UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-21034

SANFORD C. BERNSTEIN FUND II, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Mark R. Manley

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: September 30, 2007

Date of reporting period: March 31, 2007

ITEM 1. REPORTS TO STOCKHOLDERS.

2

SANFORD C. BERNSTEIN FUND II, INC.

INTERMEDIATE DURATION INSTITUTIONAL PORTFOLIO

SEMI-ANNUAL REPORT

MARCH 31, 2007

Portfolio Manager Commentary

To Our Shareholders—May 1, 2007

This report provides management’s discussion of fund performance for the one portfolio of the Sanford C. Bernstein Fund, II, Inc. for the semi-annual reporting period ended March 31, 2007.

Investment Objective and Strategy

Bernstein Intermediate Duration Institutional Portfolio (the “Portfolio”) seeks to provide safety of principal and a moderate to high rate of current income. The Portfolio seeks to maintain an average portfolio quality minimum of A, based on ratings given to the Portfolio’s securities by national rating agencies (or, if unrated, determined by the Manager to be of comparable quality).

Many types of securities may be purchased by the Portfolio, including corporate bonds, notes, U.S. Government and agency securities, asset-backed securities (ABS), mortgage related securities, bank loan debt, preferred stock, and inflation-protected securities, as well as others. The Portfolio may also invest up to 25% of its total assets in fixed-income, non-U.S. dollar denominated foreign securities, and may invest without limit in fixed-income, U.S. dollar denominated foreign securities, in each case in developed or emerging-markets countries. The Portfolio may use derivatives, such as options, futures, forwards and swaps. The Portfolio may invest up to 25% of its total assets in fixed-income securities rated below investment-grade (BB or below) by national rating agencies (commonly known as “junk bonds”). Not more than 5% of the Portfolio’s total assets may be invested in fixed-income securities rated CCC by national rating agencies. The Portfolio seeks to maintain an effective duration of three to six years under normal market conditions.

Investment Results

The chart on page 3 shows performance for the Portfolio compared with its benchmark, the Lehman Brothers Aggregate Bond Index, for the six- and 12-month periods ended March 31, 2007.

The Portfolio outperformed its benchmark for the six-month period and matched the benchmark’s performance for the 12-month period ended March 31, 2007. The Portfolio’s high-yield security selection and overweight position in commercial mortgage-backed securities (CMBS) detracted from performance during the six-month period, while the Portfolio’s hedged non-U.S. government, emerging market and bank loan holdings contributed to performance during the same period.

For the 12-month period, the Portfolio’s ABS and CMBS security selection and overweight position detracted from performance. During the same period, hedged non-U.S. government holdings in Japan, Mexico and Poland, an allocation to emerging markets debt, a Treasury/Agency underweight and corporate security selection all contributed positively to Portfolio performance.

Market Review and Investment Strategy

The U.S. Federal Reserve kept official rates on hold at 5.25% during the six-month period ended March 31, 2007. Yields fell at the short end of the yield curve while long-term yields rose slightly. Two-year yields lost 11 basis points to yield 4.58%, while the ten-year yield rose two basis points to end the period at 4.65%. Market volatility remained relatively subdued despite the limited spike in late February 2007 and early March 2007, due to concerns over subprime mortgage delinquencies. The bout of volatility roiled the lowest subprime mortgage sector, but was limited without effect on market sectors.

By index sector, mortgage-backed securities (MBS) posted the strongest returns among U.S. bond sectors at 3.19% for the semi-annual period ended March 31, 2007, despite some volatility during the period. Investment-grade corporates returned 2.86%, as solid fundamentals offset increasing event risk. CMBS posted returns of 2.65% and 2.53% respectively, according to Lehman Brothers, underpinned by strong technical demand.

Non-U.S. government debt did not fare quite as well as U.S. Treasuries, as several central banks outside of the U.S. began raising interest rates during the period. Global Treasuries (ex-U.S.) hedged into U.S. dollars posted an average return of 1.75% for the semi-annual period (versus 2.18% for U.S. Treasuries). Non-U.S. holdings in the Portfolio included Japan at 3.39%, Sweden at 1.62%, Poland at 4.72% and Mexico at 5.73% (returns hedged into U.S. dollars).

During the semi-annual reporting period, the Portfolio held a neutral to shorter-than-benchmark duration and an underweight position in U.S government bonds. The Portfolio was also overweighted in both mortgages and CMBS as sources of high-quality incremental yield. An underweight position was maintained in investment-grade corporates due to historically tight spreads, a flat yield curve and increased event risk, with the underweight focused in longer maturity corporates which are inherently more vulnerable to event risk. Hedged non-U.S. government bonds were continually employed, which offered an attractive yield over domestic bonds. As such, positions were held in several countries including Japan, Mexico, Sweden, Poland and Norway.

| | |

| 2007 Semi-Annual Report | | 1 |

Historical Performance

An Important Note About the Value of Historical Performance

The performance shown on page 3 represents past performance and does not guarantee future results. Performance information is as of the dates shown. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.bernstein.com and clicking on “Updated Fund Performance” at the bottom of any screen.

The investment return and principal value of an investment in the Portfolio will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. Before investing in any portfolio of the Sanford C. Bernstein Fund II, Inc., a prospective investor should consider carefully the portfolio’s investment objectives, policies, charges, expenses and risks. For a copy of the Fund’s prospectus, which contains this and other information, visit our website at www.bernstein.com and click on “Prospectuses” at the bottom of any screen. You should read the prospectus carefully before investing.

Returns do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares. All fees and expenses related to the operation of the Portfolio have been deducted.

During the reporting period, the Adviser waived a portion of its advisory fee or reimbursed Bernstein Intermediate Duration Institutional Portfolio for a portion of its expenses to the extent necessary to limit the Portfolio’s expenses to 0.45%. This waiver extends through the Portfolio’s current fiscal year and may be extended by the Adviser for additional one-year terms. Without the waiver, the Fund’s expenses would have been higher and its performance would have been lower than that shown.

Benchmark Disclosures

Neither of the following indices or averages reflects fees and expenses associated with the active management of a mutual fund portfolio. The Lehman Brothers Aggregate Bond Index represents the U.S. investment-grade fixed-rate bond market, including government and credit securities, agency mortgage pass-through securities, asset-backed securities and commercial mortgage-backed securities. The Lipper Intermediate Bond Composite is the equal-weighted average returns of the funds in the relevant Lipper Analytical Services category; the average fund in a category may differ in composition from the portfolio. An investor cannot invest directly in an index or average, and their results are not indicative of the performance for any specific investment, including the Portfolio.

A Word About Risk

Bernstein Intermediate Duration Institutional Portfolio: Price fluctuation may be caused by changes in the general level of interest rates or changes in bond credit-quality ratings. Increases in interest rates may cause the value of the Portfolio’s investments to decline. Changes in interest rates have a greater effect on bonds with longer maturities than on those with shorter maturities. Investments in the Portfolios are not guaranteed because of fluctuation in the net asset value of the underlying fixed-income-related investments. Similar to direct bond ownership, bond funds have the same interest rate, inflation and credit risks that are associated with the underlying bonds owned by the fund. Portfolio purchasers should understand that, in contrast to owning individual bonds, there are ongoing fees and expenses associated with owning shares of bond funds. The Portfolio invests principally in bonds and other fixed-income securities. High yield bonds involve a greater risk of default and price volatility than other bonds. Investing in non-investment-grade securities presents special risks, including credit risk.

The Portfolio can invest up to 25% of its assets in below-investment-grade (BB or below) bonds (“junk bonds”), which are subject to greater risk of loss of principal and interest, as well as the possibility of greater market risk, than higher-rated bonds.

The Portfolio can invest in foreign securities. Investing in foreign securities entails special risks, such as potential political and economic instability, greater volatility and less liquidity. In addition, there is the possibility that changes in value of a foreign currency will reduce the U.S. dollar value of securities denominated in that currency. These risks are heightened with respect to investments in emerging-market countries where there is an even greater amount of economic, political and social instability.

In order to achieve its investment objectives, the Portfolio may at times use certain types of investment derivatives, such as options, futures, forwards and swaps. These instruments involve risks different from, and in certain cases, greater than, the risks presented by more traditional investments. The Portfolio’s risks are fully discussed in its prospectus.

(Historical Performance continued on next page)

| | |

| 2 | | Sanford C. Bernstein Fund II, Inc. |

Historical Performance

Sanford C. Bernstein Fund II Portfolio vs. Its Benchmark and Lipper Composite

| | | | | | | | | | | | | | | | | |

| | | TOTAL RETURNS | | | AVERAGE ANNUAL TOTAL RETURNS | | | |

THROUGH MARCH 31, 2007 | | PAST SIX

MONTHS | | | PAST 12

MONTHS | | | PAST

FIVE YEARS | | | PAST

10 YEARS | | | SINCE

INCEPTION | | | INCEPTION DATE |

Intermediate Duration Institutional | | 3.04 | % | | 6.58 | % | | — | | | — | | | 5.11 | % | | May 17, 2002 |

Lehman Brothers Aggregate Bond Index | | 2.76 | % | | 6.58 | % | | 5.35 | % | | 6.45 | % | | | | | |

Intermediate Bond Lipper Composite | | 2.68 | % | | 6.06 | % | | 4.73 | % | | 5.53 | % | | | | | |

| | | | |

| Taxable Bond Portfolio | | | | |

| Intermediate Duration Institutional | | | | |

Growth of $25,000 | | | | |

| | | | |

| * | The Portfolio’s inception date was May 17, 2002. |

The chart shows the growth of $25,000 for the Portfolio and benchmarks from the first month-end after the Portfolio’s inception date, May 31, 2002, through March 31, 2007.

| | |

| 2007 Semi-Annual Report | | 3 |

See Historical Performance and Benchmark Disclosures on page 2.

Fund Expenses—March 31, 2007

Fund Expenses—As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses—The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes—The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | |

| | | BEGINNING ACCOUNT VALUE OCTOBER 1, 2006 | | ENDING ACCOUNT VALUE MARCH 31, 2007 | | EXPENSES PAID DURING PERIOD* | | ANNUALIZED EXPENSE RATIO* | |

Intermediate Duration Institutional Class Shares | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,030.44 | | $ | 2.28 | | 0.45 | % |

Hypothetical (5% return before expenses) | | $ | 1,000 | | $ | 1,022.69 | | $ | 2.27 | | 0.45 | % |

| * | Expenses are equal to each Class’s annualized expense ratio, shown in the table above, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half-year period). |

| | |

| 4 | | Sanford C. Bernstein Fund II, Inc. |

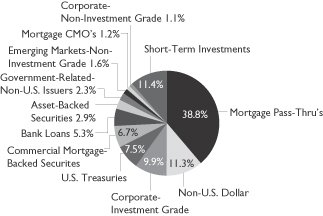

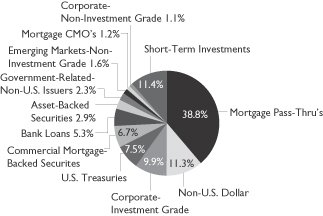

Portfolio Summary—March 31, 2007 (Unaudited)

| | | | |

| Taxable Bond Portfolio | | | | |

| Intermediate Duration Institutional |

| Security Type Breakdown1 | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

1 | All data are as of March 31, 2007. The Portfolio’s security type breakdown is expressed as a percentage of the Portfolio’s total investments and may vary over time. |

| | |

| 2007 Semi-Annual Report | | 5 |

Schedule of Investments

Sanford C. Bernstein Fund II, Inc.

Schedule of Investments

Intermediate Duration Institutional Portfolio

March 31, 2007 (unaudited)

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

| MORTGAGE PASS-THRU’S–42.3% | | | |

| Fixed Rate 30-year–32.4% | | | |

Federal Home Loan Mortgage Corp. 4.50%, 8/01/35–11/01/35(a) | | $ | 10,794 | | $ | 10,151,264 |

7.00%, 2/01/37(a) | | | 12,521 | | | 12,909,272 |

4.50%, TBA | | | 6,020 | | | 5,658,800 |

Federal National Mortgage Association 5.50%, 4/01/33–5/01/36(a) | | | 146,191 | | | 144,860,135 |

5.00%, 2/01/36–3/01/37(a) | | | 22,977 | | | 22,218,244 |

6.50%, 4/01/36–2/01/37(a) | | | 24,794 | | | 25,293,714 |

6.50%, TBA | | | 45,020 | | | 45,920,400 |

Government National Mortgage Association 5.50%, TBA | | | 28,505 | | | 28,317,936 |

| | | | | | | | |

| | | | | | 295,329,765 |

| | | | | | | | |

| Fixed Rate 15-year–5.4% | | | | | | |

Federal National Mortgage Association 5.00%, 4/01/19–3/01/22(a) | | | 24,133 | | | 23,836,022 |

4.50%, 4/01/20–7/01/21(a) | | | 21,817 | | | 21,122,864 |

4.50%, TBA | | | 4,690 | | | 4,539,038 |

| | | | | | | | |

| | | | | | 49,497,924 |

| | | | | | | | |

| Agency Arms–3.6% | | | | | | |

Federal Home Loan Mortgage Corp. 5.693%, 1/01/37(a)(b) | | | 17,463 | | | 17,549,133 |

Federal National Mortgage Association 4.41%, 8/01/34(a)(b) | | | 2,924 | | | 2,941,625 |

5.80%, 3/01/36(a)(b) | | | 3,456 | | | 3,494,613 |

5.487%, 5/01/36(a)(b) | | | 974 | | | 981,266 |

5.931%, 6/01/36(a)(b) | | | 2,485 | | | 2,503,361 |

5.725%, 1/01/37(a)(b) | | | 5,293 | | | 5,328,579 |

| | | | | | | | |

| | | | | | 32,798,577 |

| | | | | | | | |

| Non-agency Arms–0.9% | | | | | | |

Citigroup Mortgage Loan Trust, Inc.

Series 2005-2 Class 1A4

5.109%, 5/25/35(a)(b) | | | 3,577 | | | 3,553,251 |

Indymac Index Mortgage Loan Trust

Series 2006-AR7 Class 4A1

6.251%, 5/25/36(a)(b) | | | 1,888 | | | 1,909,930 |

Residential Funding Mortgage Securities I, Inc. Series 2005-SA3 Class 3A

5.236%, 8/25/35(a)(b) | | | 2,332 | | | 2,324,611 |

| | | | | | | | |

| | | | | | 7,787,792 |

| | | | | | | | |

Total Mortgage Pass-Thru’s

(cost $385,797,698) | | | | | | 385,414,058 |

| | | | | | | | |

| | | | | | | | |

| NON-US DOLLAR–12.3% | | | |

| Government-related—Sovereigns–10.7% | | | |

Japan Government

0.80%, 2/15/09(a) | | JPY | 3,185,000 | | | 27,028,417 |

0.70%, 6/20/10(a) | | | 3,744,400 | | | 31,466,909 |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Mexico

8.00%, 12/24/08–12/19/13(a) | | MXN | 211,240 | | | 19,557,225 |

9.00%, 12/20/12(a) | | | 36,680 | | | 3,565,569 |

Sweden (Kingdom of)

5.00%, 1/28/09(a) | | SEK | 54,450 | | | 7,960,704 |

5.25%, 3/15/11(a) | | | 56,430 | | | 8,467,571 |

| | | | | | | | |

| | | | | | 98,046,395 |

| | | | | | | | |

| Inflation-linked Securities–1.6% | | | |

Japan Government

.80%, 9/10/15(a) | | JPY | 1,743,480 | | | 14,434,310 |

| | | | | | | | |

Total Non-US Dollar

(cost $110,849,082) | | | | | | 112,480,705 |

| | | | | | | | |

| | | | | | | | |

| | |

| CORPORATES—INVESTMENT GRADE–10.8% | | | |

| Financial Institutions–3.0% | | | | | | |

| Banking–1.7% | | | | | | |

Barclays Bank PLC

8.55%, 9/29/49(a)(b)(c) | | $ | 1,400 | | $ | 1,567,706 |

BK Tokyo-Mitsub UFJ NY

7.40%, 6/15/11(a) | | | 280 | | | 303,675 |

BOI Capital Funding Number 2

5.571%, 2/01/49(a)(c) | | | 300 | | | 293,064 |

Citigroup, Inc. Subordinated Note

5.00%, 9/15/14(a) | | | 3,671 | | | 3,583,850 |

Mitsubishi UFG Capital Finance 1, Ltd.

6.346%, 7/29/49(a) | | | 615 | | | 628,199 |

RBS Capital Trust III

5.512%, 9/29/49(a)(b) | | | 1,950 | | | 1,918,576 |

Resona Bank, Ltd.

5.85%, 9/29/49(a)(c) | | | 240 | | | 238,827 |

Resona Preferred Global Securities

7.191%, 12/29/49(a)(b)(c) | | | 450 | | | 475,320 |

Sumitomo Mitsui Banking Corp.

5.625%, 7/29/49(a)(b)(c) | | | 410 | | | 403,857 |

The Huntington National Bank

Senior Note

4.375%, 1/15/10(a) | | | 980 | | | 956,821 |

UBS Preferred Funding Trust I

8.622%, 10/29/49(a) | | | 1,295 | | | 1,431,404 |

UFJ Finance Aruba AEC

6.75%, 7/15/13(a) | | | 500 | | | 538,591 |

Wachovia Capital Trust III

5.80%, 8/29/49(a) | | | 1,230 | | | 1,244,669 |

Wells Fargo & Co.

Senior Note

4.20%, 1/15/10(a) | | | 975 | | | 953,891 |

Zions Bancorporation

5.50%, 11/16/15(a) | | | 820 | | | 806,077 |

| | | | | | | | |

| | | | | | | | 15,344,527 |

| | | | | | | | |

| | |

| 6 | | Sanford C. Bernstein Fund II, Inc. |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

| Brokerage–0.2% |

The Goldman Sachs Group, Inc.

4.75%, 7/15/13(a) | | $ | 670 | | $ | 645,750 |

5.125%, 1/15/15(a) | | | 800 | | | 778,976 |

| | | | | | | | |

| | | | | | | | 1,424,726 |

| | | | | | | | |

| Finance Companies–0.5% |

American General Finance Corp.

Medium-Term Note

4.625%, 5/15/09(a) | | | 2,200 | | | 2,172,300 |

Countrywide Home Loans, Inc.

Medium-Term Note, Series L

4.00%, 3/22/11(a) | | | 1,400 | | | 1,327,123 |

HSBC Finance Corp.

7.00%, 5/15/12(a) | | | 580 | | | 622,431 |

iStar Financial, Inc.

Senior Note

5.15%, 3/01/12(a) | | | 600 | | | 588,578 |

| | | | | | | | |

| | | | | | 4,710,432 |

| | | | | | | | |

| Insurance–0.6% |

Assurant, Inc.

5.625%, 2/15/14(a) | | | 650 | | | 649,506 |

Humana, Inc.

Senior Note

6.30%, 8/01/18(a) | | | 700 | | | 712,973 |

Liberty Mutual Group

5.75%, 3/15/14(a)(c) | | | 855 | | | 852,668 |

MetLife, Inc.

5.00%, 11/24/13(a) | | | 780 | | | 772,331 |

WellPoint, Inc.

3.75%, 12/14/07(a) | | | 388 | | | 383,671 |

Zurich Capital Trust I

8.376%, 6/01/37(a)(c) | | | 1,740 | | | 1,816,925 |

| | | | | | | | |

| | | | | | | | 5,188,074 |

| | | | | | | | |

| | | | | | | | 26,667,759 |

| | | | | | | | |

| | | | | | | | |

| |

| Industrial–6.5% |

| Basic Industry–0.5% |

International Paper Co.

5.30%, 4/01/15(a) | | | 1,040 | | | 997,490 |

International Steel Group, Inc.

6.50%, 4/15/14(a) | | | 1,065 | | | 1,108,931 |

Ispat Inland ULC

9.75%, 4/01/14(a) | | | 600 | | | 662,173 |

The Dow Chemical Co.

7.375%, 11/01/29(a) | | | 150 | | | 166,944 |

Union Carbide Corp.

Debenture

7.75%, 10/01/96(a) | | | 735 | | | 783,331 |

Westvaco Corp.

8.20%, 1/15/30(a) | | | 390 | | | 429,179 |

Weyerhaeuser Co.

5.95%, 11/01/08(a) | | | 845 | | | 852,391 |

| | | | | | | | |

| | | | | | | | 5,000,439 |

| | | | | | | | |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

| Capital Goods–0.4% |

Hutchison Whampoa International, Ltd.

7.45%, 11/24/33(a)(c) | | $ | 1,170 | | $ | 1,347,372 |

Textron Financial Corp.

4.125%, 3/03/08(a) | | | 945 | | | 935,895 |

Tyco International Group, SA

6.00%, 11/15/13(a) | | | 1,045 | | | 1,098,496 |

| | | | | | | | |

| | | | | | | | 3,381,763 |

| | | | | | | | |

| Communications—Media–1.1% | | | | | | |

British Sky Broadcasting Group PLC

6.875%, 2/23/09(a) | | | 455 | | | 467,684 |

BSKYB Finance United Kingdom PLC

5.625%, 10/15/15(a)(c) | | | 1,200 | | | 1,189,970 |

Comcast Cable Communications Holdings, Inc.

9.455%, 11/15/22(a) | | | 1,020 | | | 1,324,564 |

Comcast Corp.

5.30%, 1/15/14(a) | | | 1,040 | | | 1,025,957 |

Cox Enterprises, Inc.

4.375%, 5/01/08(a)(c) | | | 1,155 | | | 1,136,968 |

News America Holdings, Inc.

9.25%, 2/01/13(a) | | | 890 | | | 1,055,769 |

News America, Inc.

6.55%, 3/15/33(a) | | | 665 | | | 680,032 |

R. R. Donnelley & Sons Co.

4.95%, 4/01/14(a) | | | 485 | | | 455,726 |

Time Warner Entertainment Co.

Senior Debenture

8.375%, 3/15/23(a) | | | 1,735 | | | 2,050,888 |

WPP Finance Corp.

5.875%, 6/15/14(a) | | | 750 | | | 759,139 |

| | | | | | | | |

| | | | | | | | 10,146,697 |

| | | | | | | | |

| Communications—Telecommunications–2.3% | | | |

AT&T Corp.

7.30%, 11/15/11(a) | | | 1,110 | | | 1,204,967 |

8.00%, 11/15/31(a) | | | 345 | | | 426,347 |

CenturyTel, Inc.

5.00%, 2/15/15(a) | | | 1,641 | | | 1,529,443 |

6.875%, 1/15/28(a) | | | 1,125 | | | 1,101,009 |

Embarq Corp.

6.738%, 6/01/13(a) | | | 150 | | | 154,859 |

7.082%, 6/01/16(a) | | | 2,465 | | | 2,513,178 |

New Cingular Wireless Services, Inc.

7.875%, 3/01/11(a) | | | 1,620 | | | 1,772,632 |

8.75%, 3/01/31(a) | | | 915 | | | 1,180,298 |

Sprint Capital Corp.

8.375%, 3/15/12(a) | | | 4,085 | | | 4,557,753 |

Telecom Italia Capital

4.00%, 11/15/08–1/15/10(a) | | | 3,165 | | | 3,067,002 |

6.375%, 11/15/33(a) | | | 270 | | | 254,652 |

Verizon Global Funding Corp.

4.90%, 9/15/15(a) | | | 890 | | | 853,133 |

Verizon New Jersey, Inc.

Debenture

5.875%, 1/17/12(a) | | | 1,195 | | | 1,221,121 |

Vodafone Group PLC

5.50%, 6/15/11(a) | | | 1,650 | | | 1,667,756 |

| | | | | | | | |

| | | | | | | | 21,504,150 |

| | | | | | | | |

| | |

| 2007 Semi-Annual Report | | 7 |

Schedule of Investments (continued)

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

| Consumer Cyclical—Automotive–0.1% | | | |

DaimlerChrysler North America Corp.

4.875%, 6/15/10(a) | | $ | 540 | | $ | 534,520 |

| | | | | | | | |

| Consumer Cyclical—Other–0.5% | | | | | | |

Centex Corp.

5.45%, 8/15/12(a) | | | 568 | | | 548,012 |

Starwood Hotels & Resorts Worldwide, Inc.

7.875%, 5/01/12(a) | | | 1,474 | | | 1,584,034 |

7.375%, 11/15/15(a) | | | 1,409 | | | 1,468,467 |

Toll Brothers Finance Corp.

6.875%, 11/15/12(a) | | | 715 | | | 732,091 |

| | | | | | | | |

| | | | | | | | 4,332,604 |

| | | | | | | | |

| Consumer Non-Cyclical–0.7% | | | | | | | | |

Altria Group, Inc.

7.75%, 1/15/27(a) | | | | | 1,300 | | | 1,553,772 |

Cadbury Schweppes Finance

5.125%, 10/01/13(a)(c) | | | | | 1,670 | | | 1,615,814 |

ConAgra Foods, Inc.

7.875%, 9/15/10(a) | | | | | 235 | | | 254,393 |

Kraft Foods, Inc.

5.25%, 10/01/13(a) | | | | | 675 | | | 665,148 |

Safeway, Inc.

4.125%, 11/01/08(a) | | | | | 548 | | | 538,938 |

6.50%, 3/01/11(a) | | | | | 360 | | | 374,028 |

Wyeth

5.50%, 2/01/14(a) | | | | | 1,036 | | | 1,042,310 |

| | | | | | | | |

| | | | | | | | 6,044,403 |

| | | | | | | | |

| Energy–0.3% | | | | | | | | |

Amerada Hess Corp.

7.875%, 10/01/29(a) | | | | | 691 | | | 797,075 |

Tengizchevroil Finance Co.

6.124%, 11/15/14(a)(c) | | | | | 405 | | | 402,975 |

Valero Energy Corp.

6.875%, 4/15/12(a) | | | | | 1,255 | | | 1,336,444 |

| | | | | | | | |

| | | | | | | | 2,536,494 |

| | | | | | | | |

| Technology–0.6% | | | | | | |

Cisco Systems, Inc.

5.25%, 2/22/11(a) | | | 630 | | | 633,077 |

Electronic Data Systems Corp.

6.50%, 8/01/13(a) | | | 2,494 | | | 2,547,993 |

International Business Machines Corp. Medium-Term Note

4.375%, 6/01/09(a) | | | 365 | | | 360,879 |

Motorola, Inc.

7.625%, 11/15/10(a) | | | 115 | | | 123,410 |

7.50%, 5/15/25(a) | | | 200 | | | 219,488 |

6.50%, 9/01/25(a) | | | 1,215 | | | 1,198,124 |

Oracle Corp.

5.25%, 1/15/16(a) | | | 895 | | | 882,562 |

| | | | | | | | |

| | | | | | 5,965,533 |

| | | | | | | | |

| | | | | | 59,446,603 |

| | | | | | | | |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

| Utilities–1.3% | | | | | | |

| Electric–1.2% | | | | | | |

Carolina Power & Light Co.

6.50%, 7/15/12(a) | | $ | 1,160 | | $ | 1,230,442 |

Consumers Energy Co. Series C

4.25%, 4/15/08(a) | | | 610 | | | 603,600 |

Exelon Corp.

6.75%, 5/01/11(a) | | | 1,525 | | | 1,588,643 |

FirstEnergy Corp.

6.45%, 11/15/11(a) | | | 1,440 | | | 1,509,352 |

7.375%, 11/15/31(a) | | | 1,525 | | | 1,732,501 |

MidAmerican Energy Holdings Co.

Senior Note

5.875%, 10/01/12(a) | | | 420 | | | 432,402 |

NiSource Finance Corp.

7.875%, 11/15/10(a) | | | 605 | | | 655,719 |

Pacific Gas & Electric Co.

4.80%, 3/01/14(a) | | | 985 | | | 955,111 |

Progress Energy, Inc.

7.10%, 3/01/11(a) | | | 427 | | | 455,815 |

Public Service Co. of Colorado

7.875%, 10/01/12(a) | | | 420 | | | 472,882 |

SPI Electricity & Gas Australia

Holdings Pty, Ltd.

6.15%, 11/15/13(a)(c) | | | 1,150 | | | 1,187,680 |

| | | | | | | | |

| | | | | | 10,824,147 |

| | | | | | | | |

| Natural Gas–0.1% | | | | | | |

Duke Energy Field Services Corp.

7.875%, 8/16/10(a) | | | 370 | | | 399,711 |

Enterprise Products Operating LP

Series B

5.60%, 10/15/14(a) | | | 600 | | | 598,630 |

| | | | | | | | |

| | | | | | 998,341 |

| | | | | | | | |

| | | | | | 11,822,488 |

| | | | | | | | |

Total Corporates—Investment Grade

(cost $97,883,611) | | | | | | 97,936,850 |

| | | | | | | | |

| | | | | | | | |

| |

| U.S. TREASURIES–8.2% |

United States Treasury Bonds

4.50%, 2/15/36(a)(d) | | | 31,820 | | | 30,000,278 |

8.75%, 5/15/17(a) | | | 26,305 | | | 34,773,974 |

United States Treasury Notes

4.875%, 5/31/11(a) | | | 9,435 | | | 9,552,201 |

| | | | | | | | |

Total U.S. Treasuries

(cost $73,648,222) | | | | | | 74,326,453 |

| | | | | | | | |

| | | | | | | | |

| |

| COMMERCIAL MORTGAGE BACKED SECURITIES–7.3% |

| Non-agency Fixed Rate CMBS–7.3% | | | | | | |

Banc America Commercial Mortgage, Inc. Series 2001-PB1 Class A2

5.787%, 5/11/35(a) | | | 1,707 | | | 1,744,388 |

Series 2004-4 Class A3

4.128%, 7/10/42(a) | | | 1,925 | | | 1,881,082 |

Series 2004-6 Class A2

4.161%, 12/10/42(a) | | | 2,590 | | | 2,528,877 |

| | |

| 8 | | Sanford C. Bernstein Fund II, Inc. |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Bear Stearns Commercial Mortgage Securities, Inc.

Series 2005-T18 Class A4

4.933%, 2/13/42(a) | | $ | 2,635 | | $ | 2,569,252 |

Credit Suisse Mortgage Capital Certificates Series 2006-C3 Class A3

5.827%, 6/15/38(a) | | | 2,385 | | | 2,472,963 |

CS First Boston Mortgage Securities Corp. Series 2003-CK2 Class A2

3.861%, 3/15/36(a) | | | 1,695 | | | 1,666,439 |

Series 2004-C1 Class A4

4.75%, 1/15/37(a) | | | 1,030 | | | 999,928 |

Series 2005-C1 Class A4

5.014%, 2/15/38(a) | | | 2,175 | | | 2,132,408 |

GE Capital Commercial Mortgage Corp. Series 2005-C3 Class A3FX 4.863%, 7/10/45(a) | | | | | 2,395 | | | 2,374,586 |

Greenwich Capital Commercial Funding Corp. Series 2003-C1 Class A4

4.111%, 7/05/35(a) | | | 2,035 | | | 1,919,710 |

Series 2003-C2 Class A3

4.533%, 1/05/36(a) | | | | | 1,010 | | | 988,551 |

Series 2005-GG3 Class A2

4.305%, 8/10/42(a) | | | | | 2,645 | | | 2,589,140 |

GS Mortgage Securities Corp. II Series 2004-GG2 Class A6 5.396%, 8/10/38(a) | | | | | 2,015 | | | 2,028,333 |

JPMorgan Chase Commercial Mortgage Securities Series 2004-C1 Class A2

4.302%, 1/15/38(a) | | | | | 270 | | | 261,418 |

Series 2005-LDP3 Class A2

4.851%, 8/15/42(a) | | | | | 2,085 | | | 2,064,319 |

Series 2005-LDP4 Class A2

4.79%, 10/15/42(a) | | | | | 1,970 | | | 1,946,936 |

Series 2006-CB15 Class A4

5.814%, 6/12/43(a) | | | | | 2,125 | | | 2,202,031 |

Series 2006-CB14 Class A4

5.481%, 12/12/44(a) | | | | | 1,380 | | | 1,393,289 |

Series 2006-CB16 Class A4

5.552%, 5/12/45(a) | | | | | 3,740 | | | 3,804,852 |

Series 2005-LDP1 Class A4 5.038%, 3/15/46(a) | | | | | 2,665 | | | 2,630,435 |

LB-UBS Commercial Mortgage Trust Series 2004-C4 Class A4

5.133%, 6/15/29(a) | | | | | 3,925 | | | 3,970,895 |

Series 2004-C8 Class A2

4.201%, 12/15/29(a) | | | | | 2,025 | | | 1,978,333 |

Series 2005-C1 Class A4

4.742%, 2/15/30(a) | | | | | 1,850 | | | 1,786,552 |

Series 2005-C7 Class A4

5.197%, 11/15/30(a) | | | | | 1,965 | | | 1,948,006 |

Series 2003-C3 Class A4

4.166%, 5/15/32(a) | | | | | 3,380 | | | 3,195,911 |

Merrill Lynch Mortgage Trust

Series 2005-CKI1 Class A6

5.244%, 11/12/37(a) | | | | | 1,730 | | | 1,728,844 |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Series 2005-MKB2 Class A2

4.806%, 9/12/42(a) | | | | $ | 3,210 | | $ | 3,179,480 |

Merrill Lynch/Countrywide Commercial Mortgage Trust Series 2006-2 Class A4

5.91%, 6/12/46(a) | | | | | 2,095 | | | 2,189,175 |

Morgan Stanley Capital I Series 2005-T17 Class A5

4.78%, 12/13/41(a) | | | | | 2,960 | | | 2,863,331 |

Series 2005-HQ5 Class A4

5.168%, 1/14/42(a) | | | | | 3,745 | | | 3,711,233 |

| | | | | | | | |

Total Commercial Mortgage Backed Securities

(cost $66,937,367) | | | 66,750,697 |

| | | | | | | | |

| | | | | | | | |

| | | | |

| BANK LOANS–5.8% | | | | | | | | |

| Non-Investment Grade–5.8% | | | | | | | | |

| | | | |

| Financial Institutions–0.4% | | | | | | | | |

| Finance–0.1% | | | | | | | | |

Blue Pearl USA, Ltd.

10.11%, 9/30/12 | | | | | 469 | | | 473,006 |

LPL Holdings, Inc.

7.85%, 6/28/13 | | | | | 496 | | | 500,801 |

| | | | | | | | |

| | | | | | | | 973,807 |

| | | | | | | | |

| Real Estate Investment Trust–0.3% | | | | | | | | |

Crescent Resources LLC 8.32%, 11/01/12 | | | | | 2,500 | | | 2,507,300 |

| | | | | | | | |

| | | | | | | | 3,481,107 |

| | | | | | | | |

| | | | | | | | |

| | | | |

| Industrial–5.3% | | | | | | | | |

| Basic Industry–0.6% | | | | | | | | |

Blitz 06-103 GMBH

7.625%, 12/04/13(a) | | | | | 998 | | | 1,001,739 |

Ferro Corp.

8.07%, 6/06/12 | | | | | 678 | | | 676,510 |

Freeport McMoran Copper & Gold 7.105%, 3/15/14 | | | | | 500 | | | 500,655 |

Hexion Specialty

7.875%, 5/04/13 | | | | | 2,487 | | | 2,499,165 |

John Maneely Co.

8.571%, 12/06/13(a) | | | | | 900 | | | 902,475 |

Tegrant Corp.

10.85%, 2/15/15 | | | | | 300 | | | 302,250 |

| | | | | | | | |

| | | | | | | | 5,882,794 |

| | | | | | | | |

| Capital Goods–0.7% | | | | | | | | |

Clarke American Corp.

7.85%, 3/09/14 | | | | | 750 | | | 749,535 |

7.855%, 3/09/14 | | | 2,000 | | | 1,998,760 |

Covalence Specialty Materials

8.625%, 5/08/13 | | | 748 | | | 747,652 |

Fenwal, Inc.

Zero coupon–7.61%, 2/20/14 | | | 350 | | | 349,750 |

GPS CCMP Merger Corp.

7.85%, 10/31/13 | | | 495 | | | 496,856 |

| | |

| 2007 Semi-Annual Report | | 9 |

Schedule of Investments (continued)

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Ravago Holding America, Inc.

8.125%, 1/31/14 | | $ | 500 | | $ | 500,000 |

United Subcontractor, Inc.

8.12%, 12/27/12 | | | 1,248 | | | 1,237,190 |

| | | | | | | | |

| | | | | | | | 6,079,743 |

| | | | | | | | |

| Communications—Media–0.9% | | | | | | |

Cablevision Systems Corp.

7.11%, 2/24/13 | | | 744 | | | 746,273 |

Cebridge Connections

11.36%, 5/04/15 | | | 772 | | | 800,249 |

Charter Communications

7.985%, 4/28/13 | | | 2,000 | | | 1,994,680 |

Oceania Cruises, Inc.

8.10%, 12/04/12 | | | 750 | | | 750,000 |

Six Flags, Inc.

8.61%, 6/30/09 | | | 891 | | | 897,334 |

TDS Investor Corp.

7.85%, 8/22/13 | | | 747 | | | 752,223 |

Univision Communications, Inc.

7.61%, 8/15/14 | | | 1,000 | | | 1,000,000 |

VTR Globalcom, SA

8.321%, 9/20/13 | | | 1,000 | | | 1,001,250 |

| | | | | | | | |

| | | | | | | | 7,942,009 |

| | | | | | | | |

| Communications—Telecommunications–0.7% | | | |

Cellnet Group, Inc.

7.34%, 7/24/11 | | | 350 | | | 352,305 |

9.57%, 7/24/11(a) | | | 500 | | | 506,665 |

Choice One Communications, Inc.

9.375%, 6/28/12 | | | 1,000 | | | 1,010,000 |

11.625%, 6/28/12 | | | 1,000 | | | 1,010,000 |

Crown Castle Operating Co.

6.82%–6.90%, 2/15/14 | | | 500 | | | 500,625 |

Level 3 Financing, Inc.

7.57%, 2/13/14 | | | 1,500 | | | 1,504,995 |

Proquest CSA, LLC

8.33%–8.34%, 2/07/14 | | | 1,000 | | | 1,001,250 |

Sorenson Communications, Inc.

8.32%, 8/16/13 | | | 1,000 | | | 1,002,500 |

| | | | | | | | |

| | | | | | | | 6,888,340 |

| | | | | | | | |

| Consumer Cyclical—Automotive–0.5% | | | |

Delphi Corp.

8.125%, 12/31/07 | | | 1,000 | | | 1,005,000 |

Ford Motor Co.

8.36%, 11/29/13 | | | 1,496 | | | 1,501,651 |

General Motors Corp.

7.695%, 12/16/13 | | | 750 | | | 755,205 |

Lear Corp.

7.85%, 4/25/12 | | | 499 | | | 498,625 |

Visteon Corp.

8.38%, 5/31/13 | | | 1,000 | | | 1,004,380 |

| | | | | | | | |

| | | | | | | | 4,764,861 |

| | | | | | | | |

| Consumer Cyclical—Other–0.1% | | | | | | |

Seminole Tribe of Florida

6.86%, 2/20/14 | | | 501 | | | 502,868 |

| | | | | | | | |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

| Consumer Cyclical—Retailer–0.1% | | | | | | |

Jean Coutu Group, Inc.

7.875%, 7/30/11 | | $ | 691 | | $ | 691,237 |

| | | | | | | | |

| Consumer Non-Cyclical–0.3% | | | | | | |

FHC Health Systems

12.11%, 6/30/08 | | | 1,000 | | | 1,010,000 |

HCA, Inc.

7.60%, 11/07/13 | | | 1,496 | | | 1,509,896 |

Talecris Biotherapeutics

8.86%–10.50%, 12/06/13(a) | | | 750 | | | 752,812 |

| | | | | | | | |

| | | | | | | | 3,272,708 |

| | | | | | | | |

| Energy–0.2% | | | | | | |

CDX Gas LLC

10.574%, 3/31/13(a) | | | 1,000 | | | 1,015,000 |

Endeavor

12.36%, 11/01/11 | | | 500 | | | 512,500 |

| | | | | | | | |

| | | | | | | | 1,527,500 |

| | | | | | | | |

| Service–0.6% | | | | | | |

Idearc, Inc.

7.35%, 11/17/14 | | | 1,397 | | | 1,404,013 |

On Assignment, Inc.

7.60%, 1/29/13 | | | 748 | | | 750,930 |

PGT Industries

8.36%, 2/14/12(a) | | | 659 | | | 662,656 |

Sitel LLC

7.85%, 1/30/14(a) | | | 750 | | | 754,223 |

West Corp.

7.735%–8.11%, 10/18/13 | | | 2,250 | | | 2,262,465 |

| | | | | | | | |

| | | | | | 5,834,287 |

| | | | | | | | |

| Technology–0.5% | | | | | | |

Dealer Computer Services, Inc.

7.35%, 10/26/12 | | | 1,494 | | | 1,497,733 |

10.85%, 10/26/12 | | | 500 | | | 511,250 |

Eastman Kodak Co.

7.57%, 10/18/12 | | | 407 | | | 408,095 |

IPC Acquisition Corp.

7.85%, 9/30/13 | | | 500 | | | 503,750 |

Marvell Technology Group, Ltd.

7.35%, 11/06/09 | | | 497 | | | 499,673 |

Sorenson Communications, Inc.

12.32%, 1/31/14 | | | 1,000 | | | 1,013,750 |

| | | | | | | | |

| | | | | | 4,434,251 |

| | | | | | | | |

| Transportation—Services–0.1% | | | | | | |

Oshkosh Truck Corp.

7.35%, 12/06/13(a) | | | 499 | | | 500,496 |

| | | | | | | | |

| | | | | | 48,321,094 |

| | | | | | | | |

| | | | | | | | |

| | | |

| Utilities–0.1% | | | | | | |

| Utility—Other–0.1% | | | | | | |

GBGH LLC

10.859%, 8/07/13 | | | 700 | | | 700,000 |

| | | | | | | | |

Total Bank Loans

(cost $52,418,091) | | | | | | 52,502,201 |

| | | | | | | | |

| | |

| 10 | | Sanford C. Bernstein Fund II, Inc. |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

| ASSET-BACKED SECURITIES–3.2% | | | | | | |

| Home Equity Loans—Fixed Rate–0.6% | | | |

Citifinancial Mortgage Securities, Inc.

Series 2003-1 Class AFPT

3.36%, 1/25/33(a) | | $ | 594 | | $ | 546,158 |

Credit-Based Asset Servicing & Securities Trust Series 2005-CB7 Class AF2

5.15%, 11/25/35(a) | | | 1,490 | | | 1,480,887 |

Home Equity Mortgage Trust

Series 2005-4 Class A3

4.742%, 1/25/36(a) | | | 1,655 | | | 1,638,404 |

Series 2006-1 Class A2

5.30%, 5/25/36(a) | | | 840 | | | 839,980 |

Residential Funding Mortgage

Securities II Series 2005-HI2 Class A3 4.46%, 5/25/35(a) | | | 1,100 | | | 1,086,393 |

| | | | | | | | |

| | | | | | 5,591,822 |

| | | | | | | | |

| | | | | | | | |

| Home Equity Loans—Floating Rate–2.4% | | | |

Ace Securities Corp.

Series 2007-HE2 Class M1

5.64%, 12/25/36(a)(b) | | | 1,700 | | | 1,687,284 |

Asset Backed Funding Certificates

Series 2003-WF1 Class A2

6.07%, 12/25/32(a)(b) | | | 654 | | | 654,887 |

Bear Stearns Asset Backed Securities, Inc. Series 2005-SD1 Class 1A1

5.47%, 4/25/22(a)(b) | | | 378 | | | 377,593 |

GE-WMC Mortgage Securities LLC

Series 2005-2 Class A2B

5.49%, 12/25/35(a)(b) | | | 1,785 | | | 1,785,559 |

Home Equity Asset Trust

Series 2007-2 Class M1

5.75%, 7/25/37(a)(b) | | | 4,565 | | | 4,565,000 |

Household Home Equity Loan Trust

Series 2005-3 Class A1

5.58%, 1/20/35(a)(b) | | | 1,205 | | | 1,206,961 |

HSI Asset Securitization Corp.

Series 2006-0PT2 Class M2

5.71%, 1/25/36(a)(b) | | | 1,515 | | | 1,509,758 |

Master Asset Backed Securities Trust

Series 2004-HE1 Class A1

5.72%, 9/25/34(a)(b) | | | 894 | | | 896,702 |

Option One Mortgage Loan Trust

Series 2006-3 Class M1

5.55%, 2/25/37(a)(b) | | | 1,200 | | | 1,194,060 |

RAAC Series Series 2006-SP3 Class A1

5.40%, 8/25/36(a)(b) | | | 1,436 | | | 1,435,340 |

Residential Asset Mortgage Products, Inc. Series 2005-RS3 Class AIA2

5.49%, 3/25/35(a)(b) | | | 1,209 | | | 1,209,672 |

Series 2005-RZ1 Class A

2 5.52%, 4/25/35(a)(b) | | | 2,241 | | | 2,242,617 |

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Saxon Asset Securities Trust

Series 2005-4 Class A2B

5.50%, 11/25/37(a)(b) | | $ | 1,825 | | $ | 1,825,285 |

Specialty Underwriting & Residential Finance Series 2006-BC1 Class A2A

5.40%, 12/25/36(a)(b) | | | 903 | | | 903,268 |

| | | | | | | | |

| | | | | | | | 21,493,986 |

| | | | | | | | |

| Other—Fixed Rate–0.1% | | | | | | | | |

DB Master Finance, LLC

Series 2006-1 Class A2

5.779%, 6/20/31(a)(c) | | | 700 | | | 714,252 |

| | | | | | | | |

| Other—Floating Rate–0.1% | | | | | | | | |

Cairn Mezz ABS CDO PLC

Series 2007-3A Class A2B

5.988%, 8/13/47(a)(b)(c) | | | 975 | | | 964,246 |

| | | | | | | | |

Total Asset-Backed Securities

(cost $28,830,472) | | | | | | 28,764,306 |

| | | | | | | | |

| | | | | | | | |

| | |

| GOVERNMENT-RELATED—NON-US ISSUERS–2.5% | | | |

| Sovereigns–2.5% | | | | | | | | |

Russian Federation

5.00%, 3/31/30(a)(c) | | | 13,415 | | | 15,212,610 |

United Mexican States

5.625%, 1/15/17(a) | | | 7,640 | | | 7,670,560 |

| | | | | | | | |

Total Government-Related— Non-US Issuers

(cost $22,047,223) | | | 22,883,170 |

| | | | | | | | |

| | | | | | | | |

| |

| EMERGING MARKETS—NON-INVESTMENT GRADE–1.7% |

| Sovereigns–1.7% | | | | | | | | |

Republic of Brazil

8.25%, 1/20/34(a) | | | 9,865 | | | 12,346,047 |

Republic of Peru

7.35%, 7/21/25(a) | | | 3,157 | | | 3,591,088 |

| | | | | | | | |

Total Emerging Markets—Non-Investment Grade

(cost $14,563,671) | | | 15,937,135 |

| | | | | | | | |

| | | | | | | | |

| | |

| MORTGAGE CMO’s–1.2% | | | |

| Agency Adjustable Rate–0.0% | | | | | | | | |

Fannie Mae Grantor Trust

Series 2004-T5 Class AB4 5.963%, 5/28/35(a)(b) | | | | | 323 | | | 323,718 |

| | | | | | | | |

| Non-agency Adjustable Rate–0.8% | | | | | | | | |

Countrywide Alternative Loan Trust Series 2005-62 Class 2A1 5.883%, 12/25/35(a)(b) | | | | | 1,569 | | | 1,569,230 |

Series 2006-0A14 Class 3A1 | | | | | | | | |

5.733%, 11/25/46(a)(b) | | | | | 3,121 | | | 3,110,792 |

JPMorgan Alternative Loan Trust Series 2006-S1 Class 3A1

5.43%, 3/25/36(a)(b) | | | | | 879 | | | 879,537 |

| | |

| 2007 Semi-Annual Report | | 11 |

Schedule of Investments (continued)

| | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value |

| | | | | | | | |

Structured Asset Mortgage Investment, Inc. Series 2004-AR5 Class 1A1

5.65%, 10/19/34(a)(b) | | | | $ | 1,619 | | $ | 1,620,029 |

Washington Mutual, Inc. Series 2005-AR2 Class 2A22

5.54%, 1/25/45(a)(b) | | | | | 300 | | | 299,961 |

| | | | | | | | |

| | | | | | | | 7,479,549 |

| | | | | | | | |

| Non-agency Fixed Rate–0.4% | | | | | | | | |

Wells Fargo Mortgage Backed Securities Trust Series 2006-AR11 Class A4

5.531%, 8/25/36(a) | | | | | 3,603 | | | 3,593,300 |

| | | | | | | | |

Total Mortgage CMOS

(cost $11,383,944) | | | | | | | | 11,396,567 |

| | | | | | | | |

| | | | | | | | |

| | |

| CORPORATES—NON-INVESTMENT GRADE–1.2% | | | |

| Financial Institutions–0.1% | | | | | | | | |

| Insurance–0.1% | | | | | | | | |

Liberty Mutual Group

7.80%, 3/15/37(a)(c) | | | | | 1,220 | | | 1,192,440 |

| | | | | | | | |

| | | | | | | | |

| | | | |

| Industrial–0.9% | | | | | | | | |

| Basic Industry–0.2% | | | | | | | | |

AK Steel Corp.

7.875%, 2/15/09(a) | | | | | 228 | | | 228,000 |

Ineos Group Holdings PLC

8.50%, 2/15/16(a)(c) | | | | | 730 | | | 698,975 |

Packaging Corp. of America

5.75%, 8/01/13(a) | | | | | 790 | | | 780,044 |

| | | | | | | | |

| | | | | | | | 1,707,019 |

| | | | | | | | |

| Communications—Media–0.3% | | | | | | | | |

Cablevision Systems Corp.

8.00%, 4/15/12(a) | | | | | 730 | | | 740,950 |

Clear Channel Communications, Inc. 5.50%, 9/15/14(a) | | | | | 1,575 | | | 1,394,359 |

DirecTV Holdings LLC

6.375%, 6/15/15(a) | | | 705 | | | 669,750 |

| | | | | | | | |

| | | | | | | | 2,805,059 |

| | | | | | | | |

| Communications—Telecommunications–0.1% | | | |

Qwest Communications International, Inc.

7.50%, 2/15/14(a) | | | | | 665 | | | 684,950 |

Qwest Corp.

8.875%, 3/15/12(a) | | | | | 195 | | | 215,475 |

| | | | | | | | |

| | | | | | | | 900,425 |

| | | | | | | | |

| Consumer Cyclical—Automotive–0.1% | | | |

Ford Motor Credit Co.

6.625%, 6/16/08(a) | | | | | 1,040 | | | 1,036,719 |

| | | | | | | | |

| | | | | | | | | |

| | | |

| | | Principal Amount (000) | | U.S. $ Value | |

| | | | | | | | | |

| Consumer Cyclical—Other–0.1% | | | | | | | | | |

MGM MIRAGE

8.375%, 2/01/11(a) | | | | $ | 655 | | $ | 689,387 | |

Riviera Holdings Corp.

11.00%, 6/15/10(a) | | | | | 220 | | | 229,350 | |

| | | | | | | | | |

| | | | | | | | 918,737 | |

| | | | | | | | | |

| Consumer Non-Cyclical–0.0% | | | | | | | | | |

Tyson Foods, Inc.

8.25%, 10/01/11(a) | | | | | 275 | | | 301,091 | |

| | | | | | | | | |

| Transportation—Services–0.1% | | | | | | | | | |

Hertz Corp.

8.875%, 1/01/14(a) | | | | | 610 | | | 657,275 | |

| | | | | | | | | |

| | | | | | | | 8,326,325 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | |

| Utilities–0.2% | | | | | | | | | |

| Electric–0.1% | | | | | | | | | |

NRG Energy, Inc.

7.25%, 2/01/14(a) | | | | | 115 | | | 117,875 | |

7.375%, 2/01/16(a) | | | | | 615 | | | 631,913 | |

| | | | | | | | | |

| | | | | | | | 749,788 | |

| | | | | | | | | |

| Natural Gas–0.1% | | | | | | | | | |

The Williams Cos., Inc.

7.875%, 9/01/21(a) | | | | | 650 | | | 715,000 | |

| | | | | | | | | |

| | | | | | | | 1,464,788 | |

| | | | | | | | | |

Total Corporates—Non-Investment Grade

(cost $10,958,108) | | | 10,983,553 | |

| | | | | | | | | |

| | | | | | | | | |

| | |

| SHORT-TERM INVESTMENTS–12.5% | | | | |

| Agency Discount Note–0.6% | | | | | | | | | |

Federal Home Loan Mortgage Corp.

Zero coupon, 5/07/07(e) | | | | | 5,000 | | | 4,975,087 | |

| | | | | | | | | |

| | | | | Shares | | | |

| Investment Companies–11.9% | | | | | | | | | |

AllianceBernstein Fixed Income Shares, Inc.–Government STIF Portfolio(e)(f) | | | | | 108,450,102 | | | 108,450,102 | |

| | | | | | | | | |

Total Short-Term Investments

(cost $113,425,189) | | | | | | | | 113,425,189 | |

| | | | | | | | | |

Total Investments—109.0%

(cost $988,742,678)(g) | | | | | | | | 992,800,884 | |

| | |

Other assets less liabilities—(9.0)% | | | | | | (81,948,936 | ) |

| | | | | | | | | |

| Net Assets—100% | | | | | | | $ | 910,851,948 | |

| | | | | | | | | |

| | |

| 12 | | Sanford C. Bernstein Fund II, Inc. |

| | | | | | | | | | |

| |

| INTEREST RATE SWAP CONTRACTS |

| | | | | | | Rate Type | | |

| Swap Counterparty | | Notional Amount

(000) | | Termination

Date | | Payments made

by the Portfolio | | Payments received

by the Portfolio | | Unrealized Appreciation/

(Depreciation) |

Lehman Brothers | | 24,500 | | 10/28/07 | | 3 month LIBOR† | | 4.800% | | $ 184,823 |

Lehman Brothers | | 10,130 | | 11/02/07 | | 3 month LIBOR† | | 4.814% | | 78,235 |

Lehman Brothers | | 16,000 | | 1/23/08 | | 3 month LIBOR† | | 4.778% | | (90,301) |

Lehman Brothers | | 9,000 | | 12/04/11 | | 3 month LIBOR† | | 4.850% | | 55,235 |

†Interest based on LIBOR (London Interbank Offered Rate).

| | | | | | | | | | | | | | |

| |

| FORWARD CURRENCY EXCHANGE CONTRACTS | |

| | | | | Contract Amount

(000) | | U.S. $Value on

Origination Date | | U.S. $

Current Value | | Unrealized Appreciation/

(Depreciation) | |

| | | | | | | | | | | | | | |

| Purchase Contracts | | | | | | | | | | | | | | |

Mexican Peso | | Settling 4/02/06 | | 259,918 | | $ | 23,526,274 | | $ | 23,543,690 | | $ | 17,416 | |

| | | | | |

| Sale Contracts | | | | | | | | | | | | | | |

Japanese Yen | | Settling 4/27/07 | | 8,586,190 | | | 73,199,174 | | | 73,152,610 | | | 46,564 | |

Mexican Peso | | Settling 4/02/07 | | 136,162 | | | 12,195,762 | | | 12,333,709 | | | (137,947 | ) |

Mexican Peso | | Settling 4/02/07 | | 123,756 | | | 11,087,482 | | | 11,209,981 | | | (122,499 | ) |

Mexican Peso | | Settling 5/02/07 | | 259,918 | | | 23,489,067 | | | 23,509,534 | | | (20,467 | ) |

Swedish Krona | | Settling 4/26/07 | | 118,383 | | | 17,032,857 | | | 16,978,252 | | | 54,605 | |

| | | | | | | | | | | | | | |

| |

| FINANCIAL FUTURES CONTRACTS | |

| Type | | Number of

Contracts | | Expiration

Month | | Original

Value | | Value at

March 31, 2007 | | Unrealized Appreciation/

(Depreciation) | |

| Purchased | | | | | | | | | | | | | | |

U.S. Treasury Notes 5 Yr Futures | | 178 | | June 2007 | | $ | 18,696,079 | | $ | 18,831,844 | | $ | 135,765 | |

U.S. Treasury Notes 10 Yr Futures | | 100 | | June 2007 | | | 10,818,056 | | | 10,812,500 | | | (5,556 | ) |

U.S. Treasury Bonds Futures | | 142 | | June 2007 | | | 15,764,630 | | | 15,797,500 | | | 32,870 | |

| | | | | |

| Sold | | | | | | | | | | | | | | |

Japan Government Bonds 10 Yr Futures | | 10 | | June 2007 | | | 11,402,653 | | | 11,384,080 | | | 18,573 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | $ 181,652 | |

| | | | | | | | | | | | | | |

| (a) | | Positions, or portion thereof, with an aggregate market value of $742,437,320 have been segregated to collateralize open forward currency exchange contracts. |

| (b) | | Variable rate coupon, rate shown as of March 31, 2007. |

| (c) | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. These securities are considered liquid and may be resold in transactions exempt from registration, normally to qualified institutional buyers. At March 31, 2007, the aggregate market value of these securities amounted to $31,311,669 or 3.4% of net assets. |

| (d) | | Represents entire or partial position segregated as collateral for open future contracts. |

| (e) | | Represents entire or partial position segregated as collateral for TBA securities. |

| (f) | | Investment in affiliated money market mutual fund. |

| (g) | | At March 31, 2007, the cost basis of investment securities owned was substantially identical for both book and tax purposes. Gross unrealized appreciation of investments was $8,283,146 and gross unrealized depreciation of investments was $4,224,940, resulting in net unrealized appreciation of $4,058,206 (excluding foreign currency transactions, futures contracts and swap transactions). |

Explanation of Abbreviation:

TBA—To Be Announced.

Currency Abbreviations:

JPY—Japanese Yen

MXN—Mexican Peso

SEK—Swedish Krona

See Notes to Financial Statements.

| | |

| 2007 Semi-Annual Report | | 13 |

Statement of Assets and Liabilities—March 31, 2007 (Unaudited)

| | | | |

| | | INTERMEDIATE DURATION

INSTITUTIONAL PORTFOLIO | |

| |

| ASSETS: | | | | |

Investments in securities at value | | | | |

Unaffiliated issuers | | $ | 884,350,782 | |

Affiliated issuers | | | 108,450,102 | |

Foreign currency at value (a)(b) | | | 463,861 | |

Cash in bank | | | 126,556 | |

Receivables: | | | | |

Interest | | | 7,058,163 | |

Investment securities sold | | | 4,835,552 | |

Capital shares sold | | | 3,064,539 | |

Appreciation of interest rate swap agreements | | | 318,293 | |

Appreciation of foreign currency contracts | | | 118,585 | |

| | | | |

Total assets | | | 1,008,786,433 | |

| | | | |

| |

| LIABILITIES | | | | |

Payables: | | | | |

Dividends to shareholders | | | 1,308,497 | |

Investment securities purchased and foreign currency transactions | | | 95,443,816 | |

Capital shares redeemed | | | 273,240 | |

Deferred income on dollar rolls | | | 2,078 | |

Management fee | | | 307,900 | |

Transfer Agent fee | | | 7,099 | |

Margin owed to broker on futures contracts | | | 65,437 | |

Accrued expenses | | | 155,204 | |

Depreciation of interest rate swap agreements | | | 90,301 | |

Depreciation of foreign currency contracts | | | 280,913 | |

| | | | |

Total liabilities | | | 97,934,485 | |

| | | | |

NET ASSETS | | $ | 910,851,948 | |

| | | | |

Cost of investments | | | | |

Unaffiliated issuers | | $ | 880,292,576 | |

Affiliated issuers | | $ | 108,450,102 | |

| | | | |

SHARES OF CAPITAL STOCK OUTSTANDING | | | 60,285,775 | |

| | | | |

NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE | | $ | 15.11 | |

| | | | |

| |

| NET ASSETS CONSIST OF: | | | | |

Capital stock, at par* | | $ | 60,286 | |

Additional paid-in capital | | | 917,952,345 | |

Undistributed net investment income/(excess distributions) | | | (3,632,161 | ) |

Accumulated net realized loss on investments, futures and foreign currency transactions | | | (7,839,671 | ) |

Unrealized appreciation/(depreciation) of: | | | | |

Investments, futures and swaps | | | 4,467,850 | |

Foreign currency denominated assets and liabilities | | | (156,701 | ) |

| | | | |

| | $ | 910,851,948 | |

| | | | |

(a) Cost: $465,424. (Note 1)

(b) The amount of U.S. $573 has been segregated to collaterize margin requirement for the open futures contracts at March 31, 2007.

* The Sanford C. Bernstein Fund II, Inc. has authorized 300 million shares of common stock with par value of $.001 per share.

See Notes to Financial Statements.

| | |

| 14 | | Sanford C. Bernstein Fund II, Inc. |

Statement of Operations—for the six months ended March 31, 2007 (Unaudited)

| | | | |

| | | INTERMEDIATE DURATION

INSTITUTIONAL PORTFOLIO | |

| |

| INVESTMENT INCOME | | | | |

Income: | | | | |

Interest: | | | | |

Unaffiliated issuers | | $ | 20,261,533 | |

Affiliated issuers | | | 1,419,109 | |

| | | | |

Total income | | | 21,680,642 | |

| | | | |

Expenses: | | | | |

Management fee | | | 2,070,129 | |

Custodian fee | | | 142,526 | |

Transfer Agent fee | | | 12,078 | |

Auditing and tax fees | | | 24,501 | |

Directors’ fees and expenses | | | 19,417 | |

Legal fees | | | 22,515 | |

Registration fees | | | 37,287 | |

Printing fees | | | 11,232 | |

Miscellaneous | | | 1,265 | |

| | | | |

Total expenses | | | 2,340,950 | |

Less: expenses waived and reimbursed by the Adviser | | | (477,807 | ) |

| | | | |

Net expenses | | | 1,863,143 | |

| | | | |

Net investment income | | | 19,817,499 | |

| | | | |

| |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENT AND FOREIGN CURRENCY TRANSACTIONS | | | | |

Net realized gain (loss) on: | | | | |

Investment transactions | | | 1,565,731 | |

Futures transactions | | | (347,090 | ) |

Foreign currency transactions | | | 1,777,442 | |

Swap transactions | | | (311,657 | ) |

| | | | |

Net realized gain (loss) on investment and foreign currency transactions | | | 2,684,426 | |

| | | | |

Net increase (decrease) in unrealized appreciation/(depreciation) of: | | | | |

Investments, futures and swaps | | | 3,871,087 | |

Foreign currency denominated assets and liabilities | | | (1,568,505 | ) |

| | | | |

Net increase in unrealized appreciation/(depreciation) of investments and foreign currency denominated assets and liabilities | | | 2,302,582 | |

| | | | |

Net realized and unrealized gain on investment and foreign currency transactions | | | 4,987,008 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 24,804,507 | |

| | | | |

See Notes to Financial Statements.

| | |

| 2007 Semi-Annual Report | | 15 |

Statement of Changes in Net Assets

| | | | | | | | |

| |

| | | INTERMEDIATE DURATION

INSTITUTIONAL PORTFOLIO | |

| | | | | | | | |

| | | SIX MONTHS

ENDED 3/31/07

(UNAUDITED) | | | YEAR

ENDED

9/30/06 | |

| | |

| INCREASE (DECREASE) IN NET ASSETS FROM | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 19,817,499 | | | $ | 33,233,680 | |

Net realized gain (loss) on investment and

foreign currency transactions | | | 2,684,426 | | | | (10,566,990 | ) |

Increase in unrealized appreciation/(depreciation) of

investments, futures, swaps, and foreign currency

denominated assets and liabilities | | | 2,302,582 | | | | 2,610,063 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 24,804,507 | | | | 25,276,753 | |

| | | | | | | | |

Dividends and distributions to shareholders: | | | | | | | | |

Dividends from net investment income | | | (22,026,114 | ) | | | (33,497,511 | ) |

| | | | | | | | |

Total dividends and distributions to shareholders | | | (22,026,114 | ) | | | (33,497,511 | ) |

| | | | | | | | |

Capital-share transactions: | | | | | | | | |

Net proceeds from sales of shares | | | 177,757,467 | | | | 289,200,582 | |

Net proceeds from sales of shares issued to shareholders on

reinvestment of dividends and distributions | | | 6,618,431 | | | | 9,550,714 | |

| | | | | | | | |

Total proceeds from shares sold | | | 184,375,898 | | | | 298,751,296 | |

Cost of shares redeemed | | | (34,104,566 | ) | | | (183,643,506 | ) |

| | | | | | | | |

Increase in net assets from capital-share transactions | | | 150,271,332 | | | | 115,107,790 | |

| | | | | | | | |

Net increase in net assets | | | 153,049,725 | | | | 106,887,032 | |

| | |

| NET ASSETS: | | | | | | | | |

Beginning of period | | | 757,802,223 | | | | 650,915,191 | |

| | | | | | | | |

End of period (a) | | $ | 910,851,948 | | | $ | 757,802,223 | |

| | | | | | | | |

(a) Includes excess distributions of: | | $ | (3,632,161 | ) | | $ | (1,423,546 | ) |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| 16 | | Sanford C. Bernstein Fund II, Inc. |

Financial Highlights

Selected per-share data and ratios for a share of capital stock outstanding for the Portfolio for each of the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | INTERMEDIATE DURATION

INSTITUTIONAL PORTFOLIO | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | SIX MONTHS

ENDED

3/31/07

(UNAUDITED) | | | YEAR

ENDED

9/30/06 | | | YEAR

ENDED

9/30/05 | | | YEAR

ENDED

9/30/04 | | | YEAR

ENDED

9/30/03 | | | YEAR

ENDED

9/30/02(a) | |

Net asset value, beginning of period | | | $15.06 | | | | $15.25 | | | | $15.48 | | | | $15.74 | | | | $15.44 | | | | $15.00 | (b) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Investment income, net† | | | 0.36 | | | | 0.70 | | | | 0.64 | | | | 0.60 | | | | 0.56 | | | | 0.25 | |

Net realized and unrealized gain (loss) on investments and foreign currency tansactions | | | 0.09 | | | | (0.18 | ) | | | (0.13 | ) | | | (0.03 | ) | | | 0.41 | | | | 0.44 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.45 | | | | 0.52 | | | | 0.51 | | | | 0.57 | | | | 0.97 | | | | 0.69 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from taxable net investment income | | | (0.40 | ) | | | (0.71 | ) | | | (0.65 | ) | | | (0.61 | ) | | | (0.57 | ) | | | (0.25 | ) |

Dividends from net realized gain on investment transactions | | | 0 | | | | 0 | | | | (0.09 | ) | | | (0.22 | ) | | | (0.10 | ) | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.40 | ) | | | (0.71 | ) | | | (0.74 | ) | | | (0.83 | ) | | | (0.67 | ) | | | (0.25 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | | $15.11 | | | | $15.06 | | | | $15.25 | | | | $15.48 | | | | $15.74 | | | | $15.44 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return (c) | | | 3.04% | | | | 3.53% | | | | 3.41% | | | | 3.76% | | | | 6.44% | | | | 4.62% | |

| | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 910,852 | | | $ | 757,802 | | | $ | 650,915 | | | $ | 609,248 | | | $ | 464,517 | | | $ | 328,393 | |

Average net assets (000 omitted) | | $ | 825,789 | | | $ | 710,128 | | | $ | 611,401 | | | $ | 535,624 | | | $ | 383,604 | | | $ | 237,462 | |

Ratio of expenses to average net assets | | | 0.45% | * | | | 0.45% | (d) | | | 0.45% | | | | 0.45% | | | | 0.45% | | | | 0.45% | * |

Ratio of expenses to average net assets before reimbursement | | | 0.57% | * | | | 0.58% | (d) | | | 0.57% | | | | 0.58% | | | | 0.64% | | | | 0.75% | * |

Ratio of net investment income to average net assets | | | 4.79% | * | | | 4.68% | (d) | | | 4.16% | | | | 3.86% | | | | 3.64% | | | | 4.37% | * |

Portfolio turnover rate | | | 134% | | | | 511% | | | | 619% | | | | 682% | | | | 791% | | | | 324% | |

| † | Based on average shares outstanding. |

| (a) | Commenced operations on May 17, 2002. |

| (b) | Prior to the commencement of operations, May 17, 2002, AllianceBernstein L.P. (prior to February 24, 2006 known as Alliance Capital Management L.P.), redeemed 1,333 shares representing $16,666 of the Portfolio and made a capital contribution of $16,666 into the Portfolio, adjusting the opening net asset value per share from $12.50 to $15.00. |

| (c) | Total investment return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption on the last day of the period. Total Return does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Total investment return calculated for a period of less than one year is not annualized. |

| (d) | The ratio includes expenses attributable to costs of proxy solicitation. |

See Notes to Financial Statements.

| | |

| 2007 Semi-Annual Report | | 17 |

Notes to Financial Statements

| NOTE 1. | Organization and Significant Accounting Policies |

Sanford C. Bernstein Fund II, Inc. (the “Fund”). is a managed open-end registered investment company incorporated in Maryland on February 7, 2002. The Fund, currently comprises one portfolio, the Intermediate Duration Institutional Portfolio (the “Portfolio”) which commenced offering on May 17, 2002, through an investment of securities received in an in-kind redemption in the amount of $149,411,702 from the Intermediate Duration Portfolio of the Sanford C. Bernstein Fund, Inc. The preparation of financial statements in accordance with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Fund.

Portfolio securities are valued at their current market value determined on the basis of market quotations or, if market quotations are not readily available or are deemed unreliable, at “fair value” as determined in accordance with procedures established by and under the general supervision of the Fund’s Board of Directors.

In general, the market value of securities which are readily available and deemed reliable are determined as follows: Securities listed on a national securities exchange (other than securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”)) or on a foreign securities exchange are valued at the last sale price at the close of the exchange or foreign securities exchange. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices on such day. Securities listed on more than one exchange are valued by reference to the principal exchange on which the securities are traded; securities listed only on NASDAQ are valued in accordance with the NASDAQ Official Closing Price; listed put or call options are valued at the last sale price. If there has been no sale on that day, such securities will be valued at the closing bid prices on that day; open futures contracts and options thereon are valued using the closing settlement price or, in the absence of such a price, the most recent quoted bid price. If there are no quotations available for the day of valuation, the last available closing settlement price is used; securities traded in the over-the-counter markets, (“OTC”) are valued at the mean of the current bid and asked prices as reported by the National Quotation Bureau or other comparable sources; U.S. government securities and other debt instruments having 60 days or less remaining until maturity are valued at amortized cost if their original maturity was 60 days or less; or by amortizing their fair value as of the 61st day prior to maturity if their original term to maturity exceeded 60 days; fixed-income securities, including mortgage backed and asset backed securities, may be valued on the basis of prices provided by a pricing service or at a price obtained from one or more of the major broker/dealers. In cases where broker/dealer quotes are obtained, AllianceBernstein, L.P., (the “Adviser”) may establish procedures whereby changes in market yields or spreads are used to adjust, on a daily basis, a recently obtained quoted price on a security; and OTC and other derivatives are valued on the basis of a quoted bid price or spread from a major broker/dealer in such security.

Securities for which market quotations are not readily available (including restricted securities) or are deemed unreliable are valued at fair value. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, analysis of the issuer’s financial statements or other available documents. In addition, the Fund may use fair value pricing for securities primarily traded in non-U.S. markets because most foreign markets close well before the Fund values its securities at 4:00 p.m., Eastern Time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim and may materially affect the value of those securities.

| B. | | Foreign Currency Translation |

The accounting records of the Fund are maintained in U.S. dollars. Prices of securities and other assets and liabilities denominated in non-U.S. currencies are translated into U.S. dollars using the exchange rate at 12:00 p.m., Eastern time. Amounts related to the purchases and sales of securities, investment income and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions.

Net realized gain or loss on foreign currency transactions represents net foreign exchange gains or losses from the closure of forward currency exchange contracts, disposition of foreign currencies, currency gains or losses realized between the trade and settlement dates on security transactions and the difference between the amount of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amount actually received or paid.

| | |

| 18 | | Sanford C. Bernstein Fund II, Inc. |

Net unrealized currency gains and losses arising from valuing foreign currency denominated assets and liabilities, other than security investments, at the current exchange rate are reflected as part of unrealized appreciation/depreciation on foreign currencies.

The Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the changes in the market prices of securities held at period end. The Fund does not isolate the effect of changes in foreign exchange rates from changes in market prices of equity securities sold during the year. The Fund does isolate the effect of changes in foreign exchange rates from changes in market prices of debt securities sold during the year, as required by the Internal Revenue Code.

The Fund may invest in foreign securities and foreign currency transactions that may involve risks not associated with domestic investments as a result of the level of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability, among others.

| C. | | Security Transactions and Related Investment Income |

Security transactions are accounted for on the trade date (the date the buy or sell order is executed). Securities gains and losses are calculated on the identified cost basis. Interest income is recorded on the accrual basis and dividend income is recorded on the ex-dividend date or as soon as the Fund is informed of the dividend.

Upon entering into a futures contract, the Portfolio is required to deposit cash or to pledge securities and maintain as collateral on initial margin with the broker equal to a certain percentage of the purchase price indicated in the futures contract. Subsequent payments, which are dependent on the daily fluctuations in the market value of the underlying index or security, are made or received by the Portfolio each day (daily variation margin) or at other intervals as is required. The aggregate of these payments or receipts through the expiration of the futures contract is recorded for book purposes as unrealized gains or losses by the Portfolio. If the Portfolio enters into a closing transaction, it will realize, for book purposes, a gain or loss equal to the difference between the value of the futures contract at the time it was opened or purchased and its value at the time it was closed.

When the Portfolio writes an option, an amount equal to the premium received by the Portfolio is recorded as an asset and a corresponding liability. The amount of the liability is adjusted daily to reflect the current market value of the option. When a call option is exercised, the Portfolio realizes a gain or loss on the underlying security, with the proceeds from the security sale increased by the amount of the option premium received. When a put option is exercised, the cost basis of the security purchased by the Portfolio is reduced by the option premium received. For the six months ended March 31, 2007, the Portfolio had no transactions in written options.

The Portfolio intends to continue to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986 as they apply to regulated investment companies. By so complying, the Portfolio will not be subject to federal income taxes to the extent that all of its income is distributed. The Portfolio may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on income and/or capital gains earned or repatriated. Taxes are accrued and applied to net investment income, net realized gains and net unrealized appreciation/depreciation as such income and/or gains are earned.

The Portfolio may enter into repurchase agreements with banks or securities broker-dealers. It is the Fund’s policy that its custodian receive delivery of the securities collateralizing repurchase agreements, the amount of which at the time of purchase and each subsequent business day is required to be maintained at such a level that the market value of the collateral is equal to at least 100% of the repurchase price. Repurchase agreements could involve certain risks in the event of default or insolvency of the other party, including possible delays or restrictions on the Portfolio’s ability to dispose of the underlying securities.

| | |

| 2007 Semi-Annual Report | | 19 |

Notes to Financial Statements (continued)

| H. | | Securities Transactions on a When-Issued or Delayed-Delivery Basis |

The Portfolio may purchase securities on a when-issued basis or purchase or sell securities on a delayed-delivery basis. At the time the Portfolio commits to purchase a security on a when-issued or delayed-delivery basis, the Portfolio will record the transaction and use the security’s value in determining the Portfolio’s net asset value. At the time the Portfolio commits to sell a security on a delayed-delivery basis, the Portfolio will record the transaction and exclude the security’s value in determining the Portfolio’s net asset value. The Portfolio segregates cash and marketable securities at least equal in value to its purchase commitment for when-issued or delayed-delivery securities, and segregates portfolio securities on a delayed-delivery basis.

| I. | | Distribution of Income and Gains |

Net investment income of the Portfolio is declared and recorded as a dividend to shareholders daily and is payable to shareholders monthly.

Distributions of net realized gains, less any available loss carryforwards, if any, for the Portfolio will be paid to shareholders at least once a year, and recorded on the ex-dividend date.

Elements of realized gains and net investment income may be recorded in different accounting periods for financial reporting (book) and federal income tax (tax) purposes (temporary differences). To the extent that such distributions required for tax purposes exceed income and gains recorded for book purposes as a result of such temporary differences, “excess distributions” are reflected in the accompanying financial statements. Certain other differences—permanent differences—arise because treatment of elements of income and gains is different between book and tax accounting. Permanent differences are reclassified in the year they arise.