1 Classification: Limited DEALING POLICY FOR DIRECTORS, GEC MEMBERS AND GEC ATTENDEES LLOYDS BANKING GROUP PLC LLOYDS BANK PLC HBOS PLC BANK OF SCOTLAND PLC Date approved by the Boards: 19 February 2025 – effective 19 February 2025

2 Classification: Limited CONTENTS 1 WHAT ARE THE KEY TERMS USED IN THIS POLICY? ....................................................................... 3 2 DEALING AND NOTIFICATION REQUIREMENTS "AT A GLANCE" ................................................. 4 3 DOES THIS POLICY APPLY TO ME? ................................................................................................. 5 4 WHY IS THIS POLICY IMPORTANT? ................................................................................................. 6 5 WHAT KINDS OF DEALINGS ARE COVERED BY THIS POLICY? ...................................................... 7 6 WHAT ARE MY OBLIGATIONS UNDER THIS POLICY? ..................................................................... 9 6.1 OBLIGATIONS IN RELATION TO GROUP SECURITIES .......................................................................... 9 6.2 OBLIGATIONS IN RELATION TO OTHER SECURITIES ........................................................................... 9 7 HOW DO I OBTAIN CLEARANCE TO DEAL? ................................................................................. 10 8 HOW DO I NOTIFY THE GROUP OF MY DEALINGS? .................................................................... 11 8.1 PROCEDURE FOR ALL PERSONS TO WHOM THIS DEALING POLICY APPLIES ................................. 11 8.2 ADDITIONAL OBLIGATIONS FOR PDMRS AND THEIR PCAS ............................................................. 11 APPENDIX 1 - PERSONS CLOSELY ASSOCIATED ................................................................................. 12 APPENDIX 2 – CLEARANCE AND NOTIFICATION REQUIREMENTS IN SPECIFIC DEALING SCENARIOS ........................................................................................................................................... 13 CERTAIN DEALINGS ON BEHALF OF A RESTRICTED PERSON WHERE A MANAGER OR TRUSTEE HAS COMPLETE DISCRETION .................................................................................................................................. 13 DEALINGS IN RELATION TO THE GROUP'S SHARE PLANS ............................................................................ 13 DEALINGS IN A TRUSTEE CAPACITY ............................................................................................................... 14

3 Classification: Limited 1 WHAT ARE THE KEY TERMS USED IN THIS POLICY? Board The board of directors of any Group Company Closed Period The period in respect of a Group Company during which dealing is not permitted by Restricted Persons as described in Section 6.1 Deal / dealing Any transaction in securities of any nature – see Section 5 for further details GEC Group Executive Committee of Lloyds Banking Group plc, Lloyds Bank plc, Bank of Scotland plc and/or HBOS plc Group Lloyds Banking Group plc, Lloyds Bank plc, HBOS plc and Bank of Scotland plc Group Company Each of Lloyds Banking Group plc, Lloyds Bank plc, HBOS plc and/or Bank of Scotland plc, as appropriate Group Securities Any publicly traded or quoted shares or debt instruments, and any linked derivatives or financial instruments, issued by a Group Company inside information Information that: (i) relates directly or indirectly to particular securities or to a particular issuer of securities; (ii) is of a precise nature; (iii) has not been made public; and (iv) if it were made public, would be likely to have a significant effect on the price of any securities. IMS Interim management statement Other Securities Any securities other than Group Securities PAD Rules The CCOR Control Room Personal Account Dealing Rules as amended from time to time or such other rules and/or policy which may replace them in relation to inside information and personal account dealing restrictions and obligations PCA Person closely associated as described in Appendix 1 PDMR Person discharging managerial responsibilities for the purposes of UK MAR, being all Board members and all GEC members (but not any GEC attendees) Restricted Person (or you) Any person to whom this Dealing Policy applies – see Section 3 for further details securities Any shares or debt instruments (including, but not limited to, investment funds) and any linked derivatives or financial instruments, in each case whether or not publicly traded or quoted UK MAR UK Market Abuse Regulation

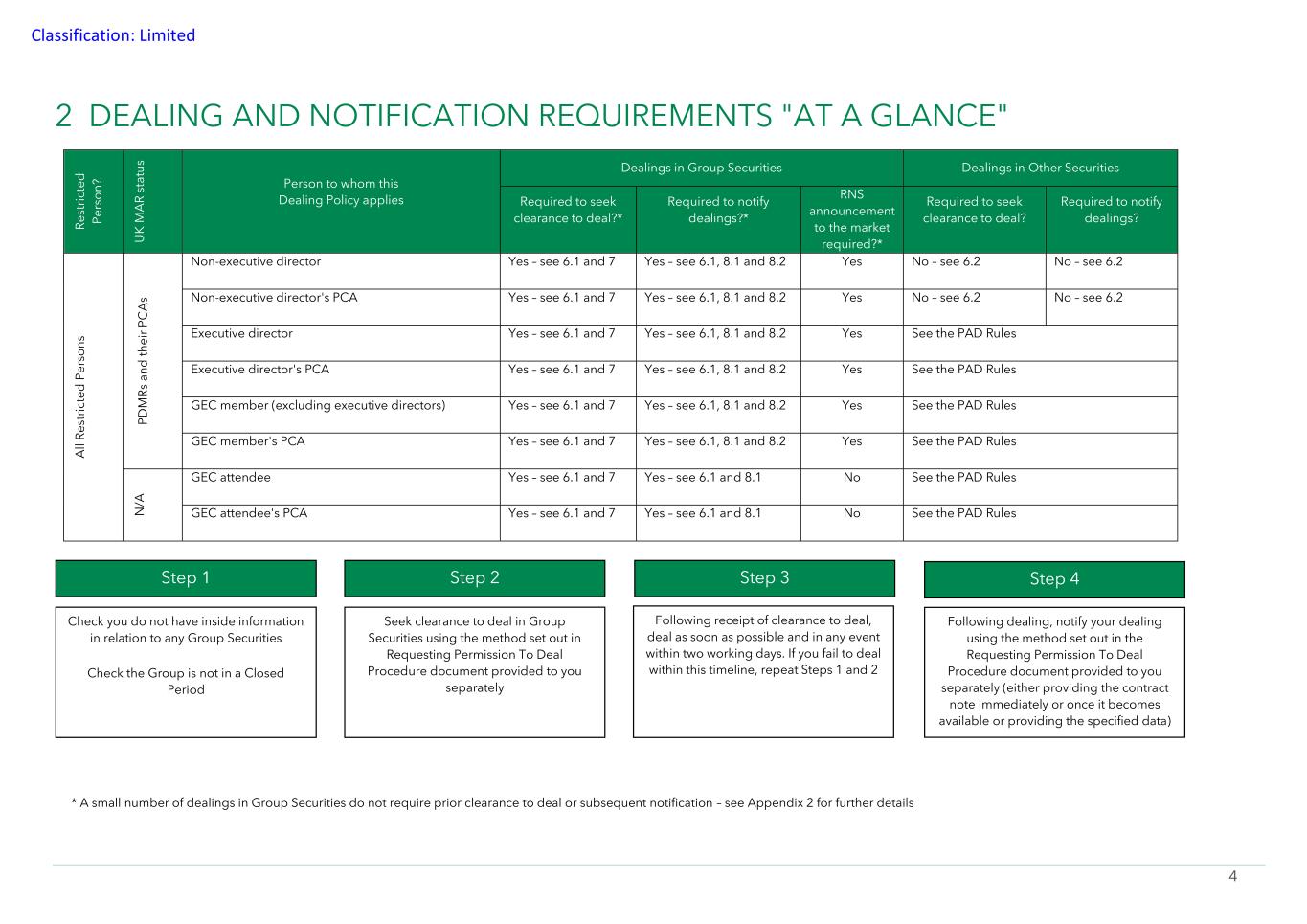

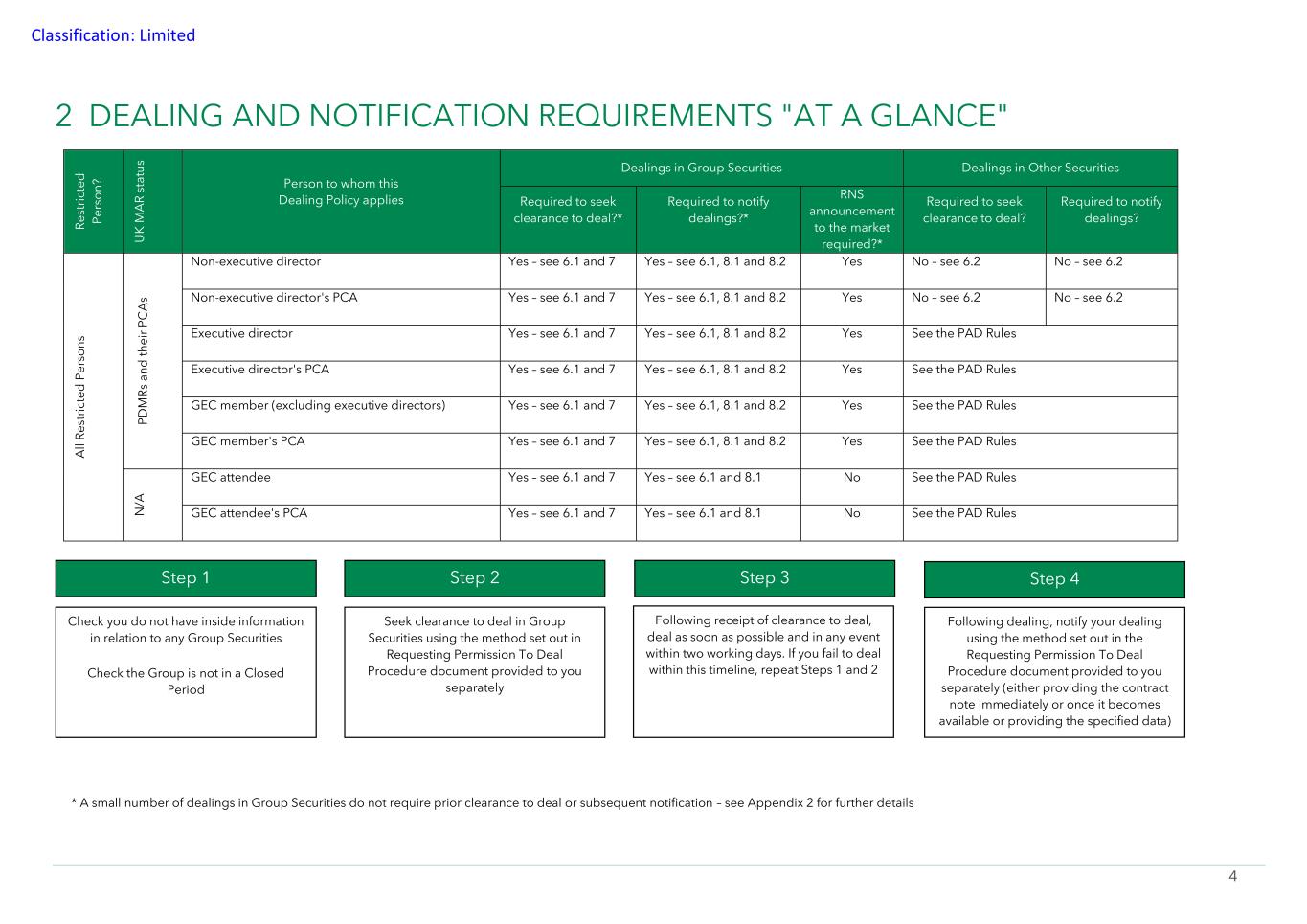

4 Classification: Limited 2 DEALING AND NOTIFICATION REQUIREMENTS "AT A GLANCE" R e st ri c te d P e rs o n ? U K M A R s ta tu s Person to whom this Dealing Policy applies Dealings in Group Securities Dealings in Other Securities Required to seek clearance to deal?* Required to notify dealings?* RNS announcement to the market required?* Required to seek clearance to deal? Required to notify dealings? A ll R e st ri c te d P e rs o n s P D M R s a n d t h e ir P C A s Non-executive director Yes – see 6.1 and 7 Yes – see 6.1, 8.1 and 8.2 Yes No – see 6.2 No – see 6.2 Non-executive director's PCA Yes – see 6.1 and 7 Yes – see 6.1, 8.1 and 8.2 Yes No – see 6.2 No – see 6.2 Executive director Yes – see 6.1 and 7 Yes – see 6.1, 8.1 and 8.2 Yes See the PAD Rules Executive director's PCA Yes – see 6.1 and 7 Yes – see 6.1, 8.1 and 8.2 Yes See the PAD Rules GEC member (excluding executive directors) Yes – see 6.1 and 7 Yes – see 6.1, 8.1 and 8.2 Yes See the PAD Rules GEC member's PCA Yes – see 6.1 and 7 Yes – see 6.1, 8.1 and 8.2 Yes See the PAD Rules N /A GEC attendee Yes – see 6.1 and 7 Yes – see 6.1 and 8.1 No See the PAD Rules GEC attendee's PCA Yes – see 6.1 and 7 Yes – see 6.1 and 8.1 No See the PAD Rules Check you do not have inside information in relation to any Group Securities Check the Group is not in a Closed Period Step 1 Seek clearance to deal in Group Securities using the method set out in Requesting Permission To Deal Procedure document provided to you separately Step 2 Following receipt of clearance to deal, deal as soon as possible and in any event within two working days. If you fail to deal within this timeline, repeat Steps 1 and 2 Step 3 Following dealing, notify your dealing using the method set out in the Requesting Permission To Deal Procedure document provided to you separately (either providing the contract note immediately or once it becomes available or providing the specified data) Step 4 * A small number of dealings in Group Securities do not require prior clearance to deal or subsequent notification – see Appendix 2 for further details

5 Classification: Limited 3 DOES THIS POLICY APPLY TO ME? This Dealing Policy applies to Restricted Persons, being: • all directors on the boards of each of Lloyds Banking Group plc, Lloyds Bank plc, HBOS plc and Bank of Scotland plc; • all members of the Group Executive Committee of each of Lloyds Banking Group plc, Lloyds Bank plc, Bank of Scotland plc and HBOS plc; • all attendees of the Group Executive Committee of each of Lloyds Banking Group plc, Lloyds Bank plc, Bank of Scotland plc and HBOS plc; and • all persons closely associated with any person falling within any of the categories set out above (see Appendix 1 for further detail). This Dealing Policy does not apply to you if you are not a director, or member or attendee of the Group Executive Committee, of any of Lloyds Banking Group plc, Lloyds Bank plc, HBOS plc and Bank of Scotland plc, or a person closely associated with any of those categories of person. It is the responsibility of Restricted Persons to be aware of their responsibilities with regard to securities dealings and to ensure they comply with this Dealing Policy. Note that other policies, such as the PAD Rules, may apply in addition to this Dealing Policy. In the event of any inconsistency between this Dealing Policy and any other policy, this Dealing Policy shall prevail.

6 Classification: Limited 4 WHY IS THIS POLICY IMPORTANT? As companies with securities that are listed and admitted to trading on various stock exchanges, including the London Stock Exchange, the Group Companies and their respective directors and employees must comply with various important regulatory requirements relating to securities dealings, including under UK MAR. UK MAR includes provisions on inside information, dealing in listed securities and market abuse. It is enforced by the UK Financial Conduct Authority. This Dealing Policy sets out the procedures that have been established to ensure that the Group Companies and their respective directors and specified employees can comply with their regulatory obligations under UK MAR. Additional processes or procedures may apply in relation to dealings in Group Securities listed on a stock exchange outside the UK. The Group Secretariat team should be consulted prior to any such dealings so that any additional requirements can be confirmed. The intention of this Dealing Policy is to prevent anyone from dealing, or placing themselves under suspicion of dealing, in securities when in possession of inside information or ahead of the publication of periodic financial information and to make all individuals to whom this Dealing Policy applies aware of their responsibilities (in particular in relation to abiding by restrictions on dealings, seeking appropriate clearance to deal and, where required, making mandatory notifications following any dealing). It is your responsibility to read and comply with this Dealing Policy. Breaches of the regulatory requirements relating to securities dealings may have serious consequences for the Group Companies and their Restricted Persons, including civil fines for market abuse dealings and criminal charges for any persons involved in insider dealing. Any breaches of this Dealing Policy will therefore be taken seriously and, in the case of employees subject to this Dealing Policy, may lead to disciplinary action being taken against the individual concerned. GEC members and attendees should read this Dealing Policy alongside the PAD Rules, which apply to dealings in Other Securities by GEC members and attendees and their respective PCAs. In the event of any inconsistency between this Dealing Policy and any other policy (including the PAD Rules), this Dealing Policy shall prevail.

7 Classification: Limited 5 WHAT KINDS OF DEALINGS ARE COVERED BY THIS POLICY? The definition of "dealing" for the purposes of this Dealing Policy is very wide. The following is a non-exhaustive list of transactions in Group Securities which are dealings for the purpose of this policy: • buying or agreeing to buy securities; • selling or agreeing to sell securities (which includes selling or agreeing to sell shares to pay tax when receiving shares under one of the Group's share plans, unless you are otherwise told that clearance is not needed); • being granted, accepting, acquiring, disposing of, exercising or discharging any option or warrant (whether for the call, or put or both) or any other transactions in or relating to any other type of derivative (including cash-settled transactions and phantom options); • participating in, receiving securities or awards or options for securities under, altering, or leaving any of the Group's share plans; • entering into or leaving any dividend re-investment plan; • using any securities as security for a loan (whether by way of borrowing or lending or otherwise); • transferring any securities to a spouse, civil partner or other family member; • transferring securities between two accounts that are ultimately beneficially owned by the same person (including transferring to or from an ISA) or any other change in the legal holder of securities (even where the beneficial ownership remains the same); • entering, amending or cancelling any trading plan or investment plan in respect of securities; • giving or receiving a gift of securities (including by way of inheritance); • giving instructions to the manager of a pension fund to invest in or sell securities (or a fund which includes securities); • subscribing for or agreeing to subscribe for securities (including participating in any capital increase or debt instrument issuance, or agreeing to subscribe for securities by way of a share-for- share exchange or similar transaction); • entering into or exercising equity swaps, a contract for difference, derivatives and financial instruments that are linked to debt instruments (including credit default swaps); and • entering into certain transactions under a life insurance policy where (i) you are the policyholder, (ii) you bear the investment risk and (iii) you have the power or discretion to make investment decisions, or execute transactions, regarding specific instruments for that life insurance policy. Dealing covers circumstances where: • you are dealing on your own behalf; • you are dealing on behalf of someone else (e.g. if you are acting as an executor of an estate, or as trustee of a trust, that holds securities); • someone else is dealing on your behalf (e.g. your broker, investment fund manager, pension fund or trustee of your family trust), including where that person exercises discretion; • transactions that are conditional in some way (e.g. where execution depends on the occurrence or fulfilment of certain conditions); and

8 Classification: Limited • there is an automatic or non-automatic conversion of one security into another (e.g. the exchange of convertible bonds for shares). Although "dealing" is interpreted broadly, different requirements and procedures for seeking clearance to deal and notifying any dealing may apply depending on the circumstances surrounding that dealing. See Section 6 and Appendix 2 for further details. If you are in doubt, you should assume that any proposed action or decision by you, or by someone on your behalf, in relation to securities may be a "dealing" and obtain guidance from the Group Secretariat team.

9 Classification: Limited 6 WHAT ARE MY OBLIGATIONS UNDER THIS POLICY? 6.1 OBLIGATIONS IN RELATION TO GROUP SECURITIES If you wish to deal in Group Securities, you must obtain prior clearance to do so. See Section 7 for further detail on how to seek clearance to deal in Group Securities. You must not deal in considerations of a short-term nature (i.e. with a maturity of one year or less). You should not seek, and will not be given, clearance to deal in Group Securities of a Group Company during: • a time when you hold inside information in relation that Group Company; • a Closed Period in relation to that Group Company (save in exceptional circumstances in accordance with applicable regulation). The Closed Periods for each of the Group Companies are as follows: • Year end results: 1 January until 7am one clear day after the announcement of the Group Company's preliminary results • Q1 IMS (applicable to Lloyds Banking Group plc and Lloyds Bank plc only): 1 April until 7am one clear day after the announcement of the Group Company's Q1 IMS • Half-year results: 30 calendar days immediately preceding the announcement of the Group Company's interim results until 7am one clear day after the announcement of the Group Company's interim results • Q3 IMS (applicable to Lloyds Banking Group plc and Lloyds Bank plc only): 1 October until 7am one clear day after the announcement of the Group Company's Q3 IMS Following any dealing in Group Securities, you must notify the Group Secretariat team so that any required announcements and notifications can be made. See Section 8 for further detail on how to notify the Group Secretariat team of your dealings in Group Securities. 6.2 OBLIGATIONS IN RELATION TO OTHER SECURITIES If you are a GEC member or a GEC attendee, you must refer to the PAD Rules which sets out your obligations in relation to dealings by you and your PCAs in Other Securities. If you are a non-executive director on the Board or the PCA of a non-executive director on the Board, you are not required to seek clearance to deal, or notify your dealings, in Other Securities. Note, however, that there is a general prohibition against dealing in any company's securities at any time when you hold inside information about that company. When making a decision on whether or not to deal in Other Securities, you should be mindful of any information that has been disclosed to you (for example, to non-executive directors in the context of impairment and other credit reviews provided periodically to the Audit Committee or Board Risk Committee or in relation to contract negotiations / reviews) and if you are in any doubt, you should seek guidance on whether it is appropriate to deal in Other Securities in those circumstances from the Group Secretariat team.

10 Classification: Limited 7 HOW DO I OBTAIN CLEARANCE TO DEAL? If you wish to seek clearance to deal in Group Securities, you must do so using the process set out in the Requesting Permission To Deal Procedure document provided to you separately. Note that there are a small number of dealings in Group Securities which do not require prior clearance – see Appendix 2 for further details. Upon receipt, the request will be considered by the Control Room, the approver relevant to your role (or their alternate) and, in the case of GEC members and attendees, Reward. When considering whether to provide clearance to deal in Group Securities, consent will not be unreasonably withheld but you should note that the approver may choose to withhold consent for reputational reasons or as a result of public perception considerations. You will generally be notified of the outcome of your request within two working days. Any clearance to deal may be provided subject to conditions, which you must comply with. A reasoned explanation for any refusal to provide clearance to deal will also be provided unless prohibited by law. Once you receive clearance to deal in Group Securities, you must deal as soon as possible after receiving clearance and in any event within two working days of receiving clearance. If you do not deal in Group Securities within this time period, or there is new information which is or has the potential to become inside information, you must seek clearance to deal again using the process set out in the Requesting Permission To Deal Procedure document provided to you separately before dealing.

11 Classification: Limited 8 HOW DO I NOTIFY THE GROUP OF MY DEALINGS? 8.1 PROCEDURE FOR ALL PERSONS TO WHOM THIS DEALING POLICY APPLIES Once you have dealt in Group Securities, you must notify the Group Secretariat team as soon as practicable and no later than two working days after the dealing occurred. You should do so following the process set out in the Requesting Permission To Deal Procedure document provided to you separately. The following information, which is usually set out on the contract note, should be included on any notification of dealings in Group Securities: • name of the person that dealt in Group Securities; • name of the relevant issuer (e.g. Lloyds Banking Group plc, Lloyds Bank plc); • description of the security (e.g. ordinary shares, debt instruments); • nature of the transaction (e.g. acquisition, disposal, exercise of options); • price and volume of the transaction(s); • date of the transaction(s); and • trading venue of the transaction(s) (e.g. London Stock Exchange). Note that there are a small number of dealings in Group Securities which do not require notification by you to the Group Secretariat team – see Appendix 2 for further details. 8.2 ADDITIONAL OBLIGATIONS FOR PDMRS AND THEIR PCAS Under UK MAR, PDMRs (i.e. all directors and GEC members) and their PCAs are required to notify the relevant Group Company and the FCA of their dealings in Group Securities promptly and no later than three working days after the dealing occurred. Unless instructed to the contrary by the PDMR or PCA, the relevant Group Company will notify the FCA of any dealings in Group Securities by a PDMR and their PCAs using the details provided, although the PDMR or PCA (as applicable) remains legally responsible for the notification. Under UK MAR, the relevant Group Company is also required to announce dealings in Group Securities by PDMRs and their PCAs via regulatory information service announcement within two working days of the Group Company receiving notification of the dealing from the PDMR or PCA (as applicable). If you are a PDMR or a PCA of a PDMR, you should be aware of the additional obligations described in this Section 8.2 and should follow the procedure described in Section 8.1 and in particular must notify the Group Secretariat team no later than two working days after the dealing occurred to ensure that these obligations can be complied with.

12 Classification: Limited APPENDIX 1 - PERSONS CLOSELY ASSOCIATED The checklists below are designed to help you identify whether a certain individual or legal person is your PCA for the purposes of this Dealing Policy. If you have any questions, you should contact the Group Secretariat team. PCA checklist – Family Members Relationship PCA Husband/wife/civil partner ✓ Husband/wife/civil partner (separated, including legally separated, but not yet divorced) ✓ Ex-husband/wife/civil partner (after divorce finalised) ✘ Live-in partner ✓ Live-out partner ✘ Child/step-child under 18 and unmarried/no civil partner ✓ Child/step-child under 18 who is married or has a civil partner and does not live at home ✘ Child/step-child over 18 and not living at home (a child/step-child attending university away from home, and only returning home during holidays is not considered to be a PCA, but will become a PCA after returning home, and remaining there for more than 12 months) ✘ Live-in relative (e.g. elderly aunt, grandchild, adult child or married child under 18) who has shared the same address for 1 year or more ✓ Live-in non-relative (e.g. au pair, lodger) ✘ Other relatives who do not share the same address as the Restricted Person (parents, siblings, in-laws etc.) ✘ PCA checklist – Corporate Interests Relationship PCA Corporate body, trust or partnership of which you or any of your PCAs discharges the managerial responsibilities (e.g. a cross-directorship, where you or your PCA is on the board of a company outside the Group and takes part in or influences the decisions of that company in relation to transactions in Group Securities – normally a non-executive directorship position on another company will not make that company a PCA) ✓ Corporate body, trust or partnership which is directly or indirectly controlled by you or any of your PCAs ✓ Corporate body, trust or partnership set up for the benefit of you or any of your PCAs ✓ Corporate body, trust or partnership the economic interests of which are substantially equivalent to those of you or any of your PCAs ✓

13 Classification: Limited APPENDIX 2 – CLEARANCE AND NOTIFICATION REQUIREMENTS IN SPECIFIC DEALING SCENARIOS As described in Section 5, "dealing" is interpreted broadly and therefore a wide range of transactions are covered by this Dealing Policy. As a general rule, you should seek clearance to deal in Group Securities as described in Section 7 and should notify the Group Secretariat team of your dealings in Group Securities as described in Section 8. This Appendix describes a number of dealings that deviate from this general rule, where clearance to deal or notification (or both) is not required. Further guidance can be obtained from the Group Secretariat team. CERTAIN DEALINGS ON BEHALF OF A RESTRICTED PERSON WHERE A MANAGER OR TRUSTEE HAS COMPLETE DISCRETION You are not required to seek clearance to deal, or to notify the Group Secretariat team of your dealings in Group Securities, where you (or someone on your behalf) buys or sells an investment product which is known to hold an interest not exceeding 20% in Group Securities and it is not possible for you to determine or influence the investment strategy or dealings carried out, such that the manager or trustee has complete discretion. The manager or trustee would have complete discretion, for example, in most mutual funds, index trackers or other retail investment products (so there would be no need to apply for clearance for dealings by those funds). Before buying or selling, you should take reasonable steps to find out if the investment product includes an exposure to Group Securities. Where you can determine or influence the investment strategy or dealings carried out by someone else on your behalf, or the exposure to Group Securities exceeds 20%, you should seek clearance to deal and notify the Group Secretariat team of your dealings in the usual way. DEALINGS IN RELATION TO THE GROUP'S SHARE PLANS Actions that do not require clearance or notification The following specific actions in relation to the Group's share plans do not require you to seek clearance and do not require you to notify the Group Secretariat team of your dealings: • you being granted an option or award under one of the Group's share plans (but, as set out below, you do have to seek clearance to accept an invitation to participate in the Group's Sharesave Scheme or to join a Group share plan or to leave a Group share plan e.g. Sharesave or Sharematch); • you receiving a normal quarterly allocation of Group Securities as a Fixed Share Award; • where you already participate in the Group's Sharematch offering, you receiving a normal monthly allocation of partnership and/or matching shares; • you being notified of the vesting of an award under any of the Group's share plans; and • you receiving Group Securities (or cash payment) in settlement of vesting (but, as set out below, you do have to seek clearance for any election that you make in connection with vesting of any award unless you are specifically told otherwise at the time); and • any other instance where you are specifically informed by a formal share plan communication or the Group Secretariat team that clearance to deal and notification of your dealings are not required.

14 Classification: Limited Actions that require clearance and notification to Group Secretariat You should seek clearance and notify the Group Secretariat team of your dealings in relation to any other action under any of the Group's share plans unless you are specifically told otherwise in the formal share plan communication at the time. Without limitation, this includes: • you joining or leaving any of the Group's share plans; • you stopping, starting or changing contributions under the Group's Sharematch plan (i.e. Partnership and Matching Shares); • you opting out of receiving a Colleague Group Ownership Share award; • you making an application to participate in the Group's Sharesave Scheme, or you withdrawing from the scheme or changing or cancelling your monthly savings contract; • you exercising any option or award under the Group's share plans; • you making any election in relation to the vesting of an award or option (such as electing to sell Group Securities or cash out an award to pay tax); and • you transferring Group Securities out of a Group share plan to your own share account, into an ISA, or to any other person. DEALINGS IN A TRUSTEE CAPACITY If you act as the trustee of a trust, you should speak to the Group Secretariat team about your obligations in respect of any dealings in Group Securities carried out by the trustees of that trust.