SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x | | | | | |

Filed by a Party other than the Registrant ¨ | | | | | |

Check the appropriate box: | | | | | |

x | | Preliminary Proxy Statement | | ¨ | | | Confidential, for Use of the Commission Only (as |

¨ | | Definitive Proxy Statement | | | | | permitted by Rule 14a-6(e)(2)) |

¨ | | Definitive Additional Materials | | | | | |

¨ | | Soliciting Material pursuant to Rule 14a-11(c) or Rule 14a-12 | | | | | |

Quantum Fuel Systems Technologies Worldwide, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ No fee required.

x Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

Title of Each Class of Securities to which Transaction Applies | | Aggregate Number of Securities to which Transaction Applies(1) | | Price Per Unit(2) | | Proposed Maximum Aggregate Value(3) | | Total Fee |

|

Common Shares of Global Theremoelectric Inc. | | 29,171,683 | | $1.80 | | $ | 52,509,029 | | $ | 4,247.98 |

| | (1) | | This total represents Global Theremoelectric Inc. (“Global”) common shares to be acquired by Quantum Fuel Systems Technologies Worldwide, Inc. ( “Quantum”) pursuant to the Combination Agreement entered into between Quantum and Global on April 8, 2003. |

| | (2) | | This total represents Cdn.$2.56, the average of the high and low sales price of Global Common Shares on the Toronto Stock Exchange on May 2, 2003, converted to U.S. dollars by applying the noon buying rate on May 2, 2003, which was 0.7032 U.S. dollars for each Canadian dollar. |

| | (3) | | Proposed maximum value calculated pursuant to Rule 0-11 of the Exchange Act of 1934, as amended. |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box, if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

NOTICE OF THE SPECIAL MEETING OF STOCKHOLDERS

OF QUANTUM FUEL SYSTEMS TECHNOLOGIES WORLDWIDE, INC.

To Be Held·, 2003

—and—

NOTICE OF THE SPECIAL MEETING OF COMMON SHAREHOLDERS

OF GLOBAL THERMOELECTRIC INC.

To Be Held·, 2003

—and—

NOTICE OF PETITION

—and—

JOINT MANAGEMENT INFORMATION CIRCULAR

AND PROXY STATEMENT

WITH RESPECT TO AN ARRANGEMENT INVOLVING

Quantum Fuel Systems Technologies Worldwide, Inc.

—and—

Global Thermoelectric Inc.

·, 2003

·, 2003

Dear Quantum Stockholder:

You are cordially invited to attend a special meeting of stockholders (the “Quantum Meeting”) of Quantum Fuel Systems Technologies Worldwide, Inc., a Delaware corporation (“Quantum”) to be held at· (Pacific time) on·, 2003 in the· Room of the·, located at·. The Quantum Meeting relates to the acquisition by Quantum of Global Thermoelectric Inc., an Alberta corporation (“Global”), pursuant to the terms of a combination agreement (the “Combination Agreement”) dated April 8, 2003 between Quantum and Global. The Combination Agreement provides for a share exchange whereby shares of Quantum common stock will be issued in consideration for all of the issued and outstanding common shares of Global.

At the Quantum Meeting, you will be asked to (i) approve the Combination Agreement and the transactions contemplated thereby, which include the issuance of Quantum common stock in exchange for all outstanding Global common shares, the assumption by Quantum of outstanding options to purchase Global common shares, and the assumption by Quantum of the obligation to issue Quantum common stock upon conversion of the outstanding Global Cumulative Redeemable Convertible Preferred Shares, Series 2 (which we refer to collectively as the “Combination”) and (ii) to consider and vote upon a proposal pursuant to which Quantum’s Amended and Restated Certificate of Incorporation (the “Quantum Charter”) will be amended and restated to increase the number of shares of authorized Quantum common stock from 60,000,000 to 100,000,000 and to eliminate the currently authorized shares of Series A common stock. Details of the Combination and the amendment and restatement of the Quantum Charter are contained in the joint management information circular and proxy statement (the “Joint Proxy Statement”) being delivered with this letter.

If the proposals contained in the Joint Proxy Statement are approved by Quantum’s stockholders and Global’s common shareholders, Global will become a consolidated subsidiary of Quantum, and each existing holder of common shares of Global will have the right to receive between 0.835 and 1.020 shares of Quantum common stock in consideration for each Global common share held by such holder, determined in accordance with the exchange ratio (as defined in the Combination Agreement) and as otherwise set forth in the Joint Proxy Statement. Upon completion of the Combination, and depending on the exchange ratio in effect at the time of completion of the Combination, Global common shareholders will own between 52% and 57% of the shares of outstanding Quantum common stock, and two directors designated by Global will become part of an expanded seven-person Quantum board of directors. Quantum’s board of directors has carefully considered and has unanimously approved the terms and conditions of the Combination Agreement and the Combination and recommends that the Quantum stockholders approve the Combination Agreement, the Combination and the amendment and restatement of the Quantum Charter. In reaching this conclusion, the Quantum board considered, among other things, the opinion dated April 8, 2003 of Adams, Harkness & Hill, Inc. (“AH&H”), an investment banking firm engaged by Quantum, that, as of such date and based on and subject to the factors and assumptions set forth therein, the exchange ratio set forth in the Combination Agreement is fair, from a financial point of view, to Quantum’s stockholders. A copy of the AH&H opinion, including the assumptions, qualifications and other matters contained therein, is included in the Joint Proxy Statement as Annex F.

Quantum’s largest stockholder and strategic partner, General Motors Corporation, which holds·% of Quantum’s outstanding common stock entitled to vote at the Quantum Meeting, has signed a voting agreement to vote in favor of the Combination.

The respective obligations of Quantum and Global to consummate the Combination Agreement and the Combination are subject to, among other conditions, the approval of the stockholders of Quantum of the Combination Agreement, the Combination and the amendment and restatement of the Quantum Charter at the

Quantum Meeting. If either of the proposals is not approved, neither of the proposals will be implemented and the Combination will not be consummated, notwithstanding that the other proposal may have been approved by the stockholders of Quantum.The Quantum board of directors believes that the terms of the Combination Agreement and the Combination are fair to and in the best interests of Quantum and its stockholders, has approved the Combination Agreement, the Combination and the amendment and restatement of the Quantum Charter, and recommends that Quantum stockholders vote “For” approval of the Combination Agreement and the Combination and “For” approval of the amendment and restatement of the Quantum Charter.

In view of the importance of the actions to be taken at the Quantum Meeting, you are urged to read the Joint Proxy Statement carefully, and, regardless of the number of shares you own, complete, sign, date and return the enclosed proxy card promptly in the accompanying prepaid envelope. You may, of course, attend the Quantum Meeting and vote in person, even if you have previously returned your proxy card.

Sincerely,

Alan P. Niedzwiecki

President and Chief Executive Officer

Quantum Fuel Systems Technologies Worldwide, Inc.

17872 Cartwright Road

Irvine, California 92614

Notice of Special Meeting of Stockholders

To Be Held·, 2003

Notice is hereby given that a special meeting of stockholders (the “Quantum Meeting”) of Quantum Fuel Systems Technologies Worldwide, Inc., a Delaware corporation (“Quantum”) will be held at· (Pacific time) on·, 2003 in the· Room of the·, located at·, for the following purposes:

1. To consider and vote upon a proposal to approve the combination agreement dated as of April 8, 2003 (the “Combination Agreement”) between Quantum and Global Thermoelectric Inc., an Alberta corporation (“Global”), and the transactions contemplated thereby, including the issuance of Quantum common stock in exchange for all issued and outstanding Global common shares, the assumption by Quantum of outstanding Global options, and the assumption by Quantum of the obligation to issue Quantum common stock upon conversion of the outstanding Global Cumulative Redeemable Convertible Preferred Shares, Series 2 (collectively referred to as the “Combination”), as more fully described in the accompanying Joint Management Information Circular and Proxy Statement;

2. To consider and vote upon a proposal pursuant to which Quantum’s Amended and Restated Certificate of Incorporation (the “Quantum Charter”) will be amended and restated to increase the number of shares of authorized common stock from 60,000,000 to 100,000,000 and to eliminate the currently authorized shares of Series A common stock; and

3. To transact such other business as may properly be presented to the Quantum Meeting or any adjournment or postponement thereof.

The respective obligations of Quantum and Global to complete the Combination are subject to, among other conditions, the approval of the stockholders of Quantum of the Combination Agreement, the Combination and the amendment and restatement of the Quantum Charter at the Quantum Meeting. If either one of the proposals is not adopted, then neither of the proposals will be implemented and the Combination will not be completed, notwithstanding that the other proposal may have been approved by the stockholders of Quantum.

Only stockholders of record at the close of business on·, 2003, will be entitled to notice of and to vote at the Quantum Meeting and any adjournments thereof. A list of stockholders of Quantum entitled to vote at the Quantum Meeting will be available for inspection during normal business hours for the ten days prior to the Quantum Meeting at the offices of Quantum, located at 17872 Cartwright Road, Irvine, California 92614, and at the time and place of the Quantum Meeting.

Please complete, date, sign and promptly return your proxy card so that your shares may be voted in accordance with your wishes and so that the presence of a quorum may be assured. The giving of such proxy does not affect your right to vote in person in the event you attend the meeting. You may revoke your proxy at any time.

By Order of the Board of Directors,

Cathryn T. Johnston

Secretary

Irvine, California

·, 2003

·, 2003

Dear Global Common Shareholder:

You are cordially invited to attend a special meeting of the common shareholders (the “Global Meeting”) of Global Thermoelectric Inc., an Alberta corporation (“Global”), to be held at· (Calgary time) on·,2003 in the· Room of the·,located at·, Calgary, Alberta, Canada.

Global began a search for strategic partners in November 2000, and engaged Citigroup Global Markets Inc. (formerly Salomon Smith Barney Inc.) in November 2002 to assist Global with a review of Global’s strategic alternatives and solicit proposals from interested third parties.

On April 8, 2003 Global and Quantum Fuel Systems Technologies Worldwide, Inc., a Delaware corporation (“Quantum”), entered into a combination agreement (the “Combination Agreement”) to combine Global with Quantum in a share-for-share exchange. At the Global Meeting, you will be asked to approve an arrangement which will combine the business of Global with that of Quantum. Quantum stockholders will meet on the same day to consider the approval of the Combination Agreement and the transactions contemplated thereby (the “Combination”).

Based in Irvine, California, Quantum is a Nasdaq National Market-listed company that designs, manufactures and supplies component and integrated fuel systems to original equipment manufacturers for use in alternative fuel vehicles, fuel cell applications and hydrogen refueling systems. Quantum’s fuel cell applications include transportation and industrial vehicles and stationary and portable power generation. Quantum is a member of the General Motors Fuel Cell Alliance and is currently owned 19.9% by General Motors. Upon closing, Quantum expects to integrate the businesses and to significantly reduce the combined company’s level of cash expenditures. Quantum expects to maintain Global’s operations in Alberta with head office functions consolidated into Quantum’s California headquarters. Alan P. Niedzwiecki, Quantum’s President and Chief Executive Officer, and W. Brian Olson, Quantum’s Chief Financial Officer, will lead the combined entity in those respective roles. Upon closing, two members of Global’s board of directors will join the expanded seven-member board of directors of Quantum.

Under the terms of the Combination Agreement, if approved, Global common shareholders will receive Quantum common stock for each Global common share outstanding at the time of the Combination. The exchange ratio will be determined by dividing U.S.$2.628387 by the 20-day volume-weighted average Quantum stock price ending three days prior to the Global Meeting. The exchange ratio will not be less than 0.835 or more than 1.020 of Quantum shares; between these two exchange ratios Global’s common shareholders will receive approximately U.S.$2.63 of Quantum common stock. Using Quantum’s trailing 20-day volume-weighted average stock price for the period ending·, 2003, each Global common shareholder would receive approximately U.S.$· of Quantum common stock at an exchange ratio of 1.020 for each Global common share held. Upon completion of the Combination and depending on the exchange ratio in effect at the time of completion of the Combination, Global common shareholders will own between 52% and 57% of the shares of outstanding Quantum common stock.

Quantum’s largest stockholder and strategic partner, General Motors Corporation, which holds·% of Quantum’s outstanding common stock entitled to vote at Quantum’s special meeting of stockholders, has signed a voting agreement to vote in favor of the Combination.

The Global board of directors has determined to submit the Combination to Global common shareholders for their consideration and is not making a recommendation as to how common shareholders should vote on this matter. The Global board of directors advises Global common shareholders to carefully consider the opportunity

presented by the proposed Combination and to review all of the information provided in the accompanying joint management information circular and proxy statement (the “Joint Proxy Statement”). The board of directors urges Global common shareholders, having regard to their own personal circumstances and investment objectives, to come to their own decision on how to vote on the matter.

We have included with this booklet a form of proxy. Please review this Joint Proxy Statement carefully as it has been prepared to help you make an informed decision. You should also carefully read the Risk Factors section which begins at page 23 of the Joint Proxy Statement.

We hope that you will be able to attend the meeting. However, if you are unable to attend the meeting in person, we urge you to complete the enclosed form of proxy and return it, not later than the time specified in the Notice of Special Meeting of Common Shareholders, in the postage-paid envelope provided.

Yours truly,

GLOBAL THERMOELECTRIC INC.

Peter Garrett

President and Chief Executive Officer

Global Thermoelectric Inc.

4908-52nd Street S.E.

Calgary, Alberta T2B 3R2

Notice of Special Meeting of Common Shareholders

To Be Held·, 2003

Notice is hereby given that a special meeting of the common shareholders (the “Global Meeting”) of Global Thermoelectric Inc., an Alberta corporation (“Global”), will be held at· (Calgary time) on·, 2003 in the· Room of the· located at·, Calgary, Alberta, Canada for the following purposes:

| 1. | | To consider, pursuant to an Interim Order of the Court of Queen’s Bench of Alberta dated·, 2003, and, if deemed advisable, to pass, with or without variation, a special resolution in the form of Annex A to the accompanying joint management information circular and proxy statement (the “Joint Proxy Statement”) to approve an arrangement under Section 193 of theBusiness Corporations Act(Alberta), all as more particularly described therein; and |

| 2. | | To transact such further or other business as may properly come before the Global Meeting or any adjournment thereof. |

Each person who is a holder of record of Global common shares at the close of business on·, 2003 (the “Global Record Date”) is entitled to notice of, and to attend and vote at, the Global Meeting and any adjournment or postponement thereof, provided that to the extent a person has transferred any Global common shares after the Global Record Date and the transferee of such shares establishes that the transferee owns the shares and demands not later than ten days before the Global Meeting to be included in the list of holders eligible to vote at the Global Meeting, the transferee will be entitled to vote the shares at the Global Meeting.

Pursuant to the Interim Order, a copy of which is attached as Annex C to the Joint Proxy Statement, registered common shareholders have been granted the right to dissent in respect of the arrangement. If the arrangement becomes effective, a dissenting common shareholder will be entitled to be paid the judicially determined fair value of the Global common shares held by such shareholder provided that Global, c/o Bennett Jones LLP, 4500, 855—2nd Street S.W., Calgary, Alberta T2P 4K7, Attention: Mr. John MacNeil, or the chairman of the Global Meeting shall have received from such dissenting common shareholder no later than 24 hours before the Global Meeting, a written objection to the resolution in respect of the arrangement and the dissenting common shareholder shall have otherwise complied with the provisions of Section 191 of theBusiness Corporations Act(Alberta), as modified by the plan of arrangement and the Interim Order. The dissent right is described in the accompanying Joint Proxy Statement, and the full text of Section 191 of theBusiness Corporations Act(Alberta) is attached as Annex H to the Joint Proxy Statement.Failure to strictly comply with the requirements set forth in Section 191 of theBusiness Corporations Act (Alberta), as modified by the plan of arrangement and Interim Order, may result in the loss of any right of dissent. Persons who are beneficial owners of common shares registered in the name of a broker, custodian, nominee or other intermediary who wish to dissent should be aware that only the registered holders of such shares are entitled to dissent. Accordingly, if you are such a beneficial owner of common shares desiring to exercise your right of dissent, you must make arrangements for the common shares beneficially owned by you to be registered in your name prior to the time the written objection to the resolution in respect of the arrangement is required to be received by Global or, alternatively, make arrangements for the registered holder of your common shares to dissent on your behalf.

Common shareholders are urged to complete, sign, date and return the enclosed proxy promptly in the envelope provided and mail it to or deposit it with Computershare Trust Company of Canada, 9th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1. To be effective, proxies must be received by Computershare Trust Company of Canada, not later than· (Calgary time) on·, 2003, or, if the Global Meeting is adjourned or postponed, not later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of the adjourned or postponed Global Meeting, or any further adjournment or postponement thereof.

DATED at Calgary, Alberta,·, 2003.

By Order of the Board of Directors of

GLOBAL THERMOELECTRIC INC.

Paul Crilly

Vice President, Finance, Chief Financial Officer and

Corporate Secretary

Action No.·

IN THE COURT OF QUEEN’S BENCH OF ALBERTA

JUDICIAL DISTRICT OF CALGARY

IN THE MATTER OF SECTION 193 OF THE

BUSINESS CORPORATIONS ACT (ALBERTA), R.S.A. 2000, AS AMENDED

AND IN THE MATTER OF AN ARRANGEMENT

PROPOSED BY GLOBAL THERMOELECTRIC INC. INVOLVING

GLOBAL THERMOELECTRIC INC., ITS SHAREHOLDERS

AND QUANTUM FUEL SYSTEMS TECHNOLOGIES WORLDWIDE, INC.

NOTICE OF PETITION

NOTICE IS HEREBY GIVEN that a Petition has been filed with the Court of Queen’s Bench of Alberta, Judicial District of Calgary (the “Court”), by Global Thermoelectric Inc. (“Global”) with respect to a proposed arrangement (the “Arrangement”) under Section 193 of theBusiness Corporations Act(Alberta), R.S.A. 2000, c. B-9, as amended (the “ABCA”), involving Global, its shareholders and Quantum Fuel Systems Technologies Worldwide, Inc. (“Quantum”), which Arrangement is described in greater detail in the Joint Management Information Circular and Proxy Statement of Global and Quantum dated·, 2003 accompanying this Notice of Petition.

AND NOTICE IS FURTHER GIVEN that the Petition will be heard before the presiding Justice in Chambers at the Court House, 611—4th Street S.W., Calgary, Alberta, Canada, on·, 2003 at· (Calgary time) or as soon thereafter as counsel may be heard.

At the hearing of the Petition, Global intends to seek the following:

| | (a) | | a declaration that the terms and conditions of the Arrangement are fair to the persons affected; |

| | (b) | | an order approving the Arrangement pursuant to the provisions of Section 193 of the ABCA; |

| | (c) | | a declaration that the Arrangement will, upon the filing of Articles of Arrangement under the ABCA, be effective in accordance with its terms; and |

| | (d) | | such other and further orders, declarations and directions as the Court may deem just. |

Any securityholder of Global or other interested party desiring to support or oppose the Petition may appear at the time of hearing in person or by counsel for that purpose, provided such securityholder or other interested party files with the Court and serves upon Global and Quantum, on or before·, 2003, a Notice of Intention to Appear, together with any evidence or materials which are to be presented to the Court, setting out such securityholder’s or other interested party’s address for service by ordinary mail and indicating whether such securityholder or other interested party intends to support or oppose the Petition or make submissions. Service on Global and Quantum is to be effected by delivery to the solicitors for Global and Quantum at the addresses set forth below.

AND NOTICE IS FURTHER GIVEN that, at the hearing and subject to the foregoing, the securityholders and any other interested persons will be entitled to make representations as to, and the Court will be requested to consider, the fairness of the Arrangement. If you do not attend, either in person or by counsel, at that time, the Court may approve or refuse to approve the Arrangement as presented, or may approve it subject to such terms and conditions as the Court shall deem fit, without any further notice.

AND NOTICE IS FURTHER GIVEN that the Court, by an Interim Order dated·, 2003, has given directions as to the calling and holding of a special meeting of the common shareholders of Global for the purpose of such shareholders voting upon a special resolution to approve the Arrangement and, in particular, has directed that registered holders of common shares of Global shall have the right to dissent under the provisions of Section 191 of the ABCA upon compliance with the terms of the Interim Order.

AND NOTICE IS FURTHER GIVEN that the final order approving the Arrangement will, if made, serve as the basis of an exemption from the registration requirements of the United StatesSecurities Act of 1933, pursuant to Section 3(a)(10) thereof, with respect to the issuance of securities of Quantum by Quantum pursuant to the Arrangement.

AND NOTICE IS FURTHER GIVEN that a copy of the Petition and other documents in the proceedings will be furnished to any securityholder of Global or other interested party requesting the same by the undermentioned solicitors for Global and Quantum upon written request delivered to such solicitors as follows:

Global: Bennett Jones LLP Barristers and Solicitors 4500, 855—2nd Street S.W. Calgary, Alberta T2P 4K7 Attention: Mr. Anthony L. Friend, Q.C. | | Quantum: Burnet, Duckworth & Palmer LLP Barristers and Solicitors 1400, 350—7th Avenue S.W. Calgary, Alberta T2P 3N9 Attention: Mr. Daniel J. McDonald, Q.C. |

DATED at the City of Calgary, in the Province of Alberta, this· day of·, 2003.

By Order of the Board of Directors of

GLOBAL THERMOELECTRIC INC.

Peter Garrett

President and Chief Executive Officer

JOINT MANAGEMENT INFORMATION CIRCULAR

AND PROXY STATEMENT

This joint management information circular and proxy statement (the “Joint Proxy Statement”) is being furnished to holders of common shares of Global Thermoelectric Inc., an Alberta corporation (“Global”), in connection with the solicitation of proxies by management of Global for use at the special meeting of the Global common shareholders (the “Global Meeting”) to be held at· (Calgary time) on·, 2003 in the· Room of the·, located at·, Calgary, Alberta, Canada and any adjournment or postponement thereof.

This Joint Proxy Statement is also being furnished to holders of common stock of Quantum Fuel Systems Technologies Worldwide, Inc., a Delaware corporation (“Quantum”), in connection with the solicitation of proxies by the board of directors of Quantum for use at the special meeting of Quantum stockholders (the “Quantum Meeting”) to be held at· (Pacific time) on·, 2003 in the· Room of the·, located at·, and any adjournment or postponement thereof.

This Joint Proxy Statement and the accompanying forms of proxy are first being mailed to common shareholders of Global on or about·, 2003 and stockholders of Quantum on or about·, 2003.

The information concerning Quantum contained in this Joint Proxy Statement, including the annexes attached hereto, has been provided by Quantum and the information concerning Global contained in this Joint Proxy Statement, including the annexes attached hereto, has been provided by Global. The information concerning Quantum and Global after the completion of the Combination and the information used to derive the pro forma financial information has been jointly provided by Quantum and Global.

Please see the section entitled “Risk Factors” beginning on page 23 for certain considerations relevant to approval of the proposals and an investment in the securities referred to in this Joint Proxy Statement.

No person is authorized to give any information or to make any representation not contained in this Joint Proxy Statement and, if given or made, such information or representation should not be relied upon as having been authorized. This Joint Proxy Statement does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities, or the solicitation of a proxy, by any person in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such an offer or solicitation of an offer or proxy solicitation. Neither delivery of this Joint Proxy Statement nor any distribution of the securities referred to in this Joint Proxy Statement shall, under any circumstances, create an implication that there has been no change in the information set forth herein since the date of this Joint Proxy Statement.

The shares of Quantum common stock to be issued in connection with the Combination have not been approved or disapproved by the U.S. Securities and Exchange Commission or securities regulatory authorities of any state of the United States or province or territory of Canada, nor has the U.S. Securities and Exchange Commission or securities regulatory authorities of any state of the United States or province or territory of Canada passed on the adequacy or accuracy of this Joint Proxy Statement. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

ii

iii

iv

NOTICE TO CANADIAN SHAREHOLDERS OF GLOBAL

Quantum is organized under the laws of the State of Delaware, United States. All of the directors and executive officers of Quantum and many of the experts named herein are residents of the United States. In addition, substantial portions of the assets of Quantum and of such individuals and experts are located outside of Canada. As a result, it may be difficult or impossible for persons who become securityholders of Quantum to effect service of process upon such persons within Canada with respect to matters arising under Canadian securities laws or to enforce against them in Canadian courts judgments predicated upon the civil liability provisions of Canadian securities laws. There is some doubt as to the enforceability in the United States in original actions, or in actions for enforcement of judgments of Canadian courts, of civil liabilities predicated upon the Canadian securities laws. In addition, awards of punitive damages in actions brought in Canada or elsewhere may be unenforceable in the United States.

The disclosure relating to Quantum included in this Joint Proxy Statement has been prepared in accordance with U.S. securities laws. Canadian shareholders of Global should be aware that these requirements may differ from Canadian requirements. The financial statements of Quantum included in this document have not been prepared in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”) and may not be comparable to financial statements of Canadian companies.

NOTICE TO UNITED STATES SHAREHOLDERS OF GLOBAL

The solicitation of proxies by Global is not subject to the requirements of Section 14(a) of the United States Securities Exchange Act of 1934. Global is a Canadian issuer subject to Canadian corporate and securities laws, and the information in this Joint Proxy Statement with respect to the solicitation of proxies from Global common shareholders has been prepared in accordance with disclosure requirements applicable in Canada. Global shareholders in the United States should be aware that these requirements are different from those of the United States applicable to registration statements under the United States Securities Act of 1933and proxy statements under the United States Securities Exchange Act of 1934.

The summary historical consolidated financial data of Global are presented in Canadian dollars in accordance with Canadian GAAP, which differs in certain respects from U.S. generally accepted accounting principles (“U.S. GAAP”). Note 18 to Global’s December 31, 2002 audited consolidated financial statements (in Global’s Annual Information Form for the year ended December 31, 2002 included in Annex I to this Joint Proxy Statement) provides a reconcilliation of the measurement differences between Global’s financial statements and U.S. GAAP.

Please see “Chapter Four—Information About Tax Considerations—Material United States Federal Tax Considerations” and “Chapter Four—Information About Tax Considerations—Canadian Federal Income Tax Considerations to Shareholders” for certain information concerning tax consequences of the Combination for shareholders who are U.S. persons.

Enforcement by Global shareholders of civil liabilities under the U.S. securities laws may be affected adversely by the fact that Global is organized under the laws of a jurisdiction other than the United States, that all of Global’s officers and directors are residents of Canada, that some of the experts named in this Joint Proxy Statement may be residents of Canada, and that all or a substantial portion of the assets of Global is and such persons may be located outside of the United States.

FOR NEW HAMPSHIRE RESIDENTS ONLY

Neither the fact that a registration statement or an application for license has been filed under RSA 421-B with the State of New Hampshire nor the fact that a security is effectively registered or a person is licensed in the State of New Hampshire constitutes a finding by the Secretary of State that any document filed under RSA 421-B is true, complete and not misleading. Neither any such fact nor the fact that an exemption or exception is available for a security or transaction means that the Secretary of State has passed in any way upon the merits or qualifications of, or recommended or given approval to, any person, security, or transaction. It is unlawful to make, or cause to be made, to any prospective purchaser, customer, or client any representation inconsistent with the provisions of this paragraph.

v

CHAPTER ONE—THE COMBINATION

QUESTIONS AND ANSWERS ABOUT THE COMBINATION

Questions and Answers for Global Common Shareholders and Quantum Stockholders

The following questions and answers are considered to be relevant in assisting Global common shareholders and Quantum stockholders in making a decision on how to vote at their respective meetings. A more detailed description of the Combination follows the question and answer part of this Joint Proxy Statement. References to the “Combination” in this Joint Proxy Statement refer to the transactions contemplated by the Combination Agreement dated April 8, 2003 between Quantum and Global (the “Combination Agreement”) and the Plan of Arrangement described therein (the “Plan of Arrangement”), which provide for, among other things, the issuance of Quantum common stock in exchange for all of the issued and outstanding Global common shares, the assumption by Quantum of outstanding Global options and the assumption by Quantum of the obligation to issue Quantum common stock upon conversion of Global’s Cumulative Redeemable Convertible Preferred Shares, Series 2 (the “Global Series 2 Preferred Shares”). References in this Joint Proxy Statement to “we,” “our,” “us,” and the “combined company” refer to the combined operations of Quantum and Global assuming completion of the Combination, with Global operating as a consolidated subsidiary of Quantum.Unless otherwise indicated, dollar amounts are expressed in U.S. dollars and assume a currency exchange rate of Cdn. $1.45 to U.S. $1.00, which was the approximate exchange rate on April 28, 2003.

| 1. | | Why does Quantum want to combine its business with Global? |

Quantum believes that:

| | • | | the Combination will result in a more cost efficient, well-capitalized and diversified company that is well-positioned to address the opportunities in the transportation, stationary power generation and hydrogen refueling markets; |

| | • | | the combined company will have complementary revenue streams across established markets with an expanded technology profile and product portfolio as an energy systems solution provider, leading to broader customer awareness, industry leadership, branding and distribution opportunities; |

| | • | | the Combination will allow the companies to combine and integrate their research and development resources, complementary distribution channels, products and technologies, strategic alliances and customer bases, which Quantum believes will lead to expanded markets, greater technical resources, diversification and cost efficiencies; |

| | • | | the companies’ respective alliance partners and customers can be utilized to assist in the commercialization and funding of each company’s products, particularly Quantum’s existing relationships with customers and U.S.-based governmental agencies. Specifically, Global’s solid oxide fuel cell program is expected to benefit from Quantum’s U.S. presence and its strategic relationships with government, military and civilian entities; |

| | • | | with a stronger balance sheet and financial foundation, the combined company will have the resources necessary to execute its business strategy, with increased visibility and market capitalization; and |

| | • | | the combined company will provide the opportunity to enhance stockholder value by creating financial strength, integrating research and product development, realizing operational efficiencies and combining two complementary businesses. Specifically, Quantum believes that significant cost savings may be realized through utilizing Global’s Alberta-based manufacturing facilities. |

| 2. | | What will Global common shareholders receive as a result of the Combination? |

Under the terms of the Plan of Arrangement, Global common shareholders (other than dissenting shareholders) will receive between 0.835 and 1.020 shares of Quantum common stock for each Global

1

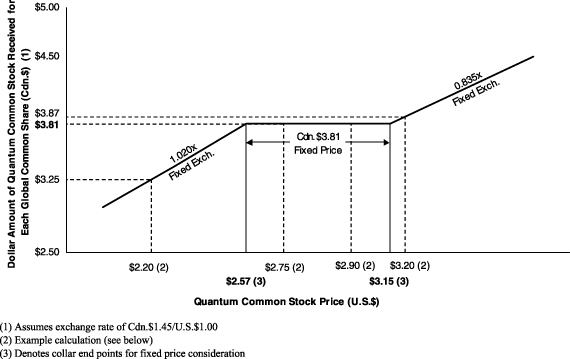

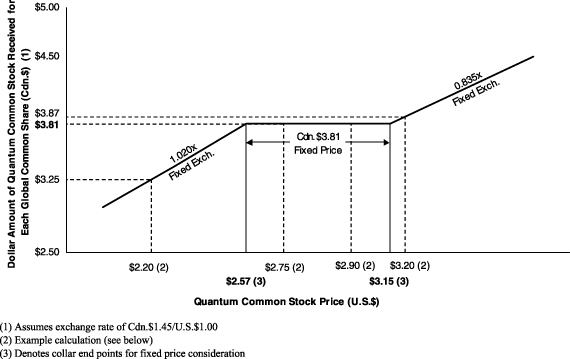

common share, depending on the exchange ratio in effect at the time the Combination is completed. The exchange ratio is based on the 20-day volume-weighted average Quantum stock price ending three days prior to the Global Meeting. If Quantum’s 20-day volume-weighted average stock price is:

| | • | | greater than U.S.$3.15, the exchange ratio will be 0.835; |

| | • | | less than U.S.$2.57, the exchange ratio will be 1.020; and |

| | • | | between U.S.$2.57 and U.S.$3.15, Global common shareholders will receive approximately U.S.$2.6284 (approximately Cdn.$3.8112) of Quantum common stock for each Global common share held. |

If, at any time prior to the effective time of the Combination, Quantum’s 15-day volume-weighted average stock price is less than U.S.$2.15, then Global has the right to terminate the Combination Agreement without having to pay a termination or expense reimbursement fee. For more information regarding this termination provision, please see “—Description of the Combination—the Combination Agreement—Termination.” As of·, 2003, Quantum’s 15-day volume-weighted average stock price was U.S.$·.

The chart below illustrates the exchange ratio:

By way of illustration, the following are four examples of the exchange ratio calculation on the basis of a range of prices of Quantum common stock. For purposes of these examples, we have assumed a foreign currency exchange rate of Cdn.$1.45 to U.S.$1.00 (the exchange rate on April 28, 2003) for purposes of valuing the shares of Quantum common stock received. If the 20-day volume-weighted average price of Quantum common stock for the period ending three days prior to the Global Meeting is:

| | • | | U.S.$2.20, then Global common shareholders will receive 1.020 shares of Quantum common stock for each Global common share held, with an approximate value of Cdn.$3.25 per share; |

| | • | | U.S.$2.75, then Global common shareholders will receive 0.956 shares of Quantum common stock for each Global common share held, with an approximate value of Cdn.$3.81 per share; |

2

| | • | | U.S.$2.90, then Global common shareholders will receive 0.906 shares of Quantum common stock for each Global common share held, with an approximate value of Cdn.$3.81 per share; and |

| | • | | U.S.$3.20, then Global common shareholders will receive 0.835 shares of Quantum common stock for each Global common share held, with an approximate value of Cdn.$3.87. |

Global will issue a press release prior to the Global Meeting advising you of the final determination of the exchange ratio.

| 3. | | Who will manage the combined company after the Combination? |

The combined company will retain the name “Quantum Fuel Systems Technologies Worldwide, Inc.” and be headquartered in Irvine, California. It will be managed by a seven-member board of directors to include the five current members of the Quantum board and two members from the current Global board. Alan P. Niedzwiecki, Quantum’s President and Chief Executive Officer, and W. Brian Olson, Quantum’s Chief Financial Officer, will lead the combined company in those respective roles.

| 4. | | When and where are the shareholder meetings? |

Both meetings will take place on·, 2003. The Global Meeting will be held at· (Calgary time) in the· Room of the·, located at·, Calgary, Alberta. The Quantum Meeting will be held at· (Pacific time) in the· Room of the·, located at·.

| 5. | | What do I need to do now? |

Please indicate on your proxy card how you want to vote, and sign and mail it in the enclosed return envelope as soon as possible so that your shares may be represented at your meeting. If you are a Quantum stockholder and sign and send in your proxy and do not indicate how you want to vote, your proxy will be counted as a vote in favor of the approval of the Combination Agreement and the transactions contemplated thereby and in favor of the amendment and restatement of the Quantum Charter. If you are a Global common shareholder and sign and send in your proxy and do not indicate how you want to vote, your proxy will be counted as a vote in favor of the approval of the arrangement resolution attached as Annex A to the Joint Proxy Statement at the Global Meeting. You may also choose to attend your meeting and vote your shares in person. For more information regarding the Quantum Meeting and the Global Meeting, please see “Chapter Five—Information about the Meetings and Voting.”

| 6. | | What do I do if I want to revoke my proxy or change my vote? |

If you are a Quantum stockholder, you may revoke your proxy at any time prior to its use by delivering to the Secretary of Quantum a later-dated notice of revocation, by delivering to the Secretary of Quantum a later-dated signed proxy (which will automatically supersede any earlier-dated proxy that you returned), or by attending the Quantum Meeting and voting in person (attendance at the Quantum Meeting does not, by itself, constitute revocation of your proxy).

If you are a Global common shareholder, to revoke your proxy you may send in a later-dated signed proxy card to Global’s Secretary, or you can attend the Global Meeting in person and vote. You may also revoke your proxy by sending a notice of revocation to Computershare Trust Company of Canada, which must be received by 5:00 p.m. (Calgary time) on the last business day prior to the Global Meeting, or by giving this notice to the Chairman of the Global Meeting prior to the commencement of the Global Meeting.

| 7. | | If my shares of stock are held in “street name” by my broker, will my broker vote my shares for me? |

Your broker will vote your shares only if you provide instructions on how to vote. Without instructions, your shares will not be voted. You should instruct your broker to vote your shares, following the directions provided by your broker.

3

| 8. | | What votes are required to complete the Combination? |

The Combination requires the approval of the holders of at least two-thirds of the Global common shares represented in person or by proxy at the Global Meeting. Approval of the Combination Agreement and the Combination requires the affirmative vote of a majority of the total shares of Quantum common stock entitled to vote and voting on the proposal in person or by proxy. Approval of the amendment and restatement of the Quantum Charter requires the approval of a majority of the outstanding shares of Quantum common stock entitled to vote on the matter.

| 9. | | What are the other material conditions to completion of the Combination? |

The Combination is subject to the receipt of required governmental and regulatory approvals, including approval of the Plan of Arrangement giving effect to the Combination by the Court of Queen’s Bench of Alberta (the “Court”) and approval of Nasdaq for listing of the shares of Quantum common stock to be issued pursuant to the Combination. The Combination is also subject to other customary conditions.

| 10. | | When do you expect the Combination to be completed? |

Both companies are working toward completing the Combination as quickly as possible. We expect that, if approved, the Combination will become effective as of the close of business on or about·, 2003.

| 11. | | Who do I call if I have more questions? |

For questions about voting and proxies, Quantum stockholders may call:

Georgeson Shareholder Communications

Tel: ·

Fax:·

For other information, Quantum stockholders may contact:

Cathy Johnston

Director of Communications and Corporate Support

Quantum Fuel Systems Technologies Worldwide, Inc.

Tel: (949) 399-4548

Fax: (949) 474-3086

For questions about voting and proxies, Global shareholders may call:

·

For other information, Global shareholders may contact:

Paul Crilly

Vice President, Finance, Chief Financial Officer and Secretary

Global Thermoelectric Inc.

Tel: (403) 204-6100

Fax: (403) 204-6105

Additional Questions and Answers for Quantum Stockholders

| 12. | | What are Quantum stockholders being asked to vote on? |

Quantum stockholders are being asked to approve:

| | • | | the Combination Agreement and the Combination; and |

| | • | | a proposal pursuant to which the Quantum Charter will be amended and restated to increase the number of shares of authorized Quantum common stock from 60,000,000 to 100,000,000 and to eliminate the currently authorized shares of Quantum’s Series A common stock. |

4

| 13. | | Why is Quantum seeking stockholder approval of the Combination? |

Under the Nasdaq Marketplace Rules, listed companies are required to obtain stockholder approval prior to issuing securities in connection with the acquisition of stock of another company if the number of shares to be issued in the transaction exceeds 20% of the shares outstanding prior to the transaction. Stockholder approval is also required when the issuance of securities will result in a change of control of the issuer. Under the terms of the Combination Agreement and the Plan of Arrangement, Quantum will issue its common stock to Global common shareholders in exchange for their Global common shares, and Global common shareholders will own between 52% and 57% of the Quantum common stock outstanding immediately following completion of the Combination.

In addition, Quantum will assume all outstanding Global stock options and the obligation to issue its common stock upon the conversion of the outstanding Global Series 2 Preferred Shares after completion of the Combination, which may result in Quantum issuing additional shares of its common stock. The Nasdaq Marketplace Rules require stockholder approval prior to any transaction (other than a public offering) involving an issuance or potential issuance of common stock (or securities convertible into or exercisable for common stock) equal to 20% or more of the outstanding common stock or voting power for less than the greater of book or market value of the stock. For a description of the number of shares of Quantum common stock that may be issued upon conversion of the Global Series 2 Preferred Shares, please see “—Description of the Combination—Mechanics for Implementing the Combination—Global Series 2 Preferred Shares.”

If Quantum were to complete the Combination without Quantum stockholder approval, Quantum common stock could not remain listed on the Nasdaq National Market. Approval of the Combination is not required by Delaware law, by the Quantum Charter or by Quantum’s bylaws.

| 14. | | Why is Quantum entering into the Combination? |

Quantum believes that the Combination is a complementary strategic combination that will result in:

| | • | | greater financial strength with a stronger balance sheet, better liquidity and complementary existing revenue streams across established markets; |

| | • | | an expanded range of products and technologies with access to broader, yet related markets in transportation, stationary power generation and infrastructure, with an enhanced ability to secure government, military and customer funding; |

| | • | | consolidated operations with opportunities for cost efficiencies by integrating research and development efforts, combining product development and commercialization, integrating manufacturing operations and consolidating general and administrative expenses; |

| | • | | significant cost savings through utilizing Global’s Alberta-based manufacturing facilities; and |

| | • | | an expanded technology and product profile as an energy systems solution provider. |

Overall, Quantum believes that the Combination will provide added value to its stockholders.

| 15. | | What will happen if the Quantum stockholders do not approve the Combination or the amendment to the Quantum Charter? |

Approval of the Combination Agreement and the transactions contemplated thereby requires the affirmative vote of a majority of shares of Quantum common stock entitled to vote and voting in person or by proxy at the Quantum Meeting. Approval of the amendment to the Quantum Charter requires the affirmative vote of a majority of the outstanding shares of Quantum common stock entitled to vote on the matter.

5

The Combination is conditioned on the approval by Quantum stockholders of both proposals. If Quantum stockholders do not approve either of the Quantum proposals, then neither proposal will be implemented and the Combination will not proceed. In that event, Quantum may be required to pay Global a termination fee. For a description of the termination fees that may apply, please see “—Description of the Combination—The Combination Agreement—Termination and Expense Reimbursement Fees.”

| 16. | | How will the Combination affect my Quantum common stock? |

Your rights as a Quantum common stockholder will not be affected by the Combination. Quantum stockholders will not receive any additional shares by virtue of their holdings in Quantum. However, the ownership of Quantum will be substantially different upon consummation of the Combination, as Global common shareholders will own between 52% and 57% of the shares of outstanding Quantum common stock. In addition, your current percentage ownership of Quantum will be affected by the future issuance of Quantum common stock upon the exercise, if any, of Global stock options being assumed by Quantum and conversion, if any, of the Global Series 2 Preferred Shares. For more information, please see “—Risk Factors—Future sales of substantial amounts of Quantum common stock could affect its market price” and “The rights of the Global Series 2 Preferred Shares could negatively impact the combined company.” In addition, assuming an exchange ratio of 1.020, Quantum may be required to issue an additional 830,746 shares of its common stock upon exercise of vested Global stock options (as of April 7, 2003) and upon an assumed immediate conversion of all outstanding Global Series 2 Preferred Shares. For more information regarding the treatment of Global stock options and the Global Series 2 Preferred Shares, please see the sections entitled “Global Stock Options” and “Global Series 2 Preferred Shares” within “Chapter One—The Combination—Description of the Combination—Mechanics for Implementing the Combination.”

| 17. | | Has Quantum’s board of directors made any recommendation to Quantum stockholders regarding the Combination and the amendment to the Quantum Charter? |

Quantum’s board of directors has carefully considered and has unanimously approved the Combination Agreement, the Combination and the amendment and restatement of the Quantum Charter and recommends that the Quantum stockholders approve the Combination Agreement, the Combination and the amendment and restatement of the Quantum Charter.

Additional Questions and Answers for Global Common Shareholders

| 18. | | What are the Global common shareholders being asked to vote on? |

Global common shareholders are being asked to approve a share exchange pursuant to an arrangement under theBusiness Corporations Act (Alberta). A court must also approve the implementation of the Plan of Arrangement.

If the proposed Plan of Arrangement is approved by the Global common shareholders and the Court, and the other conditions to the Plan of Arrangement are satisfied or waived, then:

| | • | | each Global common shareholder (other than a dissenting shareholder) will receive, for each Global common share, shares of Quantum common stock to be determined in accordance with the exchange ratio; |

| | • | | all of the Global common shares will be owned by Quantum; |

| | • | | Global common shareholders will own between 52% and 57% of the Quantum common stock outstanding immediately following completion of the Combination; |

| | • | | outstanding Global options will be assumed by Quantum and will be exercisable for shares of Quantum common stock in accordance with their terms and based on the exchange ratio; and |

| | • | | Global Series 2 Preferred Shares will remain outstanding and will be convertible into shares of Quantum common stock in accordance with their terms and based on the exchange ratio. |

6

| 19. | | Why has Global entered into the Combination Agreement? |

The Global board of directors determined in the fall of 2000 that it would be in the best interests of Global to seek a significant alliance partner to assist with Global’s commercialization of solid oxide fuel cell products. North American equity markets experienced prolonged weakness from 2000 to 2002 and over that period of time Global’s common share price traded at a significant discount to that of its peers. In late 2002, the Global board of directors determined that its plan to use equity financing as a source of long-term funding for Global’s current development focus and planned expenditures on larger power applications would not succeed, particularly in light of Global’s inability to attract a significant strategic relationship partner. In November 2002, Global retained Citigroup Global Markets Inc. (“Citigroup,” formerly Salomon Smith Barney Inc.) to review strategic alternatives and to solicit proposals from interested third parties. Global, through a worldwide process initiated in the winter of 2002, with the assistance of Citigroup, solicited potential interest in respect of a variety of alliance structures from a lengthy list of potential partners across a broad spectrum of industries. Global’s board of directors identified a prospective transaction with Quantum as the leading potential strategic alternative resulting from this process. The Global board of directors has approved the Combination Agreement in order to provide the Global common shareholders with the opportunity to consider the merits of the Combination. In reaching this decision, the Global board of directors considered the recommendation of the Special Committee of the Global board of directors that the Combination be submitted to Global’s common shareholders for their consideration.

Global received the written opinion of Citigroup that, as of the date of the opinion and based upon and subject to the matters set forth therein, the exchange ratio was fair, from a financial point of view, to the holders of Global common shares. In addition, the Plan of Arrangement:

| | • | | is subject to the affirmative approval of 66 2/3% of the holders of Global common shares voting in person or by proxy at the Global Meeting; |

| | • | | provides for assumption by Quantum of all outstanding Global options and the assumption by Quantum of the obligation to issue Quantum common stock upon conversion of the Global Series 2 Preferred Shares; |

| | • | | requires the submission of the Plan of Arrangement to the Court for a determination of fairness; and |

| | • | | provides for the right of holders of common shares to dissent under theBusiness Corporations Act (Alberta). |

| 20. | | Why is the Global board of directors taking a neutral position with respect to the Combination? |

The Combination represents the results of a number of months of effort searching for alternative transactions to enhance value for Global’s common shareholders. Global’s board of directors considered both the advantages and disadvantages associated with the Combination, and its board members had differing views on the relative merits of the Combination (for additional information regarding the foregoing, please see “—Description of the Combination—Background” at page 43 below and “—Description of the Combination—Reasons for the Combination—Global” at page 49). As a result, the Global board of directors is taking a neutral position in respect of the Combination. The Global board of directors approved entering into the Combination Agreement in order to provide Global common shareholders with the opportunity to consider the Combination. Because the Combination involves an investment in the shares of the combined company, Global’s common shareholders are urged to review the contents of the Joint Proxy Statement and, in particular, the advantages and disadvantages described in connection with the Global board of directors’ advice to shareholders set forth in “—Description of the Combination—Advice of the Global Board of Directors” commencing on page 60, and the discussion of the risks set forth in “—Risk Factors” commencing on page 23.

Global’s board urges its common shareholders to consider the information contained in the Joint Proxy Statement carefully and, having regard to their own personal circumstances and investment objectives, to come to their own decisions as to how to vote.

7

| 21. | | Will the shares of Quantum common stock issued pursuant to the Combination be listed on the Nasdaq National Market? |

Yes. Quantum’s common stock currently trades on the Nasdaq National Market under the symbol “QTWW.” Quantum will apply to list the shares of Quantum common stock to be issued to Global shareholders pursuant to the Combination on the Nasdaq National Market. Global common shares will be delisted from the Toronto Stock Exchange upon completion of the Combination.

| 22. | | How do I exchange my Global common shares for shares of Quantum common stock? |

Following completion of the Combination, a letter of transmittal will be sent to you, which will include instructions concerning how to exchange your Global common shares for Quantum common stock. You should send your share certificate together with the letter of transmittal to Computershare Trust Company of Canada in accordance with the instructions contained in the letter of transmittal.

| 23. | | What will happen if the Global common shareholders do not approve the Combination? |

In order to be effective under applicable law, the arrangement resolution effecting the Combination requires approval by at least 66 2/3% of the votes cast by Global common shareholders present in person or represented by proxy at the Global Meeting and entitled to vote.

If the required vote of Global common shareholders is not obtained, the arrangement resolution will not be approved and the Combination will not proceed. In that event, Global will be required to pay Quantum a fee for reimbursement of expenses. For a description of the fees that may apply, please see “—Description of the Combination—The Combination Agreement—Termination and Expense Reimbursement Fees.”

8

SUMMARY

The following is a summary of certain information contained in this Joint Proxy Statement and may not contain all of the information that is important to you. The summary is not intended to be complete and is qualified in its entirety by the more detailed information and financial statements, including the notes thereto, contained elsewhere in this Joint Proxy Statement and the attached annexes, all of which are important and should be reviewed carefully. You should carefully read the entire document and the other documents we refer you to for a more complete understanding of the Combination. Unless otherwise indicated in this Joint Proxy Statement, (i) share amounts set forth herein assume no exercise of outstanding options to purchase Global common shares or Quantum common stock, and no conversion of the Global Series 2 Preferred Shares; and (ii) references to Quantum’s common stock include Quantum’s Series B common stock.Unless otherwise indicated, dollar amounts are expressed in U.S. dollars and assume a currency exchange rate of Cdn.$1.45 to U.S.$1.00, which was the approximate exchange rate on April 28, 2003.

Overview of the Combination

On April 8, 2003, Global and Quantum entered into the Combination Agreement to combine Global with Quantum in a share-for-share exchange pursuant to a Plan of Arrangement to be submitted for approval by the Court of Queen’s Bench of Alberta. If all approvals are received and the Combination closes, upon receipt of Global share certificates and properly completed letters of transmittal, Global common shareholders (other than dissenting shareholders) will receive Quantum common stock for each Global common share outstanding in accordance with the exchange ratio.

Under the terms of the Plan of Arrangement, Global common shareholders (other than dissenting shareholders) will receive between 0.835 and 1.020 shares of Quantum common stock for each Global common share, depending on the exchange ratio in effect at the time the Combination is completed. The exchange ratio will be determined by dividing U.S.$2.628378 by the 20-day volume-weighted average Quantum stock price ending three days prior to the Global Meeting; however, the exchange ratio will not be greater than 1.020 nor less than 0.835. Accordingly, if Quantum’s 20-day volume-weighted average stock price is:

| | • | | greater than U.S.$3.15, the exchange ratio will be 0.835; |

| | • | | less than U.S.$2.57, the exchange ratio will be 1.020; and |

| | • | | between U.S.$2.57 and U.S.$3.15, Global common shareholders will receive approximately U.S.$2.6284 of Quantum common stock for each Global common share. |

Upon completion of the proposed Combination:

| | • | | all Global common shareholders will cease to be shareholders of Global, and Global common shareholders who have not exercised dissent rights will receive, for each Global common share held, shares of Quantum common stock in an amount determined in accordance with the exchange ratio; |

| | • | | each outstanding option to purchase Global common shares will be assumed by Quantum and will represent an option to purchase Quantum common stock in accordance with its terms based on the exchange ratio; |

| | • | | Global will become a consolidated subsidiary of Quantum; and |

| | • | | the Global Series 2 Preferred Shares will remain preferred shares of Global, as a consolidated subsidiary of Quantum, and Quantum will assume the obligation to issue Quantum common stock upon conversion thereof. |

9

The Companies

Quantum

Quantum designs, manufactures and supplies integrated fuel systems to original equipment manufacturers (“OEMs”) for use in alternative fuel vehicles and fuel cell applications. Quantum’s fuel systems enable cars, trucks and buses powered by internal combustion engines to operate on hydrogen, natural gas or propane. Its advanced enabling products for fuel cell systems are used in transportation and industrial vehicles, stationary and portable power generation, and hydrogen refueling products. Quantum’s products and capabilities include the following:

| | • | | hydrogen and compressed natural gas fuel storage and safety testing; |

| | • | | fuel control devices and technology for gaseous fuels for use in internal combustion engines and fuel cells; |

| | • | | electronic control systems and validation; |

| | • | | testing procedures to meet a variety of global regulations and emission control standards; |

| | • | | research and development; |

| | • | | application engineering and validation; and |

| | • | | manufacturing and quality assurance. |

Quantum supplies advanced gaseous fuel systems for alternative fuel vehicles to OEM customers for use by consumers and for commercial and government fleets. Since 1997, Quantum has sold over 15,000 fuel systems for alternative fuel vehicles, primarily to General Motors, which in turn has sold substantially all of these vehicles to its customers. Quantum also provides gaseous fuel systems and hydrogen refueling products for fuel cell applications to major OEMs through funded research and development contracts and on a prototype basis. These fuel cell and hydrogen refueling products are not currently used on a commercial basis and will require additional product development over the next five years; however, Quantum believes that a commercial market will begin to develop for these products in 2004 to 2005. Quantum believes that these systems will reach production volumes only if OEMs produce fuel cell applications and hydrogen refueling products using its systems on a commercial basis.

Quantum was incorporated in Delaware in October 2000 as a wholly-owned subsidiary of IMPCO Technologies, Inc. (“IMPCO”). IMPCO conducted Quantum’s business through various departments, first as a division (the Automotive OEM Division) and later as a subsidiary (Quantum Fuel Systems Technologies Worldwide, Inc.). On July 23, 2002, IMPCO distributed to its stockholders, on a pro-rata basis, all of the shares of Quantum common stock owned by IMPCO. In the distribution, IMPCO stockholders received one share of Quantum common stock for each share of IMPCO common stock owned as of July 5, 2002, the record date for the distribution. Immediately prior to the distribution, IMPCO transferred to Quantum substantially all of the operations, assets and liabilities constituting IMPCO’s automotive OEM business, which had been operated by IMPCO as its Quantum division.

Immediately following the completion of the spin-off from IMPCO, Quantum’s strategic alliance with General Motors became effective. Quantum issued to General Motors 3,513,439 shares of Series A common stock, representing a 19.9% equity position in Quantum. Pursuant to the terms of the Series A common stock and in connection with Quantum’s first public equity offering in January 2003, all of the 3,513,439 shares of Series A common stock held by General Motors converted automatically into shares of Quantum common stock on a one-for-one basis, and General Motors received 999,969 shares of Quantum’s non-voting Series B common stock. As a result of the conversion of the Series A common stock, Quantum no longer has any shares of Series A common stock outstanding with anti-dilution rights.

10

Quantum’s principal executive offices are located at:

17872 Cartwright Road

Irvine, California 92614

Tel: (949) 399-4500

Fax: (949) 399-4600

www.qtww.com (The contents of Quantum’s web site are not part of this Joint Proxy Statement.)

Global

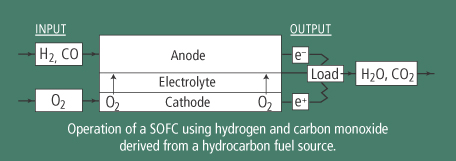

Global focuses on the development, manufacture and distribution of two stationary power technologies. Specifically, Global is in the process of commercializing natural gas and propane compatible solid oxide fuel cell products intended for residential, small commercial and light industrial markets, and also manufactures and distributes thermoelectric stationary power generators for use in remote industrial power markets.

In fiscal year 2002, Global had Cdn.$21.8 million in sales revenue from the supply of generators and related services. Thermoelectric generator systems have been manufactured and distributed by Global since 1975 and are widely used in remote applications by the oil and gas and other industries. To date, these generator systems operate in 47 countries worldwide, supplying power for applications ranging from five to 5,000 watts.

Global launched its solid oxide fuel cell development program in 1998. Since that time, Global has developed and tested a proprietary fuel cell membrane, the key enabling technological component for Global’s solid oxide fuel cell products. Global has developed a pilot volume production plant and methodology incorporating conventional manufacturing processes for the manufacture of these membranes. Cell membrane technology, combined with advanced stack technology, is now being tested by Global in system applications. Global’s focus is on the development of stationary natural gas-fueled prototype systems.

Global’s principal executive offices are located at:

4908–52nd Street S.E.

Calgary, Alberta T2B 3R2

Tel: (403) 204-6100

Fax: (403) 204-6105

www.globalte.com (The contents of Global’s web site are not part of this Joint Proxy Statement.)

Recent Developments

On May 6, 2003, Global announced a reduction of its workforce in its fuel cell division by approximately one third, or 47 employees, which is expected to result in a reduction of research and development expenses by approximately Cdn.$5 million over the next twelve months. During the course of Global’s review of alternatives to maximize shareholder value and in conjunction with its efforts to create a sustainable solid oxide fuel cell program, Global determined that it needed to significantly reduce expenditures and to focus on its core competency—the development of solid oxide fuel cell membranes and stack technology. Global believes that this reduction maintains Global’s staffing at a level which allows it to continue to focus its efforts on its core technology development while maintaining its prototype system capability.

The Combined Company (see page 113)

The combined company will retain the name “Quantum Fuel Systems Technologies Worldwide, Inc.” and will be headquartered in Irvine, California. Global will be operated as a consolidated subsidiary of Quantum and remain based in Calgary, Alberta. The seven-member board of directors of Quantum will include the five current members of the Quantum board of directors and two members from the current Global board of directors. On the effective date of the Combination, Quantum’s board of directors will appoint two of the following three individuals to serve on Quantum’s expanded board of directors: Peter Garrett, currently President, Chief

11

Executive Officer and a director of Global; Robert Snyder, currently a director and Chairman of the Board of Global; and Norman Fraser, currently a director of Global. Alan P. Niedzwiecki, Quantum’s President and Chief Executive Officer, and W. Brian Olson, Quantum’s Chief Financial Officer, will lead the combined company in these respective roles. The combined company’s fiscal year end will be April 30.

At January 31, 2003, on a pro forma combined basis, the combined company had:

| | • | | total assets of U.S.$138.0 million; |

| | • | | total cash and cash equivalents, and short-term investments of U.S.$72.8 million; |

| | • | | total stockholders’ equity of U.S.$118.5 million; |

| | • | | long-term debt and capital leases of U.S.$0.4 million; |

| | • | | preferred shares of subsidiary of U.S.$7.8 million, representing the Global Series 2 Preferred Shares remaining outstanding after the Combination; and |

| | • | | 52.4 million outstanding shares of common stock (assuming an exchange ratio of 1.020 and excluding Quantum common stock issuable upon the exercise of options and conversion of Global Series 2 Preferred Shares). |

For the nine month period ended January 31, 2003, on a pro forma combined basis, the combined company had:

| | • | | revenue of U.S.$27.6 million; |

| | • | | gross margins of U.S.$7.1 million; and |

| | • | | net loss of U.S.$27.6 million. |

Please see “Chapter Two—Certain Financial and Other Information About the Companies—Unaudited Pro Forma Condensed Combined Financial Statements” for a discussion of the underlying pro forma combined financial information.

Reasons for the Combination (see pages 48 and 49)

Quantum

Quantum believes that the Combination will result in a diversified company with complementary revenue streams, technologies, customers and alliances that, on a combined basis, is well-positioned to address opportunities in the transportation, stationary power generation and hydrogen refueling markets. Quantum believes that the Combination is a complementary strategic combination that will result in:

| | • | | greater financial strength with a stronger balance sheet, better liquidity and complementary existing revenue streams across established markets that Quantum believes will provide for sustainable growth, stability and a solid financial foundation; |

| | • | | an expanded range of products with access to broader yet related markets in transportation, stationary power generation and infrastructure. Quantum believes that the combined company will have complementary distribution channels, strategic alliances and customer bases with the opportunity to leverage current technologies and product portfolios into Quantum’s and Global’s current markets and to provide for the advancement and distribution of next-generation technologies in these markets; |

| | • | | an enhanced ability for Global’s solid oxide fuel cell program to benefit from Quantum’s U.S. presence and its strategic relationships with, and access to, funding from government, military and civilian entities; |

| | • | | consolidated operations including integrated research and development efforts, combined product development and commercialization, integrated manufacturing operations and consolidated general and administrative expenses; |

12

| | • | | significant cost savings through the utilization of Global’s Alberta-based manufacturing facilities; and |

| | • | | an expanded technology and product profile as an energy systems solution provider that Quantum believes will lead to broader customer awareness, industry leadership, branding and distribution opportunities. |

In considering the Combination, the Quantum board of directors recognized that there are risks associated with the acquisition of Global, including that some of the potential benefits described above may not be realized, that there may be significant costs associated with realizing these benefits, the risks set forth under “Risk Factors” and the disadvantages that the Quantum board of directors identified in “—Description of the Combination—Reasons for the Combination.”

Global

The Global board of directors determined in the fall of 2000 that it would be in the best interests of Global to seek a significant alliance partner to assist with Global’s commercialization of solid oxide fuel cell products. North American equity markets experienced prolonged weakness from 2000 to 2002 and over that period of time Global’s common share price traded at a significant discount to that of its peers. In late 2002, the Global board of directors determined that its plan to use equity financing as a source of long-term funding for Global’s current development focus and planned expenditures on larger power applications would not succeed, particularly in light of Global’s inability to attract a significant strategic relationship partner. Global, through a worldwide process initiated in the winter of 2002, with the assistance of Citigroup, solicited potential interest in respect of a variety of alliance structures from a lengthy list of potential partners across a broad spectrum of industries. Global’s board of directors identified a prospective transaction with Quantum as the leading potential strategic alternative resulting from this process.

In determining to submit the Combination to its common shareholders for approval, the Global board of directors consulted with Global’s management, as well as its financial and legal advisors. In reaching this decision, the Global board of directors considered the report of the Global Special Committee of the board of directors recommending that the Combination be submitted to Global’s shareholders for their consideration. The Global board also considered the elements of fairness associated with the transaction, including that it:

| | • | | is subject to the affirmative approval of 66 2/3% of the holders of Global common shares voting at the Global Meeting; |

| | • | | provides for the assumption by Quantum of all outstanding Global options and the assumption by Quantum of the obligation to issue Quantum common stock upon conversion of the Global Series 2 Preferred Shares; |

| | • | | requires the submission of the Plan of Arrangement to the Court of Queen’s Bench of Alberta for a determination of fairness; and |

| | • | | provides for the right of holders of Global common shares to dissent under theBusiness Corporations Act (Alberta). |

The Global board of directors also considered potential advantages and disadvantages of the Combination. For additional information regarding the foregoing, please see “—Description of the Combination—Reasons for the Combination—Global” and “—Risk Factors.”

Recommendation to Quantum Stockholders (see page 52)

The Quantum board of directors has unanimously determined that the Combination and the transactions contemplated thereby are advisable, fair to and in the best interests of Quantum and Quantum’s stockholders and has approved the Combination Agreement, the Combination and the amendment and restatement of the Quantum Charter.

13

Accordingly, the Quantum board of directors unanimously recommends that Quantum’s stockholders vote “For” approval of the Combination Agreement and the Combination and “For” approval of the amendment and restatement of the Quantum Charter.

Advice to Global Common Shareholders (see page 60)