Exhibit 96.8 P a g e 1 | 113 Goldfields.com Technical Report Summary of Mineral reserves and Mineral resources 31 December 2022 For Gold Fields Limited – Cerro Corona Copper and Gold Mine – Peru

P a g e 2 | 113 Table of Contents 1 Executive Summary ............................................................................................................................................................. 8 1.1 Property description and ownership ............................................................................................................................ 8 1.2 Geology and mineralisation ........................................................................................................................................ 9 1.3 Exploration, development and operations ................................................................................................................... 9 1.4 Mineral resource estimates .......................................................................................................................................... 9 1.5 Mineral reserve estimates .......................................................................................................................................... 11 1.6 Capital and operating cost estimates ......................................................................................................................... 11 1.7 Permitting .................................................................................................................................................................. 12 1.8 Conclusions and recommendations ........................................................................................................................... 13 2 Introduction......................................................................................................................................................................... 14 2.1 Registrant for whom the Technical Report Summary was prepared. ........................................................................ 14 2.2 Terms of reference and purpose of the Technical Report Summary ......................................................................... 14 2.3 Sources of Information .............................................................................................................................................. 14 2.4 Qualified persons and details of inspection ............................................................................................................... 14 2.5 Report version update ............................................................................................................................................... 14 3 Property description ........................................................................................................................................................... 16 3.1 Property location ....................................................................................................................................................... 16 3.2 Ownership ................................................................................................................................................................. 16 3.3 Property area ............................................................................................................................................................. 16 3.4 Property mineral titles, claims, mineral rights, leases and options ............................................................................ 16 3.5 Mineral rights description ......................................................................................................................................... 19 3.6 Encumbrances ........................................................................................................................................................... 20 3.7 Other significant factors and risks ............................................................................................................................. 20 3.8 Royalties or similar interest....................................................................................................................................... 20 4 Accessibility, climate, local resources, infrastructure and physiography .................................................................... 21 4.1 Topography, elevation and vegetation ...................................................................................................................... 21 4.2 Access ....................................................................................................................................................................... 21 4.3 Climate ...................................................................................................................................................................... 21 4.4 Infrastructure ............................................................................................................................................................. 21 4.5 Book Value ............................................................................................................................................................... 23 5 History .................................................................................................................................................................................. 24 6 Geological setting, mineralisation and deposit ................................................................................................................ 25 6.1 Geological setting ..................................................................................................................................................... 25 6.2 Local Geology ........................................................................................................................................................... 26 6.3 Mineralisation ........................................................................................................................................................... 28 7 Exploration .......................................................................................................................................................................... 31 7.1 Exploration at Cerro Corona ..................................................................................................................................... 31 7.2 Drilling ...................................................................................................................................................................... 31 7.2.1 Type and extent ................................................................................................................................................. 31 7.2.2 Procedures ......................................................................................................................................................... 33 7.2.3 Results ............................................................................................................................................................... 34 7.3 Hydrogeology ........................................................................................................................................................... 34 7.4 Geotechnical ............................................................................................................................................................. 36 7.5 Density ...................................................................................................................................................................... 37 8 Sample preparation, analyses and security ..................................................................................................................... 38 8.1 Sample preparation ................................................................................................................................................... 38 8.2 Sample analysis ......................................................................................................................................................... 40

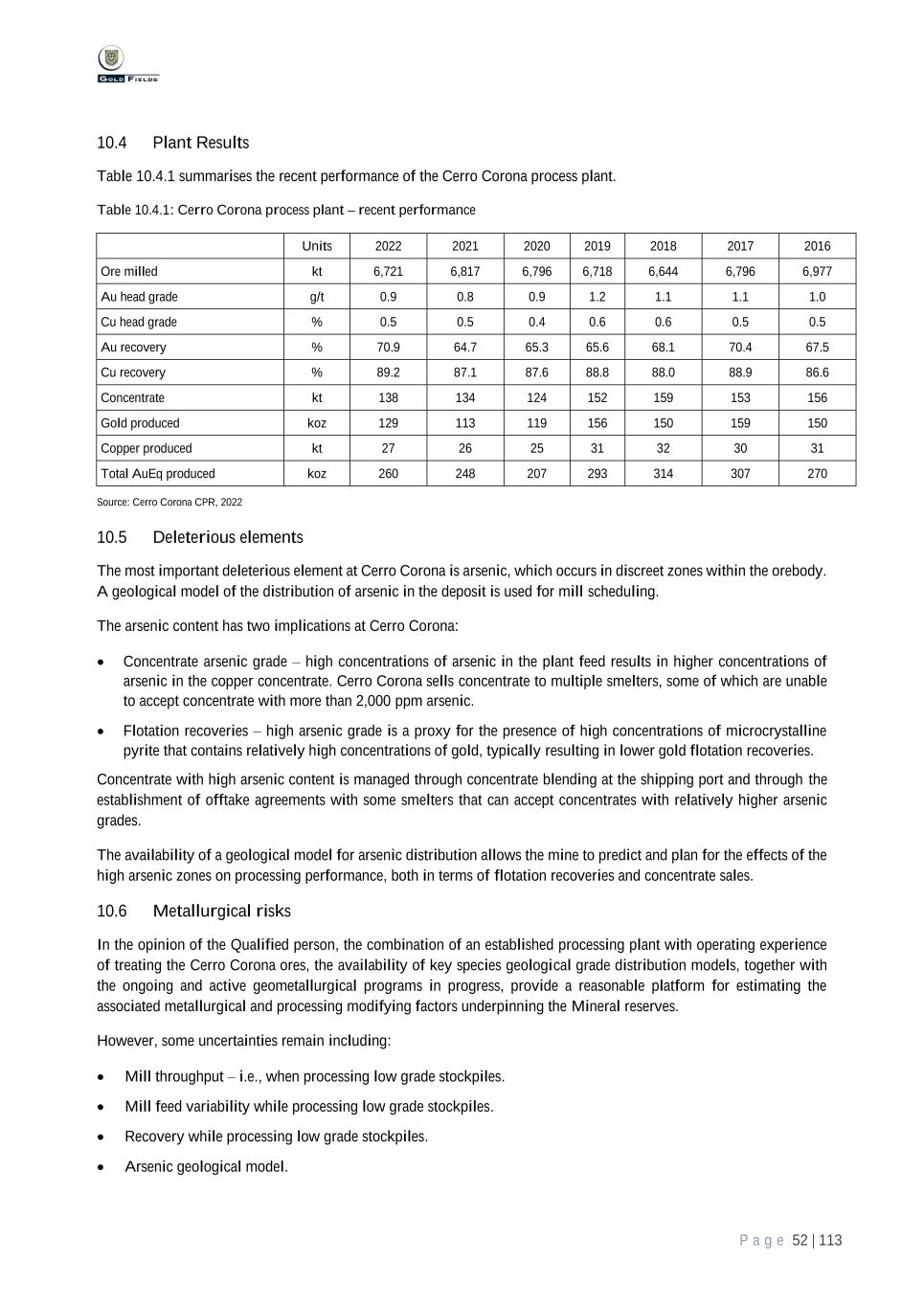

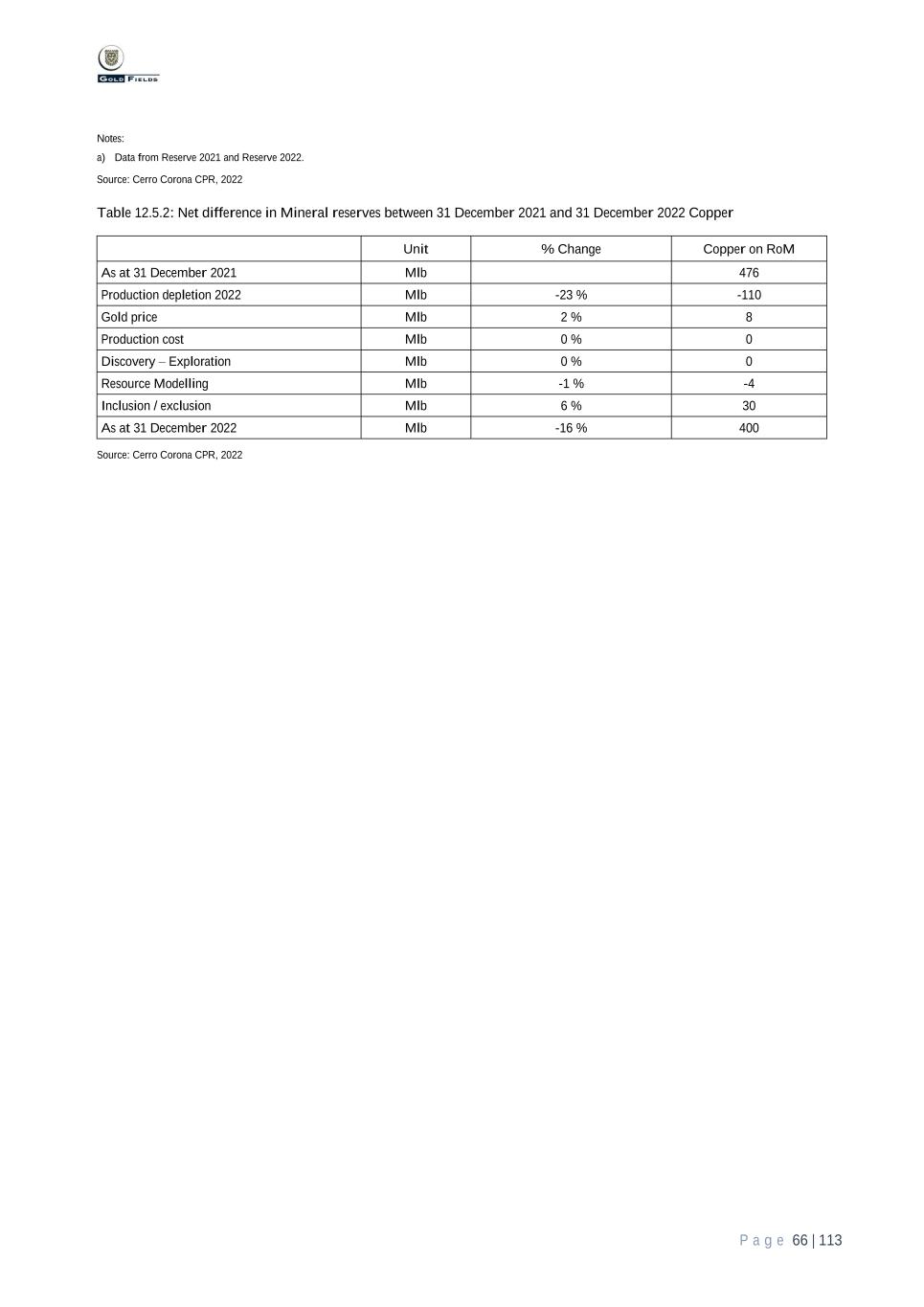

P a g e 3 | 113 8.3 Quality control and quality assurance (QA/QC) ....................................................................................................... 41 9 Data verification ................................................................................................................................................................. 43 9.1 Drilling and sampling ................................................................................................................................................ 43 9.2 Data management ...................................................................................................................................................... 43 10 Mineral processing and metallurgical testing ................................................................................................................. 45 10.1 Testing and procedures ............................................................................................................................................. 45 10.1.1 Background ....................................................................................................................................................... 45 10.1.2 Original feasibility studies ................................................................................................................................ 45 10.1.3 Production control sampling ............................................................................................................................. 45 10.2 Plant sampling and reconciliation ............................................................................................................................. 46 10.3 Relevant results ......................................................................................................................................................... 46 10.3.1 Sample head analyses and mineralogy .............................................................................................................. 46 10.3.2 Metallurgical recoveries .................................................................................................................................... 47 10.3.3 Ore hardness / mill throughput .......................................................................................................................... 50 10.4 Plant Results.............................................................................................................................................................. 52 10.5 Deleterious elements ................................................................................................................................................. 52 10.6 Metallurgical risks ..................................................................................................................................................... 52 11 Mineral resource estimates ................................................................................................................................................ 53 11.1 Mineral resource estimation criteria .......................................................................................................................... 53 11.1.1 Geological database .......................................................................................................................................... 53 11.1.2 Core recovery .................................................................................................................................................... 53 11.1.3 Domain classification ........................................................................................................................................ 53 11.1.4 Geological modelling ........................................................................................................................................ 53 11.1.5 Assay compositing ............................................................................................................................................ 53 11.1.6 Evaluation of outliers ........................................................................................................................................ 53 11.1.7 Variography ...................................................................................................................................................... 54 11.1.8 Selective mining units ....................................................................................................................................... 54 11.1.9 Grade estimation ............................................................................................................................................... 54 11.1.10 Model validation ............................................................................................................................................... 55 11.1.11 Cutoff grades ..................................................................................................................................................... 56 11.1.12 Reasonable prospects of economic extraction ................................................................................................... 57 11.1.13 Classification criteria ........................................................................................................................................ 57 11.2 Mineral resources as of 31 December 2022 .............................................................................................................. 57 11.3 Basis for establishing the prospects of economic extraction for Mineral resources .................................................. 59 11.4 Audits and reviews .................................................................................................................................................... 59 11.5 Comparison with 31 December 2021 to 31 December 2022 Mineral resource ......................................................... 59 12 Mineral reserve estimates .................................................................................................................................................. 60 12.1 Level of assessment .................................................................................................................................................. 60 12.2 Mineral reserve estimation criteria ............................................................................................................................ 61 12.2.1 Recent mine performance .................................................................................................................................. 61 12.2.2 Key assumptions and parameters ...................................................................................................................... 62 12.2.3 Cutoff grades ..................................................................................................................................................... 62 12.2.4 Mine design ....................................................................................................................................................... 63 12.2.5 Mining schedule ................................................................................................................................................ 63 12.2.6 Classification criteria ........................................................................................................................................ 64 12.2.7 Economic assessment ........................................................................................................................................ 64 12.3 Mineral reserves as of 31 December 2022 ................................................................................................................ 64 12.4 Audits and reviews .................................................................................................................................................... 65 12.5 Comparison December 2022 with 31 December 2021 Mineral reserve .................................................................... 65 13 Mining Methods .................................................................................................................................................................. 67 13.1 Methods .................................................................................................................................................................... 67

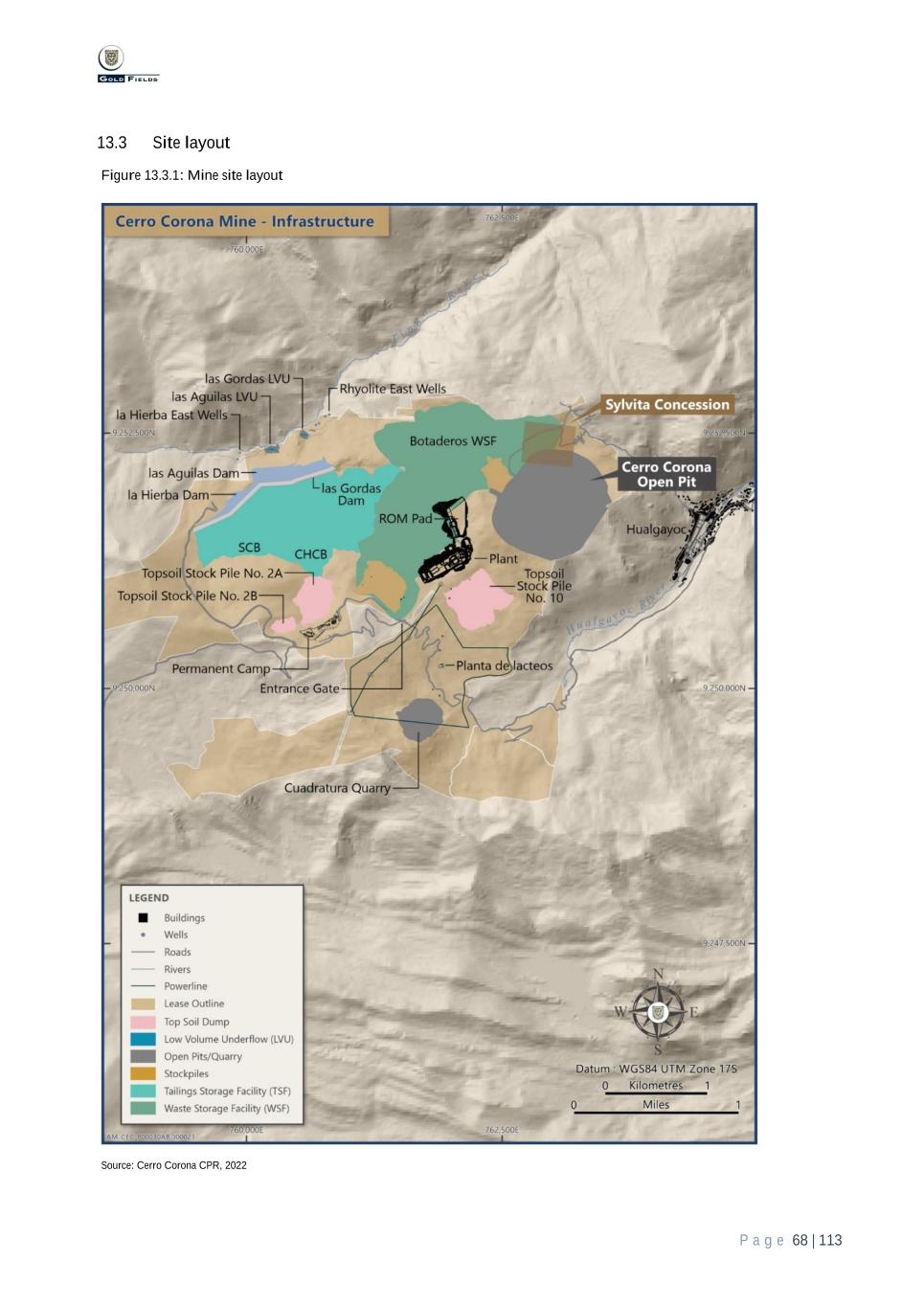

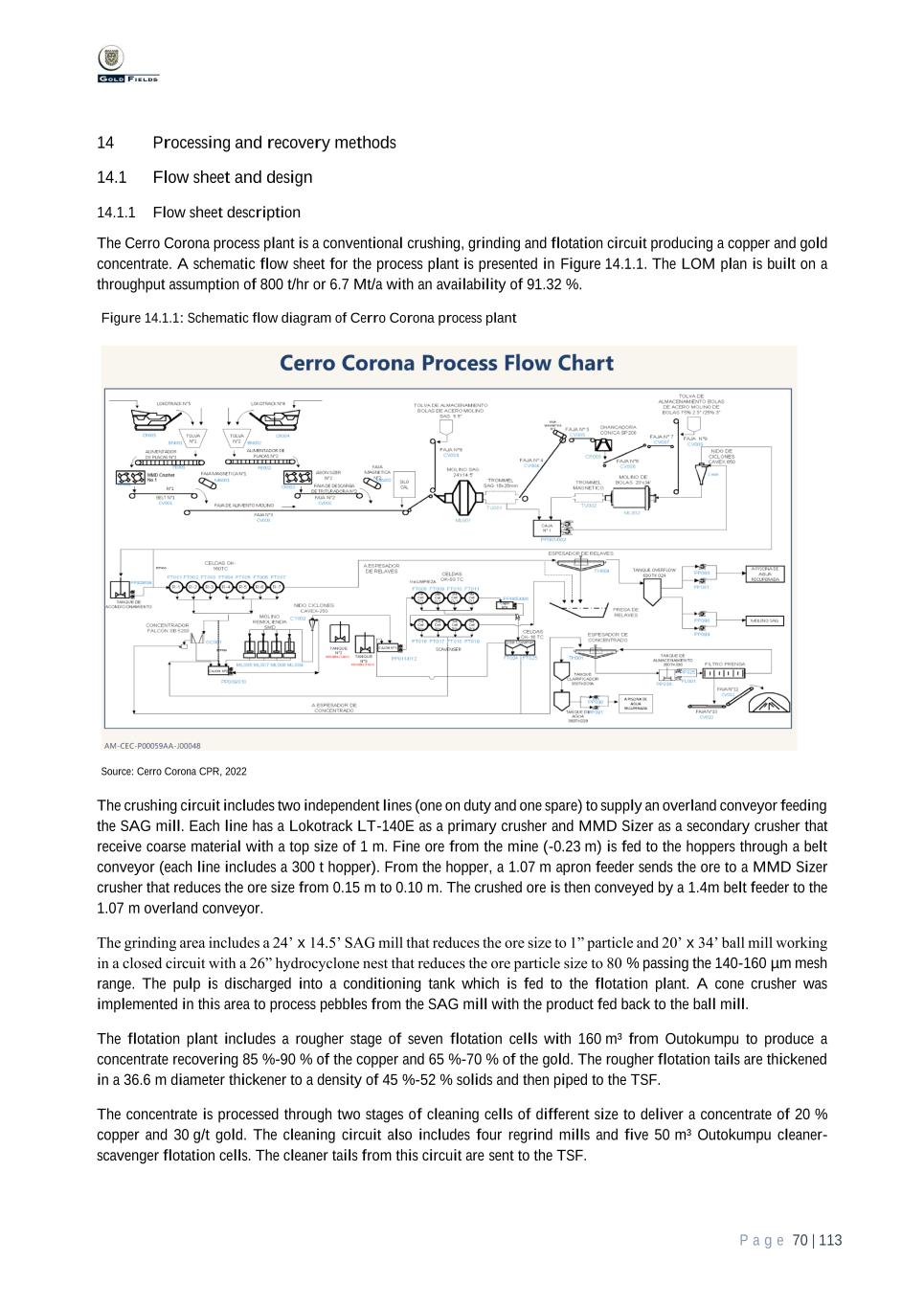

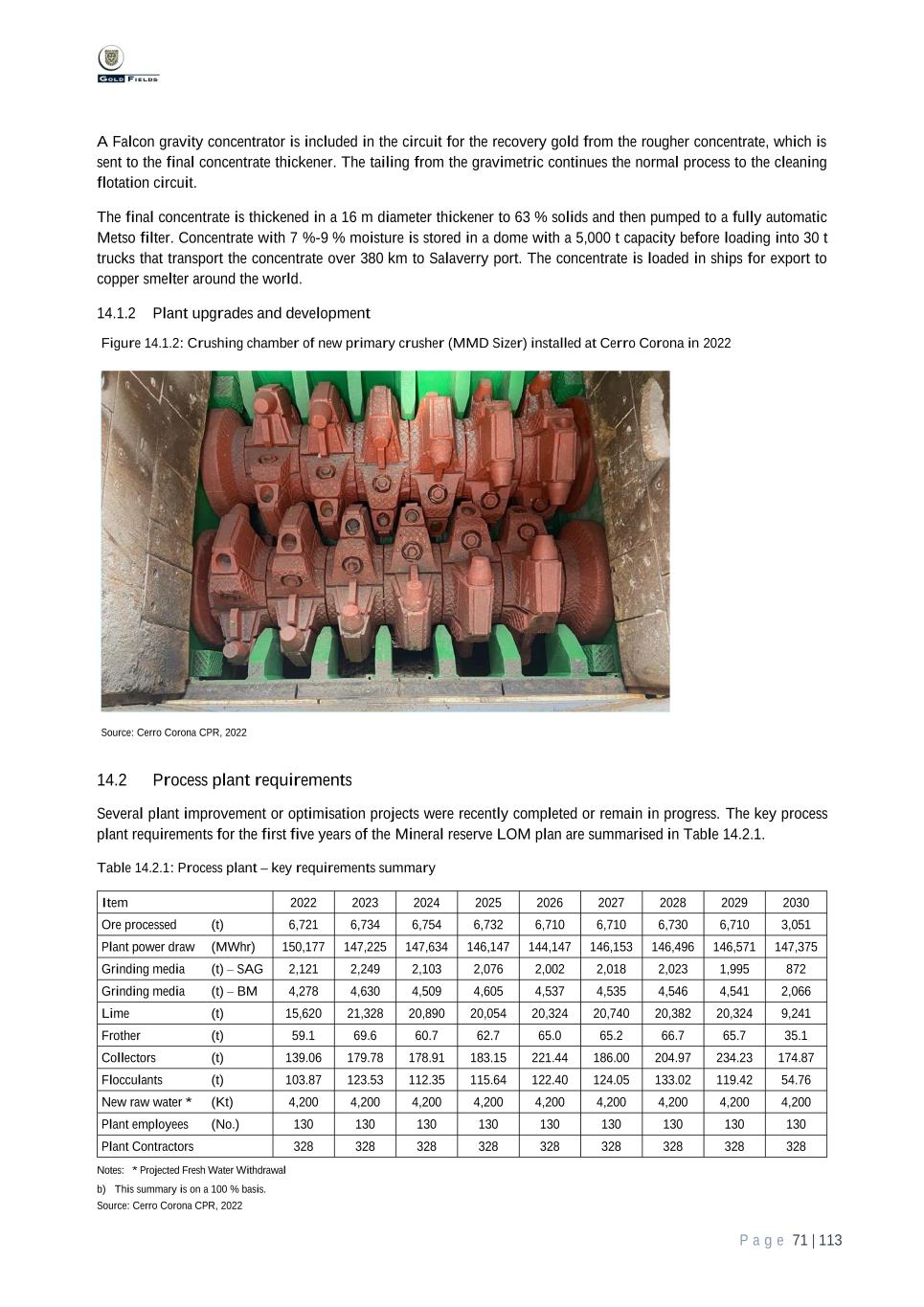

P a g e 4 | 113 13.2 Mine design and planning factors. ............................................................................................................................ 67 13.3 Site layout ................................................................................................................................................................. 68 13.4 Equipment and labour requirements .......................................................................................................................... 69 13.5 Final mine layout ...................................................................................................................................................... 69 14 Processing and recovery methods ..................................................................................................................................... 70 14.1 Flow sheet and design ............................................................................................................................................... 70 14.1.1 Flow sheet description ....................................................................................................................................... 70 14.1.2 Plant upgrades and development ....................................................................................................................... 71 14.2 Process plant requirements ........................................................................................................................................ 71 14.3 Processing risks ......................................................................................................................................................... 72 14.3.1 Major equipment failure .................................................................................................................................... 72 14.3.2 Plant operational management .......................................................................................................................... 72 14.3.3 Operating costs, plant consumables and reagents .............................................................................................. 73 14.3.4 Processing long term stockpiles ........................................................................................................................ 73 15 Infrastructure ...................................................................................................................................................................... 74 15.1 Tailings storage facility (TSF) .................................................................................................................................. 74 15.1.1 Background ....................................................................................................................................................... 74 15.2 Waste rock storage facility (WSF) ............................................................................................................................ 77 15.3 Water ......................................................................................................................................................................... 77 15.4 Power LOM .............................................................................................................................................................. 78 15.5 Accommodation ........................................................................................................................................................ 78 15.6 Other infrastructure ................................................................................................................................................... 78 16 Market studies ..................................................................................................................................................................... 79 16.1 Preliminary market study .......................................................................................................................................... 79 16.2 Metal Price history .................................................................................................................................................... 80 16.3 Market strategy ......................................................................................................................................................... 80 16.4 Pricing ....................................................................................................................................................................... 81 16.4.1 Prices ................................................................................................................................................................. 81 16.4.2 Payables ............................................................................................................................................................ 81 16.4.3 Deductions ........................................................................................................................................................ 81 16.5 Product Specifications ............................................................................................................................................... 81 16.6 Distribution, storage and shipping............................................................................................................................. 82 17 Environmental studies, permitting and plans, negotiations, or agreements with local individuals or groups ....... 83 17.1 Permitting .................................................................................................................................................................. 83 17.2 Environmental studies ............................................................................................................................................... 85 17.3 Waste disposal, monitoring and water management ................................................................................................. 86 17.3.1 Tailings storage facilities (TSF) ........................................................................................................................ 86 17.3.2 Waste rock dumps ............................................................................................................................................. 88 17.3.3 Water management............................................................................................................................................ 89 17.4 Social and community ............................................................................................................................................... 90 17.5 Mine closure.............................................................................................................................................................. 90 18 Capital and operating costs ............................................................................................................................................... 92 18.1 Capital costs .............................................................................................................................................................. 92 18.2 Operating Cost .......................................................................................................................................................... 92 18.3 Closure cost ............................................................................................................................................................... 93 19 Economic analysis ............................................................................................................................................................... 95 19.1 Key inputs and assumptions ...................................................................................................................................... 95 19.2 Economic analysis ..................................................................................................................................................... 97 19.3 Sensitivity analysis .................................................................................................................................................... 97 20 Adjacent properties ............................................................................................................................................................ 99

P a g e 5 | 113 21 Other relevant data and information ............................................................................................................................. 100 22 Interpretation and conclusions ....................................................................................................................................... 102 22.1 Conclusions ............................................................................................................................................................. 102 22.2 Risks ....................................................................................................................................................................... 102 23 Recommendations ............................................................................................................................................................ 104 24 References .......................................................................................................................................................................... 105 25 Reliance on information provided by the Registrant ................................................................................................... 106 26 Definitions .......................................................................................................................................................................... 107 26.1 Adequate geological evidence ................................................................................................................................. 107 26.2 Conclusive geological evidence .............................................................................................................................. 107 26.3 Cutoff grade ............................................................................................................................................................ 107 26.4 Development stage issuer ........................................................................................................................................ 107 26.5 Development stage property.................................................................................................................................... 107 26.6 Economically viable ................................................................................................................................................ 107 26.7 Exploration results .................................................................................................................................................. 107 26.8 Exploration stage issuer .......................................................................................................................................... 107 26.9 Exploration stage property ...................................................................................................................................... 107 26.10 Exploration target .................................................................................................................................................... 107 26.11 Feasibility study ...................................................................................................................................................... 108 26.12 Final market study ................................................................................................................................................... 108 26.13 Indicated Mineral resource. ..................................................................................................................................... 108 26.14 Inferred Mineral resource. ....................................................................................................................................... 108 26.15 Initial assessment .................................................................................................................................................... 108 26.16 Investment and market assumptions ........................................................................................................................ 109 26.17 Limited geological evidence ................................................................................................................................... 109 26.18 Material ................................................................................................................................................................... 109 26.19 Material of economic interest .................................................................................................................................. 109 26.20 Measured Mineral resource. .................................................................................................................................... 109 26.21 Mineral reserve ....................................................................................................................................................... 109 26.22 Mineral resource ..................................................................................................................................................... 109 26.23 Modifying factors .................................................................................................................................................... 110 26.24 Preliminary feasibility study (or pre-feasibility study) ............................................................................................ 110 26.25 Preliminary market study ........................................................................................................................................ 110 26.26 Probable Mineral reserve ........................................................................................................................................ 110 26.27 Production stage issuer ............................................................................................................................................ 110 26.28 Production stage property ....................................................................................................................................... 110 26.29 Proven Mineral reserve. .......................................................................................................................................... 110 26.30 Qualified person ...................................................................................................................................................... 111 26.31 Relevant experience ................................................................................................................................................ 111 27 Signature Page .................................................................................................................................................................. 113

P a g e 6 | 113 List of Tables Table 1.4.1: Cerro Corona – summary of attributable gold and copper Mineral resources at the end of the fiscal year ended 31 December 2022 based on a gold price of $1,600/oz and copper price of $3.60/lb ................................................ 10 Table 1.5.1: Cerro Corona – summary of attributable gold and copper Mineral reserves at the end of the fiscal year ended 31 December 2022 based on a gold price of $1,400/oz and copper price of $3.40/lb ................................................ 11 Table 1.6.1: Capital costs forecast ................................................................................................................................................... 12 Table 1.6.2: Operating costs forecast ............................................................................................................................................... 12 Table 2.5.1: List of Qualified persons .............................................................................................................................................. 15 Table 3.4.1: List of Cerro Corona mineral right ............................................................................................................................... 17 Table 3.4.2: List of Cerro Corona surface rights .............................................................................................................................. 19 Table 7.2.1: Historical drilling by type and company ...................................................................................................................... 31 Table 7.5.1: Density sample history (wax) ....................................................................................................................................... 37 Table 8.2.1: Cerro Corona exploration sample analysis ................................................................................................................... 40 Table 8.2.2: Cerro Corona grade control sample analysis ................................................................................................................ 40 Table 8.3.1: QA/QC insertion rate for 2021-2022 infill drilling ...................................................................................................... 41 Table 8.3.2: QA/QC failure description for infill drilling 2022 ....................................................................................................... 41 Table 10.3.1: Key minerals and principal sulphide assemblages in the different alteration types .................................................... 46 Table 10.3.2: Mine planning recovery estimation models ............................................................................................................... 47 Table 10.3.3: Comparison of the original DFS and current plant configuration .............................................................................. 47 Table 10.3.4: Stockpiled materials plant data analysis summary ..................................................................................................... 50 Table 10.3.5: Ore hardness geometallurgical model domains .......................................................................................................... 51 Table 10.4.1: Cerro Corona process plant – recent performance ..................................................................................................... 52 Table 11.1.1: Database used for Mineral resource estimate ............................................................................................................. 53 Table 11.2.1: Cerro Corona – summary of attributable gold and copper Mineral resources at the end of the fiscal year ended 31 December 2022 based on a gold price of $1,600/oz and copper price of $3.60/lb ................................................ 58 Table 12.2.1: Cerro Corona – recent production performance ......................................................................................................... 61 Table 12.2.2: Recent production performance of Cerro Corona ...................................................................................................... 61 Table 12.2.3: Key technical modifying factors for mine planning ................................................................................................... 62 Table 12.3.1: Cerro Corona - summary of attributable gold and copper Mineral reserves at the end of the fiscal year ended 31 December 2022 based on a gold price of $1,400/oz and copper price of $3.40/lb ................................................ 64 Table 12.5.1: Net difference in Mineral reserves between 31 December 2021 and 31 December 2022 Gold ................................. 65 Table 12.5.2: Net difference in Mineral reserves between 31 December 2021 and 31 December 2022 Copper .............................. 66 Table 14.2.1: Process plant – key requirements summary ............................................................................................................... 71 Table 15.1.1: LOM TSF assessment ................................................................................................................................................ 77 Table 16.1.1: Reserve and Resource metal prices ............................................................................................................................ 79 Table 16.5.1: Current contract concentrate specifications ................................................................................................................ 81 Table 16.5.2: Average Cerro Corona concentrate arsenic grades ..................................................................................................... 82 Table 16.5.3: Gold concentrate grades ............................................................................................................................................. 82 Table 17.1.1: List of Cerro Corona permits ..................................................................................................................................... 84 Table 18.1.1: Capital costs forecast ................................................................................................................................................. 92 Table 18.2.1: Operating costs forecast. ............................................................................................................................................ 93 Table 18.3.1: Post LOM costs 100 % basis ...................................................................................................................................... 93 Table 19.1.1: LOM physical, operating cost and capital cost inputs and revenue assumptions ....................................................... 96 Table 19.1.2: Gold Fields 99.53 % Attributable Gold, FCF and NPV ............................................................................................. 96 Table 19.1.3:Breakdown of ESG expenditure included in Table 18.1.1, Table 18.2.1 and Table 19.1.1 ......................................... 96 Table 19.3.1: NPV sensitivity to changes in gold price 99.53 % attributable .................................................................................. 97 Table 19.3.2: NPV sensitivity to changes in gold grade 99.53 % attributable ................................................................................. 97

P a g e 7 | 113 Table 19.3.3: NPV sensitivity to changes in copper price 99.53 % attributable ............................................................................... 98 Table 19.3.4: NPV sensitivity to changes in copper grade 99.53 % attributable .............................................................................. 98 Table 19.3.5: NPV sensitivity to changes in capital costs 99.53 % attributable ............................................................................... 98 Table 19.3.6: NPV sensitivity to changes in operating costs 99.53 % attributable .......................................................................... 98 Table 19.3.7: NPV sensitivity to changes in discount rate 99.53 % attributable .............................................................................. 98 Table 22.2.1: Cerro Corona risk register – top operational risks .................................................................................................... 103 List of Figures Figure 1.1.1: Location of Cerro Corona ............................................................................................................................................. 8 Figure 3.4.1: Cerro Corona mineral titles ......................................................................................................................................... 16 Figure 4.4.1: Cerro Corona operating sites and infrastructure ......................................................................................................... 22 Figure 6.1.1: Cerro Corona regional geology ................................................................................................................................... 25 Figure 6.2.1: Cerro Corona local geology ........................................................................................................................................ 26 Figure 6.2.2: Schematic stratigraphic column of Cajamarca district ................................................................................................ 27 Figure 6.2.3 : Geological section through the Cerro Corona pit looking north-west ........................................................................ 28 Figure 6.3.1: Sequence of intrusions by mineralised halo interpretation.......................................................................................... 30 Figure 7.2.1: Cerro Corona drillhole collars .................................................................................................................................... 32 Figure 8.1.1: DD and RC sample preparation flow chart ................................................................................................................. 38 Figure 8.1.2: BH sample preparation flow chart .............................................................................................................................. 39 Figure 10.3.1: Annual trends of mine planning recovery estimation models compared with plant recoveries ................................ 48 Figure 10.3.2: Environmental aging barrel tests .............................................................................................................................. 49 Figure 10.3.3: Spatial distribution of ore hardness geometallurgical domains ................................................................................. 51 Figure 13.3.1: Mine site layout ........................................................................................................................................................ 68 Figure 13.5.1: Final mine outline life-of-mine reserve..................................................................................................................... 69 Figure 14.1.1: Schematic flow diagram of Cerro Corona process plant ........................................................................................... 70 Figure 14.1.2: Crushing chamber of new primary crusher (MMD Sizer) installed at Cerro Corona in 2022 ................................... 71 Figure 15.1.1: TSF layout ................................................................................................................................................................ 74 Figure 15.1.2: TSF overview looking west ...................................................................................................................................... 75 Figure 15.1.3 Typical TSF embankment cross-section .................................................................................................................... 76

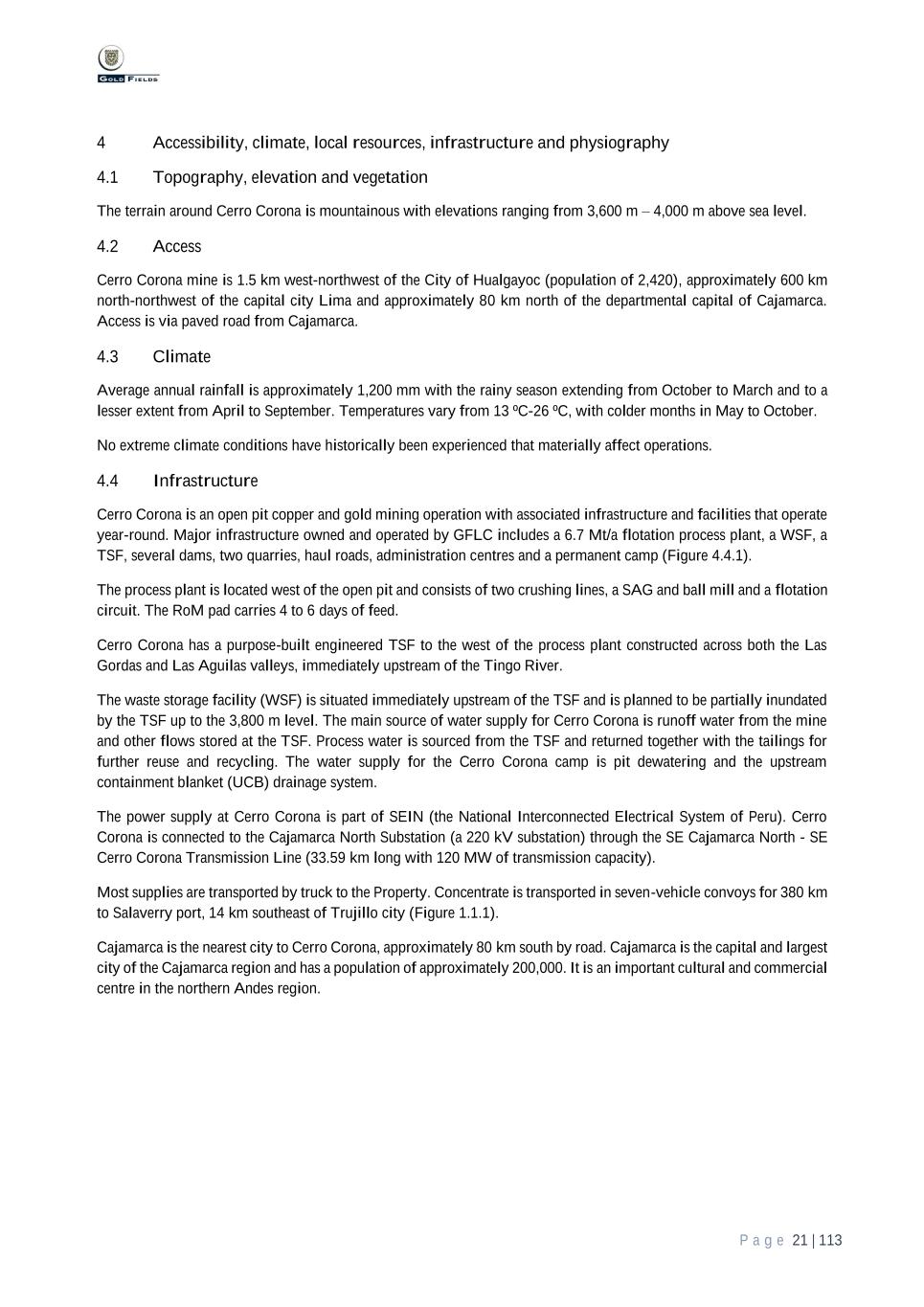

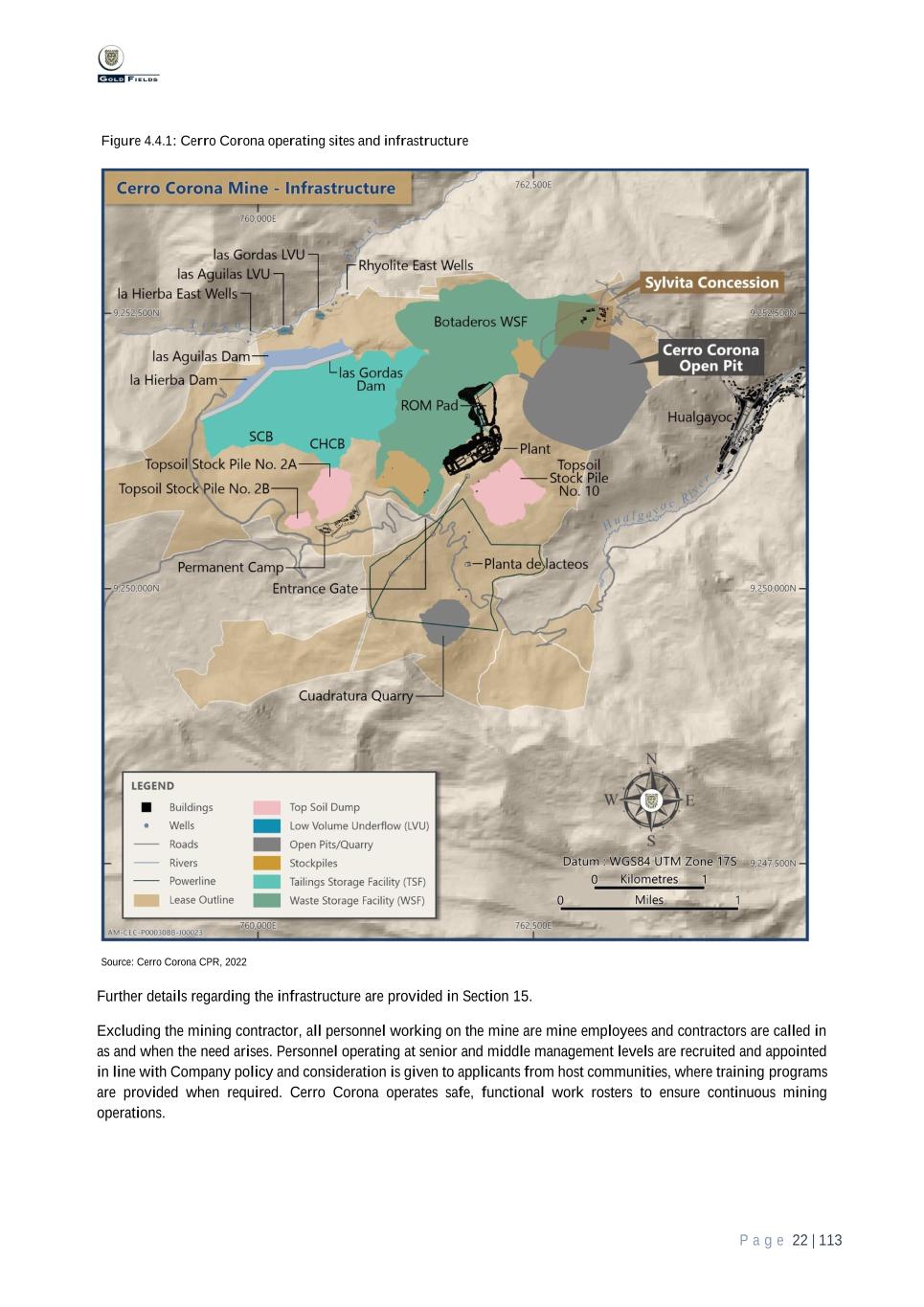

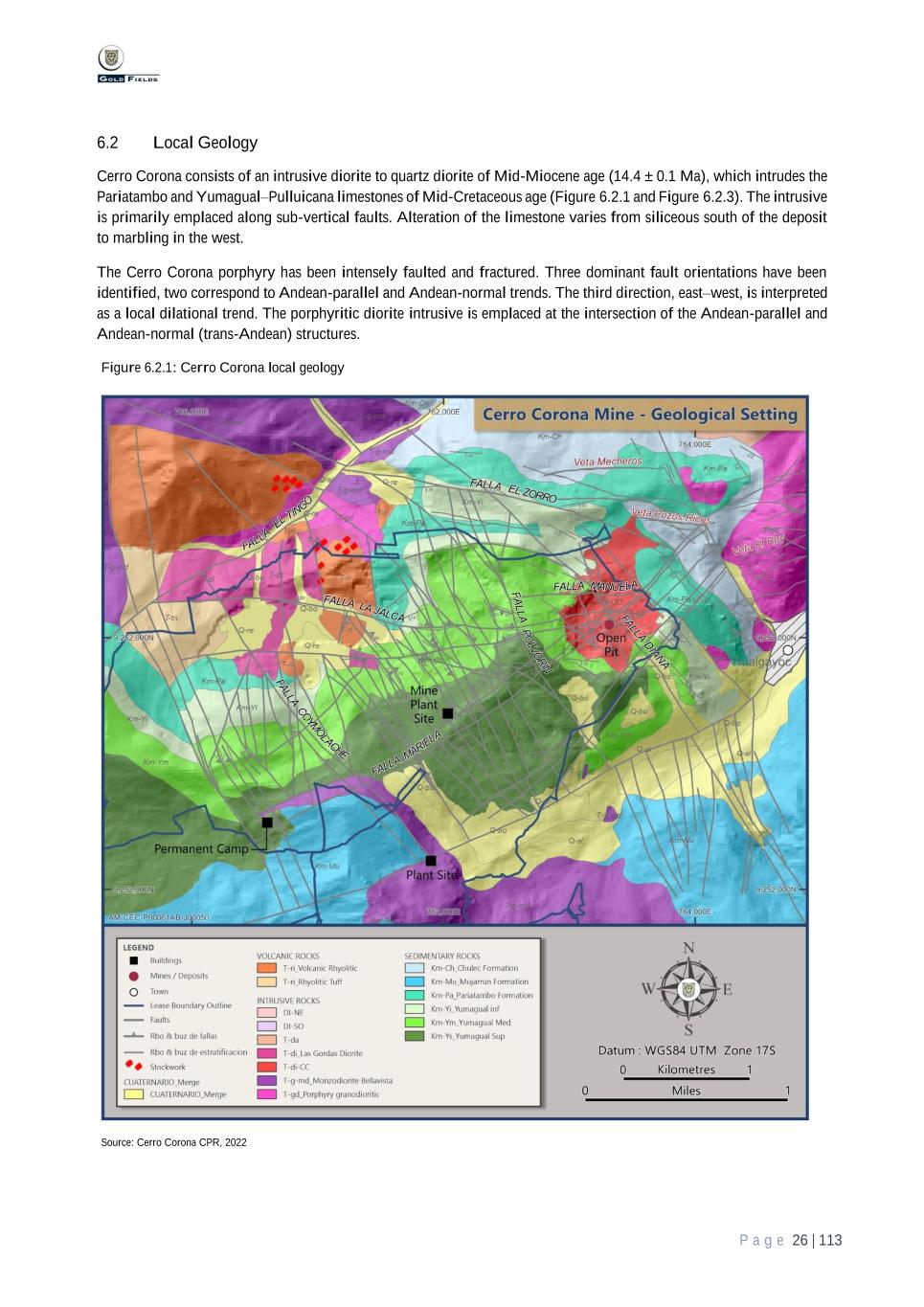

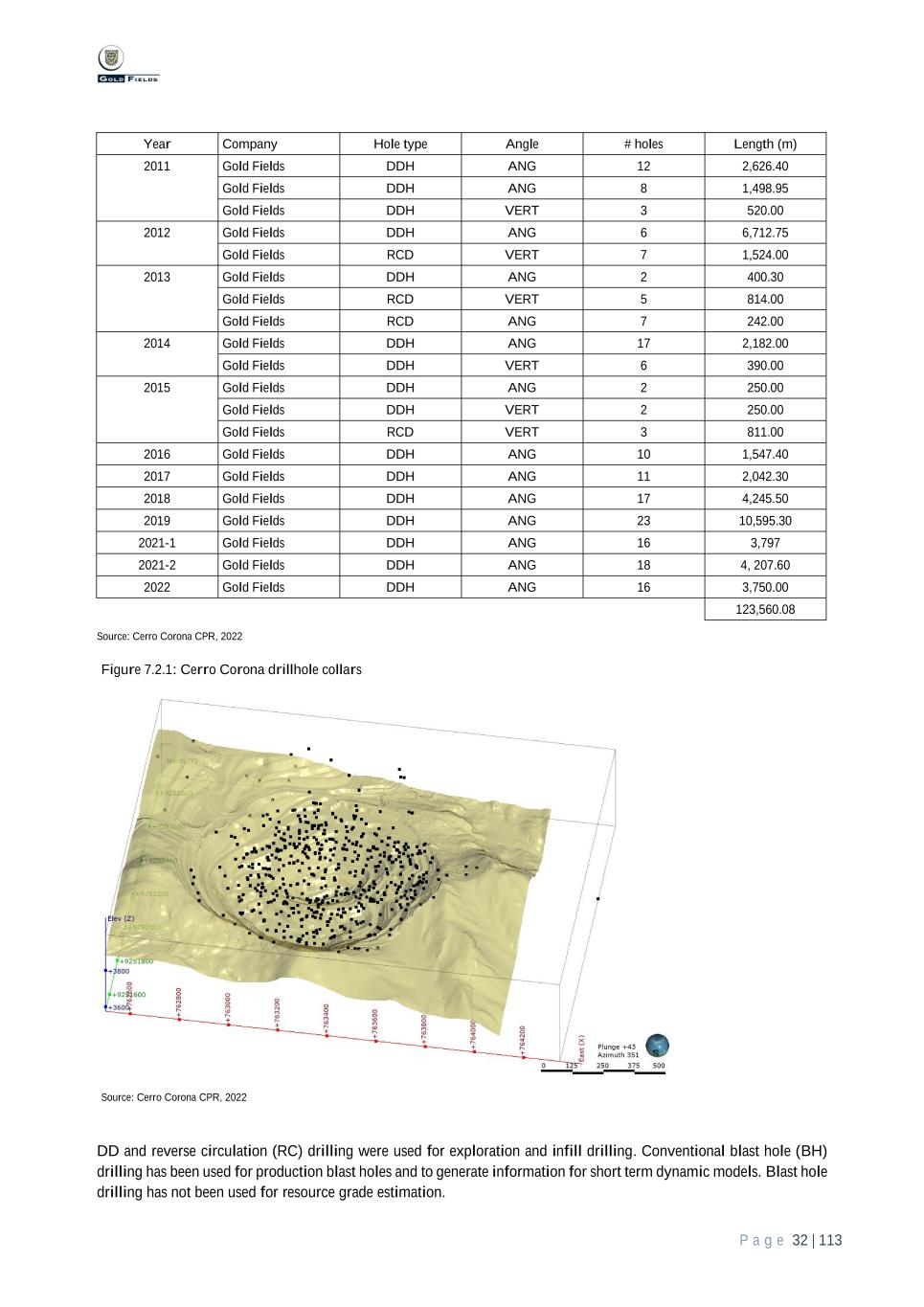

P a g e 8 | 113 1 Executive Summary This Technical Report Summary (TRS) was prepared for Gold Fields Limited (Gold Fields or the Company or the Registrant), a production stage issuer. The purpose of this TRS is to support the disclosure of exploration results, Mineral resources and Mineral reserves for the Cerro Corona Copper and Gold Mine (Cerro Corona), a production stage property located in Peru, in accordance with the disclosure requirements for mining registrants as specified in Subpart 1300 of Regulation S-K under the Securities Act of 1933 (SK 1300). The effective date of this Technical Report Summary is 31 December 2022. Unless otherwise specified, all units of currency are in United States Dollars ($). All measurements are metric with the exception of troy ounces (oz) and pounds (lb). 1.1 Property description and ownership Cerro Corona is approximately 600 km north-northwest of Lima and approximately 80 km north by road from the departmental capital of Cajamarca (Figure 1.1.1). Figure 1.1.1: Location of Cerro Corona Source: Cerro Corona CPR, 2022 Cerro Corona comprises mining concessions covering a total area of 4,804 ha and surface rights covering 1,291 ha held by Gold Fields La Cima S.A. (GFLC), a Peruvian-registered company. Gold Fields holds a 100 % interest in Gold Fields Corona (BVI) Limited, which in turn holds a 99.53 % interest in GFLC.

P a g e 9 | 113 The major components of the Cerro Corona mining and processing operation are: • Open pit mine. • Waste storage facility (WSF). • 6.7 Mt/a flotation process plant. • Tailings storage facility (TSF). • Centralised administrative office and engineering workshops. • Permanent camp. • Power substation. 1.2 Geology and mineralisation The Cerro Corona copper-gold deposit is associated with a Mid-Miocene diorite to quartz-diorite intrusive primarily emplaced along sub-vertical faults within Mid-Cretaceous limestone units. The deposit is typical of porphyry-style mineralisation, comprising an upper gold-only leached cap, underlain by mixed and supergene enriched copper zones, which overlay the variably altered hypogene portion of the deposit. The hypogene zone mineralisation is characterised by sulphide mineralisation as disseminated nodes, small patches, infill in fractures and within stockwork quartz veins. The mineralisation within the stockwork is mainly pyrite-marcasite-chalcopyrite + bornite + covellite + hematite + magnetite. 1.3 Exploration, development and operations Contract mining is employed in the open pit applying conventional drill, blast, load and haul methods. Accelerated mining based on nine separate pit stages exceeds the processing rate allowing tailings generated in the future to be placed back in the pit. Ore is stockpiled during the accelerated mining phase. Further exploration at Cerro Corona will focus on geological and geotechnical characterization, lithological continuity and structural complexity of the East Wall. 1.4 Mineral resource estimates The Cerro Corona Mineral resources exclusive of Mineral reserves as of 31 December 2022 are summarised in Table 1.4.1. The Mineral resources are 99.53 % attributable to Gold Fields and are net of production depletion up to 31 December 2022. All grades and tonnages reported are in-situ without any modifying factors applied.

P a g e 10 | 113 Table 1.4.1: Cerro Corona – summary of attributable gold and copper Mineral resources at the end of the fiscal year ended 31 December 2022 based on a gold price of $1,600/oz and copper price of $3.60/lb Resources (exclusive of Mineral reserves) NSR Cutoff Metallurgical recovery Amount/ Grade Amount Grade Amount (kt) Au/ (g/t) Au/ (koz) Cu/ (%) Cu/ (Mlbs) ($/t) Au/ (%) Cu/ (%) Open pit Mineral resources OP measured Mineral resources 33,250 0.51 547 0.34 249 16.4 75.9 88.5 OP indicated Mineral resources 7,265 0.48 113 0.31 50 16.4 76.1 88.2 OP measured + indicated Mineral resources 40,515 0.51 660 0.34 300 16.4 75.9 – 76.1 88.2 – 88.5 OP inferred Mineral resources 145 0.38 2 0.33 1 16.4 76.0 88.4 Stockpile Mineral resources SP measured Mineral resources – oxides SP measured Mineral resources – sulphide SP indicated Mineral resources SP measured + indicated Mineral resources SP inferred Mineral resources Total Cerro Corona Mineral resources Total measured Mineral resources 2022 33,250 0.51 547 0.34 249 Total indicated Mineral resources 2022 7,265 0.48 113 0.31 50 Total measured + indicated Mineral resources 2022 40,515 0.51 660 0.34 300 Total inferred Mineral resources 2022 145 0.38 2 0.33 1 Total M+I Mineral resources 2021 37,454 0.46 557 0.32 264 Total Inferred Mineral resources 2021 300 0.37 4 0.30 2 Total M+I Year on year difference (%) 8 % 10 % 19 % 5 % 13 % Total Inferred Year on year difference (%) -52 % 1 % -51 % 12 % -46 % Notes: a) Mineral resources are exclusive of Mineral reserves. Rounding of figures may result in minor computational discrepancies. b) Mineral resources categories are assigned with consideration given to geological complexity, grade variance, drillhole intersection spacing and proximity of mining development. c) Mineral resources quoted as diluted in-situ metric tonnes and grades. Metallurgical recovery factors have not been applied to the estimates. The approximate metallurgical recovery factors are 89 % to copper and 76 % to gold. The metallurgical recovery is the ratio, expressed as a percentage, of the mass of the specific mineral product recovered from ore treated at the process plant to its total specific mineral content before treatment. Cerro Corona mining operations vary according to the mix of the source material (e.g., oxide, transitional, fresh and ore type blend). d) The metal prices used for the 2022 Mineral resources are based on a gold price of $1,600 per ounce and a copper price of $3.60 per pound. Open pit Mineral resources at the South American operations are similarly based on revenue factor 1.0 pits, appropriate mine design and extraction schedules. The gold price used for Mineral resources approximates 14 % higher than the selected Mineral reserve price. e) The cutoff grade may vary per mine, depending on the respective costs, depletion schedule, ore type, expected mining dilution and expected mining recovery. The average cutoff grade value applied to the Mineral resources is: $16.4/t. f) The Mineral resources are based on initial assessments at the resource gold price of $1,600/oz and copper price of $3.60/lb consider estimates of all Cerro Corona costs, the impact of modifying factors such as mining dilution and mining recovery, processing recovery and royalties. Mineral resources are also tested through the application of Environmental, Social and Governance (ESG) criteria to demonstrate reasonable prospects for economic extraction. g) The Mineral resources are estimated at a point in time and can be affected by changes in the gold price, US Dollar currency exchange rates, permitting, legislation, costs and operating parameters. h) Cerro Corona is 99.53 % attributable to Gold Fields and is entitled to mine all declared material located within the property’s mineral leases and all necessary statutory mining authorisations and permits are in place or have reasonable expectation of being granted. Source: Cerro Corona CPR, 2022

P a g e 11 | 113 1.5 Mineral reserve estimates The Cerro Corona Mineral reserves as of 31 December 2022 are summarised in Table 1.5.1. The Mineral reserves are 99.53 % attributable to Gold Fields and are net of production depletion up to 31 December 2022. The Mineral reserves are reported in terms of run-of-mine (RoM) grades and tonnages delivered to the processing facility and are therefore fully diluted. Table 1.5.1: Cerro Corona – summary of attributable gold and copper Mineral reserves at the end of the fiscal year ended 31 December 2022 based on a gold price of $1,400/oz and copper price of $3.40/lb Amount/ Grade Amount Grade Amount Cutoff grades/ Metallurgical recovery (Kt) Au/ (g/t) Au/ (koz) Cu/ (%) Cu/ (Mlb) ($/t NSR) Au/ (%) Cu/ (%) Open Pit Mineral reserves OP proven Mineral reserves 34,705 0.56 623 0.37 284 16.4 75.8 88.8 OP probable Mineral reserves 2,006 0.47 30 0.33 14 16.4 76.0 88.3 OP total Mineral reserves 36,711 0.55 653 0.37 298 16.4 75.8 – 76.0 88.3 – 88.8 Stockpile Mineral reserves SP proven Mineral reserves 13,185 0.52 219 0.34 100 16.4 75.9 88.5 SP probable Mineral reserves SP total Mineral reserves 13,185 0.52 219 0.34 100 16.4 75.9 88.5 Total Mineral reserves Total proven Mineral reserves 47,890 0.55 842 0.36 384 Total probable Mineral reserves 2,006 0.47 30 0.33 14 Total Cerro Corona Mineral reserves 2022 49,896 0.54 872 0.36 398 Total Cerro Corona Mineral reserves 2021 58,020 0.59 1,103 0.37 474 Year-on-year difference (%) -14 % -8 % -21 % -2 % -16 % Notes: a) Rounding of figures may result in minor computational discrepancies. b) Refer to Table 12.5.1 for year-on-year Mineral reserve comparison. c) Mineral reserve quoted as mill delivered metric tonnes and RoM grades, inclusive of all mining dilutions and gold losses except mill recovery. Metallurgical recovery factors have not been applied to the Mineral reserve figures. The approximate metallurgical recovery factors are 76 % for gold and 89 % for copper. The metallurgical recovery is the ratio, expressed as a percentage, of the mass of the specific mineral product recovered from ore treated at the process plant to its total specific mineral content before treatment. The recoveries for Cerro Corona vary according to the mix of the source material (e.g., oxide, transitional fresh and ore type blend) and method of treatment. d) The metal prices used for the 2022 life-of-mine (LoM) Mineral reserves are based on a gold price of $1,400/ounce and $3.40/lb copper. Open pit Mineral reserves at Cerro Corona are based on optimised pits and appropriate mine design and extraction schedules. The gold price and copper price used for Mineral reserves is detailed in Chapter 16, Marketing. e) Dilution relates to planned and unplanned waste and/or low-grade material being mined and delivered to the process plant. Ranges are given for those operations that have multiple orebody styles and mining methodologies. The mine dilution factors are 0 %. f) The mining recovery factor relates to the proportion or percentage of ore mined from the defined orebody at the gold price used for the declaration of Mineral reserves. This percentage will vary from mining area to mining area and reflects planned and scheduled reserves against actual tonnes, grade and metal mined, with all modifying factors and mining constraints applied. The mining recovery factors are 98 %. g) The cutoff grade may vary per mine, depending on the respective costs, depletion schedule, ore type, expected mining dilution and expected mining recovery. The average NSR cutoff value applied in the planning process is $16.4/t. h) An ounces-based Mine Call Factor (metal called for over metal accounted for) determined primarily on historic performance but also on realistic planned improvements where appropriate, is applied to the Mineral reserves. A Mine Call Factor of 100 % has been applied at Cerro Corona. i) Cerro Corona is 99.53 % attributable to Gold Fields. Source: Cerro Corona CPR, 2022 1.6 Capital and operating cost estimates Major capital expenses at Cerro Corona are related to the ongoing raising of the TSF, construction of containment blankets, the WSF and the in-pit tailings facility. The total capital expenditure requirement over the life-of-mine (LOM) is estimated at $93.2 million, of this, $86.2 million (92 %) will be spent from 2023 to 2025. From 2026 onwards there only sustaining capex is planned. The capital forecast over the LOM is summarised in Table 1.6.1.

P a g e 12 | 113 Table 1.6.1: Capital costs forecast Cost item Units 2023 2024 2025 2026 2027 2028 2029 2030 Capital $ million 44.5 16.9 24.8 3.0 1.4 1.7 0.8 0.2 Note: a) The detailed capital cost schedule is presented in Table 18.1.1. b) This capital summary estimate is for the Mineral reserve LOM schedule and is on a 100 % basis. c) Closure costs are included in operating costs. Source: Cerro Corona CPR, 2022 Operating costs are prepared based on the approved mining plan schedule, with mining in the pit until 2025 and processing ore at the plant until 2030, from 2026 onwards low-grade stocks will be treated. In general, figures have been prepared based on the 2022 actual costs and the approved budget for 2023, with escalations applied and including pit closure. Mining cost estimates have been built from approved contractor rates as well as actual costs from 2022. LOM operating costs are summarised in Table 1.6.2. Table 1.6.2: Operating costs forecast Description Units 2023 2024 2025 2026 2027 2028 2029 2030 Operating costs $ million 219.1 201.9 179.9 127.3 124.1 119.9 121.4 60.5 Note: a) The detailed operating cost schedule is presented in Table 18.2.1. b) This operating cost summary estimate is for the Mineral reserve LOM schedule and is on a 100 % basis. Source: Cerro Corona CPR, 2022 The closure cost as at the end of December 2022 is estimated at $152.1 million, and has been prepared in coordination with a specialist, Ausenco. 1.7 Permitting Cerro Corona’s Environmental Impact Assessment (EIA) was approved in December 2005 allowing development activities until the approval of the operation permit (“Concesión de beneficio”) by the General Mining Bureau (GMB). The construction permit was approved in February 2006 and the Certificate of Mining issued in December 2007. The process plant and ancillary facilities were constructed, inspected and approved by GMB. Several components of the Cerro Corona construction and operations plans were modified from the plans submitted to the EIA and GMB. Eight modifications to the original EIA and thirteen Supporting Technical Reports (STR) applicable for new components or modifications that do not involve significant environmental impacts were submitted to and approved by the regulators. The eighth modification to the EIA (EIA 8) was approved by the authorities during Q4 2019, allowing an increase in the footprint of the open pit, expansion of the TSF to 3,803 masl and expansion of WSF at Arpon and Ana. An in-pit TSF will be included in the ninth modification of the EIA (EIA 9) for approval before construction commences. Compliance with EIA 9 and other permits derived from it is required before March 2026 when the first tailings material will be deposited into the open pit and is supported by a comprehensive permit application process to the regulator. The EIA modification process has already commenced, including the implementation of public participation mechanisms in the area of influence before and during EIA preparation (2021 – 2022). In addition, throughout 2021- 2022 Gold Fields carried out field work around Cerro Corona to gather environmental and social data for the EIA preparation. Gold Fields was also required to submit an additional public participation plan because of new regulations published in 2022, and the plan was approved in January 2023. Execution of this plan will begin once the EIA is admitted by the regulator for evaluation, around Q3 2023.

P a g e 13 | 113 1.8 Conclusions and recommendations The Mineral reserves currently support an 8 year LOM plan and values the Cerro Corona operation NPV at $192 million, at a gold price of $1,400/oz and copper price of $3.40/lb and a discount rate of 8.1 %. In comparison to the previous year valuation ($250 million), there has been a significant reduction, mainly due to mining depletion of reserves and higher costs in 2022 due to global inflationary pressures and an increased discount rate from 4.8 % to 8.1 %; these effects were partially offset by higher gold and copper price planning assumptions. Consequently, there has been an impairment of $63 million of the Cerro Corona CGU, $44 million after tax. The impairment calculation is based on the FVLCOD calculated using a combination of the market (resource value) and income approach using level 3 of the fair value hierarchy, in comparison to the carrying value. The main changes between 2022 and 2021 Reserves numbers are due to mining depletion during 2022, with contributions from mining cost inflation and changes in the pit design for the west wall due to definition of non- competent limestone. This has been mitigated by a pit expansion towards the northeast but has a higher stripping ratio than the west wall. Gold Fields’ commitment to materiality, transparency and competency in its Mineral resources and Mineral reserves disclosure to regulators and in the public domain is of paramount importance to the Qualified person and the Registrants Executive Committee and Board of Directors continue to endorse the company’s internal and external review and audit assurance protocols. The Qualified person is of the opinion that this report meets these requirements and there are no further recommendations regarding this disclosure. This Technical Report Summary should be read in totality to gain a full understanding of Cerro Corona’s Mineral resource and Mineral reserve estimation and reporting process, including data integrity, estimation methodologies, modifying factors, mining and processing capacity and capability, confidence in the estimates, economic analysis, risk and uncertainty and overall projected property value.

P a g e 14 | 113 2 Introduction 2.1 Registrant for whom the Technical Report Summary was prepared. This Technical Report Summary was prepared by Gold Fields La Cima S.A. representatives for Gold Fields Limited. 2.2 Terms of reference and purpose of the Technical Report Summary The purpose of this TRS is to support the disclosure of Mineral resources and Mineral reserves for the Cerro Corona Copper and Gold Mine (Cerro Corona or the Property), a production stage property located in Peru, in accordance with the disclosure requirements for mining registrants as specified in SK 1300. The Cerro Corona Technical report summary was first disclosed in 2022 with an effective date of 31 December 2021. This Technical Report Summary is effective of 31 December 2022 and is being updated primarily due to changes in the valuation of the project which have necessitated an impairment. The Mineral resources and Mineral reserves disclosed in this Technical Report Summary are reported in accordance with the South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves (SAMREC Code 2016). SAMREC is based on the Committee for Mineral Reserves International Reporting Standards (CRIRSCO) Reporting Template November 2019. Mineral resources and Mineral reserves as reported in this Technical Report Summary are also in accordance with SK 1300. 2.3 Sources of Information This Technical Report Summary is principally based on information disclosed in the “Competent Person’s Report on the Material Assets of Cerro Corona Copper and Gold Mine as of 31 December 2022” prepared by Cerro Corona management on behalf of the Company. The Competent Person’s Report (CPR) was supplemented by technical reports and studies prepared by the Company and third-party specialists engaged by the Company as cited throughout this Technical Report Summary and listed in Section 24. Reliance was also placed on certain economic, marketing and legal information beyond the expertise of the Qualified persons used in the determination of modifying factors. This information provided by the Company is cited throughout this Technical Report Summary and is listed in Section 25. All units of currency are in United States Dollars ($). All measurements are metric except for troy ounces (oz) for gold/silver and pounds (lb) for copper. 2.4 Qualified persons and details of inspection The Qualified persons responsible for the preparation of this Technical Report Summary are listed in Table 2.5.1. All the Qualified persons are eligible members in good standing of a recognised professional organisation (RPO) within the mining industry and have at least five years of relevant experience in the type of mineralisation and type of deposit under consideration and in the specific type of activity that the Qualified person is undertaking on behalf of the Company at the time this Technical Report Summary was prepared. The recognised professional organisation affiliation in good standing has been reviewed by Gold Fields. The Qualified persons have been appointed by Gold Fields. 2.5 Report version update This is the first update of the Technical Report Summary filed by Gold Fields on the Cerro Corona property in Peru, superseding the maiden TRS filed in 2022, effective date 31 December 2021.

P a g e 15 | 113 Table 2.5.1: List of Qualified persons Incumbent Employer Position Affiliation in good standing Relevant experience (years) Details of inspection Responsibility for which chapters Dr Julian Verbeek Gold Fields VP Geology and Mineral resources. Group QP FAusIMM – 207994 35 Has not attended site This document has been prepared under the supervision of and reviewed by Julian Verbeek. Chapters 1-26 Jason Sander Gold Fields VP Mining FAusIMM – 111818 27 Has not attended site Overview and review of document. Chapters 1-5, 12-13 & 15-26 Dr Winfred Assibey- Bonsu Gold Fields Group Geostatistician and Evaluator FSAIMM – 400112/00 36 Has attended site Review of Resources and Reserves. Chapters 1 – 9 & 11 & 20-26 (excluding 1.6 and 1.7) Andrew Engelbrecht Gold Fields Group Geologist MAusIMM – 224997 23 Has attended site Geology and Resources. Chapters 1 – 9 & 11 & 20-26 Peter Andrews Gold Fields VP: Geotechnical MAusIMM CP – 302255 25 Has attended site Geotechnical review. Chapters 7.4, 15.2, 17.3.2 Daniel Hillier Gold Fields VP: Metallurgy FAusIMM CP – 227106 32 Has not attended site Chapters 10 & 14 Johan Boshoff Gold Fields Group Head of Tailings FAusIMM – 1007564 27 Has attended site Tailings Review. Chapters 15.1 & 17.3.1 Andre Badenhorst Gold Fields Group Technical and Reporting Governance Manager MAusIMM – 309882 42 Has not attended site Chapters 1-26 Paul Gomez Gold Fields VP: Technical Services MAusIMM – 330373 23 Has attended site, is a Gold Fields regional Lead QP Overall conduct and standard of technical work for the purposes of estimating and reporting resources and reserves for the Americas region. Chapters 1-26 Julio Torres Gold Fields Technical Services Manager MAusIMM – 3053967 21 Has attended site is a Gold Fields employee and site Lead QP Overall conduct and standard of technical work for the purposes of estimating and reporting resources and reserves for the Cerro Corona mine. Chapters 1-26 Jony Yupa Gold Fields Mine Planning Superintendent MAusIMM – 3055128 16 Has attended site is a Gold Fields employee and site QP Responsible for Pit optimization declaration to resources, reserves, scheduling mine plan. Chapters 1-26 Joel Mejia Gold Fields Resources Geologist Supervisor AusIMM – 317107 16 Has attended site is a Gold Fields employee and site QP Responsible for the compilation of this declaration as well as resource evaluation and modelling. Chapters 6-9 & 11 Notes: a) The Qualified persons where not all able to attend site in 2022 for Mineral reserve and Mineral resource reviews, however, the Mineral reserve and Mineral resource were reviewed according to the Chapter 21 description (virtual reviews). Some Qualified persons have attended historically. Source: Cerro Corona CPR, 2022

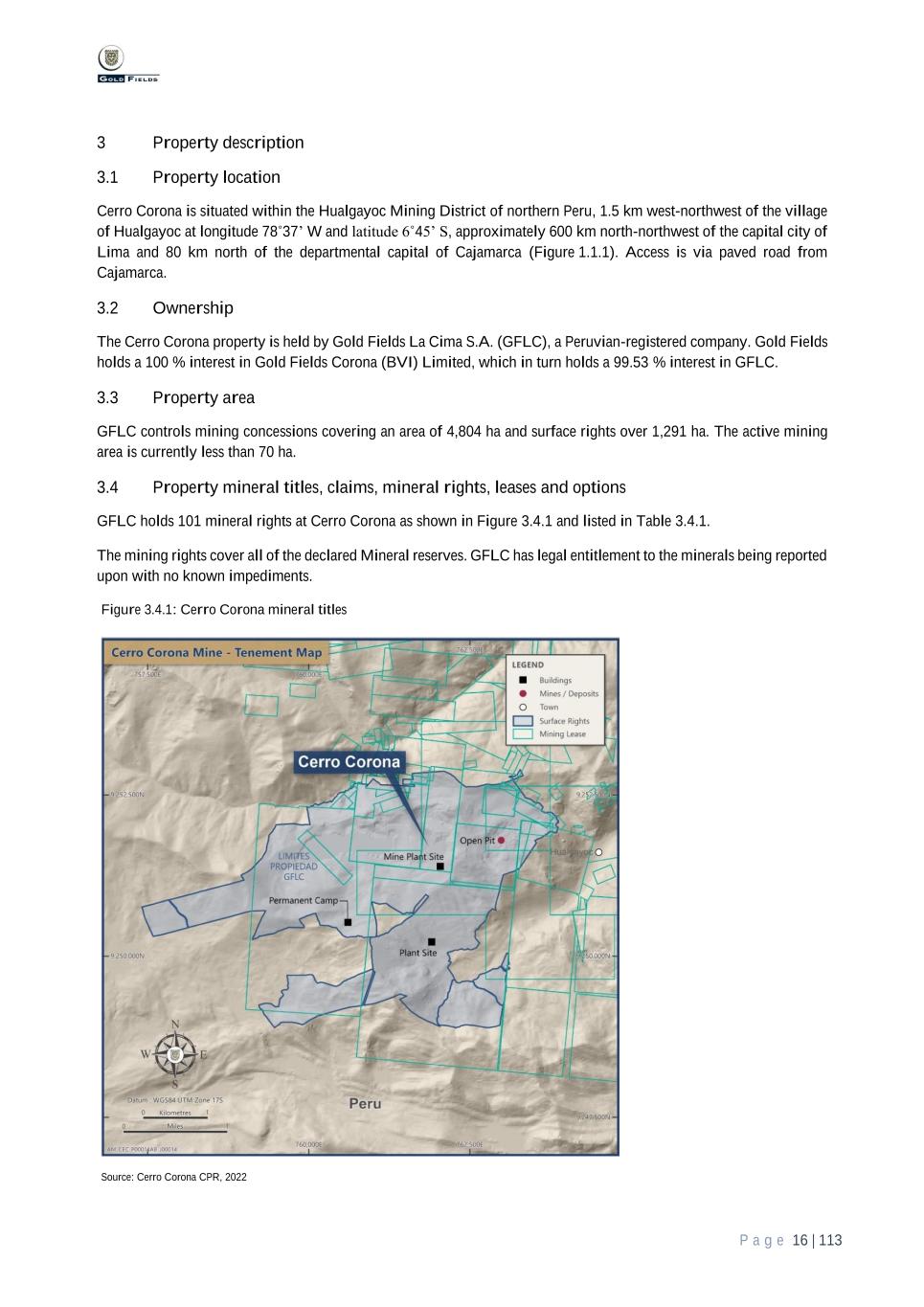

P a g e 16 | 113 3 Property description 3.1 Property location Cerro Corona is situated within the Hualgayoc Mining District of northern Peru, 1.5 km west-northwest of the village of Hualgayoc at longitude 78˚37’ W and latitude 6˚45’ S, approximately 600 km north-northwest of the capital city of Lima and 80 km north of the departmental capital of Cajamarca (Figure 1.1.1). Access is via paved road from Cajamarca. 3.2 Ownership The Cerro Corona property is held by Gold Fields La Cima S.A. (GFLC), a Peruvian-registered company. Gold Fields holds a 100 % interest in Gold Fields Corona (BVI) Limited, which in turn holds a 99.53 % interest in GFLC. 3.3 Property area GFLC controls mining concessions covering an area of 4,804 ha and surface rights over 1,291 ha. The active mining area is currently less than 70 ha. 3.4 Property mineral titles, claims, mineral rights, leases and options GFLC holds 101 mineral rights at Cerro Corona as shown in Figure 3.4.1 and listed in Table 3.4.1. The mining rights cover all of the declared Mineral reserves. GFLC has legal entitlement to the minerals being reported upon with no known impediments. Figure 3.4.1: Cerro Corona mineral titles Source: Cerro Corona CPR, 2022

P a g e 17 | 113 Table 3.4.1: List of Cerro Corona mineral right No. Code Name Title Year Available ha. License fee Minimum production Penalty Minimum investment (USD) (PEN) (PEN) (PEN) 1 03000223X01 22 DE ENERO 1966 2.00 6.00 8,800 175.96 1,759.6 2 010001701L ACUMULACION CHELITA 2002 210.38 631.15 925,672 18,513.66 185,136.6 3 03003400X01 ALEJANDRITO MP 1991 7.74 23.23 34,056 681.44 6,814.4 4 03000715Y01 ALFA 23-I (accumulate) 1985 107.06 321.19 471,064 - - 5 03000716Y01 ALFA 23-II (accumulate) 1985 24.77 74.30 108,988 - - 6 03000721Y01 ALFA 23-III (accumulate) 1986 46.98 140.93 206,712 4,134.07 41,340.7 7 03003205X01 ALFA 23-IV (accumulate) 1986 4.97 14.91 21,868 437.43 4,374.3 8 03002892X01 ALFA -G 200 0.13 0.39 572 11.34 113.4 9 03001066X01 ALFA VEINTITRES 1983 79.98 239.93 351,912 - - 10 03002889X01 ALFA-C 1991 1.64 4.93 7,216 - - 11 03002896X01 ALFA-D 1991 0.19 0.58 836 - - 12 03002890X01 ALFA-E 2000 0.14 0.43 616 - - 13 03002891X01 ALFA-F 1991 0.71 2.14 3,124 62.83 628.3 14 03002897X01 ALFA-H 1991 0.78 2.35 3,432 - - 15 03002893X01 ALFA-J 1991 1.54 4.61 6,776 135.19 1,351.9 16 03002900X01 ALFA-M 2000 0.08 0.23 352 6.87 68.7 17 010231904 AMANECER MINERO GF 2004 0.57 1.71 2,508 50.06 500.6 18 03002283X01 ANCLA 2000 1.56 4.69 6,864 137.51 1,375.1 19 0302283AX01 ANCLA A-4 (fraccionado) 2000 3.89 11.68 17,116 342.74 3,427.4 20 0302283BX01 ANCLA A-5 (fraccionado) 2000 12.86 38.59 56,584 1,132.01 11,320.1 21 03003206X01 ARPON 19-I (accumulate) 1988 55.56 166.69 244,464 - - 22 03002887X01 ARPON -A 1995 4.61 13.84 20,284 - - 23 03003101X01 ARPON C 1998 0.84 2.52 3,696 - - 24 03001067X01 ARPON DIECINUEVE 1981 89.97 269.91 395,868 - - 25 03000376X01 BELLA UNION 1966 49.99 149.97 219,956 4399.08 43,990.8 26 03001366X01 CALIZA 1998 32.83 98.48 144,452 2,888.73 28,887.3 27 03001629X01 CAÑON 1975 89.98 269.95 395,912 - - 28 03001700X01 CAPRICORNIO 2000 2.64 7.93 11,616 232.56 2,325.6 29 010265003 CAROLINA UNO 2003 2004 7.24 21.72 31,856 - - 30 03000907X01 CASUALIDAD 1969 284.98 854.95 1,253,912 25,078.42 250,784.2 31 03002064X01 CERRO 1995 166.63 499.88 733,172 - - 32 03002438X01 CERRO-A 1994 129.97 389.90 571,868 11,437.01 114,370.1 33 03001014X02 CHELA VEINTIDOS 1968 10.00 29.99 44,000 - - 34 03002144X01 CORDILLERA 2000 442.40 1327.19 1,946,560 38,930.90 389,309.0 35 03002153X01 CORDILLERA – B 1999 375.89 1127.68 1,653,916 33,078.67 330,786.7 36 010050310 CORONA NW 2011 1.19 3.58 5,236 104.97 1,049.7 37 03002331X01 DEMASIA PAMPA DE NAVAS 2000 0.01 0.03 44 - - 38 03001043X01 DON PACO 1968 38.99 116.98 171,556 3,431.28 34,312.8 39 03002145X01 DOS AMIGOS 1999 14.99 44.98 65,956 1,319.54 13,195.4 40 0302146AX01 EL MANJAR N°2-A3 (fraccionado) 2000 1.60 4.79 7,040 140.50 1,405.00 41 0302146BX01 EL MANJAR N°2-A4 (fraccionado) 2000 44.16 132.49 194,304 3,886.34 38,863.4 42 0302146CX01 EL MANJAR N°2-A6 (fraccionado) 2000 6.87 20.60 30,228 604.30 6,043.0 43 0302146DX01 EL MANJAR N°2-A7 (fraccionado) 2000 3.96 11.89 17,424 348.68 3,486.8 44 0302146EX01 EL MANJAR N°2-A8 (fraccionado) 2000 217.25 651.74 955,900 19,117.62 191,176.2 45 03001926X01 EL MESIAS 1978 |167.96 503.89 739,024 14,780.80 147,808.0 46 0302960BX01 ENSENADA-MC 2001 0.36 1.07 1,584 31.39 313.9 47 0302964BX01 FORTUNA I-M.C. 2000 7.80 23.40 34,320 686.45 6,864.5 48 03001916X01 FUMISA N°1 2000 74.70 224.11 328,68 6573.86 65,738.6 49 03001917X01 FUMISA N°2 2000 62.64 187.91 275,616 5,512.13 55,121.3 50 03001918X01 FUMISA N°3 2000 19.99 59.98 87,956 - - 51 03002736X01 FUMISA N°3-A 2000 4.51 13.53 19,844 - - 52 03002737X01 FUMISA N°3-B 1998 2.00 5.99 8,800 - -

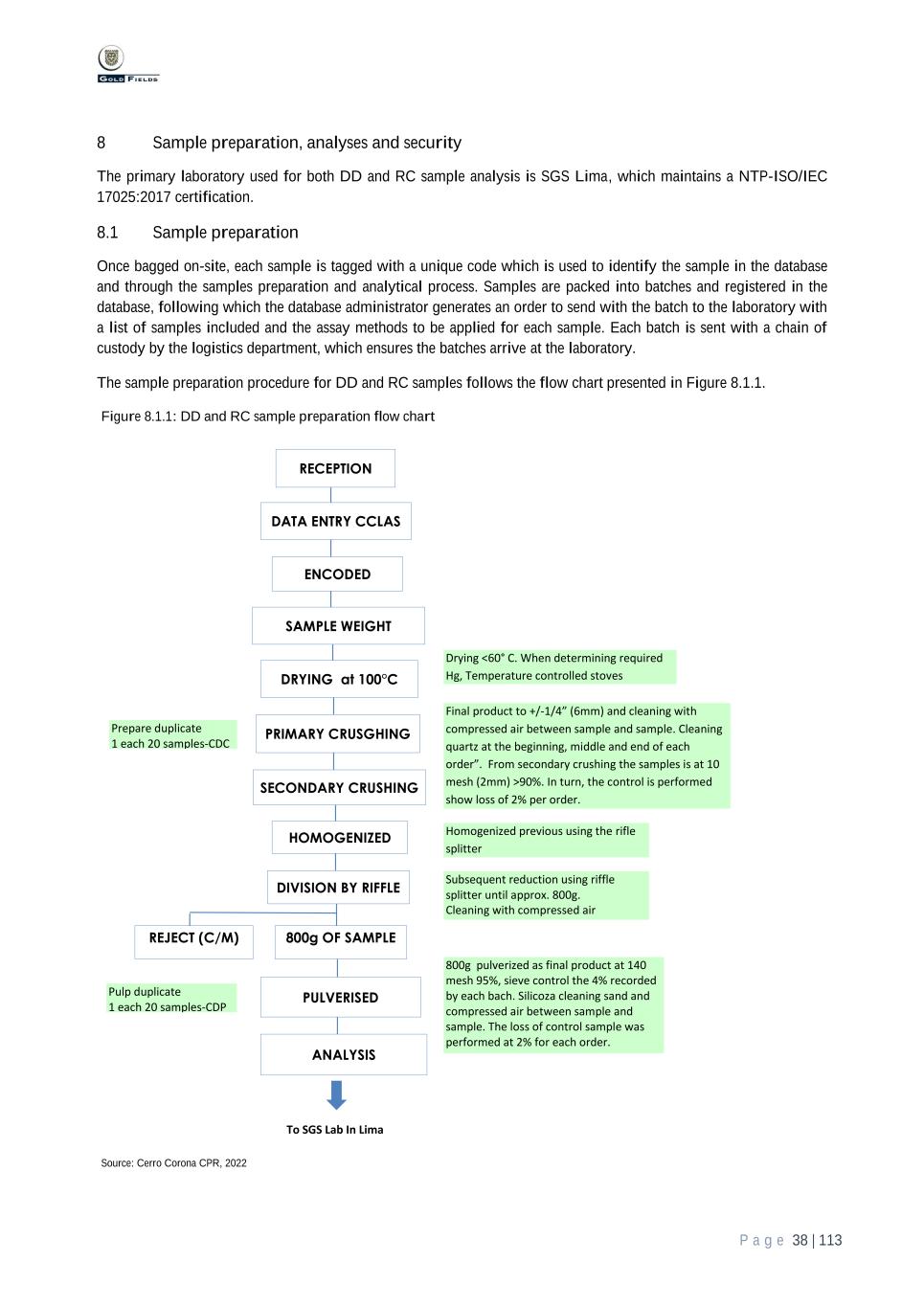

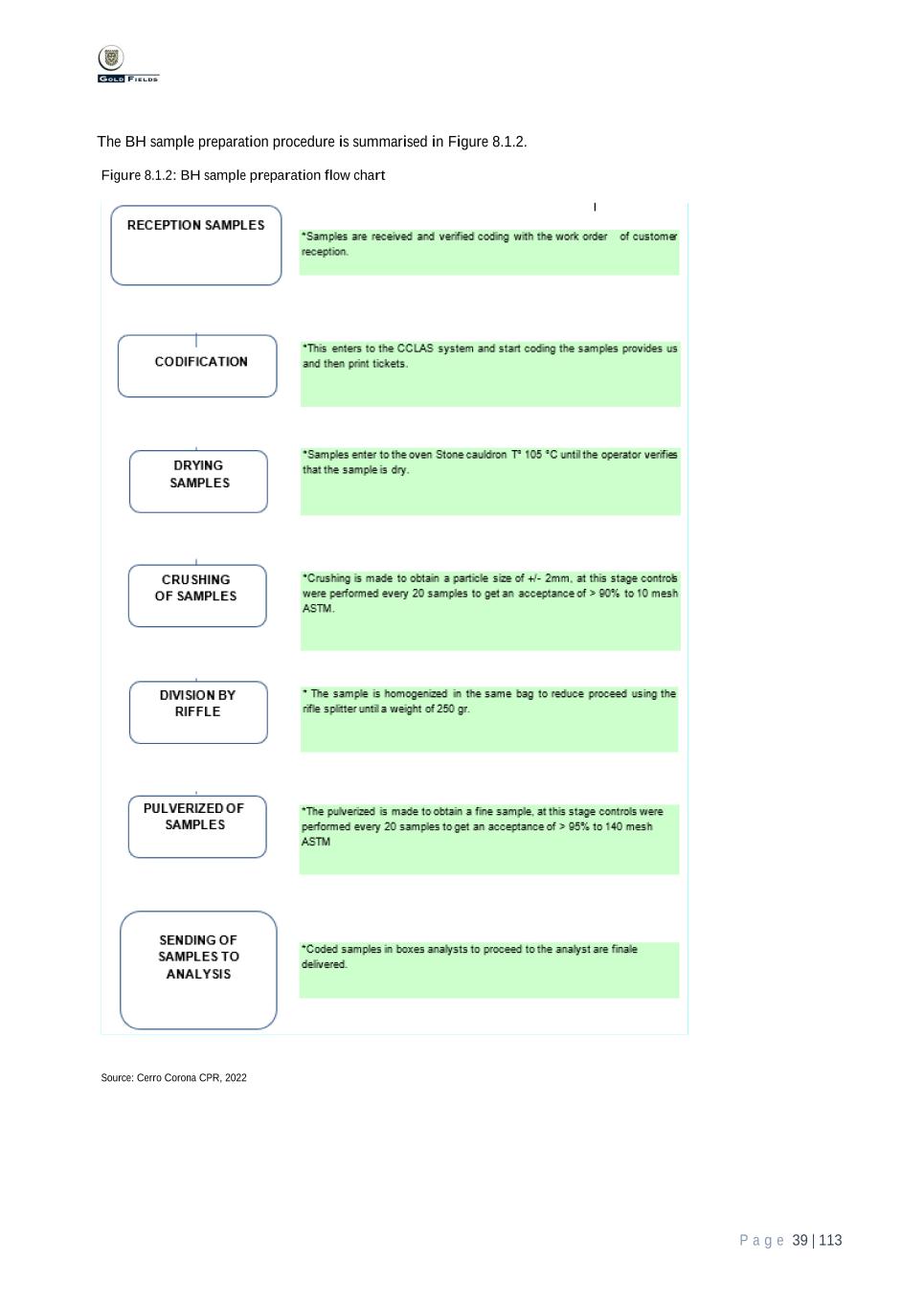

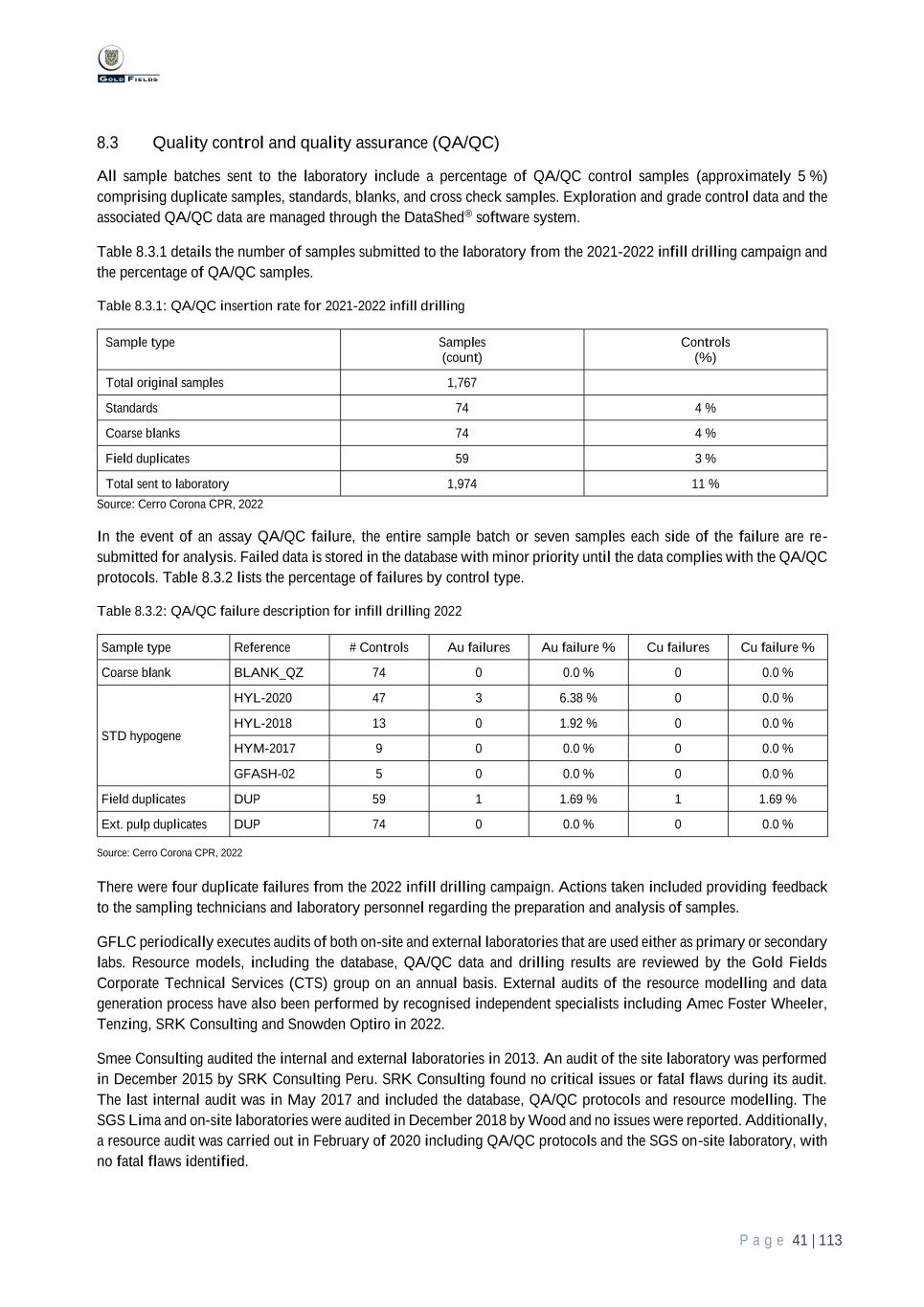

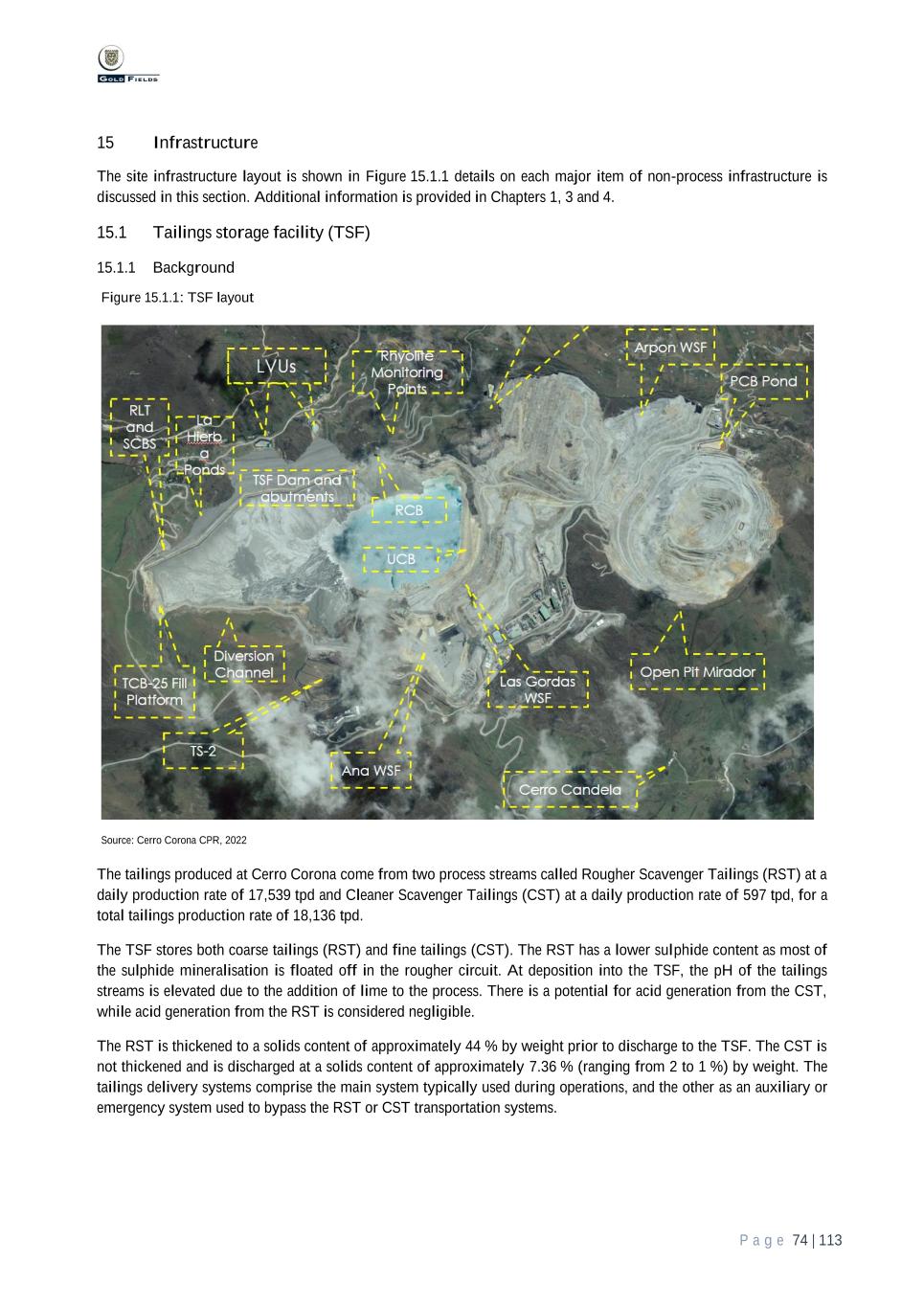

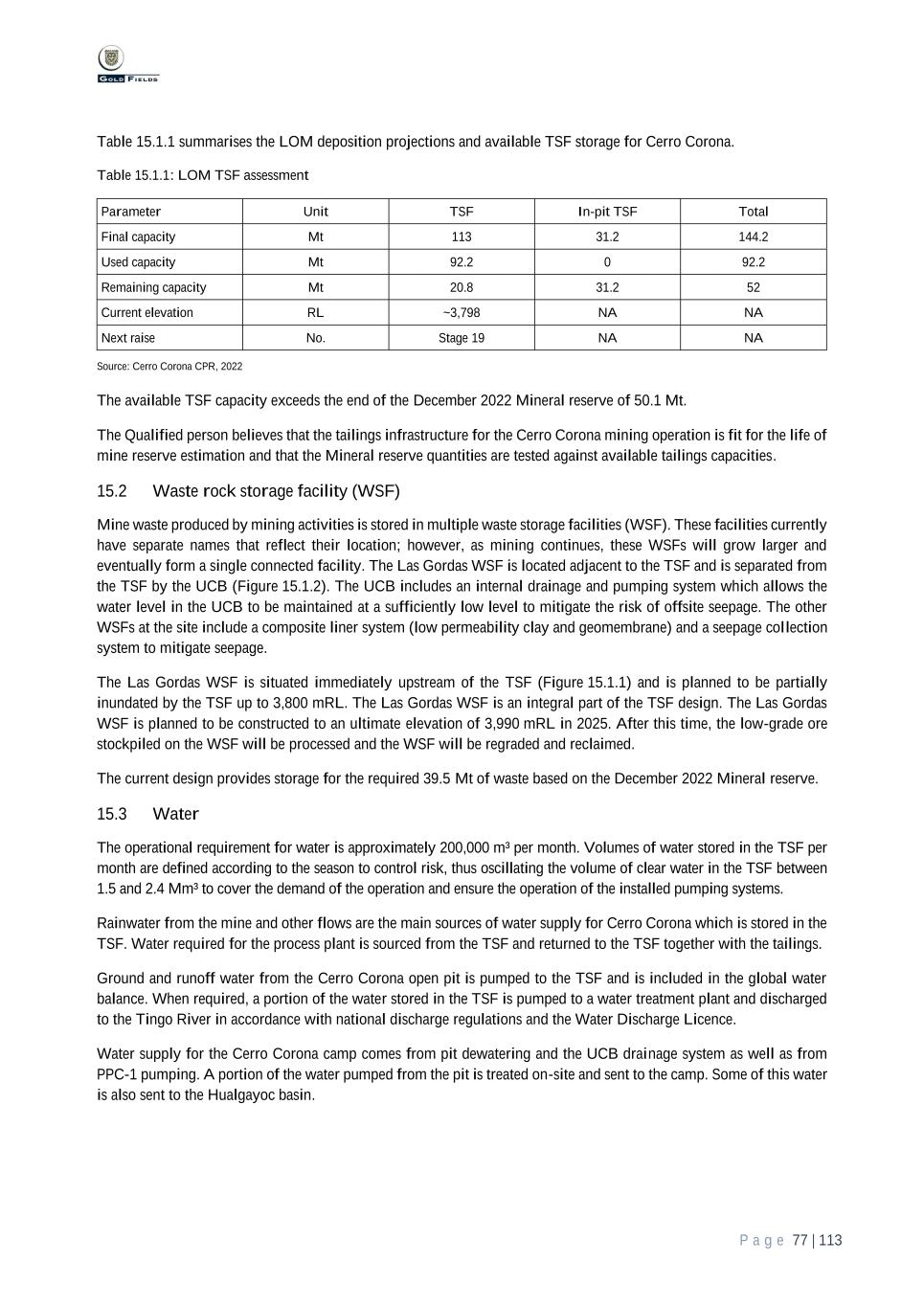

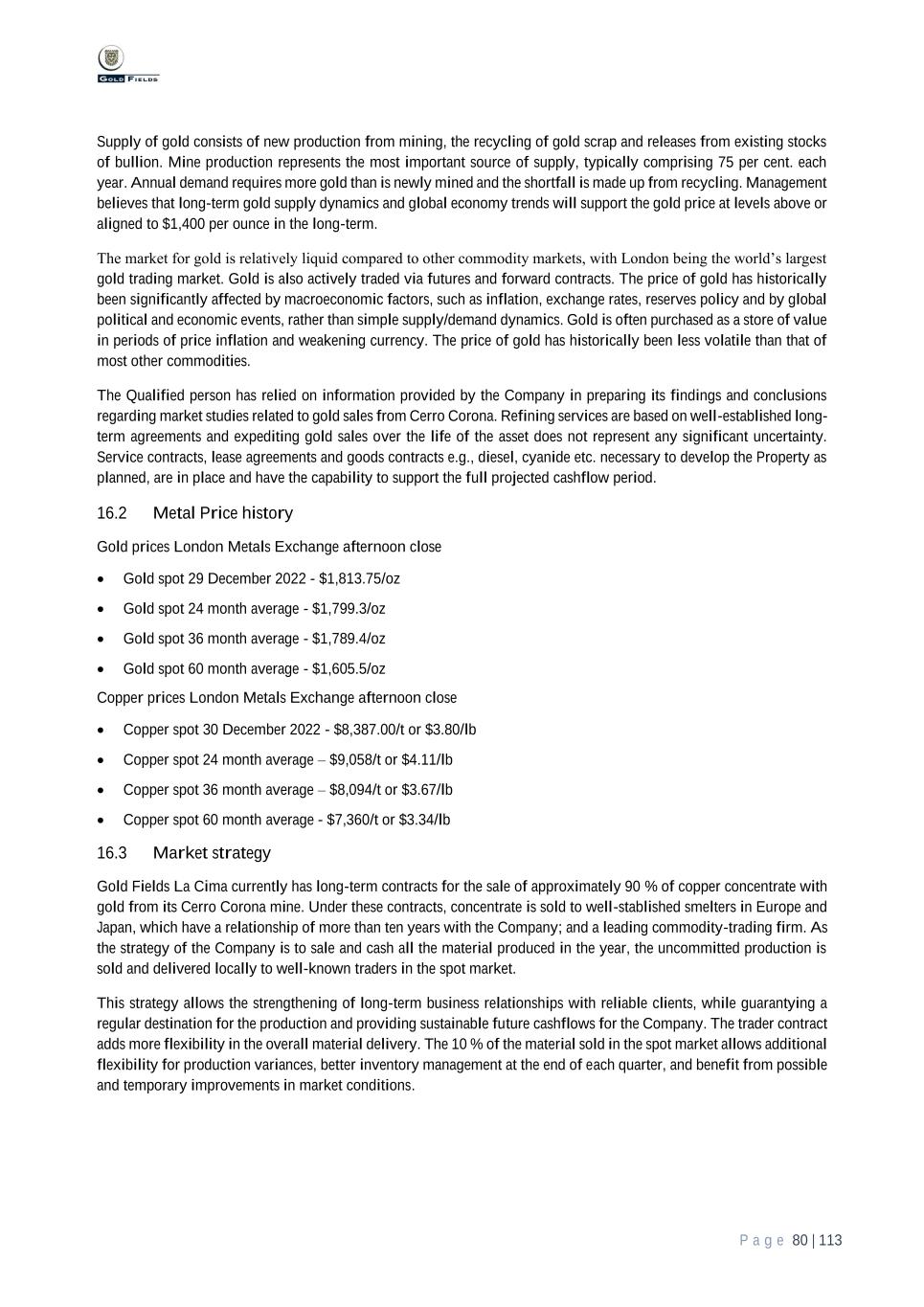

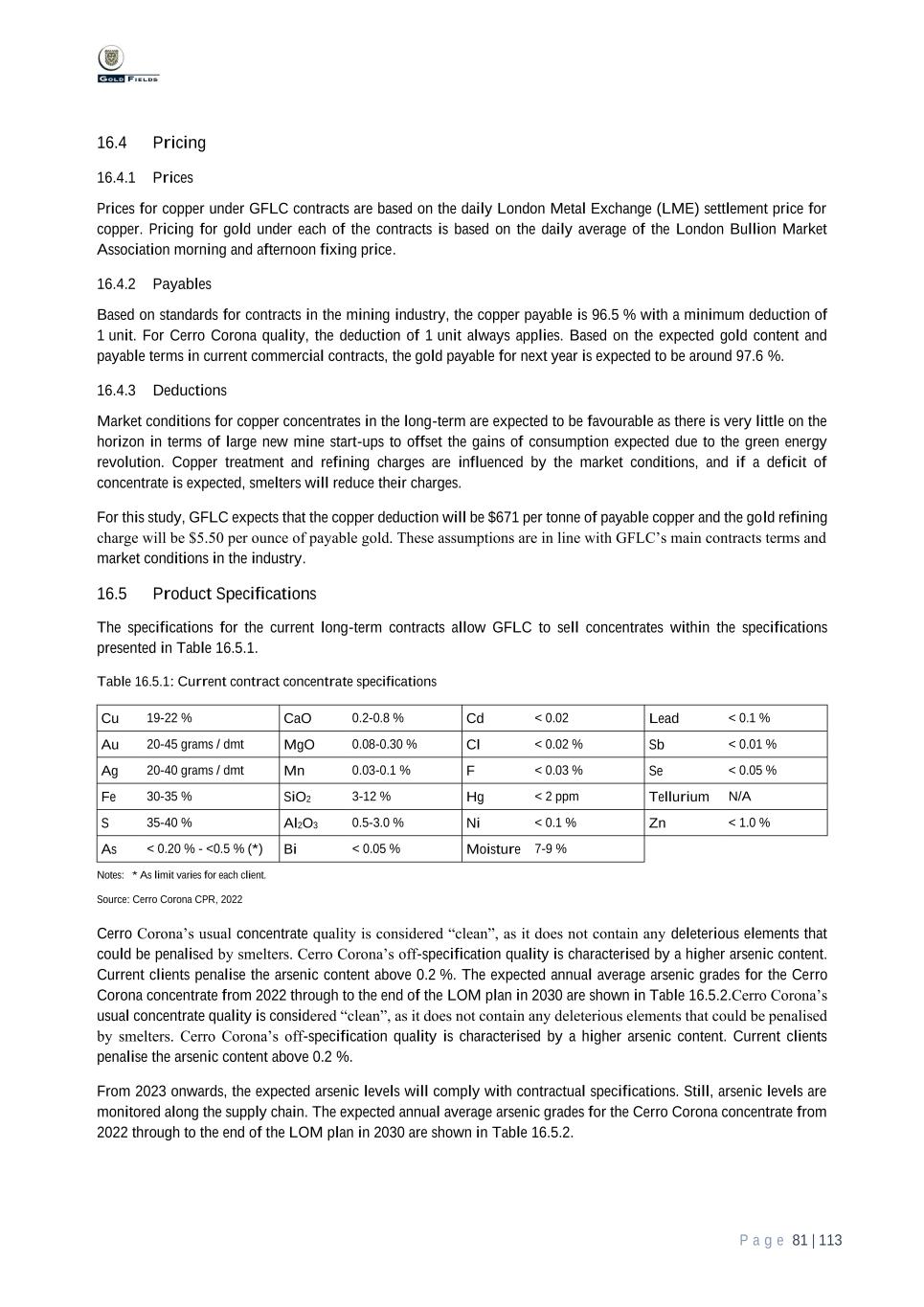

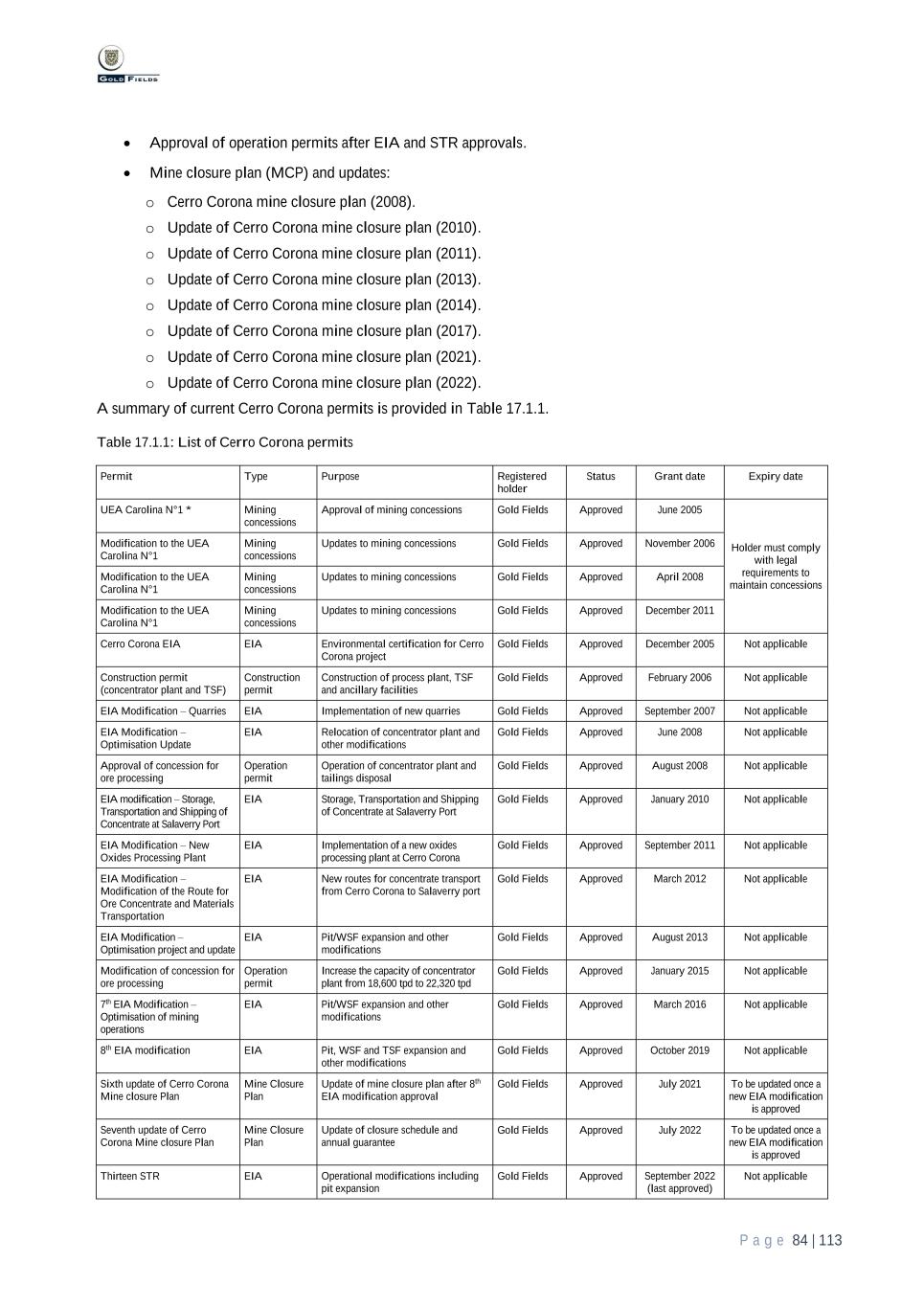

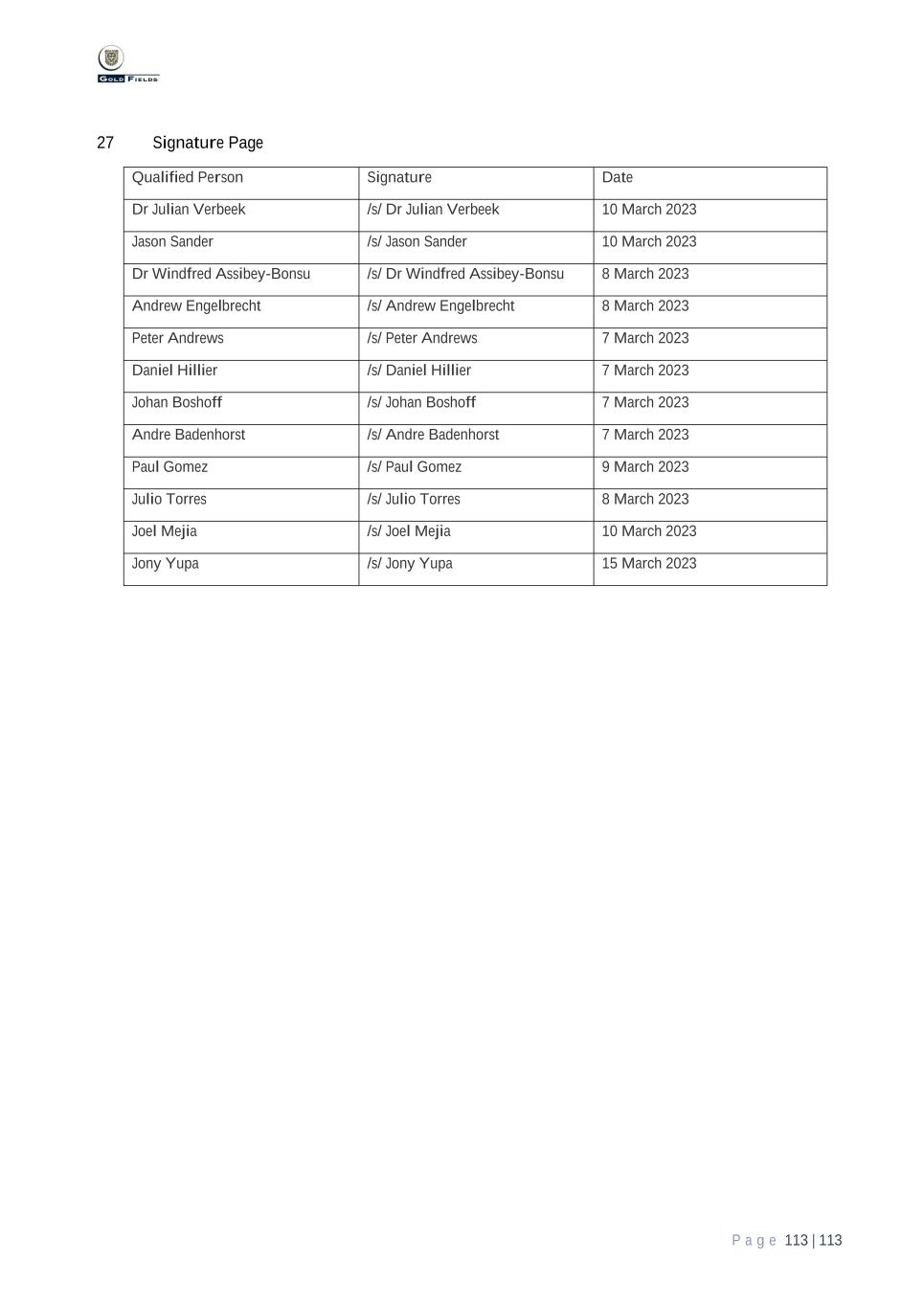

P a g e 18 | 113 No. Code Name Title Year Available ha. License fee Minimum production Penalty Minimum investment (USD) (PEN) (PEN) (PEN) 53 03002746X01 FUMISA N°3-H 2000 0.58 1.73 2,552 - - 54 0302746AX01 FUMISA N°3-H-A2 (fraccionado) 2000 1.77 5.30 7,788 - - 55 03003451X01 GEMELA DERECHA M.R. 2000 0.11 0.33 484 9.72 97.20 56 0303451AX01 GEMELA DERECHA M.R. -A4 (fraccionado) 2000 1.08 3.25 4,752 95.43 954.3 57 03001228X01 JAPON TRECE 1999 6.00 18.00 26,400 527.89 5,278.9 58 03003661X01 JUAN XXIII 2001 0.19 0.58 836 - - 59 03002199X01 LA INCREIBLE 2000 1.94 5.82 8,536 170.76 1,707.6 60 0302212DX01 LAGO AL-4 (fraccionado) 2000 6.38 19.15 28,072 561.70 5,617.00 61 03000950X01 LUCIA N°1 1983 12.00 35.99 52,800 1,055.74 10,557.4 62 03000023X01 MARUJA 1A 1967 1.66 4.99 7,304 146.24 1,462.4 63 0303613AX01 MILAGRITOS G.A.-A1 (fraccionado) 2000 1.52 4.55 6,688 133.58 1,335.8 64 03003613X01 MILAGRITOS-G.A. 2000 0.27 0.81 1,188 23.85 238.5 65 03000479X01 NANCY 1967 12.00 35.99 52,800 - - 66 03000078X01 NILDA 1968 10.00 29.99 44,000 - - 67 03003324X01 OLVIDADA 2000 0.39 1.16 1,716 33.99 339.9 68 03000267X01 ORLANDITO 1964 17.99 53.98 79,156 1583.49 15,834.9 69 03000144X01 ORLANDO 1964 23.99 71.98 105,556 2,111.35 21,113.5 70 03000151X01 ORLANDO I 1961 43.99 131.96 193,556 3,870.70 38,707 71 03000152X01 ORLANDO II 1961 17.99 53.98 79,156 1,583.44 15,834.4 72 03000156X01 ORLANDO III 1961 6.00 17.99 26,400 527.84 5,278.4 73 0303236CX01 PATY M.C. (fraccionado) 2000 49.68 149.04 218,592 4,371.73 43,717.3 74 0303236AX01 PATY-M.C. 2000 0.06 0.18 264 5.34 53.4 75 03000943X01 PORCIA N°1 1967 3.00 9.00 13,200 - - 76 03002213X01 PORCIA N°2 2000 0.33 1.00 1,452 29.39 293.9 77 0302213AX01 PORCIA N°2-A1 (fraccionado) 2000 3.47 10.42 15,268 305.72 3,057.2 78 03002211X01 PORCIA N°3 2000 3.65 10.94 16,060 320.94 3,209.4 79 03001206X01 PREDILECTA 1956 6.00 18.00 26,400 - - 80 010070004 PROYECTO 2004 2004 16.59 49.77 72,996 - - 81 03000403X01 PUNTO VICTORIA SEIS 1968 29.99 89.98 131,956 2,639.38 26,393.8 82 03001032X01 QUIJOTE 2000 0.28 0.85 1,232 24.94 249.4 83 03001824X01 QUIJOTE N°2 2000 9.00 27.00 39,600 791.97 7,919.7 84 0301032AX01 QUIJOTE-A1 2000 47.20 141.61 207,680 4,154.00 41,540 85 03002204X01 REDENCION 1998 2.92 8.76 12,848 - - 86 03000158X01 RULITO 1965 39.99 119.96 175,956 3,518.87 35,188.7 87 010236794 SAN JOSE N° 1 2003 102.32 306.95 450,208 9,003.98 90,039.8 88 010778195 SAN JOSE N°1-A 2002 153.85 461.55 676,940 13,538.89 135,388.9 89 03000176X01 SAN RAMON 1985 5.63 16.90 24,772 - - 90 03001022X01 SANTA BARBARA 1936 4.00 12.00 17,600 352.00 3520.00 91 010164412 SENECA 2013 2.69 8.06 11,836 - - 92 03000135X01 SYLVITA 1961 19.99 59.98 87,956 - - 93 03002284X01 TARA 2000 0.37 1.11 1628 - - 94 0302284AX01 TARA A-1 (fraccionado) 2000 7.24 21.73 31,856 637.27 6,372.70 95 0302284BX01 TARA A-2 (fraccionado) 2000 25.34 76.01 111,496 2,229.61 22.296.1 96 0302284CX01 TARA-A-3 (fraccionado) 2000 9.22 27.66 40,568 811.32 8,113.2 97 0302284DX01 TARA-A-4 (fraccionado) 2000 1.22 3.65 5,368 107.07 1,070.7 98 03002219X01 TRINITARIA V 2000 0.35 1.05 1,540 30.74 307.4 99 03002471X01 VALE 2000 533.73 1601.19 2,348,412 - - 100 03002085X01 VALLE 1994 615.83 1847.50 2,709,652 - - 101 03002350X01 VALLE -A 1997 23.79 71.38 104,676 - - Total (ha) 4,804.06 Notes: a) The Qualified persons opinion is that licenses and tenements are in good standing to enable execution of the life-of-mine plan and can be renewed or extended as required. Source: Cerro Corona CPR, 2022