SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

|

x Definitive Proxy Statement |

|

¨ Definitive Additional Materials |

|

¨ Soliciting Material under §240.14a-12 |

QUANTUM FUEL SYSTEMS

TECHNOLOGIES WORLDWIDE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | ¨ | | $125 per Exchange Act Rules 0-11(c)(1)(ii), 14a-6(i)(1), 14a-6(i)(2) or Item 22 (a)(2) of Schedule 14A. |

| | ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | ¨ | | Fee paid previously by written preliminary materials. |

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

QUANTUM FUEL SYSTEMS TECHNOLOGIES WORLDWIDE, INC.

Notice of Annual Meeting of Stockholders

To Be Held on October 23, 2003

Quantum Fuel Systems Technologies Worldwide, Inc. will hold its Annual Meeting of Stockholders at the Marriott Hotel located at 18000 Von Karman, Irvine, California, on Thursday, October 23, 2003, at 1:30 p.m. local time.

We are holding this meeting for the following purposes as more fully described in the proxy statement accompanying this notice:

| | • | | To elect two Class II directors to our board of directors to serve for a period of three years or until his successor is duly elected and qualified; |

| | • | | To ratify the appointment of Ernst & Young LLP as our independent public accountants for our 2004 fiscal year; and |

| | • | | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Stockholders of record at the close of business on September 15, 2003, are entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. A list of such stockholders will be available for examination by any stockholder at the Annual Meeting for any purpose germane to the Annual Meeting, at the Company’s offices at 17872 Cartwright Road, Irvine, California, 92614 for a period of ten days prior to the Annual Meeting.

A copy of our Annual Report for the fiscal year ended April 30, 2003, is included with this mailing. The vote of each stockholder is important. Whether or not you plan to attend the Annual Meeting, you are requested to please complete, date, sign and promptly return proxy card or vote via the Internet or the toll-free telephone number as instructed on your proxy card so that your shares may be voted in accordance with your wishes and so that the presence of a quorum may be assured. You may revoke your proxy at any time. If you attend the Annual Meeting in person, you may revoke your proxy and vote in person if you wish.

By Order of the Board of Directors, |

|

|

Cathryn T. Johnston Secretary |

Irvine, California

September 22, 2003

QUANTUM FUEL SYSTEMS TECHNOLOGIES WORLDWIDE, INC.

17872 Cartwright Road,

Irvine, California 92614

PROXY STATEMENT

Annual Meeting of Stockholders

To be held October 23, 2003

INFORMATION REGARDING PROXIES

This Proxy Statement and the enclosed proxy are furnished in connection with the solicitation of proxies by the Board of Directors of Quantum Fuel Systems Technologies Worldwide, Inc. for use at the Annual Meeting of Stockholders to be held on Thursday, October 23, 2003, at 1:30 p.m., local time, at the Marriott Hotel located at 18000 Von Karman, Irvine, California, and at any adjournment thereof.

These proxy materials are being mailed to stockholders commencing on or about September 22, 2003. Expenses of solicitation of proxies will be paid by us. Solicitation will be by mail. There may be telegraph, telephone, or personal solicitations by our directors, officers, and employees that will be made without paying them additional compensation. We will request banks and brokers to solicit proxies from their customers and will reimburse those banks and brokers for reasonable out-of-pocket costs for this solicitation.

If the enclosed proxy is properly executed and returned or if the stockholder executes their proxy via the internet or the toll-free number provided on the proxy card, it will be voted in accordance with the instructions specified thereon. Any proxy in which no direction is specified will be voted in favor of each matter for which no direction is specified. If other matters come before the Annual Meeting, it will be voted in accordance with the best judgment of the persons named as proxies in the enclosed proxy. Execution of the proxy will not in any way affect a stockholder’s right to attend the Annual Meeting or prevent voting in person. A proxy may be revoked at any time by (i) delivering written notice of revocation to our corporate secretary before it is voted; (ii) filing with us a duly executed proxy bearing a later date prior to the Annual Meeting; or (iii) attending the Annual Meeting and voting in person.

Only stockholders of record at the close of business on September 15, 2003, are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof. The holders of shares of a majority of the voting power of the outstanding common stock entitled to vote at the Annual Meeting will constitute a quorum at the Annual Meeting. While there is no definitive statutory or case law authority in Delaware as to the proper treatment of abstentions (also referred to as withheld votes), we believe that abstentions should be counted for purposes of determining if a quorum is present at the Annual Meeting for the transaction of business. With respect to broker nominee votes, the Delaware Supreme Court has held that broker nominee votes may be counted as present or represented for purposes of determining the presence of a quorum. Abstentions are included in determining the number of shares voted on the proposals submitted to stockholders (other than the election of directors) and will have the same effect as a vote against such proposals. Broker “non-votes” are included in determining the number of shares voted on the proposal to ratify the selection of Ernst & Young LLP as our independent auditors and will have the same effect as a vote against such proposal. However, broker non-votes will not be counted for the other proposals submitted to stockholders. Directors are elected by a plurality of the votes of the shares of common stock represented and voted at the Annual Meeting and abstentions and broker non-votes will have no effect on the outcome of the election of directors.

PROPOSAL I

ELECTION OF DIRECTORS

Our board of directors is currently comprised of five members. In accordance with our Amended and Restated Certificate of Incorporation and Amended and Restated By-Laws, the terms of office of our board of directors is divided into three classes as nearly equal in size as possible with staggered three-year terms: Class I, whose term will expire at the annual meeting of stockholders in our 2006 fiscal year, Class II, whose term will expire at the Annual Meeting of stockholders on October 23, 2003, and Class III, whose term will expire at the annual meeting of stockholders in our 2005 fiscal year. Our Class I director is Brian Runkel, our Class II directors are Scott Samuelsen and Thomas Tyson, and our Class III directors are Alan Niedzwiecki and Dale Rasmussen.

Pursuant to our strategic alliance with General Motors, we have agreed to appoint one individual nominated by General Motors to our board of directors. We also agreed that, during the term of our strategic alliance, we will continue to nominate one individual designated by General Motors to our proposed slate of directors to be presented to our stockholders as necessary for General Motors to retain one seat on our board of directors. During the term of our strategic alliance, General Motors will also be entitled to designate a non-voting “ex-officio” board member. As of the date of this Proxy Statement, General Motors has not presented a director nominee for stockholder vote. Pursuant to our agreement with General Motors, in October 2002 our board of directors approved the appointment of Wallace W. Creek as a board observer, with rights to receive notice of, and to attend, all meetings of the board of directors. The non-voting observer has no authority to exercise the powers of a director in the management of our company.

At each annual meeting of stockholders, the successors to the directors whose terms will then expire are elected to serve from the time of their election and qualification until the third annual meeting following their election or until their successors have been duly elected and qualified, or until their earlier resignation or removal.

Voting Information

Although our board of directors anticipates that all of the nominees will be available to serve as directors, if any of them do not accept the nomination, or otherwise are unwilling or unable to serve, the proxies will be voted for the election of a substitute nominee or nominees designated by our board of directors.

A stockholder submitting a proxy may vote for all or any of the nominees for election to our board of directors or may withhold his or her vote from all or any of such nominees. Directors are elected by a plurality of votes. An abstention from voting on this matter by a stockholder, while included for purposes of calculating a quorum for the Annual Meeting, has no effect. In addition, although broker “non-votes” will be counted for purposes of attaining a quorum, they will have no effect on the vote. The persons designated in the enclosed proxy will vote your shares FOR each nominee unless instructions otherwise are indicated in the enclosed proxy.

Information About Directors and Nominees for Election

The names of the nominees and the other directors, the year in which each first became a director of our company, their age, principal occupation and certain other information are as follows:

Nominees for Election to Term Continuing Until Fiscal 2007

Scott Samuelsen, age 60, has served as one of our directors since July 2002. Since 1970, Dr. Samuelsen has been a professor of Mechanical and Aerospace Engineering at the University of California, Irvine, where he serves as the Director of the National Fuel Cell Research Center and as the Director of the Advanced Power and Energy Program. He also leads the Pacific Rim Consortium on Energy, Combustion, and the Environment and serves as co-Chair of the California Stationary Fuel Cell Collaborative. Dr. Samuelsen holds B.S., M.S., and Ph.D. degrees in Mechanical Engineering from the University of California, Berkeley.

2

Thomas J. Tyson, age 70, has served as one of our directors since July 2002. Dr. Tyson currently serves as an external consultant to GE Energy & Environmental Research Corp., a developer of advanced technologies to control nitrogen oxide emissions. Dr. Tyson served as Chief Executive Officer of Energy & Environmental Research Corp. from 1980 until it was acquired by General Electric in 1999. From July 1999 to December 2001, Dr. Tyson served in various positions with GE Energy & Environmental Research Corp., including Chief Executive Officer and Director of Special Projects. Dr. Tyson received a M.S. in Nuclear Engineering from the University of California, Berkeley and holds a B.S. in Mechanical Engineering and a Ph.D. in Aeronautical Engineering from the California Institute of Technology.

The Board of Directors recommends a vote “FOR” election of these nominees.

Directors Whose Terms Continue Until Fiscal 2005

Alan P. Niedzwiecki, age 46, has served as our President and as one of our directors since February 2002, and was appointed as our Chief Executive Officer in August 2002. Mr. Niedzwiecki served as Chief Operating Officer from November 2001 until he was appointed as Chief Executive Officer in August 2002. From October 1999 to November 2001, Mr. Niedzwiecki served as Executive Director of Sales and Marketing. From February 1990 to October 1999, Mr. Niedzwiecki was President of NGV Corporation, an engineering and marketing/commercialization consulting company. Mr. Niedzwiecki has more than 25 years of experience in the alternative fuels industry in product and technology development and commercialization relating to mobile, stationary power generation and refueling infrastructure solutions. Mr. Niedzwiecki is a graduate of Southern Alberta Institute of Technology.

Dale L. Rasmussen, age 53, has served as a member of our board of directors since October 2000, and was appointed as Chairman of the Board in February 2002. Since April 1984, Mr. Rasmussen has held various positions at IMPCO Technologies, Inc., our previous parent company, including his current position as Senior Vice President and Secretary since June 1989, as well as Vice President of Finance and Administration. Prior to joining IMPCO, Mr. Rasmussen was a commercial banker for 12 years at banks that were acquired by Key Bank and U.S. Bank. He received a B.A. in Business Administration and Economics from Western Washington University and is a graduate of the Pacific Coast Banking School.

Director Whose Term Continues Until Fiscal 2006

Brian A. Runkel, age 41, has served as one of our directors since July 2002. Since 1993, Mr. Runkel has served as President of Runkel Enterprises, an environmental consulting firm. Mr. Runkel also serves as Executive Director of the California Environmental Business Council, a non-profit trade and business association representing the California environmental technology and services industries. He received a B.A. in International Relations from George Washington University, and a J.D. from Harvard Law School.

Meetings of the Board of Directors and Committees

Our board of directors has an audit committee, a compensation committee and a nominating committee. During the fiscal year ended April 30, 2003, there were 12 regular and special meetings of the board of directors. During such period, each director attended over 75% of the meetings of the board and the committees of the Board on which he served except for Mr. Runkel, who attended seven of the eleven meetings of the board of directors held during his tenure.

Committees of the Board of Directors

Compensation Committee. The members of our compensation committee are Messrs. Rasmussen (Chair), Samuelsen, and Tyson. The compensation committee reviews and makes recommendations to our board of directors concerning salaries and incentive compensation for our directors, officers, and employees. The compensation committee also administers our 2002 Stock Incentive Plan.

3

Audit Committee. The members of our audit committee are Messrs. Runkel, Samuelsen, and Tyson (Chair). The audit committee reviews our internal accounting and auditing controls and procedures, reviews our audit and examination results and procedures and consults with our management and our independent accountants prior to the presentation of our financial statements to stockholders. The audit committee makes recommendations to our board of directors about the selection of independent accountants, approves the compensation of the independent accountants, and reviews the independence of the independent accountants as a factor in making these determinations. The audit committee meets alone with our independent accountants and with management in separate executive sessions and grants them free access to the audit committee at any time. Each of the members of our audit committee is “independent” as defined in Rule 4200(a)(15) of the National Association of Securities Dealers’ listing standards.

Nominating Committee. The members of our nominating committee are Messrs. Niedzwiecki, Rasmussen (Chair), and Runkel. The nominating committee is responsible for recruiting and recommending candidates for membership on our board of directors. For information about suggesting candidates for consideration as nominees for election to our board of directors, see “Proposals of Stockholders.”

Compensation of Directors

Each director who is not one of our employees is paid an attendance fee of $1,000, plus out-of-pocket expenses, for each board or committee meeting attended. In addition, the chairs of the audit, compensation, and nominating committees are paid an annual fee of $3,000. Directors are eligible to participate in our 2002 Stock Incentive Plan. On July 25, 2002, each of Messrs. Runkel, Samuelsen and Tyson received a grant of options to purchase 20,000 shares of our common stock, and Mr. Rasmussen received a grant of options to purchase 100,000 shares of our common stock, each at an exercise price of $3.65 per share (which was the fair market value of our common stock on the date of grant). On August 11, 2003, each of Messrs. Runkel, Samuelsen and Tyson received an additional grant of options to purchase 20,000 shares of our common stock, and Mr. Rasmussen received a grant of options to purchase 100,000 shares of our common stock, each at an exercise price of $3.10 per share (which was the fair market value of our common stock on the date of grant). The options vest in equal annual increments over a four year period and expire ten years from the date of grant. Option grants to directors are at the discretion of management, and we have no specific plans regarding amounts to be granted to our directors in the future.

4

VOTING SECURITIES

The only class of stock entitled to vote at the Annual Meeting is our common stock. At the close of business on September 15, 2003, there were 22,052,420 shares of our common stock outstanding and entitled to vote at the Annual Meeting (not including shares issuable upon exercise of options). Holders of common stock are entitled to one vote per share. Shares of our Series B common stock are not entitled to vote at the Annual Meeting. As of September 15, 2003, there were 999,969 shares of our Series B common stock outstanding, all of which are held by General Motors.

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth information about the beneficial ownership of each class of our securities as of August 31, 2003. It shows shares beneficially owned by each of the following:

| | • | | each person or group of affiliated persons known by us to beneficially own more than 5% of each class of our outstanding securities; |

| | • | | each of the executive officers included in the Summary Compensation Table set forth under the caption “Executive Compensation”; and |

| | • | | all current directors and executive officers as a group |

We have determined the beneficial ownership shown on this table in accordance with the rules of the Securities and Exchange Commission. Under those rules, if a person held options or warrants to purchase shares of our common stock that were currently exercisable or exercisable within 60 days of August 31, 2003, those shares are included in that person’s reported holdings and in the calculation of the percentage of our common stock owned. Except as otherwise provided below, the percentage of beneficial ownership is based on 21,703,175 shares of common stock and 999,969 shares of Series B common stock outstanding as of August 31, 2003. General Motors owns 100% of the outstanding shares of our Series B common stock. To our knowledge, each person named in the table has sole voting and investment power over the shares listed by that person’s name, except where we have shown otherwise in the footnotes or where community property laws affect ownership rights. Except where we show otherwise, the address of each of the persons in this table is: c/o Quantum Fuel Systems Technologies Worldwide, Inc., 17872 Cartwright Road, Irvine, California 92614.

Name of Beneficial Owner

| | Shares

| | | Percent

| |

5% or Greater Stockholders: | | | | | | |

General Motors Corporation (1) | | 4,513,408 | (2) | | 19.9 | % |

SAFECO Corporation (3) | | 2,100,000 | | | 9.2 | |

Directors and Executive Officers: | | | | | | |

Dale L. Rasmussen (4) | | 130,648 | | | * | |

Brian A. Runkel (5) | | 5,000 | | | * | |

Scott Samuelsen (6) | | 5,000 | | | * | |

Thomas J. Tyson (7) | | 5,000 | | | * | |

Alan P. Niedzwiecki (8) | | 43,955 | | | * | |

W. Brian Olson (9) | | 65,200 | | | * | |

Raymond W. Corbin (10) | | 9,000 | | | * | |

Thomas K. Wiedmann (11) | | 11,295 | | | * | |

All current directors and executive officers as a group (9 persons)(12) | | 267,608 | | | 1.2 | % |

5

| * | | Represents less than 1%. |

| (1) | | The address of General Motors Corporation is 300 Renaissance Center, Detroit, Michigan 48265. |

| (2) | | The shares owned by General Motors include 999,969 shares of non-voting Series B common stock, which shares will convert on a one-for-one basis into shares of our common stock in the event General Motors transfers such shares to a person that is not controlled by or under common control with General Motors. |

| (3) | | Based on information contained in the Schedule 13G/A filed on February 10, 2003 by SAFECO Corporation, SAFECO Asset Management Company and SAFECO Common Stock Trust, each of SAFECO Corporation and SAFECO Asset Management Company have shared voting and dispositive power with respect to 2,100,000 shares of our common stock, and SAFECO Common Stock Trust has shared voting and dispositive power with respect to 1,406,700 shares of our common stock. The shares reported by SAFECO Asset Management Company and SAFECO Corporation are owned beneficially by registered investment companies for which SAFECO Asset Management Company and SAFECO Corporation serve as investment advisors, and the shares represented in the table include the 1,406,700 shares reported as owned by SAFECO Common Stock Trust. Each of SAFECO Asset Management Company and SAFECO Corporation disclaim beneficial ownership of the shares reported. The address of SAFECO Asset Management Company is 601 Union Street, Suite 2500, Seattle, WA 98101; the address of SAFECO Corporation is SAFECO Plaza, Seattle, WA 98185; and the address of SAFECO Common Stock Trust is 4854 154th Place, NE, Redmond, WA 98052. |

| (4) | | Includes 101,447 shares issuable upon exercise of outstanding options that are exercisable within 60 days after August 31, 2003. |

| (5) | | Represents 5,000 shares issuable upon exercise of outstanding options that are exercisable within 60 days after August 31, 2003. |

| (6) | | Represents 5,000 shares issuable upon exercise of outstanding options that are exercisable within 60 days after August 31, 2003. |

| (7) | | Represents 5,000 shares issuable upon exercise of outstanding options that are exercisable within 60 days after August 31, 2003. |

| (8) | | Includes 43,680 shares issuable upon exercise of outstanding options that are exercisable within 60 days after August 31, 2003. |

| (9) | | Represents 65,200 shares issuable upon exercise of outstanding options that are exercisable within 60 days after August 31, 2003. |

| (10) | | Represents 9,000 shares issuable upon exercise of outstanding options that are exercisable within 60 days after August 31, 2003. |

| (11) | | Represents 11,295 shares issuable upon exercise of outstanding options that are exercisable within 60 days after August 31, 2003. |

| (12) | | Includes an aggregate of 238,027 shares issuable upon exercise of outstanding options that are exercisable within 60 days after August 31, 2003. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers, and persons who own more than 10% of our common stock to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Executive officers, directors and greater than 10% stockholders are required by Securities and Exchange Commission regulation to furnish us with copies of all Section 16(a) reports they file. To our knowledge, based solely on review of the copies of such reports furnished to us or advise that no filings were required, during fiscal year 2003 all executive officers, directors and greater than 10% beneficial owners complied with the Section 16(a) filing requirements, except as follows: (1) IMPCO, Ms. Johnston and Messrs. Corbin, Niedzwiecki, Rasmussen and Wiedmann filed Form 3 reports one business day after their filing deadline; (2) General Motors has not filed a Form 3 to report its ownership of more that 10% of our outstanding common stock; and (3) Mr. Rasmussen filed a Form 4 report one day late with respect to the sale of an aggregate of 70,000 shares of our common stock.

6

EXECUTIVE COMPENSATION

Compensation Committee Report on Executive Compensation

During the fiscal year ended April 30, 2003, our compensation committee was responsible for establishing and administering the policies that govern the compensation of executive officers, including the named executive officers. Our compensation committee has furnished the following report on executive compensation for fiscal year 2003:

Compensation Philosophy

Compensation of the executive officers is designed to link compensation directly to the company’s growth and financial performance. Compensation consists of base compensation, a Bonus Incentive Plan and options under the Incentive Stock Option Plans. The objective of these three elements, taken together, is to provide reasonable base compensation and to retain, recognize and reward superior performance. The compensation philosophy also ensures that the Company provides a comprehensive compensation package that is competitive in the marketplace.

Base Salary

The base salaries of our executive officers (other than the Chief Executive Officer) are determined primarily on the basis of each executive officer’s responsibility, qualification and experience, as well as the general salary practices of peer companies with which we compete for executive talent. Our compensation committee relies on independent industry surveys to assess our salary competitiveness and salary range for each position. Our compensation committee reviews the base salaries of these executive officers at least annually in accordance with certain criteria determined primarily on the basis of certain factors which include: (i) individual performance, (ii) experience, (iii) the functions performed by the executive officer, and (iv) changes in the compensation peer group in which the Company competes for executive talent. The weight that our compensation committee places on such factors may vary from individual to individual and necessarily involves subjective determinations of individual performance.

Bonus Incentive Plan

Bonuses are paid pursuant to our Bonus Incentive Plan, in which certain executive officers participate. Each executive officer is eligible to receive a discretionary bonus based upon individual performance and upon our performance as a company. For the fiscal year ended April 30, 2003, our compensation committee evaluated the performance of, and set the bonuses payable to, our Chief Executive Officer and our other executive officers. The performance factors utilized by our compensation committee in determining whether bonuses should be awarded to our executive officers included the following: (i) increased profitability of the company, (ii) the executive officer’s overall individual performance during the year, and (iii) the desire of our board of directors to retain the executive officer in the face of competition for executive talent within the industry.

Stock Option Awards

We have granted stock options under our 2002 Stock Incentive Plan generally at prices equal to the fair market value of our common stock on the date of grant. Grants to executive officers are based on various subjective factors primarily relating to the executive officers’ responsibilities, their relative positions in the company, their expected future contributions and prior option grants, and are considered an integral component of total compensation. Our compensation committee believes granting options is beneficial to stockholders because it increases management’s incentive to enhance stockholder value. Grants were proposed by the Chief Executive Officer and reviewed by our compensation committee based on the individual’s overall performance. No specific quantitative weight was given to any particular performance measure. Our compensation committee believes that stock option grants are necessary to retain and motivate the company’s key employees.

7

CEO Compensation

Mr. Niedzwiecki’s base salary for the fiscal year ended April 30, 2003 was $320,000. His base salary was determined primarily based on an analysis of the company’s and Mr. Niedzwiecki’s performance and achievements, and a review of the compensation paid to the chief executive officers of peer companies. Mr. Niedzwiecki’s salary was not based on specific quantitative performance goals and achievements, but rather on the overall performance of the company and Mr. Niedzwiecki as determined by the compensation committee. Mr. Niedzwiecki’s base salary in 2003 increased by $130,000 and he was paid a $50,000 bonus under the Bonus Incentive Plan for fiscal year 2003.

Our chief executive officer participates in our 2002 Stock Incentive Plan. Mr. Niedzwiecki was awarded options to purchase 160,000 shares of our common stock during fiscal year 2003.

Policy Regarding Deductibility of Compensation

Section 162(m) of the Internal Revenue Code (“Section 162(m)”) provides that for federal income tax purposes, the otherwise allowable deduction for compensation paid or accrued to a covered employee of a publicly-held corporation is limited to no more than $1 million per year. We are not presently affected by Section 162(m) because, for the fiscal year ended April 30, 2003, no executive officer’s compensation exceeded $1 million, and we do not believe that the compensation of any executive officer will exceed $1 million for the 2004 fiscal year. Options granted under our 2002 Stock Incentive Plan will be considered performance-based compensation. As performance-based compensation, compensation attributable to options granted under our 2002 Stock Incentive Plan and awarded to covered employees will not be subject to the compensation deduction limitations of Section 162(m).

The Compensation Committee:

Dale L. Rasmussen, Chair

Scott Samuelsen

Thomas J. Tyson

Compensation Committee Interlocks and Insider Participation

Our compensation committee consists of Messrs. Rasmussen, Samuelsen, and Tyson. None of our executive officers serves as a director or member of the compensation committee or other board committee performing equivalent functions of another entity that has one or more executive officers serving on our compensation committee.

Employment Agreements and Change-in-Control Arrangements

Mr. Niedzwiecki serves as President and Chief Executive Officer of the Company pursuant to an employment agreement originally entered into on August 1, 2002, and amended on February 10, 2003. The agreement, as amended, is for a term of three consecutive 12-month periods and provides for an annual base salary of $320,000, subject to annual increases. Mr. Niedzwiecki may also be granted an annual bonus at the discretion of our board of directors. If we terminate Mr. Niedzwiecki’s employment for any reason, (i) we will be obligated to pay a lump sum payment of the full amount of Mr. Niedzwiecki’s base salary and bonus remaining in the term of the agreement, (ii) the benefits specified in the agreement will continue for the remaining months of the fiscal year following the termination, and (iii) all stock options held by Mr. Niedzwiecki will automatically vest.

Mr. Olson serves as Chief Financial Officer of the Company pursuant to an employment agreement originally entered into on September 1, 2002, and amended on February 10, 2003. The agreement, as amended, is for a term of three consecutive 12-month periods and provides for an annual base salary of $250,000, subject to

8

annual increases. Mr. Olson may also be granted an annual bonus at the discretion of the board of directors. If we terminate Mr. Olson’s employment for any reason, (i) we will be obligated to pay a lump sum payment of the full amount of Mr. Olson’s base salary and bonus remaining in the term of the agreement, (ii) the benefits specified in the agreement will continue for a six month period following the termination, and (iii) all stock options held by Mr. Olson will automatically vest.

On March 3, 2003, we entered into an employment agreement with Ray Corbin as Chief Operating Officer. Mr. Corbin resigned from our company in August 2003. The employment agreement was for a term of two consecutive twelve month periods and provided for an annual base salary of $204,750, subject to annual increases. Mr. Corbin could also have been granted an annual bonus at the discretion of the board of directors. If we were to terminate Mr. Corbin’s employment for any reason (i) we would have been obligated to pay a lump sum payment of the full amount of Mr. Corbin’s annual base salary and bonus remaining in the term of the agreement, (ii) the benefits specified in the agreement would have continued for a six month period following the termination, and (iii) all stock options held by Mr. Corbin would have automatically vested.

Summary Compensation Table

Prior to our spin-off from IMPCO on July 23, 2002, we were a wholly-owned subsidiary of IMPCO and the compensation of the individuals named below was determined in accordance with policies established by IMPCO. The information concerning the annual and long-term compensation, including equity compensation, set forth below includes payments and equity compensation awards made for services rendered in all capacities to IMPCO and its subsidiaries prior to the spin-off and to Quantum after the spin-off.

The following table sets forth information concerning the annual and long-term compensation for services rendered for the fiscal years indicated for each individual who served as Chief Executive Officer during the last completed fiscal year and the other most highly compensated executive officers whose total salary and bonus for the fiscal year ended April 30, 2003 exceeded $100,000. These individuals are referred to as the “named executive officers” in this proxy statement.

| | | | | | | Long-Term

Compensation

Awards

| | | |

| | | Fiscal Year

| | Annual Compensation

| | Securities

Underlying Options(2)

| | All Other Compensation

| |

Name and Principal Position

| | | Salary(1)

| | Bonus

| | |

Alan P. Niedzwiecki (3) | | 2003 | | $ | 214,906 | | $ | 50,000 | | 160,000 | | $ | 11,994 | (4) |

President and Chief Executive Officer | | 2002 | | | 138,560 | | | 10,000 | | 40,000 | | | 10,521 | |

| | | 2001 | | | 130,764 | | | 5,000 | | 7,500 | | | 20,155 | |

| | | | | |

W. Brian Olson (5) | | 2003 | | $ | 195,565 | | $ | 50,000 | | 100,000 | | $ | 17,820 | (6) |

Chief Financial Officer and Treasurer | | 2002 | | | 153,846 | | | 80,000 | | 25,000 | | | 14,190 | |

| | | 2001 | | | 142,500 | | | 36,000 | | 20,000 | | | 13,263 | |

| | | | | |

Raymond W. Corbin (7) | | 2003 | | $ | 197,475 | | $ | 20,000 | | 40,000 | | $ | 14,876 | (8) |

Former Chief Operating Officer | | 2002 | | | 195,000 | | | — | | — | | | 14,632 | |

| | | 2001 | | | 184,725 | | | 11,000 | | 5,000 | | | 18,526 | |

| | | | | |

Thomas K. Wiedmann (9) | | 2003 | | $ | 175,875 | | $ | — | | 40,000 | | $ | 13,757 | (10) |

Director of Contract Services & Electronic | | 2002 | | | 175,000 | | | — | | — | | | 16,336 | |

Controls | | 2001 | | | 136,923 | | | 7,000 | | 3,035 | | | 15,491 | |

| (1) | | Includes amounts deferred by executive officers pursuant to the IMPCO or Quantum Employee Savings Plan or the IMPCO Deferred Compensation Plan. |

| (2) | | Consists of options granted under our 2002 Stock Incentive Plan or IMPCO’s incentive stock option plans. In connection with our spin-off from IMPCO, each outstanding option to purchase IMPCO common stock |

9

| | was converted into an adjusted IMPCO option and an option to purchase the same number of shares of Quantum common stock. Please see “Treatment of IMPCO Options in the Spin-Off” for a description of those option adjustments. |

| (3) | | Mr. Niedzwiecki was appointed as President in February 2002 and as Chief Executive Officer in August 2002. |

| (4) | | Includes a group term life insurance premium of $96, an automobile allowance of $10,892, and a matching contribution of $1,006 pursuant to the Quantum Employee Savings Plan. |

| (5) | | Mr. Olson joined Quantum on August 27, 2002 and formerly served as Chief Financial Officer of IMPCO. |

| (6) | | Includes a group term life insurance premium of $82, a matching contribution of $5,738 pursuant to the IMPCO Employee Savings Plan and an automobile allowance of $12,000. |

| (7) | | Mr. Corbin resigned as our Chief Operating Officer in August 2003. |

| (8) | | Includes a group term life insurance premium of $147, an automobile allowance of $8,815, and a matching contribution of $5,914 pursuant to the Quantum Employee Savings Plan. |

| (9) | | Mr. Wiedmann was Vice President of Research and Development until February 2003 and was designated as one of our executive officers until June 2003. |

| (10) | | Includes a group term life insurance premium of $88, an automobile allowance of $8,400, and a matching contribution of $5,269 pursuant to the Quantum Employee Savings Plan. |

Option Grants in Last Fiscal Year

The following table provides summary information regarding options to purchase our common stock granted to each of the named executive officers in fiscal year 2003. The table does not include Quantum options granted to the named executive officers as a result of the option adjustments made in connection with our spin-off from IMPCO. For a description of those option adjustments, please see “Treatment of IMPCO Options in the Spin-Off” below.

| | | | | Individual Grants

| | | | Potential Realizable Value at Assumed Annual Rates of Stock

Price Appreciation for

Option Term (3)

|

| | | Number of

Securities

Underlying

Options Granted (1)

| | Percent of

Total Options

Granted in

Fiscal Year (2)

| | | Exercise

Price

Per Share (1)

| | Expiration Date

| |

Name

| | | | | | 5%

| | 10%

|

Alan P. Niedzwiecki | | 160,000 | | 13.2 | % | | $ | 3.65 | | 7/25/12 | | $ | 367,274 | | $ | 930,746 |

W. Brian Olson | | 100,000 | | 8.3 | | | | 3.62 | | 8/27/12 | | | 195,082 | | | 525,060 |

Raymond W. Corbin | | 40,000 | | 3.3 | | | | 3.65 | | 7/25/12 | | | 91,819 | | | 232,686 |

Thomas K. Wiedmann | | 40,000 | | 3.3 | | | | 3.65 | | 7/25/12 | | | 91,819 | | | 232,686 |

| (1) | | Options were granted at the fair market value of Quantum common stock on the date of grant and vest cumulatively at the rate of 25% on the first anniversary of the date of grant and 25% each year thereafter so that the employee is 100% vested after four years. However, the options will become fully vested upon the optionee’s retirement at or after age 62 following at least five years of continuous service with Quantum. Options may be exercised only while an optionee is employed by Quantum, or within thirty days following termination of such employment. If termination results from death or disability, options may be exercised within one year of the termination date. In no event may options be exercised more than ten years after the date of grant. In the event of a change of control, the board may in its sole discretion give all or certain optionees the right to exercise all or any portion of their unvested options. In addition, Messrs. Niedzwiecki, Olson and Corbin have agreements that provide for acceleration of vesting under certain conditions as described in “Employment Agreements and Change-in-Control Arrangements” above. |

| (2) | | Based on options to purchase an aggregate of 1,210,500 shares of common stock granted to Quantum’s employees and directors during the 2003 fiscal year. The aggregate number of options does not include Quantum options granted solely as a result of the option adjustments made in connection with our spin-off from IMPCO. |

| (3) | | The 5% and 10% assumed annual rates of compounded stock price appreciation are mandated by rules of the SEC and do not represent our estimate or projection of the future prices of our common stock. |

10

Aggregate Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth information concerning exercises of options to purchase our common stock during fiscal year 2003 and the value of unexercised options to purchase our common stock held by the named executive officers at the end of fiscal year 2003.

| | | Shares

Acquired on

Exercise

| | Value

Realized (1)

| | Number of Securities

Underlying Unexercised Options at

Fiscal Year End

| | Value of Unexercised In-The-Money Options at

Fiscal Year End (2)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Alan P. Niedzwiecki | | — | | $ | — | | 3,000 | | 204,500 | | $ | — | | $ | — |

W. Brian Olson | | — | | | — | | 35,400 | | 142,600 | | | — | | | — |

Raymond W. Corbin | | — | | | — | | 2,000 | | 43,000 | | | — | | | — |

Thomas K. Wiedmann | | — | | | — | | 1,295 | | 41,846 | | | — | | | — |

| (1) | | Calculated by determining the difference between the fair market value of the common stock underlying the options on the date each option was exercised and the exercise price of the options. |

| (2) | | Calculated by determining the difference between the fair market value of the common stock underlying the options on April 30, 2003 and the exercise price of the options. |

Treatment of IMPCO Options in the Spin-Off

On the date of our spin-off from IMPCO, each outstanding option to purchase IMPCO common stock was converted into two options: an option to purchase the same number of shares of IMPCO common stock covered by the original IMPCO option and an option to purchase the same number of shares of Quantum common stock. The exercise prices per share for each converted IMPCO option and Quantum option were adjusted in a manner so that:

| | • | | the aggregate “intrinsic value” (which is the market value of the stock underlying the option, less the exercise price of that option, multiplied by the number of shares then covered by that option) after the distribution of the converted IMPCO option plus the intrinsic value of the new Quantum option was not greater than the intrinsic value of the original IMPCO option immediately prior to the distribution; |

| | • | | the ratio of the exercise price of the converted IMPCO option to the market value per share of IMPCO common stock after the distribution was not lower than the ratio of the exercise price of the original IMPCO option to the market value per share of IMPCO common stock immediately prior to the distribution; and |

| | • | | the ratio of the exercise price of the new Quantum option to the market value per share of Quantum common stock after the distribution was not lower than the ratio of the exercise price of the original IMPCO option to the market value per share of IMPCO common stock immediately prior to the distribution. |

The terms of each converted IMPCO option and each new Quantum option (other than the exercise price and the number of shares) remained substantially the same as the original IMPCO options from which they were converted, except that the converted IMPCO options were amended to allow for vesting based on the continuation of the holder’s employment with either IMPCO or Quantum or their respective subsidiaries, as the case may be, and will give credit for continuous employment with IMPCO or Quantum or their respective subsidiaries prior to the distribution date. All of the Quantum options issued in connection with the distribution were non-qualified stock options. The vesting of each new Quantum option is subject to the same vesting schedule as the original IMPCO option and continuation of the holder’s employment with either IMPCO or Quantum or their respective subsidiaries, as the case may be, with credit given for continuous employment with IMPCO or Quantum or their respective subsidiaries, prior to the distribution date. The Quantum options granted with respect to each original IMPCO option were issued under our 2002 Stock Incentive Plan.

11

COMPARATIVE STOCK PERFORMANCE

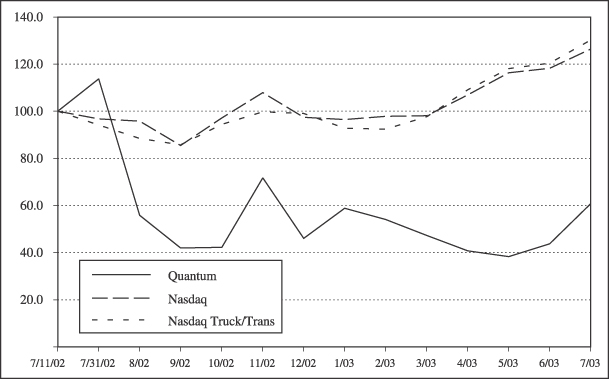

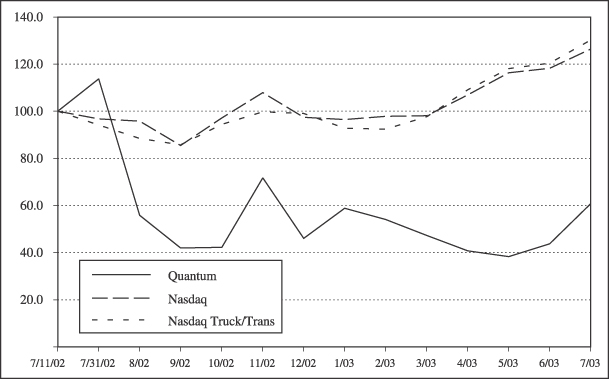

The following performance graph compares the cumulative stockholder return on our common stock on a monthly basis (as of the last trading day of each month) assuming an initial investment of $100, for the period beginning on July 11, 2002 and ending on July 31, 2003, with the cumulative total return of a broad market index (Nasdaq Stock Market—CRSP Total Return Index) and an industry index (Nasdaq Trucking and Transportation Stock Index) for the same period. We paid no dividends during the periods shown; the performance of the indexes is shown on a total return (dividend reinvestment) basis. The graph lines merely connect the prices on the dates indicated and do not reflect fluctuations between those dates.

Pursuant to the rules and interpretations of the SEC, the chart below is calculated using as the beginning measurement period the closing price of our common stock on July 11, 2002 (the first day of trading of our common stock on the Nasdaq National Market on a “when-issued” basis), which was $5.10. The comparisons in the graph below are based on historical data and are not intended to forecast the possible future performance of our common stock.

Measurement Date

| | Quantum

| | Nasdaq Total

Return Index

| | Nasdaq Trucking

and Transportation

Index

|

7/11/02 | | $ | 100.00 | | $ | 100.00 | | $ | 100.00 |

7/31/02 | | $ | 113.73 | | $ | 96.76 | | $ | 94.19 |

8/02 | | $ | 55.88 | | $ | 95.74 | | $ | 88.52 |

9/02 | | $ | 41.96 | | $ | 85.44 | | $ | 85.72 |

10/02 | | $ | 42.18 | | $ | 97.12 | | $ | 94.44 |

11/02 | | $ | 71.76 | | $ | 107.94 | | $ | 99.71 |

12/02 | | $ | 46.08 | | $ | 97.48 | | $ | 98.99 |

1/03 | | $ | 58.82 | | $ | 96.42 | | $ | 92.74 |

2/03 | | $ | 54.12 | | $ | 97.78 | | $ | 92.42 |

3/03 | | $ | 47.25 | | $ | 98.06 | | $ | 97.70 |

4/03 | | $ | 40.78 | | $ | 106.97 | | $ | 109.05 |

5/03 | | $ | 38.24 | | $ | 116.37 | | $ | 118.02 |

6/03 | | $ | 43.73 | | $ | 118.23 | | $ | 120.44 |

7/03 | | $ | 60.78 | | $ | 126.41 | | $ | 130.18 |

The report of the compensation committee of the board of directors on executive compensation and the performance graph that appears above shall not be deemed to be soliciting material or to be filed under the Securities Act or the Exchange Act, or incorporated by reference in any document so filed.

12

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Prior to our spin-off from IMPCO, each of our executive officers served as an officer or employee of IMPCO and/or its other subsidiaries. In acting on our behalf, these officers considered not only the short-term and long-term impact of operating decisions on our business, but also the impact of such decisions on the business of IMPCO. One of our directors, Dale Rasmussen, remains employed by IMPCO and will continue to serve as IMPCO’s Senior Vice President and Secretary.

During the 2003 fiscal year, we had revenue of approximately $94,000 for products and services sold to IMPCO, and we purchased approximately $482,000 in products and services from IMPCO.

In December 2002, we entered into indemnification agreements with each of our directors and executive officers that provide the maximum indemnity available to directors and officers under Section 145 of the Delaware General Corporation Law and our charter, as well as certain additional procedural protections.

Agreements with IMPCO

In connection with the contribution of assets by IMPCO to us immediately prior to the spin-off, IMPCO contributed $15.0 million in cash and assumed $8.6 million of our outstanding debt. In connection with the distribution, we entered into a Contribution and Distribution Agreement and several ancillary agreements with IMPCO that define our ongoing relationship after the distribution and to allocate tax, employee benefits and certain other liabilities and obligations arising from periods prior to the distribution date. We entered into these agreements with IMPCO while we were still a wholly-owned subsidiary of IMPCO and, while we believe the terms of these agreements reflect arms’ length transactions, these agreements may not be the same as would have been obtained through negotiations with an unaffiliated third party. Each of these agreements has been listed as an exhibit to our Annual Report on Form 10-K for the 2003 fiscal year. The following description is only a summary and is qualified by reference to the filed exhibits.

Contribution and Distribution Agreement

We entered into a Contribution and Distribution Agreement with IMPCO which provides for, among other things, certain corporate transactions required to effect the distribution and other arrangements among us and IMPCO subsequent to the distribution. The agreement provided that IMPCO would transfer to us the assets constituting IMPCO’s automotive OEM business. The agreement provides for, among other things, assumptions of liabilities and cross-indemnities designed to place financial responsibility on each of us and IMPCO for the liabilities of our respective business.

Under the agreement, if we or IMPCO act or fail to act in a manner which causes the distribution to fail to qualify under Section 355 of the Internal Revenue Code or causes Section 355(e) of the Internal Revenue Code to apply to the distribution, we or IMPCO will indemnify the other for any tax liability arising from such failure or application.

We and IMPCO have agreed to a non-competition arrangement under the Contribution and Distribution Agreement whereby each party will be restricted from engaging in competitive activities with the other party for a period of three years. Each party will refrain from directly competing with the retained businesses of the other party in such other party’s designated market (including such party’s OEM market) and/or aftermarket and from engaging in business with specified competitors of the other party. Additionally, IMPCO will refrain from engaging in business with Quantum’s OEM customers specified in the agreement for a three-year period.

Under the Contribution and Distribution Agreement, IMPCO has retained rights to use, on a royalty-free basis, the existing technology for our TriShield™ tanks, and to manufacture tanks using such technology, in certain markets, which include the automotive aftermarket, bus and truck aftermarket, the industrial aftermarket for

13

vehicles with internal combustion engines, and the bus and truck and industrial OEM markets for vehicles with internal combustion engines. Subject to the non-competition restrictions discussed above, we will be free to commercialize our TriShield™ tanks in other markets, including the worldwide OEM market for Class 1 through 5 vehicles which are powered by fuel cell applications on an exclusive basis, the OEM market in the United States and Canada for Class 1 through 5 vehicles with internal combustion engines (other than diesel vehicles) on an exclusive basis and in all other countries on a non-exclusive basis, the worldwide OEM market in the United States and Canada for Class 6 vehicles on a non-exclusive basis, the worldwide market for components, systems and subsystems for fuel cell applications on an exclusive basis, the worldwide industrial OEM market for vehicles powered by fuel cell applications on an exclusive basis, and the worldwide industrial aftermarket for vehicles powered by fuel cell applications on an exclusive basis. Each party has a right to use the modifications and improvements made by the other party to such TriShield™ technology, if any, on a royalty-bearing basis at reasonable commercial rates in the designated market for such party. These rights will last for a minimum period of five years from the date of the distribution.

The agreement also provides for a full release and discharge of all liabilities existing or arising from all acts and events occurring or failing to occur or alleged to have occurred or to have failed to occur and all conditions existing or alleged to have existed on or before the date of the agreement, between or among us or any of our subsidiaries or affiliates, on the one hand, and IMPCO or any of its subsidiaries or affiliates other than our company, on the other hand, except as expressly set forth in the agreement. The agreement also provides that, except as otherwise set forth therein or in any related agreement, all costs or expenses incurred in connection with the distribution and not paid prior to the distribution will be charged to and paid by us. Each party will pay its own expenses after the distribution.

Employee Benefit Matters Agreement

We entered into an Employee Benefit Matters Agreement with IMPCO pursuant to which we agreed to create independent retirement and other employee benefit plans that are substantially similar to IMPCO’s existing retirement and other employee benefit plans. Under the agreement and effective immediately after the distribution, IMPCO transferred the assets and liabilities of its existing 401(k) retirement and other benefit plans related to our employees to the comparable Quantum benefit plans. Generally, following the distribution, IMPCO ceased to have any continuing liability or obligation to our current employees and their beneficiaries under any of IMPCO’s benefit plans, programs or practices.

Pursuant to the Employee Benefit Matters Agreement, all IMPCO stock options that were outstanding on the record date and that had not been exercised prior to the distribution date were converted into two stock options: (1) an option to purchase the number of previously-unexercised IMPCO stock options as of the record date, and (2) an option to purchase a number of shares of our common stock equal to the number of previously-unexercised IMPCO stock options times a fraction, the numerator of which is the total number of shares of our common stock distributed to IMPCO stockholders in the distribution and the denominator of which is the total number of IMPCO shares outstanding on the record date for the distribution.

Tax Allocation and Indemnification Agreement

We and IMPCO entered into a Tax Allocation and Indemnification Agreement, which allocates tax liabilities between us and IMPCO and addresses certain other tax matters such as responsibility for filing tax returns and the conduct of audits and other tax proceedings for taxable periods before and after the distribution date. IMPCO will be responsible for and will indemnify us against all tax liabilities relating to the assets and entities that constitute IMPCO and its subsidiaries, and we will be responsible for and will indemnify IMPCO against all tax liabilities relating to the assets and entities that constitute our business. In addition, we generally will indemnify IMPCO for all tax liabilities arising if the contribution is not tax-free, other than tax liabilities arising in connection with our assumption of certain IMPCO liabilities.

14

Transition Services Agreement

We entered into a Transition Services Agreement with IMPCO pursuant to which IMPCO provided us with various administrative services. Those services included employee benefits administration, affirmative action and immigration administration, and payroll processing. We paid fees to IMPCO for services provided in amounts based on IMPCO’s loaded costs incurred in providing such services. This agreement expired on January 23, 2003; however, IMPCO continues to share certain investor relations services with us. Since our spin-off from IMPCO, Dale Rasmussen, IMPCO’s Senior Vice President, has provided these investor relations services to us, for which we have made payments to IMPCO of an aggregate $319,324 for salary, overhead and related expenses for the period ending August 31, 2003. Of this amount, Mr. Rasmussen has received $98,250 from IMPCO as a portion of Mr. Rasmussen’s annual salary from IMPCO. Mr. Rasmussen is also a member of our board of directors.

Strategic Alliance Agreement

We entered into a Strategic Alliance Agreement with IMPCO pursuant to which we will work with IMPCO in identifying and conducting research and development programs of mutual interest. As part of such research and development activities, we may develop, solely or jointly with IMPCO, technology that is owned solely by us or jointly with IMPCO. The other purpose of this relationship is to provide IMPCO access to our advanced technologies, including the CNG storage tanks, fuel injectors, in-tank regulators and other products, for use in automotive, bus and truck and industrial aftermarket applications and in the bus and truck and industrial OEM markets.

Agreements with General Motors

We have entered into a strategic alliance with General Motors regarding the development of fuel cell systems. Under the terms of the strategic alliance, General Motors acquired shares of our stock representing 19.9% of our issued and outstanding capital stock following the distribution. We entered into the agreements described below with General Motors in connection with the alliance. These agreements have been listed as exhibits to our Annual Report on Form 10-K for the 2003 fiscal year. The following description is only a summary and is qualified by reference to the filed exhibits.

Corporate Alliance Agreement

The Corporate Alliance Agreement between us and General Motors serves to formalize our agreement to work together to advance and commercialize, on a global basis, fuel cell systems, and the market for fuel cells to be used in transportation, mobile, stationary and portable applications. The Corporate Alliance Agreement became effective upon the distribution and has a term of ten years. The agreement provides that:

| | • | | General Motors is obligated to actively support, endorse and recommend us to its customer base; |

| | • | | General Motors will assist and provide guidance with respect to our directed research and development of fuel cell applications; |

| | • | | we will appoint one individual nominated by General Motors to our board of directors prior to or promptly after the distribution, and thereafter during the term of the agreement we will continue to nominate one individual designated by General Motors to our proposed slate of directors to be presented to our stockholders as necessary for General Motors to retain one seat on our board of directors; |

| | • | | General Motors will be entitled to appoint an “ex-officio” board member with non-voting capacity during the term of the agreement; |

| | • | | we committed to spend $4.0 million annually for specific research and development projects directed by General Motors to speed the commercialization of our fuel cell related products; and |

| | • | | beginning three years after the effective date of the agreement, we will pay General Motors a percentage of gross revenues derived from sales of applications developed under the strategic alliance. |

15

We retain the ownership of our existing technology and we and General Motors will jointly own technology that is jointly created under the alliance. We are free to use jointly created technologies in certain aspects of our business but will be required to share revenues with General Motors on fuel cell system-related products that are sold to General Motors or third parties. Under the agreement, General Motors has a right of first refusal in the event that we propose to sell, or otherwise transfer our fuel cell related intellectual property contemplated under the Corporate Alliance Agreement. In the event that we decide to discontinue operations or are deemed insolvent, General Motors has the right to purchase the intellectual property contemplated under the Corporate Alliance Agreement at a price to be determined by an independent appraisal firm approved by both us and General Motors.

Stock Transfer Agreement

We entered into a Stock Transfer Agreement pursuant to which we agreed to issue to General Motors shares of our Series A common stock representing 19.9% of our total issued and outstanding capital stock after the distribution. We issued the Series A common stock immediately following the distribution. The Series A common stock automatically converted into common stock upon the closing of our initial public offering in January 2003. We also agreed that, subject to limited exceptions, we would not issue any stock in a private placement transaction without the prior written consent of General Motors.

Registration Rights Agreement

We entered into a Registration Rights Agreement with General Motors pursuant to which General Motors may demand that we file a registration statement under the Securities Act covering some or all of our common stock General Motors would receive upon conversion of its Quantum Series A common stock. General Motors may make this demand any time after the earlier of three years following the distribution or six months after the effective date of our first registration statement for a public offering of our securities to the general public, which was January 16, 2003. We are not required to effect more than two demand registrations nor are we required to effect a registration if the requested registration would have an aggregate offering price to the public of less than $20 million. In an underwritten offering, the managing underwriter of any such offering has the right to limit the number of registrable securities to be included in the registration statement.

General Motors also has “piggyback” registration rights. If we propose to register any of our equity securities under the Securities Act other than pursuant to the demand registration rights described above or certain excluded registrations, General Motors may require us to include all or a portion of its registrable Quantum securities in the registration and in any related underwriting. Further, if we are eligible to effect a registration on Form S-3, General Motors may demand that we file a registration statement on Form S-3 covering all or a portion of General Motors’ registrable Quantum securities, provided that the registration has an aggregate offering price of at least $10 million. We will not be required to effect more than two such registrations in any twelve month period. In general, we will bear all fees, costs, and expenses of such registrations, other than underwriting discounts and commissions. We also agreed to take such reasonable actions as are necessary to make Rule 144 available to General Motors for the resale of its registrable Quantum securities without registration under the Securities Act.

Master Technical Development Agreement

Under the terms of our Master Technical Development Agreement with General Motors, we have agreed to work with General Motors to facilitate the integration, interface, and optimization of General Motors’ fuel cell systems with our gaseous fuel storage and handling modules. To that end, the agreement provides for the establishment of joint Quantum/General Motors technical teams to implement statements of work with respect to the development of fuel cell applications. In addition, the agreement provides that both we and General Motors will license our fuel cell related technologies to each other for the purpose of developing, manufacturing, and selling the fuel cell applications developed under our strategic alliance.

16

REPORT OF THE AUDIT COMMITTEE

We have reviewed and discussed with management the Company’s audited financial statements as of and for the fiscal year ended April 30, 2003.

We have discussed with Ernst & Young LLP, the Company’s independent public accountants, the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants.

We have received and reviewed the written disclosures and the letter from Ernst & Young LLP required by Independence Standard No. 1, Independence Discussions with Audit Committees, as amended, by the Independence Standards Board, and have discussed with the auditors their independence.

Based on the reviews and discussions referred to above, we recommend to the Board of Directors that the financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2003.

We have also considered whether the provision of services by Ernst & Young LLP, other than services related to the audit of the financial statements referred to above and the review of the interim financial statements included in the Company’s quarterly reports on Form 10-Q for the most recent fiscal year, is compatible with maintaining the independence of Ernst & Young LLP.

The Audit Committee

Thomas J. Tyson, Chair

Brian A. Runkel

Scott Samuelsen

17

PROPOSAL II

RATIFICATION OF APPROVAL OF INDEPENDENT PUBLIC ACCOUNTANTS

Our Audit Committee has appointed Ernst & Young LLP as our independent public accountants for the fiscal year ending April 30, 2004. Although not required to be voted upon by the stockholders, our Audit Committee and Board of Directors deem it appropriate for the approval to be submitted for ratification by the stockholders. The persons named in the accompanying proxy will vote the common stock represented by the proxy for ratification of the approval of Ernst & Young LLP, unless a contrary choice has been specified in the proxy. If the stockholders do not ratify the approval of Ernst & Young LLP by a majority vote, the approval of independent public accountants will be considered by our Audit Committee, although the committee would not be required to approve different independent public accountants. A representative of Ernst & Young LLP is expected to be present at the Annual Meeting and will have the opportunity to make a statement if he or she desires to do so. Such representative is expected to be available to respond to appropriate questions.

The Audit Committee considered whether Ernst & Young LLP’s provision of any professional services other than its audit of our annual financial statements and reviews of quarterly financial statements is compatible with maintaining such auditor’s independence.

Audit and Other Professional Fees

We incurred the following fees to Ernst & Young LLP during the 2003 fiscal year:

Audit Fees

The aggregate fees billed by Ernst & Young LLP for professional services rendered for the audit of our annual financial statements for the fiscal year ended April 30, 2003, and for the review of the financial statements included in our Quarterly Reports on Form 10-Q for that fiscal year were $123,000.

Audit-Related Fees

The aggregate fees billed by Ernst & Young LLP for professional services rendered during the 2003 fiscal year, other than services described above under “Audit Fees,” were $200,800, which consisted of $65,000 related to the audit of our financial statements included in our Form 10 registration statement and our spin-off from IMPCO, $76,500 related to the inclusion of our financial statements in our registration statement in connection with our initial public offering, $9,500 related to the incorporation by reference of our financial statements in our registration statement on Form S-8, and $49,800 related to the inclusion of our financial statements in our proxy statement filed with the SEC in connection with a proposed acquisition.

Tax Fees

Ernst & Young LLP billed us an aggregate of $975 for professional services rendered in our 2003 fiscal year for tax compliance, tax advice, and tax planning.

All Other Fees

Ernst & Young LLP did not bill us for any other fees as they did not perform any services other than those reported in the foregoing paragraphs.

Pre-Approval of Services by Auditors

The Audit Committee of our Board of Directors has adopted a policy requiring that all services provided to us by our independent auditors be pre-approved by the Audit Committee. The policy pre-approves specific types of services that our independent auditors may provide us if the types of services do not exceed specified cost

18

limits. Any type of service that is not clearly described in the policy, as well as any type of described service that would exceed the pre-approved cost limit set forth in the policy, must be explicitly approved by the Audit Committee prior to any engagement with respect to that type of service. The Audit Committee will review the pre-approval policy and establish fee limits annually, and may revise the list of pre-approved services from time to time.

Additionally, the Audit Committee delegated to its Chairman the authority to explicitly pre-approve engagements with our independent auditors, provided that any pre-approval decisions must be reported to the Audit Committee at its next scheduled meeting. If explicit pre-approval is required for any service, our Chief Financial Officer and our independent auditor must submit a joint request to the Audit Committee or its Chairman describing in detail the specific services proposed and the anticipated costs of those services, as well as a statement as to whether and why, in their view, providing those services will be consistent with the SEC’s rules regarding auditor independence.

The Board of Directors recommends a vote “FOR” ratification of the appointment of Ernst & Young LLP as our independent public accountants for Fiscal Year 2004.

19

PROPOSALS OF STOCKHOLDERS

Stockholders may submit proposals on matters appropriate for stockholder action at subsequent annual meetings of Quantum consistent with Rule 14a-8 promulgated under the Securities Exchange Act of 1934. Proposals of stockholders intended to be presented at our next annual meeting of stockholders must be received by our corporate secretary at the address shown at the top of page one of this Proxy Statement, no later than May 25, 2004, for inclusion in our proxy statement and form of proxy for that meeting. In order for a stockholder proposal not intended to be subject to Rule 14a-8 (and thus not subject to inclusion in our Proxy Statement) to be considered “timely” within the meaning of Rule 14a-4 under the Securities Exchange Act of 1934, and pursuant to our Amended and Restated Bylaws, stockholders must submit such proposals in writing to our corporate secretary at the address shown at the top of page one not later than 90 nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting; provided however, that in the event that the date of the annual meeting is advanced by more than 30 days, or delayed by more than 60 days, from such anniversary date, notice by the stockholder must be received not earlier than the close of business on the 120th calendar day prior to such annual meeting and not later than the close of business on the later of the 90th calendar day prior to such annual meeting or the 10th calendar day following the calendar day on which public announcement of the date of such meeting is first made by Quantum. A stockholder’s notice to our corporate secretary must set forth for each matter proposed to be brought before the annual meeting (a) as to each person whom the stockholder proposes to nominate for election or re-election as a director all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected; (b) as to any other business that the stockholder proposed to bring before the meeting, a brief description of the business desired to be brought before the meeting, the reasons for conducting such business at the meeting and any material interest in such business of such stockholder and the beneficial owner, if any, on whose behalf the proposal is made; and (c) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made (i) the name and address of such stockholder, as they appear on the corporation’s books, and of such beneficial owner and (ii) the class and number of shares of Quantum which are owned beneficially and of record by such stockholder and such beneficial owner. In the event that the number of directors to be elected to our board of directors is increased and there is no public announcement by Quantum naming all of the nominees for director or specifying the size of the increased board of directors at least 100 calendar days prior to the first anniversary of the preceding year’s annual meeting, a stockholder’s notice will also be considered timely, but only with respect to nominees for any new positions created by such increase, if it is delivered to our corporate secretary at our principal executive offices not later than the close of business on the 10th calendar day following the day on which such public announcement is first made by Quantum.

OTHER INFORMATION

Our Annual Report to Stockholders for the fiscal year ended April 30, 2003 is enclosed with this Proxy Statement.Copies of our Annual Report on Form 10-K for the year ended April 30, 2003, as filed with the Securities and Exchange Commission, will be provided to stockholders without charge upon written request to Cathryn T. Johnston, Secretary, Quantum Fuel Systems Technologies Worldwide, Inc., 17872 Cartwright Road, Irvine, CA 92614.

20

OTHER BUSINESS

As of the date of this Proxy Statement, management knows of no other business that will be presented for action at the Annual Meeting. If any other business requiring a vote of the stockholders should come before the Annual Meeting, the persons named in the enclosed form of proxy will vote or refrain from voting in accordance with their best judgment.

| By Order of the Board of Directors, |

|

|

| Cathryn T. Johnston |

| Secretary |

Irvine, California

September 22, 2003

21

PROXY

QUANTUM FUEL SYSTEMS TECHNOLOGIES WORLDWIDE, INC.

ANNUAL MEETING OF STOCKHOLDERS—OCTOBER 23, 2003

THIS PROXY IS BEING SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS.

The undersigned hereby appoints Alan P. Niedzwiecki and W. Brian Olson, and each of them, with full power of substitution as proxies and agents, in the name of the undersigned, to attend the Annual Meeting of Stockholders of Quantum Fuel Systems Technologies Worldwide, Inc., a Delaware corporation, to be held at the Marriott Hotel, 18000 Von Karman, Irvine, California, on Thursday, October 23, 2003 at 1:30 p.m. local time, or any adjournment thereof, and to vote the number of shares of Common Stock of the Company that the undersigned would be entitled to vote, and with all the power the undersigned would possess, if personally present, as follows:

THIS PROXY WHEN PROPERLY EXECUTED AND RETURNED TO THE COMPANY WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER(S). IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR ALL NOMINEES FOR THE BOARD AND FOR PROPOSAL 2.

|

Address Change/Comments (Mark the corresponding box on the reverse side) |

|

| |

|

| |

|

^ FOLD AND DETACH HERE ^

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSALS 1 AND 2.

| ¨ | | Please Mark Here for Address Change or Comments | | |

| | |

| | | SEE REVERSE SIDE | | |

1. ELECTION OF DIRECTORS

Director Nominee: 01 Scott Samuelson (term to expire at annual stockholders’ meeting in 2007 fiscal year)

Director Nominee: 02 Thomas J. Tyson (term to expire at annual stockholders’ meeting in 2007 fiscal year)

| ¨ | | FORthe nominees. | | |

| | |

| ¨ | | WITHHOLD AUTHORITYto vote for the nominees. | | |

INSTRUCTION: To withhold authority to vote for either nominee, write that nominee’s name in the space provided below.

2 PROPOSAL TO RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP as the Company’s independent accountants for the Company’s current fiscal year.

| ¨ | | FOR | | ¨ | | AGAINST | | ¨ | | ABSTAIN |

3. In their discretion, the proxy agents named above are authorized to vote on such other business as may properly come before the meeting or any adjournment thereof.