UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21034

SANFORD C. BERNSTEIN FUND II, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: September 30, 2014

Date of reporting period: March 31, 2014

ITEM 1. REPORTS TO STOCKHOLDERS.

SANFORD C. BERNSTEIN FUND II, INC.

INTERMEDIATE DURATION INSTITUTIONAL PORTFOLIO

SEMI-ANNUAL REPORT

MARCH 31, 2014

Table of Contents

Before investing in the Sanford C. Bernstein Fund II, Inc., a prospective investor should consider carefully the portfolio’s investment objectives and policies, charges, expenses and risks. These and other matters of importance to prospective investors are contained in the portfolio’s prospectus, an additional copy of which may be obtained by visiting our website at www.bernstein.com and clicking on “Investments”, then “Stocks” or “Bonds”, then “Prospectuses, SAIs and Shareholder Reports” or by calling your financial advisor or by calling Bernstein’s mutual fund shareholder help line at 212.756.4097. Please read the prospectus carefully before investing.

For performance information current to the most recent month-end, please visit our website at www.bernstein.com and click on “Investments”, then “Stocks” or “Bonds”, then “Prospectuses, SAIs and Shareholder Reports.”

This shareholder report must be preceded or accompanied by the Sanford C. Bernstein Fund II, Inc. prospectus for individuals who are not shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit www.alliancebernstein.com, or go to the Securities and Exchange Commission’s website at www.sec.gov, or call AllianceBernstein at 800.227.4618.

The Fund will file its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the Commission’s website at www.sec.gov. The Fund’s Form N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C.; information on the operation of the Public Reference Room may be obtained by calling 800.SEC.0330.

Investment Products Offered: · Are Not FDIC Insured · May Lose Value · Are Not Bank Guaranteed

Portfolio Manager Commentary (Unaudited)

To Our Shareholders—May 13, 2014

This report provides management’s discussion of fund performance for Sanford C. Bernstein Fund II, Inc. Intermediate Duration Institutional Portfolio (the “Portfolio”) for the semi-annual reporting period ended March 31, 2014.

Investment Objectives and Policies

The Portfolio’s investment objective is to provide safety of principal and a moderate to high rate of current income. The Portfolio seeks to maintain an average portfolio quality minimum of A, based on ratings given to the Portfolio’s securities by national rating agencies (or, if unrated, determined by AllianceBernstein L.P., the Portfolio’s investment manager (the “Adviser”), to be of comparable quality). Many types of securities may be purchased by the Portfolio, including corporate bonds, notes, U.S. Government and agency securities, asset-backed securities, mortgage-related securities, bank loan debt, preferred stock and inflation-protected securities, as well as others. The Portfolio may also invest up to 25% of its total assets in fixed-income, non-U.S. Dollar denominated foreign securities, and may invest without limit in fixed-income, U.S. Dollar denominated foreign securities, in each case in developed or emerging-market countries.

The Portfolio may use derivatives, such as options, futures, forwards and swaps. The Portfolio may invest up to 25% of its total assets in fixed-income securities rated below investment grade (BB or below) by national rating agencies (commonly known as “junk bonds”). No more than 5% of the Portfolio’s total assets may be invested in fixed-income securities rated CCC by national rating agencies. The Portfolio seeks to maintain an effective duration of three to six years under normal market conditions. The Portfolio may enter into foreign currency transactions on a spot (i.e., cash) basis or through the use of derivatives transactions, such as forward currency exchange contracts, currency futures and options thereon, and options on currencies.

Investment Results

The table on page 6 shows the Portfolio’s performance compared to its benchmark, the Barclays U.S. Aggregate Bond Index, and the Lipper Core Bond Funds Average (a comparison to peers of similarly managed funds, the “Lipper Average”) for the six- and 12-month periods ended March 31, 2014.

The Portfolio outperformed its benchmark and the Lipper Average for both the six- and 12-month reporting periods; sector and security selection were the primary positive drivers of relative performance. Within the Portfolio’s sector allocation, an underweight to Treasuries as well as non-benchmark exposure to high yield corporates and non-agency mortgages were positive contributors. Security selection within the Portfolio’s corporate holdings, particularly within banks, also contributed for both periods. Selection within agency mortgage holdings, specifically an underweight to medium- and high-coupon mortgage securities, which outperformed lower-coupon mortgages as rates began to climb, detracted.

The Portfolio utilized derivatives including Treasury futures and interest rate swaps to manage the overall duration positioning of the Portfolio; overall yield curve positioning was a modest detractor for both periods. Credit default swaps were utilized for both hedging and investment purposes, and currency forwards were utilized for hedging purposes, which had an immaterial impact for both periods.

Market Review and Investment Strategy

Global equity markets responded positively to economic improvement in key developed countries, and accommodative monetary policies of major central banks supported fixed-income during the six-month period ended March 31, 2014. In the U.S., solid data on employment, consumer spending and housing pointed to continued economic recovery. Despite wide differences between individual countries, the euro area showed signs of modest economic growth, reflected by stronger manufacturing activity and an increase in consumer confidence. In Japan, both employment growth and core inflation have turned positive, suggesting that the aggressive government efforts to reverse a decade of deflation and stimulate growth are delivering results.

By contrast, emerging markets continued to underperform developed markets, as sluggish exports and weak domestic demand have hampered economic growth in several bellwether countries such as China and Brazil. Investors were also concerned about the impact on growth for those emerging-market countries that have relied on abundant global liquidity and low interest rates to finance government spending as the U.S. Federal Reserve (the “Fed”) reined in its bond purchase program.

The direction of U.S. federal policy also played a significant role in market activity in the six-month period. Fixed-income markets underperformed in the beginning of the period, as

(Portfolio Manager Commentary continued on next page)

| | | | |

| 2014 Semi-Annual Report | | | 1 | |

Portfolio Manager Commentary (continued)

interest rates rose in response to signals by the Fed that it would consider reducing its bond-buying program, which then came to pass in December. At the end of the period, however, capital markets rebounded with almost all major fixed-income sectors outperforming (with the notable exception of local-currency emerging-market debt), as Fed Chair Janet Yellen reaffirmed that tapering should continue unabated. Investors were encouraged to hear that the program is expected to be reduced in measured steps, and that monetary stance should remain accommodative for the foreseeable future.

The Portfolio remained underweight U.S. Treasuries and agency mortgages with an overweight to commercial mortgage-backed securities and asset-backed securities. Among investment-grade corporates, the Portfolio favors financials. The Portfolio is also opportunistically holding a small allocation to U.S. dollar-denominated- as well as local emerging-market debt. The Portfolio’s duration remains modestly short versus its benchmark, with an emphasis on intermediate securities in order to benefit from the steepness of the U.S. yield curve.

| | |

| 2 | | Sanford C. Bernstein Fund II, Inc. |

Disclosures and Risks (Unaudited)

None of the following indices or averages reflects fees and expenses associated with the active management of a mutual fund portfolio. The Barclays U.S. Aggregate Bond Index represents the performance of securities within the U.S. investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, asset-backed securities, and commercial mortgaged-backed securities. The Lipper Core Bond Funds Average is the equal-weighted average returns of the portfolios in the relevant Lipper Inc. category; the average portfolios in a category may differ in composition from the Portfolio. The Lipper Core Bond Funds Average contains portfolios that invest primarily in investment-grade debt issues (rated in the top four grades) with dollar-weighted average maturities of five to ten years. An investor cannot invest directly in an index or average, and their results are not indicative of the performance for any specific investment, including the Portfolio.

A Word About Risk

The share price of the Portfolio will fluctuate and you may lose money. There is no guarantee that the Portfolio will achieve its investment objective.

Interest Rate Risk: This is the risk that changes in interest rates will affect the value of the Portfolio’s investments in fixed-income debt securities such as bonds and notes. Interest rates in the United States have recently been historically low. Increases in interest rates may cause the value of the Portfolio’s investments to decline and this decrease in value may not be offset by higher income from new investments. Interest rate risk is generally greater for fixed-income securities with longer maturities or durations.

Credit Risk: This is the risk that the issuer or the guarantor of a debt security, or the counterparty to a derivatives or other contract, will be unable or unwilling to make timely principal and/or interest payments, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security. Investments in fixed-income securities with lower ratings tend to have a higher probability that an issuer will default or fail to meet its payment obligations. At times when credit risk is perceived to be greater, credit “spreads” (i.e., the difference between the yields on lower quality securities and the yields on higher quality securities) may get larger or “widen”. As a result, the values of the lower quality securities may go down more.

Duration Risk: The duration of a fixed-income security may be shorter than or equal to full maturity of the fixed-income security. Fixed-income securities with longer durations have more risk and will decrease in price as interest rates rise. For example, a fixed-income security with a duration of three years will decrease in value by approximately 3% if interest rates increase by 1%.

Inflation Risk: This is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the value of the Portfolio’s assets can decline as can the value of the Portfolio’s distributions. This risk is significantly greater for fixed-income securities with longer maturities.

Inflation-Protected Securities Risk: The terms of inflation-protected securities provide for the coupon and/or maturity value to be adjusted based on changes in inflation. Decreases in the inflation rate or in investors’ expectations about inflation could cause these securities to underperform non-inflation-adjusted securities on a total-return basis. In addition, these securities may have limited liquidity in the secondary market.

Foreign (Non-U.S.) Securities Risk: Investments in foreign securities entail significant risks in addition to those customarily associated with investing in U.S. securities. These risks include risks related to adverse market, economic, political and regulatory factors and social instability, all of which could disrupt the financial markets in which the Portfolio invests and adversely affect the value of the Portfolio’s assets.

Emerging Markets Securities Risk: The risks of investing in foreign (non-U.S.) securities are heightened with respect to issuers in emerging-market countries, because the markets are less developed and less liquid and there may be a greater amount of economic, political and social uncertainty.

Derivatives Risk: The Portfolio may use derivatives as direct investments to earn income, enhance return and broaden portfolio diversification, which entail greater risk than if used solely for hedging purposes. In addition to other risks such as the credit risk of the counterparty, derivatives involve the risk that changes in the value of the derivative may not correlate with relevant assets, rates or indices. Derivatives may be illiquid and difficult to price or unwind, and small changes may

Disclosures & Risks continued on next page

| | | | |

| 2014 Semi-Annual Report | | | 3 | |

Disclosures and Risks (continued)

produce disproportionate losses for the Portfolio. Certain derivatives have the potential for unlimited loss, regardless of the size of the initial investment. Assets required to be set aside or posted to cover or secure derivatives positions may themselves go down in value, and these collateral and other requirements may limit investment flexibility. Some derivatives involve leverage, which can make the Portfolio more volatile and can compound other risks. The U.S. Government is in the process of adopting and implementing regulations governing derivatives markets, including mandatory clearing of certain derivatives, margin, reporting and registration requirements. The ultimate impact of the regulations remains unclear. Additional regulation may make derivatives more costly, may limit their availability, may disrupt markets or may otherwise adversely affect their value or performance.

Mortgage-Related Securities Risk: In the case of investments in mortgage-related securities, a loss could be incurred if the collateral backing these securities is insufficient.

Prepayment and Extension Risk: Prepayment risk is the risk that a loan, bond or other security might be called or otherwise converted, prepaid or redeemed before maturity. If this happens, particularly during a time of declining interest rates or credit spreads, the Portfolio will not benefit from the rise in market price that normally accompanies a decline in interest rates, and may not be able to invest the proceeds in securities providing as much income, resulting in a lower yield to the Portfolio. Conversely, extension risk is the risk that as interest rates rise or spreads widen, payments of securities may occur more slowly than anticipated by the market. When this happens, the values of these securities may go down because their interest rates are lower than current market rates and they remain outstanding longer than anticipated.

Subordination Risk: The Portfolio may invest in securities that are subordinated to more senior securities of an issuer, or which represent interests in pools of such subordinated securities. Subordinated securities will be disproportionately affected by a default or even a perceived decline in creditworthiness of the issuer. Subordinated securities are more likely to suffer a credit loss than non-subordinated securities of the same issuer, any loss incurred by the subordinated securities is likely to be proportionately greater, and any recovery of interest or principal may take more time.

Management Risk: The Portfolio is subject to management risk because it is an actively managed investment portfolio. The Manager will apply its investment techniques and risk analyses in making investment decisions for the Portfolio, but its decisions may not produce the desired results. In some cases, derivative and other investment techniques may be unavailable or the Manager may determine not to use them, possibly even under market conditions where their use could benefit the Portfolio.

Liquidity Risk: Liquidity risk exists when particular investments are difficult to purchase or sell, possibly preventing the Portfolio from selling out of these illiquid securities at an advantageous price. Illiquid securities may also be difficult to value. Derivatives and securities involving substantial market and credit risk tend to involve greater liquidity risk.

Foreign Currency Risk: This is the risk that changes in foreign (non-U.S.) currency exchange rates may negatively affect the value of the Portfolio’s investments or reduce the returns of the Portfolio. For example, the value of the Portfolio’s investments in foreign securities and foreign currency positions may decrease if the U.S. Dollar is strong (i.e., gaining value relative to other currencies) and other currencies are weak (i.e., losing value relative to the U.S. Dollar).

Actions by a Few Major Investors: In certain countries, volatility may be heightened by actions of a few major investors. For example, substantial increases or decreases in cash flows of mutual funds investing in these markets could significantly affect local securities prices and, therefore, share prices of the Portfolio.

Market Risk: The Portfolio is subject to market risk, which is the risk that bond prices in general may decline over short or extended periods. The global financial crisis that began in 2008 has caused a significant decline in the value and liquidity of many investments and unprecedented volatility in the markets. Some events that have contributed to ongoing and systematic market risks include the falling values of some sovereign debt and related investments, scarcity of credit, and high public debt. In response to the crisis, the U.S. Government and the Federal Reserve, as well as certain foreign governments and their central banks have taken steps to support financial markets, including by keeping interest rates low. The withdrawal of this support, failure of efforts in response to the crisis, or investor perception that such efforts are not succeeding could negatively affect financial markets generally as well as reduce the value and liquidity of certain securities.This environment could make identifying investment

Disclosures & Risks continued on next page

| | |

| 4 | | Sanford C. Bernstein Fund II, Inc. |

Disclosures and Risks (continued)

risks and opportunities especially difficult, and whether or not the Portfolio invests in securities of issuers located in or with significant exposure to countries experiencing economic and financial difficulties, the value and liquidity of the Portfolio’s investments may be negatively affected. In addition, policy and legislative changes in the United States and in other countries are affecting many aspects of financial regulation. The impact of these changes, and the practical implications for market participants, may not be fully known for some time.

Lower-rated Securities Risk: Lower-rated securities, or junk bonds/high yield securities, are subject to greater risk of loss of principal and interest and greater market risk than higher-rated securities. The capacity of issuers of lower-rated securities to pay interest and repay principal is more likely to weaken than is that of issuers of higher-rated securities in times of deteriorating economic conditions or rising interest rates.

These risks are fully discussed in the Portfolio’s prospectus.

An Important Note About Historical Performance

The performance shown on page 6 represents past performance and does not guarantee future results. Performance information is as of the dates shown. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.bernstein.com or by calling 212.756.4097.

The investment return and principal value of an investment in the Portfolio will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Investors should consider the investment objectives, risks, charges and expenses of the Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit www.bernstein.com, click on “Investments”, then “Stocks” or “Bonds”, then “Prospectuses, SAIs and Shareholder Reports” or by calling Bernstein’s mutual fund shareholder help line at 212.756.4097 or contact your Bernstein Advisor. Please read the prospectus and/or summary prospectus carefully before investing.

Except as noted, returns do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares. All fees and expenses related to the operation of the Portfolio have been deducted.

| | | | |

| 2014 Semi-Annual Report | | | 5 | |

Historical Performance (Unaudited)

Intermediate Duration Institutional Portfolio vs. Its Benchmark and Lipper Average

| | | | | | | | | | | | | | | | | | | | | | |

| | | TOTAL RETURNS | | | AVERAGE ANNUAL

TOTAL RETURNS | | | |

| THROUGH MARCH 31, 2014 | | PAST 6

MONTHS | | | PAST 12

MONTHS | | | PAST

FIVE YEARS | | | PAST

10 YEARS | | | SINCE

INCEPTION | | | INCEPTION DATE |

Intermediate Duration Institutional Portfolio† | | | 2.50 | % | | | 0.29 | % | | | 7.47 | % | | | 4.72 | % | | | 5.21 | % | | May 17, 2002 |

Barclays U.S. Aggregate Bond Index | | | 1.70 | % | | | -0.10 | % | | | 4.80 | % | | | 4.46 | % | | | 5.03 | % | | |

Lipper Core Bond Funds Average | | | 2.21 | % | | | 0.01 | % | | | 6.35 | % | | | 4.05 | % | | | 4.68 | % | | |

| † | | There are no sales charges associated with an investment in the Portfolio. Total returns and average annual returns are therefore the same. |

| * | | Includes the impact of proceeds received and credited to the Portfolio resulting from class action settlements, which enhanced the performance of the Portfolio for 12-month period ended March 31, 2014 by 0.01%. |

During the reporting period, the Adviser waived a portion of its advisory fee or reimbursed the Portfolio for a portion of its expenses to the extent necessary to limit the Portfolio’s expenses to 0.45%. These waivers/reimbursements may not be terminated before January 31, 2015 and may be extended by the Adviser for additional one-year terms. Without the waiver, the Portfolio’s expenses would have been higher (0.54%, as of 1/31/14) and its performance would have been lower than that shown.

|

| Intermediate Duration Institutional Portfolio |

| | | | |

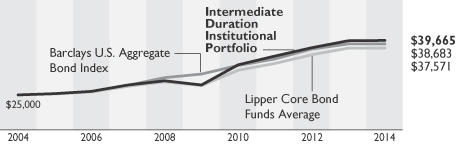

Growth of a $25,000 Investment in the Portfolio | | | | |

| | | | |

The chart shows the growth of $25,000 for the Portfolio and its benchmark and Lipper Average from March 31, 2004 through March 31, 2014.

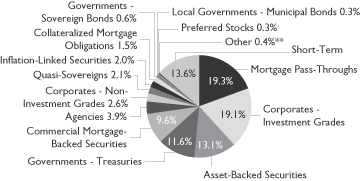

Portfolio Summary—March 31, 2014 (Unaudited)

| | | | |

| Intermediate Duration Institutional Portfolio | | | | |

| Security Type Breakdown* | | | | |

| | | | |

| * | | All data are as of March 31, 2014. The Portfolio’s security type breakdown is expressed as a percentage of total investments and may vary over time. The Portfolio also invests in other financial instruments including derivative transactions, which provide investment exposure to a variety of asset classes (see “Schedule of Investments” section of the report for additional details). |

| ** | | “Other” represents less than 0.3% in Emerging Markets—Corporate Bonds and Governments—Sovereign Agencies. |

See Disclosures, Risks and Note about Historical Performance on pages 3–5.

| | |

| 6 | | Sanford C. Bernstein Fund II, Inc. |

Expense Example—March 31, 2014 (Unaudited)

As a shareholder of the Fund, you incur various types of costs including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses—The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes—The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | BEGINNING

ACCOUNT VALUE

OCTOBER 1, 2013 | | | ENDING

ACCOUNT VALUE

MARCH 31, 2014 | | | EXPENSES

PAID DURING

PERIOD* | | | ANNUALIZED

EXPENSE

RATIO* | |

SCB II Intermediate Duration Institutional Portfolio | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,025.00 | | | $ | 2.27 | | | | 0.45 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,022.69 | | | $ | 2.27 | | | | 0.45 | % |

| |

| * | | Expenses are equal to the Fund’s annualized expense ratio, shown in the table above, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| ** | | Assumes 5% annual return before expenses. |

| | | | |

| 2014 Semi-Annual Report | | | 7 | |

Schedule of Investments

Sanford C. Bernstein Fund II, Inc.

Schedule of Investments

Intermediate Duration Portfolio

March 31, 2014 (unaudited)

| | | | | | | | | | | | |

| | | Principal Amount (000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

| MORTGAGE PASS-THROUGHS–22.0% | | | | | |

| Agency Fixed Rate 30-Year–18.1% | |

Federal Home Loan Mortgage Corp. Gold

4.00%, 2/01/41, TBA | | | U.S.$ | | | | 2,730 | | | $ | 2,832,055 | |

4.50%, 10/01/39–2/01/41 | | | | 10,539 | | | | 11,239,929 | |

Series 2005 | | | | | | | | | |

5.50%, 1/01/35 | | | | 40 | | | | 44,523 | |

Series 2007 | | | | | | | | | |

5.50%, 7/01/35 | | | | 847 | | | | 938,599 | |

Series 2013 | | | | | | | | | |

3.50%, 6/01/43 | | | | 7,008 | | | | 7,048,852 | |

Federal National Mortgage Association

3.00%, 3/01/43–11/01/43 | | | | 10,241 | | | | 9,896,985 | |

3.50%, 4/01/44, TBA | | | | 31,890 | | | | 32,079,347 | |

4.00%, 4/01/44, TBA | | | | 25,040 | | | | 26,025,950 | |

4.50%, 4/25/44, TBA | | | | 8,010 | | | | 8,544,418 | |

5.00%, 4/25/44, TBA | | | | 6,255 | | | | 6,819,416 | |

Series 2003 5.50%, 4/01/33–7/01/33 | | | | 2,344 | | | | 2,606,750 | |

Series 2004 5.50%, 2/01/34–11/01/34 | | | | 2,095 | | | | 2,329,691 | |

Series 2005 4.50%, 8/01/35 | | | | 1,996 | | | | 2,133,420 | |

5.50%, 2/01/35 | | | | 2,290 | | | | 2,545,227 | |

Series 2006 5.50%, 4/01/36 | | | | 508 | | | | 562,753 | |

Series 2007 4.50%, 9/01/35 | | | | 1,858 | | | | 1,988,374 | |

5.50%, 5/01/36–8/01/37 | | | | 202 | | | | 224,139 | |

Series 2012 3.50%, 1/01/43 | | | | 4,666 | | | | 4,697,691 | |

Series 2013 3.50%, 12/01/42–7/01/43 | | | | 8,809 | | | | 8,884,556 | |

| | | | | | | | | | | | |

| | | | | | | | 131,442,675 | |

| | | | | | | | | | | | |

| Agency Fixed Rate 15-Year–2.9% | | | | | | | | | |

Federal National Mortgage Association

2.50%, 4/01/29, TBA | | | | 21,500 | | | | 21,483,204 | |

| | | | | | | | | | | | |

| Agency ARMs–1.0% | | | | | | | | | |

Federal Home Loan Mortgage Corp.

2.36%, 4/01/35(a) | | | | 1,620 | | | | 1,729,895 | |

2.375%, 11/01/35(a) | | | | 2,829 | | | | 3,026,382 | |

2.62%, 5/01/35(a) | | | | 673 | | | | 710,118 | |

Series 2006 | | | | | | | | | |

2.686%, 12/01/36(a) | | | | 2 | | | | 1,613 | |

Series 2007 | | | | | | | | | |

2.80%, 3/01/37(a) | | | | 3 | | | | 2,793 | |

Series 2008 | | | | | | | | | |

2.407%, 11/01/37(b) | | | | 321 | | | | 339,838 | |

Federal National Mortgage Association | | | | | | | | | |

Series 2003

2.56%, 12/01/33(b) | | | | 624 | | | | 671,384 | |

| | | | | | | | | | | | |

Series 2007 | | | | | | | | | |

2.085%, 2/01/37(a) | | | U.S.$ | | | | 4 | | | $ | 4,770 | |

2.332%, 3/01/34(b) | | | | 581 | | | | 616,744 | |

2.606%, 3/01/37(b) | | | | | | | 6 | | | | 6,148 | |

| | | | | | | | | | | | |

| | | | | | | | 7,109,685 | |

| | | | | | | | | | | | |

Total Mortgage Pass-Throughs

(cost $158,212,744) | | | | | | | | 160,035,564 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | |

| CORPORATES—INVESTMENT GRADES–21.9% | | | | | |

| Industrial–11.0% | | | | | |

| Basic–2.1% | | | | | | | | | | | | |

Barrick North America Finance LLC

4.40%, 5/30/21 | | | | 1,130 | | | | 1,138,617 | |

Basell Finance Co. BV

8.10%, 3/15/27(c) | | | | 805 | | | | 1,050,329 | |

BHP Billiton Finance USA Ltd.

3.25%, 11/21/21 | | | | 10 | | | | 10,112 | |

Cia Minera Milpo SAA

4.625%, 3/28/23(c) | | | | | | | 1,126 | | | | 1,044,345 | |

Dow Chemical Co. (The)

4.375%, 11/15/42 | | | | | | | 802 | | | | 740,313 | |

7.375%, 11/01/29 | | | | | | | 170 | | | | 219,947 | |

8.55%, 5/15/19 | | | | | | | 699 | | | | 895,032 | |

Gerdau Trade, Inc.

4.75%, 4/15/23(c) | | | | | | | 2,000 | | | | 1,868,132 | |

5.75%, 1/30/21(c) | | | | | | | 114 | | | | 116,850 | |

Glencore Funding LLC

4.125%, 5/30/23(c) | | | | | | | 1,260 | | | | 1,203,407 | |

International Paper Co.

4.75%, 2/15/22 | | | | | | | 1,155 | | | | 1,248,841 | |

7.95%, 6/15/18 | | | | | | | 408 | | | | 499,004 | |

LyondellBasell Industries NV

5.75%, 4/15/24 | | | | | | | 1,481 | | | | 1,706,093 | |

Minsur SA

6.25%, 2/07/24(c) | | | | | | | 1,290 | | | | 1,354,686 | |

Rio Tinto Finance USA PLC

2.875%, 8/21/22 | | | | | | | 945 | | | | 899,446 | |

3.50%, 3/22/22 | | | | | | | 347 | | | | 347,131 | |

Sociedad Quimica y Minera de Chile SA

3.625%, 4/03/23(c) | | | | 1,043 | | | | 940,231 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 15,282,516 | |

| | | | | | | | | | | | |

| Capital Goods–0.9% | | | | | | | | | | | | |

Embraer SA

5.15%, 6/15/22 | | | | | | | 759 | | | | 787,463 | |

Odebrecht Finance Ltd.

5.125%, 6/26/22(c) | | | | | | | 960 | | | | 957,600 | |

Owens Corning

6.50%, 12/01/16(a) | | | | | | | 1,694 | | | | 1,870,554 | |

Republic Services, Inc. | | | | | | | | | | | | |

3.80%, 5/15/18 | | | | | | | 16 | | | | 16,962 | |

5.25%, 11/15/21 | | | | | | | 978 | | | | 1,093,300 | |

5.50%, 9/15/19 | | | | | | | 1,303 | | | | 1,477,439 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,203,318 | |

| | | | | | | | | | | | |

| | |

| 8 | | Sanford C. Bernstein Fund II, Inc. |

| | | | | | | | | | | | |

| | | |

| | | Principal Amount (000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

| Communications—Media–1.5% | | | | | | | | | | | | |

21st Century Fox America, Inc. | | | | | | | | | | | | |

4.50%, 2/15/21 | | | U.S.$ | | | | 40 | | | $ | 43,401 | |

6.15%, 3/01/37–2/15/41 | | | | 1,388 | | | | 1,631,879 | |

6.55%, 3/15/33 | | | | 780 | | | | 933,781 | |

CBS Corp.

8.875%, 5/15/19 | | | | 29 | | | | 37,181 | |

DirecTV Holdings LLC/DirecTV

Financing Co., Inc.

3.80%, 3/15/22 | | | | 1,935 | | | | 1,914,758 | |

4.75%, 10/01/14 | | | | 950 | | | | 968,575 | |

NBCUniversal Enterprise, Inc.

5.25%, 3/19/21(c) | | | | 1,155 | | | | 1,166,550 | |

Omnicom Group, Inc.

3.625%, 5/01/22 | | | | 839 | | | | 833,210 | |

SES Global Americas Holdings GP

2.50%, 3/25/19(c) | | | | 537 | | | | 533,723 | |

TCI Communications, Inc.

7.875%, 2/15/26 | | | | 130 | | | | 172,197 | |

Time Warner Cable, Inc.

4.00%, 9/01/21 | | | | 25 | | | | 25,934 | |

4.125%, 2/15/21 | | | | 1,740 | | | | 1,821,573 | |

5.00%, 2/01/20 | | | | 10 | | | | 10,921 | |

7.50%, 4/01/14 | | | | 1,135 | | | | 1,135,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 11,228,683 | |

| | | | | | | | | | | | |

| Communications—Telecommunications–1.5% | | | | | |

American Tower Corp.

4.70%, 3/15/22 | | | | | | | 30 | | | | 31,346 | |

5.05%, 9/01/20 | | | | | | | 2,205 | | | | 2,373,248 | |

AT&T, Inc.

3.00%, 2/15/22 | | | | | | | 20 | | | | 19,418 | |

4.30%, 12/15/42 | | | | | | | 567 | | | | 502,406 | |

5.35%, 9/01/40 | | | | | | | 524 | | | | 535,493 | |

BellSouth Telecommunications LLC

7.00%, 10/01/25 | | | | | | | 135 | | | | 155,519 | |

British Telecommunications PLC

9.625%, 12/15/30(b) | | | | | | | 23 | | | | 35,554 | |

Deutsche Telekom International Finance BV

4.875%, 3/06/42(c) | | | | | | | 1,262 | | | | 1,269,441 | |

New Cingular Wireless Services, Inc.

8.75%, 3/01/31 | | | | | | | 10 | | | | 14,530 | |

Rogers Communications, Inc.

4.00%, 6/06/22 | | | CAD | | | | 256 | | | | 235,985 | |

Telefonica Emisiones SAU

5.462%, 2/16/21 | | | U.S.$ | | | | 1,100 | | | | 1,209,264 | |

Verizon Communications, Inc.

4.60%, 4/01/21 | | | | | | | 177 | | | | 191,907 | |

5.15%, 9/15/23 | | | | | | | 1,522 | | | | 1,665,554 | |

6.55%, 9/15/43 | | | | | | | 2,422 | | | | 2,947,417 | |

Vodafone Group PLC

4.375%, 3/16/21 | | | | | | | 15 | | | | 16,067 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 11,203,149 | |

| | | | | | | | | | | | |

| Consumer Cyclical—Automotive–0.7% | | | | | | | | | |

Ford Motor Credit Co. LLC

5.00%, 5/15/18 | | | | | | | 1,984 | | | | 2,189,798 | |

5.875%, 8/02/21 | | | | | | | 930 | | | | 1,070,091 | |

| | | | | | | | | | | | |

| | | |

| | | Principal Amount (000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

Harley-Davidson Funding Corp.

5.75%, 12/15/14(c) | | | U.S.$ | | | | 1,821 | | | $ | 1,883,378 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,143,267 | |

| | | | | | | | | | | | |

| Consumer Cyclical—Entertainment–0.4% | | | | | | | | | |

Time Warner, Inc.

3.40%, 6/15/22 | | | | | | | 40 | | | | 39,788 | |

4.70%, 1/15/21 | | | | | | | 1,150 | | | | 1,257,732 | |

7.625%, 4/15/31 | | | | | | | 155 | | | | 206,509 | |

Viacom, Inc.

3.875%, 4/01/24 | | | | | | | 584 | | | | 582,566 | |

5.625%, 9/15/19 | | | | | | | 510 | | | | 577,346 | |

6.25%, 4/30/16 | | | | | | | 5 | | | | 5,540 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,669,481 | |

| | | | | | | | | | | | |

| Consumer Cyclical—Other–0.0% | | | | | | | | | | | | |

Wyndham Worldwide Corp.

2.50%, 3/01/18 | | | | | | | 35 | | | | 35,176 | |

| | | | | | | | | | | | |

| Consumer Cyclical—Retailers–0.1% | | | | | | | | | | | | |

Dollar General Corp.

4.125%, 7/15/17 | | | | | | | 468 | | | | 500,536 | |

Gap, Inc. (The)

5.95%, 4/12/21 | | | | | | | 25 | | | | 28,148 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 528,684 | |

| | | | | | | | | | | | |

| Consumer Non-Cyclical–0.8% | | | | | | | | | | | | |

Ahold Finance USA LLC

6.875%, 5/01/29 | | | | | | | 648 | | | | 789,166 | |

Altria Group, Inc.

4.75%, 5/05/21 | | | | | | | 25 | | | | 27,283 | |

Bunge Ltd. Finance Corp.

5.10%, 7/15/15 | | | | | | | 1,108 | | | | 1,164,304 | |

8.50%, 6/15/19 | | | | | | | 19 | | | | 23,447 | |

Kimberly-Clark Corp.

3.875%, 3/01/21 | | | | | | | 35 | | | | 37,293 | |

Kroger Co. (The)

3.40%, 4/15/22 | | | | | | | 1,915 | | | | 1,894,479 | |

Pfizer, Inc.

5.35%, 3/15/15 | | | | | | | 6 | | | | 6,270 | |

Reynolds American, Inc.

3.25%, 11/01/22 | | | | | | | 1,309 | | | | 1,231,509 | |

Thermo Fisher Scientific, Inc.

4.15%, 2/01/24 | | | | | | | 635 | | | | 653,308 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,827,059 | |

| | | | | | | | | | | | |

| Energy–1.6% | | | | | | | | | | | | |

Anadarko Petroleum Corp.

6.375%, 9/15/17 | | | | | | | 5 | | | | 5,724 | |

6.45%, 9/15/36 | | | | | | | 720 | | | | 851,611 | |

ConocoPhillips

4.60%, 1/15/15 | | | | | | | 6 | | | | 6,194 | |

6.00%, 1/15/20 | | | | | | | 15 | | | | 17,755 | |

ConocoPhillips Holding Co.

6.95%, 4/15/29 | | | | | | | 50 | | | | 66,649 | |

Encana Corp.

3.90%, 11/15/21 | | | | | | | 760 | | | | 779,924 | |

| | | | |

| 2014 Semi-Annual Report | | | 9 | |

Schedule of Investments (continued)

| | | | | | | | | | | | |

| | | |

| | | Principal Amount (000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

Hess Corp.

7.875%, 10/01/29 | | | U.S.$ | | | | 144 | | | $ | 189,120 | |

Nabors Industries, Inc.

4.625%, 9/15/21 | | | | | | | 7 | | | | 7,232 | |

5.10%, 9/15/23(c) | | | | | | | 1,140 | | | | 1,185,530 | |

Noble Energy, Inc.

4.15%, 12/15/21 | | | | | | | 10 | | | | 10,536 | |

8.25%, 3/01/19 | | | | | | | 2,308 | | | | 2,873,940 | |

Noble Holding International Ltd.

3.95%, 3/15/22 | | | | | | | 1,015 | | | | 1,006,481 | |

4.90%, 8/01/20 | | | | | | | 200 | | | | 213,402 | |

Reliance Holding USA, Inc.

5.40%, 2/14/22(c) | | | | | | | 1,471 | | | | 1,542,529 | |

Transocean, Inc.

6.375%, 12/15/21 | | | | | | | 5 | | | | 5,620 | |

6.50%, 11/15/20 | | | | | | | 1,615 | | | | 1,813,527 | |

Weatherford International Ltd./Bermuda

9.625%, 3/01/19 | | | | | | | 570 | | | | 739,964 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 11,315,738 | |

| | | | | | | | | | | | |

| Technology–0.8% | | | | | | | | | | | | |

Baidu, Inc.

2.25%, 11/28/17 | | | | | | | 408 | | | | 408,706 | |

3.25%, 8/06/18 | | | | | | | 1,079 | | | | 1,101,732 | |

Hewlett-Packard Co.

4.65%, 12/09/21 | | | | | | | 911 | | | | 963,728 | |

HP Enterprise Services LLC

7.45%, 10/15/29 | | | | | | | 25 | | | | 29,830 | |

Motorola Solutions, Inc. | | | | | | | | | | | | |

3.50%, 3/01/23 | | | | | | | 1,537 | | | | 1,469,321 | |

3.75%, 5/15/22 | | | | | | | 25 | | | | 24,682 | |

7.50%, 5/15/25 | | | | | | | 245 | | | | 296,396 | |

Oracle Corp.

5.25%, 1/15/16 | | | | | | | 53 | | | | 57,375 | |

Total System Services, Inc. | | | | | | | | | | | | |

2.375%, 6/01/18 | | | | | | | 671 | | | | 661,639 | |

3.75%, 6/01/23 | | | | | | | 688 | | | | 653,332 | |

Xerox Corp.

8.25%, 5/15/14 | | | | | | | 20 | | | | 20,168 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,686,909 | |

| | | | | | | | | | | | |

| Transportation—Airlines–0.3% | | | | | | | | | | | | |

Southwest Airlines Co. | | | | | | | | | | | | |

5.25%, 10/01/14 | | | | | | | 1,235 | | | | 1,262,189 | |

5.75%, 12/15/16 | | | | | | | 885 | | | | 982,643 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,244,832 | |

| | | | | | | | | | | | |

| Transportation—Railroads–0.0% | | | | | | | | | | | | |

CSX Corp.

4.75%, 5/30/42 | | | | | | | 60 | | | | 61,056 | |

| | | | | | | | | | | | |

| Transportation—Services–0.3% | | | | | | | | | | | | |

Asciano Finance Ltd. | | | | | | | | | | | | |

3.125%, 9/23/15(c) | | | | | | | 865 | | | | 886,920 | |

5.00%, 4/07/18(c) | | | | | | | 844 | | | | 906,303 | |

Ryder System, Inc.

5.85%, 11/01/16 | | | | | | | 700 | | | | 776,138 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,569,361 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 79,999,229 | |

| | | | | | | | | | | | |

| | | Principal Amount (000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

| Financial Institutions–8.4% | | | | | |

| Banking–4.6% | | | | | |

American Express Co.

2.65%, 12/02/22 | | | U.S.$ | | | | 11 | | | $ | 10,450 | |

Bank of America Corp.

3.875%, 3/22/17 | | | | | | | 10 | | | | 10,666 | |

5.625%, 7/01/20 | | | | | | | 100 | | | | 113,795 | |

5.70%, 1/24/22 | | | | | | | 320 | | | | 367,144 | |

5.875%, 1/05/21–2/07/42 | | | | | | | 1,021 | | | | 1,180,537 | |

6.11%, 1/29/37 | | | | | | | 125 | | | | 139,797 | |

7.375%, 5/15/14 | | | | | | | 15 | | | | 15,121 | |

7.625%, 6/01/19 | | | | | | | 1,435 | | | | 1,766,158 | |

Barclays Bank PLC

6.625%, 3/30/22(c) | | | EUR | | | | 1,275 | | | | 2,134,436 | |

Bear Stearns Cos. LLC (The)

5.30%, 10/30/15 | | | U.S.$ | | | | 80 | | | | 85,466 | |

BNP Paribas SA

5.186%, 6/29/15(c) | | | | | | | 512 | | | | 525,440 | |

BPCE SA

5.70%, 10/22/23(c) | | | | | | | 1,320 | | | | 1,372,100 | |

Capital One Financial Corp.

7.375%, 5/23/14 | | | | | | | 21 | | | | 21,204 | |

Compass Bank

5.50%, 4/01/20 | | | | | | | 1,344 | | | | 1,418,872 | |

Cooperatieve Centrale Raiffeisen-Boerenleenbank BA/Netherlands

3.95%, 11/09/22 | | | | | | | 443 | | | | 439,974 | |

Countrywide Financial Corp.

6.25%, 5/15/16 | | | | | | | 1,040 | | | | 1,140,688 | |

Credit Suisse AG

6.50%, 8/08/23(c) | | | | | | | 1,624 | | | | 1,775,524 | |

Danske Bank A/S

5.684%, 2/15/17 | | | GBP | | | | 614 | | | | 1,059,048 | |

Goldman Sachs Group, Inc. (The)

5.35%, 1/15/16 | | | U.S.$ | | | | 230 | | | | 247,339 | |

Series D

6.00%, 6/15/20 | | | | | | | 2,350 | | | | 2,698,526 | |

JPMorgan Chase & Co. | | | | | | | | | | | | |

4.35%, 8/15/21 | | | | | | | 10 | | | | 10,719 | |

4.625%, 5/10/21 | | | | | | | 60 | | | | 65,414 | |

4.75%, 3/01/15 | | | | | | | 6 | | | | 6,227 | |

Macquarie Bank Ltd.

5.00%, 2/22/17(c) | | | | | | | 514 | | | | 560,823 | |

Macquarie Group Ltd.

4.875%, 8/10/17(c) | | | | | | | 1,075 | | | | 1,160,008 | |

Mizuho Financial Group Cayman 3 Ltd.

4.60%, 3/27/24(c) | | | | | | | 1,806 | | | | 1,813,973 | |

Morgan Stanley

7.25%, 4/01/32 | | | | | | | 25 | | | | 32,590 | |

Series G

5.50%, 7/24/20–7/28/21 | | | | | | | 2,830 | | | | 3,194,484 | |

Murray Street Investment Trust I

4.647%, 3/09/17 | | | | | | | 270 | | | | 291,636 | |

National Capital Trust II Delaware

5.486%, 3/23/15(c) | | | | | | | 655 | | | | 669,737 | |

| | |

| 10 | | Sanford C. Bernstein Fund II, Inc. |

| | | | | | | | | | | | |

| | | |

| | | Principal Amount (000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

Nationwide Building Society

6.25%, 2/25/20(c) | | | U.S.$ | | | | 1,490 | | | $ | 1,737,042 | |

PNC Funding Corp.

5.125%, 2/08/20 | | | | | | | 35 | | | | 39,397 | |

Rabobank Capital Funding Trust III

5.254%, 10/21/16(c) | | | | | | | 745 | | | | 781,319 | |

Royal Bank of Scotland PLC (The)

9.50%, 3/16/22(c) | | | | | | | 658 | | | | 771,505 | |

Skandinaviska Enskilda Banken AB

5.471%, 3/23/15(c) | | | | | | | 343 | | | | 349,860 | |

SouthTrust Corp.

5.80%, 6/15/14 | | | | | | | 45 | | | | 45,497 | |

Standard Chartered PLC

4.00%, 7/12/22(c) | | | | | | | 2,175 | | | | 2,215,672 | |

UBS AG/Stamford CT

7.625%, 8/17/22 | | | | | | | 1,334 | | | | 1,564,630 | |

Unicredit Luxembourg Finance SA

6.00%, 10/31/17(c) | | | | | | | 1,042 | | | | 1,122,790 | |

Wachovia Bank NA

5.60%, 3/15/16 | | | | | | | 150 | | | | 163,047 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 33,118,655 | |

| | | | | | | | | | | | |

| Finance–0.0% | | | | | | | | | | | | |

General Electric Capital Corp.

2.95%, 5/09/16 | | | | | | | 22 | | | | 22,917 | |

5.875%, 1/14/38 | | | | | | | 43 | | | | 50,693 | |

Series G 5.625%, 5/01/18 | | | | | | | 115 | | | | 131,431 | |

HSBC Finance Corp.

6.676%, 1/15/21 | | | | | | | 101 | | | | 117,861 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 322,902 | |

| | | | | | | | | | | | |

| Insurance–2.4% | | | | | | | | | | | | |

Allied World Assurance Co., Holdings Ltd.

7.50%, 8/01/16 | | | | | | | 780 | | | | 887,028 | |

American International Group, Inc.

3.80%, 3/22/17 | | | | | | | 215 | | | | 230,028 | |

4.875%, 6/01/22 | | | | | | | 1,590 | | | | 1,741,085 | |

6.40%, 12/15/20 | | | | | | | 770 | | | | 917,410 | |

Coventry Health Care, Inc.

5.95%, 3/15/17 | | | | | | | 545 | | | | 613,901 | |

6.125%, 1/15/15 | | | | | | | 205 | | | | 213,703 | |

6.30%, 8/15/14 | | | | | | | 1,670 | | | | 1,703,978 | |

Guardian Life Insurance Co. of America

7.375%, 9/30/39(c) | | | | | | | 884 | | | | 1,204,362 | |

Hartford Financial Services Group, Inc. (The)

4.00%, 3/30/15 | | | | 505 | | | | 521,901 | |

5.125%, 4/15/22 | | | | | | | 1,090 | | | | 1,212,737 | |

5.50%, 3/30/20 | | | | | | | 513 | | | | 581,005 | |

6.10%, 10/01/41 | | | | | | | 130 | | | | 156,873 | |

Humana, Inc.

6.45%, 6/01/16 | | | | | | | 245 | | | | 272,131 | |

Lincoln National Corp.

8.75%, 7/01/19 | | | | | | | 681 | | | | 878,023 | |

MetLife Capital Trust IV

7.875%, 12/15/37(c) | | | | | | | 970 | | | | 1,144,600 | |

| | | | | | | | | | | | |

MetLife, Inc.

4.75%, 2/08/21 | | | U.S.$ | | | | 350 | | | $ | 389,377 | |

6.75%, 6/01/16 | | | | | | | 25 | | | | 28,037 | |

7.717%, 2/15/19 | | | | | | | 519 | | | | 645,515 | |

10.75%, 8/01/39 | | | | | | | 5 | | | | 7,575 | |

Nationwide Mutual Insurance Co.

9.375%, 8/15/39(c) | | | | | | | 890 | | | | 1,308,868 | |

Prudential Financial, Inc.

4.50%, 11/15/20 | | | | | | | 19 | | | | 20,602 | |

5.625%, 6/15/43 | | | | | | | 875 | | | | 892,500 | |

XLIT Ltd.

5.25%, 9/15/14 | | | | | | | 1,570 | | | | 1,602,381 | |

6.25%, 5/15/27 | | | | | | | 175 | | | | 201,986 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 17,375,606 | |

| | | | | | | | | | | | |

| Other Finance–0.3% | | | | | | | | | | | | |

ORIX Corp.

4.71%, 4/27/15 | | | | | | | 1,874 | | | | 1,954,820 | |

| | | | | | | | | | | | |

| REITS–1.1% | | | | | | | | | | | | |

ERP Operating LP

5.25%, 9/15/14 | | | | | | | 185 | | | | 188,800 | |

HCP, Inc.

5.375%, 2/01/21 | | | | | | | 3,010 | | | | 3,370,092 | |

Health Care REIT, Inc.

5.25%, 1/15/22 | | | | | | | 3,010 | | | | 3,315,497 | |

Healthcare Realty Trust, Inc.

6.50%, 1/17/17 | | | | | | | 10 | | | | 11,284 | |

Trust F/1401

5.25%, 12/15/24(c) | | | | | | | 1,410 | | | | 1,406,475 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,292,148 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 61,064,131 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | |

| Utility–2.2% | | | | | |

| Electric–0.3% | | | | | | | | | | | | |

CMS Energy Corp.

5.05%, 3/15/22 | | | | | | | 345 | | | | 383,738 | |

Constellation Energy Group, Inc.

5.15%, 12/01/20 | | | | | | | 559 | | | | 610,524 | |

Duke Energy Carolinas LLC

3.90%, 6/15/21 | | | | | | | 42 | | | | 44,867 | |

Pacific Gas & Electric Co.

6.05%, 3/01/34 | | | | | | | 10 | | | | 11,810 | |

TECO Finance, Inc.

4.00%, 3/15/16 | | | | | | | 550 | | | | 581,891 | |

5.15%, 3/15/20 | | | | | | | 685 | | | | 757,559 | |

Wisconsin Electric Power Co.

4.25%, 12/15/19 | | | | | | | 23 | | | | 25,085 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,415,474 | |

| | | | | | | | | | | | |

| Natural Gas–1.9% | | | | | | | | | | | | |

DCP Midstream LLC

5.35%, 3/15/20(c) | | | | | | | 563 | | | | 604,990 | |

Energy Transfer Partners LP

4.65%, 6/01/21 | | | | | | | 25 | | | | 26,281 | |

6.125%, 2/15/17 | | | | | | | 140 | | | | 156,761 | |

| | | | |

| 2014 Semi-Annual Report | | | 11 | |

Schedule of Investments (continued)

| | | | | | | | | | | | |

| | | |

| | | Principal Amount (000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

6.625%, 10/15/36 | | | U.S.$ | | | | 120 | | | $ | 135,533 | |

6.70%, 7/01/18 | | | | | | | 734 | | | | 852,508 | |

7.50%, 7/01/38 | | | | | | | 1,685 | | | | 2,079,113 | |

Enterprise Products Operating LLC

3.35%, 3/15/23 | | | | | | | 30 | | | | 29,263 | |

5.20%, 9/01/20 | | | | | | | 521 | | | | 581,541 | |

Kinder Morgan Energy Partners LP

3.95%, 9/01/22 | | | | | | | 3,189 | | | | 3,172,124 | |

4.15%, 3/01/22 | | | | | | | 683 | | | | 691,517 | |

Talent Yield Investments Ltd.

4.50%, 4/25/22(c) | | | | | | | 1,775 | | | | 1,772,055 | |

TransCanada PipeLines Ltd.

3.80%, 10/01/20 | | | | | | | 10 | | | | 10,504 | |

6.35%, 5/15/67 | | | | | | | 1,365 | | | | 1,414,140 | |

Williams Partners LP

4.00%, 11/15/21 | | | | | | | 30 | | | | 30,503 | |

5.25%, 3/15/20 | | | | | | | 1,834 | | | | 2,019,337 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 13,576,170 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 15,991,644 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | |

| Non Corporate Sectors–0.3% | | | | | | | | | | | | |

| Agencies—Not Government Guaranteed–0.3% | | | | | |

CNOOC Finance 2013 Ltd.

3.00%, 5/09/23 | | | | | | | 1,870 | | | | 1,691,841 | |

Petrobras International Finance Co.

5.75%, 1/20/20 | | | | | | | 20 | | | | 20,877 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,712,718 | |

| | | | | | | | | | | | |

Total Corporates—Investment Grades

(cost $148,804,080) | | | | | | | | 158,767,722 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | |

| ASSET-BACKED SECURITIES–15.0% | | | | | | | | | |

| Autos—Fixed Rate–9.6% | | | | | | | | | | | | |

Ally Auto Receivables Trust

Series 2013-SN1, Class A3

0.72%, 5/20/16 | | | | | | | 3,803 | | | | 3,811,035 | |

Ally Master Owner Trust

Series 2012-4, Class A

1.72%, 7/15/19 | | | | | | | 2,525 | | | | 2,537,345 | |

Series 2014-1, Class A2

1.29%, 1/15/19 | | | | | | | 2,433 | | | | 2,432,662 | |

AmeriCredit Automobile Receivables Trust

Series 2012-3, Class A3

0.96%, 1/09/17 | | | | | | | 3,225 | | | | 3,233,491 | |

Series 2013-1, Class A2

0.49%, 6/08/16 | | | | | | | 999 | | | | 998,539 | |

Series 2013-3, Class A3

0.92%, 4/09/18 | | | | | | | 3,380 | | | | 3,381,334 | |

Series 2013-4, Class A3

0.96%, 4/09/18 | | | | | | | 1,205 | | | | 1,207,160 | |

Series 2013-5, Class A2A

0.65%, 3/08/17 | | | | | | | 699 | | | | 699,374 | |

ARI Fleet Lease Trust

Series 2013-A, Class A2

0.70%, 12/15/15(c) | | | | | | | 2,125 | | | | 2,124,678 | |

| | | | | | | | | | | | |

Avis Budget Rental Car Funding AESOP LLC

Series 2013-2A, Class A

2.97%, 2/20/20(c) | | | U.S.$ | | | | 2,535 | | | $ | 2,597,546 | |

Series 2014-1A, Class A

2.46%, 7/20/20(c) | | | | | | | 1,831 | | | | 1,816,416 | |

Bank of America Auto Trust

Series 2012-1, Class A4

1.03%, 12/15/16 | | | | | | | 1,825 | | | | 1,835,802 | |

Capital Auto Receivables Asset Trust

Series 2013-3, Class A2

1.04%, 11/21/16 | | | | | | | 2,500 | | | | 2,510,572 | |

Series 2014-1, Class B

2.22%, 1/22/19 | | | | | | | 360 | | | | 360,079 | |

Capital Auto Receivables Asset Trust/Ally

Series 2013-1, Class A2

0.62%, 7/20/16 | | | | 1,955 | | | | 1,955,189 | |

CarMax Auto Owner Trust

Series 2012-1, Class A3

0.89%, 9/15/16 | | | | | | | 1,029 | | | | 1,032,152 | |

Enterprise Fleet Financing LLC

Series 2014-1, Class A2

0.87%, 9/20/19(c) | | | | | | | 656 | | | | 655,994 | |

Exeter Automobile Receivables Trust

Series 2012-2A, Class A

1.30%, 6/15/17(c) | | | | | | | 972 | | | | 973,511 | |

Series 2013-1A, Class A

1.29%, 10/16/17(c) | | | | | | | 775 | | | | 776,482 | |

Series 2014-1A, Class A

1.29%, 5/15/18(c) | | | | | | | 911 | | | | 913,079 | |

Fifth Third Auto Trust

Series 2013-A, Class A3

0.61%, 9/15/17 | | | | | | | 1,943 | | | | 1,944,218 | |

Flagship Credit Auto Trust

Series 2013-1, Class A

1.32%, 4/16/18(c) | | | | | | | 697 | | | | 696,351 | |

Ford Auto Securitization Trust

Series 2013-R1A, Class A2

1.676%, 9/15/16(c) | | | CAD | | | | 1,627 | | | | 1,474,963 | |

Series 2013-R4A, Class A1

1.487%, 8/15/15(c) | | | | | | | 606 | | | | 548,119 | |

Series 2014-R2A, Class A1

1.353%, 3/15/16(c) | | | | | | | 1,774 | | | | 1,604,704 | |

Ford Credit Auto Owner Trust

Series 2012-B, Class A4

1.00%, 9/15/17 | | | U.S.$ | | | | 1,865 | | | | 1,875,612 | |

Series 2012-D, Class B

1.01%, 5/15/18 | | | | | | | 860 | | | | 850,731 | |

Ford Credit Floorplan Master Owner Trust

Series 2012-4, Class A1

0.74%, 9/15/16 | | | | | | | 3,432 | | | | 3,436,653 | |

Series 2014-1, Class A1

1.20%, 2/15/19 | | | | | | | 1,713 | | | | 1,712,910 | |

Hertz Vehicle Financing LLC

Series 2013-1A, Class A1

1.12%, 8/25/17(c) | | | | | | | 1,665 | | | | 1,664,241 | |

| | |

| 12 | | Sanford C. Bernstein Fund II, Inc. |

| | | | | | | | | | | | |

| | | |

| | | Principal Amount (000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

Series 2013-1A, Class A2 1.83%, 8/25/19(c) | | | U.S.$ | | | | 3,745 | | | $ | 3,681,887 | |

Hyundai Auto Lease Securitization Trust

Series 2013-A, Class A3

0.66%, 6/15/16(c) | | | | 2,693 | | | | 2,697,432 | |

M&T Bank Auto Receivables Trust

Series 2013-1A, Class A3

1.06%, 11/15/17, TBA(c) | | | | | | | 1,875 | | | | 1,880,011 | |

Mercedes-Benz Auto Lease Trust

Series 2013-A, Class A3

0.59%, 2/15/16 | | | | | | | 1,665 | | | | 1,666,635 | |

Navistar Financial Corp. Owner Trust

Series 2012-A, Class A2

0.85%, 3/18/15(c) | | | | | | | 128 | | | | 127,789 | |

Santander Drive Auto Receivables Trust

Series 2012-3, Class A3

1.08%, 4/15/16 | | | | 1,657 | | | | 1,659,023 | |

Series 2013-3, Class C 1.81%, 4/15/19 | | | | | | | 2,404 | | | | 2,408,874 | |

Series 2013-4, Class A3 1.11%, 12/15/17 | | | | | | | 2,650 | | | | 2,664,012 | |

Series 2013-5, Class A2A 0.64%, 4/17/17 | | | | | | | 1,073 | | | | 1,073,490 | |

SMART Trust/Australia

Series 2012-4US, Class A2A

0.67%, 6/14/15 | | | | | | | 582 | | | | 581,736 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 70,101,831 | |

| | | | | | | | | | | | |

| Autos—Floating Rate–1.8% | | | | | | | | | | | | |

Ally Master Owner Trust

Series 2014-2, Class A

0.526%, 1/16/18(a) | | | | | | | 161 | | | | 161,381 | |

BMW Floorplan Master Owner Trust

Series 2012-1A, Class A

0.555%, 9/15/17(a)(c) | | | | | | | 3,257 | | | | 3,265,651 | |

Ford Credit Floorplan Master Owner Trust Series 2010-3, Class A2

1.855%, 2/15/17(a)(c) | | | | | | | 3,630 | | | | 3,677,786 | |

GE Dealer Floorplan Master Note Trust

Series 2012-3, Class A

0.647%, 6/20/17(a) | | | | 4,370 | | | | 4,384,255 | |

Hertz Fleet Lease Funding LP

Series 2013-3, Class A

0.704%, 12/10/27(a)(c) | | | | | | | 1,675 | | | | 1,680,345 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 13,169,418 | |

| | | | | | | | | | | | |

| Credit Cards—Fixed Rate–1.4% | | | | | | | | | | | | |

Cabela’s Master Credit Card Trust

Series 2013-1A, Class A

2.71%, 2/17/26(c) | | | | | | | 2,485 | | | | 2,358,473 | |

Chase Issuance Trust

Series 2013-A1, Class A1

1.30%, 2/18/20 | | | | | | | 1,020 | | | | 1,004,986 | |

Series 2014-A2, Class A2 2.77%, 3/15/23 | | | | | | | 1,550 | | | | 1,549,033 | |

Discover Card Execution Note Trust

Series 2012-A1, Class A1

0.81%, 8/15/17 | | | | | | | 1,593 | | | | 1,598,561 | |

| | | | | | | | | | | | |

Discover Card Master Trust

Series 2012-A3, Class A3

0.86%, 11/15/17 | | | U.S.$ | | | | 1,908 | | | $ | 1,916,868 | |

World Financial Network Credit Card Master Trust

Series 2012-B, Class A

1.76%, 5/17/21 | | | | | | | 1,815 | | | | 1,811,768 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 10,239,689 | |

| | | | | | | | | | | | |

| Other ABS—Fixed Rate–1.0% | | | | | | | | | | | | |

CIT Equipment Collateral

Series 2012-VT1, Class A3

1.10%, 8/22/16(c) | | | | | | | 686 | | | | 687,280 | |

Series 2013-VT1, Class A3 1.13%, 7/20/20(c) | | | | | | | 1,764 | | | | 1,775,151 | |

CNH Equipment Trust

Series 2012-A, Class A3

0.94%, 5/15/17 | | | | | | | 902 | | | | 905,035 | |

Series 2013-C, Class A2 0.63%, 1/17/17 | | | | | | | 1,649 | | | | 1,650,397 | |

Series 2013-D, Class A2 0.49%, 3/15/17 | | | | | | | 1,744 | | | | 1,745,021 | |

GE Equipment Midticket LLC

Series 2011-1, Class A3

1.00%, 8/24/15 | | | | | | | 281 | | | | 281,702 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,044,586 | |

| | | | | | | | | | | | |

| Credit Cards—Floating Rate–0.8% | | | | | | | | | |

Barclays Dryrock Issuance Trust

Series 2014-1, Class A

0.53%, 12/16/19(a) | | | | | | | 2,297 | | | | 2,297,027 | |

Cabela’s Master Credit Card Trust

Series 2014-1, Class A

0.504%, 3/16/20(a) | | | | | | | 720 | | | | 720,060 | |

First National Master Note Trust

Series 2013-2, Class A

0.685%, 10/15/19(a) | | | | | | | 1,523 | | | | 1,523,000 | |

World Financial Network Credit Card Master Trust

Series 2014-A, Class A

0.535%, 12/15/19(a) | | | | | | | 1,570 | | | | 1,570,055 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,110,142 | |

| | | | | | | | | | | | |

| Home Equity Loans—Floating Rate–0.3% | | | | | | | | | |

Asset Backed Funding Certificates

Series 2003-WF1, Class A2

0.904%, 12/25/32(a) | | | | | | | 280 | | | | 268,286 | |

GSAA Home Equity Trust

Series 2006-5, Class 2A3

0.424%, 3/25/36(a) | | | | | | | 2,005 | | | | 1,396,961 | |

HSBC Home Equity Loan Trust

Series 2005-3, Class A1

0.417%, 1/20/35(a) | | | | | | | 309 | | | | 307,211 | |

Wells Fargo Home Equity Trust

Series 2004-1, Class 1A

0.454%, 4/25/34(a) | | | | | | | 134 | | | | 128,041 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,100,499 | |

| | | | | | | | | | | | |

| | | | |

| 2014 Semi-Annual Report | | | 13 | |

Schedule of Investments (continued)

| | | | | | | | | | | | |

| | | |

| | | Principal Amount (000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

| Home Equity Loans—Fixed Rate–0.1% | | | | | |

Citifinancial Mortgage Securities, Inc.

Series 2003-1, Class AFPT

3.86%, 1/25/33 | | | U.S.$ | | | | 266 | | | $ | 271,503 | |

Credit-Based Asset Servicing and Securitization LLC

Series 2003-CB1, Class AF

3.95%, 1/25/33 | | | | | | | 183 | | | | 181,240 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 452,743 | |

| | | | | | | | | | | | |

Total Asset-Backed Securities

(cost $109,406,431) | | | | | | | | 109,218,908 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | |

| GOVERNMENTS—TREASURIES–13.3% | | | | | |

| Brazil–1.3% | | | | | | | | | | | | |

Brazil Notas do Tesouro Nacional

Series F

10.00%, 1/01/17 | | | BRL | | | | 22,335 | | | | 9,319,047 | |

| | | | | | | | | | | | |

| United States–12.0% | | | | | | | | | | | | |

U.S. Treasury Bonds | | | | | | | | | | | | |

2.75%, 8/15/42 | | | U.S.$ | | | | 50 | | | | 42,687 | |

3.125%, 2/15/43 | | | | | | | 50 | | | | 46,016 | |

3.625%, 8/15/43–2/15/44 | | | | | | | 8,906 | | | | 9,012,652 | |

3.75%, 11/15/43 | | | | | | | 5,640 | | | | 5,839,160 | |

4.625%, 2/15/40 | | | | | | | 11,441 | | | | 13,716,684 | |

5.375%, 2/15/31 | | | | | | | 40 | | | | 51,169 | |

8.125%, 8/15/21 | | | | | | | 384 | | | | 536,040 | |

U.S. Treasury Notes | | | | | | | | | | | | |

0.50%, 7/31/17 | | | | | | | 235 | | | | 230,502 | |

0.625%, 4/30/18 | | | | | | | 55 | | | | 53,277 | |

0.75%, 6/30/17–2/28/18 | | | | | | | 220 | | | | 215,879 | |

0.875%, 11/30/16–1/31/18 | | | | | | | 960 | | | | 959,953 | |

1.50%, 6/30/16–1/31/19 | | | | | | | 15,310 | | | | 15,234,309 | |

1.625%, 8/15/22–11/15/22 | | | | | | | 245 | | | | 227,544 | |

1.75%, 10/31/20 | | | | | | | 2,215 | | | | 2,150,628 | |

2.00%, 11/15/21–2/15/22 | | | | | | | 125 | | | | 120,947 | |

2.125%, 8/15/21 | | | | | | | 125 | | | | 122,842 | |

2.50%, 8/15/23 | | | | | | | 22,485 | | | | 22,163,532 | |

2.625%, 4/30/16–11/15/20 | | | | | | | 1,659 | | | | 1,708,734 | |

2.75%, 11/15/23–2/15/24 | | | | | | | 15,066 | | | | 15,112,074 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 87,544,629 | |

| | | | | | | | | | | | |

Total Governments—Treasuries

(cost $94,329,859) | | | | | | | | 96,863,676 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| |

| COMMERCIAL MORTGAGE-BACKED SECURITIES–10.9% | |

| Non-Agency Fixed Rate CMBS–10.4% | | | | | | | | | |

Banc of America Commercial Mortgage Trust

Series 2007-4, Class A1A

5.774%, 2/10/51 | | | | | | | 2,995 | | | | 3,360,708 | |

Bear Stearns Commercial Mortgage Securities Trust

Series 2006-PW12, Class A4

5.712%, 9/11/38 | | | | | | | 1,375 | | | | 1,496,734 | |

CGRBS Commercial Mortgage Trust

Series 2013-VN05

3.369%, 3/13/23(c) | | | | | | | 2,495 | | | | 2,417,213 | |

| | | | | | | | | | | | |

Citigroup Commercial Mortgage Trust

Series 2004-C1, Class A4

5.406%, 4/15/40 | | | U.S.$ | | | | 22 | | | $ | 21,941 | |

Series 2006-C4, Class A1A

5.783%, 3/15/49 | | | | | | | 726 | | | | 783,908 | |

COBALT CMBS Commercial Mortgage Trust

Series 2007-C3, Class A4

5.771%, 5/15/46 | | | | | | | 1,589 | | | | 1,760,339 | |

Commercial Mortgage Pass Through Certificates

Series 2013-CR6, Class A2

2.122%, 3/10/46 | | | | | | | 65 | | | | 65,422 | |

Commercial Mortgage Pass-Through Certificates

Series 2005-C6, Class A5A

5.116%, 6/10/44 | | | | | | | 1,569 | | | | 1,637,564 | |

Series 2013-SFS, Class A1

1.873%, 4/12/35(c) | | | | | | | 1,171 | | | | 1,134,684 | |

Credit Suisse Commercial Mortgage Trust

Series 2006-C3, Class A3

5.792%, 6/15/38 | | | | | | | 4,952 | | | | 5,365,801 | |

Series 2006-C3, Class AJ

5.792%, 6/15/38 | | | | | | | 1,015 | | | | 1,010,739 | |

Credit Suisse First Boston Mortgage Securities Corp.

Series 2005-C1, Class A4

5.014%, 2/15/38 | | | | | | | 3,767 | | | | 3,848,405 | |

Extended Stay America Trust

Series 2013-ESH7, Class A17

2.295%, 12/05/31(c) | | | | | | | 1,740 | | | | 1,671,265 | |

Greenwich Capital Commercial Funding Corp.

Series 2007-GG9, Class A4

5.444%, 3/10/39 | | | | | | | 4,745 | | | | 5,198,348 | |

GS Mortgage Securities Corp. II

Series 2004-GG2, Class A6

5.396%, 8/10/38 | | | | | | | 128 | | | | 127,987 | |

Series 2013-KING, Class A

2.706%, 12/10/27(c) | | | | | | | 2,792 | | | | 2,790,797 | |

GS Mortgage Securities Trust

Series 2013-G1, Class A2

3.557%, 4/10/31(c) | | | | | | | 1,499 | | | | 1,428,441 | |

JP Morgan Chase Commercial Mortgage Securities Trust | | | | | | | | | | | | |

Series 2007-CB18, Class A1A

5.431%, 6/12/47 | | | | | | | 4,218 | | | | 4,616,037 | |

Series 2007-CB20, Class A1A

5.746%, 2/12/51 | | | | | | | 3,881 | | | | 4,334,320 | |

Series 2007-LDPX, Class A3

5.42%, 1/15/49 | | | | | | | 5,075 | | | | 5,565,869 | |

Series 2010-C2, Class A1

2.749%, 11/15/43(c) | | | | | | | 1,877 | | | | 1,924,414 | |

LB-UBS Commercial Mortgage Trust

Series 2004-C4, Class A4

6.00%, 6/15/29 | | | | | | | 18 | | | | 17,657 | |

| | |

| 14 | | Sanford C. Bernstein Fund II, Inc. |

| | | | | | | | | | | | |

| | | |

| | | Principal Amount (000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

Merrill Lynch Mortgage Trust

Series 2005-CIP1, Class A2

4.96%, 7/12/38 | | | U.S.$ | | | | 11 | | | $ | 10,777 | |

Series 2006-C2, Class A1A

5.739%, 8/12/43 | | | | | | | 1,619 | | | | 1,775,511 | |

Merrill Lynch/Countrywide Commercial Mortgage Trust

Series 2006-3, Class A4

5.414%, 7/12/46 | | | | | | | 24 | | | | 25,899 | |

Series 2006-4, Class A1A

5.166%, 12/12/49 | | | | | | | 6,065 | | | | 6,589,496 | |

Series 2007-9, Class A4

5.70%, 9/12/49 | | | | | | | 315 | | | | 351,880 | |

Morgan Stanley Capital I Trust

Series 2007-T27, Class A1A

5.648%, 6/11/42 | | | | | | | 3,803 | | | | 4,254,010 | |

Motel 6 Trust

Series 2012-MTL6, Class A2

1.948%, 10/05/25(c) | | | | | | | 2,019 | | | | 2,003,474 | |

UBS-Barclays Commercial Mortgage Trust

Series 2012-C3, Class A4

3.091%, 8/10/49 | | | | | | | 1,061 | | | | 1,032,832 | |

Series 2012-C4, Class A5

2.85%, 12/10/45 | | | | | | | 2,117 | | | | 2,014,690 | |

Wachovia Bank Commercial Mortgage Trust

Series 2006-C25, Class A1A

5.717%, 5/15/43 | | | | | | | 4,049 | | | | 4,411,409 | |

WF-RBS Commercial Mortgage Trust

Series 2013-C14, Class A5

3.337%, 6/15/46 | | | | | | | 2,247 | | | | 2,211,154 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 75,259,725 | |

| | | | | | | | | | | | |

| Non-Agency Floating Rate CMBS–0.5% | | | | | | | | | |

Extended Stay America Trust

Series 2013-ESFL, Class A2FL

0.855%, 12/05/31(a)(c) | | | | | | | 1,345 | | | | 1,339,725 | |

GS Mortgage Securities Corp. II

Series 2013-KYO, Class A

1.004%, 11/08/29(a)(c) | | | | | | | 2,700 | | | | 2,700,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,039,725 | |

| | | | | | | | | | | | |

| Agency CMBS–0.0% | | | | | | | | | | | | |

Federal Home Loan Mortgage Corp. Multifamily Structured Pass Through Certificates

Series K008, Class A2

3.531%, 6/25/20 | | | | | | | 78 | | | | 81,635 | |

Series K010, Class A1

3.32%, 7/25/20 | | | | | | | 47 | | | | 49,952 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 131,587 | |

| | | | | | | | | | | | |

Total Commercial Mortgage-Backed Securities

(cost $78,979,039) | | | | 79,431,037 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| AGENCIES–4.5% | | | | | | | | | | | | |

| Agency Debentures–4.5% | | | | | | | | | | | | |

Federal National Mortgage Association

6.25%, 5/15/29 | | | U.S.$ | | | | 8,051 | | | $ | 10,586,654 | |

6.625%, 11/15/30 | | | | | | | 5,575 | | | | 7,660,530 | |

Residual Funding Corp. Principal Strip Zero Coupon, 7/15/20 | | | | | | | 16,846 | | | | 14,433,552 | |

| | | | | | | | | | | | |

Total Agencies

(cost $29,681,035) | | | | | | | | | | | 32,680,736 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | |

| CORPORATES—NON-INVESTMENT GRADES–3.0% | | | | | |

| Financial Institutions–1.8% | | | | | |

| Banking–1.5% | | | | | | | | | | | | |

ABN AMRO Bank NV

4.31%, 3/10/16 | | | EUR | | | | 570 | | | | 795,076 | |

Bank of America Corp.

Series U

5.20%, 6/01/23 | | | U.S.$ | | | | 930 | | | | 874,200 | |

Barclays Bank PLC

7.625%, 11/21/22 | | | | | | | 1,645 | | | | 1,813,613 | |

Citigroup, Inc.

5.95%, 1/30/23 | | | | | | | 1,472 | | | | 1,438,880 | |

Credit Agricole SA

7.875%, 1/23/24(c) | | | | | | | 346 | | | | 365,895 | |

Credit Suisse Group AG

7.50%, 12/11/23(c) | | | | | | | 283 | | | | 307,409 | |

HBOS Capital Funding LP

4.939%, 5/23/16 | | | EUR | | | | 1,828 | | | | 2,437,756 | |

6.071%, 6/30/14(c) | | | U.S.$ | | | | 784 | | | | 784,980 | |

LBG Capital No.1 PLC

8.00%, 6/15/20(c) | | | | | | | 1,240 | | | | 1,331,140 | |

Societe Generale SA

4.196%, 1/26/15 | | | EUR | | | | 404 | | | | 561,802 | |

5.922%, 4/05/17(c) | | | U.S.$ | | | | 225 | | | | 239,354 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 10,950,105 | |

| | | | | | | | | | | | |

| Finance–0.3% | | | | | | | | | | | | |

Aviation Capital Group Corp.

7.125%, 10/15/20(c) | | | | | | | 955 | | | | 1,068,981 | |

SLM Corp.

Series A

5.375%, 5/15/14 | | | | | | | 1,179 | | | | 1,184,895 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,253,876 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 13,203,981 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | |

| Industrial–0.9% | | | | | | | | | | | | |

| Communications—Media–0.1% | | | | | | | | | |

Sirius XM Holdings, Inc.

4.625%, 5/15/23(c) | | | | | | | 923 | | | | 869,927 | |

| | | | | | | | | | | | |

| | | | |

| 2014 Semi-Annual Report | | | 15 | |

Schedule of Investments (continued)

| | | | | | | | | | | | |

| | | |

| | | Principal Amount (000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

| Communications—Telecommunications–0.4% | | | | | |

Sprint Corp.

7.875%, 9/15/23(c) | | | U.S.$ | | | | 885 | | | $ | 973,500 | |

T-Mobile USA, Inc.

6.625%, 4/01/23 | | | | | | | 835 | | | | 885,100 | |

Telecom Italia Capital SA

7.175%, 6/18/19 | | | | | | | 935 | | | | 1,071,744 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,930,344 | |

| | | | | | | | | | | | |

| Consumer Cyclical—Automotive–0.1% | | | | | | | | | |

Dana Holding Corp.

6.00%, 9/15/23 | | | | | | | 322 | | | | 335,283 | |

| | | | | | | | | | | | |

| Consumer Cyclical—Other–0.1% | | | | | | | | | |

MCE Finance Ltd.

5.00%, 2/15/21(c) | | | | | | | 418 | | | | 418,000 | |

| | | | | | | | | | | | |

| Energy–0.2% | | | | | | | | | |

Cimarex Energy Co.

5.875%, 5/01/22 | | | | | | | 832 | | | | 902,720 | |

Denbury Resources, Inc.

4.625%, 7/15/23 | | | | | | | 915 | | | | 850,950 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,753,670 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,307,224 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | |

| Utility–0.3% | | | | | | | | | | | | |

| Natural Gas–0.3% | | | | | | | | | |

ONEOK, Inc.

4.25%, 2/01/22 | | | | | | | 1,862 | | | | 1,783,472 | |

Regency Energy Partners LP/Regency Energy Finance Corp.

4.50%, 11/01/23 | | | | | | | 251 | | | | 233,430 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,016,902 | |

| | | | | | | | | | | | |

Total Corporates—Non-Investment Grades

(cost $19,336,462) | | | | | | | | 21,528,107 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | |

| QUASI-SOVEREIGNS–2.4% | | | | | |

| Quasi-Sovereign Bonds–2.4% | | | | | |

| Chile–0.1% | | | | | | | | | |

Empresa de Transporte de Pasajeros

Metro SA

4.75%, 2/04/24(c) | | | | 545 | | | | 563,188 | |

| | | | | | | | | | | | |

| China–0.3% | | | | | | | | | |

Sinopec Group Overseas Development

2013 Ltd.

4.375%, 10/17/23(c) | | | | 1,835 | | | | 1,844,831 | |

| | | | | | | | | | | | |

| Indonesia–0.3% | | | | | | | | | |

Perusahaan Listrik Negara PT

5.50%, 11/22/21(c) | | | | | | | 2,009 | | | | 2,029,090 | |

| | | | | | | | | | | | |

| Kazakhstan–0.2% | | | | | | | | | |

KazMunayGas National Co. JSC

7.00%, 5/05/20(c) | | | | | | | 1,426 | | | | 1,607,815 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Malaysia–0.4% | | | | | | | | | |

Petronas Capital Ltd.

5.25%, 8/12/19(c) | | | U.S.$ | | | | 2,675 | | | $ | 3,008,607 | |

| | | | | | | | | | | | |

| Mexico–0.3% | | | | | | | | | |

Petroleos Mexicanos

3.50%, 7/18/18-1/30/23 | | | | | | | 2,121 | | | | 2,112,240 | |

| | | | | | | | | | | | |

| South Korea–0.4% | | | | | | | | | |

Korea National Oil Corp.

3.125%, 4/03/17(c) | | | | | | | 2,845 | | | | 2,964,780 | |

| | | | | | | | | | | | |

| United Arab Emirates–0.4% | | | | | | | | | |

IPIC GMTN Ltd.

3.75%, 3/01/17(c) | | | | | | | 2,815 | | | | 2,997,975 | |

| | | | | | | | | | | | |

Total Quasi-Sovereigns

(cost $16,155,899) | | | | | | | | | | | 17,128,526 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | |

| INFLATION-LINKED SECURITIES–2.3% | | | | | |

| United States–2.3% | | | | | | | | | |

U.S. Treasury Inflation Index

0.125%, 4/15/16 (TIPS)

(cost $16,537,391) | | | | | | | 16,201 | | | | 16,639,378 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | |

| COLLATERALIZED MORTGAGE OBLIGATIONS–1.7% | | | | | |

| Non-Agency Floating Rate–1.2% | | | | | | | | | |

Deutsche Alt-A Securities Mortgage Loan Trust

Series 2006-AR4, Class A2

0.344%, 12/25/36(a) | | | | 2,075 | | | | 1,273,442 | |

Fannie Mae Connecticut Avenue Securities

Series 2014-C01, Class M2

4.554%, 1/25/24(a) | | | | 497 | | | | 522,611 | |

HomeBanc Mortgage Trust

Series 2005-1, Class A1

0.404%, 3/25/35(a) | | | | | | | 1,096 | | | | 930,383 | |

IndyMac Index Mortgage Loan Trust

Series 2006-AR15, Class A1

0.274%, 7/25/36(a) | | | | 1,576 | | | | 1,203,377 | |

Series 2006-AR27, Class 2A2

0.354%, 10/25/36(a) | | | | | | | 1,676 | | | | 1,427,694 | |

Sequoia Mortgage Trust

Series 2007-3, Class 1A1

0.357%, 7/20/36(a) | | | | | | | 102 | | | | 93,295 | |

Structured Agency Credit Risk Debt Notes

Series 2013-DN2, Class M2

4.404%, 11/25/23(a) | | | | | | | 1,760 | | | | 1,817,804 | |

Series 2014-DN1, Class M3 | | | | | | | | | | | | |

4.654%, 2/25/24(a) | | | | | | | 1,260 | | | | 1,339,834 | |

Washington Mutual Mortgage Pass-Through Certificates

Series 2007-OA1, Class A1A

0.829%, 2/25/47(a) | | | | | | | 79 | | | | 64,360 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,672,800 | |

| | | | | | | | | | | | |

| | |

| 16 | | Sanford C. Bernstein Fund II, Inc. |

| | | | | | | | | | | | |

| | | |

| | | Principal Amount (000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

| Non-Agency Fixed Rate–0.5% | | | | | | | | | | | | |

Citigroup Mortgage Loan Trust, Inc.

Series 2005-2, Class 1A4