UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811‑21077

PIMCO California Municipal Income Fund II

(Exact name of registrant as specified in charter)

1633 Broadway, New York, NY 10019

(Address of principal executive offices)

Bijal Y. Parikh

Treasurer (Principal Financial & Accounting Officer)

650 Newport Center Drive, Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

David C. Sullivan

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, MA 02199

Registrant’s telephone number, including area code: (844) 337-4626

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Shareholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

PIMCO CLOSED-END FUNDS

Annual Report

December 31, 2022

PIMCO Municipal Income Fund | PMF | NYSE

PIMCO Municipal Income Fund II | PML | NYSE

PIMCO Municipal Income Fund III | PMX | NYSE

PIMCO California Municipal Income Fund | PCQ | NYSE

PIMCO California Municipal Income Fund II | PCK | NYSE

PIMCO California Municipal Income Fund III | PZC | NYSE

PIMCO New York Municipal Income Fund | PNF | NYSE

PIMCO New York Municipal Income Fund II | PNI | NYSE

PIMCO New York Municipal Income Fund III | PYN | NYSE

Table of Contents

| | | | | | | | |

| | |

| | | | | | Page | |

| | | | | | | | |

| | |

| | | | | | | 2 | |

| | |

| | | | | | | 3 | |

| | |

| | | | | | | 18 | |

| | |

| | | | | | | 20 | |

| | |

| | | | | | | 26 | |

| | |

| | | | | | | 28 | |

| | |

| | | | | | | 30 | |

| | |

| | | | | | | 33 | |

| | |

| | | | | | | 73 | |

| | |

| | | | | | | 95 | |

| | |

| | | | | | | 96 | |

| | |

| | | | | | | 97 | |

| | |

| | | | | | | 98 | |

| | |

| | | | | | | 100 | |

| | |

| | | | | | | 103 | |

| | |

| | | | | | | 104 | |

| | |

| | | | | | | 106 | |

| | |

| | | | | | | 107 | |

| | |

| | | | | | | 111 | |

| | |

| | | | | | | 134 | |

| | |

| | | | | | | 135 | |

| | |

| | | | | | | 136 | |

| | |

| | | | | | | 142 | |

| | |

| | | | | | | 145 | |

| | | | | | | | |

| | |

| Fund | | Fund

Summary | | | Schedule of

Investments | |

| | | | | | | | |

| | |

| �� | | 7 | | | | 35 | |

| | |

| | | 8 | | | | 40 | |

| | |

| | | 11 | | | | 46 | |

| | |

| | | 12 | | | | 52 | |

| | |

| | | 13 | | | | 56 | |

| | |

| | | 14 | | | | 60 | |

| | |

| | | 15 | | | | 64 | |

| | |

| | | 16 | | | | 67 | |

| | |

| | | 17 | | | | 70 | |

Letter from the Chair of the Board & President

Dear Shareholder,

2022 was a challenging year in the financial markets. We continue to work tirelessly to navigate global markets and manage the assets that you have entrusted with us. Following this letter is the PIMCO Municipal Closed‑End Funds Annual Report, which covers the 12‑month reporting period ended December 31, 2022 (the “reporting period”). On the subsequent pages, you will find details regarding investment results and a discussion of the factors that most affected performance during the reporting period.

For the 12‑month reporting period ended December 31, 2022

The global economy faced significant headwinds in 2022, including those related to higher inflation, the COVID‑19 pandemic, and the Russia-Ukraine conflict. In the U.S., first and second quarter 2022 annualized gross domestic product (“GDP”) returned ‑1.6% and ‑0.6%, respectively. The economy then strengthened, as third quarter annualized GDP was +3.2%. The Commerce Department’s initial estimate for fourth quarter 2022 annualized GDP — released after the reporting period ended — was 2.9%.

The Federal Reserve Board (the “Fed” or “U.S. central bank”) took actions to combat elevated inflation. In March 2022, the Fed raised the federal funds rate 0.25% to a range between 0.25% and 0.50%, its first rate hike since 2018. The U.S. central bank then raised rates at its next six meetings, for a total increase of 4.25% in 2022. At the end of the year, the federal funds rate was in a range between 4.25% and 4.50%.

During the reporting period, short- and long-term U.S. Treasury yields moved higher. The yield on the benchmark 10‑year U.S. Treasury note was 3.88% on December 31, 2022, versus 1.52% on December 31, 2021. Against this backdrop, the municipal (or “muni”) bond market was weak, with the Bloomberg Municipal Bond Index returning ‑8.53% during 2022. In addition to the negative impact from rising interest rates, the muni market faced headwinds from substantial outflows from muni mutual funds and exchange-traded funds (“ETFs”). However, munis were able to outperform the overall taxable bond market on a relative basis, as the Bloomberg U.S. Aggregate Bond Index returned ‑13.01% in 2022.

Thank you for the assets you have placed with us. We deeply value your trust, and we will continue to work diligently to meet your broad investment needs. For any questions regarding your PIMCO Municipal Closed‑End Funds investments, please contact your financial advisor, or call the Funds’ shareholder servicing agent at (844) 33‑PIMCO.

Sincerely,

| | |

| |  |

| |

| |  |

| Deborah A. DeCotis | | Eric D. Johnson |

| Chair of the Board of Trustees | | President |

Past performance is no guarantee of future results. Unless otherwise noted, index returns reflect the reinvestment of income distributions and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an unmanaged index.

| | | | |

| Important Information About the Funds | | | | |

Information regarding each Fund’s principal investment strategies, principal risks and risk management strategies, the effects of each Fund’s leverage, and each Fund’s fundamental investment restrictions, including a summary of certain changes thereto during the most recent fiscal year, can be found within the relevant sections of this report. Please refer to the Table of Contents for further information.

We believe that bond funds have an important role to play in a well-diversified investment portfolio. It is important to note, however, that in an environment where interest rates may trend upward, rising rates would negatively impact the performance of most bond funds, and fixed-income securities and other instruments held by a Fund are likely to decrease in value. A wide variety of factors can cause interest rates or yields of U.S. Treasury securities (or yields of other types of bonds) to rise (e.g., central bank monetary policies, inflation rates, general economic conditions). In addition, changes in interest rates can be sudden and unpredictable, and there is no guarantee that Fund management will anticipate such movement accurately. A Fund may lose money as a result of movement in interest rates.

As of the date of this report, interest rates in the United States and many parts of the world, including certain European countries, continue to increase. In efforts to combat inflation, the U.S. Federal Reserve raised interest rates multiple times in 2022 and has indicated an expectation that it will continue to raise interest rates in 2023. Thus, the Funds currently face a heightened level of risk associated with rising interest rates and/or bond yields. This could be driven by a variety of factors, including but not limited to central bank monetary policies, changing inflation or real growth rates, general economic conditions, increasing bond issuances or reduced market demand for low yielding investments. Further, while bond markets have steadily grown over the past three decades, dealer inventories of corporate bonds are near historic lows in relation to market size. As a result, there has been a significant reduction in the ability of dealers to “make markets.”

Bond funds and individual bonds with a longer duration (a measure used to determine the sensitivity of a security’s price to changes in interest rates) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities or funds with shorter durations. In addition, in the current low interest rate environment, the market price of the Funds’ common shares may be particularly sensitive to changes in interest rates or the perception that there will be a change in interest rates. All of the factors mentioned above, individually or collectively, could lead to increased volatility and/or lower liquidity in the fixed income markets or negatively impact a Fund’s performance or cause a Fund to incur losses.

Classifications of the Funds’ portfolio holdings in this report are made according to financial reporting standards. The classification of a

particular portfolio holding as shown in the Allocation Breakdown and Schedule of Investments and other sections of this report may differ from the classification used for the Funds’ compliance calculations, including those used in the Funds’ prospectus, investment objectives, regulatory, and other investment limitations and policies, which may be based on different asset class, sector or geographical classifications. Each Fund is separately monitored for compliance with respect to prospectus and regulatory requirements.

The geographical classification of foreign (non-U.S.) securities in this report, if any, are classified by the country of incorporation of a holding. In certain instances, a security’s country of incorporation may be different from its country of economic exposure.

Beginning in January 2020, global financial markets have experienced and may continue to experience significant volatility resulting from the spread of a novel coronavirus known as COVID-19. The outbreak of COVID-19 has resulted in travel and border restrictions, quarantines, supply chain disruptions, lower consumer demand and general market uncertainty. In 2022, many countries lifted some or all restrictions related to COVID-19. However, the effects of COVID-19 have and may continue to adversely affect the global economy, the economies of certain nations and individual issuers, all of which may negatively impact the Funds’ performance. In addition, COVID-19 and governmental responses to COVID-19 may negatively impact the capabilities of the Funds’ service providers and disrupt the Funds’ operations.

The United States’ enforcement of restrictions on U.S. investments in certain issuers and tariffs on goods from certain other countries has contributed to and may continue to contribute to international trade tensions and may impact portfolio securities. The United States’ enforcement of sanctions or other similar measures on various Russian entities and persons, and the Russian government’s response, may also negatively impact securities and instruments that are economically tied to Russia.

The United Kingdom’s withdrawal from the European Union may impact Fund returns. The withdrawal may cause substantial volatility in foreign exchange markets, lead to weakness in the exchange rate of the British pound, result in a sustained period of market uncertainty, and destabilize some or all of the other European Union member countries and/or the Eurozone.

The Funds may invest in certain instruments that rely in some fashion upon the London Interbank Offered Rate (“LIBOR”). LIBOR is an average interest rate, determined by the ICE Benchmark Administration, that banks charge one another for the use of short-term money. The United Kingdom’s Financial Conduct Authority, which regulates LIBOR,

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | DECEMBER 31, 2022 | | | 3 |

| | | | |

| Important Information About the Funds | | (Cont.) | | |

has announced plans to ultimately phase out the use of LIBOR. The transition may result in a reduction in the value of certain instruments held by a Fund or a reduction in the effectiveness of related Fund transactions such as hedges. There remains uncertainty regarding future utilization of LIBOR and the nature of any replacement rate (e.g., the Secured Overnight Financing Rate, which is intended to replace U.S. dollar LIBOR and measures the cost of overnight borrowings through repurchase agreement transactions collateralized with U.S. Treasury securities). Any potential effects of the transition away from LIBOR on the Fund or on certain instruments in which the Fund invests can be difficult to ascertain, and they may vary depending on a variety of factors. Any such effects of the transition away from LIBOR, as well as other unforeseen effects, could result in losses to a Fund.

Investing in the municipal bond market involves the risks of investing in debt securities generally and certain other risks. The amount of public information available about the municipal bonds in which a Fund may invest is generally less than that for corporate equities or bonds, and the investment performance of a Fund’s investment in municipal bonds may therefore be more dependent on the analytical abilities of Pacific Investment Management Company LLC (“PIMCO”) than its investments in taxable bonds. The secondary market for municipal bonds also tends to be less well-developed or liquid than many other securities markets, which may adversely affect a Fund’s ability to sell its bonds at attractive prices.

The ability of municipal issuers to make timely payments of interest and principal may be diminished during general economic downturns, by litigation, legislation or political events, or by the bankruptcy of the issuer. Issuers of municipal securities also might seek protection under the bankruptcy laws. In the event of bankruptcy of such an issuer, a Fund could experience delays in collecting principal and interest and the Fund may not, in all circumstances, be able to collect all principal and interest to which it is entitled.

A Fund that has substantial exposures to California municipal bonds may be affected significantly by economic, regulatory or political developments affecting the ability of California issuers to pay interest or repay principal. Certain issuers of California municipal bonds have experienced serious financial difficulties in the past and reoccurrence of these difficulties may impair the ability of certain California issuers to pay principal or interest on their obligations. Provisions of the California Constitution and State statutes that limit the taxing and spending authority of California governmental entities may impair the ability of California issuers to pay principal and/or interest on their obligations. While California’s economy is broad, it does have major concentrations in advanced technology, aerospace and defense-related manufacturing, trade, entertainment, real estate and financial services, and may be sensitive to economic problems affecting those industries.

Future California political and economic developments, constitutional amendments, legislative measures, executive orders, administrative regulations, litigation and voter initiatives could have an adverse effect on the debt obligations of California issuers.

A Fund that has substantial exposures to New York municipal bonds may be affected significantly by economic, regulatory or political developments affecting the ability of New York issuers to pay interest or repay principal. While New York’s economy is broad, it does have concentrations in the financial services industry, and may be sensitive to economic problems affecting that industry. Certain issuers of New York municipal bonds have experienced serious financial difficulties in the past and reoccurrence of these difficulties may impair the ability of certain New York issuers to pay principal or interest on their obligations. The financial health of New York City affects that of the State, and when New York City experiences financial difficulty, it may have an adverse effect on New York municipal bonds held by a Fund. The growth rate of New York has at times been somewhat slower than the nation overall. The economic and financial condition of New York also may be affected by various financial, social, economic and political factors.

The common shares of the Funds trade on the New York Stock Exchange. As with any stock, the price of a Fund’s common shares will fluctuate with market conditions and other factors. If you sell your common shares of a Fund, the price received may be more or less than your original investment.

Shares of closed-end investment management companies, such as the Funds, frequently trade at a discount from their net asset value (“NAV”) and may trade at a price that is less than the initial offering price and/or the NAV of such shares. Further, if a Fund’s shares trade at a price that is more than the initial offering price and/or the NAV of such shares, including at a substantial premium and/or for an extended period of time, there is no assurance that any such premium will be sustained for any period of time and will not decrease, or that the shares will not trade at a discount to NAV thereafter.

The Funds may be subject to various risks as described in each Fund’s prospectus and in the Principal and Other Risks in the Notes to Financial Statements.

On each Fund Summary page in this Shareholder Report, the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that any dividend and capital gain distributions were reinvested. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions. Total return for a period

of more than one year represents the average annual total return. Performance at market price will differ from results at NAV. Although market price returns tend to reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about a Fund, market conditions, supply and demand for the Fund’s shares, or changes in the Fund’s dividends. Performance shown is net of fees and expenses. Historical NAV performance for a Fund may have been positively impacted by fee waivers or expense limitations in place during some or all of the periods shown, if applicable. Future performance (including total return or yield) and distributions may be negatively impacted by the expiration or reduction of any such fee waivers or expense limitations.

The dividend rate that a Fund pays on its common shares may vary as portfolio and market conditions change, and will depend on a number of factors, including without limit the amount of a Fund’s undistributed net investment income and net short- and long-term capital gains, as well as the costs of any leverage obtained by a Fund. As portfolio and market conditions change, the rate of distributions on the common shares and a Fund’s dividend policy could change. There can be no assurance that a change in market conditions or other factors will not result in a change in a Fund’s distribution rate or that the rate will be sustainable in the future.

The following table discloses the inception date and diversification status of each Fund:

| | | | | | | | | | |

| | | |

| Fund Name | | | | | Inception

Date | | | Diversification

Status |

| PIMCO Municipal Income Fund | | | | | | | 06/29/01 | | | Diversified |

| PIMCO Municipal Income Fund II | | | | | | | 06/28/02 | | | Diversified |

| PIMCO Municipal Income Fund III | | | | | | | 10/31/02 | | | Diversified |

| PIMCO California Municipal Income Fund | | | | | | | 06/29/01 | | | Diversified |

| PIMCO California Municipal Income Fund II | | | | | | | 06/28/02 | | | Diversified |

| PIMCO California Municipal Income Fund III | | | | | | | 10/31/02 | | | Diversified |

| PIMCO New York Municipal Income Fund | | | | | | | 06/29/01 | | | Non‑diversified |

| PIMCO New York Municipal Income Fund II | | | | | | | 06/28/02 | | | Diversified |

| PIMCO New York Municipal Income Fund III | | | | | | | 10/31/02 | | | Non-diversified |

An investment in a Fund is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Funds.

The Trustees are responsible generally for overseeing the management of the Funds. The Trustees authorize the Funds to enter into service agreements with PIMCO and other service providers in order to provide, and in some cases authorize service providers to procure through other parties, necessary or desirable services on behalf of the Funds. Shareholders are not parties to or third-party beneficiaries of such service agreements. Neither a Fund’s prospectus or Statement of

Additional Information (“SAI”), any press release or shareholder report, any contracts filed as exhibits to a Fund’s registration statement, nor any other communications, disclosure documents or regulatory filings (including this report) from or on behalf of a Fund creates a contract between or among any shareholders of a Fund, on the one hand, and the Fund, a service provider to the Fund, and/or the Trustees or officers of the Fund, on the other hand. The Trustees (or the Funds and their officers, service providers or other delegates acting under authority of the Trustees) may amend its most recent prospectus or use a new prospectus or SAI with respect to a Fund, adopt and disclose new or amended policies and other changes in press releases and shareholder reports and/or amend, file and/or issue any other communications, disclosure documents or regulatory filings, and may amend or enter into any contracts to which a Fund is a party, and interpret the investment objective(s), policies, restrictions and contractual provisions applicable to any Fund, without shareholder input or approval, except in circumstances in which shareholder approval is specifically required by law (such as changes to fundamental investment policies) or where a shareholder approval requirement was specifically disclosed in a Fund’s prospectus, SAI or shareholder report and is otherwise still in effect.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)‑6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by the Funds as the policies and procedures that PIMCO will use when voting proxies on behalf of the Funds. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of each Fund, and information about how each Fund voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30th, are available without charge, upon request, by calling the Funds at (844) 33-PIMCO, on the Funds’ website at www.pimco.com, and on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

The Funds file portfolio holdings information with the SEC on Form N‑PORT within 60 days of the end of each fiscal quarter. The Funds’ complete schedules of securities holdings as of the end of each fiscal quarter will be made available to the public on the SEC’s website at www.sec.gov and on PIMCO’s website at www.pimco.com, and will be made available, upon request, by calling PIMCO at (844) 33-PIMCO.

SEC rules allow shareholder reports to be delivered to investors by providing access to such reports online free of charge and by mailing a notice that the report is electronically available. Investors may elect to receive all reports in paper free of charge by contacting their financial intermediary or, if invested directly with a Fund, investors can inform the Fund by calling (844) 33-PIMCO. Any election to receive reports in paper will apply to all funds held with the fund complex if invested directly with

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | DECEMBER 31, 2022 | | | 5 |

| | | | |

| Important Information About the Funds | | (Cont.) | | |

a Fund or to all funds held in the investor’s account if invested through a financial intermediary, such as a broker-dealer or bank.

In April 2020, the SEC adopted amended rules modifying the registration, communications, and offering processes for registered closed-end funds and interval funds. Among other things, the amendments: (1) permit qualifying closed-end funds to use a short-form registration statement to offer securities in eligible transactions and certain funds to qualify as Well Known Seasoned Issuers; (2) permit interval funds to pay registration fees based on net issuance of shares in a manner similar to mutual funds; (3) require closed-end funds and interval funds to include additional disclosures in their annual reports; and (4) require certain information to be filed in interactive data format. The new rules have phased compliance dates, with some requirements having already taken effect and others requiring compliance as late as February 1, 2023.

In October 2020, the SEC adopted a rule related to the use of derivatives, short sales, reverse repurchase agreements and certain other transactions by registered investment companies that rescinds and withdraws prior guidance of the SEC and its staff regarding asset segregation and cover transactions. Subject to certain exceptions, the rule requires funds that trade derivatives and other transactions that create future payment or delivery obligations to comply with a value-at-risk leverage limit and certain derivatives risk management program and reporting requirements. These requirements may limit the ability of the Funds to use derivatives and reverse repurchase agreements and similar financing transactions as part of their investment strategies and may increase the cost of the Funds’ investments and cost of doing business, which could adversely affect investors. The rule went into effect on February 19, 2021. The compliance date for the new rule and related reporting requirements was August 19, 2022.

In October 2020, the SEC adopted a rule regarding the ability of a fund to invest in other funds. The rule allows a fund to acquire shares of another fund in excess of certain limitations currently imposed by the Investment Company Act of 1940 (the “Act”) without obtaining individual exemptive relief from the SEC, subject to certain conditions. The rule also includes the rescission of certain exemptive relief from the SEC and guidance from the SEC staff for funds to invest in other funds. The effective date for the rule was January 19, 2021, and the compliance date for the rule was January 19, 2022.

In December 2020, the SEC adopted a rule addressing fair valuation of fund investments. The new rule sets forth requirements for good faith determinations of fair value as well as for the performance of fair value determinations, including related oversight and reporting obligations. The new rule also defines “readily available market quotations” for purposes of the definition of “value” under the Act, and the SEC noted that this definition will apply in all contexts under the Act. The effective date for the rule was March 8, 2021. The compliance date for the new rule and the related reporting requirements was September 8, 2022.

In May 2022, the SEC proposed amendments to a current rule governing fund naming conventions. In general, the current rule requires funds with certain types of names to adopt a policy to invest at least 80% of their assets in the type of investment suggested by the name. The proposed amendments would expand the scope of the current rule in a number of ways that would result in an expansion of the types of fund names that would require the fund to adopt an 80% investment policy under the rule. Additionally, the proposed amendments would modify the circumstances under which a fund may deviate from its 80% investment policy and address the use and valuation of derivatives instruments for purposes of the rule. The proposal’s impact on the Funds will not be known unless and until any final rulemaking is adopted.

In May 2022, the SEC proposed a framework that would require certain registered funds (such as the Funds) to disclose their environmental, social, and governance (“ESG”) investing practices. Among other things, the proposed requirements would mandate that funds meeting three pre-defined classifications (i.e., integrated, ESG focused and/or impact funds) provide prospectus and shareholder report disclosure related to the ESG factors, criteria and processes used in managing the fund. The proposal’s impact on the Funds will not be known unless and until any final rulemaking is adopted.

In October 2022, the SEC adopted changes to the mutual fund and exchange-traded fund (“ETF”) shareholder report and registration statement disclosure requirements and the registered fund advertising rules, which will impact the disclosures provided to shareholders. The rule amendments are effective as of January 24, 2023, but the SEC is providing an 18-month compliance period following the effective date for such amendments other than those addressing fee and expense information in advertisements that might be materially misleading.

In November 2022, the SEC adopted amendments to Form N-PX under the Act to improve the utility to investors of proxy voting information reported by mutual funds, ETFs and certain other funds. The rule amendments will expand the scope of funds’ Form N-PX reporting obligations, subject managers to Form N-PX reporting obligations for “Say on Pay” votes, enhance Form N-PX disclosures, permit joint reporting by funds, managers and affiliated managers on Form N-PX; and require website availability of fund proxy voting records. The amendments will become effective on July 1, 2024. Funds and managers will be required to file their first reports covering the period from July 1, 2023 to June 30, 2024 on amended Form N-PX by August 31, 2024.

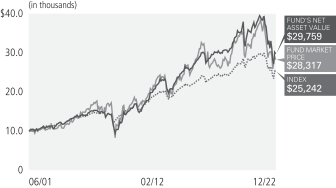

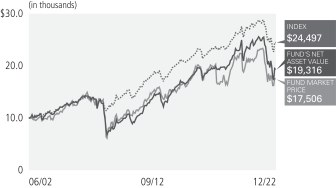

PIMCO Municipal Income Fund

Cumulative Returns Through December 31, 2022

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown

as of December 31, 2022†§

| | | | |

| Municipal Bonds & Notes | | | | |

| |

| Health, Hospital & Nursing Home Revenue | | | 20.1% | |

| |

| Ad Valorem Property Tax | | | 8.3% | |

| |

| Miscellaneous Revenue | | | 6.7% | |

| |

| Sales Tax Revenue | | | 6.6% | |

| |

| Highway Revenue Tolls | | | 6.3% | |

| |

| Natural Gas Revenue | | | 6.1% | |

| |

| Tobacco Settlement Funded | | | 5.0% | |

| |

| Industrial Revenue | | | 4.4% | |

| |

| Electric Power & Light Revenue | | | 4.3% | |

| |

| Sewer Revenue | | | 3.6% | |

| |

| Local or Guaranteed Housing | | | 3.3% | |

| |

| Water Revenue | | | 3.0% | |

| |

| Appropriations | | | 2.7% | |

| |

| Port, Airport & Marina Revenue | | | 2.6% | |

| |

| Lease (Appropriation) | | | 1.9% | |

| |

| Nuclear Revenue | | | 1.6% | |

| |

| Income Tax Revenue | | | 1.3% | |

| |

| College & University Revenue | | | 1.3% | |

| |

| Transit Revenue | | | 1.2% | |

| |

| Miscellaneous Taxes | | | 1.2% | |

| |

| Fuel Sales Tax Revenue | | | 1.1% | |

| |

| Other | | | 6.7% | |

| |

| Short-Term Instruments | | | 0.7% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

Fund Information

(as of December 31, 2022)(1)

| | | | |

| Market Price | | | $10.43 | |

| |

| NAV | | | $9.51 | |

| |

| Premium/(Discount) to NAV | | | 9.67% | |

| |

Market Price Distribution Rate(2) | | | 6.21% | |

| |

NAV Distribution Rate(2) | | | 6.81% | |

| |

Total Effective Leverage(3) | | | 44.82% | |

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return(1) for the period ended December 31, 2022 | |

| | | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Commencement

of Operations

(06/29/01) | |

| | Market Price | | | (27.24)% | | | | 1.03% | | | | 2.01% | | | | 4.96% | |

| | NAV | | | (24.19)% | | | | (0.48)% | | | | 2.70% | | | | 5.20% | |

| | Bloomberg Long Municipal Bond Index | | | (15.58)% | | | | 0.47% | | | | 2.39% | | | | 4.28% | ¨ |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

¨ Average annual total return since 06/30/2002.

| (1) | Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month‑end is available at www.pimco.com or via (844) 33‑PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

| | Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

| (2) | Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (“ROC”) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

| (3) | Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Investment Objective and Strategy Overview

PIMCO Municipal Income Fund’s investment objective is to seek to provide current income exempt from federal income tax.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » | | Security selection within the taxable municipal bonds sector contributed to performance, as select securities posted positive returns. |

| » | | Security selection within the resource recovery sector contributed to performance, as a select security posted positive returns. |

| » | | There were no other material contributors for this Fund. |

| » | | Exposure to the hospitals sector detracted from performance, as the sector posted negative performance. |

| » | | Exposure to the special tax sector detracted from performance, as the sector posted negative performance. |

| » | | Exposure to the industrial revenue sector detracted from performance, as the sector posted negative performance. |

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | DECEMBER 31, 2022 | | | 7 |

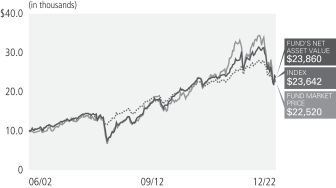

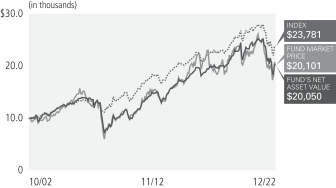

PIMCO Municipal Income Fund II

Cumulative Returns Through December 31, 2022

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown

as of December 31, 2022†§

| | | | |

| Municipal Bonds & Notes | | | | |

| |

| Health, Hospital & Nursing Home Revenue | | | 19.2% | |

| |

| Highway Revenue Tolls | | | 8.7% | |

| |

| Ad Valorem Property Tax | | | 7.0% | |

| |

| Natural Gas Revenue | | | 6.6% | |

| |

| Sales Tax Revenue | | | 5.8% | |

| |

| Tobacco Settlement Funded | | | 5.1% | |

| |

| Industrial Revenue | | | 4.5% | |

| |

| Miscellaneous Revenue | | | 4.3% | |

| |

| Sewer Revenue | | | 4.2% | |

| |

| Water Revenue | | | 3.7% | |

| |

| Port, Airport & Marina Revenue | | | 3.4% | |

| |

| Local or Guaranteed Housing | | | 3.0% | |

| |

| Appropriations | | | 2.8% | |

| |

| Lease (Appropriation) | | | 2.5% | |

| |

| Electric Power & Light Revenue | | | 2.3% | |

| |

| College & University Revenue | | | 1.9% | |

| |

| Transit Revenue | | | 1.5% | |

| |

| Income Tax Revenue | | | 1.4% | |

| |

| Miscellaneous Taxes | | | 1.3% | |

| |

| Lottery Revenue | | | 1.2% | |

| |

| Nuclear Revenue | | | 1.1% | |

| |

| Government Fund/Grant Revenue | | | 1.0% | |

| |

| Other | | | 7.4% | |

| |

| Short-Term Instruments | | | 0.1% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

Fund Information

(as of December 31, 2022)(1)

| | | | |

| Market Price | | | $9.04 | |

| |

| NAV | | | $8.76 | |

| |

| Premium/(Discount) to NAV | | | 3.20% | |

| |

Market Price Distribution Rate(2) | | | 7.83% | |

| |

NAV Distribution Rate(2) | | | 8.08% | |

| |

Total Effective Leverage(3) | | | 43.44% | |

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return(1) for the period ended December 31, 2022 | |

| | | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Commencement

of Operations

(06/28/02) | |

| | Market Price | | | (33.71)% | | | | (1.69)% | | | | 2.42% | | | | 4.11% | |

| | NAV | | | (23.92)% | | | | (0.16)% | | | | 2.94% | | | | 4.33% | |

| | Bloomberg Long Municipal Bond Index | | | (15.58)% | | | | 0.47% | | | | 2.39% | | | | 4.28% | ¨ |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

¨ Average annual total return since 06/30/2002.

| (1) | Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month‑end is available at www.pimco.com or via (844) 33‑PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

| | Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

| (2) | Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (“ROC”) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

| (3) | Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Investment Objective and Strategy Overview

PIMCO Municipal Income Fund II’s investment objective is to seek to provide current income exempt from federal income tax.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » | | Security selection within the taxable municipal bonds sector contributed to performance, as select securities posted positive returns. |

| » | | Security selection within the resource recovery sector contributed to performance, as a select security posted positive returns. |

| » | | There were no other material contributors for this Fund. |

| » | | Exposure to the hospitals sector detracted from performance, as the sector posted negative performance. |

| » | | Exposure to the special tax sector detracted from performance, as the sector posted negative performance. |

| » | | Exposure to the industrial revenue sector detracted from performance, as the sector posted negative performance. |

| | | | |

| | Market and Net Asset Value Information | | |

The Fund’s common shares are listed on the NYSE under the trading or “ticker” symbol “PML”. The Fund’s common shares commenced trading on the NYSE in June 2002. The conduct of any offering and the issuance of additional common shares pursuant to any offering may have an adverse effect on prices in the secondary market for the Fund’s common shares by increasing the number of shares available, which may put downward pressure on the market price for the common shares. The NAV of the Fund’s common shares will be reduced immediately following an offering by the sales load, commissions and offering expenses paid or reimbursed by the Fund in connection with such offering. The completion of an offering may result in an immediate dilution of the NAV per common share for all existing common shareholders.

The following table sets forth, for each of the periods indicated, the high and low closing market prices of the Fund’s common shares on the NYSE, the high and low NAV per common share and the high and low premium/discount to NAV per common share. See “Net Asset Value” for information as to how the Fund’s NAV is determined.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common share

market price(1) | | | Common share

net asset value | | | Premium (discount) as

a % of net asset value | |

| Quarter | | High | | | Low | | | High | | | Low | | | High | | | Low | |

| Quarter ended December 31, 2022 | | | $ 9.89 | | | | $ 8.58 | | | | $ 9.13 | | | | $ 8.03 | | | | 14.60% | | | | 2.83% | |

| Quarter ended September 30, 2022 | | | $12.10 | | | | $ 9.53 | | | | $10.12 | | | | $ 8.42 | | | | 20.64% | | | | 12.74% | |

| Quarter ended June 30, 2022 | | | $11.82 | | | | $10.12 | | | | $10.78 | | | | $ 9.14 | | | | 16.48% | | | | 2.22% | |

| Quarter ended March 31, 2022 | | | $14.55 | | | | $11.20 | | | | $12.37 | | | | $10.70 | | | | 19.55% | | | | 3.99% | |

| Quarter ended December 31, 2021 | | | $14.83 | | | | $13.86 | | | | $12.42 | | | | $12.15 | | | | 19.58% | | | | 13.51% | |

| Quarter ended September 30, 2021 | | | $15.31 | | | | $14.74 | | | | $12.77 | | | | $12.32 | | | | 20.72% | | | | 16.72% | |

| Quarter ended June 30, 2021 | | | $15.08 | | | | $14.53 | | | | $12.68 | | | | $12.26 | | | | 22.02% | | | | 16.48% | |

| Quarter ended March 31, 2021 | | | $15.35 | | | | $14.15 | | | | $12.65 | | | | $12.14 | | | | 21.67% | | | | 13.63% | |

| Quarter ended December 31, 2020 | | | $14.71 | | | | $13.09 | | | | $12.42 | | | | $11.87 | | | | 18.92% | | | | 9.91% | |

| Quarter ended September 30, 2020 | | | $14.28 | | | | $13.14 | | | | $12.44 | | | | $11.95 | | | | 14.93% | | | | 8.86% | |

| Quarter ended June 30, 2020 | | | $13.45 | | | | $11.59 | | | | $11.95 | | | | $10.95 | | | | 13.64% | | | | 4.70% | |

| Quarter ended March 31, 2020 | | | $15.97 | | | | $10.10 | | | | $13.30 | | | | $10.12 | | | | 27.45% | | | | (11.79)% | |

| (1) | Such prices reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. |

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | DECEMBER 31, 2022 | | | 9 |

The following information is presented in conformance with annual reporting requirements for funds that have filed a Short Form N-2.

Summary of Fund Expenses

The following table is intended to assist investors in understanding the fees and expenses (annualized) that an investor in Common Shares of the Fund would bear, directly or indirectly, as a result of an offering. The table reflects the use of leverage attributable to the Fund’s outstanding Preferred Shares and Tender Option Bonds averaged over the fiscal year ended December 31, 2022 in an amount equal to 45.92% of the Fund’s total average managed assets (including assets attributable to such leverage), and shows Fund expenses as a percentage of net assets attributable to Common Shares. The percentage above does not reflect the Fund’s use of other forms of economic leverage, such as credit default swaps or other derivative instruments. The table and example below are based on the Fund’s capital structure as of December 31, 2022. The extent of the Fund’s assets attributable to leverage following an offering, and the Fund’s associated expenses, are likely to vary (perhaps significantly) from these assumptions.

Shareholder Transaction Expense

| | | | | | | | |

| | |

Sales load (as a percentage of offering price)(1) | | | | | | | [ ]% | |

| | |

Offering Expenses Borne by Common Shareholders (as a percentage of offering price)(2) | | | | | | | [ ]% | |

| | |

Dividend Reinvestment Plan Fees(3) | | | | | | | None | |

| (1) | In the event that the Common Shares to which this relates are sold to or through underwriters or dealer managers, a corresponding supplement will disclose the applicable sale load and/or commission. |

| (2) | The related supplement will disclose the estimated amount of offering expense, the offering price and the offering expenses borne by the Fund and indirectly by all of its Common Shareholders as a percentage of the offering price. |

| (3) | You will pay broker chargers if you direct your broker or the plan agent to sell your Common Shares that you acquired pursuant to a dividend reinvestment plan. You may also pay a pro rata share of brokerage commissions incurred in connection with open market purchase pursuant to the Fund’s Dividend Reinvestment Plan. |

Annual Fund Operating Expenses

| | | | | | | | |

| | | | | | Percentage of

Net Assets Attributable to

Common Shares (reflecting

leverage attributable to

Preferred Shares,

and tender option bonds) | |

| | |

Management Fees(1) | | | | | | | 1.08% | |

| | |

Dividend Cost on Preferred Shares(2) | | | | | | | 3.33% | |

| | |

Interest Payments on Borrowed Funds(3) | | | | | | | 0.34% | |

| | |

Other Expenses(4) | | | | | | | 0.06% | |

| | |

Total Annual Fund Operating Expenses(5) | | | | | | | 4.81% | |

| (1) | Management fees include fees payable to the Investment Manager for advisory services and for supervisory, administrative and other services. The Fund pays for the advisory, supervisory and administrative services it requires under what is essentially an all‑in fee structure. Pursuant to an investment management agreement, PIMCO is paid a Management Fee of 0.685% of the Fund’s average daily net assets (including daily net assets attributable to any preferred shares of the Fund that may be |

| | outstanding). The Fund (and not PIMCO) will be responsible for certain fees and expenses which are, reflected in the table above, that are not covered by the management fee under the investment management agreement. Please see Note 9, Fees and Expenses in the Notes to Financial Statements for an explanation of the management fee. |

| (2) | “Dividends and Other Costs on Preferred Shares” reflects the Fund’s outstanding ARPS and RVMTP averaged over the year ended December 31, 2022 which represented 25.54% and 5.88%, respectively of the Fund’s total average managed assets (including the liquidation preference of outstanding Preferred Shares and assets attributable to tender option bond) at an annual dividend cost of 6.01% for ARPS and 4.58% for RVMTP as of December 31, 2022, and including the amortization of Preferred Share offering costs of $37,515 over the three-year term of the Preferred Shares). The actual dividend rate paid on the PreferredShares will vary over time in accordance with variations in market interest rates. See “Use of Leverage” and “Description of Capital Structure.” Dividend and Other Costs on Preferred Shares are borne directly by the Fund and reflected in the Fund’s financial statement; however, the information presented in the table will differ from that presented in the Fund’s Financial Highlights. |

| (3) | “Interest Payments on Borrowed Funds” reflects the Fund’s use of leverage in the form of tender option bonds averaged over the year ended December 31, 2022, which represented 14.50% of the Fund’s total managed assets, at an annual interest rate cost to the Fund of 1.43%, as of December 31, 2022. The actual amount of borrowing expenses borne by the Fund will vary over time in accordance with the level of the Fund’s use of tender option bonds and/or other forms of borrowings and variations in market interest rates. Borrowing expense is required to be treated as an expense of the Fund for accounting purposes. Any associated income or gains (or losses) realized from leverage obtained through such instruments is not reflected in the Annual Expenses table above, but would be reflected in the Fund’s performance results. |

| (4) | Other expenses are estimated for the Fund’s fiscal year ending December 31, 2023. |

| (5) | “Dividend Cost on Preferred Shares”, including distributions on Preferred Shares, and “Interest Payments on Borrowed Funds” are borne by the Fund separately from management fees paid to PIMCO. Excluding these expenses, Total Annual Fund Operating Expenses are 1.14%. |

Example

The following example illustrates the expenses that you would pay on a $1,000 investment in Common Shares of the Fund, assuming (1) that the Fund’s net assets do not increase or decrease, (2) that the Fund incurs total annual expenses of 4.81% of net assets attributable to Common Shares in years 1 through 10 (assuming assets attributable to Preferred Shares and Tender Option Bonds representing 45.92% of the Fund’s total managed assets) and (3) a 5% annual return(1):

| | | | | | | | | | | | | | | | | | | | |

| | | | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

| | | | | |

| Total Expenses Incurred | | | | | | $ | 48 | | | $ | 145 | | | $ | 242 | | | $ | 486 | |

| (1) | The example above should not be considered a representation of future expenses. Actual expenses may be higher or lower than those shown. The example assumes that the estimated Interest Payments on Borrowed Funds, Dividend Cost on Preferred Shares and Other Expenses set forth in the Annual Fund Operating Expenses table are accurate, that the rate listed under Total Annual Fund Operating Expenses remains the same each year and that all dividends and distributions are reinvested at NAV. Actual expenses may be greater or less than those assumed. Moreover, the Fund’s actual rate of return may be greater or less than the hypothetical 5% annual return shown in the example. The example does not include commissions or estimated offering expenses, which would cause the expenses shown in the example to increase. In connection with an offering of common shares, the applicable prospectus supplement will set forth an example including sales load and estimated offering costs. |

| | | | | | |

| 10 | | PIMCO CLOSED-END FUNDS | | | | |

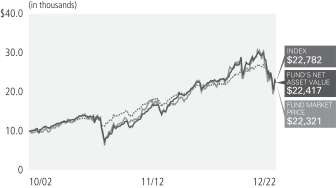

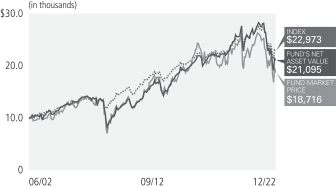

PIMCO Municipal Income Fund III

Cumulative Returns Through December 31, 2022

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown

as of December 31, 2022†§

| | | | |

| Municipal Bonds & Notes | | | | |

| |

| Health, Hospital & Nursing Home Revenue | | | 18.1% | |

| |

| Sales Tax Revenue | | | 6.9% | |

| |

| Ad Valorem Property Tax | | | 6.5% | |

| |

| Natural Gas Revenue | | | 6.0% | |

| |

| Local or Guaranteed Housing | | | 5.9% | |

| |

| Highway Revenue Tolls | | | 5.4% | |

| |

| Water Revenue | | | 5.2% | |

| |

| Electric Power & Light Revenue | | | 4.5% | |

| |

| Sewer Revenue | | | 4.4% | |

| |

| Industrial Revenue | | | 4.0% | |

| |

| Miscellaneous Revenue | | | 3.9% | |

| |

| Port, Airport & Marina Revenue | | | 3.5% | |

| |

| Tobacco Settlement Funded | | | 3.4% | |

| |

| Appropriations | | | 3.4% | |

| |

| College & University Revenue | | | 1.9% | |

| |

| Fuel Sales Tax Revenue | | | 1.7% | |

| |

| Lease (Appropriation) | | | 1.7% | |

| |

| Nuclear Revenue | | | 1.4% | |

| |

| Transit Revenue | | | 1.4% | |

| |

| General Fund | | | 1.4% | |

| |

| Miscellaneous Taxes | | | 1.1% | |

| |

| Income Tax Revenue | | | 1.1% | |

| |

| Other | | | 6.7% | |

| |

| Short-Term Instruments | | | 0.5% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

Fund Information

(as of December 31, 2022)(1)

| | | | |

| Market Price | | | $8.71 | |

| |

| NAV | | | $8.02 | |

| |

| Premium/(Discount) to NAV | | | 8.60% | |

| |

Market Price Distribution Rate(2) | | | 6.34% | |

| |

NAV Distribution Rate(2) | | | 6.88% | |

| |

Total Effective Leverage(3) | | | 44.16% | |

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return(1) for the period ended December 31, 2022 | |

| | | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Commencement

of Operations

(10/31/02) | |

| | Market Price | | | (27.40)% | | | | (0.04)% | | | | 2.83% | | | | 4.06% | |

| | NAV | | | (25.29)% | | | | (0.63)% | | | | 3.10% | | | | 4.08% | |

| | Bloomberg Long Municipal Bond Index | | | (15.58)% | | | | 0.47% | | | | 2.39% | | | | 4.16% | |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

| (1) | Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month‑end is available at www.pimco.com or via (844) 33‑PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

| | Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

| (2) | Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (“ROC”) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

| (3) | Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Investment Objective and Strategy Overview

PIMCO Municipal Income Fund III’s investment objective is to seek to provide current income exempt from federal income tax.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » | | Security selection within the taxable municipal bonds sector contributed to performance, as select securities posted positive returns. |

| » | | Security selection within the resource recovery sector contributed to performance, as a select security posted positive returns. |

| » | | There were no other material contributors for this Fund. |

| » | | Exposure to the special tax sector detracted from performance, as the sector posted negative performance. |

| » | | Exposure to the hospitals sector detracted from performance, as the sector posted negative performance. |

| » | | Exposure to the industrial revenue sector detracted from performance, as the sector posted negative performance. |

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | DECEMBER 31, 2022 | | | 11 |

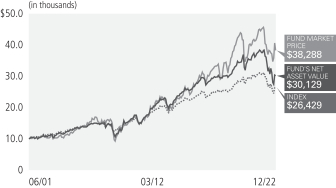

PIMCO California Municipal Income Fund

Cumulative Returns Through December 31, 2022

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown

as of December 31, 2022†§

| | | | |

| Municipal Bonds & Notes | | | | |

| |

| Ad Valorem Property Tax | | | 21.3% | |

| |

| Health, Hospital & Nursing Home Revenue | | | 14.1% | |

| |

| College & University Revenue | | | 6.6% | |

| |

| Local or Guaranteed Housing | | | 6.5% | |

| |

| Natural Gas Revenue | | | 6.4% | |

| |

| Electric Power & Light Revenue | | | 6.2% | |

| |

| Lease (Abatement) | | | 6.0% | |

| |

| Sales Tax Revenue | | | 5.2% | |

| |

| Port, Airport & Marina Revenue | | | 5.0% | |

| |

| General Fund | | | 4.9% | |

| |

| Tobacco Settlement Funded | | | 4.6% | |

| |

| Lease (Non‑Terminable) | | | 2.2% | |

| |

| Sewer Revenue | | | 2.1% | |

| |

| Water Revenue | | | 1.9% | |

| |

| Special Assessment | | | 1.3% | |

| |

| Special Tax | | | 1.1% | |

| |

| Highway Revenue Tolls | | | 1.1% | |

| |

| Other | | | 2.5% | |

| |

| Short-Term Instruments | | | 1.0% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

Fund Information

(as of December 31, 2022)(1)

| | | | |

| Market Price | | | $15.07 | |

| |

| NAV | | | $10.31 | |

| |

| Premium/(Discount) to NAV | | | 46.17% | |

| |

Market Price Distribution Rate(2) | | | 5.18% | |

| |

NAV Distribution Rate(2) | | | 7.57% | |

| |

Total Effective Leverage(3) | | | 44.49% | |

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return(1) for the period ended December 31, 2022 | |

| | | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Commencement

of Operations

(06/29/01) | |

| | Market Price | | | (14.34)% | | | | 2.49% | | | | 5.32% | | | | 6.44% | |

| | NAV | | | (21.44)% | | | | (0.07)% | | | | 3.03% | | | | 5.27% | |

| | Bloomberg CA Muni 22+ Year Index | | | (14.94)% | | | | 0.63% | | | | 2.76% | | | | 4.62% | ¨ |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

¨ Average annual total return since 06/30/2001.

| (1) | Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month‑end is available at www.pimco.com or via (844) 33‑PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

| | Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

| (2) | Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (“ROC”) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

| (3) | Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Investment Objective and Strategy Overview

PIMCO California Municipal Income Fund’s investment objective is to seek to provide current income exempt from federal and California income tax.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » | | Security selection within the pre‑refunded segment contributed to performance, as a select security posted positive returns. |

| » | | Security selection within the taxable municipal bonds sector contributed to performance, as select securities posted positive returns. |

| » | | Security selection within the tobacco sector contributed to performance, as select securities posted positive returns. |

| » | | Exposure to the general obligation sector detracted from performance, as the sector posted negative performance. |

| » | | Exposure to the industrial revenue sector detracted from performance, as the sector posted negative performance. |

| » | | Exposure to the special tax sector detracted from performance, as the sector posted negative performance. |

| | | | | | |

| 12 | | PIMCO CLOSED-END FUNDS | | | | |

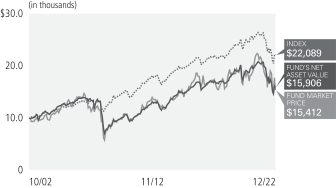

PIMCO California Municipal Income Fund II

Cumulative Returns Through December 31, 2022

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown

as of December 31, 2022†§

| | | | |

| Municipal Bonds & Notes | | | | |

| |

| Ad Valorem Property Tax | | | 21.4% | |

| |

| Health, Hospital & Nursing Home Revenue | | | 11.4% | |

| |

| Natural Gas Revenue | | | 8.6% | |

| |

| Local or Guaranteed Housing | | | 6.9% | |

| |

| General Fund | | | 6.3% | |

| |

| Port, Airport & Marina Revenue | | | 5.9% | |

| |

| Tobacco Settlement Funded | | | 5.5% | |

| |

| Electric Power & Light Revenue | | | 5.5% | |

| |

| Sewer Revenue | | | 4.8% | |

| |

| College & University Revenue | | | 4.4% | |

| |

| Sales Tax Revenue | | | 4.2% | |

| |

| Lease (Abatement) | | | 3.6% | |

| |

| Highway Revenue Tolls | | | 2.4% | |

| |

| Lease (Non‑Terminable) | | | 2.1% | |

| |

| Water Revenue | | | 1.4% | |

| |

| Special Assessment | | | 1.3% | |

| |

| Special Tax | | | 1.1% | |

| |

| Other | | | 2.8% | |

| |

| Short-Term Instruments | | | 0.4% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

Fund Information

(as of December 31, 2022)(1)

| | | | |

| Market Price | | | $6.79 | |

| |

| NAV | | | $6.53 | |

| |

| Premium/(Discount) to NAV | | | 3.98% | |

| |

Market Price Distribution Rate(2) | | | 5.66% | |

| |

NAV Distribution Rate(2) | | | 5.88% | |

| |

Total Effective Leverage(3) | | | 44.24% | |

| | | | | | | | | | | | | | | | | | |

| |

| Average Annual Total Return(1) for the period ended December 31, 2022 | | | | |

| | | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Commencement

of Operations

(06/28/02) | |

| | Market Price | | | (23.32)% | | | | (2.94)% | | | | 1.55% | | | | 2.83% | |

| | NAV | | | (24.38)% | | | | (0.60)% | | | | 3.03% | | | | 3.26% | |

| | Bloomberg CA Muni 22+ Year Index | | | (14.94)% | | | | 0.63% | | | | 2.76% | | | | 4.46% | ¨ |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

¨ Average annual total return since 06/30/2002.

| (1) | Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month‑end is available at www.pimco.com or via (844) 33‑PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

| | Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

| (2) | Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (“ROC”) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

| (3) | Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Investment Objective and Strategy Overview