Exhibit 3.1

Schedule / Annexe

Amendment Schedules / Annexes - Modification

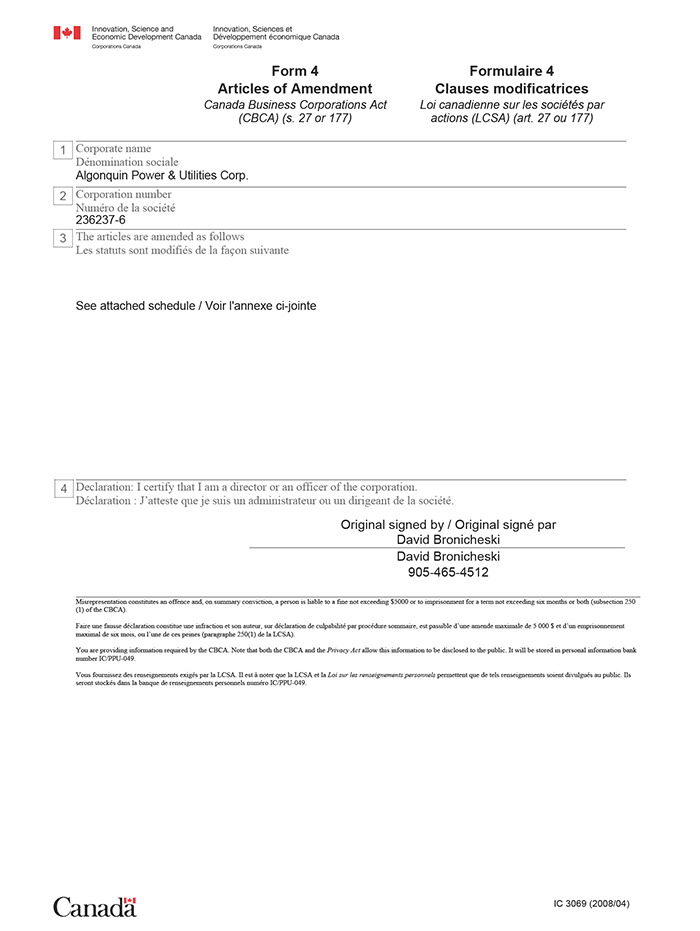

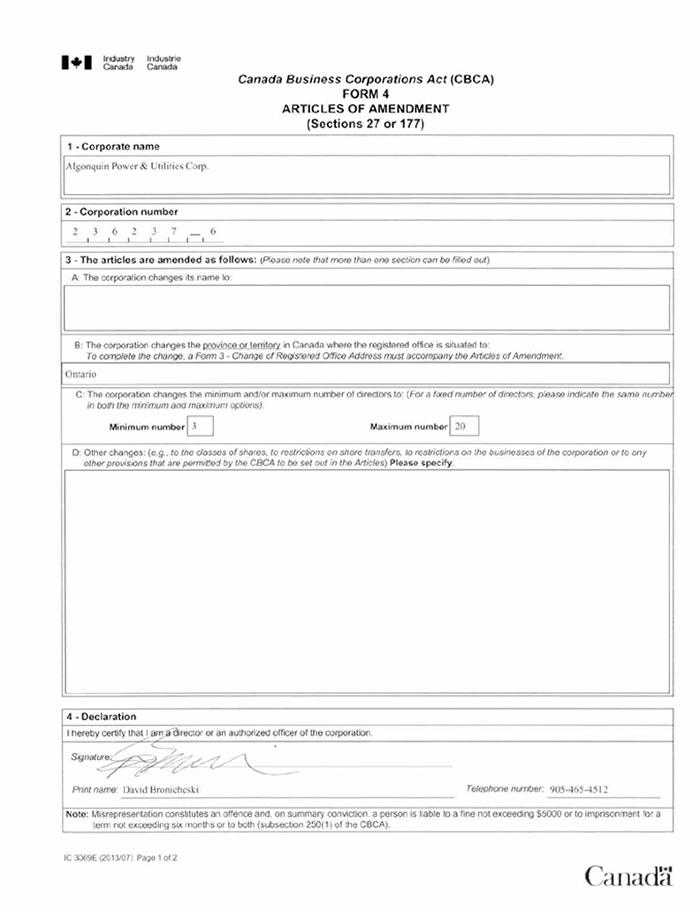

The articles of the Corporation are amended to increase the classes and any maximum number of shares that the Corporation is authorized to issue by creating an unilimited number of Preferred Shares, Series F. The rights, privileges, restrictions and conditions attaching to the Preferred Shares, Series F are set out on the schedule annexed to these articles, which schedule is incorporated into that form.

PROVISIONS ATTACHING TO

FIXED-TO-FLOATING PREFERRED SHARES, SERIES F

OF

ALGONQUIN POWER & UTILITIES CORP.

(the “Corporation”)

The sixth series of preferred shares, designated as Preferred Shares, Series F (the “Preferred Shares, Series F”), shall consist of such number of shares as are required to be issued by the Corporation upon the occurrence of an Automatic Conversion Event (as defined below) and which, in addition and subject to the rights, privileges, restrictions and conditions attaching to the preferred shares as a class, shall have attached thereto the following rights, privileges, restrictions and conditions.

1. DEFINITION OF TERMS

The following definitions are relevant to the Preferred Shares, Series F:

“Act” means the Canada Business Corporations Act;

“Automatic Conversion Event” means an event giving rise to an automatic conversion of Notes — Series 2018-A, without the consent of the holders of such notes and pursuant to the terms and conditions of the Indenture, into Preferred Shares, Series F, and specifically, meaning the occurrence of any one of the following: (i) the making by the Corporation of a general assignment for the benefit of its creditors or a proposal (or the filing of a notice of its intention to do so) under the Bankruptcy and Insolvency Act (Canada); (ii) any proceeding instituted by the Corporation seeking to adjudicate it as bankrupt (including any voluntary assignment in bankruptcy) or insolvent or, where the Corporation is insolvent, seeking liquidation, winding up, dissolution, reorganization, arrangement, adjustment, protection, relief or composition of its debts under any law relating to bankruptcy or insolvency in Canada, or seeking the entry of an order for the appointment of a receiver, interim receiver, trustee or other similar official for the Corporation or any substantial part of its property and assets in circumstances where the Corporation is adjudged as bankrupt (including any voluntary assignment in bankruptcy) or insolvent; (iii) a receiver, interim receiver, trustee or other similar official is appointed over the Corporation or for any substantial part of its property and assets by a court of competent jurisdiction in circumstances where the Corporation is adjudged as bankrupt (including any voluntary assignment in bankruptcy) or insolvent under any law relating to bankruptcy or insolvency in Canada; or (iv) any proceeding is instituted against the Corporation seeking to adjudicate it as bankrupt (including any voluntary assignment in bankruptcy) or insolvent, or where the Corporation is insolvent, seeking liquidation, winding up, dissolution, reorganization, arrangement, adjustment, protection, relief or composition of its debts under any law relating to bankruptcy or insolvency in Canada, or seeking the entry of an order for the appointment of a receiver, interim receiver, trustee or other similar official for the Corporation or any substantial part of its property and assets in circumstances where the Corporation is adjudged as bankrupt or insolvent under any law relating to bankruptcy or insolvency in Canada, and either such proceeding has not been stayed or dismissed within sixty (60) days of the institution of any such proceeding or the actions sought in such proceedings occur (including the entry of an order for relief against the Corporation or the appointment of a receiver, interim receiver, trustee, or other similar official for it or for any substantial part of its property and assets);

“Board of Directors” means the board of directors of the Corporation;

“Business Day” means a day other than a Saturday or Sunday or civic holiday on which chartered banks are open for business in the City of Toronto, Ontario;

“Common Shares” means the common shares of the Corporation;

“Dividend Payment” means dividends payable on a Dividend Payment Date;

“Dividend Payment Date” means January 17, April 17, July 17 and October 17 of each year during which any Preferred Shares, Series F are issued and outstanding;

“Indenture” means the Indenture, to be dated on or about October 17, 2018, among the Corporation, American Stock Transfer and Trust Company, LLC, as U.S. trustee (the “U.S. Trustee”), and AST Trust Company (Canada), as Canadian co-trustee (the “Canadian Co-Trustee”) as supplemented by the First Supplemental Indenture, to be dated on or about October 17, 2018, among the Corporation, the U.S. Trustee and the Canadian Co-Trustee;

“ITA” means the Income Tax Act (Canada) and the regulations thereunder, as amended from time to time, and any successor or replacement provision of similar effect;

“Notes — Series 2018-A” means the 6.875% Fixed-to-Floating Subordinated Notes — Series 2018-A due October 17, 2078 of the Corporation;

“Perpetual Preferred Share Rate” means the dividend rate payable on the Preferred Shares, Series F from time to time, being the same rate as the interest rate which would have accrued on the Notes — Series 2018-A at any such time if such notes had not been automatically converted into Preferred Shares, Series F upon an Automatic Conversion Event, and had remained outstanding;

“Preferred Shares” means the preferred shares of the Corporation, issuable in series;

All dollar amounts are in United States dollars.

2. ISSUE PRICE

The issue price of each of the Preferred Shares, Series F will be $25.00.

3. DIVIDENDS

Holders of Preferred Shares, Series F will be entitled to receive and the Corporation shall pay thereon, cumulative preferential cash dividends, if, as and when declared by the Board of Directors, subject to the Act, at the Perpetual Preferred Share Rate, payable on each Dividend Payment Date, subject to any applicable withholding tax.

The dividends on Preferred Shares, Series F will accrue (but not compound) on a daily basis. If, on any Dividend Payment Date, the dividends accrued to such date are not paid in full on all of the Preferred Shares, Series F then issued and outstanding, such dividends, or the unpaid portion thereof, shall be paid on a subsequent date or dates determined by the Board of Directors on which the Corporation will have sufficient funds properly available, under the provisions of applicable law and under the provisions of any trust indenture governing bonds, debentures or other securities of the Corporation, for the payment of such dividends.

Any dividends declared on the Preferred Shares, Series F will (except in case of redemption in which case payment of dividends will be made upon surrender of the certificates representing the Preferred Shares, Series F to be redeemed or except as otherwise provided with the consent of a registered holder of Preferred Shares, Series F) be paid by electronic funds transfer or by cheque of or on behalf of the Corporation in lawful money of the United States (less any tax required to be deducted) and payment thereof shall satisfy such dividends. Each dividend on the Preferred Shares, Series F shall be paid to the registered holders appearing on the Corporation’s registers at the close of business on the first day of the month, whether or not a Business Day, during which a Dividend Payment Date falls.

The Corporation shall elect, in the manner and within the time provided under section 191.2 of the ITA, or any successor or replacement provision of similar effect, and take all other necessary action under the ITA, to pay tax at a rate such that no holder of Preferred Shares, Series F will be required to pay tax under section 187.2 of Part IV.1 of the ITA or any successor or replacement provision of similar effect on dividends received on the Preferred Shares, Series F. Nothing in this paragraph shall prevent the Corporation from entering into an agreement with a taxable Canadian corporation with which it is related to transfer all or a portion of the Corporation’s liability for tax under section 191.1 of the ITA to that taxable Canadian corporation in accordance with the provisions of section 191.3 of the ITA.

4. VOTING RIGHTS

Except as otherwise required by law or in the conditions attaching to the Preferred Shares as a class, the holders of Series F Shares shall not be entitled to receive notice of, attend at, or vote at any meeting of shareholders of the Corporation, unless and until the Corporation has failed to pay, in aggregate, eight Dividend Payments on the Preferred Shares, Series F, in accordance with the terms hereof, regardless of whether (i) the failures to make such Dividend Payments were consecutive, (ii) such dividends were declared or (iii) there were any monies of the Corporation properly applicable to the payment of such dividends. In the event of such non-payment, and only for so long as any such dividends remain in arrears, the holders of the Preferred Shares, Series F shall be entitled to receive notice of all meetings of shareholders of the Corporation and to attend thereat (other than a separate meeting of the holders of another series or class of shares), and shall at any such meeting be entitled to vote together with all of the voting shares of the Corporation (except when the vote of the holders of shares of any other class or series is to be taken separately and as a class or series) on the basis of one vote in respect of each Preferred Share, Series F held by such holder.

In connection with any action to be taken by the Corporation which requires the approval of the holders of the Preferred Shares, Series F voting as a series or as part of the class of Preferred Shares, each such Preferred Share, Series F will entitle the holder thereto to one vote.

5. REDEMPTION

The Preferred Shares, Series F will not be redeemable by the Corporation on or prior to October 17, 2023. After that date, but subject to the Act and the provisions described below under Article 8, the Corporation may redeem at any time all, or from time to time any part, of the then-outstanding Preferred Shares, Series F, at the Corporation’s option without the consent of the holders, by the payment of an amount in cash for each such share so redeemed of $25.00 together with all accrued and unpaid dividends up to but excluding the date fixed for redemption, subject to any applicable withholding tax.

Where a part only of the then-outstanding Preferred Shares, Series F is at any time to be redeemed, the Preferred Shares, Series F to be redeemed will be redeemed pro rata, disregarding fractions or in such other manner as the Board of Directors determines.

Written notice of any redemption will be given by the Corporation to registered holders of Preferred Shares, Series F at least thirty (30) and not more than sixty (60) days prior to the redemption date. The notice of redemption must include the redemption price, the place at which the redemption price is to be paid, and the redemption date, and, if less than all of the Preferred Shares, Series F are to be redeemed, the number of shares to be redeemed. On or before the redemption date, the Corporation shall deposit the redemption price of the shares to be redeemed with the transfer agent and registrar for the Preferred Shares, Series F, less any applicable withholding tax, to be paid without interest to or to the order of the registered holders of such shares upon presentation and surrender to the transfer agent and registrar of the certificates representing the shares. Such deposit shall be deemed to be payment to holders of the Preferred Shares, Series F and shall satisfy and discharge all liability for the redemption price for the shares to be redeemed. Provided such deposit has been made, the shares called for redemption shall, on the redemption date, be and be deemed to be redeemed and no longer outstanding. If only a portion of the shares represented by any certificate are to be redeemed, the Corporation, at its sole expense, shall cause a new certificate for the remaining portion of shares to be issued and delivered to the holder of such shares. Provided the redemption price is deposited, the shares called for redemption shall from and after the redemption date cease to be entitled to dividends, and holders shall not be entitled to exercise any of the other rights of shareholders in respect thereof, and their rights shall be limited to receiving, without interest, their proportionate part of the total redemption price deposited against presentation and surrender of the certificates held by them respectively. If the redemption price is not deposited, the rights of holders of the shares called for redemption shall remain unaffected.

6. PURCHASE FOR CANCELLATION

Subject to the provisions described below under Article 8, on or after October 17, 2023, the Corporation may at any time and from time to time purchase for cancellation any outstanding Preferred Shares, Series F in the open market, by tender or private contract, at any price, subject to any applicable withholding tax. Any such Preferred Shares, Series F purchased by the Corporation shall be cancelled and shall not be reissued.

In the case of any purchase of shares by tender, the Corporation shall give notice of its intention to invite tenders to all holders of the Preferred Shares, Series F by forwarding by prepaid post or delivering the same to each registered holder at their address as it appears on the books of the Corporation or, failing such address, then to the last known address of such shareholder and, if two or more tenders of shares at the same price be received, which shares when added to any shares already tendered at a lower price or prices aggregate more than the number of shares to be purchased at such time, the Corporation shall prorate as nearly as possible (disregarding fractions) among the holders of Preferred Shares, Series F submitting such tenders at the same price the number of shares necessary to complete the number of shares to be purchased at such time.

7. RIGHTS ON LIQUIDATION

In the event of the liquidation, dissolution or winding-up of the Corporation, holders of the Preferred Shares, Series F shall be entitled to receive $25.00 per share (less any amount that may have been returned to holders as a return of capital), together with all accrued and unpaid dividends up to but excluding the date of payment, subject to any applicable withholding tax, before any amount shall be paid or any assets of the Corporation distributed to the holders of Common Shares or any other shares ranking junior to the Preferred Shares, Series F. Upon payment to the registered holders of the Preferred Shares, Series F of the amount payable to them pursuant to this Article 7, holders thereof shall not be entitled to share in any further distribution of the property or assets of the Corporation.

8. RESTRICTIONS ON DIVIDENDS AND RETIREMENT OF SHARES

So long as any of the Preferred Shares, Series F are outstanding, the Corporation shall not, without the approval of the holders of the Preferred Shares, Series F given in the manner specified under Article 11 below:

| (a) | declare any dividend on the Common Shares or any other shares ranking junior to the Preferred Shares, Series F (other than stock dividends on shares ranking junior to the Preferred Shares, Series F); |

| (b) | redeem, purchase or otherwise retire any Common Shares or any other shares ranking junior to the Preferred Shares, Series F (except out of the net cash proceeds of a substantially concurrent issue of shares ranking junior to the Preferred Shares, Series F); or |

| (c) | redeem, purchase or otherwise retire: (i) less than all the Preferred Shares, Series F; or (ii) except pursuant to any purchase obligation, sinking fund, retraction privilege or mandatory redemption provisions attaching to any series of preferred shares of the Corporation, any other shares ranking on a parity with the Preferred Shares, Series F, |

unless, in each case, all dividends on the Preferred Shares, Series F and on all other shares ranking prior to or on a parity with the Preferred Shares, Series F, have been declared and paid or set apart for payment.

9. ISSUE OF ADDITIONAL SERIES OF PREFERRED SHARES

The Corporation may issue other series of preferred shares ranking on a parity with the Preferred Shares, Series F without the authorization of the holders of the Preferred Shares, Series F as a series provided that at the date of such issuance all cumulative dividends up to and including the Dividend Payment Date for the last completed period for which dividends shall be payable shall have been declared and paid or set aside for payment in respect of the Preferred Shares, Series F.

10. AMENDMENTS TO PREFERRED SHARES, SERIES F

The Corporation will not, without the approval of holders of the Preferred Shares, Series F or, if applicable, of the Notes given as provided in Article 11 below, delete or vary any rights, privileges, restrictions and conditions attaching to the Preferred Shares, Series F.

11. APPROVALS

The approval of any amendments to the rights, privileges, restrictions and conditions attaching to the Preferred Shares, Series F may be given by a resolution carried by the affirmative vote of not less than 66⅔% of the votes cast at a meeting of holders of Preferred Shares, Series F at which at least a majority of the outstanding Preferred Shares, Series F is represented or, if no quorum is present at such meeting, at a meeting following such adjourned meeting at which no quorum would apply. At any meeting of holders of Preferred Shares, Series F as a series, each such holder shall be entitled to one vote for each Preferred Share, Series F held. For so long as the Notes are outstanding, no amendment will be made to the rights, privileges, restrictions and conditions of the Preferred Shares, Series F (other than any amendments relating to the preferred shares of the Corporation as a class) without the prior approval of the holders of not less than a majority of the aggregate principal amount of the Notes then outstanding.

12. BOOK-ENTRY ONLY ISSUE

Unless the Corporation directs otherwise, the Preferred Shares, Series F shall be issued and held under the “book-entry only” system and shall be represented by a single fully-registered permanent global share certificate.

13. BUSINESS DAYS

If any action is required to be taken by the Corporation on a day that is not a Business Day, then such action will be taken on the next succeeding day that is a Business Day.

14. FRACTIONAL SHARES

The Preferred Shares, Series F may be issued in whole or in fractional shares. Each fractional Preferred Share, Series F shall carry and be subject to the rights, privileges, restrictions and conditions (including voting rights and dividend rights) of the Preferred Shares, Series F in proportion to the applicable fractions.

SCHEDULE A

| IV.1 | CUMULATIVE RATE RESET PREFERRED SHARES, SERIES D |

The fourth series of preferred shares shall consist of up to 4,000,000 shares, which shares shall be designated as Cumulative Rate Reset Preferred Shares, Series D (the “Series D Shares”) and which, in addition to the rights, privileges, restrictions and conditions attached to the preferred shares as a class, shall have attached thereto the following rights, privileges, restrictions and conditions:

| (i) | Dividend Periods and Dividend Payment Dates. A “Dividend Period” means the period from and including the date of initial issue of the Series D Shares to, but excluding, June 30, 2014 and, thereafter, the next succeeding period that is from and including the 31st day (each, a “Quarter End Date”) of each of the months of March, June, September and December in each year, as the case may be, to but excluding the next succeeding Quarter End Date. The dividend payment dates (the “Dividend Payment Dates”) in respect of the dividends payable on the Series D Shares shall be the last day (or, if such day is not a Business Day, the immediately following Business Day) of each of the months of March, June, September and December in each year. |

| (ii) | Payment of Dividends. |

| (A) | During the Initial Fixed Rate Period and each Subsequent Fixed Rate Period, the holders of Series D Shares shall be entitled to receive, and the Corporation shall pay thereon, if, as and when declared by the board of directors of the Corporation (the “Board”), out of moneys of the Corporation properly applicable to the payment of dividends, fixed, cumulative, preferential cash dividends (the “Quarterly Dividends”) in the amounts set forth in subsection IV.1(a)(ii)(B) payable, with respect to each Dividend Period, on the Dividend Payment Date in respect of such Dividend Period. |

| (B) | Subject to subsection IV.1(a)(iii), for all Dividend Periods during: |

| (1) | the Initial Fixed Rate Period, each Quarterly Dividend shall be in an amount equal to $0.31250 per Series D Share (being an annual rate equal to $1.25 per Series D Share); and |

| (2) | each Subsequent Fixed Rate Period, each Quarterly Dividend shall be in an amount per Series D Share equal to the result of the following calculation: ¼ x [($25.00 x AFDR)], where “AFDR” means the Annual Fixed Dividend Rate applicable to such Subsequent Fixed Rate Period. |

| (C) | The Corporation shall determine the Annual Fixed Dividend Rate for each Subsequent Fixed Rate Period on the relevant Fixed Rate Calculation Date. Such determination shall, in the absence of manifest error, be final and binding on the Corporation and all holders of Series D Shares. The Corporation shall, on the relevant Fixed Rate Calculation Date, give written notice of the Annual Fixed Dividend Rate for the ensuing Subsequent Fixed Rate Period to the registered holders of the then outstanding Series D Shares in accordance with the provisions of subsection IV.1(f)(i). |

| (D) | Dividends on the Series D Shares shall accrue daily from and including the date of issue of such shares. |

| (iii) | Initial Dividend and Dividend for Other than a Full Dividend Period. The holders of Series D Shares shall be entitled to receive, and the Corporation shall pay thereon, if, as and when declared by the Board out of moneys of the Corporation properly applicable to the payment of dividends, cumulative, preferential cash dividends for the initial period or any period which is less than afull Dividend Period, as follows: |

| (A) | an initial dividend in respect of the period from and including the date of the initial issue of the Series D Shares to but excluding June 30, 2014 in an amount per Series D Share equal to $1.25 multiplied by a fraction, the numerator of which is the number of calendar days from and including the date of the initial issue of the Series D Shares to but excluding June 30, 2014 and the denominator of which is 365, (which, if the Series D Shares are issued on March 5, 2014, shall be $0.4007 per Series D Share); and |

| (B) | a dividend in an amount per share with respect to any Series D Share: |

| (1) | which is issued, redeemed or converted during any Dividend Period; |

| (2) | where the assets of the Corporation are distributed to the holders of the Series D Shares pursuant to subsection IV.1(i) with an effective date during any Dividend Period; or |

| (3) | in any other circumstance where the number of days in a Dividend Period that such share has been outstanding is less than a full Dividend Period (other than the period referred to in subsection IV.1(a)(iii)(A)), |

equal to the amount obtained when the amount of the Quarterly Dividend payable in respect of the applicable full Dividend Period is multiplied by a fraction, the numerator of which is the number of calendar days in such Dividend Period that such share has been outstanding (excluding the date of redemption or conversion, the effective date for the distribution of assets or the last day of the applicable shorter period, as applicable) and the denominator of which is the number of calendar days in such Dividend Period.

| (iv) | Payment Procedure. The Corporation shall pay the dividends declared on the Series D Shares on the relevant Dividend Payment Date (less any tax required to be deducted or withheld by the Corporation) by electronic funds transfer or by cheque(s) drawn on a Canadian chartered bank or trust company and payable in lawful money of Canada at any branch of such bank or trust company in Canada or in such other manner, not contrary to applicable law, as the Corporation shall reasonably determine. The delivery or mailing of any cheque to a holder of Series D Shares (in the manner provided for in subsection IV.1(f)(i)) or the electronic transfer of funds to an account specified by such holder shall be a full and complete discharge of the Corporation’s obligation to pay the dividends to such holder to the extent of the sum represented thereby (plus the amount of any tax required to be and in fact deducted or withheld by the Corporation from the related dividends as aforesaid and remitted to the proper taxing authority), unless such cheque is not honoured when presented for payment. Subject to applicable law, dividends which are represented by a cheque which has not been presented to the Corporation’s banker for payment or that otherwise remain unclaimed for a period of six years from the date on which they were declared to be payable may be reclaimed and used by the Corporation for its own purposes. |

| (v) | Cumulative Payment of Dividends. If on any Dividend Payment Date, the Quarterly Dividends payable in respect of the Dividend Period ending in the calendar month in which such Dividend Payment Date occurs are not paid in full on all of the Series D Shares then outstanding, such Quarterly Dividends, or the unpaid part thereof, shall be paid (less any tax required to be deducted or withheld by the Corporation) on a subsequent date or dates determined by the Board on which the Corporation shall have sufficient monies properly applicable to the payment of such Quarterly Dividends. The holder of Series D Shares shall not be entitled to any dividends other than or in excess of the cumulative preferential cash dividends herein provided for. |

| (vi) | Priority. The Series D Shares rank senior to the Common Shares and rank on a parity with every other series of Preferred Shares as to dividends. |

| (b) | Redemption, Conversion and Purchase |

| (i) | General. To the extent permitted by applicable law, the Series D Shares may be redeemed, converted or purchased by the Corporation as provided in this subsection IV.1(b) but not otherwise. |

| (ii) | Corporation’s Redemption Rights. The Series D Shares shall not be redeemable by the Corporation prior to March 31, 2019. On any Series D Conversion Date, the Corporation may redeem all or any number of the outstanding Series D Shares, at its option, by the payment in cash of $25.00 per share so redeemed together with all accrued and unpaid dividends thereon up to, but excluding, the date fixed for redemption (less any tax required to be deducted or withheld by the Corporation) (the “Redemption Price”). Where applicable, if less than all of the outstanding Series D Shares are at any time to be redeemed, the particular shares to be redeemed shall be selected on a pro rata basis (disregarding fractions) or, with the consent of any applicable stock exchange, in such other manner as the Board may in its sole discretion determine by resolution. |

| (iii) | Notice of Redemption. Notice of any redemption of Series D Shares pursuant to subsection IV.1(b)(ii) shall be given to each holder of Series D Shares to be redeemed by the Corporation at least 30 and not more than 60 days prior to the date fixed for redemption. Any notice of redemption of Series D Shares by the Corporation shall be validly and effectively given on the date on which it is sent to each holder of Series D Shares to be redeemed in the manner provided for in subsection IV.1(f)(i). Such notice shall set out: |

| (A) | the date (the “Redemption Date”) on which the redemption is to take place; |

| (B) | unless all the Series D Shares held by the holder to whom it is addressed are to be redeemed, the number of Series D Shares so held which are to be redeemed; and |

| (iv) | Payment of Redemption Price. The Corporation shall on the Redemption Date pay or cause to be paid to the holders of the Series D Shares so called for redemption the Redemption Price therefor on presentation and delivery at the principal transfer office of the Transfer Agent in the city of Toronto or such other place or places in Canada designated in the notice of redemption, of the certificate or certificates representing the Series D Shares so called for redemption. Such payment shall be made by electronic funds transfer to an account specified by such holder or by cheque drawn on a Canadian chartered bank or trust company in the amount of the Redemption Price and such electronic transfer of funds or the delivery or mailing of such cheque (in the manner provided for in subsection IV.1(f)(i)) shall be a full and complete discharge of the Corporation’s obligation to pay the Redemption Price owed to the holders of Series D Shares so called for redemption to the extent of the sum represented thereby (plus the amount of any tax required to be and in fact deducted or withheld by the Corporation as aforesaid and remitted to the proper taxing authority) unless such cheque is not honoured when presented for payment. From and after the Redemption Date, the holders of Series D Shares called for redemption shall cease to be entitled to dividends or to exercise any of the rights of holders of Series D Shares in respect of such shares except the right to receive the Redemption Price, provided that if payment of such Redemption Price is not duly made in accordance with the provisions hereof, then the rights of such holders shall remain unimpaired. If less than all the Series D Shares represented by any certificate shall be redeemed, a new certificate for the balance shall be issued without cost to the holder. Subject to applicable law, redemption monies which remain unclaimed for a period of six years from the Redemption Date may be reclaimed and used by the Corporation for its own purposes. |

| (v) | Deposit of Redemption Price. The Corporation shall have the right, at any time after mailing a notice of redemption, to deposit the aggregate Redemption Price for the Series D Shares thereby called for redemption, or such part thereof as at the time of deposit has not been claimed by the holders entitled thereto, in a special account with a Canadian chartered bank or trust company named in the notice of redemption in trust for the holders of such shares, and upon such deposit being made or upon the Redemption Date, whichever is the later, the Series D Shares in respect of which such deposit shall have been made shall be deemed to be redeemed on the Redemption Date and the rights of each holder thereof shall be limited to receiving, without interest, the holder’s proportionate part (after taking into account any amounts required to be deducted or withheld on account of tax in respect of such holder) of the Redemption Price so deposited upon presentation and surrender of the certificate or certificates representing the Series D Shares so redeemed. Any interest on any such deposit shall belong to the Corporation. Subject to applicable law, redemption monies which remain unclaimed for a period of six years from the Redemption Date may be reclaimed and used by the Corporation for its own purposes. |

| (vi) | Declaration of Dividends in Respect of Shares to be Redeemed. If a dividend is declared by the Board in respect of any Dividend Period during which the Series D Shares are redeemed, notwithstanding the provisions of subsection IV.1(a)(iv), no electronic funds transfer or cheque shall be made or issued in payment of such dividend; rather, the amount of such dividend declared shall be considered to be an accrued and unpaid dividend for purposes of subsection IV.1(b)(ii). |

| (vii) | Conversion at the Option of the Holder. Subject to the second paragraph of subsection IV.1(b)(viii), subsection IV.1(b)(ix) and subsection IV.1(b)(x), each holder of Series D Shares shall have the right, at its option, on any Series D Conversion Date, to convert all or any part of its Series D Shares registered in its name into Cumulative Floating Rate Preferred Shares, Series E (the “Series E Shares”) on the basis of one Series E Share for each Series D Share converted. Such right may be exercised by notice in writing (an “Election Notice”) given not earlier than the 30th day prior to, and not later than 5:00 p.m. (Toronto time) on the 15th day preceding, the applicable Series D Conversion Date during usual business hours at any principal transfer office of the Transfer Agent, or such other place or places designated by the Corporation. On any conversion of Series D Shares into Series E Shares, the certificates representing the Series E Shares resulting from the conversion of Series D Shares to which such holder is entitled shall be issued in the name of the holder of the Series D Shares converted or in such name or names as such holder may direct in writing; provided that such holder shall pay any applicable security transfer taxes. Any Election Notice shall be accompanied by (1) payment or evidence of payment of the tax (if any) payable: and (2) the certificate or certificates representing the Series D Shares in respect of which the holder thereof desires to convert into Series E Shares with the transfer form on the back thereof or other appropriate stock transfer power of attorney duly endorsed by the holder, or his or her attorney duly authorized in writing, in which Election Notice such holder may elect to convert part only of the Series D Shares represented by such certificate or certificates not theretofore called for redemption in which event the Corporation will issue and deliver or cause to be delivered to such holder, at the expense of the Corporation. a new certificate representing the Series D Shares represented by such certificate or certificates that have not been converted. Such conversion shall be deemed to have been made at 5:00 p.m. (Toronto time) on the Series D Conversion Date, so that the rights of the holder of such Series D Shares as the holder thereof shall cease at such time and the person or persons entitled to receive the Series E Shares upon such conversion will be treated for all purposes as having become the holder or holders of record of such Series E Shares at such time. An Election Notice is irrevocable once received by the Corporation. If the Corporation does not receive an Election Notice within the specified time, the Series D Shares shall be deemed not to have been converted (subject to subsection IV.1(b)(ix)). |

| (viii) | Notice of Conversion Rate and Dividend Rates and Election Notice. The Corporation shall, at least 30 days and not more than 60 days prior to each Series D Conversion Date, provide notice in writing to the then registered holders of the Series D Shares of the Series D Conversion Date and a form of Election Notice as specified by the Corporation. On the 30th day prior to each Series D Conversion Date, the Corporation shall give notice in writing to the registered holders of the Series D Shares of the Annual Fixed Dividend Rate for the next Subsequent Fixed Rate Period and the Floating Quarterly Dividend Rate for the next Quarterly Floating Rate Period (as these terms are defined in the Series E Share Provisions). |

If the Corporation gives notice pursuant to subsection IV.1(b)(iii) to the registered holders of the Series D Shares of the redemption of all Series D Shares pursuant to subsection IV.1(b)(ii), it shall not be required to give notice to the holders of the Series D Shares of any dividend rates or of the conversion right of holders of Series D Shares and the right of holders of Series D Shares to convert such shares pursuant to subsection IV.1(b)(vii) shall terminate.

| (ix) | Automatic Conversion. If the Corporation determines that there would remain outstanding on a Series D Conversion Date less than 1,000,000 Series D Shares, after having taken into account all Election Notices in respect of Series D Shares duly tendered for conversion into Series E Shares and all Election Notices in respect of Series EShares duly tendered for conversion into Series D Shares in accordance with the Series E Share Provisions, in each case received by the Corporation during the time fixed therefor, then, all, but not part, of the remaining outstanding Series D Shares will automatically be converted into Series E Shares on the basis of one Series E Share for each Series D Share on the applicable Series D Conversion Date. The Corporation shall give notice in writing of the automatic conversion thereof to all holders of the Series D Shares at least seven days prior to the applicable Series D Conversion Date. |

| (x) | Restrictions on Conversion. The holders of Series D Shares shall not be entitled to convert their shares into Series E Shares if the Corporation determines that there would remain outstanding on a Series D Conversion Date less than 1,000,000 Series E Shares after having taken into account all Election Notices in respect of Series D Shares duly tendered for conversion into Series E Shares and all Election Notices in respect of Series E Shares duly tendered for conversion into Series D Shares in accordance with the Series E Share Provisions, in each case received by the Corporation during the time fixed therefor. The Corporation shall give notice in writing of the inability to convert Series D Shares to all holders of the Series D Shares at least seven days prior to the applicable Series D Conversion Date. |

| (xi) | Non-Residents. The Corporation is not required to (but may at its option) issue Series E Shares upon the conversion of Series D Shares into Series EShares to any person whose address is in, or whom the Corporation or the Transfer Agent has reason to believe is a resident of, any jurisdiction outside Canada, to the extent that such issue would require the Corporation to take any action to comply with the securities laws or analogous laws of such jurisdiction. |

| (xii) | Purchase for Cancellation. Subject to applicable laws, the Corporation may, at any time, purchase for cancellation (if obtainable), out of capital or otherwise, the whole or any part of the Series D Shares outstanding from time to time at any price by tender to all holders of record of Series D Shares or through the facilities of any stock exchange on which the Series D Shares are listed, or in any other manner, provided that in the case of a purchase in any other manner the price for such Series D Shares so purchased for cancellation shall not exceed the highest price offered for a board lot of the Series D Shares on any stock exchange on which such shares are listed on the date of purchase for cancellation, plus the costs of purchase. If upon any tender to holders of Series D Shares under the provisions of this subsection IV.1(b)(xii), more shares are offered than the Corporation is prepared to purchase, the shares so offered will be purchased as nearly as may be pro rata (disregarding fractions) according to the number of Series D Shares so offered by each of the holders of Series D Shares who offered shares to such tender. From and after the date of purchase of any Series D Shares under the provisions of this subsection IV.1(b)(xii), the shares so purchased shall be cancelled. |

| (xiii) | Conversion — General. On the conversion of a Series D Share to a Series E Share pursuant to the terms of these Series D Share Provisions, each such Series D Share shall become an issued Series E Share and the number of unissued Series D Shares shall be increased by the number of Series D Shares that became Series E Shares. |

| (i) | Voting Rights – General. Except as otherwise required by law or in the conditions attaching to the Preferred Shares as a class, the holders of Series D Shares shall not be entitled to receive notice of, attend at, or vote at any meeting of shareholders of the Corporation, unless and until the Corporation shall have failed to pay eight Quarterly Dividends on the Series D Shares in accordance with the terms hereof, whether or not consecutive and whether or not such dividends were declared and whether or not there are any monies of the Corporation properly applicable to the payment of such dividends. In the event of such non-payment, and for only so long as any such dividends remain in arrears, the holders of the Series D Shares shall be entitled to receive notice of all meetings of shareholders of the Corporation and to attend thereat (other than a separate meeting of the holders of another series or class of shares), and shall at any such meetings which they shall be entitled to attend, except when the vote of the holders of shares of any other class or series is to be taken separately and as a class or series, be entitled to vote together with all of the voting shares of the Corporation on the basis of one vote in respect of each Series D Share held by each such holder, until all such arrears of such dividends shall have been paid, whereupon such rights shall cease unless and until the Corporation shall again fail to pay eight Quarterly Dividends on the Series D Shares in accordance with the terms hereof, whether or not consecutive and whether or not such dividends were declared and whether or not there are any monies of the Corporation properly applicable to the payment of such dividends, in which event such voting rights shall become effective again and so on from time to time. |

The consideration for which each Series D Share shall be issued is $25.00 and, upon payment of such consideration, each such share shall be issued as fully paid and non-assessable.

In the event of a conversion of a Series E Share into a Series D Share, the amount to be deducted from the stated capital account maintained for the Series E Shares and added to the stated capital account maintained for the Series D Shares will be $25.00 per share so converted.

| (e) | Election under the Income Tax Act (Canada) |

The Corporation shall elect in the manner and within the time provided under the Income Tax Act (Canada) (the “Tax Act”), under Subsection 191.2(1) of Part VI.1 of the Tax Act, or any successor or replacement provision of similar effect, and take all other necessary action under the Tax Act, to pay or cause payment of tax under Part VI.1 of the Tax Act at a rate such that the corporate holders will not be required to pay tax on dividends received on the Series D Shares under Section 187.2 of Part IV.1 of the Tax Act or any successor or replacement provision of similar effect.

| (f) | Notice and Interpretation |

| (i) | Notices. Any notice, cheque, invitation for tenders or other communication from the Corporation herein provided for shall be sufficiently given, sent or made if delivered or if sent by first class unregistered mail, postage prepaid, to the holders of the Series D Shares at their respective addresses appearing on the records of the Corporation maintained by the Corporation or the Transfer Agent, or, in the case of joint holders, to the address of the holder whose name appears first on the records of the Corporation maintained by the Corporation or the Transfer Agent as one of such joint holders, or, in the event of the address of any of such holders not so appearing, then at the last address of such holder known to the Corporation. Accidental failure to give such notice, invitation for tenders or other communication to one or more holders of the Series D Shares shall not affect the validity of the notices, invitations for tenders or other communications properly given or any action taken pursuant to such notice, invitation for tender or other communication but, upon such failure being discovered, the notice, invitation for tenders or other communication, as the case may be, shall be sent forthwith to such holder or holders. If any notice, cheque, invitation for tenders or other communication from the Corporation given to a holder of Series D Shares pursuant to this subsection is returned on three consecutive occasions because the holder cannot be found, the Corporation shall not be required to give or mail any further notices, cheques, invitations for tenders or other communications to such shareholder until the holder informs the Corporation in writing of such holder’s new address. |

If the Board determines that mail service is or is threatened to be interrupted at the time when the Corporation is required or elects to give any notice hereunder by mail, or is required to send any cheque or any share certificate to a holder, whether in connection with the redemption of such share or otherwise, the Corporation may, notwithstanding the provisions hereof:

| (A) | give such notice by publication thereof once in a newspaper having national circulation in Canada or, if there is no newspaper having national circulation in Canada, in an English language newspaper of general circulation published in each of Vancouver, Calgary, Toronto and Montreal and such notice shall be deemed to have been validly given on the day next succeeding its publication; and |

| (B) | fulfill the requirement to send such cheque or such share certificate by arranging for the delivery thereof to such holder by the Transfer Agent at its principal offices in the city of Toronto, and such cheque and/or share certificate shall be deemed to have been sent on the date on which notice of such arrangement shall have been given as provided in (A) above, provided that as soon as the Board determines that mail service is no longer interrupted or threatened to be interrupted, such cheque or share certificate, if not theretofore delivered to such holder, shall be sent by mail as herein provided. |

| (ii) | Interpretation. If any day on which any dividend on the Series D Shares is payable, on which any Redemption Date or any Series D Conversion Date shall occur, or on or by which any other action is required or permitted to be taken hereunder is not a Business Day, then such dividend shall be payable, such Redemption Date or Series D Conversion Date shall occur or such other action shall be required or permitted to be taken on the immediately following day that is a Business Day. |

If a holder of Series D Shares is entitled to a cheque and such cheque is not received by the holder, or if the cheque is lost or destroyed, the Corporation, on being furnished with reasonable evidence of non-receipt, loss or destruction, and an indemnity satisfactory to the Corporation, acting reasonably, will issue to the holder of the Series D Shares a replacement cheque for the amount of the original cheque.

The Corporation will be entitled to deduct or withhold from any amount payable to a holder of Series D Shares under these Series D Share provisions any amount required by law to be deducted or withheld from that payment.

Reference to any statute is to that statute as in force from time to time, including any regulations, rules, policy statements or guidelines made under that statute, and includes any statute that may be enacted in substitution of that statute.

All references herein to a holder of Series D Shares shall be interpreted as referring to a registered holder of the Series D Shares.

For the purposes hereof:

| (A) | “Annual Fixed Dividend Rate” means, for any Subsequent Fixed Rate Period, the annual rate (expressed as a percentage rounded to the nearest one hundred-thousandth of one percent (with 0.000005% being rounded up)) equal to the sum of the Government of Canada Yield on the applicable Fixed Rate Calculation Date plus 3.28%; |

| (B) | “Bloomberg Screen GCAN5YR Page” means the display designated as page “GCAN5YR<INDEX>” on the Bloomberg Financial L.P. service (or such other page as may replace the GCAN5YR page on that service or if such service is no longer available, a successor service as determined by the Corporation) for purposes of displaying Government of Canada Yields; |

| (C) | “Business Day” means a day other than a Saturday, a Sunday or any other day that is a statutory or civic holiday in the place where the Corporation has its head office; |

| (D) | “Fixed Rate Calculation Date” means, for any Subsequent Fixed Rate Period, the 30th day prior to the first day of such Subsequent Fixed Rate Period; |

| (E) | “Government of Canada Yield” on any date means the yield to maturity on such date (assuming semi-annual compounding) of a Canadian dollar denominated non-callable Government of Canada bond with a term to maturity of five years as quoted as of 10:00 a.m. (Toronto time) on such date and which appears on the Bloomberg Screen GCAN5YR Page on such date; provided that, if such rate does not appear on the Bloomberg Screen GCAN5YR Page on such date, the Government of Canada Yield will mean the average of the yields determined by two registered Canadian investment dealers selected by the Corporation, as being the yield to maturity on such date (assuming semi-annual compounding) which a Canadian dollar denominated non-callable Government of Canada bond would carry if issued in Canadian dollars at 100% of its principal amount on such date with a term to maturity of five years; |

| (F) | “in priority to”, “on a parity with” and “junior to” have reference to the order of priority in payment of dividends and in the distribution of assets in the event of any liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, or other distribution of the assets of the Corporation among its shareholders for the purpose of winding-up its affairs; |

| (G) | “Initial Fixed Rate Period” means the period from and including the date of the initial issue of the Series D Shares to, but excluding, March 31, 2019; |

| (H) | “Quarter End Date” has the meaning given to it in subsection IV.1(a)(i); |

| (I) | “ranking as to capital” and similar expressions mean ranking with respect to priority in the distribution of assets of the Corporation in the event of any liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, upon a return of capital or upon any other distribution of the assets of the Corporation among its shareholders for the purpose of winding-up its affairs; |

| (J) | “ranking as to dividends” and similar expressions mean ranking with respect to priority in the payment of dividends by the Corporation; |

| (K) | “Series D Conversion Date” means March 31, 2019 and March 31 (or, if such date is not a Business Day, the immediately following Business Day) of every fifth year thereafter; |

| (L) | “Series D Share Provisions” means the designation, rights, privileges, restrictions and conditions of the Series D Shares; |

| (M) | “Series E Share Provisions” means the designation, rights, privileges, restrictions and conditions of the Series E Shares; |

| (N) | “Subsequent Fixed Rate Period” means for the initial Subsequent Fixed Rate Period, the period from and including March 31, 2019 to, but excluding, March 31, 2024 and for each succeeding Subsequent Fixed Rate Period, the period commencing on the day immediately following the end of the immediately preceding Subsequent Fixed Rate Period to, but excluding, March 31 in the fifth year thereafter; and |

| (O) | “Transfer Agent” means CIBC Mellon Trust Company at its principal transfer office in Toronto, Ontario, its successors and assigns, or such other person as from time to time may be appointed as the registrar and transfer agent for the Series D Shares. |

Subject to subsection IV.1(b)(ii), the designation, rights, privileges, restrictions and conditions attaching to the Series D Shares as a series may be repealed, deleted, varied, modified, amended or amplified from time to time only with the approval of the holders of the Series D Shares given in accordance with the Canada Business Corporations Act (the “CBCA”) and subsection IV.1(h) and with any required approvals of any stock exchanges on which the Series D Shares may be listed.

| (h) | Approval of Holders of Series D Shares |

| (i) | Approval of Holders of Series D Shares. Except as otherwise provided herein, any approval of the holders of the Series D Shares with respect to any matters requiring the consent of such holders may be given in such manner as may then be required by law, subject to a minimum requirement that such approval be given by a resolution signed by all such holders or passed by the affirmative vote of at least two-thirds of the votes cast by the holders who voted in respect of that resolution at a meeting of the holders duly called for that purpose and at which the holders of 10% of the outstanding Series D Shares are present in person or represented by proxy. If at any such meeting the holder(s) of 10% of the outstanding Series D Shares are not present in person or represented by proxy within one-half hour after the time appointed for such meeting, then the meeting shall be adjourned to such date not less than 15 days thereafter and to such time and place as may be designated by the chairman of such meeting, and not less than 10 days’ written notice shall be given of such adjourned meeting. At such adjourned meeting the holders(s) of Series D Shares present in person or represented by proxy shall form the necessary quorum and may transact the business for which the meeting was originally called and a resolution passed thereat by the affirmative vote of at least two-thirds of the votes cast at such meeting shall constitute the approval of the holders of the Series D Shares. At any meeting of holders of Series D Shares as a series, each such holder shall be entitled to one vote in respect of each share held. |

| (ii) | Formalities, etc. The proxy rules applicable to, the formalities to be observed in respect of the giving notice of, and the formalities to be observed in respect of the conduct of, any meeting or any adjourned meeting of holders of the Series D Shares shall be those required by law, as may from time to time be supplemented by the by-laws of the Corporation. On every poll taken at every meeting of holders of Series D Shares as a series, each holder entitled to vote thereat shall have one vote in respect of each Series D Share held. |

In the event of the liquidation, dissolution or winding-up of the Corporation or other distribution of assets of the Corporation among its shareholders for the purpose of winding-up its affairs, whether voluntary or involuntary, subject to the prior satisfaction of the claims of all creditors of the Corporation and of holders of shares of the Corporation ranking prior to the Series D Shares, the holders of the Series D Shares shall rank (a) on a parity with the Preferred Shares of every other series and (b) senior to the Common Shares and the shares of any other class ranking junior to the Preferred Shares. The Series D Shares shall be entitled to receive an amount equal to $25.00 per Series D Share, together with an amount equal to all accrued and unpaid dividends up to but excluding the date fixed for payment or distribution (less any tax required to be deducted or withheld by the Corporation), before any amount is paid or any assets of the Corporation are distributed to the holders of any shares of the Corporation ranking junior as to capital to the Series D Shares. Upon payment to the holders of the Series D Shares of the amounts so payable to them, such holders shall not be entitled to share in any further distribution of the assets of the Corporation.

| (i) | Withholdinq Taxes. For greater certainty, and notwithstanding any other provision of this Section IV.1, the Corporation shall be entitled to deduct and withhold any amounts required to be deducted or withheld on account of any taxes from any amounts (including shares) payable or otherwise deliverable in respect of the Series D Shares, including on the redemption, cancellation or conversion of the Series D Shares. To the extent that any amounts are deducted or withheld, such deducted or withheld amounts shall be treated for all purposes hereof as having been paid or delivered to the person in respect of which such deduction or withholding was made. The Corporation is hereby authorized to sell or otherwise dispose of all or any number of Series EShares otherwise deliverable to a holder of Series D Shares on the conversion of such Series D Shares in order to meet any applicable tax deduction or withholding tax requirements. |

| (ii) | Transfer Taxes. For greater certainty, and notwithstanding any other provision of this Section IV.1, the Corporation shall not be required to pay any tax which may be: |

| (A) | imposed upon the person or persons to whom Series E Shares are issued, |

| (B) | payable in respect of the issuance of such Series E Shares or a certificate therefor, or |

| (C) | payable in respect of any transfer involved in the issuance and delivery of any certificate in the name or names other than that of the holder of the Series D Shares, |

in connection with the conversion of Series D Shares into Series E Shares. The Corporation may refuse to issue any Series E Share or deliver any such Series E Share certificate unless and until the person or persons requesting the issuance thereof shall have paid to the Corporation the amount of such tax or shall have established to the satisfaction of the Corporation that such tax has been paid or is otherwise not required to be paid in the circumstances

| V.1 | CUMULATIVE FLOATING RATE PREFERRED SHARES, SERIES E |

The fifth series of preferred shares shall consist of up to 4,000,000 shares, which shares shall be designated as Cumulative Floating Rate Preferred Shares, Series E (the “Series E Shares”) and which, in addition to the rights, privileges, restrictions and conditions attached to the preferred shares as a class, shall have attached thereto the following rights, privileges, restrictions and conditions:

| (i) | Dividend Payment Dates. The dividend payment dates (the “Dividend Payment Dates”) in respect of the dividends payable on the Series E Shares shall be the last day (or if such day is not a Business Day, the immediately following Business Day) of each of the months of March, June, September and December in each year. |

| (ii) | Payment of Dividends. The holders of Series E Shares shall be entitled to receive, and the Corporation shall pay thereon, if, as and when declared by the board of directors of the Corporation (the “Board”), out of moneys of the Corporation properly applicable to the payment of dividends, quarterly floating rate, cumulative, preferential cash dividends in respect of each Quarterly Floating Rate Period in an amount per Series E Share determined by multiplying the applicable Floating Quarterly Dividend Rate by $25.00 (“Quarterly Dividends”). |

The Corporation shall determine the Floating Quarterly Dividend Rate for each Quarterly Floating Rate Period on the relevant Floating Rate Calculation Date. Such determination shall be, in the absence of manifest error, final and binding on the Corporation and all holders of Series E Shares. The Corporation shall, on the relevant Floating Rate Calculation Date, give written notice of the Floating Quarterly Dividend Rate for the ensuing Quarterly Floating Rate Period to the registered holders of outstanding Series E Shares in accordance with the provisions of subsection V.1(f)(i).

Dividends on the Series E Shares shall accrue daily from and including the date of issue of such shares.

| (iii) | Dividend for Other than a Full Quarterly Floating Rate Period. The holders of Series E Shares shall be entitled to receive, and the Corporation shall pay thereon, if, as and when declared by the Board out of moneys of the Corporation properly applicable to the payment of dividends, cumulative, preferential cash dividends for any period which is less than a full Quarterly Floating Rate Period, in an amount per share with respect to any Series E Share: |

| (A) | which is issued, redeemed or converted during any Quarterly Floating Rate Period; |

| (B) | where the assets of the Corporation are distributed to the holders of the Series EShares pursuant to subsection V.1 (i) with an effective date during any Quarterly Floating Rate Period; or |

| (C) | in any other circumstance where the number of days in a Quarterly Floating Rate Period that such share has been outstanding is less than a full Quarterly Floating Rate Period; |

equal to the amount (rounded to five decimal places) obtained when the amount of the Quarterly Dividend payable in respect of the applicable full Quarterly Floating Rate Period is multiplied by a fraction, the numerator of which is the number of calendar days in such Quarterly Floating Rate Period that such share has been outstanding (excluding the date of redemption or conversion, the effective date for the distribution of assets or the last day of the applicable shorter period, as applicable) and the denominator of which is thenumber of calendar days in such Quarterly Floating Rate Period.

| (iv) | Payment Procedure. The Corporation shall pay the dividends declared on the Series E Shares on the relevant Dividend Payment Date (less any tax required to be deducted or withheld by the Corporation) by electronic funds transfer or by cheque(s) drawn on a Canadian chartered bank or trust company and payable in lawful money of Canada at any branch of such bank or trust company in Canada or in such other manner, not contrary to applicable law, as the Corporation shall reasonably determine. The delivery or mailing of any cheque to a holder of Series E Shares (in the manner provided for in subsection V.1(f)(i)) or the electronic transfer of funds to an account specified by such holder shall be a full and complete discharge of the Corporation’s obligation to pay the dividends to such holder to the extent of the sum represented thereby (plus the amount of any tax required to be and in fact deducted or withheld by the Corporation from the related dividends as aforesaid and remitted to the proper taxing authority), unless such cheque is not honoured when presented for payment. Subject to applicable law, dividends which are represented by a cheque which has not been presented to the Corporation’s banker for payment or that otherwise remain unclaimed for a period of six years from the date on which they were declared to be payable may be reclaimed and used by the Corporation for its own purposes. |

| (v) | Cumulative Payment of Dividends. If on any Dividend Payment Date, the Quarterly Dividends payable in respect of the Dividend Period ending in the calendar month in which such Dividend Payment Date occurs are not paid in full on all of the Series E Shares then outstanding, such Quarterly Dividends, or the unpaid part thereof, shall be paid (less any tax required to be deducted or withheld by the Corporation) on a subsequent date or dates determined by the Board on which the Corporation shall have sufficient monies properly applicable to the payment of such Quarterly Dividends. The holder of Series EShares shall not be entitled to any dividends other than or in excess of the cumulative preferential cash dividends herein provided for. |

| (vi) | Priority. The Series E Shares rank senior to the Common Shares and rank on a parity with every other series of Preferred Shares as to dividends. |

| (b) | Redemption, Conversion and Purchase |

| (i) | General. To the extent permitted by applicable law, the Series EShares may be redeemed, converted or purchased by the Corporation as provided in this subsection V.1(b) but not otherwise. |

| (ii) | Corporation’s Redemption Rights. The Series E Shares shall not be redeemable by the Corporation on or prior to March 31, 2019. On any Series E Conversion Date, the Corporation may redeem all or any number of the outstanding Series E Shares, at its option, by the payment in cash of $25.00 per share so redeemed together with all accrued and unpaid dividends thereon to, but excluding, the date fixed for redemption (less any tax required to be deducted or withheld by the Corporation) (the “Conversion Date Redemption Price”). |

On any date after March 31, 2019 that is not a Series E Conversion Date, the Corporation may redeem all or any number of the outstanding Series E Shares, at its option, by payment in cash of $25.50 per share so redeemed together with all accrued and unpaid dividends thereon up to, but excluding, the date fixed for redemption (less any tax required to be deducted or withheld by the Corporation) (the “Non-Conversion Date Redemption Price”).

Where applicable, if less than all of the then outstanding Series E Shares are at any time to be redeemed, the particular shares to be redeemed shall be selected on a pro rata basis (disregarding fractions) or, with the consent of any applicable stock exchange, in such other manner as the Board may in its sole discretion determine by resolution.

| (iii) | Notice of Redemption. Notice of any redemption of Series E Shares pursuant to subsection V.1(b)(ii) shall be given to each holder of Series E Shares to be redeemed by the Corporation at least 30 and not more than 60 days prior to the date fixed for redemption. Any notice of redemption of Series E Shares by the Corporation shall be validly and effectively given on the date on which it is sent to each holder of Series E Shares to be redeemed in the manner provided for in subsection V.1(f)(i). Such notice shall set out: |

| (A) | the date (the “Redemption Date”) on which the redemption is to take place; |

| (B) | unless all the Series E Shares held by the holder to whom it is addressed are to be redeemed, the number of Series E Shares so held which are to be redeemed; and |

| (C) | the Conversion Date Redemption Price or the Non-Conversion Date Redemption Price, as applicable (such applicable redemption price referred to hereinafter as the “Redemption Price”). |

| (iv) | Payment of Redemption Price. The Corporation shall on the Redemption Date pay or cause to be paid to the holders of the Series E Shares so called for redemption the Redemption Price therefor on presentation and delivery at the principal transfer office of the Transfer Agent in the city of Toronto or such other place or places in Canada designated in the notice of redemption, of the certificate or certificates representing the Series E Shares so called for redemption. Such payment shall be made by electronic funds transfer to an account specified by such holder or by cheque drawn on a Canadian chartered bank or trust company in the amount of the Redemption Price and such electronic transfer of funds or the delivery or mailing of such cheque (in the manner provided for in subsection V.1(f)(i)) shall be a full and complete discharge of the Corporation’s obligation to pay the Redemption Price owed to the holders of Series E Shares so called for redemption to the extent of the sum represented thereby (plus the amount of any tax required to be and in fact deducted or withheld by the Corporation as aforesaid and remitted to the proper taxing authority) unless such cheque is not honoured when presented for payment. From and after the Redemption Date, the holders of Series E Shares called for redemption shall cease to be entitled to dividends or to exercise any of the rights of holders of Series E Shares in respect of such shares except the right to receive the Redemption Price, provided that if payment of such Redemption Price is not duly made in accordance with the provisions hereof, then the rights of such holders shall remain unimpaired. If less than all the Series E Shares represented by any certificate shall be redeemed, a new certificate for the balance shall be issued without cost to the holder. Subject to applicable law, redemption monies which remain unclaimed for a period of six years from the Redemption Date may be reclaimed and used by the Corporation for its own purposes. |

| (v) | Deposit of Redemption Price. The Corporation shall have the right, at any time after mailing a notice of redemption, to deposit the aggregate Redemption Price for the Series E Shares thereby called for redemption, or such part thereof as at the time of deposit has not been claimed by the holders entitled thereto, in a special account with a Canadian chartered bank or trust company named in the notice of redemption in trust for the holders of such shares, and upon such deposit being made or upon the Redemption Date, whichever is the later, the Series E Shares in respect of which such deposit shall have been made shall be deemed to be redeemed on the Redemption Date and the rights of each holder thereof shall be limited to receiving, without interest, the holder’s proportionate part (after taking into account any amounts required to be deducted or withheld on account of tax in respect of such holder) of the Redemption Price so deposited upon presentation and surrender of the certificate or certificates representing the Series E Shares so redeemed. Any interest on any such deposit shall belong to the Corporation. Subject to applicable law, redemption monies which remain unclaimed for a period of six years from the Redemption Date may be reclaimed and used by the Corporation for its own purposes. |

| (vi) | Declaration of Dividends in Respect of Shares to be Redeemed. If a dividend is declared by the Board in respect of any Quarterly Floating Rate Period during which the Series E Shares are redeemed, notwithstanding the provisions of subsection V.1(a)(iv), no electronic funds transfer or cheque shall be made or issued in payment of such dividend; rather, the amount of such dividend declared shall be considered to be an accrued and unpaid dividend for purposes of subsection V.1(b)(ii). |

| (vii) | Conversion at the Option of the Holder. Subject to second paragraph of subsection V.1(b)(viii), subsection V.1(b)(ix) and subsection V.1(b)(x), each holder of Series E Shares shall have the right, at its option, on any Series E Conversion Date, to convert all or any part of its Series E Shares registered in its name into Cumulative Rate Reset Preferred Shares, Series D (the “Series D Shares”) on the basis of one Series D Share for each Series E Share converted. Such right may be exercised by notice in writing (an “Election Notice”) given not earlier than the 30th day prior to and not later than 5:00 p.m. (Toronto time) on the 15th day preceding the applicable Series E Conversion Date during usual business hours at any principal transfer office of the Transfer Agent, or such other place or places designated by the Corporation. On any conversion of Series E Shares into Series D Shares, the certificates representing the Series D Shares resulting from the conversion of Series E Shares to which such holder is entitled shall be issued in the name of the holder of the Series E Shares converted or in such name or names as such holder may direct in writing; provided that such holder shall pay any applicable security transfer taxes. Any Election Notice shall be accompanied by (1) payment or evidence of payment of the tax (if any) payable; and (2) the certificate or certificates representing the Series E Shares in respect of which the holder thereof desires to convert into Series D Shares with the transfer form on the back thereof or other appropriate stock transfer power of attorney duly endorsed by the holder, or his or her attorney duly authorized in writing, in which Election Notice such holder may elect to convert part only of the Series E Shares represented by such certificate or certificates not theretofore called for redemption in which event the Corporation will issue and deliver or cause to be delivered to such holder, at the expense of the Corporation, a new certificate representing the Series E Shares represented by such certificate or certificates that have not been converted. Such conversion shall be deemed to have been made at 5:00 p.m. (Toronto time) on the Series E Conversion Date, so that the rights of the holder of such Series E Shares as the holder thereof shall cease at such time and the person or persons entitled to receive the Series D Shares upon such conversion will be treated for all purposes as having become the holder or holders of record of such Series D Shares at such time. An Election Notice is irrevocable once received by the Corporation. If the Corporation does not receive an Election Notice within the specified time, the Series E Shares shall be deemed not to have been converted (subject to subsection V.1(b)(ix)). |

| (viii) | Notice of Conversion Date and Dividend Rates and Election Notice. The Corporation shall, at least 30 days and not more than 60 days prior to each Series E Conversion Date, provide notice in writing to the then registered holders of the Series E Shares of the Series E Conversion Date and a form of Election Notice as specified by the Corporation. On the 30th day prior to each Series E Conversion Date, the Corporation shall give notice in writing to the registered holders of the Series E Shares of the Floating Quarterly Dividend Rate for the next Quarterly Floating Rate Period and the Annual Fixed Dividend Rate applicable to the Series D Shares for the next Subsequent Fixed Rate Period (as such terms are defined in the Series D Share Provisions). |

If the Corporation gives notice pursuant to subsection V.1(b)(iii) to the registered holders of the Series E Shares of the redemption of all Series E Shares pursuant to subsection V.1(b)(ii), it shall not be required to give notice to the holders of the Series E Shares of any dividend rates or of the conversion right of holders of Series E Shares and the right of holders of Series E Shares to convert such shares pursuant to subsection V.1(b)(vii) shall terminate.

| (ix) | Automatic Conversion. If the Corporation determines that there would remain outstanding on a Series E Conversion Date less than 1,000,000 Series E Shares, after having taken into account all Election Notices in respect of Series E Shares duly tendered for conversion into Series D Shares and all Election Notices in respect of Series D Shares duly tendered for conversion into Series E Shares in accordance with the Series D Share Provisions, in each case received by the Corporation during the time fixed therefor then, all, but not part, of the remaining outstanding Series E Shares will automatically be converted into Series D Shares on the basis of one Series D Share for each Series E Share on the applicable Series E Conversion Date. The Corporation shall give notice in writing of the automatic conversion thereof to all holders of the Series E Shares at least seven days prior to the applicable Series E Conversion Date. |

| (x) | Restrictions on Conversion. The holders of Series E Shares shall not be entitled to convert their shares into Series D Shares if the Corporation determines that there would remain outstanding on a Series E Conversion Date less than 1,000,000 Series D Shares after having taken into account all Election Notices in respect of Series E Shares duly tendered for conversion into Series D Shares and all Election Notices in respect of Series D Shares duly tendered for conversion into Series E Shares in accordance with the Series D Share Provisions, in each case received by the Corporation during the time fixed therefor. The Corporation shall give notice in writing of the inability to convert Series E Shares to all holders of the Series E Shares at least seven days prior to the applicable Series E Conversion Date. |

| (xi) | Non-Residents. The Corporation is not required to (but may at its option) issue Series D Shares upon the conversion of Series E Shares into Series D Shares to any person whose address is in, or whom the Corporation or the Transfer Agent has reason to believe is a resident of, any jurisdiction outside Canada, to the extent that such issue would require the Corporation to take any action to comply with the securities laws or analogous laws of such jurisdiction. |

| (xii) | Purchase for Cancellation. Subject to applicable laws, the Corporation may, at any time, purchase for cancellation (if obtainable), out of capital or otherwise, the whole or any part of the Series E Shares outstanding from time to time at any price by tender to all holders of record of Series E Shares or through the facilities of any stock exchange on which the Series E Shares are listed, or in any other manner, provided that in the case of a purchase in any other manner the price for such Series E Shares so purchased for cancellation shall not exceed the highest price offered for a board lot of the Series E Shares on any stock exchange on which such shares are listed on the date of purchase for cancellation, plus the costs of purchase. If upon any tender to holders of Series E Shares under the provisions of this subsection V.1(b)(xii), more shares are offered than the Corporation is prepared to purchase, the shares so offered will be purchased as nearly as may be pro rata (disregarding fractions) according to the number of Series E Shares so offered by each of the holders of Series E Shares who offered shares to such tender. From and after the date of purchase of any Series E Shares under the provisions of this subsection V.1(b)(xii), the shares so purchased shall be cancelled. |

| (xiii) | Conversion — General. On the conversion of a Series E Share to a Series D Share pursuant to the terms of these Series E Share Provisions, each such Series E Share shall become an issued Series D Share and the number of unissued Series EShares shall be increased by the number of Series EShares that became Series D Shares. |

| (i) | Voting Rights — General. Except as otherwise required by law or in the conditions attaching to the Preferred Shares as a class, the holders of Series E Shares shall not be entitled to receive notice of, attend at, or vote at any meeting of shareholders of the Corporation, unless and until the Corporation shall have failed to pay eight Quarterly Dividends on the Series E Shares in accordance with the terms hereof, whether or not consecutive and whether or not such dividends were declared and whether or not there are any monies of the Corporation properly applicable to the payment of such dividends. |