short positions, trade or otherwise conduct such activities in or with respect to certain debt or equity securities, bank debt and derivative products of or relating to the Transaction Participants. Furthermore, Guggenheim Securities and its affiliates, directors, officers and employees may have investments in the Transaction Participants and other parties interested in a Transaction.

Consistent with applicable legal and regulatory guidelines, Guggenheim Securities has adopted certain policies and procedures to establish and maintain the independence of its research department and personnel. As a result, Guggenheim Securities’ research analysts may hold views, make statements or investment recommendations and publish research reports with respect to the Transaction Participants and/or any potential Transaction that differ from the views of Guggenheim Securities’ investment banking personnel. Among other things, the aforementioned policies prohibit Guggenheim Securities’ employees from offering research coverage, a favorable research rating or a specific price target or offering to change a research rating or price target as consideration for or an inducement to obtain investment banking business or other compensation.

Notwithstanding any agreement or representation, written or oral, by either the Recipients or Guggenheim Securities in connection with any Transaction, each Recipient and its representatives will have no obligation to Guggenheim Securities to maintain the confidentiality of the tax treatment and tax structure of any Transaction or any materials of any kind (including opinions or other analyses) that are provided to such Recipient relating to such tax treatment and tax structure. Guggenheim Securities hereby informs each Recipient that (i) any discussion of federal tax issues contained or referred to in this Presentation and any materials prepared by Guggenheim Securities is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties that may be imposed under the Internal Revenue Code and (ii) such discussion is written to support the promotion or marketing of the matters addressed therein.

As the Company’s financial advisor and investment banker, Guggenheim Securities has obligations solely to the Company and will be entitled to be paid a fee or fees upon the successful consummation of certain Transactions or otherwise pursuant to the terms of its engagement letter. By accepting this Presentation, each Recipient hereby acknowledges and agrees that neither Guggenheim Securities nor any of its subsidiaries, affiliates, directors, officers, employees, representatives, consultants, legal counsel and/or agents (i) is acting as a financial advisor or investment banker to the Recipient with respect to any Transaction or (ii) owes any duty of loyalty or care to such Recipient (whether in contract, in tort or otherwise) with respect to this Presentation or any Transaction, in all cases notwithstanding any commercial relationship that may currently exist or have previously existed between such Recipient and Guggenheim Securities or any of its subsidiaries, affiliates, directors, officers, employees, representatives or consultants, legal counsel and/or agents.

All of the aforementioned disclosures, limiting conditions and disclaimers are an integral part of the Presentation and may not be read, distributed or referenced separately.

2 Guggenheim Securities

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

Table of Contents

Section

1 Illustrative Transaction Assumptions

2 1L Only Transaction

3 1L & 2L Transaction

4 Deleveraging Transaction

Guggenheim Securities

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

1 Illustrative Transaction Assumptions

Guggenheim Securities

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

Introduction

Guggenheim has prepared preliminary illustrative analyses regarding potential transactions for Project Aptitude which are for discussion purposes only and subject to material change

These transactions include a refinancing as well as a deleveraging of the balance sheet and are designed to provide runway and liquidity in connection with the Company’s long-term business plan

Refinancing Transaction

1 First Lien only refinancing (“1L Only”)

2 First Lien Refinancing with a Second Lien Note extension (“1L & 2L”)

Deleveraging Transaction

3 First Lien Refinancing plus equitization of [100%] of the existing Second Lien Notes (“Debt to Equity”)

The Company would like to engage in discussions with members of theAd-Hoc Group of Second Lien Noteholders regarding a consensual transaction

3 Guggenheim Securities

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

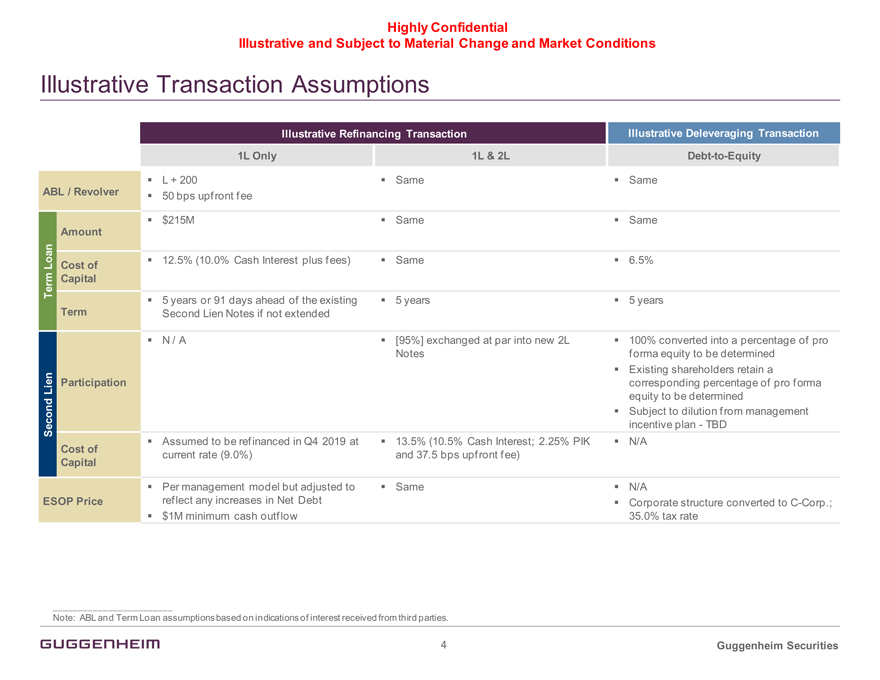

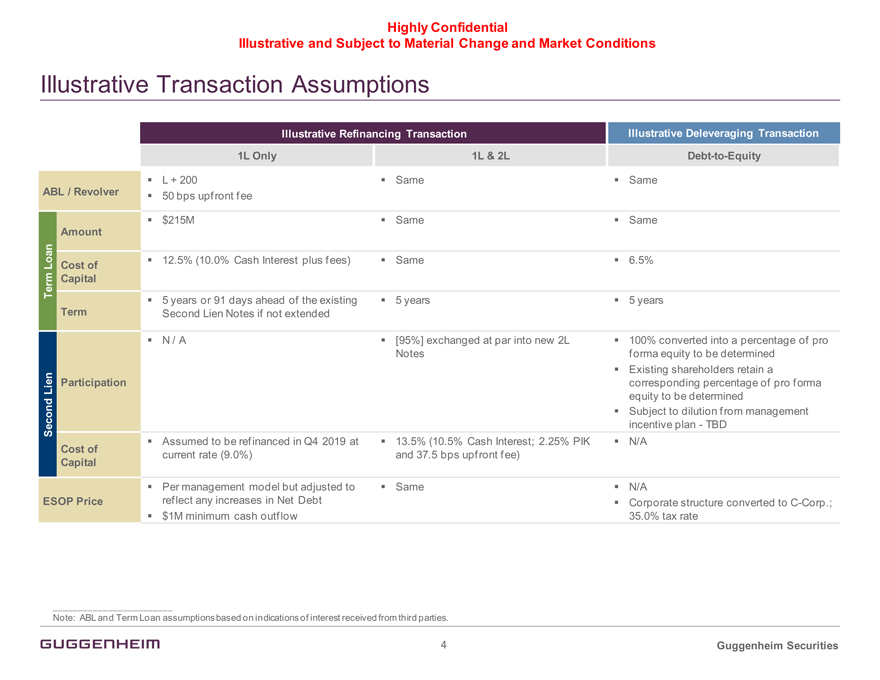

Illustrative Transaction Assumptions

Illustrative Refinancing Transaction Illustrative Deleveraging Transaction

Illustrative Refinancing Transaction Illustrative Deleveraging Transaction

1L Only 1L & 2L Debt-to-Equity

L + 200 Same Same

ABL / Revolver

50 bps upfront fee

$215M Same Same

Amount

12.5% (10.0% Cash Interest plus fees) Same 6.5%

Loan Cost of Term Capital

5 years or 91 days ahead of the existing 5 years 5 years Term Second Lien Notes if not extended

N / A [95%] exchanged at par into new 2L 100% converted into a percentage of pro Notes forma equity to be determined Existing shareholders retain a Lien Participation corresponding percentage of pro forma equity to be determined Subject to dilution from management Second incentive plan - TBD

Assumed to be refinanced in Q4 2019 at 13.5% (10.5% Cash Interest; 2.25% PIK N/A

Cost of current rate (9.0%) and 37.5 bps upfront fee)

Capital

Per management model but adjusted to Same N/A

ESOP Price reflect any increases in Net Debt Corporate structure converted to C-Corp.; $1M minimum cash outflow 35.0% tax rate

Note: ABL and Term Loan assumptions based on indications of interest received from third parties.

4 Guggenheim Securities

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

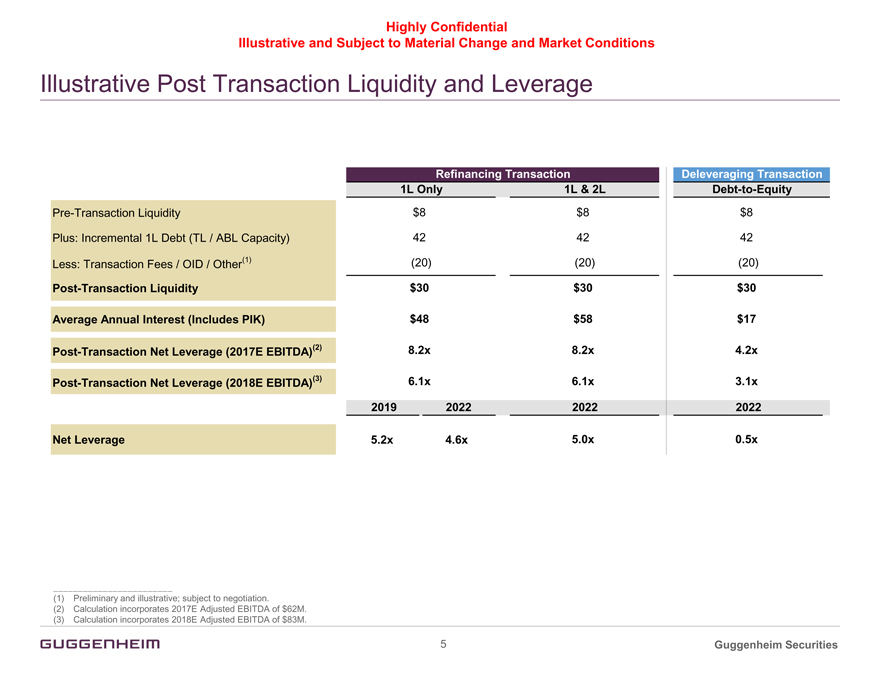

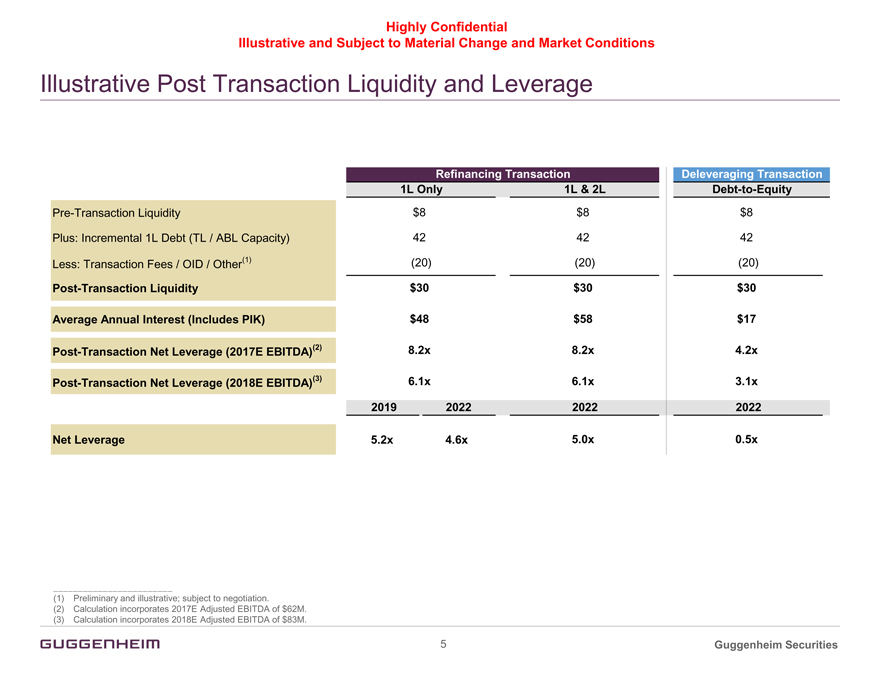

Illustrative Post Transaction Liquidity and Leverage

Refinancing Transaction Deleveraging Transaction

1L Only 1L & 2LDebt-to-Equity

Pre-Transaction Liquidity $8 $8 $8

Plus: Incremental 1L Debt (TL / ABL Capacity) 42 42 42

Less: Transaction Fees / OID / Other(1) (20) (20) (20)

Post-Transaction Liquidity $30 $30 $30

Average Annual Interest (Includes PIK) $48 $58 $17

Post-Transaction Net Leverage (2017E EBITDA)(2) 8.2x 8.2x 4.2x

Post-Transaction Net Leverage (2018E EBITDA)(3) 6.1x 6.1x 3.1x

2019 2022 2022 2022

Net Leverage 5.2x 4.6x 5.0x 0.5x

(1) Preliminary and illustrative; subject to negotiation.

(2) Calculation incorporates 2017E Adjusted EBITDA of $62M.

(3) Calculation incorporates 2018E Adjusted EBITDA of $83M.

5 Guggenheim Securities

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

2 1L Only Transaction

Guggenheim Securities

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

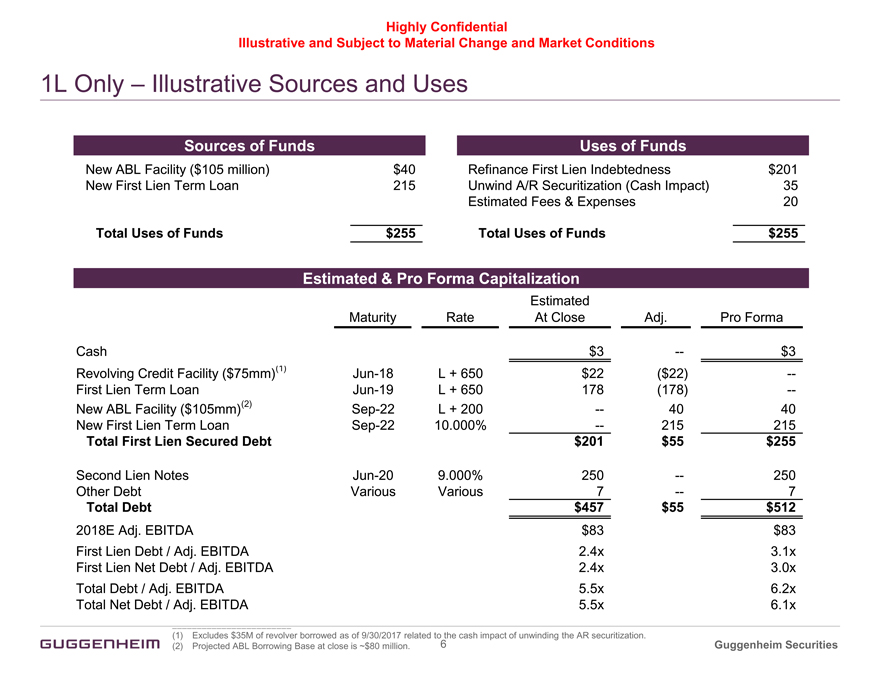

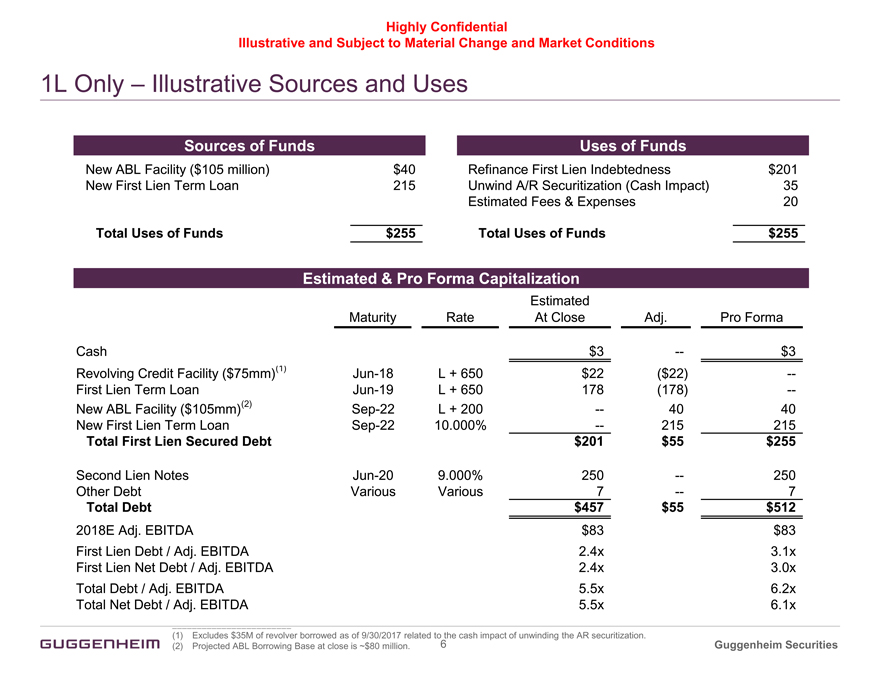

1L Only – Illustrative Sources and Uses

Sources of Funds Uses of Funds

New ABL Facility ($105 million) $40 Refinance First Lien Indebtedness $201

New First Lien Term Loan 215 Unwind A/R Securitization (Cash Impact) 35

Estimated Fees & Expenses 20

Total Uses of Funds $255 Total Uses of Funds $255

Estimated & Pro Forma Capitalization

Estimated

Maturity Rate At Close Adj. Pro Forma

Cash $3 — $3

Revolving Credit Facility ($75mm)(1)Jun-18 L + 650 $22 ($22) —

First Lien Term LoanJun-19 L + 650 178 (178) —

New ABL Facility ($105mm)(2)Sep-22 L + 200 — 40 40

New First Lien Term LoanSep-22 10.000% — 215 215

Total First Lien Secured Debt $201 $55 $255

Second Lien NotesJun-20 9.000% 250 — 250

Other Debt Various Various 7 — 7

Total Debt $457 $55 $512

2018E Adj. EBITDA $83 $83

First Lien Debt / Adj. EBITDA 2.4x 3.1x

First Lien Net Debt / Adj. EBITDA 2.4x 3.0x

Total Debt / Adj. EBITDA 5.5x 6.2x

Total Net Debt / Adj. EBITDA 5.5x 6.1x

(1) Excludes $35M of revolver borrowed as of 9/30/2017 related to6 the cash impact of unwinding the AR securitization. Guggenheim Securities

(2) Projected ABL Borrowing Base at close is ~$80 million.

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

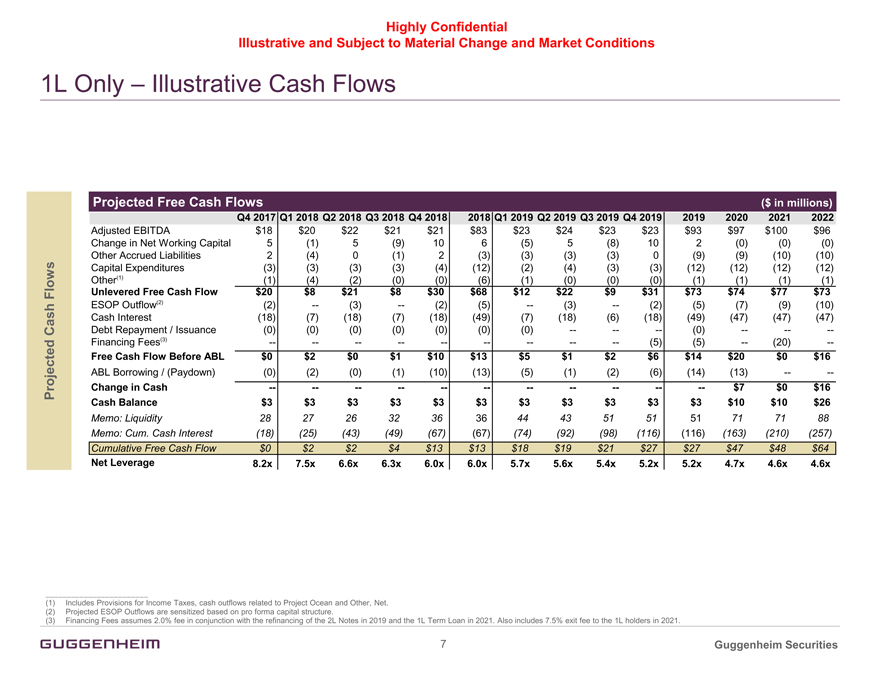

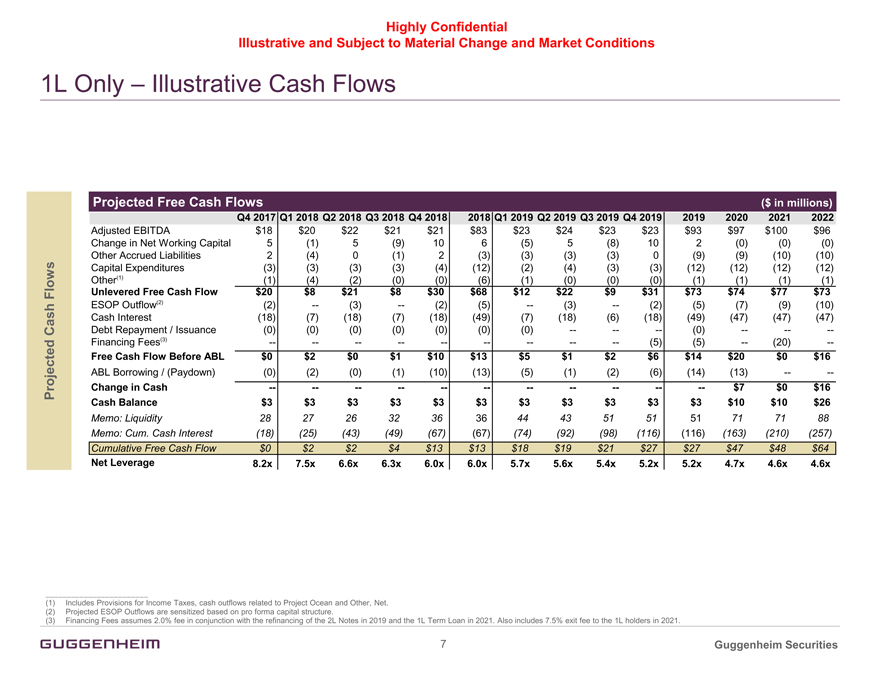

1L Only – Illustrative Cash Flows

Projected Free Cash Flows ($ in millions)

Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 2020 2021 2022

Adjusted EBITDA $18 $20 $22 $21 $21 $83 $23 $24 $23 $23 $93 $97 $100 $96 Change in Net Working Capital 5 (1) 5 (9) 10 6 (5) 5 (8) 10 2 (0) (0) (0) Other Accrued Liabilities 2 (4) 0 (1) 2 (3) (3) (3) (3) 0 (9) (9) (10) (10) Capital Expenditures (3) (3) (3) (3) (4) (12) (2) (4) (3) (3) (12) (12) (12) (12) Other(1) (1) (4) (2) (0) (0) (6) (1) (0) (0) (0) (1) (1) (1) (1)

Flows Unlevered Free Cash Flow $20 $8 $21 $8 $30 $68 $12 $22 $9 $31 $73 $74 $77 $73

ESOP Outflow(2) (2) — (3) — (2) (5) — (3) — (2) (5) (7) (9) (10) Cash Interest (18) (7) (18) (7) (18) (49) (7) (18) (6) (18) (49) (47) (47) (47) Cash Debt Repayment / Issuance (0) (0) (0) (0) (0) (0) (0) -——- (0) -——- Financing Fees(3) -————————- (5) (5) — (20) —

Free Cash Flow Before ABL $0 $2 $0 $1 $10 $13 $5 $1 $2 $6 $14 $20 $0 $16

ABL Borrowing / (Paydown) (0) (2) (0) (1) (10) (13) (5) (1) (2) (6) (14) (13) -—-

Projected Change in Cash -——————————- $7 $0 $16 Cash Balance $3 $3 $3 $3 $3 $3 $3 $3 $3 $3 $3 $10 $10 $26

Memo: Liquidity 28 27 26 32 36 36 44 43 51 51 51 71 71 88 Memo: Cum. Cash Interest (18) (25) (43) (49) (67) (67) (74) (92) (98) (116) (116) (163) (210) (257) Cumulative Free Cash Flow $0 $2 $2 $4 $13 $13 $18 $19 $21 $27 $27 $47 $48 $64

Net Leverage 8.2x 7.5x 6.6x 6.3x 6.0x 6.0x 5.7x 5.6x 5.4x 5.2x 5.2x 4.7x 4.6x 4.6x

(1) Includes Provisions for Income Taxes, cash outflows related to Project Ocean and Other, Net. (2) Projected ESOP Outflows are sensitized based on pro forma capital structure.

(3) Financing Fees assumes 2.0% fee in conjunction with the refinancing of the 2L Notes in 2019 and the 1L Term Loan in 2021. Also includes 7.5% exit fee to the 1L holders in 2021.

7 Guggenheim Securities

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

3 1L & 2L Transaction

Guggenheim Securities

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

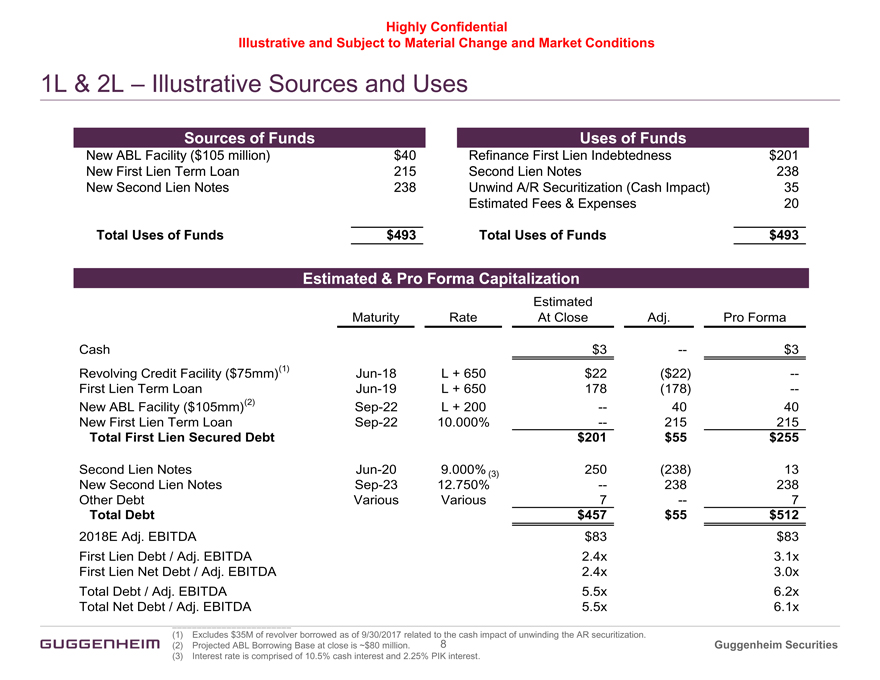

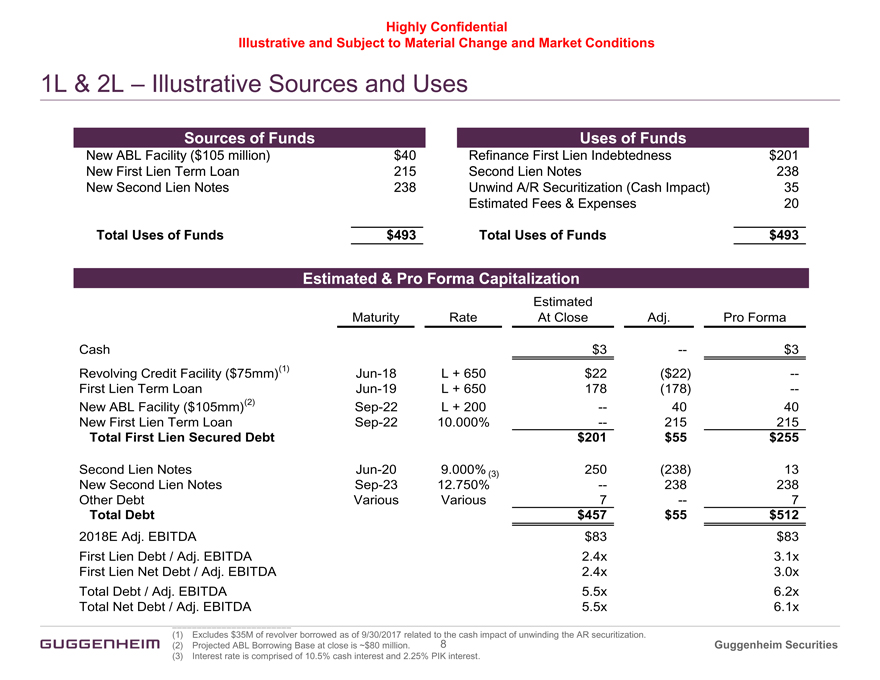

1L & 2L – Illustrative Sources and Uses

Sources of Funds Uses of Funds

New ABL Facility ($105 million) $40 Refinance First Lien Indebtedness $201

New First Lien Term Loan 215 Second Lien Notes 238

New Second Lien Notes 238 Unwind A/R Securitization (Cash Impact) 35

Estimated Fees & Expenses 20

Total Uses of Funds $493 Total Uses of Funds $493

Estimated & Pro Forma Capitalization

Estimated

Maturity Rate At Close Adj. Pro Forma

Cash $3 — $3

Revolving Credit Facility ($75mm)(1)Jun-18 L + 650 $22 ($22) —

First Lien Term LoanJun-19 L + 650 178 (178) —

New ABL Facility ($105mm)(2)Sep-22 L + 200 — 40 40

New First Lien Term LoanSep-22 10.000% — 215 215

Total First Lien Secured Debt $201 $55 $255

Second Lien NotesJun-20 9.000% (3) 250 (238) 13

New Second Lien NotesSep-23 12.750% — 238 238

Other Debt Various Various 7 — 7

Total Debt $457 $55 $512

2018E Adj. EBITDA $83 $83

First Lien Debt / Adj. EBITDA 2.4x 3.1x

First Lien Net Debt / Adj. EBITDA 2.4x 3.0x

Total Debt / Adj. EBITDA 5.5x 6.2x

Total Net Debt / Adj. EBITDA 5.5x 6.1x

(1) Excludes $35M of revolver borrowed as of 9/30/2017 related to8 the cash impact of unwinding the AR securitization.

(2) Projected ABL Borrowing Base at close is ~$80 million. Guggenheim Securities

(3) Interest rate is comprised of 10.5% cash interest and 2.25% PIK interest.

Guggenheim Securities

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

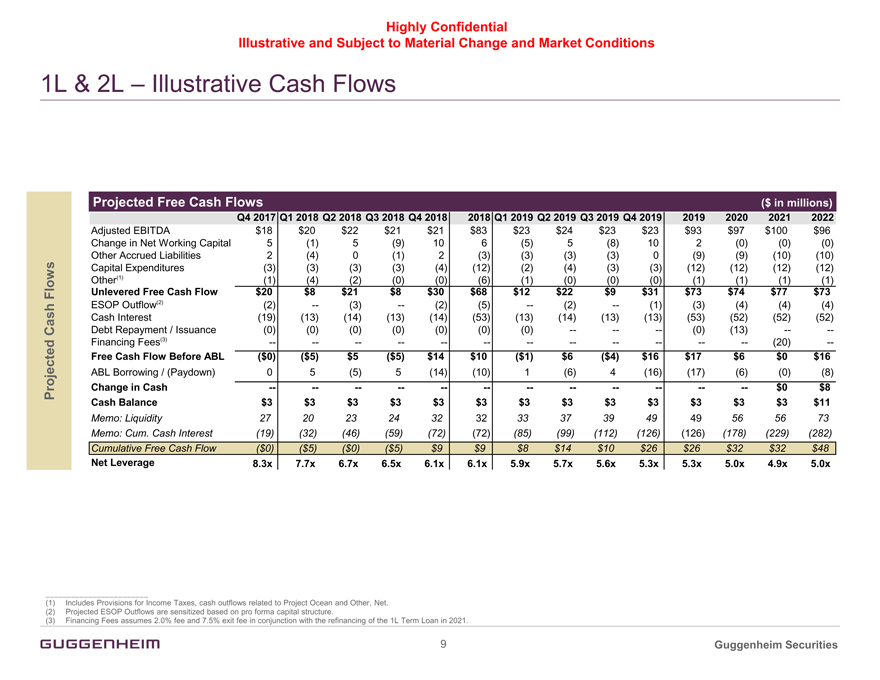

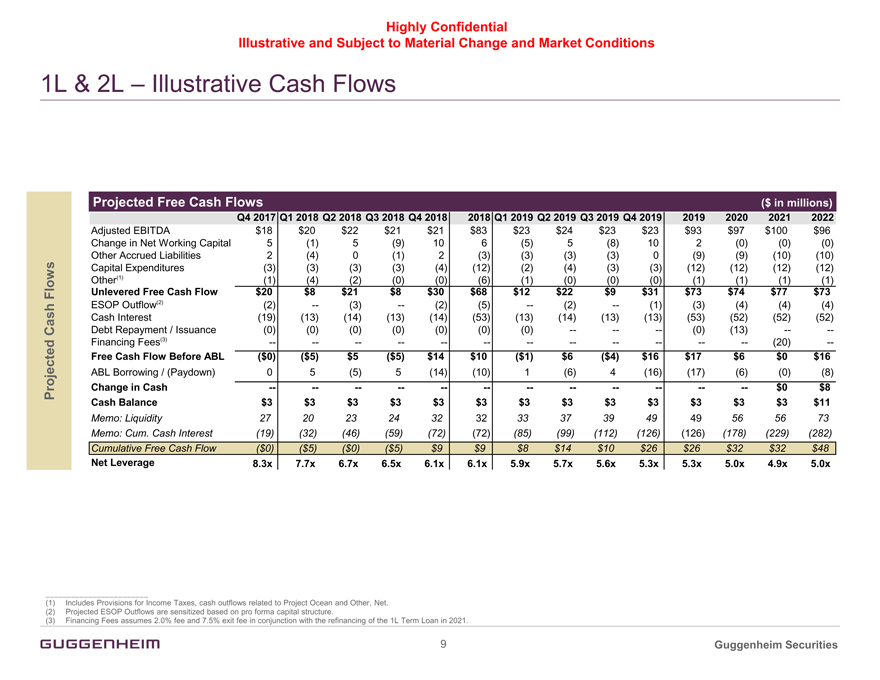

1L & 2L – Illustrative Cash Flows

Projected Free Cash Flows ($ in millions)

Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 2020 2021 2022

Adjusted EBITDA $18 $20 $22 $21 $21 $83 $23 $24 $23 $23 $93 $97 $100 $96 Change in Net Working Capital 5 (1) 5 (9) 10 6 (5) 5 (8) 10 2 (0) (0) (0) Other Accrued Liabilities 2 (4) 0 (1) 2 (3) (3) (3) (3) 0 (9) (9) (10) (10) Capital Expenditures (3) (3) (3) (3) (4) (12) (2) (4) (3) (3) (12) (12) (12) (12) Other(1) (1) (4) (2) (0) (0) (6) (1) (0) (0) (0) (1) (1) (1) (1)

Flows Unlevered Free Cash Flow $20 $8 $21 $8 $30 $68 $12 $22 $9 $31 $73 $74 $77 $73

ESOP Outflow(2) (2) — (3) — (2) (5) — (2) — (1) (3) (4) (4) (4) Cash Interest (19) (13) (14) (13) (14) (53) (13) (14) (13) (13) (53) (52) (52) (52) Cash Debt Repayment / Issuance (0) (0) (0) (0) (0) (0) (0) -——- (0) (13) -—- Financing Fees(3) -———————————- (20) —

Free Cash Flow Before ABL ($0) ($5) $5 ($5) $14 $10 ($1) $6 ($4) $16 $17 $6 $0 $16

ABL Borrowing / (Paydown) 0 5 (5) 5 (14) (10) 1 (6) 4 (16) (17) (6) (0) (8)

Projected Change in Cash -———————————- $0 $8 Cash Balance $3 $3 $3 $3 $3 $3 $3 $3 $3 $3 $3 $3 $3 $11

Memo: Liquidity 27 20 23 24 32 32 33 37 39 49 49 56 56 73 Memo: Cum. Cash Interest (19) (32) (46) (59) (72) (72) (85) (99) (112) (126) (126) (178) (229) (282) Cumulative Free Cash Flow ($0) ($5) ($0) ($5) $9 $9 $8 $14 $10 $26 $26 $32 $32 $48

Net Leverage 8.3x 7.7x 6.7x 6.5x 6.1x 6.1x 5.9x 5.7x 5.6x 5.3x 5.3x 5.0x 4.9x 5.0x

(1) Includes Provisions for Income Taxes, cash outflows related to Project Ocean and Other, Net. (2) Projected ESOP Outflows are sensitized based on pro forma capital structure.

(3) Financing Fees assumes 2.0% fee and 7.5% exit fee in conjunction with the refinancing of the 1L Term Loan in 2021.

9 Guggenheim Securities

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

4 Deleveraging Transaction

Guggenheim Securities

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

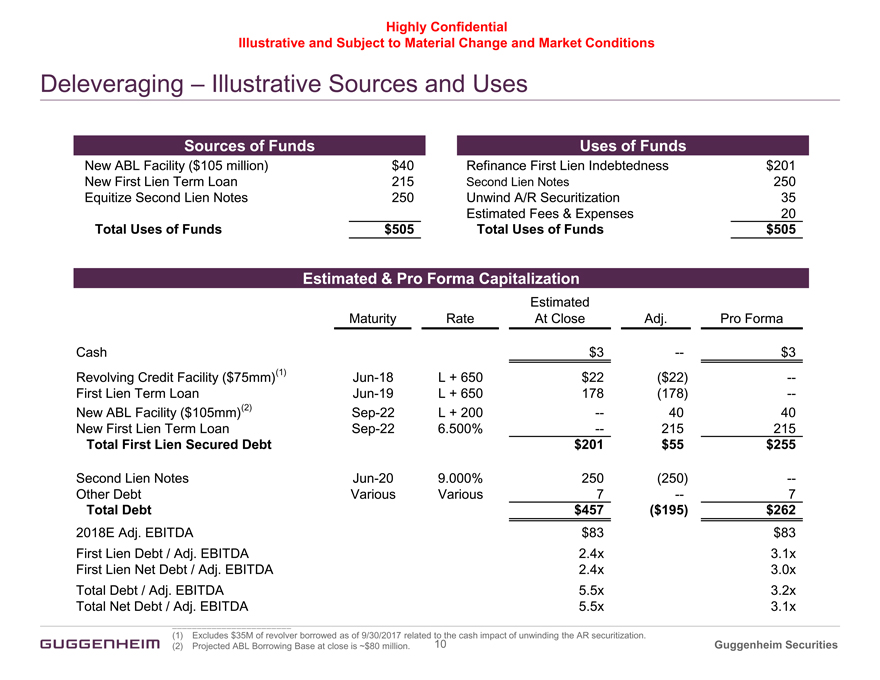

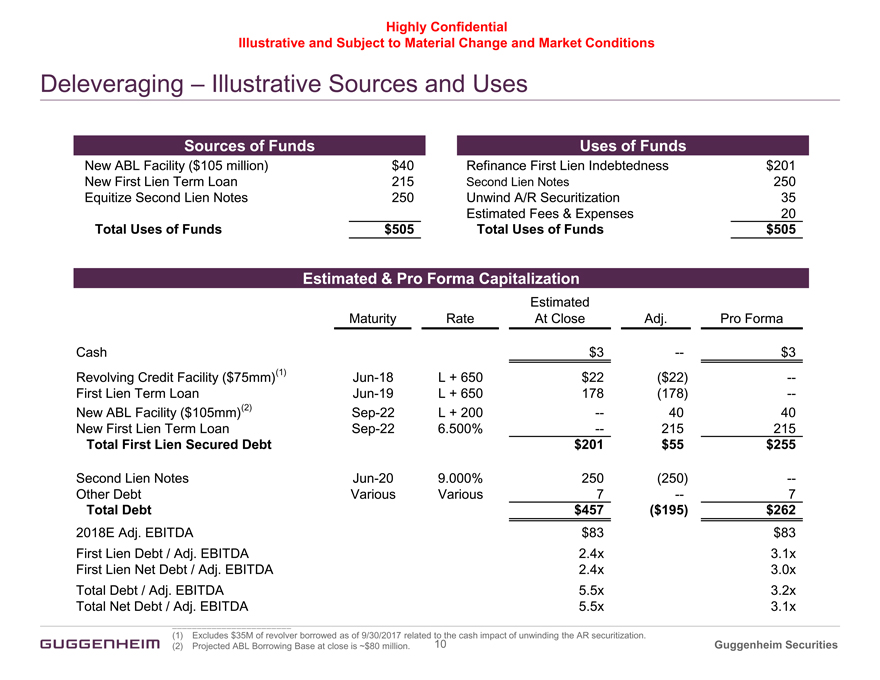

Deleveraging – Illustrative Sources and Uses

Sources of Funds Uses of Funds

New ABL Facility ($105 million) $40 Refinance First Lien Indebtedness $201 New First Lien Term Loan 215 Second Lien Notes 250 Equitize Second Lien Notes 250 Unwind A/R Securitization 35 Estimated Fees & Expenses 20

Total Uses of Funds $505 Total Uses of Funds $505

Estimated & Pro Forma Capitalization

Estimated

Maturity Rate At Close Adj. Pro Forma

Cash $3 — $3 Revolving Credit Facility ($75mm)(1)Jun-18 L + 650 $22 ($22) —First Lien Term LoanJun-19 L + 650 178 (178)--New ABL Facility ($105mm)(2)Sep-22 L + 200 — 40 40 New First Lien Term LoanSep-22 6.500% — 215 215

Total First Lien Secured Debt $201 $55 $255

Second Lien NotesJun-20 9.000% 250 (250) —Other Debt Various Various 7 — 7

Total Debt $457 ($195) $262

2018E Adj. EBITDA $83 $83 First Lien Debt / Adj. EBITDA 2.4x 3.1x First Lien Net Debt / Adj. EBITDA 2.4x 3.0x Total Debt / Adj. EBITDA 5.5x 3.2x Total Net Debt / Adj. EBITDA 5.5x 3.1x

(1) Excludes $35M of revolver borrowed as of 9/30/2017 related to 10 the cash impact of unwinding the AR securitization. Guggenheim Securities (2) Projected ABL Borrowing Base at close is ~$80 million.

Guggenheim Securities 10

Highly Confidential

Illustrative and Subject to Material Change and Market Conditions

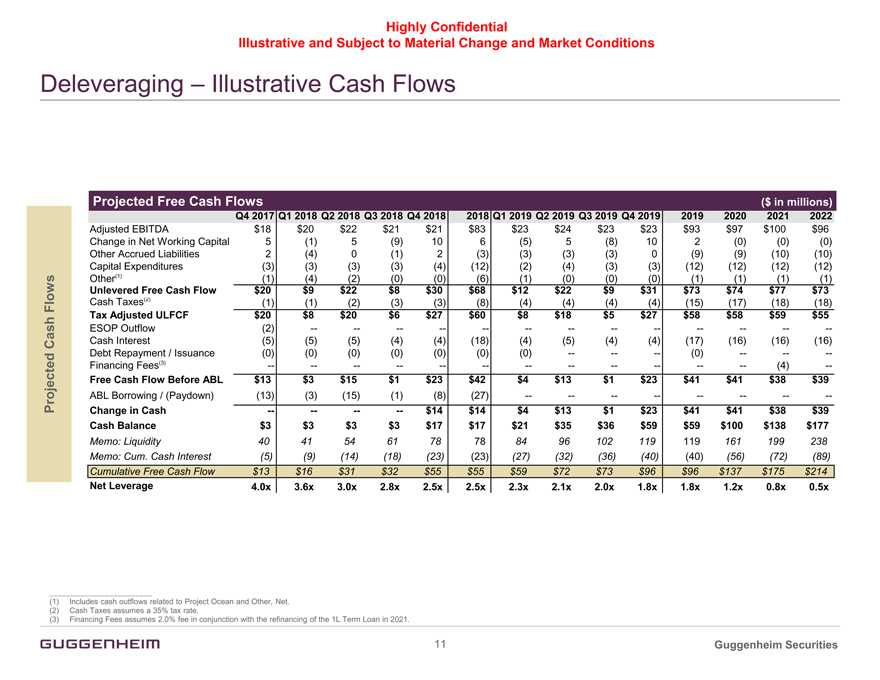

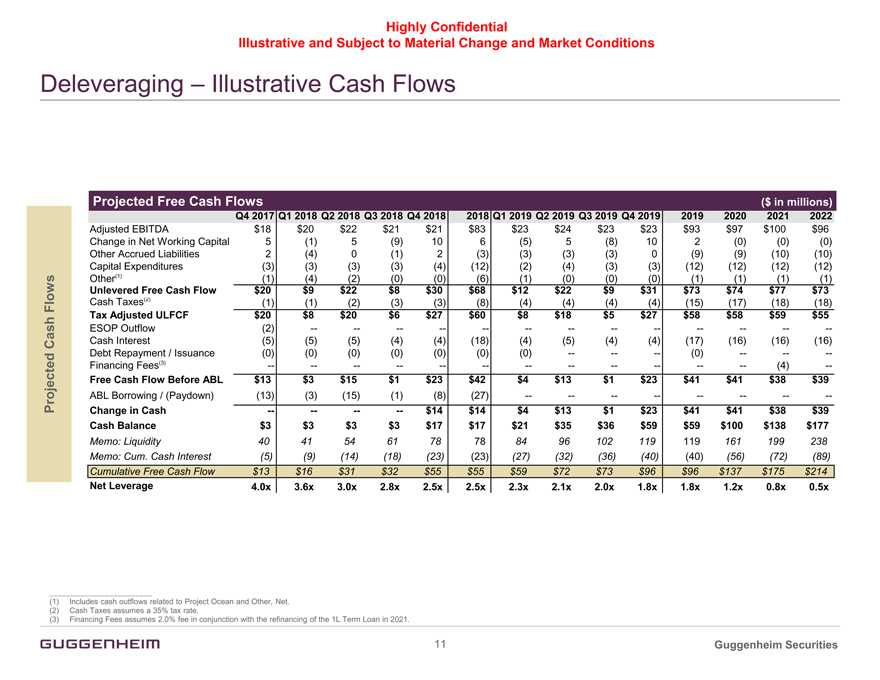

Deleveraging – Illustrative Cash Flows

Projected Free Cash Flows ($ in millions)

Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 2019 2020 2021 2022

Adjusted EBITDA $18 $20 $22 $21 $21 $83 $23 $24 $23 $23 $93 $97 $100 $96 Change in Net Working Capital 5 (1) 5 (9) 10 6 (5) 5 (8) 10 2 (0) (0) (0) Other Accrued Liabilities 2 (4) 0 (1) 2 (3) (3) (3) (3) 0 (9) (9) (10) (10) Capital Expenditures (3) (3) (3) (3) (4) (12) (2) (4) (3) (3) (12) (12) (12) (12) Other(1) (1) (4) (2) (0) (0) (6) (1) (0) (0) (0) (1) (1) (1) (1)

Unlevered Free Cash Flow $20 $9 $22 $8 $30 $68 $12 $22 $9 $31 $73 $74 $77 $73

Flows Cash Taxes(2) (1) (1) (2) (3) (3) (8) (4) (4) (4) (4) (15) (17) (18) (18)

Tax Adjusted ULFCF $20 $8 $20 $6 $27 $60 $8 $18 $5 $27 $58 $58 $59 $55

ESOP Outflow (2) -————————————-Cash Cash Interest (5) (5) (5) (4) (4) (18) (4) (5) (4) (4) (17) (16) (16) (16) Debt Repayment / Issuance (0) (0) (0) (0) (0) (0) (0) -——- (0) -——-Financing Fees(3) -———————————- (4) —

Free Cash Flow Before ABL $13 $3 $15 $1 $23 $42 $4 $13 $1 $23 $41 $41 $38 $39

Projected ABL Borrowing / (Paydown) (13) (3) (15) (1) (8) (27) -———————-

Change in Cash -———- $14 $14 $4 $13 $1 $23 $41 $41 $38 $39 Cash Balance $3 $3 $3 $3 $17 $17 $21 $35 $36 $59 $59 $100 $138 $177

Memo: Liquidity 40 41 54 61 78 78 84 96 102 119 119 161 199 238 Memo: Cum. Cash Interest (5) (9) (14) (18) (23) (23) (27) (32) (36) (40) (40) (56) (72) (89) Cumulative Free Cash Flow $13 $16 $31 $32 $55 $55 $59 $72 $73 $96 $96 $137 $175 $214

Net Leverage 4.0x 3.6x 3.0x 2.8x 2.5x 2.5x 2.3x 2.1x 2.0x 1.8x 1.8x 1.2x 0.8x 0.5x

(1) Includes cash outflows related to Project Ocean and Other, Net. (2) Cash Taxes assumes a 35% tax rate.

(3) Financing Fees assumes 2.0% fee in conjunction with the refinancing of the 1L Term Loan in 2021.

11 Guggenheim Securities