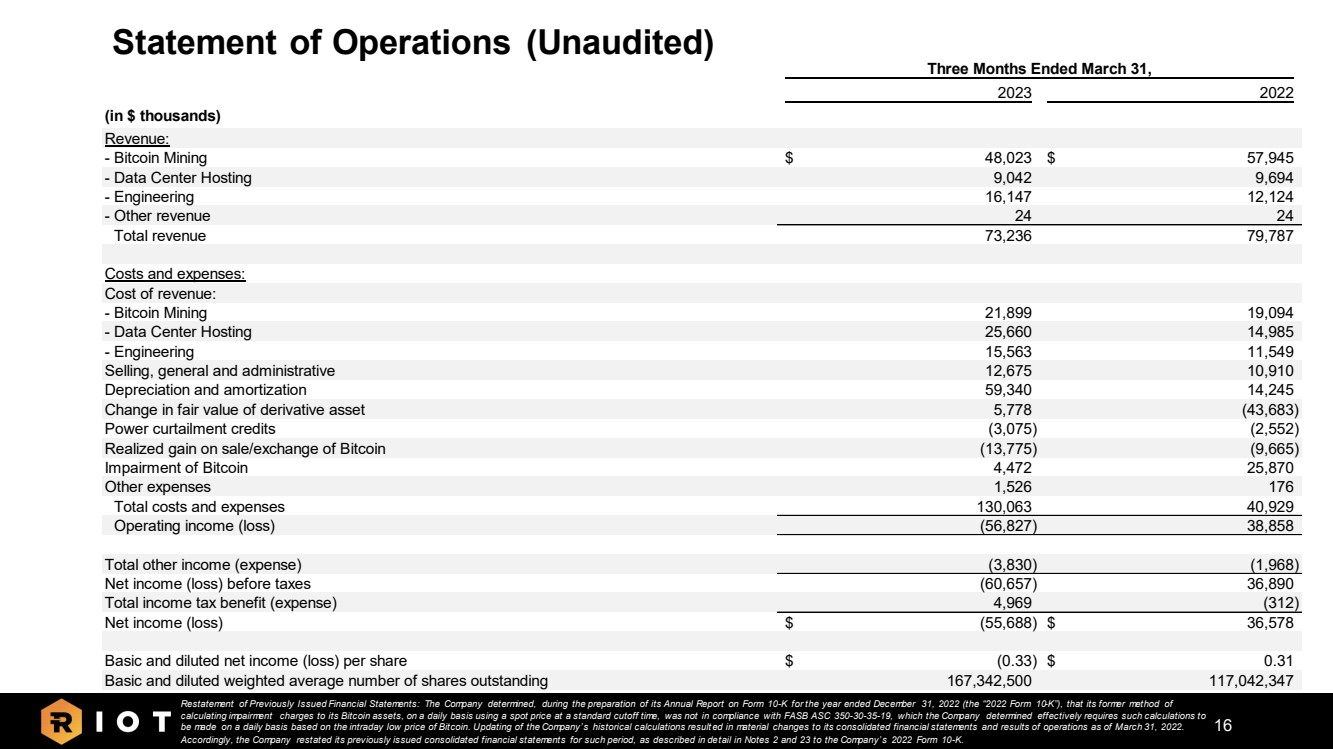

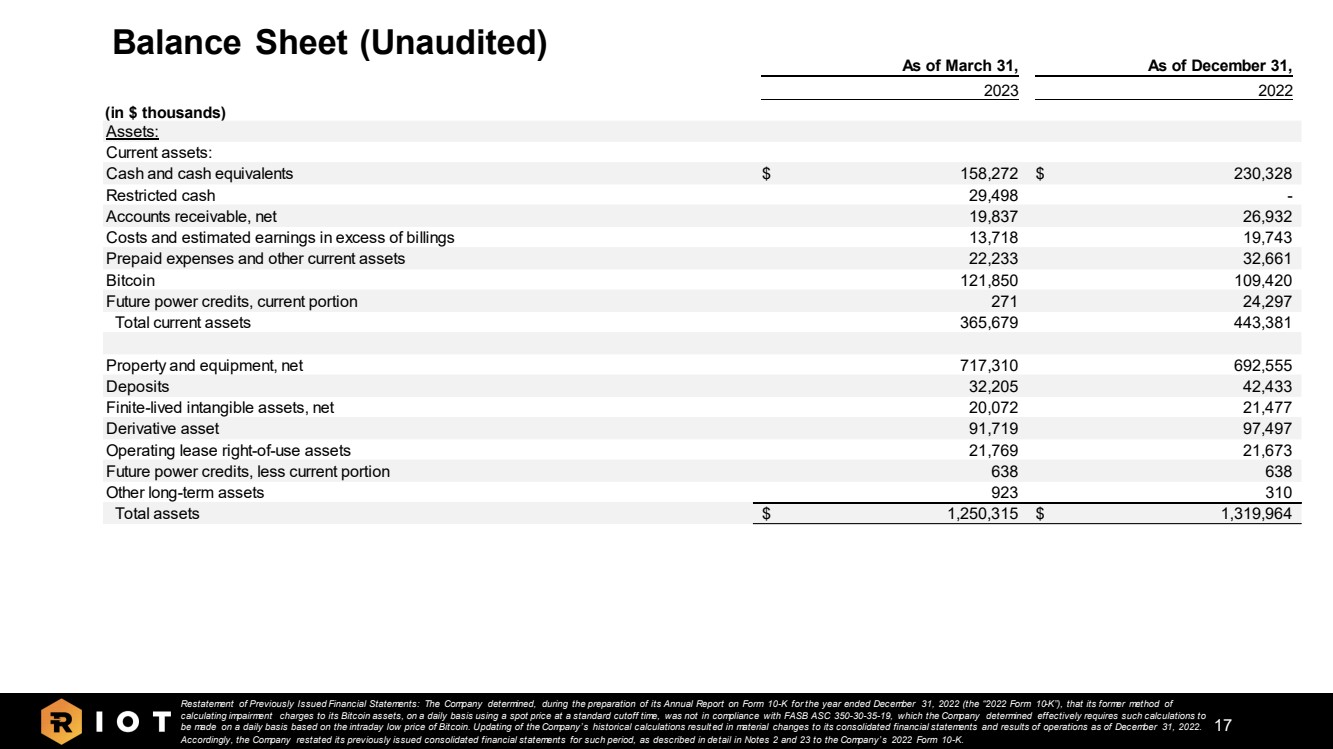

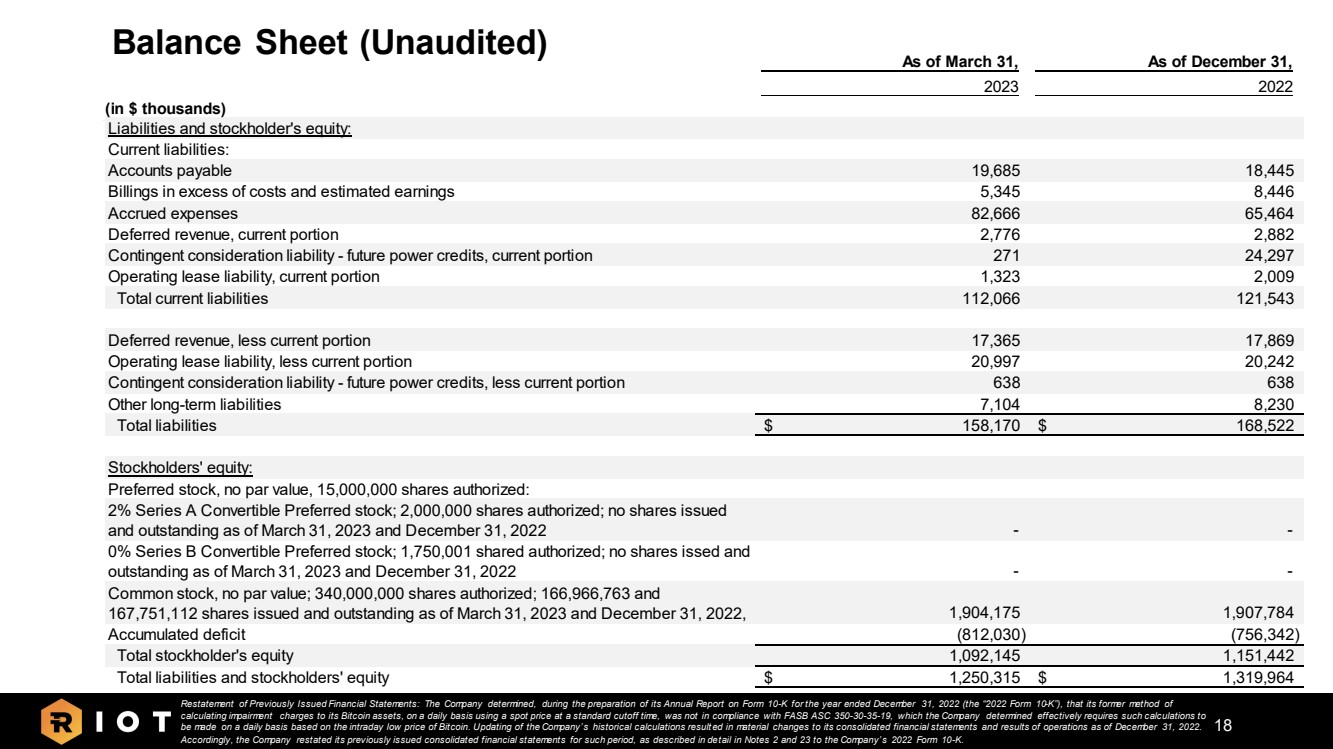

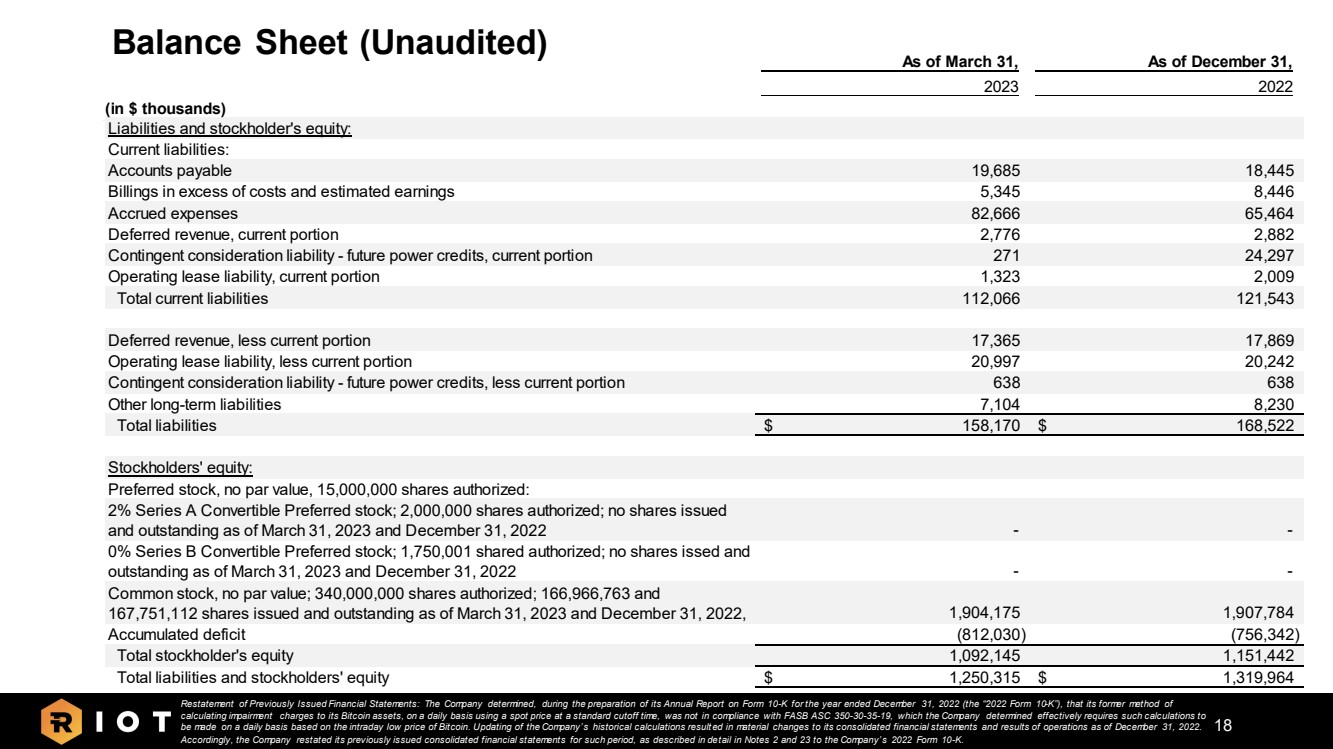

| 18 Balance Sheet (Unaudited) Liabilities and stockholder's equity: Current liabilities: Accounts payable 19,685 18,445 Billings in excess of costs and estimated earnings 5,345 8,446 Accrued expenses 82,666 65,464 Deferred revenue, current portion 2,776 2,882 Contingent consideration liability - future power credits, current portion 271 24,297 Operating lease liability, current portion 1,323 2,009 Total current liabilities 112,066 121,543 Deferred revenue, less current portion 17,365 17,869 Operating lease liability, less current portion 20,997 20,242 Contingent consideration liability - future power credits, less current portion 638 638 Other long-term liabilities 7,104 8,230 Total liabilities $ 158,170 $ 168,522 Stockholders' equity: Preferred stock, no par value, 15,000,000 shares authorized: - - - - 1,904,175 1,907,784 Accumulated deficit (812,030) (756,342) Total stockholder's equity 1,092,145 1,151,442 Total liabilities and stockholders' equity $ 1,250,315 $ 1,319,964 2% Series A Convertible Preferred stock; 2,000,000 shares authorized; no shares issued and outstanding as of March 31, 2023 and December 31, 2022 0% Series B Convertible Preferred stock; 1,750,001 shared authorized; no shares issed and outstanding as of March 31, 2023 and December 31, 2022 Common stock, no par value; 340,000,000 shares authorized; 166,966,763 and 167,751,112 shares issued and outstanding as of March 31, 2023 and December 31, 2022, As of March 31, As of December 31, 2023 2022 (in $ thousands) Restatement of Previously Issued Financial Statements: The Company determined, during the preparation of its Annual Report on Form 10-K for the year ended December 31, 2022 (the “2022 Form 10-K”), that its former method of calculating impairment charges to its Bitcoin assets, on a daily basis using a spot price at a standard cutoff time, was not in compliance with FASB ASC 350-30-35-19, which the Company determined effectively requires such calculations to be made on a daily basis based on the intraday low price of Bitcoin. Updating of the Company’s historical calculations resulted in material changes to its consolidated financial statements and results of operations as of December 31, 2022. Accordingly, the Company restated its previously issued consolidated financial statements for such period, as described in detail in Notes 2 and 23 to the Company’s 2022 Form 10-K. |