Exhibit 96.2 P a g e 1 | 123 Goldfields.com Technical Report Summary of Mineral reserves and Mineral resources 31 December 2022 For Gold Fields Limited – Tarkwa Gold Mine – Ghana

P a g e 2 | 123 Table of Contents 1 Executive Summary ............................................................................................................................................................. 8 1.1 Property description and ownership ............................................................................................................................ 8 1.2 Geology and mineralisation ........................................................................................................................................ 9 1.3 Exploration, development and operations ................................................................................................................... 9 1.4 Mineral resource estimates ........................................................................................................................................ 10 1.5 Mineral reserve estimates .......................................................................................................................................... 11 1.6 Capital and operating cost estimates ......................................................................................................................... 12 1.7 Permitting .................................................................................................................................................................. 12 1.8 Conclusions and recommendations ........................................................................................................................... 13 2 Introduction......................................................................................................................................................................... 14 2.1 Registrant for whom the Technical Report Summary was prepared ......................................................................... 14 2.2 Terms of reference and purpose of the Technical Report Summary ......................................................................... 14 2.3 Sources of information .............................................................................................................................................. 14 2.4 Qualified persons and details of inspection ............................................................................................................... 14 2.5 Report version update ............................................................................................................................................... 15 3 Property description ........................................................................................................................................................... 16 3.1 Property location ....................................................................................................................................................... 16 3.2 Ownership ................................................................................................................................................................. 16 3.3 Property area ............................................................................................................................................................. 16 3.4 Property mineral titles, claims, mineral rights, leases and options ............................................................................ 16 3.5 Mineral rights description ......................................................................................................................................... 18 3.6 Encumbrances ........................................................................................................................................................... 19 3.7 Other significant factors and risks ............................................................................................................................. 19 3.8 Royalties or similar interest....................................................................................................................................... 19 4 Accessibility, climate, local resources, infrastructure and physiography .................................................................... 20 4.1 Topography, elevation and vegetation ...................................................................................................................... 20 4.2 Access ....................................................................................................................................................................... 20 4.3 Climate ...................................................................................................................................................................... 20 4.4 Infrastructure ............................................................................................................................................................. 20 4.5 Book Value ............................................................................................................................................................... 22 5 History .................................................................................................................................................................................. 23 6 Geological setting, mineralisation and deposit ................................................................................................................ 24 6.1 Geological setting ..................................................................................................................................................... 24 6.1.1 Regional Geology South Western Ghana .......................................................................................................... 24 6.1.2 Tarkwa Geology Southwestern Ghana .............................................................................................................. 26 6.1.3 Tarkwa Sedimentology ..................................................................................................................................... 28 6.1.4 Tarkwa lithology – Kobada ............................................................................................................................... 29 6.1.5 Tarkwa weathering ............................................................................................................................................ 29 6.2 Mineralisation ........................................................................................................................................................... 29 7 Exploration .......................................................................................................................................................................... 31 7.1 Exploration at Tarkwa ............................................................................................................................................... 31 7.2 Drilling ...................................................................................................................................................................... 31 7.2.1 Type and extent ................................................................................................................................................. 31 7.2.2 Procedures ......................................................................................................................................................... 32 7.2.3 Results ............................................................................................................................................................... 34 7.3 Hydrogeology ........................................................................................................................................................... 34 7.3.1 Data from stream flows and location ................................................................................................................. 35 7.3.2 Data from exploration boreholes ....................................................................................................................... 35 7.3.3 Rainfall data ...................................................................................................................................................... 35 7.3.4 Hydrogeology assessment summary ................................................................................................................. 35

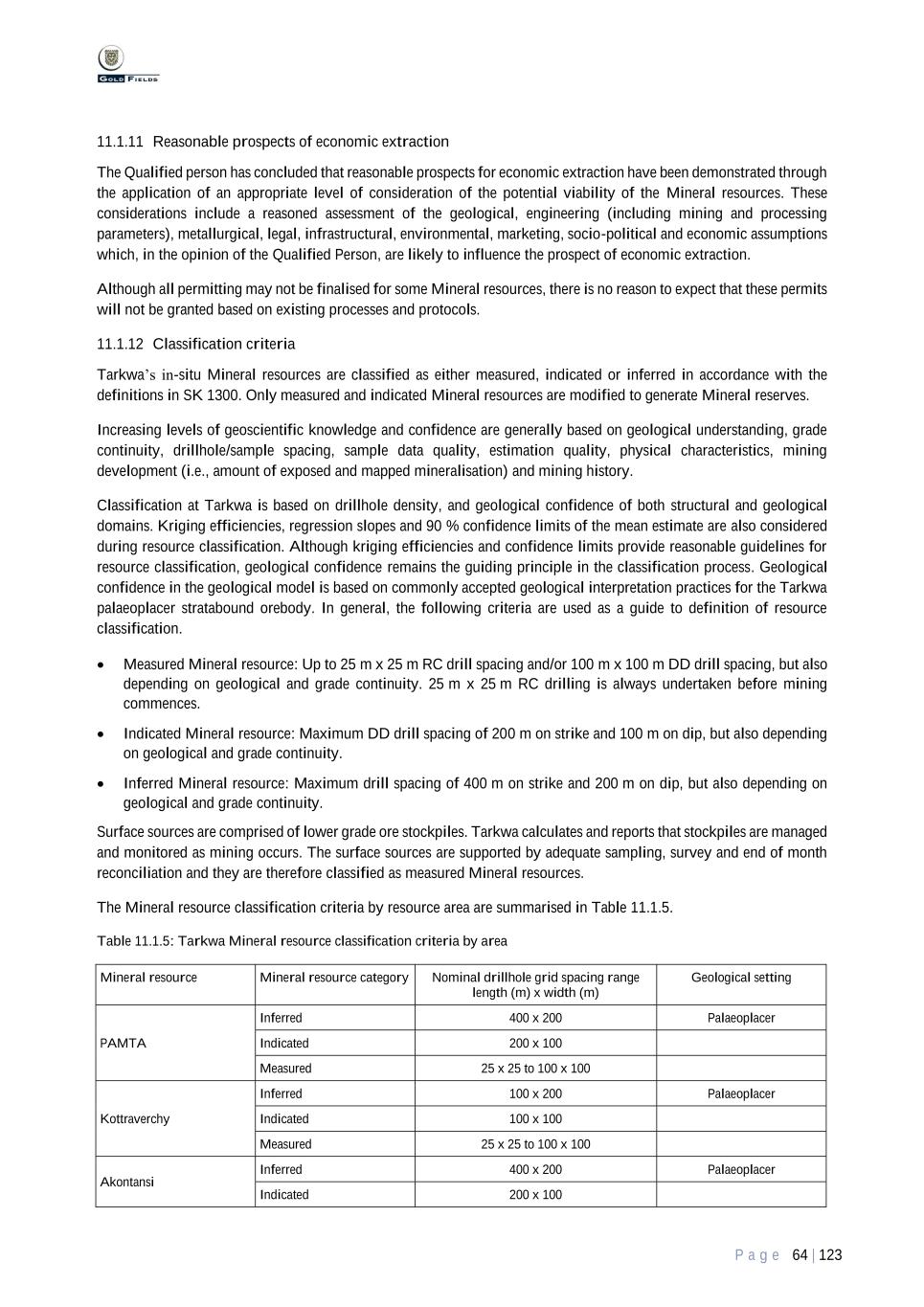

P a g e 3 | 123 7.4 Geotechnical ............................................................................................................................................................. 36 7.4.1 Uniaxial compressive test (UCS) ...................................................................................................................... 36 7.4.2 Triaxial compressive test (TCS) ........................................................................................................................ 36 7.5 Density ...................................................................................................................................................................... 38 8 Sample preparation, analyses and security ..................................................................................................................... 40 8.1 Sample preparation and collection ............................................................................................................................ 40 8.1.1 For DD core ...................................................................................................................................................... 40 8.1.2 For RC chips ..................................................................................................................................................... 40 8.2 Sample analysis ......................................................................................................................................................... 41 8.2.1 For samples analysed by bottle roll leach: ......................................................................................................... 41 8.3 Quality control and quality assurance (QA/QC) ....................................................................................................... 42 9 Data verification ................................................................................................................................................................. 44 9.1 Data management ...................................................................................................................................................... 44 9.2 Plant Sampling .......................................................................................................................................................... 45 9.3 Drilling ...................................................................................................................................................................... 45 9.4 Sampling ................................................................................................................................................................... 45 9.5 Survey ....................................................................................................................................................................... 46 9.6 Sample analysis ......................................................................................................................................................... 46 9.7 Geological modelling ................................................................................................................................................ 46 10 Mineral processing and metallurgical testing ................................................................................................................. 48 10.1 Testing and procedures ............................................................................................................................................. 48 10.1.1 Background ....................................................................................................................................................... 48 10.1.2 Akontansi Pit Underlap Extension (Ulap) 2019 Testwork ................................................................................ 49 10.1.3 Kobada Project 2016 Testwork ......................................................................................................................... 49 10.1.4 South Heap Leach Tailings 2012 Testwork ....................................................................................................... 50 10.2 Relevant results ......................................................................................................................................................... 50 10.2.1 Ulap ................................................................................................................................................................... 50 10.2.2 Kobada .............................................................................................................................................................. 51 10.2.3 Maximum recovery estimation model is constrained to 94.0 %, being the highest test result obtained from the testwork. South Heap Leach ........................................................................................................................ 52 10.2.4 Main Tarkwa Pits .............................................................................................................................................. 53 10.3 Plant sampling and reconciliation ............................................................................................................................. 53 10.4 Deleterious elements ................................................................................................................................................. 54 10.5 Metallurgical Risks ................................................................................................................................................... 54 10.5.1 Sample Representativity .................................................................................................................................... 54 10.5.2 Laboratory Test Methods and Scale-up ............................................................................................................. 55 10.5.3 Deleterious Elements ........................................................................................................................................ 55 11 Mineral resource estimates ................................................................................................................................................ 57 11.1 Mineral resource estimation criteria .......................................................................................................................... 57 11.1.1 Geological model and interpretation ................................................................................................................. 57 11.1.2 Block modelling ................................................................................................................................................ 58 11.1.3 Bulk density ...................................................................................................................................................... 58 11.1.4 Compositing and domaining ............................................................................................................................. 59 11.1.5 Top cuts ............................................................................................................................................................. 59 11.1.6 Variography ...................................................................................................................................................... 60 11.1.7 Grade estimation ............................................................................................................................................... 61 11.1.8 Selective mining units ....................................................................................................................................... 61 11.1.9 Model validation ............................................................................................................................................... 62 11.1.10 Cutoff grades ..................................................................................................................................................... 62 11.1.11 Reasonable prospects of economic extraction ................................................................................................... 64 11.1.12 Classification criteria ........................................................................................................................................ 64 11.2 Mineral resources as of 31 December 2022 .............................................................................................................. 65 11.3 Audits and reviews .................................................................................................................................................... 67 11.4 Comparison with 31 December 2021 against 31 December 2022 Mineral resource ................................................. 67

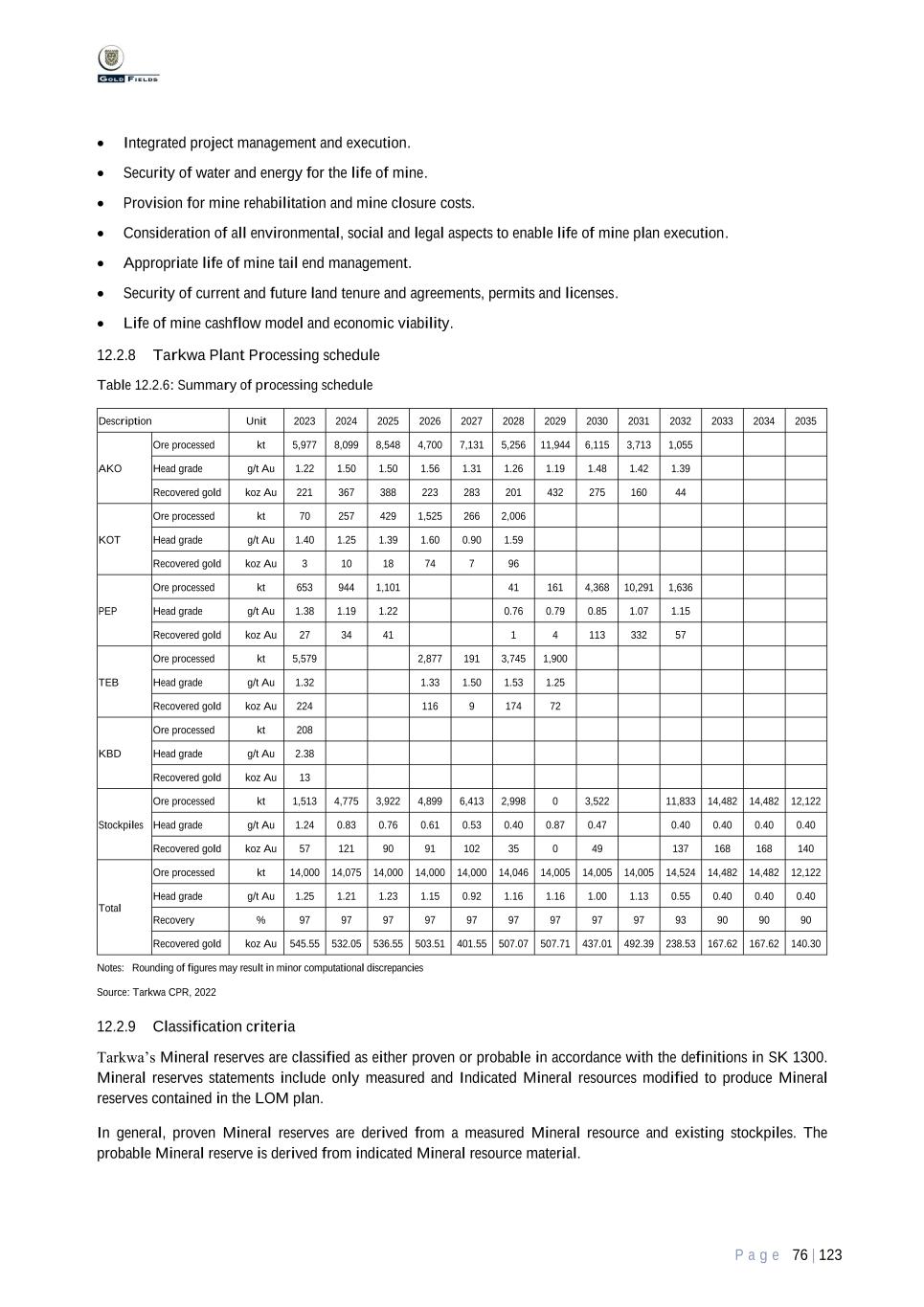

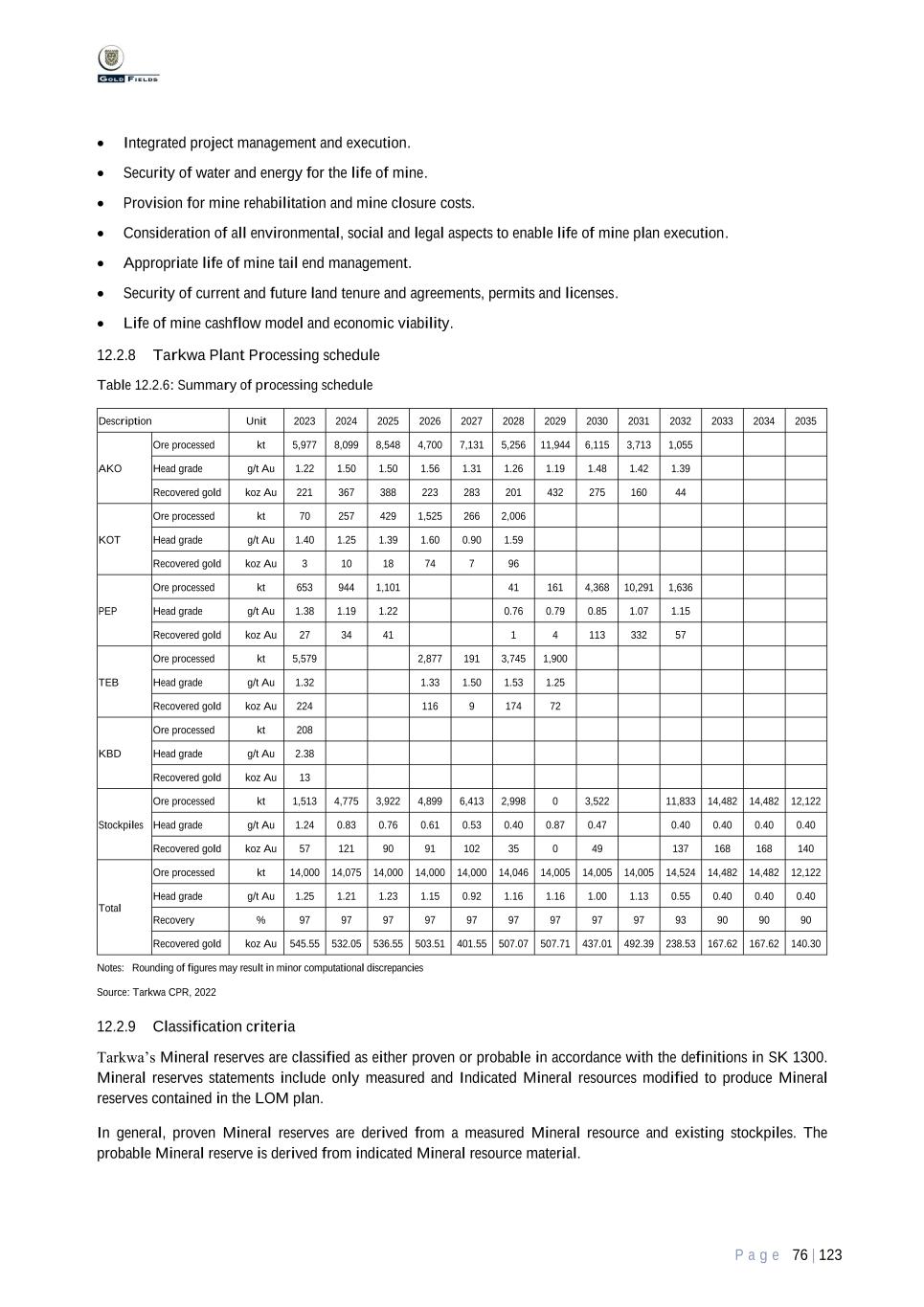

P a g e 4 | 123 12 Mineral reserve estimates .................................................................................................................................................. 68 12.1 Level of assessment .................................................................................................................................................. 68 12.2 Mineral reserve estimation criteria ............................................................................................................................ 69 12.2.1 Recent mine performance .................................................................................................................................. 69 12.2.2 Key assumptions and parameters ...................................................................................................................... 69 12.2.3 Gold Price ......................................................................................................................................................... 71 12.2.4 Risks.................................................................................................................................................................. 72 12.2.5 Cutoff grades ..................................................................................................................................................... 72 12.2.6 Mine design ....................................................................................................................................................... 73 12.2.7 Mine planning and schedule .............................................................................................................................. 73 12.2.8 Tarkwa Plant Processing schedule .................................................................................................................... 76 12.2.9 Classification criteria ........................................................................................................................................ 76 12.2.10 Economic assessment ........................................................................................................................................ 77 12.3 Mineral reserves as at 31 December 2022 ................................................................................................................. 77 12.4 Audits and reviews .................................................................................................................................................... 78 12.5 Comparison 31 December 2021 with 31 December 2022 Mineral reserves ............................................................. 78 13 Mining methods .................................................................................................................................................................. 79 13.1 Mining methods ........................................................................................................................................................ 79 13.2 Final Reserve outline ................................................................................................................................................ 79 13.3 Geotechnical models ................................................................................................................................................. 80 13.4 Hydrogeological models ........................................................................................................................................... 81 13.5 Site layout ................................................................................................................................................................. 81 13.6 Equipment and labour requirements .......................................................................................................................... 82 14 Processing and recovery methods ..................................................................................................................................... 83 14.1 Flow sheet and design ............................................................................................................................................... 83 14.2 Recent process plant performance ............................................................................................................................. 85 14.3 Process plant requirements ........................................................................................................................................ 85 14.4 Processing Risks ....................................................................................................................................................... 85 14.4.1 Major Equipment Failure .................................................................................................................................. 85 14.4.2 Plant Operational Management ......................................................................................................................... 86 14.4.3 Operating Costs, Plant Consumables and Reagents .......................................................................................... 86 15 Infrastructure ...................................................................................................................................................................... 87 15.1 Tailings storage facilities (TSF) ................................................................................................................................ 87 15.1.1 Background ....................................................................................................................................................... 87 15.1.2 GISTM .............................................................................................................................................................. 88 15.1.3 LOM Capacity................................................................................................................................................... 88 15.1.4 QP assessment ................................................................................................................................................... 88 15.2 Waste rock dumps ..................................................................................................................................................... 88 15.3 Water ......................................................................................................................................................................... 89 15.4 Power ........................................................................................................................................................................ 89 15.5 Accommodation ........................................................................................................................................................ 89 15.6 Site access ................................................................................................................................................................. 89 15.7 Other infrastructure ................................................................................................................................................... 90 16 Market studies ..................................................................................................................................................................... 91 16.1 Preliminary market study .......................................................................................................................................... 91 16.2 Metal Price history .................................................................................................................................................... 92 17 Environmental studies, permitting and plans, negotiations, or agreements with local individuals or groups ....... 93 17.1 Permitting .................................................................................................................................................................. 93 17.2 Environmental Provision ........................................................................................................................................... 95 17.3 Waste disposal, monitoring and water management ................................................................................................. 96 17.3.1 Tailings storage facilities (TSF) ........................................................................................................................ 96 17.3.2 Waste rock dumps ............................................................................................................................................. 98 17.3.3 Water management............................................................................................................................................ 98

P a g e 5 | 123 17.4 Social and community ............................................................................................................................................... 99 17.5 Mine closure.............................................................................................................................................................. 99 18 Capital and operating costs ............................................................................................................................................. 101 18.1 Basis and accuracy .................................................................................................................................................. 101 18.2 Capital costs ............................................................................................................................................................ 101 18.3 Operating costs ........................................................................................................................................................ 101 19 Economic analysis ............................................................................................................................................................. 104 19.1 Key inputs and assumptions .................................................................................................................................... 104 19.2 Economic analysis ................................................................................................................................................... 105 19.3 Sensitivity analysis .................................................................................................................................................. 107 20 Adjacent properties .......................................................................................................................................................... 108 21 Other relevant data and information ............................................................................................................................. 109 22 Interpretation and conclusions ....................................................................................................................................... 111 22.1 Conclusions ............................................................................................................................................................. 111 22.2 Risks ....................................................................................................................................................................... 112 23 Recommendations ............................................................................................................................................................ 114 24 References .......................................................................................................................................................................... 115 25 Reliance on information provided by the Registrant ................................................................................................... 116 26 Definitions .......................................................................................................................................................................... 117 26.1 Adequate geological evidence ................................................................................................................................. 117 26.2 Conclusive geological evidence .............................................................................................................................. 117 26.3 Cutoff grade ............................................................................................................................................................ 117 26.4 Development stage issuer ........................................................................................................................................ 117 26.5 Development stage property.................................................................................................................................... 117 26.6 Economically viable ................................................................................................................................................ 117 26.7 Exploration results .................................................................................................................................................. 117 26.8 Exploration stage issuer .......................................................................................................................................... 117 26.9 Exploration stage property ...................................................................................................................................... 117 26.10 Exploration target .................................................................................................................................................... 117 26.11 Feasibility study ...................................................................................................................................................... 118 26.12 Final market study ................................................................................................................................................... 118 26.13 Indicated Mineral resource ...................................................................................................................................... 118 26.14 Inferred Mineral resource ........................................................................................................................................ 118 26.15 Initial assessment .................................................................................................................................................... 118 26.16 Investment and market assumptions ........................................................................................................................ 119 26.17 Limited geological evidence ................................................................................................................................... 119 26.18 Material ................................................................................................................................................................... 119 26.19 Material of economic interest .................................................................................................................................. 119 26.20 Measured Mineral resource ..................................................................................................................................... 119 26.21 Mineral reserve ....................................................................................................................................................... 119 26.22 Mineral resource ..................................................................................................................................................... 119 26.23 Modifying factors .................................................................................................................................................... 120 26.24 Preliminary feasibility study (or pre-feasibility study) ............................................................................................ 120 26.25 Preliminary market study ........................................................................................................................................ 120 26.26 Probable Mineral reserves ....................................................................................................................................... 120 26.27 Production stage issuer ............................................................................................................................................ 120 26.28 Production stage property ....................................................................................................................................... 120 26.29 Proven Mineral reserve ........................................................................................................................................... 120 26.30 Qualified person ...................................................................................................................................................... 121 26.31 Relevant experience ................................................................................................................................................ 121 27 Signature Page .................................................................................................................................................................. 123

P a g e 6 | 123 List of Tables Table 1.4.1: Tarkwa - summary of attributable gold Mineral resources as at 31 December 2022 (fiscal year end) based on a gold price of $1,600/oz .............................................................................................................................................. 10 Table 1.5.1: Tarkwa – summary of attributable gold Mineral reserves as at 31 December 2022 based on a gold price of $1,400/oz ................................................................................................................................................................... 11 Table 1.6.1: Sustaining and project capital expenditure estimate ..................................................................................................... 12 Table 1.6.2: Operating costs estimate .............................................................................................................................................. 12 Table 2.4.1: List of Qualified persons .............................................................................................................................................. 15 Table 3.4.1: List of Tarkwa mineral leases ...................................................................................................................................... 16 Table 3.5.1: Royalty rate schedule ................................................................................................................................................... 18 Table 7.4.1: Required representative samples for laboratory testing ................................................................................................ 37 Table 7.4.2: Tarkwa material testing parameters ............................................................................................................................. 37 Table 7.5.1: Tarkwa Density – Akontansi ........................................................................................................................................ 38 Table 7.5.2: Tarkwa Density – Pepe, Teberebie............................................................................................................................... 39 Table 7.5.3: Tarkwa Density – Kottraverchy ................................................................................................................................... 39 Table 8.3.1: Quality control sample types ........................................................................................................................................ 42 Table 10.2.1: Ulap metallurgical samples head analyses – key species ........................................................................................... 50 Table 10.2.2: Ulap metallurgical samples hardness test results ....................................................................................................... 50 Table 10.2.3: Ulap metallurgical samples gravity/leach test results ................................................................................................. 51 Table 10.2.4: Kobada metallurgical samples head analyses – key species ....................................................................................... 51 Table 10.2.5: Kobada metallurgical samples hardness test results ................................................................................................... 52 Table 10.2.6: Kobada metallurgical samples gravity/leach test results ............................................................................................ 52 Table 11.1.1: Summary of Mineral resource estimation parameters ................................................................................................ 59 Table 11.1.2: Tarkwa Open Pit search parameters ........................................................................................................................... 60 Table 11.1.3: Tarkwa Mineral resource reconciliation ..................................................................................................................... 62 Table 11.1.4: Tarkwa open pit resource cutoff grades ..................................................................................................................... 62 Table 11.1.5: Tarkwa Mineral resource classification criteria by area ............................................................................................. 64 Table 11.2.1: Tarkwa - summary of gold Mineral resources at the end of the fiscal year ended 31 December 2022 based on a gold price of $1,600/oz .............................................................................................................................................. 66 Table 12.2.1: Tarkwa - recent operating statistics ............................................................................................................................ 69 Table 12.2.2: Tarkwa – summary of material modifying factors ..................................................................................................... 70 Table 12.2.3: Tarkwa open pit reserves cutoff grades ...................................................................................................................... 72 Table 12.2.4: Mining equipment assumptions (efficiencies and constraints) ................................................................................... 74 Table 12.2.5: Tarkwa mining schedule to 2032 ............................................................................................................................... 75 Table 12.2.6: Summary of processing schedule ............................................................................................................................... 76 Table 12.3.1: Tarkwa - summary of gold Mineral reserves at the end of the fiscal year ended 31 December 2022 based on a gold price of $1,400/oz .............................................................................................................................................. 77 Table 12.5.1: Net difference in Mineral Reserves between 31 December 2021 and 31 December 2022 ......................................... 78 Table 14.3.1: Tarkwa process plant – key requirements .................................................................................................................. 85 Table 16.1.1: Mineral reserves and resources metal prices .............................................................................................................. 91 Table 17.1.1: List of Tarkwa permits ............................................................................................................................................... 95 Table 18.2.1: Sustaining and project capital costs forecast (100 %) .............................................................................................. 101 Table 18.3.1: Operating costs forecast (100 %) ............................................................................................................................. 102 Table 18.3.2: Post LOM costs 100 % Basis ................................................................................................................................... 102 Table 19.1.1: LOM physical, operating cost and capital cost inputs and revenue assumptions 100 % basis ................................. 104 Table 19.1.2: Gold Fields 90 % Attributable Gold, FCF and NPV ................................................................................................ 105 Table 19.1.3: Breakdown of ESG expenditure included in Table 18.2.1, Table 18.3.1 and Table 19.1.1 ...................................... 105 Table 19.2.1: Tarkwa Impairment Calculation ............................................................................................................................... 106 Table 19.3.1: NPV sensitivity to changes in gold price 90 % attributable ..................................................................................... 107

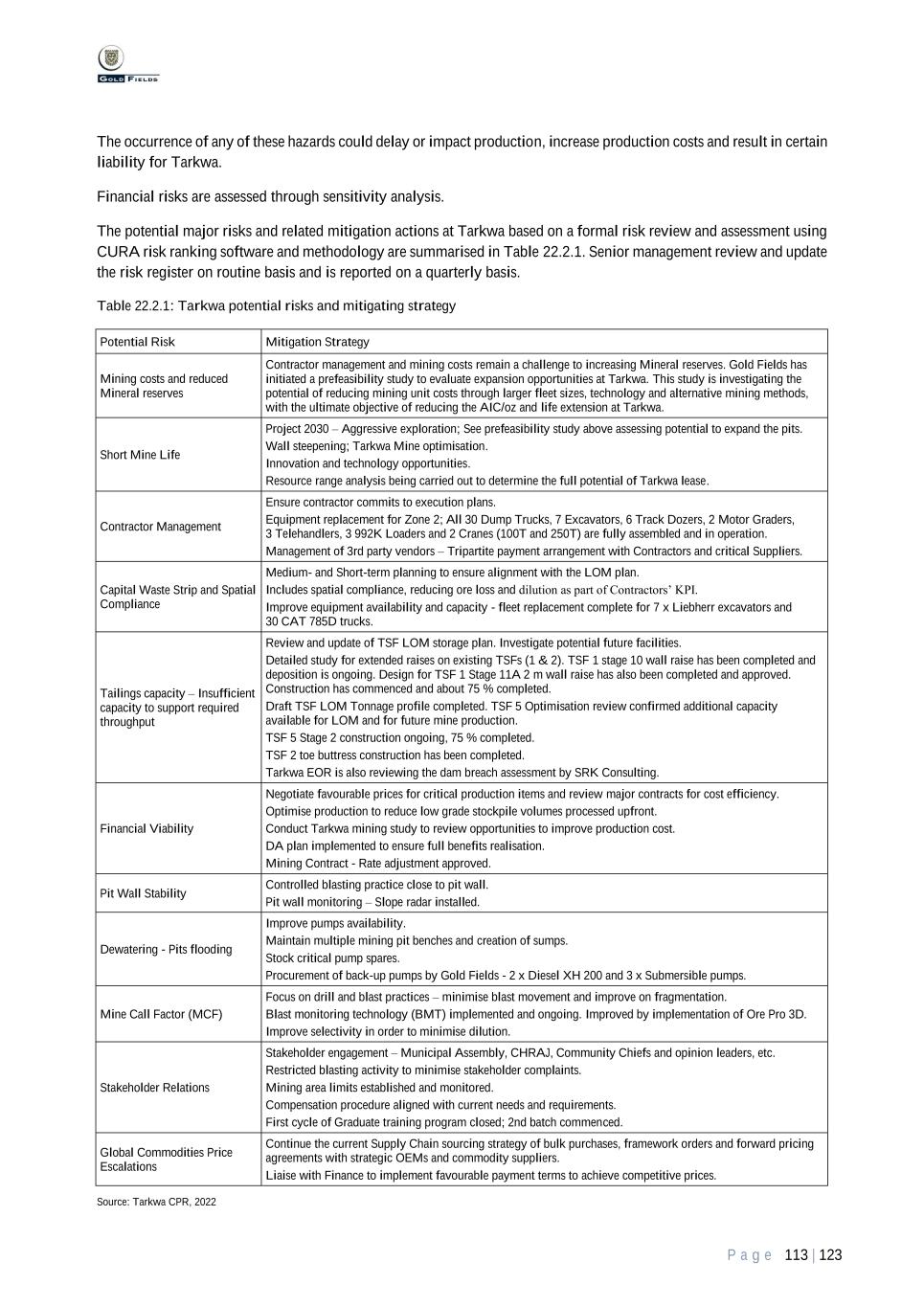

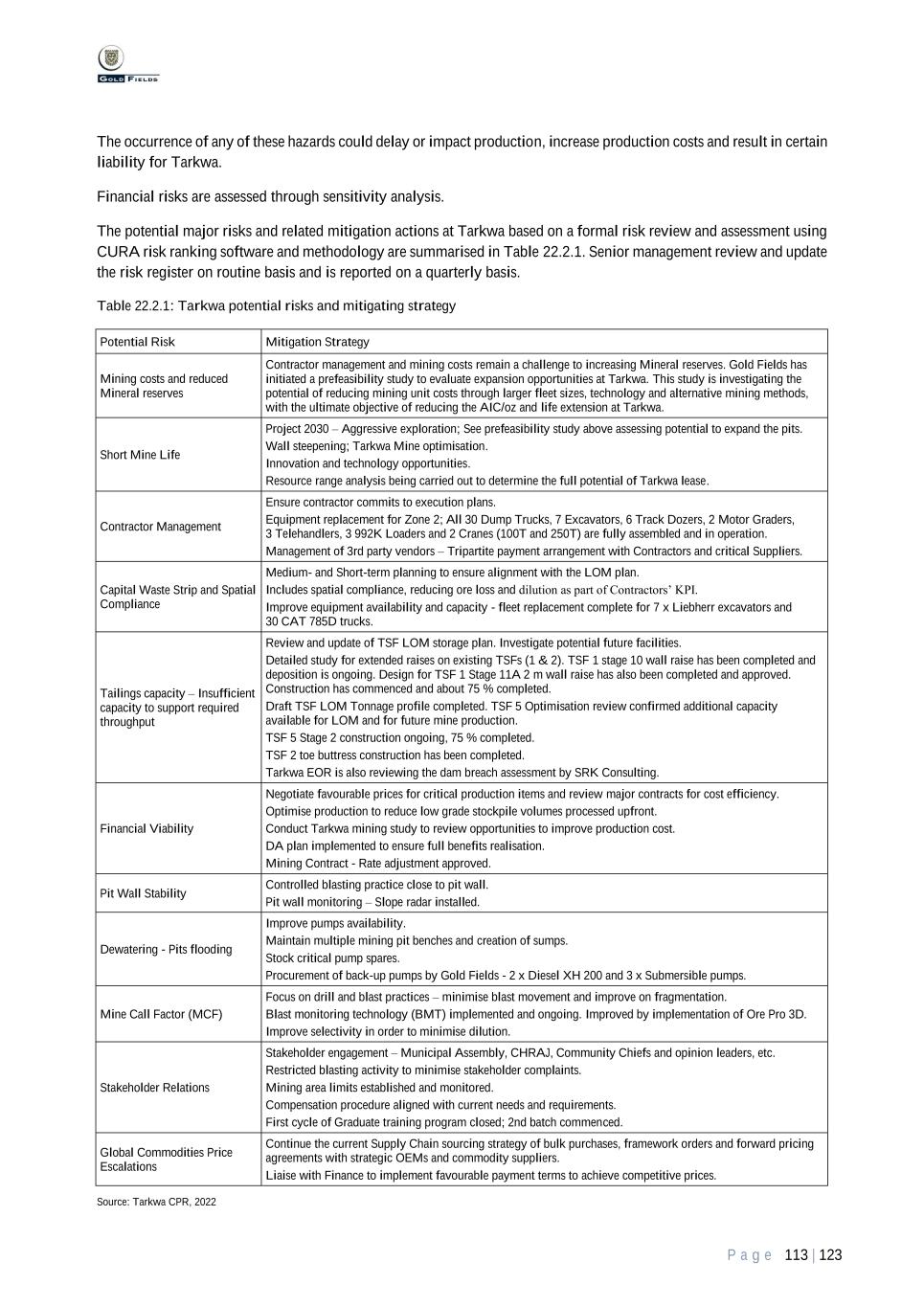

P a g e 7 | 123 Table 19.3.2: NPV sensitivity to changes in grade 90 % attributable ............................................................................................ 107 Table 19.3.3: NPV sensitivity to changes in capital costs 90 % attributable .................................................................................. 107 Table 19.3.4: NPV sensitivity to changes in operating costs 90 % attributable ............................................................................. 107 Table 19.3.5: NPV sensitivity to changes in discount rate 90 % attributable ................................................................................. 107 Table 22.2.1: Tarkwa potential risks and mitigating strategy......................................................................................................... 113 List of Figures Figure 1.1.1: Location of Tarkwa in Ghana ....................................................................................................................................... 8 Figure 3.4.1: Tarkwa mineral lease map .......................................................................................................................................... 17 Figure 4.4.1: Tarkwa operating sites, infrastructure and mineral lease ............................................................................................ 21 Figure 6.1.1: Regional geology of the Ashanti Belt, south-western Ghana ...................................................................................... 25 Figure 6.1.2: Regional generalised stratigraphic column, south-western Ghana .............................................................................. 26 Figure 6.1.3: Local geology of Tarkwa gold mine area ................................................................................................................... 27 Figure 6.1.4: Figure Tarkwa Stratigraphic Column ......................................................................................................................... 28 Figure 6.1.5: Schematic diagram showing lateral and vertical facies variations within the A and A Footwall reefs ....................... 29 Figure 7.2.1: Locality Map of 2022 Exploration Activities ............................................................................................................. 32 Figure 7.2.2: Example of diamond drill core photo ......................................................................................................................... 33 Figure 10.2.1: Tarkwa monthly plant recovery model fit chart ........................................................................................................ 53 Figure 12.2.1: Illustration of dilution skins applied to reef zones .................................................................................................... 70 Figure 12.2.2: Akontansi pit design ................................................................................................................................................. 73 Figure 13.2.1: Final Pit Life of Mine Mineral reserve ..................................................................................................................... 80 Figure 14.1.1: Schematic flow diagram of Tarkwa mill process plant ............................................................................................. 83 Figure 15.1.1: Tarkwa TSFs............................................................................................................................................................. 87

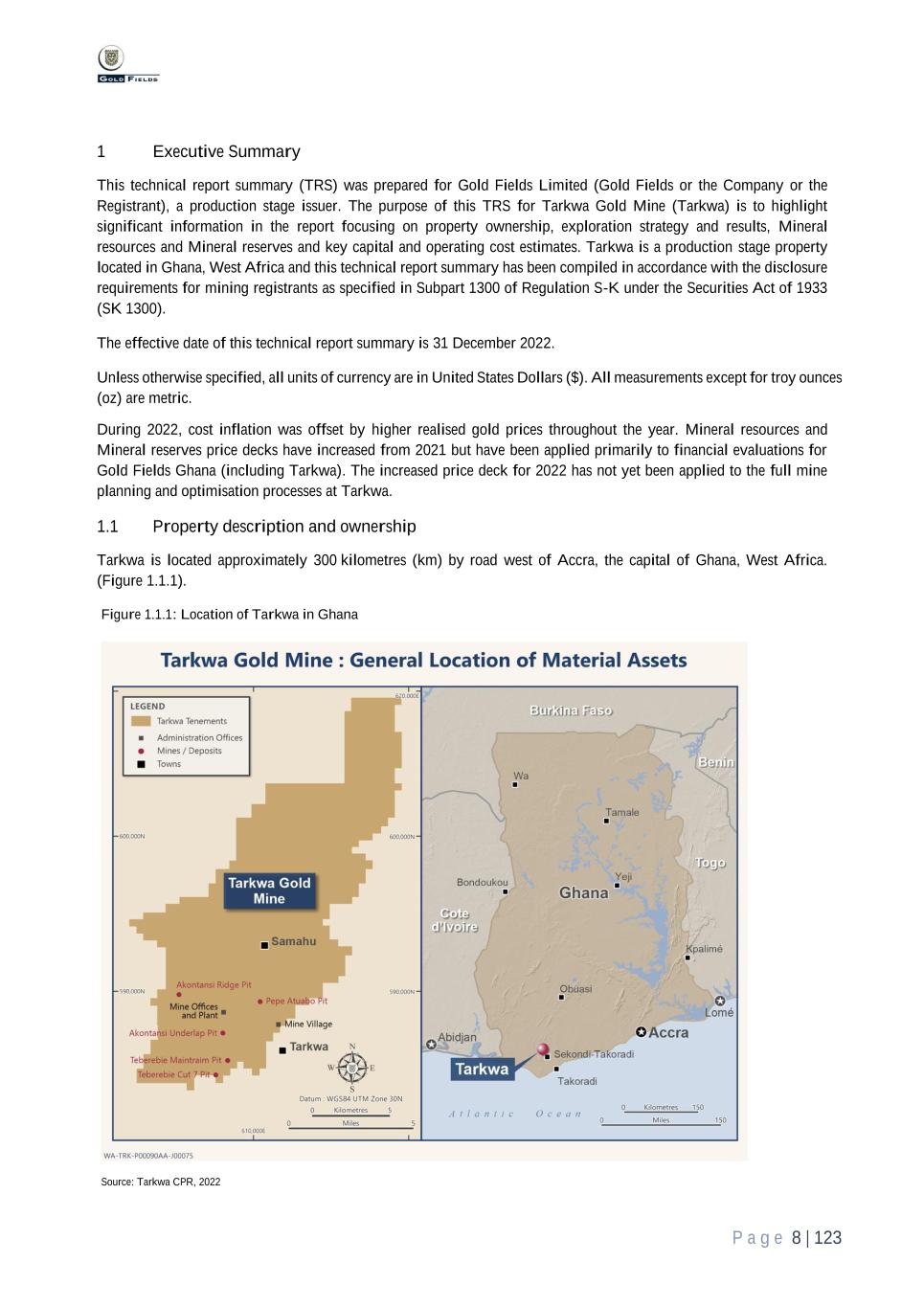

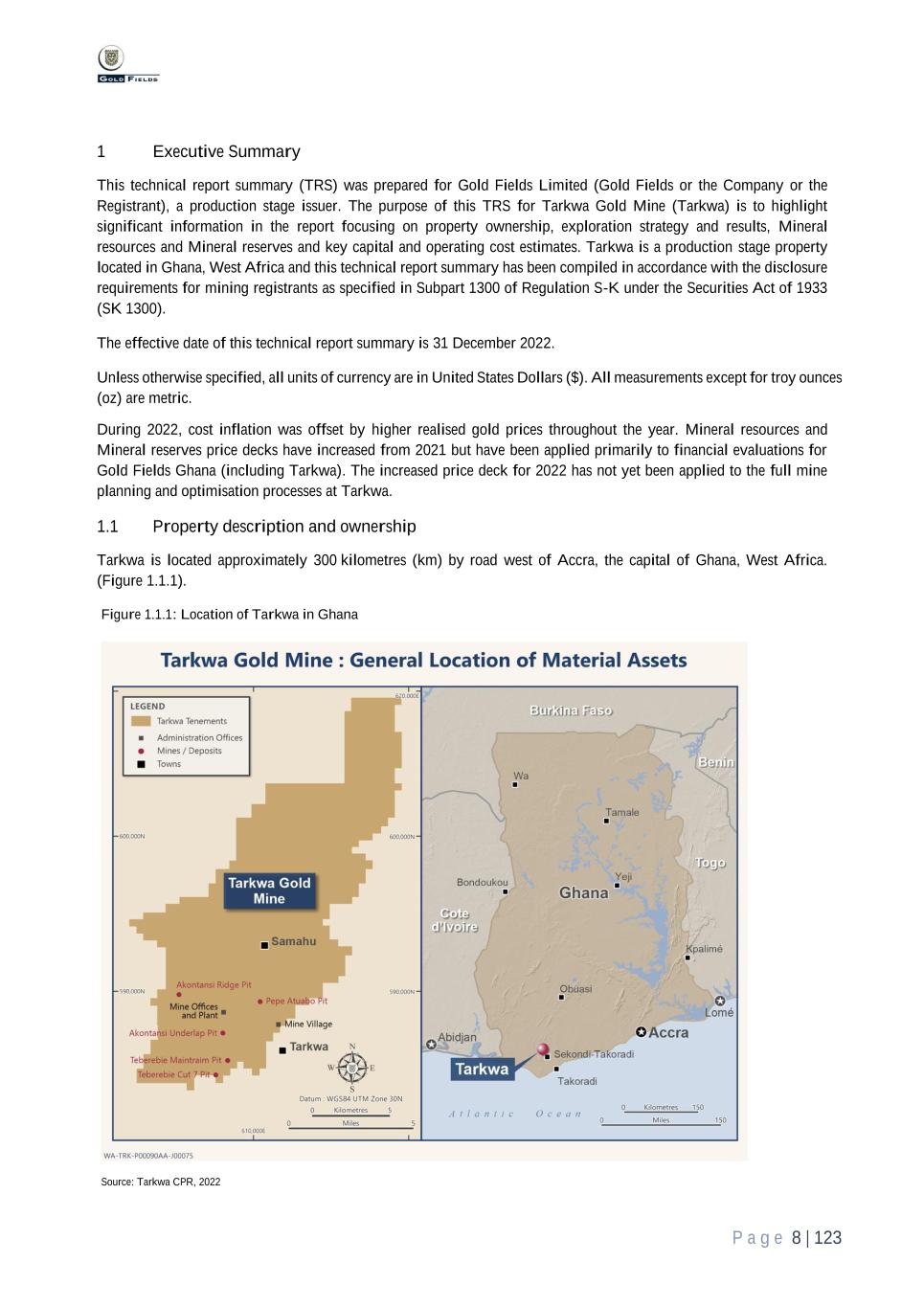

P a g e 8 | 123 1 Executive Summary This technical report summary (TRS) was prepared for Gold Fields Limited (Gold Fields or the Company or the Registrant), a production stage issuer. The purpose of this TRS for Tarkwa Gold Mine (Tarkwa) is to highlight significant information in the report focusing on property ownership, exploration strategy and results, Mineral resources and Mineral reserves and key capital and operating cost estimates. Tarkwa is a production stage property located in Ghana, West Africa and this technical report summary has been compiled in accordance with the disclosure requirements for mining registrants as specified in Subpart 1300 of Regulation S-K under the Securities Act of 1933 (SK 1300). The effective date of this technical report summary is 31 December 2022. Unless otherwise specified, all units of currency are in United States Dollars ($). All measurements except for troy ounces (oz) are metric. During 2022, cost inflation was offset by higher realised gold prices throughout the year. Mineral resources and Mineral reserves price decks have increased from 2021 but have been applied primarily to financial evaluations for Gold Fields Ghana (including Tarkwa). The increased price deck for 2022 has not yet been applied to the full mine planning and optimisation processes at Tarkwa. 1.1 Property description and ownership Tarkwa is located approximately 300 kilometres (km) by road west of Accra, the capital of Ghana, West Africa. (Figure 1.1.1). Figure 1.1.1: Location of Tarkwa in Ghana Source: Tarkwa CPR, 2022

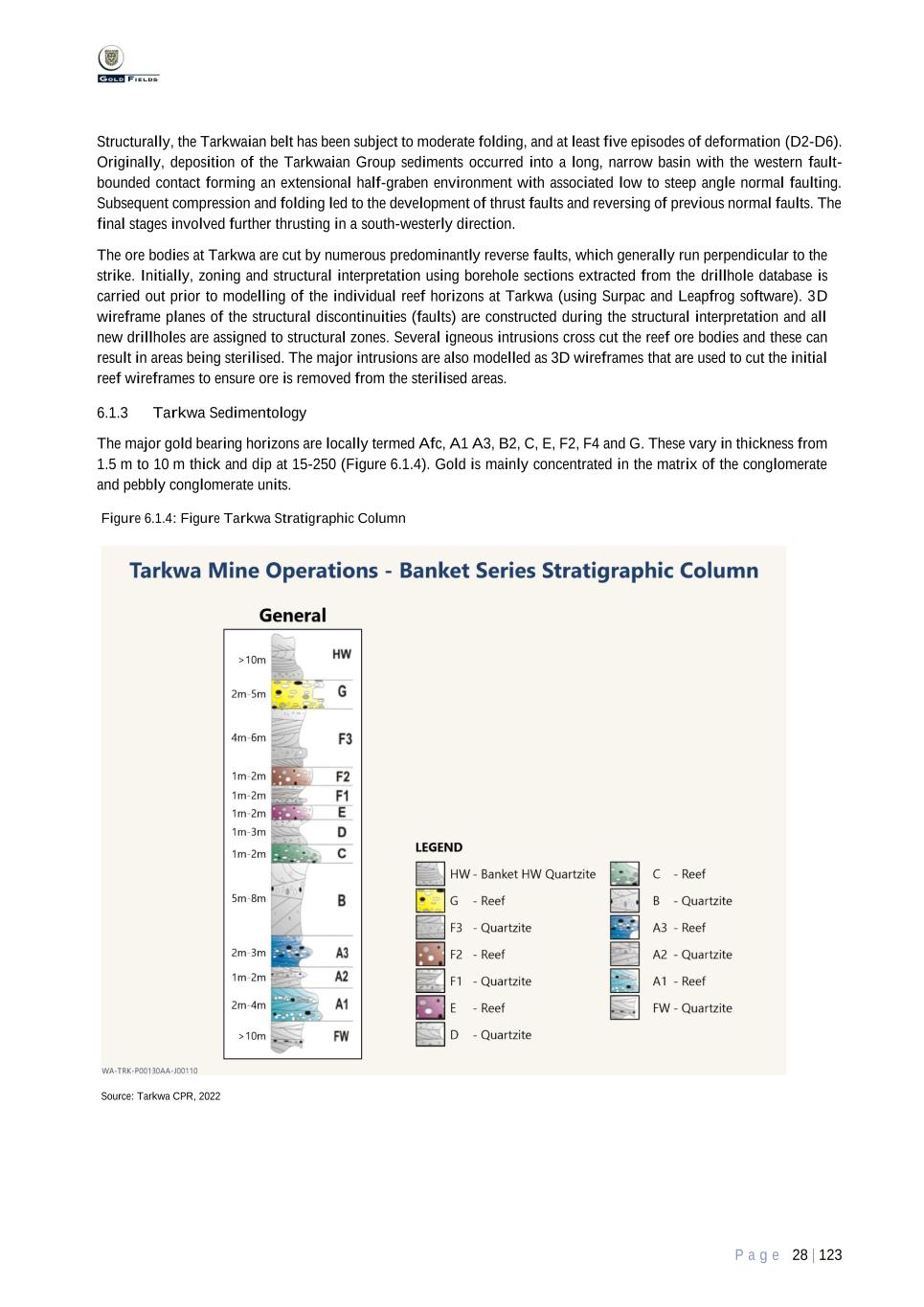

P a g e 9 | 123 Gold Fields Ghana Ltd (GFGL) was incorporated in Ghana in 1993 as the legal entity holding the Tarkwa concession exploration and mining rights over a total area of 20,825 ha. GFGL is the operator of the mine, and the Company is the majority shareholder with 90 % of the issued shares in GFGL with the Ghanaian Government holding a 10 % free carried interest as required under the Mining Law of Ghana. The major components of the Tarkwa mining and processing operation are: • Four large open pits (Pepe-Mantraim, Teberebie, Akontansi and Kottraverchy). • A large ore stockpile and ‘spent ore’ on the South Heap Leach Pad. • A 14 Mt per annum carbon-in-leach (CIL) process plant. • Tailings storage facilities (TSF). • A power plant. • A hybrid renewable power plant. • Centralised administrative office, engineering and equipment workshops and residential villages. 1.2 Geology and mineralisation The Tarkwa orebodies are located within the Tarkwaian System, which forms a significant portion of the stratigraphy of the Ashanti Belt which is a broadly synclinal structure of Proterozoic age in south-western Ghana. The geology of the Tarkwa orebodies is dominated by the Banket series, subdivided into footwall and barren hanging wall quartzites, separated by a sequence of mineralised conglomerates and pebbly quartzites. The stratigraphy of the individual quartzite units is well established, with auriferous reefs interbedded with barren immature quartzites. Structurally, the Tarkwaian belt has been subject to moderate folding and at least five episodes of deformation. Generally, the reefs dip between 15 and 35 degrees except at the Pepe North and Kottraverchy open pits, where the limbs of the anticline steepen to 70 degrees. 1.3 Exploration, development and operations Tarkwa is a well-established mining operation and exploration activities are focused on discovery and Mineral resource development necessary to support the exploration pipeline and life of mine extension opportunities. Four large open pits currently exploit the stacked, narrow auriferous conglomerates using conventional drill and blast with truck and shovel methods. Tarkwa utilises contractor mining and haulage to the processing facility. Momentum on waste stripping is closely monitored to ensure that the ore bodies are opened-up timeously to expose the ore as required by the mine plan and schedule. A total of 2,538 exploration holes have been drilled on the Tarkwa concession, of which 2,096 were drilled by GFGL (591 RC and 1,505 DD with an additional 94 deflections completed on the DD holes). A further 228 DD holes were drilled on the Tarkwa concession prior to 1993 and an additional 214 DD holes on the northern Teberebie concession area prior to 2000. An annual budget of $3.0 million was approved for 2022 to drill a total of 4 km and conduct ground geophysical survey work over two target areas. A significant portion of the budget was spent testing for a northern extension to the Kobada orebody in the Kobada North target area. In addition, a Mineral resource definition drilling programme was successfully completed in the Ulap South target area. A budget of $3.0 million (Table 5) has been approved for 2023. The team plans to use this to complete 11.4 km of drilling over three target areas. Early-stage prospective exploration targets will be tested for structurally controlled hydrothermal orebodies. The recent production performance of Tarkwa is summarised in Table 12.2.1.

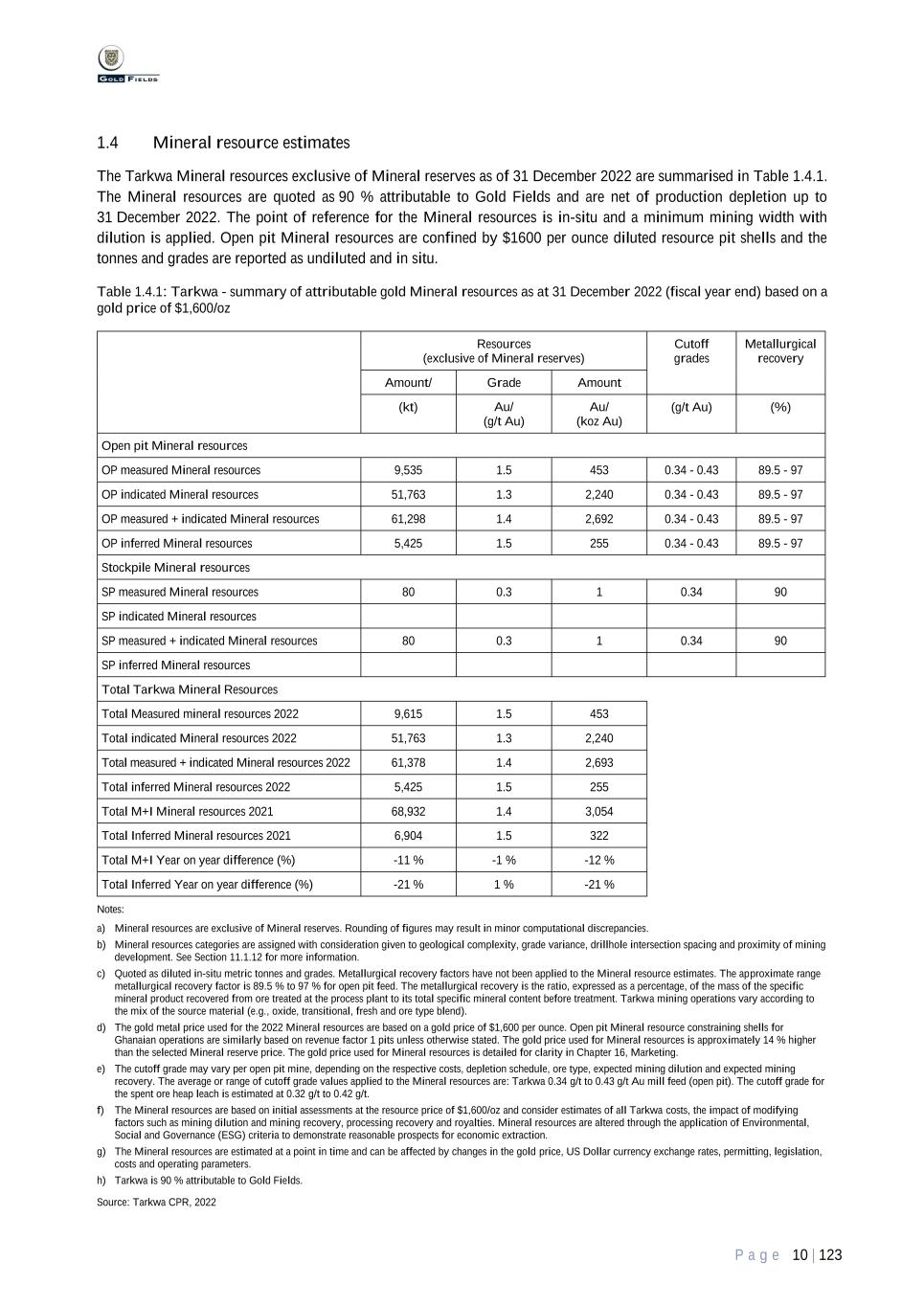

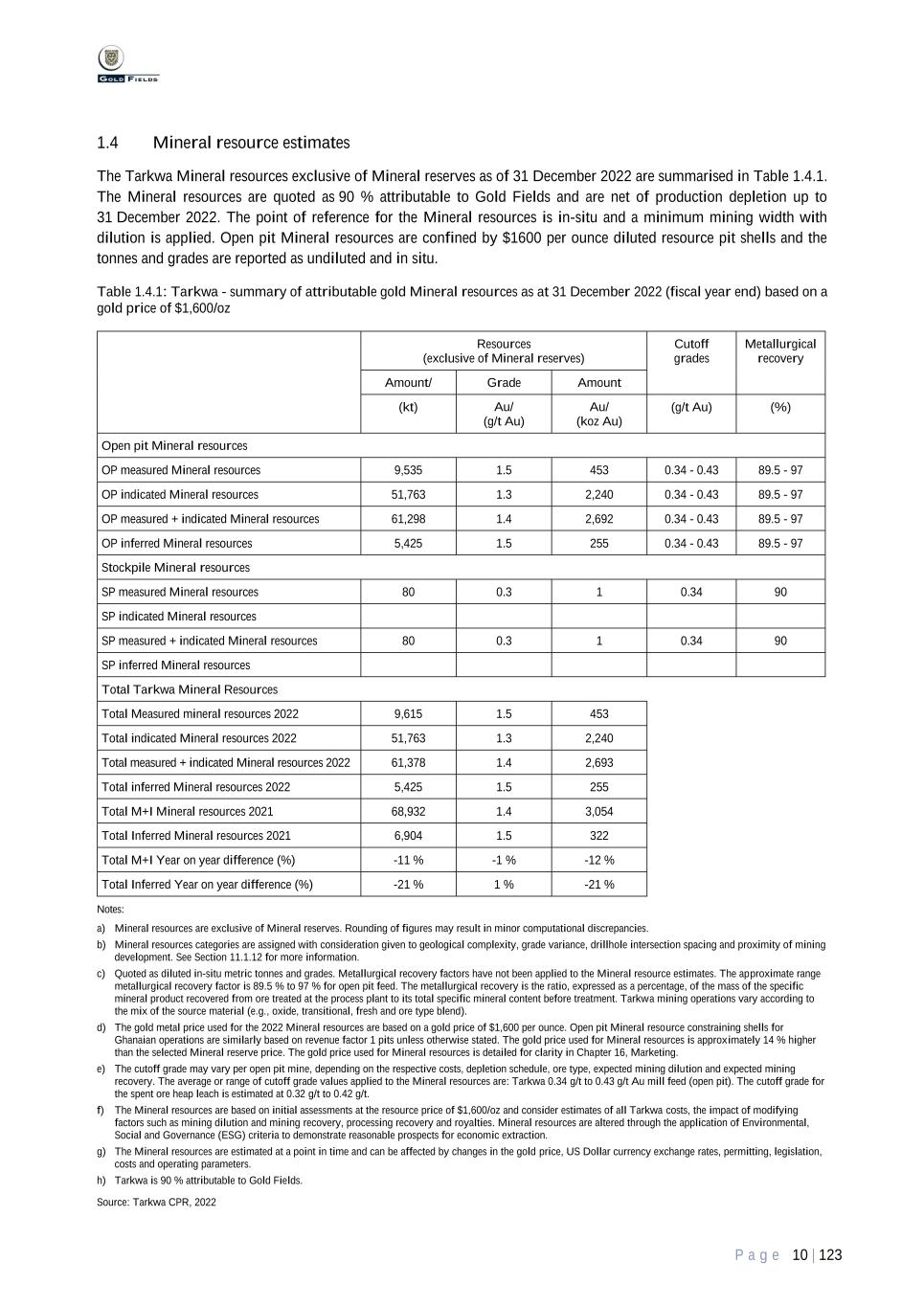

P a g e 10 | 123 1.4 Mineral resource estimates The Tarkwa Mineral resources exclusive of Mineral reserves as of 31 December 2022 are summarised in Table 1.4.1. The Mineral resources are quoted as 90 % attributable to Gold Fields and are net of production depletion up to 31 December 2022. The point of reference for the Mineral resources is in-situ and a minimum mining width with dilution is applied. Open pit Mineral resources are confined by $1600 per ounce diluted resource pit shells and the tonnes and grades are reported as undiluted and in situ. Table 1.4.1: Tarkwa - summary of attributable gold Mineral resources as at 31 December 2022 (fiscal year end) based on a gold price of $1,600/oz Resources (exclusive of Mineral reserves) Cutoff grades Metallurgical recovery Amount/ Grade Amount (kt) Au/ (g/t Au) Au/ (koz Au) (g/t Au) (%) Open pit Mineral resources OP measured Mineral resources 9,535 1.5 453 0.34 - 0.43 89.5 - 97 OP indicated Mineral resources 51,763 1.3 2,240 0.34 - 0.43 89.5 - 97 OP measured + indicated Mineral resources 61,298 1.4 2,692 0.34 - 0.43 89.5 - 97 OP inferred Mineral resources 5,425 1.5 255 0.34 - 0.43 89.5 - 97 Stockpile Mineral resources SP measured Mineral resources 80 0.3 1 0.34 90 SP indicated Mineral resources SP measured + indicated Mineral resources 80 0.3 1 0.34 90 SP inferred Mineral resources Total Tarkwa Mineral Resources Total Measured mineral resources 2022 9,615 1.5 453 Total indicated Mineral resources 2022 51,763 1.3 2,240 Total measured + indicated Mineral resources 2022 61,378 1.4 2,693 Total inferred Mineral resources 2022 5,425 1.5 255 Total M+I Mineral resources 2021 68,932 1.4 3,054 Total Inferred Mineral resources 2021 6,904 1.5 322 Total M+I Year on year difference (%) -11 % -1 % -12 % Total Inferred Year on year difference (%) -21 % 1 % -21 % Notes: a) Mineral resources are exclusive of Mineral reserves. Rounding of figures may result in minor computational discrepancies. b) Mineral resources categories are assigned with consideration given to geological complexity, grade variance, drillhole intersection spacing and proximity of mining development. See Section 11.1.12 for more information. c) Quoted as diluted in-situ metric tonnes and grades. Metallurgical recovery factors have not been applied to the Mineral resource estimates. The approximate range metallurgical recovery factor is 89.5 % to 97 % for open pit feed. The metallurgical recovery is the ratio, expressed as a percentage, of the mass of the specific mineral product recovered from ore treated at the process plant to its total specific mineral content before treatment. Tarkwa mining operations vary according to the mix of the source material (e.g., oxide, transitional, fresh and ore type blend). d) The gold metal price used for the 2022 Mineral resources are based on a gold price of $1,600 per ounce. Open pit Mineral resource constraining shells for Ghanaian operations are similarly based on revenue factor 1 pits unless otherwise stated. The gold price used for Mineral resources is approximately 14 % higher than the selected Mineral reserve price. The gold price used for Mineral resources is detailed for clarity in Chapter 16, Marketing. e) The cutoff grade may vary per open pit mine, depending on the respective costs, depletion schedule, ore type, expected mining dilution and expected mining recovery. The average or range of cutoff grade values applied to the Mineral resources are: Tarkwa 0.34 g/t to 0.43 g/t Au mill feed (open pit). The cutoff grade for the spent ore heap leach is estimated at 0.32 g/t to 0.42 g/t. f) The Mineral resources are based on initial assessments at the resource price of $1,600/oz and consider estimates of all Tarkwa costs, the impact of modifying factors such as mining dilution and mining recovery, processing recovery and royalties. Mineral resources are altered through the application of Environmental, Social and Governance (ESG) criteria to demonstrate reasonable prospects for economic extraction. g) The Mineral resources are estimated at a point in time and can be affected by changes in the gold price, US Dollar currency exchange rates, permitting, legislation, costs and operating parameters. h) Tarkwa is 90 % attributable to Gold Fields. Source: Tarkwa CPR, 2022

P a g e 11 | 123 1.5 Mineral reserve estimates The Tarkwa Mineral reserves as at 31 December 2022 are summarised in Table 1.5.1. The Mineral reserves are 90 % attributable to Gold Fields and are net of production depletion up to 31 December 2022. The point of reference for the Mineral reserves is ore delivered to the processing facility. Table 1.5.1: Tarkwa – summary of attributable gold Mineral reserves as at 31 December 2022 based on a gold price of $1,400/oz Amount/ Grades/ Amount/ Cutoff grades/ Metallurgical recovery/ (kt) (g/t Au) (koz Au) (g/t Au) (%) Open Pit Mineral Reserves OP proved Mineral reserves 33,601 1.3 1,357 0.4 – 0.5 89.5 – 97.2 OP probable Mineral reserves 66,374 1.2 2,549 0.4 – 0.5 89.5 – 97.2 OP total Mineral reserves 99,975 1.2 3,906 0.4 – 0.5 89.5 – 97.2 Stockpile Mineral Reserves SP proved Mineral reserves 9,726 0.8 255 0.42 97.2 SP probable Mineral reserves 53,964 0.4 694 0.32 90 SP total Mineral reserves 63,690 0.5 949 0.32 – 0.42 90 – 97.2 Total Mineral reserves Total proved Mineral reserves 43,327 1.2 1,612 Total probable Mineral reserves 120,339 0.8 3,243 Total Tarkwa Mineral reserves 2022 163,666 0.92 4,856 Total Tarkwa Mineral reserves 2021 174,246 0.93 5,224 Year on year difference (%) -6 % -1 % -7 % Notes: a) Rounding of figures may result in minor computational discrepancies. b) Refer to Table 12.5.1 for year-on-year Mineral Reserve comparison. c) Quoted as mill delivered metric tonnes and run-of-mine grades, inclusive of all mining dilutions and gold losses except mill recovery. Metallurgical recovery factors have not been applied to the reserve figures. The approximate range metallurgical recovery factor is 89.5 % to 97.2 % for open pit feed. The metallurgical recovery is the ratio, expressed as a percentage, of the mass of the specific mineral product recovered from ore treated at the process plant to its total specific mineral content before treatment. The recoveries for Tarkwa vary according to the mix of the source material (e.g., oxide, transitional fresh and ore type blend) and method of treatment. d) The gold price used for the 2022 LOM Mineral reserves is $1,400 per ounce. Open pit Mineral reserves at Tarkwa are based on optimised pits using appropriate mine design and extraction schedules. The gold price used for Mineral reserves is detailed in particularity in Chapter 16 Marketing. e) Dilution relates to planned and unplanned waste and/or low-grade material being mined and delivered to the process plant. Ranges are given for those operations that have multiple orebody styles and mining methodologies. The mine dilution factors are 30 cm hanging wall and 20 cm footwall skins. f) The mining recovery factor relates to the proportion or percentage of ore mined from the defined orebody at the gold price used for the declaration of Mineral reserves. This percentage will vary from mining area to mining area and reflects planned and scheduled reserves against actual tonnes, grade and metal mined, with all modifying factors and mining constraints applied. The mining recovery factors are 100 % (open pit). g) The cutoff grade may vary per open pit, depending on the respective costs, depletion schedule, ore type, expected mining dilution and expected mining recovery. The range of cutoff grade values applied in the planning process is: Tarkwa 0.32 g/t to 0.5 g/t Au mill feed. h) A gold ounces-based Mine Call Factor (metal called for over metal accounted for) determined primarily on historic performance but also on realistic planned improvements where appropriate is applied to the Mineral reserves. A Mine Call Factor of 97 % has been applied at Tarkwa. i) The Mineral reserves are estimated at a point in time and can be affected by changes in the gold price, US Dollar currency exchange rates, permitting, legislation, costs and operating parameters. j) Tarkwa is 90 % attributable to Gold Fields and is entitled to mine all declared material located within the property’s mineral leases and all necessary statutory mining authorisations and permits are in place or have reasonable expectation of being granted. Source: Tarkwa CPR, 2022 The Tarkwa Mineral reserves are the economically mineable part of the measured and indicated Mineral resources based on based on technical and economic studies completed to a minimum of a pre-feasibility level of study using a reserve gold price of $1,400/oz to justify their extraction as at 31 December 2022. The Tarkwa life of mine reserve has a pre-feasibility study estimated accuracy of ±25 % with a contingency lower than or equal to 15 %.

P a g e 12 | 123 1.6 Capital and operating cost estimates Major budgeted capital cost items forecast to 2035 for the 31 December 2022 Mineral reserve LOM plan are summarised in Table 1.6.1. Table 1.6.1: Sustaining and project capital expenditure estimate 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Capital $ million 237.1 204.6 198.4 208.6 277.6 236.5 156.1 177.7 59.1 8.8 8.9 12.8 0.0 Notes: a) The detailed capital cost schedule is presented in Table 18.2.1. b) This capital summary estimate is for the Mineral reserve life of mine schedule. c) Closure costs are included in operating costs. Source: Tarkwa CPR, 2022 Table 1.6.2: Operating costs estimate 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Operating costs $ million 439.0 458.0 427.3 408.6 331.2 389.2 402.1 398.1 282.2 241.4 142.9 161.1 139.4 Notes: a) The detailed operating cost schedule is presented in Table 18.3.1. b) This operating cost summary estimate is for the Mineral reserve LOM schedule. c) Closure costs are presented from 2035 onwards. Source: Tarkwa CPR, 2022 The estimated closure cost as at the end of December 2022 is $113.0 million. A cash deposit of $68.7 million has been made available to finance the closure cost with the remaining $44.3 million provided for in the LOM model. 1.7 Permitting The key operating environmental permits for the operation are issued by the Ghanaian Environmental Protection Agency (EPA) and the Minerals Commission depending on type. The Water Use permits listed below are in place and are valid up to December 2025. • Water Abstraction �� Groundwater. • Water Discharge. • Pit Dewatering. • Environmental Licence. The permits for the construction and operation of the Tailings Storage Facility (TSF) 2 stage 8 were approved in 2022 and are valid until construction is completed. The Environmental certificate expired in January 2022. The mine has submitted an updated Environmental Management Plan (EMP) to the EPA for consideration and approval. The processing and permit fees have been paid and Tarkwa is awaiting issuance of the certificate. Permit required in 2023 is for the construction of TSF 5 stage 3 embankment wall raise. Environmental management at Tarkwa is conducted within the framework of an ISO 14001 certified environmental management system (EMS). The foundation of the EMS is Tarkwa’s Environmental Policy, which is aligned with the Gold Fields Limited Environmental Policy.

P a g e 13 | 123 1.8 Conclusions and recommendations The Tarkwa Mineral reserves currently support a 13-year life of mine plan to 2035 that values the operation at a net present value of $182.3 million at a DCF discount rate of 15.9 % and a reserve gold price of $1,400/oz. Potential life extensions to the open pits will require additional exploration that is funded annually and the completion of relevant studies which have a current focus on reducing mining costs through the use of appropriate technology and innovation. The maiden TRS for Tarkwa had an effective date of 31 December 2021. This Technical Report Summary is the first update of the Tarkwa TRS and has an effective date of 31 December 2022. The triggering event for this update is the impairment of the Tarkwa book value by $325 million (grossed up for tax) because of increased inflationary pressure, higher applied discount rate, and lower applied Mineral resource price for the book value. Table 19.2.1 outlines the impairment calculation. Gold Fields’ commitment to materiality, transparency and competency in its Mineral resources and Mineral reserves disclosure to regulators and in the public domain is of paramount importance to the Qualified person. The QP is satisfied that this report meets these objectives and has no further recommendations regarding this disclosure. The Registrants Executive Committee and Board of Directors continue to endorse the company’s internal and external review and audit assurance protocols. This Technical Report Summary should be read in totality to gain a full understanding of Tarkwa’s Mineral resource and Mineral reserve estimation and reporting process, including data integrity, estimation methodologies, modifying factors, mining and processing capacity and capability, confidence in the estimates, economic analysis, risk and uncertainty and overall projected property value. However, to ensure consolidated coverage of the company’s primary internal controls in generating Mineral resource and reserve estimates a key point summary is provided in Chapter 21 for reference.

P a g e 14 | 123 2 Introduction 2.1 Registrant for whom the Technical Report Summary was prepared The Tarkwa Technical Report Summary was prepared for Gold Fields Limited (Gold Fields or the Company or the Registrant), a production stage issuer. 2.2 Terms of reference and purpose of the Technical Report Summary The purpose of this TRS is to support the disclosure of Mineral resources and Mineral reserves for Tarkwa, a production stage property located in Ghana (Figure 1.1.1), and the report has been prepared in accordance with disclosure requirements for mining registrants as specified in SK 1300. The maiden TRS for Tarkwa had an effective date of 31 December 2021. This Technical Report Summary is the first update of the Tarkwa TRS and has an effective date of 31 December 2022. The triggering event for an updated TRS is that Tarkwa has booked a $325 million impairment (grossed up for tax) due to increased inflationary pressure, higher applied discount rate, and lower applied Mineral resource price. Table 19.2.1 outlines the impairment calculation. In addition to this disclosure being in line with the S-K 1300 rule, the Mineral resources and Mineral reserves stated in this Technical Report Summary have also been reported in accordance with the South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves (SAMREC Code 2016). SAMREC is aligned to the Committee for Mineral Reserves International Reporting Standards (CRIRSCO) Reporting Template November 2019. 2.3 Sources of information This Technical Report Summary is principally based on information disclosed in the “Competent Person’s Report on the Material Assets of Tarkwa Gold Mine” prepared by Tarkwa Qualified persons on behalf of the Company and has been reviewed by Regional and Corporate subject matter experts and Qualified persons. The Competent Person’s Report (CPR) was supplemented by technical reports and studies prepared by the Company and third-party specialists engaged by the Company as cited throughout this Technical Report Summary and listed in Chapter 24. Reliance was also placed on certain economic, marketing and legal information beyond the expertise of the Qualified persons used in the determination of modifying factors. This information provided by the Company is cited in this Technical Report Summary and is listed in Chapter 25. Unless otherwise specified, all units of currency are in United States Dollars ($). All measurements are metric except for troy ounces (oz). 2.4 Qualified persons and details of inspection The Qualified persons responsible for the preparation of this Technical Report Summary are listed in Table 2.4.1. All the Qualified persons are eligible members in good standing of a recognised professional organisation (RPO) within the mining industry and have at least five years of relevant experience in the type of mineralisation and type of deposit under consideration and in the specific type of activity that the Qualified person is undertaking on behalf of the Company at the time this Technical Report Summary was prepared. The recognised professional organisation affiliation in good standing has been reviewed by Gold Fields. The Qualified persons have been appointed by Gold Fields.

P a g e 15 | 123 Table 2.4.1: List of Qualified persons Incumbent Employer Position Affiliation in good standing Relevant experience (years) Details of inspection Responsibility for which chapters Dr Julian Verbeek Gold Fields VP Geology and Mineral resources and Group QP FAusIMM – 207994 35 Has attended site This document has been prepared under the supervision of and reviewed by Julian Verbeek. Chapters 1-26 Jason Sander Gold Fields VP Mining FAusIMM – 111818 27 Has attended site Overview and review of document. Chapters 1-5, 10 & 12-26 Dr Winfred Assibey- Bonsu Gold Fields Group Geostatistician and Evaluator FSAIMM – 700632 36 Has attended site Resources Estimation. Chapters 1 – 9 & 11 & 20-26 Geology (excluding sections 1.6 and 7.4) Andrew Engelbrecht Gold Fields Group Geologist MAusIMM – 224997 22 Has attended site Geology and Resources. Chapters 1 – 9 & 11 & 20-26 Peter Andrews Gold Fields VP: Geotechnical MAusIMM CP – 302255 26 Has attended site Geotechnical review. Sections 7.4, 15.2 & 17.3.2 Daniel Hillier Gold Fields VP: Metallurgy FAusIMM CP – 227106 32 Has attended site Chapters 10 & 14 Johan Boshoff Gold Fields Group Head of Tailings FAusIMM – 1007564 27 Has attended site Tailings Review. Sections 15.1 & 17.3.1 Andre Badenhorst Gold Fields Group Technical and Reporting Governance Manager AusIMM – 309882 42 Has attended site Chapters 1-26 Joseph Nyan Gold Fields Regional Strategic Planning Manager FAusIMM CP(Min) – 305323 23 Site employee Economic analysis Chapters 1-5, 10 & 12-26 Steven Robins Gold Fields Regional Geology Manager and Acting Vice President Technical Services AusIMM – 222533 26 Regional employee based at site on rotation Jointly responsible for the overall correctness, standard and compliance of the Mineral resource and Mineral reserve estimate. Chapters 1 – 26 Godfred Baba Avane Gold Fields Geology Manager AusIMM – 309400 27 Site employee Chapters 1-26 Matthew Aboagye Gold Fields Unit Manager Resource Evaluation MAusIMM – 322689 18 Site employee Mineral resources. Chapters 6 – 9 & 11 Kwame Appau Gold Fields Study Manager MAusIMM CP (No 316308) 15 Site employee Chapters 1-5, 10 & 12-26 Notes: The Qualified persons attended site during 2022 for Mineral reserve and Mineral resource reviews, and the Mineral reserves and Mineral resources were reviewed according to the Chapter 21 description. 2.5 Report version update The maiden Technical Report Summary for Tarkwa was filed with an effective date of 31 December 2021. This is the first update provided by Gold Fields for the Tarkwa property with an effective date of 31 December 2022. The triggering event for this update is the impairment of the Tarkwa book value by $325 million, including gross up for tax, because of increased inflationary pressure, higher applied discount rate and lower applied Mineral resource price. Table 19.2.1 outlines the impairment calculation.

P a g e 16 | 123 3 Property description 3.1 Property location The Tarkwa Gold Mine is located in south-western Ghana, about 300 km by road west of the capital city Accra (Figure 1.1.1), at latitude 519’37” N and longitude 201’17” W. The Property consists of the Tarkwa open pit mining and processing operation on the Tarkwa concession and the adjacent northern portion of the Teberebie concession acquired in August 2000 (Figure 1.1.1 shows location of Tarkwa and the material assets). The mine is served by a main road, which connects it to the port of Takoradi some 60 km to the southeast. Most supplies are transported by truck to the property. 3.2 Ownership Gold Fields Ghana Ltd (GFGL) was incorporated in Ghana in 1993 as the legal entity holding the Tarkwa concession mining rights. GFGL is the operator of the mine, and the Company is the majority shareholder with 90 % of the issued shares in GFGL with the Ghanaian Government holding a 10 % free carried interest as required under the Mining Law of Ghana. 3.3 Property area The Tarkwa property comprises exploration and mineral rights over a total area of 20,825 ha. 3.4 Property mineral titles, claims, mineral rights, leases and options GFGL holds five mining leases in respect of its operations at Tarkwa and two mining leases for its operations at Teberebie. The rights to the two Teberebie mining leases are held through a deed of assignment with a subsidiary of AngloGold Ashanti that is operating the adjacent Iduapriem Mine. The map of Tarkwa mineral leases is shown in Figure 3.4.1 and the mineral leases are listed in Table 3.4.1. The mineral leases cover all the declared Mineral reserves. GFGL has legal entitlement to the minerals being reported upon with no known impediments. Table 3.4.1: List of Tarkwa mineral leases Location Mining Lease ID Mining Leases Expiry date Unblocked area Blocked area Cadastral / block system (ha) (km²) (km²) (no. of blocks) Tarkwa WR 637/97 (ML1) 2,227 17 April, 2027 22.27 10.92 52 Tarkwa WR 640/97 (ML4) 3,420 17 April, 2027 34.20 32.97 157 Tarkwa WR 639/97 (ML3) 4,951 17 April, 2027 49.51 47.04 224 Tarkwa WR 638/97 (ML2) 4,299 17 April, 2027 42.99 46.62 222 Tarkwa WR 641/97 (ML5) 4,338 17 April, 2027 43.38 43.89 209 Teberebie WR 1518/96 1,590 (Includes 1,520/96) 1 February, 2036 15.90 17.22 82 Notes: The Qualified Persons opinion is that licenses and tenements are in good standing to enable execution of the life of mine plan and can be renewed or extended as required. Source: Tarkwa CPR, 2022

P a g e 17 | 123 Figure 3.4.1: Tarkwa mineral lease map Source: Tarkwa CPR, 2022 The Government of Ghana through the Minerals Commission has implemented a new lease boundary system called the cadastral (block) system in which all leases were converted into block sizes of a minimum 5” x 5” size. Under this new system, the 208.25 km² belonging to GFGL translates to 946 blocks (198.66 km²). There used to be an area of overlap between the Tarkwa and Damang licenses in WR 637/97 where Damang had rights to a depth of 30 m with Tarkwa holding the rights below that depth. Both Damang and Tarkwa have applied to relinquish this overlap area to the government, which has been accepted in principle and will be applied in 2023. In 2013, an agreement was entered into between GFGL and AngloGold Ashanti Iduapriem Ltd (AAIL) with the consent of the Minerals Commission to mine the 100 m boundary pillars left between the two mines as a statutory requirement. The two pillars occur along major ridges which are being mined by both companies. There is a pillar between the Ajopa Lease Area (AAIL) and Kottraverchy Lease Area (GFGL) called the “Ajopa Pillar” and a second between the Awunaben Lease Area (AAIL) and Teberebie Lease Area (GFGL) called the “Teberebie Pillar”. For operational reasons, and in accordance with the terms of this agreement, the parties agreed that AAIL will solely and wholly mine the Ajopa pillar and GFGL will solely and wholly mine the Teberebie Pillar.

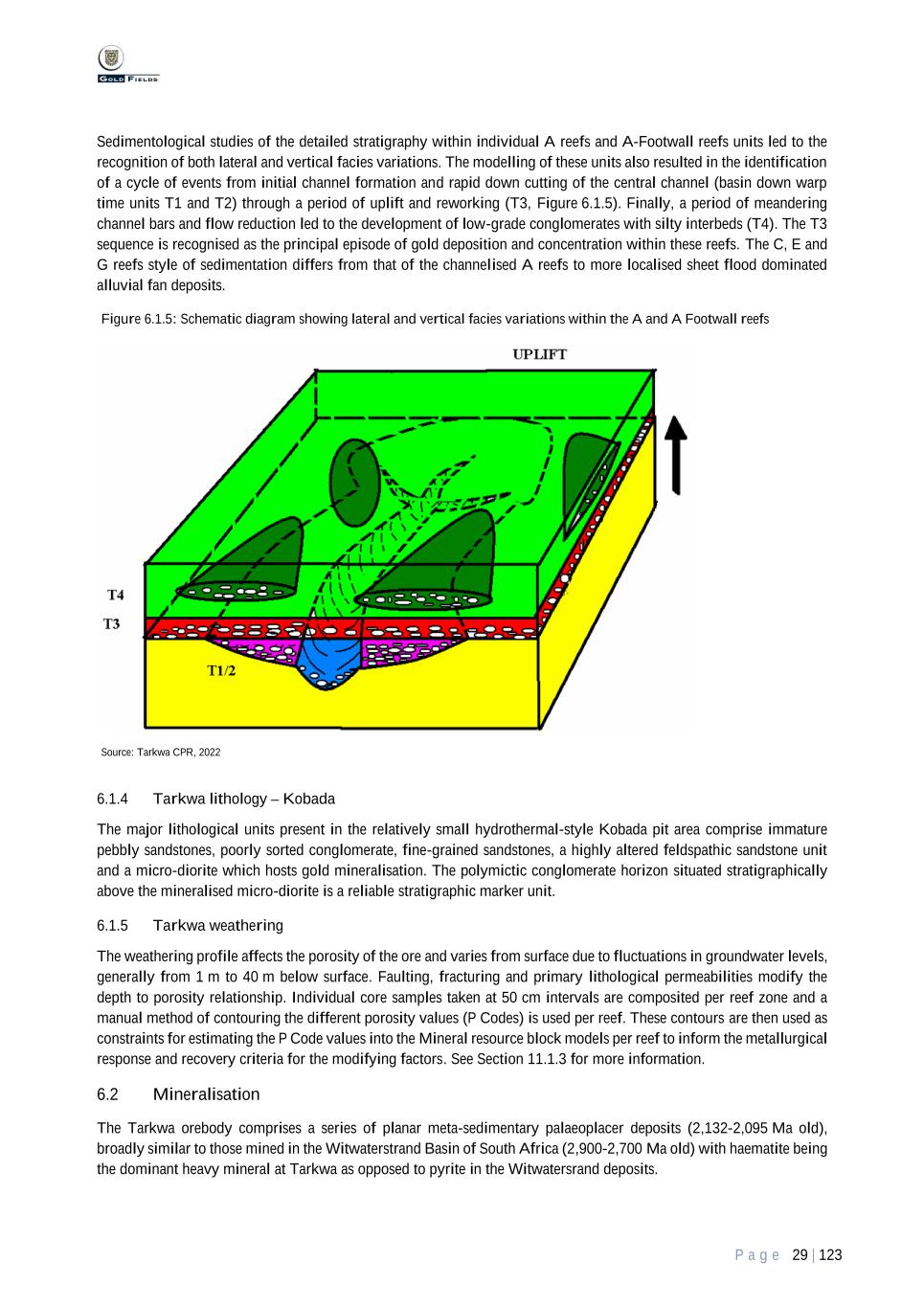

P a g e 18 | 123 3.5 Mineral rights description Under the Constitution of Ghana, the ownership of all minerals in their natural state in Ghana is in the Republic of Ghana, and all minerals are vested in the President on behalf of and in trust for the people. Under Ghanaian law, neither a landowner nor any other person may search for minerals or mine on any land without having been granted a mineral right by the Minister responsible for mines. In addition, under Ghanaian law, the Tarkwa property mining leases are subject to the ratification by the Parliament of the Republic of Ghana. The Minerals Commission, the statutory corporation overseeing the mining operations on behalf of the Government of Ghana, has confirmed that the Tarkwa mining leases have been ratified by Parliament. The Minerals and Mining Law 1986 (PNDCL 153) (as amended) under which the mineral rights to GFGL were granted has been repealed and replaced by the Minerals and Mining Act, 2006 (Act 703) which came into effect on 31 March 2006. However, Act 703 provides that leases, permits and licenses granted or issued under the repealed laws will continue under those laws unless the Minister responsible for minerals provides otherwise by regulation. Therefore, unless and until such regulations are passed in respect of GFGL’s mineral rights, PNDCL 153 will continue to apply to GFGL’s current operations in Ghana. Act 703 further provides that even if a mineral right is made subject to its provisions shall not have the effect of increasing the holder’s costs or financial burden for a period of five years from Act 703 coming into effect. Under the provisions of PNDCL 153, the size of an area in respect of which a mining lease may be granted cannot exceed 50 km² for any single grant or 150 km² in the aggregate for any company. GFGL’s mining leases cover approximately 198.66 km² which was acquired before the restrictions were put in place and GFGL is therefore not affected by this later directive. Three forms of mineral rights are recognised under Ghanaian law. The first is a reconnaissance licence that entitles the holder to search for minerals by geochemical, geophysical and geological means but does not permit drilling or excavation. The second is a prospecting licence that allows the holder to search for minerals and permits, among other things, such excavation as may be necessary for prospecting and the third a mining lease which entitles the holder to extract minerals. A licence is required for the export, sale or other disposal of minerals and the permission of the Chief Inspector of Mines is required to remove minerals obtained by the holder of a mineral right. Under Ghanaian law, the Government has a pre-emptive right to purchase gold produced and all products derived from the refining or treatment of minerals at fair market value. However, under the Property’s Development Agreement the Company is entitled to export and sell its entire production of gold and by-products. In Ghana, mining companies are required to pay a royalty rate of 5 % to the Government based on gold production in accordance with Section 25 of the Minerals and Mining Act, 2006 (Act 703). From 1 January 2017 a Development Agreement was signed between GFGL and the Government of Ghana and included a statutory royalty to be paid dependent on the gold price and is calculated annually on the sliding scale shown in Table 3.5.1. A royalty rate of 4 % applied based on the average gold price for the period. Table 3.5.1: Royalty rate schedule Royalty rate Average annual gold price Low value High value 3.0 % $0.00 $1,299.99 3.5 % $1,300.00 $1,450.00 4.0 % $1,451.00 $2,300.00 5.0 % $2,301.00 Unlimited Source: Tarkwa CPR, 2022 Mineral rights and/or mining rights are subject to the necessary approvals and permits discussed in Chapter 17.